0001006415 hmfi1:C000089184Member 2019-10-31 0001006415 hmfi1:C000166660Member us-gaap:RealEstateSectorMember 2024-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

The Hartford Mutual Funds, Inc.

(Exact name of registrant as specified in charter)

690 Lee Road, Wayne, Pennsylvania 19087

(Address of Principal Executive Offices) (Zip Code)

Thomas R. Phillips, Esquire

Hartford Funds Management Company, LLC

690 Lee Road

Wayne, Pennsylvania 19087

(Name and Address of Agent for Service)

Copy to:

John V. O’Hanlon, Esquire

Dechert LLP

One International Place, 40th Floor

100 Oliver Street

Boston, Massachusetts 02110-2605

Registrant's telephone number, including area code:

Date of reporting period:

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-1090. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

(a) The Annual Shareholder Reports for each of Hartford Climate Opportunities Fund, Hartford Emerging Markets Equity Fund, Hartford Global Impact Fund, Hartford International Equity Fund, The Hartford International Growth Fund, The Hartford International Opportunities Fund, The Hartford International Value Fund, Hartford Dynamic Bond Fund, The Hartford Emerging Markets Local Debt Fund, The Hartford Floating Rate Fund, The Hartford High Yield Fund, The Hartford Inflation Plus Fund, Hartford Low Duration High Income Fund, The Hartford Municipal Opportunities Fund, Hartford Municipal Short Duration Fund, The Hartford Short Duration Fund, The Hartford Strategic Income Fund, Hartford Sustainable Municipal Bond Fund, The Hartford Total Return Bond Fund and The Hartford World Bond Fund are filed herewith.

Annual Shareholder Report

October 31, 2024

Hartford Climate Opportunities Fund

Class A/HEOMX

This annual shareholder report contains important information about the Hartford Climate Opportunities Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-hmf. You can also request this information by contacting us by calling 1‑888‑843‑7824.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Class A | $134 | 1.17% |

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

Global equities, as measured by the MSCI ACWI Index (Net), rose over the trailing twelve-month period ending October 31, 2024, supported by easing inflation and interest rate cuts. During the period, within the MSCI ACWI Index (Net), clean energy and energy efficiency companies performed well while electric vehicle companies struggled due to fading demand. Fund performance described below is relative to the MSCI ACWI Index (Net) for the trailing twelve-month period ended October 31, 2024.

Top Contributors to Performance

Security selection within the Industrials sector was the primary contributor to relative returns during the period.

Sector allocation was also positive with strength within the Industrials, Health Care, and Energy sectors.

Top relative individual contributors over the period were an overweight position in Vertiv Holdings (Industrials), an out-of-benchmark allocation to Acuity Brands (Industrials) and ARM Holdings (Industrials), and an overweight position in Westinghouse Air Brake Technologies (Industrials).

Top Detractors to Performance

Security selection detracted from relative performance during the period, driven by selection within the Information Technology, Utilities, Consumer Discretionary and Financials sectors.

Sector allocation also detracted from results within the Information Technology, Financials, and Communication Services sectors.

The largest individual relative detractors over the period were not owning benchmark constituent NVIDIA (Information Technology), owning Vestas Wind Systems (Industrials) and overweight positions in Enphase Energy (Information Technology) and Samsung SDI C. (Information Technology).

The views expressed in this section reflect the opinions of the Fund's portfolio managers as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

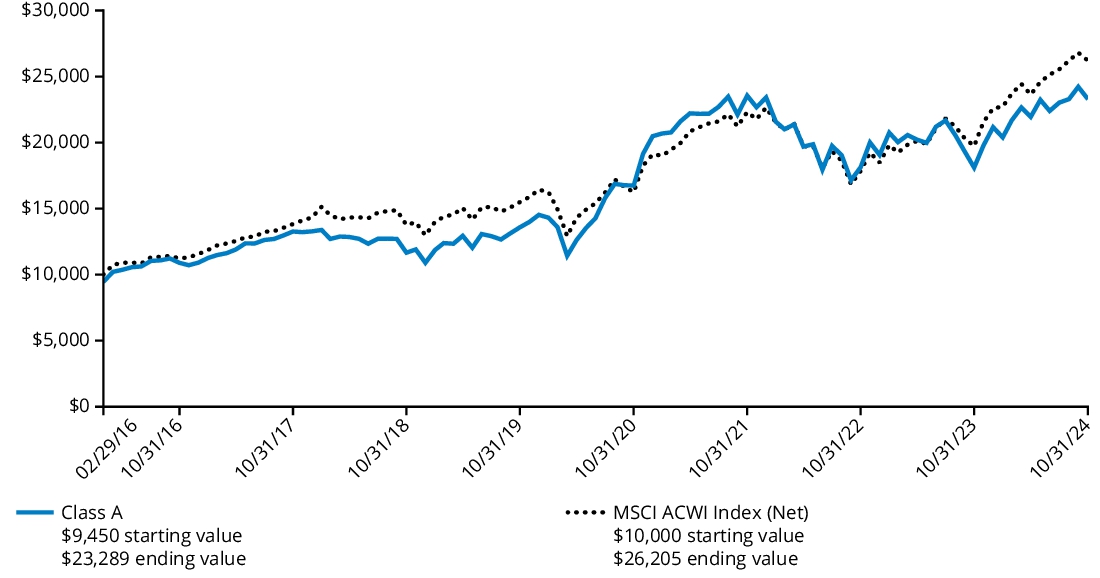

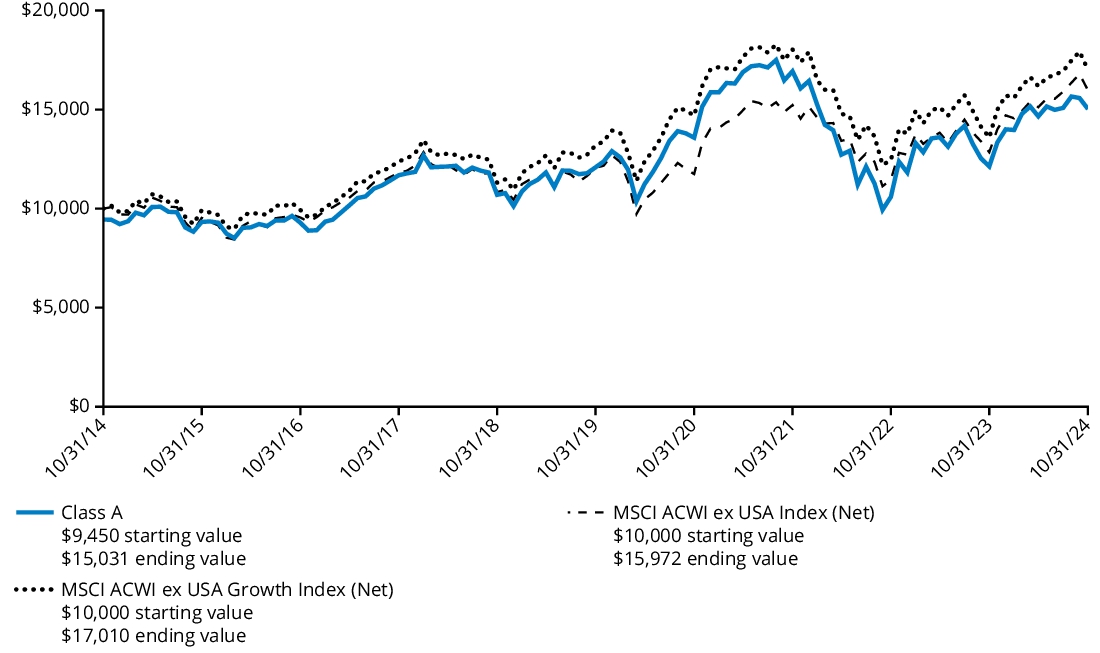

Comparison of Change in Value of $ 10,000 Investment

The graph below represents the hypothetical growth of a $10,000 investment in Class A shares and the comparative index. The returns for Class A shares include the maximum front-end sales charge applicable to Class A shares.

Average Annual Total Returns

For the Periods Ended October 31, 2024 | 1 Year | 5 Years | Since Inception

(February 29, 2016) |

| Class A (with 5.50% maximum front-end sales charge) | 21.54% | 10.13% | 10.24% |

| Class A (without 5.50% maximum front-end sales charge) | 28.62% | 11.38% | 10.96% |

| MSCI ACWI Index (Net) | 32.79% | 11.08% | 11.69% |

Prior to November 8, 2019, the Fund pursued a modified strategy and Wellington Management Company LLP served as the Fund’s only sub-adviser.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance information reflects fee waivers and/or expense limitation arrangements, if any. Absent any applicable fee waivers and/or expense limitation arrangements, performance would have been lower. Visit hartfordfunds.com for the most recent performance information.

Key Fund Statistics as of October 31, 2024

| Fund's net assets | $133,306,341% |

| Total number of portfolio holdings (excluding derivatives, if any) | $93% |

| Total investment management fees paid | $834,616% |

| Portfolio turnover rate | $108% |

Graphical Representation of Holdings as of October 31, 2024

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| Industrials | 47.4 | % |

| Information Technology | 13.1 | % |

| Consumer Discretionary | 10.1 | % |

| Utilities | 9.2 | % |

| Financials | 7.8 | % |

| Materials | 3.5 | % |

| Communication Services | 2.3 | % |

| Consumer Staples | 2.3 | % |

| Real Estate | 0.8 | % |

| Short-Term Investments | 0.3 | % |

| Other Assets & Liabilities | 3.2 | % |

| Total | 100.0 | % |

* | For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please visit the Fund’s website at the website address included at the beginning of this report.

The Fund is distributed by Hartford Funds Distributors, LLC (HFD).

Annual Shareholder Report

October 31, 2024

Hartford Climate Opportunities Fund

Class C/HEONX

This annual shareholder report contains important information about the Hartford Climate Opportunities Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-hmf. You can also request this information by contacting us by calling 1‑888‑843‑7824.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Class C | $221 | 1.94% |

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

Global equities, as measured by the MSCI ACWI Index (Net), rose over the trailing twelve-month period ending October 31, 2024, supported by easing inflation and interest rate cuts. During the period, within the MSCI ACWI Index (Net), clean energy and energy efficiency companies performed well while electric vehicle companies struggled due to fading demand. Fund performance described below is relative to the MSCI ACWI Index (Net) for the trailing twelve-month period ended October 31, 2024.

Top Contributors to Performance

Security selection within the Industrials sector was the primary contributor to relative returns during the period.

Sector allocation was also positive with strength within the Industrials, Health Care, and Energy sectors.

Top relative individual contributors over the period were an overweight position in Vertiv Holdings (Industrials), an out-of-benchmark allocation to Acuity Brands (Industrials) and ARM Holdings (Industrials), and an overweight position in Westinghouse Air Brake Technologies (Industrials).

Top Detractors to Performance

Security selection detracted from relative performance during the period, driven by selection within the Information Technology, Utilities, Consumer Discretionary and Financials sectors.

Sector allocation also detracted from results within the Information Technology, Financials, and Communication Services sectors.

The largest individual relative detractors over the period were not owning benchmark constituent NVIDIA (Information Technology), owning Vestas Wind Systems (Industrials) and overweight positions in Enphase Energy (Information Technology) and Samsung SDI C. (Information Technology).

The views expressed in this section reflect the opinions of the Fund's portfolio managers as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

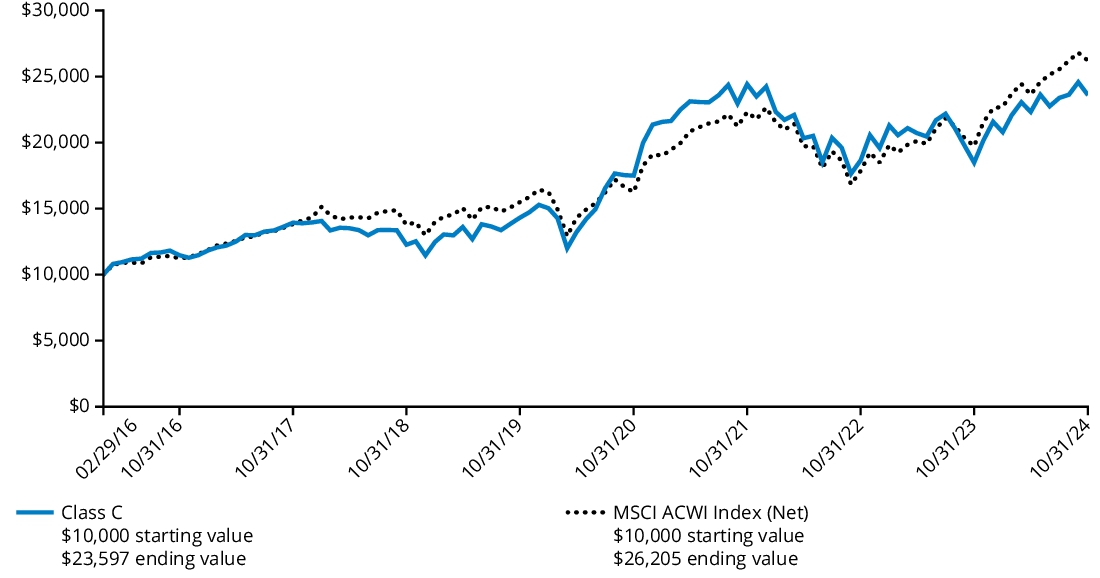

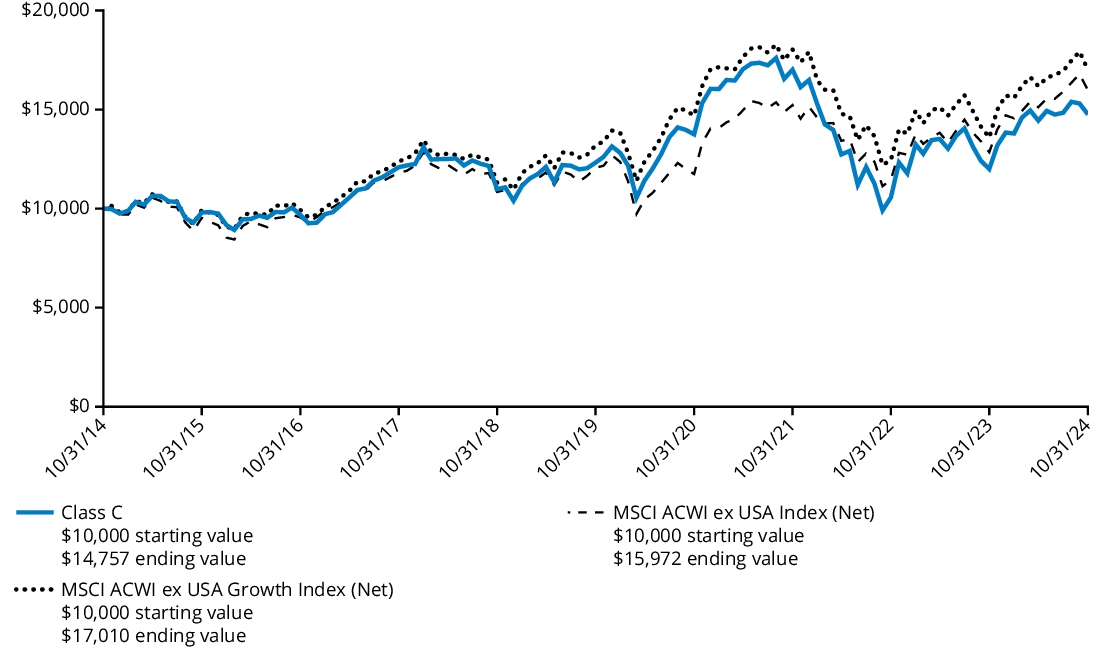

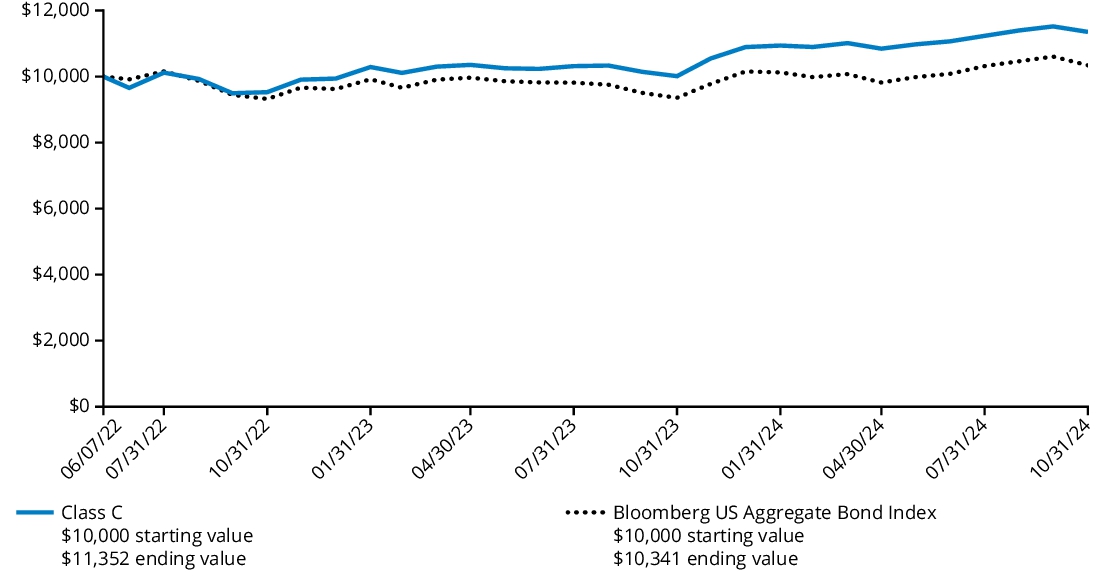

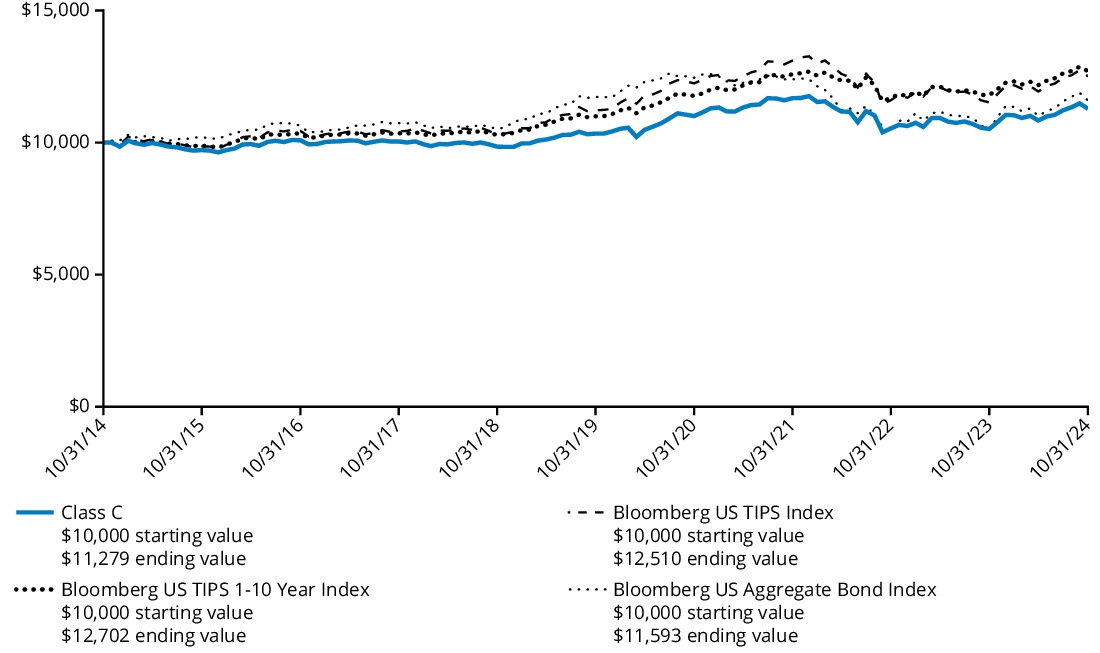

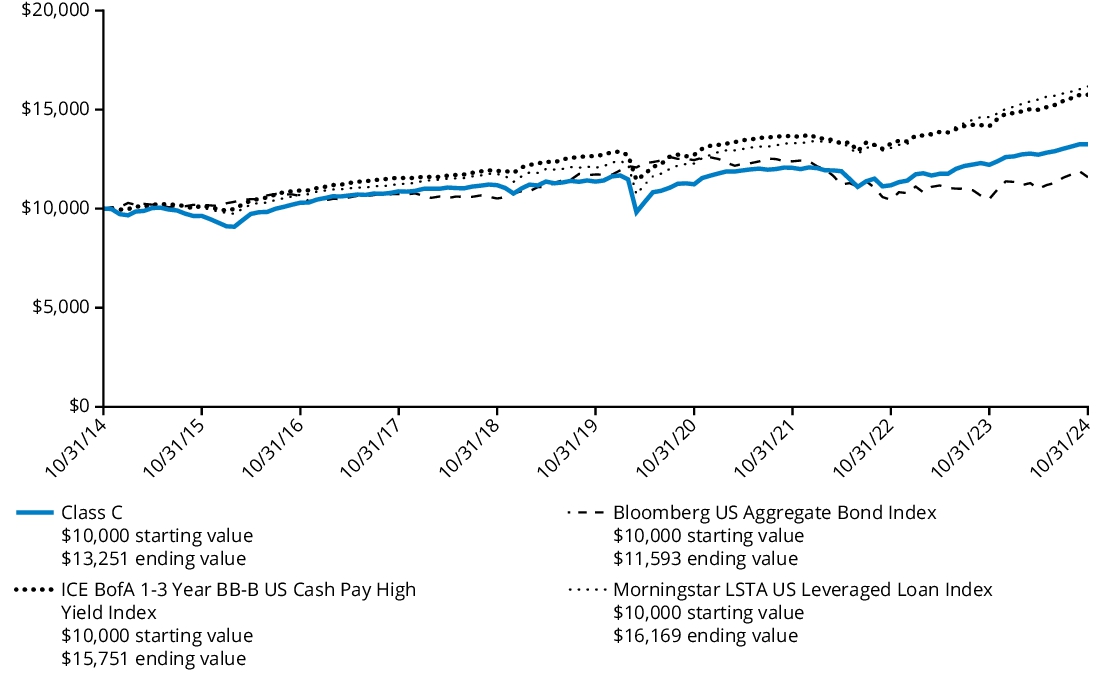

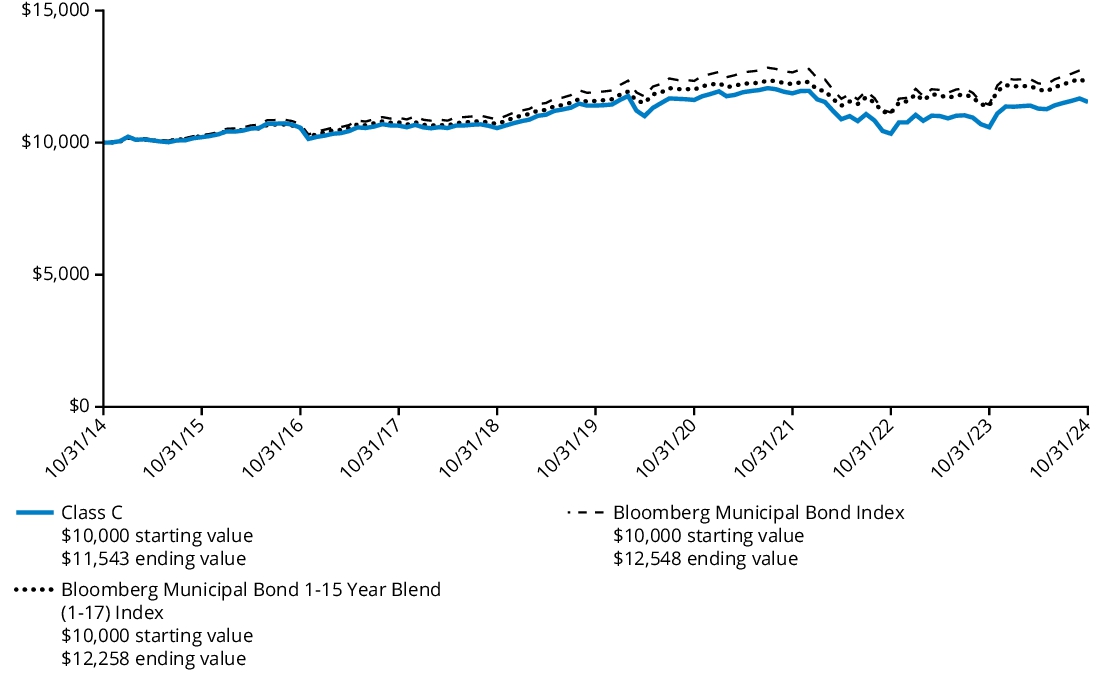

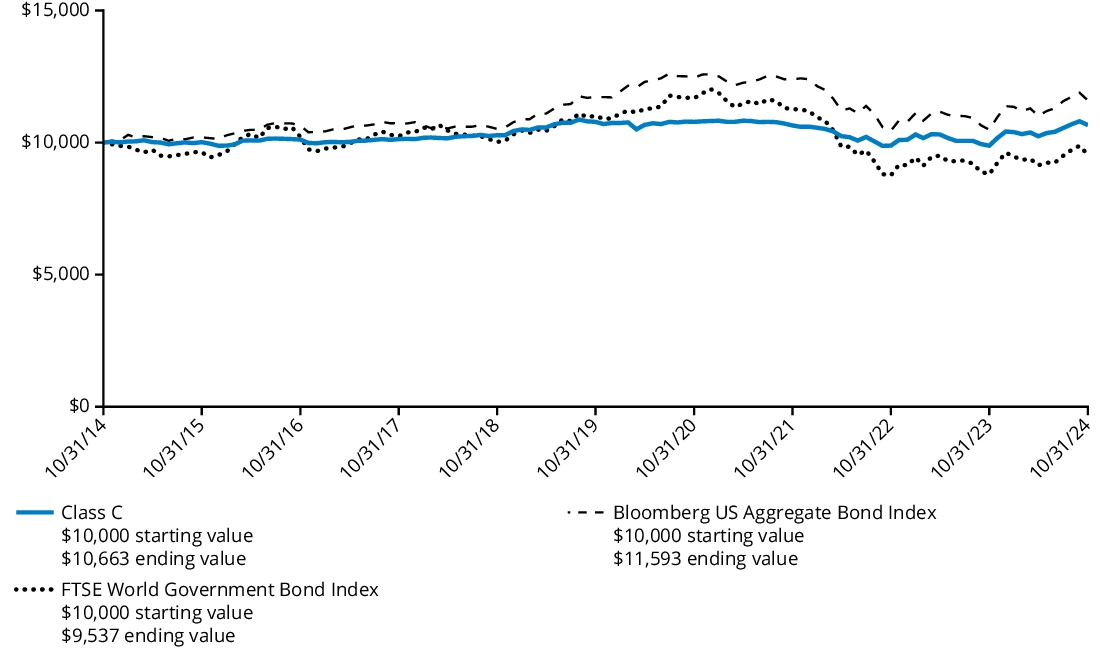

Comparison of Change in Value of $ 10,000 Investment

The graph below represents the hypothetical growth of a $10,000 investment in Class C shares (excluding sales charges) and the comparative index. If sales charges had been included, the value would have been lower.

Average Annual Total Returns

For the Periods Ended October 31, 2024 | 1 Year | 5 Years | Since Inception

(February 29, 2016) |

| Class C (with 1.00% contingent deferred sales charge) | 26.65% | 10.51% | 10.41% |

| Class C (without 1.00% contingent deferred sales charge) | 27.65% | 10.51% | 10.41% |

| MSCI ACWI Index (Net) | 32.79% | 11.08% | 11.69% |

Prior to November 8, 2019, the Fund pursued a modified strategy and Wellington Management Company LLP served as the Fund’s only sub-adviser.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance information reflects fee waivers and/or expense limitation arrangements, if any. Absent any applicable fee waivers and/or expense limitation arrangements, performance would have been lower. Visit hartfordfunds.com for the most recent performance information.

Key Fund Statistics as of October 31, 2024

| Fund's net assets | $133,306,341% |

| Total number of portfolio holdings (excluding derivatives, if any) | $93% |

| Total investment management fees paid | $834,616% |

| Portfolio turnover rate | $108% |

Graphical Representation of Holdings as of October 31, 2024

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| Industrials | 47.4 | % |

| Information Technology | 13.1 | % |

| Consumer Discretionary | 10.1 | % |

| Utilities | 9.2 | % |

| Financials | 7.8 | % |

| Materials | 3.5 | % |

| Communication Services | 2.3 | % |

| Consumer Staples | 2.3 | % |

| Real Estate | 0.8 | % |

| Short-Term Investments | 0.3 | % |

| Other Assets & Liabilities | 3.2 | % |

| Total | 100.0 | % |

* | For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please visit the Fund’s website at the website address included at the beginning of this report.

The Fund is distributed by Hartford Funds Distributors, LLC (HFD).

Annual Shareholder Report

October 31, 2024

Hartford Climate Opportunities Fund

Class I/HEOIX

This annual shareholder report contains important information about the Hartford Climate Opportunities Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-hmf. You can also request this information by contacting us by calling 1‑888‑843‑7824.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Class I | $102 | 0.89% |

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

Global equities, as measured by the MSCI ACWI Index (Net), rose over the trailing twelve-month period ending October 31, 2024, supported by easing inflation and interest rate cuts. During the period, within the MSCI ACWI Index (Net), clean energy and energy efficiency companies performed well while electric vehicle companies struggled due to fading demand. Fund performance described below is relative to the MSCI ACWI Index (Net) for the trailing twelve-month period ended October 31, 2024.

Top Contributors to Performance

Security selection within the Industrials sector was the primary contributor to relative returns during the period.

Sector allocation was also positive with strength within the Industrials, Health Care, and Energy sectors.

Top relative individual contributors over the period were an overweight position in Vertiv Holdings (Industrials), an out-of-benchmark allocation to Acuity Brands (Industrials) and ARM Holdings (Industrials), and an overweight position in Westinghouse Air Brake Technologies (Industrials).

Top Detractors to Performance

Security selection detracted from relative performance during the period, driven by selection within the Information Technology, Utilities, Consumer Discretionary and Financials sectors.

Sector allocation also detracted from results within the Information Technology, Financials, and Communication Services sectors.

The largest individual relative detractors over the period were not owning benchmark constituent NVIDIA (Information Technology), owning Vestas Wind Systems (Industrials) and overweight positions in Enphase Energy (Information Technology) and Samsung SDI C. (Information Technology).

The views expressed in this section reflect the opinions of the Fund's portfolio managers as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

