HC2 HOLDINGS, INC. First Quarter 2018 Conference Call © HC2 Holdings, Inc. 2018

Safe Harbor Disclaimers Special Note Regarding Forward-Looking Statements Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995: This presentation contains, and certain oral statements made by our representatives from time to time may contain, forward-looking statements. Generally, forward-looking statements include information describing actions, events, results, strategies and expectations and are generally identifiable by use of the words “believes,” “expects,” “intends,” “anticipates,” “plans,” “seeks,” “estimates,” “projects,” “may,” “will,” “could,” “might,” or “continues” or similar expressions. The forward-looking statements in this press release include without limitation our 2018 guidance for the Construction and Marine Services segments and statements regarding our expectations regarding building shareholder value and future cash and invested assets. Such statements are based on the beliefs and assumptions of HC2's management and the management of HC2's subsidiaries and portfolio companies. The Company believes these judgments are reasonable, but you should understand that these statements are not guarantees of performance or results, and the Company’s actual results could differ materially from those expressed or implied in the forward-looking statements due to a variety of important factors, both positive and negative, that may be revised or supplemented in subsequent reports on Forms 10-K, 10-Q and 8-K. Such important factors include, without limitation, issues related to the restatement of our financial statements; the fact that we have historically identified material weaknesses in our internal control over financial reporting, and any inability to remediate future material weaknesses; capital market conditions; the ability of HC2's subsidiaries and portfolio companies to generate sufficient net income and cash flows to make upstream cash distributions; volatility in the trading price of HC2 common stock; the ability of HC2 and its subsidiaries and portfolio companies to identify any suitable future acquisition or disposition opportunities; our ability to realize efficiencies, cost savings, income and margin improvements, growth, economies of scale and other anticipated benefits of strategic transactions; difficulties related to the integration of financial reporting of acquired or target businesses; difficulties completing pending and future acquisitions and dispositions; effects of litigation, indemnification claims, and other contingent liabilities; changes in regulations and tax laws; and risks that may affect the performance of the operating subsidiaries and portfolio companies of HC2. Although HC2 believes its expectations and assumptions regarding its future operating performance are reasonable, there can be no assurance that the expectations reflected herein will be achieved. These risks and other important factors discussed under the caption “Risk Factors” in our most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”), and our other reports filed with the SEC could cause actual results to differ materially from those indicated by the forward-looking statements made in this presentation. You should not place undue reliance on forward-looking statements. All forward-looking statements attributable to HC2 or persons acting on its behalf are expressly qualified in their entirety by the foregoing cautionary statements. All such statements speak only as of the date made, and unless legally required, HC2 undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise. © 2 0 1 8 H C 2 H O L D I N G S , I NC. 1

Safe Harbor Disclaimers Non-GAAP Financial Measures Adjusted EBITDA In this presentation, HC2 refers to certain financial measures that are not presented in accordance with U.S. generally accepted accounting principles (“GAAP”), including Core Operating Subsidiary Adjusted EBITDA, Total Adjusted EBITDA (excluding the Insurance segment) and Adjusted EBITDA for its operating segments. Management believes that Adjusted EBITDA measures provide investors with meaningful information for gaining an understanding of the Company’s results as it is frequently used by the financial community to provide insight into an organization’s operating trends and facilitates comparisons between peer companies, because interest, taxes, depreciation, amortization and the other items for which adjustments are made as noted in the definition of Adjusted EBITDA below can differ greatly between organizations as a result of differing capital structures and tax strategies. In addition, management uses Adjusted EBITDA measures in evaluating certain of the Company’s segments performance because they eliminate the effects of considerable amounts of non-cash depreciation and amortization and items not within the control of the Company’s operations managers. While management believes that these non-GAAP measurements are useful as supplemental information, such adjusted results are not intended to replace our GAAP financial results and should be read together with HC2’s results reported under GAAP. Management defines Adjusted EBITDA as net income (loss) adjusted to exclude the impact of depreciation and amortization; amortization of equity method fair value adjustments at acquisition; (gain) loss on sale or disposal of assets; lease termination costs; asset impairment expense; interest expense; net gain (loss) on contingent consideration; loss on early extinguishment or restructuring of debt; other (income) expense, net; foreign currency transaction (gain) loss included in cost of revenue; income tax (benefit) expense; (gain) loss from discontinued operations; noncontrolling interest; bonus to be settled in equity; share-based compensation expense; non-recurring items; and acquisition costs. A reconciliation of Adjusted EBITDA to Net Income (Loss) is included in the financial tables at the end of this presentation. Management recognizes that using Adjusted EBITDA as a performance measure has inherent limitations as an analytical tool as compared to net income (loss) or other GAAP financial measures, as these non-GAAP measures exclude certain items, including items that are recurring in nature, which may be meaningful to investors. As a result of the exclusions, Adjusted EBITDA should not be considered in isolation and do not purport to be alternatives to net income (loss) or other GAAP financial measures or a measure of our operating performance. Adjusted EBITDA excludes the results of operations and any consolidating eliminations of our Insurance segment. Adjusted Operating Income Insurance Adjusted Operating Income for the Insurance segment ("Insurance AOI") is a non-U.S. GAAP financial measure frequently used throughout the insurance industry and is an economic measure the Insurance segment uses to evaluate its financial performance. Management believes that Insurance AOI measures provide investors with meaningful information for gaining an understanding of certain results and provides insight into an organization’s operating trends and facilitates comparisons between peer companies. However, Insurance AOI has certain limitations and we may not calculate it the same as other companies in our industry. It should therefore be read together with the Company's results calculated in accordance with U.S. GAAP. Similarly to Adjusted EBITDA, using Insurance AOI as a performance measure has inherent limitations as an analytical tool as compared to income (loss) from operations or other U.S. GAAP financial measures, as this non-U.S. GAAP measure excludes certain items, including items that are recurring in nature, which may be meaningful to investors. As a result of the exclusions, Insurance AOI should not be considered in isolation and does not purport to be an alternative to income (loss) from operations or other U.S. GAAP financial measures as a measure of our operating performance. Management defines Insurance AOI as Net income (loss) for the Insurance segment adjusted to exclude the impact of net investment gains (losses), including OTTI losses recognized in operations; asset impairment; intercompany elimination; non-recurring items; and acquisition costs. Management believes that Insurance AOI provides a meaningful financial metric that helps investors understand certain results and profitability. While these adjustments are an integral part of the overall performance of the Insurance segment, market conditions impacting these items can overshadow the underlying performance of the business. Accordingly, we believe using a measure which excludes their impact is effective in analyzing the trends of our operations. By accepting this document, each recipient agrees to and acknowledges the foregoing terms and conditions. © 2 0 1 8 H C 2 H O L D I N G S , I NC. 2

Agenda OVERVIEW AND Philip Falcone Chairman, President and CEO FINANCIAL HIGHLIGHTS Philip A. Falcone Chairman, President and CEO Michael J. Sena Chief Financial Officer Q AND A Andrew G. Backman Managing Director © 2 0 1 8 H C 2 H O L D I N G S , I NC. 3

Quarterly Overview

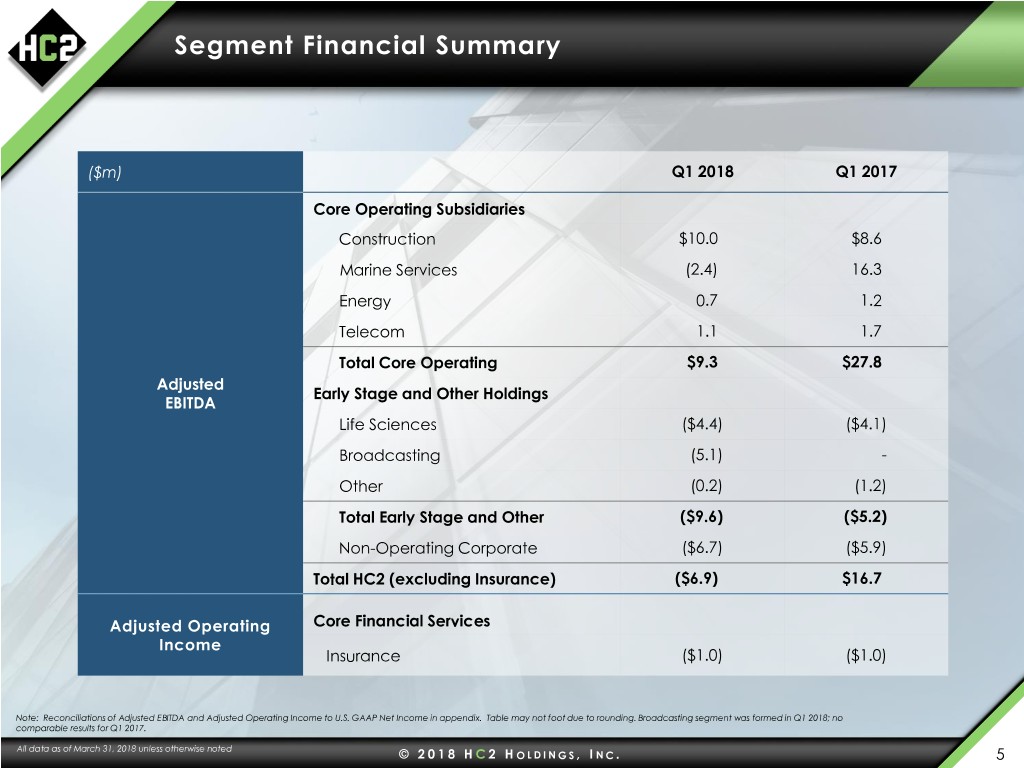

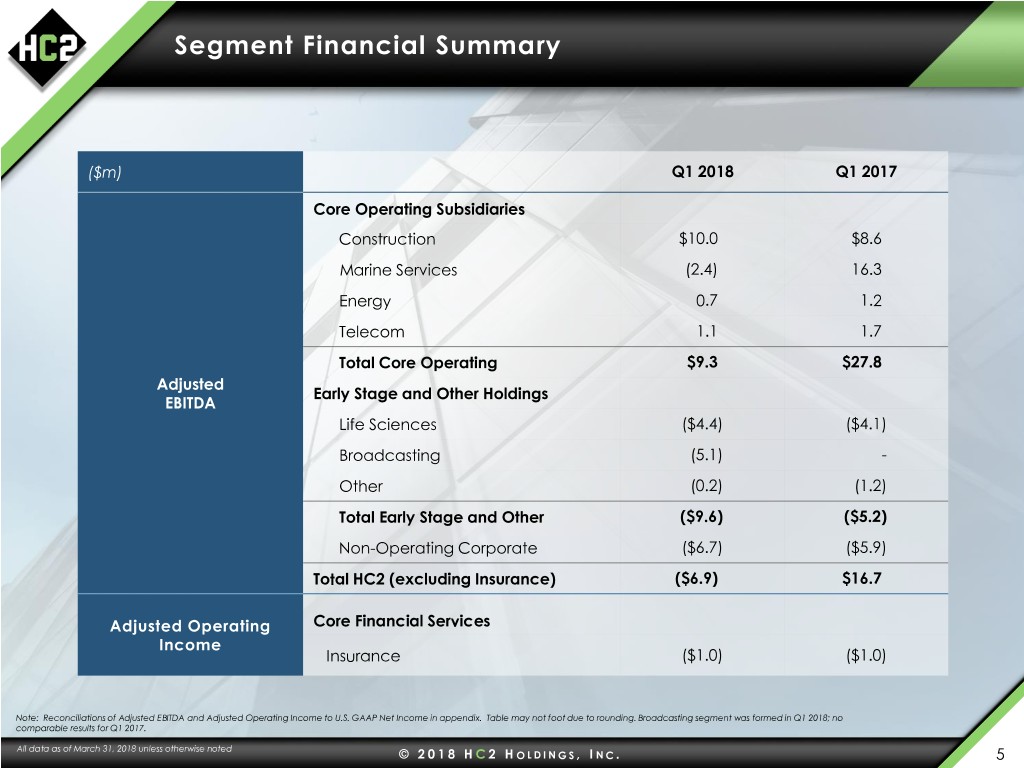

Segment Financial Summary ($m) Q1 2018 Q1 2017 Core Operating Subsidiaries Construction $10.0 $8.6 Marine Services (2.4) 16.3 Energy 0.7 1.2 Telecom 1.1 1.7 Total Core Operating $9.3 $27.8 Adjusted Early Stage and Other Holdings EBITDA Life Sciences ($4.4) ($4.1) Broadcasting (5.1) - Other (0.2) (1.2) Total Early Stage and Other ($9.6) ($5.2) Non-Operating Corporate ($6.7) ($5.9) Total HC2 (excluding Insurance) ($6.9) $16.7 Adjusted Operating Core Financial Services Income Insurance ($1.0) ($1.0) Note: Reconciliations of Adjusted EBITDA and Adjusted Operating Income to U.S. GAAP Net Income in appendix. Table may not foot due to rounding. Broadcasting segment was formed in Q1 2018; no comparable results for Q1 2017. All data as of March 31, 2018 unless otherwise noted © 2 0 1 8 H C 2 H O L D I N G S , I NC. 5

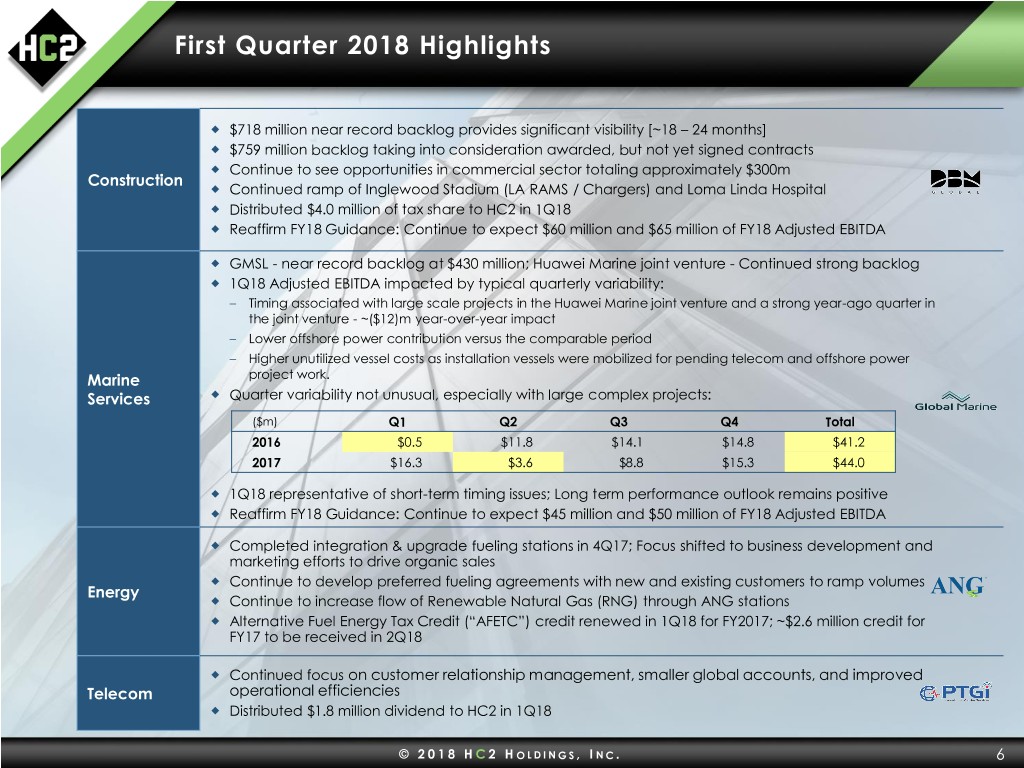

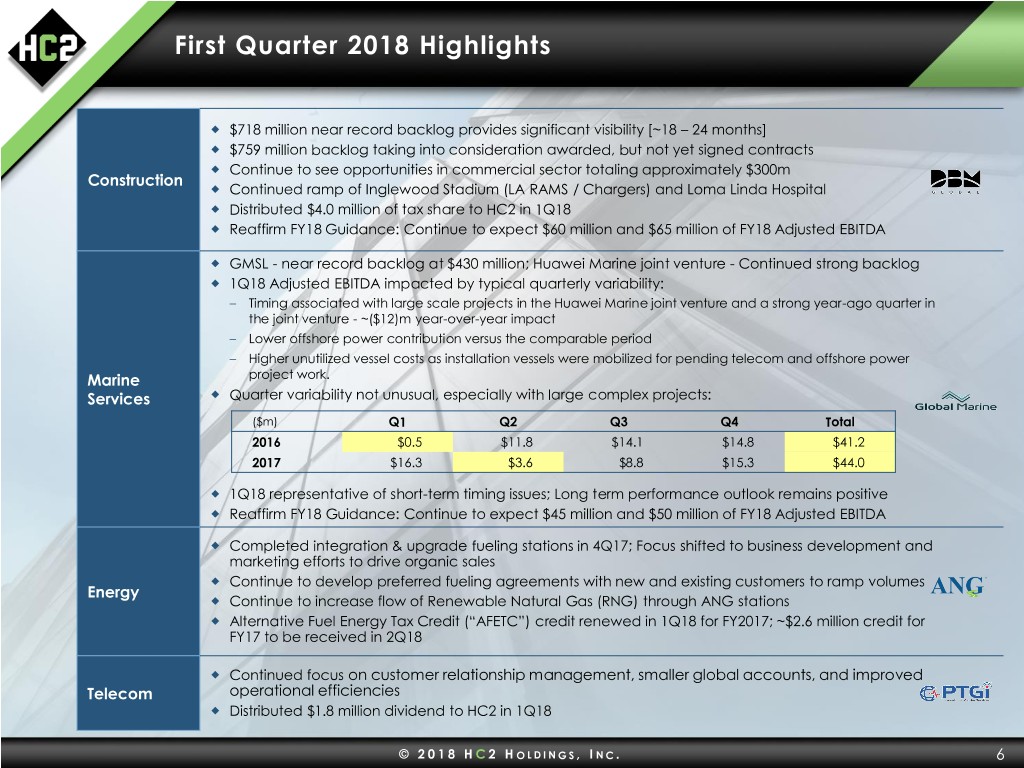

First Quarter 2018 Highlights $718 million near record backlog provides significant visibility [~18 – 24 months] $759 million backlog taking into consideration awarded, but not yet signed contracts Continue to see opportunities in commercial sector totaling approximately $300m Construction Continued ramp of Inglewood Stadium (LA RAMS / Chargers) and Loma Linda Hospital Distributed $4.0 million of tax share to HC2 in 1Q18 Reaffirm FY18 Guidance: Continue to expect $60 million and $65 million of FY18 Adjusted EBITDA GMSL - near record backlog at $430 million; Huawei Marine joint venture - Continued strong backlog 1Q18 Adjusted EBITDA impacted by typical quarterly variability: – Timing associated with large scale projects in the Huawei Marine joint venture and a strong year-ago quarter in the joint venture - ~($12)m year-over-year impact – Lower offshore power contribution versus the comparable period – Higher unutilized vessel costs as installation vessels were mobilized for pending telecom and offshore power Marine project work. Services Quarter variability not unusual, especially with large complex projects: ($m) Q1 Q2 Q3 Q4 Total 2016 $0.5 $11.8 $14.1 $14.8 $41.2 2017 $16.3 $3.6 $8.8 $15.3 $44.0 1Q18 representative of short-term timing issues; Long term performance outlook remains positive Reaffirm FY18 Guidance: Continue to expect $45 million and $50 million of FY18 Adjusted EBITDA Completed integration & upgrade fueling stations in 4Q17; Focus shifted to business development and marketing efforts to drive organic sales Continue to develop preferred fueling agreements with new and existing customers to ramp volumes Energy Continue to increase flow of Renewable Natural Gas (RNG) through ANG stations Alternative Fuel Energy Tax Credit (“AFETC”) credit renewed in 1Q18 for FY2017; ~$2.6 million credit for FY17 to be received in 2Q18 Continued focus on customer relationship management, smaller global accounts, and improved Telecom operational efficiencies Distributed $1.8 million dividend to HC2 in 1Q18 © 2 0 1 8 H C 2 H O L D I N G S , I NC. 6

