QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

First Federal Bancshares of Arkansas, Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

[First Federal Bancshares of Arkansas, Inc. Letterhead]

April 2, 2003

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of First Federal Bancshares of Arkansas, Inc. The meeting will be held at First Federal Bank of Arkansas located at 1401 Highway 62-65 North, Harrison, Arkansas 72601, on Wednesday, April 30, 2003 at 10:00 a.m., Central Time. The matters to be considered by stockholders at the Annual Meeting are described in the accompanying materials.

It is very important that you be represented at the Annual Meeting regardless of the number of shares you own or whether you are able to attend the meeting in person. We urge you to mark, sign, and date your proxy card today and return it in the envelope provided, even if you plan to attend the Annual Meeting. This will not prevent you from voting in person, but will ensure that your vote is counted if you are unable to attend.For the reasons set forth in the Proxy Statement, the Board unanimously recommends that you vote "FOR" each matter to be considered.

Your continued support of and interest in First Federal Bancshares of Arkansas, Inc. are sincerely appreciated.

| | | Sincerely, |

|

|

/s/ LARRY J. BRANDT |

|

|

Larry J. Brandt

President/CEO |

FIRST FEDERAL BANCSHARES OF ARKANSAS, INC.

200 West Stephenson

Harrison, Arkansas 72601

(870) 741-7641

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on April 30, 2003

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders ("Annual Meeting") of First Federal Bancshares of Arkansas, Inc. (the "Company") will be held at First Federal Bank of Arkansas located at 1401 Highway 62-65 North, Harrison, Arkansas 72601, on Wednesday, April 30, 2003 at 10:00 a.m., Central Time, for the following purposes, all of which are more completely set forth in the accompanying Proxy Statement:

(1) To elect two directors for a term of three years and until their successors are elected and qualified;

(2) To ratify the appointment by the Board of Directors of Deloitte & Touche LLP as the Company's independent auditors for the year ending December 31, 2003; and

(3) To transact such other business as may properly come before the meeting or any adjournment thereof. Management is not aware of any other such business.

The Board of Directors has fixed March 20, 2003 as the voting record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting. Only those stockholders of record as of the close of business on that date will be entitled to vote at the Annual Meeting.

| | | BY ORDER OF THE BOARD OF DIRECTORS |

|

|

/s/ TOMMY W. RICHARDSON |

|

|

Tommy W. Richardson

Secretary |

Harrison, Arkansas

April 2, 2003

|

| YOU ARE CORDIALLY INVITED TO ATTEND THE ANNUAL MEETING. IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED REGARDLESS OF THE NUMBER YOU OWN. EVEN IF YOU PLAN TO BE PRESENT, YOU ARE URGED TO COMPLETE, SIGN, DATE AND RETURN THE ENCLOSED PROXY PROMPTLY IN THE ENVELOPE PROVIDED. IF YOU ATTEND THE MEETING, YOU MAY VOTE EITHER IN PERSON OR BY PROXY. ANY PROXY GIVEN MAY BE REVOKED BY YOU IN WRITING OR IN PERSON AT ANY TIME PRIOR TO THE EXERCISE THEREOF. |

|

FIRST FEDERAL BANCSHARES OF ARKANSAS, INC.

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

April 30, 2003

This Proxy Statement is furnished to holders of common stock, $.01 par value per share ("Common Stock"), of First Federal Bancshares of Arkansas, Inc. (the "Company"), the holding company of First Federal Bank of Arkansas, FA (the "Bank"). The Company acquired all of the Bank's common stock issued in connection with the conversion of the Bank from mutual to stock form in May 1996. Proxies are being solicited on behalf of the Board of Directors of the Company to be used at the Annual Meeting of Stockholders ("Annual Meeting") to be held at First Federal Bank of Arkansas located at 1401 Highway 62-65 North, Harrison, Arkansas 72601, on April 30, 2003 at 10:00 a.m., Central Time, for the purposes set forth in the Notice of Annual Meeting of Stockholders. This Proxy Statement is first being mailed to stockholders on or about April 2, 2003.

The proxy solicited hereby, if properly signed and returned to the Company and not revoked prior to its use, will be voted in accordance with the instructions contained therein. If no contrary instructions are given, each proxy received will be votedFOR the matters described below and, upon the transaction of such other business as may properly come before the meeting, in accordance with the best judgment of the persons appointed as proxies. Any stockholder giving a proxy has the power to revoke it at any time before it is exercised by (i) filing with the Secretary of the Company written notice thereof (Tommy Richardson, Secretary, First Federal Bancshares of Arkansas, Inc., P.O. Box 550, Harrison, Arkansas 72602); (ii) submitting a duly-executed proxy bearing a later date; or (iii) appearing at the Annual Meeting and giving the Secretary notice of his or her intention to vote in person. Proxies solicited hereby may be exercised only at the Annual Meeting and any adjournment thereof and will not be used for any other meeting.

VOTING

Only stockholders of record at the close of business on March 20, 2003 ("Voting Record Date") will be entitled to vote at the Annual Meeting. On the Voting Record Date, there were 2,665,743 shares of Common Stock outstanding and the Company had no other class of equity securities outstanding. Each share of Common Stock is entitled to one vote at the Annual Meeting on all matters properly presented at the meeting. Directors are elected by a plurality of the votes cast with a quorum present. Abstentions are considered in determining the presence of a quorum and will not affect the plurality vote required for the election of directors. The affirmative vote of the holders of a majority of the total votes present in person or by proxy is required to ratify the appointment of the independent auditors. Under rules of the New York Stock Exchange, the proposal for ratification of the auditors is considered a "discretionary" item upon which brokerage firms may vote in their discretion on behalf of their clients if such clients have not furnished voting instructions and for which there will not be "broker non-votes."

2

INFORMATION WITH RESPECT TO NOMINEES FOR DIRECTORS

AND EXECUTIVE OFFICERS

Election of Directors

The Bylaws of the Company presently provide that the Board of Directors shall consist of five members, and the Articles of Incorporation and Bylaws of the Company presently provide that the Board of Directors shall be divided into three classes as nearly equal in number as possible. The members of each class are to be elected for a term of three years or until their successors are elected and qualified, with one class of directors to be elected annually. There are no arrangements or understandings between the Company and any person pursuant to which such person has been elected a director. Stockholders of the Company are not permitted to cumulate their votes for the election of directors.

Other than Larry J. Brandt, who is the father of Jeffrey L. Brandt and the cousin by marriage of Kenneth C. Savells, no director or executive officer of the Company is related to any other director or executive officer of the Company by blood, marriage or adoption, and each of the nominees currently serve as a director of the Company.

