UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

| | | | | |

Filed by the Registrant x | Filed by a Party other than the Registrant o |

Check the appropriate box: | | | | | |

| o | Preliminary Proxy Statement |

| o | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to §240.14a-12 |

HC2 Holdings, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

| | | | | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| x | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| | | |

| o | Fee paid previously with preliminary materials: |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | Amount previously paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing Party: |

| | | |

| | (4) | Date Filed: |

| | | | | |

| HC2 Holdings, Inc.

450 Park Avenue, 29th Floor

New York, NY 10022 |

Notice of 2021 Annual Meeting

And

Proxy Statement

| | | | | |

| HC2 Holdings, Inc.

450 Park Avenue, 29th Floor

New York, NY 10022 |

Dear HC2 Holdings, Inc. Stockholder:

It is our pleasure to invite you to participate in the 2021 Annual Meeting of Stockholders (the “2021 Annual Meeting” or the “Annual Meeting”) of HC2 Holdings, Inc., a Delaware corporation (“HC2” or the “Company”). We will hold the 2021 Annual Meeting on Thursday, June 17, 2021, at 11:00 a.m., Eastern Time. Due to the continuing public health impact of the coronavirus outbreak (“COVID-19”), the 2021 Annual Meeting will be held solely by remote communication, in a virtual meeting format. You will be able to attend and participate in the Annual Meeting online, vote your shares electronically and submit your questions prior to and during the meeting by visiting www.meetingcenter.io/244313913, and using the password HCHC2021, at the meeting date and time described in the accompanying proxy statement. You will not be able to attend the 2021 Annual Meeting in person. You will need the 15-digit control number on your proxy card to participate in the virtual Annual Meeting. Beneficial owners of shares held in street name will need to follow the instructions provided by the broker, bank or other nominee that holds their shares. Online check-in will begin at 10:30 a.m., Eastern Time, on June 17, 2021. Once admitted, you may participate in the meeting and vote during the Annual Meeting by following the instructions that will be available on the meeting website.

The items to be considered and voted on at the 2021 Annual Meeting are described in the Notice of 2021 Annual Meeting of Stockholders and are more fully addressed in our proxy materials accompanying this letter. We encourage you to read all of these materials carefully and then to vote using the enclosed proxy card.

This year we are furnishing our proxy materials via the Internet. Providing our proxy materials to stockholders electronically allows us to “be green” by conserving natural resources and reducing our printing and mailing costs related to the distribution of the proxy materials. To ensure your representation at the 2021 Annual Meeting, we urge you to cause your shares to be voted (i) via the Internet at www.investorvote.com/HCHC, (ii) by telephone by following the instructions on the Notice of Internet Availability of Proxy Materials (the “Notice”) that you received in the mail and that is also provided on that website, or, (iii) if you have requested a paper copy of the proxy materials and the proxy card by mail, by signing, voting and returning your proxy card to HC2 Holdings, Inc., Computershare Investor Services, PO Box 505008, Louisville, KY 40233-5008 by regular U.S. mail or to Computershare Investor Services, 462 South 4th Street, Suite 1600, Louisville, KY 40202 if by overnight mail. For specific instructions on how to vote your shares, please review the instructions for each of these voting options that are detailed in the Notice and in the accompanying Proxy Statement.

The Notice and Proxy Statement and our Annual Report on Form 10-K for the year ended December 31, 2020 (the “2020 Annual Report”) are available for viewing and printing under the “Investor Relations-Proxy Materials” section of our website at www.hc2.com. You may also obtain these materials at www.edocumentview.com/HCHC and the U.S. Securities and Exchange Commission website at www.sec.gov. These materials were first sent or made available to stockholders on our website on or about April 28, 2021. Any stockholder may, at no cost to the stockholder, request to receive proxy materials in printed form by mail or electronically by e-mail. To ensure timely delivery, please be sure to complete this request by June 7, 2021. If you would like to receive a printed or e-mail copy of the proxy materials, you should follow the instructions for requesting such materials in the Notice. You will not otherwise receive a printed or e-mail copy of the proxy materials.

If you have any questions about the proposals to be voted on, please call our proxy solicitation agent, Okapi Partners LLC at (877) 629-6355.

