| |

UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

|

SCHEDULE 14A |

|

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. ) |

|

Filed by the Registrant☒ |

|

Filed by a Party other than the Registrant☐ |

|

Check the appropriate box: |

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to §240.14a-12 |

Bear State Financial, Inc. |

(Name of Registrant as Specified In Its Charter) |

|

Not Applicable |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

☒ | No fee required. |

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

☐ | Fee paid previously with preliminary materials. |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held on May 29, 2015

Dear Shareholder:

You are cordially invited to attend the 2015 Annual Meeting of Shareholders (the “Annual Meeting”) of Bear State Financial, Inc. (the “Company”), to be held at the Company’s office located at 1401 Highway 62-65 North, Harrison, Arkansas 72601, on Friday, May 29, 2015 at 11:00 a.m., Central Time, for the following purposes, all of which are discussed in greater detail in the accompanying proxy statement:

| | (1) | To elect up to nine director nominees named in the accompanying proxy statement to the Company’s Board of Directors; |

| (2) | To ratify the appointment of BKD, LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2015; and |

| (3) | To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

On April 1, 2015, we lost our friend, colleague and long-time supporter, John Paul Hammerschmidt. John Paul served as a director of the Company since 1996 and served as a director of Bear State Bank, N.A. and its predecessor, First Federal Bank, since 1966. John Paul was a valued member of our board and we will miss his presence in the boardroom.

The Board of Directors has fixed April 9, 2015 as the record date for the determination of shareholders entitled to receive notice of and to vote at the Annual Meeting. Only those shareholders of record as of the close of business on that date will be entitled to vote at the Annual Meeting.

The Company’s proxy statement and a form of proxy card are included with this Notice. The Annual Report on Form 10-K for the year ended December 31, 2014 is also enclosed.

| BY ORDER OF THE BOARD OF DIRECTORS |

| | |

| /s/ Richard N. Massey |

| Richard N. Massey |

| Chairman of the Board |

Little Rock, Arkansas

April 27, 2015

IMPORTANT

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON May 29, 2015: The Company’s Proxy Statement for this Annual Meeting of Shareholders and Annual Report on Form 10-K for the year ended December 31, 2014 are available over the Internet atwww.edocumentview.com/bsf.

YOU ARE CORDIALLY INVITED TO ATTEND THE ANNUAL MEETING. IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED REGARDLESS OF THE NUMBER YOU OWN. EVEN IF YOU PLAN TO BE PRESENT, YOU ARE URGED TO COMPLETE, SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD PROMPTLY IN THE ENVELOPE PROVIDED. IF YOU ARE THE RECORD OWNER OF YOUR SHARES AND YOU ATTEND THE MEETING, YOU MAY VOTE EITHER IN PERSON OR BY PROXY. IF YOUR SHARES ARE HELD BY A BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO VOTE AT THE MEETING IN PERSON, YOU MUST OBTAIN FROM THE RECORD HOLDER OF YOUR SHARES AND BRING WITH YOU A PROXY FROM THE RECORD HOLDER ISSUED IN YOUR NAME.

TABLE OF CONTENTS

| Page |

| |

ABOUT THE ANNUAL MEETING OF SHAREHOLDERS | 1 |

What is the purpose of the Annual Meeting? | 1 |

Who is entitled to vote? | 1 |

Can I access the Company’s proxy materials and annual report electronically? | 1 |

How do I vote? | 1 |

If my shares are held in street name by my broker, can my broker vote my shares without instructions from me? | 2 |

Can I attend the meeting and vote my shares in person? | 2 |

Can I change my vote or revoke my proxy after I return my proxy card? | 2 |

What constitutes a quorum? | 2 |

What are the Board of Directors’ recommendations? | 2 |

What vote is required to approve each item? | 3 |

Will abstentions and broker “non-votes” have an impact on the proposals contained in this proxy statement? | 3 |

Who pays the cost for soliciting proxies by the Board of Directors? | 3 |

Who is Bear State Financial Holdings, LLC? | 3 |

ITEM 1 - ELECTION OF DIRECTORS | 4 |

Director Nominees | 4 |

Vote Required | 4 |

Board Recommendation | 5 |

INFORMATION REGARDING THE BOARD AND ITS COMMITTEES | 5 |

Director Nominees | 5 |

Director Independence and “Controlled Company” | 7 |

Shareholder Nominations | 8 |

Directors’ Attendance at Annual Meetings | 8 |

Board Leadership Structure and Role in Risk Oversight | 8 |

Committees and Meetings of the Board of Directors of the Company | 9 |

EXECUTIVE OFFICERS OF THE COMPANY | 11 |

CODE OF ETHICS FOR EXECUTIVE OFFICERS AND FINANCIAL PROFESSIONALS | 12 |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | 12 |

BENEFICIAL OWNERSHIP OF COMMON STOCK BY CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED SHAREHOLDER MATTERS | 13 |

TRANSACTIONS WITH CERTAIN RELATED PERSONS | 14 |

REPORT OF THE AUDIT COMMITTEE | 15 |

ITEM 2 - RATIFICATION OF APPOINTMENT OF AUDITORS | 16 |

Accounting Fees and Services | 16 |

Vote Required | 16 |

Board Recommendation | 16 |

EXECUTIVE COMPENSATION | 17 |

Summary Compensation Table | 17 |

Outstanding Equity Awards At Fiscal Year-End | 18 |

401(k) Plan | 19 |

Director Compensation | 19 |

SHAREHOLDER PROPOSALS | 20 |

SHAREHOLDER COMMUNICATIONS WITH THE BOARD OF DIRECTORS | 20 |

ANNUAL REPORT | 20 |

OTHER MATTERS | 21 |

PROXYSTATEMENT FOR THE 2015ANNUAL MEETING OF SHAREHOLDERS

MAY 29, 2015

This proxy statement is being furnished to holders of common stock, $.01 par value per share, of Bear State Financial, Inc. (the “Company”), the holding company of Bear State Bank, N.A. (the “Bank”). Proxies are being solicited on behalf of the Board of Directors of the Company (the “Board”) to be used at the Annual Meeting of Shareholders (the “Annual Meeting”) to be held at the Company’s office located at 1401 Highway 62-65 North, Harrison, Arkansas 72601, on May 29, 2015 at 11:00 a.m., Central Time, for the purposes set forth in the Notice of Annual Meeting of Shareholders. The Company intends to deliver copies of the proxy materials for the Annual Meeting to shareholders on or about April 27, 2015.

ABOUT THE ANNUAL MEETING OF SHAREHOLDERS

What is the purpose of the Annual Meeting?

At the Annual Meeting, shareholders will consider and vote on: (i) the election of directors, (ii) the ratification of our independent registered public accounting firm, and (iii) such other business as may properly come before the meeting or any adjournment or postponement thereof.

Who is entitled to vote?

Only our shareholders of record at the close of business on the record date for the meeting, April 9, 2015, are entitled to vote at the Annual Meeting. On the record date, we had 33,375,753 shares of common stock issued and outstanding.

Can I access the Company’s proxy materials and annual report electronically?

Yes. This proxy statement and our annual report on Form 10-K for the year ended December 31, 2014 are available online at www.edocumentview.com/bsf.