Unless otherwise directed, each proxy executed and returned by a stockholder will be voted for the election of the nominees for director listed below. If the person or persons named as nominee should be unable or unwilling to stand for election at the time of the Annual Meeting, the proxies will nominate and vote for one or more replacement nominees recommended by the Board of Directors. At this time, the Board of Directors knows of no reason why the nominees listed below may not be able to serve as directors if elected. Ages are reflected as of December 31, 2002.

Nominees for Director for Three-Year Term Expiring in 2006

Name

| | Age

| | Positions Held with

the Company

| | Director

Since

|

|---|

| Jeffrey L. Brandt | | 32 | | Senior Vice President/Regional Manager and Director | | 2001 |

| John P. Hammerschmidt | | 80 | | Chairman of the Board | | 1966 |

The Board of Directors recommends that you vote FOR the election of the above nominees for director.

Members of the Board of Directors Continuing in Office

Director Whose Term Expires in 2004

Name

| | Age

| | Positions Held with

the Company

| | Director

Since

|

|---|

| Larry J. Brandt | | 54 | | President, Chief Executive Officer and Director | | 1979 |

Directors Whose Terms Expire in 2005

Name

| | Age

| | Positions Held with

The Company

| | Director

Since

|

|---|

| James D. Heuer | | 85 | | Director | | 1957 |

| Kenneth C. Savells | | 50 | | Director | | 2000 |

Set forth below is information with respect to the principal occupations of the above listed individuals during at least the last five years.

Larry J. Brandt. Mr. Brandt is President, Chief Executive Officer and a director of the Company and the Bank. He became President and Managing Officer of the Bank in 1987, its Chief Operating

3

Officer in 1984 and its Chief Executive Officer in 2001. Mr. Brandt initially was employed by the Bank in 1973.

John P. Hammerschmidt. Mr. Hammerschmidt is Chairman of the Board of the Company and the Bank. He is a former United States Congressman from Arkansas (1966-1993). Mr. Hammerschmidt also serves on the boards of directors of Dillards, Inc. and Southwestern Energy.

James D. Heuer. Mr. Heuer is a director of the Company and the Bank. He is engaged in the raising of cattle in Harrison, Arkansas.

Kenneth C. Savells. Since February 2003, Mr. Savells, a registered representative and investment advisor representative, has been in the insurance and investment business with securities offered through Linsco/Private Ledger. From August 1999 to February 2003, Mr. Savells was employed as a registered representative with AXA Advisors, LLC, a registered brokerage firm located in Oklahoma City, Oklahoma. Mr. Savells resides in Harrison, Arkansas. Mr. Savells also previously held the position of Vice President of Management Information Services for Millbrook Distribution Services, a consumer products distribution company located in Harrison, Arkansas, where he was employed from 1981 to 1999.

Jeffrey L. Brandt. Mr. Brandt is Senior Vice President/Regional Manager and a director of the Company and the Bank. Mr. Brandt initially was employed by the Bank in 1993. He was elected in 2001 to fill the unexpired term of Frank L. Coffman, Jr., the former Chairman of the Board and Chief Executive Officer of both the Company and the Bank.

Stockholder Nominations

Article VII.D of the Company's Articles of Incorporation governs nominations for election to the Board of Directors and requires all such nominations, other than those made by the Board, to be made at a meeting of stockholders called for the election of directors, and only by a stockholder who has complied with the notice provisions in that section. The Articles of Incorporation set forth specific requirements with respect to stockholder nominations. The Company did not receive any nominations with respect to the 2003 Annual Meeting.

Committees and Meetings of the Board of the Company and the Bank

The Board of Directors of the Company meets on a monthly basis and may have additional special meetings. During the year ended December 31, 2002, the Board of Directors of the Company met 13 times. No director attended fewer than 75% of the total number of Board meetings or committee meetings on which he served that were held during this period.

The Board of Directors has established various committees, including an Audit Committee and a Compensation Committee.

The Audit Committee currently consists of Messrs. Hammerschmidt, Heuer and Savells (Chairman). Each of these persons is independent within the meaning of the listing standards of the Nasdaq Stock Market, Inc. In addition, the Board has determined that at least one member of the Audit Committee meets the current Nasdaq Stock Market, Inc. standard of having accounting or related financial expertise. The Audit Committee reviews the records and affairs of the Company, meets with the Bank's internal auditor or the accounting firm performing such function quarterly, engages the Company's external auditors and reviews their reports. The Audit Committee met 8 times during 2002, including quarterly meetings with the Company's external auditors. The Boards of Directors of the Company and the Bank adopted an Audit Committee Charter on January 28, 2003. Recently the Audit Committee Charter was amended to increase the responsibilities of the Audit

4

Committee in several areas. A copy of the amended charter is attached hereto as Appendix A. The Audit Committee reviews and reassesses the charter annually.

The Compensation Committee currently consists of Messrs. Hammerschmidt, Heuer and Savells. The Compensation Committee, which reviews and recommends compensation and benefits for the Company's employees, met once in 2002. Each of these persons is independent within the meaning of the listing standards of the Nasdaq Stock Market, Inc.

The Board of Directors of the Bank met 13 times during 2002. The Bank has established an Audit Committee and a Compensation Committee. Both committees currently consist of Messrs. Hammerschmidt, Heuer and Savells.

Executive Officers Who Are Not Directors

Set forth below is information with respect to the principal occupations during at least the last five years for the current executive officers of the Company and the Bank who do not serve as a director. Ages are reflected as of December 31, 2002.

Tommy W. Richardson, age 45. Mr. Richardson is the Executive Vice President and Chief Operating Officer. He became Executive Vice President for the Bank in 2001, Chief Financial Officer for the Bank in 1993, and its Chief Operating Officer in 2002. Mr. Richardson initially was employed by the Bank in 1984.

Sherri R. Billings, age 45. Mrs. Billings is the Executive Vice President and Chief Financial Officer. She became Senior Vice President for the Bank in 1993, its Treasurer in 1986 and its Executive Vice President/Chief Financial Officer in 2002. Mrs. Billings initially was employed by the Bank in 1979.

Ross Mallioux, age 40. Mr. Mallioux was promoted to Executive Vice President, Chief Lending Officer and Regional Manager in January 2002. He became a Senior Vice President in 1994, and initially was employed by the Bank in 1984.

Scott H. Tennyson, age 41. Mr. Tennyson was promoted to Executive Vice President and Chief Retail Officer in January 2002. He became a Senior Vice President for the Bank in 1994, its Corporate Loan Manager in 1996 and initially was employed by the Bank in 1983.

