HC2 HOLDINGS, INC. Fourth Quarter 2018 Conference Call © HC2 Holdings, Inc. 2019

Safe Harbor Disclaimers Special Note Regarding Forward-Looking Statements Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995: This presentation contains, and certain oral statements made by our representatives from time to time may contain, forward-looking statements. Generally, forward-looking statements include information describing actions, events, results, strategies and expectations and are generally identifiable by use of the words “believes,” “expects,”“guidance,”“intends,”“anticipates,”“plans,”“seeks,”“estimates,”“projects,”“may,”“will,”“could,”“might,”or“continues”or similar expressions. The forward-looking statements in this presentation include, without limitation, our 2019 guidance for the Construction segment and statements regarding our expectations regarding building shareholder value and future cash flow and invested assets. Such statements are based on the beliefs and assumptions of HC2's management and the management of HC2's subsidiaries and portfolio companies. HC2 believes these judgments are reasonable, but you should understand that these statements are not guarantees of performance or results, and the Company’s actual results could differ materially from those expressed or implied in the forward-looking statements due to a variety of important factors, both positive and negative, that may be revised or supplemented in subsequent statements and reports filed with the Securities and Exchange Commission (“SEC”), including in our reports on Forms 10-K, 10-Q, and 8-K. Such important factors include, without limitation, issues related to the restatement of our financial statements; the fact that we have historically identified material weaknesses in our internal control over financial reporting, and any inability to remediate future material weaknesses; capital market conditions; the ability of HC2's subsidiaries and portfolio companies to generate sufficient net income and cash flows to make upstream cash distributions; volatility in the trading price of HC2 common stock; the ability of HC2 and its subsidiaries and portfolio companies to identify any suitable future acquisition or disposition opportunities; our ability to realize efficiencies, cost savings, income and margin improvements, growth, economies of scale and other anticipated benefits of strategic transactions; difficulties related to the integration of financial reporting of acquired or target businesses; difficulties completing pending and future acquisitions and dispositions; effects of litigation, indemnification claims, and other contingent liabilities; changes in regulations and tax laws; and risks that may affect the performance of the operating subsidiaries and portfolio companies of HC2. Although HC2 believes its expectations and assumptionsregardingitsfutureoperatingperformancearereasonable,therecanbenoassurancethattheexpectationsreflectedherein will be achieved. These risks and other important factors discussed under the caption “Risk Factors” in our most recent Annual Report on Form 10-K filed with the SEC, and our other reports filed with the SEC could cause actual results to differ materially from those indicated by the forward-looking statements made in this presentation. You should not place undue reliance on forward-looking statements. All forward-looking statements attributable to HC2 or persons acting on its behalf are expressly qualified in their entirety by the foregoing cautionary statements. HC2 has no obligation to update any of the guidance provided to conform to actual results or changes in HC2's expectations. All statements speak only as of the date made, and unless legally required, HC2 undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise. © 2019 HC 2 HOLDINGS, INC. 1

Safe Harbor Disclaimers Non-GAAP Financial Measures In this release, HC2 refers to certain financial measures that are not presented in accordance with U.S. generally accepted accounting principles (“GAAP”), including Adjusted EBITDA (excluding the Insurance segment) and Adjusted Operating Income (“Insurance AOI”) and Pre-tax Adjusted Operating Income ("Pre-tax Insurance AOI") for our Insurance segment. Adjusted EBITDA Management believes that Adjusted EBITDA measures provide investors with meaningful information for gaining an understanding of the Company’s results as it is frequently used by the financial community to provide insight into an organization’s operating trends and facilitates comparisons between peer companies, because interest, taxes, depreciation, amortization and the other items for which adjustments are made as noted in the definition of Adjusted EBITDA below candiffergreatly between organizations as a result of differing capital structures and tax strategies. In addition, management uses Adjusted EBITDA measures in evaluating certain of the Company’s segments' performance because they eliminate the effects of considerable amounts of non-cash depreciation and amortization and itemsnotwithin the control of the Company’s operations managers. While management believes that these non-GAAP measurements are useful as supplemental information, such adjusted results are not intended to replace our GAAP financial results and should be read together with HC2’s results reported under GAAP. Management defines Adjusted EBITDA as net income (loss), excluding the Insurance segment, as adjusted for depreciation and amortization; amortization of equity method fair value adjustments at acquisition; (gain) loss on sale or disposal of assets; lease termination costs; asset impairment expense; interest expense; net gain (loss) on contingent consideration; loss on early extinguishment or restructuring of debt; gain (loss) on sale and deconsolidation of subsidiary; other (income) expense, net; foreign currency transaction (gain) loss included in cost of revenue; income tax (benefit) expense; (gain) loss from discontinued operations; noncontrolling interest; bonus to be settled in equity; share-based payment expense; non-recurring items; and acquisition and disposition costs. A reconciliation of Adjusted EBITDA to Net Income (Loss) is included in the financial tables at the end of this release. Management recognizes that using Adjusted EBITDA as a performance measurehasinherent limitations as an analytical tool as compared to net income (loss) or other GAAP financial measures, as these non-GAAP measures exclude certain items, including items that are recurring in nature, which may be meaningful to investors. As a result of the exclusions, Adjusted EBITDA should not be considered in isolation and do not purport to be alternatives to net income (loss) or other GAAP financial measures or a measure of our operating performance. Adjusted Operating Income Adjusted Operating Income (“Insurance AOI”) and Pre-tax Adjusted Operating Income (“Pre-tax Insurance AOI”) for the Insurance segment are non-U.S. GAAP financial measures frequently used throughout the insurance industry and are economic measures the Insurance segment uses to evaluate its financial performance. Management believes that Insurance AOI and Pre-tax Insurance AOI measures provide investors with meaningful information for gaining an understanding of certain results and provide insight into an organization’s operating trends and facilitates comparisons between peer companies. However, Insurance AOI andPre-tax Insurance AOI have certain limitations, and we may not calculate it the same as other companies in our industry. It should, therefore, be read together with the Company's results calculated in accordance with U.S. GAAP. Management recognizes that using Insurance AOI and Pre-tax Insurance AOI as performance measures have inherent limitations as an analytical tool as compared to income (loss) from operations or other U.S. GAAP financial measures, as these non-U.S. GAAP measures excludes certain items, including items that are recurring in nature, which may be meaningful to investors. As a result of the exclusions, Insurance AOI and Pre-tax Insurance AOI should not be considered in isolation and do not purport to be an alternative to income (loss) from operations or other U.S. GAAP financialmeasuresas a measure of our operating performance. Management defines Insurance AOI as Net income (loss) for the Insurance segment adjusted to exclude the impact of net investment gains (losses), including other- than-temporary impairment ("OTTI") losses recognized in operations; asset impairment; intercompany elimination; bargain purchase gains; reinsurance gains; and acquisition costs. Management defines Pre-tax Insurance AOI as Insurance AOI adjusted to exclude the impact of income tax (benefit) expense recognized during the current period. Management believes that Insurance AOI and Pre-tax Insurance AOI provide meaningful financial metrics that help investors understand certain results and profitability. While these adjustments are an integral part of the overall performance of the Insurance segment, market conditions impacting these items can overshadow the underlying performance of the business. Accordingly, we believe using a measure which excludes their impact is effective in analyzing the trends of our operations. © 2019 HC 2 HOLDINGS, INC. 2

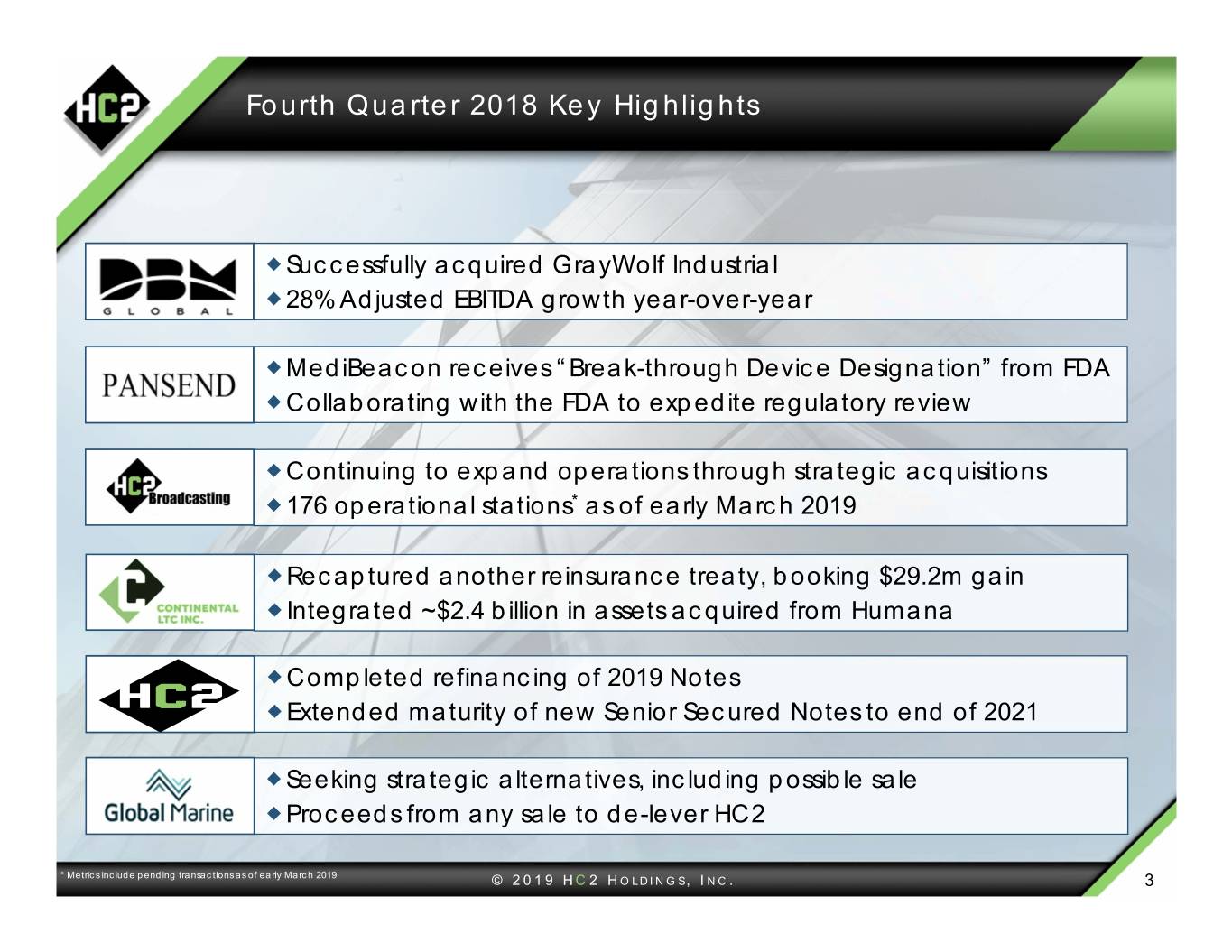

Fourth Quarter 2018 Key Highlights Successfully acquired GrayWolf Industrial 28% Adjusted EBITDA growth year-over-year MediBeacon receives “Break-through Device Designation” from FDA Collaborating with the FDA to expedite regulatory review Continuing to expand operations through strategic acquisitions 176 operational stations* as of early March 2019 Recaptured another reinsurance treaty, booking $29.2m gain Integrated ~$2.4 billion in assets acquired from Humana Completed refinancing of 2019 Notes Extended maturity of new Senior Secured Notes to end of 2021 Seeking strategic alternatives, including possible sale Proceeds from any sale to de-lever HC2 * Metrics include pending transactions as of early March 2019 © 2019 HC 2 HOLDINGS, INC. 3

Hybrid, Diversified Long-Term Strategy Strong Cash Flow Driving Growth and Generation Unlocking Value © 2019 HC 2 HOLDINGS, INC. 4

DBM Global Inc. – Consistent and Growing Cash Flow Fourth Quarter 2018 Highlights 2019 and Longer Term Initiatives Adjusted EBITDA rose 28% 4Q18 vs. 4Q17 Fully integrate GrayWolf into DBM Global Build relationships and find additional cross-selling FY18 Adjusted EBITDA up 18% to $61 million opportunities Completed GrayWolf Industrial acquisition Remain on schedule with Western U.S. projects and retain strong pipeline and robust backlog – Diversify into servicing, maintenance, repair – Greater recurring revenue Disciplined job selection – strong execution and profitability Approximately $528 million reported backlog; Focus on winning more small to mid-size projects $707 million adjusted backlog taking into consideration awarded, but not yet signed – Enhance margins through improved capacity contracts utilization and faster turn-around time Rising Revenue, Improving Adj. EBITDA $716.4 $579.0 $502.6 $59.9 $60.9 $51.6 11.9% 8.5% 8.9% 2016A 2017A 2018A Loma Linda Hospital Adjusted EBITDA Revenue LA Rams / Chargers Stadium All data as of December 31, 2018 unless otherwise noted © 2019 HC 2 HOLDINGS, INC. 5