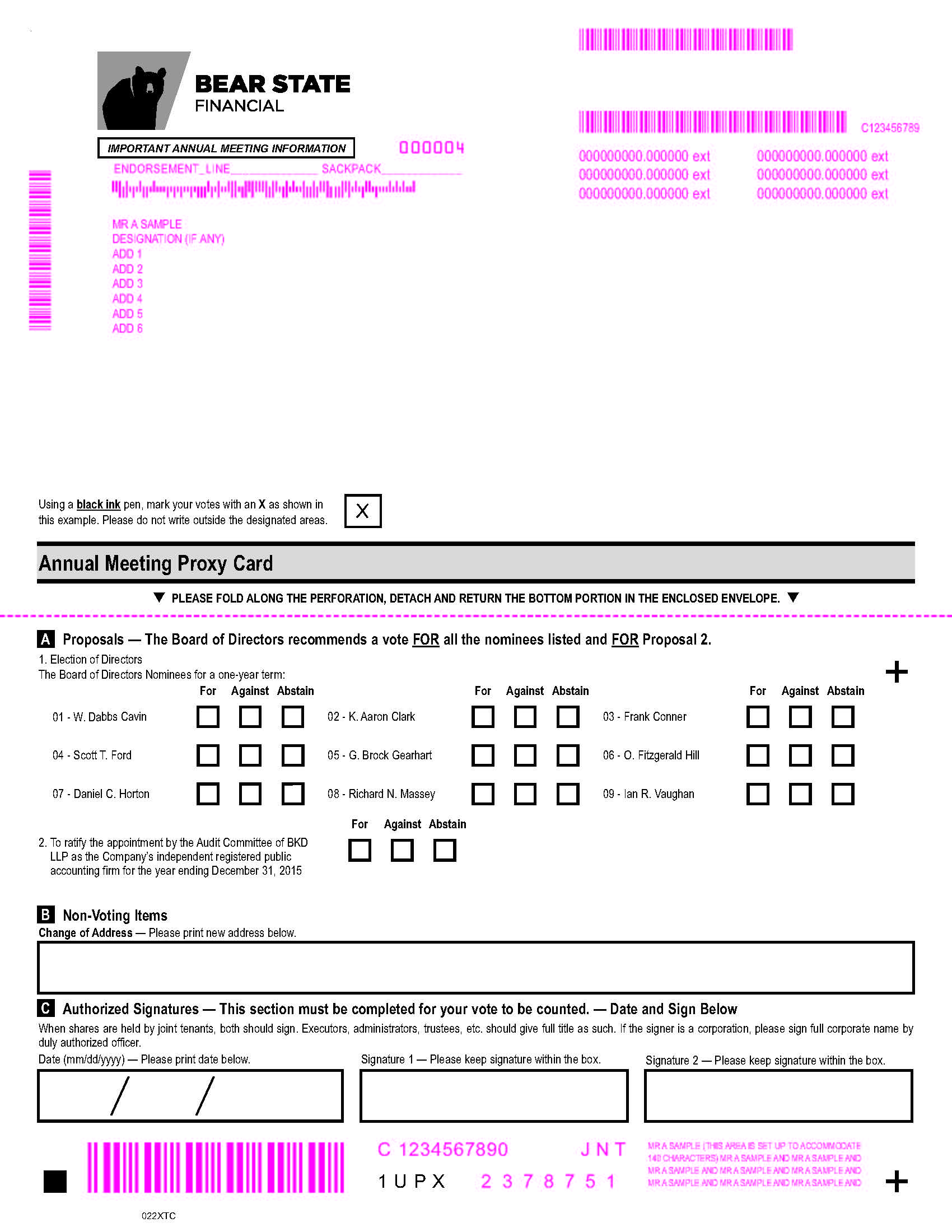

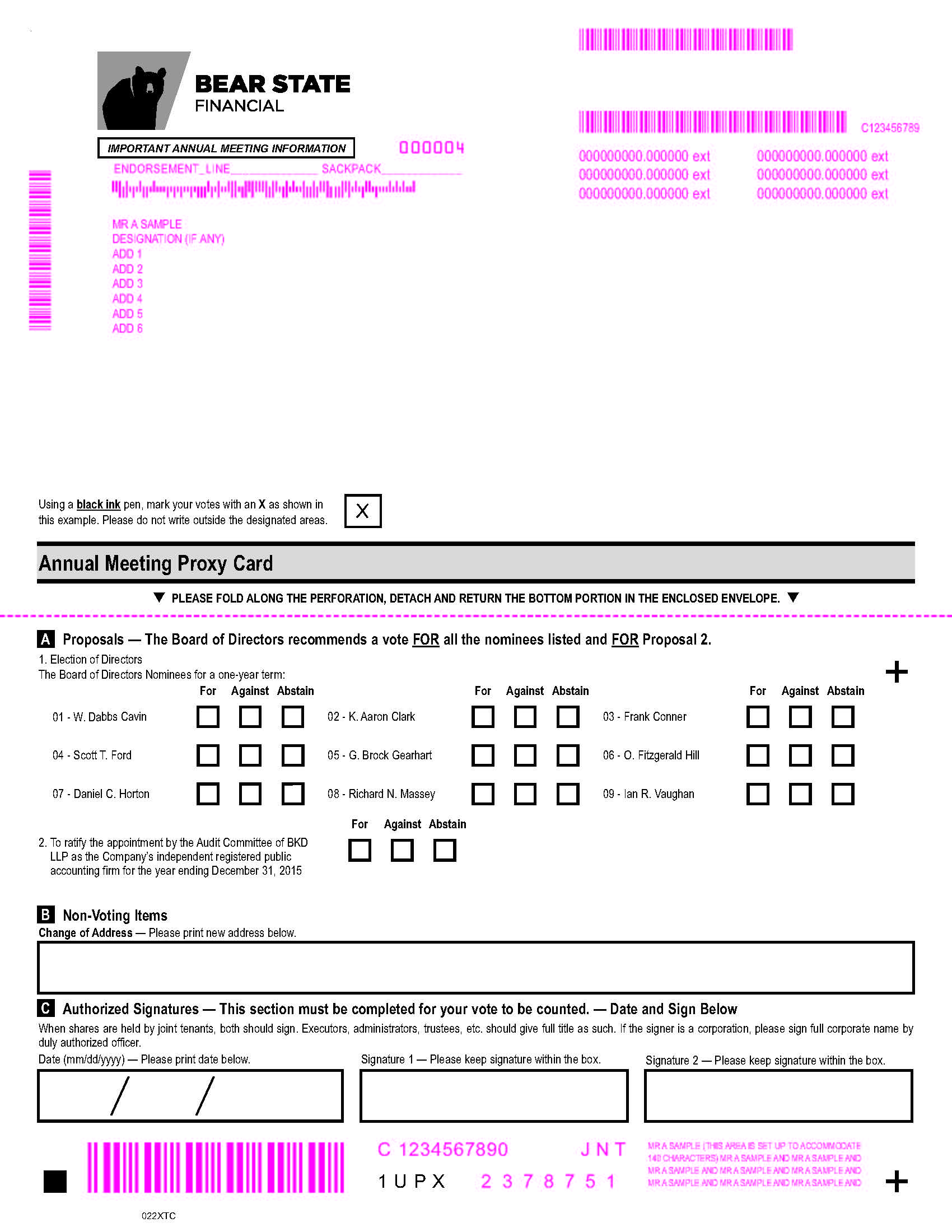

How do I vote?

If your shares are registered in your name, meaning you are the record holder of your shares, you may vote in person at the Annual Meeting or by proxy without attending the meeting. Record holders may mark, sign, date, and mail the proxy card you received from the Company in the return envelope provided. If you vote by submitting a proxy card, your shares will be voted at the Annual Meeting in accordance with your instructions. If you sign and return the proxy card but do not give any instructions on some or all of the proposals, your shares will be voted by the persons named in the proxy card on all uninstructed proposals in accordance with the recommendations of the Board of Directors given below.

Proxies solicited hereby may be exercised only at the Annual Meeting and any adjournment or postponement of the Annual Meeting and will not be used for any other meeting.

If your shares are held in “street name” by a bank, broker, custodian or other nominee, such bank, broker, custodian or other nominee is deemed the record holder of your shares. If you wish to vote in person at the meeting, you must obtain from your bank, broker, custodian or other nominee, and bring with you to the meeting, a proxy from such record holder issued in your name. If you do not plan to vote in person at the Annual Meeting, please mark, date, sign, and return the voting instruction form you received from your bank, broker, custodian or other nominee with this proxy statement. As indicated on the form or other documentation provided by your bank, broker, custodian or other nominee, you may have the choice of voting your shares over the Internet or by telephone as instructed by your bank, broker, custodian or other nominee. To do so, follow the instructions on the form you received from your bank, broker, custodian or other nominee.

If my shares are held in street name by my broker, can my broker vote my shares without instructions from me?

Under New York Stock Exchange Rule 452, which governs all brokers (including those holding NASDAQ-listed securities), brokers are entitled to vote shares held by them for their customers on matters deemed “routine” under applicable rules, even though the brokers have not received voting instructions from their customers.

Brokers, however, may not vote on “non-routine” matters on behalf of their clients in the absence of specific voting instructions. A broker “non-vote” occurs when a broker’s customer does not provide the broker with voting instructions on “non-routine” matters for shares owned by the customer but held in the name of the broker. In those instances, the broker cannot vote the uninstructed shares and reports the number of such shares as “non-votes.”

The election of directors is considered a “non-routine” matter. Accordingly, a broker may not vote on this proposal without instructions from its customer and broker “non-votes” may occur with respect to this proposal. The proposal to ratify the appointment of the Company’s independent registered public accounting firm qualifies as a “routine” matter. Your broker, therefore, may vote your shares in its discretion if you do not provide instructions on how to vote on this “routine” matter.

Can I attend the meeting and vote my shares in person?

Yes. All shareholders are invited to attend the Annual Meeting. Shareholders of record can vote in person at the Annual Meeting. If your shares are held by a bank, broker, custodian or other nominee and you wish to vote in person at the meeting, you must obtain from the record holder and bring with you a proxy from the record holder issued in your name. The Annual Meeting will be held at the Company’s office located at 1401 Highway 62-65 North, Harrison, Arkansas 72601. If you wish to attend the Annual Meeting in person, you may obtain directions to the Company’s executive office by calling (501) 320-4904.

