UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM N-CSRS

Investment Company Act file number: 811-07507

Deutsche DWS Investments VIT Funds

(Exact Name of Registrant as Specified in Charter)

875 Third Avenue

New York, NY 10022-6225

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code: (212) 454-4500

Diane Kenneally

One International Place

Boston, MA 02110

(Name and Address of Agent for Service)

| Date of fiscal year end: | 12/31 |

| | |

| Date of reporting period: | 6/30/2020 |

| ITEM 1. | REPORT TO STOCKHOLDERS |

| | |

June 30, 2020

Semiannual Report

Deutsche DWS Investments VIT Funds

DWS Small Cap Index VIP

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, you may not be receiving paper copies of the Fund’s shareholder reports from the insurance company that offers your contract unless you specifically request paper copies from your insurance company or from your financial intermediary. Instead, the shareholder reports will be made available on a Web site, and your insurance company will notify you by mail each time a report is posted and provide you with a Web site link to access the report. Instructions for requesting paper copies will be provided by your insurance company.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from your insurance company electronically by following the instructions provided by your insurance company.

You may elect to receive all future reports in paper free of charge from your insurance company. If your insurance company informs you that future reports will be delivered via Web access, you can inform your insurance company that you wish to continue receiving paper copies of your shareholder reports by following the instructions provided by your insurance company.

Contents

This report must be preceded or accompanied by a prospectus. To obtain an additional prospectus or summary prospectus, if available, call (800) 728-3337 or your financial representative. We advise you to consider the Fund’s objectives, risks, charges and expenses carefully before investing. The summary prospectus and prospectus contain this and other important information about the Fund. Please read the prospectus carefully before you invest.

Stocks may decline in value. Various factors, including costs, cash flows and security selection, may cause the Fund’s performance to differ from that of the index. Smaller company stocks tend to be more volatile than medium-sized or large company stocks. The Fund may lend securities to approved institutions. Investing in derivatives entails special risks relating to liquidity, leverage and credit that may reduce returns and/or increase volatility. Please read the prospectus for details.

War, terrorism, economic uncertainty, trade disputes, public health crises (including the recent pandemic spread of the novel coronavirus) and related geopolitical events could lead to increased market volatility, disruption to U.S. and world economies and markets and may have significant adverse effects on the Fund and its investments.

The brand DWS represents DWS Group GmbH & Co. KGaA and any of its subsidiaries such as DWS Distributors, Inc. which offers investment products or DWS Investment Management Americas, Inc. and RREEF America L.L.C. which offer advisory services.

DWS Distributors, Inc., 222 South Riverside Plaza, Chicago, IL 60606, (800) 621-1148

NOT FDIC/NCUA INSURED NO BANK GUARANTEE MAY LOSE VALUE NOT A DEPOSIT NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

| | | | | | |

| | 2 | | | | | | DWS Small Cap Index VIP |

| | |

| Performance Summary | | June 30, 2020 (Unaudited) |

Fund performance shown is historical, assumes reinvestment of all dividend and capital gain distributions, and does not guarantee future results. Investment return and principal value fluctuate with changing market conditions so that, when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please contact your participating insurance company for the Fund’s most recent month-end performance. Performance figures for Classes A and B differ because each class maintains a distinct expense structure. Performance does not reflect charges and fees (“contract charges”) associated with the separate account that invests in the Fund or any variable life insurance policy or variable annuity contract for which the Fund is an investment option. These charges and fees will reduce returns.

The gross expense ratios of the Fund, as stated in the fee table of the prospectus dated May 1, 2020 are 0.53% and 0.81% for Class A and Class B shares, respectively, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report.

Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes only, and as such, the total return based on the unadjusted net asset value per share may differ from the total return reported in the financial highlights.

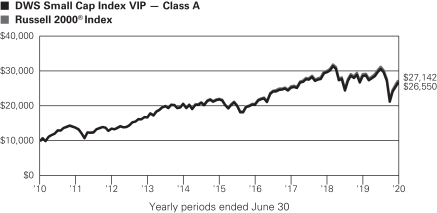

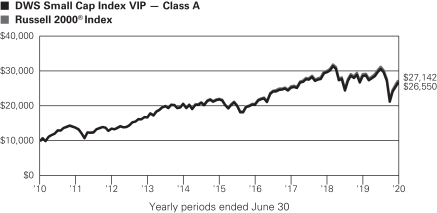

Growth of an Assumed $10,000 Investment

| | |

| | Russell 2000® Index is an unmanaged, capitalization-weighted measure of approximately 2,000 of the smallest companies in the Russell 3000® Index. The Russell 3000® Index is an unmanaged index that measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market. Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index. |

| | | | | | | | | | | | |

| Comparative Results | | | | |

| | | | | | |

| DWS Small Cap Index VIP | | | | 6-Month‡ | | 1-Year | | 3-Year | | 5-Year | | 10-Year |

| Class A | | Growth of $10,000 | | $8,674 | | $9,293 | | $10,516 | | $12,164 | | $26,550 |

| | | Average annual total return | | –13.26% | | –7.07% | | 1.69% | | 4.00% | | 10.26% |

| Russell 2000 Index | | Growth of $10,000 | | $8,702 | | $9,337 | | $10,614 | | $12,335 | | $27,142 |

| | | Average annual total return | | –12.98% | | –6.63% | | 2.01% | | 4.29% | | 10.50% |

| | | | | | |

| DWS Small Cap Index VIP | | | | 6-Month‡ | | 1-Year | | 3-Year | | 5-Year | | 10-Year |

| Class B | | Growth of $10,000 | | $8,656 | | $9,262 | | $10,430 | | $11,993 | | $25,851 |

| | | Average annual total return | | –13.44% | | –7.38% | | 1.41% | | 3.70% | | 9.96% |

| Russell 2000 Index | | Growth of $10,000 | | $8,702 | | $9,337 | | $10,614 | | $12,335 | | $27,142 |

| | Average annual total return | | –12.98% | | –6.63% | | 2.01% | | 4.29% | | 10.50% |

The growth of $10,000 is cumulative.

| ‡ | Total returns shown for periods less than one year are not annualized. |

| | | | |

| DWS Small Cap Index VIP | | | | | 3 |

| | | | |

| Portfolio Summary | | (Unaudited) |

| | | | | | | | |

| Asset Allocation (As a % of Investment Portfolio excluding Securities Lending Collateral) | | 6/30/20 | | | 12/31/19 | |

Common Stocks | | | 98% | | | | 98% | |

Cash Equivalents | | | 2% | | | | 2% | |

Government & Agency Obligations | | | 0% | | | | 0% | |

Rights | | | 0% | | | | 0% | |

| Warrants | | | 0% | | | | — | |

| | | | 100% | | | | 100% | |

| | |

| Sector Diversification (As a % of Common Stocks and Rights) | | 6/30/20 | | | 12/31/19 | |

Health Care | | | 21% | | | | 18% | |

Financials | | | 16% | | | | 18% | |

Industrials | | | 14% | | | | 16% | |

Information Technology | | | 14% | | | | 13% | |

Consumer Discretionary | | | 12% | | | | 11% | |

Real Estate | | | 7% | | | | 8% | |

Materials | | | 4% | | | | 4% | |

Utilities | | | 4% | | | | 4% | |

Consumer Staples | | | 3% | | | | 3% | |

Communication Services | | | 3% | | | | 2% | |

| Energy | | | 2% | | | | 3% | |

| | | | 100% | | | | 100% | |

| | | | | | |

| | Ten Largest Equity Holdings (2.7% of Net Assets) | | Percent |

| | 1 | | | Deckers Outdoor Corp. | | |

| | | | | Designs and markets function-oriented footwear and apparel | | 0.3% |

| | 2 | | | LHC Group, Inc. | | |

| | | | | Provider of post-acute healthcare services primarily to Medicare beneficiaries in rural markets | | 0.3% |

| | 3 | | | BJ’s Wholesale Club Holdings, Inc. | | |

| | | | | Operates as warehouse club | | 0.3% |

| | 4 | | | Churchill Downs, Inc. | | |

| | | | | Operator of racing, gaming and online entertainment | | 0.3% |

| | 5 | | | Novavax, Inc. | | |

| | | | | Clinical stage biotechnology company | | 0.3% |

| | 6 | | | MyoKardia, Inc. | | |

| | | | | Operates as a precision cardiovascular medicine company | | 0.3% |

| | 7 | | | Helen of Troy Ltd. | | |

| | | | | Designs, markets, and distributes hair care appliances | | 0.3% |

| | 8 | | | SiteOne Landscape Supply, Inc. | | |

| | | | | Distributor of landscape supplies | | 0.2% |

| | 9 | | | EastGroup Properties, Inc. | | |

| | | | | Developer of industrial properties | | 0.2% |

| | 10 | | | Ultragenyx Pharmaceutical, Inc. | | |

| | | | | Provider of biotechnology services | | 0.2% |

Portfolio holdings and characteristics are subject to change.

For more complete details about the Fund’s investment portfolio, see page 5.

Following the Fund’s fiscal first and third quarter-end, a complete portfolio holdings listing is filed with the SEC on Form N-PORT. The Fund’s Form N-PORT will be available on the SEC’s Web site at sec.gov. The Fund’s portfolio holdings are also posted on dws.com from time to time. Please read the Fund’s current prospectus for more information.