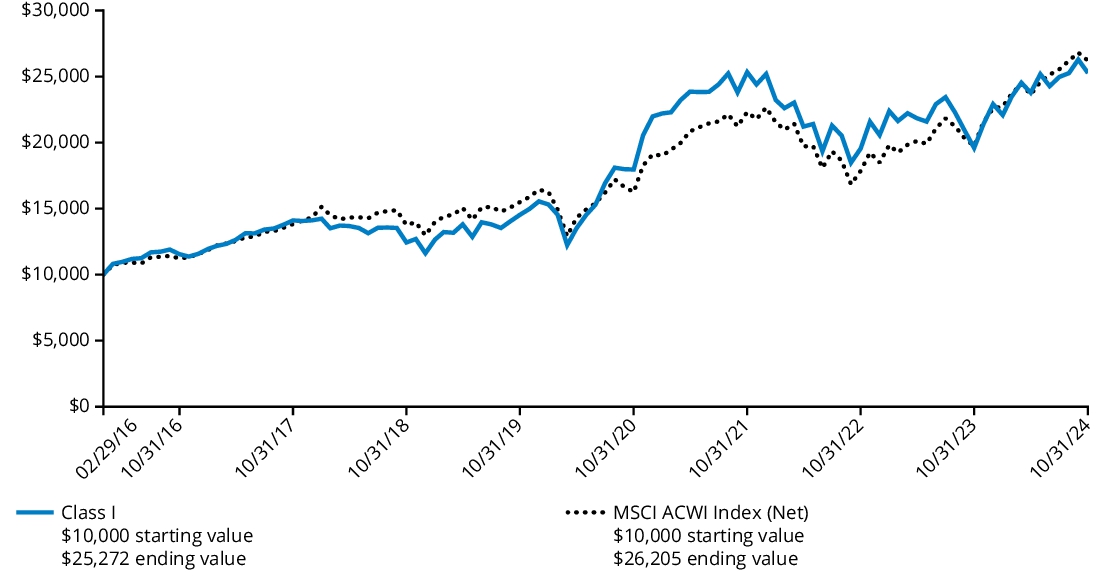

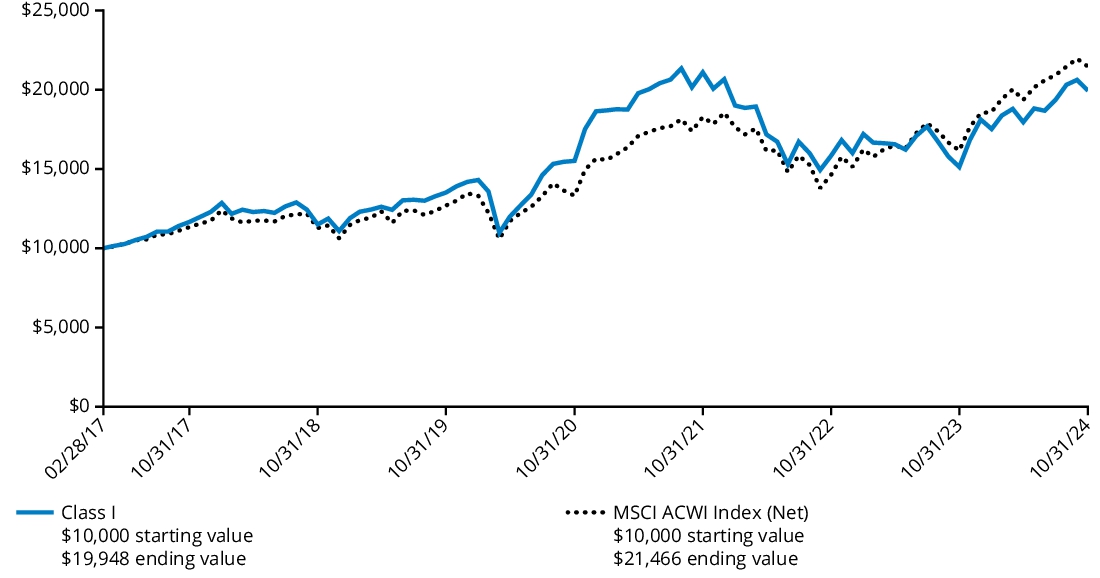

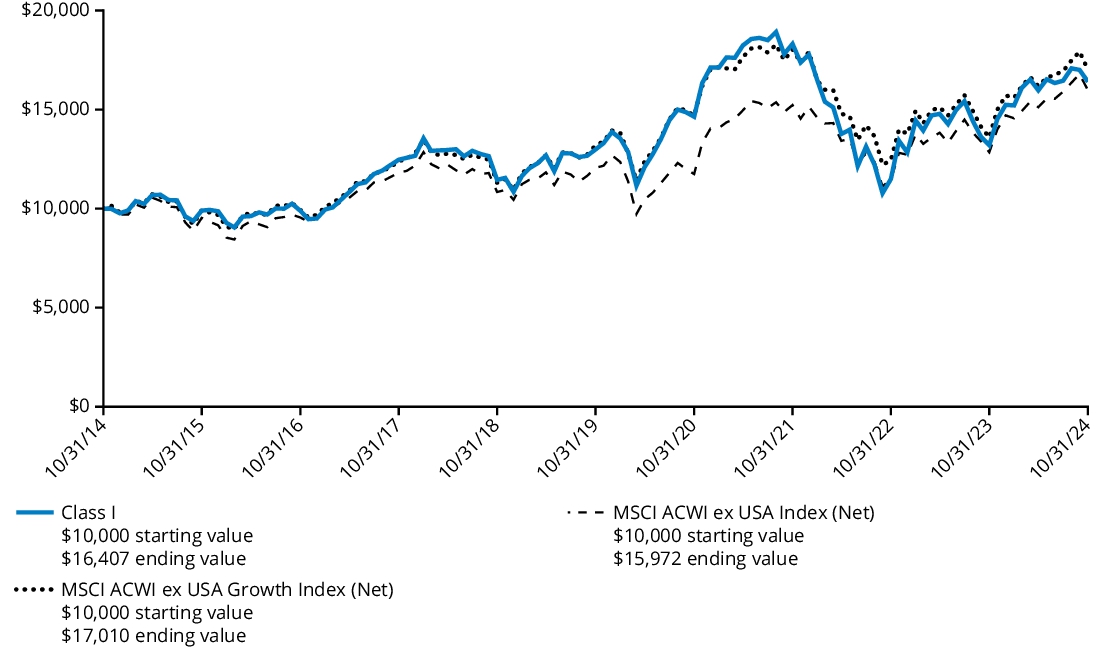

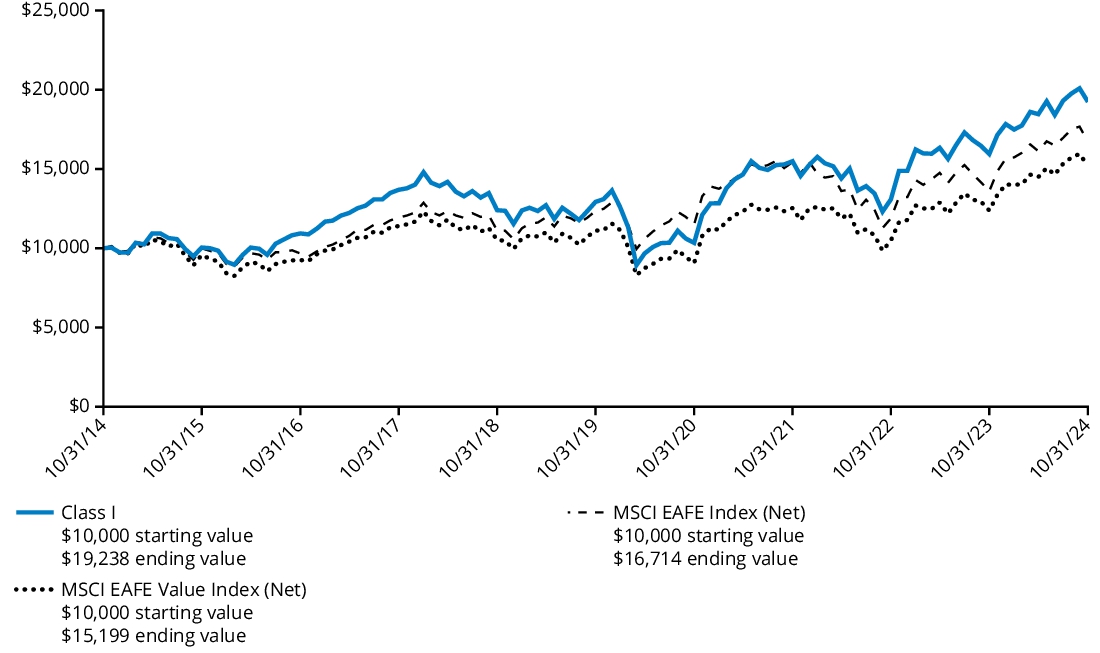

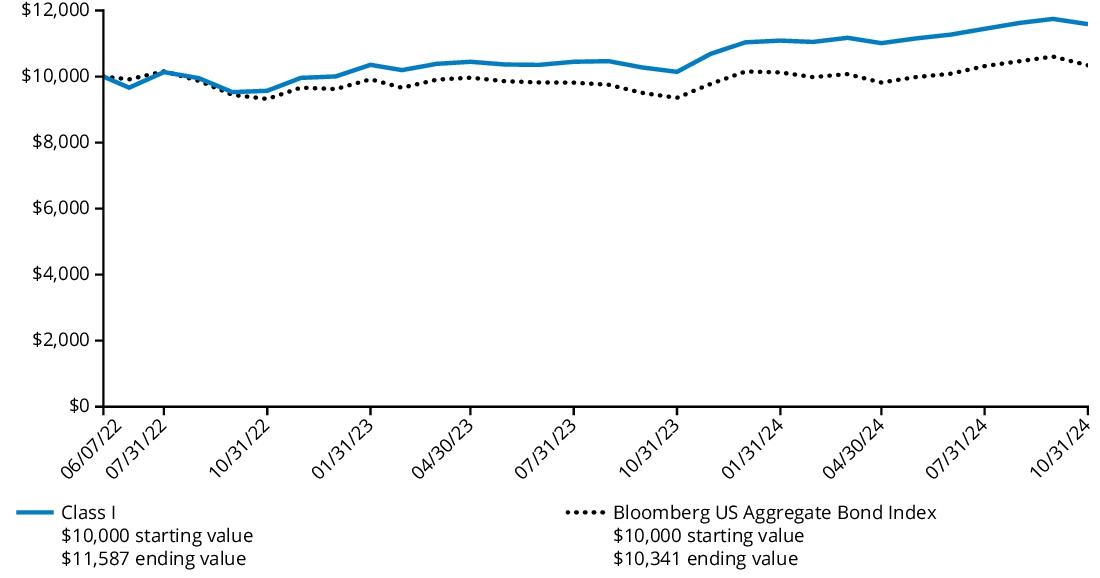

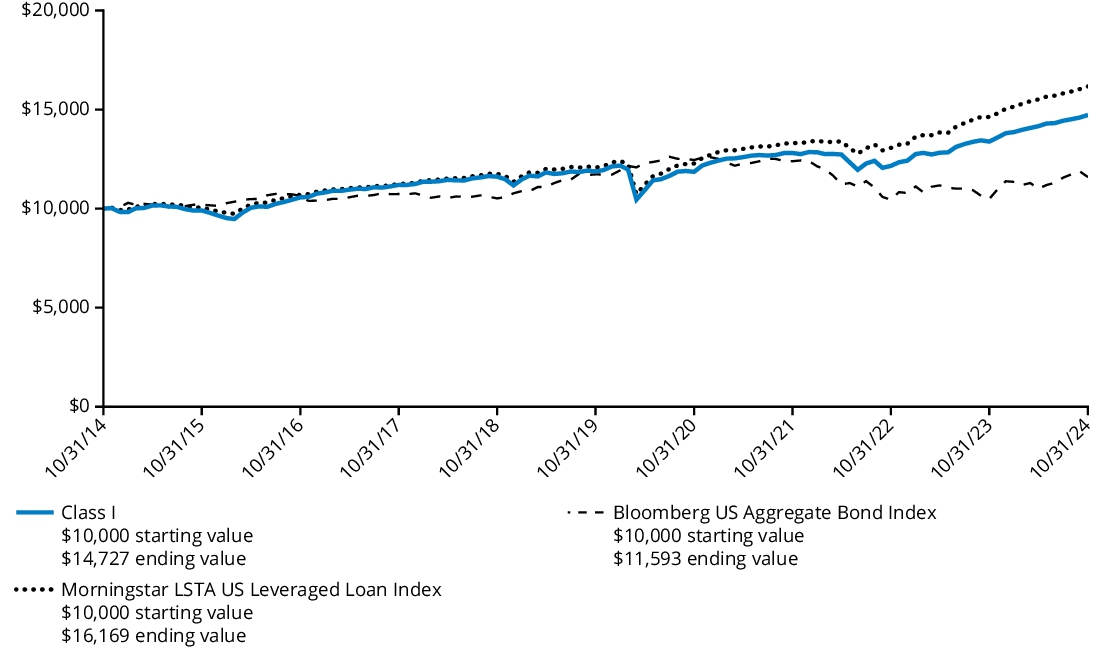

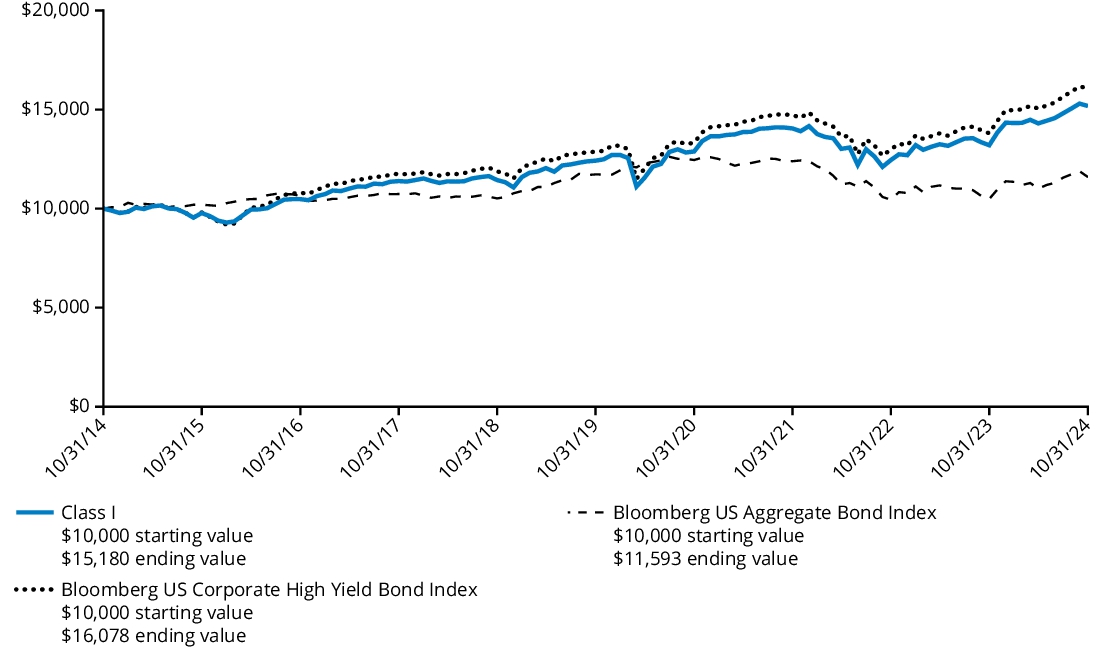

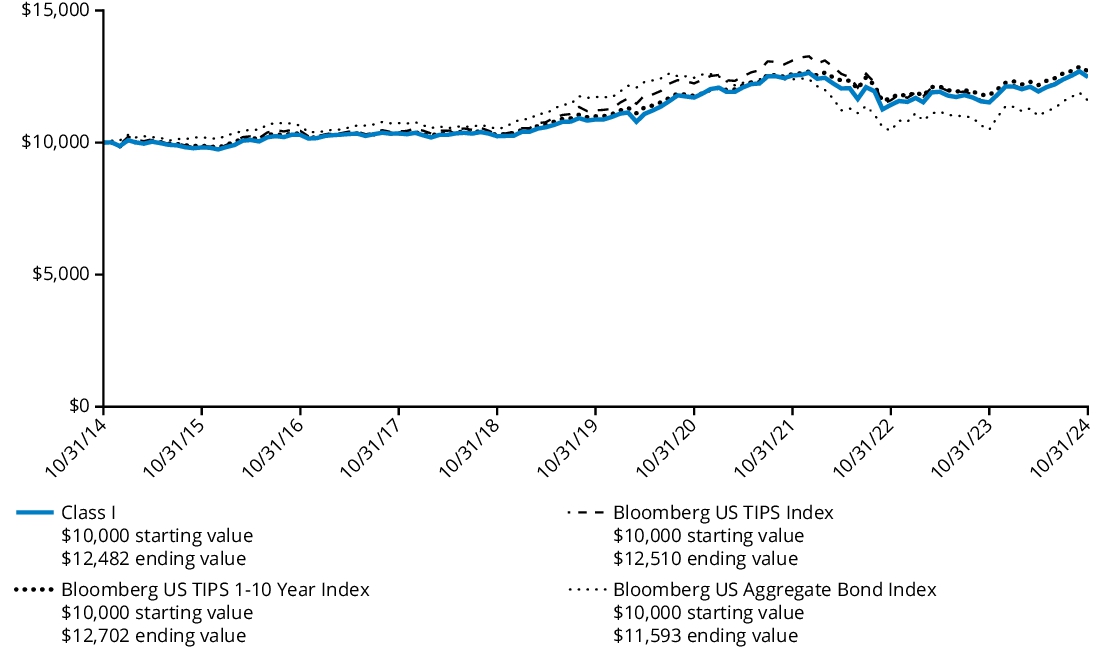

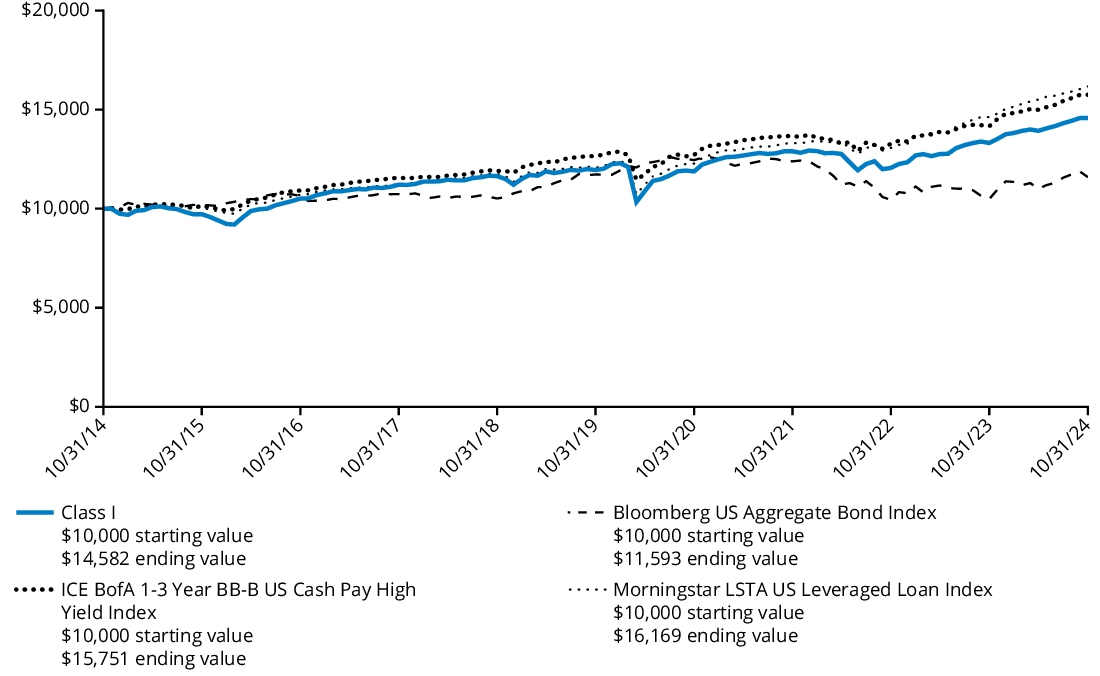

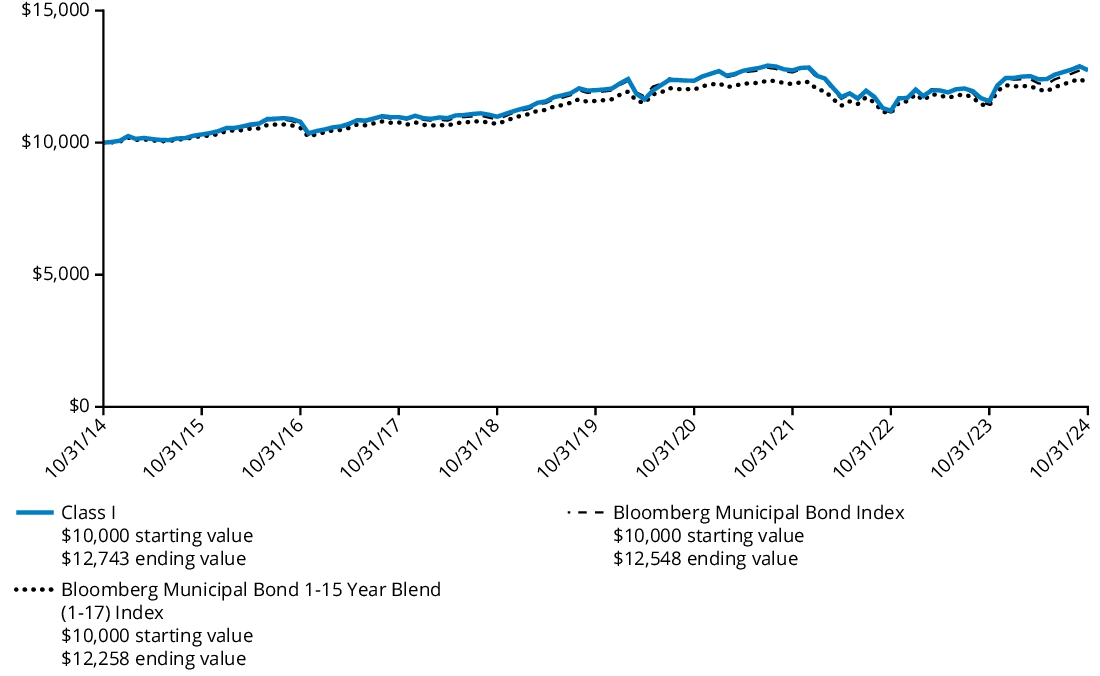

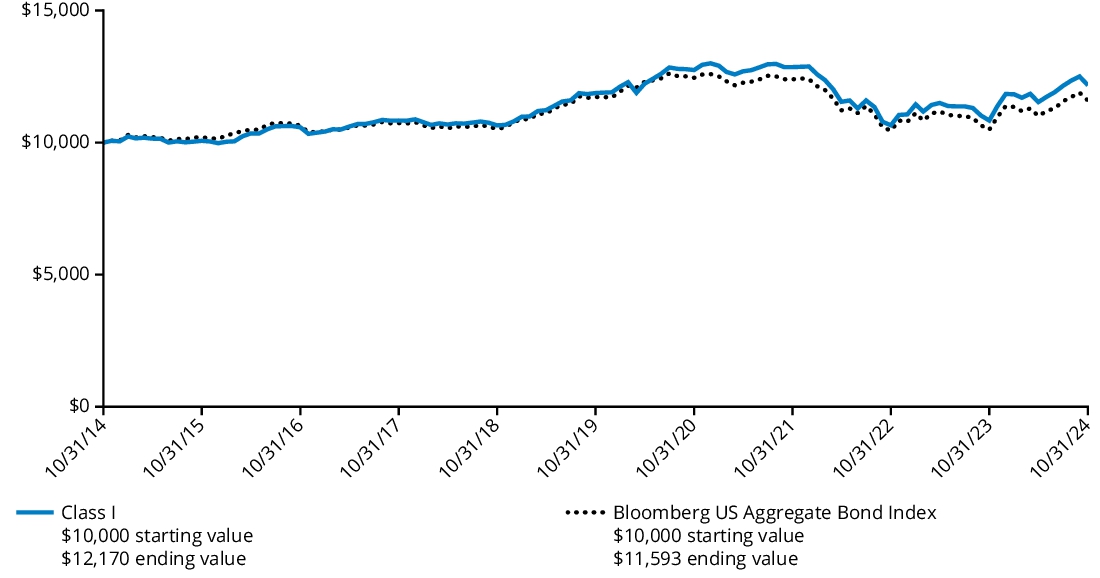

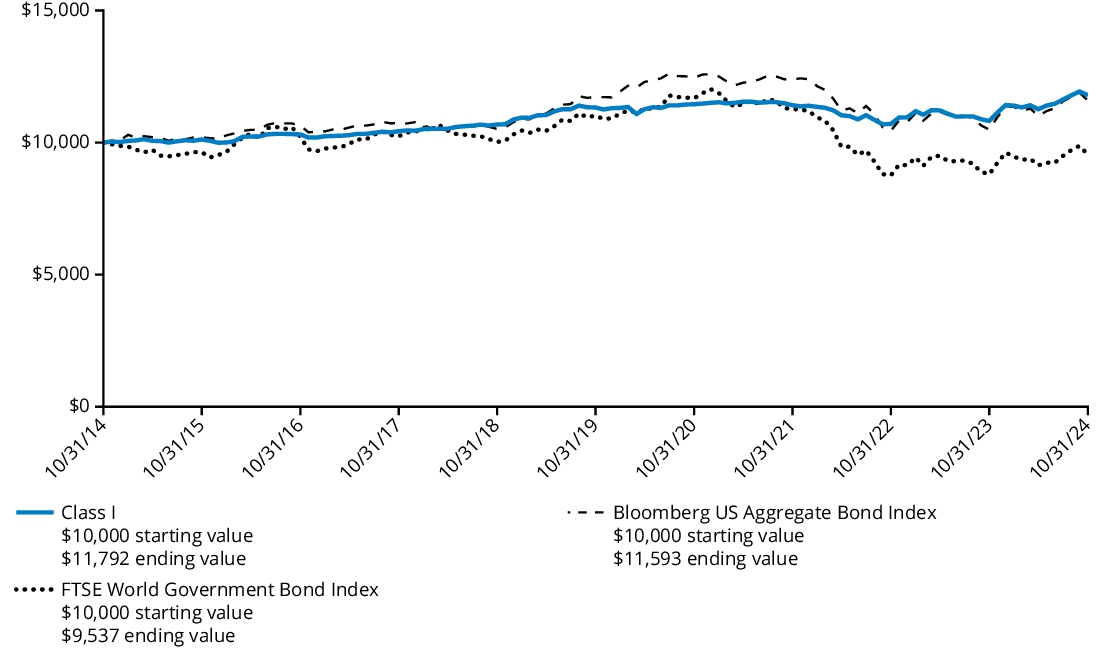

Comparison of Change in Value of $ 10,000 Investment

The graph below represents the hypothetical growth of a $10,000 investment in Class I shares and the comparative index.

Average Annual Total Returns

For the Periods Ended October 31, 2024 | 1 Year | 5 Years | Since Inception

(February 29, 2016) |

| Class I | 28.99% | 11.70% | 11.28% |

| MSCI ACWI Index (Net) | 32.79% | 11.08% | 11.69% |

Prior to November 8, 2019, the Fund pursued a modified strategy and Wellington Management Company LLP served as the Fund’s only sub-adviser.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance information reflects fee waivers and/or expense limitation arrangements, if any. Absent any applicable fee waivers and/or expense limitation arrangements, performance would have been lower. Visit hartfordfunds.com for the most recent performance information.

Key Fund Statistics as of October 31, 2024

| Fund's net assets | $133,306,341% |

| Total number of portfolio holdings (excluding derivatives, if any) | $93% |

| Total investment management fees paid | $834,616% |

| Portfolio turnover rate | $108% |

Graphical Representation of Holdings as of October 31, 2024

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| Industrials | 47.4 | % |

| Information Technology | 13.1 | % |

| Consumer Discretionary | 10.1 | % |

| Utilities | 9.2 | % |

| Financials | 7.8 | % |

| Materials | 3.5 | % |

| Communication Services | 2.3 | % |

| Consumer Staples | 2.3 | % |

| Real Estate | 0.8 | % |

| Short-Term Investments | 0.3 | % |

| Other Assets & Liabilities | 3.2 | % |

| Total | 100.0 | % |

* | For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please visit the Fund’s website at the website address included at the beginning of this report.

The Fund is distributed by Hartford Funds Distributors, LLC (HFD).

Annual Shareholder Report

October 31, 2024

Hartford Climate Opportunities Fund

Class R3/HEORX

This annual shareholder report contains important information about the Hartford Climate Opportunities Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-hmf. You can also request this information by contacting us by calling 1‑888‑843‑7824.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Class R3 | $161 | 1.41% |

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

Global equities, as measured by the MSCI ACWI Index (Net), rose over the trailing twelve-month period ending October 31, 2024, supported by easing inflation and interest rate cuts. During the period, within the MSCI ACWI Index (Net), clean energy and energy efficiency companies performed well while electric vehicle companies struggled due to fading demand. Fund performance described below is relative to the MSCI ACWI Index (Net) for the trailing twelve-month period ended October 31, 2024.

Top Contributors to Performance

Security selection within the Industrials sector was the primary contributor to relative returns during the period.

Sector allocation was also positive with strength within the Industrials, Health Care, and Energy sectors.

Top relative individual contributors over the period were an overweight position in Vertiv Holdings (Industrials), an out-of-benchmark allocation to Acuity Brands (Industrials) and ARM Holdings (Industrials), and an overweight position in Westinghouse Air Brake Technologies (Industrials).

Top Detractors to Performance

Security selection detracted from relative performance during the period, driven by selection within the Information Technology, Utilities, Consumer Discretionary and Financials sectors.

Sector allocation also detracted from results within the Information Technology, Financials, and Communication Services sectors.

The largest individual relative detractors over the period were not owning benchmark constituent NVIDIA (Information Technology), owning Vestas Wind Systems (Industrials) and overweight positions in Enphase Energy (Information Technology) and Samsung SDI C. (Information Technology).

The views expressed in this section reflect the opinions of the Fund's portfolio managers as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

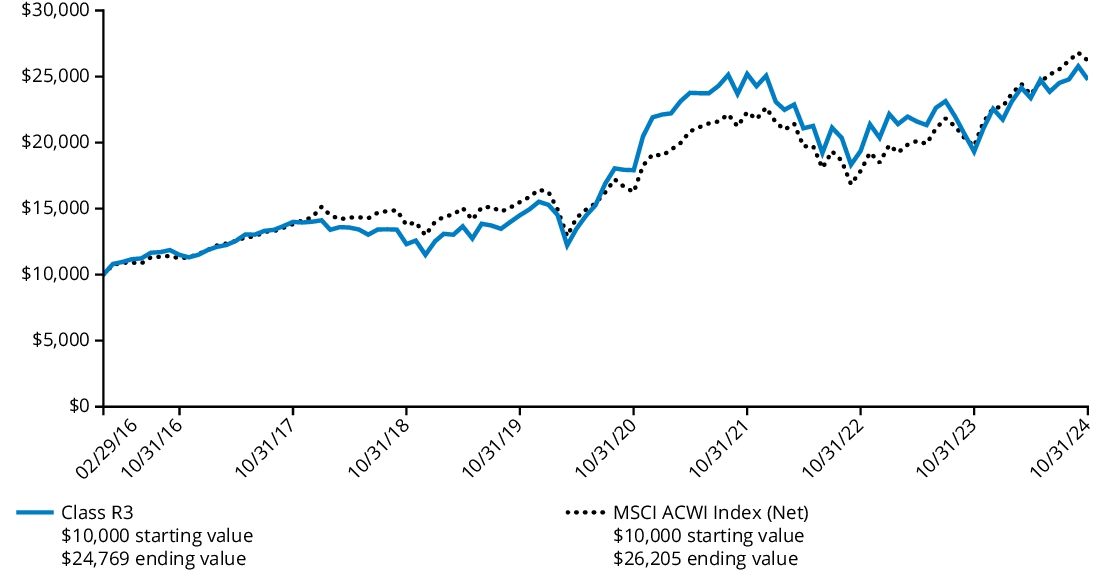

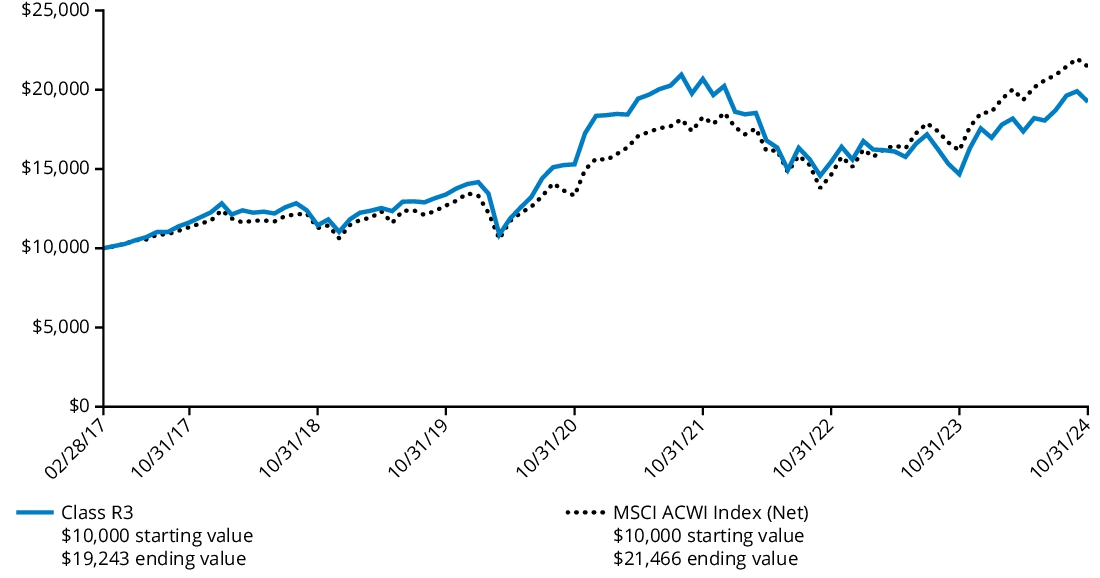

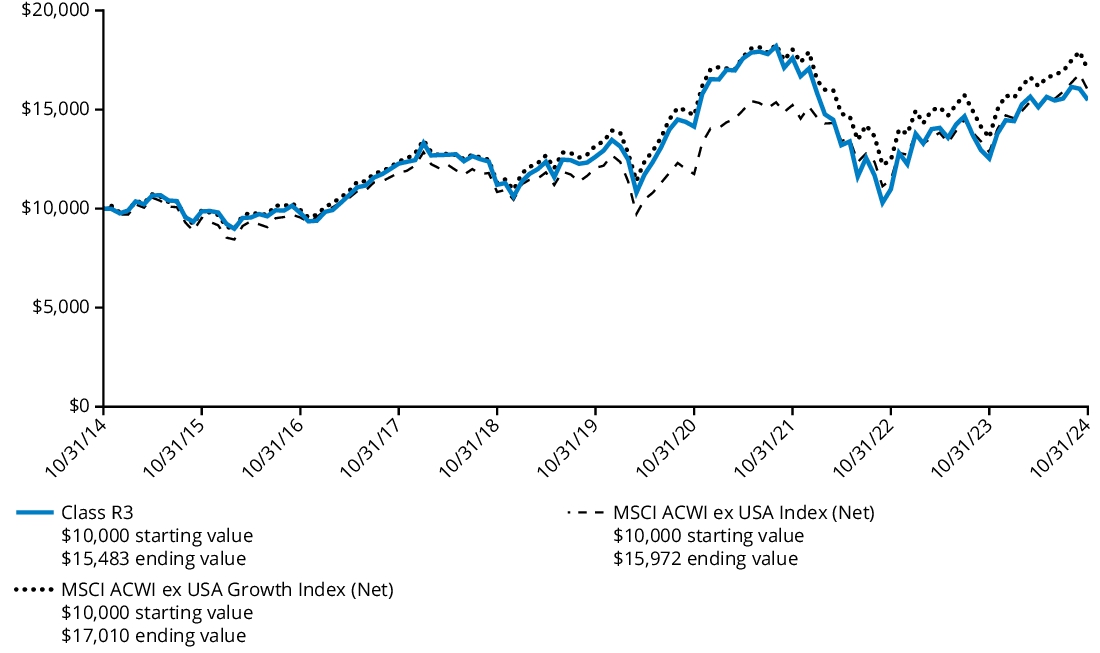

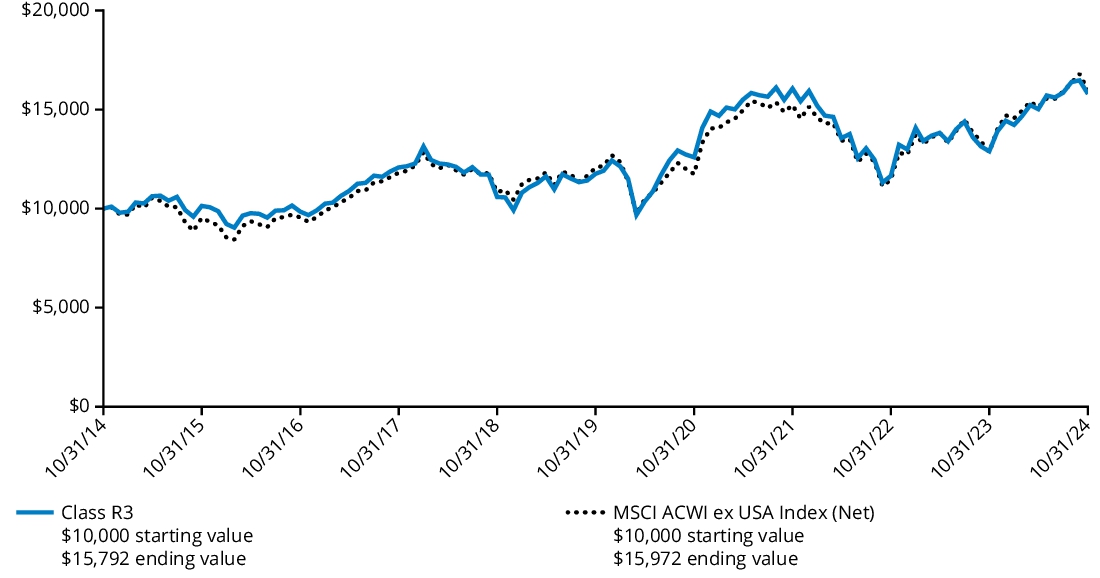

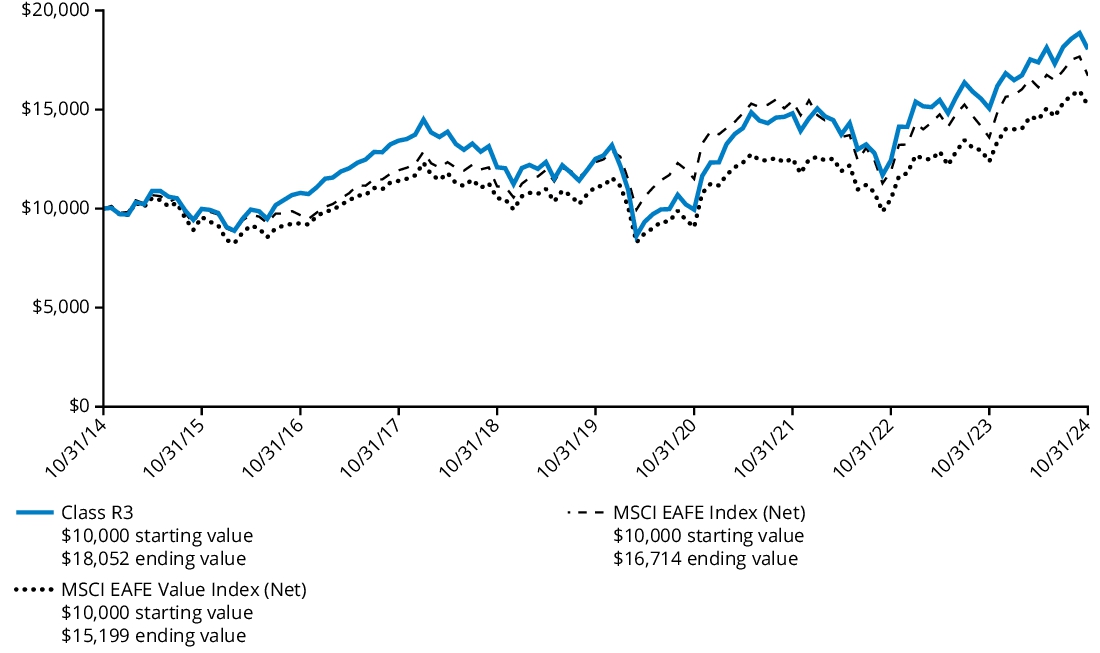

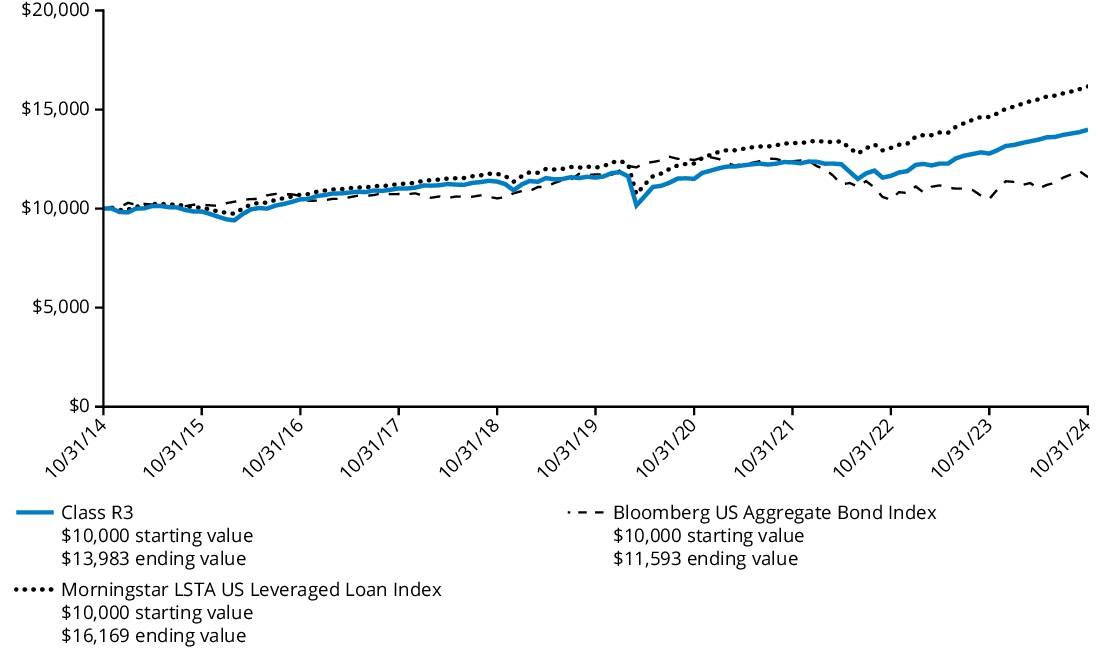

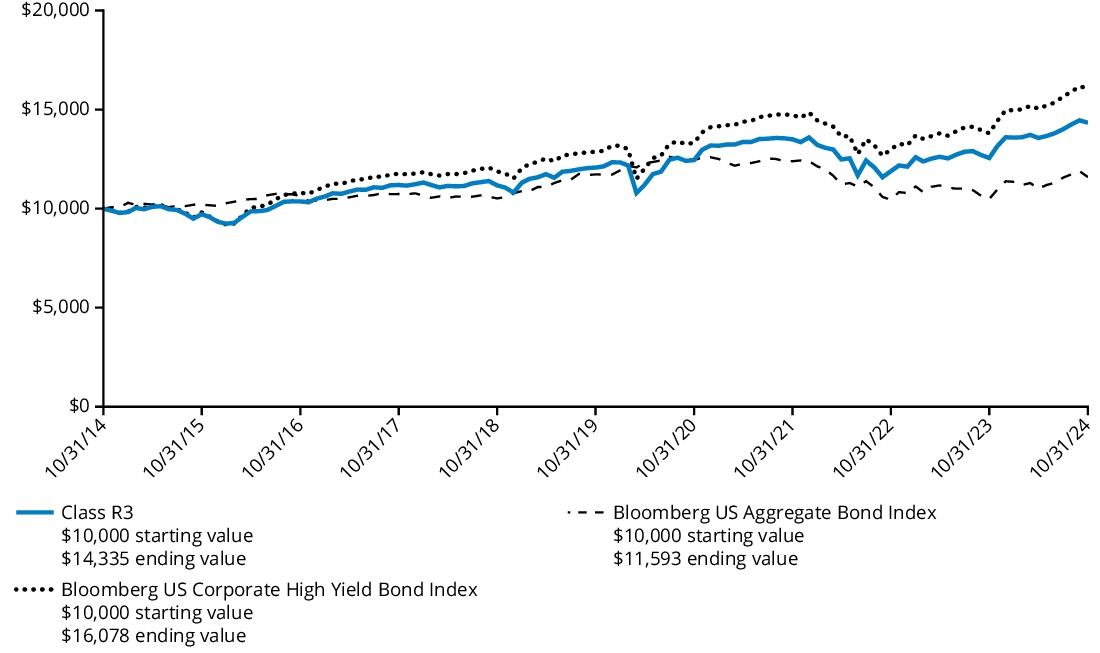

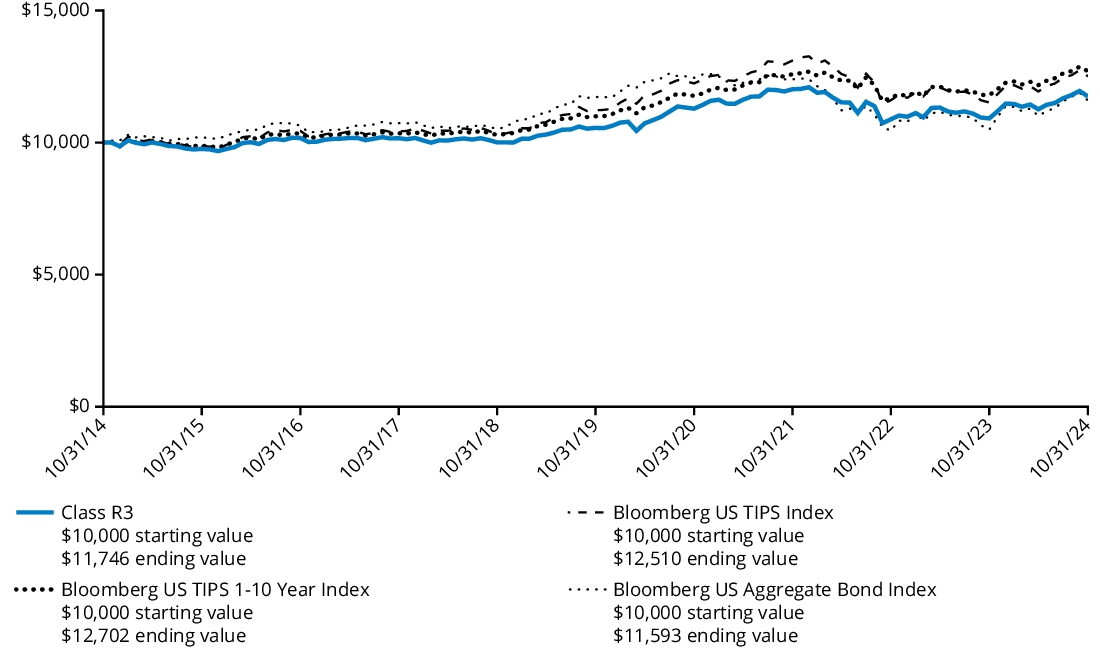

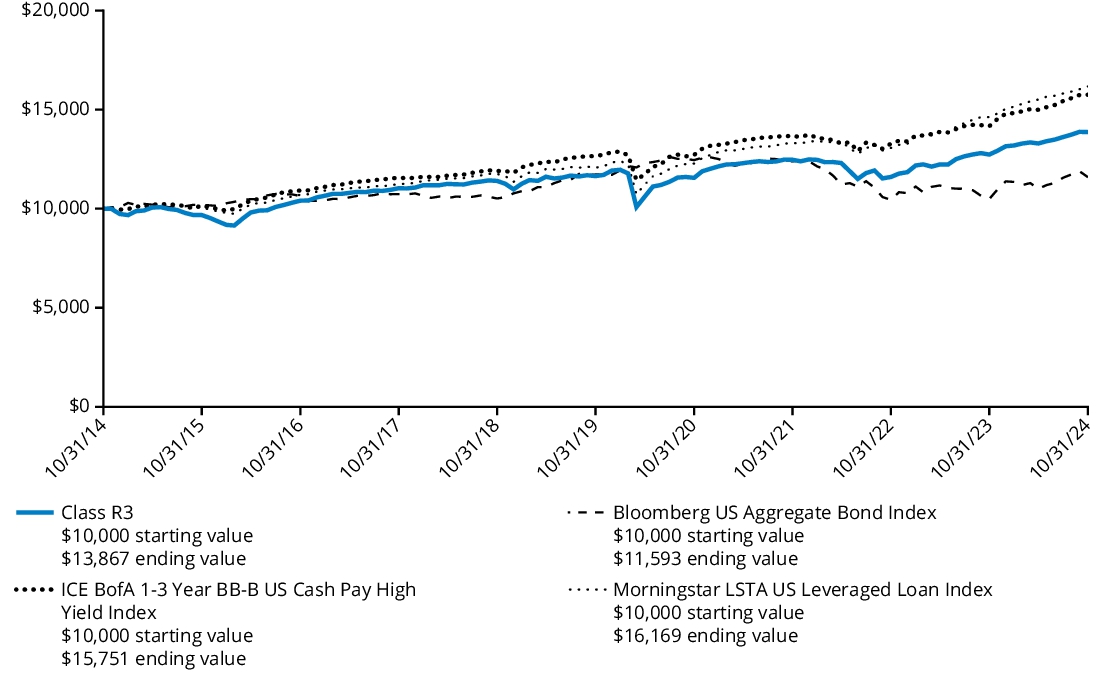

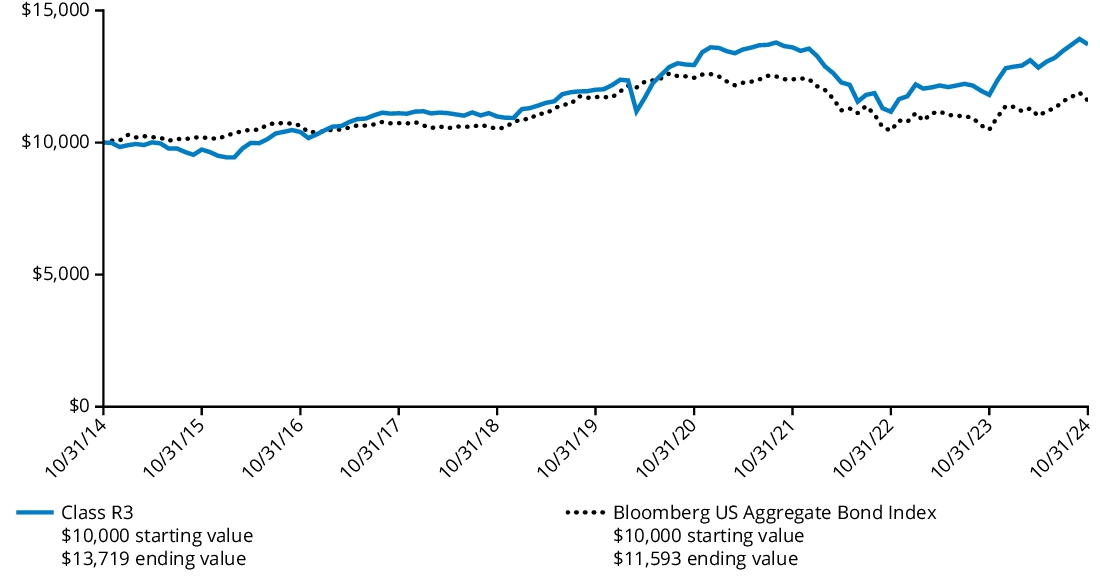

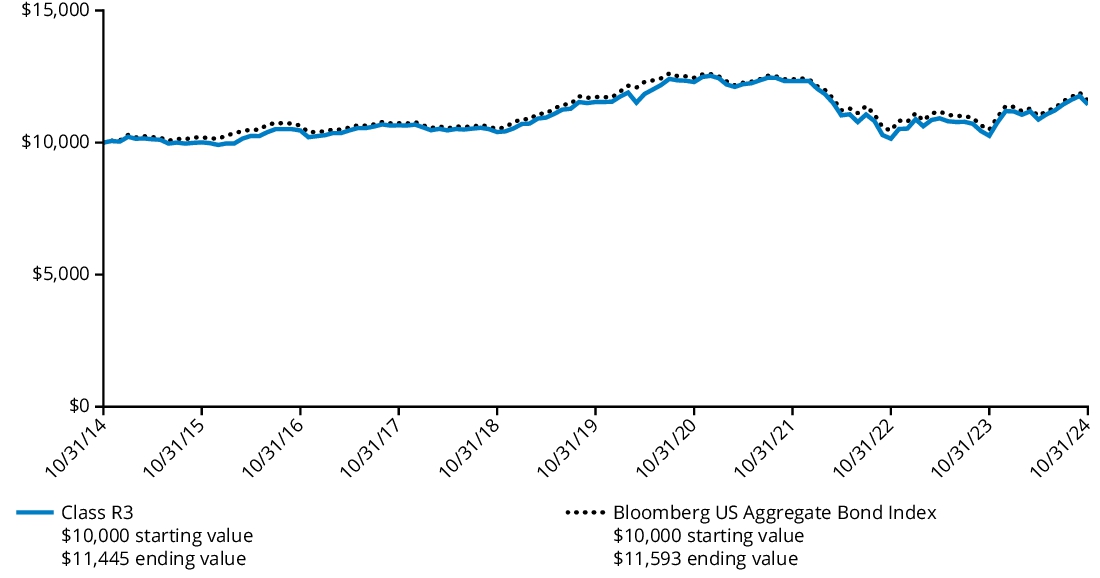

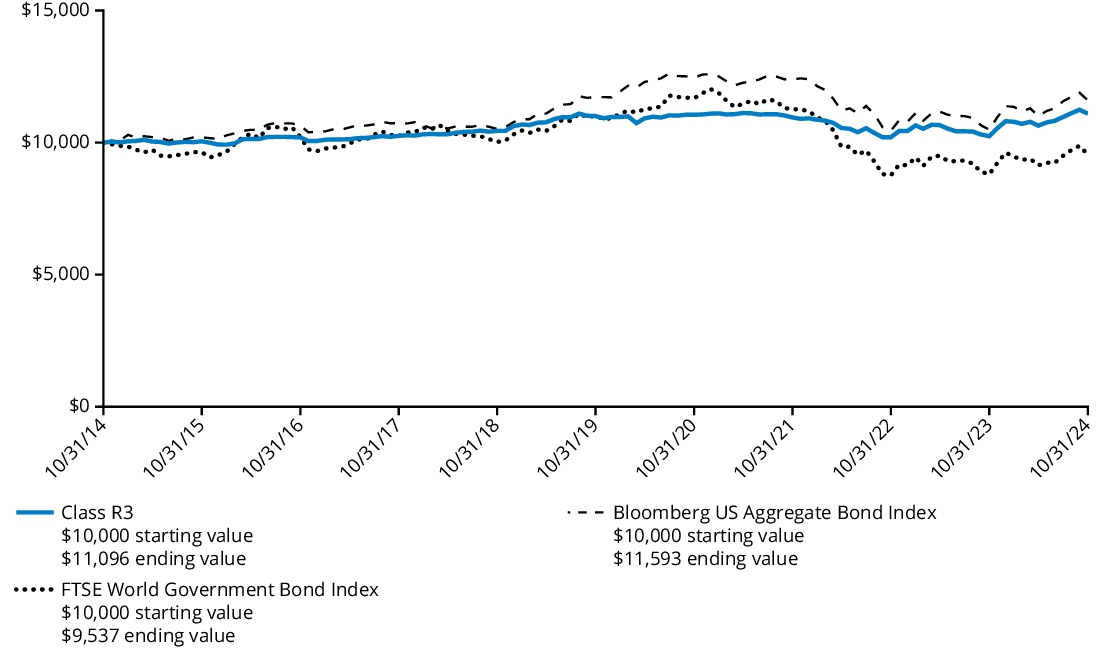

Comparison of Change in Value of $ 10,000 Investment

The graph below represents the hypothetical growth of a $10,000 investment in Class R3 shares and the comparative index.