5

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended (the "1934 Act"), requires the Company's officers and directors, and persons who own more than 10% of the Company's Common Stock, to file reports of ownership and changes in ownership with the Securities and Exchange Commission ("SEC") and the National Association of Securities Dealers, Inc. Officers, directors and greater than 10% stockholders are required by regulation to furnish the Company with copies of all Section 16(a) forms they file. The Company knows of no person who owns 10% or more of the Company's Common Stock.

Based solely on review of the copies of such forms furnished to the Company, or written representations from its officers and directors, the Company believes that during, and with respect to, the year ended December 31, 2002, the Company's officers and directors satisfied the reporting requirements promulgated under Section 16(a) of the 1934 Act.

6

BENEFICIAL OWNERSHIP OF COMMON STOCK

BY CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

The following table sets forth, as of the Voting Record Date, certain information as to the Common Stock beneficially owned by (i) each person or entity, including any "group" as that term is used in Section 13(d)(3) of the 1934 Act, who or which was known to the Company to be the beneficial owner of more than 5% of the issued and outstanding Common Stock, (ii) the directors of the Company, (iii) those executive officers of the Company whose salary and bonus exceeded $100,000 in 2002, and (iv) all directors and executive officers of the Company and the Bank as a group.

| | Common Stock Beneficially Owned as of

March 20, 2003(1)

| |

|---|

Name of Beneficial Owner

| |

|---|

| | No.

| | %

| |

|---|

First Federal Bancshares of Arkansas, Inc.

Employee Stock Ownership Trust

200 West Stephenson

Harrison, Arkansas 72601 | | 388,380 | (2) | 14.6 | % |

Dimensional Fund Advisors, Inc.

1299 Ocean Avenue, 11th Floor

Santa Monica, CA 90401 |

|

188,100 |

(3) |

7.1 |

|

First Manhattan Co.

437 Madison Avenue

New York, New York 10002 |

|

262,450 |

(3) |

9.8 |

|

Directors: |

|

|

|

|

|

| |

Larry J. Brandt |

|

176,871 |

(4) |

6.5 |

|

| |

John P. Hammerschmidt |

|

43,577 |

(5) |

1.6 |

|

| |

James D. Heuer |

|

53,777 |

(6) |

2.0 |

|

| |

Kenneth C. Savells |

|

8,557 |

(7) |

* |

|

| |

Jeffrey L. Brandt |

|

28,263 |

(8) |

1.1 |

|

Certain other executive officers: |

|

|

|

|

|

| |

Tommy W. Richardson |

|

78,114 |

(9) |

2.9 |

|

| |

Sherri R. Billings |

|

80,709 |

(10) |

3.0 |

|

| |

Ross Mallioux |

|

33,873 |

(11) |

1.3 |

|

All directors and executive officers of the Company and the Bank as a group (9 persons) |

|

532,920 |

(12) |

18.3 |

|

- *

- Represents less than 1% of the outstanding Common Stock.

- (1)

- Based upon information provided by the respective beneficial owners and filings with the SEC made pursuant to the 1934 Act. For purposes of this table, pursuant to rules promulgated under the 1934 Act, an individual is considered to beneficially own shares of Common Stock if he or she directly or indirectly has or shares (1) voting power, which includes the power to vote or to direct the voting of the shares, or (2) investment power, which includes the power to dispose or direct the disposition of the shares. Unless otherwise indicated, an individual has sole voting power and sole investment power with respect to the indicated shares.

(Footnotes continued on following page)

7

- (2)

- The First Federal Bancshares of Arkansas, Inc. Employee Stock Ownership Trust ("Trust") was established pursuant to the First Federal Bancshares of Arkansas, Inc. Employee Stock Ownership Plan ("ESOP") by an agreement between the Bank and Messrs. Brandt and Richardson and Mrs. Billings, directors and/or officers of the Company and the Bank, who act as trustees of the plan ("Trustees"). As of the Voting Record Date, 253,168 shares held in the Trust had been allocated to the accounts of participating employees. The Trustees must vote the allocated shares held in the ESOP in accordance with the instructions of the participating employees. Under the terms of the ESOP, unallocated shares held in the ESOP will be voted by the ESOP Trustees in the same proportion for and against proposals to stockholders of the Company as participating employees actually vote shares of Common Stock which have been allocated to their accounts. The amount of Common Stock beneficially owned by directors who serve as trustees of the ESOP and by all directors and executive officers as a group does not include the unallocated shares held by the Trust.

- (3)

- Based on filings made with the SEC as of December 31, 2002.

- (4)

- Includes 30,099 shares held jointly with Mr. Brandt's spouse, 1,800 shares held jointly with Mr. Brandt's children, 31,000 shares held individually by Mr. Brandt's spouse, 5,025 shares held in a limited liability corporation of which Mr. Brandt's spouse has a 12.0% ownership interest, 12,678 shares held in Mr. Brandt's account in the ESOP, and 51,538 shares which may be acquired pursuant to the exercise of stock options exercisable within 60 days of the Voting Record Date.

- (5)

- Includes 15,308 shares held jointly with Mr. Hammerschmidt's spouse, 2,500 shares held by a company owned by Mr. Hammerschmidt, and 25,769 shares which may be acquired pursuant to the exercise of stock options exercisable within 60 days of the Voting Record Date.

- (6)

- Includes 15,000 shares held jointly with Mr. Heuer's children, and 25,769 shares which may be acquired pursuant to the exercise of stock options exercisable within 60 days of the Voting Record Date.

- (7)

- Includes 1,380 shares held jointly with Mr. Savells' spouse and 4,989 shares held by Mr. Savells' spouse as custodian for their children.

- (8)

- Includes 800 shares held jointly with Mr. Brandt's father, 3,963 shares held in Mr. Brandt's account in the ESOP, and 3,000 shares which may be acquired pursuant to the exercise of stock options exercisable within 60 days of the Voting Record Date.

- (9)

- Includes 14,491 shares held jointly with Mr. Richardson's spouse, 11,289 shares held in Mr. Richardson's account in the ESOP, and 51,538 shares which may be acquired pursuant to the exercise of stock options exercisable within 60 days of the Voting Record Date.

- (10)

- Includes 15,916 shares held jointly with Mrs. Billings' spouse, 1,000 shares held individually by Mrs. Billings' spouse, 1,000 shares held jointly with Mrs. Billings' children, 11,255 shares held in Mrs. Billings' account in the ESOP, and 51,538 shares which may be acquired pursuant to the exercise of stock options exercisable within 60 days of the Voting Record Date.

