- PLX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

424B5 Filing

Protalix BioTherapeutics (PLX) 424B5Prospectus supplement for primary offering

Filed: 5 Oct 07, 12:00am

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-144801

The information in this preliminary prospectus is not complete and may be changed. Neither we nor any securityholder may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS SUPPLEMENT |  |  | Subject to completion |  |  | October 3, 2007 |  | |||||||||||||

| (To Prospectus dated September 26, 2007) | ) |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  | |||

4,968,944 Shares

Common Stock

We are offering 3,726,708 shares of common stock and the selling securityholders identified in this prospectus supplement are offering 1,242,236 shares of common stock. We will not receive any proceeds from the sale of shares of common stock by the selling securityholders.

Our common stock is traded on the American Stock Exchange, or the AMEX, under the symbol ‘‘PLX.’’ On October 2, 2007, the last reported sales price for our common stock on the AMEX was $35.90 per share.

Investing in our common stock involves a high degree of risk. You should read and consider carefully the risk factors beginning on page S-5 of this prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or passed upon the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

|  |  |  |  | Per Share |  |  |  | Total |  | ||||||

| Public offering price |  |  |  | $ |  |  |  |  |  |  | $ |  |  |  |  |

| Underwriting discounts and commissions |  |  |  | $ |  |  |  |  |  |  | $ |  |  |  |  |

| Proceeds, before expenses, to us |  |  |  | $ |  |  |  |  |  |  | $ |  |  |  |  |

| Proceeds, before expenses, to the selling securityholders |  |  |  | $ |  |  |  |  |  |  | $ |  |  |  |  |

The underwriters may also purchase up to an additional 745,342 shares of common stock from the selling securityholders at the public offering price, less the underwriting discounts and commissions payable by the selling securityholders to cover over-allotments, if any, within 30 days from the date of this prospectus supplement. If the underwriters exercise their over-allotment option in full, the total underwriting discounts and commissions will be $ , the total proceeds to the selling securityholders will be $ .

The underwriters are offering the shares of common stock as set forth under ‘‘Underwriting.’’ Delivery of the shares of common stock will be made on or about , 2007.

Sole Book-Running Manager

UBS Investment Bank

CIBC World Markets

The date of this Prospectus Supplement is , 2007.

You should rely only on the information contained in this prospectus supplement, the accompanying prospectus and any free writing prospectus prepared by or on our behalf. We have not, and the underwriters have not, authorized anyone to provide you with information different from that contained in this prospectus supplement and the accompanying prospectus. We are not, and the underwriters are not, making an offer to sell or seeking offers to buy these securities in any jurisdiction where the offer or sale of these securities is not permitted. The information contained in this prospectus supplement and the accompanying prospectus is accurate only as of the date of this prospectus supplement, regardless of the time of delivery of this prospectus supplement or any sale of our common stock.

We obtained most of the statistical data, market data and other industry data and forecasts used throughout this prospectus supplement from publicly available information. We have not sought the consent of the sources to refer to their reports in this prospectus supplement.

TABLE OF CONTENTS

| Prospectus Supplement |  |  |  |  |

| Forward-looking statements |  |  | S-ii |  |

| Prospectus summary |  |  | S-1 |  |

| Risk factors |  |  | S-5 |  |

| Use of proceeds |  |  | S-24 |  |

| Selected financial data |  |  | S-25 |  |

| Management’s discussion and analysis of financial condition and results of operations |  |  | S-27 |  |

| Business |  |  | S-38 |  |

| Management |  |  | S-62 |  |

| Our principal and selling securityholders |  |  | S-66 |  |

| Capitalization |  |  | S-70 |  |

| Dilution |  |  | S-71 |  |

| Description of capital stock |  |  | S-72 |  |

| Certain United States federal tax considerations to non-United States holders |  |  | S-73 |  |

| Underwriting |  |  | S-76 |  |

| Legal matters |  |  | S-82 |  |

| Experts |  |  | S-82 |  |

| Incorporation by reference |  |  | S-82 |  |

| Where you can find more information |  |  | S-83 |  |

| Disclosure of Commission position on indemnification for Securities Act liabilities |  |  | S-83 |  |

| Prospectus Dated September 26, 2007 |  |  |  |  |

| Forward-looking statements |  |  | ii |  |

| About this prospectus |  |  | 1 |  |

| Summary of business |  |  | 2 |  |

| Risk factors |  |  | 3 |  |

| Use of proceeds |  |  | 4 |  |

| Selling securityholders |  |  | 5 |  |

| Plan of distribution |  |  | 8 |  |

| Legal matters |  |  | 10 |  |

| Experts |  |  | 10 |  |

| Incorporation by reference |  |  | 10 |  |

| Where you can find more information |  |  | 11 |  |

| Disclosure of Commission position on indemnification for Securities Act liabilities |  |  | 11 |  |

This prospectus supplement and the accompanying prospectus contain our trademarks and trademarks of our affiliates, and may contain trademarks, trade names and service marks of other parties. Unless we indicate otherwise, references in this prospectus supplement and the accompanying prospectus to ‘‘our company,’’ ‘‘we,’’ ‘‘our,’’ and ‘‘us’’ refer to Protalix BioTherapeutics, Inc. and our wholly owned subsidiary, Protalix Ltd., an Israeli corporation.

S-i

Forward-looking statements

The statements set forth and incorporated by reference in this prospectus supplement and the accompanying prospectus, which are not historical, constitute ‘‘forward looking statements’’ within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding our expectations, beliefs, intentions or strategies for the future. When used in this prospectus supplement and the accompanying prospectus, the terms ‘‘anticipate,’’ ‘‘believe,’’ ‘‘estimate,’’ ‘‘expect’’ and ‘‘intend’’ and words or phrases of similar import, as they relate to us, our subsidiary or our management, are intended to identify forward-looking statements. We intend that all forward-looking statements be subject to the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are only predictions and reflect our views as of the date they are made with respect to future events and financial performance and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events, except as may be required under applicable law. Forward-looking statements are subject to many risks and uncertainties that could cause our actual results to differ materially from any future results expressed or implied by the forward-looking statements.

Examples of the risks and uncertainties include, but are not limited to, the following:

the inherent risks and uncertainties in developing drug platforms and products of the type we are developing;

delays in our preparation and filing of applications for regulatory approval;

delays in the approval or potential rejection of any applications we file with the United States Food and Drug Administration, or other regulatory authorities;

any lack of progress of our research and development (including the results of clinical trials we are conducting);

obtaining on a timely basis sufficient patient enrollment in our clinical trials;

the impact of development of competing therapies and/or technologies by other companies;

our ability to obtain additional financing required to fund our research programs;

the risk that we will not be able to develop a successful sales and marketing organization in a timely manner, if at all;

our ability to establish and maintain strategic license, collaboration and distribution arrangements and to manage our relationships with collaborators, distributors and partners;

potential product liability risks and risks of securing adequate levels of product liability and clinical trial insurance coverage;

the availability of reimbursement to patients from health care payors for procedures in which our products are used;

the possibility of infringing a third party’s patents or other intellectual property rights;

the uncertainty of obtaining patents covering our products and processes and successfully enforcing them against third parties; and

the possible disruption of our operations due to terrorist activities and armed conflict, including as a result of the disruption of the operations of regulatory authorities, our subsidiary, our manufacturing facilities and our customers, suppliers, distributors, collaborative partners, licensees and clinical trial sites.