Average Annual Total Returns

For the Periods Ended October 31, 2024 | 1 Year | 5 Years | Since Inception

(February 29, 2016) |

| Class R3 | 28.25% | 11.30% | 11.03% |

| MSCI ACWI Index (Net) | 32.79% | 11.08% | 11.69% |

Prior to November 8, 2019, the Fund pursued a modified strategy and Wellington Management Company LLP served as the Fund’s only sub-adviser.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance information reflects fee waivers and/or expense limitation arrangements, if any. Absent any applicable fee waivers and/or expense limitation arrangements, performance would have been lower. Visit hartfordfunds.com for the most recent performance information.

Key Fund Statistics as of October 31, 2024

| Fund's net assets | $133,306,341% |

| Total number of portfolio holdings (excluding derivatives, if any) | $93% |

| Total investment management fees paid | $834,616% |

| Portfolio turnover rate | $108% |

Graphical Representation of Holdings as of October 31, 2024

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| Industrials | 47.4 | % |

| Information Technology | 13.1 | % |

| Consumer Discretionary | 10.1 | % |

| Utilities | 9.2 | % |

| Financials | 7.8 | % |

| Materials | 3.5 | % |

| Communication Services | 2.3 | % |

| Consumer Staples | 2.3 | % |

| Real Estate | 0.8 | % |

| Short-Term Investments | 0.3 | % |

| Other Assets & Liabilities | 3.2 | % |

| Total | 100.0 | % |

* | For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please visit the Fund’s website at the website address included at the beginning of this report.

The Fund is distributed by Hartford Funds Distributors, LLC (HFD).

Annual Shareholder Report

October 31, 2024

Hartford Climate Opportunities Fund

Class R4/HEOSX

This annual shareholder report contains important information about the Hartford Climate Opportunities Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-hmf. You can also request this information by contacting us by calling 1‑888‑843‑7824.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Class R4 | $110 | 0.96% |

Costs paid include the impact of certain non-contractual waivers and/or reimbursements. In the absence of such waivers and reimbursements, the expense ratio would be higher.

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

Global equities, as measured by the MSCI ACWI Index (Net), rose over the trailing twelve-month period ending October 31, 2024, supported by easing inflation and interest rate cuts. During the period, within the MSCI ACWI Index (Net), clean energy and energy efficiency companies performed well while electric vehicle companies struggled due to fading demand. Fund performance described below is relative to the MSCI ACWI Index (Net) for the trailing twelve-month period ended October 31, 2024.

Top Contributors to Performance

Security selection within the Industrials sector was the primary contributor to relative returns during the period.

Sector allocation was also positive with strength within the Industrials, Health Care, and Energy sectors.

Top relative individual contributors over the period were an overweight position in Vertiv Holdings (Industrials), an out-of-benchmark allocation to Acuity Brands (Industrials) and ARM Holdings (Industrials), and an overweight position in Westinghouse Air Brake Technologies (Industrials).

Top Detractors to Performance

Security selection detracted from relative performance during the period, driven by selection within the Information Technology, Utilities, Consumer Discretionary and Financials sectors.

Sector allocation also detracted from results within the Information Technology, Financials, and Communication Services sectors.

The largest individual relative detractors over the period were not owning benchmark constituent NVIDIA (Information Technology), owning Vestas Wind Systems (Industrials) and overweight positions in Enphase Energy (Information Technology) and Samsung SDI C. (Information Technology).

The views expressed in this section reflect the opinions of the Fund's portfolio managers as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

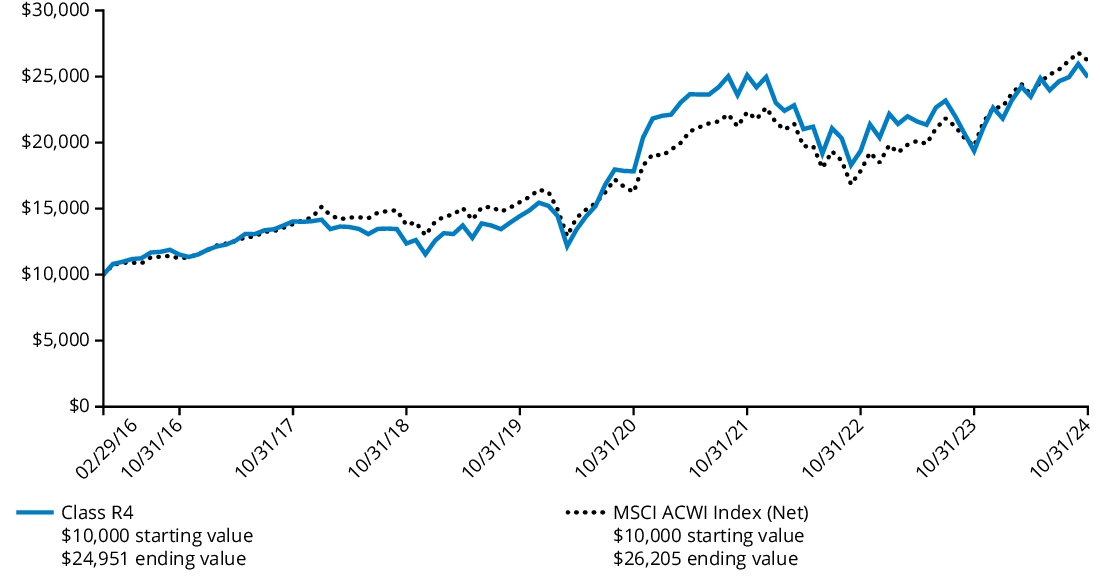

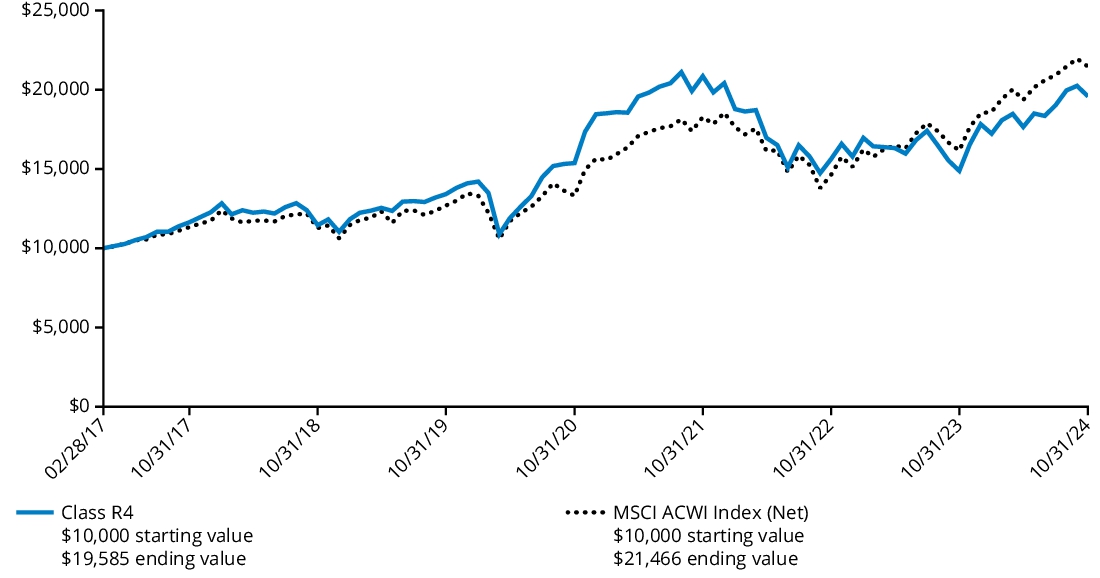

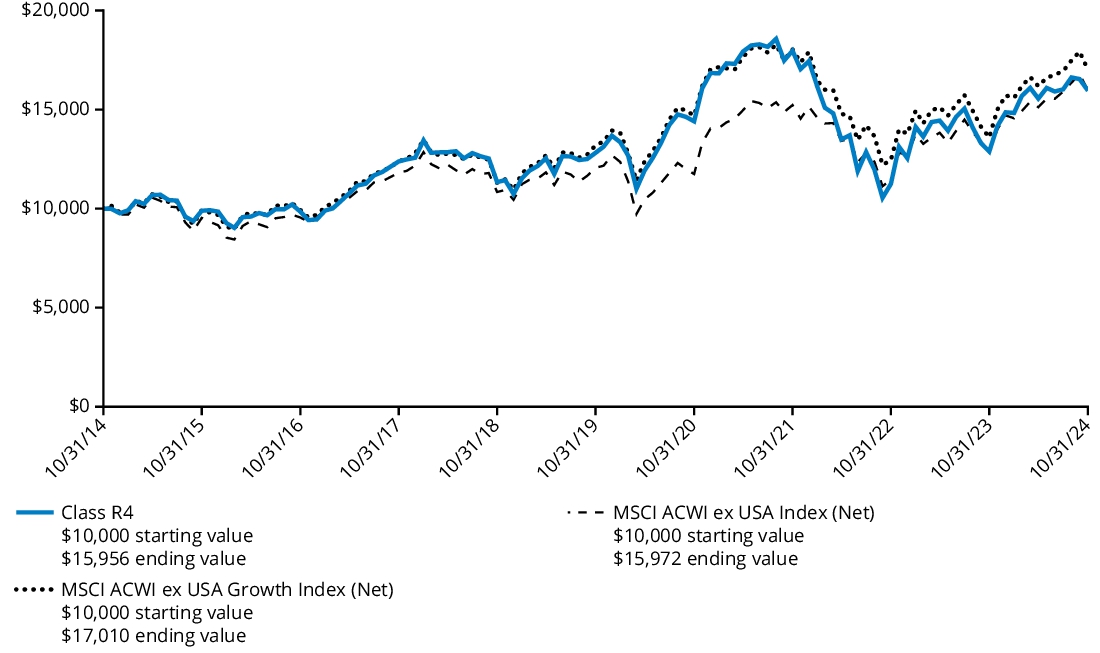

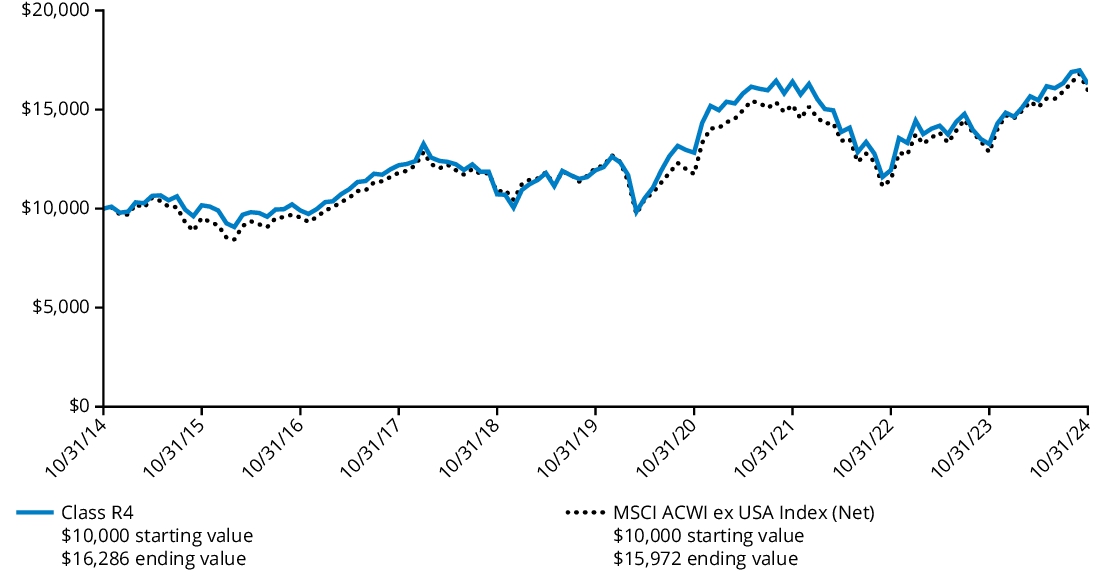

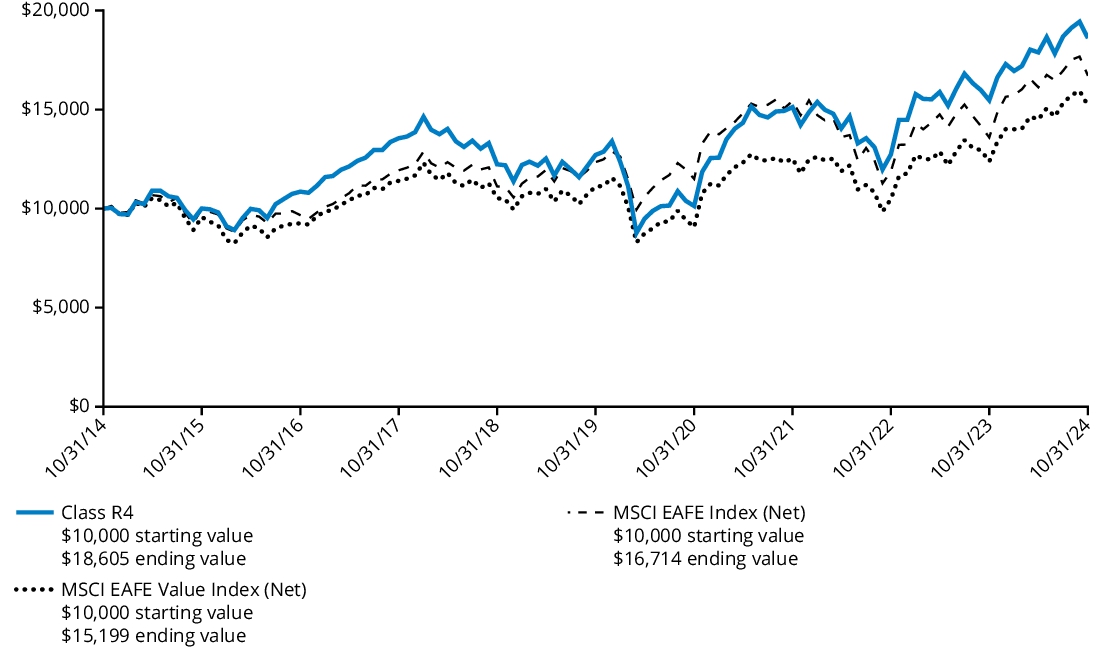

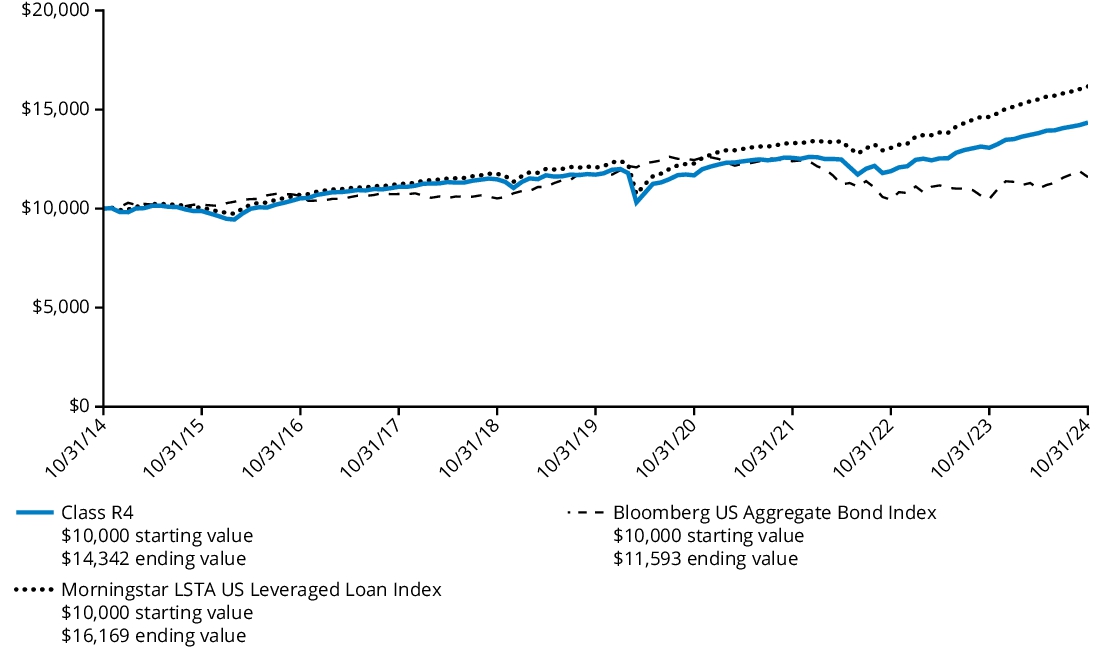

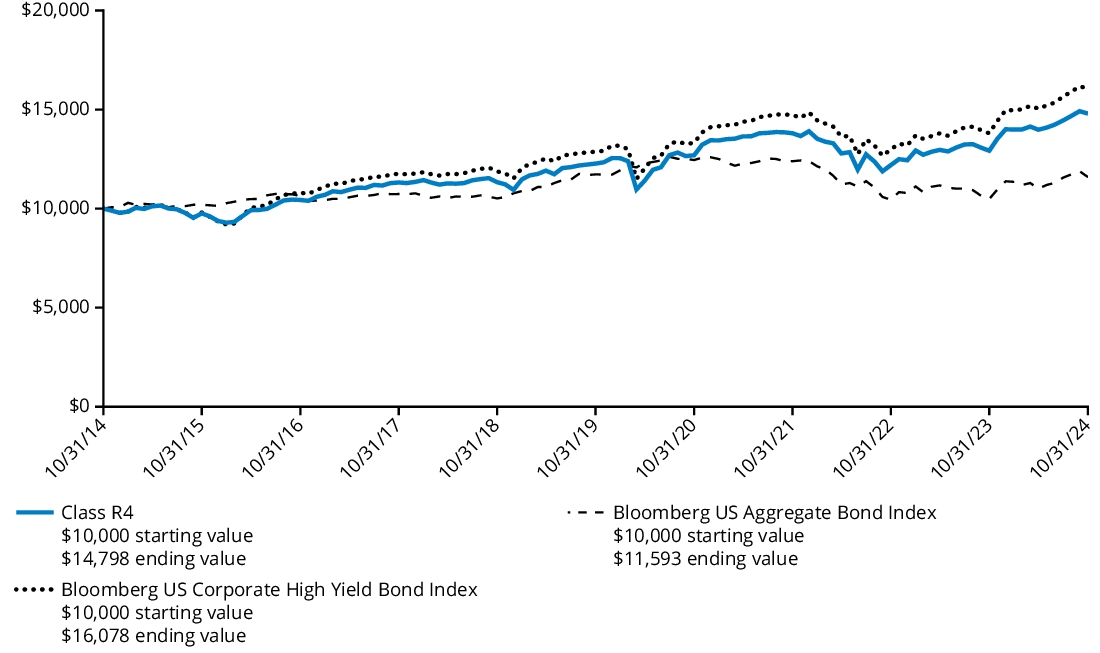

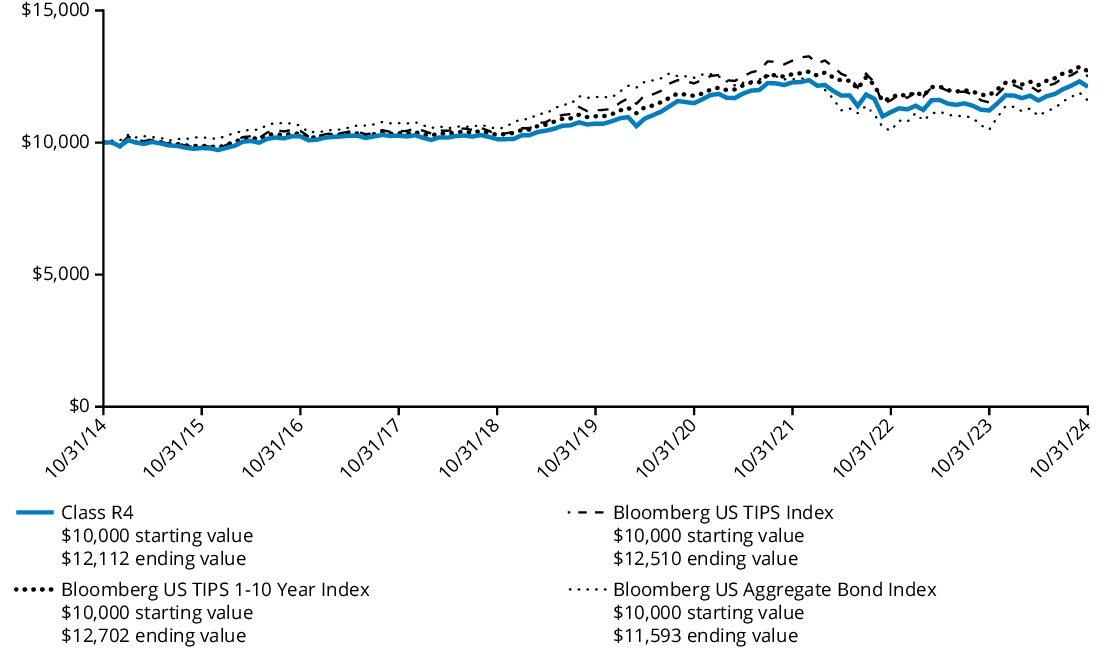

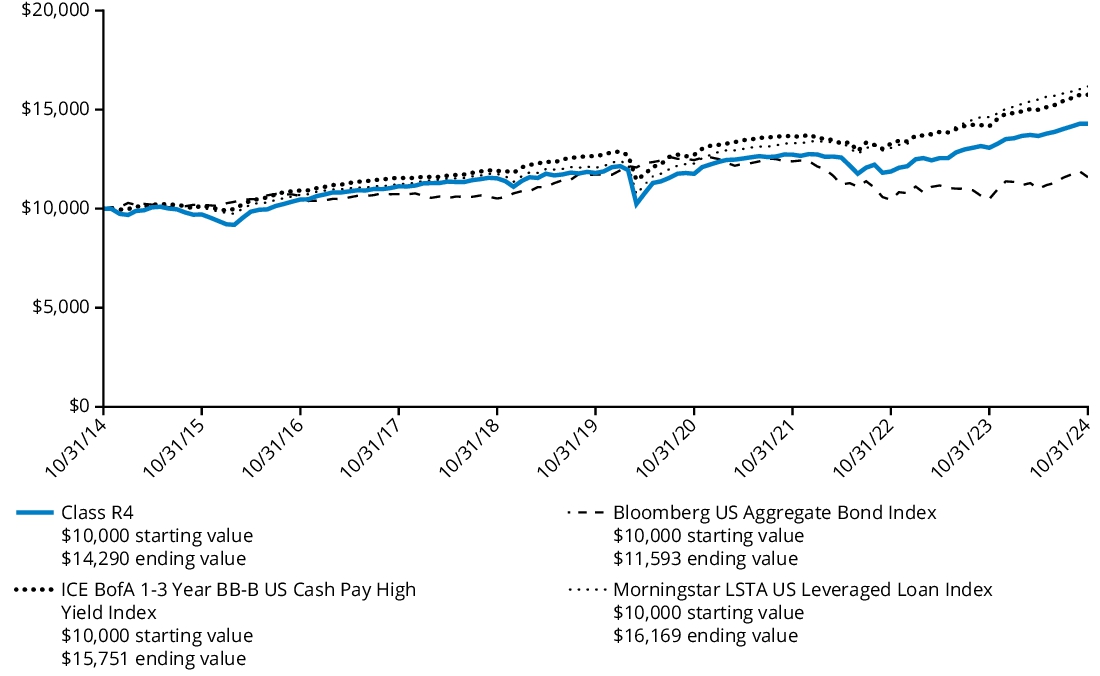

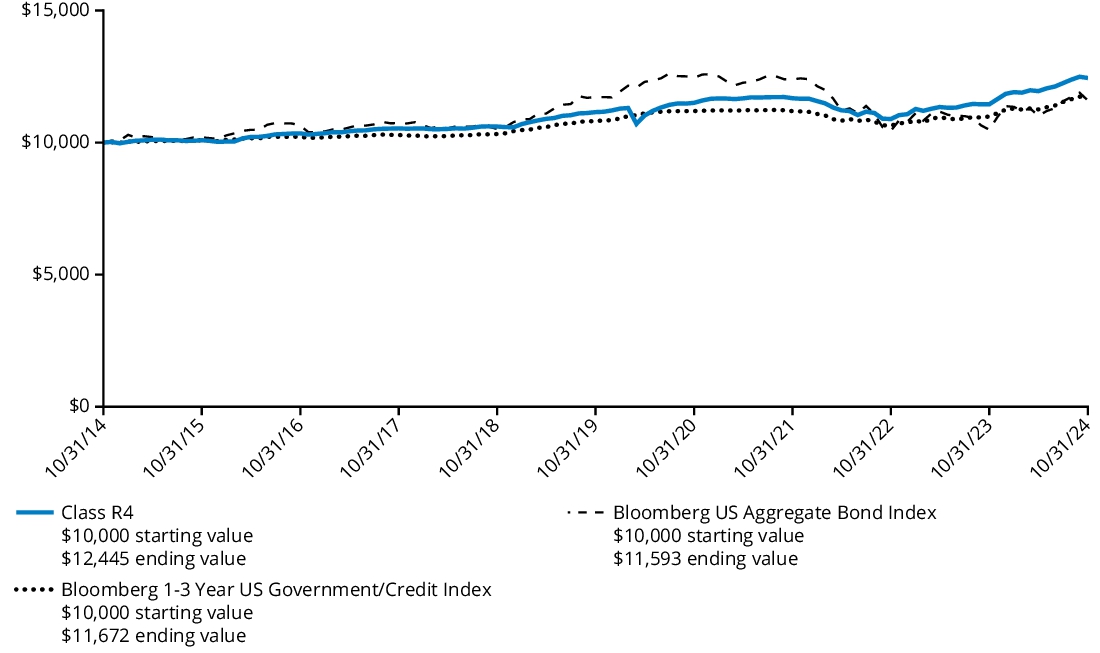

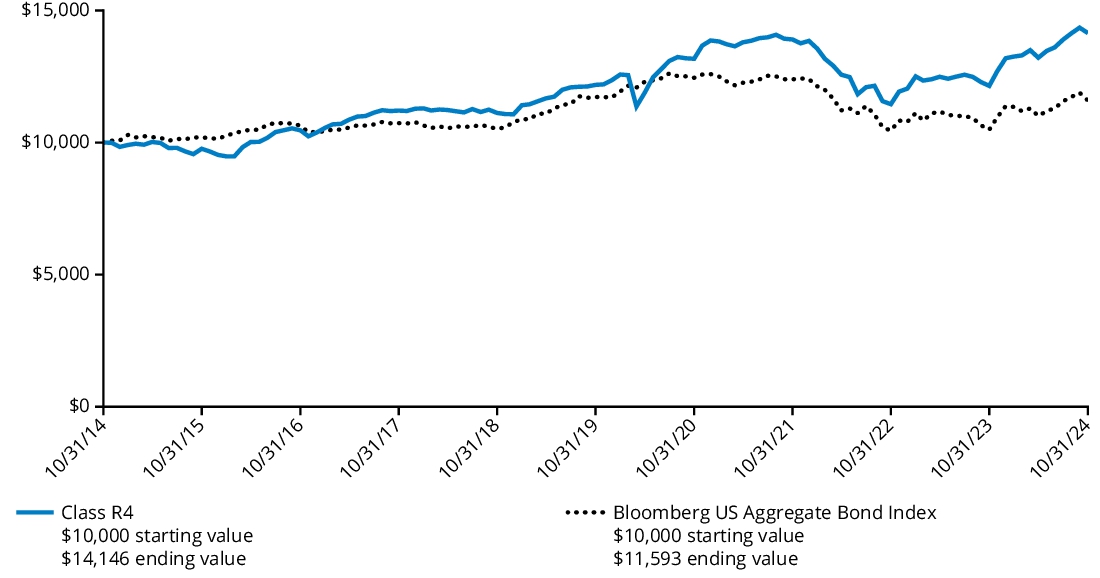

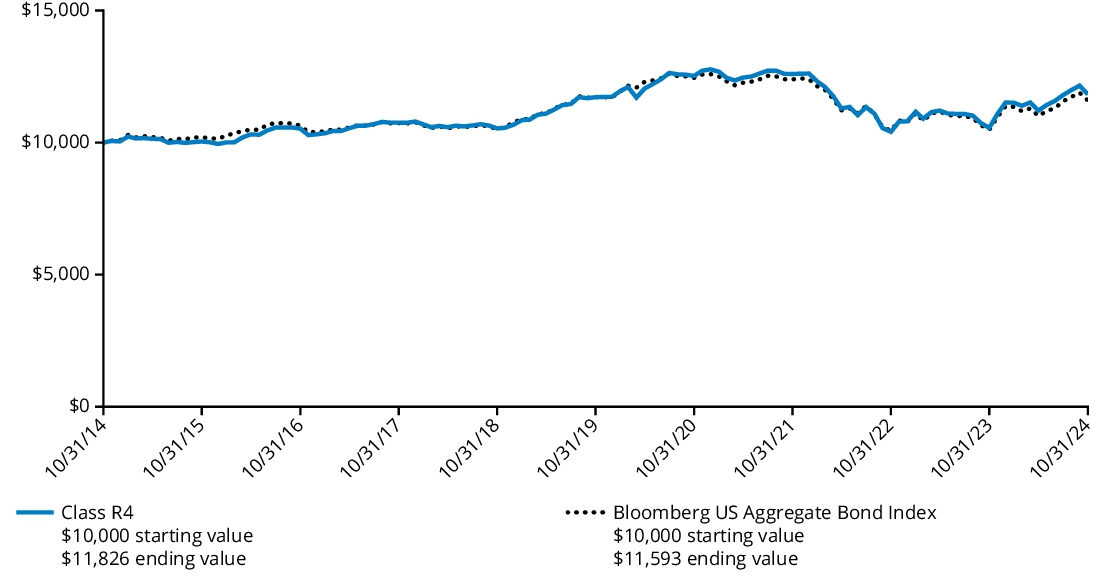

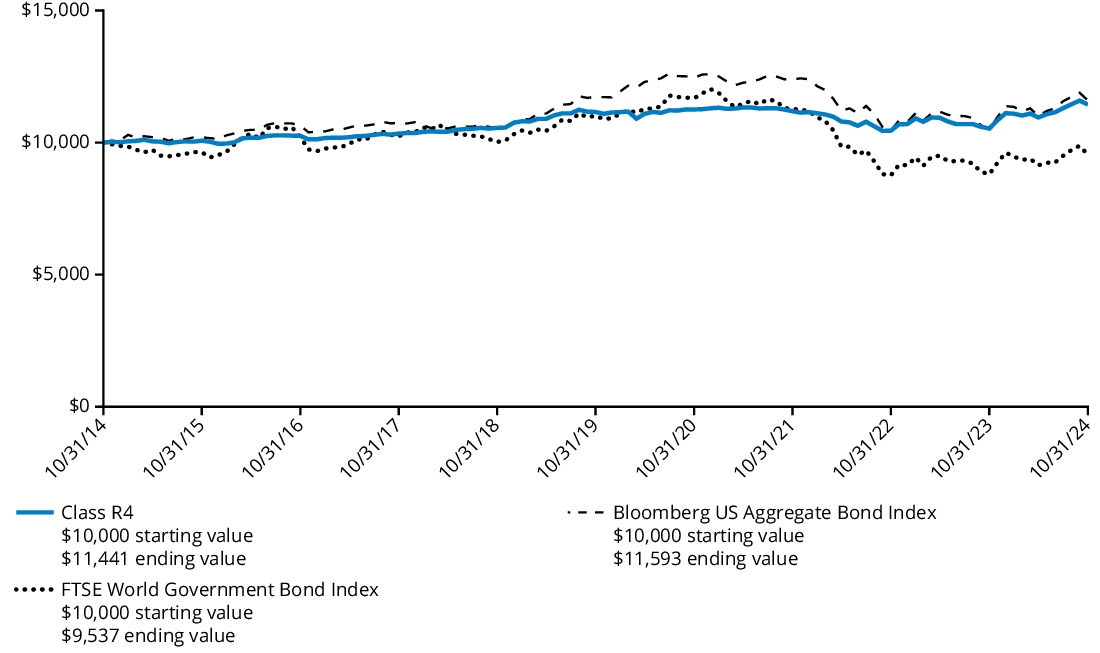

Comparison of Change in Value of $ 10,000 Investment

The graph below represents the hypothetical growth of a $10,000 investment in Class R4 shares and the comparative index.

Average Annual Total Returns

For the Periods Ended October 31, 2024 | 1 Year | 5 Years | Since Inception

(February 29, 2016) |

| Class R4 | 28.88% | 11.56% | 11.12% |

| MSCI ACWI Index (Net) | 32.79% | 11.08% | 11.69% |

Prior to November 8, 2019, the Fund pursued a modified strategy and Wellington Management Company LLP served as the Fund’s only sub-adviser.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance information reflects fee waivers and/or expense limitation arrangements, if any. Absent any applicable fee waivers and/or expense limitation arrangements, performance would have been lower. Visit hartfordfunds.com for the most recent performance information.

Key Fund Statistics as of October 31, 2024

| Fund's net assets | $133,306,341% |

| Total number of portfolio holdings (excluding derivatives, if any) | $93% |

| Total investment management fees paid | $834,616% |

| Portfolio turnover rate | $108% |

Graphical Representation of Holdings as of October 31, 2024

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| Industrials | 47.4 | % |

| Information Technology | 13.1 | % |

| Consumer Discretionary | 10.1 | % |

| Utilities | 9.2 | % |

| Financials | 7.8 | % |

| Materials | 3.5 | % |

| Communication Services | 2.3 | % |

| Consumer Staples | 2.3 | % |

| Real Estate | 0.8 | % |

| Short-Term Investments | 0.3 | % |

| Other Assets & Liabilities | 3.2 | % |

| Total | 100.0 | % |

* | For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please visit the Fund’s website at the website address included at the beginning of this report.

The Fund is distributed by Hartford Funds Distributors, LLC (HFD).

Annual Shareholder Report

October 31, 2024

Hartford Climate Opportunities Fund

Class R5/HEOTX

This annual shareholder report contains important information about the Hartford Climate Opportunities Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-hmf. You can also request this information by contacting us by calling 1‑888‑843‑7824.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Class R5 | $93 | 0.81% |

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

Global equities, as measured by the MSCI ACWI Index (Net), rose over the trailing twelve-month period ending October 31, 2024, supported by easing inflation and interest rate cuts. During the period, within the MSCI ACWI Index (Net), clean energy and energy efficiency companies performed well while electric vehicle companies struggled due to fading demand. Fund performance described below is relative to the MSCI ACWI Index (Net) for the trailing twelve-month period ended October 31, 2024.

Top Contributors to Performance

Security selection within the Industrials sector was the primary contributor to relative returns during the period.

Sector allocation was also positive with strength within the Industrials, Health Care, and Energy sectors.

Top relative individual contributors over the period were an overweight position in Vertiv Holdings (Industrials), an out-of-benchmark allocation to Acuity Brands (Industrials) and ARM Holdings (Industrials), and an overweight position in Westinghouse Air Brake Technologies (Industrials).

Top Detractors to Performance

Security selection detracted from relative performance during the period, driven by selection within the Information Technology, Utilities, Consumer Discretionary and Financials sectors.

Sector allocation also detracted from results within the Information Technology, Financials, and Communication Services sectors.

The largest individual relative detractors over the period were not owning benchmark constituent NVIDIA (Information Technology), owning Vestas Wind Systems (Industrials) and overweight positions in Enphase Energy (Information Technology) and Samsung SDI C. (Information Technology).

The views expressed in this section reflect the opinions of the Fund's portfolio managers as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