Thank you for your continued support and interest in HC2. We look forward to your participation at the 2021 Annual Meeting on Thursday, June 17, 2021.

| | |

| Very truly yours, |

|

| Avram A. Glazer |

| Chairman of the Board |

|

|

| Wayne Barr, Jr. |

| President and Chief Executive Officer |

| | |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF

PROXY MATERIALS FOR THE ANNUAL MEETING OF

STOCKHOLDERS TO BE HELD ON JUNE 17, 2021 |

| This proxy statement and the 2020 Annual Report are available at www.hc2.com (Investor Relations-Proxy Materials). |

| | | | | |

| HC2 Holdings, Inc.

450 Park Avenue, 29th Floor

New York, NY 10022 |

| | |

NOTICE OF 2021 ANNUAL MEETING

OF STOCKHOLDERS |

| To be Held on Thursday, June 17, 2021, at 11:00 a.m. Eastern Time |

To our Stockholders:

HC2 Holdings, Inc., a Delaware corporation (“HC2” or the “Company”) will hold its 2021 Annual Meeting of Stockholders (the “2021 Annual Meeting” or the “Annual Meeting”) on Thursday, June 17, 2021, at 11:00 a.m., Eastern Time. Due to the continuing public health impact of the coronavirus outbreak (“COVID-19”), the 2021 Annual Meeting will be held solely by remote communication, in a virtual meeting format. You will be able to attend and participate in the Annual Meeting online, vote your shares electronically and submit your questions prior to and during the meeting by visiting www.meetingcenter.io/244313913, and using the password HCHC2021, at the meeting date and time described in the accompanying proxy statement. You will not be able to attend the 2021 Annual Meeting in person. You will need the 15-digit control number on your proxy card to participate in the virtual Annual Meeting. Beneficial owners of shares held in street name will need to follow the instructions provided by the broker, bank or other nominee that holds their shares. Online check-in will begin at 10:30 a.m., Eastern Time, on June 17, 2021. Once admitted, you may participate in the meeting and vote during the Annual Meeting by following the instructions that will be available on the meeting website.

At the 2021 Annual Meeting, holders of the shares of the Company’s common stock, par value $0.001 per share (the “Common Stock”), Series A Convertible Participating Preferred Stock, par value $0.001 per share (the “Series A Preferred Stock”), and Series A-2 Convertible Participating Preferred Stock, par value $0.001 per share (together with the Series A Preferred Stock, the “Preferred Stock”) (collectively, the “Company Securities”), in each case, outstanding and entitled to vote as of the close of business on April 23, 2021, the record date for voting at the Annual Meeting (the “Record Date”), will be asked to vote upon the following proposals:

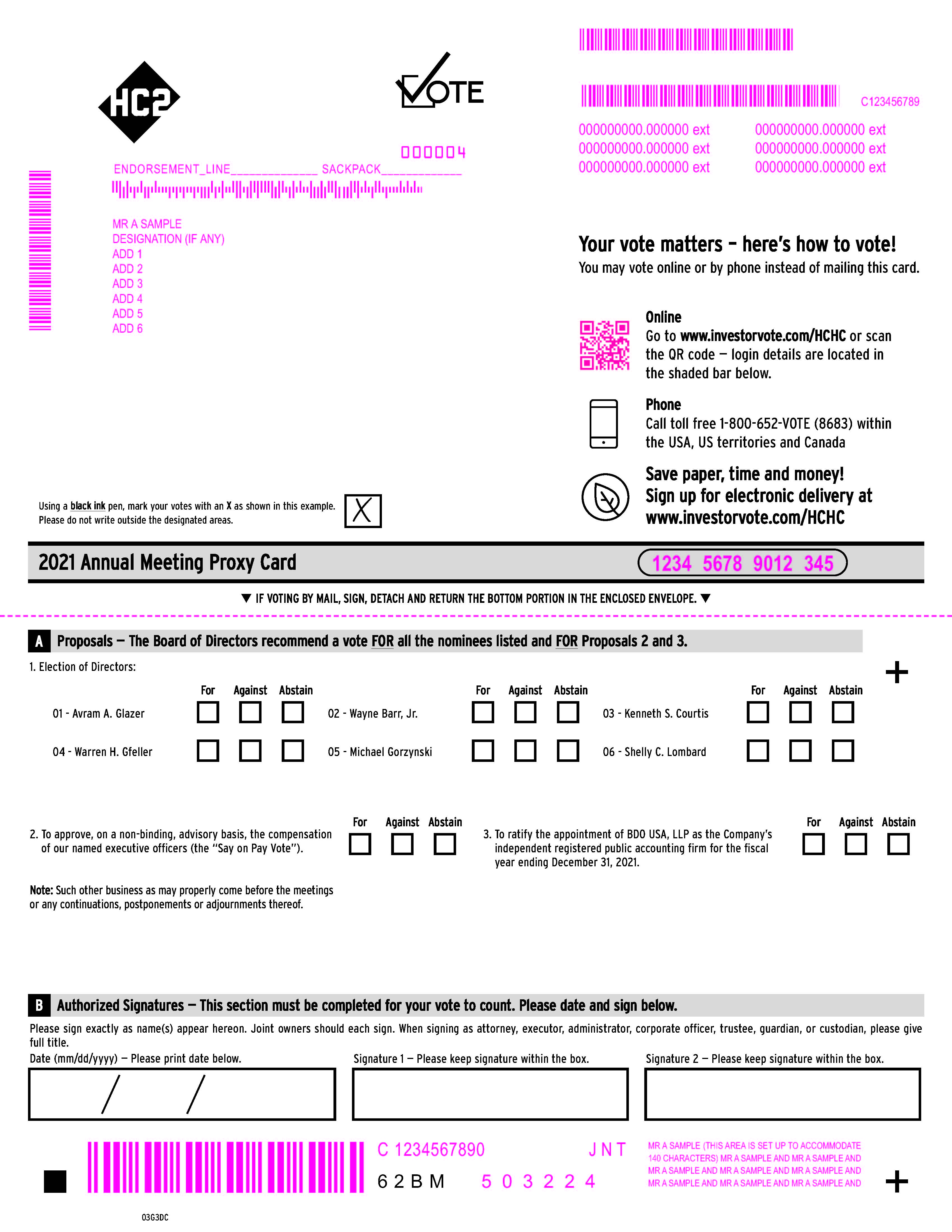

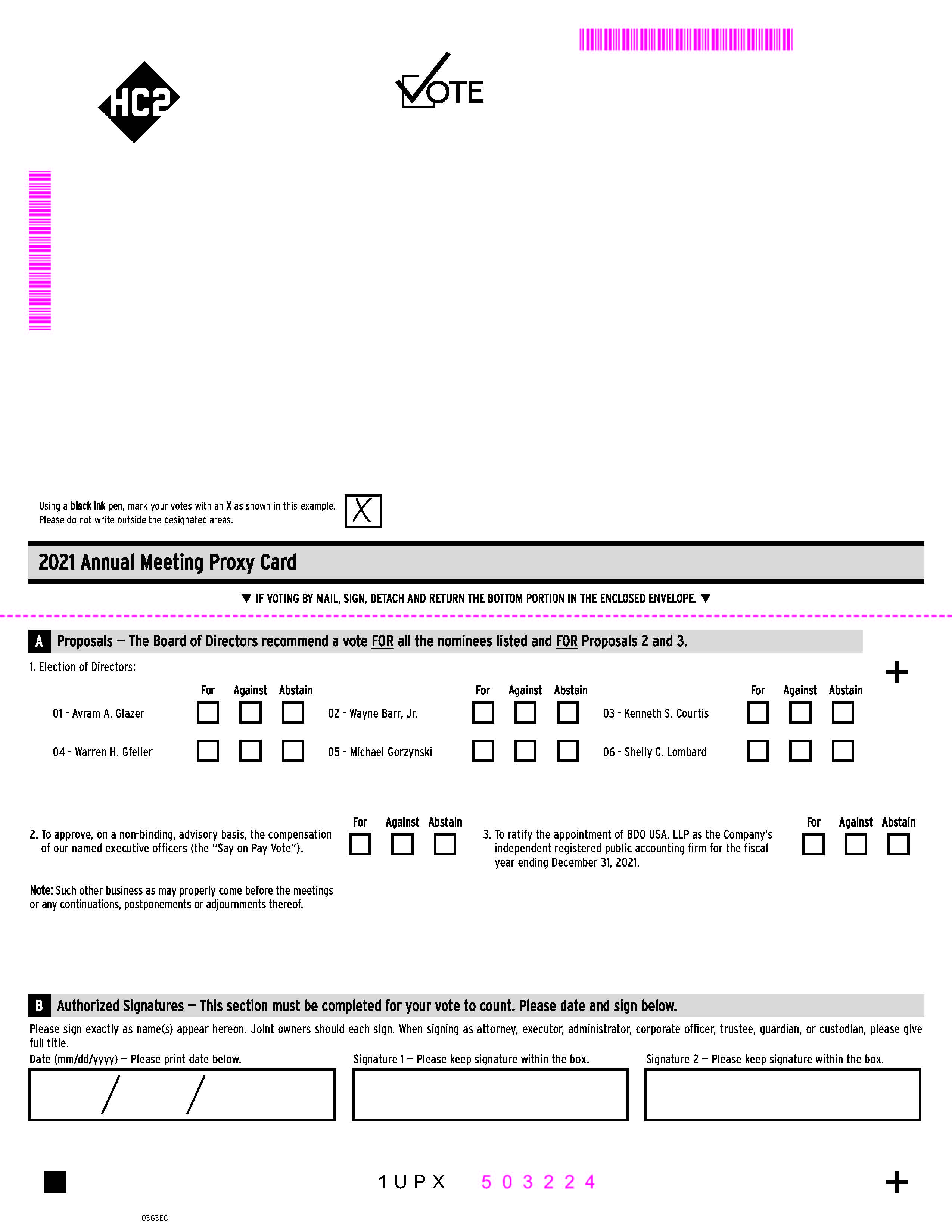

1. To elect the six nominees identified in the accompanying proxy statement (the “Proxy Statement”), each to hold office until the 2022 Annual Meeting of Stockholders and until his or her successor is duly elected and qualified.

2. To approve, on a non-binding, advisory basis, the compensation of our named executive officers (the “Say on Pay Vote”).

3. To ratify the appointment of BDO USA, LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2021.

4. To consider and take action upon any other business that may properly come before the 2021 Annual Meeting or any continuations, postponements or adjournments thereof.

Only stockholders of record of Company Securities outstanding and entitled to vote as of the close of business on the Record Date are entitled to notice of, and to vote at, the 2021 Annual Meeting and any continuations, adjournments or postponements thereof. The list of stockholders entitled to vote at the Annual Meeting will be open for examination by any stockholder entitled to vote at the meeting, for any purpose germane to the Annual Meeting, for a period of 10 days prior to the 2021 Annual Meeting by email request, during ordinary business hours, to the Office of the Corporate Secretary of HC2 at

corpsec@hc2.com. The list of stockholders entitled to vote at the Annual Meeting will also be open to examination by any stockholders during the meeting.

Your vote is very important. We appreciate your taking the time to vote promptly. After reading the accompanying Proxy Statement, please cause your shares to be voted at your earliest convenience to ensure the presence of a quorum. As described in the Notice of Internet Availability of Proxy Materials, your shares may be voted over the Internet, by telephone, or, if you have requested a paper copy of the proxy materials and the proxy card by mail, by completing, signing and returning the proxy card in the postage pre-paid envelope accompanying the proxy materials.

The Board of Directors of HC2 recommends that stockholders vote:

| | | | | | | | |

| Voting Matter | Board Vote Recommendation | Page Reference For More Information |

| Proposal 1 — Election of Directors | FOR each nominee | |

| Proposal 2 — Advisory vote on compensation of our named executive officers (“Say on Pay Vote”) | FOR | |

| Proposal 3 — Ratification of appointment of independent registered public accounting firm | FOR | |

If you have any questions about the proposals to be voted on, please call our solicitor, Okapi Partners LLC at (877) 629-6355.