- (11)

- Includes 6,674 shares held in Mr. Mallioux's account in the ESOP, and 25,769 shares which may be acquired pursuant to the exercise of stock options exercisable within 60 days of the Voting Record Date.

- (12)

- Includes 51,369 shares allocated to the accounts of executive officers as a group in the ESOP and 253,690 shares which may be acquired by all directors and executive officers as a group upon the exercise of stock options exercisable within 60 days of the Voting Record Date.

8

Equity-Based Compensation Plans

The Company adopted a Stock Option Plan and a Management Recognition and Retention Plan in 1997. Stockholders of the Company approved both compensation plans.

Set forth below is certain information as of December 31, 2002 regarding equity-based compensation plans for directors and officers of the Company.

| | Number of securities to

be issued upon exercise

of outstanding options

| | Weighted average

exercise price

| | Number of securities

remaining available

for future issuance

|

|---|

| Equity Compensation Plans Approved by Security Holders: | | | | | | | |

| | Management Recognition and Retention Plan | | N/A | | | N/A | | 10,306 |

| | Stock Option Plan | | 491,265 | | $ | 19.41 | | 2,210 |

| | Equity Compensation Plans Not Approved by Security Holders | | — | | | — | | — |

| | |

| |

| |

|

| Total | | 491,265 | | $ | 19.41 | | 12,516 |

| | |

| |

| |

|

9

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth a summary of certain information concerning the compensation paid by the Bank for services rendered in all capacities during the years ended December 31, 2002, 2001 and 2000 to the Chief Executive Officer of the Bank and the other executive officers of the Bank whose total compensation during the year exceeded $100,000.

| |

| | Annual Compensation

| | Long Term Compensation

| |

|

|---|

| |

| |

| |

| |

| | Awards

| | Payouts

| |

|

|---|

Name and

Principal Position

| | Year

| | Salary(1)

| | Bonus

| | Other Annual

Compensation(2)

| | Stock

Grants

| | Number of

Options

| | LTIP

Payouts

| | All Other

Compensation(3)

|

|---|

Larry J. Brandt

Chief Executive

Officer and President | | 2002

2001

2000 | | $

$

$ | 284,400

258,780

258,780 | | $

$

$ | 25,368

18,265

16,743 | | $

| —

—

— | | —

—

— | | —

—

— | | —

—

— | | $

$

$ | 42,545

40,204

34,067 |

Tommy W. Richardson

Executive Vice President and Chief Operating Officer |

|

2002

2001

2000 |

|

$

$

$ |

169,200

132,000

108,600 |

|

$

$

$ |

15,221

13,191

17,250 |

|

$

|

—

—

— |

|

—

—

— |

|

—

—

— |

|

—

—

— |

|

$

$

$ |

37,553

38,640

33,054 |

Sherri R. Billings

Executive Vice President and Chief Financial Officer |

|

2002

2001

2000 |

|

$

$

$ |

150,000

126,000

108,000 |

|

$

$

$ |

14,713

12,177

10,147 |

|

$

|

—

—

— |

|

—

—

— |

|

—

—

— |

|

—

—

— |

|

$

$

$ |

36,943

38,614

33,045 |

Ross Mallioux

Executive Vice President and Chief Lending Officer |

|

2002

2001

2000 |

|

$

$

$ |

126,000

102,000

90,000 |

|

$

$

$ |

13,191

10,147

7,103 |

|

$

|

—

—

— |

|

—

—

— |

|

—

—

— |

|

—

—

— |

|

$

$

$ |

28,196

23,966

18,829 |

- (1)

- Includes director's fees from the Company and the Bank with respect to Mr. Brandt. Also includes fees for Mr. Richardson for acting as Secretary.

- (2)

- Does not include amounts attributable to miscellaneous benefits received by the named executive officers. In the opinion of management of the Company, the costs to the Company of providing such benefits to the named executive officer during the indicated periods did not exceed the lesser of $50,000 or 10% of the total of annual salary and bonus reported for the individual.

- (3)

- Consists of amounts allocated pursuant to the ESOP based on the market price per share on the allocation date of December 31, 2002, 2001, and 2000.

Directors' Fees

Members of the Board of Directors of the Bank receive $1,300 per month. The Chairman of the Board receives an additional $200 per month for serving in such capacity. Directors receive the normal monthly payment regardless of attendance. Members of the Board serving on committees do not receive any additional compensation for serving on such committees. Members of the Board of Directors of the Company receive $500 per month. The Chairman of the Board receives an additional $100 per month for serving in such capacity.

Employment Agreements

Currently, the Company and the Bank (the "Employers") have an employment agreement with Larry J. Brandt, the Company's and the Bank's Chief Executive Officer and President, Tommy W. Richardson, the Company's and the Bank's Executive Vice President and Chief Operating Officer, and Sherri R. Billings, the Company's and the Bank's Executive Vice President and Chief Financial Officer, (the "Executives"). The Employers have agreed to employ the Executives for a term of three years, in each case in their current respective positions. The employment agreements are reviewed annually by the Boards of Directors of the Employers, and the term of the Executives' employment agreements are extended each year for a successive additional one-year period upon approval of the Employers' Board

10

of Directors, unless either party elects, not less than 30 days prior to the annual anniversary date, not to extend the employment term.

Each of the employment agreements are terminable with or without cause by the Employers. The officer has no right to compensation or other benefits pursuant to the employment agreement for any period after voluntary termination or termination by the Employers for cause, disability or retirement. The agreements provide for certain benefits in the event of the Executives' death. In the event that (i) the officer terminates his employment because of failure of the Employers to comply with any material provision of the employment agreement or the Employers change the officers' title or duties or (ii) the employment agreement is terminated by the Employers other than for cause, disability, retirement or death or by the officer as a result of certain adverse actions which are taken with respect to the officer's employment following a change in control of the Company, as defined below, the officer will be entitled to a cash severance amount equal to 3.0 times the officer's average annual compensation, as defined in the Agreement, over the most recent five taxable years.

A change in control is generally defined in the employment agreements to include any change in control of the Company required to be reported under the federal securities laws, as well as (i) the acquisition by any person of 25% or more of the Company's outstanding voting securities and (ii) a change in a majority of the directors of the Company during any two-year period without the approval of at least two-thirds of the persons who were directors of the Company at the beginning of such period.