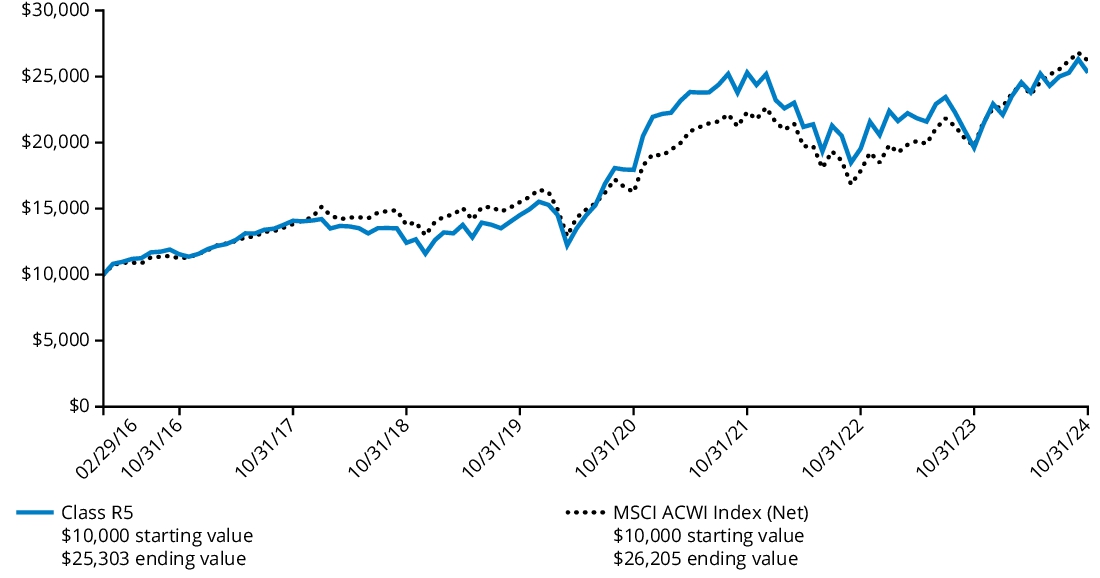

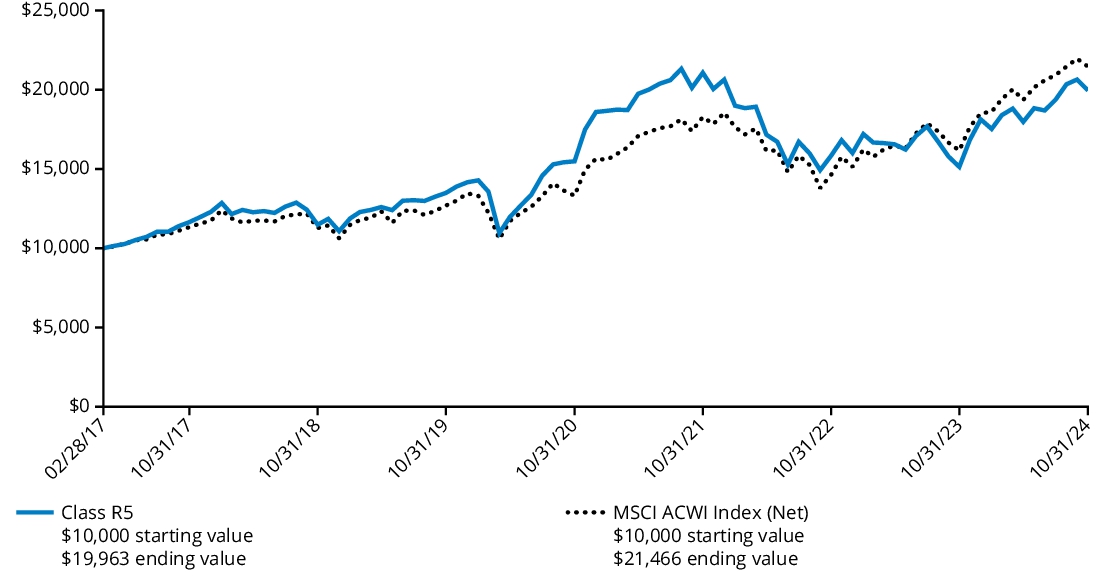

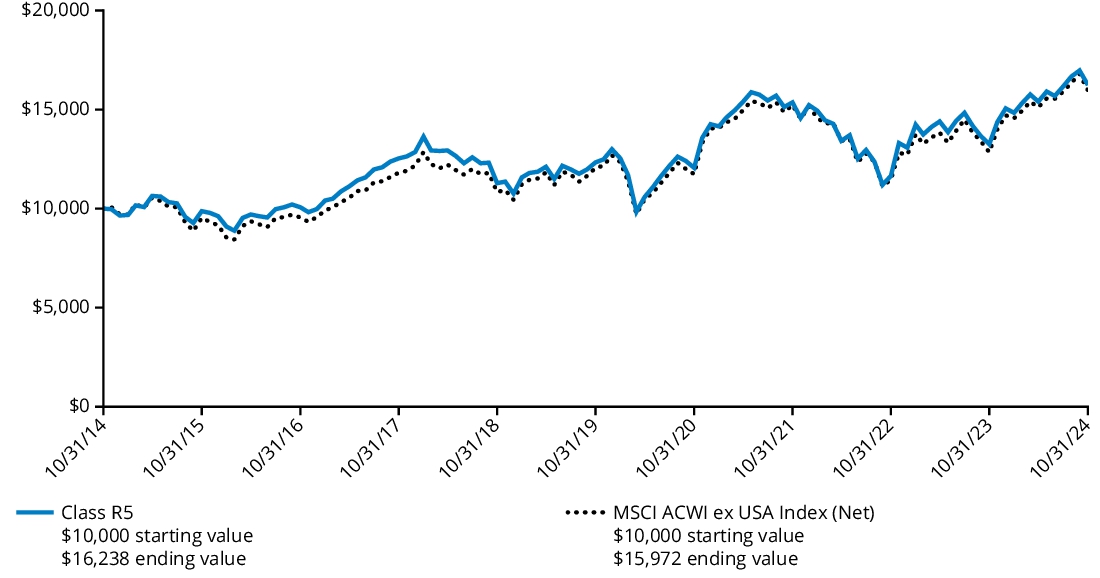

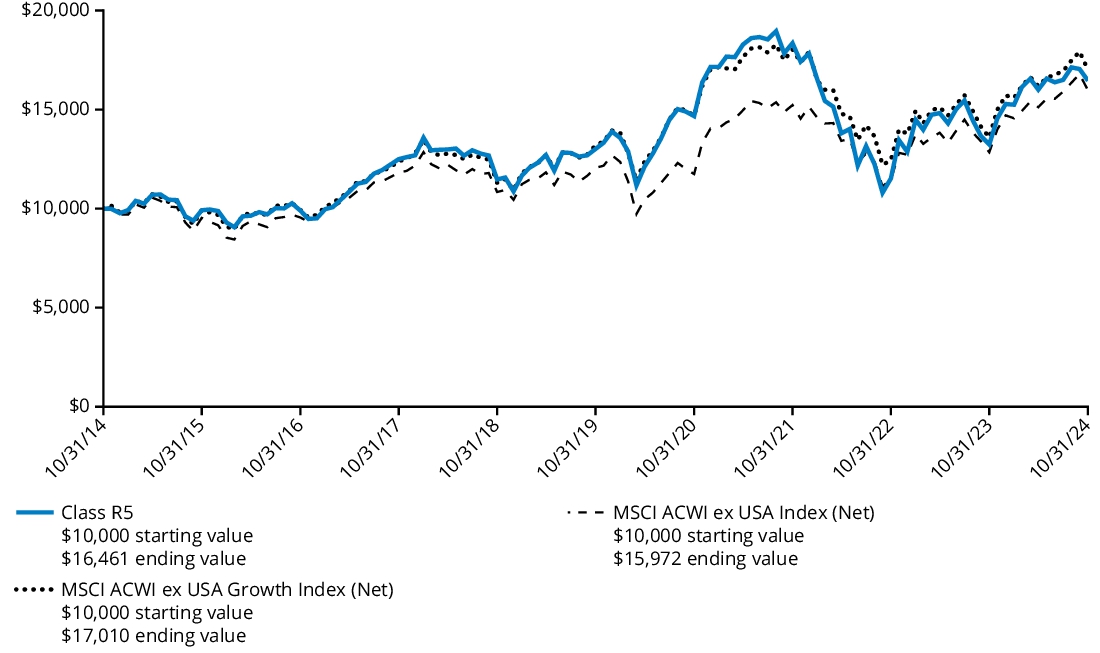

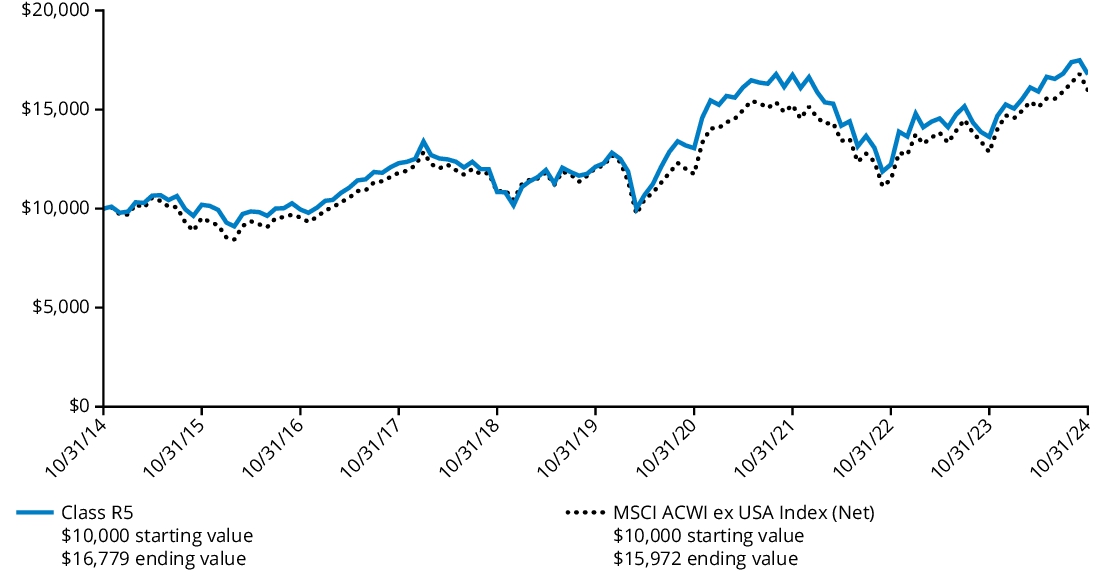

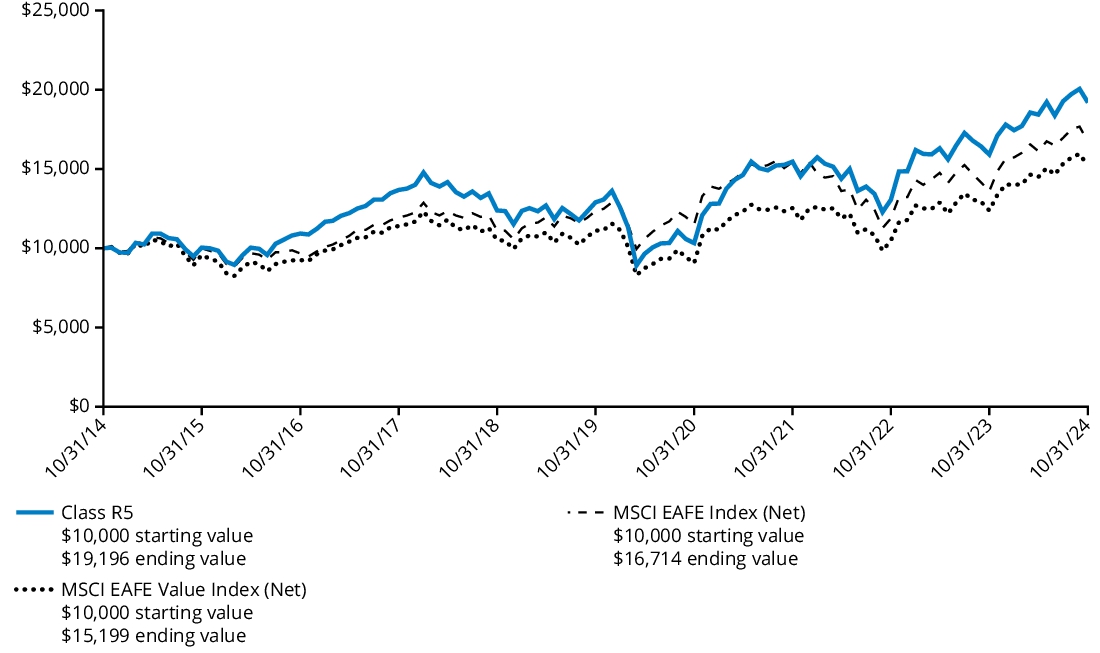

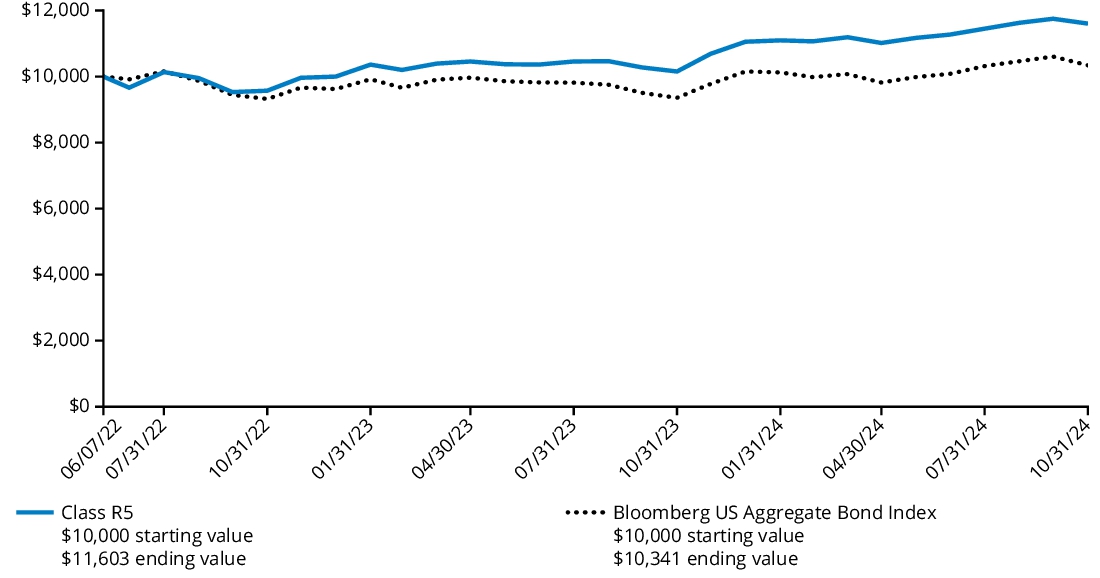

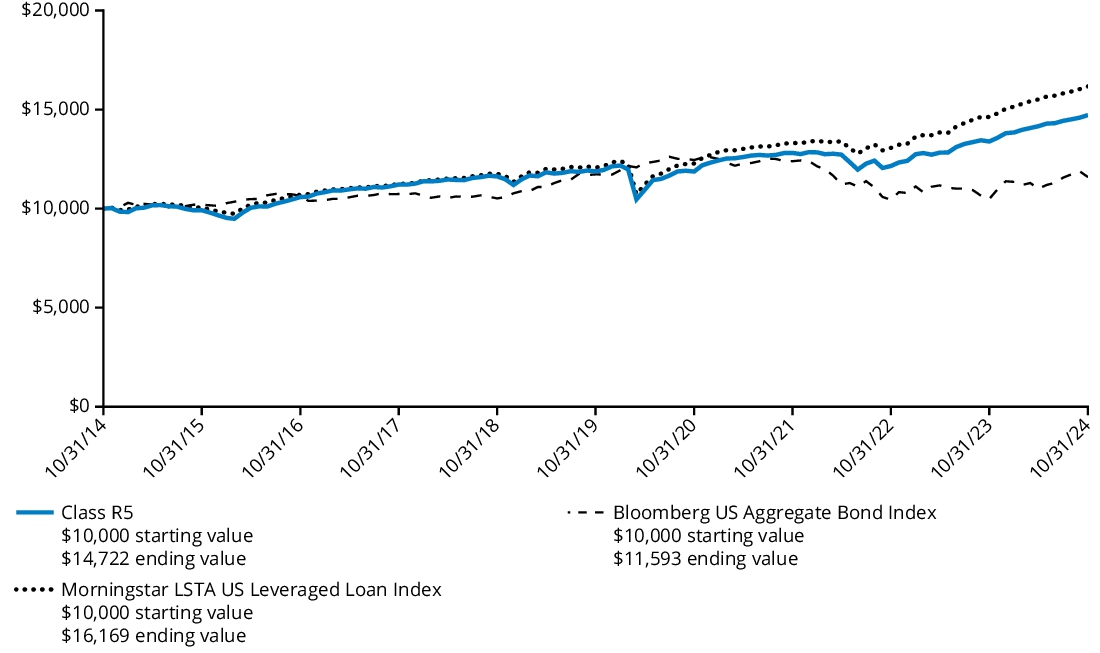

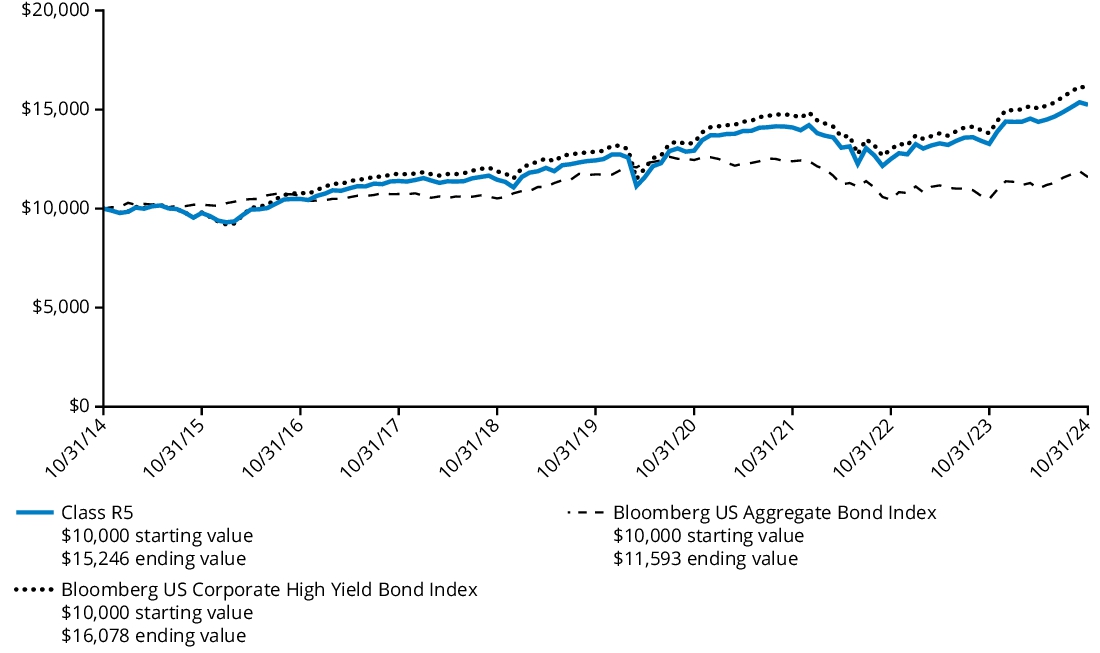

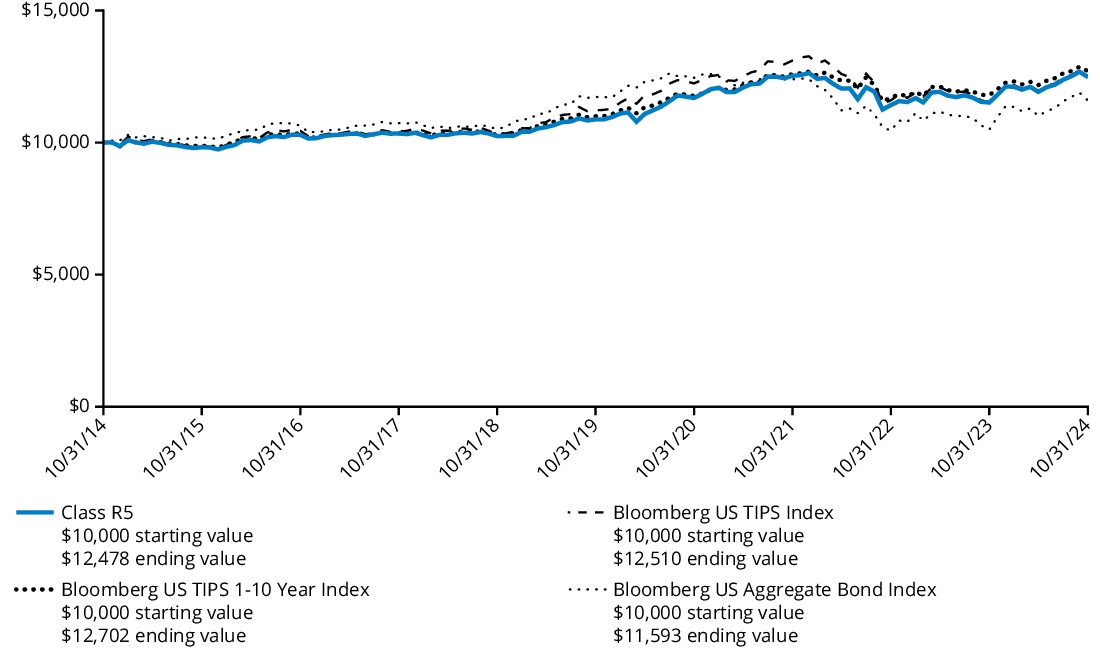

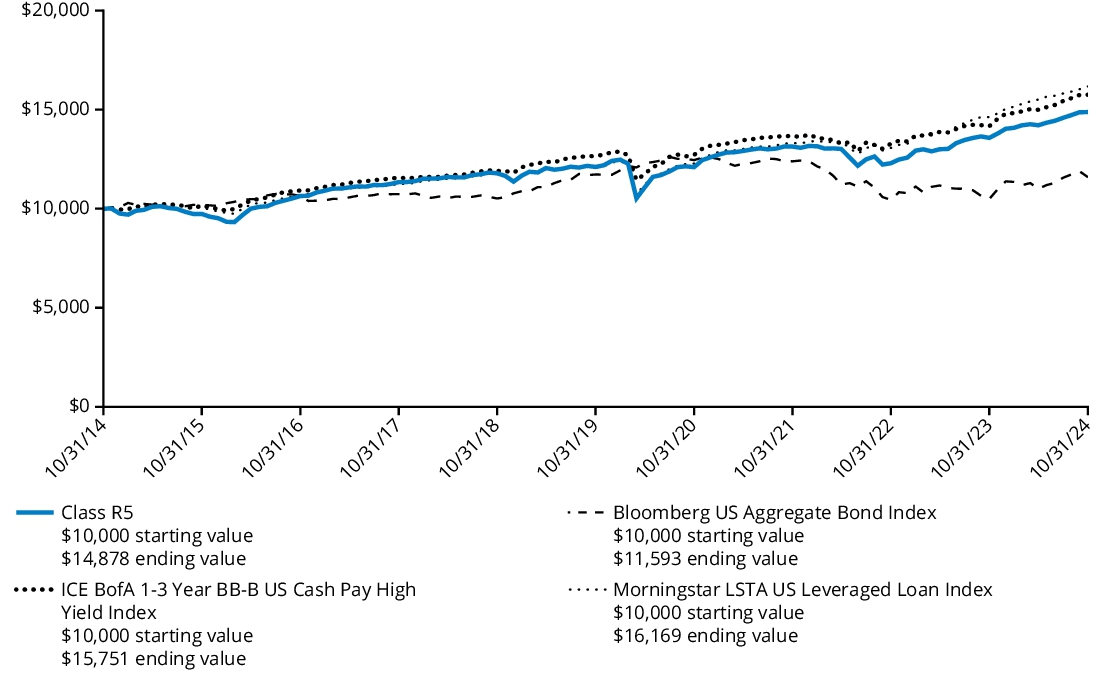

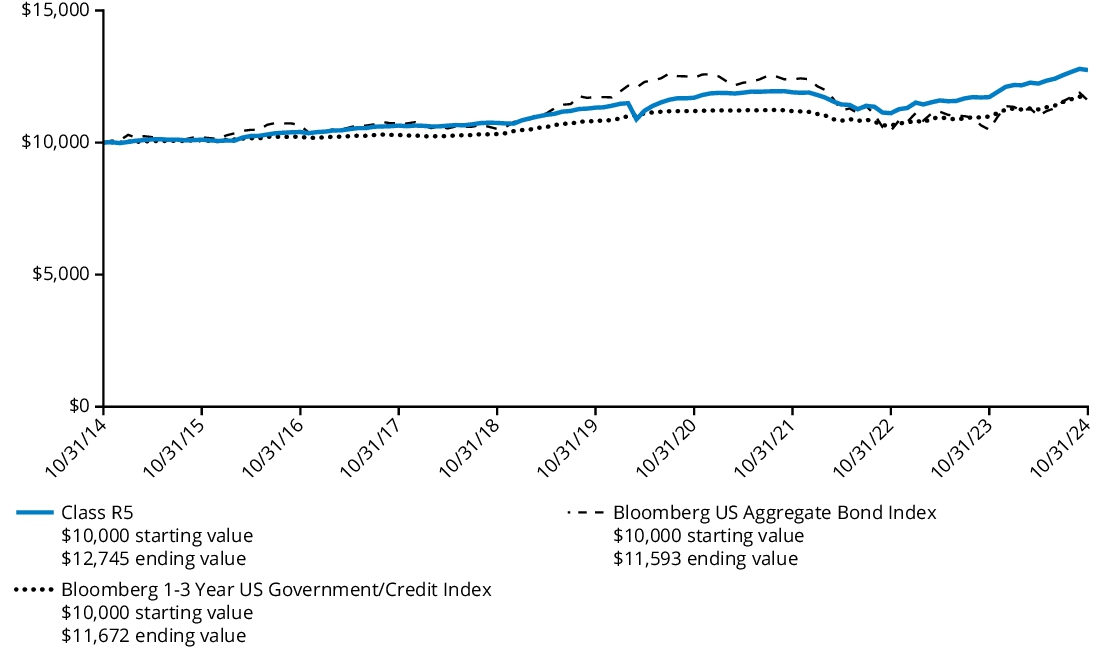

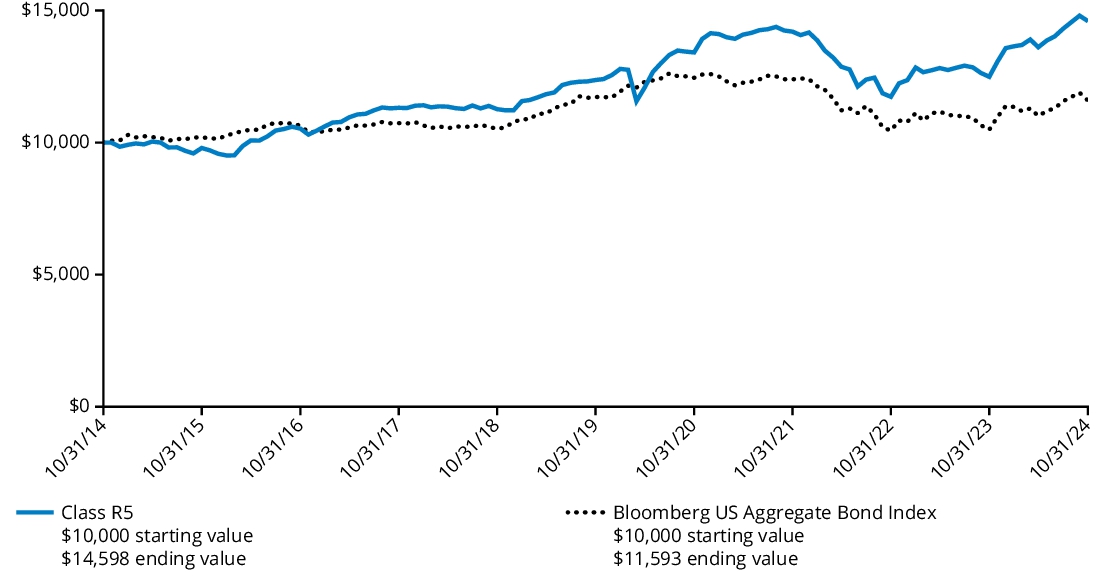

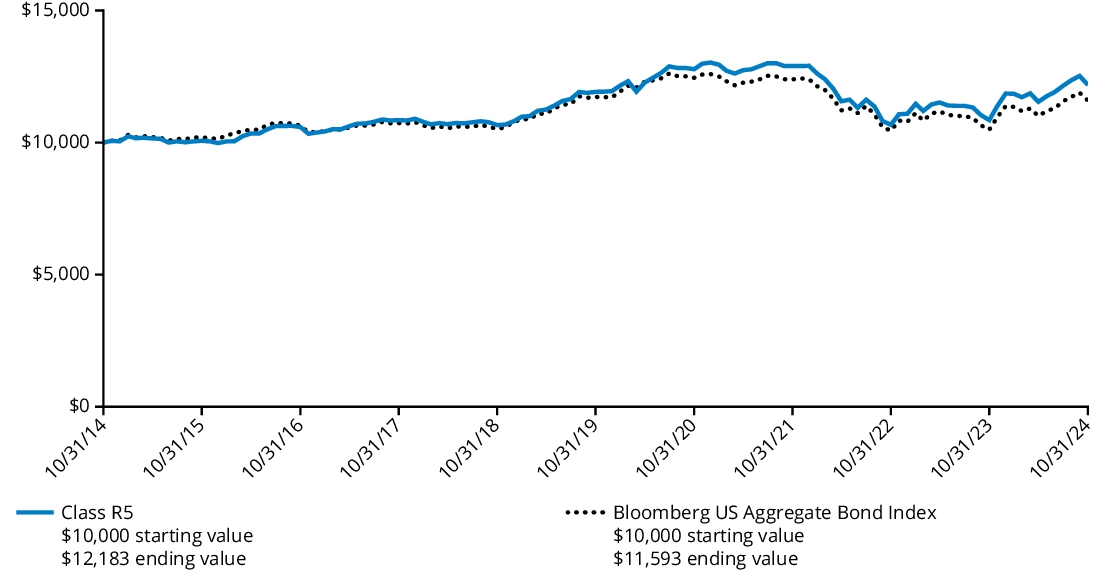

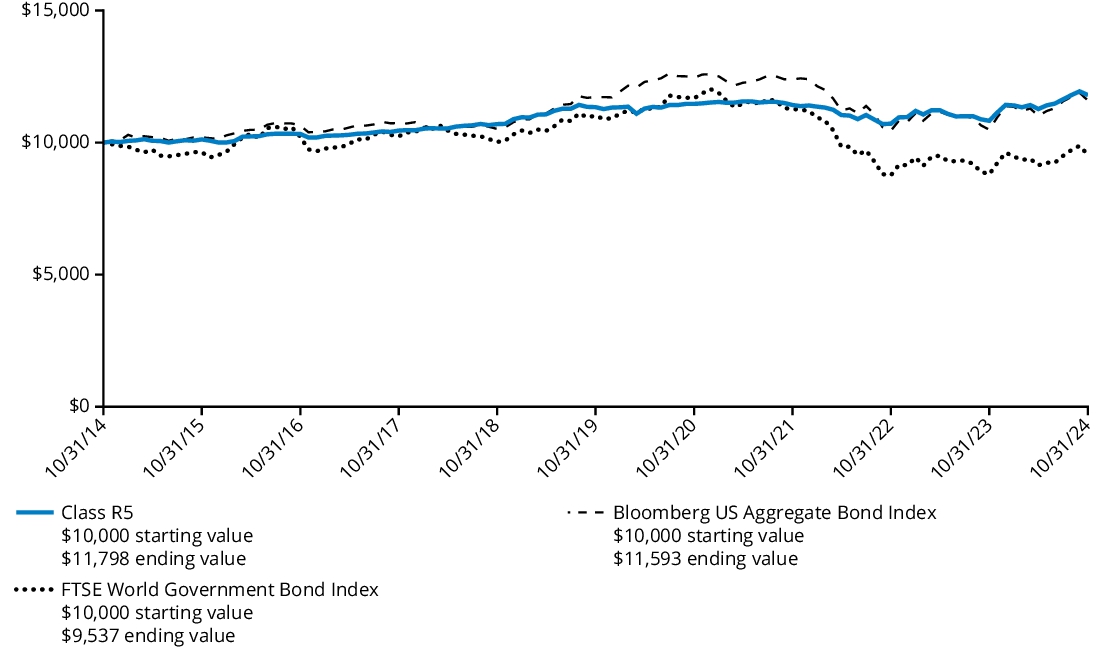

Comparison of Change in Value of $ 10,000 Investment

The graph below represents the hypothetical growth of a $10,000 investment in Class R5 shares and the comparative index.

Average Annual Total Returns

For the Periods Ended October 31, 2024 | 1 Year | 5 Years | Since Inception

(February 29, 2016) |

| Class R5 | 29.06% | 11.76% | 11.30% |

| MSCI ACWI Index (Net) | 32.79% | 11.08% | 11.69% |

Prior to November 8, 2019, the Fund pursued a modified strategy and Wellington Management Company LLP served as the Fund’s only sub-adviser.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance information reflects fee waivers and/or expense limitation arrangements, if any. Absent any applicable fee waivers and/or expense limitation arrangements, performance would have been lower. Visit hartfordfunds.com for the most recent performance information.

Key Fund Statistics as of October 31, 2024

| Fund's net assets | $133,306,341% |

| Total number of portfolio holdings (excluding derivatives, if any) | $93% |

| Total investment management fees paid | $834,616% |

| Portfolio turnover rate | $108% |

Graphical Representation of Holdings as of October 31, 2024

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| Industrials | 47.4 | % |

| Information Technology | 13.1 | % |

| Consumer Discretionary | 10.1 | % |

| Utilities | 9.2 | % |

| Financials | 7.8 | % |

| Materials | 3.5 | % |

| Communication Services | 2.3 | % |

| Consumer Staples | 2.3 | % |

| Real Estate | 0.8 | % |

| Short-Term Investments | 0.3 | % |

| Other Assets & Liabilities | 3.2 | % |

| Total | 100.0 | % |

* | For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please visit the Fund’s website at the website address included at the beginning of this report.

The Fund is distributed by Hartford Funds Distributors, LLC (HFD).

Annual Shareholder Report

October 31, 2024

Hartford Climate Opportunities Fund

Class R6/HEOVX

This annual shareholder report contains important information about the Hartford Climate Opportunities Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-hmf. You can also request this information by contacting us by calling 1‑888‑843‑7824.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Class R6 | $79 | 0.69% |

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

Global equities, as measured by the MSCI ACWI Index (Net), rose over the trailing twelve-month period ending October 31, 2024, supported by easing inflation and interest rate cuts. During the period, within the MSCI ACWI Index (Net), clean energy and energy efficiency companies performed well while electric vehicle companies struggled due to fading demand. Fund performance described below is relative to the MSCI ACWI Index (Net) for the trailing twelve-month period ended October 31, 2024.

Top Contributors to Performance

Security selection within the Industrials sector was the primary contributor to relative returns during the period.

Sector allocation was also positive with strength within the Industrials, Health Care, and Energy sectors.

Top relative individual contributors over the period were an overweight position in Vertiv Holdings (Industrials), an out-of-benchmark allocation to Acuity Brands (Industrials) and ARM Holdings (Industrials), and an overweight position in Westinghouse Air Brake Technologies (Industrials).

Top Detractors to Performance

Security selection detracted from relative performance during the period, driven by selection within the Information Technology, Utilities, Consumer Discretionary and Financials sectors.

Sector allocation also detracted from results within the Information Technology, Financials, and Communication Services sectors.

The largest individual relative detractors over the period were not owning benchmark constituent NVIDIA (Information Technology), owning Vestas Wind Systems (Industrials) and overweight positions in Enphase Energy (Information Technology) and Samsung SDI C. (Information Technology).

The views expressed in this section reflect the opinions of the Fund's portfolio managers as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