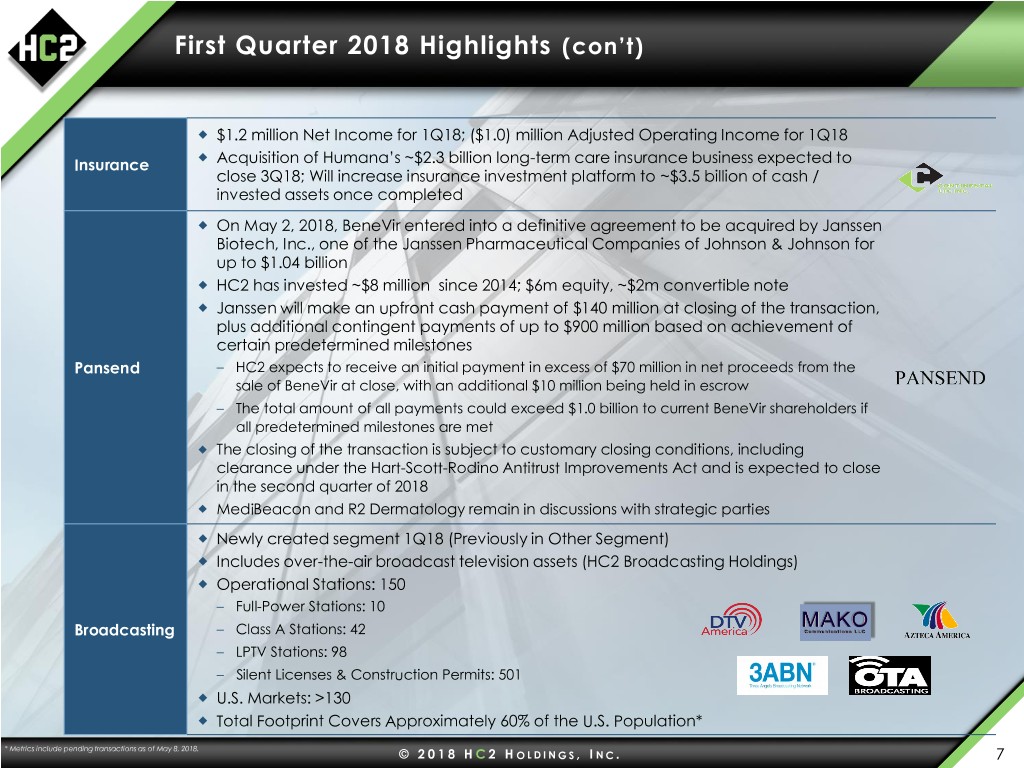

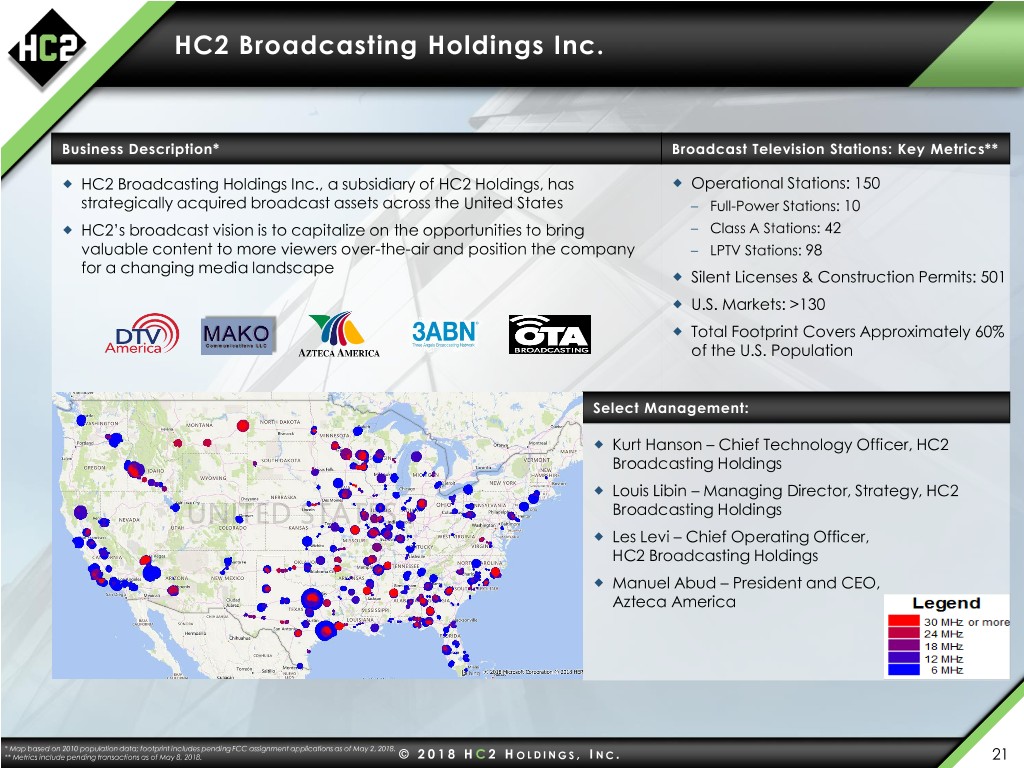

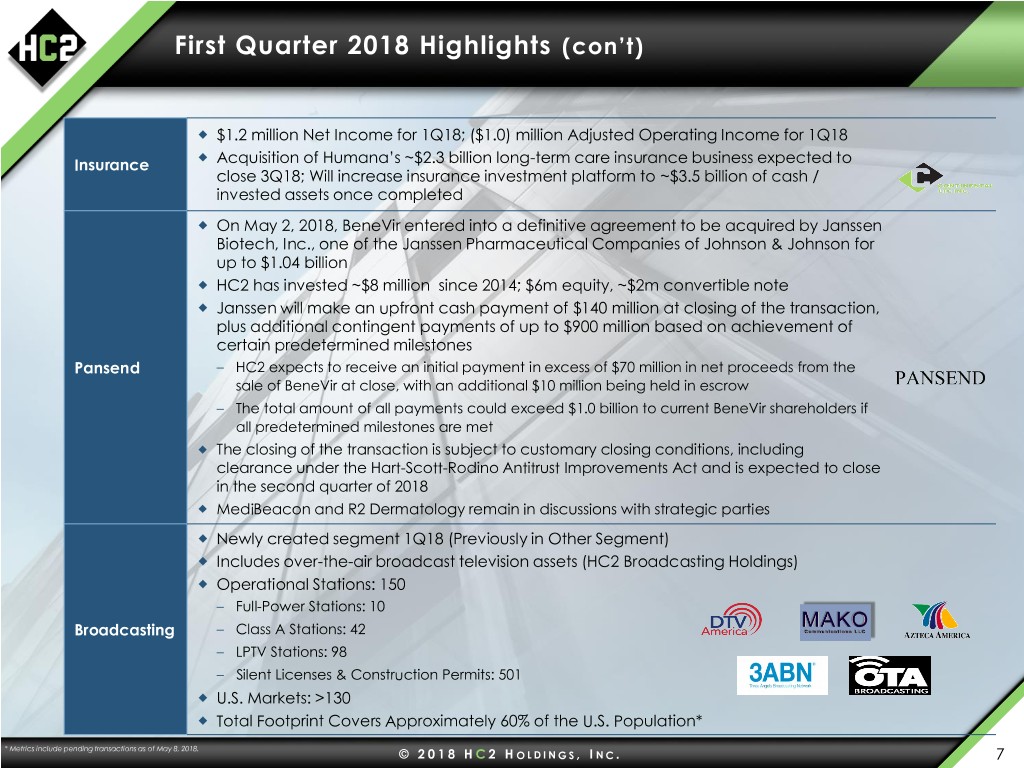

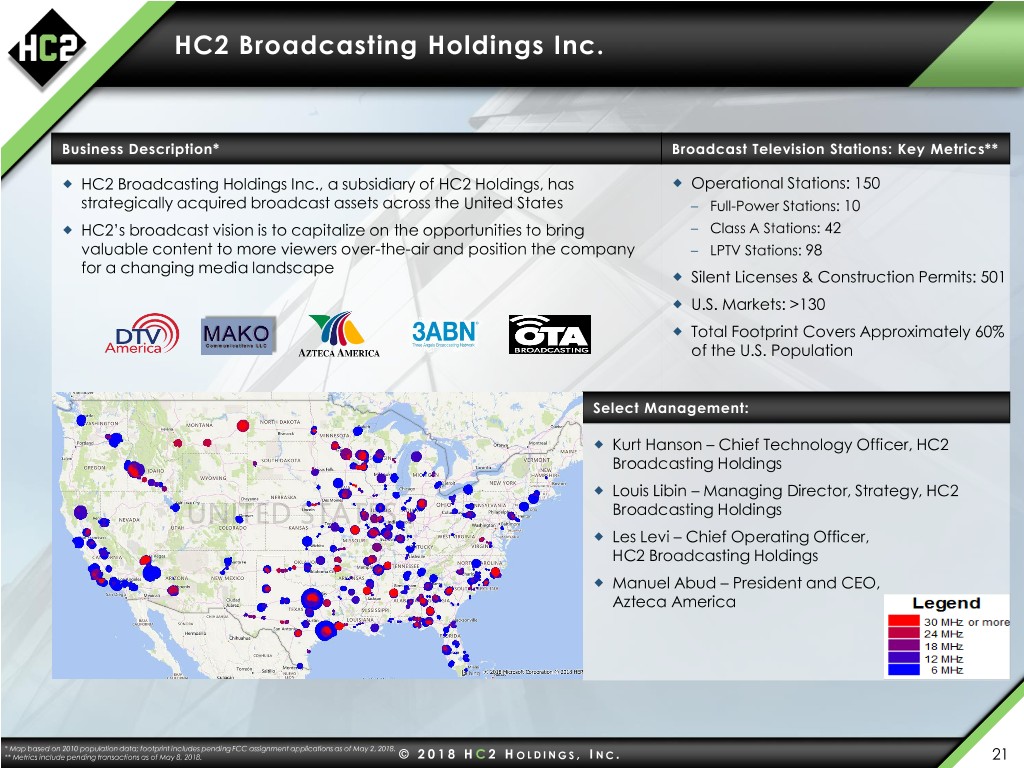

First Quarter 2018 Highlights (con’t) $1.2 million Net Income for 1Q18; ($1.0) million Adjusted Operating Income for 1Q18 Insurance Acquisition of Humana’s ~$2.3 billion long-term care insurance business expected to close 3Q18; Will increase insurance investment platform to ~$3.5 billion of cash / invested assets once completed On May 2, 2018, BeneVir entered into a definitive agreement to be acquired by Janssen Biotech, Inc., one of the Janssen Pharmaceutical Companies of Johnson & Johnson for up to $1.04 billion HC2 has invested ~$8 million since 2014; $6m equity, ~$2m convertible note Janssen will make an upfront cash payment of $140 million at closing of the transaction, plus additional contingent payments of up to $900 million based on achievement of certain predetermined milestones Pansend – HC2 expects to receive an initial payment in excess of $70 million in net proceeds from the sale of BeneVir at close, with an additional $10 million being held in escrow – The total amount of all payments could exceed $1.0 billion to current BeneVir shareholders if all predetermined milestones are met The closing of the transaction is subject to customary closing conditions, including clearance under the Hart-Scott-Rodino Antitrust Improvements Act and is expected to close in the second quarter of 2018 MediBeacon and R2 Dermatology remain in discussions with strategic parties Newly created segment 1Q18 (Previously in Other Segment) Includes over-the-air broadcast television assets (HC2 Broadcasting Holdings) Operational Stations: 150 – Full-Power Stations: 10 Broadcasting – Class A Stations: 42 – LPTV Stations: 98 – Silent Licenses & Construction Permits: 501 U.S. Markets: >130 Total Footprint Covers Approximately 60% of the U.S. Population* * Metrics include pending transactions as of May 8, 2018. © 2 0 1 8 H C 2 H O L D I N G S , I NC. 7

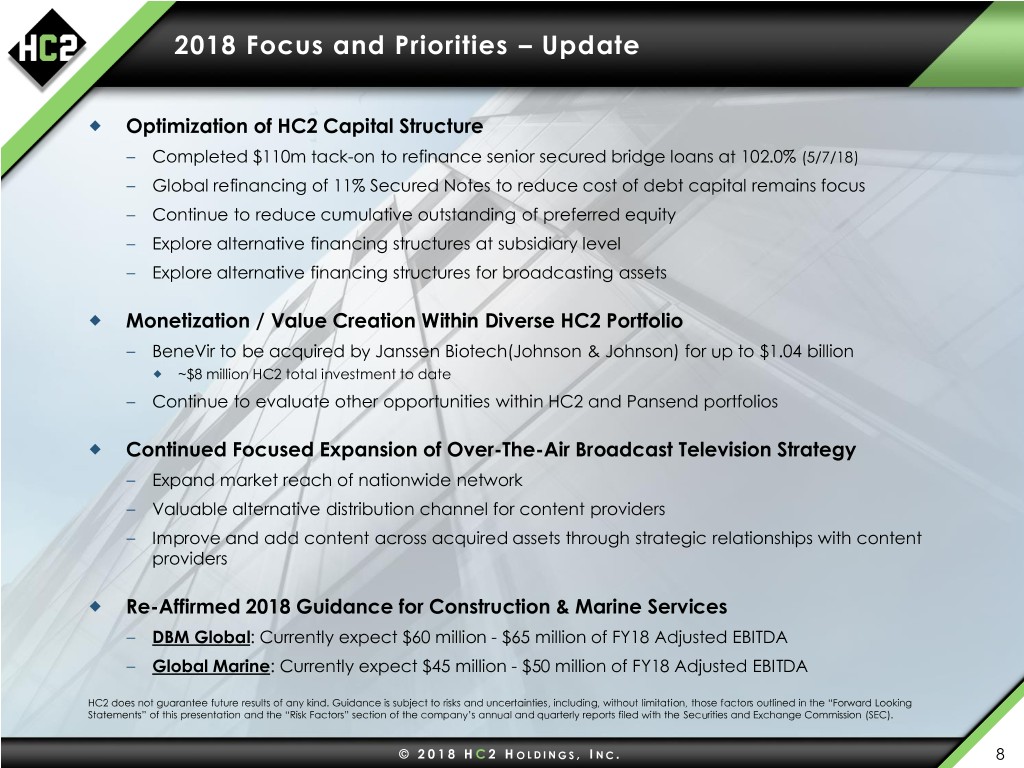

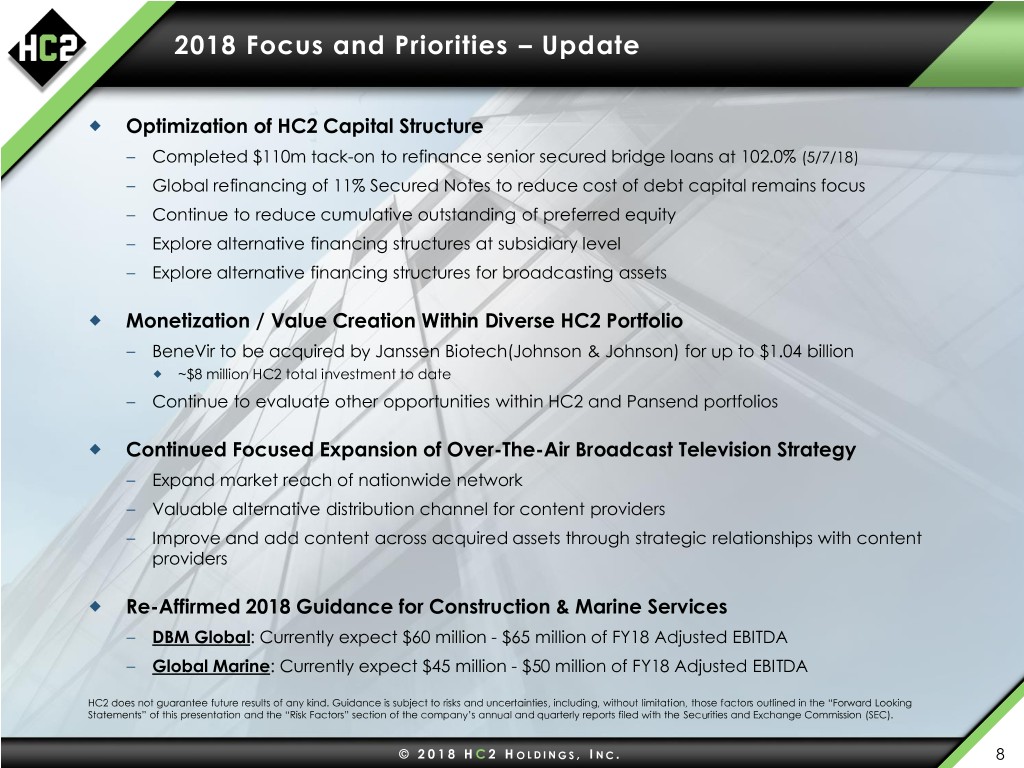

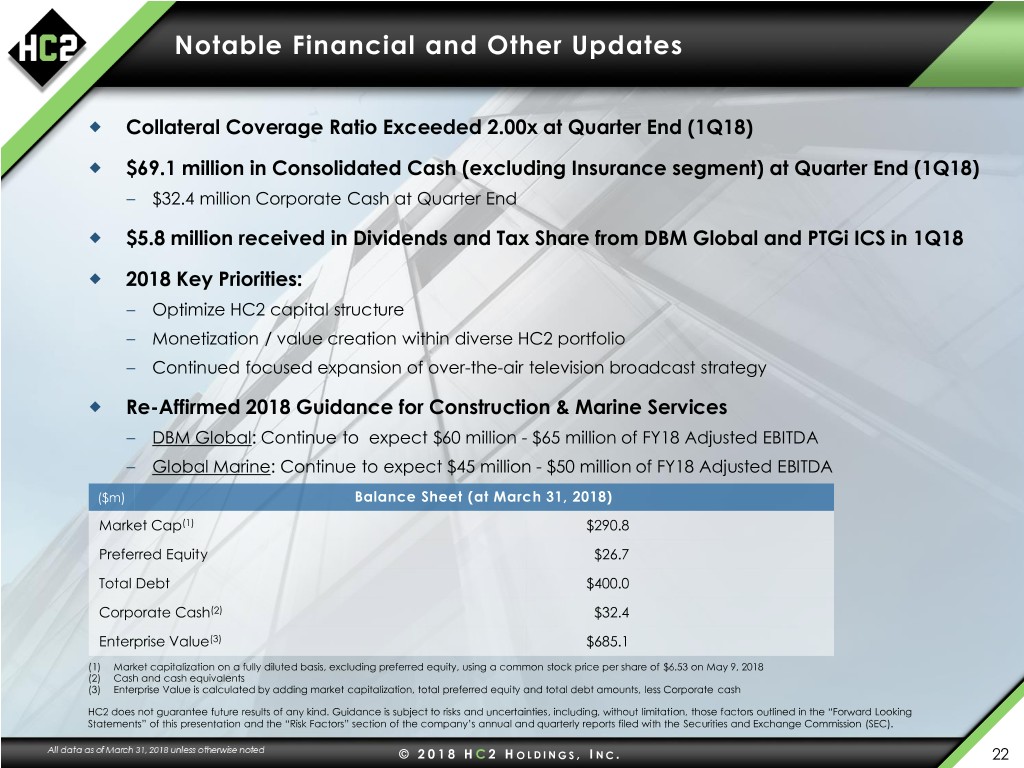

2018 Focus and Priorities – Update Optimization of HC2 Capital Structure – Completed $110m tack-on to refinance senior secured bridge loans at 102.0% (5/7/18) – Global refinancing of 11% Secured Notes to reduce cost of debt capital remains focus – Continue to reduce cumulative outstanding of preferred equity – Explore alternative financing structures at subsidiary level – Explore alternative financing structures for broadcasting assets Monetization / Value Creation Within Diverse HC2 Portfolio – BeneVir to be acquired by Janssen Biotech(Johnson & Johnson) for up to $1.04 billion ~$8 million HC2 total investment to date – Continue to evaluate other opportunities within HC2 and Pansend portfolios Continued Focused Expansion of Over-The-Air Broadcast Television Strategy – Expand market reach of nationwide network – Valuable alternative distribution channel for content providers – Improve and add content across acquired assets through strategic relationships with content providers Re-Affirmed 2018 Guidance for Construction & Marine Services – DBM Global: Currently expect $60 million - $65 million of FY18 Adjusted EBITDA – Global Marine: Currently expect $45 million - $50 million of FY18 Adjusted EBITDA HC2 does not guarantee future results of any kind. Guidance is subject to risks and uncertainties, including, without limitation, those factors outlined in the “Forward Looking Statements” of this presentation and the “Risk Factors” section of the company’s annual and quarterly reports filed with the Securities and Exchange Commission (SEC). © 2 0 1 8 H C 2 H O L D I N G S , I NC. 8

Questions and Answers

Appendix:

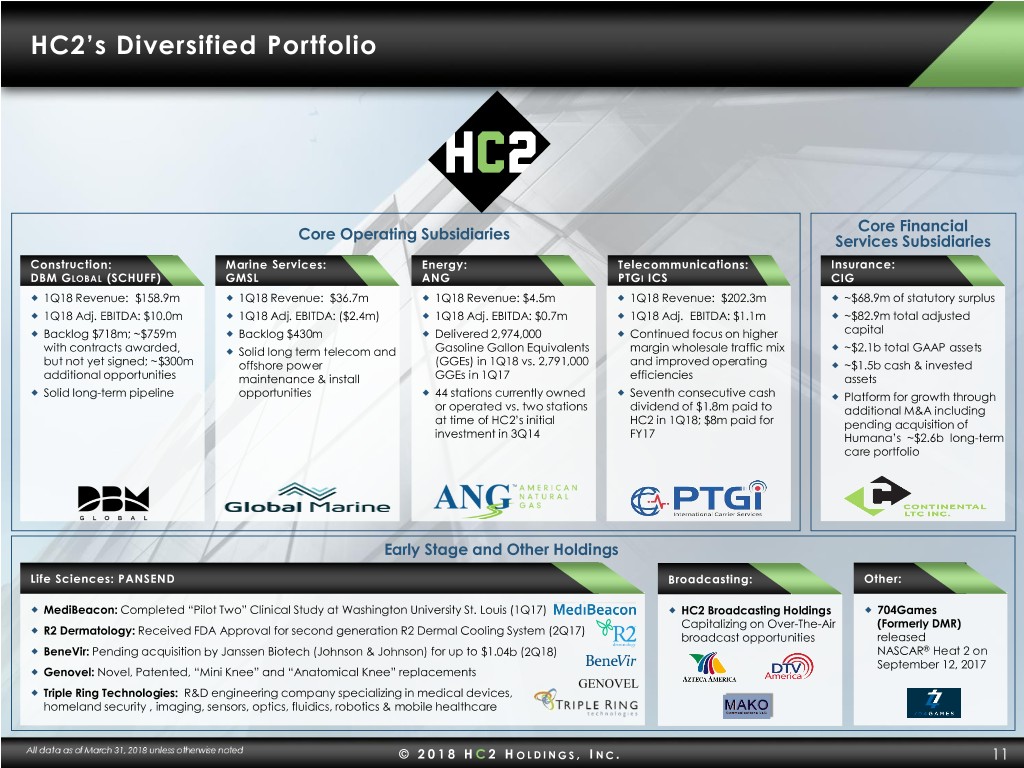

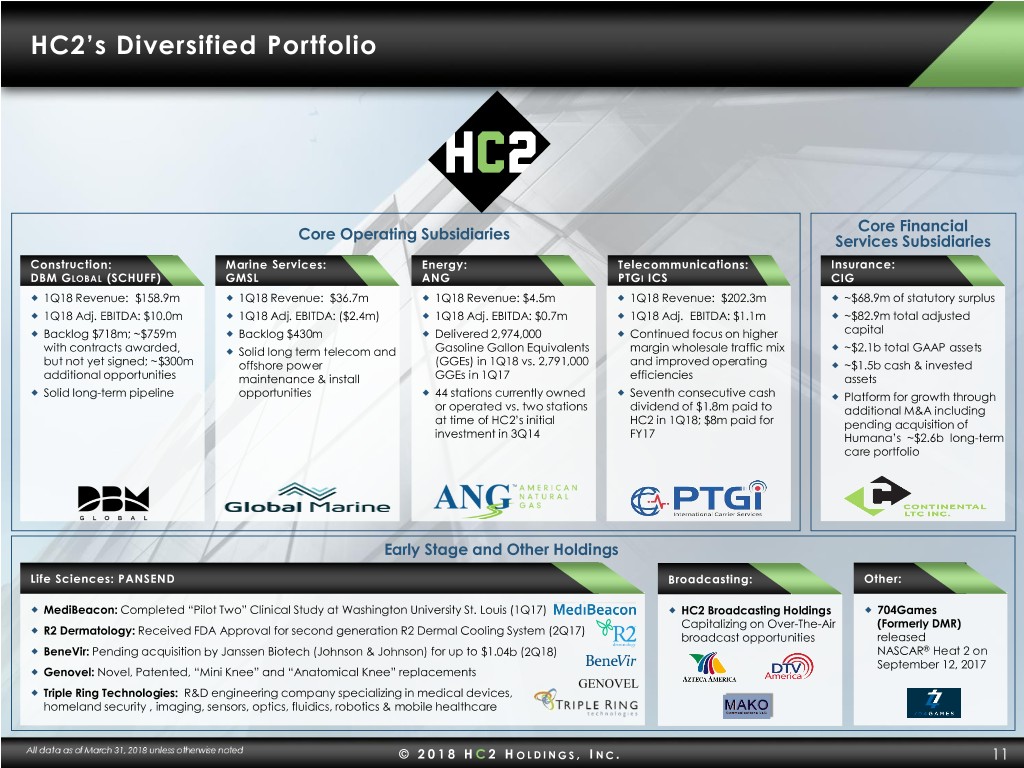

HC2’s Diversified Portfolio Core Financial Core Operating Subsidiaries Services Subsidiaries Construction: Marine Services: Energy: Telecommunications: Insurance: DBM GLOBAL (SCHUFF) GMSL ANG PTGI ICS CIG 1Q18 Revenue: $158.9m 1Q18 Revenue: $36.7m 1Q18 Revenue: $4.5m 1Q18 Revenue: $202.3m ~$68.9m of statutory surplus 1Q18 Adj. EBITDA: $10.0m 1Q18 Adj. EBITDA: ($2.4m) 1Q18 Adj. EBITDA: $0.7m 1Q18 Adj. EBITDA: $1.1m ~$82.9m total adjusted Backlog $718m; ~$759m Backlog $430m Delivered 2,974,000 Continued focus on higher capital with contracts awarded, Solid long term telecom and Gasoline Gallon Equivalents margin wholesale traffic mix ~$2.1b total GAAP assets but not yet signed; ~$300m offshore power (GGEs) in 1Q18 vs. 2,791,000 and improved operating ~$1.5b cash & invested additional opportunities maintenance & install GGEs in 1Q17 efficiencies assets Solid long-term pipeline opportunities 44 stations currently owned Seventh consecutive cash Platform for growth through or operated vs. two stations dividend of $1.8m paid to additional M&A including at time of HC2’s initial HC2 in 1Q18; $8m paid for pending acquisition of investment in 3Q14 FY17 Humana’s ~$2.6b long-term care portfolio Early Stage and Other Holdings Life Sciences: PANSEND Broadcasting: Other: MediBeacon: Completed “Pilot Two” Clinical Study at Washington University St. Louis (1Q17) HC2 Broadcasting Holdings 704Games Capitalizing on Over-The-Air (Formerly DMR) R2 Dermatology: Received FDA Approval for second generation R2 Dermal Cooling System (2Q17) broadcast opportunities released BeneVir: Pending acquisition by Janssen Biotech (Johnson & Johnson) for up to $1.04b (2Q18) NASCAR® Heat 2 on September 12, 2017 Genovel: Novel, Patented, “Mini Knee” and “Anatomical Knee” replacements Triple Ring Technologies: R&D engineering company specializing in medical devices, homeland security , imaging, sensors, optics, fluidics, robotics & mobile healthcare © 2 0 1 8 H C 2 H O L D I N G S , I NC. 11

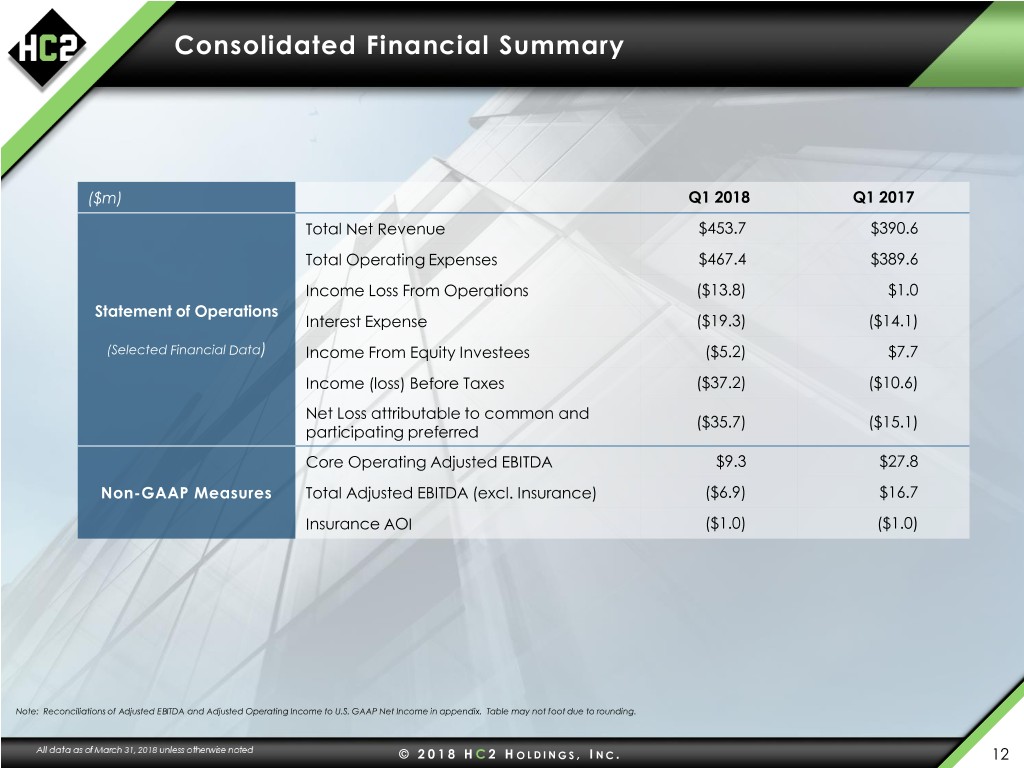

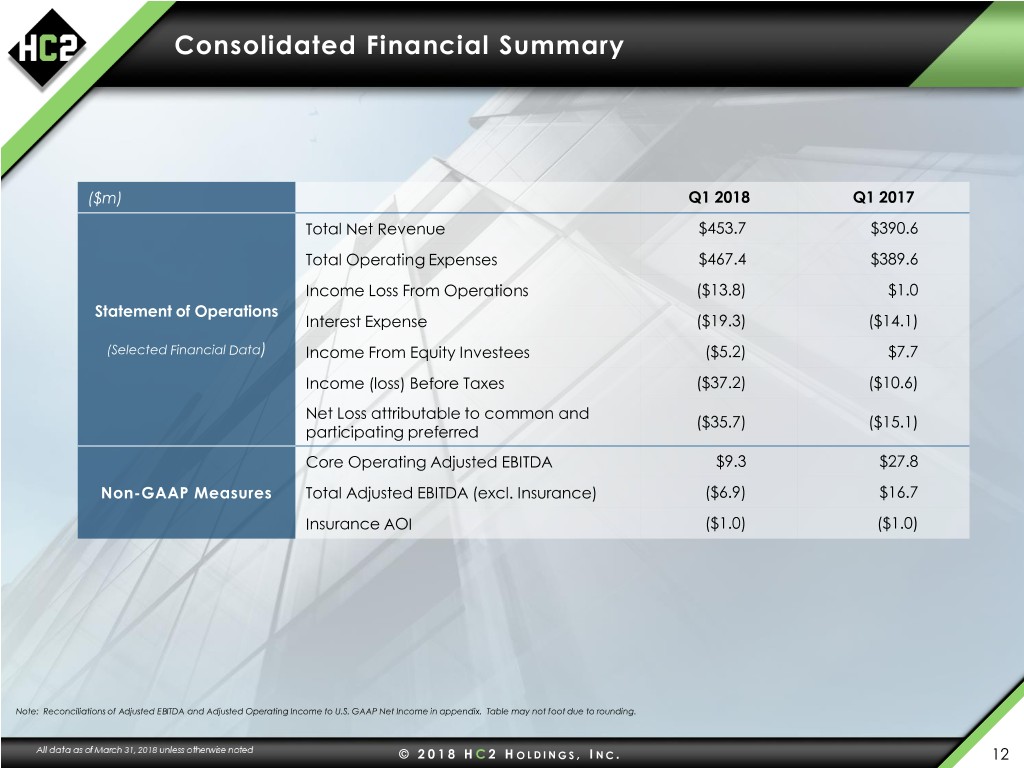

Consolidated Financial Summary ($m) Q1 2018 Q1 2017 Total Net Revenue $453.7 $390.6 Total Operating Expenses $467.4 $389.6 Income Loss From Operations ($13.8) $1.0 Statement of Operations Interest Expense ($19.3) ($14.1) (Selected Financial Data) Income From Equity Investees ($5.2) $7.7 Income (loss) Before Taxes ($37.2) ($10.6) Net Loss attributable to common and ($35.7) ($15.1) participating preferred Core Operating Adjusted EBITDA $9.3 $27.8 Non-GAAP Measures Total Adjusted EBITDA (excl. Insurance) ($6.9) $16.7 Insurance AOI ($1.0) ($1.0) Note: Reconciliations of Adjusted EBITDA and Adjusted Operating Income to U.S. GAAP Net Income in appendix. Table may not foot due to rounding. © 2 0 1 8 H C 2 H O L D I N G S , I NC. 12

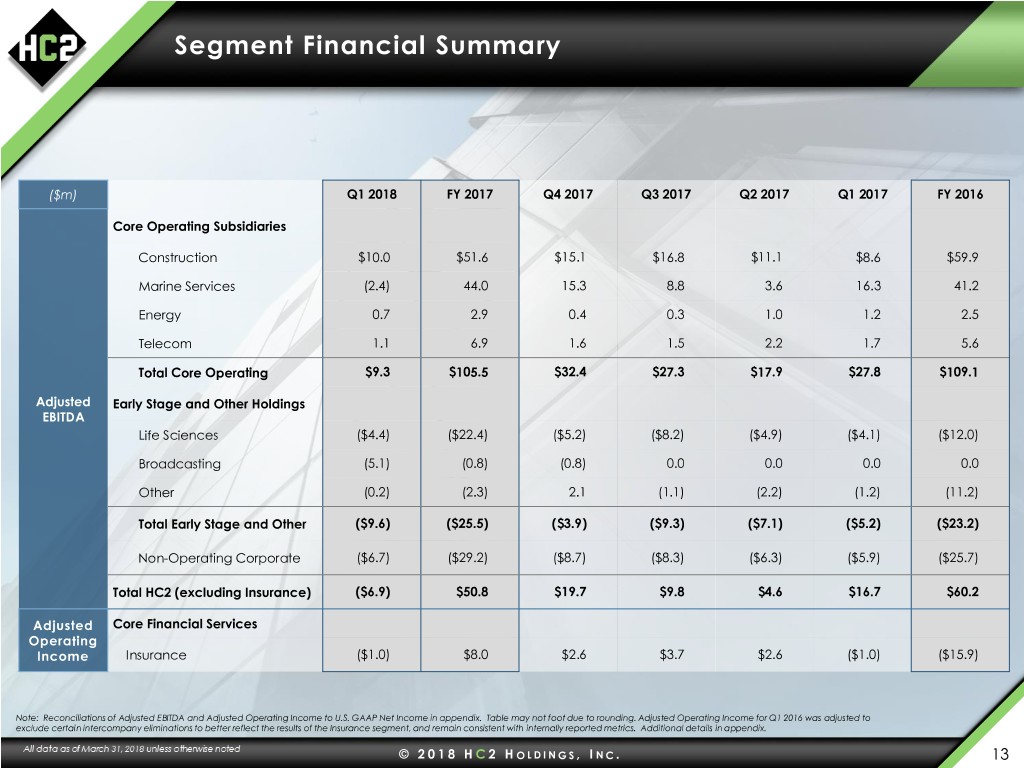

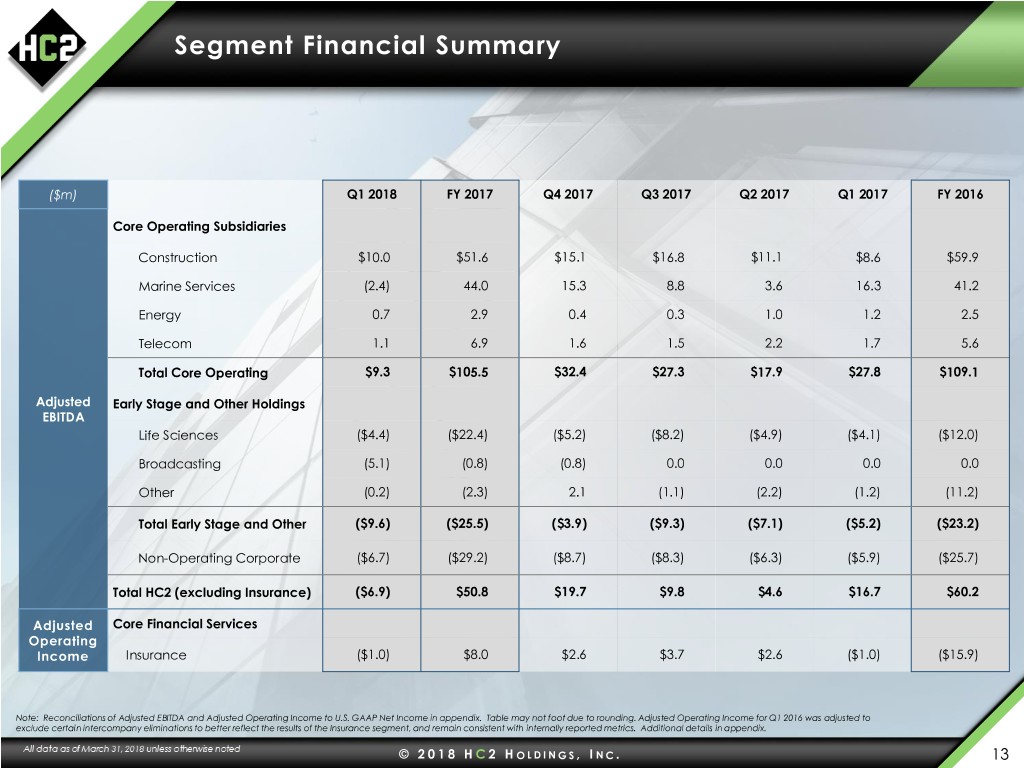

Segment Financial Summary ($m) Q1 2018 FY 2017 Q4 2017 Q3 2017 Q2 2017 Q1 2017 FY 2016 Core Operating Subsidiaries Construction $10.0 $51.6 $15.1 $16.8 $11.1 $8.6 $59.9 Marine Services (2.4) 44.0 15.3 8.8 3.6 16.3 41.2 Energy 0.7 2.9 0.4 0.3 1.0 1.2 2.5 Telecom 1.1 6.9 1.6 1.5 2.2 1.7 5.6 Total Core Operating $9.3 $105.5 $32.4 $27.3 $17.9 $27.8 $109.1 Adjusted Early Stage and Other Holdings EBITDA Life Sciences ($4.4) ($22.4) ($5.2) ($8.2) ($4.9) ($4.1) ($12.0) Broadcasting (5.1) (0.8) (0.8) 0.0 0.0 0.0 0.0 Other (0.2) (2.3) 2.1 (1.1) (2.2) (1.2) (11.2) Total Early Stage and Other ($9.6) ($25.5) ($3.9) ($9.3) ($7.1) ($5.2) ($23.2) Non-Operating Corporate ($6.7) ($29.2) ($8.7) ($8.3) ($6.3) ($5.9) ($25.7) Total HC2 (excluding Insurance) ($6.9) $50.8 $19.7 $9.8 $4.6 $16.7 $60.2 Adjusted Core Financial Services Operating Income Insurance ($1.0) $8.0 $2.6 $3.7 $2.6 ($1.0) ($15.9) Note: Reconciliations of Adjusted EBITDA and Adjusted Operating Income to U.S. GAAP Net Income in appendix. Table may not foot due to rounding. Adjusted Operating Income for Q1 2016 was adjusted to exclude certain intercompany eliminations to better reflect the results of the Insurance segment, and remain consistent with internally reported metrics. Additional details in appendix. © 2 0 1 8 H C 2 H O L D I N G S , I NC. 13

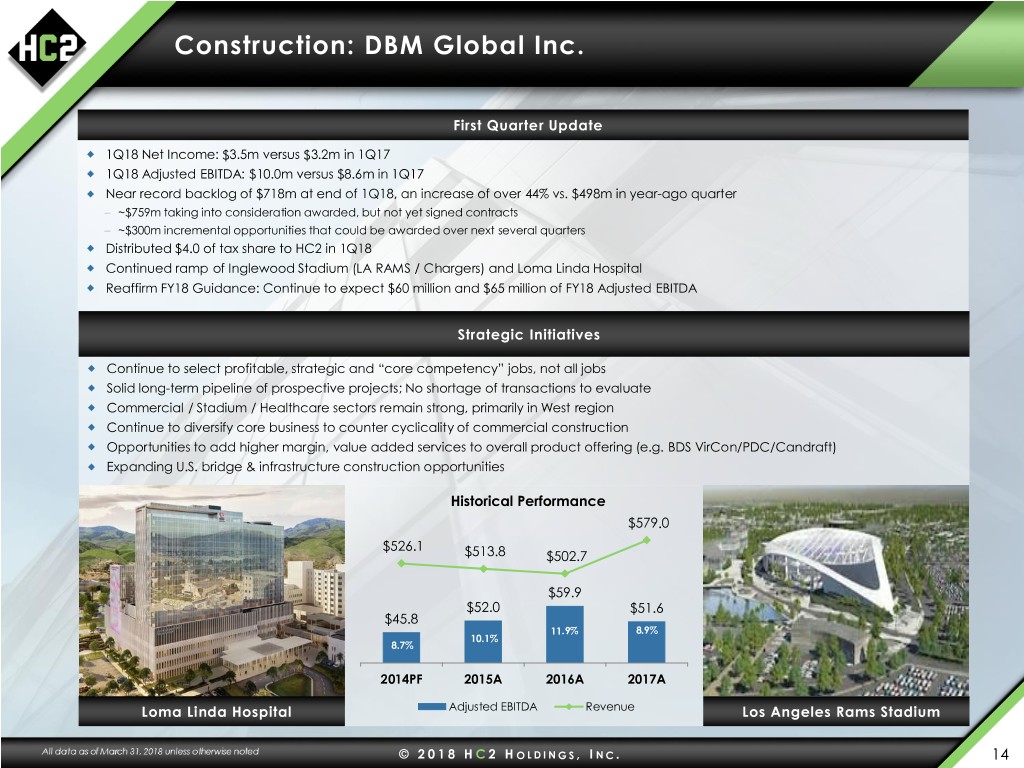

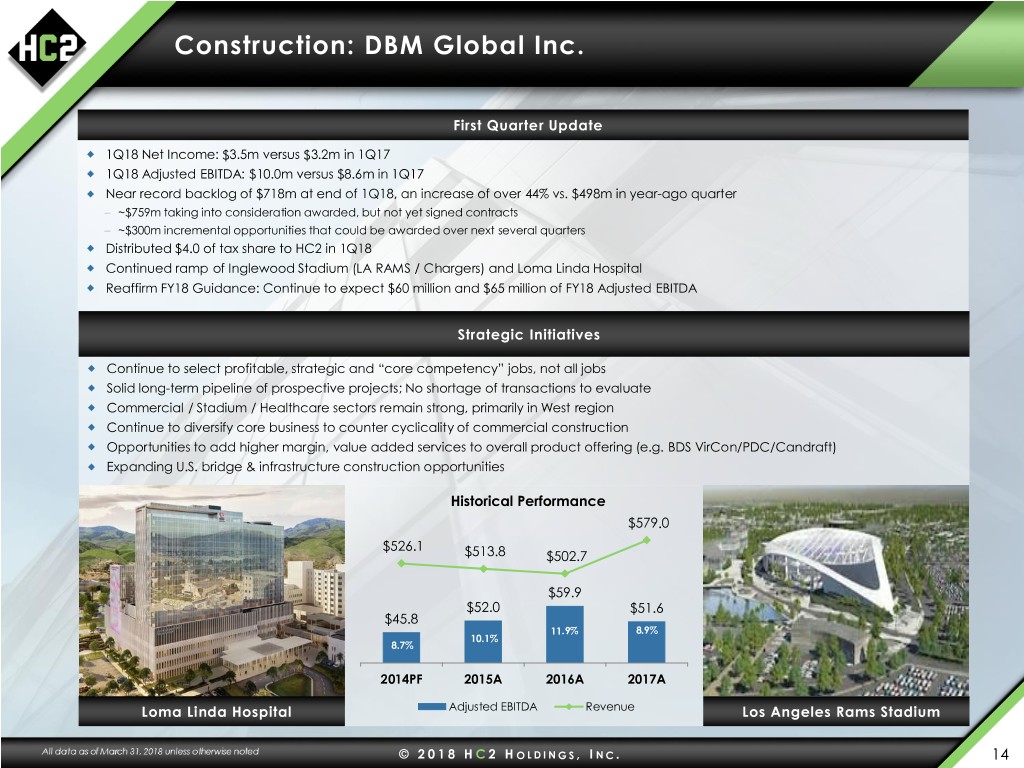

Construction: DBM Global Inc. First Quarter Update 1Q18 Net Income: $3.5m versus $3.2m in 1Q17 1Q18 Adjusted EBITDA: $10.0m versus $8.6m in 1Q17 Near record backlog of $718m at end of 1Q18, an increase of over 44% vs. $498m in year-ago quarter – ~$759m taking into consideration awarded, but not yet signed contracts – ~$300m incremental opportunities that could be awarded over next several quarters Distributed $4.0 of tax share to HC2 in 1Q18 Continued ramp of Inglewood Stadium (LA RAMS / Chargers) and Loma Linda Hospital Reaffirm FY18 Guidance: Continue to expect $60 million and $65 million of FY18 Adjusted EBITDA Strategic Initiatives Continue to select profitable, strategic and “core competency” jobs, not all jobs Solid long-term pipeline of prospective projects; No shortage of transactions to evaluate Commercial / Stadium / Healthcare sectors remain strong, primarily in West region Continue to diversify core business to counter cyclicality of commercial construction Opportunities to add higher margin, value added services to overall product offering (e.g. BDS VirCon/PDC/Candraft) Expanding U.S. bridge & infrastructure construction opportunities Historical Performance $579.0 $526.1 $513.8 $502.7 $59.9 $52.0 $51.6 $45.8 11.9% 8.9% 10.1% 8.7% 2014PF 2015A 2016A 2017A Loma Linda Hospital Adjusted EBITDA Revenue Los Angeles Rams Stadium © 2 0 1 8 H C 2 H O L D I N G S , I NC. 14