Can I change my vote or revoke my proxy after I return my proxy card?

Yes. If you are a shareholder of record, there are three ways you can change your vote or revoke your proxy any time before the proxy is voted.

| ● | First, you may send a written notice to Mr. John T. Adams, Corporate Secretary, Bear State Financial, Inc., 900 South Shackleford Rd., Suite 401, Little Rock, Arkansas 72211, stating that you would like to revoke your proxy. |

| ● | Second, you may complete and submit a new proxy card with a later date. Any earlier proxies will be revoked automatically by subsequently submitted proxies. New proxy cards may be obtained over the internet at www.edocumentview.com/bsf. |

| ● | Third, you may attend the Annual Meeting and vote in person. Any earlier proxy will be revoked. However, attending the Annual Meeting without voting in person will not revoke your proxy. |

If your shares are held in street name and you have instructed a broker or other nominee to vote your shares, you must follow directions you receive from your broker or other nominee to change your vote.

What constitutes a quorum?

The presence at the Annual Meeting, in person or by proxy, of a majority of the votes entitled to be cast on any matter at the Annual Meeting will constitute a quorum. If a quorum is established, each holder of common stock will be entitled to one vote on each matter to be voted on at the Annual Meeting for each issued and outstanding share of common stock owned on the record date. Proxies received but marked as abstentions and broker “non-votes” will be included in the calculation of the number of votes considered to be present at the meeting and will be counted for quorum purposes.

What are the Board of Directors’ recommendations?

The recommendations of the Board of Directors are set forth under the description of each proposal in this proxy statement. In summary, the Board of Directors recommends that you vote (i)“FOR” each of the director nominees named herein and (ii)“FOR” the ratification of the appointment of BKD, LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2015.

What vote is required to approve each item?

With respect to the election of directors in an uncontested election (i.e. where the number of director nominees equals the number of open board seats), the Company’s Bylaws require that each director be elected by the affirmative vote of a majority of the votes cast at the meeting, either in person or by proxy. In other words, the number of shares voted “for” a director nominee must exceed the number of votes cast “against” that director nominee. You may vote for, against, or abstain from voting for any or all of the director nominees named herein. With respect to the election of directors in a contested election (i.e. where the number of director nominees exceeds the number of open board seats), the Company’s Bylaws require that directors be elected by the plurality of the votes of the shares present in person or by proxy at the meeting and entitled to vote. In that case, the nominees receiving the greatest number of votes cast for their election would be elected as directors. The Company is not aware of any persons that have been or will be properly nominated for election to the Company’s Board of Directors at the Annual Meeting in accordance with the Company’s Bylaws other than the nominees set forth herein. Accordingly, the Company believes that the election of directors at the Annual Meeting will be an uncontested election.

If a nominee who is serving as a director is not re-elected, Arkansas law provides that the incumbent director would continue to serve on the Board as a “holdover director.” However, under the Company’s Bylaws, such director must tender his or her resignation to the Board of Directors. In that situation, the Board of Directors would consider whether to accept or reject the tendered resignation and will act on the tendered resignation within 90 days from the date the election results are certified and then publicly disclose its decision. If a non-incumbent nominee fails to receive a majority of votes cast at the Annual Meeting, such nominee would not serve on the Board as a “holdover director.”

A majority of the votes cast at the Annual Meeting is required to ratify the appointment of BKD, LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2015.

Will abstentions and broker “non-votes” have an impact on the proposals contained in this proxy statement?

As discussed above, proxies received but marked as abstentions and broker “non-votes” will be included in the calculation of the number of votes considered to be present at the meeting for quorum purposes. However, neither abstentions nor broker “non-votes” will have an impact on the proposals contained in this proxy statement because they are not considered votes cast for voting purposes.

Who pays the cost for soliciting proxies by the Board of Directors?

The Company will bear the cost of soliciting proxies, including the cost of preparing, printing and mailing the materials in connection with the solicitation of proxies. The Company will reimburse brokerage firms and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending the proxy materials to the beneficial owners of the Company’s common stock. In addition to solicitations by mail, officers and regular employees of the Company may, without being additionally compensated, solicit proxies personally and by mail, telephone, facsimile or electronic communication.

Who is Bear State Financial Holdings, LLC?

Bear State Financial Holdings, LLC (“BSF Holdings”) is the Company’s largest shareholder. As of March 31, 2015, BSF Holdings owns 18,978,035 shares of Company common stock. This represents approximately 57% of the Company’s common stock.

As a result of its controlling interest in the Company, BSF Holdings is able to determine the Company’s corporate and management policies and determine the outcome of any corporate transaction or other matter submitted to shareholders for approval. Mr. Richard N. Massey, the Chairman of the Board of the Company and its Acting President and Chief Executive Officer, is the managing member of BSF Holdings, which provides him with the sole power to vote and dispose of the shares of the Company held by BSF Holdings. Directors Scott T. Ford and W. Dabbs Cavin and certain officers of the Company, including J. Matthew Machen, Sherri R. Billings, R. Thomas Fritsche, Jr., Shelly Loftin, Donna Merriweather and John Adams are also members of BSF Holdings. As such, each has an indirect interest in BSF Holdings’ investment in the Company to the extent of their individual pecuniary interests in BSF Holdings.

ITEM 1 - ELECTION OF DIRECTORS

The number of directors that serve on the Board of Directors is currently set at nine and may be fixed from time to time by the Board of Directors in the manner provided in the Company’s Bylaws. In accordance with the Company’s Bylaws, directors are elected for a term of one year or until their successors are duly elected and qualified or until their earlier removal, resignation or death.

Director Nominees

Name | | Age | | Positions Held with the Company | | Director of the Company Since |

| | | | | | |

W. Dabbs Cavin | | 50 | | Vice Chairman of the Board | | 2011 |

| | | | | | |

K. Aaron Clark | | 33 | | Director | | 2011 |

| | | | | | |

Frank Conner | | 65 | | Director | | 2003 |

| | | | | | |

Scott T. Ford | | 52 | | Director | | 2011 |

| | | | | | |

G. Brock Gearhart | | 33 | | Director | | 2012 |

| | | | | | |

Daniel C. Horton | | 74 | | Vice Chairman of the Board | | 2014 |

| | | | | | | |

O. Fitzgerald Hill | | 51 | | Director | | 2011 |

| | | | | | |

Richard N. Massey | | 59 | | Chairman of the Board, Acting President and Chief Executive Officer | | 2011 |

| | | | | | | |

Ian R. Vaughan | | 38 | | Director | | 2014 |

Each of the nine director nominees listed above currently serves as a director of the Company and was recommended by the nominating and corporate governance committee and nominated by the Board of Directors to stand for election at the Annual Meeting.

Each of the above director nominees was elected to the Board at the 2014 annual meeting of shareholders. In connection with the 2011 initial investment of BSF Holdings in the Company, the Company agreed to nominate Messrs. Massey, Cavin, Ford and Clark (or such other designees as BSF Holdings may designate) to the Board of Directors each year so long as BSF Holdings owns in excess of 33% of the Company’s common stock. There are no other arrangements or understandings between the Company and any person pursuant to which such person has been elected a director.

Vote Required

Pursuant to the Company’s Bylaws, in an uncontested election directors are elected by a majority of the votes cast by the shares entitled to vote in the election of directors at a meeting at which a quorum is present. Each nominee who receives more votes cast “for” than “against” his or her election at the Annual Meeting will be elected as a director. Shareholders of the Company are not permitted to cumulate their votes for the election of directors.

Unless contrary instructions are given, shares represented by proxies solicited by the Board of Directors will be voted for the election of each of the nominees to the Board of Directors. If the person named as nominee should be unable or unwilling to stand for election at the time of the Annual Meeting, proxies will be voted for a replacement nominee designated by the Board of Directors or, in the event no such designation is made, proxies will be voted for a lesser number of nominees. At this time, the Board knows of no reason why the nominees listed above may not be able to serve as a director if elected. Proxies cannot be voted for a greater number of persons than the nominees named herein.

Board Recommendation

The Board of Directors recommends that you vote “FOR” the election of each of the director nominees named above.

INFORMATION REGARDING THE BOARD AND ITS COMMITTEES

Director Nominees

Set forth below is biographical information for each director nominee listed above. The following descriptions also outline the specific experience, qualifications, attributes and skills that qualify each person to serve on the Company’s Board of Directors.