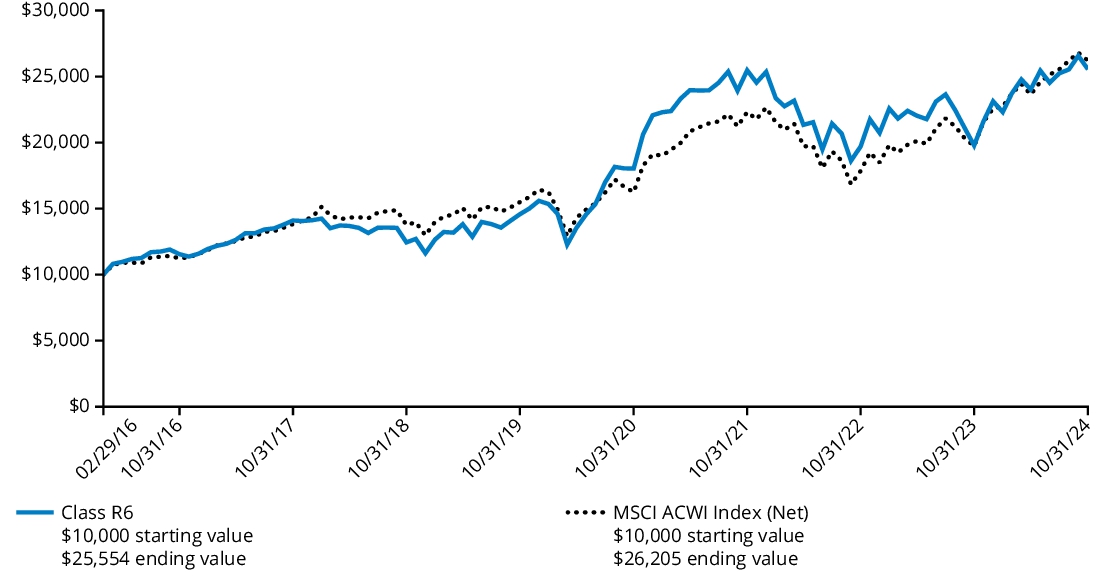

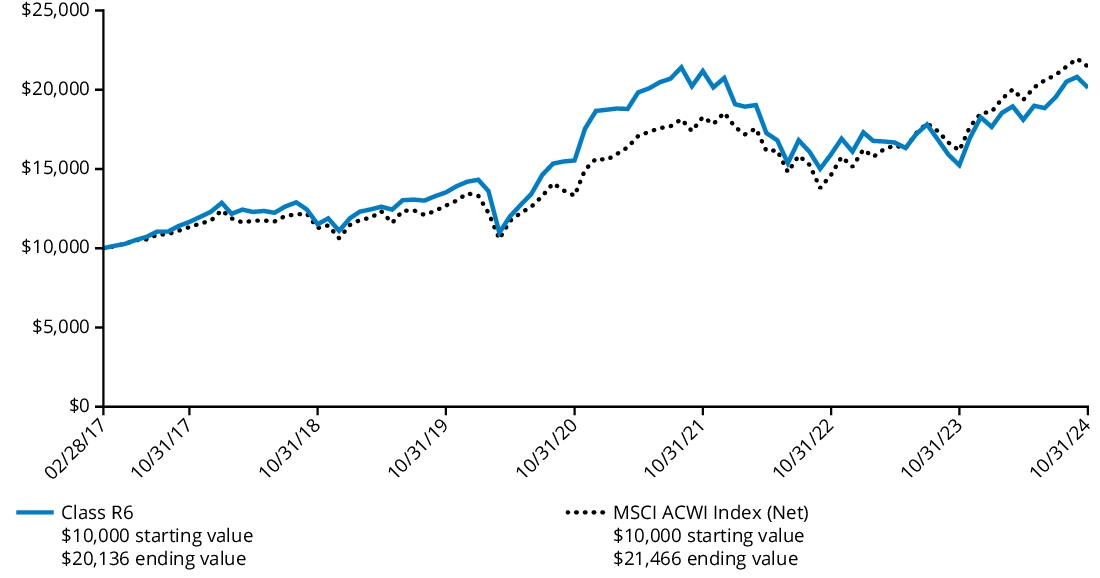

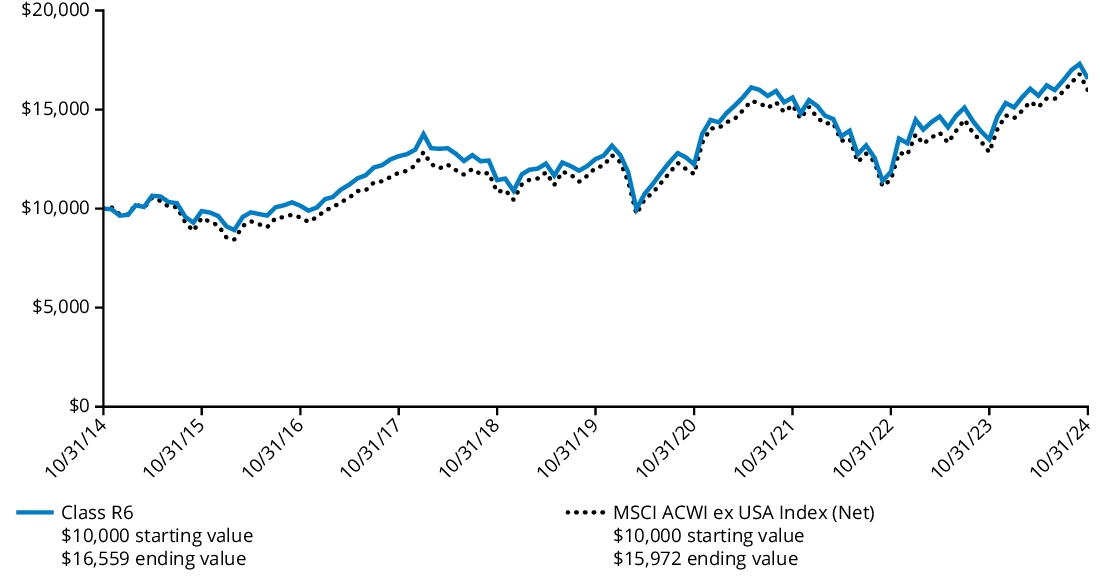

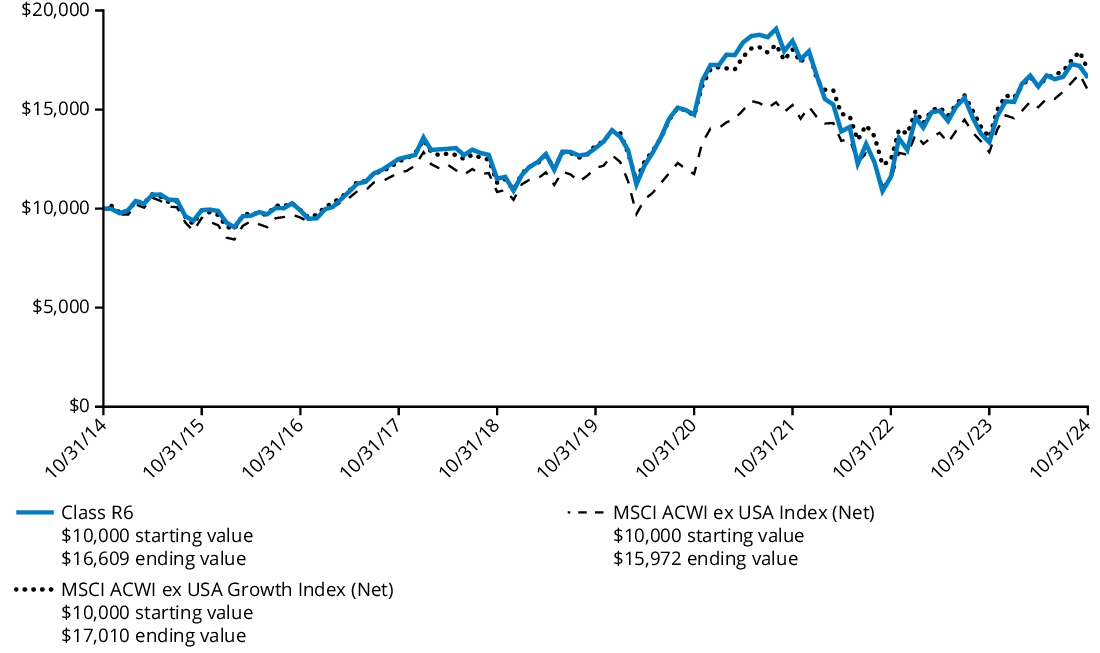

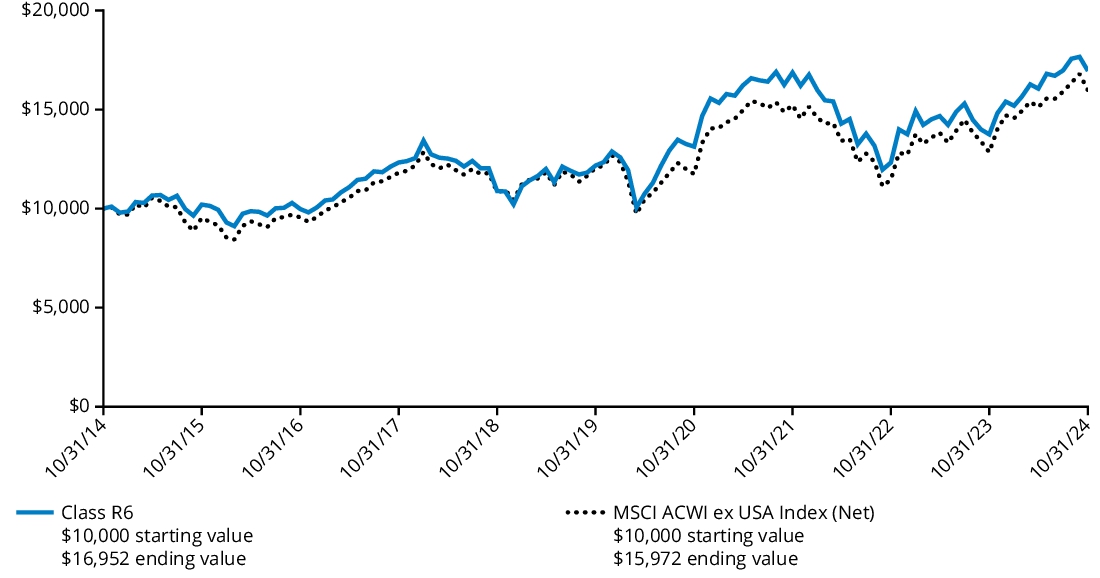

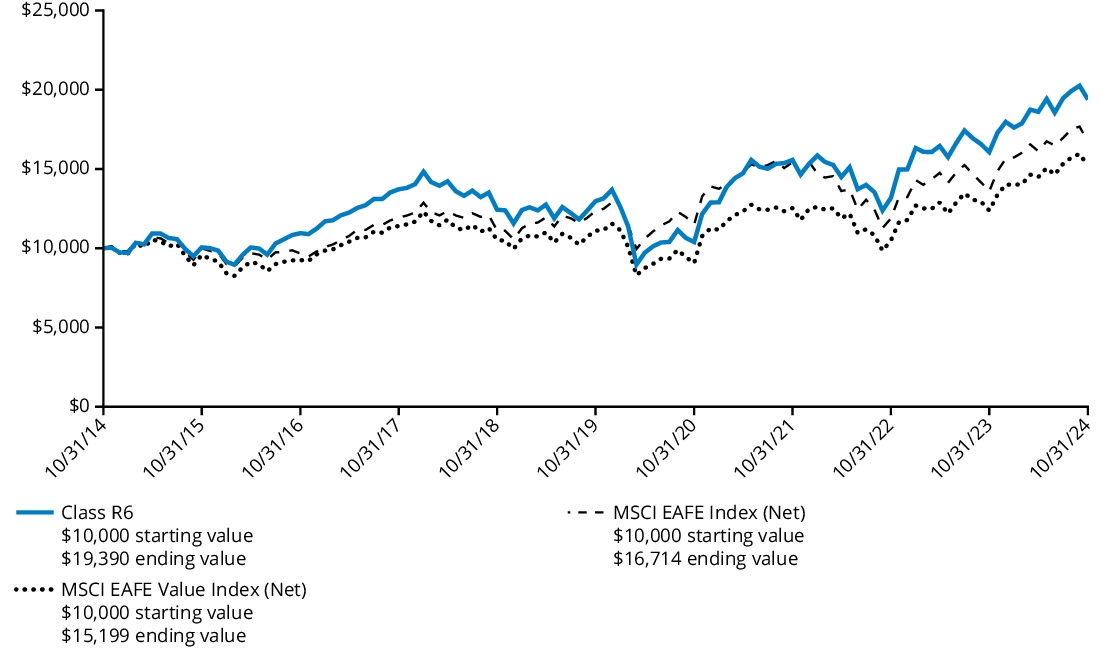

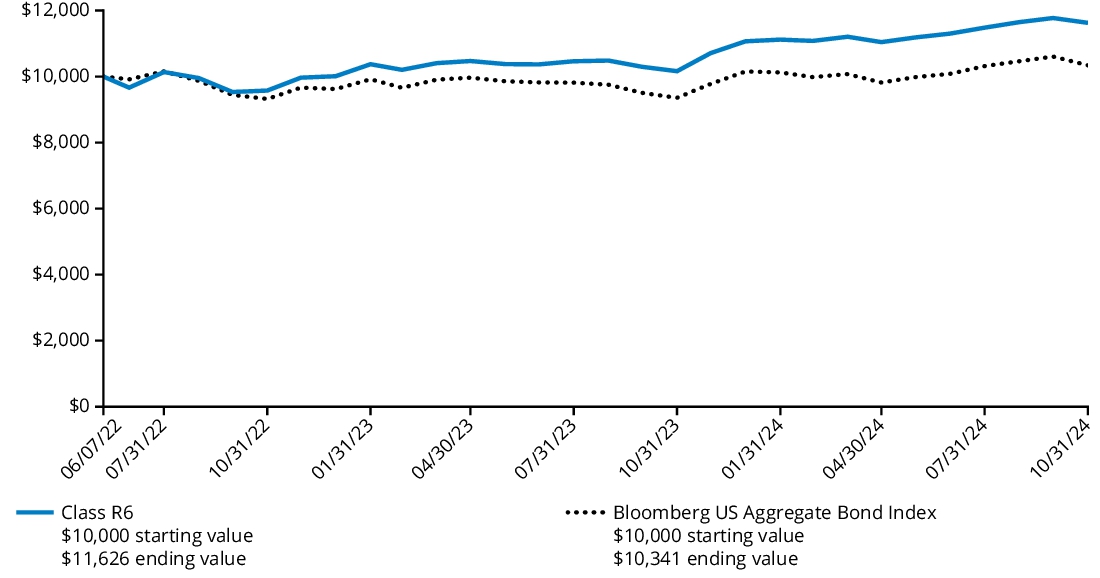

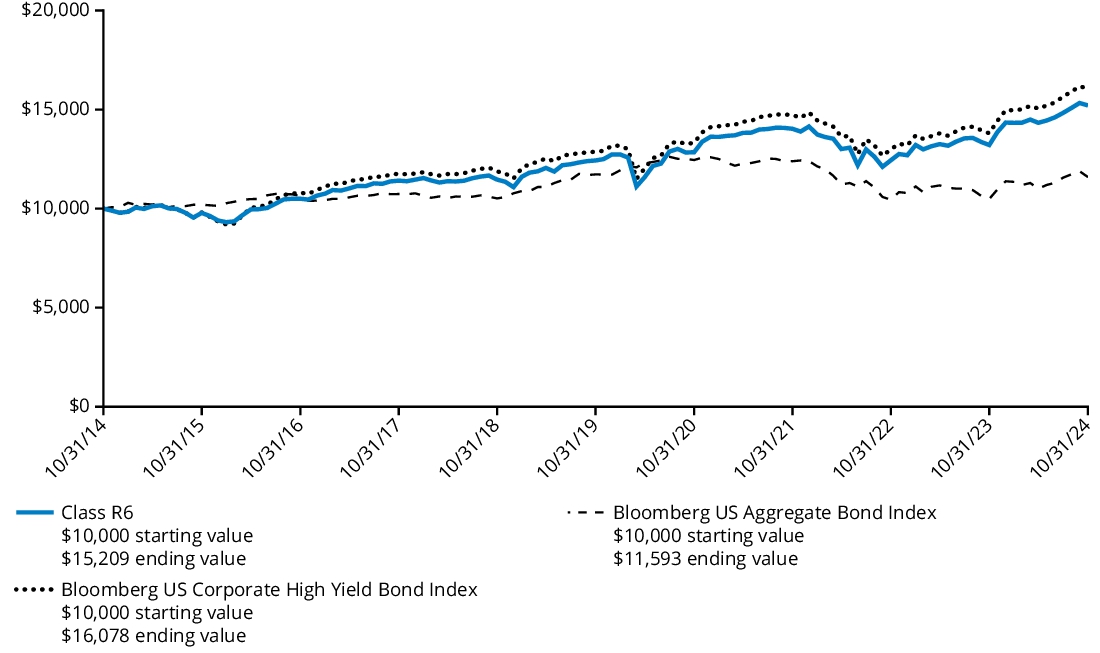

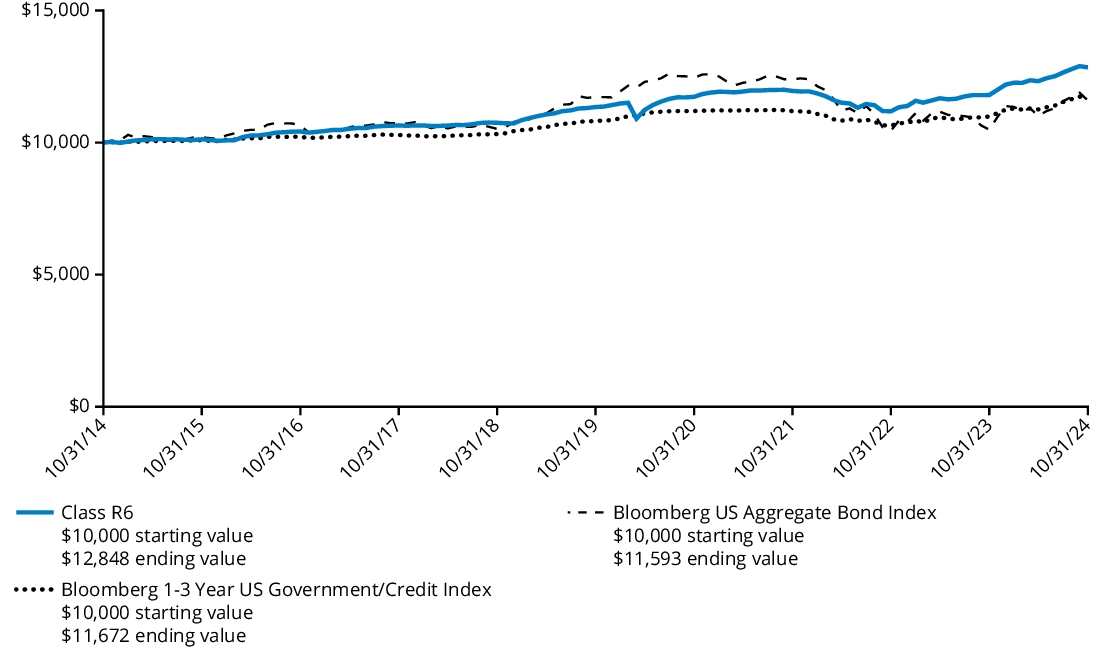

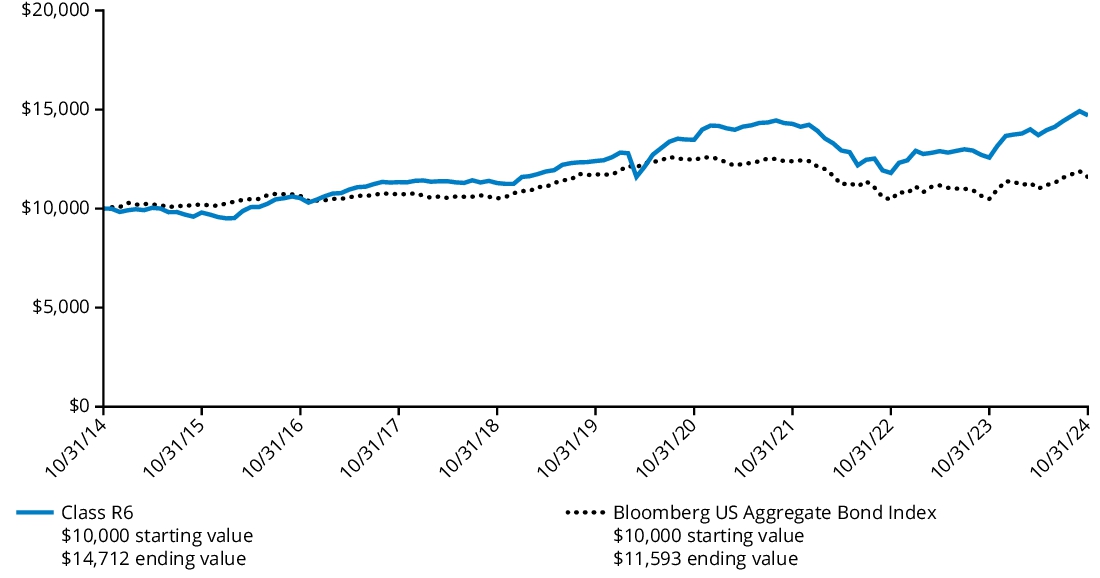

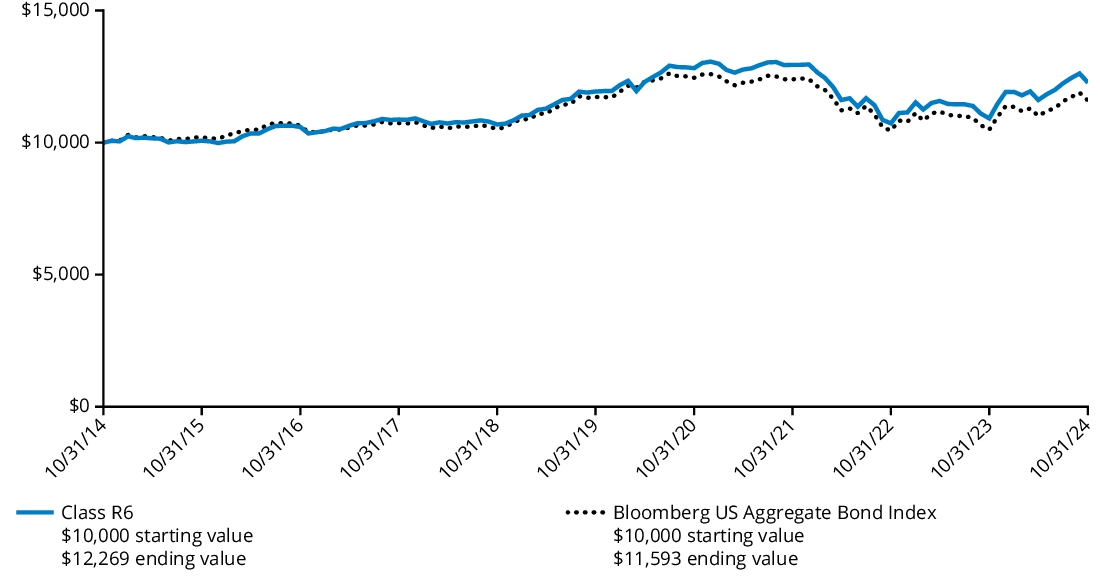

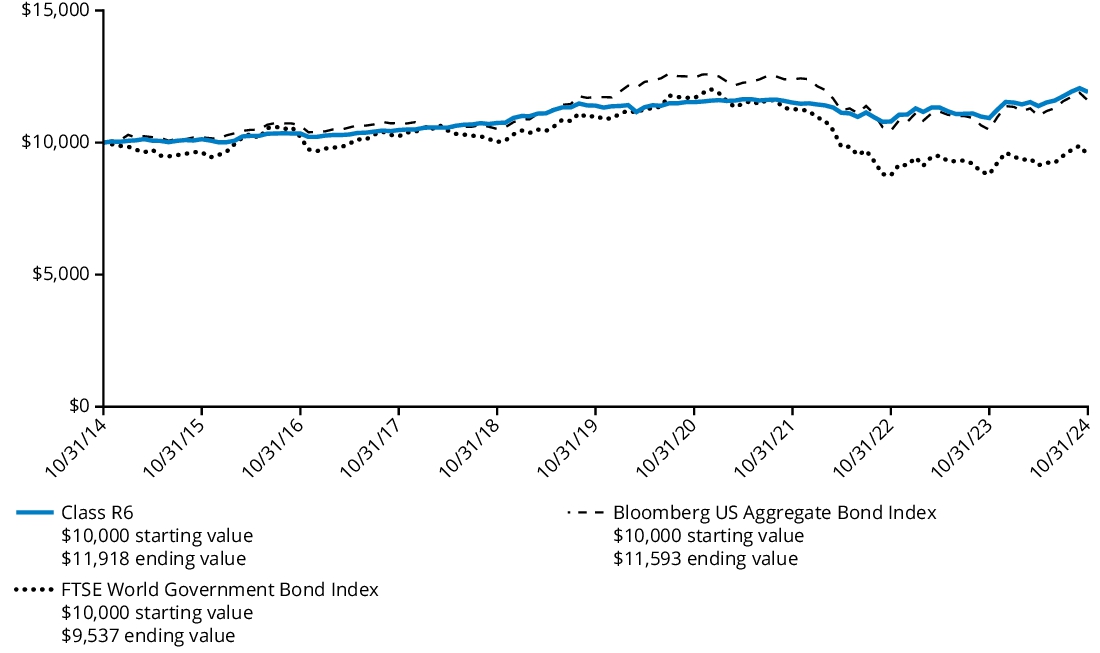

Comparison of Change in Value of $ 10,000 Investment

The graph below represents the hypothetical growth of a $10,000 investment in Class R6 shares and the comparative index.

Average Annual Total Returns

For the Periods Ended October 31, 2024 | 1 Year | 5 Years | Since Inception

(February 29, 2016) |

| Class R6 | 29.18% | 11.88% | 11.43% |

| MSCI ACWI Index (Net) | 32.79% | 11.08% | 11.69% |

Prior to November 8, 2019, the Fund pursued a modified strategy and Wellington Management Company LLP served as the Fund’s only sub-adviser.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance information reflects fee waivers and/or expense limitation arrangements, if any. Absent any applicable fee waivers and/or expense limitation arrangements, performance would have been lower. Visit hartfordfunds.com for the most recent performance information.

Key Fund Statistics as of October 31, 2024

| Fund's net assets | $133,306,341% |

| Total number of portfolio holdings (excluding derivatives, if any) | $93% |

| Total investment management fees paid | $834,616% |

| Portfolio turnover rate | $108% |

Graphical Representation of Holdings as of October 31, 2024

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| Industrials | 47.4 | % |

| Information Technology | 13.1 | % |

| Consumer Discretionary | 10.1 | % |

| Utilities | 9.2 | % |

| Financials | 7.8 | % |

| Materials | 3.5 | % |

| Communication Services | 2.3 | % |

| Consumer Staples | 2.3 | % |

| Real Estate | 0.8 | % |

| Short-Term Investments | 0.3 | % |

| Other Assets & Liabilities | 3.2 | % |

| Total | 100.0 | % |

* | For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please visit the Fund’s website at the website address included at the beginning of this report.

The Fund is distributed by Hartford Funds Distributors, LLC (HFD).

Annual Shareholder Report

October 31, 2024

Hartford Climate Opportunities Fund

Class Y/HEOYX

This annual shareholder report contains important information about the Hartford Climate Opportunities Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-hmf. You can also request this information by contacting us by calling 1‑888‑843‑7824.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Class Y | $90 | 0.79% |

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

Global equities, as measured by the MSCI ACWI Index (Net), rose over the trailing twelve-month period ending October 31, 2024, supported by easing inflation and interest rate cuts. During the period, within the MSCI ACWI Index (Net), clean energy and energy efficiency companies performed well while electric vehicle companies struggled due to fading demand. Fund performance described below is relative to the MSCI ACWI Index (Net) for the trailing twelve-month period ended October 31, 2024.

Top Contributors to Performance

Security selection within the Industrials sector was the primary contributor to relative returns during the period.

Sector allocation was also positive with strength within the Industrials, Health Care, and Energy sectors.

Top relative individual contributors over the period were an overweight position in Vertiv Holdings (Industrials), an out-of-benchmark allocation to Acuity Brands (Industrials) and ARM Holdings (Industrials), and an overweight position in Westinghouse Air Brake Technologies (Industrials).

Top Detractors to Performance

Security selection detracted from relative performance during the period, driven by selection within the Information Technology, Utilities, Consumer Discretionary and Financials sectors.

Sector allocation also detracted from results within the Information Technology, Financials, and Communication Services sectors.

The largest individual relative detractors over the period were not owning benchmark constituent NVIDIA (Information Technology), owning Vestas Wind Systems (Industrials) and overweight positions in Enphase Energy (Information Technology) and Samsung SDI C. (Information Technology).

The views expressed in this section reflect the opinions of the Fund's portfolio managers as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

