Exhibit 99.2

Protalix BioTherapeutics Corporate Update January 2017

This presentation contains forward - looking statements within the meaning of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended. The forward - looking statements including, among others, statements regarding expectations as to regulatory approvals, market opportunity for, and potential sales of, the Company’s product and pr oduct candidates, goals as to product candidate development and timing of the Company’s clinical trials, are based on the Company’ s current intent, belief and expectations. These statements are not guarantees of future performance and are subject to certain risks and uncer tai nties that are difficult to predict. Factors that might cause material differences include, among others: failure or delay in the commenceme nt or completion of the Company’s preclinical and clinical trials which may be caused by several factors, including: slower than expected rates of patient recruitment; unforeseen safety issues; determination of dosing issues; lack of effectiveness during clinical trials; inabilit y t o monitor patients adequately during or after treatment; inability or unwillingness of medical investigators and institutional review boards to fol low the Company’s clinical protocols; and lack of sufficient funding to finance clinical trials; the risk that the results of the clinical tria ls of the Company’s product candidates will not support the Company’s claims of safety or efficacy, that the Company’s product candidates will not have the desired effects or will be associated with undesirable side effects or other unexpected characteristics; the Company’s dependence on performance by third party providers of services and supplies, including without limitation, clinical trial services; delays in the Company’s preparation and filing of applications for regulatory approval; delays in the approval or potential rejection of any applications we file with the FDA or other health regulatory authorities, and other risks relating to the review process; the inherent risks and uncertainties in developing dr ug platforms and products of the type we are developing; the impact of development of competing therapies and/or technologies by other compani es and institutions; potential product liability risks, and risks of securing adequate levels of product liability and other necessa ry insurance coverage; and other factors described in the Company’s filings with the U.S. Securities and Exchange Commission. Existing and prospective investors are cautioned not to place undue reliance on these forward - looking statements, which speak only as of today’s date. The Company undertakes no obligation to update or revise the information contained in this presentation whether as a result of new information, futu re events or circumstances or otherwise. Note Regarding Forward - Looking Statements

3 Protalix Snapshot • FDA approval for plant cell culture based production of a protein - Elelyso® ( afaltaliglicerase ) • Protein production site approved by FDA, EMA and other major regulatory bodies world - wide • Phase II candidates : • Inhaled protein for Cystic Fibrosis • Oral protein for inflammatory diseases • Commercialization of alfataliglicerase in Brazil • Order of ~ $ 24 M for 2017 was secured • Phase III clinical program testing the superiority of drug candidate for Fabry Disease

Strategy Highlights 4 Focus on development of proprietary proteins with superior clinical profiles Execution of late stage clinical studies Advancement of early pipeline products into clinical development Significant reduction of capital consumption through sales of alfataliglicerase in Brazil

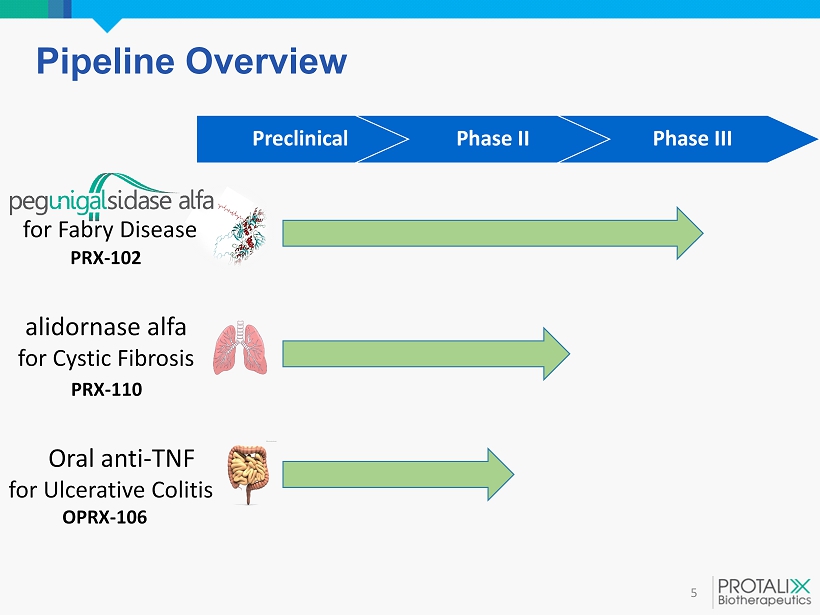

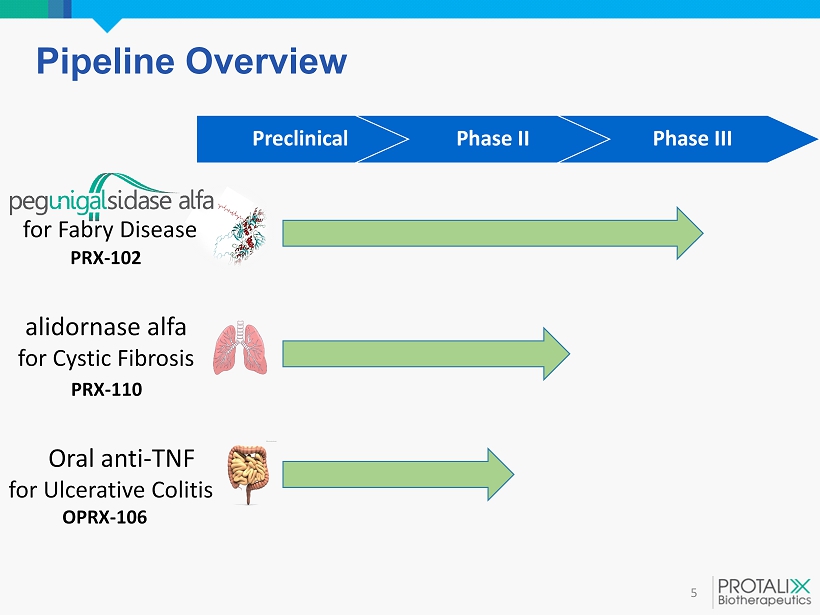

Pipeline Overview 5 for Fabry Disease PRX - 102 alidornase alfa for Cystic Fibrosis PRX - 110 Oral anti - TNF for Ulcerative Colitis OPRX - 106 Preclinical Phase II Phase III

for Fabry Disease (PRX - 102)

Fabry Disease 7 Rare genetic lysosomal storage disorder caused by deficiency in the enzyme α - galactosidase A. ~5,000 patients treated worldwide Lipids accumulate in key organs (kidney, heart, CNS ) leading to a progressive and potentially life threatening disease. Renal and Cardiac failures are the most predominant causes for morbidity ~$1.2B growing market (CAGR ~10%) Fabrazyme ® , Sanofi Enzyme Replacement Therapy (ERT) • Approved Worldwide Replagal ® , Shire • Approved ex - US only Galafold ™ , Amicus pharmacological chaperone • Approved in EU only • Only for patients with amenable mutations (~30%) Key Players