Portfolio Manager

Brent Reeder

Senior Vice President, Northern Trust Investments, Inc., Subadvisor to the Fund

| | | | | | |

| | 4 | | | | | | DWS Small Cap Index VIP |

| | |

| Investment Portfolio | | as of June 30, 2020 (Unaudited) |

| | | | | | | | |

| | | Shares | | | Value ($) | |

Common Stocks 97.6% | |

| Communication Services 2.5% | |

Diversified Telecommunication Services 0.9% | |

| | |

Alaska Communications Systems Group, Inc. | | | 9,664 | | | | 26,963 | |

| | |

Anterix, Inc.* | | | 2,494 | | | | 113,078 | |

| | |

ATN International, Inc. | | | 2,052 | | | | 124,290 | |

| | |

Bandwidth, Inc. “A”* | | | 3,582 | | | | 454,914 | |

| | |

Cincinnati Bell, Inc.* | | | 9,522 | | | | 141,402 | |

| | |

Cogent Communications Holdings, Inc. | | | 7,940 | | | | 614,238 | |

| | |

Consolidated Communications Holdings, Inc.* | | | 13,959 | | | | 94,502 | |

| | |

IDT Corp. “B”* | | | 3,076 | | | | 20,086 | |

| | |

Iridium Communications, Inc.* | | | 21,973 | | | | 558,993 | |

| | |

Liberty Latin America Ltd. “A”* | | | 8,472 | | | | 82,348 | |

| | |

Liberty Latin America Ltd. “C”* | | | 21,133 | | | | 199,496 | |

| | |

Ooma, Inc.* | | | 3,961 | | | | 65,277 | |

| | |

Orbcomm, Inc.* (a) | | | 14,110 | | | | 54,324 | |

| | |

Vonage Holdings Corp.* | | | 43,286 | | | | 435,457 | |

| | | | | | | | |

| | | | | | | 2,985,368 | |

|

Entertainment 0.3% | |

| | |

Accel Entertainment, Inc.* | | | 7,892 | | | | 76,000 | |

| | |

AMC Entertainment Holdings, Inc. “A” (a) | | | 9,964 | | | | 42,746 | |

| | |

Cinemark Holdings, Inc. | | | 19,990 | | | | 230,885 | |

| | |

Eros International PLC* (a) | | | 12,889 | | | | 40,729 | |

| | |

Gaia, Inc.* | | | 2,099 | | | | 17,590 | |

| | |

Glu Mobile, Inc.* | | | 24,223 | | | | 224,547 | |

| | |

IMAX Corp.* | | | 9,283 | | | | 104,062 | |

| | |

Liberty Media Corp.-Liberty Braves “A”* | | | 1,868 | | | | 37,509 | |

| | |

Liberty Media Corp.-Liberty Braves “C”* | | | 6,831 | | | | 134,844 | |

| | |

LiveXLive Media, Inc.* (a) | | | 5,338 | | | | 19,324 | |

| | |

Marcus Corp. | | | 4,379 | | | | 58,109 | |

| | | | | | | | |

| | | | | | | 986,345 | |

|

Interactive Media & Services 0.4% | |

| | |

Cargurus, Inc.* | | | 16,135 | | | | 409,022 | |

| | |

Cars.com, Inc.* | | | 12,646 | | | | 72,841 | |

| | |

DHI Group, Inc.* | | | 9,464 | | | | 19,874 | |

| | |

Eventbrite, Inc. “A”* (a) | | | 11,871 | | | | 101,735 | |

| | |

EverQuote, Inc. “A”* | | | 2,616 | | | | 152,147 | |

| | |

Liberty TripAdvisor Holdings, Inc. “A”* | | | 13,010 | | | | 27,711 | |

| | |

Meet Group, Inc.* | | | 12,896 | | | | 80,471 | |

| | |

QuinStreet, Inc.* | | | 8,872 | | | | 92,801 | |

| | |

TrueCar, Inc.* | | | 20,048 | | | | 51,724 | |

| | |

Yelp, Inc.* | | | 13,103 | | | | 303,072 | |

| | | | | | | | |

| | | | | | | 1,311,398 | |

|

Media 0.7% | |

| | |

AMC Networks, Inc. “A”* | | | 7,244 | | | | 169,437 | |

| | |

Boston Omaha Corp. “A”* | | | 2,173 | | | | 34,768 | |

| | |

Cardlytics, Inc.* | | | 4,829 | | | | 337,933 | |

| | |

Central European Media Enterprises Ltd. “A”* | | | 16,948 | | | | 59,996 | |

| | |

comScore, Inc.* | | | 10,987 | | | | 34,060 | |

| | |

Daily Journal Corp.* | | | 205 | | | | 55,350 | |

| | |

Emerald Holding, Inc. | | | 4,554 | | | | 14,026 | |

| | | | | | | | |

| | | Shares | | | Value ($) | |

| | |

Entercom Communications Corp. “A” | | | 21,360 | | | | 29,477 | |

| | |

Entravision Communications Corp. “A” | | | 11,617 | | | | 16,612 | |

| | |

Fluent, Inc.* | | | 7,895 | | | | 14,053 | |

| | |

Gannett Co., Inc. | | | 24,749 | | | | 34,154 | |

| | |

Gray Television, Inc.* | | | 16,700 | | | | 232,965 | |

| | |

Hemisphere Media Group, Inc.* | | | 2,832 | | | | 27,839 | |

| | |

iHeartMedia, Inc. “A”* | | | 11,199 | | | | 93,512 | |

| | |

Loral Space & Communications, Inc. | | | 2,490 | | | | 48,605 | |

| | |

Meredith Corp. | | | 7,436 | | | | 108,194 | |

| | |

MSG Networks, Inc. “A”* | | | 7,474 | | | | 74,366 | |

| | |

National CineMedia, Inc. | | | 11,569 | | | | 34,360 | |

| | |

Saga Communications, Inc. “A” | | | 704 | | | | 18,022 | |

| | |

Scholastic Corp. | | | 5,397 | | | | 161,586 | |

| | |

Sinclair Broadcast Group, Inc. “A” | | | 9,732 | | | | 179,653 | |

| | |

TechTarget, Inc.* | | | 4,310 | | | | 129,429 | |

| | |

TEGNA, Inc. | | | 40,996 | | | | 456,696 | |

| | |

The E.W. Scripps Co. “A” | | | 10,255 | | | | 89,731 | |

| | |

Tribune Publishing Co. | | | 2,716 | | | | 27,133 | |

| | |

WideOpenWest, Inc.* | | | 9,801 | | | | 51,651 | |

| | | | | | | | |

| | | | | | | 2,533,608 | |

|

Wireless Telecommunication Services 0.2% | |

| | |

Boingo Wireless, Inc.* | | | 8,191 | | | | 109,104 | |

| | |

Gogo, Inc.* (a) | | | 10,268 | | | | 32,447 | |

| | |

Shenandoah Telecommunications Co. | | | 9,012 | | | | 444,201 | |

| | |

Spok Holdings, Inc. | | | 3,174 | | | | 29,677 | |

| | | | | | | | |

| | | | | | | 615,429 | |

|

| Consumer Discretionary 11.5% | |

Auto Components 1.2% | |

| | |

Adient PLC* | | | 16,299 | | | | 267,630 | |

| | |

American Axle & Manufacturing Holdings, Inc.* | | | 21,004 | | | | 159,630 | |

| | |

Cooper Tire & Rubber Co. | | | 9,424 | | | | 260,197 | |

| | |

Cooper-Standard Holdings, Inc.* | | | 3,051 | | | | 40,426 | |

| | |

Dana, Inc. | | | 26,951 | | | | 328,533 | |

| | |

Dorman Products, Inc.* | | | 4,989 | | | | 334,612 | |

| | |

Fox Factory Holding Corp.* | | | 7,202 | | | | 594,957 | |

| | |

Gentherm, Inc.* | | | 6,077 | | | | 236,395 | |

| | |

Goodyear Tire & Rubber Co. | | | 43,313 | | | | 387,435 | |

| | |

LCI Industries | | | 4,604 | | | | 529,368 | |

| | |

Modine Manufacturing Co.* | | | 9,481 | | | | 52,335 | |

| | |

Motorcar Parts of America, Inc.* (a) | | | 3,501 | | | | 61,863 | |

| | |

Standard Motor Products, Inc. | | | 3,884 | | | | 160,021 | |

| | |

Stoneridge, Inc.* | | | 4,778 | | | | 98,713 | |

| | |

Tenneco, Inc. “A”* | | | 9,329 | | | | 70,527 | |

| | |

Visteon Corp.* | | | 5,195 | | | | 355,857 | |

| | |

Workhorse Group, Inc.* | | | 11,853 | | | | 206,124 | |

| | |

Xpel, Inc.* | | | 3,126 | | | | 48,891 | |

| | | | | | | | |

| | | | | | | 4,193,514 | |

|

Automobiles 0.1% | |

Winnebago Industries, Inc. | | | 5,841 | | | | 389,127 | |

|

Distributors 0.1% | |

| | |

Core-Mark Holding Co., Inc. | | | 8,387 | | | | 209,297 | |

| | |

Funko, Inc. “A”* | | | 4,715 | | | | 27,347 | |

| | |

Greenlane Holdings, Inc. “A”* | | | 2,508 | | | | 9,982 | |

The accompanying notes are an integral part of the financial statements.