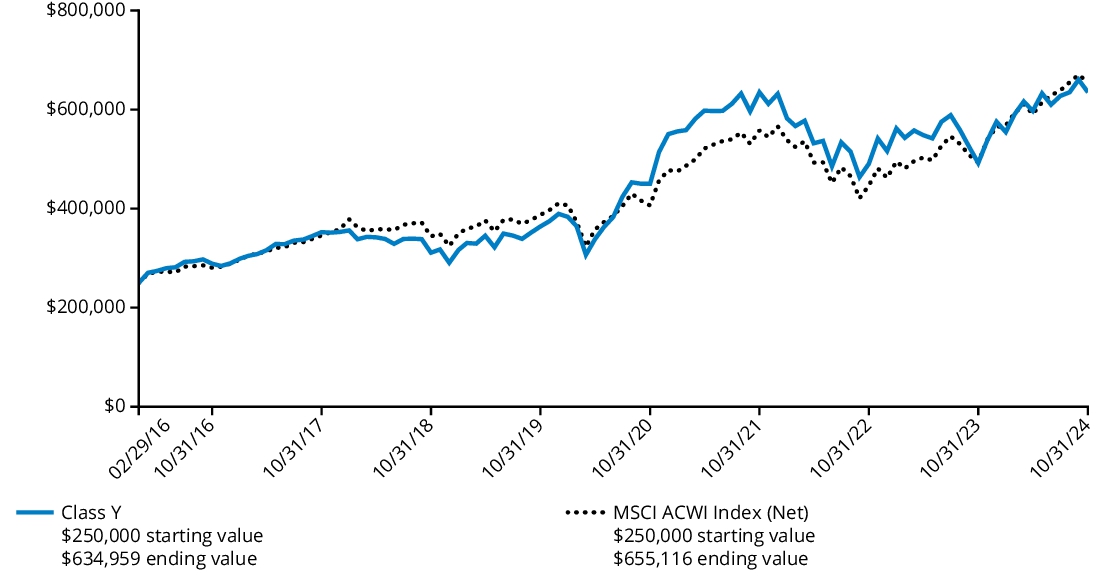

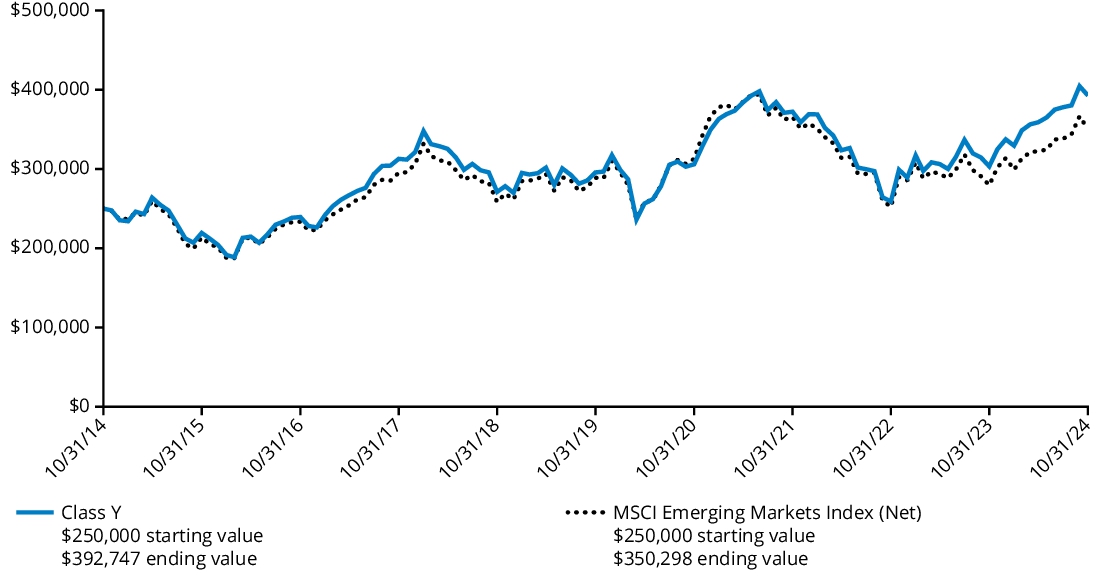

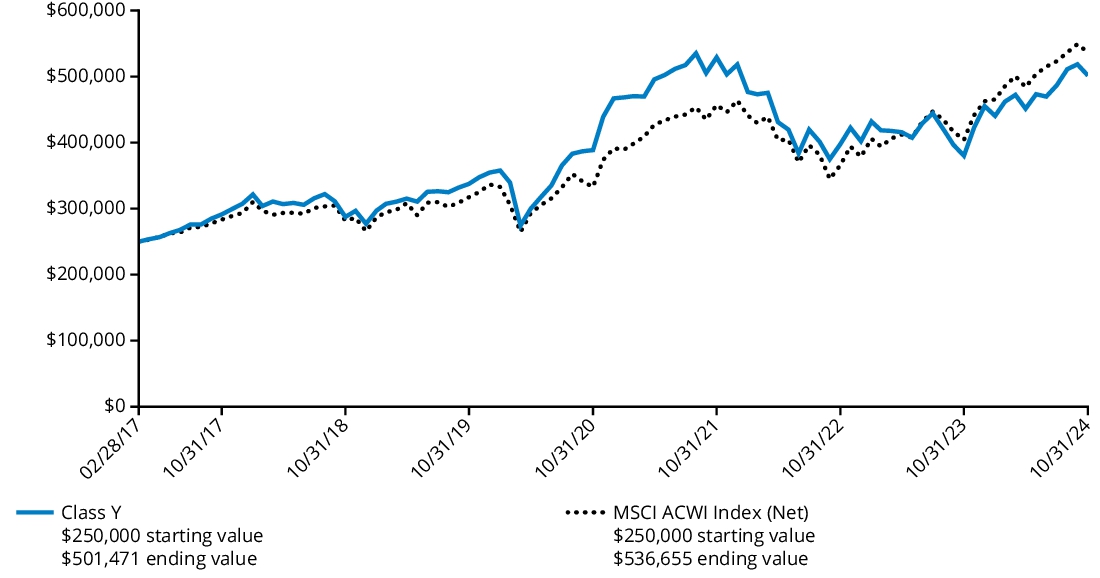

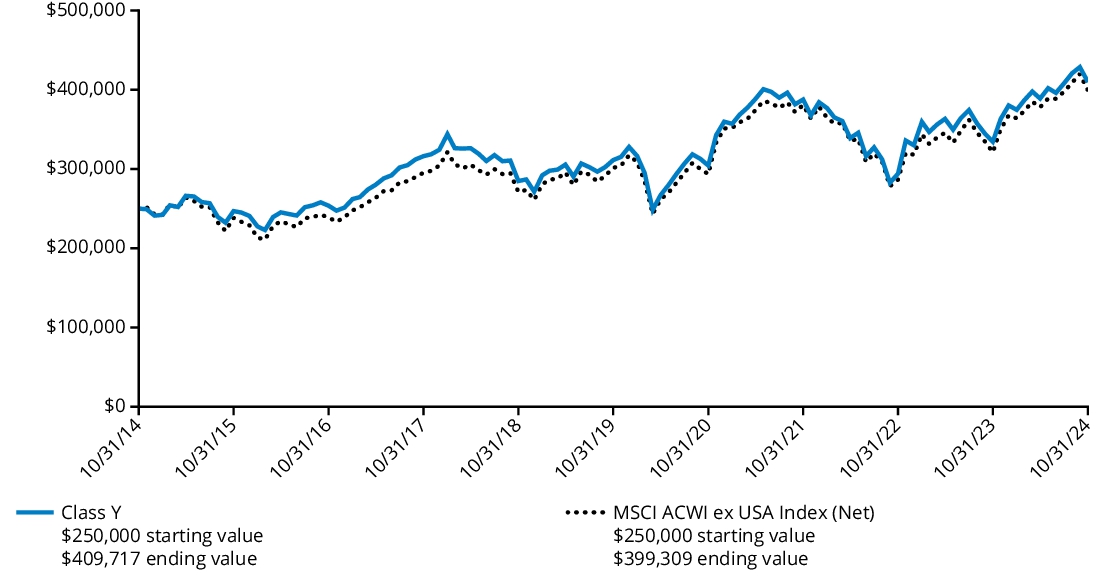

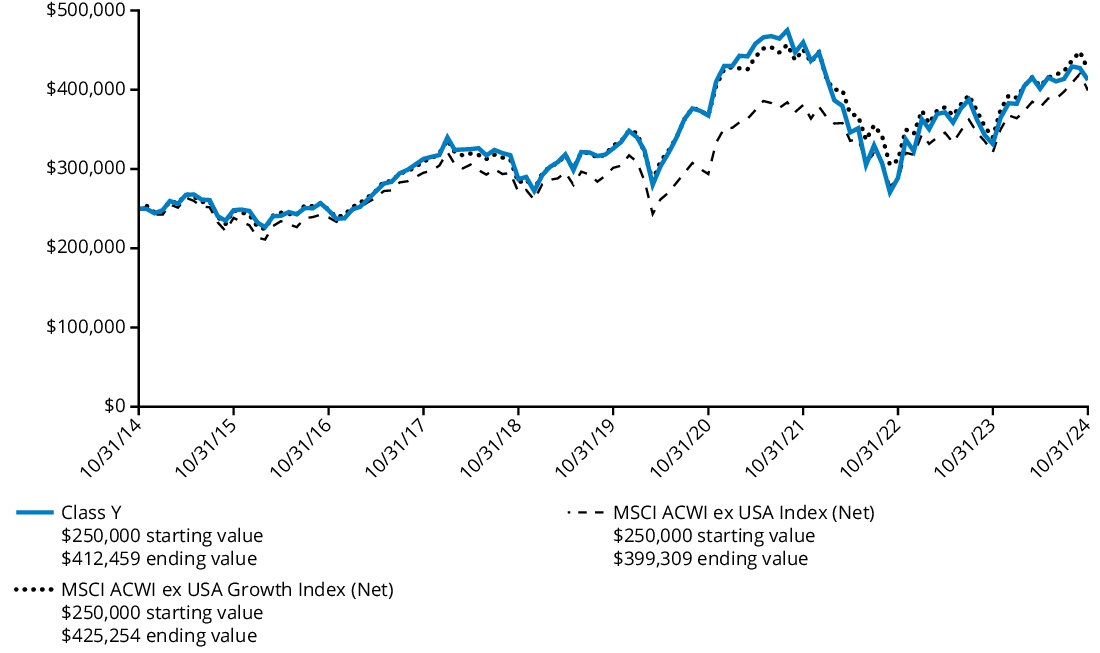

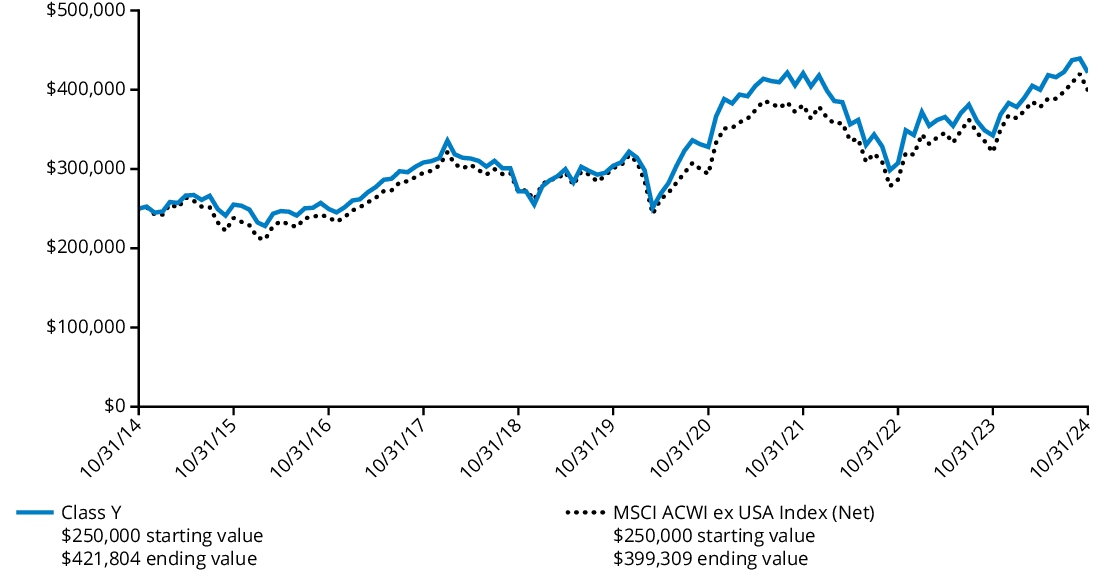

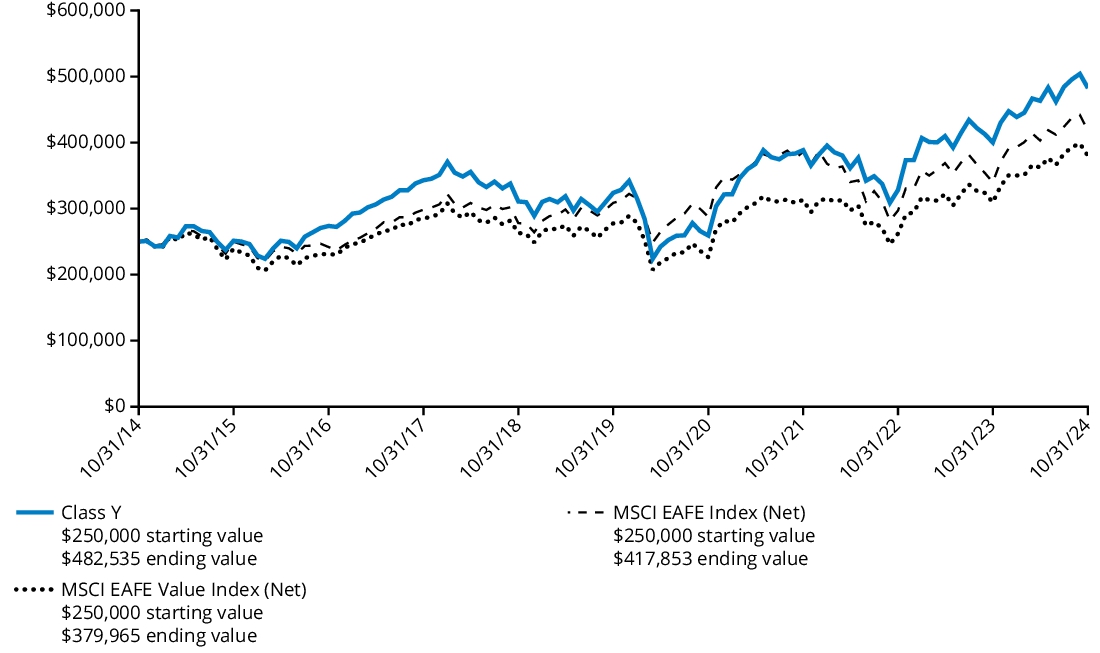

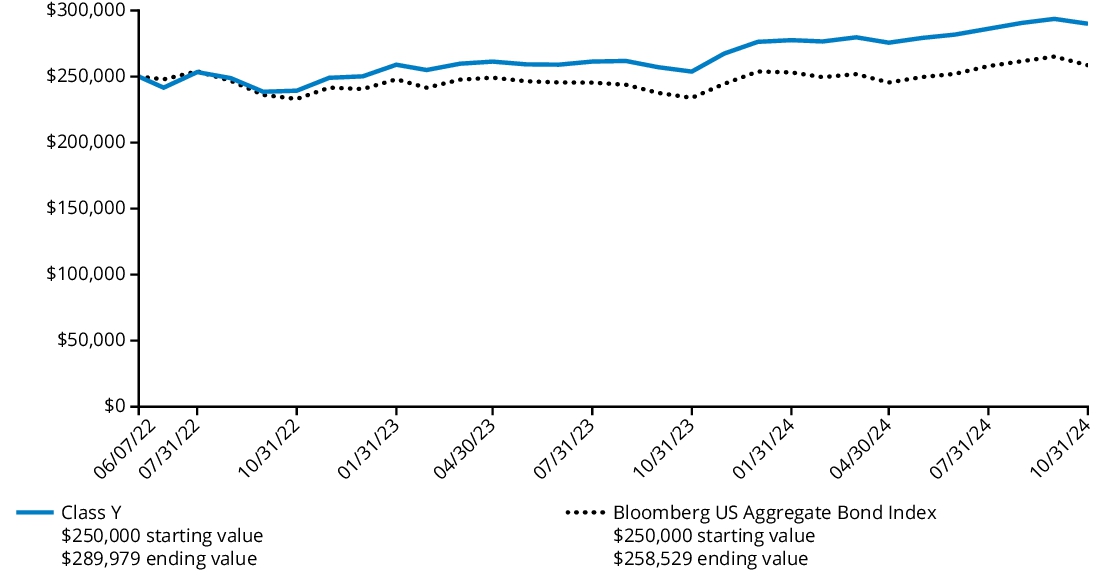

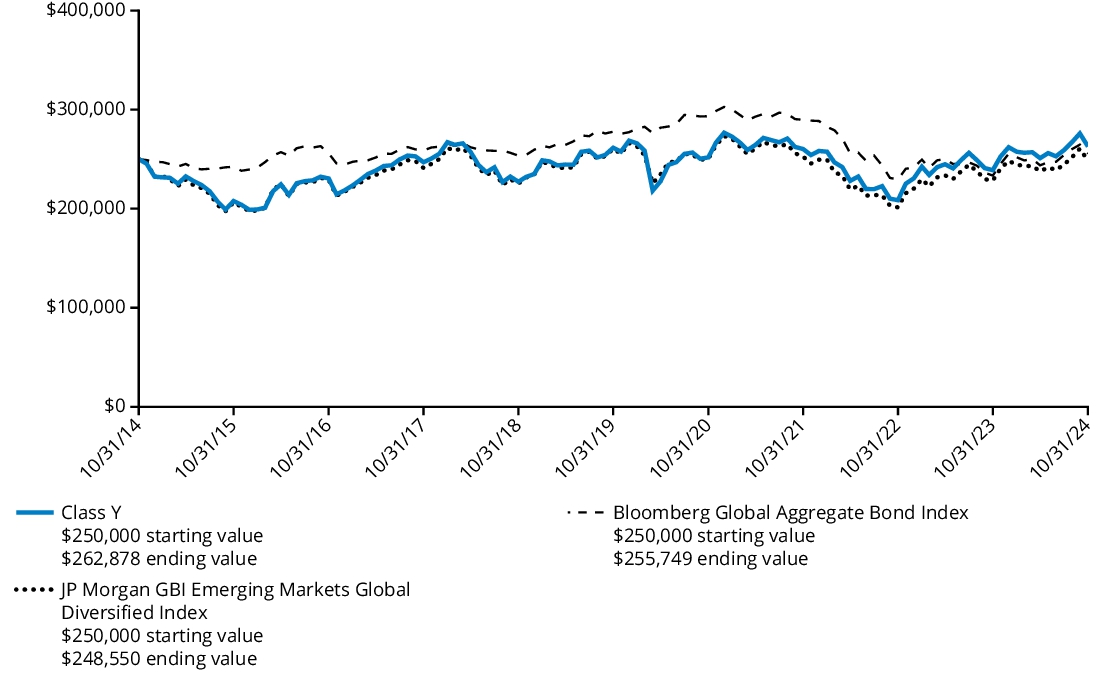

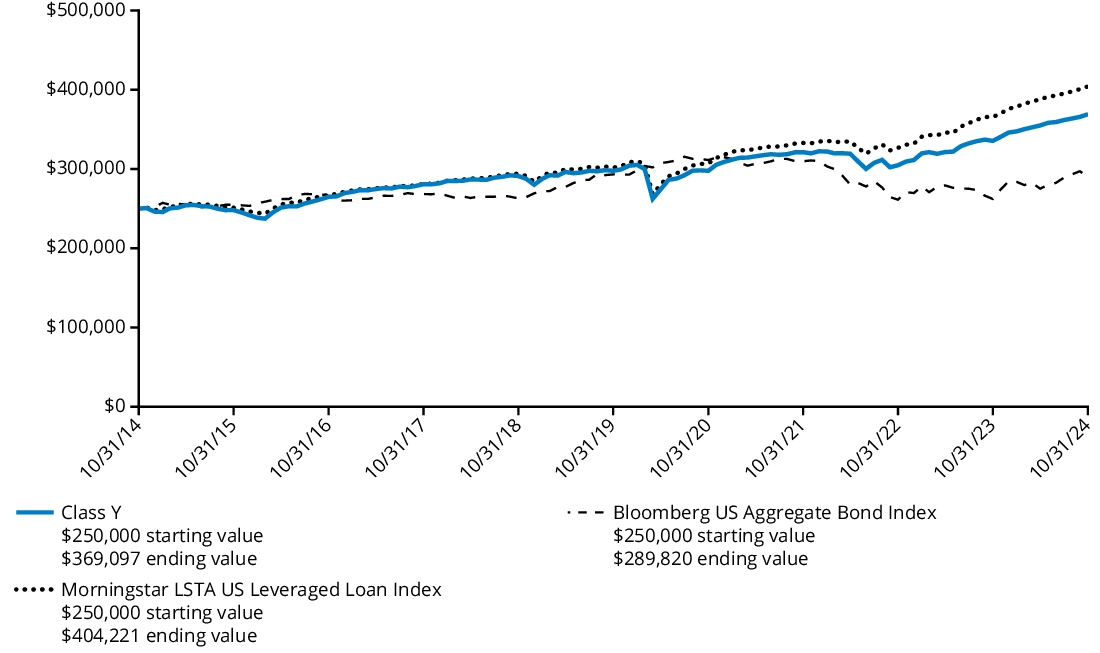

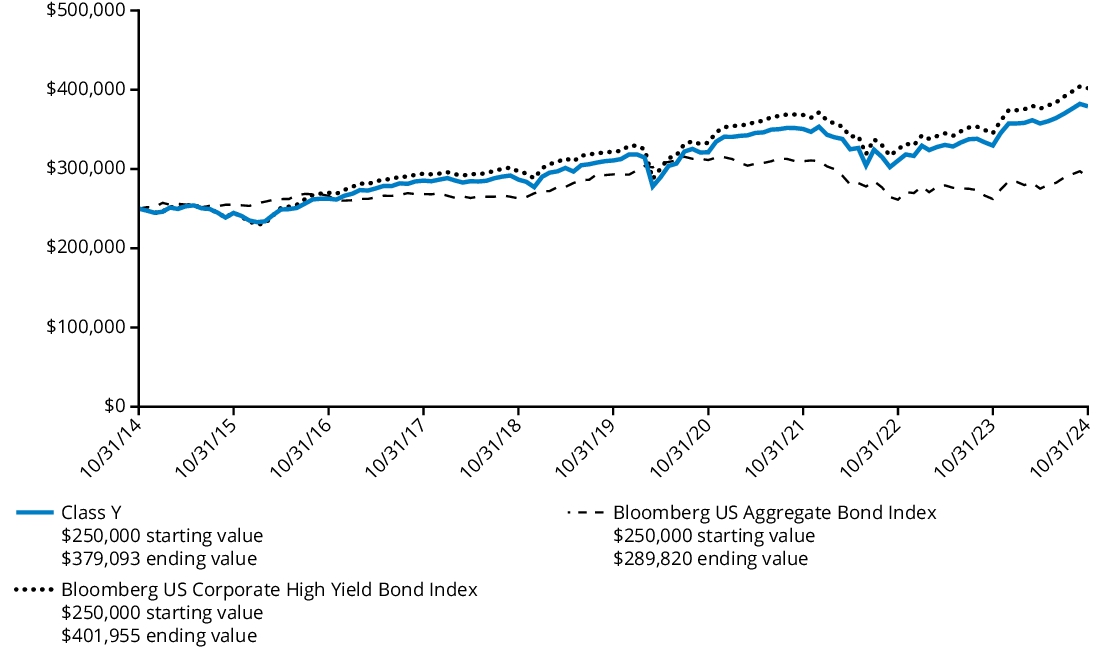

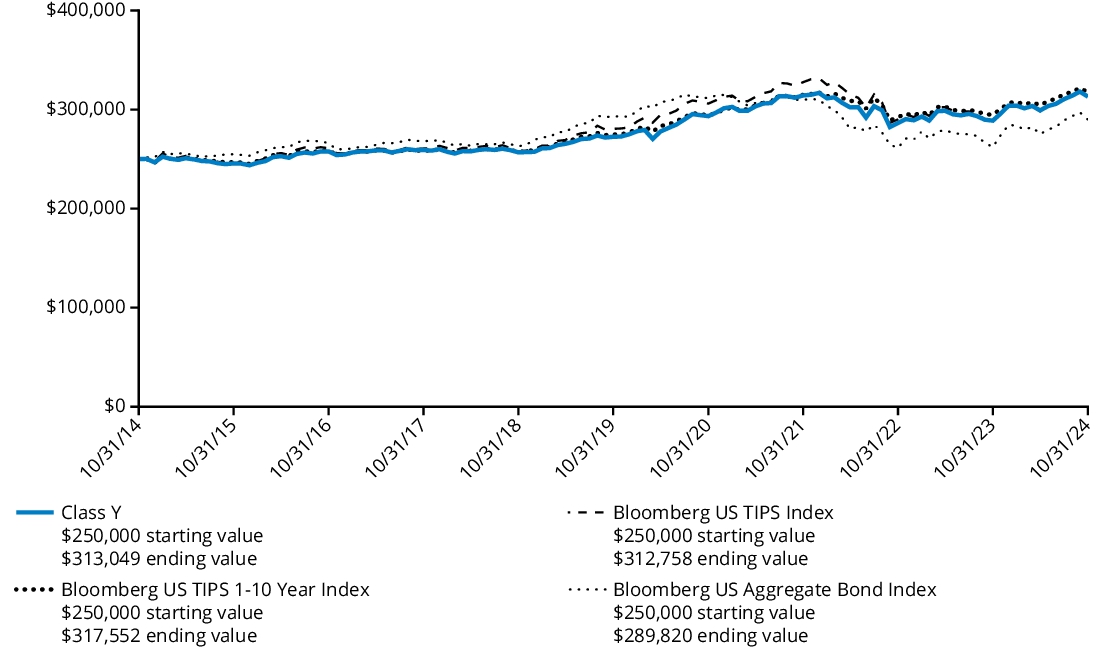

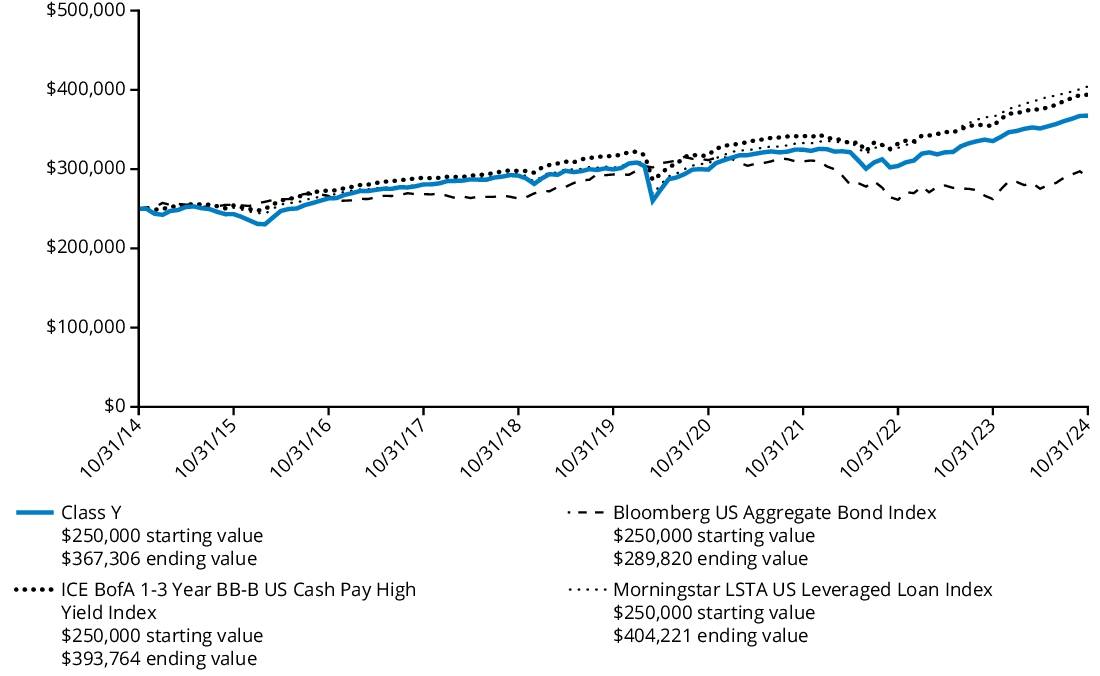

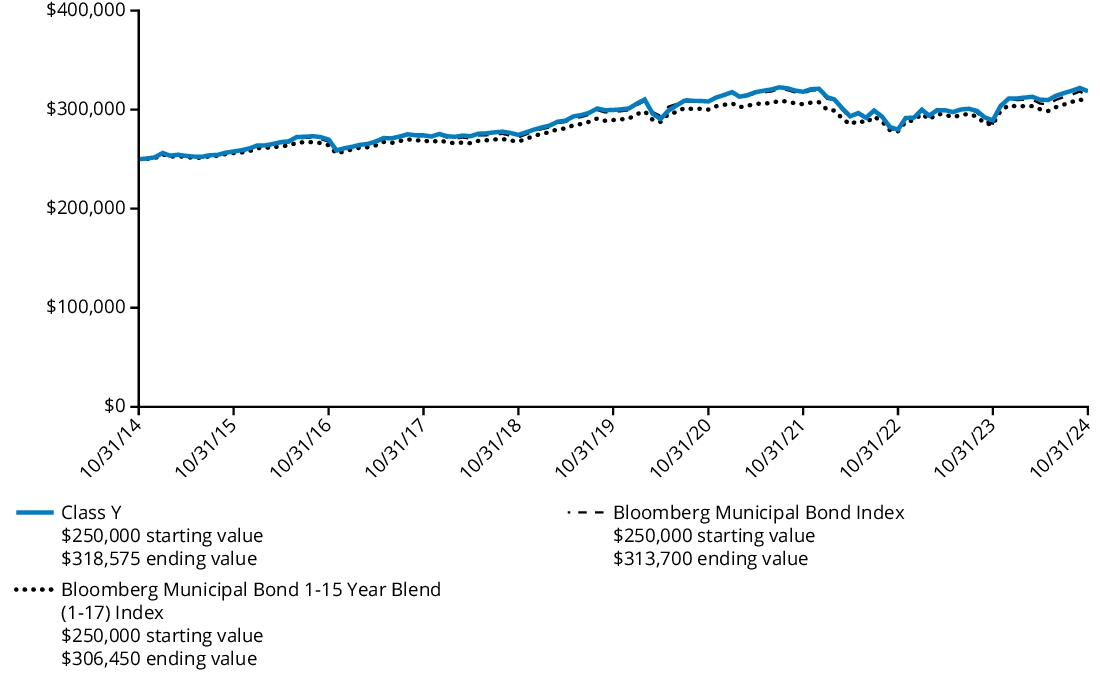

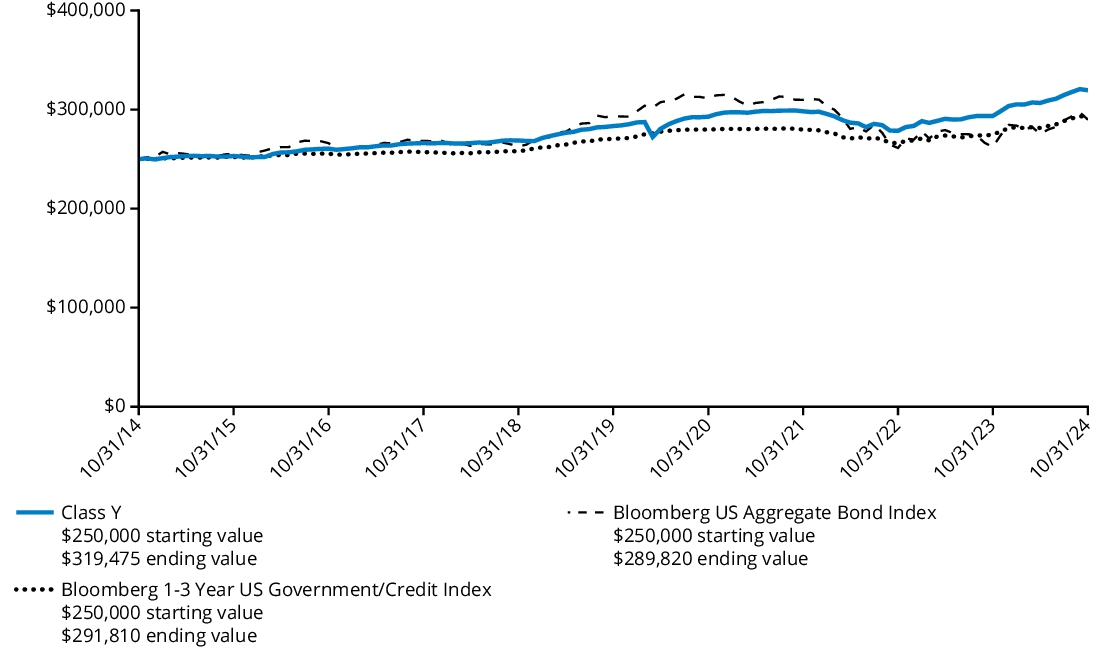

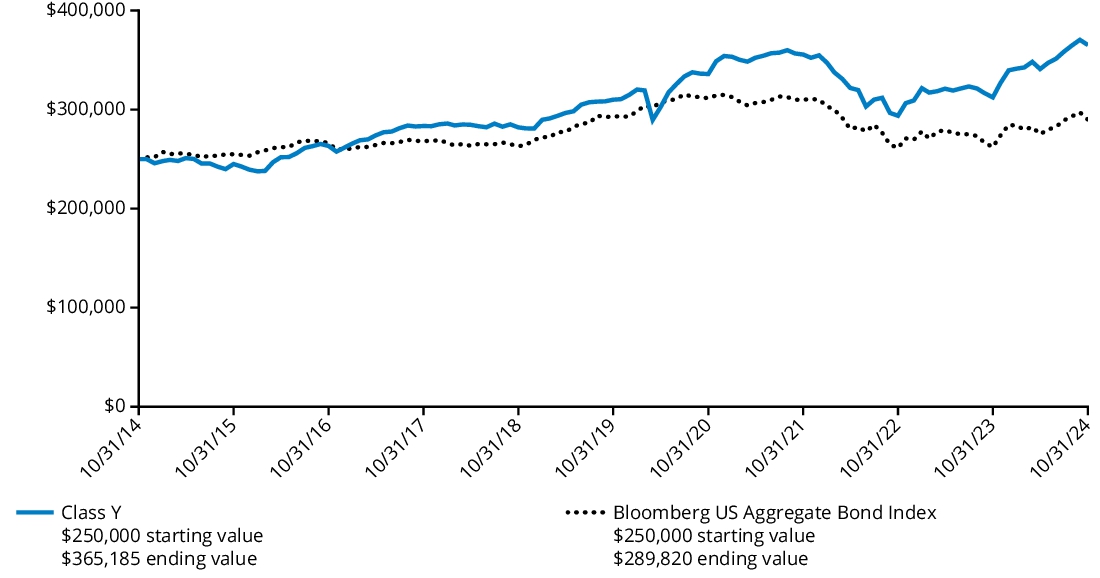

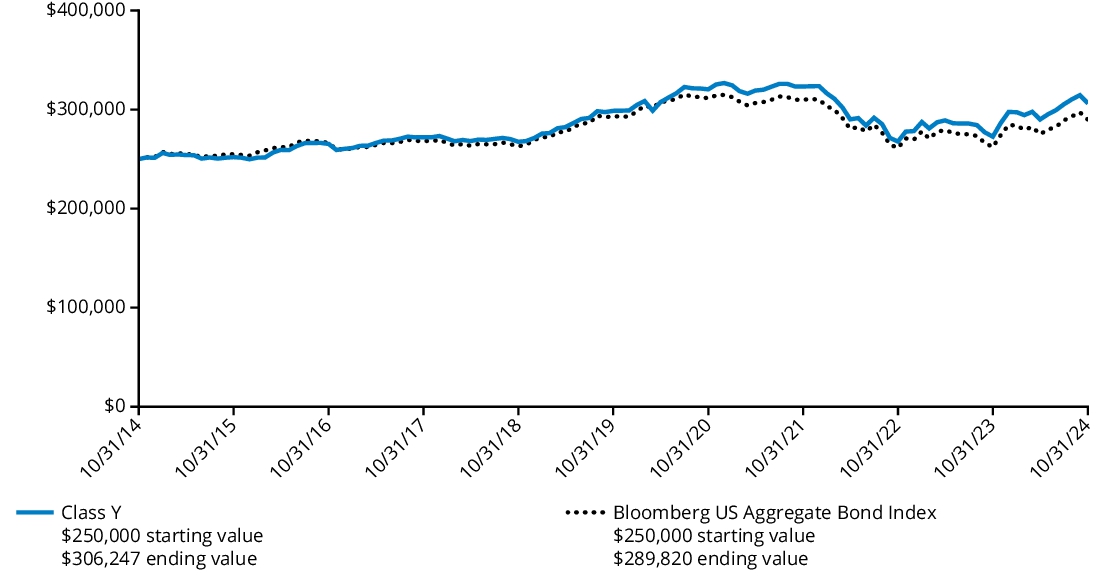

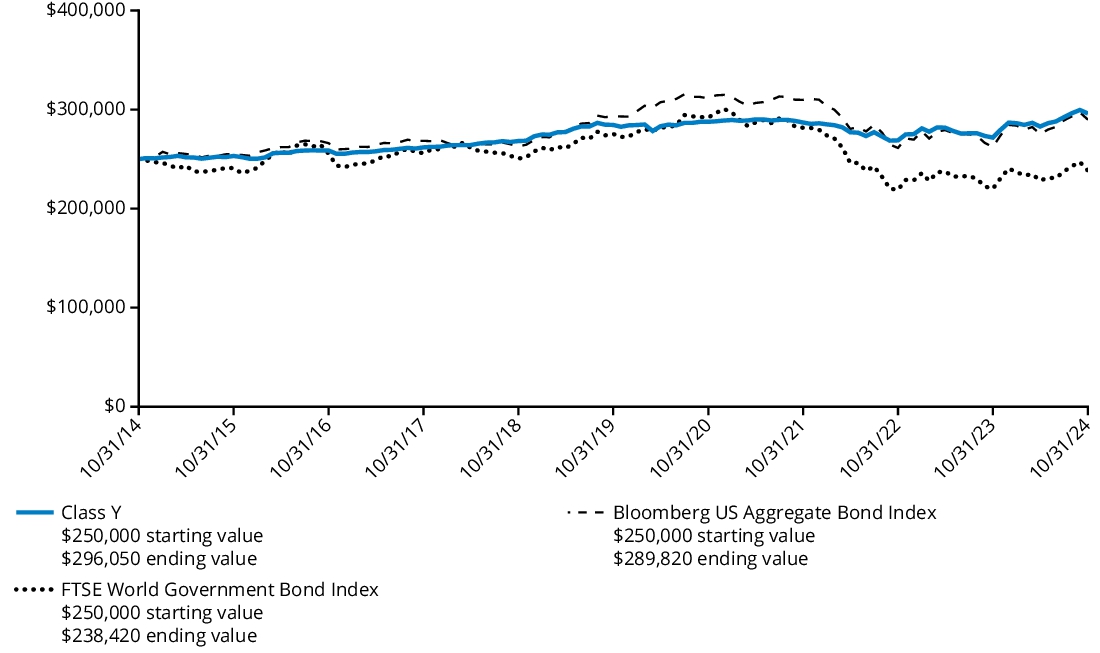

Comparison of Change in Value of $ 250,000 Investment

The graph below represents the hypothetical growth of a $250,000 investment in Class Y shares and the comparative index.

Average Annual Total Returns

For the Periods Ended October 31, 2024 | 1 Year | 5 Years | Since Inception

(February 29, 2016) |

| Class Y | 29.03% | 11.78% | 11.35% |

| MSCI ACWI Index (Net) | 32.79% | 11.08% | 11.69% |

Prior to November 8, 2019, the Fund pursued a modified strategy and Wellington Management Company LLP served as the Fund’s only sub-adviser.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance information reflects fee waivers and/or expense limitation arrangements, if any. Absent any applicable fee waivers and/or expense limitation arrangements, performance would have been lower. Visit hartfordfunds.com for the most recent performance information.

Key Fund Statistics as of October 31, 2024

| Fund's net assets | $133,306,341% |

| Total number of portfolio holdings (excluding derivatives, if any) | $93% |

| Total investment management fees paid | $834,616% |

| Portfolio turnover rate | $108% |

Graphical Representation of Holdings as of October 31, 2024

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| Industrials | 47.4 | % |

| Information Technology | 13.1 | % |

| Consumer Discretionary | 10.1 | % |

| Utilities | 9.2 | % |

| Financials | 7.8 | % |

| Materials | 3.5 | % |

| Communication Services | 2.3 | % |

| Consumer Staples | 2.3 | % |

| Real Estate | 0.8 | % |

| Short-Term Investments | 0.3 | % |

| Other Assets & Liabilities | 3.2 | % |

| Total | 100.0 | % |

* | For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please visit the Fund’s website at the website address included at the beginning of this report.

The Fund is distributed by Hartford Funds Distributors, LLC (HFD).

Annual Shareholder Report

October 31, 2024

Hartford Climate Opportunities Fund

Class F/HEOFX

This annual shareholder report contains important information about the Hartford Climate Opportunities Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-hmf. You can also request this information by contacting us by calling 1‑888‑843‑7824.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Class F | $79 | 0.69% |

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

Global equities, as measured by the MSCI ACWI Index (Net), rose over the trailing twelve-month period ending October 31, 2024, supported by easing inflation and interest rate cuts. During the period, within the MSCI ACWI Index (Net), clean energy and energy efficiency companies performed well while electric vehicle companies struggled due to fading demand. Fund performance described below is relative to the MSCI ACWI Index (Net) for the trailing twelve-month period ended October 31, 2024.

Top Contributors to Performance

Security selection within the Industrials sector was the primary contributor to relative returns during the period.

Sector allocation was also positive with strength within the Industrials, Health Care, and Energy sectors.

Top relative individual contributors over the period were an overweight position in Vertiv Holdings (Industrials), an out-of-benchmark allocation to Acuity Brands (Industrials) and ARM Holdings (Industrials), and an overweight position in Westinghouse Air Brake Technologies (Industrials).

Top Detractors to Performance

Security selection detracted from relative performance during the period, driven by selection within the Information Technology, Utilities, Consumer Discretionary and Financials sectors.

Sector allocation also detracted from results within the Information Technology, Financials, and Communication Services sectors.

The largest individual relative detractors over the period were not owning benchmark constituent NVIDIA (Information Technology), owning Vestas Wind Systems (Industrials) and overweight positions in Enphase Energy (Information Technology) and Samsung SDI C. (Information Technology).

The views expressed in this section reflect the opinions of the Fund's portfolio managers as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