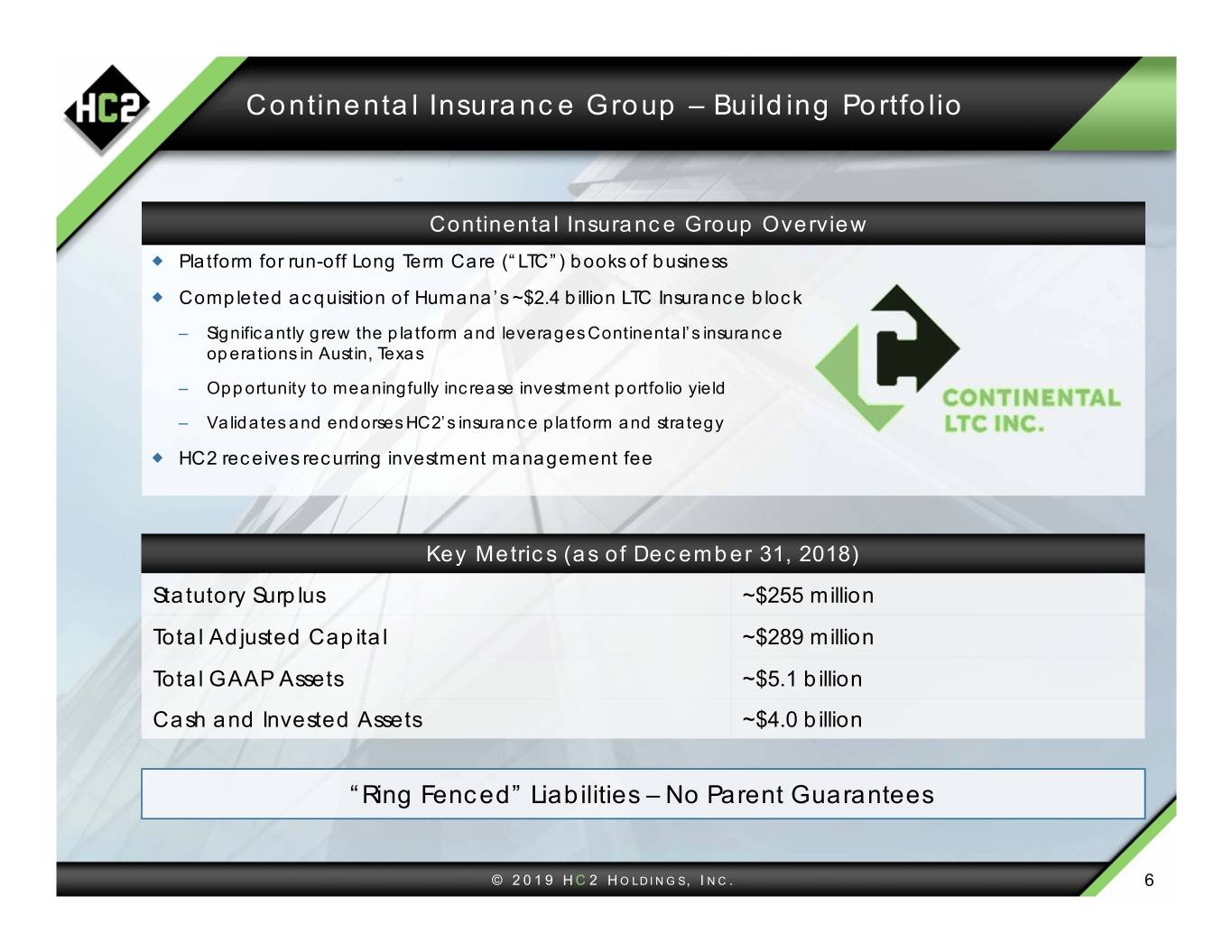

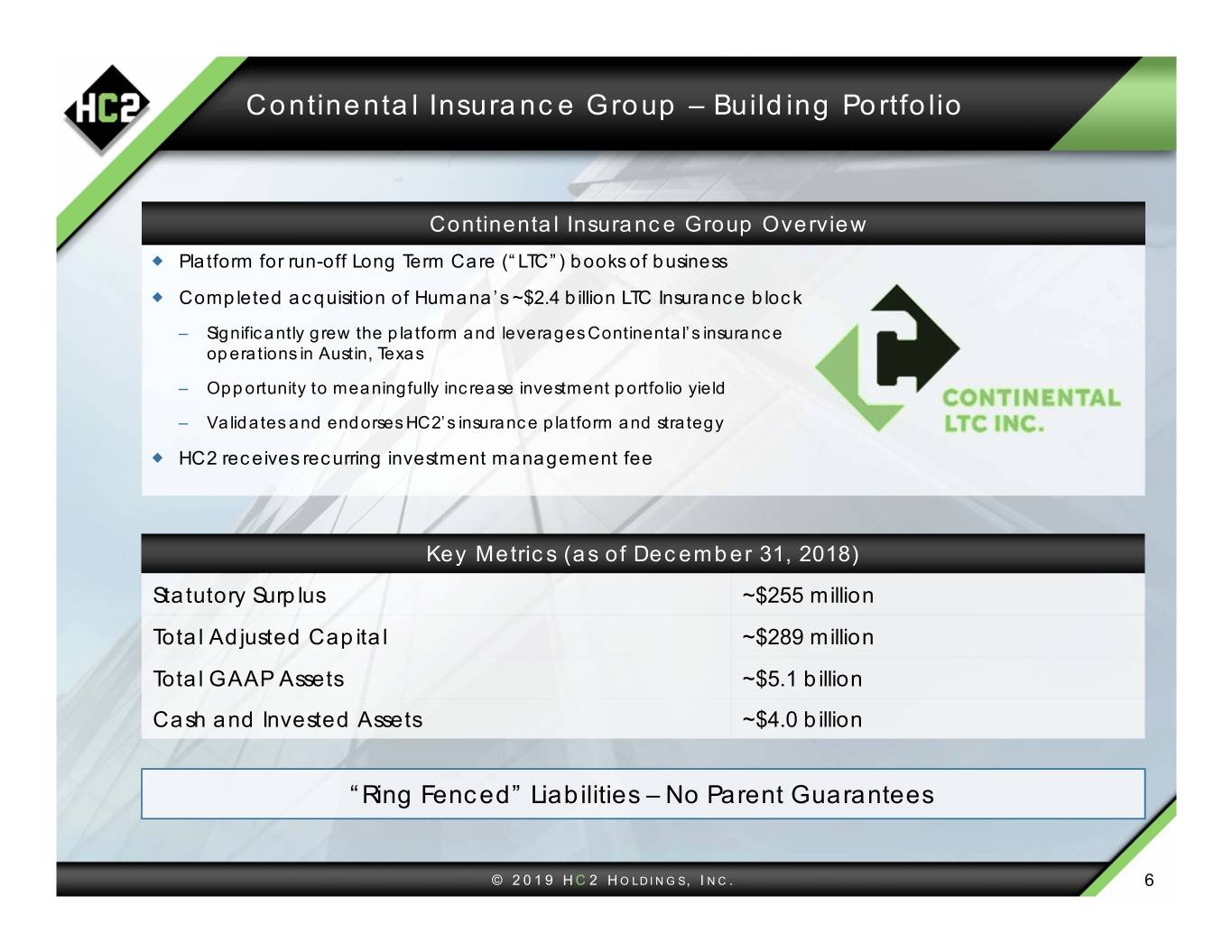

Continental Insurance Group – Building Portfolio Continental Insurance Group Overview Platform for run-off Long Term Care (“LTC”) books of business Completed acquisition of Humana’s ~$2.4 billion LTC Insurance block – Significantly grew the platform and leverages Continental’s insurance operations in Austin, Texas – Opportunity to meaningfully increase investment portfolio yield – Validates and endorses HC2’s insurance platform and strategy HC2 receives recurring investment management fee Key Metrics (as of December 31, 2018) Statutory Surplus ~$255 million Total Adjusted Capital ~$289 million Total GAAP Assets ~$5.1 billion Cash and Invested Assets ~$4.0 billion “Ring Fenced” Liabilities – No Parent Guarantees © 2019 HC 2 HOLDINGS, INC. 6

HC2 Broadcasting – Growth Engine Significant Opportunities Broadcast Television Station: Key Metrics* Positioned to take advantage of changing media Operational Stations: 176 landscape – Full-Power Stations: 15 Create and utilize alternative distribution platform to bring valuable content to over-the-air viewers – Class A Stations: 58 2019 priorities: – LPTV Stations: 103 – Adding broadcast assets where necessary Silent Licenses & Construction Permits: 385 – Upgrading technology / infrastructure – Begin building out distribution platform U.S. Markets: >130 Once platform is built, will be positioned for margin expansion and rapidly growing free cash Covering approximately 60% of U.S. Population flow * Metrics include pending transactions as of early March 2019 © 2019 HC 2 HOLDINGS, INC. 7

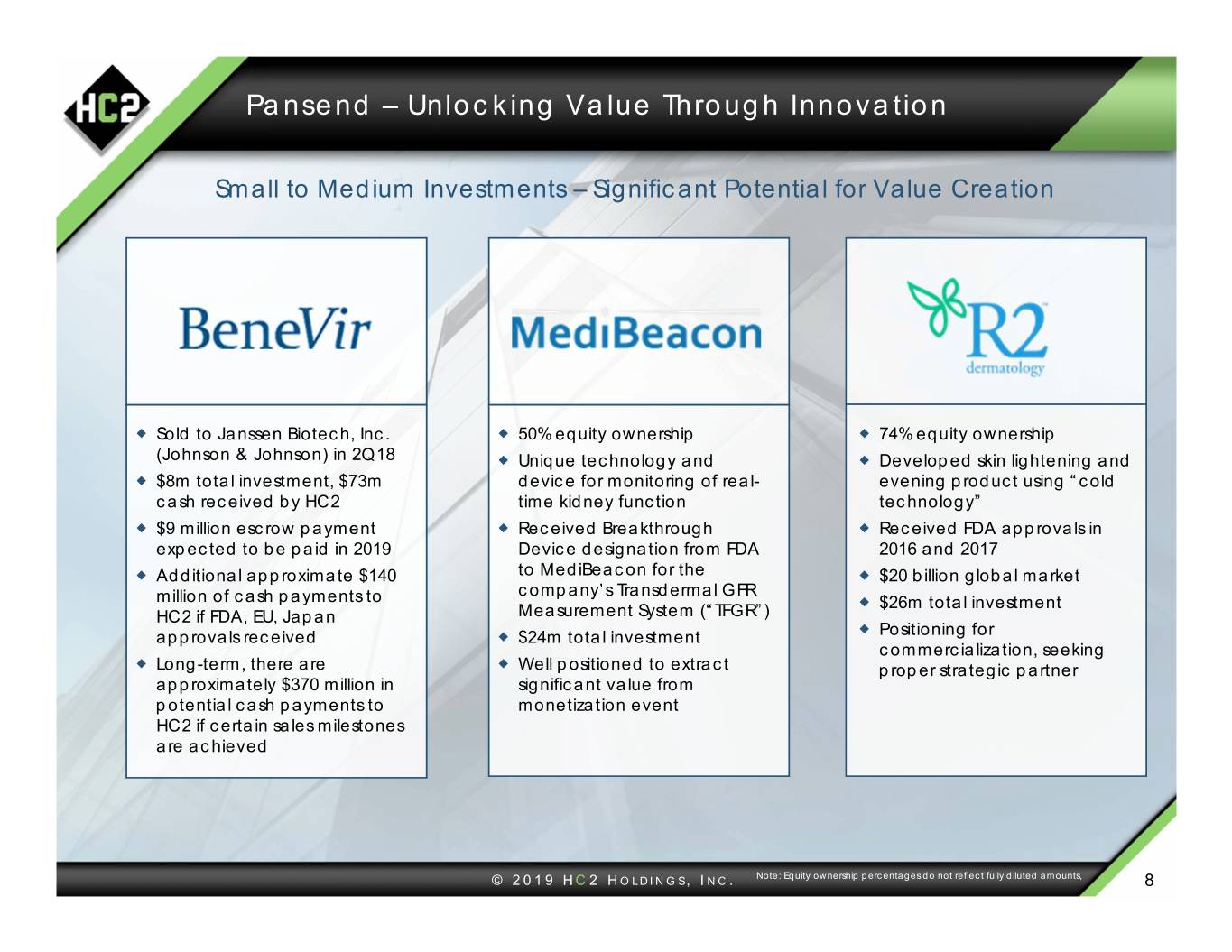

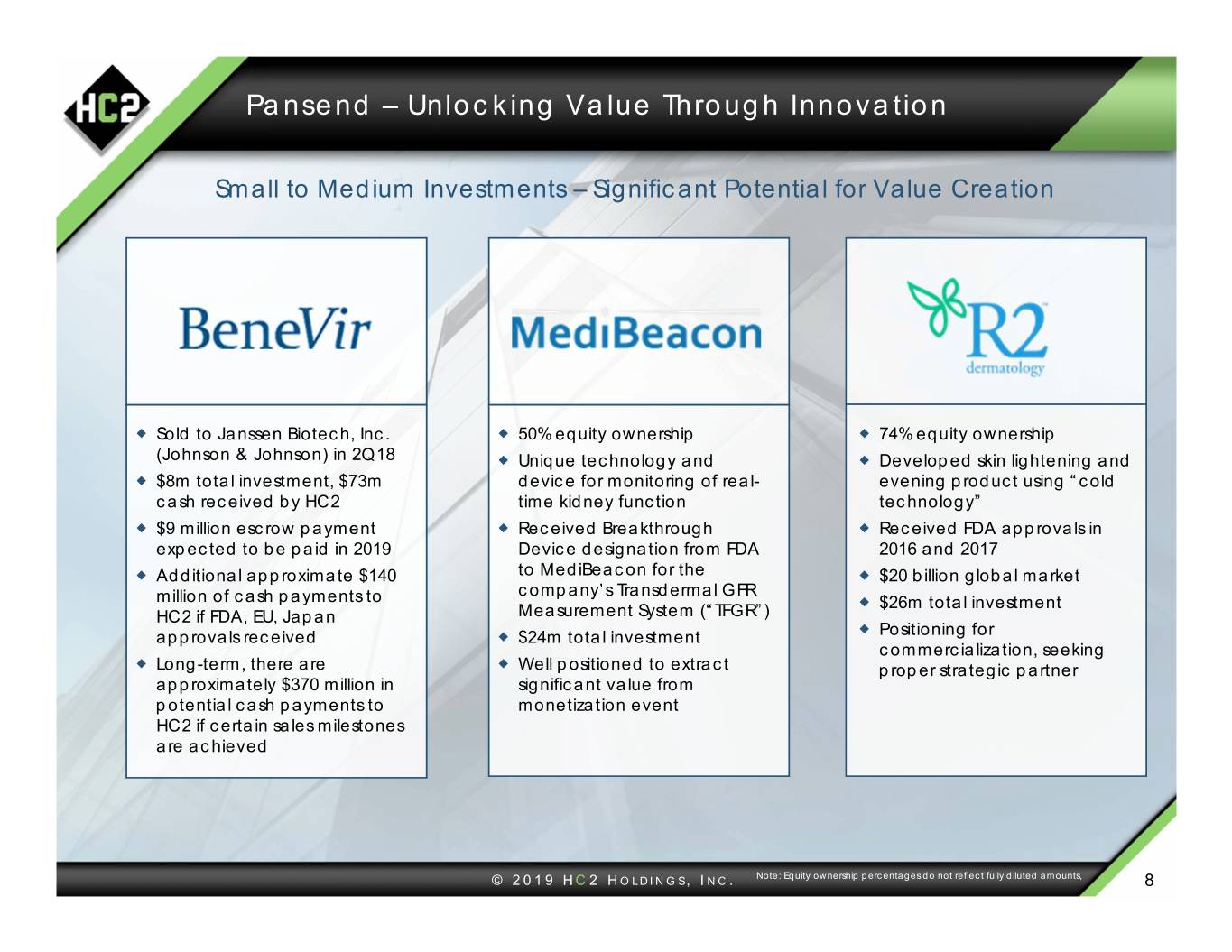

Pansend – Unlocking Value Through Innovation Small to Medium Investments – Significant Potential for Value Creation Sold to Janssen Biotech, Inc. 50% equity ownership 74% equity ownership (Johnson & Johnson) in 2Q18 Unique technology and Developed skin lightening and $8m total investment, $73m device for monitoring of real- evening product using “cold cash received by HC2 time kidney function technology” $9 million escrow payment Received Breakthrough Received FDA approvals in expected to be paid in 2019 Device designation from FDA 2016 and 2017 Additional approximate $140 to MediBeacon for the $20 billion global market company’s Transdermal GFR million of cash payments to $26m total investment HC2 if FDA, EU, Japan Measurement System (“TFGR”) approvals received $24m total investment Positioning for commercialization, seeking Long-term, there are Well positioned to extract proper strategic partner approximately $370 million in significant value from potential cash payments to monetization event HC2 if certain sales milestones are achieved © 2019 HC 2 HOLDINGS, INC. Note: Equity ownership percentages do not reflect fully diluted amounts, 8