| | |

| By Order of the Board of Directors, |

|

Joseph A. Ferraro Chief Legal Officer and Corporate Secretary |

YOUR VOTE IS VERY IMPORTANT. PLEASE CAUSE YOUR SHARES TO BE VOTED AS PROMPTLY AS POSSIBLE BY USING THE INTERNET OR TELEPHONE OR, IF YOU HAVE REQUESTED A PAPER COPY OF THE PROXY MATERIALS AND THE PROXY CARD BY MAIL, BY COMPLETING, SIGNING AND RETURNING THE PROXY CARD IN THE ENVELOPE PROVIDED WITH YOUR PROXY MATERIALS, WHICH REQUIRES NO POSTAGE IF MAILED IN THE UNITED STATES. STOCKHOLDERS WHO DECIDE TO ATTEND THE 2021 ANNUAL MEETING MAY, IF THEY SO DESIRE, REVOKE THEIR PROXIES AND VOTE THEIR SHARES AT THE MEETING.

AS DESCRIBED IN THE NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS, COPIES OF THE PROXY STATEMENT AND OUR ANNUAL REPORT ON FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2020 ARE AVAILABLE AT WWW.HC2.COM (INVESTOR RELATIONS-PROXY MATERIALS).

| | | | | | | | | | | |

| TABLE OF CONTENTS |

| Page |

| |

| |

| |

| |

| | |

| | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | | |

| |

| |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Potential Payments to Named Executive Officers Upon Termination or Change in Control | |

| | | |

| | | |

| | Outstanding Equity Awards at Fiscal Year End | |

| | |

| | |

| |

| |

| |

| |

| |

| | |

| | |

| | | | | |

| HC2 Holdings, Inc.

450 Park Avenue, 29th Floor

New York, NY 10022 |

| | |

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 17, 2021 |

GENERAL INFORMATION ABOUT THE 2021 ANNUAL MEETING

This proxy statement (this “Proxy Statement”) is furnished in connection with the solicitation of proxies by our Board of Directors (the “Board” or the “Board of Directors”) for use at the 2021 Annual Meeting of Stockholders (the “2021 Annual Meeting” or the “Annual Meeting”) to be held on Thursday, June 17, 2021 at 11:00 a.m., Eastern Time, and any continuations, adjournments or postponements thereof. As used in this Proxy Statement, the terms “HC2,” the “Company,” “we,” “us” and “our” mean HC2 Holdings, Inc., a Delaware corporation and its subsidiaries unless the context indicates otherwise.

How do I attend the 2021 Annual Meeting?

The 2021 Annual Meeting will be held on Thursday, June 17, 2021 at 11:00 a.m., Eastern Time. Due to the continuing public health impact of the coronavirus outbreak (“COVID-19”), the 2021 Annual Meeting will be held entirely online this year. Registered shareholders will be able to participate in the 2021 Annual Meeting online by visiting www.meetingcenter.io/244313913 and using the password HCHC2021, where you will be able to vote electronically and submit questions. You will not be able to attend the 2021 Annual Meeting in person. You will need the 15-digit control number on your Notice or your proxy card (if you receive a printed copy of the proxy materials) to participate in the virtual Annual Meeting. Beneficial owners of shares held in street name must follow one of the following two options.

Registration in Advance: Submit proof of your proxy power (“Legal Proxy”) from your broker or bank reflecting your HC2 Holdings, Inc. holdings along with your name and email address to Computershare. Requests must be labeled as “Legal Proxy” and be received no later than 5:00 p.m., Eastern Time on June 14, 2021. You will receive a confirmation of your registration by email after we receive your registration material. Submit your request along with a copy of your Legal Proxy by email: legalproxy@computershare.com or by mail: Computershare, HC2 Holdings, Inc. Legal Proxy, PO Box 43001, Providence, RI 02940-3001.

Access on the Day of the Annual Meeting without Prior Registration: For the 2021 proxy season, an industry solution has been agreed upon to allow Beneficial Holders to register at the time of the annual meeting and be able to attend, ask questions and vote. We expect that the vast majority of Beneficial Holders will be able to fully participate using the control number received with their voting instruction form or email. This option is intended to be provided as a convenience to Beneficial Holders and there is no guarantee this option will be available for every type of Beneficial Holder voting control number. Note, the inability to provide this option to any or all Beneficial Holders shall in no way impact the validity of the Annual Meeting. In order to ensure you are able to attend, ask questions and vote at the Annual Meeting, you should use the “Registration in Advance” option above.