S-ii

Forward-looking statements

In addition, companies in the pharmaceutical and biotechnology industries have suffered significant setbacks in advanced clinical trials, even after obtaining promising earlier trial results. These and other risks and uncertainties are detailed under the heading ‘‘Risk Factors’’ herein and in our filings with the Securities and Exchange Commission incorporated by reference in this prospectus supplement and the accompanying prospectus. We undertake no obligation to update, and we do not have a policy of updating or revising, these forward-looking statements.

S-iii

Prospectus summary

This summary highlights information contained elsewhere in this prospectus supplement and the accompanying prospectus and the documents incorporated therein by reference. Because this is a summary, it does not contain all of the information that you should consider before buying our common stock in this offering. You should read the entire prospectus supplement and the accompanying prospectus carefully, including the information under the heading ‘‘Risk factors’’ beginning on page S-5 and the information incorporated by reference in this prospectus supplement and the accompanying prospectus. Except as otherwise stated, all information in this prospectus supplement assumes that the underwriters in this offering do not exercise their over-allotment option.

Our Business

We are a biopharmaceutical company focused on the development and commercialization of recombinant therapeutic proteins based on our proprietary ProCellExtm protein expression system. Using our ProCellEx system we are developing a pipeline of proprietary recombinant therapeutic proteins based on our plant cell-based expression technology that target large, established pharmaceutical markets and that rely upon known biological mechanisms of action. Our initial commercial focus has been on complex therapeutic proteins, including proteins for the treatment of genetic disorders, such as Gaucher disease and Fabry disease, and female infertility disorders. We believe our ProCellEx protein expression system will enable us to develop proprietary recombinant proteins that are therapeutically equiv alent or superior to existing recombinant proteins currently marketed for the same indications. Because we are targeting biologically equivalent versions of highly active, well-tolerated and commercially successful therapeutic proteins, we believe our development process is associated with relatively less risk compared to other biopharmaceutical development processes for novel therapeutic proteins.

Our Lead Product Candidate, prGCD

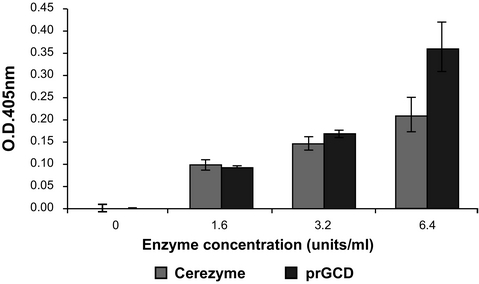

Our lead product development candidate is prGCD for the treatment of Gaucher disease, which we are developing using our ProCellEx protein expression system. In July 2007, we reached an agreement with the United States Food and Drug Administration, or the FDA, on the final design of our pivotal phase III clinical trial of prGCD, through the FDA’s special protocol assessment (SPA) process. In the third quarter of 2007, we initiated enrollment and treatment of patients in our phase III clinical trial of prGCD. prGCD is our proprietary recombinant form of Glucocerebrosidase (GCD), an enzyme naturally found in human cells that is mutated or deficient in patients with Gaucher disease. The current standard of care for Gaucher disease is enzyme replacement therapy, a medical treatment in which GC D is replaced for patients in whom the enzyme is lacking or dysfunctional. Although Gaucher disease is a relatively rare disease, it represents a large commercial market due to the severity of the symptoms and the chronic nature of the disease. The annual worldwide sales of Cerezyme®, an enzyme replacement therapy produced by Genzyme Corporation and currently the only approved enzyme replacement therapy for Gaucher disease, were approximately $1 billion in 2006, and $546.8 million for the six months ended June 30, 2007, according to public reports by Genzyme. prGCD is a plant cell expressed version of the GCD enzyme, developed through our ProCellEx protein expression system. prGCD has an amino acid, glycan and three-dimensional structure that is very similar to its naturally-produced counterpart as well as to Cerezyme, the mammalian cell expressed version of the same protein. We believe prGCD may prove more cost-effective than the currently marketed alternative due to the c ost benefits of expression through our ProCellEx protein expression system. In addition, based on our laboratory testing, preclinical and clinical results, we believe that prGCD may have the potential for increased potency and efficacy compared to the existing enzyme replacement therapy for Gaucher disease which may translate into lower dosages and/or less frequent treatments.

Other Drug Candidates in Our Pipeline

In addition to prGCD, we are developing an innovative product pipeline using our ProCellEx protein expression system, including therapeutic protein candidates for the treatment of Fabry disease, a rare, genetic lysosomal disorder in humans and female infertility disorders. We plan to file an investigational new drug application (IND) with the FDA with respect to at least one additional product during 2008. Because these

S-1

product candidates are based on well-understood proteins with known biological mechanisms of action, we believe we may be able to reduce the development risks and time to market for our product candidates. We hold the worldwide commercialization rights to our proprietary development candidates and we intend to establish an internal, commercial infrastructure and targeted sales force to market prGCD and our other products, if approved, in North America, the European Union and in other significant markets, including Israel.

ProCellEx: Our Proprietary Protein Expression System

Our ProCellEx protein expression system consists of a comprehensive set of technologies and capabilities for the development of recombinant proteins, including advanced genetic engineering technology and plant cell-based protein expression methods. Through our ProCellEx protein expression system, we can develop highly complex recombinant therapeutic proteins all the way to the scale-up of a purified product produced in compliance with current good manufacturing practices, or cGMP. We believe that our plant cell-based expression technology will enable us, in certain cases, to develop and commercialize recombinant proteins without infringing upon the method-based patents or other intellectual property rights of third parties. Moreover, we expect to enjoy method-based patent protection for the proteins we develop using our proprietary ProCellEx protein expression technology, although there can be no assurance that any such patents will be granted. In some cases, we may be able to obtain patent protection for the compositions of the proteins themselves. We have filed for United States and international composition of matter patents for prGCD.

Our ProCellEx protein expression system is built on flexible custom-designed bioreactors made of polyethylene and optimized for the development of complex proteins in plant cell cultures. These bioreactors entail low initial capital investment, are rapidly scalable at a low cost and require less hands-on maintenance between cycles, compared to the highly complex, expensive, stainless steel bioreactors typically used in mammalian cell-based production systems. As a result, through our ProCellEx protein expression system, we believe that we can develop recombinant therapeutic proteins yielding substantial cost advantages, accelerated development and other competitive benefits as compared to mammalian cell-based protein expression systems.