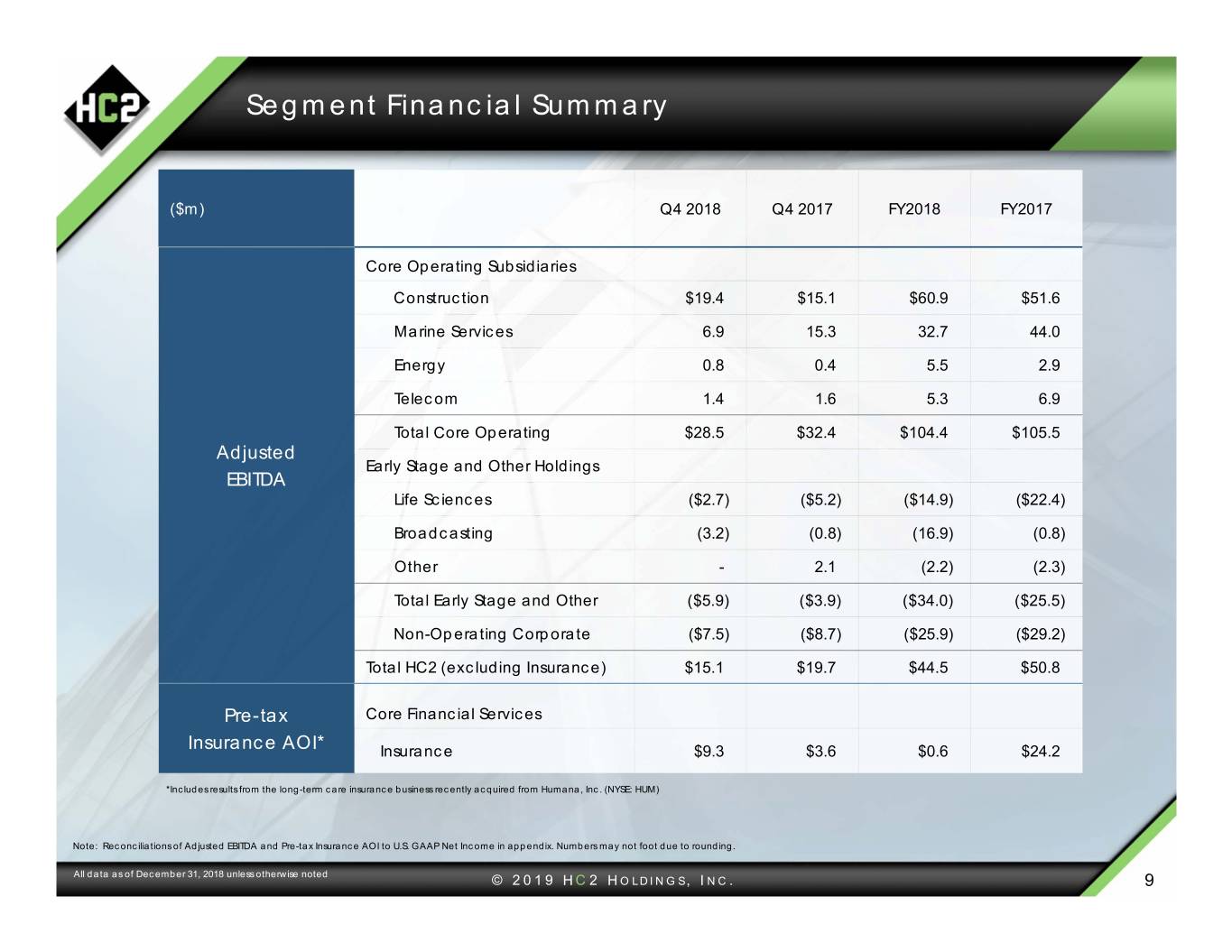

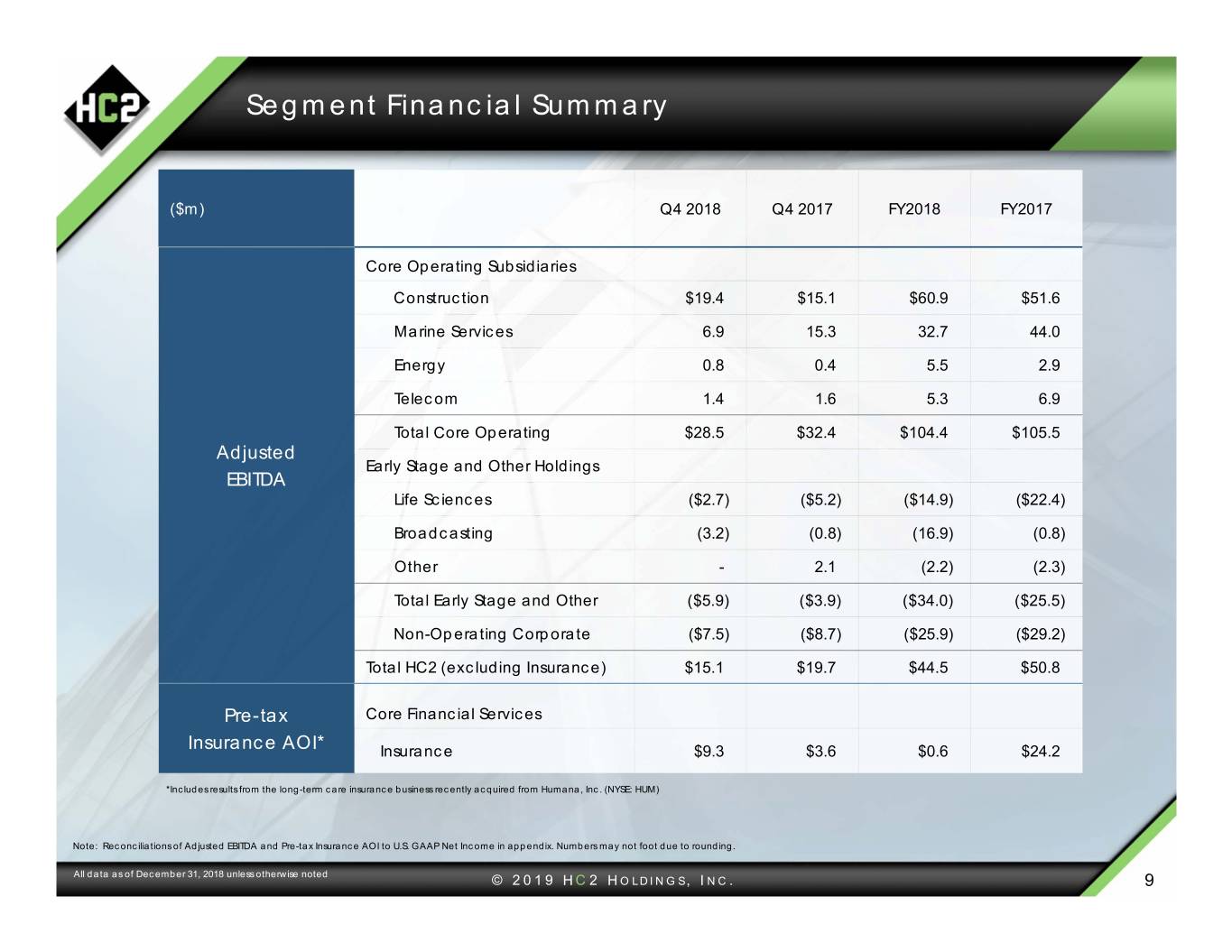

Segment Financial Summary ($m) Q4 2018 Q4 2017 FY2018 FY2017 Core Operating Subsidiaries Construction $19.4 $15.1 $60.9 $51.6 Marine Services 6.9 15.3 32.7 44.0 Energy 0.8 0.4 5.5 2.9 Telecom 1.4 1.6 5.3 6.9 Total Core Operating $28.5 $32.4 $104.4 $105.5 Adjusted Early Stage and Other Holdings EBITDA Life Sciences ($2.7) ($5.2) ($14.9) ($22.4) Broadcasting (3.2) (0.8) (16.9) (0.8) Other - 2.1 (2.2) (2.3) Total Early Stage and Other ($5.9) ($3.9) ($34.0) ($25.5) Non-Operating Corporate ($7.5) ($8.7) ($25.9) ($29.2) Total HC2 (excluding Insurance) $15.1 $19.7 $44.5 $50.8 Pre-tax Core Financial Services Insurance AOI* Insurance $9.3 $3.6 $0.6 $24.2 *Includes results from the long-term care insurance business recently acquired from Humana, Inc. (NYSE: HUM) Note: Reconciliations of Adjusted EBITDA and Pre-tax Insurance AOI to U.S. GAAP Net Income in appendix. Numbers may not foot due to rounding. All data as of December 31, 2018 unless otherwise noted © 2019 HC 2 HOLDINGS, INC. 9

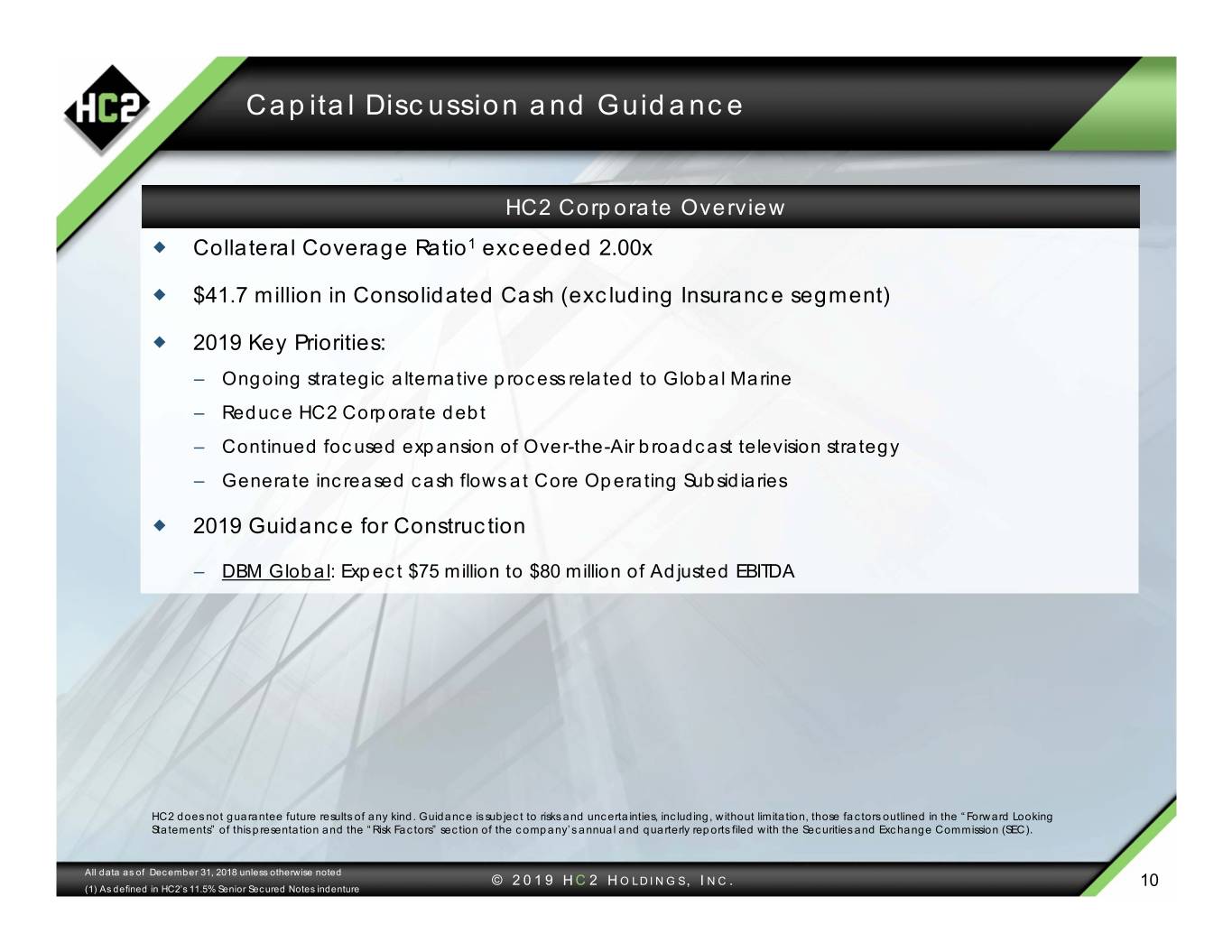

Capital Discussion and Guidance HC2 Corporate Overview Collateral Coverage Ratio1 exceeded 2.00x $41.7 million in Consolidated Cash (excluding Insurance segment) 2019 Key Priorities: – Ongoing strategic alternative process related to Global Marine – Reduce HC2 Corporate debt – Continued focused expansion of Over-the-Air broadcast television strategy – Generate increased cash flows at Core Operating Subsidiaries 2019 Guidance for Construction – DBM Global: Expect $75 million to $80 million of Adjusted EBITDA HC2 does not guarantee future results of any kind. Guidance is subject to risks and uncertainties, including, without limitation, those factors outlined in the “Forward Looking Statements” of this presentation and the “Risk Factors” section of the company’s annual and quarterly reports filed with the Securities and Exchange Commission (SEC). All data as of December 31, 2018 unless otherwise noted © 2019 HC 2 HOLDINGS, INC. (1) As defined in HC2’s 11.5% Senior Secured Notes indenture 10

Appendix:

HC2’s Diversified Portfolio Core Financial Core Operating Subsidiaries Services Subsidiaries Construction: Marine Services: Energy: Telecommunications: Insurance: DBM GLOBAL (SCHUFF) GMSL ANG PTGI ICS CIG 4Q18 Revenue: $185.1m 4Q18 Revenue: $44.4m 4Q18 Revenue: $4.6m 4Q18 Revenue: $213.0m $255m of statutory surplus 4Q18 Adj. EBITDA: $19.4m 4Q18 Adj. EBITDA: $6.9m 4Q18 Adj. EBITDA: $0.8m 4Q18 Adj. EBITDA: $1.4m $289m total adjusted capital 2018 Revenue: $716.4m 2018 Revenue: $194.3m 2018 Revenue: $20.7m 2018 Revenue: $793.6m $5.1b total GAAP assets 2018 Adj. EBITDA: $60.9m 2018 Adj. EBITDA: $32.7m 2018 Adj. EBITDA: $5.5m 2018 Adj. EBITDA: $5.3m $4.0b cash & invested assets Backlog $528.5m; ~$707m GMSL Backlog $483.4m Delivered ~11.8m Gasoline Continued focus on higher Platform for growth through with contracts awarded, but Solid long term telecom and Gallon Equivalents (GGEs) in margin wholesale traffic mix additional M&A including not yet signed. offshore power maintenance 2018 vs. ~11.1m GGEs in 2017 and improved operating recent acquisition of Humana’s Solid long-term pipeline & install opportunities ~40 stations currently owned efficiencies long-term care portfolio Recent acquisition of Evaluating strategic or operated or under Graywolf Industrial alternatives including a development vs. two stations potential sale at time of HC2’s initial investment in 3Q14 Early Stage and Other Holdings Life Sciences: PANSEND Broadcasting: BeneVir: Oncolytic viral immunotherapy for treatment of solid cancer tumors; Sold to Janssen Biotech (Johnson & Johnson) in 2Q18 HC2 Broadcasting Holdings Our Vision: Capitalize on the opportunities to bring valuable MediBeacon: Unique non-invasive real-time monitoring of kidney function; MediBeacon recently content to more viewers over-the-air and position the company for granted Breakthrough Device designation from the FDA; MediBeacon’s device is intended to a changing media landscape measure GFR in patients with impaired or normal kidney function R2 Dermatology: Medical device to brighten skin based on Mass. General Hospital technology, including two FDA approvals Genovel: Novel, Patented, “Mini Knee” and “Anatomical Knee” replacements Triple Ring Technologies: R&D engineering company specializing in medical devices, homeland security, imaging, sensors, optics, fluidics, robotics & mobile healthcare All data as of December 31, 2018 unless otherwise noted; Humana acquisition closed on 8/9/18 © 2019 HC 2 HOLDINGS, INC. 12