W. Dabbs Cavin. Mr. Cavin serves as Chief Financial Officer of Mountaire Corporation and is a member of its board of directors, and he also serves as a Vice Chairman of the Board of Directors of the Company. From 2011 until June 30, 2013, Mr. Cavin served as Chief Executive Officer of the Company and First Federal Bank (predecessor to the Bank). He has been active in commercial banking in a variety of executive positions for over 20 years. In 1996, Mr. Cavin was a co-founder and organizer of Pinnacle Bancshares and Pinnacle Bank in Little Rock, Arkansas where he served as executive vice president and chief lending officer while also serving as a member of that bank’s and its holding company’s board of directors. After the 2002 sale of Pinnacle to BancorpSouth, Mr. Cavin became president of the Little Rock market for BancorpSouth until joining Summit Bank as executive vice president. At Summit, Mr. Cavin was responsible for leading its entrance into the Little Rock market as well as working with executive management on corporate strategic initiatives, market expansion, marketing, and business development. From 2008 until 2011, Mr. Cavin was employed by Mountaire Corporation in a position similar to his present capacity, while also consulting with Summit Bank on strategic issues. Mr. Cavin is also a former regulatory examiner with the Federal Home Loan Bank of Dallas which was the precursor to the Office of Thrift Supervision.

Mr. Cavin has over 20 years of community and commercial banking experience, much of which he acquired as an executive officer or director of various Arkansas-based financial institutions. His understanding of the community banking needs of Arkansas makes him an invaluable asset as a director of the Company. His long and successful career as a bank executive and his intimate knowledge of community banking in Arkansas led the Board of Directors to conclude that Mr. Cavin is qualified to serve on the Company’s Board of Directors.

K. Aaron Clark. Mr. Clark currently serves as a Managing Director of The Stephens Group, LLC, a private, family-owned investment firm, which he joined in 2006. In addition to helping analyze, coordinate and execute The Stephens Group’s investment transactions, Mr. Clark devotes a considerable amount of his time to supporting the firm’s partner companies’ efforts to grow the long-term value of their businesses. Prior to joining The Stephens Group, Mr. Clark was a corporate financial analyst at Stephens, Inc., where he gained experience in detailed financial analysis, modeling and diligence.

Mr. Clark provides a unique perspective to the Board. In addition to his investment banking experience, he brings to the Board a keen understanding and knowledge of partnering with management teams of a wide-range of companies across various industries to assist them in growing the long-term value of their businesses and accomplishing their strategic goals. His professional experience and strong community ties led the Board of Directors to conclude that Mr. Clark is qualified to serve as a director of the Company.

Frank Conner.Mr. Conner served as Vice President, Finance and Accounting and Chief Financial Officer of FedEx Freight East (formerly American Freightways, Inc.) from February 2001 through June 2010. Mr. Conner previously served as a director of American Freightways from 1989 to February 2001 and held various positions with American Freightways, including serving as Executive Vice President-Finance and Accounting and Chief Financial Officer from November 1995 to February 2001. Mr. Conner previously served thirteen years with McKesson Service Merchandise in various positions including General Manager and Chief Financial Officer. Mr. Conner served seven years in public accounting with Peat, Marwick & Mitchell prior to joining McKesson. Mr. Conner also serves on the board of directors of P.A.M. Transportation Services, Inc. (NASDAQ: PTSI), based in Tontitown, Arkansas.

Mr. Conner brings to the Board of Directors extensive management and business experience including over 26 years of service in senior financial management positions for both private and publicly-traded companies. He has served on the Board of Directors of the Company and the Bank (and its predecessor) since 2003. He is the Chairman of the Company’s audit committee, qualifies as an audit committee financial expert (as defined by the rules of the Securities and Exchange Commission (“SEC”)) and is a member of the Company’s compensation and nominating and corporate governance committees. He has extensive experience in performing audits of banking and non-banking publicly-traded companies and has served on the audit and compensation committees of American Freightways Corp. and P.A.M. Transportation Services, Inc. Additionally, Mr. Conner’s extensive ties to the community, strength of character, mature judgment, familiarity with our business and industry, independence of thought and ability to work collegially with others led the Board of Directors to conclude that Mr. Conner is qualified to serve on the Company’s Board of Directors.

Scott T. Ford. Mr. Ford is a member and chief executive officer of Westrock Group, LLC, a private, family-owned commodities trading firm he founded in 2013. Westrock Group operates Westrock Coffee Company, LLC, a coffee exporter, trader, importer and roaster, and Westrock Asset Management, LLC, a global asset management firm. He founded Westrock Coffee Company in 2009 and Westrock Asset Management in 2014. He previously served as President and Chief Executive Officer of Alltel Corporation (a provider of wireless voice and data communications services) from 2002 to 2009, and prior to that, he served as its President and Chief Operating Officer from 1998 to 2002. During Mr. Ford’s tenure with Alltel Corporation, he led the company through several major business transformations, culminating with the sale of the company to Verizon Wireless in 2009. Mr. Ford currently serves on the board of directors of AT&T, Inc. (NYSE: T).

Mr. Ford’s corporate management experience makes him an invaluable member of the Company’s Board. His proven track record as CEO of a Fortune 200 company, in addition to his expansive experience as a director of public and private companies and charitable organizations, provides him the ability to understand and address the challenges and issues facing the Company. In addition, Mr. Ford, through his affiliation with BSF Holdings, has a substantial personal interest in the Company that aligns his interests with those of the Company’s shareholder base. The Board of Directors believes that Mr. Ford’s extensive management experience, proven leadership capabilities and his personal stake in the success of the Company qualify him to serve on the Board.

G. Brock Gearhart. Mr. Gearhart is President of Greenwood Gearhart Inc., a registered investment advisor located in Fayetteville, Arkansas. Prior to assuming his current role in September 2008, he was a Vice President with Merrill Lynch’s Private Banking and Investment Group in New York City. He is a graduate of the University of Arkansas where he earned a B.S.B.A in Financial Management and Investments and was named Outstanding Student in Finance. He holds the Chartered Financial Analyst (CFA®) designation.

Mr. Gearhart’s financial expertise and ties to the community led the Board of Directors to conclude that he is qualified to serve as a director of the Company.

O. Fitzgerald Hill.Since 2006, Dr. Hill has served as President of Arkansas Baptist College in Little Rock. During his tenure, Arkansas Baptist College grew from fewer than 200 to more than 1,100 students and raised more than $23 million to update the institution's facilities. From 2010 to 2011, Dr. Hill served on the advisory board of Summit Bank. From 2005 to 2006, Dr. Hill led the Ouachita Baptist Opportunity Fund in Arkadelphia, Arkansas, as its Executive Director. From 2001 to 2005, he served as head football coach of the San Jose State Spartans. Dr. Hill earned a Doctorate of Education degree from the University of Arkansas and has received numerous awards recognizing his leadership on educational and community-development issues at the local, state and national levels. He is also the recipient of the Bronze Star for his service in the United States Armed Forces during Operation Desert Shield and Desert Storm.

Dr. Hill brings a wealth of leadership experience and skills to the Board. This depth of experience, proven success as a leader, and his strong community ties led the Board of Directors to conclude that Dr. Hill is qualified to serve as a director of the Company.

Daniel C. Horton. Mr. Horton serves as a Vice Chairman of the Board of Directors of the Company. From 2005 through the closing of the Company’s merger with First National Security Company (“FNSC”), Mr. Horton served as Chief Executive Officer and a director of FNSC. Additionally, from 2005 to December 31, 2012, he served as Chief Executive Officer of First National Bank, a subsidiary bank of FNSC. From 2000 until 2005, when First Community Banking Corporation (“FCBC”) was acquired by FNSC, Mr. Horton served as the President and Chief Executive Officer of FCBC and its subsidiary banks. From 1983 until 2000, he was the principal of Horton & Associates, Inc., where he acted as a consultant to community banks on various matters. Mr. Horton’s banking career began in 1973 with First Arkansas Bancstock Corporation (“FABC”), where he served for ten years in various capacities, including as executive vice president, chief financial officer and as a member of FABC’s board of directors.

Mr. Horton has over 30 years of community and commercial banking experience, much of which he acquired as an executive officer, director or consultant of various Arkansas-based financial institutions. The Board of Directors believes that Mr. Horton’s community banking experience combined with his intimate knowledge of the markets in which the Bank operates makes him an integral part of the Company’s Board of Directors. For these reasons, the Company’s Board of Directors has concluded that Mr. Horton is qualified to serve as a director of the Company.

Richard N. Massey. Mr. Massey is Chairman of the Board of Directors of the Company and its Acting President and Chief Executive Officer. He has been a member of Westrock Capital Partners, LLC, a private investment partnership (“Westrock”), since January 2009, and is the managing member of BSF Holdings, the Company’s controlling shareholder. From 2006 to 2009, Mr. Massey was Executive Vice President, Chief Strategy Officer and General Counsel of Alltel Corporation, then the fifth largest provider of wireless services in the United States. Prior to joining Alltel, Mr. Massey acted as Managing Director of Stephens Inc., a private investment bank, for 6 years. Mr. Massey is a licensed attorney in the state of Arkansas and has over 30 years of experience as a corporate and securities attorney. Since 2006, Mr. Massey has been a director of Fidelity National Financial, Inc. (“FNF”), a title insurance, mortgage services, specialty insurance and information services company, and Fidelity National Information Systems, Inc. (“FIS”), a global provider of technology and services to the financial services industry. He serves as a member of the compensation committee of FNF, and as chairman of the compensation committee and a member of both the executive and the corporate governance and nominating committees of FIS. Since 2014, he has also been a director of Black Knight Financial Services.