We have successfully demonstrated the feasibility of our ProCellEx system by expressing, on an exploratory, research scale, many complex therapeutic proteins belonging to different drug classes, such as enzymes, hormones, monoclonal antibodies, cytokines and vaccines. The therapeutic proteins we have expressed to date in research models have produced the intended composition and similar biological activity compared to their respective human-equivalent proteins. Moreover, several of such proteins demonstrated advantageous biological activity when compared to the biotherapeutics currently available in the market to treat the applicable disease or disorder. We believe that clinical success of prGCD would be a strong proof-of-concept for our ProCellEx protein expression system and plant cell-based prote in expression technology. We also believe that the significant benefits of our ProCellEx protein expression system, if further substantiated in clinical trials and commercialization of our product candidates, have the potential to transform the industry standard for the development of complex therapeutic proteins.

Competitive Advantages of Our ProCellEx Protein Expression System

We believe that our ProCellEx protein expression system, including our advanced genetic engineering technology and plant cell-based protein expression methods, affords us a number of significant advantages over mammalian, bacterial, yeast and transgenic cell-based expression technologies, including the following:

Ability to penetrate certain patent-protected markets.

Significantly lower capital and production costs.

More effective and potent end product relative to mammalian based systems.

Elimination of the risk of viral transmission or infection by mammalian components.

Broad range of expression capabilities.

S-2

Strategic Collaborations

In addition to the product candidates that we are developing internally, we have entered into agreements for additional compounds with academic institutions, including a licensing agreement with the technology transfer arm of Israel’s Weizmann Institute of Science and an agreement with the technology transfer arm of the Hebrew University of Jerusalem. We are also collaborating with other pharmaceutical companies to develop therapeutic proteins that can benefit from the significant cost, intellectual property and other competitive advantages of our ProCellEx protein expression system. We entered into an agreement with Teva Pharmaceutical Industries Ltd. in September 2006 under which we have agreed to collaborate on the research and development of two proteins to be developed using our ProC ellEx protein expression system. We also continuously review and consider additional development and commercialization alliances with other pharmaceutical companies and academic institutions.

Our Strategy

Our goal is to become a leading fully integrated biopharmaceutical company focused on the development and commercialization of proprietary recombinant therapeutic proteins. To achieve our goal, we intend to:

Obtain regulatory approval for prGCD for the treatment of Gaucher disease.

Develop a pipeline of innovative recombinant therapeutic proteins.

Build a targeted sales and marketing infrastructure.

Establish development and commercialization alliances with corporate partners.

Acquire or in-license new technologies, products or companies.

Leverage strength and experience of our management team and board of directors.

S-3

The offering

Common stock we are offering

3,726,708 shares

Common stock being offered by our selling securityholders

1,242,236 shares

Total

4,968,944 shares

Common stock outstanding immediately following this offering

69,502,963 shares

AMEX symbol

PLX

Use of proceeds

We estimate that the net proceeds to us from the offering after expenses will be approximately $121.0 million, assuming a public offering price of $35.00* per share. The net proceeds from the securities sold by us will be added to our general corporate funds and may be used for research and development expenses, clinical trials, establishing an internal sales force and general corporate and administrative purposes. We expect to use a portion of the proceeds of any offering by us in connection with the construction and furnishing of a new manufacturing facility.

We will not receive any proceeds from the sale of shares of common stock by the selling securityholders.

Risk factors

See ‘‘Risk factors’’ beginning on page S-5 of this prospectus supplement for a discussion of factors you should carefully consider before deciding to invest in shares of our common stock.

The number of shares of our common stock to be outstanding after this offering is based on the number of shares outstanding as of September 15, 2007, and does not include:

5,443,686 shares of common stock available for issuance under our employee stock incentive plan as of September 15, 2007; and

6,341,618 shares of common stock issuable upon the exercise of outstanding options and warrants as of September 15, 2007.

Unless otherwise stated, all information contained in this prospectus supplement assumes that the underwriters do not exercise their over-allotment option, and all currency amounts in this prospectus are stated in US dollars.

*

Throughout the prospectus supplement, we have used the $35.00 per share assumed public offering price, which is based upon the last reported sales price of $35.90 for our common stock on the AMEX on October 2, 2007. Given the limited liquidity of our common stock, this trading price may not reflect the actual fair market value of our common stock. The trading of our common stock, including as a result of the marketing of the offering described in this prospectus supplement, may depress the trading price of our stock resulting in a significantly lower actual public offering price. See ‘‘The market price of our common stock may fluctuate significantly’’, ‘‘ Future sales of our common stock could reduce our stock price’’ and ‘‘Trading of our commo n stock is limited’’ under the section titled ‘‘Risk Factors’’. The actual public offering price of the common stock we are offering will be negotiated between us and the underwriters.

You should rely only on the information incorporated by reference or provided in this prospectus supplement and the accompanying prospectus. We have not authorized anyone to provide you with different information.

S-4

Risk factors

Investment in our securities involves a high degree of risk. Our business, financial condition or results of operations could be adversely affected by any of these risks. If any of these risks occur, the value our common stock and our other securities may decline. You should carefully consider the risk factors discussed in this section with the other information included in this prospectus supplement and the accompanying prospectus, as well as the discussion set forth under the caption ‘‘Risk Factors’’ in our Annual Report on Form 10-K, as amended, for the year ended December 31, 2006, before making your investment decision, as well as those contained in any filing with the Commission subsequent to the date of the Annual Report. Our business, financial condition or results of operations could be adversely affected by any of these risks. If any of these risks occur, the value of our common stock could decline.

Risks Related to Our Business

We currently have no product revenues and will need to raise additional capital to operate our business, which may not be available on favorable terms, or at all, and which will have a dilutive effect on our shareholders.

To date, we have generated no revenues from product sales and only minimal revenues from research and development services and other fees. Our accumulated deficit as of June 30, 2007 was $33.1 million. For the years ended December 31, 2006, 2005 and 2004, we had net losses of $9.4 million, $5.7 million and $2.4 million, respectively, primarily as a result of expenses incurred through a combination of research and development activities and expenses supporting those activities. Drug development and commercialization is very capital intensive. Until we receive approval from the FDA and other regulatory authorities for our drug candidates, we cannot sell our drugs and will not have product revenues. Therefore, for the foreseeable future, we will have to fund all of ou r operations and capital expenditures from the net proceeds of any equity or debt offerings, cash on hand, licensing fees and grants. Over the next 12 months, we expect to spend a minimum of approximately $8 million on preclinical and clinical development for our products under development. Based on our current plans and capital resources, we believe that our cash and cash equivalents will be sufficient to enable us to meet our minimum planned operating needs for at least the next 12 months. However, changes may occur that could consume our existing capital at a faster rate than projected, including, among others, changes in the progress of our research and development efforts, the cost and timing of regulatory approvals and the costs of protecting our intellectual property rights. We expect to seek additional financing to implement and fund product development, preclinical studies and clinical trials for the drugs in our pipeline, as well as additional drug candidates and other research and development projects. If we are unable to secure additional financing in the future on acceptable terms, or at all, we may be unable to commence or complete planned preclinical and clinical trials or obtain approval of our drug candidates from the FDA and other regulatory authorities. In addition, we may be forced to reduce or discontinue product development or product licensing, reduce or forego sales and marketing efforts and other commercialization activities or forego attractive business opportunities in order to improve our liquidity and to enable us to continue operations which would have a material adverse effect on our business and results of operations. Any additional sources of financing will likely involve the issuance of our equity securities, which will have a dilutive effect on our shareholders.