| | | | |

| DWS Small Cap Index VIP | | | | | 5 |

| | | | | | | | |

| | | Shares | | | Value ($) | |

| | |

Weyco Group, Inc. | | | 1,242 | | | | 26,815 | |

| | | | | | | | |

| | | | | | | 273,441 | |

|

Diversified Consumer Services 0.7% | |

| | |

Adtalem Global Education, Inc.* | | | 9,725 | | | | 302,934 | |

| | |

American Public Education, Inc.* | | | 2,711 | | | | 80,246 | |

| | |

Aspen Group Inc/co* | | | 3,451 | | | | 31,232 | |

| | |

Carriage Services, Inc. | | | 3,136 | | | | 56,824 | |

| | |

Collectors Universe, Inc. | | | 1,707 | | | | 58,516 | |

| | |

Franchise Group, Inc. | | | 3,577 | | | | 78,265 | |

| | |

Houghton Mifflin Harcourt Co.* | | | 18,628 | | | | 33,717 | |

| | |

K12, Inc.* | | | 7,473 | | | | 203,564 | |

| | |

Laureate Education, Inc. “A”* | | | 20,103 | | | | 200,326 | |

| | |

OneSpaWorld Holdings Ltd. | | | 8,097 | | | | 38,623 | |

| | |

Perdoceo Education Corp.* | | | 12,950 | | | | 206,293 | |

| | |

Regis Corp.* | | | 4,169 | | | | 34,102 | |

| | |

Strategic Education, Inc. | | | 4,103 | | | | 630,426 | |

| | |

Universal Technical Institute, Inc.* | | | 5,358 | | | | 37,238 | |

| | |

Vivint Smart Home, Inc.* | | | 13,033 | | | | 225,862 | |

| | |

WW International, Inc.* | | | 8,858 | | | | 224,816 | |

| | | | | | | | |

| | | | | | | 2,442,984 | |

|

Hotels, Restaurants & Leisure 2.7% | |

| | |

BBX Capital Corp. | | | 12,037 | | | | 30,574 | |

| | |

Biglari Holdings, Inc. “A”* | | | 15 | | | | 5,025 | |

| | |

Biglari Holdings, Inc. “B”* | | | 164 | | | | 11,313 | |

| | |

BJ’s Restaurants, Inc. | | | 3,402 | | | | 71,238 | |

| | |

Bloomin’ Brands, Inc. | | | 16,213 | | | | 172,831 | |

| | |

Bluegreen Vacations Corp. | | | 1,381 | | | | 7,485 | |

| | |

Boyd Gaming Corp. | | | 15,175 | | | | 317,157 | |

| | |

Brinker International, Inc. | | | 8,182 | | | | 196,368 | |

| | |

Carrols Restaurant Group, Inc.* | | | 7,085 | | | | 34,291 | |

| | |

Century Casinos, Inc.* | | | 4,779 | | | | 19,833 | |

| | |

Churchill Downs, Inc. | | | 7,099 | | | | 945,232 | |

| | |

Chuy’s Holdings, Inc.* | | | 2,979 | | | | 44,328 | |

| | |

Cracker Barrel Old Country Store, Inc. | | | 4,479 | | | | 496,766 | |

| | |

Dave & Buster’s Entertainment, Inc. (a) | | | 8,680 | | | | 115,704 | |

| | |

Del Taco Restaurants, Inc.* | | | 5,634 | | | | 33,410 | |

| | |

Denny’s Corp.* | | | 10,145 | | | | 102,464 | |

| | |

Dine Brands Global, Inc. (a) | | | 2,924 | | | | 123,100 | |

| | |

El Pollo Loco Holdings, Inc.* | | | 3,501 | | | | 51,675 | |

| | |

Eldorado Resorts, Inc.* (a) | | | 15,787 | | | | 632,427 | |

| | |

Everi Holdings, Inc.* | | | 15,192 | | | | 78,391 | |

| | |

Fiesta Restaurant Group, Inc.* | | | 3,393 | | | | 21,647 | |

| | |

Gan Ltd.* | | | 1,384 | | | | 35,223 | |

| | |

Golden Entertainment, Inc.* | | | 3,233 | | | | 28,838 | |

| | |

Hilton Grand Vacations, Inc.* | | | 15,883 | | | | 310,513 | |

| | |

International Game Technology PLC | | | 18,604 | | | | 165,576 | |

| | |

Jack in the Box, Inc. | | | 4,220 | | | | 312,660 | |

| | |

Kura Sushi USA, Inc.* | | | 598 | | | | 8,539 | |

| | |

Lindblad Expeditions Holdings, Inc.* | | | 4,795 | | | | 37,017 | |

| | |

Marriott Vacations Worldwide Corp. | | | 7,560 | | | | 621,508 | |

| | |

Monarch Casino & Resort, Inc.* | | | 2,361 | | | | 80,463 | |

| | |

Nathan’s Famous, Inc. | | | 536 | | | | 30,145 | |

| | |

Noodles & Co.* | | | 6,086 | | | | 36,820 | |

| | |

Papa John’s International, Inc. | | | 6,046 | | | | 480,113 | |

| | |

Penn National Gaming, Inc.* (a) | | | 25,007 | | | | 763,714 | |

| | |

PlayAGS, Inc.* | | | 4,708 | | | | 15,913 | |

| | |

RCI Hospitality Holdings, Inc. | | | 1,715 | | | | 23,770 | |

| | |

Red Robin Gourmet Burgers, Inc.* | | | 2,426 | | | | 24,745 | |

| | | | | | | | |

| | | Shares | | | Value ($) | |

| | |

Red Rock Resorts, Inc. “A” | | | 12,309 | | | | 134,291 | |

| | |

Ruth’s Hospitality Group, Inc. | | | 5,002 | | | | 40,816 | |

| | |

Scientific Games Corp. “A”* | | | 10,708 | | | | 165,546 | |

| | |

SeaWorld Entertainment, Inc.* | | | 9,480 | | | | 140,399 | |

| | |

Shake Shack, Inc. “A”* | | | 6,557 | | | | 347,390 | |

| | |

Target Hospitality Corp.* | | | 6,100 | | | | 10,309 | |

| | |

Texas Roadhouse, Inc. | | | 12,285 | | | | 645,822 | |

| | |

The Cheesecake Factory, Inc. (a) | | | 7,836 | | | | 179,601 | |

| | |

Twin River Worldwide Holdings, Inc. (a) | | | 3,404 | | | | 75,875 | |

| | |

Wingstop, Inc. | | | 5,534 | | | | 769,060 | |

| | | | | | | | |

| | | | | | | 8,995,925 | |

|

Household Durables 2.0% | |

| | |

Beazer Homes U.S.A., Inc.* | | | 5,570 | | | | 56,090 | |

| | |

Casper Sleep, Inc.* (a) | | | 1,685 | | | | 15,114 | |

| | |

Cavco Industries, Inc.* | | | 1,617 | | | | 311,838 | |

| | |

Century Communities, Inc.* | | | 5,487 | | | | 168,231 | |

| | |

Ethan Allen Interiors, Inc. | | | 4,220 | | | | 49,923 | |

| | |

GoPro, Inc. “A”* | | | 24,096 | | | | 114,697 | |

| | |

Green Brick Partners, Inc.* | | | 4,485 | | | | 53,147 | |

| | |

Hamilton Beach Brands Holding Co. “A” | | | 1,206 | | | | 14,351 | |

| | |

Helen of Troy Ltd.* | | | 4,726 | | | | 891,135 | |

| | |

Hooker Furniture Corp. | | | 2,130 | | | | 41,428 | |

| | |

Installed Building Products, Inc.* | | | 4,236 | | | | 291,352 | |

| | |

iRobot Corp.* | | | 5,165 | | | | 433,343 | |

| | |

KB HOME | | | 16,447 | | | | 504,594 | |

| | |

La-Z-Boy, Inc. | | | 8,261 | | | | 223,543 | |

| | |

Legacy Housing Corp.* | | | 1,580 | | | | 22,468 | |

| | |

LGI Homes, Inc.* | | | 4,151 | | | | 365,413 | |

| | |

Lifetime Brands, Inc. | | | 2,187 | | | | 14,697 | |

| | |

Lovesac Co.* | | | 1,741 | | | | 45,666 | |

| | |

M.D.C. Holdings, Inc. | | | 9,551 | | | | 340,971 | |

| | |

M/I Homes, Inc.* | | | 5,256 | | | | 181,017 | |

| | |

Meritage Homes Corp.* | | | 6,921 | | | | 526,827 | |

| | |

Purple Innovation, Inc.* | | | 2,671 | | | | 48,078 | |

| | |

Skyline Champion Corp.* | | | 10,153 | | | | 247,124 | |

| | |

Sonos, Inc.* | | | 14,928 | | | | 218,397 | |

| | |

Taylor Morrison Home Corp. “A”* | | | 23,505 | | | | 453,411 | |

| | |

TopBuild Corp.* | | | 6,178 | | | | 702,871 | |

| | |

TRI Pointe Group, Inc.* | | | 24,075 | | | | 353,662 | |

| | |

Tupperware Brands Corp. | | | 8,754 | | | | 41,581 | |

| | |

Turtle Beach Corp.* | | | 2,513 | | | | 36,991 | |

| | |

Universal Electronics, Inc.* | | | 2,490 | | | | 116,582 | |

| | |

VOXX International Corp.* | | | 3,727 | | | | 21,542 | |

| | | | | | | | |

| | | | | | | 6,906,084 | |

|

Internet & Direct Marketing Retail 0.6% | |

| | |

1-800 FLOWERS.COM, Inc. “A”* | | | 4,702 | | | | 94,134 | |

| | |

Duluth Holdings, Inc. “B”* (a) | | | 1,991 | | | | 14,674 | |

| | |

Groupon, Inc.* | | | 4,306 | | | | 78,025 | |

| | |

Lands’ End, Inc.* | | | 1,999 | | | | 16,072 | |

| | |

Liquidity Services, Inc.* | | | 4,921 | | | | 29,329 | |

| | |

Overstock.com, Inc.* | | | 7,505 | | | | 213,367 | |

| | |

PetMed Express, Inc. | | | 3,617 | | | | 128,910 | |

| | |

Quotient Technology, Inc.* | | | 16,101 | | | | 117,859 | |

| | |

RealReal, Inc.* | | | 11,659 | | | | 149,119 | |

| | |

Rubicon Project, Inc.* (a) | | | 19,575 | | | | 130,565 | |

| | |

Shutterstock, Inc. | | | 3,569 | | | | 124,808 | |

| | |

Stamps.com, Inc.* | | | 3,099 | | | | 569,255 | |

| | |

Stitch Fix, Inc. “A”* (a) | | | 10,499 | | | | 261,845 | |

| | |

U.S. Auto Parts Network, Inc.* | | | 3,932 | | | | 34,051 | |

| | |

Waitr Holdings, Inc.* (a) | | | 14,195 | | | | 37,333 | |

| | | | | | | | |

| | | | | | | 1,999,346 | |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| | 6 | | | | | | DWS Small Cap Index VIP |