Each employment agreement provides that in the event that any of the payments to be made thereunder or otherwise upon termination of employment are deemed to constitute "excess parachute payments" within the meaning of Section 280G of the Internal Revenue Code of 1986, as amended (the "Code"), then such payments and benefits received thereunder shall be reduced, in the manner determined by the Executive, by the amount, if any, which is the minimum necessary to result in no portion of the payments and benefits being non-deductible by the Employers for federal income tax purposes. Excess parachute payments generally are payments in excess of three times the recipient's average annual compensation from the employer includable in the recipient's gross income during the most recent five taxable years ending before the date on which a change in control of the employer occurred. Recipients of excess parachute payments are subject to a 20% excise tax on the amount by which such payments exceed the base amount, in addition to regular income taxes, and payments in excess of the base amount are not deductible by the employer as compensation expense for federal income tax purposes.

Although the above-described employment agreements could increase the cost of any acquisition of control of the Company, management of the Company does not believe that the terms thereof would have a significant anti-takeover effect.

Change in Control Agreement

The Company and the Bank entered into a change in control severance agreement with Ross Mallioux, the Bank's Executive Vice President and Chief Lending Officer.

The agreement provides for a three-year term, and subject to satisfactory performance reviews, shall extend on each anniversary date for an additional year so that the remaining term will be three years, unless the Board of Directors of the Bank or the executive provides contrary written notice to the other not less than 30 days in advance of such anniversary date. The agreement provides for payments in the event that certain adverse actions are taken with respect to the executive's employment subsequent to a change in control in an amount equal to three times the executive's annual compensation, as defined.

11

Benefits

Retirement Plan. The Bank has a defined benefit pension plan ("Retirement Plan") for all full time employees who have attained the age of 21 years and have completed one year of service with the Bank. In general, the Retirement Plan provides for annual benefits payable monthly upon retirement at age 65 in an amount equal to 1.5% of an employee's career average annual salary during benefit service ("Career Average Compensation") multiplied by his number of years of service. The Retirement Plan benefit percent of salary was reduced from 2% to 1.5% during the year 2001. Retirement benefits were based on an employee's average annual salary for the five consecutive years of highest salary during benefit service prior to February 2001. Under the Retirement Plan, an employee's benefits are fully vested after five years of service. A year of service is any year in which an employee works a minimum of 1,000 hours. Members who have reached age 65 are automatically 100% vested, regardless of completed years of employment. The Retirement Plan also provides for an early retirement option with reduced benefits. The Retirement Plan also provides for death benefits depending on the age of the participant and the years of service. Death benefits are paid in a lump sum distribution. For the year ended December 31, 2002, net pension expense was approximately $108,000.

The following table illustrates annual pension benefits for retirement at age 65 under various levels of compensation and years of service. The figures in the table assume that the Retirement Plan continues in its present form and that the participants elect a straight life annuity form of benefit with a twelve year certain death benefit.

Career Average

Compensation

| | 15 Years of

Service

| | 20 Years of

Service

| | 25 Years of

Service

| | 30 Years of

Service

| | 35 Years of

Service

|

|---|

| $ | 80,000 | | $ | 18,000 | | $ | 24,000 | | $ | 30,000 | | $ | 36,000 | | $ | 42,000 |

| | 90,000 | | | 20,250 | | | 27,000 | | | 33,750 | | | 40,500 | | | 47,250 |

| | 100,000 | | | 22,500 | | | 30,000 | | | 37,500 | | | 45,000 | | | 52,500 |

| | 110,000 | | | 24,750 | | | 33,000 | | | 41,250 | | | 49,500 | | | 57,750 |

| | 120,000 | | | 27,000 | | | 36,000 | | | 45,000 | | | 54,000 | | | 63,000 |

| | 140,000 | | | 31,500 | | | 42,000 | | | 52,500 | | | 63,000 | | | 73,500 |

| | 160,000 | | | 36,000 | | | 48,000 | | | 60,000 | | | 72,000 | | | 84,000 |

| | 180,000 | | | 40,500 | | | 54,000 | | | 67,500 | | | 81,000 | | | 94,500 |

| | 200,000 | | | 45,000 | | | 60,000 | | | 75,000 | | | 90,000 | | | 105,000 |

| | 220,000 | | | 49,500 | | | 66,000 | | | 82,500 | | | 99,000 | | | 115,500 |

The maximum annual compensation which may be taken into account under the Code (as adjusted from time to time by the Internal Revenue Service) for calculating contributions under qualified defined benefit plans currently is $200,000 and the maximum annual benefit permitted under such plans currently is $145,455.

At December 31, 2002, Messrs. Brandt, Richardson, Mallioux and Mrs. Billings had 29, 18, 18, and 21 years, respectively, of credited service under the Retirement Plan.

Stock Options

The following table sets forth certain information concerning exercises of stock options by the named executive officers during the year ended December 31, 2002 and stock options held at December 31, 2002.

12

Aggregated Option Exercise in Last Fiscal Year

and Year End Option Values

| |

| |

| | Number of Unexercised

Options at Year End

| | Value of Unexercised

Options at Year End(1)

|

|---|

Name

| | Shares

Acquired on

Exercise

| | Value

Realized

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Larry J. Brandt | | — | | — | | 51,538 | | — | | $ | 316,959 | | $ | — |

| Tommy Richardson | | — | | — | | 51,538 | | — | | $ | 316,959 | | $ | — |

| Sherri R. Billings | | — | | — | | 51,538 | | — | | $ | 316,959 | | $ | — |

| Ross Mallioux | | — | | — | | 25,769 | | — | | $ | 158,479 | | $ | — |

- (1)

- Based on a per share market price of $25.40 at December 31, 2002 and an exercise price of $19.25.

Transactions With Certain Related Persons

The Bank's policy provides that all loans made by the Bank to its directors and officers and their immediate families and related business interests are made in the ordinary course of business, on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with other persons. The Bank's policy provides that such loans may not involve more than the normal risk of collectibility or present other unfavorable features. All such loans were made by the Bank in accordance with the aforementioned policy.

Compensation Committee Interlocks and Insider Participation

The Compensation Committee of the Board of Directors of the Bank determines the salary and bonus of the Bank's Chief Executive Officer. The Committee also reviews and approves the salaries and bonuses for the Bank's other officers and employees as prepared and submitted to the Committee by the Bank's senior executive officers. During 2002, the members of the committee were Messrs. Hammerschmidt (Chairman), Heuer and Savells. No member of the Committee was a former or current full-time officer or employee of the Bank or the Company. The Compensation Committee met once during 2002. The report of the Compensation Committee with respect to compensation for the Chief Executive Officer and all other Bank officers and employees for the year ended December 31, 2002 is set forth on the following page.

13

Report of the Compensation Committee

The purpose of the Committee is to assist the Company and the Bank in attracting and retaining qualified management, motivating executives to achieve performance goals as outlined in the Bank's business plan and to ensure that executive compensation is related to and supports the Company's overall objective of enhancing stockholder value.