We are not currently profitable and may never become profitable which would have a material adverse effect on our business and results of operations and could negatively impact the value of our common stock.

We expect to incur substantial losses for the foreseeable future and may never become profitable. We also expect to continue to incur significant operating and capital expenditures, and we anticipate that our expenses will increase substantially in the foreseeable future as we:

continue to undertake preclinical development and clinical trials for our current and new drug candidates;

seek regulatory approvals for our drug candidates;

implement additional internal systems and infrastructure;

seek to license-in additional technologies to develop; and

hire additional personnel.

S-5

Risk factors

We also expect to continue to experience negative cash flow for the foreseeable future as we fund our operating losses and capital expenditures. As a result, we will need to generate significant revenues in order to achieve and maintain profitability. We may not be able to generate these revenues or achieve profitability in the future. Any failure to achieve or maintain profitability would have a material adverse effect on our business and results of operations and could negatively impact the value of our common stock.

We have a limited operating history which may limit the ability of investors to make an informed investment decision.

We are a clinical stage biopharmaceutical company. To date, we have not commercialized any of our drug candidates or received any FDA or other approval to market any drug. The successful commercialization of our drug candidates will require us to perform a variety of functions, including:

continuing to undertake preclinical development and clinical trials;

participating in regulatory approval processes;

formulating and manufacturing products; and

conducting sales and marketing activities.

Our operations have been limited to organizing and staffing our company, acquiring, developing and securing our proprietary technology and undertaking, through third parties, preclinical trials and clinical trials of our principal drug candidates. To date, we have commenced a phase III clinical trial in connection with only one drug candidate, prGCD, and we have not commenced the preclinical trial phase of development under Good Laboratory Practice (GLP) standards for any of our other drug candidates. These operations provide a limited basis for investors to assess our ability to commercialize our drug candidates and whether to invest in us.

Our ProCellEx protein expression system is based on our proprietary plant cell-based expression technology which has a limited history and any material problems with the system, which may be unforeseen, may have a material adverse effect on our business and results of operations.

Our ProCellEx protein expression system is based on our proprietary plant cell-based expression technology. Our business is dependent upon the successful development and approval of our product candidates produced through our protein expression system. Our ProCellEx protein expression system is novel and is still in the early stages of development and optimization, and, accordingly, is subject to certain risks. Mammalian cell-based protein expression systems have been used in connection with recombinant therapeutic protein expression for more than 20 years and are the subject of a wealth of data; in contrast, there is not a significant amount of data generated regarding plant cell-based protein expression and, accordingly, plant cell-based protein expression systems may be subject to unknown risks. In addition, the protein glycosilation pattern created by our protein expression system is not identical to the natural human glycosilation pattern and its long term effect on human patients is still unknown. Lastly, as our protein expression system is a new technology, we cannot always rely on existing equipment; rather, there is a need to design custom-made equipment and to generate specific growth media for the plant cells, which may not be available at favorable prices, if at all. Any material problems with the technology underlying our plant cell-based protein expression system may have a material adverse effect on our business and results of operations.

We currently depend heavily on the success of prGCD, our lead product candidate which is in clinical development. Any failure to commercialize prGCD, or the experience of significant delays in doing so, will have a material adverse effect on our business, results of operations and financial condition.

We have invested a significant portion of our efforts and financial resources in the development of prGCD. Our ability to generate product revenue, which we do not expect to occur in the near term, if at all, will depend heavily on the successful development and commercialization of prGCD. The successful commercialization of prGCD will depend on several factors, including the following:

successful completion of our clinical trials for prGCD;

obtaining marketing approvals from the FDA and other foreign regulatory authorities;

S-6

Risk factors

maintaining the cGMP compliance of our manufacturing facility or establishing manufacturing arrangements with third parties;

the successful audit of our facilities by the FDA and other foreign regulatory authorities;

a continued acceptable safety and efficacy profile of our product candidates following approval; and

other risks described in these Risk Factors.

Any failure to commercialize prGCD or the experience of significant delays in doing so will have a material adverse effect on our business, results of operations and financial condition.

All of our product candidates other than prGCD are in research stages. If we are unable to develop and commercialize our other product candidates, our business will be adversely affected.

A key element of our strategy is to develop and commercialize a portfolio of new products in addition to prGCD. We are seeking to do so through our internal research programs and strategic collaborations for the development of new products. Research programs to identify new product candidates require substantial technical, financial and human resources, whether or not any product candidates are ultimately identified. Our research programs may initially show promise in identifying potential product candidates, yet fail to yield product candidates for clinical development for many reasons, including the following:

the research methodology used may not be successful in identifying potential product candidates;

competitors may develop alternatives that render our product candidates obsolete;

a product candidate may on further study be shown to have harmful side effects or other characteristics that indicate it is unlikely to be effective or otherwise does not meet applicable regulatory approval;

a product candidate is not capable of being produced in commercial quantities at an acceptable cost, or at all; or

a product candidate may not be accepted by patients, the medical community or third-party payors.

We may not obtain the necessary U.S. or worldwide regulatory approvals to commercialize our drug candidates in a timely manner, if at all, which would have a material adverse effect on our business and results of operations.

We will need FDA approval to commercialize our drug candidates in the United States and approvals from foreign regulators to commercialize our drug candidates elsewhere. In order to obtain FDA approval of any of our drug candidates, we must submit to the FDA a New Drug Application, an NDA, demonstrating that the drug candidate is safe for humans and effective for its intended use. This demonstration requires significant research and animal tests, which are referred to as preclinical studies, as well as human tests, which are referred to as clinical trials. Satisfaction of the FDA’s regulatory requirements typically takes many years, and depends upon the type, complexity and novelty of the drug candidate and requires substantial resources for research, development and testing. Our research and clinical efforts may not result in drugs that the FDA considers safe for humans and effective for indicated uses which would have a material adverse effect on our business and results of operations. After clinical trials are completed for any drug candidate, if at all, the FDA has substantial discretion in the drug approval process of the drug candidate and may require us to conduct additional clinical testing or to perform post-marketing studies which would cause us to incur additional costs. Incurring such costs could have a material adverse effect on our business and results of operations.

The approval process for any drug candidate may also be delayed by changes in government regulation, future legislation or administrative action or changes in FDA policy that occur prior to or during its regulatory review of such drug candidate. Delays in obtaining regulatory approvals with respect to any drug candidate may:

delay commercialization of, and our ability to derive product revenues from, such drug candidate;

require us to perform costly procedures with respect to such drug candidate; or

otherwise diminish any competitive advantages that we may have with respect to such drug candidate.