| | | | | | | | |

| | | Shares | | | Value ($) | |

|

Leisure Products 0.7% | |

| | |

Acushnet Holdings Corp. | | | 6,357 | | | | 221,160 | |

| | |

Callaway Golf Co. (a) | | | 17,465 | | | | 305,812 | |

| | |

Clarus Corp. | | | 4,349 | | | | 50,362 | |

| | |

Escalade, Inc. | | | 1,919 | | | | 26,789 | |

| | |

Johnson Outdoors, Inc. “A” | | | 953 | | | | 86,742 | |

| | |

Malibu Boats, Inc. “A”* | | | 3,824 | | | | 198,657 | |

| | |

Marine Products Corp. | | | 1,244 | | | | 17,229 | |

| | |

MasterCraft Boat Holdings, Inc.* | | | 3,473 | | | | 66,161 | |

| | |

Nautilus, Inc.* | | | 5,543 | | | | 51,384 | |

| | |

Smith & Wesson Brands, Inc.* (a) | | | 10,248 | | | | 220,537 | |

| | |

Sturm, Ruger & Co., Inc. | | | 3,161 | | | | 240,236 | |

| | |

Vista Outdoor, Inc.* | | | 10,745 | | | | 155,265 | |

| | |

YETI Holdings, Inc.* | | | 13,852 | | | | 591,896 | |

| | | | | | | | |

| | | | | | | 2,232,230 | |

|

Multiline Retail 0.2% | |

| | |

Big Lots, Inc. | | | 7,378 | | | | 309,876 | |

| | |

Dillard’s, Inc. “A” (a) | | | 1,418 | | | | 36,570 | |

| | |

Macy’s, Inc. | | | 58,392 | | | | 401,737 | |

| | | | | | | | |

| | | | | | | 748,183 | |

|

Specialty Retail 2.3% | |

| | |

Aaron’s, Inc. | | | 12,590 | | | | 571,586 | |

| | |

Abercrombie & Fitch Co. “A” | | | 11,694 | | | | 124,424 | |

| | |

America’s Car-Mart, Inc.* | | | 1,153 | | | | 101,314 | |

| | |

American Eagle Outfitters, Inc. | | | 28,204 | | | | 307,424 | |

| | |

Asbury Automotive Group, Inc.* | | | 3,615 | | | | 279,548 | |

| | |

At Home Group, Inc.* | | | 8,850 | | | | 57,437 | |

| | |

Bed Bath & Beyond, Inc. (a) | | | 23,719 | | | | 251,421 | |

| | |

Boot Barn Holdings, Inc.* | | | 5,339 | | | | 115,109 | |

| | |

Caleres, Inc. | | | 7,202 | | | | 60,065 | |

| | |

Camping World Holdings, Inc. “A” | | | 6,053 | | | | 164,399 | |

| | |

Cato Corp. “A” | | | 3,675 | | | | 30,062 | |

| | |

Chico’s FAS, Inc. | | | 21,424 | | | | 29,565 | |

| | |

Citi Trends, Inc. | | | 2,123 | | | | 42,927 | |

| | |

Conn’s, Inc.* (a) | | | 3,031 | | | | 30,583 | |

| | |

Designer Brands, Inc. “A” | | | 11,566 | | | | 78,302 | |

| | |

Envela Corp.* | | | 1,440 | | | | 8,784 | |

| | |

Express, Inc.* | | | 12,075 | | | | 18,596 | |

| | |

GameStop Corp. “A”* (a) | | | 10,743 | | | | 46,625 | |

| | |

Genesco, Inc.* | | | 2,548 | | | | 55,190 | |

| | |

Group 1 Automotive, Inc. | | | 3,244 | | | | 214,007 | |

| | |

Growgeneration Corp.* | | | 5,344 | | | | 36,553 | |

| | |

Guess?, Inc. | | | 8,218 | | | | 79,468 | |

| | |

Haverty Furniture Companies, Inc. | | | 3,107 | | | | 49,712 | |

| | |

Hibbett Sports, Inc.* | | | 3,037 | | | | 63,595 | |

| | |

Hudson Ltd. “A”* | | | 7,874 | | | | 38,346 | |

| | |

Lithia Motors, Inc. “A” | | | 4,122 | | | | 623,782 | |

| | |

Lumber Liquidators Holdings, Inc.* (a) | | | 5,184 | | | | 71,850 | |

| | |

MarineMax, Inc.* | | | 3,762 | | | | 84,231 | |

| | |

Monro, Inc. | | | 6,173 | | | | 339,145 | |

| | |

Murphy USA, Inc.* | | | 5,153 | | | | 580,176 | |

| | |

National Vision Holdings, Inc.* | | | 15,030 | | | | 458,716 | |

| | |

Office Depot, Inc. | | | 97,646 | | | | 229,468 | |

| | |

OneWater Marine, Inc. “A”* | | | 817 | | | | 19,837 | |

| | |

Rent-A-Center, Inc. | | | 9,146 | | | | 254,442 | |

| | |

RH* (a) | | | 3,123 | | | | 777,315 | |

| | |

Sally Beauty Holdings, Inc.* | | | 21,082 | | | | 264,157 | |

| | |

Shoe Carnival, Inc. | | | 1,661 | | | | 48,617 | |

| | |

Signet Jewelers Ltd. (a) | | | 9,769 | | | | 100,328 | |

| | |

Sleep Number Corp.* | | | 5,059 | | | | 210,657 | |

| | |

Sonic Automotive, Inc. “A” | | | 4,462 | | | | 142,382 | |

| | | | | | | | |

| | | Shares | | | Value ($) | |

| | |

Sportsman’s Warehouse Holdings, Inc.* | | | 7,988 | | | | 113,829 | |

| | |

The Buckle, Inc. | | | 5,447 | | | | 85,409 | |

| | |

The Children’s Place, Inc. (a) | | | 2,646 | | | | 99,013 | |

| | |

The Container Store Group, Inc.* | | | 2,885 | | | | 9,347 | |

| | |

The Michaels Companies, Inc.* (a) | | | 13,934 | | | | 98,513 | |

| | |

Tilly’s, Inc. “A” | | | 3,823 | | | | 21,676 | |

| | |

Urban Outfitters, Inc.* | | | 12,911 | | | | 196,505 | |

| | |

Winmark Corp. (a) | | | 551 | | | | 94,353 | |

| | |

Zumiez, Inc.* | | | 3,916 | | | | 107,220 | |

| | | | | | | | |

| | | | | | | 7,886,010 | |

|

Textiles, Apparel & Luxury Goods 0.9% | |

| | |

Crocs, Inc.* | | | 12,473 | | | | 459,256 | |

| | |

Deckers Outdoor Corp.* | | | 5,218 | | | | 1,024,763 | |

| | |

Fossil Group, Inc.* (a) | | | 8,665 | | | | 40,292 | |

| | |

G-III Apparel Group Ltd.* | | | 8,395 | | | | 111,570 | |

| | |

Kontoor Brands, Inc.* (a) | | | 9,631 | | | | 171,528 | |

| | |

Lakeland Industries, Inc.* | | | 1,429 | | | | 32,053 | |

| | |

Movado Group, Inc. | | | 3,094 | | | | 33,539 | |

| | |

Oxford Industries, Inc. | | | 3,058 | | | | 134,583 | |

| | |

Rocky Brands, Inc. | | | 1,238 | | | | 25,453 | |

| | |

Steven Madden Ltd. | | | 15,423 | | | | 380,794 | |

| | |

Superior Group of Company, Inc. | | | 1,996 | | | | 26,746 | |

| | |

Unifi, Inc.* | | | 2,631 | | | | 33,887 | |

| | |

Vera Bradley, Inc.* | | | 3,753 | | | | 16,663 | |

| | |

Wolverine World Wide, Inc. | | | 14,912 | | | | 355,055 | |

| | | | | | | | |

| | | | | | | 2,846,182 | |

|

| Consumer Staples 3.3% | |

Beverages 0.3% | |

| | |

Celsius Holdings, Inc.* | | | 6,415 | | | | 75,505 | |

| | |

Coca-Cola Bottling Co. Consolidated | | | 871 | | | | 199,624 | |

| | |

Craft Brew Alliance, Inc.* | | | 2,104 | | | | 32,381 | |

| | |

MGP Ingredients, Inc. (a) | | | 2,455 | | | | 90,111 | |

| | |

National Beverage Corp.* (a) | | | 2,196 | | | | 134,000 | |

| | |

New Age Beverages Corp.* (a) | | | 16,576 | | | | 25,361 | |

| | |

Primo Water Corp. | | | 29,194 | | | | 401,417 | |

| | | | | | | | |

| | | | | | | 958,399 | |

|

Food & Staples Retailing 0.9% | |

| | |

BJ’s Wholesale Club Holdings, Inc.* | | | 25,584 | | | | 953,516 | |

| | |

HF Foods Group, Inc.* (a) | | | 6,673 | | | | 60,391 | |

| | |

Ingles Markets, Inc. “A” | | | 2,625 | | | | 113,059 | |

| | |

Natural Grocers by Vitamin Cottage, Inc. | | | 1,700 | | | | 25,296 | |

| | |

Performance Food Group Co.* | | | 24,481 | | | | 713,376 | |

| | |

PriceSmart, Inc. | | | 4,253 | | | | 256,584 | |

| | |

Rite Aid Corp.* (a) | | | 10,245 | | | | 174,780 | |

| | |

SpartanNash Co. | | | 6,523 | | | | 138,614 | |

| | |

The Andersons, Inc. | | | 5,920 | | | | 81,459 | |

| | |

The Chefs’ Warehouse, Inc.* | | | 4,659 | | | | 63,269 | |

| | |

United Natural Foods, Inc.* | | | 9,891 | | | | 180,115 | |

| | |

Village Super Market, Inc. “A” | | | 1,509 | | | | 41,829 | |

| | |

Weis Markets, Inc. | | | 1,754 | | | | 87,910 | |

| | | | | | | | |

| | | | | | | 2,890,198 | |

|

Food Products 1.4% | |

| | |

Alico, Inc. | | | 961 | | | | 29,945 | |

| | |

B&G Foods, Inc. (a) | | | 11,955 | | | | 291,463 | |

| | |

Bridgford Foods Corp.* | | | 322 | | | | 5,332 | |

| | |

Cal-Maine Foods, Inc.* | | | 5,948 | | | | 264,567 | |

| | |

Calavo Growers, Inc. | | | 3,056 | | | | 192,253 | |

The accompanying notes are an integral part of the financial statements.