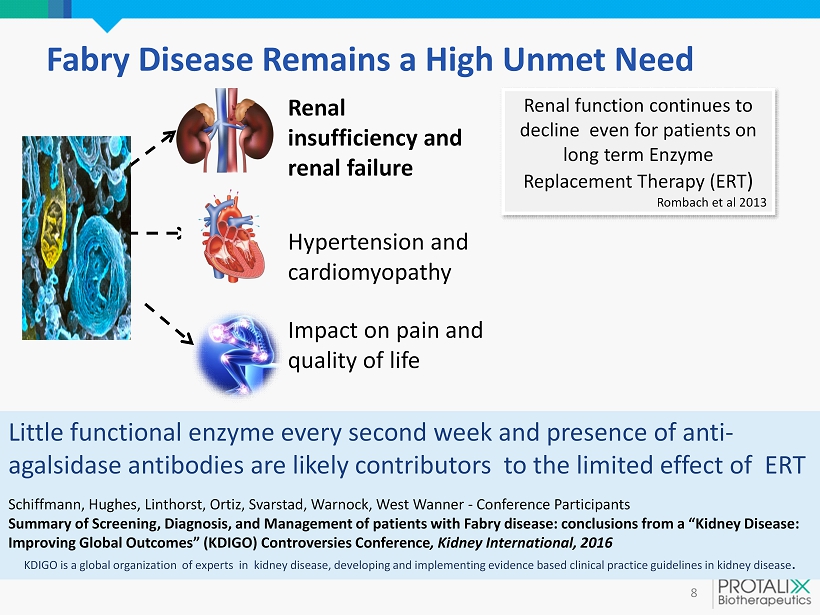

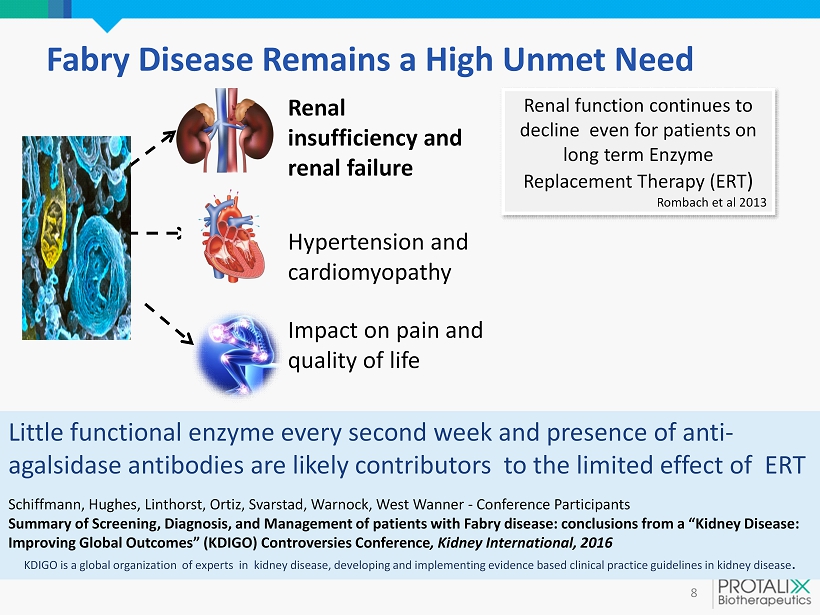

Fabry Disease Remains a High Unmet Need 8 Hypertension and cardiomyopathy Renal insufficiency and renal failure Impact on pain and quality of life Renal function continues to decline even for patients on long term Enzyme Replacement Therapy (ERT ) Rombach et al 2013 Little functional enzyme every second week and presence of anti - agalsidase antibodies are likely contributors to the limited effect of ERT Schiffmann , Hughes, Linthorst , Ortiz, Svarstad , Warnock, West Wanner - Conference Participants Summary of Screening, Diagnosis , and Management of patients with Fabry disease: conclusions from a ” Kidney Disease : Improving Global Outcomes” ( KDIGO) Controversies Conference , Kidney International, 2016 KDIGO is a global organization of experts in kidney disease, developing and implementing evidence based clinical practice guidelines in kidney disease .

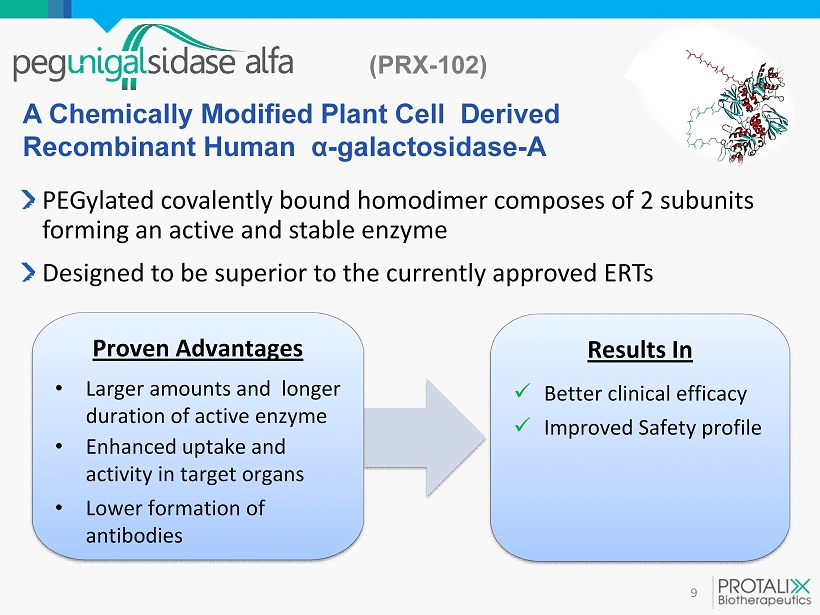

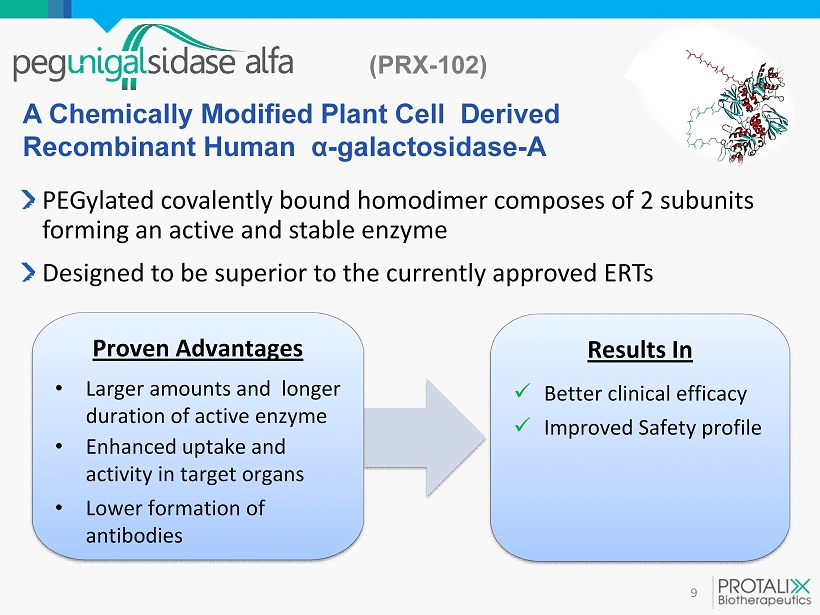

(PRX - 102 ) 9 PEGylated covalently bound homodimer composes of 2 subunits forming an active and stable enzyme Designed to be superior to the currently approved ERTs Proven Advantages • Larger amounts and longer duration of active enzyme • Enhanced uptake and activity in target organs • Lower formation of antibodies A Chemically Modified Plant Cell Derived Recombinant Human α - galactosidase - A Results In x Better clinical efficacy x Improved Safety profile

