UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR/A

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07589

THE HARTFORD MUTUAL FUNDS, INC.

(Exact name of registrant as specified in charter)

5 Radnor Corporate Center, Suite 300, 100 Matsonford Road, Radnor, Pennsylvania 19087

(Address of Principal Executive Offices) (Zip Code)

Edward P. Macdonald, Esquire

Hartford Funds Management Company, LLC

5 Radnor Corporate Center, Suite 300

100 Matsonford Road

Radnor, PA 19087

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (610) 386-4068

Date of fiscal year end: October 31

Date of reporting period: April 30, 2014

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Explanatory Note:

The Registrant is filing this amendment to its Form N-CSR (the “Amendment”) for the period ended April 30, 2014, originally filed with the U.S. Securities and Exchange Commission on July 1, 2014 (Accession Number 0001144204-14-040645) (“Original Filing”), to amend Item 1, “Reports to Stockholders.” The purpose of the Amendment is to correct the returns presented for the Global Real Asset Fund Blended Index, a custom benchmark, in the semi-annual report for The Hartford Global Real Asset Fund. Other than the aforementioned revision, the Amendment does not reflect events occurring after the Original Filing, or modify or update the disclosures therein in any way.

Item 1 (as supplemented further herein) to the Amendment is incorporated by reference to the semi-annual report for The Hartford Global Real Asset Fund contained in Item 1 of the Original Filing. Item 2 through Item 12(a)(1) to the Amendment are incorporated by reference to the Original Filing.

Item 1. Reports to Stockholders

NOVEMBER 6, 2014

SUPPLEMENT TO THE HARTFORD GLOBAL REAL ASSET FUND

(A SERIES OF THE HARTFORD MUTUAL FUNDS, INC.)

SEMI-ANNUAL REPORT DATED APRIL 30, 2014

This Supplement revises information contained in the Semi-Annual Report listed above and should be read in conjunction with the Semi-Annual Report.