| | | | |

| DWS Small Cap Index VIP | | | | | 7 |

| | | | | | | | |

| | | Shares | | | Value ($) | |

| | |

Darling Ingredients, Inc.* | | | 30,066 | | | | 740,225 | |

| | |

Farmer Brothers Co.* | | | 3,038 | | | | 22,299 | |

| | |

Fresh Del Monte Produce, Inc. (a) | | | 5,886 | | | | 144,913 | |

| | |

Freshpet, Inc.* | | | 7,234 | | | | 605,196 | |

| | |

Hostess Brands, Inc.* | | | 22,972 | | | | 280,718 | |

| | |

J & J Snack Foods Corp. | | | 2,779 | | | | 353,294 | |

| | |

John B. Sanfilippo & Son, Inc. | | | 1,653 | | | | 141,050 | |

| | |

Lancaster Colony Corp. | | | 3,546 | | | | 549,595 | |

| | |

Landec Corp.* | | | 4,936 | | | | 39,291 | |

| | |

Limoneira Co. | | | 2,997 | | | | 43,427 | |

| | |

Sanderson Farms, Inc. | | | 3,768 | | | | 436,674 | |

| | |

Seneca Foods Corp. “A”* | | | 1,226 | | | | 41,451 | |

| | |

Simply Good Foods Co.* | | | 15,935 | | | | 296,072 | |

| | |

Tootsie Roll Industries, Inc. (a) | | | 2,994 | | | | 102,604 | |

| | | | | | | | |

| | | | | | | 4,580,369 | |

|

Household Products 0.2% | |

| | |

Central Garden & Pet Co.* | | | 1,786 | | | | 64,278 | |

| | |

Central Garden & Pet Co. “A”* | | | 7,363 | | | | 248,796 | |

| | |

Oil-Dri Corp. of America | | | 930 | | | | 32,271 | |

| | |

WD-40 Co. | | | 2,549 | | | | 505,467 | |

| | | | | | | | |

| | | | | | | 850,812 | |

|

Personal Products 0.4% | |

| | |

Bellring Brands, Inc.* | | | 7,358 | | | | 146,719 | |

| | |

Edgewell Personal Care Co.* | | | 10,111 | | | | 315,059 | |

| | |

elf Beauty, Inc.* | | | 4,894 | | | | 93,329 | |

| | |

Inter Parfums, Inc. | | | 3,320 | | | | 159,858 | |

| | |

Lifevantage Corp.* | | | 2,581 | | | | 34,895 | |

| | |

Medifast, Inc. (a) | | | 2,112 | | | | 293,082 | |

| | |

Nature’s Sunshine Products, Inc.* | | | 1,427 | | | | 12,857 | |

| | |

Revlon, Inc. “A”* (a) | | | 1,271 | | | | 12,583 | |

| | |

USANA Health Sciences, Inc.* | | | 2,164 | | | | 158,902 | |

| | |

Veru, Inc.* | | | 9,244 | | | | 30,875 | |

| | | | | | | | |

| | | | | | | 1,258,159 | |

|

Tobacco 0.1% | |

| | |

Turning Point Brands, Inc. | | | 1,528 | | | | 38,062 | |

| | |

Universal Corp. | | | 4,546 | | | | 193,250 | |

| | |

Vector Group Ltd. | | | 25,208 | | | | 253,593 | |

| | | | | | | | |

| | | | | | | 484,905 | |

|

| Energy 2.2% | |

Energy Equipment & Services 0.7% | |

| | |

Archrock, Inc. | | | 24,366 | | | | 158,135 | |

| | |

Aspen Aerogels, Inc.* | | | 3,815 | | | | 25,103 | |

| | |

Cactus, Inc. “A” (a) | | | 8,859 | | | | 182,761 | |

| | |

Championx Corp.* | | | 34,719 | | | | 338,857 | |

| | |

DMC Global, Inc. (a) | | | 2,718 | | | | 75,017 | |

| | |

Dril-Quip, Inc.* | | | 6,481 | | | | 193,069 | |

| | |

Exterran Corp.* | | | 4,890 | | | | 26,357 | |

| | |

Frank’s International NV* | | | 29,028 | | | | 64,732 | |

| | |

Helix Energy Solutions Group, Inc.* | | | 26,649 | | | | 92,472 | |

| | |

Liberty Oilfield Services, Inc. “A” | | | 11,781 | | | | 64,560 | |

| | |

Matrix Service Co.* | | | 5,074 | | | | 49,319 | |

| | |

Nabors Industries Ltd. | | | 1,271 | | | | 47,052 | |

| | |

National Energy Services Reunited Corp.* | | | 3,528 | | | | 24,273 | |

| | |

Newpark Resources, Inc.* | | | 15,711 | | | | 35,036 | |

| | |

NexTier Oilfield Solutions, Inc.* | | | 30,658 | | | | 75,112 | |

| | |

Oceaneering International, Inc.* | | | 18,720 | | | | 119,621 | |

| | |

Oil States International, Inc.* | | | 10,756 | | | | 51,091 | |

| | |

Patterson-UTI Energy, Inc. | | | 34,255 | | | | 118,865 | |

| | |

ProPetro Holding Corp.* | | | 15,093 | | | | 77,578 | |

| | | | | | | | |

| | | Shares | | | Value ($) | |

| | |

RPC, Inc. | | | 10,105 | | | | 31,123 | |

| | |

SEACOR Holdings, Inc.* | | | 3,587 | | | | 101,584 | |

| | |

Select Energy Services, Inc. “A”* | | | 10,567 | | | | 51,778 | |

| | |

Solaris Oilfield Infrastructure, Inc. “A” | | | 5,366 | | | | 39,816 | |

| | |

Tidewater, Inc.* | | | 7,846 | | | | 43,859 | |

| | |

Transocean Ltd.* | | | 109,297 | | | | 200,014 | |

| | |

U.S. Silica Holdings, Inc. | | | 13,188 | | | | 47,609 | |

| | | | | | | | |

| | | | | | | 2,334,793 | |

|

Oil, Gas & Consumable Fuels 1.5% | |

| | |

Adams Resources & Energy, Inc. | | | 404 | | | | 10,815 | |

| | |

Antero Resources Corp.* | | | 45,375 | | | | 115,252 | |

| | |

Arch Resources, Inc. | | | 2,852 | | | | 81,025 | |

| | |

Ardmore Shipping Corp. | | | 5,725 | | | | 24,847 | |

| | |

Berry Corp. | | | 12,653 | | | | 61,114 | |

| | |

Bonanza Creek Energy, Inc.* | | | 3,602 | | | | 53,382 | |

| | |

Brigham Minerals, Inc. “A” | | | 5,663 | | | | 69,938 | |

| | |

California Resources Corp.* (a) | | | 8,735 | | | | 10,657 | |

| | |

Chesapeake Energy Corp.* | | | 1,841 | | | | 9,021 | |

| | |

Clean Energy Fuels Corp.* | | | 25,316 | | | | 56,202 | |

| | |

CNX Resources Corp.* | | | 34,855 | | | | 301,496 | |

| | |

Comstock Resources, Inc.* | | | 3,872 | | | | 16,959 | |

| | |

CONSOL Energy, Inc.* | | | 4,697 | | | | 23,814 | |

| | |

Contango Oil & Gas Co.* | | | 16,741 | | | | 38,337 | |

| | |

CVR Energy, Inc. | | | 5,521 | | | | 111,027 | |

| | |

Delek U.S. Holdings, Inc. | | | 11,667 | | | | 203,122 | |

| | |

DHT Holdings, Inc. | | | 20,415 | | | | 104,729 | |

| | |

Diamond S Shipping, Inc.* | | | 5,184 | | | | 41,420 | |

| | |

Dorian LPG Ltd.* | | | 6,439 | | | | 49,838 | |

| | |

Earthstone Energy, Inc. “A”* | | | 5,119 | | | | 14,538 | |

| | |

Energy Fuels, Inc.* (a) | | | 21,828 | | | | 32,960 | |

| | |

Evolution Petroleum Corp. | | | 5,348 | | | | 14,974 | |

| | |

Falcon Minerals Corp. | | | 7,120 | | | | 22,784 | |

| | |

Frontline Ltd. | | | 22,010 | | | | 153,630 | |

| | |

Golar LNG Ltd.* (a) | | | 16,997 | | | | 123,058 | |

| | |

Goodrich Petroleum Corp.* | | | 1,605 | | | | 11,556 | |

| | |

Green Plains, Inc.* | | | 6,395 | | | | 65,325 | |

| | |

Gulfport Energy Corp.* | | | 28,635 | | | | 31,212 | |

| | |

International Seaways, Inc. | | | 4,733 | | | | 77,337 | |

| | |

Kosmos Energy Ltd. | | | 75,346 | | | | 125,074 | |

| | |

Magnolia Oil & Gas Corp. “A”* | | | 23,434 | | | | 142,010 | |

| | |

Matador Resources Co.* (a) | | | 20,511 | | | | 174,343 | |

| | |

Montage Resources Corp.* | | | 3,954 | | | | 15,618 | |

| | |

NACCO Industries, Inc. “A” | | | 660 | | | | 15,378 | |

| | |

NextDecade Corp* (a) | | | 4,427 | | | | 9,562 | |

| | |

Nordic American Tankers Ltd. (a) | | | 27,429 | | | | 111,362 | |

| | |

Overseas Shipholding Group, Inc. “A”* | | | 13,216 | | | | 24,582 | |

| | |

Ovintiv, Inc. | | | 48,902 | | | | 467,014 | |

| | |

Par Pacific Holdings, Inc.* | | | 7,462 | | | | 67,083 | |

| | |

PBF Energy, Inc. “A” | | | 18,028 | | | | 184,607 | |

| | |

PDC Energy, Inc.* (a) | | | 18,649 | | | | 231,994 | |

| | |

Peabody Energy Corp. | | | 11,159 | | | | 32,138 | |

| | |

Penn Virginia Corp.* | | | 2,508 | | | | 23,901 | |

| | |

PrimeEnergy Resources Corp.* | | | 96 | | | | 6,825 | |

| | |

Range Resources Corp. | | | 40,004 | | | | 225,223 | |

| | |

Renewable Energy Group, Inc.* | | | 7,136 | | | | 176,830 | |

| | |

REX American Resources Corp.* | | | 1,050 | | | | 72,839 | |

| | |

Scorpio Tankers, Inc. (a) | | | 9,555 | | | | 122,400 | |

| | |

SFL Corp. Ltd. | | | 17,365 | | | | 161,321 | |

| | |

SM Energy Co. | | | 20,698 | | | | 77,618 | |

| | |

Southwestern Energy Co.* (a) | | | 101,797 | | | | 260,600 | |

| | |

Talos Energy, Inc.* | | | 2,061 | | | | 18,961 | |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| | 8 | | | | | | DWS Small Cap Index VIP |