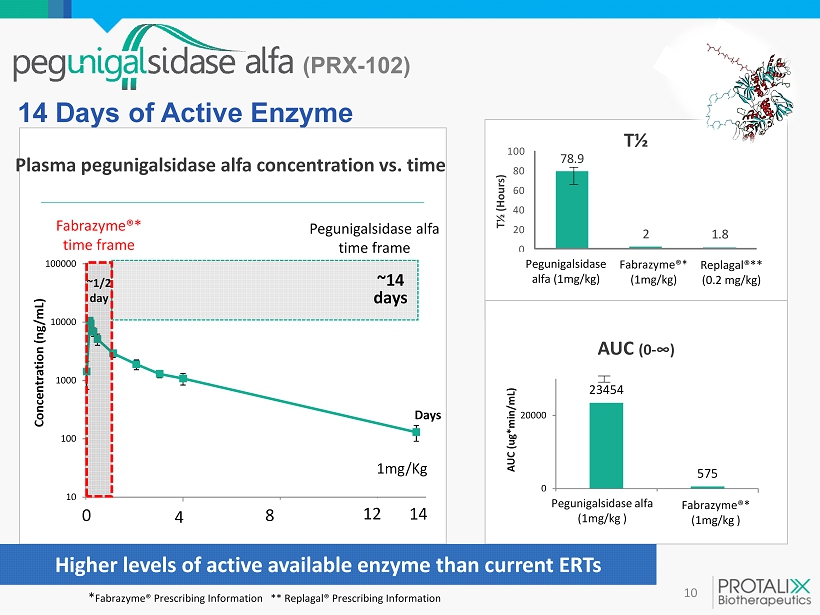

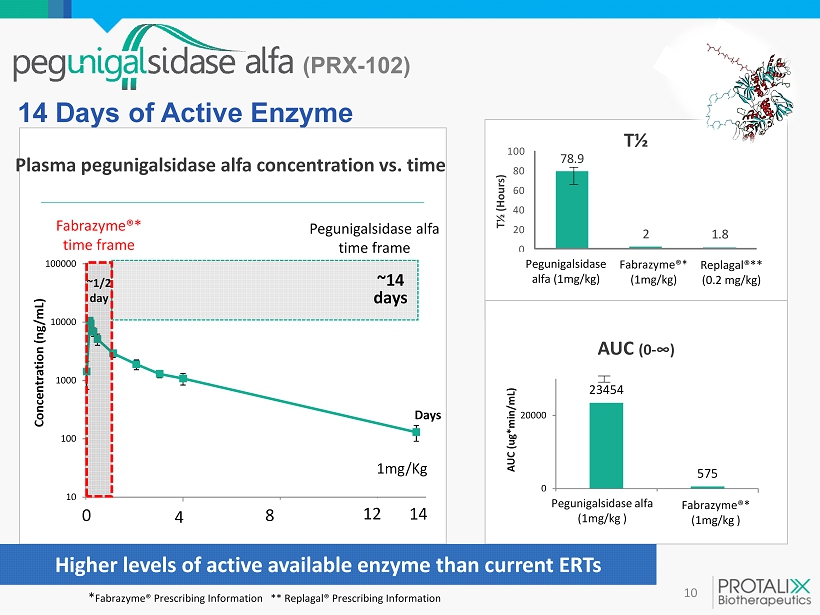

10 14 Days of Active Enzyme 10 100 1000 10000 100000 0 100 200 300 Concentration ( ng/mL) Days ~ 1 / 2 day ~14 days Plasma pegunigalsidase alfa concentration vs. time 1mg/Kg Pegunigalsidase alfa time frame Fabrazyme ®* time frame 4 8 14 12 0 T½ 78.9 2 1.8 0 20 40 60 80 100 Pegunigalsidase alfa (1mg/kg) Fabrazyme® (1mg/kg) Replagal® (0.2mg/kg) T½ (Hours) AUC (0 - ∞) 23454 575 0 20000 PRX-102 (1mg/Kg) Fabrazyme (1mg/Kg) AUC ( ug *min/mL) Higher levels of active available enzyme than current ERTs (PRX - 102) Pegunigalsidase alfa (1mg/kg ) Fabrazyme ®* (1mg/kg ) * Fabrazyme ® Prescribing Information ** Replagal ® Prescribing Information Pegunigalsidase alfa ( 1 mg/kg) Fabrazyme ®* (1mg/kg) Replagal ®** ( 0.2 mg/kg)