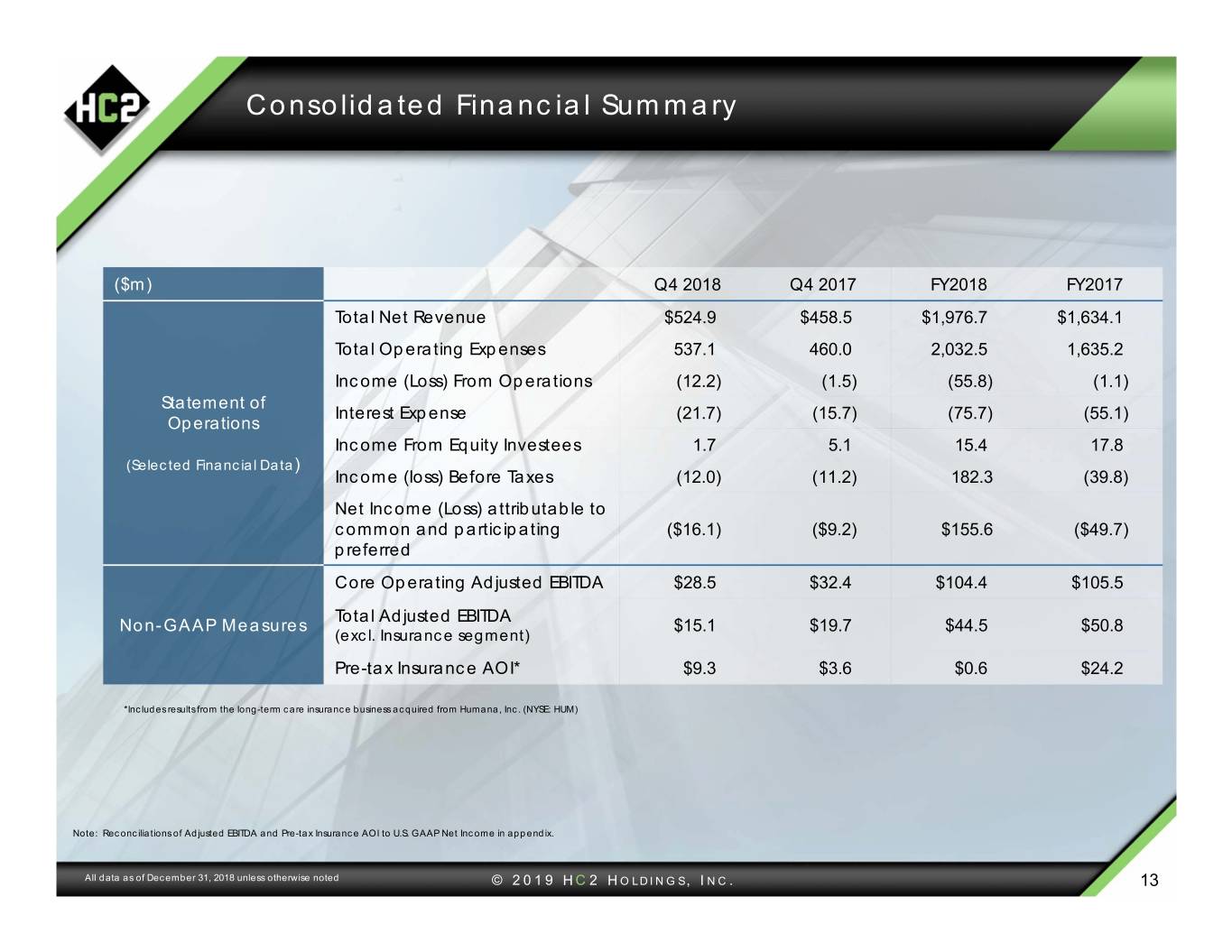

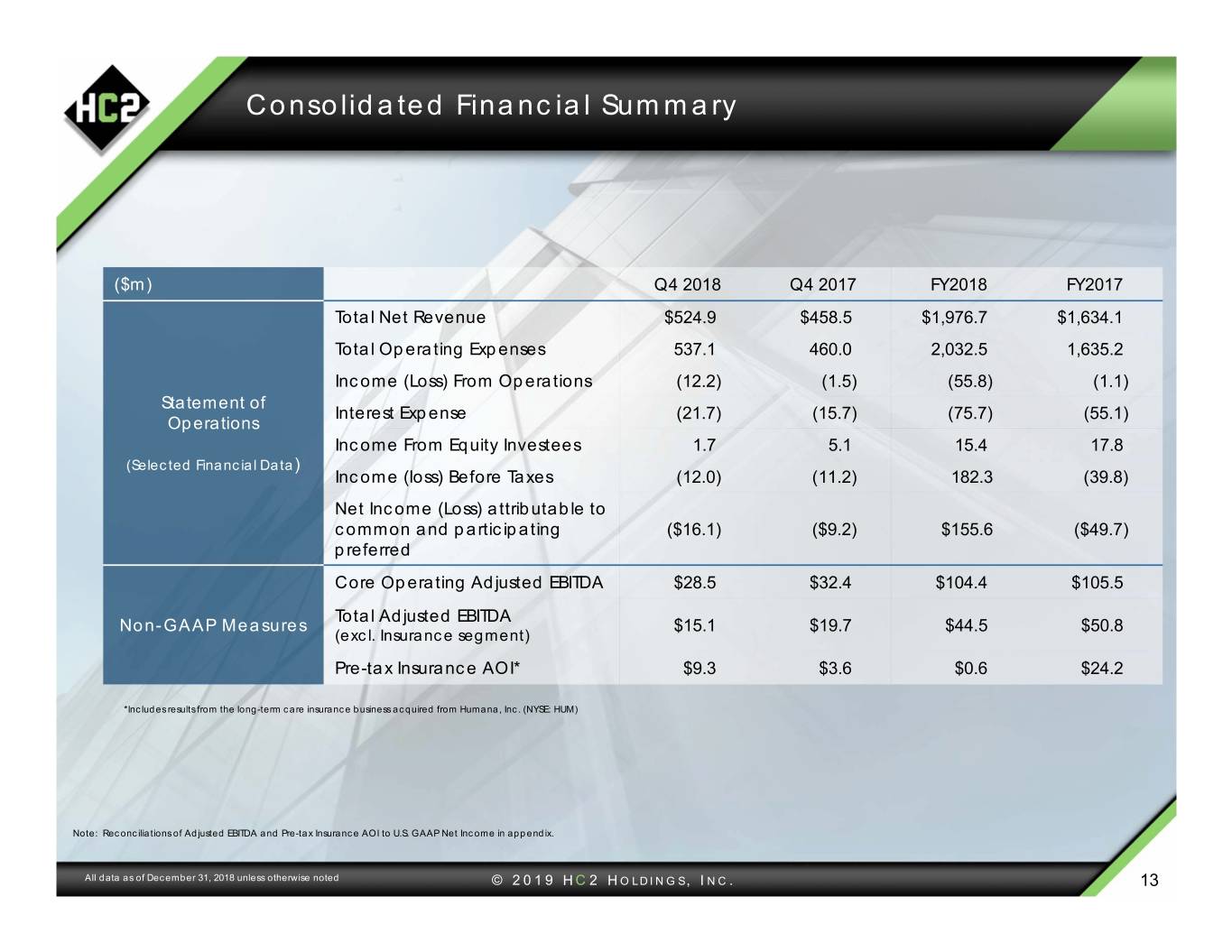

Consolidated Financial Summary ($m) Q4 2018 Q4 2017 FY2018 FY2017 Total Net Revenue $524.9 $458.5 $1,976.7 $1,634.1 Total Operating Expenses 537.1 460.0 2,032.5 1,635.2 Income (Loss) From Operations (12.2) (1.5) (55.8) (1.1) Statement of Interest Expense (21.7) (15.7) (75.7) (55.1) Operations Income From Equity Investees 1.7 5.1 15.4 17.8 (Selected Financial Data) Income (loss) Before Taxes (12.0) (11.2) 182.3 (39.8) Net Income (Loss) attributable to common and participating ($16.1) ($9.2) $155.6 ($49.7) preferred Core Operating Adjusted EBITDA $28.5 $32.4 $104.4 $105.5 Total Adjusted EBITDA Non-GAAP Measures $15.1 $19.7 $44.5 $50.8 (excl. Insurance segment) Pre-tax Insurance AOI* $9.3 $3.6 $0.6 $24.2 *Includes results from the long-term care insurance business acquired from Humana, Inc. (NYSE: HUM) Note: Reconciliations of Adjusted EBITDA and Pre-tax Insurance AOI to U.S. GAAP Net Income in appendix. All data as of December 31, 2018 unless otherwise noted © 2019 HC 2 HOLDINGS, INC. 13

Additional Segment Profiles

Marine Services: Global Marine Group Fourth Quarter Update 4Q18 Net Income (Loss): Net (Loss) ($3.8)m vs. Net Income $6.2m in 4Q17; 2018 Net Income $0.3m vs. $15.2m for 2017 4Q18 Adjusted EBITDA: $6.9m vs. $15.3m in 4Q17 2018 Adjusted EBITDA: $32.7m vs. $44.0m in 2017 Global Marine backlog of $483m at year-end Huawei Marine Network implemented a new long-term annual dividend policy after several years of meaningful shareholder value creation: – Global Marine received ~US$15m of dividends 2018; Will receive additional special dividends of ~$4.9m in 2Q19 – HMN will annually distribute a minimum of 30% of cumulative distributable net profits as dividends based on audited annual financials. Exploring strategic alternatives for the Global Marine business, including a potential sale; proceeds to pay down HC2 debt Equity Investments 49% ownership 49% ownership Total HMN* 2018 2017 2016 2015 Equity investment established in 1995 with China Telecom Revenue NA ~$246m ~$207m ~$203m China’s leading provider of submarine cable installation Profit NA ~$37m ~$25m ~$14m Cash, Equivalents, & Located in Shanghai and possesses a fleet of advanced purpose-built cable NA ~$73m ~$48m ~$27m AFS Securities ships Historical Performance $194.3 $169.5 $161.9 $41.2 $44.0 $32.7 25.4% 26.0% 16.8 % 2016A 2017A 2018A Adjusted EBITDA Revenue *Currency Exchange: CNY:USD 1:0.129 used for illustrative purposes All data as of December 31, 2018 unless otherwise noted © 2019 HC 2 HOLDINGS, INC. 15