| | | | | | | | |

| | | Shares | | | Value ($) | |

| | |

Tellurian, Inc.* (a) | | | 27,289 | | | | 31,382 | |

| | |

Uranium Energy Corp.* | | | 34,451 | | | | 30,238 | |

| | |

W&T Offshore, Inc.* | | | 18,390 | | | | 41,929 | |

| | |

Whiting Petroleum Corp.* (a) | | | 16,658 | | | | 18,824 | |

| | |

World Fuel Services Corp. | | | 11,666 | | | | 300,516 | |

| | | | | | | | |

| | | | | | | 5,100,541 | |

|

| Financials 15.9% | |

Banks 8.3% | |

| | |

1st Constitution Bancorp. | | | 1,722 | | | | 21,353 | |

| | |

1st Source Corp. | | | 3,076 | | | | 109,444 | |

| | |

ACNB Corp. | | | 1,674 | | | | 43,825 | |

| | |

Allegiance Bancshares, Inc. (a) | | | 3,500 | | | | 88,865 | |

| | |

Amalgamated Bank “A” | | | 2,558 | | | | 32,333 | |

| | |

Amerant Bancorp, Inc.* | | | 4,236 | | | | 63,709 | |

| | |

American National Bankshares, Inc. | | | 2,057 | | | | 51,507 | |

| | |

Ameris Bancorp. | | | 12,403 | | | | 292,587 | |

| | |

Ames National Corp. | | | 1,759 | | | | 34,723 | |

| | |

Arrow Financial Corp. | | | 2,484 | | | | 73,849 | |

| | |

Atlantic Capital Bancshares, Inc.* | | | 3,831 | | | | 46,585 | |

| | |

Atlantic Union Bankshares Corp. (a) | | | 14,573 | | | | 337,511 | |

| | |

Auburn National Bancorporation, Inc. | | | 436 | | | | 24,891 | |

| | |

Banc of California, Inc. | | | 8,518 | | | | 92,250 | |

| | |

BancFirst Corp. | | | 3,540 | | | | 143,618 | |

| | |

BancorpSouth Bank | | | 18,491 | | | | 420,485 | |

| | |

Bank First Corp. (a) | | | 1,172 | | | | 75,125 | |

| | |

Bank of Commerce Holdings | | | 2,999 | | | | 22,732 | |

| | |

Bank of Marin Bancorp. | | | 2,487 | | | | 82,892 | |

| | |

Bank of NT Butterfield & Son Ltd. | | | 9,726 | | | | 237,217 | |

| | |

Bank of Princeton | | | 1,156 | | | | 23,212 | |

| | |

Bank7 Corp. | | | 588 | | | | 6,383 | |

| | |

BankFinancial Corp. | | | 2,654 | | | | 22,294 | |

| | |

BankUnited, Inc. | | | 17,151 | | | | 347,308 | |

| | |

Bankwell Financial Group, Inc. | | | 1,267 | | | | 20,145 | |

| | |

Banner Corp. | | | 6,451 | | | | 245,138 | |

| | |

Bar Harbor Bankshares | | | 2,785 | | | | 62,356 | |

| | |

Baycom Corp.* | | | 2,189 | | | | 28,260 | |

| | |

BCB Bancorp., Inc. | | | 2,455 | | | | 22,782 | |

| | |

Berkshire Hills Bancorp., Inc. | | | 8,397 | | | | 92,535 | |

| | |

Boston Private Financial Holdings, Inc. | | | 15,438 | | | | 106,213 | |

| | |

Bridge Bancorp., Inc. | | | 3,098 | | | | 70,758 | |

| | |

Brookline Bancorp., Inc. | | | 14,366 | | | | 144,809 | |

| | |

Bryn Mawr Bank Corp. | | | 3,657 | | | | 101,153 | |

| | |

Business First Bancshares, Inc. | | | 2,304 | | | | 35,366 | |

| | |

Byline Bancorp., Inc. | | | 4,537 | | | | 59,435 | |

| | |

C&F Financial Corp. | | | 613 | | | | 20,382 | |

| | |

Cadence BanCorp. | | | 23,427 | | | | 207,563 | |

| | |

California Bancorp, Inc.* | | | 1,410 | | | | 21,009 | |

| | |

Cambridge Bancorp. (a) | | | 1,211 | | | | 71,740 | |

| | |

Camden National Corp. | | | 2,776 | | | | 95,883 | |

| | |

Capital Bancorp. Inc* | | | 1,557 | | | | 16,660 | |

| | |

Capital City Bank Group, Inc. | | | 2,530 | | | | 53,004 | |

| | |

Capstar Financial Holdings, Inc. | | | 3,129 | | | | 37,548 | |

| | |

Carter Bank & Trust | | | 3,961 | | | | 31,965 | |

| | |

Cathay General Bancorp. | | | 14,175 | | | | 372,803 | |

| | |

CB Financial Services, Inc. | | | 920 | | | | 20,074 | |

| | |

CBTX, Inc. | | | 3,224 | | | | 67,704 | |

| | |

Central Pacific Financial Corp. | | | 5,057 | | | | 81,064 | |

| | |

Central Valley Community Bancorp. | | | 1,861 | | | | 28,641 | |

| | | | | | | | |

| | | Shares | | | Value ($) | |

| | |

Century Bancorp., Inc. “A” | | | 520 | | | | 40,414 | |

| | |

Chemung Financial Corp. | | | 703 | | | | 19,192 | |

| | |

Choiceone Financial Services, Inc. | | | 1,275 | | | | 37,689 | |

| | |

CIT Group, Inc. | | | 18,432 | | | | 382,095 | |

| | |

Citizens & Northern Corp. | | | 2,374 | | | | 49,023 | |

| | |

Citizens Holdings Co. | | | 871 | | | | 21,775 | |

| | |

City Holding Co. | | | 2,976 | | | | 193,946 | |

| | |

Civista Bancshares, Inc. | | | 2,895 | | | | 44,583 | |

| | |

CNB Financial Corp. | | | 2,854 | | | | 51,172 | |

| | |

Coastal Financial Corp.* | | | 1,827 | | | | 26,528 | |

| | |

Codorus Valley Bancorp., Inc. | | | 1,585 | | | | 21,921 | |

| | |

Colony Bankcorp, Inc. | | | 1,369 | | | | 16,113 | |

| | |

Columbia Banking System, Inc. | | | 13,453 | | | | 381,325 | |

| | |

Community Bank System, Inc. | | | 9,594 | | | | 547,050 | |

| | |

Community Bankers Trust Corp. | | | 3,937 | | | | 21,654 | |

| | |

Community Financial Corp. | | | 915 | | | | 22,326 | |

| | |

Community Trust Bancorp., Inc. | | | 2,909 | | | | 95,299 | |

| | |

ConnectOne Bancorp., Inc. | | | 6,930 | | | | 111,712 | |

| | |

County Bancorp., Inc. | | | 931 | | | | 19,486 | |

| | |

CrossFirst Bankshares, Inc.* | | | 8,847 | | | | 86,524 | |

| | |

Customers Bancorp., Inc.* | | | 5,382 | | | | 64,692 | |

| | |

CVB Financial Corp. | | | 24,147 | | | | 452,515 | |

| | |

Delmar Bancorp. | | | 1,827 | | | | 12,003 | |

| | |

Dime Community Bancshares | | | 5,347 | | | | 73,414 | |

| | |

Eagle Bancorp. Montana, Inc. | | | 1,167 | | | | 20,282 | |

| | |

Eagle Bancorp., Inc. | | | 6,015 | | | | 196,991 | |

| | |

Enterprise Bancorp., Inc. | | | 1,753 | | | | 41,756 | |

| | |

Enterprise Financial Services Corp. | | | 4,512 | | | | 140,413 | |

| | |

Equity Bancshares, Inc. “A”* | | | 2,609 | | | | 45,501 | |

| | |

Esquire Financial Holdings, Inc.* | | | 1,121 | | | | 18,945 | |

| | |

Evans Bancorp., Inc. | | | 846 | | | | 19,678 | |

| | |

Farmers & Merchants Bancorp., Inc. | | | 1,921 | | | | 40,802 | |

| | |

Farmers National Banc Corp. | | | 4,973 | | | | 58,980 | |

| | |

FB Financial Corp. | | | 3,322 | | | | 82,286 | |

| | |

Fidelity D&D Bancorp, Inc. | | | 736 | | | | 35,394 | |

| | |

Financial Institutions, Inc. | | | 2,920 | | | | 54,341 | |

| | |

First BanCorp. | | | 40,438 | | | | 226,048 | |

| | |

First BanCorp. — North Carolina | | | 5,371 | | | | 134,705 | |

| | |

First Bancorp., Inc. | | | 1,840 | | | | 39,928 | |

| | |

First Bancshares, Inc. | | | 3,861 | | | | 86,873 | |

| | |

First Bank | | | 3,074 | | | | 20,042 | |

| | |

First Busey Corp. | | | 9,461 | | | | 176,448 | |

| | |

First Business Financial Services, Inc. | | | 1,434 | | | | 23,589 | |

| | |

First Capital, Inc. | | | 597 | | | | 41,474 | |

| | |

First Choice Bancorp. | | | 1,780 | | | | 29,156 | |

| | |

First Commonwealth Financial Corp. | | | 18,052 | | | | 149,471 | |

| | |

First Community Bancshares, Inc. | | | 3,329 | | | | 74,736 | |

| | |

First Community Corp. | | | 1,338 | | | | 20,271 | |

| | |

First Financial Bancorp. | | | 17,985 | | | | 249,812 | |

| | |

First Financial Bankshares, Inc. | | | 24,083 | | | | 695,758 | |

| | |

First Financial Corp. — Indiana | | | 2,580 | | | | 95,047 | |

| | |

First Foundation, Inc. | | | 7,290 | | | | 119,119 | |

| | |

First Guaranty Bancshares, Inc. | | | 514 | | | | 6,286 | |

| | |

First Internet Bancorp. | | | 1,676 | | | | 27,855 | |

| | |

First Interstate BancSystem, Inc. “A” | | | 7,946 | | | | 246,008 | |

| | |

First Merchants Corp. | | | 10,096 | | | | 278,347 | |

| | |

First Mid-Illinois Bancshares, Inc. | | | 2,680 | | | | 70,296 | |

| | |

First Midwest Bancorp., Inc. | | | 21,325 | | | | 284,689 | |

| | |

First Northwest Bancorp. | | | 1,649 | | | | 20,481 | |

The accompanying notes are an integral part of the financial statements.