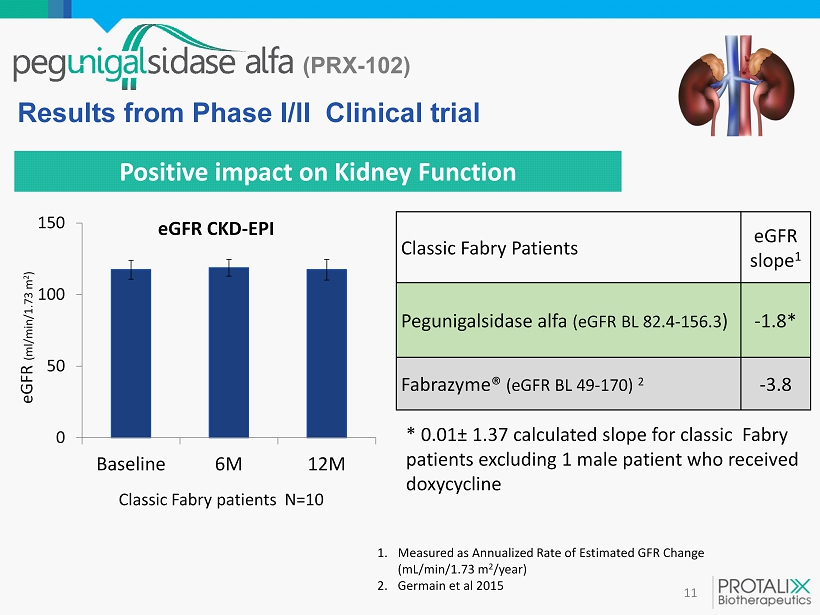

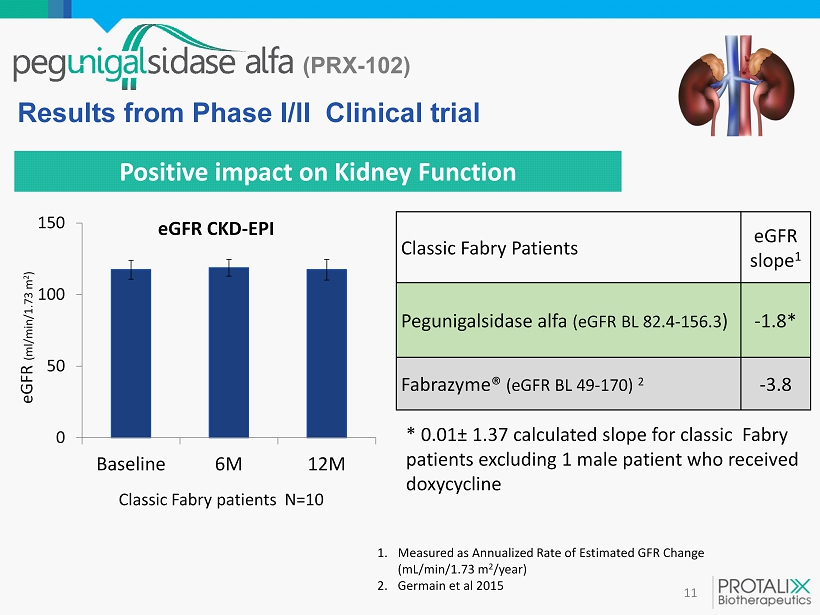

(PRX - 102) 11 Positive impact on Kidney Function Results from Phase I/II Clinical trial 1. Measured as Annualized Rate of Estimated GFR Change (mL/min/1.73 m 2 /year ) 2. Germain et al 2015 Classic Fabry Patients eGFR slope 1 Pegunigalsidase alfa ( eGFR BL 82.4 - 156.3 ) - 1.8* Fabrazyme ® ( eGFR BL 49 - 170) 2 - 3.8 0 50 100 150 Baseline 6M 12M eGFR CKD - EPI eGFR (ml/min/1.73 m 2 ) Classic Fabry patients N= 10 * 0.01 ± 1.37 calculated slope for classic Fabry patients excluding 1 male patient who received doxycycline

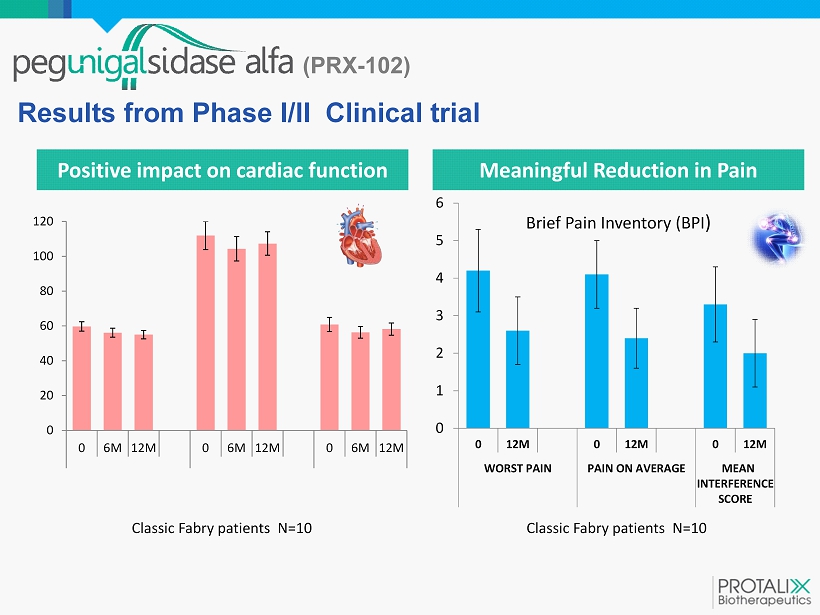

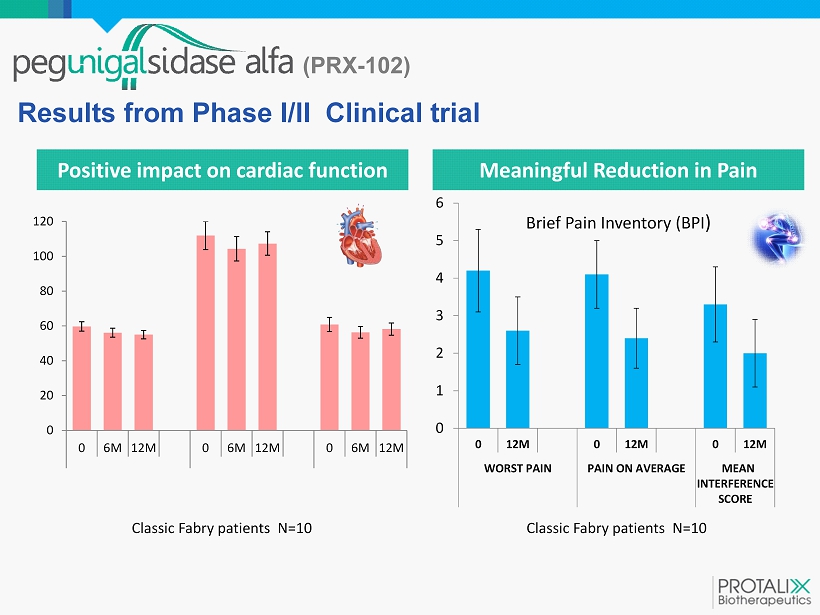

(PRX - 102) Positive impact on cardiac function Results from Phase I/II Clinical trial 0 20 40 60 80 100 120 0 6M 12M 0 6M 12M 0 6M 12M EJECTION FRACTION (%) LEFT VENTRICULAR MASS (g) LV MASS INDEX (g/m^2) Classic Fabry patients N=10 0 1 2 3 4 5 6 0 12M 0 12M 0 12M WORST PAIN PAIN ON AVERAGE MEAN INTERFERENCE SCORE Brief Pain Inventory (BPI ) Classic Fabry patients N=10 Meaningful Reduction in Pain