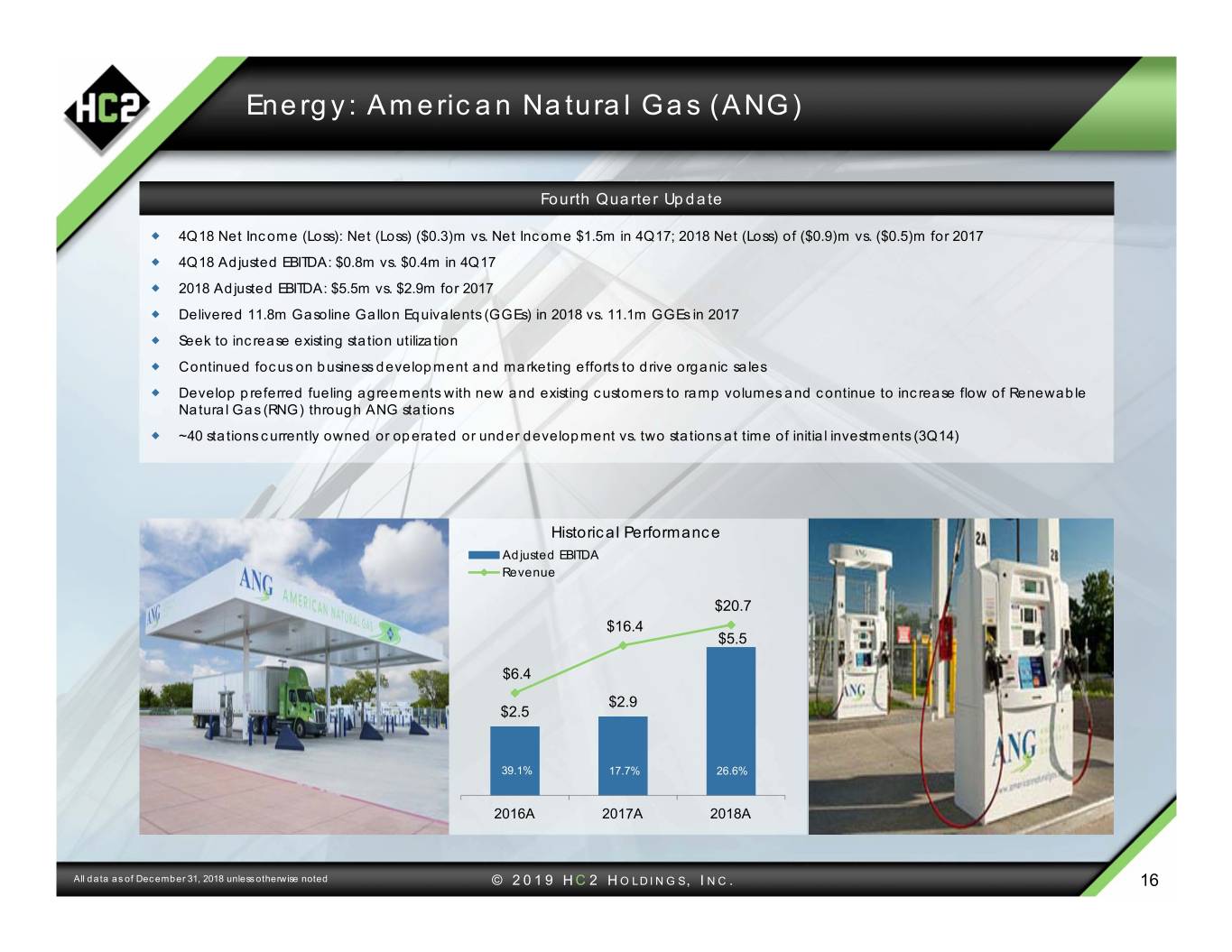

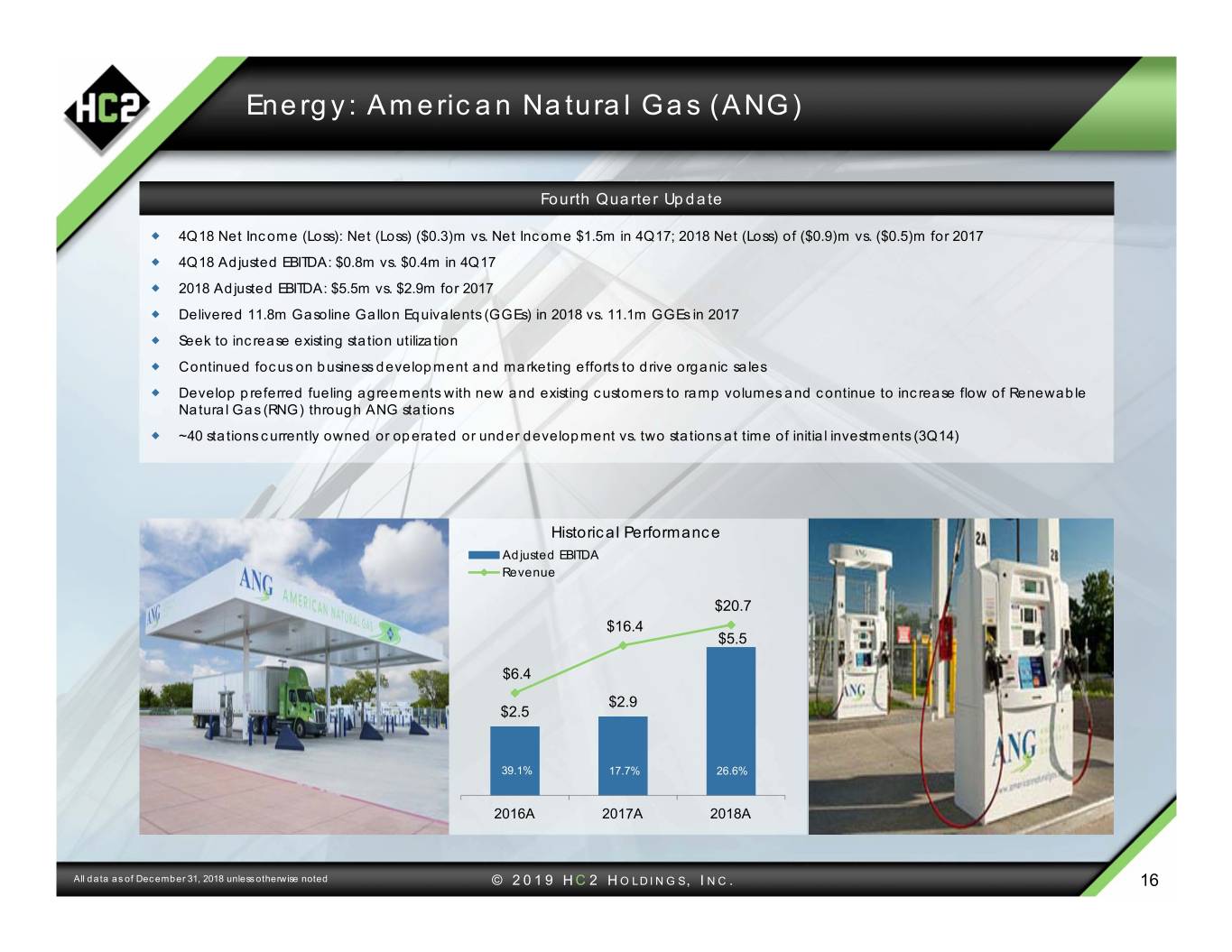

Energy: American Natural Gas (ANG) Fourth Quarter Update 4Q18 Net Income (Loss): Net (Loss) ($0.3)m vs. Net Income $1.5m in 4Q17; 2018 Net (Loss) of ($0.9)m vs. ($0.5)m for 2017 4Q18 Adjusted EBITDA: $0.8m vs. $0.4m in 4Q17 2018 Adjusted EBITDA: $5.5m vs. $2.9m for 2017 Delivered 11.8m Gasoline Gallon Equivalents (GGEs) in 2018 vs. 11.1m GGEs in 2017 Seek to increase existing station utilization Continued focus on business development and marketing efforts to drive organic sales Develop preferred fueling agreements with new and existing customers to ramp volumes and continue to increase flow of Renewable Natural Gas (RNG) through ANG stations ~40 stations currently owned or operated or under development vs. two stations at time of initial investments (3Q14) Historical Performance Adjusted EBITDA Revenue $20.7 $16.4 $5.5 $6.4 $2.9 $2.5 39.1% 17.7% 26.6% 2016A 2017A 2018A All data as of December 31, 2018 unless otherwise noted © 2019 HC 2 HOLDINGS, INC. 16

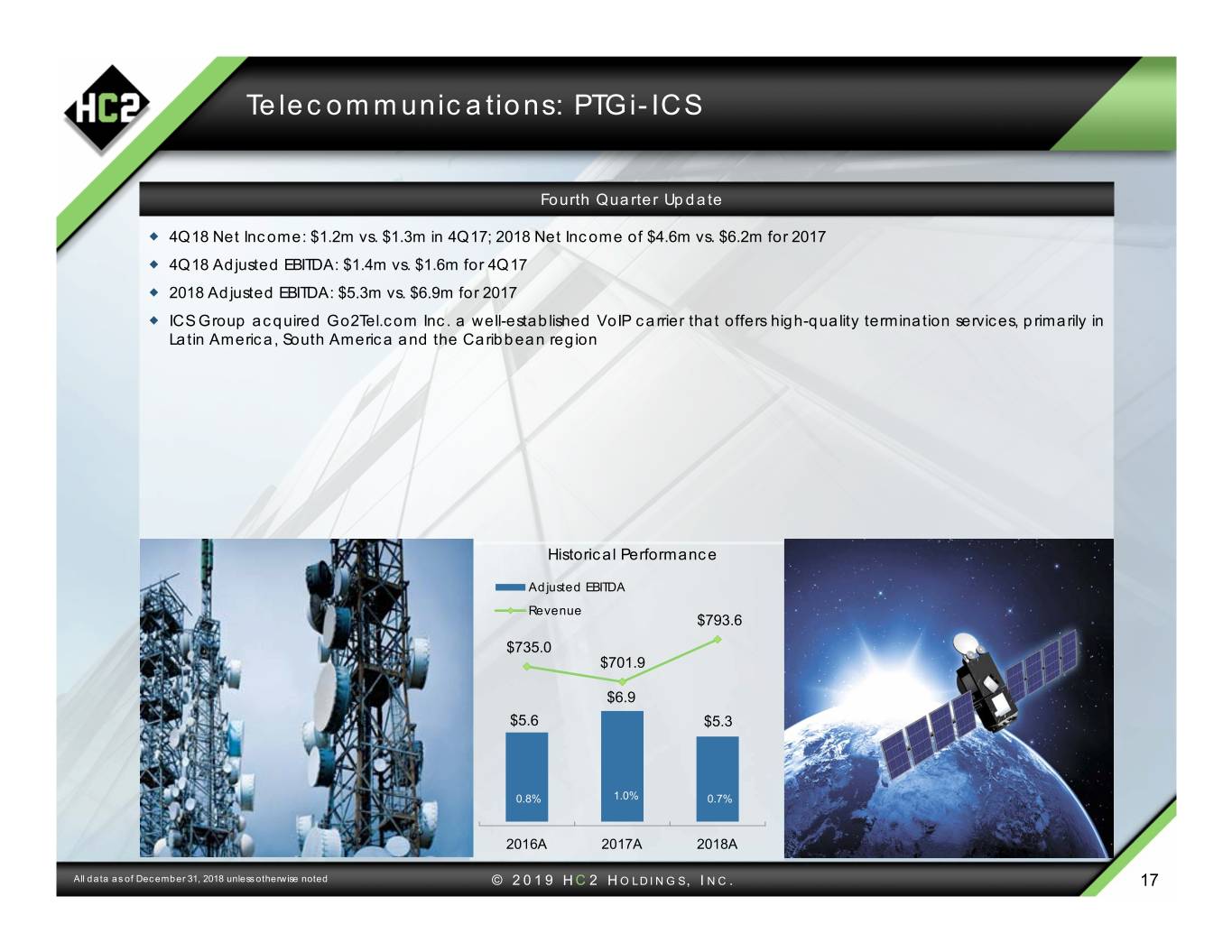

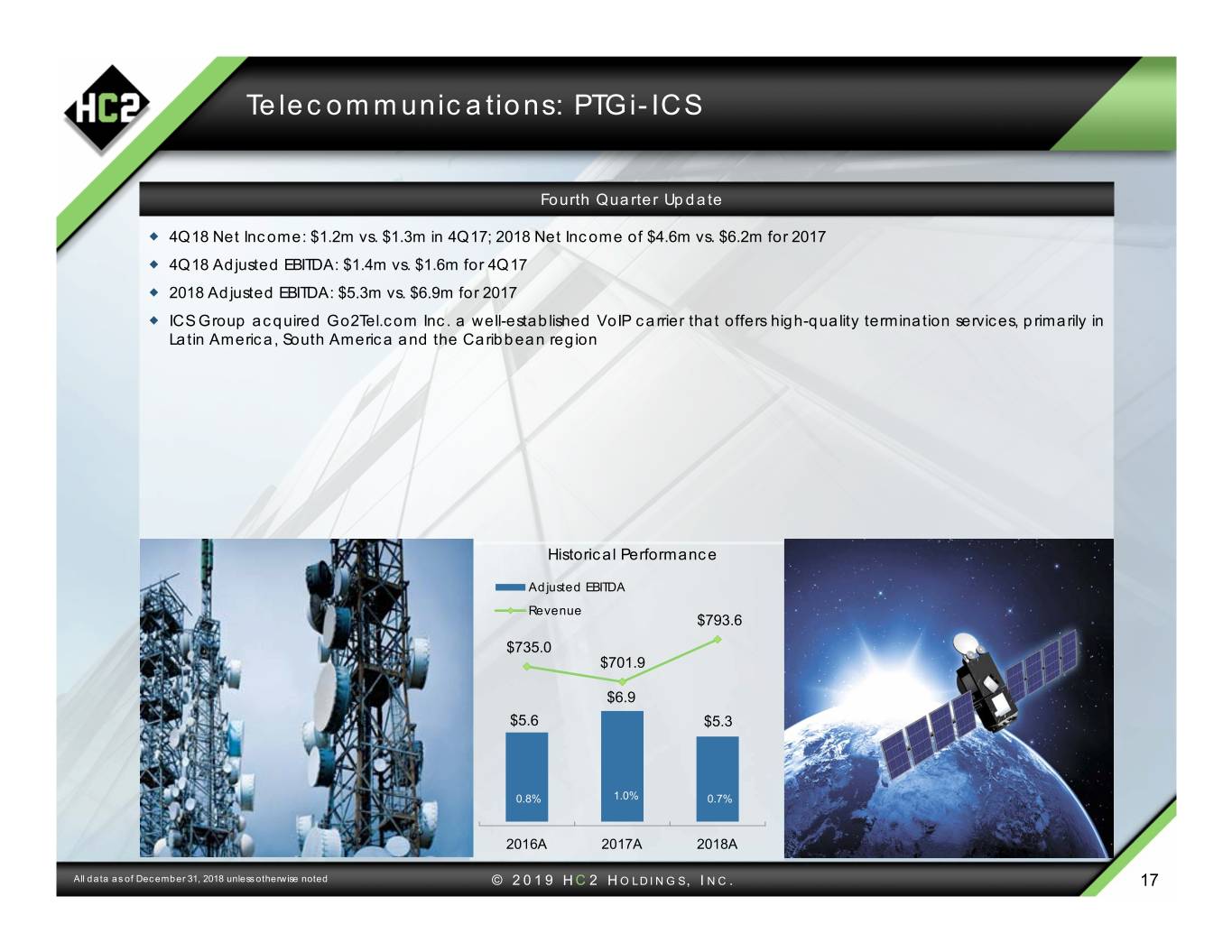

Telecommunications: PTGi-ICS Fourth Quarter Update 4Q18 Net Income: $1.2m vs. $1.3m in 4Q17; 2018 Net Income of $4.6m vs. $6.2m for 2017 4Q18 Adjusted EBITDA: $1.4m vs. $1.6m for 4Q17 2018 Adjusted EBITDA: $5.3m vs. $6.9m for 2017 ICS Group acquired Go2Tel.com Inc. a well-established VoIP carrier that offers high-quality termination services, primarily in Latin America, South America and the Caribbean region Historical Performance Adjusted EBITDA Revenue $793.6 $735.0 $701.9 $6.9 $5.6 $5.3 0.8%1.0% 0.7% 2016A 2017A 2018A All data as of December 31, 2018 unless otherwise noted © 2019 HC 2 HOLDINGS, INC. 17