In order to establish base salary levels and to determine an annual cash bonus for the Bank's Chief Executive Officer, the Compensation Committee considered the financial performance of the Bank, including net income of the Bank and various financial ratios. The Committee also considered the responsibilities related to being a public company. Further, with respect to the Bank's other executive officers, the Committee reviewed and approved the salary increases and bonuses as submitted by the Bank's Chief Executive Officer.

Based upon the above factors, the Committee increased Mr. Brandt's base salary by approximately $18,000 or 6.8% for 2003 and Mr. Brandt was given a cash bonus of $25,368 for his service during 2002.

| | | John P. Hammerschmidt, Chairman

James D. Heuer, Director

Kenneth C. Savells, Director |

Report of the Audit Committee

The Audit Committee has reviewed and discussed the audited financial statements with management. The Audit Committee has discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61 "Communication with Audit Committees," as may be modified or supplemented. The Audit Committee has received the written disclosures and the letter from the independent accountants required by Independence Standards Board Standard No. 1, as may be modified or supplemented, and has discussed with the independent accountant, the independent accountant's independence. Based on the review and discussions referred to above in this report, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company's Annual Report on Form 10-K for the year ended December 31, 2002 for filing with the SEC.

| | | Kenneth C. Savells, Chairman

James D. Heuer, Director

John P. Hammerschmidt, Director |

14

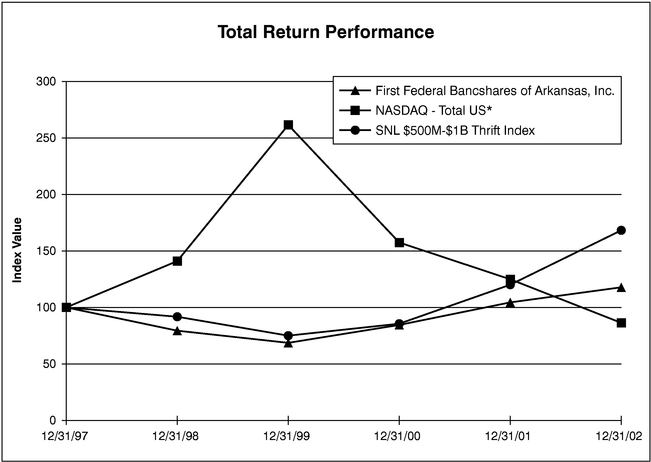

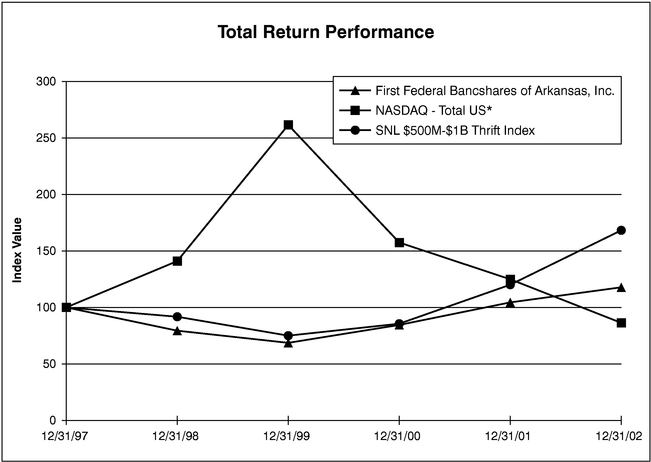

Performance Graph

The following graph demonstrates comparison of the cumulative total returns for the Common Stock of the Company, the SNL Securities $500 million to $1 Billion Thrift Asset Size Index, and the Nasdaq Stock Market Index since the close of trading of the Company's Common Stock on December 31, 1997. The graph represents $100 invested in the Company's Common Stock at $23.75 per share, the closing price per share as of December 31, 1997. The cumulative total returns do include the payment of dividends by the Company.

| | Period Ending

|

|---|

Index

|

|---|

| | 12/31/97

| | 12/31/98

| | 12/31/99

| | 12/31/00

| | 12/31/01

| | 12/31/02

|

|---|

| First Federal Bancshares of Arkansas, Inc. | | 100.00 | | 79.40 | | 68.64 | | 84.48 | | 104.44 | | 117.80 |

| NASDAQ — Total US* | | 100.00 | | 140.99 | | 261.48 | | 157.42 | | 124.89 | | 86.33 |

| SNL $500M-$1B Thrift Index | | 100.00 | | 91.74 | | 75.00 | | 85.58 | | 120.07 | | 168.21 |

- *

- Source: CRSP, Center for Research in Security Prices, Graduate School of Business, The University of Chicago 2003. Used with permission. All rights reserved. crsp.com.

15

RATIFICATION OF APPOINTMENT OF AUDITORS

General

The Board of Directors of the Company has appointed Deloitte & Touche LLP, independent certified public accountants, to perform the audit of the Company's financial statements for the year ending December 31, 2003, and further directed that the selection of auditors be submitted for ratification by the stockholders at the Annual Meeting.

The Company has been advised by Deloitte & Touche LLP that neither that firm nor any of its associates has any relationship with the Company or its subsidiaries other than the usual relationship that exists between independent certified public accountants and clients. Deloitte & Touche LLP will have one or more representatives at the Annual Meeting who will have an opportunity to make a statement, if they so desire, and who will be available to respond to appropriate questions.

Audit Fees

The aggregate fees billed by Deloitte & Touche LLP, the member firms of Deloitte Touche Tohmatsu, and their respective affiliates (collectively, "Deloitte") for professional services rendered for the audit of the Company's annual financial statements for the fiscal year ended December 31, 2002 and for the reviews of the financial statements included in the Company's Quarterly Reports on Form 10-Q for that fiscal year were $197,181.

Financial Information Systems Design and Implementation

Deloitte rendered no professional services relating to financial information systems design and implementation for the fiscal year ended December 31, 2002.

All Other Fees

The aggregate fees billed by Deloitte for services rendered to the Company, other than the services described above under "Audit Fees" and "Financial Information Systems Design and Implementation Fees", for the fiscal year ended December 31, 2002 were $21,360, including audit related services of approximately $10,110 and non-audit services of $11,250. Audit related services generally include fees for the audit of the Company's employee stock ownership plan. Non-audit services consisted of tax services.

The Audit Committee has considered whether the provision of non-audit services is compatible with maintaining the principal accountant's independence.

The Board of Directors recommends that you vote FOR the ratification of the appointment of Deloitte & Touche LLP as independent auditors for the year ending December 31, 2003.