S-7

Risk factors

Even if we comply with all FDA requests, the FDA may ultimately reject one or more of the NDAs we file in the future, if any, or we might not obtain regulatory clearance in a timely manner. Companies in the pharmaceutical and biotechnology industries have suffered significant setbacks in advanced clinical trials, even after obtaining promising earlier trial results. Failure to obtain FDA approval of any of our drug candidates in a timely manner, if at all, will severely undermine our business and results of operation by reducing our potential marketable products and our ability to generate corresponding product revenues.

In foreign jurisdictions, we must receive approval from the appropriate regulatory authorities before we can commercialize any drug. Foreign regulatory approval processes generally include all of the risks associated with the FDA approval procedures described above. We might not be able to obtain the approvals necessary to commercialize our drug candidates for sale outside of the United States in a timely manner, if at all, which could adversely affect our business, operating results and financial condition.

Clinical trials are very expensive, time-consuming and difficult to design and implement and may result in unforeseen costs which may have a material adverse effect on our business and results of operations.

Human clinical trials are very expensive and difficult to design and implement, in part because they are subject to rigorous regulatory requirements. The clinical trial process is also time-consuming. Our drug candidates are in early stages of preclinical studies or clinical trials. We estimate that clinical trials of prGCD or any of our other potential drug candidates will take at least several years to complete. Furthermore, failure can occur at any stage of the trials, and we may encounter problems that cause us to abandon or repeat preclinical studies or clinical trials. Failure or delay in the commencement or completion of our clinical trials may be caused by several factors, including:

unforeseen safety issues;

determination of dosing issues;

lack of effectiveness during clinical trials;

slower than expected rates of patient recruitment;

inability to monitor patients adequately during or after treatment;

inability or unwillingness of medical investigators and institutional review boards to follow our clinical protocols; and

lack of sufficient funding to finance the clinical trials.

Any failure or delay in commencement or completion of any clinical trials may have a material adverse effect on our business and results of operations. In addition, we or the FDA or other regulatory authorities may suspend our clinical trials at any time if it appears that we are exposing participants to unacceptable safety or health risks or if the FDA or such other regulatory authorities, as applicable, find deficiencies in our IND submissions or the conduct of these trials. Any suspensions of our clinical trials may have a material adverse effect on our business and results of operations.

If the results of our clinical trials do not support our claims relating to any drug candidate or if serious side effects are identified, the completion of development of such drug candidate may be significantly delayed or we may be forced to abandon development altogether, which will significantly impair our ability to generate product revenues.

The results of our clinical trials with respect to any drug candidate might not support our claims of safety or efficacy, the effects of our drug candidates may not be the desired effects or may include undesirable side effects or the drug candidates may have other unexpected characteristics. Further, success in preclinical testing and early clinical trials does not ensure that later clinical trials will be successful, and the results of later clinical trials may not replicate the results of prior clinical trials and preclinical testing. The clinical trial process may fail to demonstrate that our drug candidates are safe for humans and effective for indicated uses. In addition, our clinical trials may involve a specific and small patient population. Because of the small sample size, the results of t hese early clinical trials may not be indicative of future results. Adverse or inconclusive results may cause us to

S-8

Risk factors

abandon a drug candidate and may delay development of other drug candidates. Any delay in, or termination of, our clinical trials will delay the filing of our NDAs with the FDA and, ultimately, significantly impair our ability to commercialize our drug candidates and generate product revenues which would have a material adverse effect on our business and results of operations.

We may find it difficult to enroll patients in our clinical trials, which could cause significant delays in the completion of such trials or may cause us to abandon one or more clinical trials.

Each of the diseases or disorders that our product candidates are intended to treat is relatively rare and we expect only a subset of the patients with these diseases to be eligible for our clinical trials. Given that each of our product candidates is in the early stages of preclinical or clinical development, we may not be able to initiate or continue clinical trials for each or all of our product candidates if we are unable to locate a sufficient number of eligible subjects to participate in the clinical trials required by the FDA and/or other foreign regulatory authorities. The requirements of our clinical testing mandate that a patient cannot be involved in another clinical trial for the same indication. We are aware that our competitors have ongoing clinical trials for products that are competi tive with our product candidates and subjects who would otherwise be eligible for our clinical trials may be involved in such testing, rendering them unavailable for testing of our product candidates. Our inability to enroll a sufficient number of patients for any of our current or future clinical trials would result in significant delays or may require us to abandon one or more clinical trials altogether, which would have a material adverse effect on our business.

If physicians, patients, third party payors and others in the medical community do not accept and use our drugs, our ability to generate revenue from sales of our products under development will be materially impaired.

Even if the FDA or other foreign regulatory authorities approve any of our drug candidates for commercialization, physicians and patients, and other healthcare providers, may not accept and use such candidates. Future acceptance and use of our products will depend upon a number of factors including:

perceptions by physicians, patients, third party payors and others in the medical community, about the safety and effectiveness of our drug candidates;

the willingness of the target patient population to try new therapies and of physicians to prescribe these therapies;

the prevalence and severity of any side effects, including any limitations or warnings contained in our product’s approved labeling;

pharmacological benefit of our products relative to competing products and products under development;

the efficacy and potential advantages relative to competing products and products under development;

relative convenience and ease of administration;

effectiveness of education, marketing and distribution efforts by us and our licensees and distributors, if any;

publicity concerning our products or competing products and treatments;

reimbursement of our products by third party payors; and

the price for our products and competing products.

Because we expect sales of our current drug candidates, if approved, to generate substantially all of our product revenues for the foreseeable future, the failure of any of these drugs to find market acceptance would harm our business and revenues from sales of our products would be materially impaired.

S-9

Risk factors

Because our clinical trials depend upon third-party researchers, the results of our clinical trials and such research activities are subject to delays and other risks which are, to a certain extent, beyond our control, which could impair our clinical development programs and our competitive position.

We depend upon independent investigators and collaborators, such as universities and medical institutions, to conduct our preclinical and clinical trials. These collaborators are not our employees, and we cannot control the amount or timing of resources that they devote to our clinical development programs. The investigators may not assign as great a priority to our clinical development programs or pursue them as diligently as we would if we were undertaking such programs directly. If outside collaborators fail to devote sufficient time and resources to our clinical development programs, or if their performance is substandard, the approval of our FDA and other applications, if any, and our introduction of new drugs, if any, may be delayed which could impair our clinical development programs and woul d have a material adverse effect on our business and results of operations. The collaborators may also have relationships with other commercial entities, some of whom may compete with us. If our collaborators also assist our competitors, our competitive position could be harmed.

Our strategy, in many cases, is to enter into collaboration agreements with third parties to leverage our ProCellEx system to develop product candidates. If we fail to enter into these agreements or if we or the third parties do not perform under such agreements or terminate or elect to discontinue the collaboration, it could have a material adverse affect on our revenues.