Mr. Massey has an extensive understanding of corporate law, finance and investment banking that he gained through years of experience as a financial and legal advisor to public and private companies. In addition, Mr. Massey, through his affiliation with BSF Holdings, has a substantial personal interest in the Company that aligns his interests with those of the Company’s shareholder base. His professional experience combined with his personal stake in the success of the Company led the Board of Directors to determine that Mr. Massey is qualified to serve on the Company’s Board of Directors and as its Chairman.

Ian R. Vaughan. Since 2008, Mr. Vaughan has served as the Ranch Operations Manager for John H. Hendrix Corp., managing a 5,000-acre ranch in northern Texas engaged in cattle and hay production. Mr. Vaughan is also a licensed real estate professional affiliated with David Norman Realty Advisors, focusing on the marketing, purchase and sale of farming, ranching and recreational properties in northern Texas and southern Oklahoma.

Through his prior service as a director of First National Bank, a subsidiary bank of FNSC, Mr. Vaughan gained substantial experience in the leadership and management of a community bank, as well as a deep understanding of that bank’s operations and the markets in which it operates. The Company’s Board of Directors believes that Mr. Vaughan will provide a unique perspective to the Board through his past affiliation with First National Bank, his real estate expertise and his experience as the manager of a major agricultural operation, all of which led the Board of Directors to conclude that Mr. Vaughan is qualified to serve as a director of the Company.

Director Independence and “Controlled Company”

After reviewing all relevant relationships and considering NASDAQ’s requirements for independence, the Board of Directors concluded that Messrs. Clark, Conner, Ford, Gearhart, Hill and Vaughan are independent under applicable listing rules, and that Mr. Hammerschmidt was independent under applicable listing rules while he was a director of the Company. No director or executive officer of the Company is related to any other director or executive officer of the Company by blood, marriage or adoption. In making its independence determination, the Board considered all relevant transactions, relationships, or arrangements disclosed in this Proxy Statement under the section titled “Transactions with Certain Related Persons” and the following:

| ● | Mr. Ford is an investor in BSF Holdings, and both he and Mr. Clark were nominated as directors pursuant to an agreement between the Company and BSF Holdings. The Board does not believe these relationships affect the independence of Messrs. Ford or Clark. |

While a majority of our directors are independent, we are not required to have a majority of independent directors on our Board as would otherwise be required under NASDAQ listing rules because the Company qualifies as a “controlled company.” Under applicable NASDAQ rules, if an individual or another entity owns more than 50% of the voting power for the election of directors of a listed company, that company is considered a “controlled company” and is exempt from certain corporate governance requirements, including the requirements to have a board of directors comprised of a majority of independent directors and independent director oversight of such board’s nominating and executive compensation functions. Because BSF Holdings owns more than 50% of the voting power for the election of directors, the Company qualifies as a “controlled company” and therefore relies on the “controlled company” exemption.

Shareholder Nominations

Pursuant to the Company’s Bylaws, shareholders are permitted to nominate directors in accordance with the Company’s advance notice provision contained in Article II, Section 16 of the Bylaws. Article II, Section 16 provides that only business properly brought before an annual meeting of shareholders shall be conducted at such meeting. To be properly brought before an annual meeting, business must be (i) specified in the notice of meeting (or any supplement thereto) given by or at the direction of the Board of Directors, (ii) brought before the meeting by or at the direction of the Board of Directors, or (iii) otherwise properly brought before the meeting by a shareholder. For business to be properly brought before an annual meeting by a shareholder, such proposed business must constitute a proper matter for shareholder actions, which includes the nomination of directors, and the shareholder must have given timely notice thereof in writing to the secretary of the Company. To be timely, a shareholder’s notice must be delivered to or mailed and received at the principal executive offices of the Company, not less than 90 days nor more than 120 days prior to the anniversary date of the immediately preceding annual meeting of shareholders; provided, however, if an annual meeting of shareholders is called for a date that is not within 25 days before or after the anniversary date of the preceding annual meeting, then, in order to be timely, a shareholder’s notice must be received by the Company no later than the close of business on the 10th day following the earlier of the date on which notice of the date of the annual meeting was mailed or public announcement of such date was made. For a shareholder nomination to be timely for purposes of the 2016 annual meeting of shareholders, assuming the date of such annual meeting is within 25 days before or after the one-year anniversary of the 2015 annual meeting of shareholders, the notice of such nomination must be received by the Company’s Corporate Secretary no earlier than January 30, 2016, and no later than February 29, 2016.

Directors’ Attendance at Annual Meetings

Although we do not have a formal policy regarding attendance by members of the Board of Directors at annual meetings of shareholders, we expect that our directors will attend, absent a valid reason for not doing so. All Board members who were Board members at the time of the 2014 annual meeting attended such meeting except Scott T. Ford and John H. Hendrix.

Board Leadership Structure and Role in Risk Oversight

Board of Directors Leadership Structure. The Board of Directors has no fixed policy with respect to the separation of the offices of Chairman of the Board of Directors and Chief Executive Officer. The Board retains the discretion to determine, at any time, whether to combine or separate the positions as it deems to be in the best interests of the Company and its shareholders. The Board currently believes that combining the positions of Chief Executive Officer and Chairman is the best structure for the Company because it promotes strategy development, facilitates information flow between management and the Board, and allows Mr. Massey to be involved in every aspect of leading the Company, while exercising oversight of the management of the Company’s subsidiary bank.

The Board believes that maintaining a healthy mix of qualified independent, non-management, and management directors on the Board is an integral part of effective corporate governance and management of the Company. The Board also believes that the current leadership structure strikes an appropriate balance between independent directors, management directors, and directors affiliated with BSF Holdings, the Company’s controlling shareholder, which allows the Board to effectively represent the best interests of the Company’s entire shareholder base.

The Board does not utilize a lead independent director. However, the independent directors of the Board are actively involved in the decision-making of the Board and its various committees.

Board of Directors Role in Risk Oversight. Management has the primary responsibility for identifying and managing the risks facing the Company and the Bank, subject to the oversight of the Board. The Board’s role in the risk oversight process includes receiving regular reports from senior management and internal audit regarding material risk exposure of the Company, including credit, market (including liquidity and interest rate risk), operational, financial, legal and regulatory, strategic and reputational risks. The full Board (or the appropriate committee in the case of risks that are under the purview of a particular committee) receives these reports from the appropriate “risk owner” within the organization to enable the Board or committee, as applicable, to understand our risk identification, risk management and risk mitigation strategies. When a committee receives these reports, the chairman of the relevant committee reports on the discussion to the full Board during the next Board meeting. This enables the Board and its committees to coordinate the risk oversight role, particularly with respect to risk interrelationships.

The Board’s administration of its risk oversight function has not specifically affected the Board’s current leadership structure. Instead, when periodically evaluating the Board’s leadership structure, risk oversight is one factor among many considered by the Board. The Board believes that the current leadership structure facilitates its role in the risk oversight process of the Company. If in the future the Board believes that a change in its leadership structure is required to, or potentially could, improve the Board’s risk oversight function, it may make such change as it deems appropriate in its sole discretion.

Committees and Meetings of the Board of Directors of the Company

The Board of Directors of the Company meets on a quarterly basis and may have additional special meetings. During the year ended December 31, 2014, the Board of Directors of the Company met six times. No incumbent director attended fewer than 75% of the total number of meetings of the Board or any committee on which he served that were held during this period and while such person was serving as a director.

The Board of Directors of the Company has established an audit committee, a compensation committee, and a nominating and corporate governance committee. Each of the committees has adopted a written charter, all of which are available in the Investor Relations section of our website at www.bearstatefinancial.com.

Audit Committee. The audit committee engages the Company’s independent registered public accounting firm and reviews the Company’s systems of internal control with management, the internal auditor and the Company’s independent registered public accounting firm. In addition, the audit committee reviews with the independent registered public accounting firm and management the annual audited financial statements (including the Form 10-K) and the quarterly reports on Form 10-Q and monitors the Company’s adherence to accounting principles generally accepted in the United States of America. Prior to the consummation of the merger with FNSC in June 2014, the audit committee consisted of Messrs. Conner (Chairman), Hammerschmidt and Clark. Following the merger with FNSC and through 2014, the audit committee consisted of Messrs. Conner (Chairman), Hammerschmidt and Gearhart. Mr. Hammerschmidt continued to serve on the audit committee until his death on April 1, 2015. The audit committee presently consists of two members: Messrs. Conner and Gearhart, and as a result, the Company is no longer in compliance with NASDAQ Listing Rule 5605(c)(2)(A), which requires the Company’s audit committee to be composed of at least three independent directors. The Company is in the process of evaluating suitable candidates to add to the Board and the audit committee and intends to rely on the cure period provided by NASDAQ Listing Rule 5605(c)(4)(B).