| | | | |

| DWS Small Cap Index VIP | | | | | 9 |

| | | | | | | | |

| | | Shares | | | Value ($) | |

| | |

First of Long Island Corp. | | | 4,264 | | | | 69,674 | |

| | |

First Savings Financial Group, Inc. | | | 348 | | | | 15,079 | |

| | |

First United Corp. | | | 1,254 | | | | 16,728 | |

| | |

First Western Financial, Inc.* | | | 1,163 | | | | 16,573 | |

| | |

Flushing Financial Corp. | | | 4,988 | | | | 57,462 | |

| | |

FNCB Bancorp, Inc. | | | 3,161 | | | | 18,176 | |

| | |

Franklin Financial Network, Inc. | | | 2,502 | | | | 64,427 | |

| | |

Franklin Financial Services Corp. | | | 769 | | | | 19,917 | |

| | |

Fulton Financial Corp. | | | 30,135 | | | | 317,322 | |

| | |

FVCBankcorp, Inc.* | | | 2,234 | | | | 24,038 | |

| | |

German American Bancorp., Inc. (a) | | | 4,587 | | | | 142,656 | |

| | |

Glacier Bancorp., Inc. | | | 17,894 | | | | 631,479 | |

| | |

Great Southern Bancorp., Inc. | | | 2,071 | | | | 83,586 | |

| | |

Great Western Bancorp., Inc. | | | 10,496 | | | | 144,425 | |

| | |

Guaranty Bancshares, Inc. | | | 1,309 | | | | 33,864 | |

| | |

Hancock Whitney Corp. | | | 16,126 | | | | 341,871 | |

| | |

Hanmi Financial Corp. | | | 5,734 | | | | 55,677 | |

| | |

Harborone Bancorp, Inc.* | | | 9,889 | | | | 84,452 | |

| | |

Hawthorn Bancshares, Inc. | | | 1,085 | | | | 21,358 | |

| | |

HBT Financial, Inc. | | | 1,956 | | | | 26,073 | |

| | |

Heartland Financial U.S.A., Inc. | | | 6,412 | | | | 214,417 | |

| | |

Heritage Commerce Corp. | | | 10,779 | | | | 80,896 | |

| | |

Heritage Financial Corp. (a) | | | 6,768 | | | | 135,360 | |

| | |

Hilltop Holdings, Inc. | | | 13,463 | | | | 248,392 | |

| | |

Home Bancshares, Inc. | | | 28,581 | | | | 439,576 | |

| | |

HomeTrust Bancshares, Inc. | | | 2,976 | | | | 47,616 | |

| | |

Hope Bancorp., Inc. | | | 22,007 | | | | 202,905 | |

| | |

Horizon Bancorp, Inc. | | | 8,006 | | | | 85,584 | |

| | |

Howard Bancorp., Inc.* | | | 2,502 | | | | 26,571 | |

| | |

IBERIABANK Corp. | | | 9,742 | | | | 443,651 | |

| | |

Independent Bank Corp. | | | 6,105 | | | | 409,584 | |

| | |

Independent Bank Corp./Michigan | | | 3,955 | | | | 58,732 | |

| | |

Independent Bank Group, Inc. | | | 6,918 | | | | 280,317 | |

| | |

International Bancshares Corp. | | | 9,974 | | | | 319,367 | |

| | |

Investar Holding Corp. | | | 1,915 | | | | 27,768 | |

| | |

Investors Bancorp., Inc. | | | 43,117 | | | | 366,495 | |

| | |

Lakeland Bancorp., Inc. | | | 9,163 | | | | 104,733 | |

| | |

Lakeland Financial Corp. | | | 4,531 | | | | 211,099 | |

| | |

Landmark Bancorp. Inc/manhattan Ks | | | 694 | | | | 17,149 | |

| | |

LCNB Corp. | | | 2,332 | | | | 37,219 | |

| | |

Level One Bancorp, Inc. | | | 921 | | | | 15,418 | |

| | |

Limestone Bancorp, Inc.* | | | 940 | | | | 12,361 | |

| | |

Live Oak Bancshares, Inc. (a) | | | 5,247 | | | | 76,134 | |

| | |

Macatawa Bank Corp. | | | 4,755 | | | | 37,184 | |

| | |

Mackinac Financial Corp. | | | 1,700 | | | | 17,629 | |

| | |

MainStreet Bancshares, Inc.* | | | 1,307 | | | | 17,252 | |

| | |

Mercantile Bank Corp. | | | 2,942 | | | | 66,489 | |

| | |

Meridian Corp.* | | | 999 | | | | 15,834 | |

| | |

Metrocity Bankshares, Inc. | | | 3,232 | | | | 46,315 | |

| | |

Metropolitan Bank Holding Corp.* | | | 1,295 | | | | 41,544 | |

| | |

Mid Penn Bancorp, Inc. | | | 1,273 | | | | 23,461 | |

| | |

Middlefield Banc Corp. | | | 1,114 | | | | 23,116 | |

| | |

Midland States Bancorp., Inc. (a) | | | 4,132 | | | | 61,773 | |

| | |

MidWestOne Financial Group, Inc. | | | 2,752 | | | | 55,040 | |

| | |

MVB Financial Corp. | | | 2,023 | | | | 26,906 | |

| | |

National Bank Holdings Corp. “A” | | | 5,415 | | | | 146,205 | |

| | |

National Bankshares, Inc. | | | 1,117 | | | | 31,946 | |

| | |

NBT Bancorp., Inc. | | | 7,872 | | | | 242,143 | |

| | |

Nicolet Bankshares, Inc.* (a) | | | 1,743 | | | | 95,516 | |

| | |

Northeast Bank* | | | 1,409 | | | | 24,728 | |

| | |

Northrim BanCorp., Inc. | | | 1,086 | | | | 27,302 | |

| | |

Norwood Financial Corp. | | | 1,066 | | | | 26,426 | |

| | | | | | | | |

| | | Shares | | | Value ($) | |

| | |

Oak Valley Bancorp. | | | 1,299 | | | | 16,471 | |

| | |

OceanFirst Financial Corp. | | | 10,876 | | | | 191,744 | |

| | |

OFG Bancorp. | | | 9,445 | | | | 126,280 | |

| | |

Ohio Valley Banc Corp. | | | 758 | | | | 17,093 | |

| | |

Old National Bancorp. (a) | | | 30,638 | | | | 421,579 | |

| | |

Old Second Bancorp., Inc. | | | 5,377 | | | | 41,833 | |

| | |

Origin Bancorp, Inc. | | | 4,123 | | | | 90,706 | |

| | |

Orrstown Financial Services, Inc. | | | 2,173 | | | | 32,052 | |

| | |

Pacific Premier Bancorp., Inc. | | | 15,767 | | | | 341,829 | |

| | |

Park National Corp. | | | 2,682 | | | | 188,759 | |

| | |

Parke Bancorp., Inc. | | | 1,830 | | | | 24,797 | |

| | |

PCB Bancorp. | | | 2,369 | | | | 24,401 | |

| | |

Peapack-Gladstone Financial Corp. | | | 3,300 | | | | 61,809 | |

| | |

Penns Woods Bancorp., Inc. | | | 1,246 | | | | 28,297 | |

| | |

People’s Utah Bancorp. | | | 2,964 | | | | 66,601 | |

| | |

Peoples Bancorp. of North Carolina, Inc. | | | 847 | | | | 14,966 | |

| | |

Peoples Bancorp., Inc. | | | 3,563 | | | | 75,821 | |

| | |

Peoples Financial Services Corp. | | | 1,331 | | | | 50,831 | |

| | |

Plumas Bancorp. | | | 862 | | | | 19,067 | |

| | |

Preferred Bank | | | 2,539 | | | | 108,796 | |

| | |

Premier Financial Bancorp., Inc. | | | 2,273 | | | | 29,140 | |

| | |

Professional Holding Corp.* | | | 897 | | | | 12,450 | |

| | |

QCR Holdings, Inc. | | | 2,695 | | | | 84,030 | |

| | |

RBB Bancorp. | | | 2,922 | | | | 39,885 | |

| | |

Red River Bancshares, Inc. | | | 923 | | | | 40,510 | |

| | |

Reliant Bancorp., Inc. | | | 2,868 | | | | 46,720 | |

| | |

Renasant Corp. | | | 10,187 | | | | 253,656 | |

| | |

Republic Bancorp., Inc. “A” | | | 1,860 | | | | 60,841 | |

| | |

Republic First Bancorp., Inc.* | | | 8,082 | | | | 19,720 | |

| | |

Richmond Mutual Bancorp., Inc. | | | 2,083 | | | | 23,413 | |

| | |

S&T Bancorp., Inc. | | | 7,234 | | | | 169,637 | |

| | |

Salisbury Bancorp, Inc. | | | 472 | | | | 19,347 | |

| | |

Sandy Spring Bancorp., Inc. | | | 8,610 | | | | 213,356 | |

| | |

Sb Financial Group, Inc. | | | 1,324 | | | | 22,005 | |

| | |

SB One Bancorp. | | | 1,485 | | | | 29,255 | |

| | |

Seacoast Banking Corp. of Florida* | | | 9,743 | | | | 198,757 | |

| | |

Select Bancorp, Inc.* | | | 2,954 | | | | 24,046 | |

| | |

ServisFirst Bancshares, Inc. | | | 9,098 | | | | 325,344 | |

| | |

Shore Bancshares, Inc. | | | 2,489 | | | | 27,603 | |

| | |

Sierra Bancorp. | | | 2,586 | | | | 48,824 | |

| | |

Silvergate Capital Corp.* | | | 2,879 | | | | 40,306 | |

| | |

Simmons First National Corp. “A” | | | 20,223 | | | | 346,016 | |

| | |

SmartFinancial, Inc. | | | 2,699 | | | | 43,670 | |

| | |

South Plains Financial, Inc. | | | 2,062 | | | | 29,363 | |

| | |

South State Corp. | | | 13,072 | | | | 623,012 | |

| | |

Southern First Bancshares, Inc.* | | | 1,312 | | | | 36,356 | |

| | |

Southern National Bancorp. of Virginia, Inc. | | | 3,587 | | | | 34,758 | |

| | |

Southside Bancshares, Inc. | | | 5,911 | | | | 163,853 | |

| | |

Spirit of Texas Bancshares, Inc.* | | | 2,479 | | | | 30,516 | |

| | |

Stock Yards Bancorp., Inc. | | | 3,844 | | | | 154,529 | |

| | |

Summit Financial Group, Inc. | | | 2,232 | | | | 36,783 | |

| | |

Texas Capital Bancshares, Inc.* | | | 9,451 | | | | 291,752 | |

| | |

The Bancorp., Inc.* | | | 9,630 | | | | 94,374 | |

| | |

Tompkins Financial Corp. (a) | | | 2,645 | | | | 171,317 | |

| | |

TowneBank | | | 12,542 | | | | 236,291 | |

| | |

TriCo Bancshares | | | 4,907 | | | | 149,418 | |

| | |

TriState Capital Holdings, Inc.* | | | 5,234 | | | | 82,226 | |

| | |

Triumph Bancorp., Inc.* | | | 4,201 | | | | 101,958 | |

| | |

Trustmark Corp. | | | 11,780 | | | | 288,846 | |

| | |

UMB Financial Corp. | | | 8,148 | | | | 420,029 | |

| | |

United Bankshares, Inc. | | | 23,078 | | | | 638,337 | |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| | 10 | | | | | | DWS Small Cap Index VIP |