Once admitted, you may participate in the meeting and vote during the 2021 Annual Meeting by following the instructions that will be available on the meeting website. You do not need to participate in the 2021 Annual Meeting in order to vote.

How can I participate and ask questions at the 2021 Annual Meeting?

In order to submit a question at the 2021 Annual Meeting, you will need your 15-digit control number that is printed on the Notice or proxy card that you received in the mail, or via email if you have elected to receive material electronically. You may log in 30 minutes before the start of the 2021 Annual Meeting and submit questions online. If you would like to submit a question during the 2021 Annual Meeting, once you have logged into the webcast, simply click on the message icon at

the top of the screen, type in your question, then click the arrow icon on the right to submit. You can submit a question up until the time we indicate that the question-and-answer session is concluded.

What if I have technical or other “IT” problems logging into or participating in the 2021 Annual Meeting webcast?

Stockholders are encouraged to log into the webcast at least 30 minutes prior to the start of the meeting to test their Internet connectivity. If you experience technical difficulties during the check-in process call 1-888-724-2416 (Toll Free) or 1-781-575-2748 (International Toll) for assistance. If you have technical issues once you access the webcast, please click on the “Support” link in the upper right of the broadcast screen for assistance.

What documentation must I provide to vote online at the 2021 Annual Meeting?

If you are a stockholder of record and provide your 15-digit control number when you access the meeting, you may vote all shares registered in your name during the 2021 Annual Meeting webcast. If you are not a stockholder of record as to any of your shares (i.e., instead of being registered in your name, all or a portion of your shares are registered in “street name” and held by your broker, bank or other institution for your benefit), you must follow the instructions provided by the broker, bank or other nominee that holds your shares.

Why am I receiving proxy materials?

These proxy materials are being furnished to you in connection with the solicitation of proxies by our Board of Directors for the 2021 Annual Meeting, and any continuations, adjournments or postponements thereof. The proxy materials include our Notice of 2021 Annual Meeting of Stockholders of HC2 Holdings, Inc., this Proxy Statement, the proxy card and our Annual Report on Form 10-K for the year ended December 31, 2020 (the “2020 Annual Report”). The proxy materials include detailed information about the matters that will be discussed and voted on at the 2021 Annual Meeting and furnish you with the information you need in order to vote, whether or not you participate in the 2021 Annual Meeting.

HC2 expects to mail the Notice of Internet Availability of Proxy Materials (the “Notice”) to all stockholders of record entitled to vote at the 2021 Annual Meeting on or about April 30, 2021.

Can I access these proxy materials on the Internet?

Yes. This Proxy Statement and the 2020 Annual Report are available free of charge under the “Investor Relations — Proxy Materials” section of our website at www.hc2.com. You may also obtain these materials at www.edocumentview.com/HCHC and the U.S. Securities and Exchange Commission (“SEC”) website at www.sec.gov.

Who can vote?

Stockholders who owned the Company’s common stock, par value $0.001 per share (the “Common Stock”), Series A Convertible Participating Preferred Stock, par value $0.001 per share (“Series A Preferred Stock”), and Series A-2 Convertible Participating Preferred Stock, par value $0.001 per share (“Series A-2 Preferred Stock” and, together with the Series A Preferred Stock, the “Preferred Stock”) (collectively, the “Company Securities”), as of the close of business on April 23, 2021, the record date for voting at the 2021 Annual Meeting (the “Record Date”), are entitled to vote at the 2021 Annual Meeting (however, pursuant to Delaware law, those shares of Preferred Stock owned by the Company’s wholly-owned subsidiary, Continental General Insurance Company (“Continental”), are not entitled to be voted at the 2021 Annual Meeting).

How many votes do I have?

Each share of Common Stock outstanding on the Record Date entitles the holder thereof to one vote, without cumulation, on each matter to be voted upon at the 2021 Annual Meeting, as further described in this Proxy Statement. Holders of Preferred Stock (except for the Preferred Stock that may not be voted as stated herein) will vote together as a single class with holders of Common Stock, on an as-converted basis, with respect to all matters before the 2021 Annual Meeting.