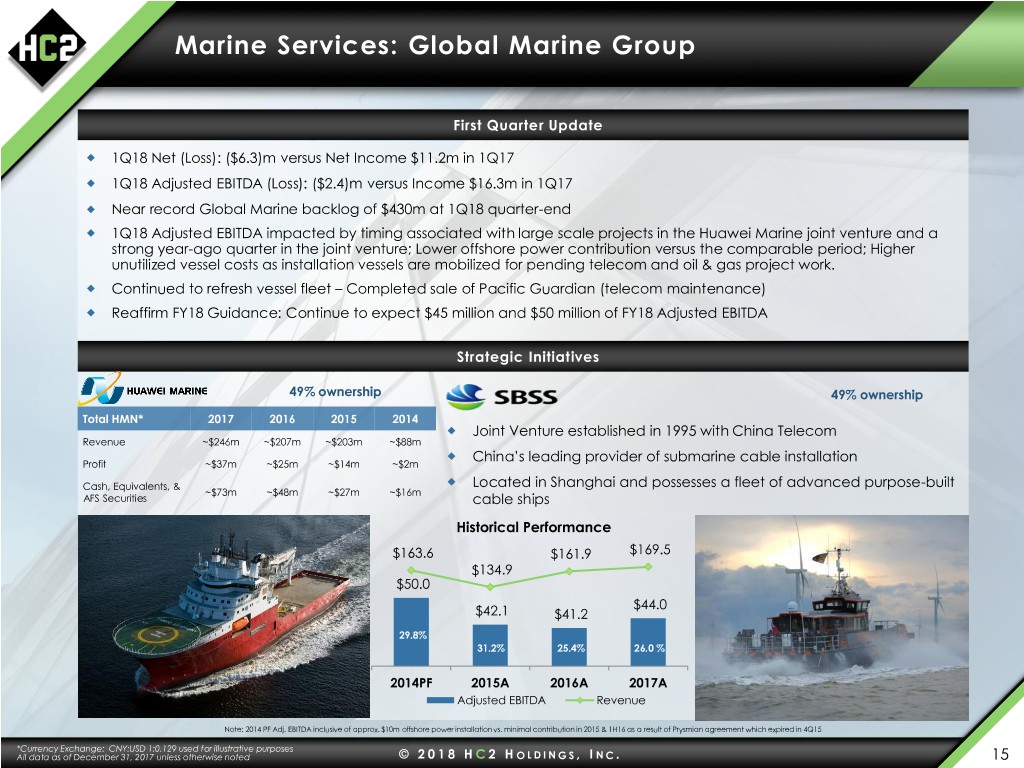

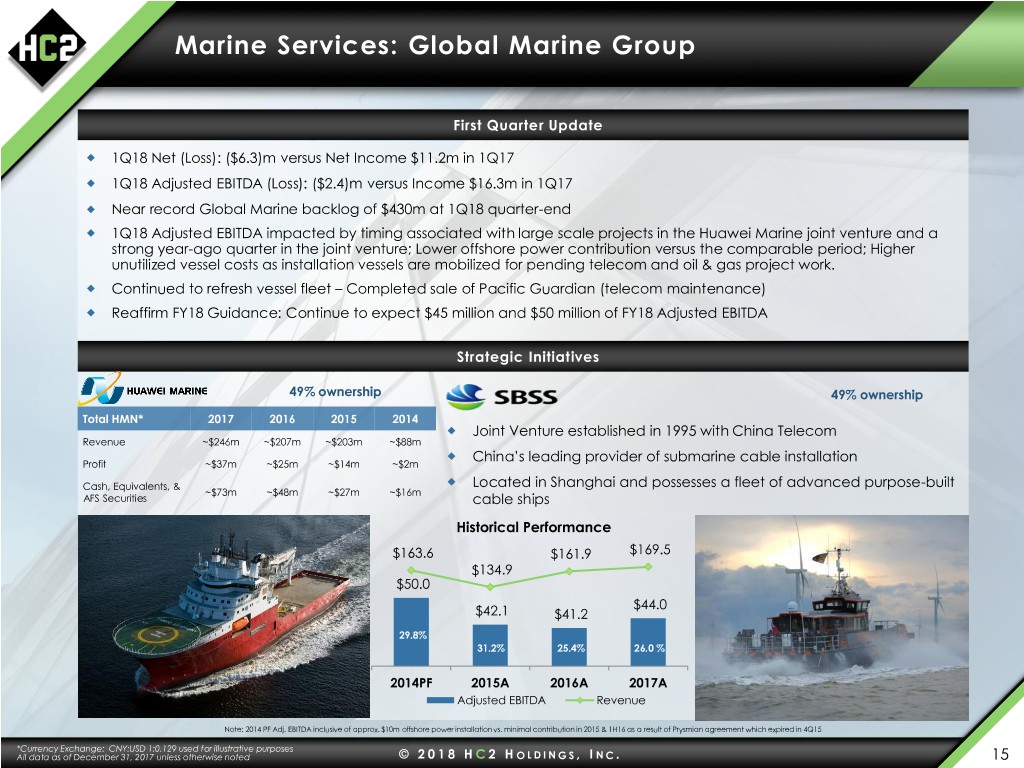

Marine Services: Global Marine Group First Quarter Update 1Q18 Net (Loss): ($6.3)m versus Net Income $11.2m in 1Q17 1Q18 Adjusted EBITDA (Loss): ($2.4)m versus Income $16.3m in 1Q17 Near record Global Marine backlog of $430m at 1Q18 quarter-end 1Q18 Adjusted EBITDA impacted by timing associated with large scale projects in the Huawei Marine joint venture and a strong year-ago quarter in the joint venture; Lower offshore power contribution versus the comparable period; Higher unutilized vessel costs as installation vessels are mobilized for pending telecom and oil & gas project work. Continued to refresh vessel fleet – Completed sale of Pacific Guardian (telecom maintenance) Reaffirm FY18 Guidance: Continue to expect $45 million and $50 million of FY18 Adjusted EBITDA Strategic Initiatives 49% ownership 49% ownership Total HMN* 2017 2016 2015 2014 Joint Venture established in 1995 with China Telecom Revenue ~$246m ~$207m ~$203m ~$88m China’s leading provider of submarine cable installation Profit ~$37m ~$25m ~$14m ~$2m Cash, Equivalents, & Located in Shanghai and possesses a fleet of advanced purpose-built ~$73m ~$48m ~$27m ~$16m AFS Securities cable ships Historical Performance $163.6 $161.9 $169.5 $134.9 $50.0 $44.0 $42.1 $41.2 29.8% 31.2% 25.4% 26.0 % 2014PF 2015A 2016A 2017A Adjusted EBITDA Revenue Note: 2014 PF Adj. EBITDA inclusive of approx. $10m offshore power installation vs. minimal contribution in 2015 & 1H16 as a result of Prysmian agreement which expired in 4Q15 *Currency Exchange: CNY:USD 1:0.129 used for illustrative purposes All data as of December 31, 2017 unless otherwise noted © 2 0 1 8 H C 2 H O L D I N G S , I NC. 15

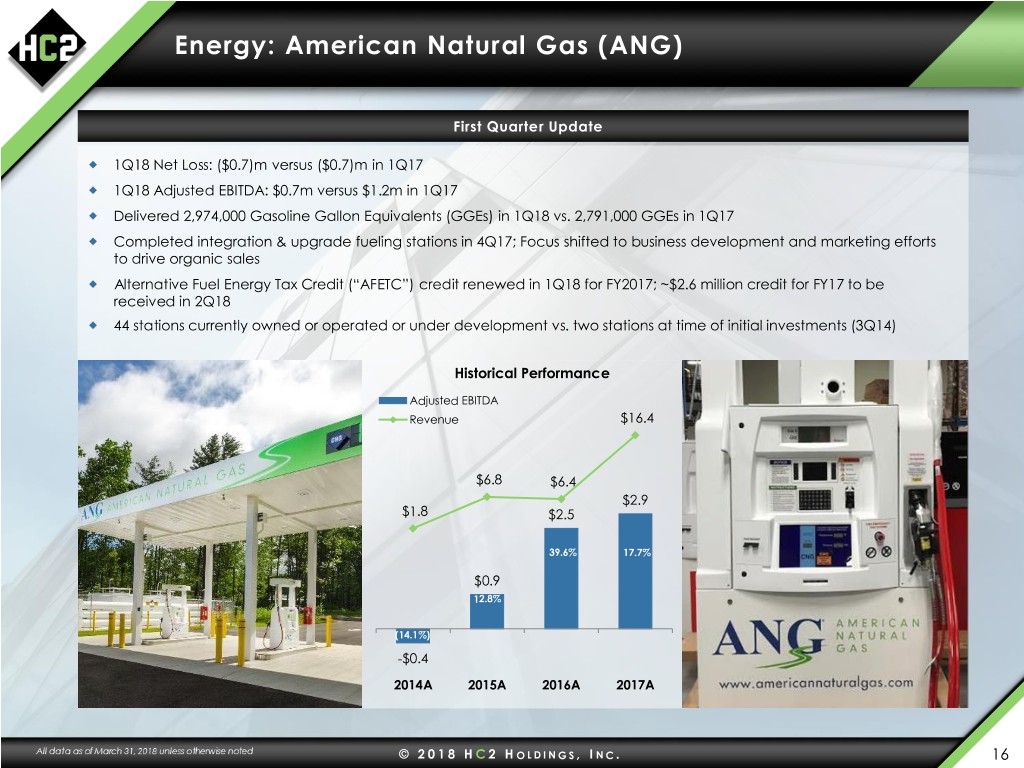

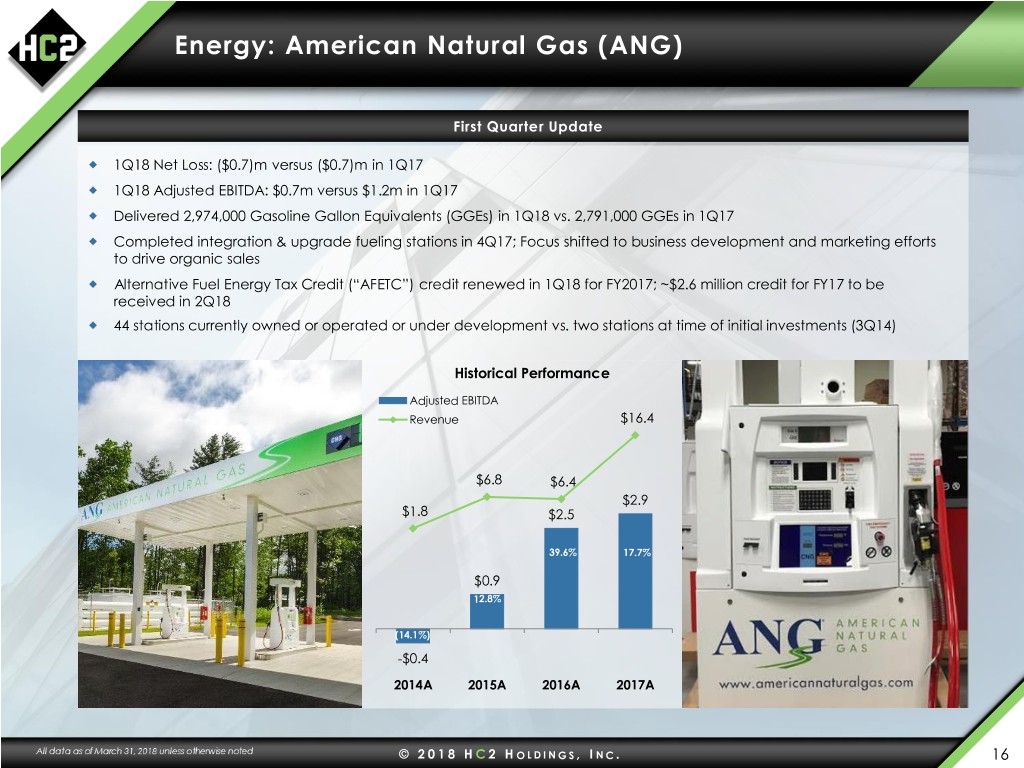

Energy: American Natural Gas (ANG) First Quarter Update 1Q18 Net Loss: ($0.7)m versus ($0.7)m in 1Q17 1Q18 Adjusted EBITDA: $0.7m versus $1.2m in 1Q17 Delivered 2,974,000 Gasoline Gallon Equivalents (GGEs) in 1Q18 vs. 2,791,000 GGEs in 1Q17 Completed integration & upgrade fueling stations in 4Q17; Focus shifted to business development and marketing efforts to drive organic sales Alternative Fuel Energy Tax Credit (“AFETC”) credit renewed in 1Q18 for FY2017; ~$2.6 million credit for FY17 to be received in 2Q18 44 stations currently owned or operated or under development vs. two stations at time of initial investments (3Q14) Historical Performance Adjusted EBITDA Revenue $16.4 $6.8 $6.4 $2.9 $1.8 $2.5 39.6% 17.7% $0.9 12.8% (14.1%) -$0.4 2014A 2015A 2016A 2017A © 2 0 1 8 H C 2 H O L D I N G S , I NC. 16

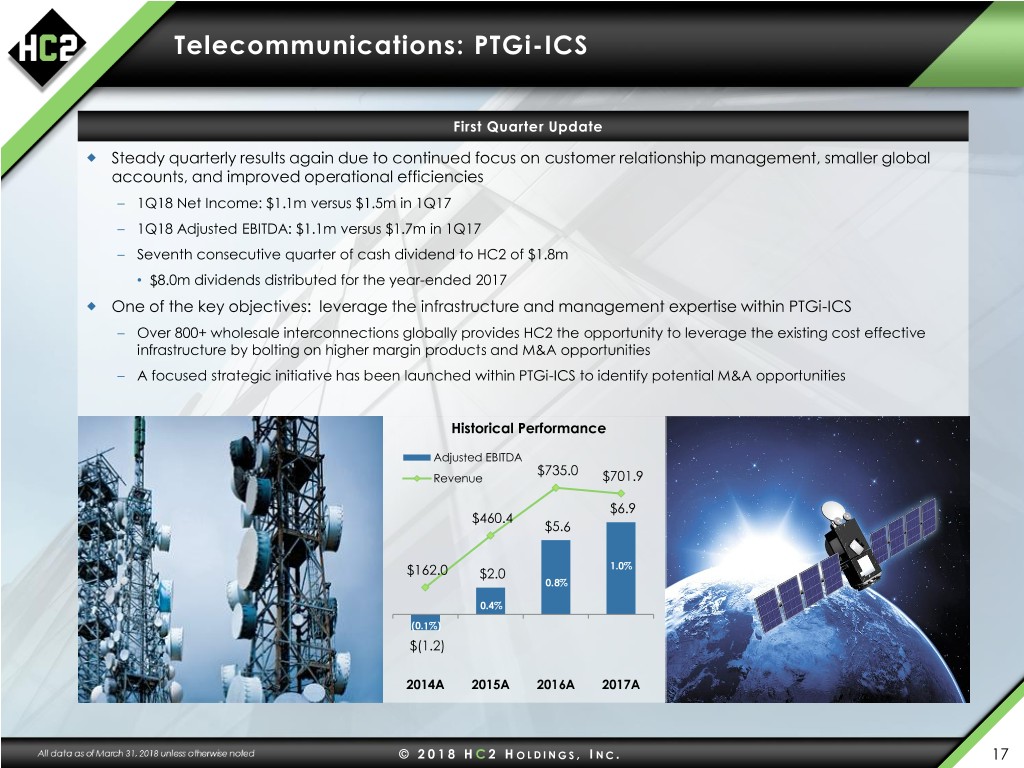

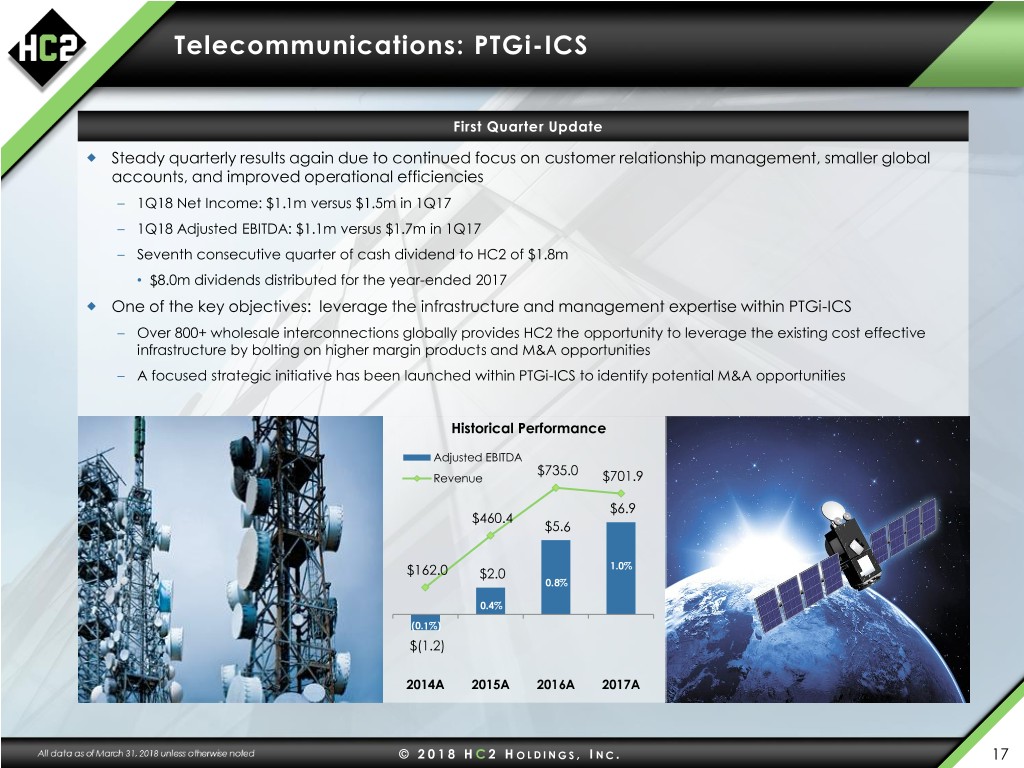

Telecommunications: PTGi-ICS First Quarter Update Steady quarterly results again due to continued focus on customer relationship management, smaller global accounts, and improved operational efficiencies – 1Q18 Net Income: $1.1m versus $1.5m in 1Q17 – 1Q18 Adjusted EBITDA: $1.1m versus $1.7m in 1Q17 – Seventh consecutive quarter of cash dividend to HC2 of $1.8m • $8.0m dividends distributed for the year-ended 2017 One of the key objectives: leverage the infrastructure and management expertise within PTGi-ICS – Over 800+ wholesale interconnections globally provides HC2 the opportunity to leverage the existing cost effective infrastructure by bolting on higher margin products and M&A opportunities – A focused strategic initiative has been launched within PTGi-ICS to identify potential M&A opportunities Historical Performance Adjusted EBITDA $735.0 Revenue $701.9 $6.9 $460.4 $5.6 1.0% $162.0 $2.0 0.8% 0.4% (0.1%) $(1.2) 2014A 2015A 2016A 2017A © 2 0 1 8 H C 2 H O L D I N G S , I NC. 17