STOCKHOLDER PROPOSALS

Any proposal which a stockholder wishes to have included in the proxy materials of the Company relating to the next annual meeting of stockholders of the Company, which is scheduled to be held in April 2004, must be received at the principal executive offices of the Company, P.O. Box 550, Harrison, Arkansas 72602 Attention: Tommy Richardson, Secretary, no later than December 3, 2003. If such proposal is in compliance with all of the requirements of Rule 14a-8 under the 1934 Act, it will be included in the proxy statement and set forth on the form of proxy issued for such annual meeting of stockholders. It is urged that any such proposals be sent by certified mail, return receipt requested.

16

ANNUAL REPORTS

A copy of the Company's Annual Report to Stockholders for the year ended December 31, 2002 accompanies this Proxy Statement. Such annual report is not part of the proxy solicitation materials.

Upon receipt of a written request, the Company will furnish to any stockholder without charge a copy of the Company's Annual Report on Form 10-K for 2002 without exhibits required to be filed under the 1934 Act. Such written requests should be directed to Tommy Richardson, Secretary, First Federal Bancshares of Arkansas, Inc., P.O. Box 550, Harrison, Arkansas 72602. The Form 10-K is not part of the proxy solicitation materials.

OTHER MATTERS

Each proxy solicited hereby also confers discretionary authority on the Board of Directors of the Company to vote the proxy with respect to the election of any person as a director if the nominee is unable to serve or for good cause will not serve, matters incident to the conduct of the meeting, and upon such other matters as may properly come before the Annual Meeting. Management is not aware of any business that may properly come before the Annual Meeting other than the matters described above in this Proxy Statement. However, if any other matters should properly come before the meeting, it is intended that the proxies solicited hereby will be voted with respect to those other matters in accordance with the judgment of the persons voting the proxies.

The cost of the solicitation of proxies will be borne by the Company. The Company will reimburse brokerage firms and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending the proxy materials to the beneficial owners of the Company's Common Stock. In addition to solicitations by mail, directors, officers and employees of the Company may solicit proxies personally or by telephone without additional compensation.

YOUR VOTE IS IMPORTANT! WE URGE YOU TO SIGN AND DATE THE ENCLOSED PROXY CARD AND RETURN IT TODAY IN THE ENCLOSED POSTAGE-PAID ENVELOPE.

17

Appendix A

CHARTER OF THE AUDIT COMMITTEE OF THE BOARDS OF DIRECTORS

OF FIRST FEDERAL BANK OF ARKANSAS, FA

AND FIRST FEDERAL BANCSHARES OF ARKANSAS, INC.

The Audit Committee ("the Committee") is appointed by the Board of Directors of First Federal Bank of Arkansas, FA, ("the Bank") and the Board of Directors of First Federal Bancshares of Arkansas, Inc. ("the Holding Company") to assist the Boards in monitoring 1) the integrity of the financial statements of the Bank consolidated with the Holding Company, 2) the external audit firm's qualifications and independence, 3) the performance of the internal audit function and external auditors and 4) the compliance by the Bank and the Holding Company with legal and regulatory requirements. The Committee will operate and conduct its affairs based upon the following guidelines:

Composition:

The Committee will at all times consist of at least three independent members of the Board of Directors of First Federal Bancshares of Arkansas, FA. These members will not be actively involved in the day-to-day management of the institution nor will they be employees of the Bank or the Holding Company. Family relationships with employees of the Bank, lending relationships with the Bank and percentage ownership of the Holding Company should also be considered to ensure the Committee can function in an independent manner. These standards shall also be in conformity with standards set by the SEC, the Nasdaq Stock Market, Inc. and other regulatory bodies.

The Committee will elect one of its members to serve as Chairperson of the Committee until such time as any change is made in the members on the Committee or until specific action on the part of the Committee changes such designation. In addition, one member of the Committee must meet the then current accounting or related financial expertise standard of the Nasdaq Stock Market, Inc. Any time there is a change in the membership of the Committee, the existing Chairperson will be reappointed by the Committee or a new Chairperson will be elected. This Director will preside over the meetings of the Committee and serve as the primary contact person for the Director of Internal Audit and the External Audit Firm.

Governance Responsibilities:

The primary function of the Committee is to assist the Boards of Directors in fulfilling their oversight responsibilities by:

- 1)

- Reviewing and assessing the adequacy of this charter on at least an annual basis and making recommendation to the full Boards for approval of any proposed changes.

- 2)

- Managing both the internal and external audit process:

- 2.1

- External—

- The Committee will be responsible for ensuring the external auditor's independence from the Bank and the Holding Company. This will be accomplished by 1) reviewing and confirming the external audit firm's letter of independence in conformity with IASB Statement #1 and 2) review and approval of all non-audit related services to be provided by the external auditors and the fees related to the rendering of those services prior to those services being rendered. The external audit firm will report on all engagements performed on behalf of the Bank and the Holding Company directly to the Audit Committee.

A-1

- In addition, the Committee will review and evaluate the external audit firm's lead partner as well as the firm's internal quality control procedures. At least annually, the Committee will also obtain and review the audit firm's most recent internal or peer review report of its adherence to industry standard quality practices and procedures.

- 2.2

- Internal—

- This will include overseeing and administering the internal audit function of the Bank and the Holding Company. In order to maintain the independence of the internal audit function, the Committee will have sole discretion over the employment matters of the Director of Internal Audit and will manage the Internal Audit Plan of the Bank and Holding Company. The Committee will meet with the Director of Internal Audit on a regular basis and will make a report to the full Boards of Directors of any significant findings reported to the Committee.

- 3)

- Establishing procedures for the receipt, retention and confidential treatment of complaints received by the Bank or the Holding Company regarding accounting, internal accounting controls or auditing matters and the confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters. These procedures will be communicated to all employees on at least an annual basis.

- 4)

- Approving all related party transactions prior to consummation. A related party is any person or entity who can exercise control or significant influence over another party, to the extent that one of the parties may be prevented from pursuing its own separate interests.

- 5)

- Discussing with the external auditors the matters required to be discussed by Statement of Auditing Standards No. 61 (as amended) relating to the conduct of the annual financial statement audit.

- 6)

- Recommending to the Boards policies for the hiring of employees or former employees of the Holding Company's external audit firm who participated in any capacity in the audit of the Holding Company's financial statements.

- 7)

- Advising the Boards with respect to the Bank's policies and procedures regarding compliance with applicable laws and regulations and with the Bank's and Holding Company's Codes of Conduct.