The Board of Directors of the Company has determined that each member of the audit committee qualifies as an “independent” director under the Sarbanes-Oxley Act, related SEC rules and NASDAQ listing standards related to audit committees, and that each satisfies all other applicable standards for service on the audit committee. In addition, the Board has determined that Mr. Conner, the Chairman of the audit committee, meets the requirements adopted by the SEC for qualification as an audit committee financial expert. The identification of a person as an audit committee financial expert does not impose on such person any duties, obligations or liability that are greater than those that are imposed on such person as a member of the audit committee and the Board of Directors in the absence of such identification. Moreover, the identification of a person as an audit committee financial expert for purposes of the regulations of the SEC does not affect the duties, obligations or liability of any other member of the audit committee or the Board of Directors. Finally, a person who is determined to be an audit committee financial expert will not be deemed an “expert” for purposes of Section 11 of the Securities Act of 1933.

In accordance with its charter, the audit committee meets a minimum of four times each year. In 2014 the audit committee met in regular session eight times.

Compensation Committee.The compensation committee administers the Company’s director and executive compensation programs. Its primary functions are to oversee the Company’s compensation and benefit plans and policies and to administer its stock benefit plans (including reviewing and approving equity grants to executive officers). As stated above, the Company qualifies as a “controlled company” under applicable NASDAQ listing rules due to the ownership by BSF Holdings of more than 50% of the voting power for the Company’s election of directors. Accordingly, we rely on the “controlled company” exemption from NASDAQ rules that generally require independent director oversight of executive compensation.

The compensation committee currently consists of Messrs. Scott T. Ford (Chairman), Ian R. Vaughan, G. Brock Gearhart and Frank Conner. Mr. Hammerschmidt was a member of the compensation committee until his death on April 1, 2015. Additionally, Mr. Massey and Mr. Clark served on the compensation committee for a portion of 2014, but resigned from the committee upon the closing of the Company’s merger with FNSC. There were two meetings of the full compensation committee in 2014.

The compensation committee has historically exercised exclusive authority over the compensation paid to the Company’s President and Chief Executive Officer and has reviewed and approved salary increases and bonuses for the Company’s other executive officers as prepared and submitted to the compensation committee by the President and Chief Executive Officer. As a matter of philosophy, the Company and the compensation committee are committed to creating a compensation structure for executives that is simple and readily comprehensible to investors. The types of compensation we offer our executives remain within the traditional categories: salary, short and long-term incentive compensation (cash bonus and stock-based awards), standard executive benefits, and retirement and severance benefits.

The compensation committee recognizes the importance of maintaining sound principles for the development and administration of compensation and benefit programs, and has taken steps to significantly enhance the compensation committee’s ability to effectively carry out its responsibilities as well as enhance the link between executive pay and performance.

Although the compensation committee does not delegate any of its authority for determining executive compensation, the compensation committee has in the past engaged the services of outside advisors, experts and others to assist the compensation committee on an as-needed basis. Additionally, our Chief Executive Officer and Chief Financial Officer each provide input to the compensation committee regarding the Company’s performance, the individual performance of the Company’s executive officers, and such additional information the compensation committee requests on an as-needed basis. The compensation committee, however, exercises complete discretion in making all compensation decisions regarding cash compensation and equity awards for all of the Company’s executive officers.

Nominating and Corporate Governance Committee. The nominating and corporate governance committee evaluates and makes recommendations to the Board of Directors for the election of directors. As stated above, the Company qualifies as a “controlled company” under applicable NASDAQ listing rules due to the ownership by BSF Holdings of more than 50% of the voting power for the Company’s election of directors. Accordingly, we rely on the “controlled company” exemption from NASDAQ rules that generally require independent director oversight of director nominations.

The nominating and corporate governance committee consists of the entire Board of Directors, with Mr. Massey serving as chairman. The nominating and corporate governance committee met once, during regular board session, in 2014 in connection with the nomination of directors for the 2014 annual meeting.

The nominating and corporate governance committee considers candidates for director suggested by its members, as well as by management and shareholders. The nominating and corporate governance committee also may solicit prospective nominees identified by it. A shareholder who desires to recommend a prospective nominee for the board should notify the Company’s Secretary or any member of the nominating and corporate governance committee in writing with supporting material the shareholder considers appropriate. The nominating and corporate governance committee also considers whether to nominate any person nominated pursuant to the provision of the Company’s governing documents relating to shareholder nominations, which is described in the section above titled “Shareholder Nominations.” The nominating and corporate governance committee has the authority and ability to retain a search firm to identify or evaluate potential nominees if it so desires.

The charter of the nominating and corporate governance committee sets forth certain criteria the committee may consider when recommending individuals for nomination as director including: (i) ensuring that the Board of Directors, as a whole, is diverse and consists of individuals with various and relevant career experience, relevant technical skills, banking industry knowledge and experience, financial expertise (including expertise that could qualify a director as an “audit committee financial expert,” as that term is defined by the rules of the SEC), local or community ties and (ii) minimum individual qualifications, including strength of character, mature judgment, familiarity with our business and industry, independence of thought and an ability to work collegially. Though neither the Board of Directors nor the nominating and corporate governance committee has a formal policy concerning diversity, the Board of Directors values diversity on the Board, believes diversity should be considered in the director identification and nominating process, and seeks director nominees that have a diverse range of views, backgrounds and leadership and business experience. The committee also considers the extent to which the candidate would fill a present need on the Board of Directors.

Once the nominating and corporate governance committee has identified a prospective nominee, the committee makes an initial determination as to whether to conduct a full evaluation of the candidate. This initial determination is based on the information provided to the committee with the recommendation of the prospective candidate, as well as the committee’s own knowledge of the prospective candidate, which may be supplemented by inquiries to the person making the recommendation or others.

EXECUTIVE OFFICERS OF THE COMPANY

Set forth below is biographical information with respect to each current executive officer of the Company and the Bank. In addition to the executive officers listed below, Mr. Massey, who also serves as a director of the Company, is an executive officer of the Company and the Bank. Biographical information regarding Mr. Massey is available above in the section titled “Director Nominees.” All executive officers of the Company and the Bank are elected annually by the Board of Directors and serve at the discretion of the Board. There are no arrangements or understandings between any person on the one hand and the Company or the Bank on the other hand pursuant to which such person has been selected as an executive officer of either the Company or the Bank.

John T. Adams, age 38. Mr. Adams is Senior Vice President, General Counsel and Corporate Secretary of the Company and the Bank. Mr. Adams has served in related capacities since 2011. Mr. Adams has represented various financial institutions in securities, regulatory, and lending matters as a lawyer at Davis Polk in New York City from 2003 - 2006, and at the Rose Law Firm in Little Rock from 2006 - 2009. Prior to joining the Company and the Bank in 2011, he served as an Assistant Attorney General for the State of Arkansas. He is an adjunct professor at the University of Arkansas at Little Rock - Bowen School of Law. Mr. Adams is licensed to practice law in Arkansas and New York.

Sherri R. Billings, age 58. Mrs. Billings is Executive Vice President and Chief Accounting Officer of the Company and the Bank. She has served as an Executive Vice President since 2002 and became Chief Accounting Officer in 2014. She previously served as Chief Financial Officer of the Company and First Federal Bank from 2002 until 2014 and as Senior Vice President for First Federal Bank from 1993 to 2002, and as Treasurer for First Federal Bank from 1986 to 1993. Mrs. Billings initially was employed by the Bank in 1979. Mrs. Billings is a certified public accountant licensed to practice in the state of Arkansas, a member of the American Institute of Certified Public Accountants and the Arkansas Society of Certified Public Accountants, and has attained the designation Chartered Global Management Accountant.

R. Thomas Fritsche, Jr. age 54.Mr. Fritsche is Executive Vice President and Chief Risk Officer of the Company and the Bank and has served in credit and risk management capacities since 2011. Mr. Fritsche has over twenty-five years of commercial banking experience in executive and managerial positions with banks in Arkansas. Prior to joining the Company and the Bank, Mr. Fritsche worked at Southwest Power Pool, a regional utility transmission organization, as Director of Treasury and Risk Management from 2007 - 2011. He previously served as Chief Administrative Officer and Commercial Banking Executive from 2004 - 2007, and as Senior Vice President and Commercial Real Estate Lending Manager from 2000 - 2002, at Regions Financial Corp.; as Executive Vice President and Lending Manager at Arvest Banking Company from 2002 - 2004; as Vice President and Commercial Lender at Mercantile Bank; as Vice President, Mergers & Acquisitions, at First Commercial Corp.; and as Director of Mergers & Acquisitions and Director of Asset/Liability Management for Worthen Banking Corp. Mr. Fritsche began his career in banking as a National Bank Examiner with the Office of the Comptroller of the Currency.