Reconciliations

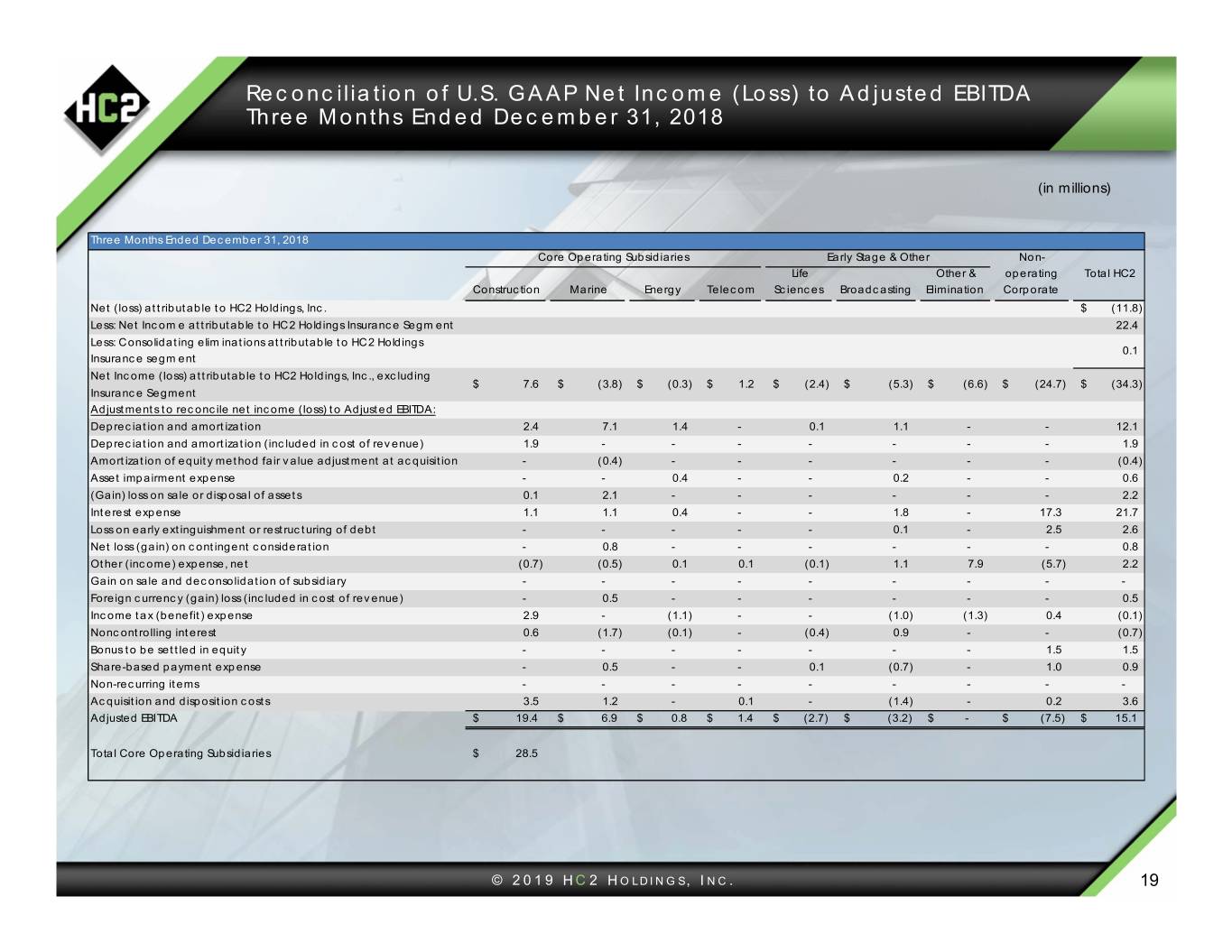

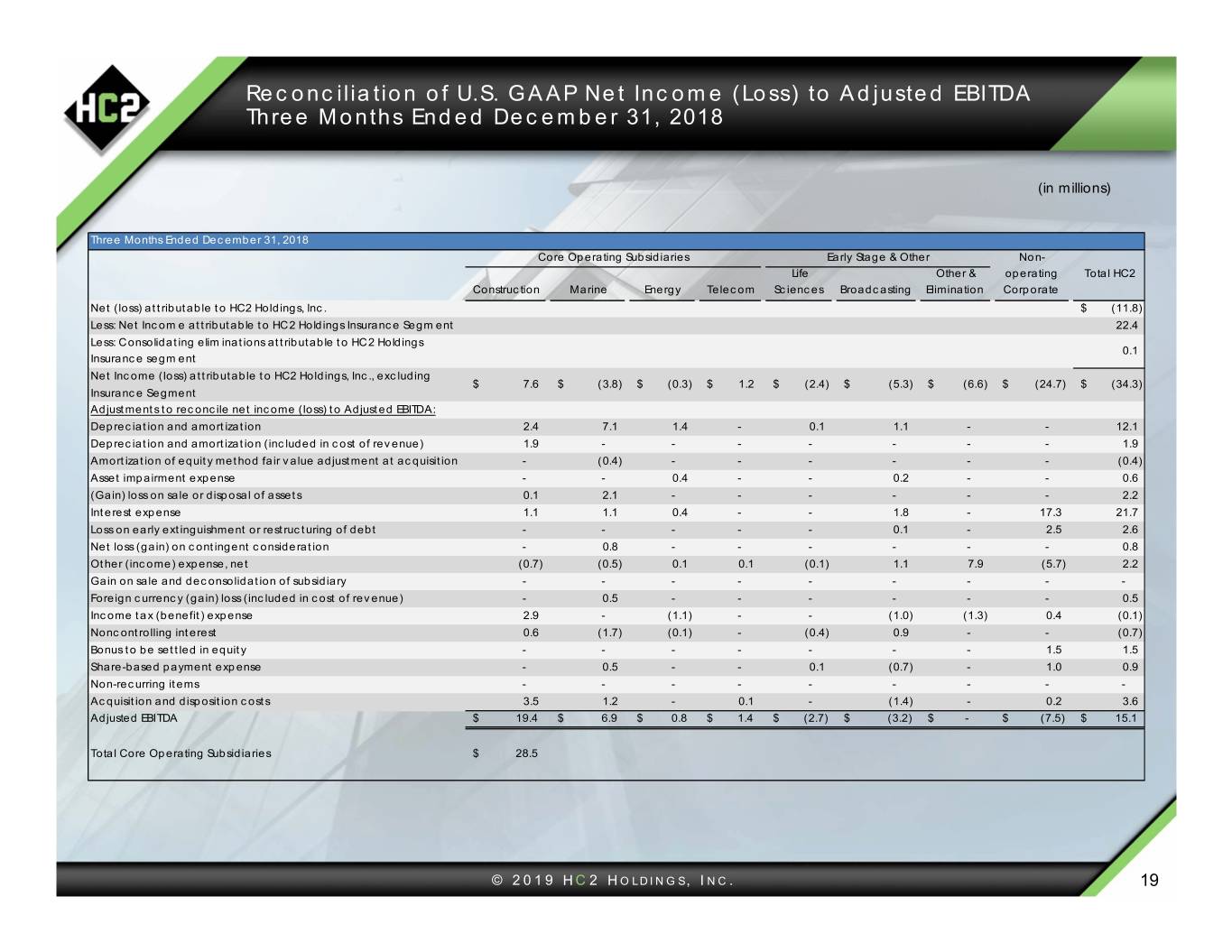

Reconciliation of U.S. GAAP Net Income (Loss) to Adjusted EBITDA Three Months Ended December 31, 2018 (in millions) Three Months Ended December 31, 2018 Core Operating Subsidiaries Early Stage & Other Non- operating Total HC2 Life Other & Corporate Construction Marine Energy Telecom Sciences Broadcastin g Elimination Net (loss) attributable to HC2 Holdings, Inc. $ (11.8) Less: Net Income attributable to HC2 Holdings Insurance Segment 22.4 Less: Consolidating elim inations attributable to HC2 Holdings 0.1 Insurance segment Net Income (loss) attributable to HC2 Holdings, Inc., excluding $ 7.6 $ (3.8) $ (0.3) $ 1.2 $ (2.4) $ (5.3) $ (6.6) $ (24.7) $ (34.3) Insurance Segment Adjustments to reconcile net income (loss) to Adjusted EBITDA: Depreciation and amortization 2.4 7.1 1.4 - 0.1 1.1 - - 12.1 Depreciation and amortization (included in cost of revenue) 1.9 - - - - - - - 1.9 Amortization of equity method fair value adjustment at acquisition - (0.4) - - - - - - (0.4) Asset impairment expense - - 0.4 - - 0.2 - - 0.6 (Gain) loss on sale or disposal of assets 0.1 2.1 - - - - - - 2.2 Interest expense 1.1 1.1 0.4 - - 1.8 - 17.3 21.7 Loss on early extinguishment or restructuring of debt - - - - - 0.1 - 2.5 2.6 Net loss (gain) on contingent consideration - 0.8 - - - - - - 0.8 Other (income) expense, net (0.7) (0.5) 0.1 0.1 (0.1) 1.1 7.9 (5.7) 2.2 Gain on sale and deconsolidation of subsidiary - - - - - - - - - Foreign currency (gain) loss (included in cost of revenue) - 0.5 - - - - - - 0.5 Income tax (benefit) expense 2.9 - (1.1) - - (1.0) (1.3) 0.4 (0.1) Noncontrolling interest 0.6 (1.7) (0.1) - (0.4) 0.9 - - (0.7) Bonus to be settled in equity - - - - - - - 1.5 1.5 Share-based payment expense - 0.5 - - 0.1 (0.7) - 1.0 0.9 Non-recurring items - - - - - - - - - Acquisition and disposition costs 3.5 1.2 - 0.1 - (1.4) - 0.2 3.6 Adjusted EBITDA$ 19.4 $ 6.9 $ 0.8 $ 1.4 $ (2.7) $ (3.2) $ - $ (7.5) $ 15.1 Total Core Operating Subsidiaries$ 28.5 © 2019 HC 2 HOLDINGS, INC. 19

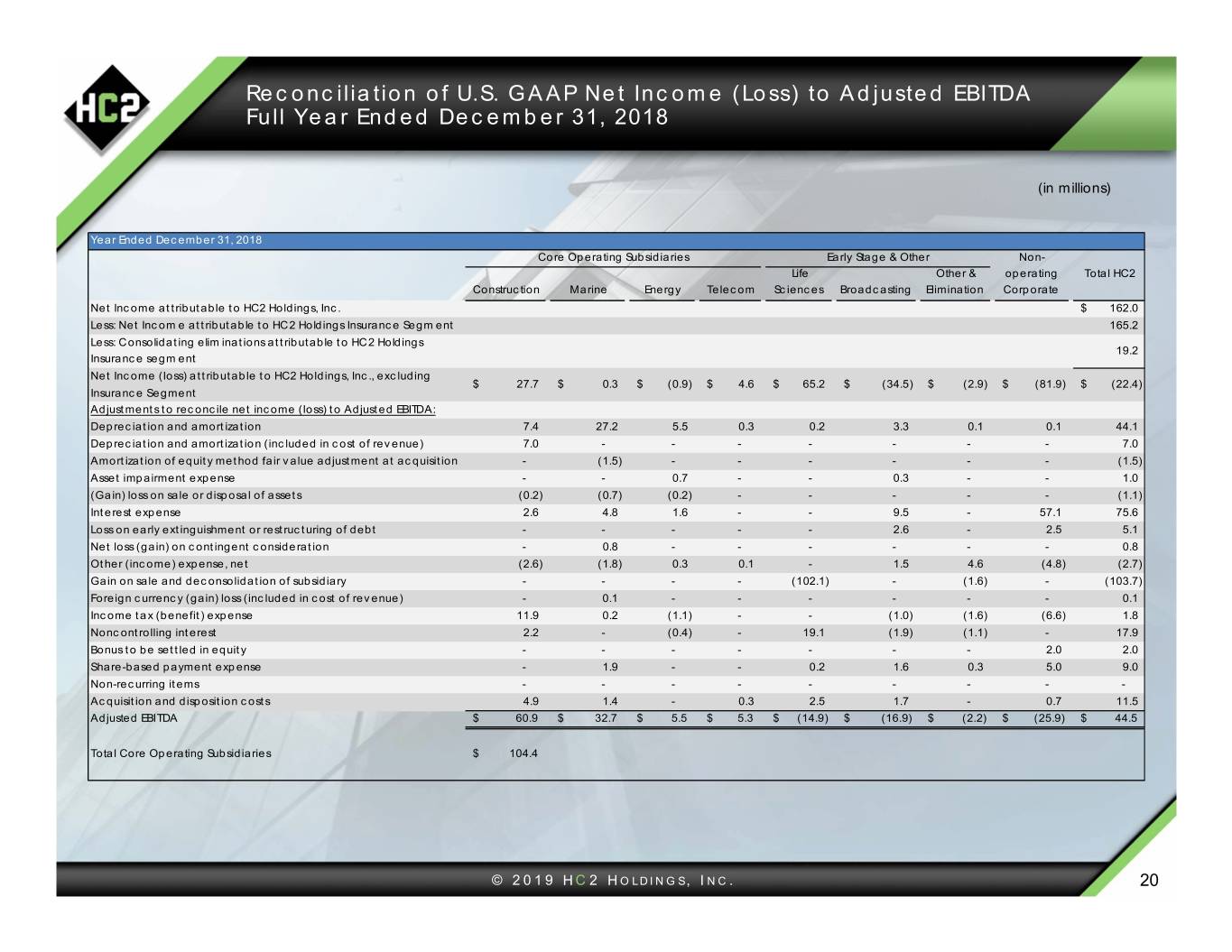

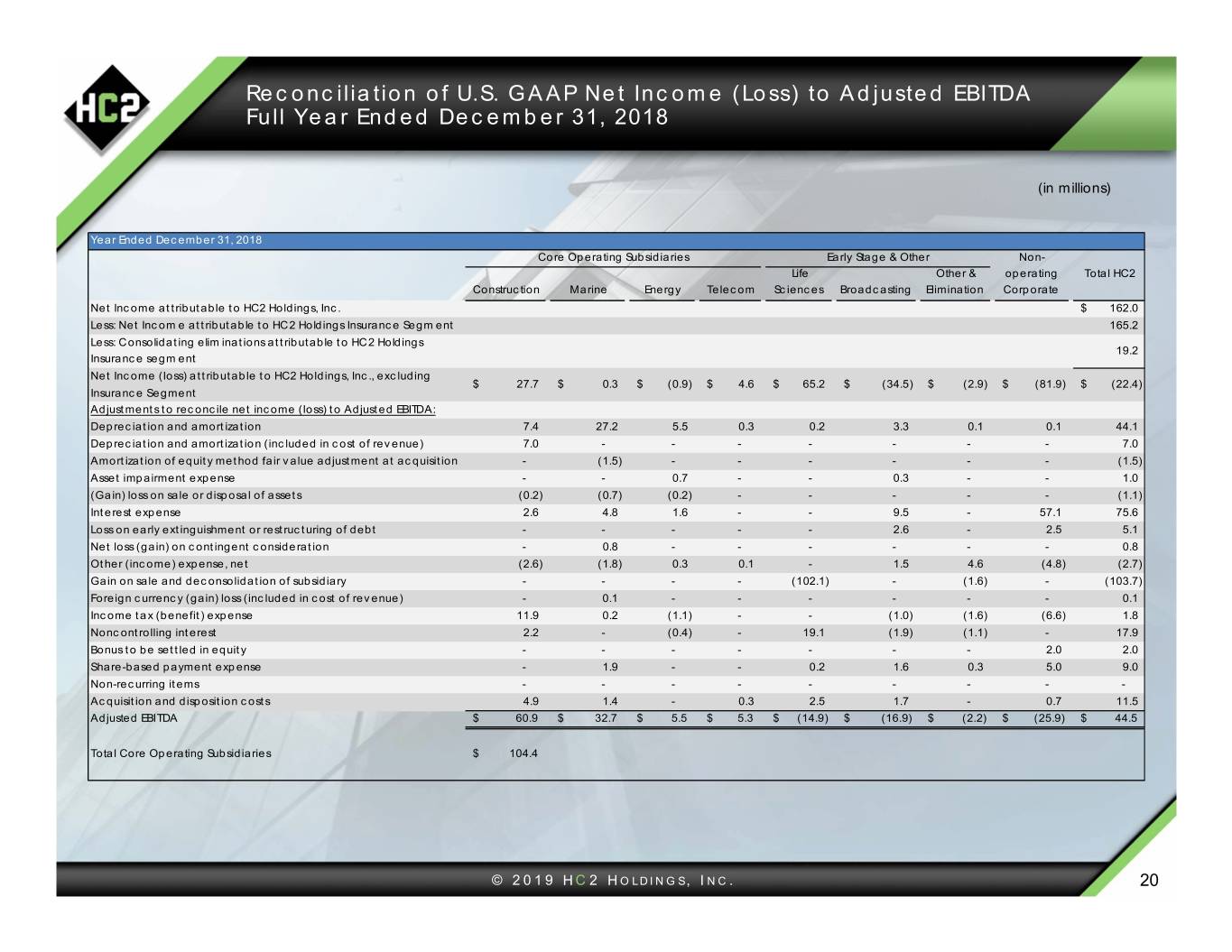

Reconciliation of U.S. GAAP Net Income (Loss) to Adjusted EBITDA Full Year Ended December 31, 2018 (in millions) Year Ended December 31, 2018 Core Operating Subsidiaries Early Stage & Other Non- operating Total HC2 Life Other & Corporate Construction Marine Energy Telecom Sciences Broadcastin g Elimination Net Income attributable to HC2 Holdings, Inc. $ 162.0 Less: Net Income attributable to HC2 Holdings Insurance Segment 165.2 Less: Consolidating elim inations attributable to HC2 Holdings 19.2 Insurance segment Net Income (loss) attributable to HC2 Holdings, Inc., excluding $ 27.7 $ 0.3 $ (0.9) $ 4.6 $ 65.2 $ (34.5) $ (2.9) $ (81.9) $ (22.4) Insurance Segment Adjustments to reconcile net income (loss) to Adjusted EBITDA: Depreciation and amortization 7.4 27.2 5.5 0.3 0.2 3.3 0.1 0.1 44.1 Depreciation and amortization (included in cost of revenue) 7.0 - - - - - - - 7.0 Amortization of equity method fair value adjustment at acquisition - (1.5) - - - - - - (1.5) Asset impairment expense - - 0.7 - - 0.3 - - 1.0 (Gain) loss on sale or disposal of assets (0.2) (0.7) (0.2) - - - - - (1.1) Interest expense 2.6 4.8 1.6 - - 9.5 - 57.1 75.6 Loss on early extinguishment or restructuring of debt - - - - - 2.6 - 2.5 5.1 Net loss (gain) on contingent consideration - 0.8 - - - - - - 0.8 Other (income) expense, net (2.6) (1.8) 0.3 0.1 - 1.5 4.6 (4.8) (2.7) Gain on sale and deconsolidation of subsidiary - - - - (102.1) - (1.6) - (103.7) Foreign currency (gain) loss (included in cost of revenue) - 0.1 - - - - - - 0.1 Income tax (benefit) expense 11.9 0.2 (1.1) - - (1.0) (1.6) (6.6) 1.8 Noncontrolling interest 2.2 - (0.4) - 19.1 (1.9) (1.1) - 17.9 Bonus to be settled in equity - - - - - - - 2.0 2.0 Share-based payment expense - 1.9 - - 0.2 1.6 0.3 5.0 9.0 Non-recurring items - - - - - - - - - Acquisition and disposition costs 4.9 1.4 - 0.3 2.5 1.7 - 0.7 11.5 Adjusted EBITDA$ 60.9 $ 32.7 $ 5.5 $ 5.3 $ (14.9) $ (16.9) $ (2.2) $ (25.9) $ 44.5 Total Core Operating Subsidiaries$ 104.4 © 2019 HC 2 HOLDINGS, INC. 20