As of the Record Date for the 2021 Annual Meeting, there were (i) 77,612,041 shares of Common Stock outstanding and entitled to vote, (ii) 12,500 shares of Series A Preferred Stock, equal to 3,599,401 shares of Common Stock on an as-converted basis and (iii) 14,000 shares of Series A-2 Preferred Stock, equal to 2,631,579 shares of Common Stock on an as-converted basis; however, 6,125 shares of Series A Preferred Stock, equal to 1,763,706 shares of Common Stock on an as-converted basis, and 10,000 shares of Series A-2 Preferred Stock, equal to 1,879,699 shares of Common Stock on an as-converted basis, were owned by Continental, and, pursuant to Delaware law, such shares may not be voted at the 2021 Annual

Meeting. Therefore, as of the Record Date, there were a total of 80,199,616 shares of Common Stock (including the Preferred Stock on an as-converted basis and excluding the Preferred Stock that may not be voted on an as-converted basis) outstanding and entitled to vote.

How do I vote?

Whether or not you plan to participate in the 2021 Annual Meeting, we urge you to vote by proxy. If you vote by proxy, the individuals named on the proxy card, or your “proxies,” will vote in the manner you indicate. If you submit a proxy but do not indicate any voting instructions, your votes will be voted in accordance with the Board’s recommendations. Voting by proxy will not affect your right to participate in the 2021 Annual Meeting.

If your shares are registered directly in your name through our stock transfer agent, you may vote:

| | | | | | | | | | | | | | |

| | | | |

| VIA THE INTERNET Follow the instructions included in the Notice to vote by Internet. Internet voting facilities for stockholders of record will be available 24 hours a day and will remain open until such time the polls are closed during the 2021 Annual Meeting. | | | BY MAIL As described in the Notice, you may request printed proxy materials, in which case you may complete, sign and return the proxy card in the postage pre-paid envelope accompanying the proxy materials so that it is received prior to the 2021 Annual Meeting. |

| | | | |

| BY TELEPHONE Follow the instructions included in the Notice to vote by telephone. Telephone voting facilities for stockholders of record will be available 24 hours a day and will remain open until such time the polls are closed during the 2021 Annual Meeting. | | | VOTE ONLINE DURING THE ANNUAL MEETING You will be able to participate in the Annual Meeting online by visiting www.meetingcenter.io/244313913 and using the password HCHC2021, where you will be able to vote electronically and submit questions. You will not be able to attend the 2021 Annual Meeting in person. You will need the 15-digit control number on your proxy card to participate in the virtual Annual Meeting. |

| | | | |

If your shares are held in “street name” (meaning the shares are held in the name of a bank, broker or other nominee who is the record holder), you must provide the bank, broker or other nominee with instructions on how to vote your shares and can do so as follows:

| | | | | | | | | | | | | | |

| | | | |

| VIA THE INTERNET Follow the instructions you receive from the bank, broker or other nominee to vote by Internet. | | | BY MAIL You will receive instructions from the bank, broker or other nominee explaining how to vote your shares by mail. |

| | | | |

| BY TELEPHONE Follow the instructions you receive from the bank, broker or other nominee to vote by telephone.

| | | VOTE ONLINE DURING THE ANNUAL MEETING

Register in Advance: In order to obtain a 15-digit control number that will enable you to participate in the Annual Meeting, you must first submit your legal proxy reflecting your HC2 Holdings, Inc. holdings along with your name and email address to Computershare, HC2 Holdings, Inc. Legal Proxy, PO Box 43001, Providence RI 02940-3001, or by email to legalproxy@computershare.com. Such requests to Computershare must be labeled as “Legal Proxy” and be received no later than 5:00 p.m., Eastern Time, June 14, 2021. You will receive a confirmation email from Computershare of your registration.

Voting without prior registration: 2021 industry solution allows Beneficial Holders the ability to vote. Please refer to “How do I attend the Annual Meeting?” section above. |

| | | | |

How Does the Board Recommend that I Vote on the Proposals?

| | | | | | | | |

| Voting Matter | Board Vote Recommendation | Page Reference For More Information |

| Proposal 1 — Election of Directors | FOR each nominee | |

| Proposal 2 — Advisory vote on compensation of our named executive officers (“Say on Pay Vote”) | FOR | |

| Proposal 3 — Ratification of appointment of independent registered public accounting firm | FOR | |

If any other matter is presented at the 2021 Annual Meeting, your proxy provides that your shares will be voted by the proxy holder listed on the proxy card in accordance with his discretion. As of the time this Proxy Statement was filed, we knew of no matters that need to be acted on at the 2021 Annual Meeting, other than those described in this Proxy Statement.