Shelly Loftin, age 33.Mrs. Loftin serves as Executive Vice President and Chief Marketing Officer of Bear State Financial, Inc., a position she has held since January 2015. Mrs. Loftin joined First Federal Bank in October of 2011 as Vice President of Marketing and Retail. Prior to joining the Company and the Bank, Mrs. Loftin worked in marketing at Bank of the Ozarks and Summit Bank. She has over 15 years of banking experience and graduated with a M.B.A. from the University of Arkansas at Little Rock. Her day to day responsibilities include marketing, advertising, branding, culture, employee relations and the customer experience.

J.Matthew Machen,age 34.Mr. Machen serves as Executive Vice President and Chief Financial Officer of Bear State Financial, Inc., a position he has held since 2014. Mr. Machen joined First Federal Bank in 2011 as a Senior Vice President and prior to being named the company’s CFO, he served as a Regional President of First Federal Bank. Before joining the Company and the Bank he served as Vice President and Commercial Lender for First Security Bank from 2003 to 2011. Mr. Machen holds a Finance degree from the University of Arkansas and is a board member of the Dean’s Alumni Advisory Council at the University of Arkansas’s Walton College of Business.

Donna Merriweather, age 55. Ms. Merriweather, SPHR, serves as Executive Vice President and Human Resources Director of Bear State Financial, Inc. Ms. Merriweather joined the Company in June 2014 bringing over 30 years of human resources management experience, 15 years in the financial services industry and 18 years in manufacturing. She received her Senior Professional in Human Resources certification in 2001. Ms. Merriweather currently serves as State-Director Elect for the Arkansas Society for Human Resource Management State Council, an affiliate of the national Society for Human Resource Management association. Her responsibilities include compensation and benefit administration, policy and regulatory administration, recruitment and retainment, employee relations, and performance management.

CODE OF ETHICS FOR EXECUTIVE OFFICERS AND FINANCIAL PROFESSIONALS

The Board of Directors has adopted a code of ethics for the Company’s executive officers, including the Chief Executive Officer and the Chief Financial Officer, and other financial professionals. These officers are expected to adhere at all times to this code of ethics. Failure to comply with this code of ethics is a serious offense and will result in appropriate disciplinary action. We have posted this code of ethics in the Corporate Governance section of our website at www.bearstatefinancial.com.

We will disclose on our website at www.bearstatefinancial.com, to the extent and in the manner permitted by Item 5.05 of Form 8-K under Section 13 of the Securities Exchange Act of 1934 (the “Exchange Act”), the nature of any amendment to this code of ethics (other than technical, administrative, or other non-substantive amendments), our approval of any material departure from a provision of this code of ethics, and our failure to take action within a reasonable period of time regarding any material departure from a provision of this code of ethics that has been made known to any of the executive officers noted above.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires the Company’s officers and directors, and persons who own more than 10% of the Company’s common stock, to file reports of ownership and changes in ownership with the SEC. Officers, directors and greater than 10% shareholders are required by regulation to furnish the Company with copies of all Section 16(a) forms they file. The Company currently knows of no person, other than BSF Holdings, who owns 10% or more of the Company’s common stock.

Based solely on a review of the copies of such forms furnished to the Company, or written representations from its officers and directors, the Company believes that during, and with respect to, the year ended December 31, 2014, the Company’s officers, directors and BSF Holdings, the sole beneficial owner of more than 10% of the Company’s common stock, satisfied the reporting requirements promulgated under Section 16(a) of the Exchange Act.

BENEFICIAL OWNERSHIP OF COMMON STOCK BY CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED SHAREHOLDER MATTERS

The following table sets forth, as of March 31, 2015, certain information as to the common stock beneficially owned by (i) each person or entity, including any “group” as that term is used in Section 13(d)(3) of the Exchange Act, who or which was known to the Company to be the beneficial owner of more than 5% of the issued and outstanding common stock, (ii) the directors and director nominees of the Company, (iii) the executive officers of the Company named in the Summary Compensation Table below, and (iv) all directors, director nominees and executive officers of the Company as a group.

| | | Common Stock Beneficially Owned as of March 31, 2015 |

Name of Beneficial Owner | | Number | | % |

| | | | | | | | | |

Bear State Financial Holdings, LLC 900 S. Shackleford, Suite 200 Little Rock, Arkansas 72211 | | | 18,978,035 | | | | 56.86 | % |

| | | | | | | | | |

John H. Hendrix 2610 County Rd. 856 McKinney, Texas | | | 3,007,105 | (1) | | | 9.01 | % |

| | | | | | | | | |

Directors and Nominees: | | | | | | | | |

Richard N. Massey | | | 19,416,074 | (2)(3) | | | 58.11 | % (4) |

W. Dabbs Cavin | | | 103,509 | (5) | | | * | |

K. Aaron Clark | | | - | | | | - | |

Frank Conner | | | 17,472 | (6) | | | * | |

Scott T. Ford | | | 364,295 | (3) | | | 1.09 | % (4) |

G. Brock Gearhart | | | - | | | | - | |

O. Fitzgerald Hill | | | 83 | | | | * | |

| Daniel C. Horton | | | 128 | | | | * | |

| Ian R. Vaughan | | | 13,597 | | | | * | |

| | | | | | | | | |

Certain other executive officers: | | | | | | | | |

J. Matthew Machen | | | 9,514 | (7) | | | * | |

R. Thomas Fritsche, Jr. | | | 24,514 | (8) | | | * | |

Christopher Wewers | | | 79,964 | | | | * | |

| | | | | | | | | |

All directors and executive officers of the Company as a group (18 persons) | | | 20,177,597 | (2)(9) | | | 60.22 | % (10) |

* Represents less than 1% of the outstanding common stock.

| (1) | Based upon information contained in a Schedule 13D filed by Mr. Hendrix on June 23, 2014 with the SEC, as adjusted to give effect to the Company’s 11% stock dividend paid in December 2014. Mr. Hendrix has sole voting and dispositive power with respect to 1,612,528 shares and shared voting and dispositive power with respect to 1,394,577 shares. |

| (2) | As managing member of BSF Holdings with sole voting and dispositive power over the shares of common stock owned by BSF Holdings, Mr. Massey is deemed to be the beneficial owner of all shares of common stock owned by BSF Holdings, for purposes of SEC rules. |

| (3) | Includes 39,381 shares issuable upon exercise of warrants within 60 days of March 31, 2015. |

| (4) | Based upon 33,375,753 shares of common stock of the Company issued and outstanding as of March 31, 2015 and 39,381 shares of common stock issuable upon exercise of warrants within 60 days of March 31, 2015. |

| (5) | Includes 3,736 shares held by Mr. Cavin’s spouse. |

| (6) | Includes 430 shares held individually by Mr. Conner’s child and 17,042 shares held jointly by Mr. Conner and his spouse as co-trustees for a trust for their benefit. |

| (7) | Includes 6,666 shares which may be acquired pursuant to the exercise of stock options exercisable within 60 days of March 31, 2015. |

| (8) | Includes 21,666 shares which may be acquired pursuant to the exercise of stock options exercisable within 60 days of March 31, 2015. |

| (9) | Includes 32,830 shares allocated to the accounts of executive officers as a group in the Company’s 401(k) Plan, 51,663 shares which may be acquired pursuant to the exercise of stock options exercisable within 60 days of March 31, 2015, and warrants to purchase 78,762 shares of common stock exercisable within 60 days of March 31, 2015. |

| (10) | Based upon 33,375,753 shares of common stock of the Company issued and outstanding as of March 31, 2015, 51,663 shares which may be acquired pursuant to the exercise of stock options exercisable within 60 days March 31, 2015, and warrants to purchase 78,762 shares of common stock exercisable within 60 days of March 31, 2015. |

TRANSACTIONS WITH CERTAIN RELATED PERSONS

The Company’s Lending Policy requires that all loans made by the Bank to any of the directors or executive officers of the Company or the Bank, or their immediate families or related business interests, be made in the ordinary course of business, on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with other persons. In addition, such loans may not involve more than the normal risk of collectability or present other unfavorable features. Pursuant to the Company’s Lending Policy, loans made to any of the directors or executive officers of the Company or the Bank, or their immediate families or related business interests must be approved in the same manner as are loans for all employees, which require an initial approval by the Regional President or Market Manager in addition to any other committee approvals required for a loan of that type and size. All such loans outstanding have been made by the Bank in accordance with the aforementioned policy.