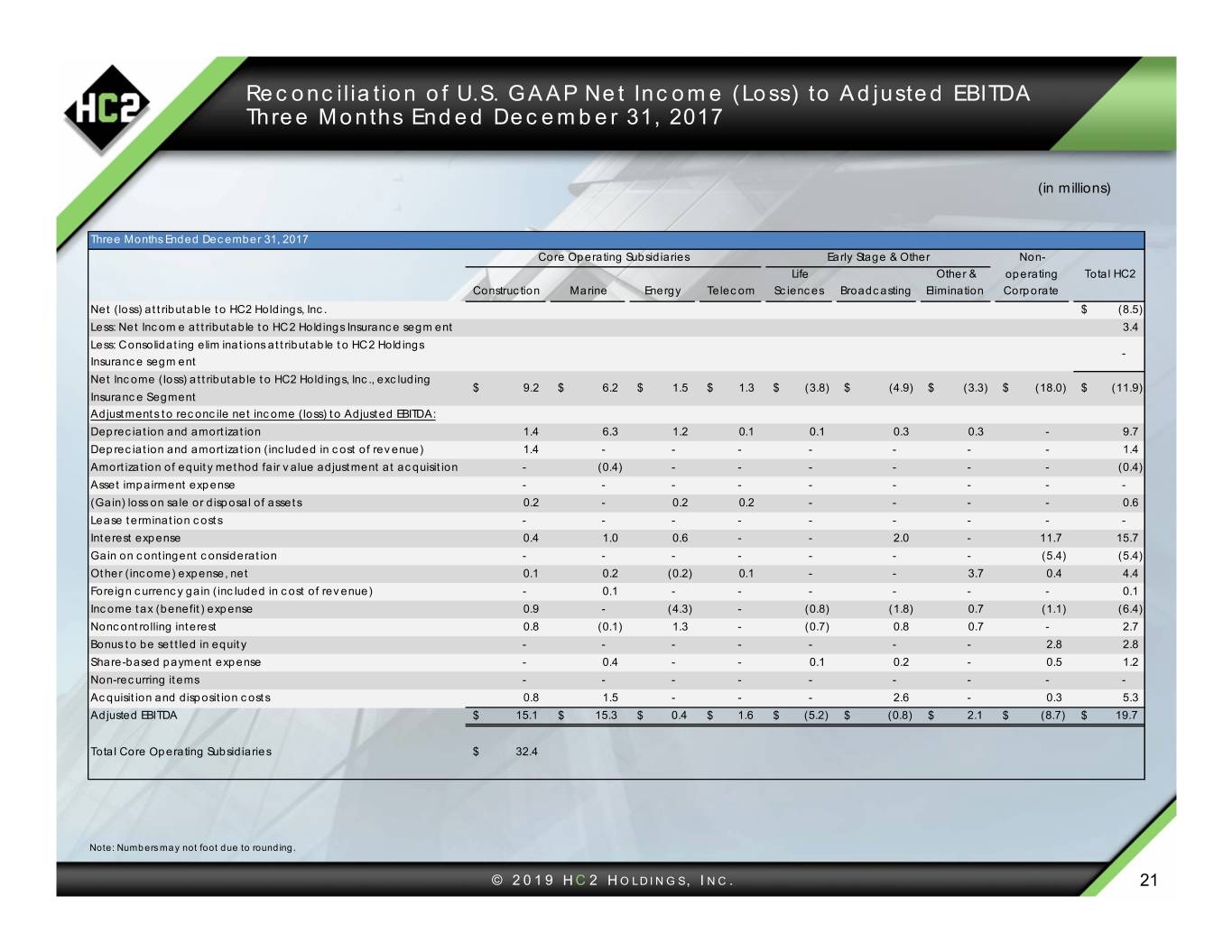

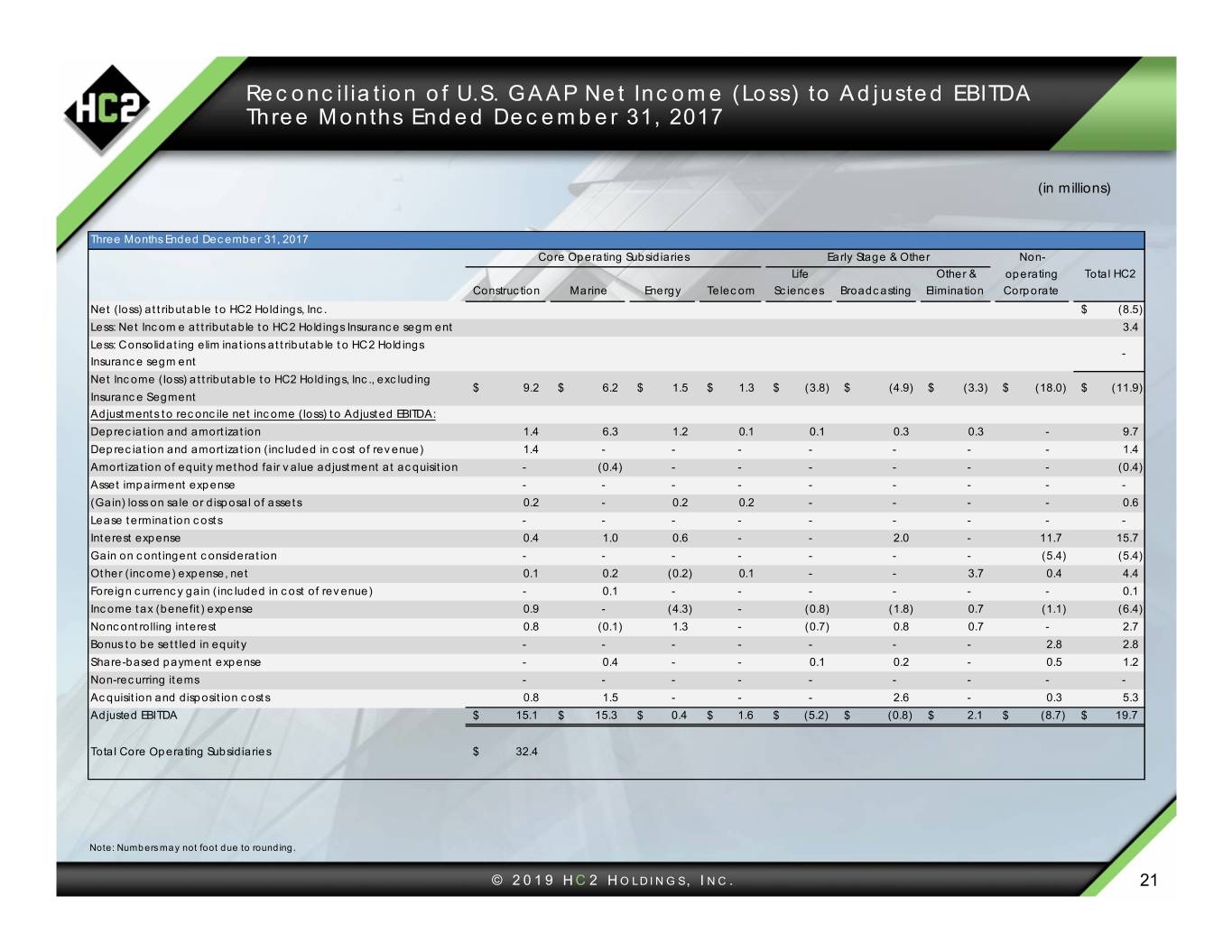

Reconciliation of U.S. GAAP Net Income (Loss) to Adjusted EBITDA Three Months Ended December 31, 2017 (in millions) Three Months Ended December 31, 2017 Core Operating Subsidiaries Early Stage & Other Non- Life Other & operating Total HC2 Construction Marine Energy Telecom Sciences Broadcasting Elimination Corporate Net (loss) attributable to HC2 Holdings, Inc. $ (8.5) Less: Net Income attributable to HC2 Holdings Insurance segment 3.4 Less: Consolidating eliminations attributable to HC2 Holdings - Insurance segment Net Income (loss) attributable to HC2 Holdings, Inc., excluding $ 9.2 $ 6.2 $ 1.5 $ 1.3 $ (3.8) $ (4.9) $ (3.3) $ (18.0) $ (11.9) Insurance Segment Adjustments to reconcile net income (loss) to Adjusted EBITDA: Depreciation and amortization 1.4 6.3 1.2 0.1 0.1 0.3 0.3 - 9.7 Depreciation and amortization (included in cost of rev enue) 1.4 - - - - - - - 1.4 Amortization of equity method fair value adjustment at acquisition - (0.4) - - - - - - (0.4) Asset impairment expense - - - - - - - - - (Gain) loss on sale or disposal of assets 0.2 - 0.2 0.2 - - - - 0.6 Lease termination costs - - - - - - - - - Interest expense 0.4 1.0 0.6 - - 2.0 - 11.7 15.7 Gain on contingent consideration - - - - - - - (5.4) (5.4) Other (income) expense, net 0.1 0.2 (0.2) 0.1 - - 3.7 0.4 4.4 Foreign currency gain (included in cost of revenue) - 0.1 - - - - - - 0.1 Income tax (benefit) expense 0.9 - (4.3) - (0.8) (1.8) 0.7 (1.1) (6.4) Noncontrolling interest 0.8 (0.1) 1.3 - (0.7) 0.8 0.7 - 2.7 Bonus to be settled in equity - - - - - - - 2.8 2.8 Share-based payment expense - 0.4 - - 0.1 0.2 - 0.5 1.2 Non-recurring items - - - - - - - - - Acquisition and disposition costs 0.8 1.5 - - - 2.6 - 0.3 5.3 Adjusted EBITDA$ 15.1 $ 15.3 $ 0.4 $ 1.6 $ (5.2) $ (0.8) $ 2.1 $ (8.7) $ 19.7 Total Core Operating Subsidiaries$ 32.4 Note: Numbers may not foot due to rounding. © 2019 HC 2 HOLDINGS, INC. 21