Our strategy, in many cases, is to enter into collaboration arrangements with pharmaceutical companies to leverage our ProCellEx system to develop additional product candidates. Under these arrangements, we may grant to our collaboration partners rights to license and commercialize pharmaceutical products developed under collaboration agreements. Our collaboration partners may control key decisions relating to the development of the products and we may depend on our collaborators’ expertise and dedication of sufficient resources to develop and commercialize the products. The rights of our collaboration partners would limit our flexibility in considering alternatives for the commercialization of the developed products. To date, we have entered into an agreement with Teva Pharmaceutical Industri es Ltd., which relates to the development of two proteins, and licensing by Teva of such proteins in consideration for royalties and milestone payments. If we or any of our partners breach or terminate the agreements that make up such collaboration arrangements or such partners otherwise fail to conduct their collaboration-related activities in a timely manner or if there is a dispute about their obligations or if either party terminates the agreement or elects not to continue the collaboration, we may not enjoy the benefits of the collaboration agreements or receive any royalties or milestone payments from them.

The manufacture of our products is an exacting and complex process, and if we or one of our materials suppliers encounter problems manufacturing our products, it will have a material adverse effect on our business and results of operations.

The FDA and foreign regulators require manufacturers to register manufacturing facilities. The FDA and foreign regulators also inspect these facilities to confirm compliance with cGMP or similar requirements that the FDA or foreign regulators establish. We or our materials suppliers may face manufacturing or quality control problems causing product production and shipment delays or a situation where we or the supplier may not be able to maintain compliance with the FDA’s cGMP requirements, or those of foreign regulators, necessary to continue manufacturing our drug candidates. Any failure to comply with cGMP requirements or other FDA or foreign regulatory requirements could adversely affect our clinical research activities and our ability to market and develop our products. Our current facilit y has not been audited by the FDA or other foreign regulatory authorities and is unlikely to be audited until we submit an NDA for a product candidate. There can be no assurance that we will be able to comply with FDA or foreign regulatory manufacturing requirements for our current facility or any future facility that we may establish, which would have a material adverse effect on our business.

S-10

Risk factors

We rely on third parties for final processing of our prGCD candidate, which exposes us to a number of risks that may delay development, regulatory approval and commercialization of our product candidates or result in higher product costs.

We have no experience in the final filling and freeze drying steps of the drug manufacturing process. We have entered into a contract with Teva pursuant to which Teva has agreed to perform the final filling and freeze drying steps for prGCD in connection with our clinical trials. If any of our product candidates receive FDA or other regulatory authority approval, we will rely on Teva or other third-party contractors to perform the final manufacturing steps for our products on a commercial scale. We may be unable to identify manufacturers and replacement manufacturers on acceptable terms or at all because the number of potential manufacturers is limited and the FDA and other regulatory authorities, as applicable, must approve any replacement manufacturer, including us, and we or any such third party manufacturer might be unable to formulate and manufacture our drug products in the volume and of the quality required to meet our clinical and commercial needs. If we engage any contract manufacturers, such manufacturers may not perform as agreed or may not remain in the contract manufacturing business for the time required to supply our clinical or commercial needs. Each of these risks could delay our clinical trials, the approval, if any, of prGCD and our other potential drug candidates by the FDA or other regulatory authorities, or the commercialization of prGCD and our other drug candidates or could result in higher product costs or otherwise deprive us of potential product revenues.

We have no experience selling, marketing or distributing products and no internal capability to do so.

We currently have no sales, marketing or distribution capabilities and no experience in building a sales force and distribution capabilities. To commercialize our product candidates, we must either develop internal sales, marketing and distribution capabilities, which will be expensive and time consuming, or make arrangements with third parties to perform these services. If we decide to market any of our products directly, we must commit significant financial and managerial resources to develop a marketing and sales force with technical expertise and with supporting distribution capabilities. Building an in-house marketing and sales force with technical expertise and distribution capabilities will require significant expenditures, management resources and time. Factors that may inhibit our efforts t o commercialize our products directly and without strategic partners include:

our inability to recruit and retain adequate numbers of effective sales and marketing personnel;

the inability of sales personnel to obtain access to or persuade adequate numbers of physicians to prescribe our products;

the lack of complementary products to be offered by sales personnel, which may put us at a competitive disadvantage relative to companies with more extensive product lines; and

unforeseen costs and expenses associated with creating and sustaining an independent sales and marketing organization.

We may not be successful in recruiting the sales and marketing personnel necessary to sell our products and even if we do build a sales force, they may not be successful in marketing our products, which would have a material adverse effect on our business and results of operations.

If the market opportunities for our current product candidates are smaller than we believe they are, then our revenues may be adversely affected and our business may suffer.

The focus of our current clinical pipeline is on relatively rare disorders with small patient populations, in particular Gaucher disease and Fabry disease. Currently, most reported estimates of the prevalence of these diseases are based on studies of small subsets of the population of specific geographic areas, which are then extrapolated to estimate the prevalence of the diseases in the broader world population. As new studies are performed, the estimated prevalence of these diseases may change. There can be no assurance that the prevalence of Gaucher disease or Fabry disease in the study populations, particularly in these newer studies, accurately reflect the prevalence of these diseases in the broader world population. If the market opportunities for our current product candidates are smaller tha n we believe they are, our revenues may be adversely affected and our business may suffer.

S-11

Risk factors

We may enter into distribution arrangements and marketing alliances for certain products and any failure to successfully identify and implement these arrangements on favorable terms, if at all, may impair our ability to commercialize our product candidates.

While we intend to build a sales force to market prGCD and other product candidates, we do not anticipate having the resources in the foreseeable future to develop global sales and marketing capabilities for all of the products we develop, if any. We may pursue arrangements regarding the sales and marketing and distribution of one or more of our product candidates and our future revenues may depend, in part, on our ability to enter into and maintain arrangements with other companies having sales, marketing and distribution capabilities and the ability of such companies to successfully market and sell any such products. Any failure to enter into such arrangements and marketing alliances on favorable terms, if at all, could delay or impair our ability to commercialize our product candidates and could increase our costs of commercialization. Our use of distribution arrangements and marketing alliances to commercialize our product candidates will subject us to a number of risks, including the following:

we may be required to relinquish important rights to our products or product candidates;

we may not be able to control the amount and timing of resources that our distributors or collaborators may devote to the commercialization of our product candidates;

our distributors or collaborators may experience financial difficulties;

our distributors or collaborators may not devote sufficient time to the marketing and sales of our products; and

business combinations or significant changes in a collaborator’s business strategy may adversely affect a collaborator’s willingness or ability to complete its obligations under any arrangement.

We may need to enter into additional co-promotion arrangements with third parties where our own sales force is neither well situated nor large enough to achieve maximum penetration in the market. We may not be successful in entering into any co-promotion arrangements, and the terms of any co-promotion arrangements we enter into may not be favorable to us.

Developments by competitors may render our products or technologies obsolete or non-competitive which would have a material adverse effect on our business and results of operations.