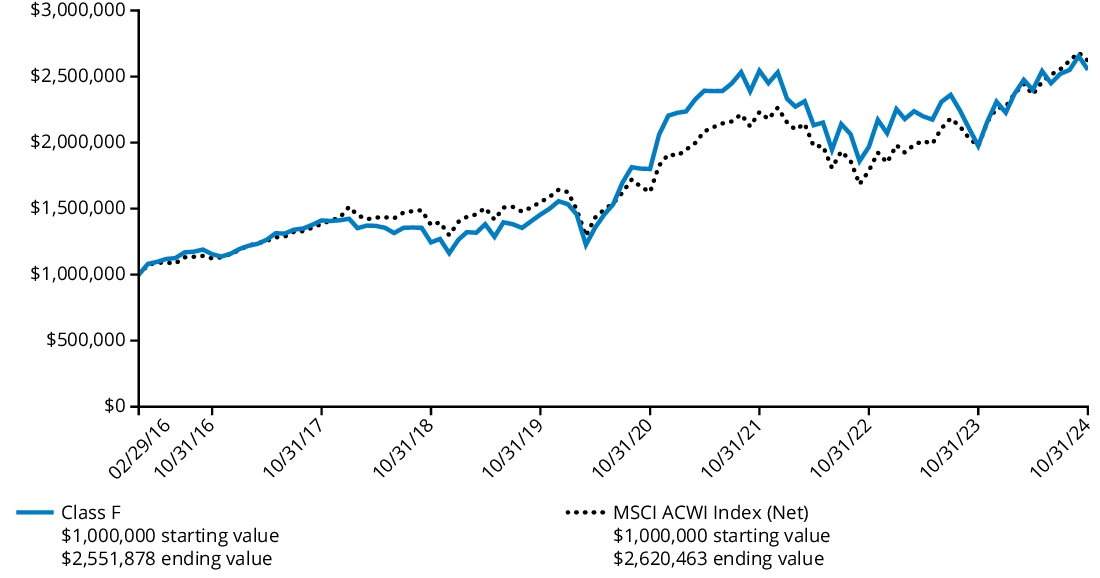

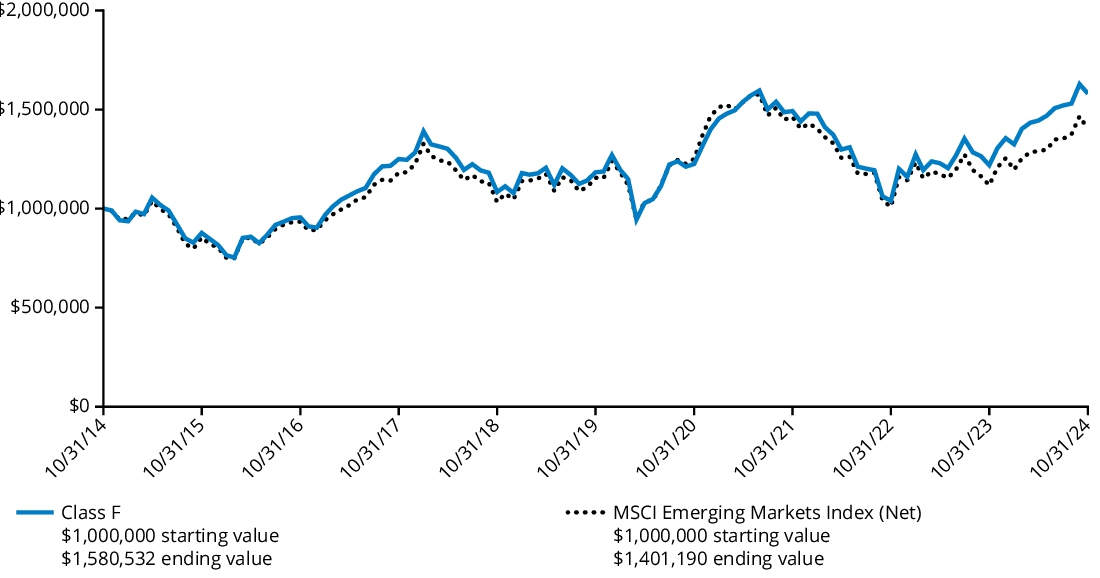

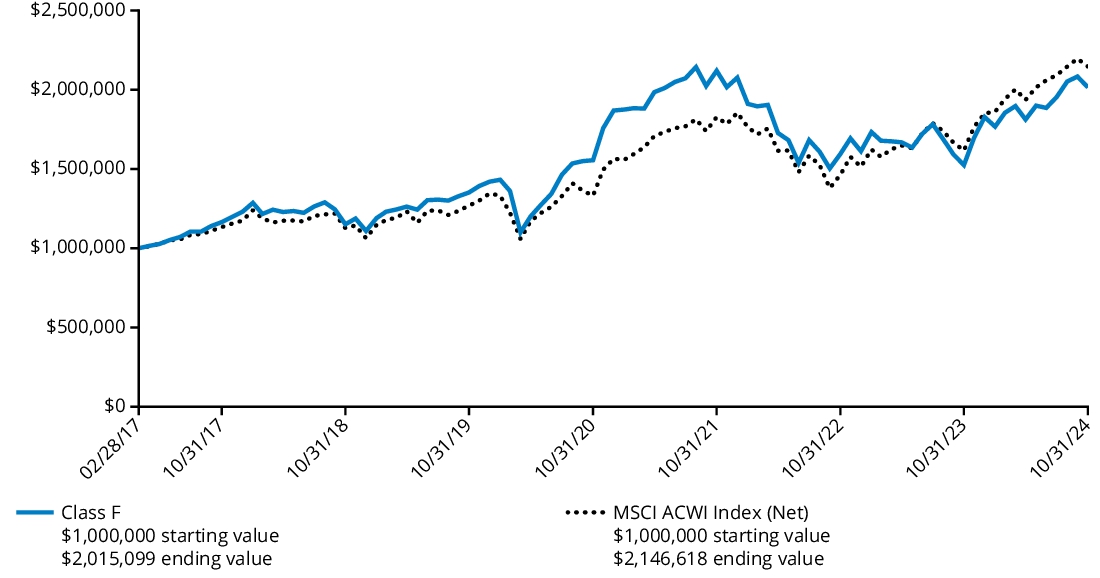

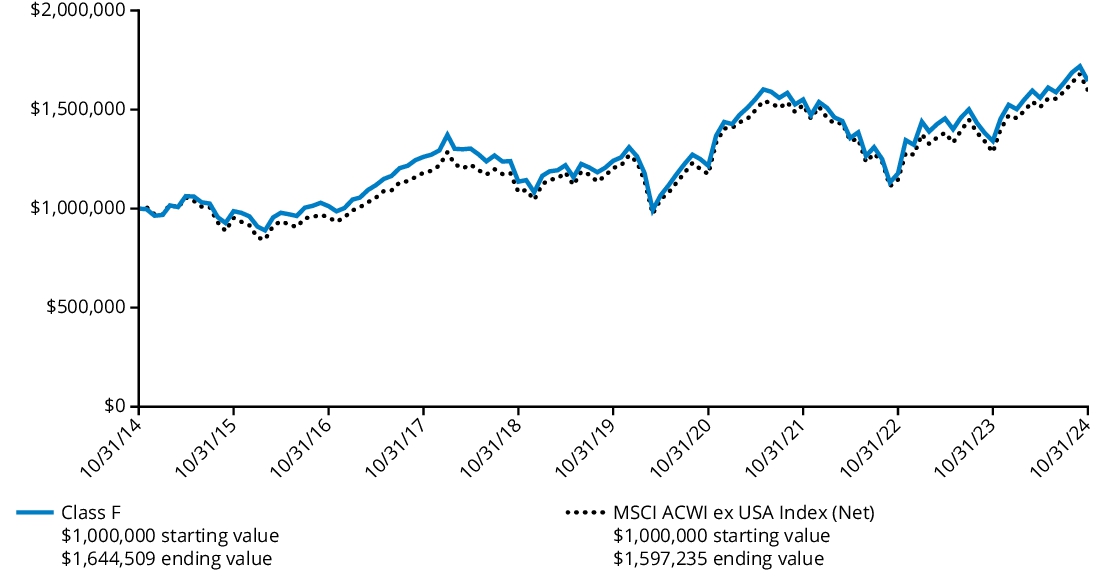

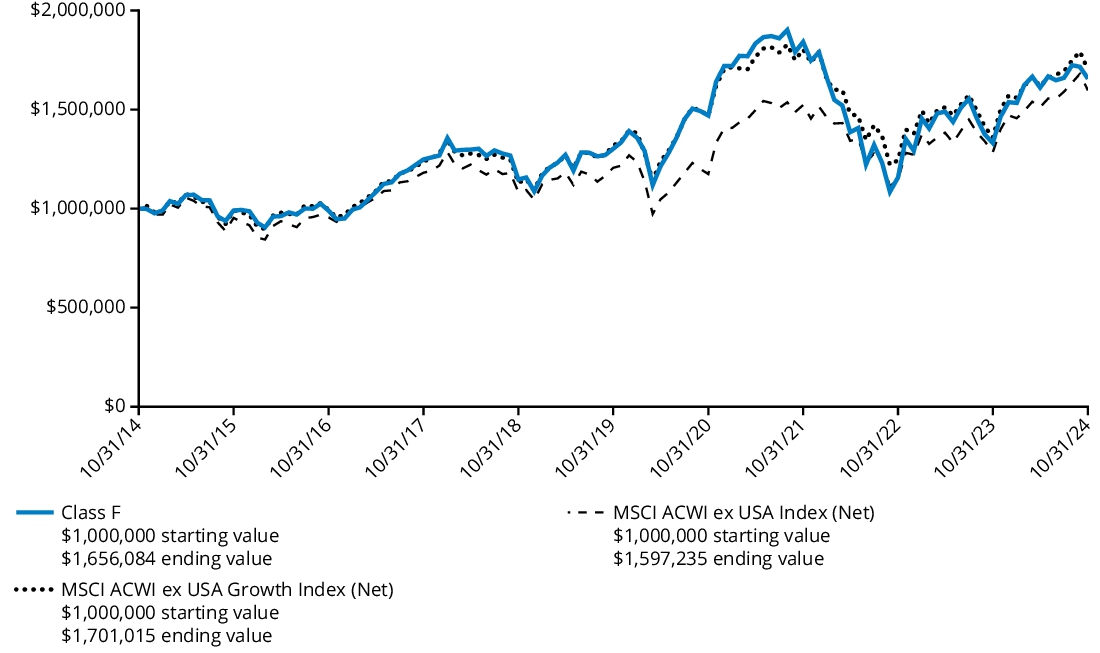

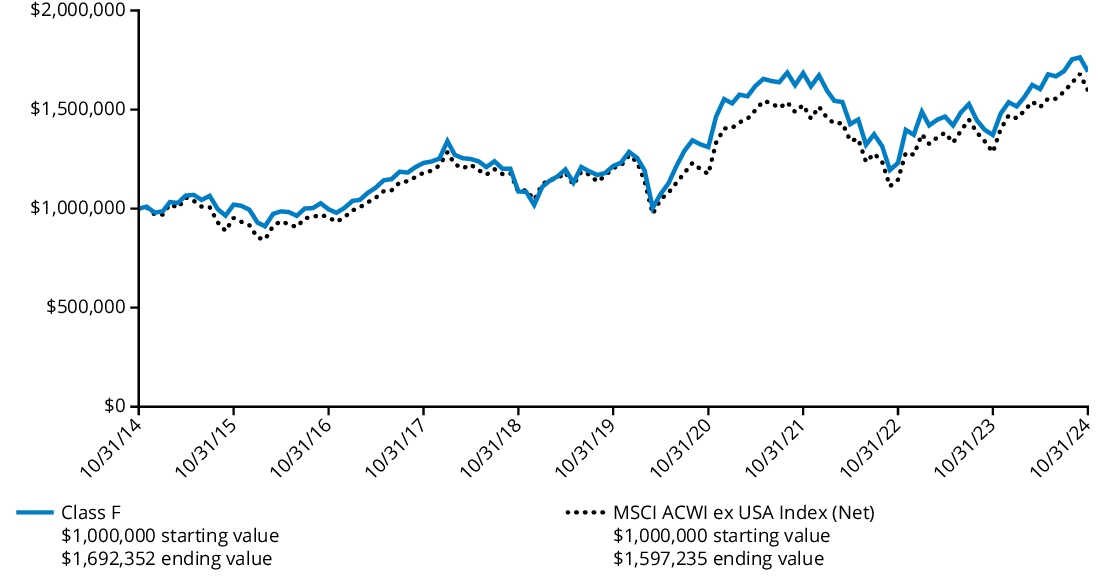

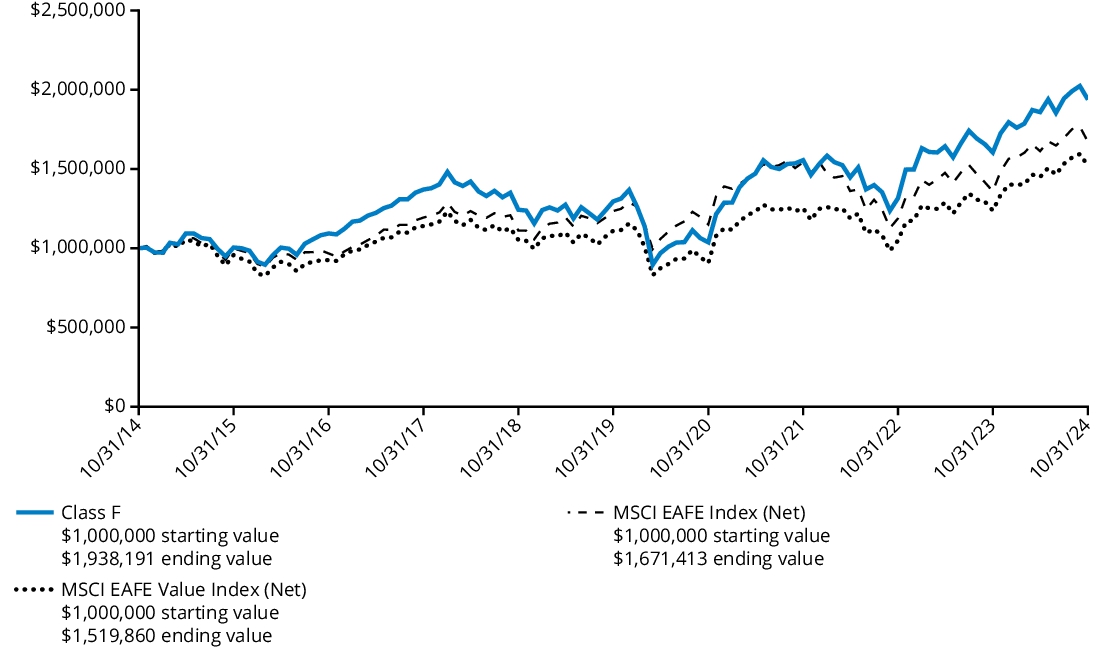

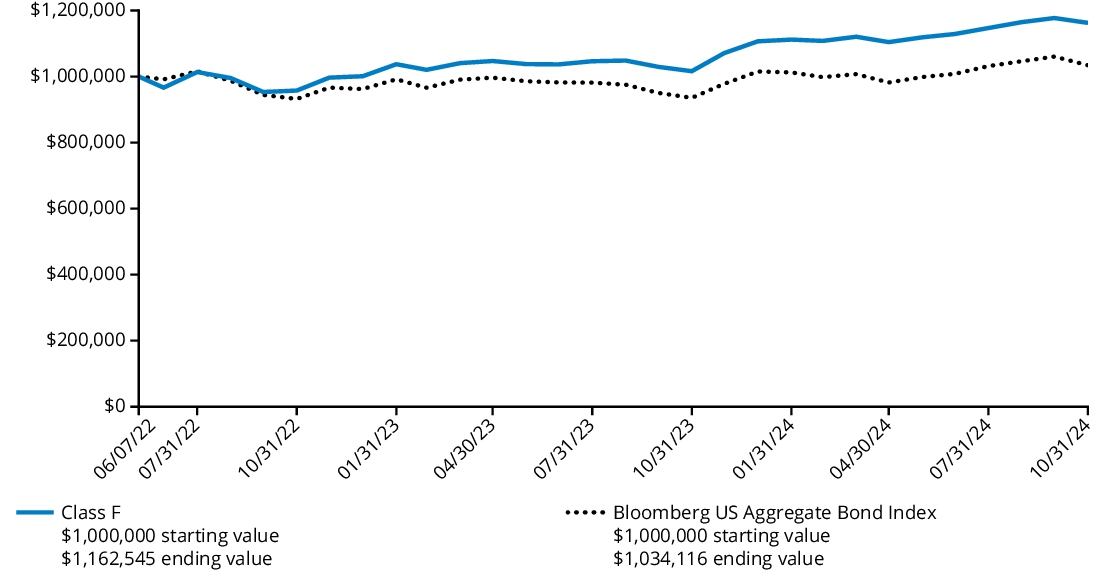

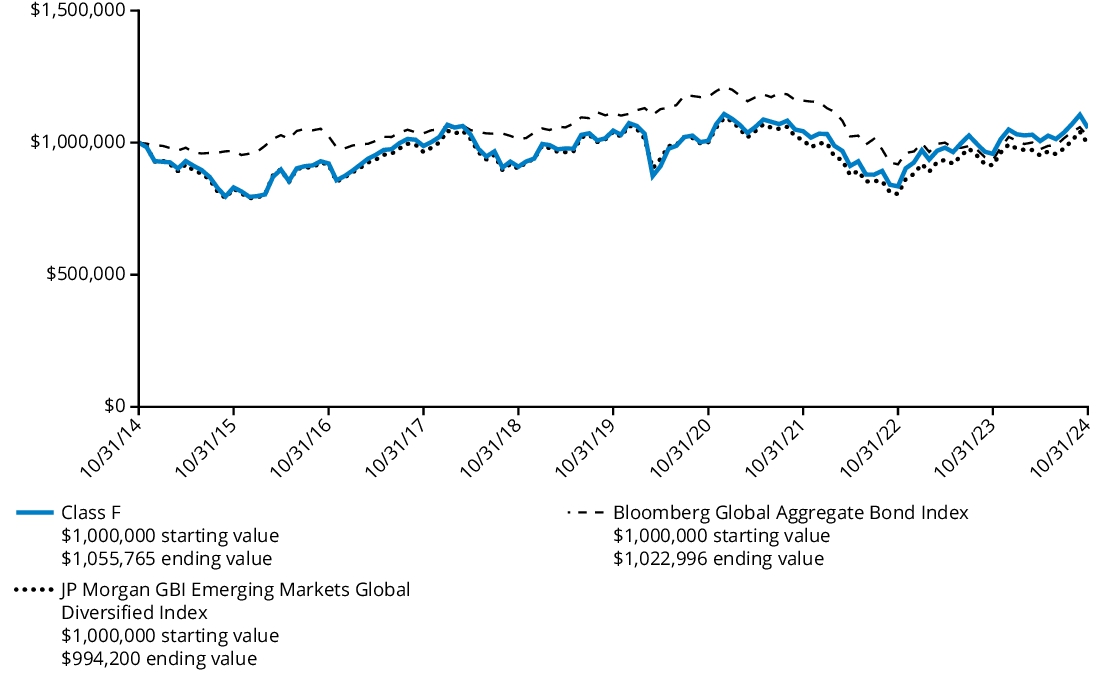

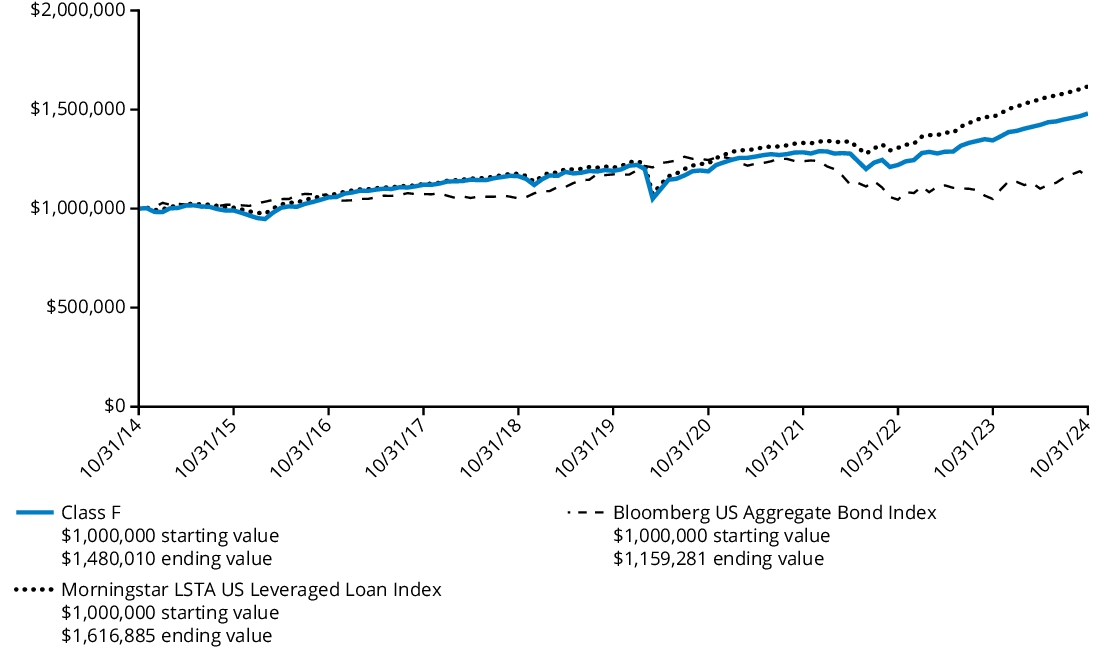

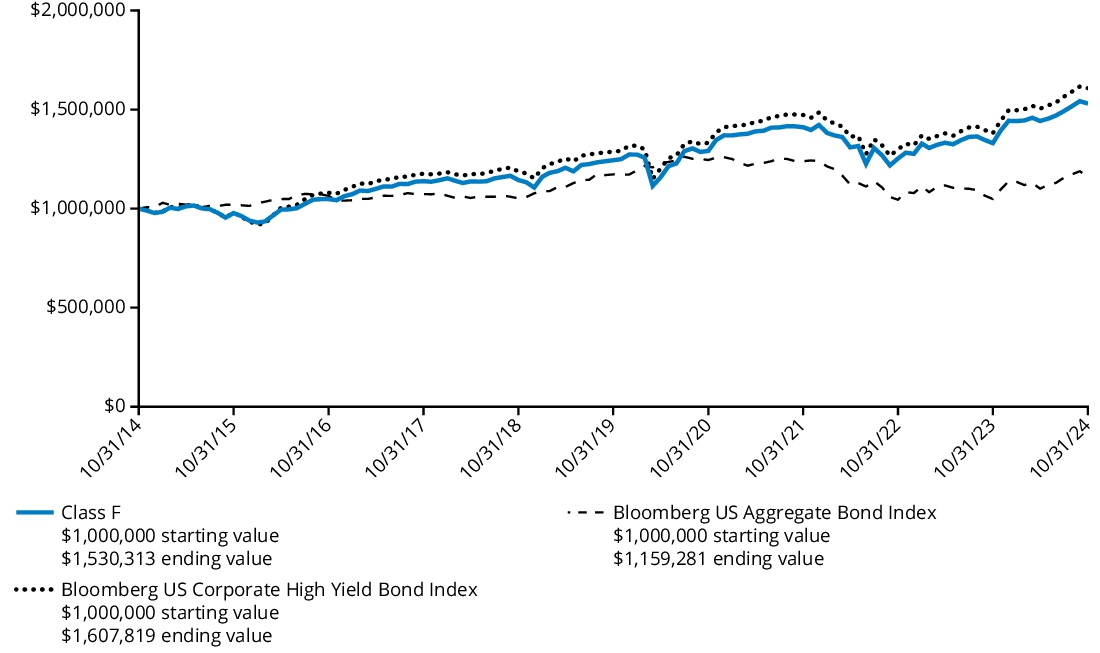

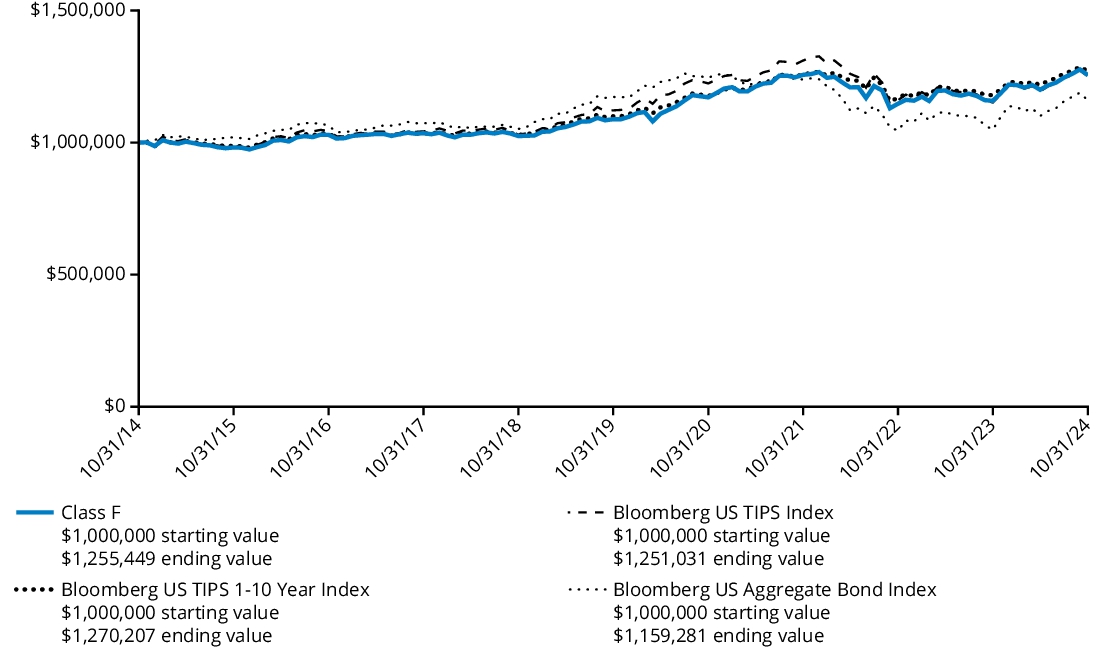

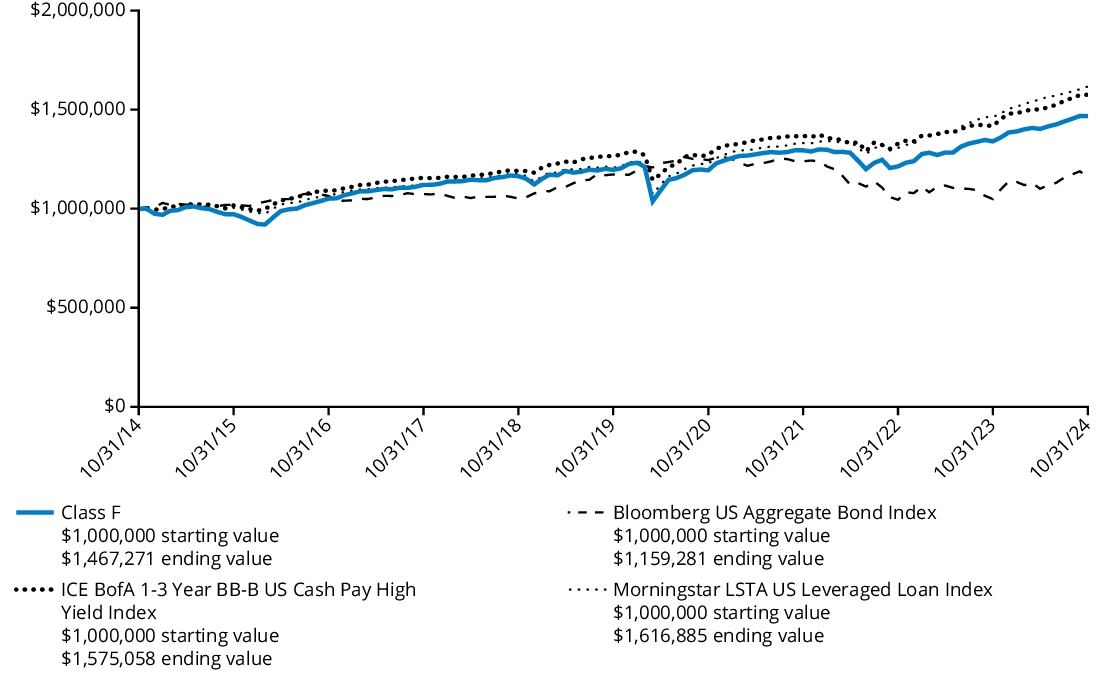

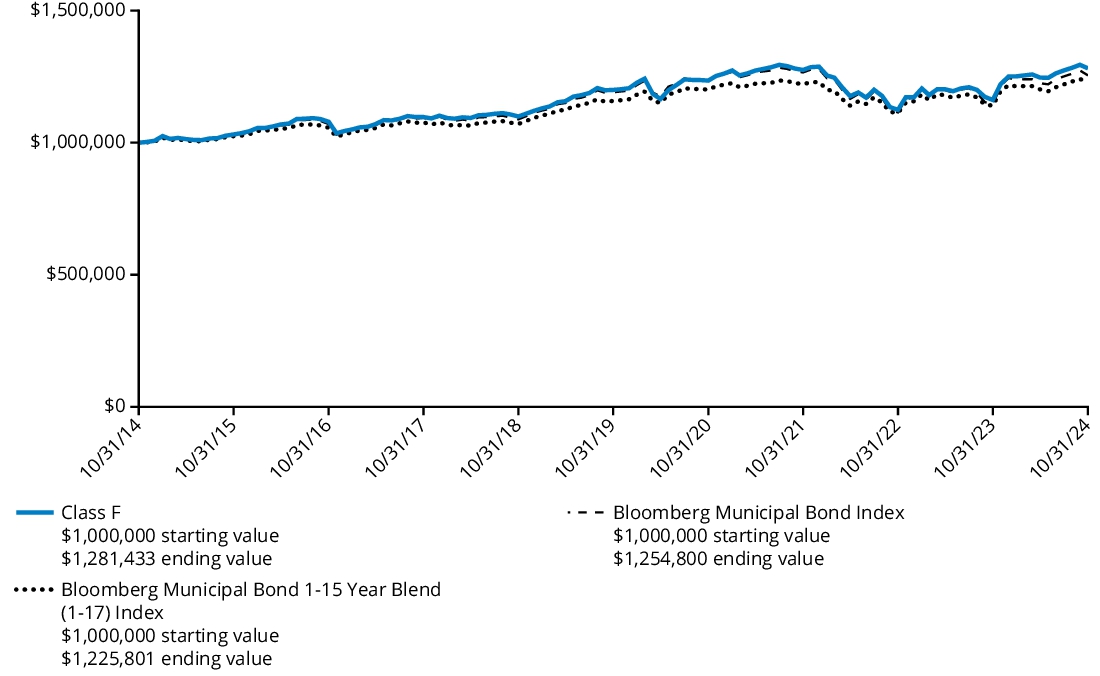

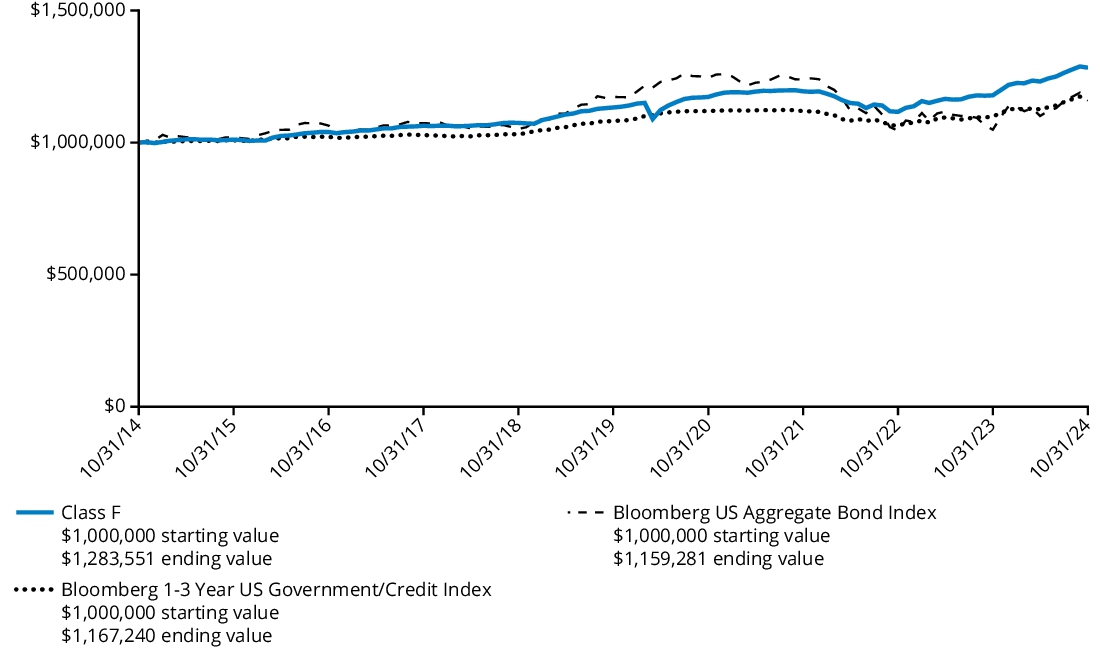

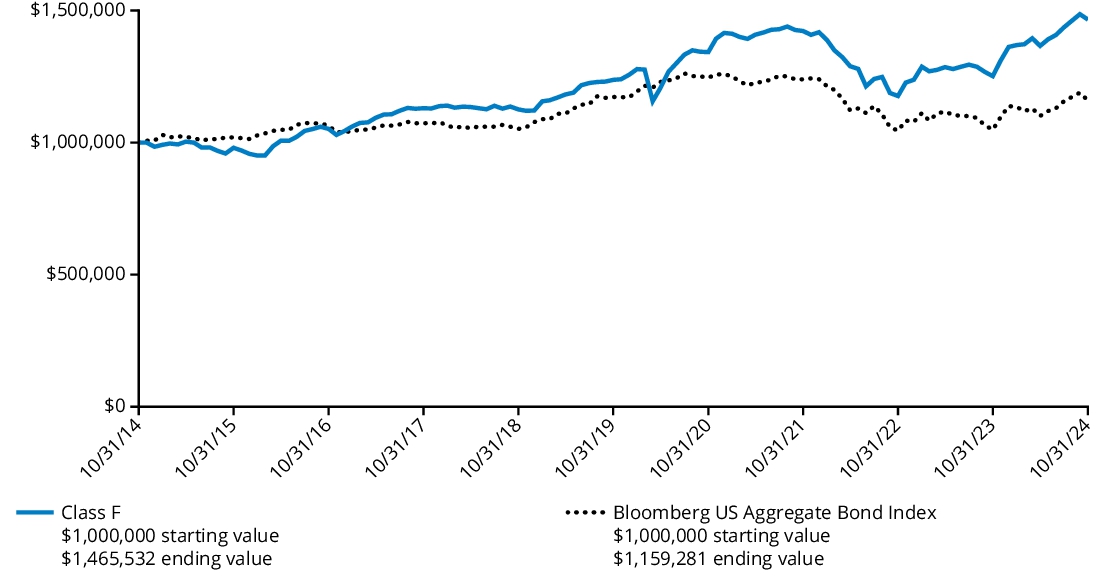

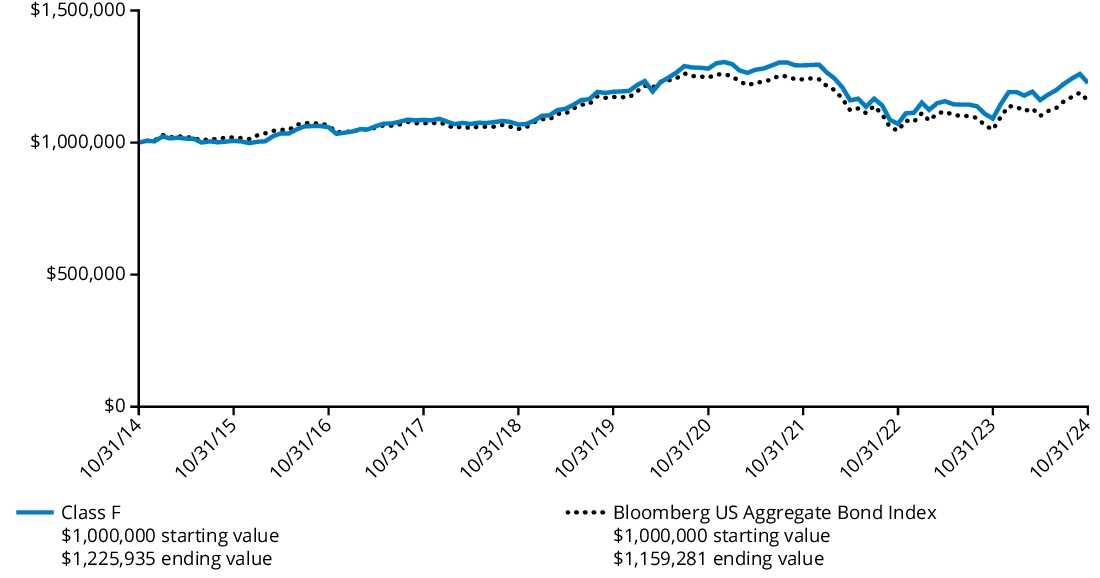

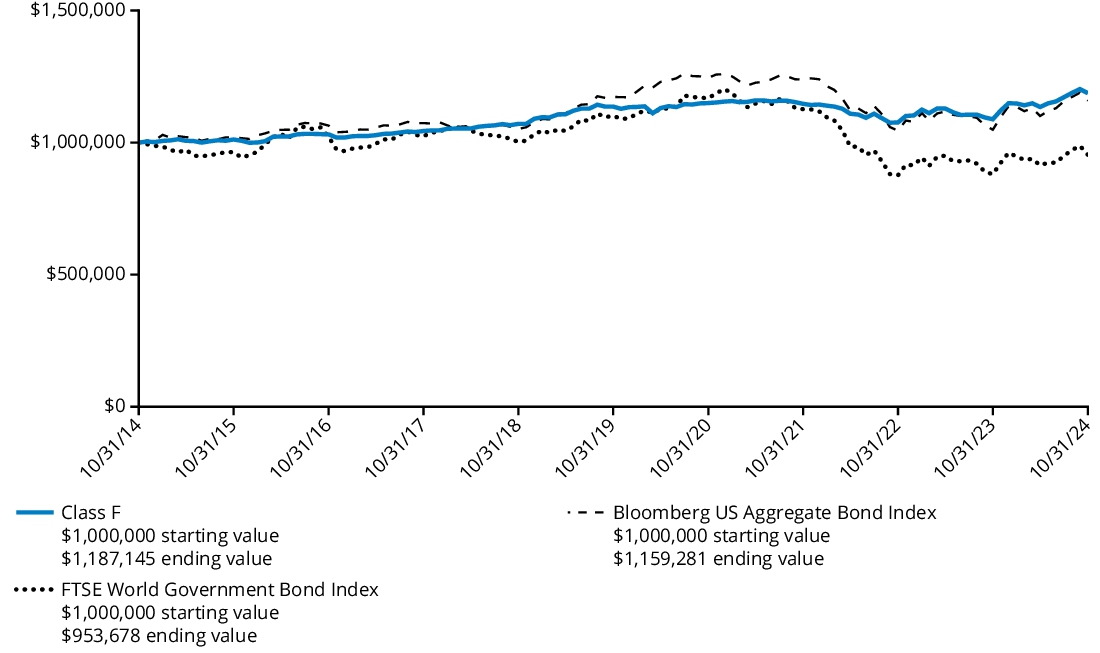

Comparison of Change in Value of $ 1,000,000 Investment

The graph below represents the hypothetical growth of a $1,000,000 investment in Class F shares and the comparative index.

Average Annual Total Returns

For the Periods Ended October 31, 2024 | 1 Year | 5 Years | Since Inception

(February 29, 2016) |

| Class F | 29.19% | 11.90% | 11.41% |

| MSCI ACWI Index (Net) | 32.79% | 11.08% | 11.69% |

Class F shares commenced operations on February 28, 2017 and performance prior to that date is that of the Fund’s Class I shares. Performance prior to the inception date of the class has not been adjusted to reflect the operating expenses of the class.

Prior to November 8, 2019, the Fund pursued a modified strategy and Wellington Management Company LLP served as the Fund’s only sub-adviser.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance information reflects fee waivers and/or expense limitation arrangements, if any. Absent any applicable fee waivers and/or expense limitation arrangements, performance would have been lower. Visit hartfordfunds.com for the most recent performance information.

Key Fund Statistics as of October 31, 2024

| Fund's net assets | $133,306,341% |

| Total number of portfolio holdings (excluding derivatives, if any) | $93% |

| Total investment management fees paid | $834,616% |

| Portfolio turnover rate | $108% |

Graphical Representation of Holdings as of October 31, 2024

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| Industrials | 47.4 | % |

| Information Technology | 13.1 | % |

| Consumer Discretionary | 10.1 | % |

| Utilities | 9.2 | % |

| Financials | 7.8 | % |

| Materials | 3.5 | % |

| Communication Services | 2.3 | % |

| Consumer Staples | 2.3 | % |

| Real Estate | 0.8 | % |

| Short-Term Investments | 0.3 | % |

| Other Assets & Liabilities | 3.2 | % |

| Total | 100.0 | % |

* | For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please visit the Fund’s website at the website address included at the beginning of this report.

The Fund is distributed by Hartford Funds Distributors, LLC (HFD).

Annual Shareholder Report

October 31, 2024

Hartford Emerging Markets Equity Fund

Class A/HERAX

This annual shareholder report contains important information about the Hartford Emerging Markets Equity Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-hmf. You can also request this information by contacting us by calling 1‑888‑843‑7824.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Class A | $166 | 1.45% |

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

Emerging Markets equities rose over the trailing twelve-month period ending October 31, 2024, as measured by the MSCI Emerging Markets Index (Net). In the period, heightened market volatility coincided with notable central bank policy decisions, major political developments, and an escalating conflict in the Middle East. Lower energy prices helped to ease inflationary pressures, and resilient labor markets in the United States, Europe, and Japan reinforced the view that the global economy could achieve a soft landing. Fund performance described below is relative to the MSCI Emerging Markets Index (Net), for the trailing twelve-month period ended October 31, 2024.

Top Contributors to Performance

Security selection was the primary contributor to relative performance during the period, driven by strong selection within the Financials, Industrials, and Consumer Staples sectors.

Top individual contributors over the period were out-of-benchmark allocation to International Games System (Communication Services) and overweight positions in Power Finance Corporation (Financials) and JD.com (Consumer Discretionary).

The Fund’s underweight allocation to the Energy and Materials sectors contributed to relative performance.

Top Detractors to Performance

Security selection within the Communication Services and Utilities sectors detracted from relative performance.

The largest individual detractors over the period were an underweight position in Hon Hai Precision Industry (Information Technology), an overweight position in NAVER (Communication Services) and an out-of-benchmark allocation to PTT Exploration and Production (Energy).

Sector allocation, a result of our quantitative security selection process, was a detractor to relative performance during the period due to the Fund’s underweight allocations to the Information Technology and Communication Services sectors.

The views expressed in this section reflect the opinions of the Fund's sub-adviser, Wellington Management Company LLP, as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

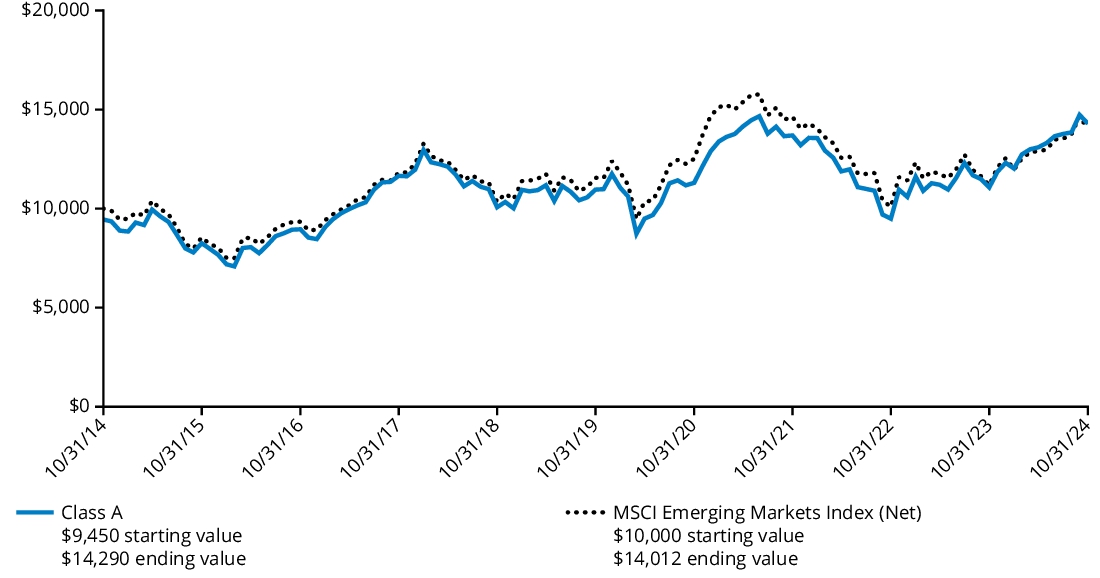

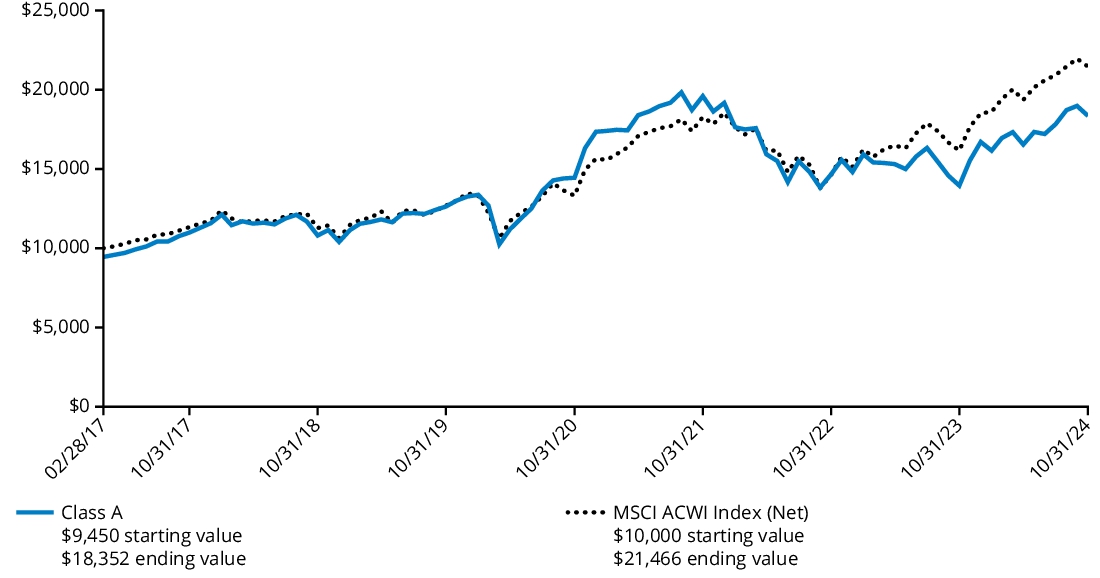

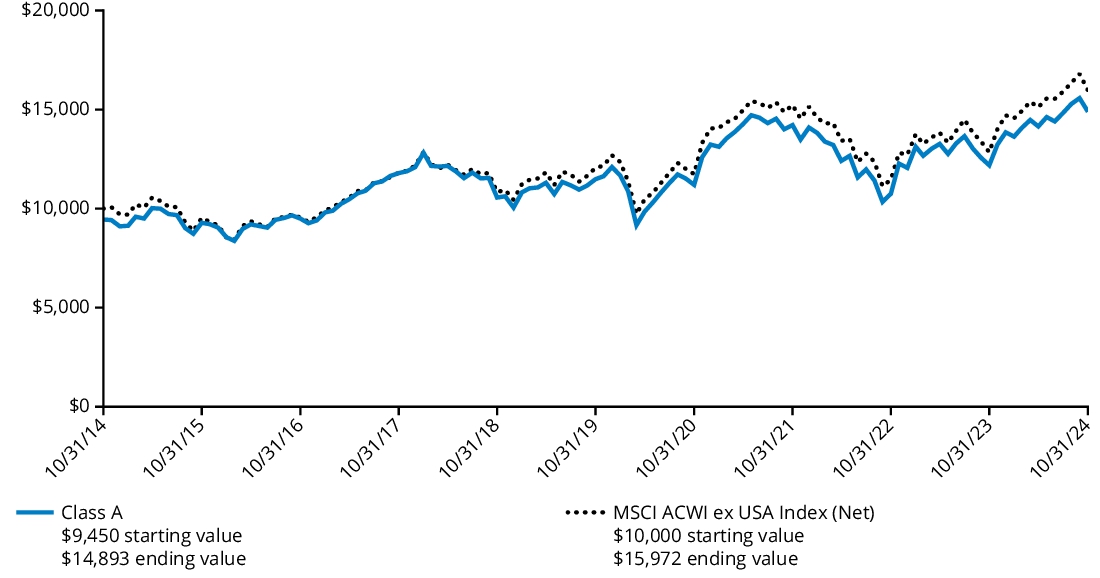

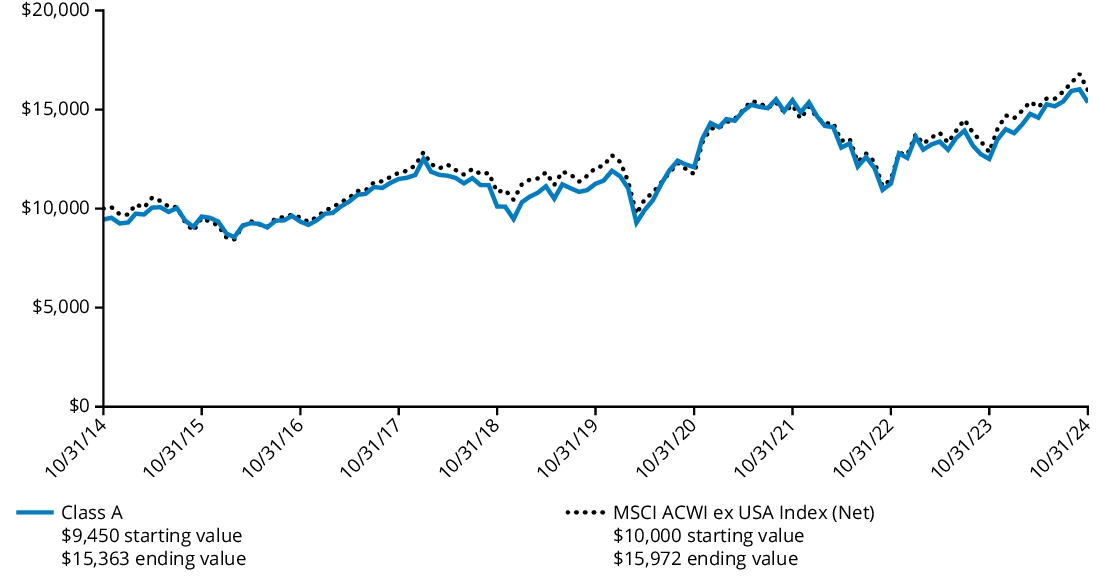

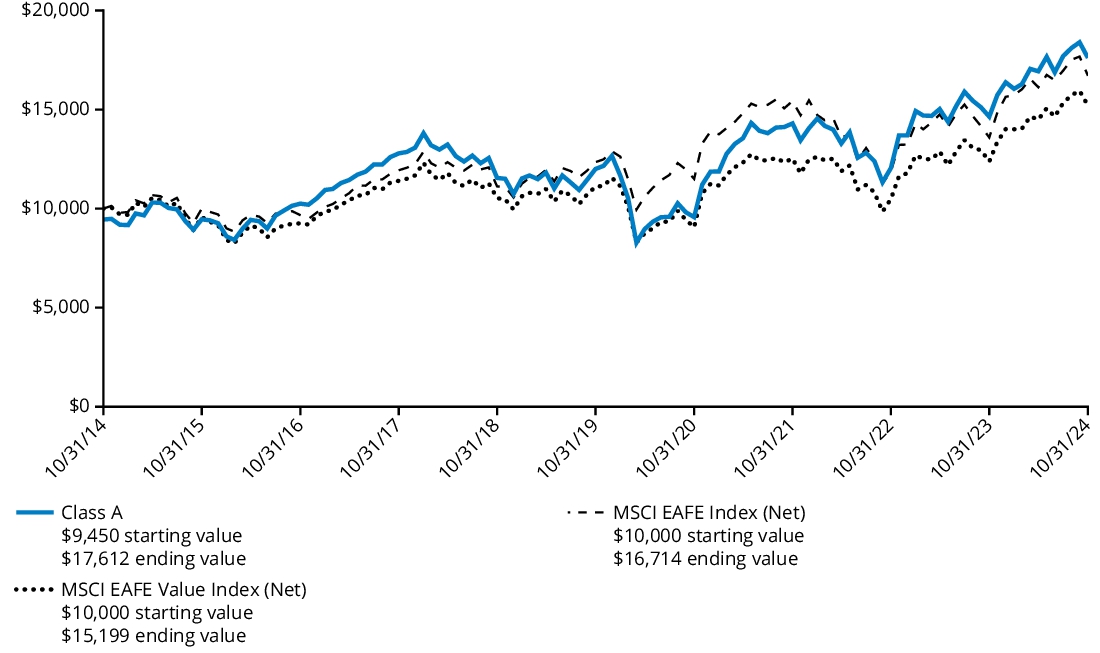

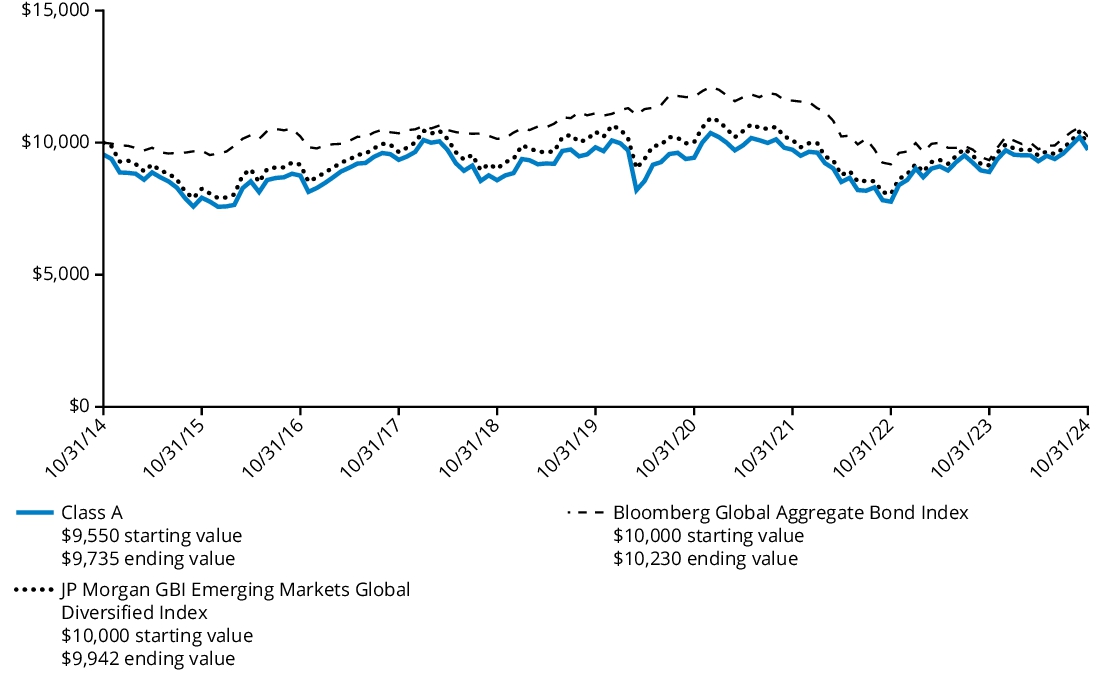

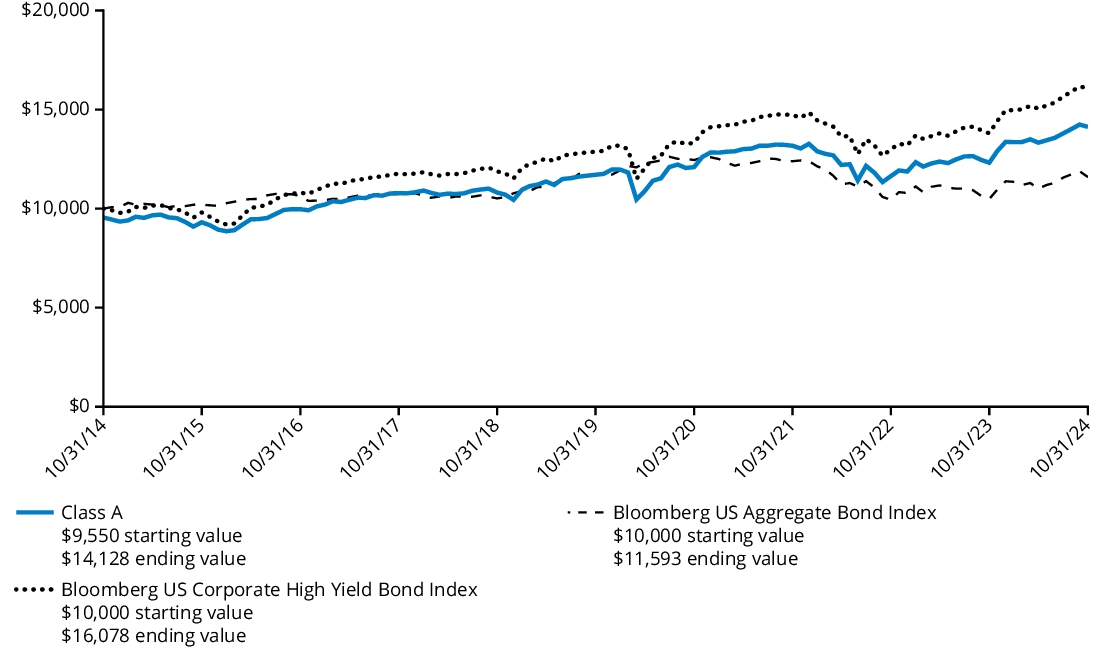

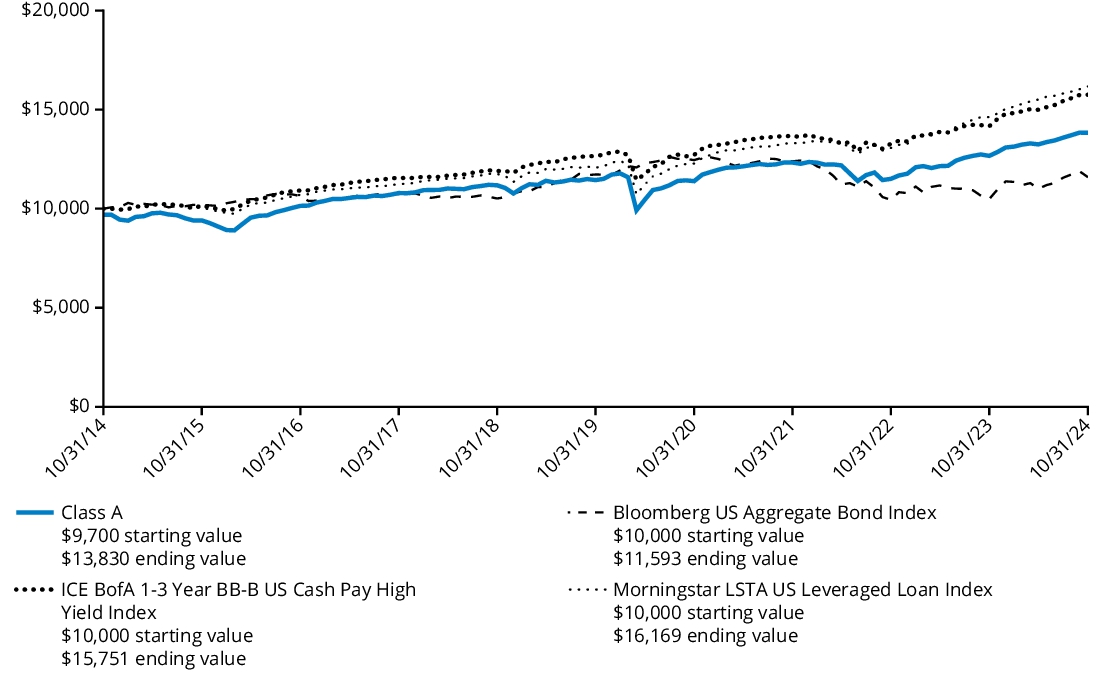

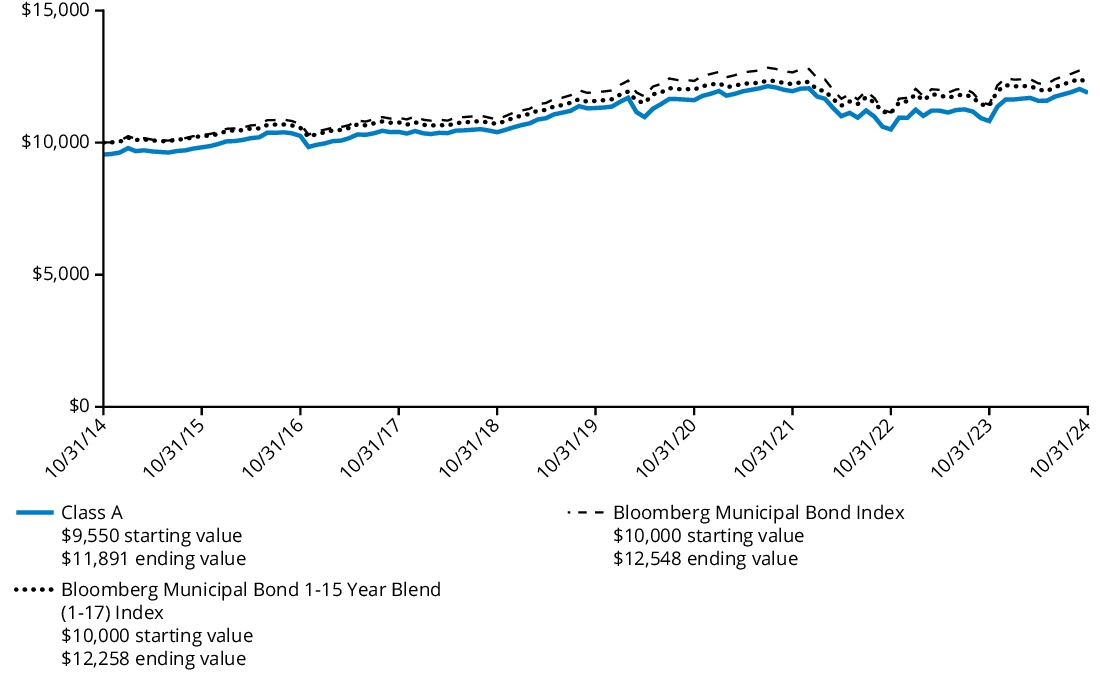

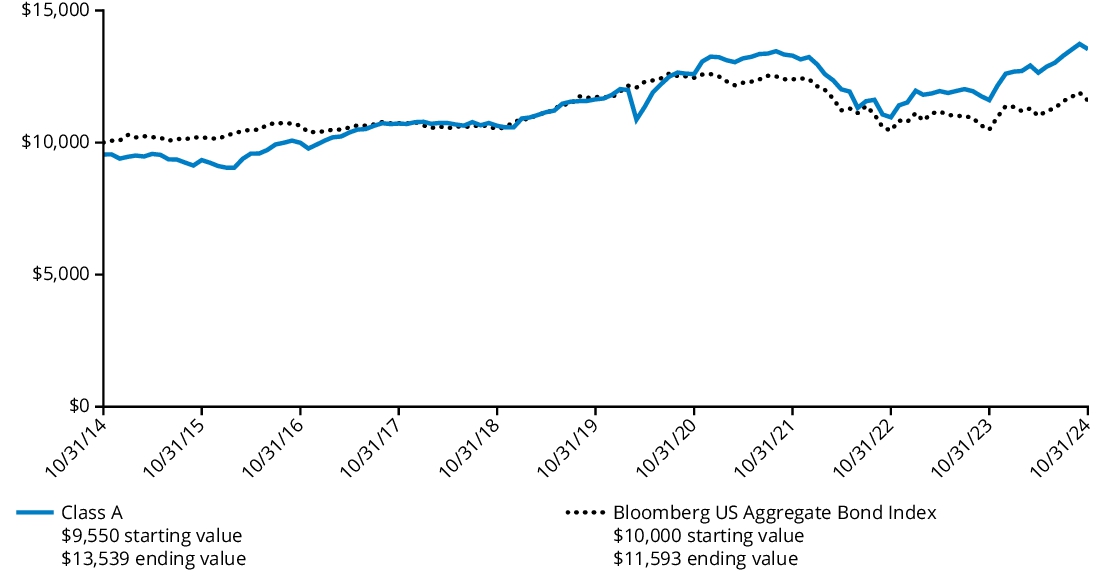

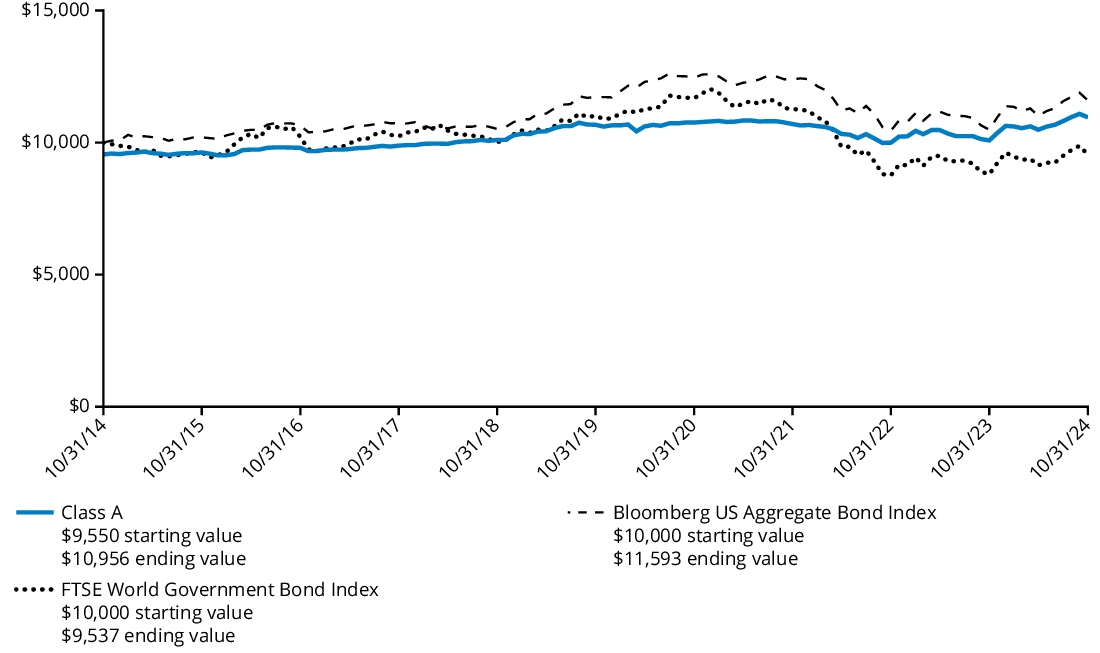

Comparison of Change in Value of $ 10,000 Investment

The graph below represents the hypothetical growth of a $10,000 investment in Class A shares and the comparative index. The returns for Class A shares include the maximum front-end sales charge applicable to Class A shares.

Average Annual Total Returns

For the Periods Ended October 31, 2024 | 1 Year | 5 Years | 10 Years |

| Class A (with 5.50% maximum front-end sales charge) | 21.98% | 4.27% | 3.63% |

| Class A (without 5.50% maximum front-end sales charge) | 29.08% | 5.45% | 4.22% |

| MSCI Emerging Markets Index (Net) | 25.32% | 3.93% | 3.43% |

Performance information for the Fund prior to May 7, 2015 reflects when the Fund pursued a modified investment strategy.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance information reflects fee waivers and/or expense limitation arrangements, if any. Absent any applicable fee waivers and/or expense limitation arrangements, performance would have been lower. Visit hartfordfunds.com for the most recent performance information.

Key Fund Statistics as of October 31, 2024

| Fund's net assets | $358,958,860% |

| Total number of portfolio holdings (excluding derivatives, if any) | $215% |

| Total investment management fees paid | $3,416,866% |

| Portfolio turnover rate | $113% |

Graphical Representation of Holdings as of October 31, 2024

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| China | 27.8 | % |

| Taiwan | 17.4 | % |

| India | 16.6 | % |

| South Korea | 11.7 | % |

| Brazil | 4.3 | % |

| Saudi Arabia | 3.6 | % |

| Thailand | 3.1 | % |

| United Arab Emirates | 2.7 | % |

| South Africa | 2.6 | % |

| Malaysia | 1.8 | % |

| Other** | 7.5 | % |

| Short-Term Investments | 0.3 | % |

| Other Assets & Liabilities | 0.6 | % |

| Total | 100.0 | % |

| * | For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

| ** | Ten largest country/geographic regions are presented. Additional country/geographic regions are found in Other. |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please visit the Fund’s website at the website address included at the beginning of this report.

The Fund is distributed by Hartford Funds Distributors, LLC (HFD).

Annual Shareholder Report

October 31, 2024

Hartford Emerging Markets Equity Fund

Class C/HERCX

This annual shareholder report contains important information about the Hartford Emerging Markets Equity Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-hmf. You can also request this information by contacting us by calling 1‑888‑843‑7824.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Class C | $251 | 2.20% |

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

Emerging Markets equities rose over the trailing twelve-month period ending October 31, 2024, as measured by the MSCI Emerging Markets Index (Net). In the period, heightened market volatility coincided with notable central bank policy decisions, major political developments, and an escalating conflict in the Middle East. Lower energy prices helped to ease inflationary pressures, and resilient labor markets in the United States, Europe, and Japan reinforced the view that the global economy could achieve a soft landing. Fund performance described below is relative to the MSCI Emerging Markets Index (Net), for the trailing twelve-month period ended October 31, 2024.

Top Contributors to Performance

Security selection was the primary contributor to relative performance during the period, driven by strong selection within the Financials, Industrials, and Consumer Staples sectors.

Top individual contributors over the period were out-of-benchmark allocation to International Games System (Communication Services) and overweight positions in Power Finance Corporation (Financials) and JD.com (Consumer Discretionary).

The Fund’s underweight allocation to the Energy and Materials sectors contributed to relative performance.

Top Detractors to Performance

Security selection within the Communication Services and Utilities sectors detracted from relative performance.

The largest individual detractors over the period were an underweight position in Hon Hai Precision Industry (Information Technology), an overweight position in NAVER (Communication Services) and an out-of-benchmark allocation to PTT Exploration and Production (Energy).

Sector allocation, a result of our quantitative security selection process, was a detractor to relative performance during the period due to the Fund’s underweight allocations to the Information Technology and Communication Services sectors.