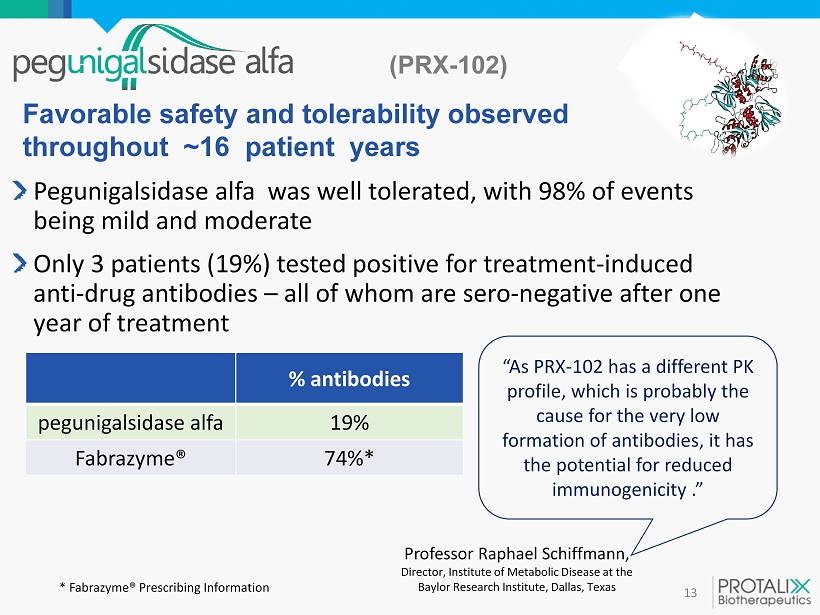

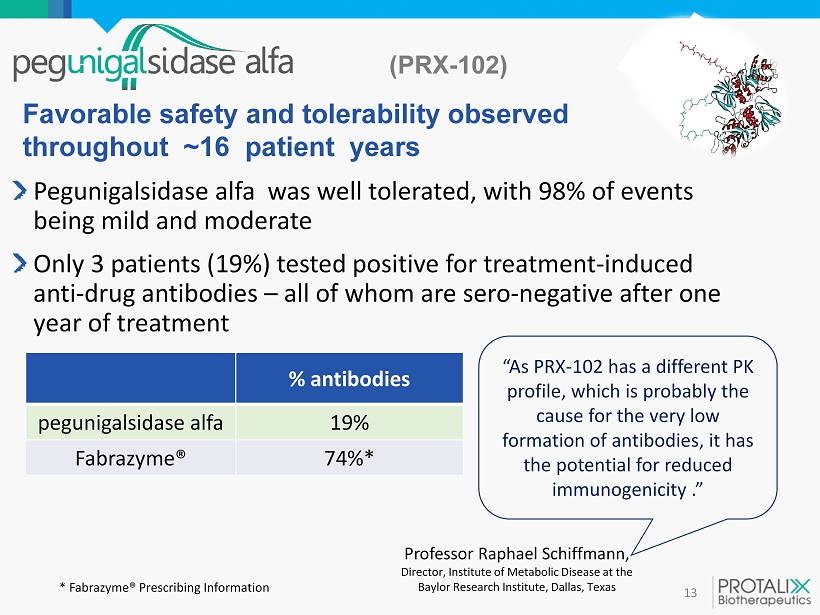

(PRX - 102) 13 Pegunigalsidase alfa was well tolerated, with 98% of events being mild and moderate Only 3 patients (19%) tested positive for treatment - induced anti - drug antibodies – all of whom are sero - negative after one year of treatment Favorable safety and tolerability observed throughout ~ 16 patient years “As PRX - 102 has a different PK profile, which is probably the cause for the very low formation of antibodies, it has the potential for reduced immunogenicity .” Professor Raphael Schiffmann , Director, Institute of Metabolic Disease at the Baylor Research Institute, Dallas, Texas * Fabrazyme ® Prescribing Information % antibodies pegunigalsidase alfa 19% Fabrazyme ® 74%*

(PRX - 102 ) Randomized, double blind, active control study of pegunigalsidase alfa (PRX - 102) compared to Fabrazyme ® in Fabry patients previously treated with Fabrazyme ® Number of patients to be enrolled : 78 52 to be switched to pegunigalsidase alfa 26 to remain on Fabrazyme ® Objective : Demonstrate superiority to Fabrazyme ® in renal function over 24 months with interim results at 12 months Primary Endpoint : Comparison of eGFR slope (mean annualized change ) between treatment groups Other Endpoints : LVMI, pain, plasma lyso GB3, safety, immunogenicity, Quality of Life Phase III pivotal trial initiated 14

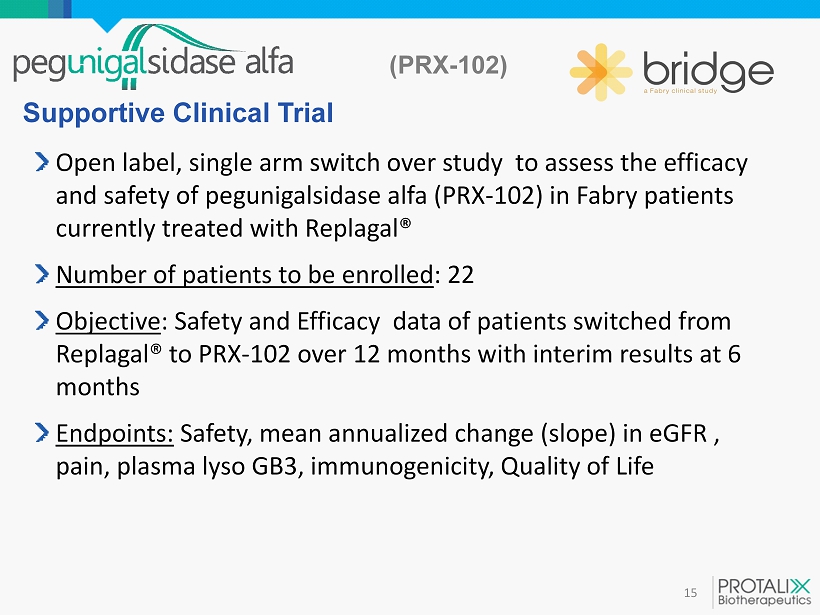

(PRX - 102) Open label, single arm switch over study to assess the efficacy and safety of pegunigalsidase alfa (PRX - 102) in Fabry patients currently treated with Replagal ® Number of patients to be enrolled : 22 Objective : Safety and Efficacy data of patients switched from Replagal® to PRX - 102 over 12 months with interim results at 6 months Endpoints: Safety , mean annualized change (slope) in eGFR , pain, plasma lyso GB3, immunogenicity, Quality of Life Supportive Clinical T rial 15