Insurance: Continental Insurance Group First Quarter Update Continental Insurance Group serves as HC2’s insurance platform and through its wholly owned subsidiary, Continental LTC Inc. (“CLI”), offers a platform for run-off Long Term Care (“LTC”) books of business – 1Q18 Net Income: $1.2m versus Net Loss ($0.8)m in 1Q17 – 1Q18 Adjusted Operating Income: ($1.0)m AOI Loss versus ($1.0)m in 1Q17 – ~$68.9m statutory surplus at end of first quarter – ~$82.9m total adjusted capital at end of first quarter – ~$2.1b in total GAAP assets at March 31, 2018 – ~$1.5b in cash and invested assets at March 31, 2018 Signed Definitive Agreement to Acquire Humana’s ~$2.6 billion Long-Term Care Insurance Business – Significantly grows the platform and leverages Continental’s insurance operations in Austin, Texas – Once completed, Continental will have approximately $3.5 billion portfolio of cash and investable assets – Immediately accretive to Continental’s RBC Ratio and Statutory Capital – Opportunity to meaningfully increase investment portfolio yield – Validates and endorses HC2’s insurance platform and strategy – Expected to close by third quarter 2018 Note: Reconciliation of Adjusted Operating Income to U.S. GAAP Net Income in appendix. All data as of March 31, 2018 unless otherwise noted © 2 0 1 8 H C 2 H O L D I N G S , I NC. 18

Pansend HC2’s Pansend Life Sciences Segment Is Focused on the Development of Innovative Healthcare Technologies and Products 80% equity ownership of company focused on immunotherapy; Oncolytic virotherapy for treatment of solid cancer tumors Founded by Dr. Matthew Mulvey & Dr. Ian Mohr (who co-developed T-Vec); Biovex (owner of T-Vec) acquired by Amgen for ~$1billion Benevir’s T-Stealth is a second generation oncolytic virus with new features and new intellectual property BeneVir holds exclusive worldwide license to develop BV-2711 (T-Stealth) Granted new patent entitled “Oncolytic Herpes Simplex Virus and Therapeutic Uses Thereof”, covering the composition of matter for Stealth-1H, BeneVir’s lead oncolytic immunotherapy, as well as other platform assets (2Q17) Entered into definitive agreement to be acquired by Janssen Biotech, Inc. (Johnson & Johnson) for up to $1.04 billion (2Q18) 74% equity ownership of dermatology company focused on lightening and brightening skin Founded by Pansend in partnership with Mass. General Hospital and inventors Dr. Rox Anderson, Dieter Manstein and Dr. Henry Chan Over $20 billion global market Received Food and Drug Administration approval for the R2 Dermal Cooling System (4Q16) Received Food and Drug Administration approval for second generation R2 Dermal Cooling System (2Q17) 80% equity ownership in company with unique knee replacements based on technology from Dr. Peter Walker, NYU Dept. of Orthopedic Surgery and one of the pioneers of the original Total Knee. “Mini-Knee” for early osteoarthritis of the knee; “Anatomical Knee” – A Novel Total Knee Replacement Strong patent portfolio 50% equity ownership in company with unique technology and device for monitoring of real-time kidney function Current standard diagnostic tests measure kidney function are often inaccurate and not real-time MediBeacon’s Optical Renal Function Monitor will be first and only, non-invasive system to enable real-time, direct monitoring of renal function at point-of-care $3.5 billion potential market Successfully completed a key clinical study of its unique, real-time kidney monitoring system on subjects with impaired kidney function at Washington University in St. Louis. (1Q17) Profitable technology and product development company Areas of expertise include medical devices, homeland security, imaging systems, sensors, optics, fluidics, robotics and mobile healthcare Located in Silicon Valley and Boston area with over 90,000 square feet of working laboratory and incubator space Contract R&D market growing rapidly Customers include Fortune 500 companies and start-ups © 2 0 1 8 H C 2 H O L D I N G S , I NC. Note: Equity ownership percentages do not reflect fully diluted amounts 19

Pansend: BeneVir / Janssen Acquisition Summary BeneVir: BeneVir is a portfolio company of Pansend, our Life Sciences segment – Focused on the development of a patent-protected oncolytic virus, BV-2711, for the treatment of solid cancer tumors Pansend is the owner of all of BeneVir's outstanding preferred stock, through which Pansend holds an approximate 80%, or ~76% on a fully diluted basis, controlling interest in BeneVir On May 1st, BeneVir entered into a definitive agreement to be acquired by Janssen Biotech, Inc. (“Janssen”), one of the Janssen Pharmaceutical Companies of Johnson & Johnson Janssen will make an upfront cash payment of $140 million to current BeneVir shareholders at closing of the transaction, plus additional contingent payments of up to $900 million based on achievement of certain predetermined milestones – HC2 expects to receive an initial payment in excess of $70 million in net proceeds from the sale of BeneVir at closing, with an additional $10 million being held in escrow – The total amount of all payments could exceed $1 billion to current BeneVir shareholders if all milestones are met – HC2 has invested ~$8 million to date The closing of the transaction is subject to customary closing conditions, including clearance under the Hart-Scott-Rodino Antitrust Improvements Act and is expected to * close in the second quarter of 2018 © 2 0 1 8 H C 2 H O L D I N G S , I NC. 20

HC2 Broadcasting Holdings Inc. Business Description* Broadcast Television Stations: Key Metrics** HC2 Broadcasting Holdings Inc., a subsidiary of HC2 Holdings, has Operational Stations: 150 strategically acquired broadcast assets across the United States – Full-Power Stations: 10 HC2’s broadcast vision is to capitalize on the opportunities to bring – Class A Stations: 42 valuable content to more viewers over-the-air and position the company – LPTV Stations: 98 for a changing media landscape Silent Licenses & Construction Permits: 501 U.S. Markets: >130 Total Footprint Covers Approximately 60% of the U.S. Population Select Management: Kurt Hanson – Chief Technology Officer, HC2 Broadcasting Holdings Louis Libin – Managing Director, Strategy, HC2 Broadcasting Holdings Les Levi – Chief Operating Officer, HC2 Broadcasting Holdings Manuel Abud – President and CEO, Azteca America * Map based on 2010 population data; footprint includes pending FCC assignment applications as of May 2, 2018. ** Metrics include pending transactions as of May 8, 2018. © 2 0 1 8 H C 2 H O L D I N G S , I NC. 21

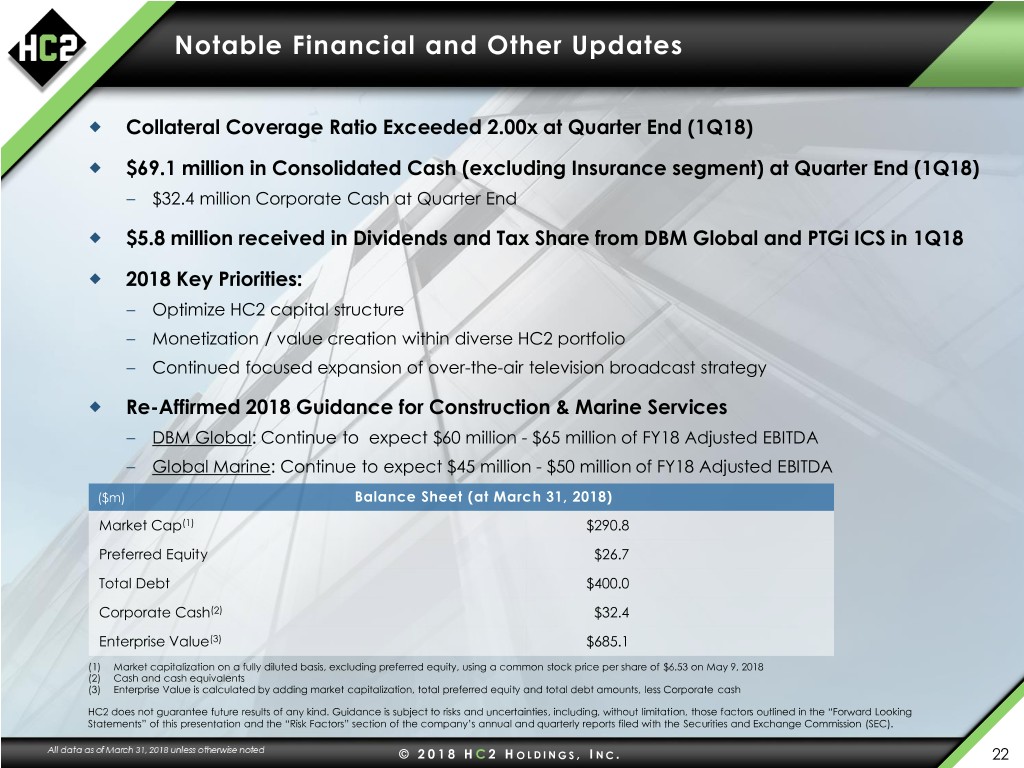

Notable Financial and Other Updates Collateral Coverage Ratio Exceeded 2.00x at Quarter End (1Q18) $69.1 million in Consolidated Cash (excluding Insurance segment) at Quarter End (1Q18) – $32.4 million Corporate Cash at Quarter End $5.8 million received in Dividends and Tax Share from DBM Global and PTGi ICS in 1Q18 2018 Key Priorities: – Optimize HC2 capital structure – Monetization / value creation within diverse HC2 portfolio – Continued focused expansion of over-the-air television broadcast strategy Re-Affirmed 2018 Guidance for Construction & Marine Services – DBM Global: Continue to expect $60 million - $65 million of FY18 Adjusted EBITDA – Global Marine: Continue to expect $45 million - $50 million of FY18 Adjusted EBITDA ($m) Balance Sheet (at March 31, 2018) Market Cap (1) $290.8 Preferred Equity $26.7 Total Debt $400.0 Corporate Cash(2) $32.4 Enterprise Value(3) $685.1 (1) Market capitalization on a fully diluted basis, excluding preferred equity, using a common stock price per share of $6.53 on May 9, 2018 (2) Cash and cash equivalents (3) Enterprise Value is calculated by adding market capitalization, total preferred equity and total debt amounts, less Corporate cash HC2 does not guarantee future results of any kind. Guidance is subject to risks and uncertainties, including, without limitation, those factors outlined in the “Forward Looking Statements” of this presentation and the “Risk Factors” section of the company’s annual and quarterly reports filed with the Securities and Exchange Commission (SEC). © 2 0 1 8 H C 2 H O L D I N G S , I NC. 22

Reconciliations

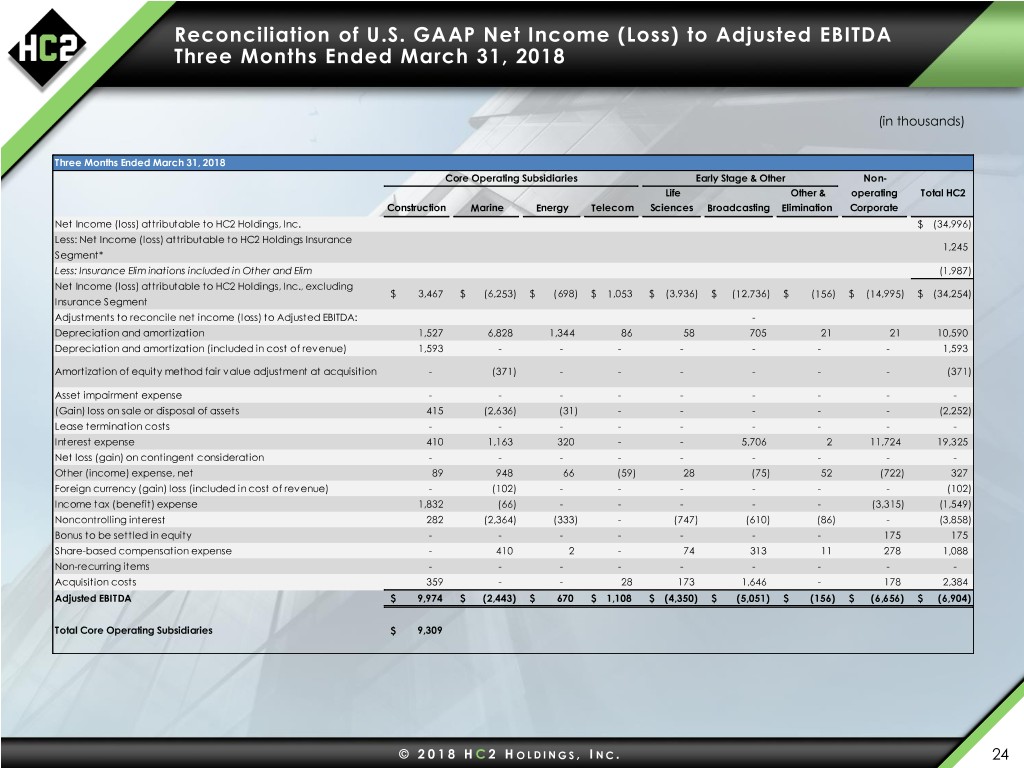

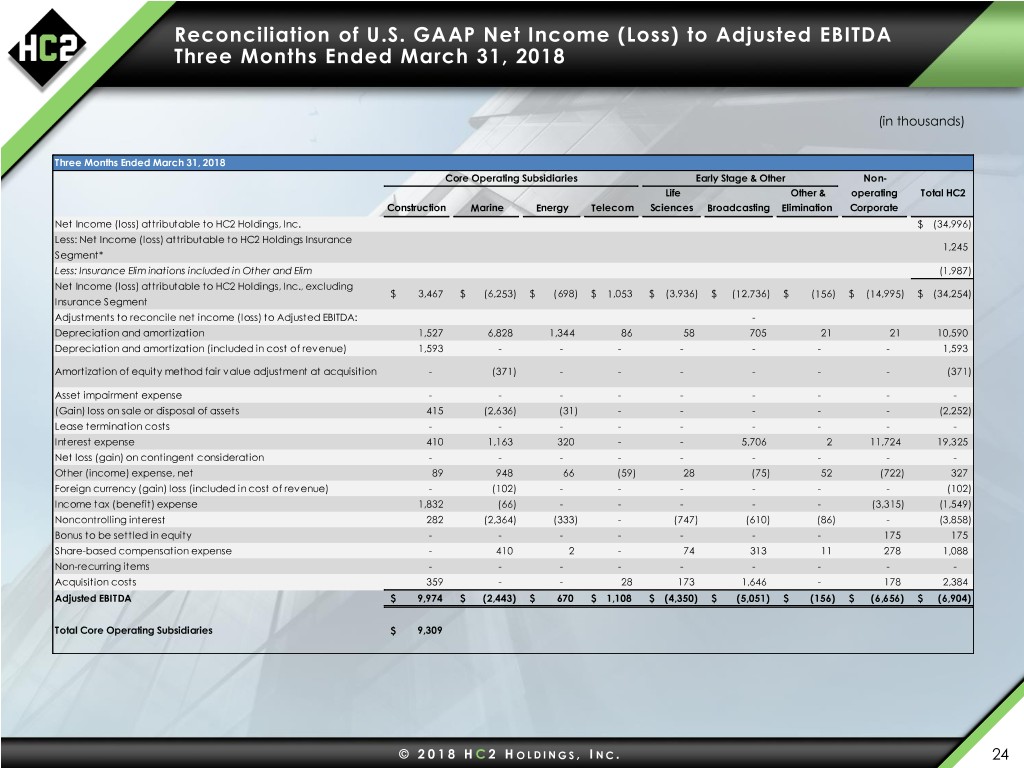

Reconciliation of U.S. GAAP Net Income (Loss) to Adjusted EBITDA Three Months Ended March 31, 2018 (in thousands) Three Months Ended March 31, 2018 Core Operating Subsidiaries Early Stage & Other Non- Life Other & operating Total HC2 Construction Marine Energy Telecom Sciences Broadcasting Elimination Corporate Net Income (loss) attributable to HC2 Holdings, Inc. $ (34,996) Less: Net Income (loss) attributable to HC2 Holdings Insurance 1,245 Segment* Less: Insurance Elim inations included in Other and Elim (1,987) Net Income (loss) attributable to HC2 Holdings, Inc., excluding $ 3,467 $ (6,253) $ (698) $ 1,053 $ (3,936) $ (12,736) $ (156) $ (14,995) $ (34,254) Insurance Segment Adjustments to reconcile net income (loss) to Adjusted EBITDA: - Depreciation and amortization 1,527 6,828 1,344 86 58 705 21 21 10,590 Depreciation and amortization (included in cost of revenue) 1,593 - - - - - - - 1,593 Amortization of equity method fair value adjustment at acquisition - (371) - - - - - - (371) Asset impairment expense - - - - - - - - - (Gain) loss on sale or disposal of assets 415 (2,636) (31) - - - - - (2,252) Lease termination costs - - - - - - - - - Interest expense 410 1,163 320 - - 5,706 2 11,724 19,325 Net loss (gain) on contingent consideration - - - - - - - - - Other (income) expense, net 89 948 66 (59) 28 (75) 52 (722) 327 Foreign currency (gain) loss (included in cost of revenue) - (102) - - - - - - (102) Income tax (benefit) expense 1,832 (66) - - - - - (3,315) (1,549) Noncontrolling interest 282 (2,364) (333) - (747) (610) (86) - (3,858) Bonus to be settled in equity - - - - - - - 175 175 Share-based compensation expense - 410 2 - 74 313 11 278 1,088 Non-recurring items - - - - - - - - - Acquisition costs 359 - - 28 173 1,646 - 178 2,384 Adjusted EBITDA $ 9,974 $ (2,443) $ 670 $ 1,108 $ (4,350) $ (5,051) $ (156) $ (6,656) $ (6,904) Total Core Operating Subsidiaries $ 9,309 © 2 0 1 8 H C 2 H O L D I N G S , I NC. 24

Reconciliation of U.S. GAAP Net Income (Loss) to Adjusted EBITDA Full Year Ended December 31, 2017 (in thousands) Year Ended December 31, 2017 Core Operating Subsidiaries Early Stage & Other Non- operating Total HC2 Life Other & Corporate Construction Marine Energy Telecom Sciences Broadcasting Elimination Net loss attributable to HC2 Holdings, Inc. $ (46,911) Less: Net Incom e attributable to HC2 Holdings Insurance segm ent 7,066 Net Income (loss) attributable to HC2 Holdings, Inc., excluding $ 23,624 $ 15,173 $ (516) $ 6,163 $ (18,098) $ (4,941) $ (13,064) $ (62,318) $ (53,977) Insurance Segment Adjustments to reconcile net income (loss) to Adjusted EBITDA: Depreciation and amortization 5,583 22,898 5,071 371 186 302 1,206 71 35,688 Depreciation and amortization (included in cost of revenue) 5,254 - - - - - - - 5,254 Amortization of equity method fair value adjustment at acquisition - (1,594) - - - - - - (1,594) Asset impairment expense - - - - - - 1,810 - 1,810 (Gain) loss on sale or disposal of assets 292 (3,500) 247 181 - - - - (2,780) Lease termination costs - 249 - 17 - - - - 266 Interest expense 976 4,392 1,181 41 - 1,963 2,410 44,135 55,098 Net loss (gain) on contingent consideration - - - - - - - (11,411) (11,411) Other (income) expense, net (41) 2,683 1,488 149 (17) 41 6,500 (92) 10,711 Foreign currency (gain) loss (included in cost of revenue) - (79) - - - - - - (79) Income tax (benefit) expense 10,679 203 (4,243) 7 (820) (1,811) 682 (10,185) (5,488) Noncontrolling interest 1,941 260 (681) - (3,936) 755 (1,919) - (3,580) Bonus to be settled in equity - - - - - - - 4,130 4,130 Share-based compensation expense - 1,527 364 - 319 194 85 2,754 5,243 Non-recurring items - - - - - - - - - Acquisition costs 3,280 1,815 - - - 2,648 - 3,764 11,507 Adjusted EBITDA $ 51,588 $ 44,027 $ 2,911 $ 6,929 $ (22,366) $ (849) $ (2,290) $ (29,152) $ 50,798 Total Core Operating Subsidiaries $ 105,455 © 2 0 1 8 H C 2 H O L D I N G S , I NC. 25