The views expressed in this section reflect the opinions of the Fund's sub-adviser, Wellington Management Company LLP, as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

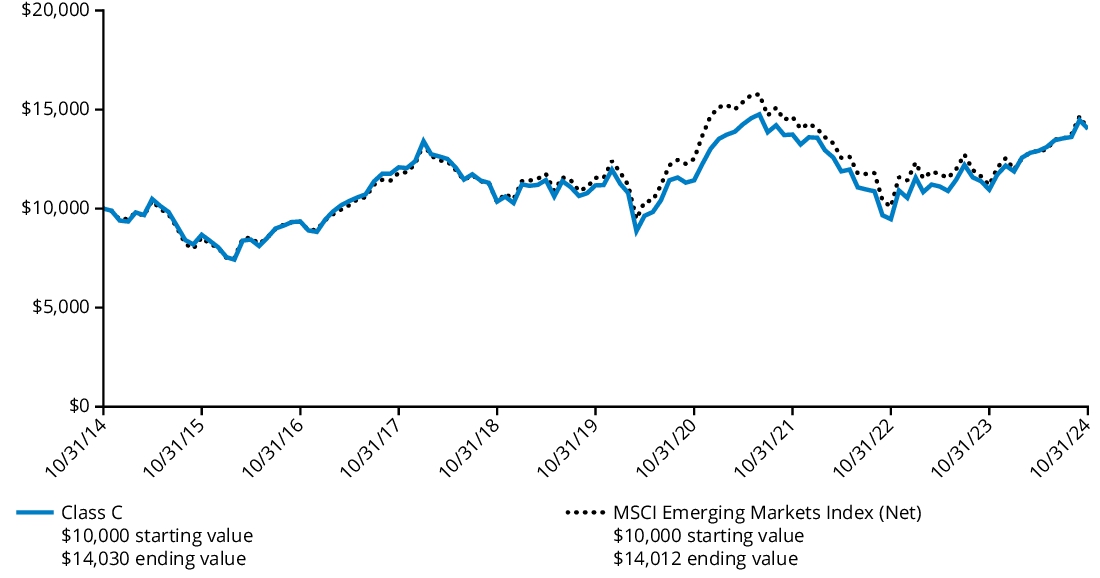

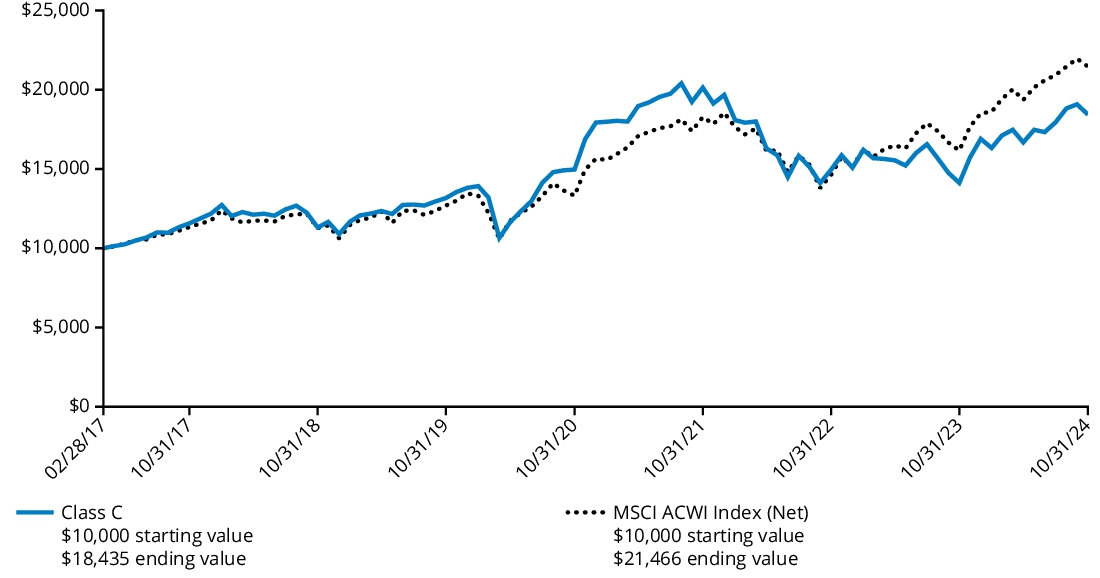

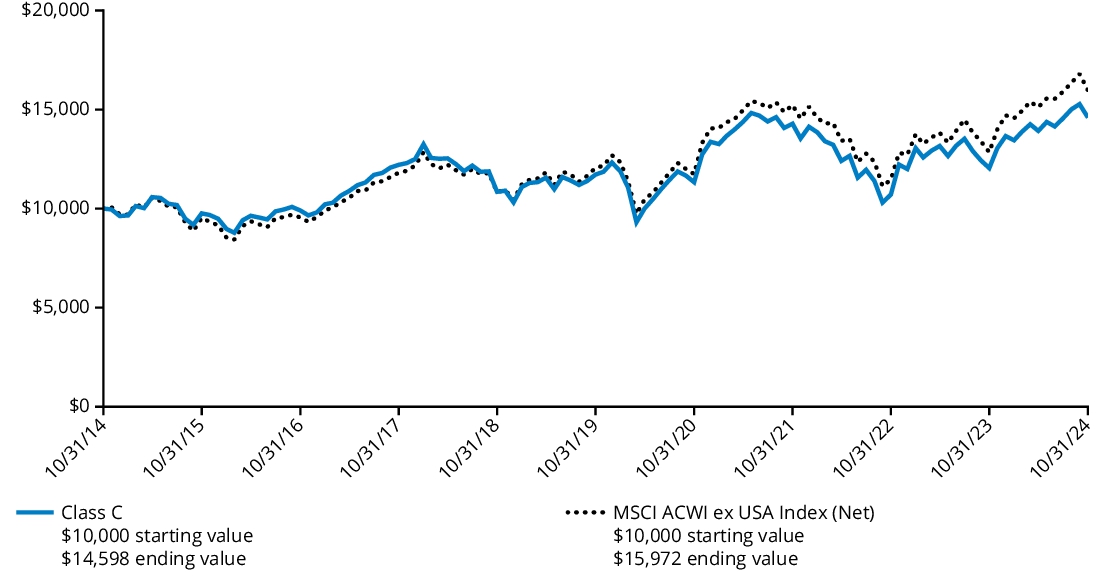

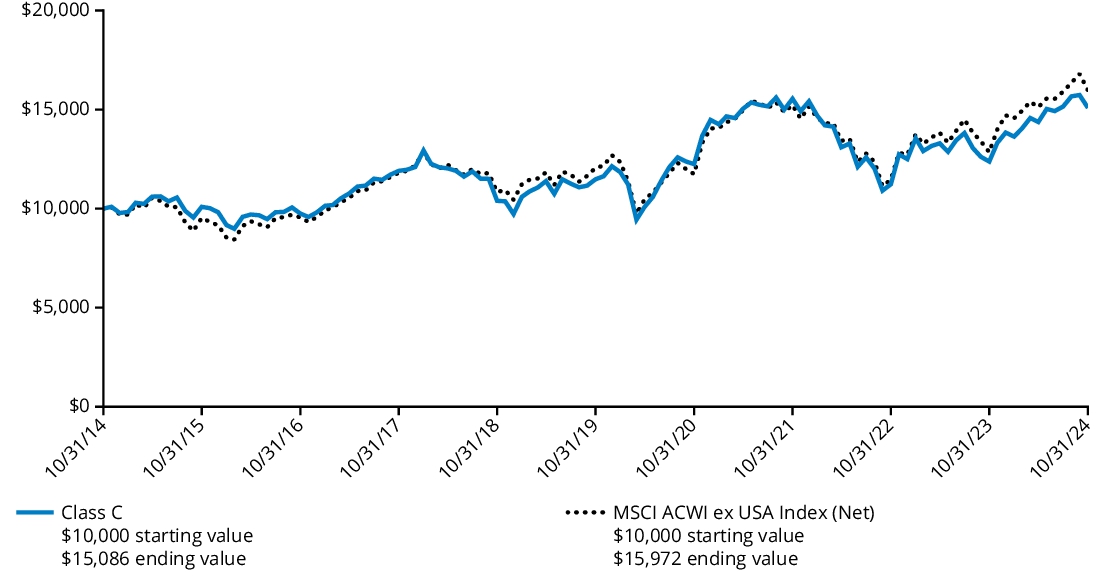

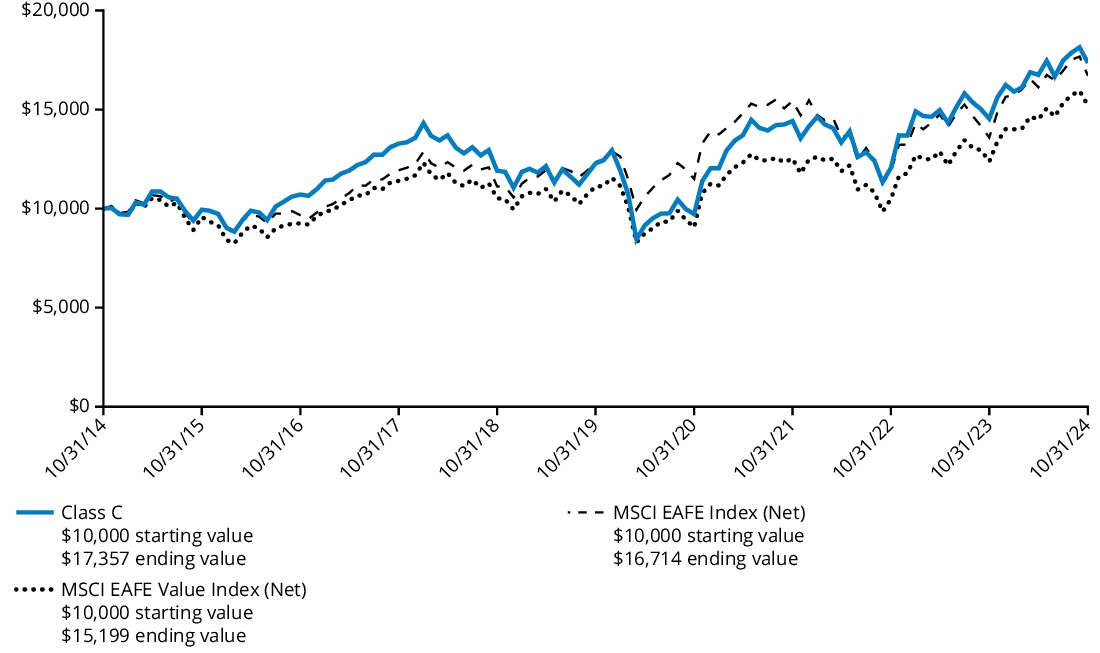

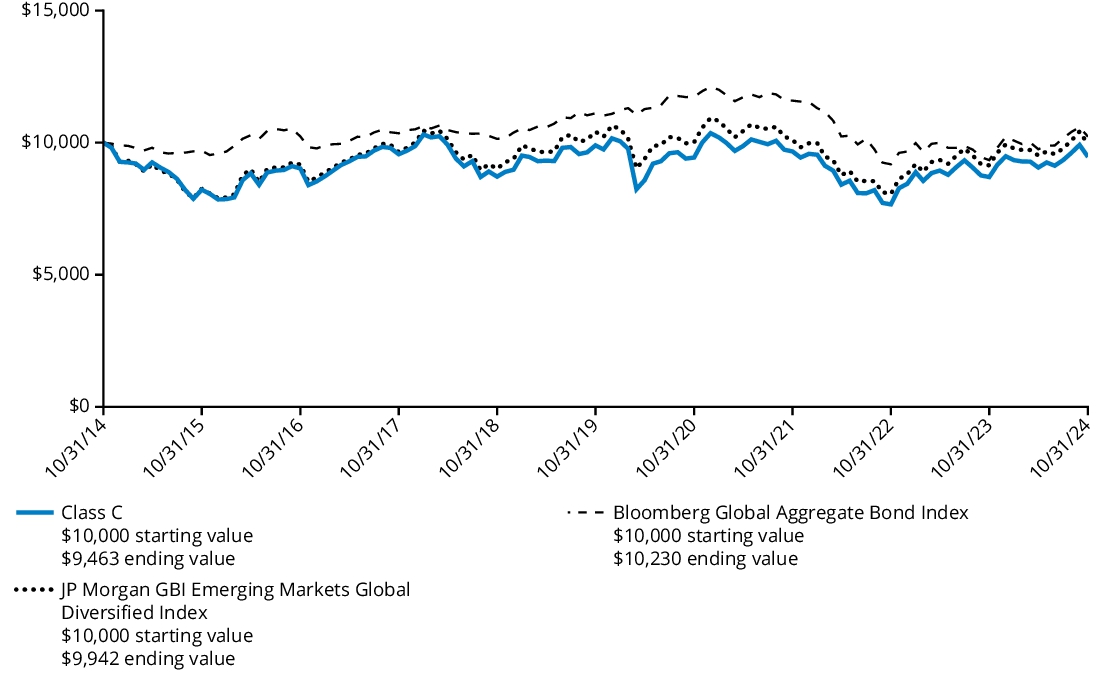

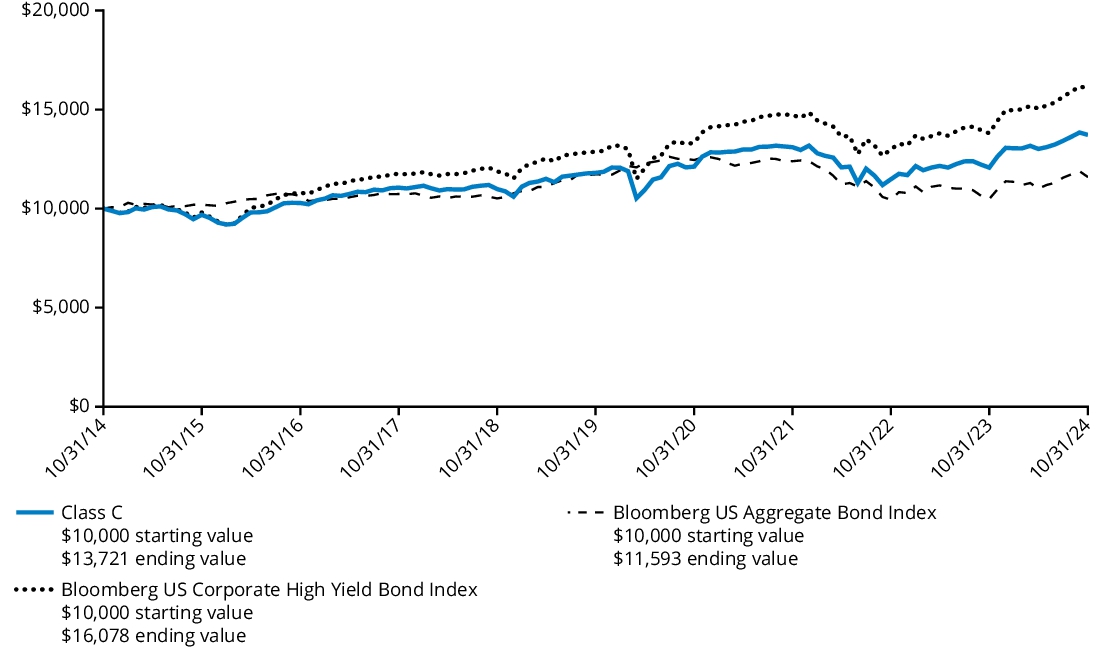

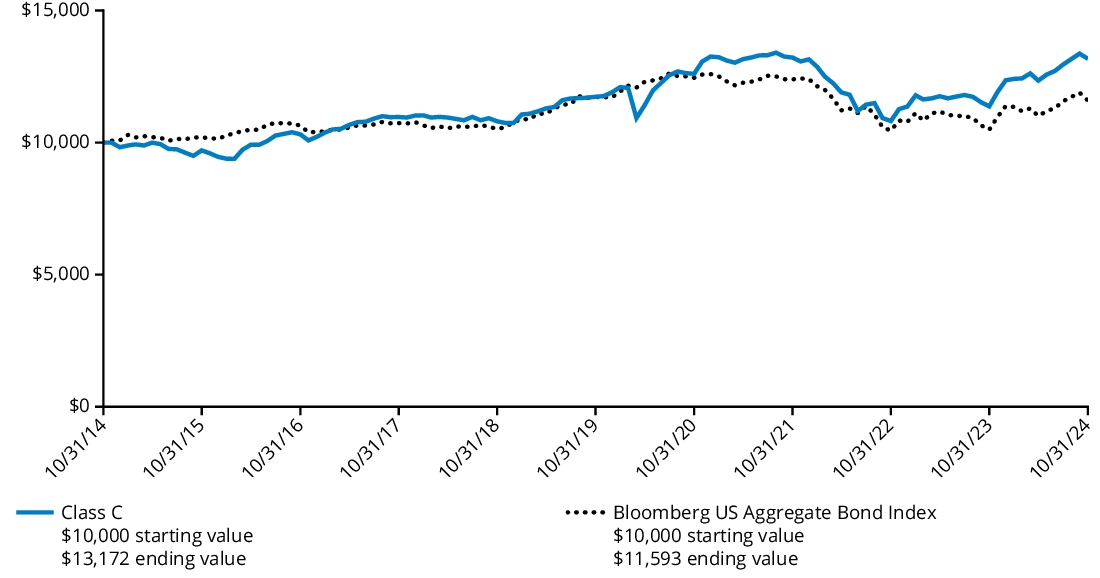

Comparison of Change in Value of $ 10,000 Investment

The graph below represents the hypothetical growth of a $10,000 investment in Class C shares (excluding sales charges) and the comparative index. If sales charges had been included, the value would have been lower.

Average Annual Total Returns

For the Periods Ended October 31, 2024 | 1 Year | 5 Years | 10 Years |

| Class C (with 1.00% contingent deferred sales charge) | 27.03% | 4.66% | 3.44% |

| Class C (without 1.00% contingent deferred sales charge) | 28.03% | 4.66% | 3.44% |

| MSCI Emerging Markets Index (Net) | 25.32% | 3.93% | 3.43% |

Performance information for the Fund prior to May 7, 2015 reflects when the Fund pursued a modified investment strategy.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance information reflects fee waivers and/or expense limitation arrangements, if any. Absent any applicable fee waivers and/or expense limitation arrangements, performance would have been lower. Visit hartfordfunds.com for the most recent performance information.

Key Fund Statistics as of October 31, 2024

| Fund's net assets | $358,958,860% |

| Total number of portfolio holdings (excluding derivatives, if any) | $215% |

| Total investment management fees paid | $3,416,866% |

| Portfolio turnover rate | $113% |

Graphical Representation of Holdings as of October 31, 2024

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| China | 27.8 | % |

| Taiwan | 17.4 | % |

| India | 16.6 | % |

| South Korea | 11.7 | % |

| Brazil | 4.3 | % |

| Saudi Arabia | 3.6 | % |

| Thailand | 3.1 | % |

| United Arab Emirates | 2.7 | % |

| South Africa | 2.6 | % |

| Malaysia | 1.8 | % |

| Other** | 7.5 | % |

| Short-Term Investments | 0.3 | % |

| Other Assets & Liabilities | 0.6 | % |

| Total | 100.0 | % |

| * | For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

| ** | Ten largest country/geographic regions are presented. Additional country/geographic regions are found in Other. |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please visit the Fund’s website at the website address included at the beginning of this report.

The Fund is distributed by Hartford Funds Distributors, LLC (HFD).

Annual Shareholder Report

October 31, 2024

Hartford Emerging Markets Equity Fund

Class I/HERIX

This annual shareholder report contains important information about the Hartford Emerging Markets Equity Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-hmf. You can also request this information by contacting us by calling 1‑888‑843‑7824.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Class I | $133 | 1.16% |

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

Emerging Markets equities rose over the trailing twelve-month period ending October 31, 2024, as measured by the MSCI Emerging Markets Index (Net). In the period, heightened market volatility coincided with notable central bank policy decisions, major political developments, and an escalating conflict in the Middle East. Lower energy prices helped to ease inflationary pressures, and resilient labor markets in the United States, Europe, and Japan reinforced the view that the global economy could achieve a soft landing. Fund performance described below is relative to the MSCI Emerging Markets Index (Net), for the trailing twelve-month period ended October 31, 2024.

Top Contributors to Performance

Security selection was the primary contributor to relative performance during the period, driven by strong selection within the Financials, Industrials, and Consumer Staples sectors.

Top individual contributors over the period were out-of-benchmark allocation to International Games System (Communication Services) and overweight positions in Power Finance Corporation (Financials) and JD.com (Consumer Discretionary).

The Fund’s underweight allocation to the Energy and Materials sectors contributed to relative performance.

Top Detractors to Performance

Security selection within the Communication Services and Utilities sectors detracted from relative performance.

The largest individual detractors over the period were an underweight position in Hon Hai Precision Industry (Information Technology), an overweight position in NAVER (Communication Services) and an out-of-benchmark allocation to PTT Exploration and Production (Energy).

Sector allocation, a result of our quantitative security selection process, was a detractor to relative performance during the period due to the Fund’s underweight allocations to the Information Technology and Communication Services sectors.

The views expressed in this section reflect the opinions of the Fund's sub-adviser, Wellington Management Company LLP, as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

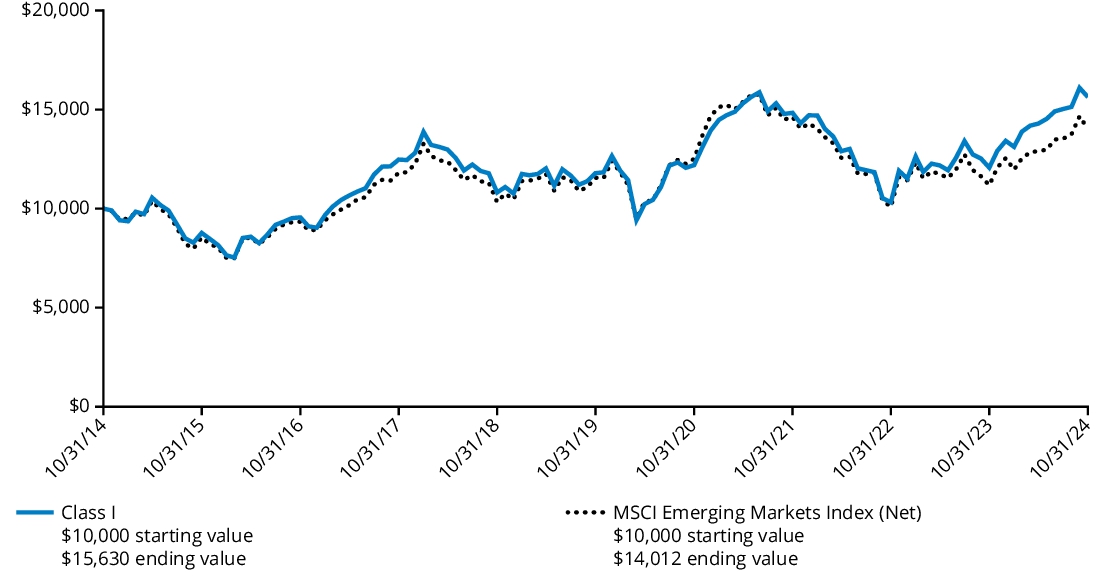

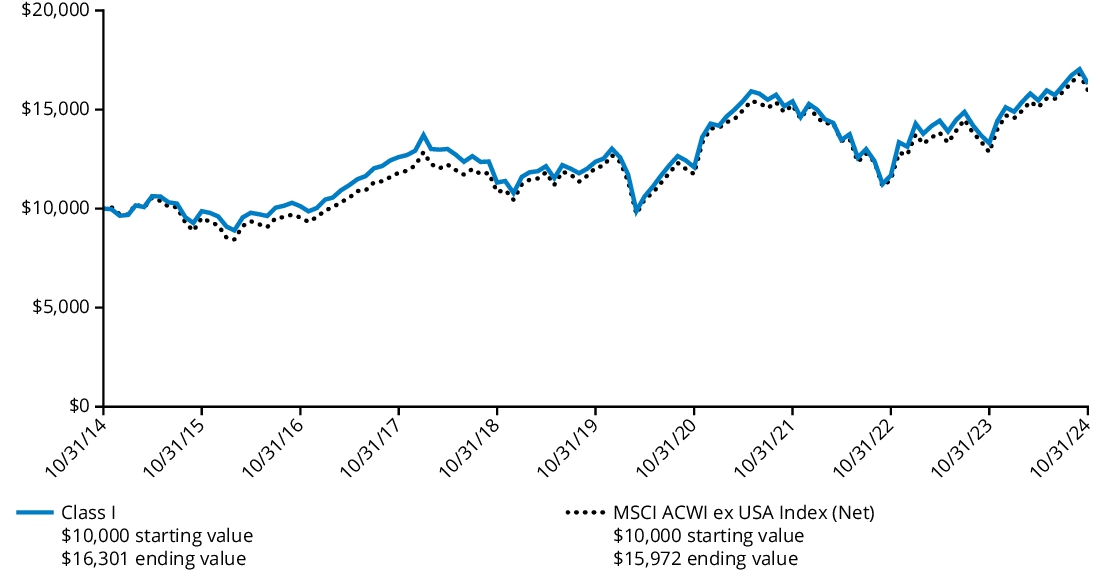

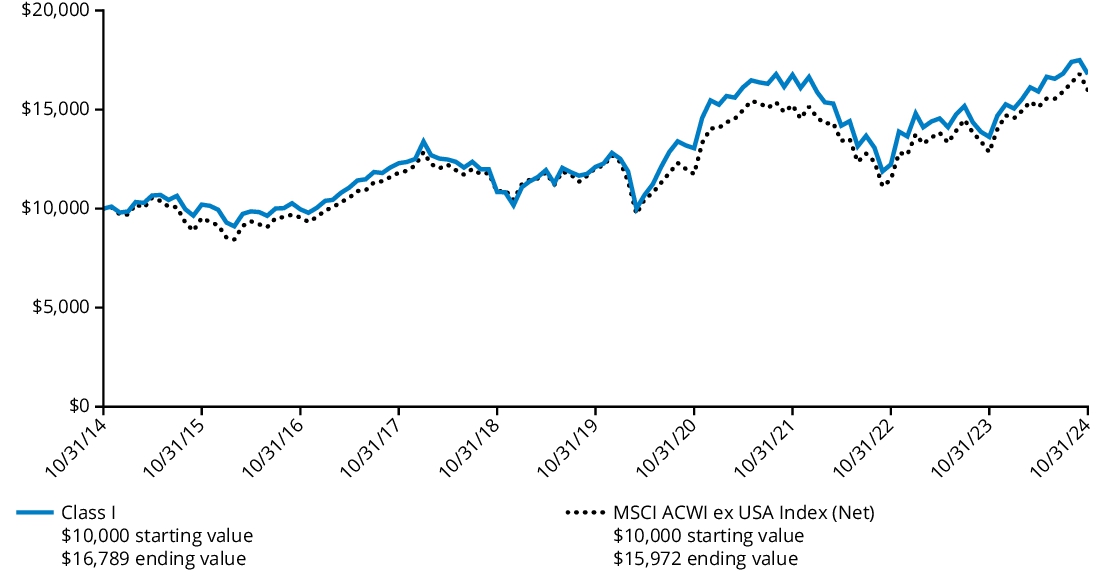

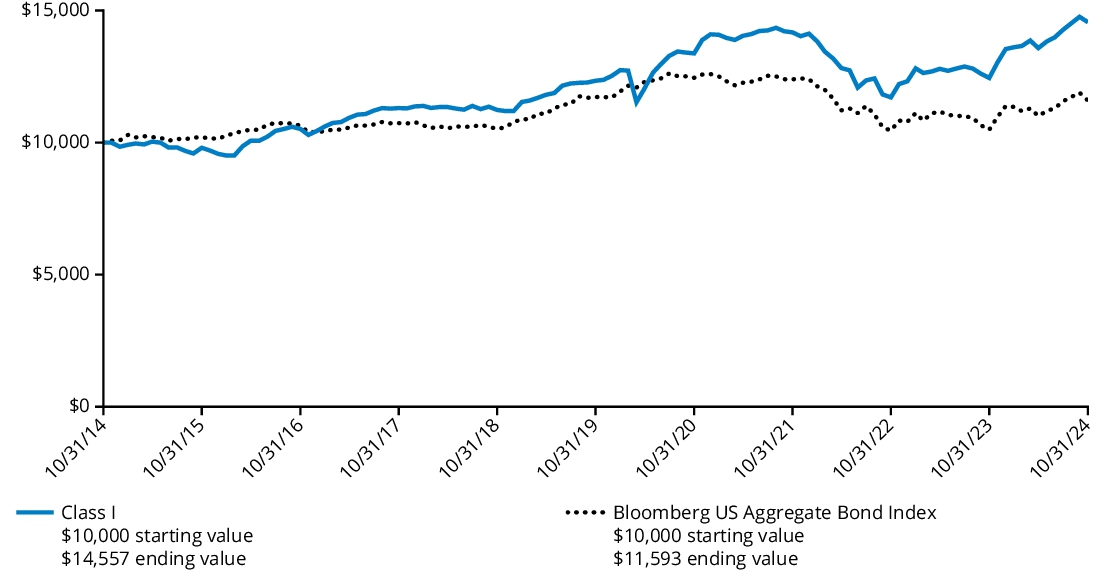

Comparison of Change in Value of $ 10,000 Investment

The graph below represents the hypothetical growth of a $10,000 investment in Class I shares and the comparative index.

Average Annual Total Returns

For the Periods Ended October 31, 2024 | 1 Year | 5 Years | 10 Years |

| Class I | 29.53% | 5.80% | 4.57% |

| MSCI Emerging Markets Index (Net) | 25.32% | 3.93% | 3.43% |

Performance information for the Fund prior to May 7, 2015 reflects when the Fund pursued a modified investment strategy.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance information reflects fee waivers and/or expense limitation arrangements, if any. Absent any applicable fee waivers and/or expense limitation arrangements, performance would have been lower. Visit hartfordfunds.com for the most recent performance information.

Key Fund Statistics as of October 31, 2024

| Fund's net assets | $358,958,860% |

| Total number of portfolio holdings (excluding derivatives, if any) | $215% |

| Total investment management fees paid | $3,416,866% |

| Portfolio turnover rate | $113% |

Graphical Representation of Holdings as of October 31, 2024

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| China | 27.8 | % |

| Taiwan | 17.4 | % |

| India | 16.6 | % |

| South Korea | 11.7 | % |

| Brazil | 4.3 | % |

| Saudi Arabia | 3.6 | % |

| Thailand | 3.1 | % |

| United Arab Emirates | 2.7 | % |

| South Africa | 2.6 | % |

| Malaysia | 1.8 | % |

| Other** | 7.5 | % |

| Short-Term Investments | 0.3 | % |

| Other Assets & Liabilities | 0.6 | % |

| Total | 100.0 | % |

| * | For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

| ** | Ten largest country/geographic regions are presented. Additional country/geographic regions are found in Other. |

Material Fund Changes

This is a summary of certain changes to the Fund since the beginning of the reporting period.

Effective July 1, 2024, Hartford Funds Management Company, LLC has contractually agreed to reimburse expenses (exclusive of taxes, interest expenses, brokerage commissions, acquired fund fees and expenses and extraordinary expenses) to the extent necessary to limit total annual fund operating expenses for Class I of the Fund as follows: 1.16% of the average daily net assets attributable to the class. This contractual arrangement will remain in effect until February 28, 2025 unless the Board of Directors of the Fund approves its earlier termination.

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please visit the Fund’s website at the website address included at the beginning of this report.

The Fund is distributed by Hartford Funds Distributors, LLC (HFD).

Annual Shareholder Report

October 31, 2024

Hartford Emerging Markets Equity Fund

Class R3/HERRX

This annual shareholder report contains important information about the Hartford Emerging Markets Equity Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-hmf. You can also request this information by contacting us by calling 1‑888‑843‑7824.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Class R3 | $194 | 1.70% |

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

Emerging Markets equities rose over the trailing twelve-month period ending October 31, 2024, as measured by the MSCI Emerging Markets Index (Net). In the period, heightened market volatility coincided with notable central bank policy decisions, major political developments, and an escalating conflict in the Middle East. Lower energy prices helped to ease inflationary pressures, and resilient labor markets in the United States, Europe, and Japan reinforced the view that the global economy could achieve a soft landing. Fund performance described below is relative to the MSCI Emerging Markets Index (Net), for the trailing twelve-month period ended October 31, 2024.

Top Contributors to Performance

Security selection was the primary contributor to relative performance during the period, driven by strong selection within the Financials, Industrials, and Consumer Staples sectors.

Top individual contributors over the period were out-of-benchmark allocation to International Games System (Communication Services) and overweight positions in Power Finance Corporation (Financials) and JD.com (Consumer Discretionary).

The Fund’s underweight allocation to the Energy and Materials sectors contributed to relative performance.

Top Detractors to Performance

Security selection within the Communication Services and Utilities sectors detracted from relative performance.

The largest individual detractors over the period were an underweight position in Hon Hai Precision Industry (Information Technology), an overweight position in NAVER (Communication Services) and an out-of-benchmark allocation to PTT Exploration and Production (Energy).

Sector allocation, a result of our quantitative security selection process, was a detractor to relative performance during the period due to the Fund’s underweight allocations to the Information Technology and Communication Services sectors.

The views expressed in this section reflect the opinions of the Fund's sub-adviser, Wellington Management Company LLP, as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

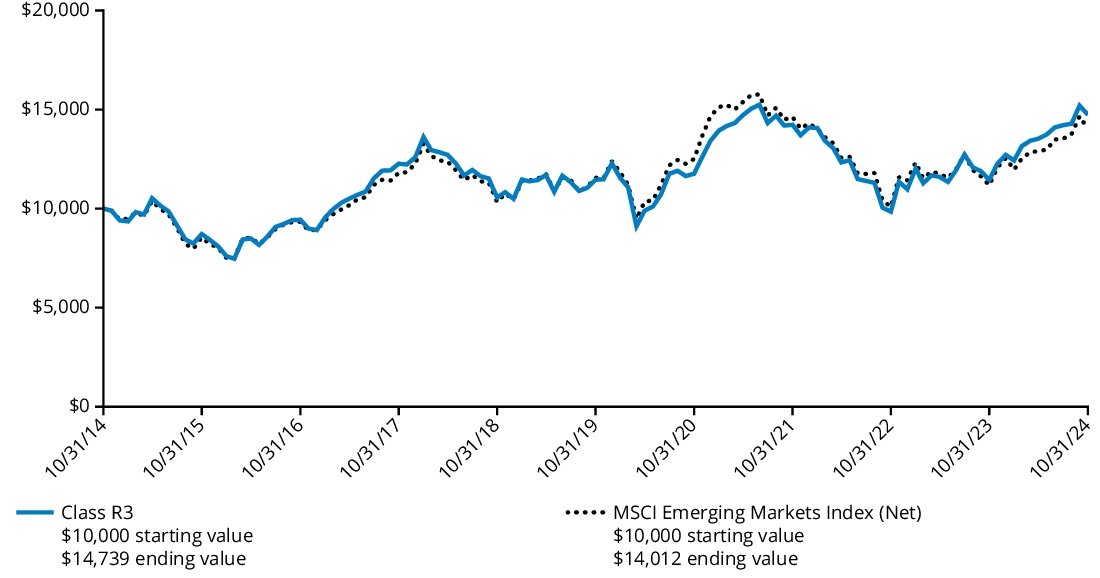

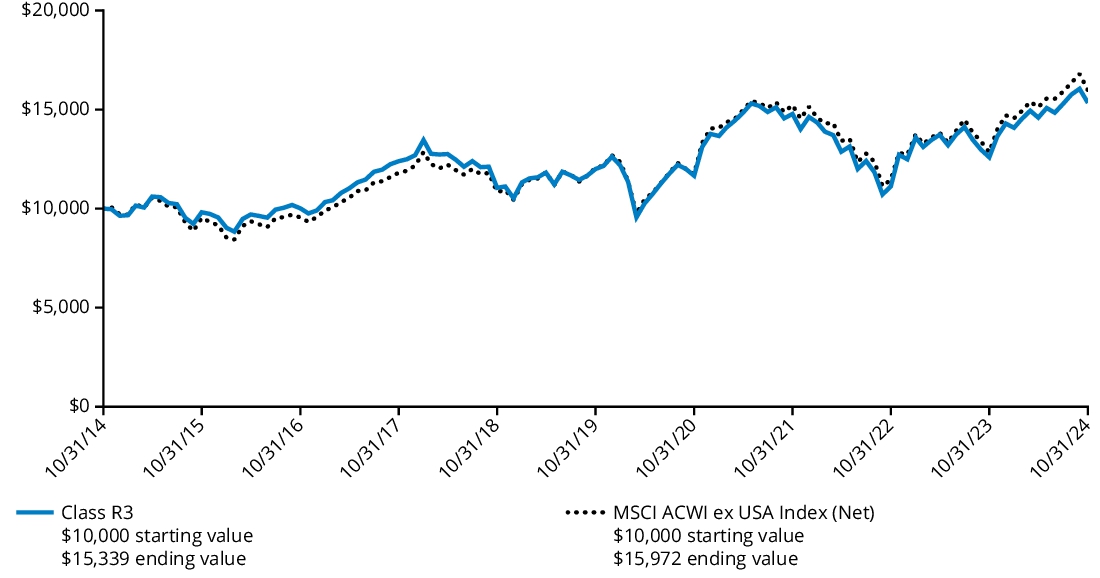

Comparison of Change in Value of $ 10,000 Investment

The graph below represents the hypothetical growth of a $10,000 investment in Class R3 shares and the comparative index.

Average Annual Total Returns

For the Periods Ended October 31, 2024 | 1 Year | 5 Years | 10 Years |

| Class R3 | 28.76% | 5.17% | 3.96% |

| MSCI Emerging Markets Index (Net) | 25.32% | 3.93% | 3.43% |

Performance information for the Fund prior to May 7, 2015 reflects when the Fund pursued a modified investment strategy.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance information reflects fee waivers and/or expense limitation arrangements, if any. Absent any applicable fee waivers and/or expense limitation arrangements, performance would have been lower. Visit hartfordfunds.com for the most recent performance information.

Key Fund Statistics as of October 31, 2024

| Fund's net assets | $358,958,860% |

| Total number of portfolio holdings (excluding derivatives, if any) | $215% |

| Total investment management fees paid | $3,416,866% |

| Portfolio turnover rate | $113% |

Graphical Representation of Holdings as of October 31, 2024

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| China | 27.8 | % |

| Taiwan | 17.4 | % |

| India | 16.6 | % |

| South Korea | 11.7 | % |

| Brazil | 4.3 | % |

| Saudi Arabia | 3.6 | % |

| Thailand | 3.1 | % |

| United Arab Emirates | 2.7 | % |

| South Africa | 2.6 | % |

| Malaysia | 1.8 | % |

| Other** | 7.5 | % |

| Short-Term Investments | 0.3 | % |

| Other Assets & Liabilities | 0.6 | % |

| Total | 100.0 | % |

| * | For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

| ** | Ten largest country/geographic regions are presented. Additional country/geographic regions are found in Other. |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please visit the Fund’s website at the website address included at the beginning of this report.

The Fund is distributed by Hartford Funds Distributors, LLC (HFD).

Annual Shareholder Report

October 31, 2024

Hartford Emerging Markets Equity Fund

Class R4/HERSX

This annual shareholder report contains important information about the Hartford Emerging Markets Equity Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-hmf. You can also request this information by contacting us by calling 1‑888‑843‑7824.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Class R4 | $166 | 1.45% |

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

Emerging Markets equities rose over the trailing twelve-month period ending October 31, 2024, as measured by the MSCI Emerging Markets Index (Net). In the period, heightened market volatility coincided with notable central bank policy decisions, major political developments, and an escalating conflict in the Middle East. Lower energy prices helped to ease inflationary pressures, and resilient labor markets in the United States, Europe, and Japan reinforced the view that the global economy could achieve a soft landing. Fund performance described below is relative to the MSCI Emerging Markets Index (Net), for the trailing twelve-month period ended October 31, 2024.

Top Contributors to Performance

Security selection was the primary contributor to relative performance during the period, driven by strong selection within the Financials, Industrials, and Consumer Staples sectors.

Top individual contributors over the period were out-of-benchmark allocation to International Games System (Communication Services) and overweight positions in Power Finance Corporation (Financials) and JD.com (Consumer Discretionary).

The Fund’s underweight allocation to the Energy and Materials sectors contributed to relative performance.

Top Detractors to Performance

Security selection within the Communication Services and Utilities sectors detracted from relative performance.

The largest individual detractors over the period were an underweight position in Hon Hai Precision Industry (Information Technology), an overweight position in NAVER (Communication Services) and an out-of-benchmark allocation to PTT Exploration and Production (Energy).

Sector allocation, a result of our quantitative security selection process, was a detractor to relative performance during the period due to the Fund’s underweight allocations to the Information Technology and Communication Services sectors.

The views expressed in this section reflect the opinions of the Fund's sub-adviser, Wellington Management Company LLP, as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

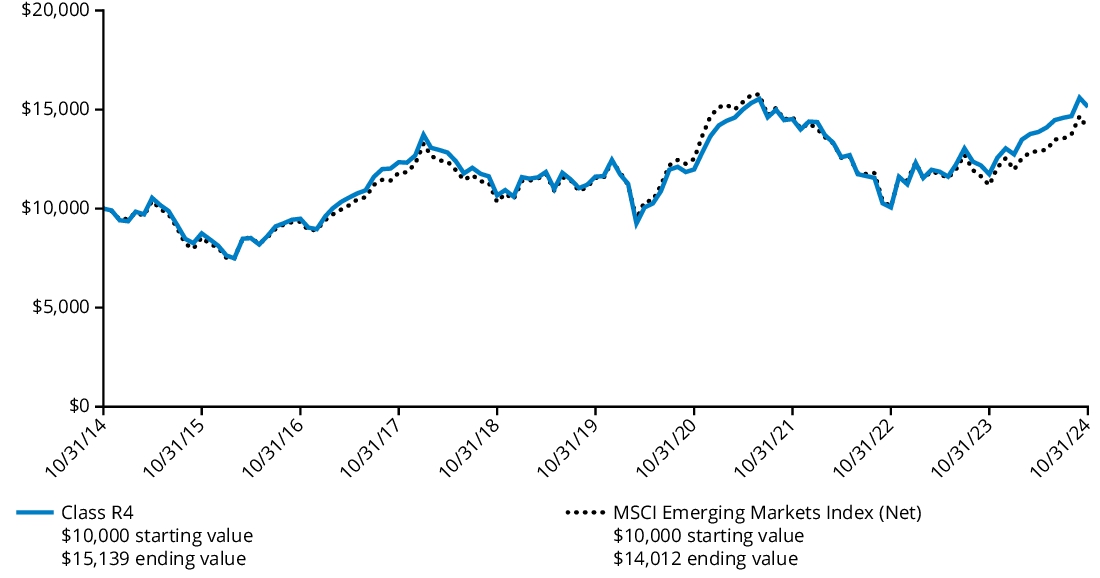

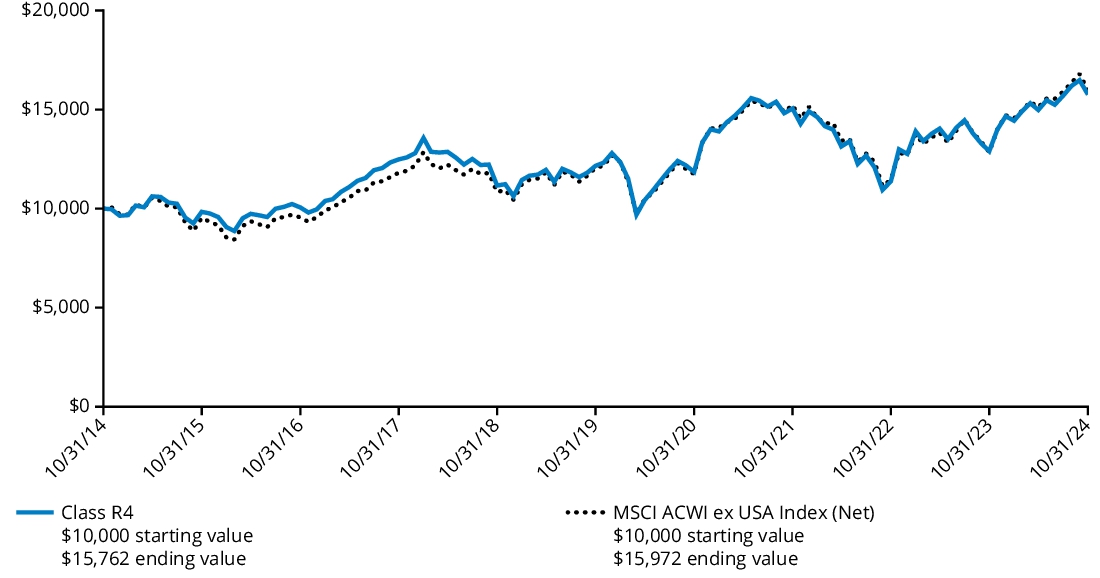

Comparison of Change in Value of $ 10,000 Investment

The graph below represents the hypothetical growth of a $10,000 investment in Class R4 shares and the comparative index.

Average Annual Total Returns

For the Periods Ended October 31, 2024 | 1 Year | 5 Years | 10 Years |

| Class R4 | 28.97% | 5.44% | 4.23% |

| MSCI Emerging Markets Index (Net) | 25.32% | 3.93% | 3.43% |

Performance information for the Fund prior to May 7, 2015 reflects when the Fund pursued a modified investment strategy.