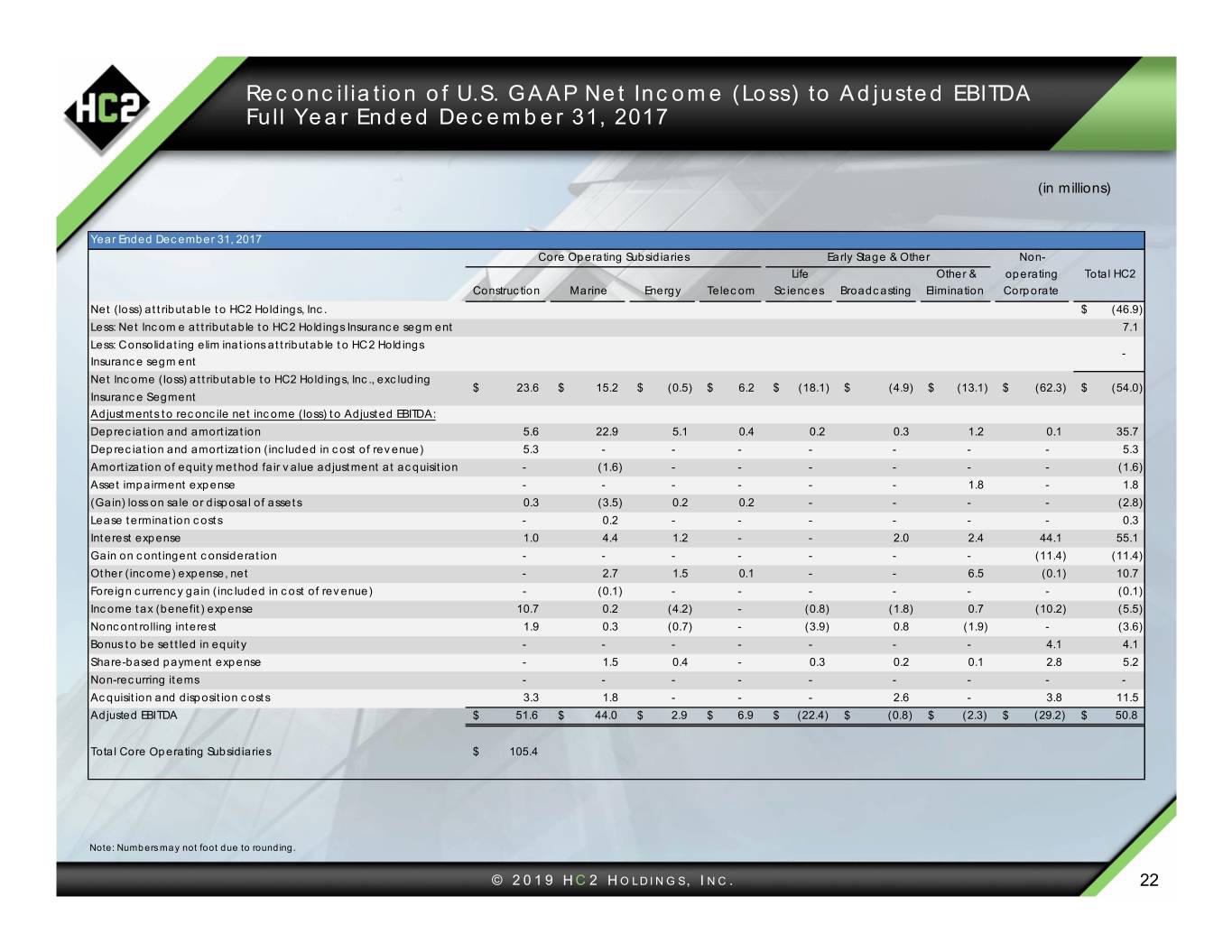

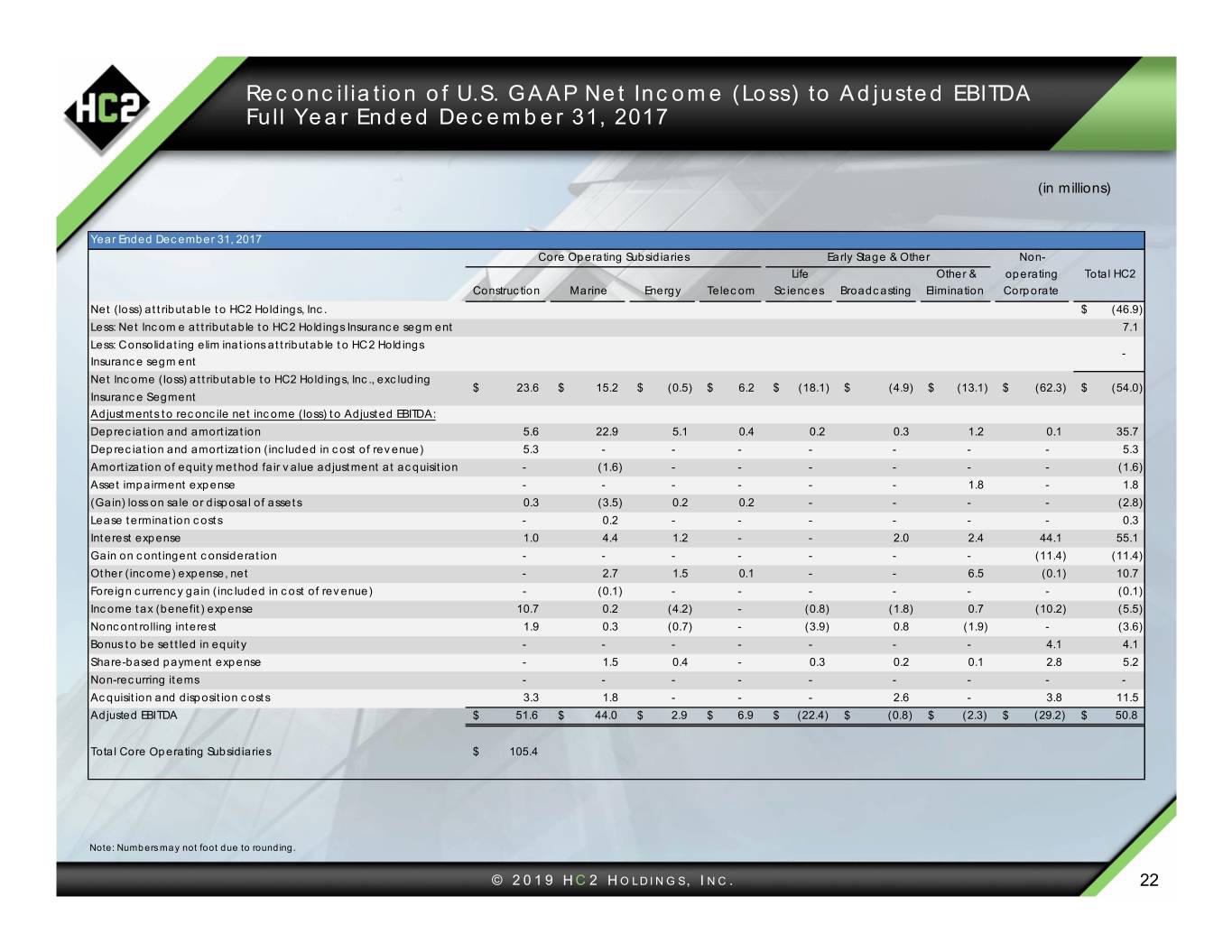

Reconciliation of U.S. GAAP Net Income (Loss) to Adjusted EBITDA Full Year Ended December 31, 2017 (in millions) Year Ended December 31, 2017 Core Operating Subsidiaries Early Stage & Other Non- Life Other & operating Total HC2 Construction Marine Energy Telecom Sciences Broadcasting Elimination Corporate Net (loss) attributable to HC2 Holdings, Inc. $ (46.9) Less: Net Income attributable to HC2 Holdings Insurance segment 7.1 Less: Consolidating eliminations attributable to HC2 Holdings - Insurance segment Net Income (loss) attributable to HC2 Holdings, Inc., excluding $ 23.6 $ 15.2 $ (0.5) $ 6.2 $ (18.1) $ (4.9) $ (13.1) $ (62.3) $ (54.0) Insurance Segment Adjustments to reconcile net income (loss) to Adjusted EBITDA: Depreciation and amortization 5.6 22.9 5.1 0.4 0.2 0.3 1.2 0.1 35.7 Depreciation and amortization (included in cost of rev enue) 5.3 - - - - - - - 5.3 Amortization of equity method fair value adjustment at acquisition - (1.6) - - - - - - (1.6) Asset impairment expense - - - - - - 1.8 - 1.8 (Gain) loss on sale or disposal of assets 0.3 (3.5) 0.2 0.2 - - - - (2.8) Lease termination costs - 0.2 - - - - - - 0.3 Interest expense 1.0 4.4 1.2 - - 2.0 2.4 44.1 55.1 Gain on contingent consideration - - - - - - - (11.4) (11.4) Other (income) expense, net - 2.7 1.5 0.1 - - 6.5 (0.1) 10.7 Foreign currency gain (included in cost of revenue) - (0.1) - - - - - - (0.1) Income tax (benefit) expense 10.7 0.2 (4.2) - (0.8) (1.8) 0.7 (10.2) (5.5) Noncontrolling interest 1.9 0.3 (0.7) - (3.9) 0.8 (1.9) - (3.6) Bonus to be settled in equity - - - - - - - 4.1 4.1 Share-based payment expense - 1.5 0.4 - 0.3 0.2 0.1 2.8 5.2 Non-recurring items - - - - - - - - - Acquisition and disposition costs 3.3 1.8 - - - 2.6 - 3.8 11.5 Adjusted EBITDA$ 51.6 $ 44.0 $ 2.9 $ 6.9 $ (22.4) $ (0.8) $ (2.3) $ (29.2) $ 50.8 Total Core Operating Subsidiaries$ 105.4 Note: Numbers may not foot due to rounding. © 2019 HC 2 HOLDINGS, INC. 22

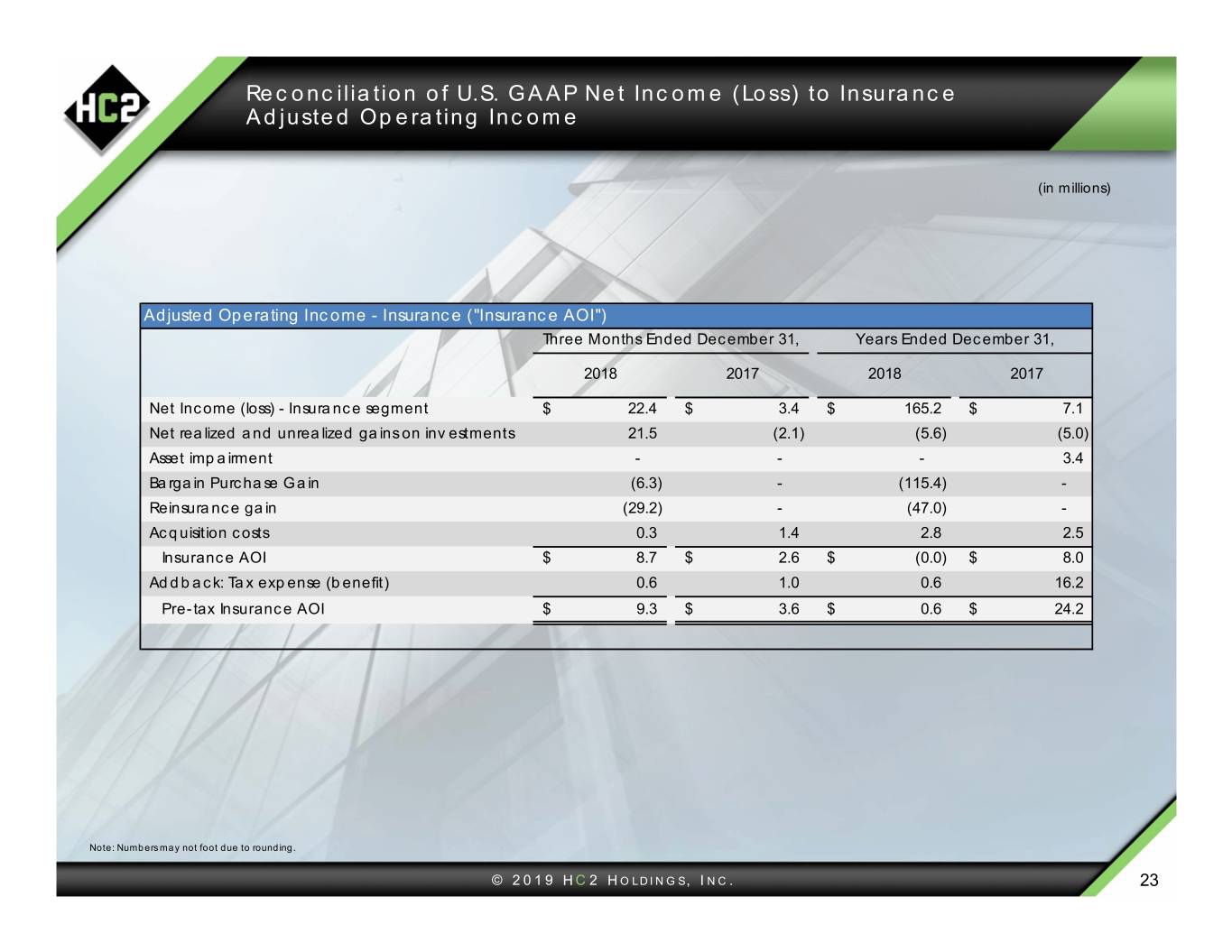

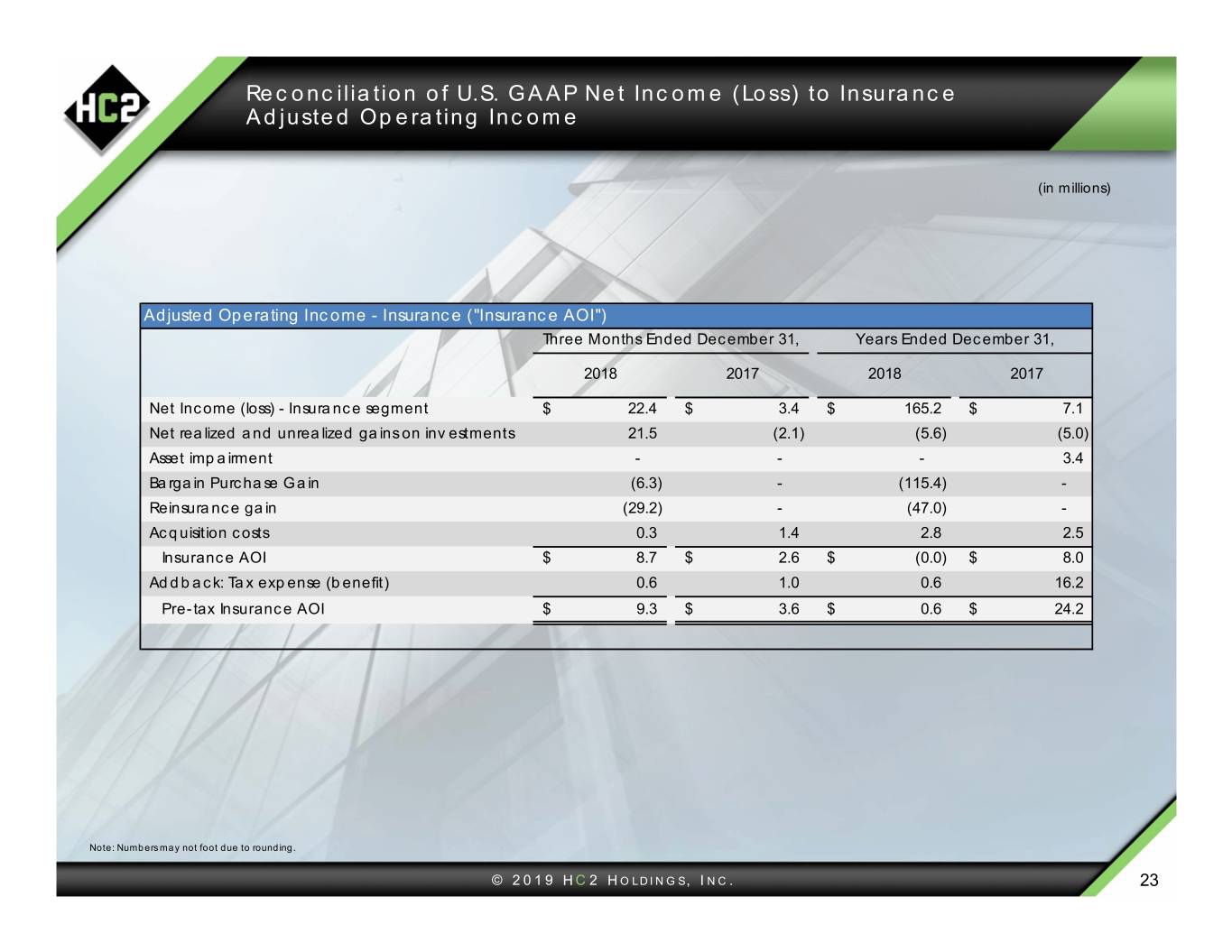

Reconciliation of U.S. GAAP Net Income (Loss) to Insurance Adjusted Operating Income (in millions) Adjusted Operating Income - Insurance ("Insurance AOI") Three Months Ended December 31, Years Ended December 31, 2018 2017 2018 2017 Net Income (loss) - Insurance segment$ 22.4 $ 3.4 $ 165.2 $ 7.1 Net realized and unrealized gains on inv estments 21.5 (2.1) (5.6) (5.0) Asset impairment - - - 3.4 Bargain Purchase Gain (6.3) - (115.4) - Reinsurance gain (29.2) - (47.0) - Acquisition costs 0.3 1.4 2.8 2.5 In su r an ce AOI$ 8.7 $ 2.6 $ (0.0) $ 8.0 Addback: Tax expense (benefit) 0.6 1.0 0.6 16.2 Pre-tax Insurance AOI$ 9.3 $ 3.6 $ 0.6 $ 24.2 Note: Numbers may not foot due to rounding. © 2019 HC 2 HOLDINGS, INC. 23

HC2 HOLDINGS, INC. ir@hc2.com • 212.235.2691 • 450 Park Avenue, 30th Floor, New York, NY 10022 © HC2 Holdings, Inc. 2019 March 2019