We compete against fully integrated pharmaceutical companies and smaller companies that are collaborating with larger pharmaceutical companies, academic institutions, government agencies and other public and private research organizations. Our drug candidates will have to compete with existing therapies and therapies under development by our competitors. In addition, our commercial opportunities may be reduced or eliminated if our competitors develop and market products that are less expensive, more effective or safer than our drug products. Other companies have drug candidates in various stages of preclinical or clinical development to treat diseases for which we are also seeking to develop drug products. Some of these potential competing drugs are further advanced in development than our drug cand idates and may be commercialized earlier. Even if we are successful in developing effective drugs, our products may not compete successfully with products produced by our competitors.

We specifically face competition from companies with approved treatments of Gaucher disease, including Genzyme Corporation and to a certain extent, Actelion Ltd. In addition, we are aware of other early stage, experimental, small molecule, oral drugs which are being developed for the treatment of Gaucher disease by Amicus Therapeutics, Inc. and Genzyme. Shire plc is currently developing a gene-activated enzyme expressed in human cancer cells to treat Gaucher disease. We also face competition from companies with approved treatments of Fabry disease, including Genzyme and Shire, and we are aware of other early stage drugs which are being developed for the treatment of Fabry disease, including a drug being developed by Amicus Therapeutics.

We also face competition from companies that are developing other platforms for the expression of recombinant therapeutic pharmaceuticals. We are aware of companies that are developing alternative technologies to develop

S-12

Risk factors

and produce therapeutic proteins in anticipation of the expiration of certain patent claims covering marketed proteins. Competitors developing alternative expression technologies include Crucell N.V., Shire and GlycoFi Inc. (which was acquired by Merck). Other companies are developing alternate plant-based technologies, include Biolex, Inc., Chlorogen, Inc., Greenovation Biotech GmbH and Dow Agroscience.

Several biogeneric companies are pursuing the opportunity to develop and commercialize follow-on versions of other currently marketed biologic products, including growth factors, hormones, enzymes, cytokines and monoclonal antibodies, which are areas that interest us. These companies include, among others, Novartis AG/Sandoz Pharmaceuticals, BioGeneriX AG, Barr Pharmaceuticals, Stada Arzneimittel AG, BioPartners GmbH and Teva.

Most of our competitors, either alone or together with their collaborative partners, operate larger research and development programs, staff and facilities and have substantially greater financial resources than we do, as well as significantly greater experience in:

developing drugs;

undertaking preclinical testing and human clinical trials;

obtaining FDA and other regulatory approvals of drugs;

formulating and manufacturing drugs; and

launching, marketing and selling drugs.

These organizations also compete with us to attract qualified personnel, acquisitions and joint ventures candidates and for other collaborations. Activities of our competitors may impose unanticipated costs on our business which would have a material adverse effect on our business and results of operations.

If we fail to adequately protect or enforce our intellectual property rights or secure rights to third party patents, the value of our intellectual property rights would diminish and our business, competitive position and results of operations would suffer.

As of June 30, 2007, we had 44 pending patent applications and four joint pending patent applications, and held licensed rights to 21 pending patent applications. However, the filing of a patent application does not mean that we will be issued a patent, or that any patent eventually issued will be as broad as requested in the patent application or sufficient to protect our technology. Any modification required to a current patent application may delay the approval of such patent application which would have a material adverse effect on our business and results of operations. In addition, there are a number of factors that could cause our patents, if granted, to become invalid or unenforceable or that could cause our patent applications to not be granted, including known or unknown prior ar t, deficiencies in the patent application or the lack of originality of the technology.

Our competitive position and future revenues will depend in part on our ability and the ability of our licensors and collaborators to obtain and maintain patent protection for our products, methods, processes and other technologies, to preserve our trade secrets, to prevent third parties from infringing on our proprietary rights and to operate without infringing the proprietary rights of third parties. We have filed United States and international patent applications for process patents, as well as composition of matter patents, for prGCD. However, we cannot predict:

the degree and range of protection any patents will afford us against competitors and those who infringe upon our patents, including whether third parties will find ways to invalidate or otherwise circumvent our licensed patents;

if and when patents will issue;��

whether or not others will obtain patents claiming aspects similar to those covered by our licensed patents and patent applications; or

whether we will need to initiate litigation or administrative proceedings, which may be costly, and whether we win or lose.

S-13

Risk factors

We hold, or have license rights to, eight patents. If patent rights covering our products are not sufficiently broad, they may not provide us with sufficient proprietary protection or competitive advantages against competitors with similar products and technologies. Furthermore, if the United States Patent and Trademark Office or foreign patent offices issue patents to us or our licensors, others may challenge the patents or circumvent the patents, or the patent office or the courts may invalidate the patents. Thus, any patents we own or license from or to third parties may not provide any protection against our competitors and those who infringe upon our patents.

Furthermore, the life of our patents is limited. The patents we hold relating to our ProCellEx protein expression system will expire in 2016. If patents issue from other currently pending patent applications, those patents will expire between 2023 and 2027.

We rely on confidentiality agreements that could be breached and may be difficult to enforce which could have a material adverse effect on our business and competitive position.

Our policy is to enter agreements relating to the non-disclosure of confidential information with third parties, including our contractors, consultants, advisors and research collaborators, as well as agreements that purport to require the disclosure and assignment to us of the rights to the ideas, developments, discoveries and inventions of our employees and consultants while we employ them. However, these agreements can be difficult and costly to enforce. Moreover, to the extent that our contractors, consultants, advisors and research collaborators apply or independently develop intellectual property in connection with any of our projects, disputes may arise as to the proprietary rights to this type of information. If a dispute arises, a court may determine that the right belongs to a third party, and enforcement of our rights can be costly and unpredictable. In addition, we rely on trade secrets and proprietary know-how that we will seek to protect in part by confidentiality agreements with our employees, contractors, consultants, advisors or others. Despite the protective measures we employ, we still face the risk that:

these agreements may be breached;

these agreements may not provide adequate remedies for the applicable type of breach; or

our trade secrets or proprietary know-how will otherwise become known.

Any breach of our confidentiality agreements or our failure to effectively enforce such agreements would have a material adverse effect on our business and competitive position.

If we infringe the rights of third parties we could be prevented from selling products, forced to pay damages and required to defend against litigation which could result in substantial costs and may have a material adverse effect on our business and results of operations.

We have not received to date any claims of infringement by any third parties. However, as our drug candidates progress into clinical trials and commercialization, if at all, our public profile and that of our drug candidates may be raised and generate such claims. Defending against such claims, and occurrence of a judgment adverse to us, could result in unanticipated costs and may have a material adverse effect on our business and competitive position. If our products, methods, processes and other technologies infringe the proprietary rights of other parties, we could incur substantial costs and we may have to:

obtain licenses, which may not be available on commercially reasonable terms, if at all;

redesign our products or processes to avoid infringement;

stop using the subject matter claimed in the patents held by others, which could cause us to lose the use of one or more of our drug candidates;

defend litigation or administrative proceedings that may be costly whether we win or lose, and which could result in a substantial diversion of management resources; or

pay damages.