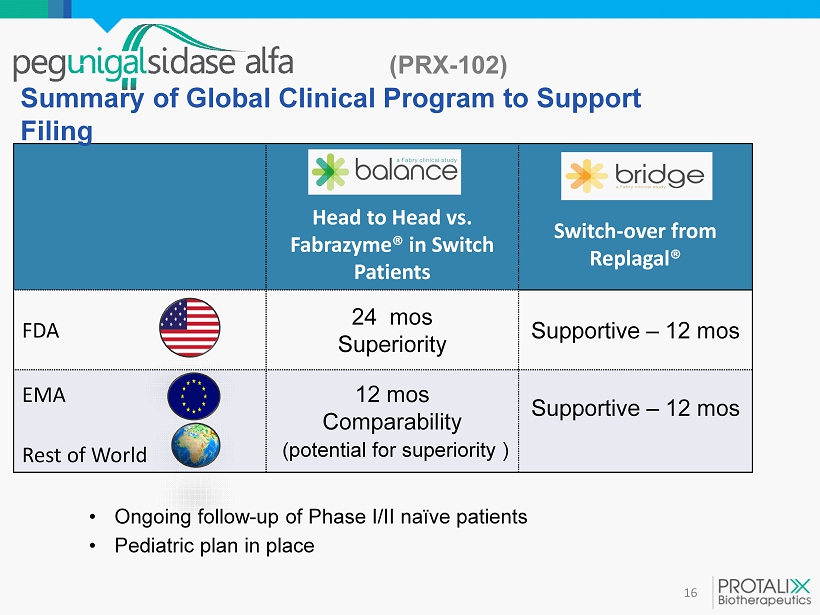

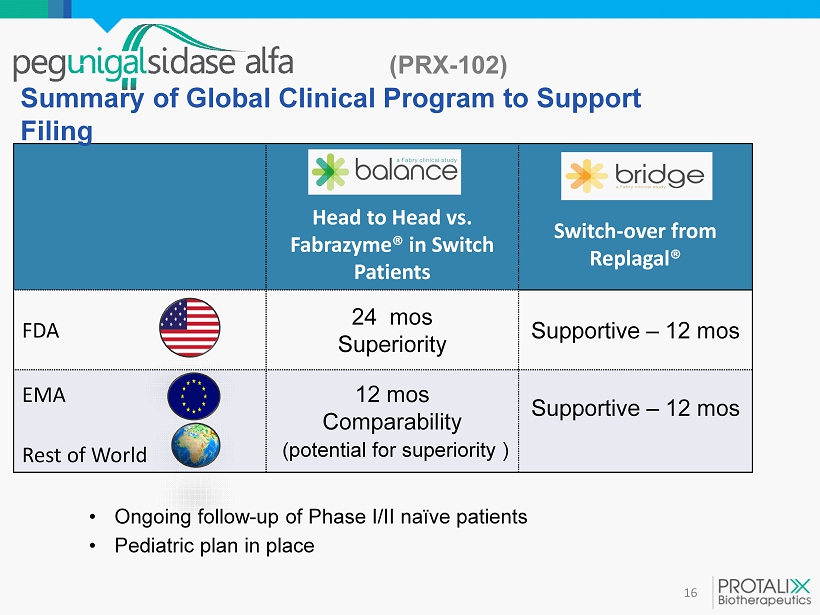

(PRX - 102 ) 16 Head to Head vs. Fabrazyme ® in Switch Patients Switch - over from Replagal ® FDA 24 mos Superiority Supportive – 12 mos EMA Rest of World 12 mos Comparability (potential for superiority ) Supportive – 12 mos Summary of Global Clinical Program to Support Filing • Ongoing follow - up of Phase I/II naïve patients • Pediatric plan in place

(PRX - 102) 17 At current rate, market is projected to grow from $ 1.2 B to $ 1.7 B in the next 5 yrs Target – Worldwide Naïve & Switch patients Potential superiority in efficacy based on : Peak Sales Potential of $1B Annually Potential to be gold standard therapy Fabrazyme ® pegunigalsidase alfa eGFR slope - 3.8 - 1.8* Half life 2 hours ~80 hours Active enzyme ½ day 14 days Antibody formation 74% 19% *0.01 ± 1.37 calculated slope for classic Fabry patients excluding one male patient who received doxycycline

alidornase alfa (PRX - 110) For Cystic Fibrosis

Cystic Fibrosis (CF) Rare genetic disease characterized by a highly viscous mucus most prominently leading to severe lung damage and loss of respiratory function More than 70,000 CF patients worldwide. Growth in number of patients and increase in life expectancy Target Product Annual Sales Reduction of mucus viscosity Pulmozyme ® $678M (2015 ) CFTR protein modulation • Applicable to ~40% of patients • Given on top of all other treatments Kalydeco ® and Orkambi ® $1.6B (4Q15 - 3Q16 ) Top Selling Drugs

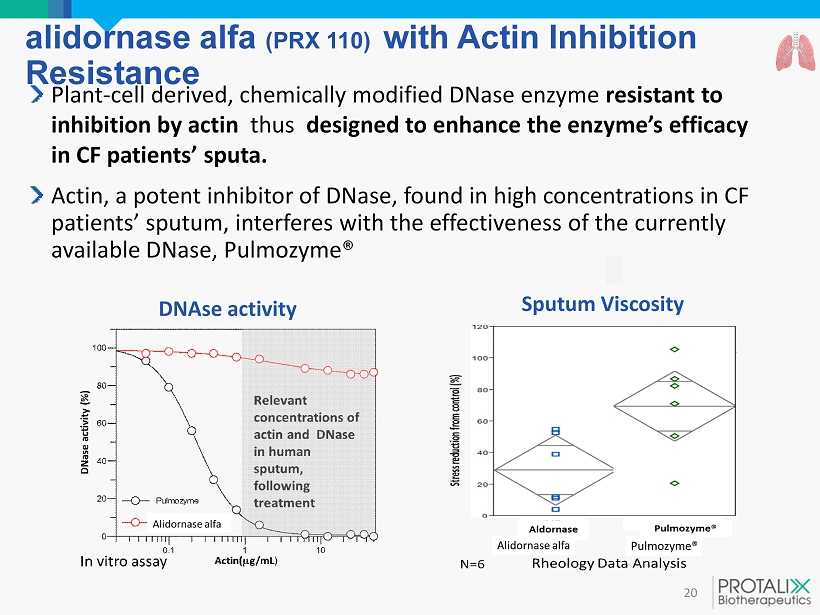

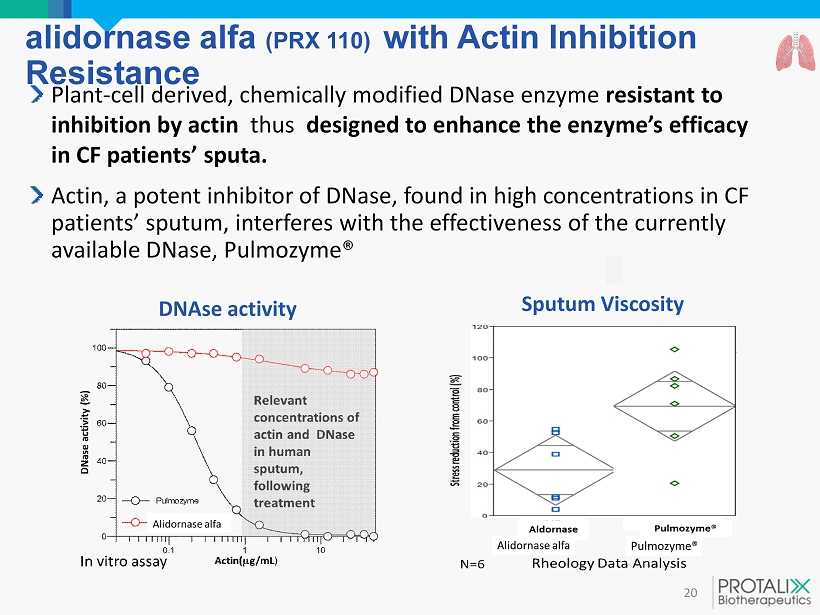

alidornase alfa (PRX 110 ) with Actin Inhibition Resistance 20 Plant - cell derived, chemically modified DNase enzyme resistant to inhibition by actin thus designed to enhance the enzyme’s efficacy in CF patients’ sputa. Actin , a potent inhibitor of DNase, found in high concentrations in CF patients’ sputum, interferes with the effectiveness of the currently available DNase, Pulmozyme ® Sputum Viscosity DNAse activity