Except as described above concerning loans made to insiders, once we become aware of a proposed transaction with a related party, it is referred to an executive officer for consideration to determine whether the related party transaction should be allowed. If such executive officer determines that the transaction is permissible, he or she then refers the matter to the audit committee for final approval. The Board of Directors does not have a separate written policy regarding the review and approval of related party transactions, but pursuant to the audit committee charter, which is available in the Corporate Governance section of our website at www.bearstatefinancial.com, the proposed transaction will be permitted only if the audit committee determines that it is fair to the Company and approves it or ratifies it after the fact.

The following are the only transactions occurring since the beginning of fiscal year 2014, or that are currently proposed, (i) in which the Company was or is to be a participant, (ii) where the amount involved exceeds $120,000, and (iii) in which the Company’s executive officers, directors, nominees, principal shareholders and other related parties had a direct or indirect material interest:

| | ● | In anticipation of the merger with FNSC, the Company raised approximately $20,000,000 in additional capital in June 2014 through a private placement of its common stock (the “Private Placement”). In 2013, prior to accepting any subscriptions for the Private Placement, the Company issued warrants to purchase 35,443 shares of Company common stock at an exercise price of $7.90 per share to five individual investors in exchange for their commitments to backstop the Private Placement in the event that the Company was unable to cause the Private Placement to be fully subscribed. Two of the individual investors that were issued warrants are Richard N. Massey and Scott T. Ford. Additionally, BSF Holdings subscribed for and purchased 2,297,031 shares of Company common stock in the Private Placement at a purchase price of $7.90 per share, or $18.1 million in the aggregate. Pursuant to their “backstop” commitments, Messrs. Massey and Ford also each purchased approximately 47,000 shares of Company common stock at a purchase price of $7.90 per share, or approximately $371,000. All of the warrants and shares of Company common stock issued in the Private Placement were subsequently adjusted to give effect to the Company’s 11% stock dividend paid in December 2014. |

| | ● | In 2014 the Company and its Chairman entered into an aircraft purchase agreement whereby the Company acquired a 75% undivided interest and Mr. Massey acquired a 25% undivided interest in an airplane acquired at a cost of $775,000. The Company’s share is recorded in office properties and equipment on the consolidated statement of financial condition and has a net book value of $583,000 at December 31, 2014. The Company and Mr. Massey also entered into an agreement pursuant to which the parties agreed to apportion the fixed costs of the aircraft on a pro rata basis and each party agreed to pay its own variable costs associated with the use of the aircraft. Variable costs attributable to Mr. Massey's use of the Aircraft in connection with Company business, and not in connection with his personal use of the Aircraft, were paid by the Company. During 2014, the Company paid approximately $102,000 in expenses related to this airplane to Westrock Aviation, an entity owned indirectly in part by Mr. Massey and Mr. Ford. |

REPORT OF THE AUDIT COMMITTEE

The audit committee has reviewed and discussed the audited consolidated financial statements of the Company with management. The audit committee has discussed with the independent registered public accounting firm the matters required to be discussed by Auditing Standard No. 16. The audit committee has received the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the audit committee concerning independence, and has discussed with the independent accountant the independent accountant’s independence. Based on the review and discussions referred to above in this report, the audit committee recommended to the Board of Directors that the audited financial statements be included in the Company’s annual report on Form 10-K for the year ended December 31, 2014 for filing with the SEC.

| Members of the Audit Committee |

| |

| Frank Conner, Chairman |

| G. Brock Gearhart |

ITEM 2 - RATIFICATION OF APPOINTMENT OF AUDITORS

The audit committee of the Company appointed BKD, LLP (“BKD”) to serve as the Company’s independent registered public accounting firm for the year ending December 31, 2015, and further directed that the selection of the independent registered public accounting firm be submitted for ratification by the shareholders at the Annual Meeting. Shareholders are asked to ratify the appointment of BKD at the Annual Meeting. Representatives of BKD are expected to be present at the Annual Meeting, will have an opportunity to make a statement if they desire to do so, and are expected to be available to respond to appropriate questions from shareholders.

Accounting Fees and Services

The following table sets forth the aggregate fees paid by us to BKD for professional services rendered in connection with the audit of the Company’s consolidated financial statements for 2014 and 2013.

| | | BKD, LLP | |

| | | 2014 | | | 2013 | |

Audit fees (1) | | $ | 305,000 | | | $ | 195,000 | |

Audit-related fees (2) | | | 92,057 | | | | 75,503 | |

Tax Fees | | | - | | | | - | |

All other fees | | | - | | | | - | |

Total | | $ | 397,057 | | | $ | 273,503 | |

________________________

(1) | Audit fees consist of fees incurred in connection with the audit of our annual financial statements and the review of the interim financial statements included in our quarterly reports filed with the SEC. |

(2) | Audit-related fees in 2014 and 2013 primarily include audit fees related to the Company’s various SEC registration statements paid to BKD in 2013 and audit fees related to the purchase price allocation of the FNSC merger in 2014. |

Since May 6, 2003, the effective date of SEC rules stating that an auditor is not independent of an audit client if the services it provides to the client are not appropriately approved, each new engagement of an independent registered public accounting firm has been approved in advance by the audit committee in accordance with SEC rules. The audit committee selects the Company’s independent registered public accounting firm and separately pre-approves all audit services to be provided by it to the Company. The audit committee also reviews and separately pre-approves all audit-related, tax and all other services rendered by our independent registered public accounting firm in accordance with the audit committee’s charter and policy on pre-approval of audit-related, tax and other services. In its review of these services and related fees and terms, the audit committee considers, among other things, the possible effect of the performance of such services on the independence of our independent registered public accounting firm.

None of the services described above were approved pursuant to thede minimis exception provided in Rule 2-01(c)(7)(i)(C) of Regulation S-X promulgated by the SEC.

Vote Required

Approval of the ratification of the appointment of BKD as the Company’s independent registered public accounting firm for the year ending December 31, 2015 requires the affirmative vote of a majority of the votes cast at the meeting. If the appointment of BKD is ratified, the audit committee, in its sole discretion, may change the appointment at any time during the year if it determines that such a change would be in the best interests of the Company and its shareholders. Conversely, if shareholders fail to ratify the appointment, the audit committee will reconsider the appointment.

Board Recommendation

The Board of Directors recommends that you vote “FOR” the ratification of the appointment of BKD as the Company’s independent registered public accounting firm for the year ending December 31, 2015.

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth a summary of certain information concerning the compensation awarded or paid to our named executive officers for services rendered in all capacities during the last two fiscal years. For fiscal 2014, our named executive officers were: (i) Richard N. Massey, President and Chief Executive Officer; (ii) Christopher M. Wewers, former President and Chief Executive Officer; (iii) J. Matthew Machen, Chief Financial Officer; and (iv) R. Thomas Fritsche, Jr., Chief Risk Officer.

Name and Principal Position | | Year | | Salary (1) | | | Bonus | | | Stock Awards (2) | | | Non-Equity Incentive Plan Compensation (3) | | | All Other Compensation | | | Total | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Richard N. Massey (4) | | 2014 | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

Acting President and ChiefExecutive Officer | | 2013 | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Christopher M. Wewers | | 2014 | | $ | 250,000 | | | $ | - | | | $ | 12,285 | | | $ | - | | | $ | 5,400 | | | $ | 267,685 | |

Former President andChief Executive Officer | | 2013 | | $ | 233,905 | | | $ | - | | | $ | 254,400 | | | $ | 20,000 | | | $ | — | | | $ | 508,305 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

J. Matthew Machen | | 2014 | | $ | 170,250 | | | $ | - | | | $ | 69,335 | | | $ | - | | | $ | 3,081 | | | $ | 242,666 | |

Executive Vice President and Chief Financial Officer | | 2013 | | $ | 133,921 | | | $ | - | | | $ | 38,850 | | | $ | 7,500 | | | $ | - | | | $ | 180,271 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

R. Thomas Fritsche, Jr. | | 2014 | | $ | 230,000 | | | $ | 10,000 | | | $ | 12,285 | | | $ | - | | | $ | 3,573 | | | $ | 255,858 | |

Executive Vice Presidentand Chief Risk Officer | | 2013 | | $ | 200,000 | | | $ | - | | | $ | 9,750 | | | $ | 10,000 | | | $ | — | | | $ | 219,750 | |

_________

(1) We periodically review, and may increase, base salaries in accordance with the Company’s normal annual compensation review for each of our named executive officers. Annual base salaries as of December 31, 2014 were $0, $250,000, $200,000 and $265,000 for Mr. Massey, Mr. Wewers, Mr. Machen and Mr. Fritsche, respectively.