| | | | | | | | |

| | | Shares | | | Value ($) | |

| | |

United Community Banks, Inc. | | | 14,560 | | | | 292,947 | |

| | |

United Securities Bancshares | | | 2,548 | | | | 17,046 | |

| | |

Unity Bancorp., Inc. | | | 1,412 | | | | 20,192 | |

| | |

Univest Corp. of Pennsylvania | | | 5,377 | | | | 86,785 | |

| | |

Valley National Bancorp. | | | 74,442 | | | | 582,136 | |

| | |

Veritex Holdings, Inc. | | | 8,908 | | | | 157,672 | |

| | |

Washington Trust Bancorp., Inc. | | | 3,196 | | | | 104,669 | |

| | |

WesBanco, Inc. | | | 12,159 | | | | 246,949 | |

| | |

West Bancorp. | | | 3,031 | | | | 53,012 | |

| | |

Westamerica Bancorp. | | | 4,901 | | | | 281,415 | |

| | | | | | | | |

| | | | | | | 28,035,741 | |

|

Capital Markets 1.4% | |

| | |

Artisan Partners Asset Management, Inc. “A” | | | 10,153 | | | | 329,973 | |

| | |

Assetmark Financial Holdings, Inc.* (a) | | | 3,060 | | | | 83,507 | |

| | |

Associated Capital Group, Inc. “A” | | | 276 | | | | 10,126 | |

| | |

B. Riley Financial, Inc. | | | 3,654 | | | | 79,511 | |

| | |

BGC Partners, Inc. “A” | | | 57,020 | | | | 156,235 | |

| | |

Blucora, Inc.* | | | 9,134 | | | | 104,310 | |

| | |

Brightsphere Investment Group, Inc.* | | | 11,570 | | | | 144,162 | |

| | |

Cohen & Steers, Inc. | | | 4,564 | | | | 310,580 | |

| | |

Cowen, Inc. | | | 5,001 | | | | 81,066 | |

| | |

Diamond Hill Investment Group | | | 564 | | | | 64,110 | |

| | |

Donnelley Financial Solutions, Inc.* | | | 5,454 | | | | 45,814 | |

| | |

Federated Hermes, Inc. “B” | | | 17,935 | | | | 425,059 | |

| | |

Focus Financial Partners, Inc. “A”* | | | 5,875 | | | | 194,169 | |

| | |

Gain Capital Holdings, Inc. | | | 3,505 | | | | 21,100 | |

| | |

GAMCO Investors, Inc. “A” | | | 957 | | | | 12,738 | |

| | |

Greenhill & Co., Inc. | | | 2,892 | | | | 28,891 | |

| | |

Hamilton Lane, Inc. “A” | | | 4,133 | | | | 278,440 | |

| | |

Houlihan Lokey, Inc. | | | 8,268 | | | | 460,032 | |

| | |

Moelis & Co. “A” | | | 9,872 | | | | 307,612 | |

| | |

Oppenheimer Holdings, Inc. “A” | | | 1,751 | | | | 38,154 | |

| | |

Piper Sandler Companies | | | 3,256 | | | | 192,625 | |

| | |

PJT Partners, Inc. “A” | | | 4,398 | | | | 225,793 | |

| | |

Pzena Investment Management, Inc. “A” | | | 3,077 | | | | 16,739 | |

| | |

Safeguard Scientifics, Inc. | | | 3,490 | | | | 24,430 | |

| | |

Sculptor Capital Management, Inc. | | | 3,504 | | | | 45,307 | |

| | |

Siebert Financial Corp.* | | | 2,244 | | | | 11,355 | |

| | |

Silvercrest Asset Management Group, Inc. “A” | | | 1,608 | | | | 20,438 | |

| | |

Stifel Financial Corp. | | | 12,470 | | | | 591,452 | |

| | |

Value Line, Inc. | | | 187 | | | | 5,047 | |

| | |

Virtus Investment Partners, Inc. | | | 1,373 | | | | 159,666 | |

| | |

Waddell & Reed Financial, Inc. “A” (a) | | | 12,036 | | | | 186,678 | |

| | |

Westwood Holdings Group, Inc. | | | 1,479 | | | | 23,294 | |

| | |

WisdomTree Investments, Inc. | | | 27,195 | | | | 94,367 | |

| | | | | | | | |

| | | | | | | 4,772,780 | |

|

Consumer Finance 0.7% | |

| | |

Atlanticus Holdings Corp.* | | | 928 | | | | 9,596 | |

| | |

Curo Group Holdings Corp. | | | 3,408 | | | | 27,843 | |

| | |

Encore Capital Group, Inc.* (a) | | | 5,875 | | | | 200,808 | |

| | |

Enova International, Inc.* | | | 5,481 | | | | 81,502 | |

| | |

EZCORP, Inc. “A”* | | | 9,415 | | | | 59,315 | |

| | |

FirstCash, Inc. | | | 7,578 | | | | 511,363 | |

| | |

Green Dot Corp. “A”* | | | 9,513 | | | | 466,898 | |

| | | | | | | | |

| | | Shares | | | Value ($) | |

| | |

Lendingclub Corp.* | | | 13,274 | | | | 60,397 | |

| | |

Navient Corp. | | | 35,748 | | | | 251,308 | |

| | |

Nelnet, Inc. “A” | | | 3,301 | | | | 157,590 | |

| | |

Oportun Financial Corp.* | | | 3,632 | | | | 48,814 | |

| | |

PRA Group, Inc.* | | | 8,388 | | | | 324,280 | |

| | |

Regional Management Corp.* | | | 1,560 | | | | 27,628 | |

| | |

World Acceptance Corp.* | | | 897 | | | | 58,771 | |

| | | | | | | | |

| | | | | | | 2,286,113 | |

|

Diversified Financial Services 0.3% | |

| | |

A-mark Precious Metals, Inc.* | | | 916 | | | | 17,450 | |

| | |

Alerus Financial Corp. | | | 2,780 | | | | 54,933 | |

| | |

Banco Latinoamericano de Comercio Exterior SA “E” | | | 5,938 | | | | 68,287 | |

| | |

Cannae Holdings, Inc.* | | | 15,814 | | | | 649,955 | |

| | |

GWG Holdings, Inc.* | | | 642 | | | | 4,924 | |

| | |

Marlin Business Services Corp. | | | 1,586 | | | | 13,418 | |

| | |

Stonex Group, Inc.* | | | 3,089 | | | | 169,895 | |

| | |

Swk Holdings Corp.* | | | 653 | | | | 7,823 | |

| | | | | | | | |

| | | | | | | 986,685 | |

|

Insurance 2.2% | |

| | |

Ambac Financial Group, Inc.* | | | 8,600 | | | | 123,152 | |

| | |

American Equity Investment Life Holding Co. | | | 16,847 | | | | 416,289 | |

| | |

AMERISAFE, Inc. | | | 3,594 | | | | 219,809 | |

| | |

Argo Group International Holdings Ltd. | | | 6,024 | | | | 209,816 | |

| | |

Benefytt Technologies, Inc.* (a) | | | 2,050 | | | | 41,943 | |

| | |

BRP Group, Inc.* | | | 3,712 | | | | 64,106 | |

| | |

Citizens, Inc.* (a) | | | 9,311 | | | | 55,773 | |

| | |

CNO Financial Group, Inc. | | | 26,744 | | | | 416,404 | |

| | |

Crawford & Co. “A” | | | 3,038 | | | | 23,970 | |

| | |

Donegal Group, Inc. “A” | | | 1,923 | | | | 27,345 | |

| | |

eHealth, Inc.* | | | 4,761 | | | | 467,721 | |

| | |

Employers Holdings, Inc. | | | 5,591 | | | | 168,569 | |

| | |

Enstar Group Ltd.* | | | 2,246 | | | | 343,121 | |

| | |

FBL Financial Group, Inc. “A” | | | 1,857 | | | | 66,648 | |

| | |

FedNat Holding, Co. | | | 2,451 | | | | 27,133 | |

| | |

Genworth Financial, Inc. “A”* | | | 94,721 | | | | 218,805 | |

| | |

Global Indemnity Ltd. | | | 1,416 | | | | 33,899 | |

| | |

Goosehead Insurance, Inc. “A”* | | | 2,409 | | | | 181,060 | |

| | |

Greenlight Capital Re Ltd. “A”* | | | 5,111 | | | | 33,324 | |

| | |

HCI Group, Inc. | | | 1,086 | | | | 50,151 | |

| | |

Heritage Insurance Holdings, Inc. | | | 4,636 | | | | 60,685 | |

| | |

Horace Mann Educators Corp. | | | 7,761 | | | | 285,062 | |

| | |

Independence Holding Co. | | | 889 | | | | 27,194 | |

| | |

Investors Title Co. | | | 242 | | | | 29,359 | |

| | |

James River Group Holdings Ltd. | | | 5,585 | | | | 251,325 | |

| | |

Kinsale Capital Group, Inc. | | | 3,887 | | | | 603,301 | |

| | |

MBIA, Inc.* (a) | | | 13,000 | | | | 94,250 | |

| | |

National General Holdings Corp. | | | 12,760 | | | | 275,744 | |

| | |

National Western Life Group, Inc. “A” | | | 479 | | | | 97,328 | |

| | |

NI Holdings, Inc.* | | | 1,683 | | | | 24,858 | |

| | |

Palomar Holdings, Inc.* | | | 3,603 | | | | 308,993 | |

| | |

ProAssurance Corp. | | | 9,876 | | | | 142,906 | |

| | |

ProSight Global, Inc.* | | | 1,658 | | | | 14,756 | |

| | |

Protective Insurance Corp. “B” | | | 1,579 | | | | 23,796 | |

| | |

RLI Corp. | | | 7,412 | | | | 608,525 | |

| | |

Safety Insurance Group, Inc. | | | 2,714 | | | | 206,970 | |

| | |

Selective Insurance Group, Inc. | | | 11,050 | | | | 582,777 | |

| | |

State Auto Financial Corp. | | | 3,257 | | | | 58,137 | |

| | |

Stewart Information Services Corp. | | | 4,360 | | | | 141,744 | |

The accompanying notes are an integral part of the financial statements.

| | | | |

| DWS Small Cap Index VIP | | | | | 11 |

| | | | | | | | |

| | | Shares | | | Value ($) | |

| | |

Third Point Reinsurance Ltd.* | | | 15,074 | | | | 113,206 | |

| | |

Tiptree, Inc. | | | 4,324 | | | | 27,890 | |

| | |

Trupanion, Inc.* (a) | | | 5,549 | | | | 236,887 | |

| | |

United Fire Group, Inc. | | | 3,923 | | | | 108,706 | |

| | |

United Insurance Holdings Corp. | | | 3,590 | | | | 28,074 | |

| | |

Universal Insurance Holdings, Inc. | | | 5,260 | | | | 93,365 | |

| | |

Vericity, Inc. | | | 465 | | | | 4,943 | |

| | |

Watford Holdings Ltd.* | | | 3,139 | | | | 52,390 | |

| | | | | | | | |

| | | | | | | 7,692,209 | |

|

Mortgage Real Estate Investment Trusts (REITs) 1.3% | |

| | |

Anworth Mortgage Asset Corp. | | | 18,024 | | | | 30,641 | |

| | |

Apollo Commercial Real Estate Finance, Inc. | | | 28,967 | | | | 284,166 | |

| | |

Arbor Realty Trust, Inc. | | | 19,253 | | | | 177,898 | |

| | |

Ares Commercial Real Estate Corp. | | | 5,546 | | | | 50,580 | |

| | |

Arlington Asset Investment Corp. “A” | | | 6,671 | | | | 19,813 | |

| | |

ARMOUR Residential REIT, Inc. | | | 11,995 | | | | 112,633 | |

| | |

Blackstone Mortgage Trust, Inc.,“A” | | | 25,786 | | | | 621,185 | |

| | |

Broadmark Realty Capital, Inc. | | | 24,029 | | | | 227,555 | |

| | |

Capstead Mortgage Corp. | | | 17,366 | | | | 95,339 | |

| | |

Cherry Hill Mortgage Investment Corp. | | | 2,848 | | | | 25,689 | |

| | |

Chimera Investment Corp. | | | 35,837 | | | | 344,394 | |

| | |

Colony Credit Real Estate, Inc. | | | 15,714 | | | | 110,312 | |

| | |

Dynex Capital, Inc. | | | 4,270 | | | | 61,061 | |

| | |

Ellington Financial, Inc. | | | 7,704 | | | | 90,753 | |

| | |

Ellington Residential Mortgage REIT | | | 1,675 | | | | 17,252 | |

| | |

Granite Point Mortgage Trust, Inc. | | | 10,366 | | | | 74,428 | |

| | |

Great Ajax Corp. | | | 3,849 | | | | 35,411 | |

| | |

Hannon Armstrong Sustainable Infrastructure Capital, Inc. | | | 13,201 | | | | 375,700 | |

| | |

Invesco Mortgage Capital, Inc. (a) | | | 34,519 | | | | 129,101 | |

| | |

KKR Real Estate Finance Trust, Inc. | | | 5,331 | | | | 88,388 | |

| | |

Ladder Capital Corp. | | | 19,556 | | | | 158,404 | |

| | |

MFA Financial, Inc. | | | 84,758 | | | | 211,047 | |

| | |

New York Mortgage Trust, Inc. | | | 70,502 | | | | 184,010 | |

| | |

Orchid Island Capital, Inc. | | | 12,414 | | | | 58,470 | |

| | |

PennyMac Mortgage Investment Trust | | | 18,627 | | | | 326,531 | |

| | |

Ready Capital Corp. | | | 6,965 | | | | 60,526 | |

| | |

Redwood Trust, Inc. | | | 21,184 | | | | 148,288 | |

| | |

TPG RE Finance Trust, Inc. | | | 11,205 | | | | 96,363 | |

| | |

Two Harbors Investment Corp. | | | 51,184 | | | | 257,967 | |

| | |

Western Asset Mortgage Capital Corp. | | | 9,007 | | | | 24,679 | |

| | | | | | | | |

| | | | | | | 4,498,584 | |

|

Thrifts & Mortgage Finance 1.7% | |

| | |

Axos Financial, Inc.* | | | 10,912 | | | | 240,937 | |

| | |

Bogota Financial Corp.* | | | 1,088 | | | | 9,509 | |

| | |

Bridgewater Bancshares, Inc.* | | | 4,096 | | | | 41,984 | |

| | |

Capitol Federal Financial, Inc. | | | 24,793 | | | | 272,971 | |

| | |

Columbia Financial, Inc.* | | | 9,170 | | | | 127,967 | |

| | |

ESSA Bancorp., Inc. | | | 1,656 | | | | 23,052 | |

| | |

Essent Group Ltd. | | | 20,269 | | | | 735,157 | |

| | |

Federal Agricultural Mortgage Corp. “C” | | | 1,701 | | | | 108,881 | |

| | |

Flagstar Bancorp., Inc. | | | 6,668 | | | | 196,239 | |

| | |

FS Bancorp, Inc. | | | 707 | | | | 27,269 | |

| | | | | | | | |

| | | Shares | | | Value ($) | |

| | |

Greene County Bancorp., Inc. | | | 571 | | | | 12,733 | |

| | |

Hingham Institution for Savings | | | 273 | | | | 45,804 | |

| | |

Home Bancorp., Inc. | | | 1,408 | | | | 37,664 | |

| | |

HomeStreet, Inc. (a) | | | 4,286 | | | | 105,478 | |

| | |

Kearny Financial Corp. | | | 14,097 | | | | 115,313 | |

| | |

Luther Burbank Corp. | | | 3,695 | | | | 36,950 | |

| | |

Merchants Bancorp. | | | 1,599 | | | | 29,566 | |

| | |

Meridian Bancorp., Inc. | | | 8,930 | | | | 103,588 | |

| | |

Meta Financial Group, Inc. | | | 6,304 | | | | 114,544 | |

| | |

MMA Capital Holdings, Inc.* | | | 909 | | | | 21,016 | |

| | |

Mr Cooper Group, Inc.* | | | 14,478 | | | | 180,106 | |

| | |

NMI Holdings, Inc. “A”* | | | 12,547 | | | | 201,756 | |

| | |

Northfield Bancorp., Inc. | | | 8,059 | | | | 92,840 | |

| | |

Northwest Bancshares, Inc. | | | 21,954 | | | | 224,480 | |

| | |

Oconee Federal Financial Corp. | | | 194 | | | | 4,999 | |

| | |

OP Bancorp. | | | 2,318 | | | | 15,994 | |

| | |

PCSB Financial Corp. | | | 2,806 | | | | 35,580 | |

| | |

PennyMac Financial Services, Inc. | | | 8,673 | | | | 362,445 | |

| | |

Pioneer Bancorp. Inc.* | | | 1,979 | | | | 18,108 | |

| | |

Ponce de Leon Federal Bank* | | | 1,616 | | | | 16,451 | |

| | |

Premier Financial Corp. | | | 7,008 | | | | 123,831 | |

| | |

Provident Bancorp, Inc. | | | 1,687 | | | | 13,260 | |

| | |

Provident Financial Holdings, Inc. | | | 1,084 | | | | 14,536 | |

| | |

Provident Financial Services, Inc. | | | 11,341 | | | | 163,877 | |

| | |

Prudential Bancorp., Inc. | | | 1,575 | | | | 18,963 | |

| | |

Radian Group, Inc. | | | 35,753 | | | | 554,529 | |

| | |

Riverview Bancorp., Inc. | | | 3,700 | | | | 20,905 | |

| | |

Security National Financial Corp. “A”* | | | 1,695 | | | | 11,433 | |

| | |

Southern Missouri Bancorp., Inc. | | | 1,509 | | | | 36,669 | |

| | |

Standard Avb Financial Corp. | | | 719 | | | | 16,681 | |

| | |

Sterling Bancorp., Inc. | | | 3,148 | | | | 11,270 | |

| | |

Territorial Bancorp., Inc. | | | 1,551 | | | | 36,898 | |

| | |

Timberland Bancorp., Inc. | | | 1,398 | | | | 25,458 | |

| | |

TrustCo Bank Corp. | | | 17,561 | | | | 111,161 | |

| | |

Walker & Dunlop, Inc. | | | 5,282 | | | | 268,378 | |

| | |

Washington Federal, Inc. | | | 14,108 | | | | 378,659 | |

| | |

Waterstone Financial, Inc. | | | 4,267 | | | | 63,280 | |

| | |

Western New England Bancorp, Inc. | | | 4,291 | | | | 24,845 | |

| | |

WSFS Financial Corp. | | | 9,315 | | | | 267,340 | |

| | | | | | | | |

| | | | | | | 5,721,354 | |

|

| Health Care 20.1% | |

Biotechnology 10.6% | |

| | |

89bio, Inc.* | | | 547 | | | | 10,902 | |

| | |

Abeona Therapeutics, Inc.* | | | 11,128 | | | | 32,438 | |

| | |

ADMA Biologics, Inc.* | | | 11,244 | | | | 32,945 | |

| | |

Aduro Biotech, Inc.* | | | 11,642 | | | | 26,893 | |

| | |

Adverum Biotechnologies, Inc.* | | | 13,636 | | | | 284,720 | |

| | |

Aeglea BioTherapeutics, Inc.* | | | 7,841 | | | | 72,529 | |

| | |

Affimed NV* | | | 13,800 | | | | 63,687 | |

| | |

Agenus, Inc.* (a) | | | 25,850 | | | | 101,590 | |

| | |

Aimmune Therapeutics, Inc.* (a) | | | 8,685 | | | | 145,126 | |

| | |

Akcea Therapeutics, Inc.* | | | 3,081 | | | | 42,210 | |

| | |