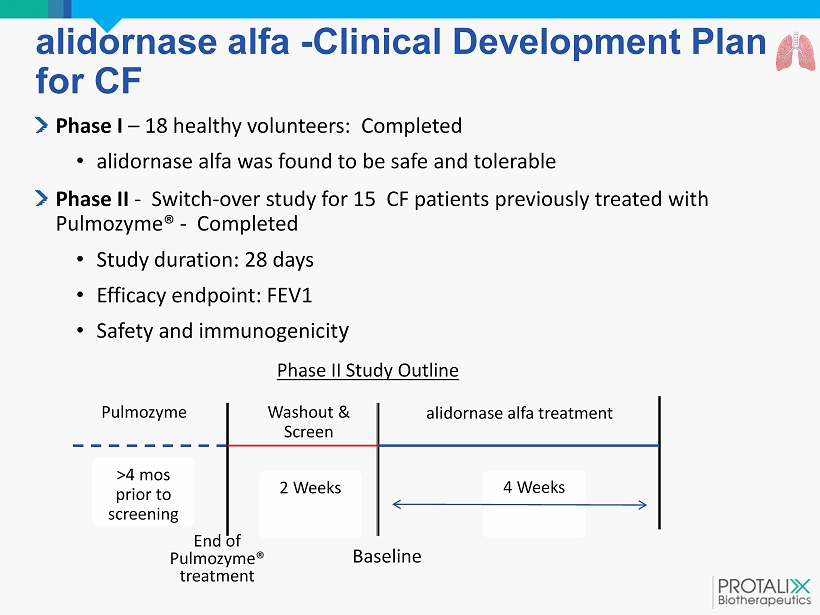

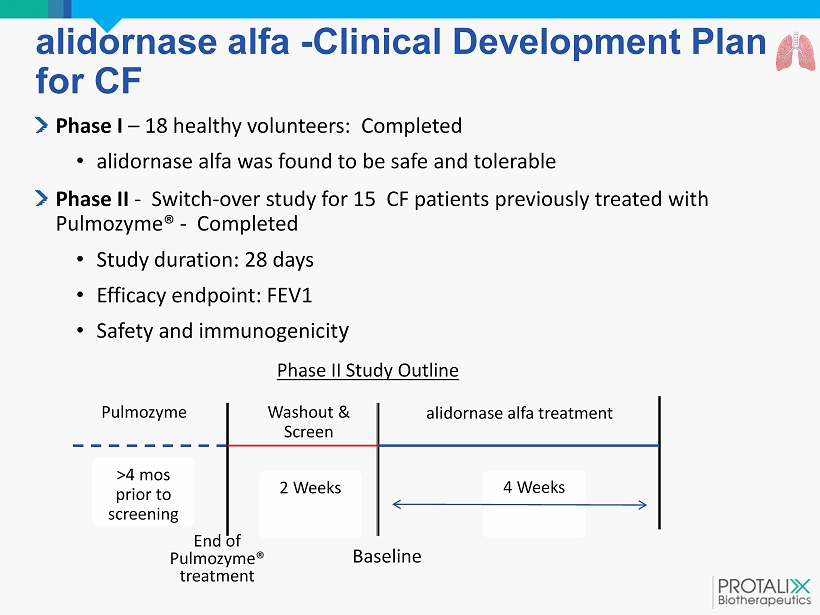

alidornase alfa - Clinical Development Plan for CF Phase I – 18 healthy volunteers: Completed • a lidornase alfa was found to be safe and tolerable Phase II - Switch - over study for 15 CF patients previously treated with Pulmozyme ® - Completed • Study duration: 28 days • Efficacy endpoint: FEV1 • Safety and immunogenicit y Pulmozyme > 4 mos prior to screening Washout & Screen 2 Weeks alidornase alfa treatment 4 Weeks Baseline Phase II Study Outline End of Pulmozyme ® treatment

Top Line Results from Interim Analysis of Phase II trial 22 alidornase alfa (PRX 110 ) was found to be safe and well - tolerated Clinically meaningful improvement in lung function • Mean absolute improvement in ppFEV 1 compared to baseline of 4.1 points * n=13 ** Orkambi ® phase III trial “The preliminary efficacy results of alidornase alfa are very encouraging, even when compared to past trials of approved drugs for the treatment of CF. Although the study was performed on a small number of patients, the data is very encouraging since it shows clinically meaningful results,” Prof . Eitan Kerem , Chairman of Pediatrics Head of CF Center, Hadassah Medical Center, Jerusalem ; 3.1 4.1 2.5 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 4.5 alidornase alfa vs end of Pulmozyme® treatment * alidornase alfa vs baseline* Orkambi® vs baseline** Mean Absolute change in ppFEV1 % points

Decrease in Sputum DNA Content and Sputum Viscosity upon a lidornase alfa Treatment Initiation 23 * n=7 **n=5 1.42 0.53 0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6 Dose Initiation Baseline Treatment 4 weeks mg/mL Mean DNA content* 36.40 3.86 0.0 5.0 10.0 15.0 20.0 25.0 30.0 35.0 40.0 Dose Initiation Baseline Treatment 4 weeks Stress (Pa) Mean visco - elasticity** 63% reduction 89% reduction

Oral anti - TNF (OPRX - 106) For Ulcerative Colitis

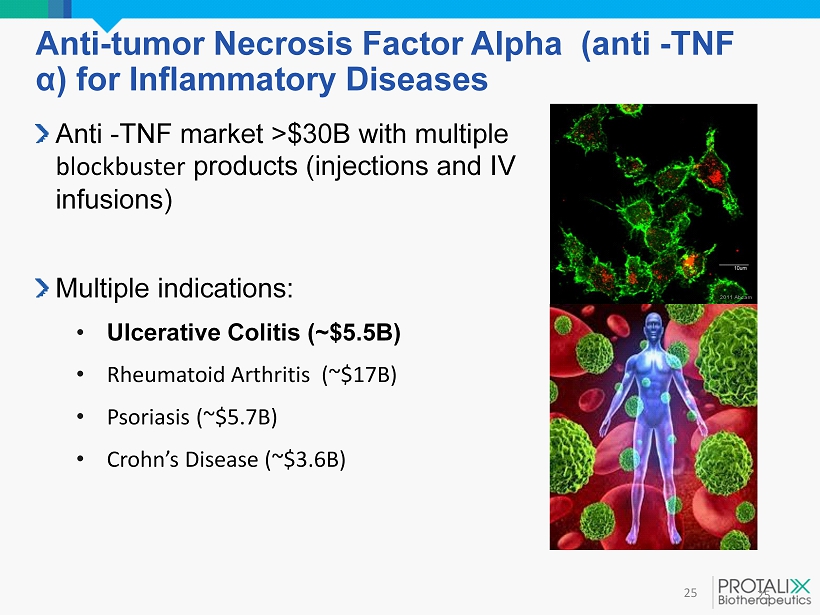

Anti - tumor Necrosis Factor Alpha (anti - TNF α ) for Inflammatory Diseases Anti - TNF market >$30B with multiple blockbuster products (injections and IV infusions ) Multiple indications: • Ulcerative Colitis (~$5.5B) • Rheumatoid Arthritis ( ~ $ 1 7 B ) • Psoriasis ( ~ $5.7B ) • Crohn’s Disease ( ~ $ 3 .6 B ) 25 25