Any costs incurred in connection with such events or the inability to sell our products may have a material adverse effect on our business and results of operations

S-14

Risk factors

If we cannot meet requirements under our license agreements, we could lose the rights to our products, which could have a material adverse effect on our business.

We depend on licensing agreements with third parties to maintain the intellectual property rights to certain of our products under development. Presently, we have licensed rights from Yeda which allow us to use their technology and discoveries for the development, production and sale of enzymatically active mutations of GCD and derivatives thereof for the treatment of Gaucher disease. Our license agreements require us to make payments and satisfy performance obligations in order to maintain our rights under these agreements. All of these agreements last either throughout the life of the patents that are the subject of the agreements, or with respect to other licensed technology, for a number of years after the first commercial sale of the relevant product.

In addition, we are responsible for the cost of filing and prosecuting certain patent applications and maintaining certain issued patents licensed to us. If we do not meet our obligations under our license agreements in a timely manner, we could lose the rights to our proprietary technology which could have a material adverse effect on our business.

If we in-license drug candidates, we may delay or otherwise adversely affect the development of our existing drug candidates, which may negatively impact our business, results of operations and financial condition.

In addition to our own internally developed drug candidates, we proactively seek opportunities to in-license and advance other drug candidates that are strategic and have value-creating potential to take advantage of our development know-how and technology. If we in-license any additional drug candidates, our capital requirements may increase significantly. In addition, in-licensing additional drug candidates may place a strain on the time of our existing personnel, which may delay or otherwise adversely affect the development of our existing drug candidates or cause us to re-prioritize our drug pipeline if we do not have the necessary capital resources to develop all of our drug candidates, which may delay the development of our drug candidates and negatively impact our business, results of operati ons and financial condition.

If we are unable to successfully manage our growth, there could be a material adverse impact on our business, results of operations and financial condition.

We have grown rapidly and expect to continue to grow. We expect to hire more employees, particularly in the areas of drug development, regulatory affairs and sales and marketing, and increase our facilities and corporate infrastructure, further increasing the size of our organization and related expenses. To manage our anticipated future growth, we must continue to implement and improve our managerial, operational and financial systems, expand our facilities and continue to recruit and train additional qualified personnel. We have begun to prepare conceptual designs of a new manufacturing facility and are currently evaluating potential locations for such facility. Due to our limited resources, we may not be able to effectively manage the expansion of our operations or recruit and train additional qu alified personnel. The expansion of our operations may lead to significant costs and may divert our management and business development resources. Any inability on the part of our management to manage growth could delay the execution of our business plans or disrupt our operations. If we are unable to manage our growth effectively, we may not use our resources in an efficient manner, which may delay the development of our drug candidates and negatively impact our business, results of operations and financial condition.

If we acquire companies, products or technologies, we may face integration risks and costs associated with those acquisitions that could negatively impact our business, results from operations and financial condition.

If we are presented with appropriate opportunities, we may acquire or make investments in complementary companies, products or technologies. We may not realize the anticipated benefit of any acquisition or investment. If we acquire companies or technologies, we will face risks, uncertainties and disruptions associated with the integration process, including difficulties in the integration of the operations of an acquired company, integration of acquired technology with our products, diversion of our management’s attention from other business concerns, the potential loss of key employees or customers of the acquired business and impairment

S-15

Risk factors

charges if future acquisitions are not as successful as we originally anticipate. In addition, our operating results may suffer because of acquisition-related costs or amortization expenses or charges relating to acquired intangible assets. Any failure to successfully integrate other companies, products or technologies that we may acquire may have a material adverse effect on our business and results of operations. Furthermore, we may have to incur debt or issue equity securities to pay for any additional future acquisitions or investments, the issuance of which could be dilutive to our existing shareholders.

We depend upon key employees and consultants in a competitive market for skilled personnel. If we are unable to attract and retain key personnel, it could adversely affect our ability to develop and market our products.

We are highly dependent upon the principal members of our management team, especially our President and Chief Executive Officer, Dr. David Aviezer, as well as our directors, including Eli Hurvitz and Phillip Frost, M.D., scientific advisory board members, consultants and collaborating scientists. Many of these people have been involved with us for many years and have played integral roles in our progress, and we believe that they will continue to provide value to us. A loss of any of these personnel may have a material adverse effect on aspects of our business and clinical development and regulatory programs. We have employment agreements with Dr. Aviezer and four other officers that may be terminated by us or the applicable officer at any time with varying notice periods of 60 to 90 days. Although these employment agreements generally include non-competition covenants and provide for severance payments that are contingent upon the applicable employee’s refraining from competition with us, the applicable noncompetition provisions can be difficult and costly to monitor and enforce. The loss of any of these persons’ services would adversely affect our ability to develop and market our products and obtain necessary regulatory approvals. Further, we do not maintain key-man life insurance.

We also depend in part on the continued service of our key scientific personnel and our ability to identify, hire and retain additional personnel, including marketing and sales staff. We experience intense competition for qualified personnel, and the existence of non-competition agreements between prospective employees and their former employers may prevent us from hiring those individuals or subject us to suit from their former employers. While we attempt to provide competitive compensation packages to attract and retain key personnel, many of our competitors are likely to have greater resources and more experience than we have, making it difficult for us to compete successfully for key personnel.

Our collaborations with outside scientists and consultants may be subject to restriction and change.

We work with chemists, biologists and other scientists at academic and other institutions, and consultants who assist us in our research, development, regulatory and commercial efforts, including the members of our scientific advisory board. These scientists and consultants have provided, and we expect that they will continue to provide, valuable advice on our programs. These scientists and consultants are not our employees, may have other commitments that would limit their future availability to us and typically will not enter into non-compete agreements with us. If a conflict of interest arises between their work for us and their work for another entity, we may lose their services. In addition, we will be unable to prevent them from establishing competing businesses or developing competing product s. For example, if a key scientist acting as a principal investigator in any of our clinical trials identifies a potential product or compound that is more scientifically interesting to his or her professional interests, his or her availability to remain involved in such clinical trials could be restricted or eliminated.

Under current U.S. and Israeli law, we may not be able to enforce employees’ covenants not to compete and therefore may be unable to prevent our competitors from benefiting from the expertise of some of our former employees.

We have entered into non-competition agreements with all of our employees. These agreements prohibit our employees, if they cease working for us, from competing directly with us or working for our competitors for a limited period. Under current U.S. and Israeli law, we may be unable to enforce these agreements against most

S-16

Risk factors

of our employees and it may be difficult for us to restrict our competitors from gaining the expertise our former employees gained while working for us. If we cannot enforce our employees’ non-compete agreements, we may be unable to prevent our competitors from benefiting from the expertise of our former employees.

If product liability claims are brought against us, it may result in reduced demands for our products or damages that exceed our insurance coverage.