Financial Reporting Integrity:

- 1)

- It will be the responsibility of this Committee to lead in the selection of and for the engagement of a qualified, independent, external auditing firm to examine the accounting and operating records of the institution for the purpose of expressing an opinion on the annual financial statements of the Bank consolidated with the Holding Company. The Committee will confer with appropriate representatives of the external audit firm on at least a quarterly basis and will make a report to the full Boards of Directors of any significant findings reported to the Committee.

- 2)

- The Committee may also meet with Executive Management, the Chief Financial Officer, the Treasurer, Compliance Officers, External Auditors and the Director of Internal Audit on an as needed basis.

- 3)

- The Committee will review the Bank's and Holding Company's financial information, including discussing the results of the external auditor's review of the quarterly financial statements, quarterly press release and any other information which will be provided to the shareholders and others as well as the financial and reporting process in general. Annually, the Committee will review and discuss with the external auditors and the appropriate levels of

A-2

Management, as needed, the annual audited financial statements, including disclosures made in Management's Discussion and Analysis, and recommend to the Boards whether the audited financial statements should be included in the Holding Company's Form 10-K.

- 4)

- The Committee will monitor the ongoing review of the Bank's and Holding Company's systems of internal controls to ensure an adequate internal control structure is in place and functioning properly within the various operating systems of the Bank and the Holding Company.

- 5)

- The Committee will discuss with Management and the external auditors significant financial reporting issues and judgments made in connection with the preparation of the Holding Company's consolidated financial statements, including any significant change in the selection or application of accounting principles, any major issues as to the adequacy of internal controls and any special steps adopted in light of any identified material control deficiencies.

- 6)

- The Committee will review and discuss with the external auditors any written communications between the audit firm and the Bank or Holding Company, such as any Management Letter or schedule of unadjusted differences. The aggregate of all unposted audit adjustments will be reviewed by the Committee and discussed with the external auditors.

- 7)

- The Committee will have the authority, to the extent it deems necessary or appropriate, to retain independent legal, accounting or other advisors. The Bank or the Holding Company will provide appropriate funding, as determined by the Committee, for payment or compensation to the external audit firm for the purpose of rendering or issuing an audit report or to any advisor employed by the Committee.

Limitation Of The Audit Committee's Role

While the Audit Committee has the responsibilities and powers as set forth in this Charter, it is not the duty of the Committee to plan or conduct audits or to determine that the Holding Company's financial statements and disclosures are complete, accurate and in accordance with generally accepted accounting principles and applicable rules and regulations. These are the responsibilities of Management and the external audit firm.

A-3

REVOCABLE PROXY

FIRST FEDERAL BANCSHARES OF ARKANSAS, INC.

- ý

- PLEASE MARK VOTES

AS IN THIS EXAMPLE

| | | | | | |

For | | With-

hold | | For All

Except |

| THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS OF FIRST FEDERAL BANCSHARES OF | | 1. | | ELECTION OF DIRECTORS | | o | | o | | o |

| ARKANSAS, INC. ("COMPANY") FOR USE AT THE ANNUAL | | | | Nominees for a three-year term: | | John P. Hammerschmidt |

| MEETING OF STOCKHOLDERS TO BE HELD ON APRIL 30, | | | | | | Jeffrey L. Brandt |

| 2003 AND AT ANY ADJOURNMENT THEREOF. | | | | | | | | | | |

The undersigned, being a stockholder of the Company as of March 20, 2003, hereby authorizes the Board of Directors of the Company or any successors thereto as proxies with full powers of substitution, to represent the undersigned at the Annual Meeting of Stockholders of the Company to be held at First Federal Bank, 1401 Highway 62-65 North, Harrison, Arkansas 72601, on Wednesday, April 30, 2003 at 10:00 a.m., Central Time, and at any adjournment of said meeting, and thereat to act with respect to all votes that the undersigned would be entitled to cast, if then personally present, as follows: |

|

INSTRUCTION: To withhold authority to vote for any Individual nominee, mark "For All Except" and write that nominee's name in the space provided below.

|

| | | 2. | | PROPOSAL to ratify the appointment by the Board of Directors of Deloitte & Touche LLP as the Company's independent auditors for the year ending December 31, 2003. | | For

o | | Against

o | | Abstain

o |

|

|

In their discretion, the proxies are authorized to vote with respect to approval of the minutes of the last meeting of stockholders, the election of any person as a director if the nominee is unable to serve or for good cause will not serve, matters incident to the conduct of the meeting, and upon such other matters as may properly come before the meeting. |

|

|

Date |

|

|

| Please be sure to sign and date this Proxy in the box below | | | | |

| | |

|

|

|

|

|

| | |

| Stockholder sign above Co-holder (if any) sign above | | |

/*\Detach above card, sign, date and mail in postage paid envelope provided. /*\

FIRST FEDERAL BANCSHARES OF ARKANSAS, INC.

|

The Board of Directors recommends that you voteFOR the Board of Directors' nominees listed above andFOR Proposal 2. Shares of common stock of the Company will be voted as specified.If no specification is made, shares will be voted for the election of the Board of Directors' nominees to the Board of Directors and for Proposal 2 and otherwise at the discretion of the proxies.This proxy may not be voted for any person who is not a nominee of the Board of Directors of the Company.This proxy may be revoked at any time before it is exercised.

The above signed hereby acknowledges receipt of the Notice of the Annual Meeting of Stockholders of First Federal Bancshares of Arkansas, Inc. called for April 30, 2003, a Proxy Statement for the Annual Meeting and the 2002 Annual Report to Stockholders.

Please sign exactly as your name(s) appear(s) on this proxy card. Only one signature is required in the case of a joint account. When signing in a representative capacity, please give title. |

PLEASE ACT PROMPTLY

SIGN, DATE & MAIL YOUR PROXY CARD TODAY |

|

IF YOUR ADDRESS HAS CHANGED, PLEASE CORRECT THE ADDRESS IN THE SPACE PROVIDED BELOW AND RETURN THIS PORTION WITH THE PROXY IN THE ENVELOPE PROVIDED.

QuickLinks

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS To Be Held on April 30, 2003VOTINGINFORMATION WITH RESPECT TO NOMINEES FOR DIRECTORS AND EXECUTIVE OFFICERSSECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCEBENEFICIAL OWNERSHIP OF COMMON STOCK BY CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERSEXECUTIVE COMPENSATIONRATIFICATION OF APPOINTMENT OF AUDITORSSTOCKHOLDER PROPOSALSANNUAL REPORTSOTHER MATTERSCHARTER OF THE AUDIT COMMITTEE OF THE BOARDS OF DIRECTORS OF FIRST FEDERAL BANK OF ARKANSAS, FA AND FIRST FEDERAL BANCSHARES OF ARKANSAS, INC.