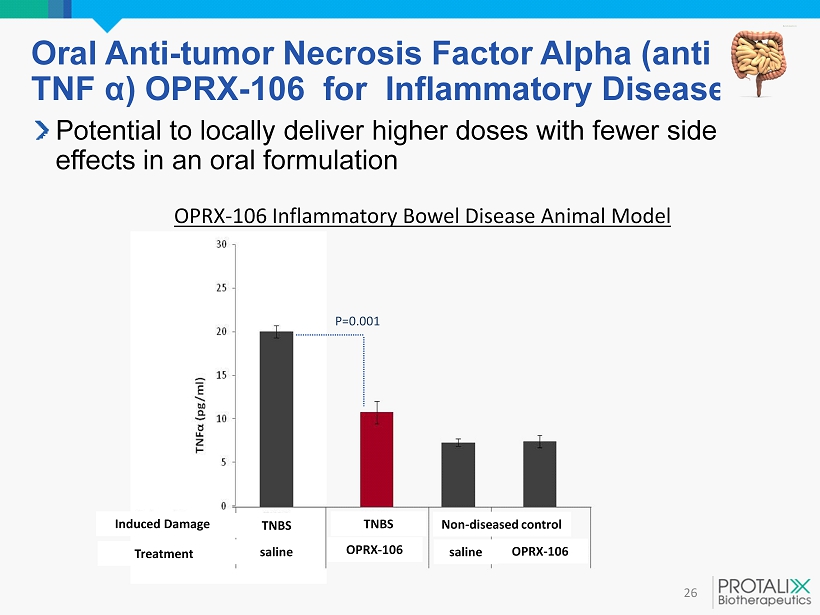

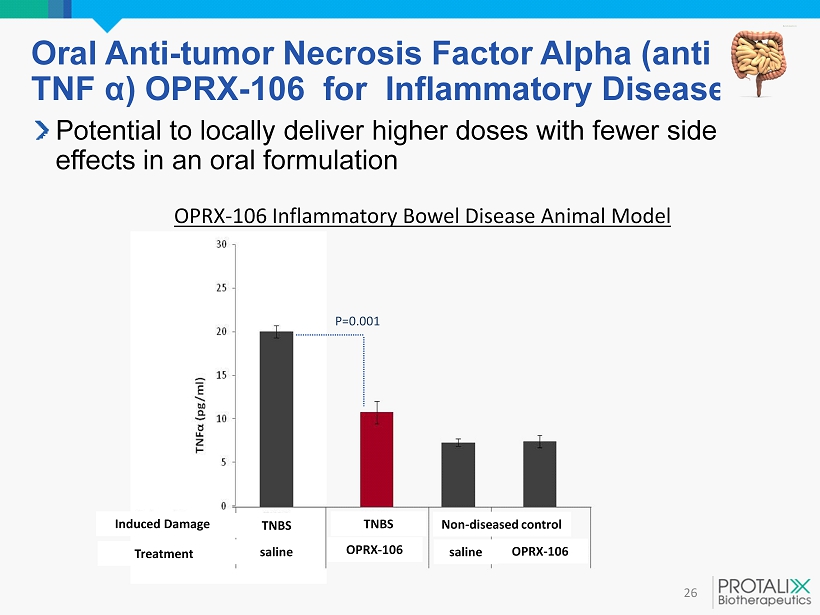

Oral Anti - tumor Necrosis Factor Alpha (anti TNF α ) OPRX - 106 for Inflammatory Diseases 26 Potential to locally deliver higher doses with fewer side effects in an oral formulation OPRX - 106 Inflammatory Bowel Disease Animal Model P= 0.001 Non - diseased control OPRX - 106 OPRX - 106 TNBS saline saline TNBS Induced Damage Treatment

OPRX - 106 Clinical Program 27 Phase I – COMPLETED Safe and well tolerated. Immunomodulation: Regulatory T cell activation showed biological activity in the gut Alteration of systemic immune system without significant systemic absorption Serum cytokine levels remained stable Phase II – ONGOING 15 mild to moderate untreated ulcerative colitis patients Oral once daily administration - 8 week follow - up Evaluating two doses for: Safety and Tolerability Pharmacokinetics Efficacy parameters: Mayo score, rectal bleeding, CRP levels, fecal calprotectin level ” The results demonstrated in the Phase I trial are very exciting and encouraging. As T regulatory cells have a central role in the immune system, PRX - 106 has the potential to be an effective agent for numerous immune - mediated indications .” ” Prof. Yaron Ilan Director, Gastroenterology and Liver Units, Department of Medicine , Hebrew University Hadassah Medical Center , Jerusalem.

Sales of Alfataliglicerase in Brazil 28 Negotiations held with the newly elected government officials in the Brazilian Ministry of Health regarding the potential of alfataliglicerase to become the preferred enzyme replacement therapy for the approximately 700 Gaucher patients treated in Brazil Brazilian Ministry’s order consists of 3 product shipments to start in mid 2017 and reach approximately $24.3M this year Size of the last shipment of this order in Q4 - 17 represents annual revenues of approximately $42 million. Sales to Brazil significantly reduce Protalix’s cash consumption rate and close to breakeven in 4Q 2017 Protalix owns full rights to alfataliglicerase in Brazil

Financial Overview 29 • 124M shares outstanding, as of December 31, 2016 • Dual listed on NYSE MKT and TASE • Strong cash position: ~$63M as of December 31, 2016 • Cash level currently projected to fund operations into late 2019 • $14.9M convertible note due by September 2018, $62.7M convertible note due by November 2021 • 10 years of 0% tax after using up NOL (currently ~$150M)

Protalix has an exciting road ahead… 30 x Promising results for pegunigalsidase alfa and alidornase alfa x Clinical development pipeline targeting markets >$8B x R&D focus to advance early pipeline with attractive opportunities for proteins designed for superior clinical profiles x Sales in Brazil significantly reduce cash consumption rate and multiple near term catalysts in the next 12 months 1. Report phase II full results on alidornase alfa (PRX - 110 ) 2. Report results from Phase II for oral anti TNF (OPRX - 106 ) 3. Finalize enrollment in Phase III pegunigalsidase alfa (PRX - 102 ) studies 4. Introduce new pipeline (currently in preclinical)

Moshe Manor President and CEO Protalix Biotherapeutics moshe.manor@protalix.com