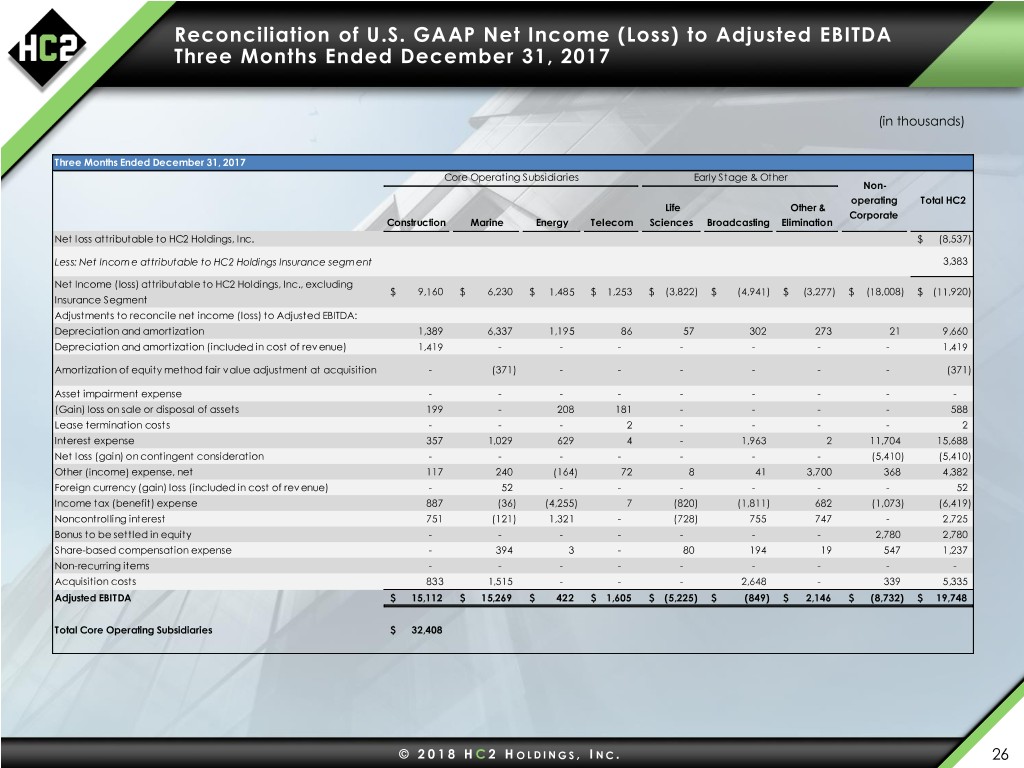

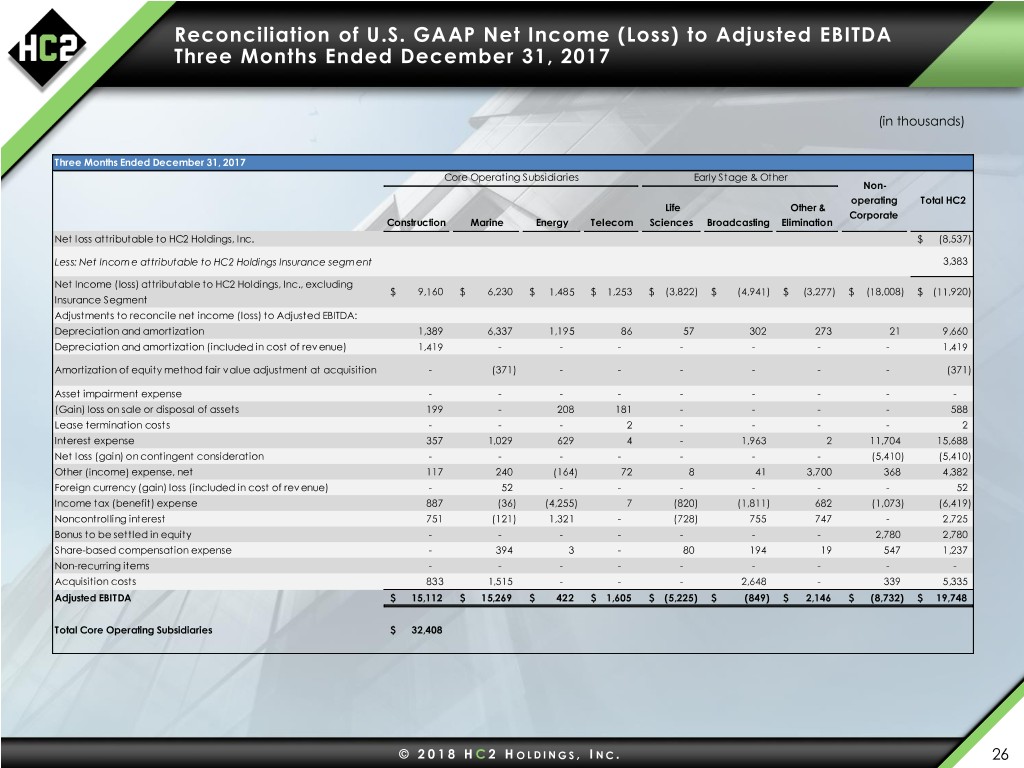

Reconciliation of U.S. GAAP Net Income (Loss) to Adjusted EBITDA Three Months Ended December 31, 2017 (in thousands) Three Months Ended December 31, 2017 Core Operating Subsidiaries Early Stage & Other Non- operating Total HC2 Life Other & Corporate Construction Marine Energy Telecom Sciences Broadcasting Elimination Net loss attributable to HC2 Holdings, Inc. $ (8,537) Less: Net Incom e attributable to HC2 Holdings Insurance segm ent 3,383 Net Income (loss) attributable to HC2 Holdings, Inc., excluding $ 9,160 $ 6,230 $ 1,485 $ 1,253 $ (3,822) $ (4,941) $ (3,277) $ (18,008) $ (11,920) Insurance Segment Adjustments to reconcile net income (loss) to Adjusted EBITDA: Depreciation and amortization 1,389 6,337 1,195 86 57 302 273 21 9,660 Depreciation and amortization (included in cost of revenue) 1,419 - - - - - - - 1,419 Amortization of equity method fair value adjustment at acquisition - (371) - - - - - - (371) Asset impairment expense - - - - - - - - - (Gain) loss on sale or disposal of assets 199 - 208 181 - - - - 588 Lease termination costs - - - 2 - - - - 2 Interest expense 357 1,029 629 4 - 1,963 2 11,704 15,688 Net loss (gain) on contingent consideration - - - - - - - (5,410) (5,410) Other (income) expense, net 117 240 (164) 72 8 41 3,700 368 4,382 Foreign currency (gain) loss (included in cost of revenue) - 52 - - - - - - 52 Income tax (benefit) expense 887 (36) (4,255) 7 (820) (1,811) 682 (1,073) (6,419) Noncontrolling interest 751 (121) 1,321 - (728) 755 747 - 2,725 Bonus to be settled in equity - - - - - - - 2,780 2,780 Share-based compensation expense - 394 3 - 80 194 19 547 1,237 Non-recurring items - - - - - - - - - Acquisition costs 833 1,515 - - - 2,648 - 339 5,335 Adjusted EBITDA $ 15,112 $ 15,269 $ 422 $ 1,605 $ (5,225) $ (849) $ 2,146 $ (8,732) $ 19,748 Total Core Operating Subsidiaries $ 32,408 © 2 0 1 8 H C 2 H O L D I N G S , I NC. 26

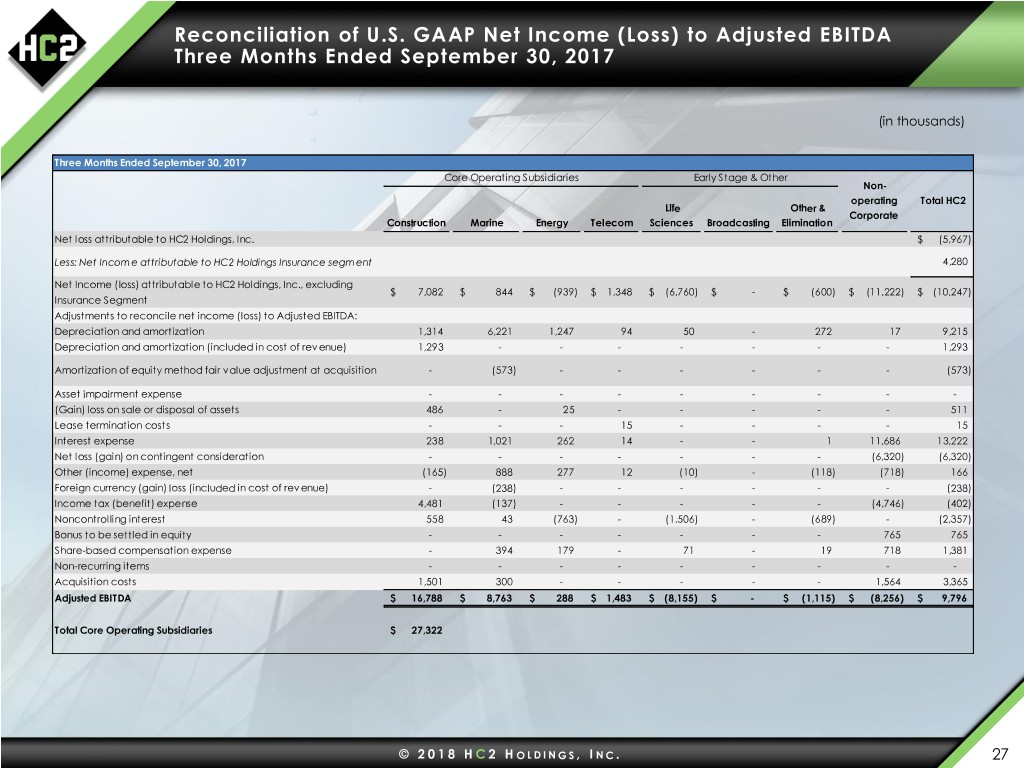

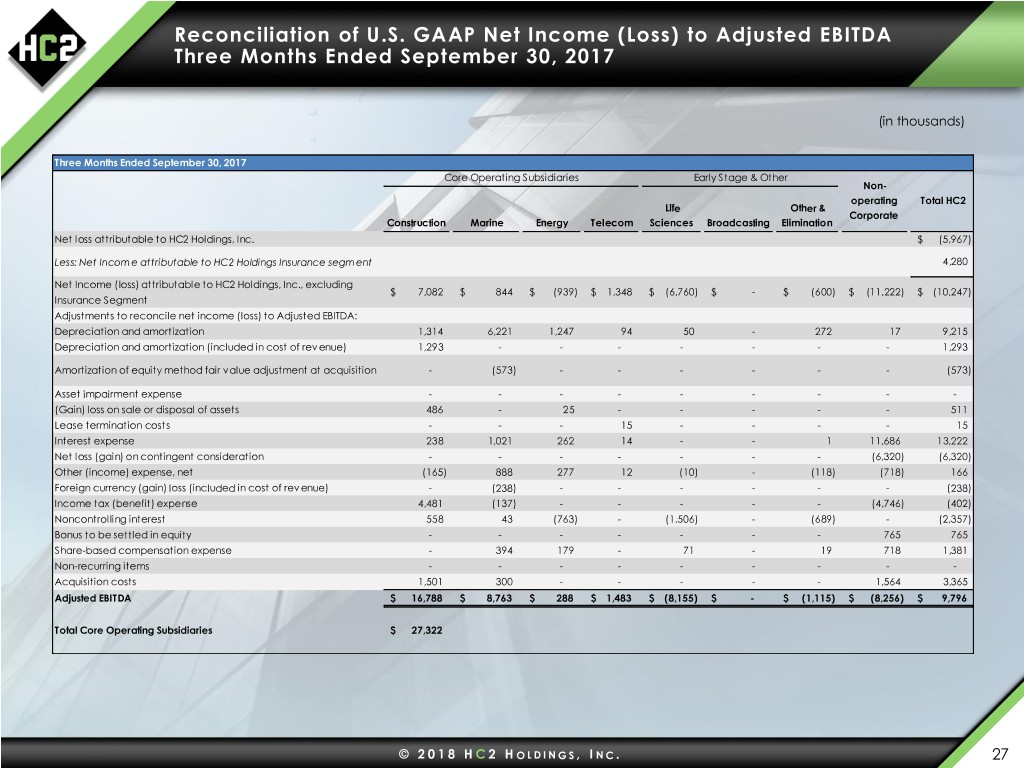

Reconciliation of U.S. GAAP Net Income (Loss) to Adjusted EBITDA Three Months Ended September 30, 2017 (in thousands) Three Months Ended September 30, 2017 Core Operating Subsidiaries Early Stage & Other Non- operating Total HC2 Life Other & Corporate Construction Marine Energy Telecom Sciences Broadcasting Elimination Net loss attributable to HC2 Holdings, Inc. $ (5,967) Less: Net Incom e attributable to HC2 Holdings Insurance segm ent 4,280 Net Income (loss) attributable to HC2 Holdings, Inc., excluding $ 7,082 $ 844 $ (939) $ 1,348 $ (6,760) $ - $ (600) $ (11,222) $ (10,247) Insurance Segment Adjustments to reconcile net income (loss) to Adjusted EBITDA: Depreciation and amortization 1,314 6,221 1,247 94 50 - 272 17 9,215 Depreciation and amortization (included in cost of revenue) 1,293 - - - - - - - 1,293 Amortization of equity method fair value adjustment at acquisition - (573) - - - - - - (573) Asset impairment expense - - - - - - - - - (Gain) loss on sale or disposal of assets 486 - 25 - - - - - 511 Lease termination costs - - - 15 - - - - 15 Interest expense 238 1,021 262 14 - - 1 11,686 13,222 Net loss (gain) on contingent consideration - - - - - - - (6,320) (6,320) Other (income) expense, net (165) 888 277 12 (10) - (118) (718) 166 Foreign currency (gain) loss (included in cost of revenue) - (238) - - - - - - (238) Income tax (benefit) expense 4,481 (137) - - - - - (4,746) (402) Noncontrolling interest 558 43 (763) - (1,506) - (689) - (2,357) Bonus to be settled in equity - - - - - - - 765 765 Share-based compensation expense - 394 179 - 71 - 19 718 1,381 Non-recurring items - - - - - - - - - Acquisition costs 1,501 300 - - - - - 1,564 3,365 Adjusted EBITDA $ 16,788 $ 8,763 $ 288 $ 1,483 $ (8,155) $ - $ (1,115) $ (8,256) $ 9,796 Total Core Operating Subsidiaries $ 27,322 © 2 0 1 8 H C 2 H O L D I N G S , I NC. 27

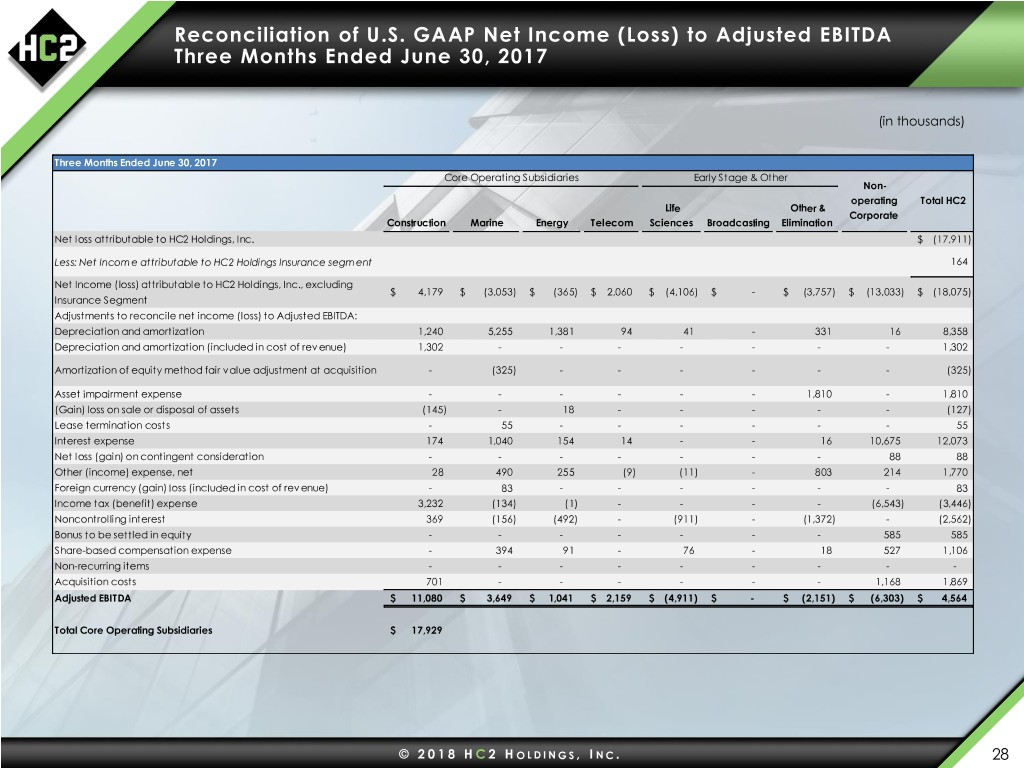

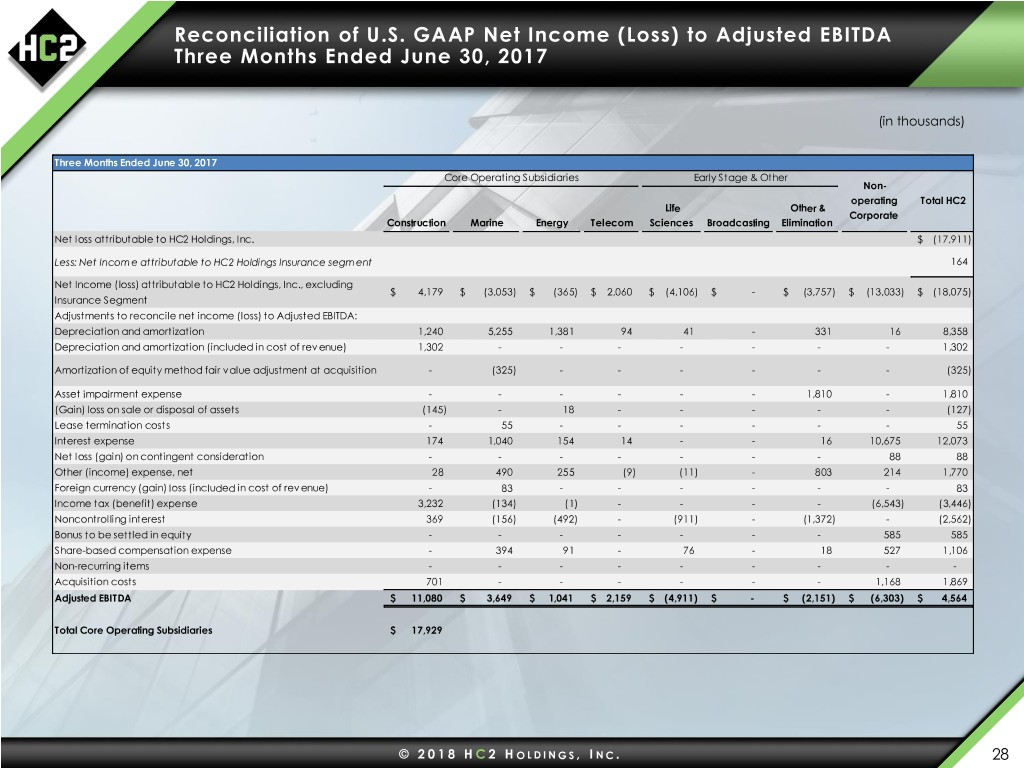

Reconciliation of U.S. GAAP Net Income (Loss) to Adjusted EBITDA Three Months Ended June 30, 2017 (in thousands) Three Months Ended June 30, 2017 Core Operating Subsidiaries Early Stage & Other Non- operating Total HC2 Life Other & Corporate Construction Marine Energy Telecom Sciences Broadcasting Elimination Net loss attributable to HC2 Holdings, Inc. $ (17,911) Less: Net Incom e attributable to HC2 Holdings Insurance segm ent 164 Net Income (loss) attributable to HC2 Holdings, Inc., excluding $ 4,179 $ (3,053) $ (365) $ 2,060 $ (4,106) $ - $ (3,757) $ (13,033) $ (18,075) Insurance Segment Adjustments to reconcile net income (loss) to Adjusted EBITDA: Depreciation and amortization 1,240 5,255 1,381 94 41 - 331 16 8,358 Depreciation and amortization (included in cost of revenue) 1,302 - - - - - - - 1,302 Amortization of equity method fair value adjustment at acquisition - (325) - - - - - - (325) Asset impairment expense - - - - - - 1,810 - 1,810 (Gain) loss on sale or disposal of assets (145) - 18 - - - - - (127) Lease termination costs - 55 - - - - - - 55 Interest expense 174 1,040 154 14 - - 16 10,675 12,073 Net loss (gain) on contingent consideration - - - - - - - 88 88 Other (income) expense, net 28 490 255 (9) (11) - 803 214 1,770 Foreign currency (gain) loss (included in cost of revenue) - 83 - - - - - - 83 Income tax (benefit) expense 3,232 (134) (1) - - - - (6,543) (3,446) Noncontrolling interest 369 (156) (492) - (911) - (1,372) - (2,562) Bonus to be settled in equity - - - - - - - 585 585 Share-based compensation expense - 394 91 - 76 - 18 527 1,106 Non-recurring items - - - - - - - - - Acquisition costs 701 - - - - - - 1,168 1,869 Adjusted EBITDA $ 11,080 $ 3,649 $ 1,041 $ 2,159 $ (4,911) $ - $ (2,151) $ (6,303) $ 4,564 Total Core Operating Subsidiaries $ 17,929 © 2 0 1 8 H C 2 H O L D I N G S , I NC. 28