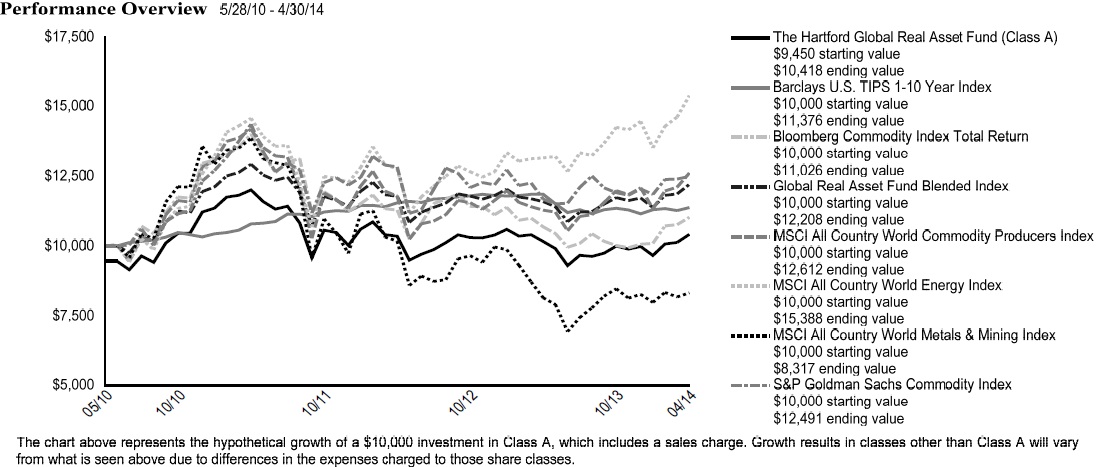

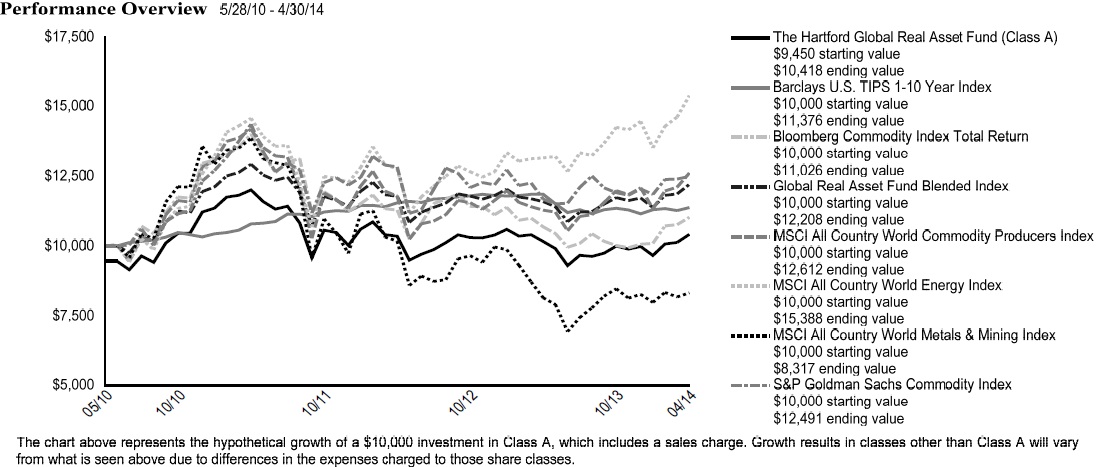

| 1. | The following replaces in its entirety the line graph presented in the section entitled “Fund Performance (Unaudited)” on page 2 of the Semi-Annual Report. |

| 2. | The following replaces in its entirety the average annual total return table presented in the section entitled “Fund Performance (Unaudited)” on page 2 of the Semi-Annual Report. |

Average Annual Total Returns (as of 4/30/14) (1) |

| | 6 Month† | 1 Year | Since Inception▲ |

| Global Real Asset A# | 4.25% | 2.56% | 2.52% |

| Global Real Asset A## | -1.48% | -3.08% | 1.05% |

| Global Real Asset C# | 3.83% | 1.83% | 1.76% |

| Global Real Asset C## | 2.83% | 0.83% | 1.76% |

| Global Real Asset I# | 4.33% | 2.84% | 2.77% |

| Global Real Asset R3# | 4.13% | 2.35% | 2.27% |

| Global Real Asset R4# | 4.26% | 2.57% | 2.55% |

| Global Real Asset R5# | 4.36% | 2.87% | 2.82% |

| Global Real Asset Y# | 4.51% | 3.01% | 2.88% |

| Barclays U.S. TIPS 1-10 Year Index | 0.22% | -4.02% | 3.34% |

| Dow Jones UBS Commodities Index | 10.07% | 3.17% | 2.52% |

| Global Real Asset Fund Blended Index | 4.06% | 5.35% | 5.17% |

| MSCI All Country World Commodity Producers Index | 5.25% | 11.78% | 6.09% |

| MSCI All Country World Energy Index | 7.97% | 16.94% | 11.61% |

| MSCI All Country World Metals & Mining Index | -1.72% | 2.15% | -4.59% |

| S&P Goldman Sachs Commodity Index | 4.88% | 6.93% | 5.83% |

| † | Not Annualized |

| ▲ | Inception: 05/28/2010 |

| # | Without sales charge |

| ## | With sales charge |

| 3. | The following replaces in its entirety the sub-section entitled “How did the Fund perform” presented in the section entitled “Management Discussion (Unaudited)” on page 3 of the Semi-Annual Report. |

How did the Fund perform?

The Class A shares of The Hartford Global Real Asset Fund returned 4.25%, before sales charge, for the six-month period ended April 30, 2014, outperforming the custom benchmark* (55% MSCI All Country World Commodity Producers Index, 35% Barclays U.S. TIPS 1 – 10 Year Index, and 10% Dow Jones UBS Commodities Index), which returned 4.06% for the same period. The MSCI All Country World Commodity Producers Index, the Barclays U.S. TIPS 1 – 10 Year Index, and the Dow Jones UBS Commodities Index returned 5.25%, 0.22%, and 10.07%, respectively.

*Until 2/28/14, the benchmark consisted of 33% MSCI All Country World Energy Index, 16.5% MSCI All Country World Metals and Mining Index, 5.5% MSCI All Country World Agriculture / Chemicals and Forest, Paper and Products Index, 35% Barclays U.S. TIPS 1-10 Year Index, and 10% S&P Goldman Sachs Commodity Index (2.5% Precious Metals, 2.5% Industrial Metals, 2.5% Energy, 2.5% Agriculture and Livestock).

Item 12. Exhibits.

| (a)(2) | Separate certifications for each principal executive officer and principal financial officer of the registrant as required by Rule 30a-2(a) under the 1940 Act (17 CFR 270.30a-2(a)) and Section 302 of the Sarbanes-Oxley Act of 2002 are attached herewith. |

| (b) | Certifications pursuant to Rule 30a-2(b) under the 1940 Act and Section 906 of the Sarbanes-Oxley Act of 2002 are attached hereto. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | THE HARTFORD MUTUAL FUNDS, INC. |

| | | |

| | | |

| Date: November 6, 2014 | By: | /s/ James E. Davey |

| | | James E. Davey |

| | | President and Chief Executive Officer |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| Date: November 6, 2014 | By: | /s/ James E. Davey |

| | | James E. Davey |

| | | President and Chief Executive Officer |

| Date: November 6, 2014 | By: | /s/ Mark A. Annoni |

| | | Mark A. Annoni |

| | | Vice President, Treasurer and Controller |