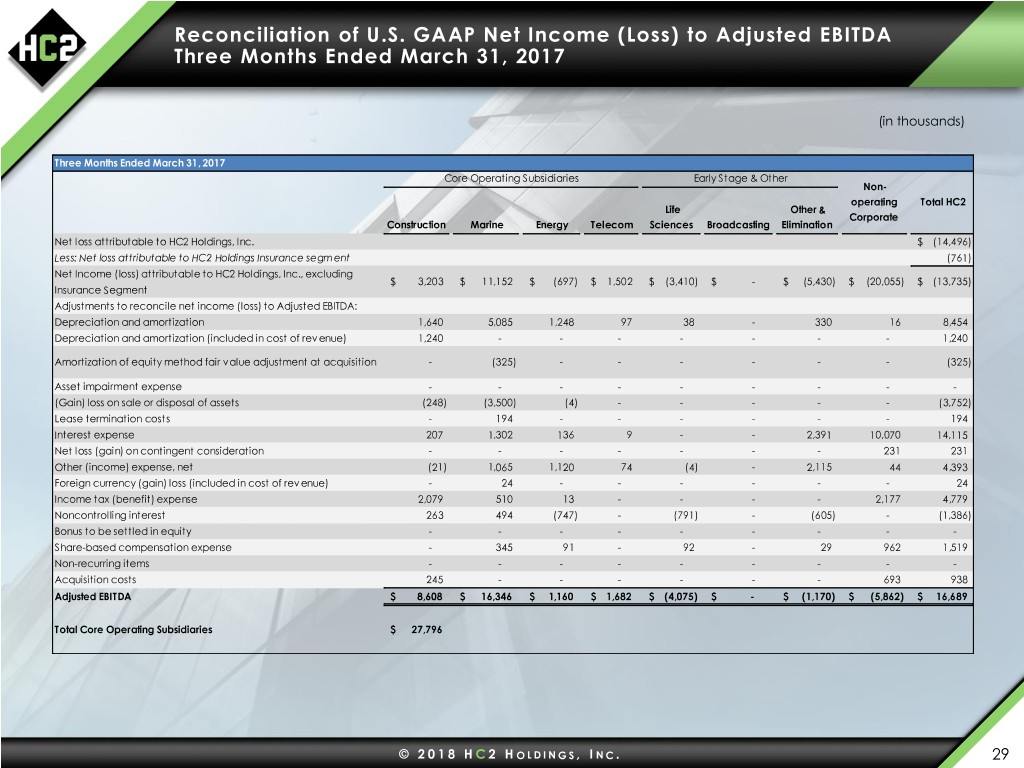

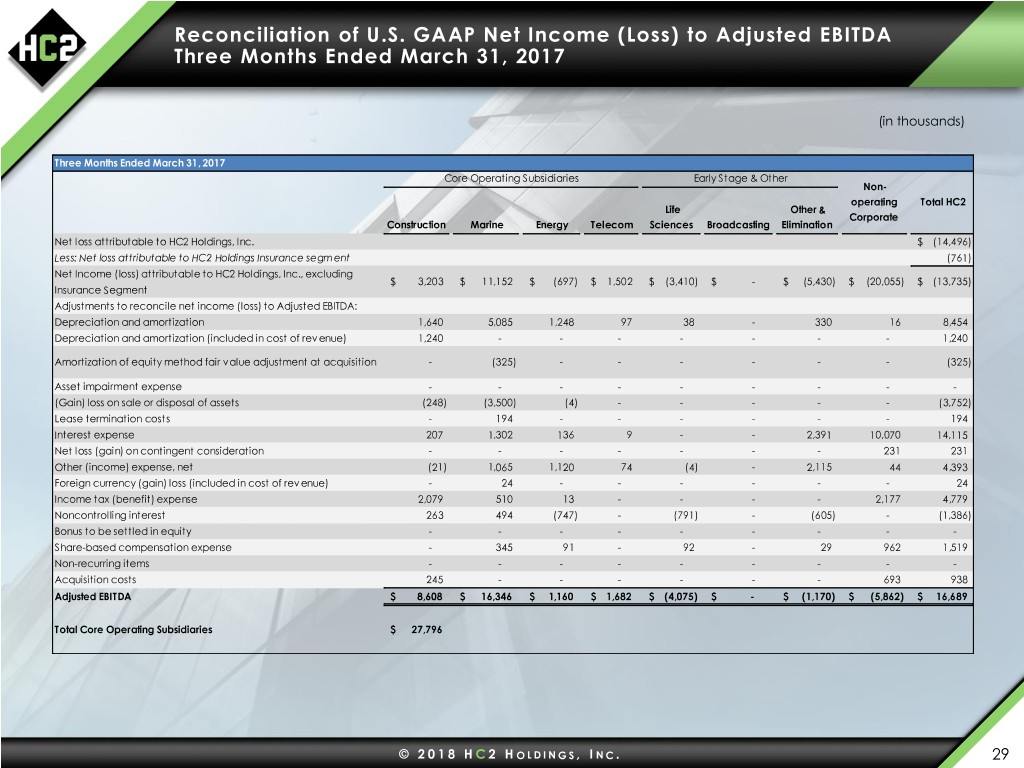

Reconciliation of U.S. GAAP Net Income (Loss) to Adjusted EBITDA Three Months Ended March 31, 2017 (in thousands) Three Months Ended March 31, 2017 Core Operating Subsidiaries Early Stage & Other Non- operating Total HC2 Life Other & Corporate Construction Marine Energy Telecom Sciences Broadcasting Elimination Net loss attributable to HC2 Holdings, Inc. $ (14,496) Less: Net loss attributable to HC2 Holdings Insurance segm ent (761) Net Income (loss) attributable to HC2 Holdings, Inc., excluding $ 3,203 $ 11,152 $ (697) $ 1,502 $ (3,410) $ - $ (5,430) $ (20,055) $ (13,735) Insurance Segment Adjustments to reconcile net income (loss) to Adjusted EBITDA: Depreciation and amortization 1,640 5,085 1,248 97 38 - 330 16 8,454 Depreciation and amortization (included in cost of revenue) 1,240 - - - - - - - 1,240 Amortization of equity method fair value adjustment at acquisition - (325) - - - - - - (325) Asset impairment expense - - - - - - - - - (Gain) loss on sale or disposal of assets (248) (3,500) (4) - - - - - (3,752) Lease termination costs - 194 - - - - - - 194 Interest expense 207 1,302 136 9 - - 2,391 10,070 14,115 Net loss (gain) on contingent consideration - - - - - - - 231 231 Other (income) expense, net (21) 1,065 1,120 74 (4) - 2,115 44 4,393 Foreign currency (gain) loss (included in cost of revenue) - 24 - - - - - - 24 Income tax (benefit) expense 2,079 510 13 - - - - 2,177 4,779 Noncontrolling interest 263 494 (747) - (791) - (605) - (1,386) Bonus to be settled in equity - - - - - - - - - Share-based compensation expense - 345 91 - 92 - 29 962 1,519 Non-recurring items - - - - - - - - - Acquisition costs 245 - - - - - - 693 938 Adjusted EBITDA $ 8,608 $ 16,346 $ 1,160 $ 1,682 $ (4,075) $ - $ (1,170) $ (5,862) $ 16,689 Total Core Operating Subsidiaries $ 27,796 © 2 0 1 8 H C 2 H O L D I N G S , I NC. 29

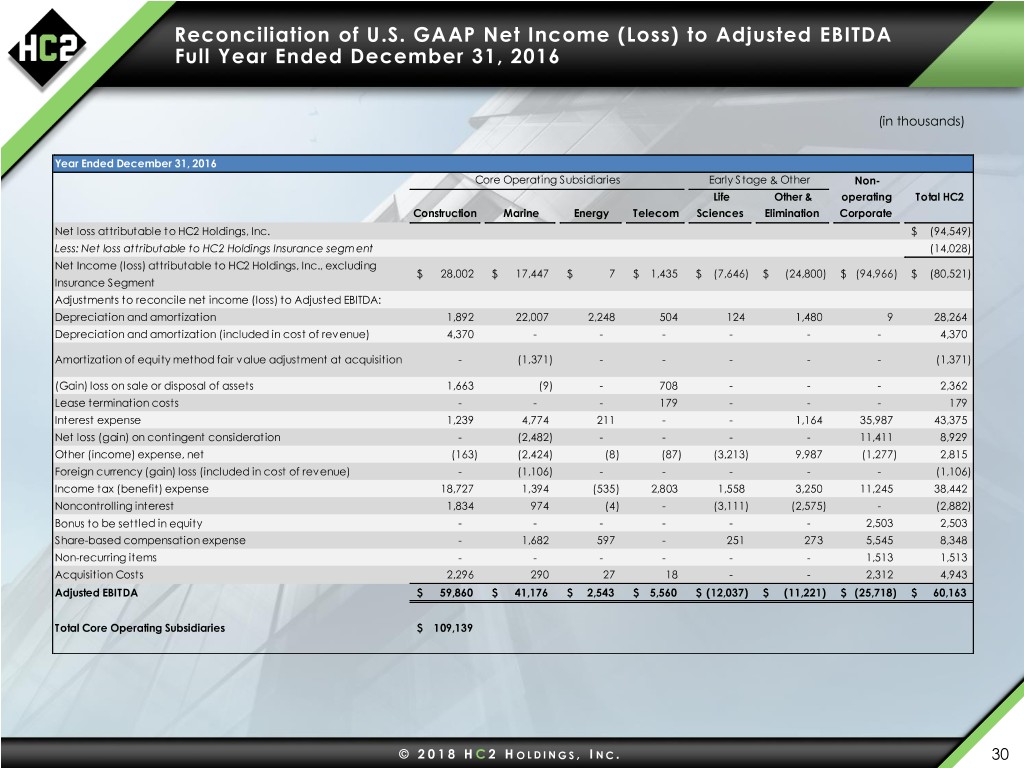

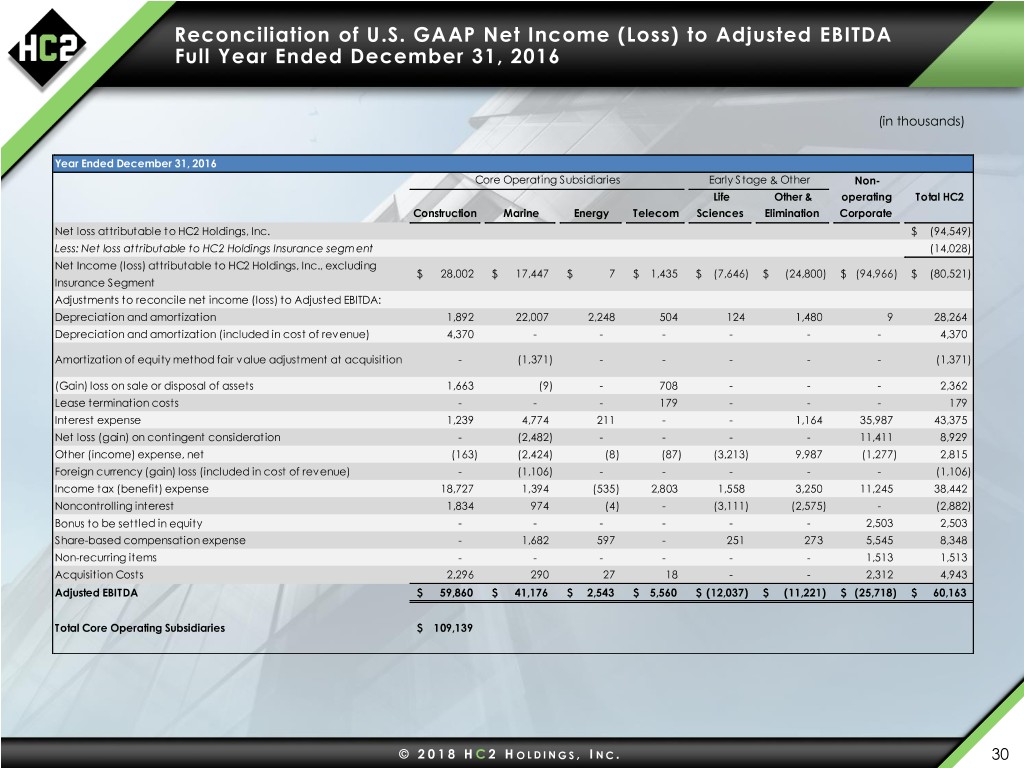

Reconciliation of U.S. GAAP Net Income (Loss) to Adjusted EBITDA Full Year Ended December 31, 2016 (in thousands) Year Ended December 31, 2016 Core Operating Subsidiaries Early Stage & Other Non- Life Other & operating Total HC2 Construction Marine Energy Telecom Sciences Elimination Corporate Net loss attributable to HC2 Holdings, Inc. $ (94,549) Less: Net loss attributable to HC2 Holdings Insurance segm ent (14,028) Net Income (loss) attributable to HC2 Holdings, Inc., excluding $ 28,002 $ 17,447 $ 7 $ 1,435 $ (7,646) $ (24,800) $ (94,966) $ (80,521) Insurance Segment Adjustments to reconcile net income (loss) to Adjusted EBITDA: Depreciation and amortization 1,892 22,007 2,248 504 124 1,480 9 28,264 Depreciation and amortization (included in cost of revenue) 4,370 - - - - - - 4,370 Amortization of equity method fair value adjustment at acquisition - (1,371) - - - - - (1,371) (Gain) loss on sale or disposal of assets 1,663 (9) - 708 - - - 2,362 Lease termination costs - - - 179 - - - 179 Interest expense 1,239 4,774 211 - - 1,164 35,987 43,375 Net loss (gain) on contingent consideration - (2,482) - - - - 11,411 8,929 Other (income) expense, net (163) (2,424) (8) (87) (3,213) 9,987 (1,277) 2,815 Foreign currency (gain) loss (included in cost of revenue) - (1,106) - - - - - (1,106) Income tax (benefit) expense 18,727 1,394 (535) 2,803 1,558 3,250 11,245 38,442 Noncontrolling interest 1,834 974 (4) - (3,111) (2,575) - (2,882) Bonus to be settled in equity - - - - - - 2,503 2,503 Share-based compensation expense - 1,682 597 - 251 273 5,545 8,348 Non-recurring items - - - - - - 1,513 1,513 Acquisition Costs 2,296 290 27 18 - - 2,312 4,943 Adjusted EBITDA $ 59,860 $ 41,176 $ 2,543 $ 5,560 $ (12,037) $ (11,221) $ (25,718) $ 60,163 Total Core Operating Subsidiaries $ 109,139 © 2 0 1 8 H C 2 H O L D I N G S , I NC. 30

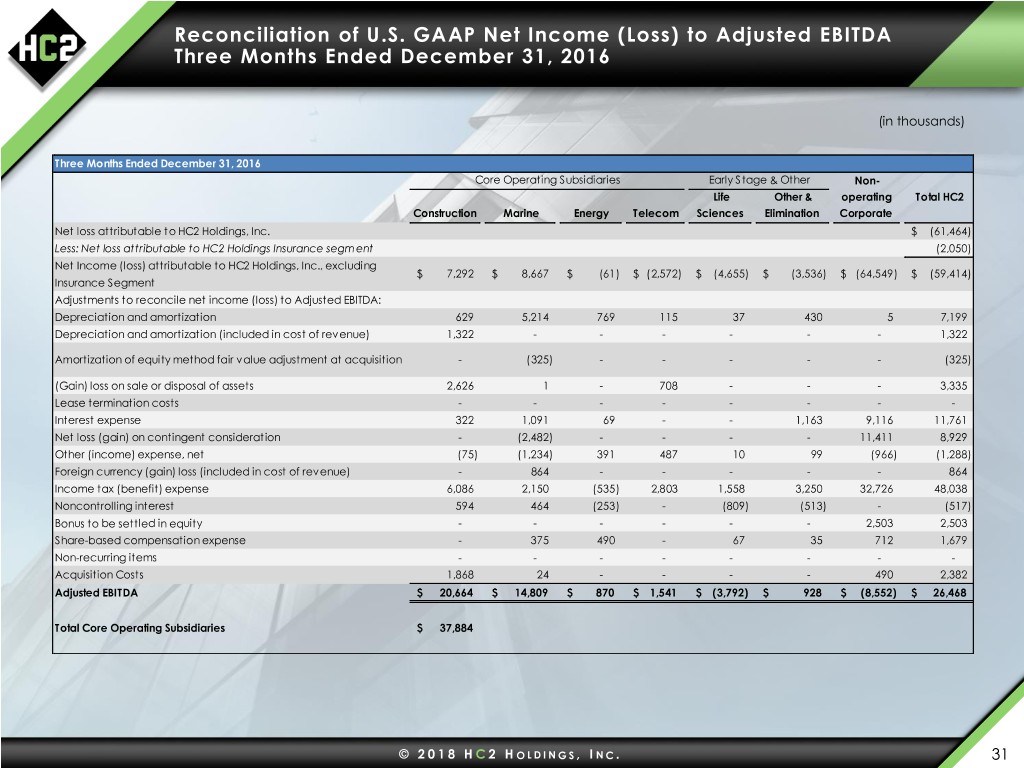

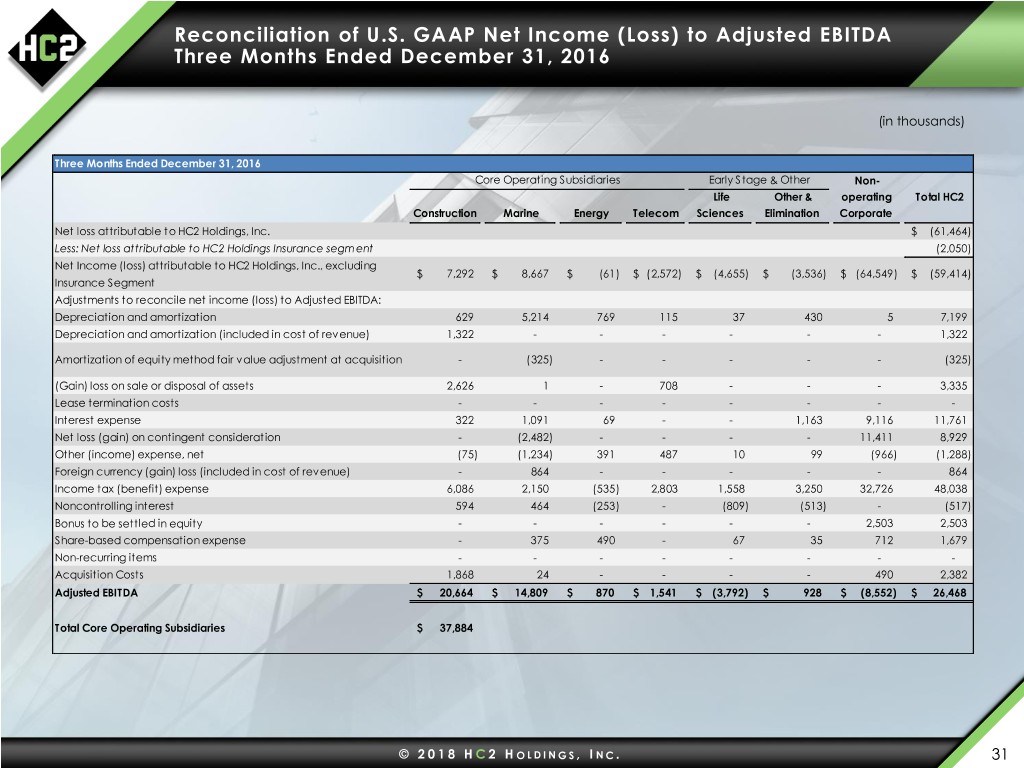

Reconciliation of U.S. GAAP Net Income (Loss) to Adjusted EBITDA Three Months Ended December 31, 2016 (in thousands) Three Months Ended December 31, 2016 Core Operating Subsidiaries Early Stage & Other Non- Life Other & operating Total HC2 Construction Marine Energy Telecom Sciences Elimination Corporate Net loss attributable to HC2 Holdings, Inc. $ (61,464) Less: Net loss attributable to HC2 Holdings Insurance segm ent (2,050) Net Income (loss) attributable to HC2 Holdings, Inc., excluding $ 7,292 $ 8,667 $ (61) $ (2,572) $ (4,655) $ (3,536) $ (64,549) $ (59,414) Insurance Segment Adjustments to reconcile net income (loss) to Adjusted EBITDA: Depreciation and amortization 629 5,214 769 115 37 430 5 7,199 Depreciation and amortization (included in cost of revenue) 1,322 - - - - - - 1,322 Amortization of equity method fair value adjustment at acquisition - (325) - - - - - (325) (Gain) loss on sale or disposal of assets 2,626 1 - 708 - - - 3,335 Lease termination costs - - - - - - - - Interest expense 322 1,091 69 - - 1,163 9,116 11,761 Net loss (gain) on contingent consideration - (2,482) - - - - 11,411 8,929 Other (income) expense, net (75) (1,234) 391 487 10 99 (966) (1,288) Foreign currency (gain) loss (included in cost of revenue) - 864 - - - - - 864 Income tax (benefit) expense 6,086 2,150 (535) 2,803 1,558 3,250 32,726 48,038 Noncontrolling interest 594 464 (253) - (809) (513) - (517) Bonus to be settled in equity - - - - - - 2,503 2,503 Share-based compensation expense - 375 490 - 67 35 712 1,679 Non-recurring items - - - - - - - - Acquisition Costs 1,868 24 - - - - 490 2,382 Adjusted EBITDA $ 20,664 $ 14,809 $ 870 $ 1,541 $ (3,792) $ 928 $ (8,552) $ 26,468 Total Core Operating Subsidiaries $ 37,884 © 2 0 1 8 H C 2 H O L D I N G S , I NC. 31

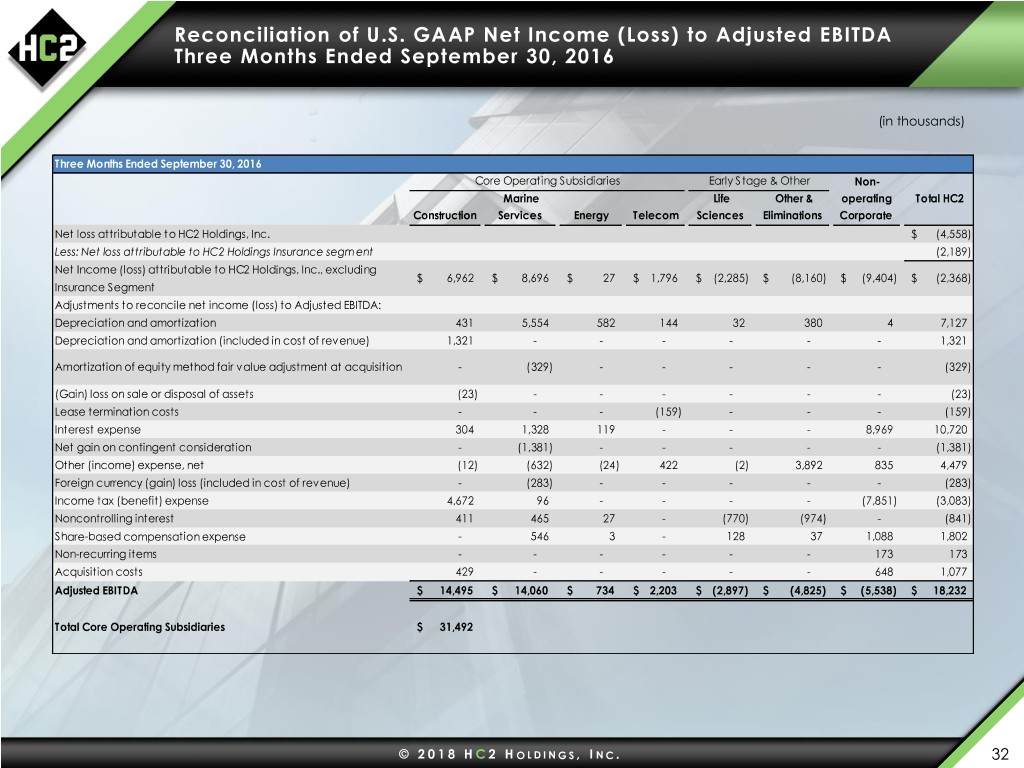

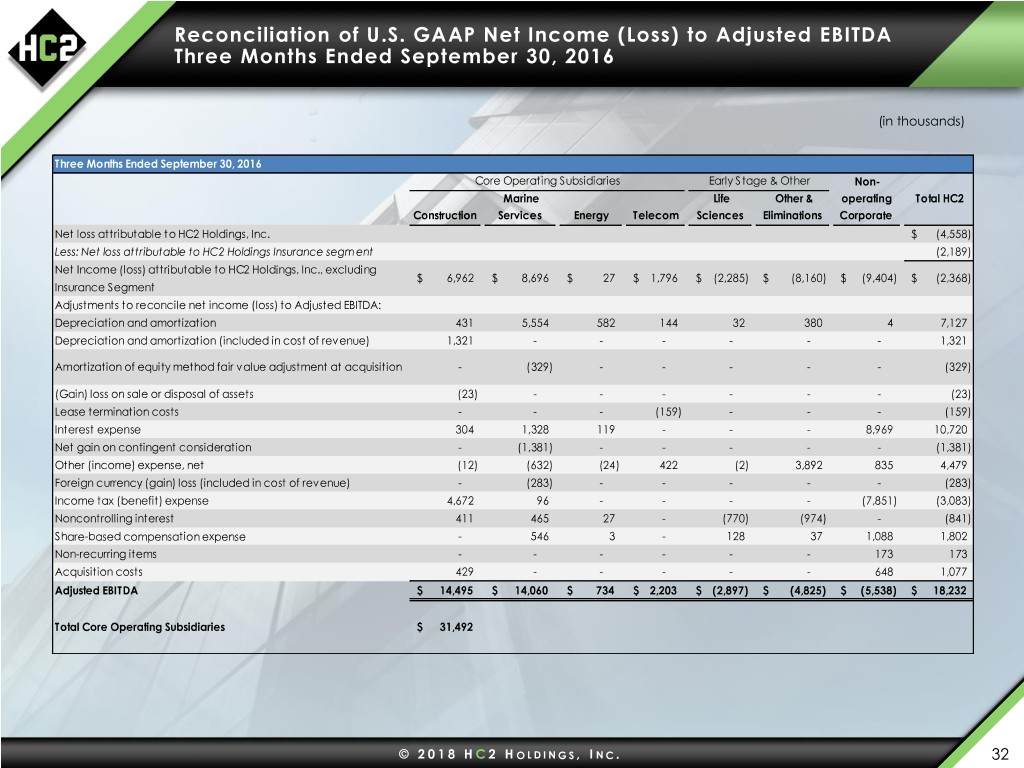

Reconciliation of U.S. GAAP Net Income (Loss) to Adjusted EBITDA Three Months Ended September 30, 2016 (in thousands) Three Months Ended September 30, 2016 Core Operating Subsidiaries Early Stage & Other Non- Marine Life Other & operating Total HC2 Construction Services Energy Telecom Sciences Eliminations Corporate Net loss attributable to HC2 Holdings, Inc. $ (4,558) Less: Net loss attributable to HC2 Holdings Insurance segm ent (2,189) Net Income (loss) attributable to HC2 Holdings, Inc., excluding $ 6,962 $ 8,696 $ 27 $ 1,796 $ (2,285) $ (8,160) $ (9,404) $ (2,368) Insurance Segment Adjustments to reconcile net income (loss) to Adjusted EBITDA: Depreciation and amortization 431 5,554 582 144 32 380 4 7,127 Depreciation and amortization (included in cost of revenue) 1,321 - - - - - - 1,321 Amortization of equity method fair value adjustment at acquisition - (329) - - - - - (329) (Gain) loss on sale or disposal of assets (23) - - - - - - (23) Lease termination costs - - - (159) - - - (159) Interest expense 304 1,328 119 - - - 8,969 10,720 Net gain on contingent consideration - (1,381) - - - - - (1,381) Other (income) expense, net (12) (632) (24) 422 (2) 3,892 835 4,479 Foreign currency (gain) loss (included in cost of revenue) - (283) - - - - - (283) Income tax (benefit) expense 4,672 96 - - - - (7,851) (3,083) Noncontrolling interest 411 465 27 - (770) (974) - (841) Share-based compensation expense - 546 3 - 128 37 1,088 1,802 Non-recurring items - - - - - - 173 173 Acquisition costs 429 - - - - - 648 1,077 Adjusted EBITDA $ 14,495 $ 14,060 $ 734 $ 2,203 $ (2,897) $ (4,825) $ (5,538) $ 18,232 Total Core Operating Subsidiaries $ 31,492 © 2 0 1 8 H C 2 H O L D I N G S , I NC. 32

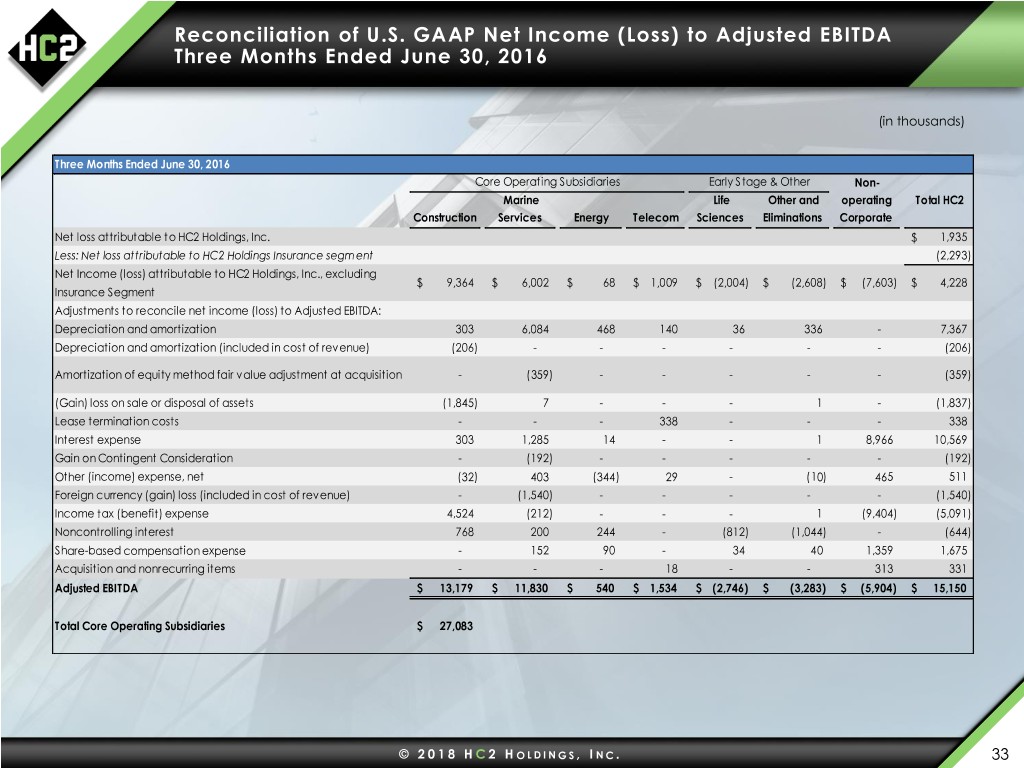

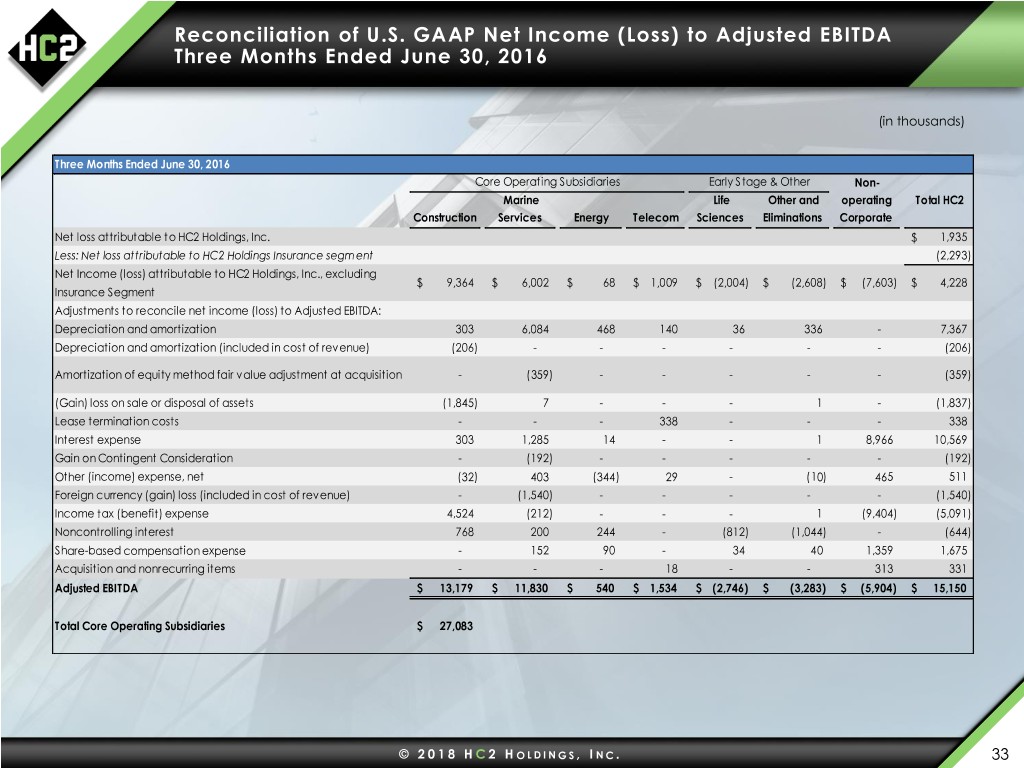

Reconciliation of U.S. GAAP Net Income (Loss) to Adjusted EBITDA Three Months Ended June 30, 2016 (in thousands) Three Months Ended June 30, 2016 Core Operating Subsidiaries Early Stage & Other Non- Marine Life Other and operating Total HC2 Construction Services Energy Telecom Sciences Eliminations Corporate Net loss attributable to HC2 Holdings, Inc. $ 1,935 Less: Net loss attributable to HC2 Holdings Insurance segm ent (2,293) Net Income (loss) attributable to HC2 Holdings, Inc., excluding $ 9,364 $ 6,002 $ 68 $ 1,009 $ (2,004) $ (2,608) $ (7,603) $ 4,228 Insurance Segment Adjustments to reconcile net income (loss) to Adjusted EBITDA: Depreciation and amortization 303 6,084 468 140 36 336 - 7,367 Depreciation and amortization (included in cost of revenue) (206) - - - - - - (206) Amortization of equity method fair value adjustment at acquisition - (359) - - - - - (359) (Gain) loss on sale or disposal of assets (1,845) 7 - - - 1 - (1,837) Lease termination costs - - - 338 - - - 338 Interest expense 303 1,285 14 - - 1 8,966 10,569 Gain on Contingent Consideration - (192) - - - - - (192) Other (income) expense, net (32) 403 (344) 29 - (10) 465 511 Foreign currency (gain) loss (included in cost of revenue) - (1,540) - - - - - (1,540) Income tax (benefit) expense 4,524 (212) - - - 1 (9,404) (5,091) Noncontrolling interest 768 200 244 - (812) (1,044) - (644) Share-based compensation expense - 152 90 - 34 40 1,359 1,675 Acquisition and nonrecurring items - - - 18 - - 313 331 Adjusted EBITDA $ 13,179 $ 11,830 $ 540 $ 1,534 $ (2,746) $ (3,283) $ (5,904) $ 15,150 Total Core Operating Subsidiaries $ 27,083 © 2 0 1 8 H C 2 H O L D I N G S , I NC. 33

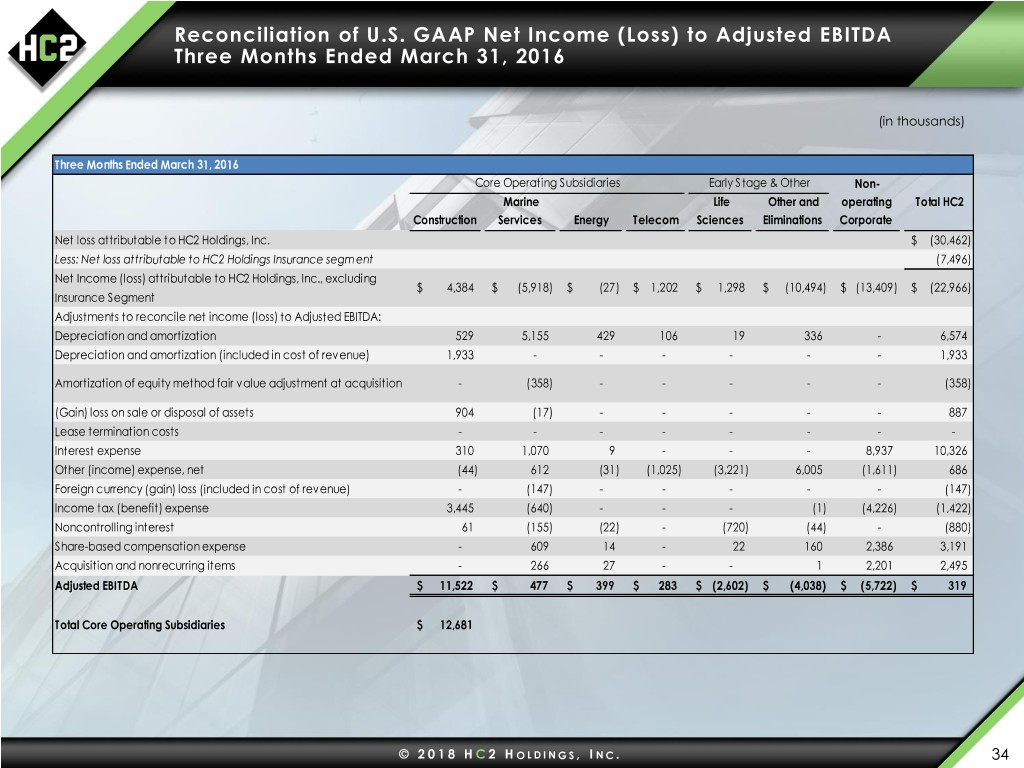

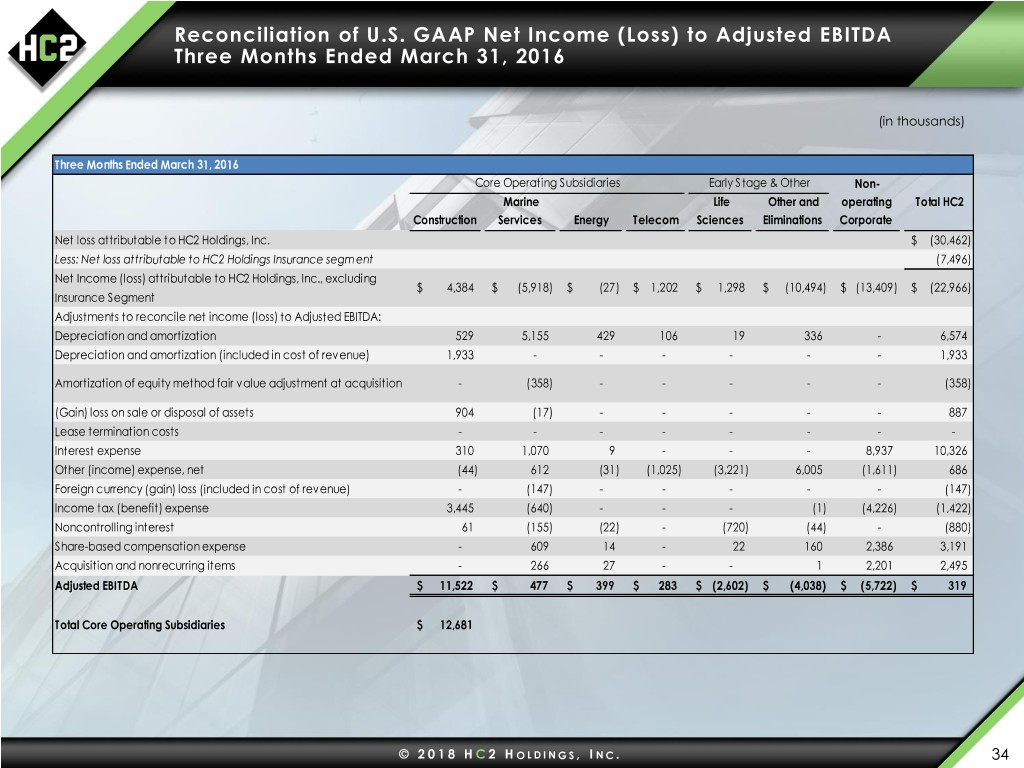

Reconciliation of U.S. GAAP Net Income (Loss) to Adjusted EBITDA Three Months Ended March 31, 2016 (in thousands) Three Months Ended March 31, 2016 Core Operating Subsidiaries Early Stage & Other Non- Marine Life Other and operating Total HC2 Construction Services Energy Telecom Sciences Eliminations Corporate Net loss attributable to HC2 Holdings, Inc. $ (30,462) Less: Net loss attributable to HC2 Holdings Insurance segm ent (7,496) Net Income (loss) attributable to HC2 Holdings, Inc., excluding $ 4,384 $ (5,918) $ (27) $ 1,202 $ 1,298 $ (10,494) $ (13,409) $ (22,966) Insurance Segment Adjustments to reconcile net income (loss) to Adjusted EBITDA: Depreciation and amortization 529 5,155 429 106 19 336 - 6,574 Depreciation and amortization (included in cost of revenue) 1,933 - - - - - - 1,933 Amortization of equity method fair value adjustment at acquisition - (358) - - - - - (358) (Gain) loss on sale or disposal of assets 904 (17) - - - - - 887 Lease termination costs - - - - - - - - Interest expense 310 1,070 9 - - - 8,937 10,326 Other (income) expense, net (44) 612 (31) (1,025) (3,221) 6,005 (1,611) 686 Foreign currency (gain) loss (included in cost of revenue) - (147) - - - - - (147) Income tax (benefit) expense 3,445 (640) - - - (1) (4,226) (1,422) Noncontrolling interest 61 (155) (22) - (720) (44) - (880) Share-based compensation expense - 609 14 - 22 160 2,386 3,191 Acquisition and nonrecurring items - 266 27 - - 1 2,201 2,495 Adjusted EBITDA $ 11,522 $ 477 $ 399 $ 283 $ (2,602) $ (4,038) $ (5,722) $ 319 Total Core Operating Subsidiaries $ 12,681 © 2 0 1 8 H C 2 H O L D I N G S , I NC. 34

Reconciliation of U.S. GAAP Net Income (Loss) to Insurance Adjusted Operating Income (in thousands) Adjusted Operating Income - Insurance ("Insurance AOI") Q1 2018 FY 2017 Q4 2017 Q3 2017 Q2 2017 Q1 2017 FY 2016 Q4 2016 Net Income (loss) - Insurance segment $ 1,245 $ 7,066 $ 3,381 $ 4,282 $ 164 $ (761) $ (14,028) $ (2,050) Net realized and unrealized gains on inv estments (2,510) (4,983) (2,129) (978) (1,095) (781) (5,019) (7,696) Asset impairment - 3,364 - - 2,842 522 2,400 2,400 Acquisition costs 303 2,535 1,377 422 736 - 714 445 Insurance AOI $ (962) $ 7,982 $ 2,629 $ 3,726 $ 2,647 $ (1,020) $ (15,933) $ (6,901) © 2 0 1 8 H C 2 H O L D I N G S , I NC. 35

HC2 HOLDINGS, INC. A n d r e w G . B a c k m a n • i r @ h c 2 . c o m • 2 1 2 . 2 3 5 . 2 6 9 1 • 4 5 0 P a r k A v e n u e , 3 0 th F l o o r , N e w Y o r k , © HC2 Holdings, Inc. 2018 N Y 1 0 0 2 2 May 2018