May I change or revoke my proxy?

You may change or revoke your previously submitted proxy at any time before the 2021 Annual Meeting or, if you participate in the 2021 Annual Meeting virtually, at the 2021 Annual Meeting.

If you hold your shares as a record holder, you may change or revoke your proxy in any one of the following ways:

•by re-voting at a subsequent time by Internet or by telephone as instructed above;

•by signing a new proxy card with a date later than your previously delivered proxy and submitting it as instructed above; or

•by voting during the 2021 Annual Meeting.

You may also revoke your proxy by delivering a signed revocation letter to Joseph A. Ferraro, the Company’s Corporate Secretary, at the Company’s address above before the 2021 Annual Meeting, which states that you have revoked

your proxy. In light of disruptions caused by the COVID-19 outbreak, if you intend to revoke your proxy by providing such written notice, we advise that you also send a copy via email to corpsec@hc2.com.

Your latest dated proxy card, Internet or telephone vote is the one that is counted.

If your shares are held in the name of a bank, broker or other nominee, you may change your voting instructions by following the instructions of your bank, broker or other nominee.

What if I receive more than one Notice or proxy card?

You may receive more than one Notice or, if you have requested proxy materials, more than one proxy card, if you hold shares of our Common Stock or Preferred Stock in more than one account, which may be in registered form or held in street name. Please vote in the manner described under “How Do I Vote?” for each account to ensure that all of your shares are voted.

Will my shares be voted if I do not vote or instruct my nominee how to vote?

If your shares are registered in your name, they will not be voted if you do not vote by Internet, by telephone, by completing, signing and returning your proxy card, if you have requested printed proxy materials, or during the 2021 Annual Meeting, as described above under “How Do I Vote?”.

With respect to shares held in street name, your bank, broker or other nominee generally has the discretionary authority to vote uninstructed shares on “routine” matters, but cannot vote such uninstructed shares on “non-routine” matters. A “broker non-vote” will occur if your bank, broker or other nominee cannot vote your shares on a particular matter because it has not received instructions from you and does not have discretionary voting authority on that matter or because your bank, broker or other nominee chooses not to vote on a matter for which it does have discretionary voting authority. The Election Proposal and the Say on Pay Vote are considered non-routine matters under applicable rules, and therefore your bank, broker or other nominee does not have discretionary authority to vote your uninstructed shares on such matters. Therefore, if you hold your shares in street name, it is critical that you instruct your bank, broker or other nominee how to vote if you want your vote to be counted.

What vote is required to approve each proposal and how are votes counted?

With respect to the Election Proposal, in an uncontested election of directors, the Fourth Amended and Restated By-Laws of the Company (the “By-Laws”) provide that directors will be elected by a majority of the votes cast. This means that the number of shares voted FOR each nominee must exceed 50% of the votes cast with respect to that nominee. The six nominees who receive a majority of FOR votes will be elected as directors. Voting stockholders may vote either FOR any or all of these nominees or AGAINST any or all of these nominees. Abstentions and broker non-votes will have no effect on the outcome of the election of these directors.

With respect to the Say on Pay Vote and the Accounting Firm Proposal, the favorable vote of a majority of the votes cast by the holders of the Common Stock and Preferred Stock (with the exception of those shares of Preferred Stock owned by Continental, which are not entitled to be voted at the 2021 Annual Meeting pursuant to Delaware law), voting as a single class (with the Preferred Stock voting on an as-converted basis), will constitute the stockholders’ approval of the proposals, which in the case of the Say on Pay Vote, will be non-binding. For purposes of the Say on Pay Vote and the Accounting Firm Proposal, abstentions will not be counted as votes cast and will have no effect on the result of the vote, although they will be considered present for the purpose of determining the presence of a quorum. For purposes of the Say on Pay Vote and the Accounting Firm Proposal, broker non-votes will not be counted as votes cast and will have no effect on the result of the vote, although they will be considered present for the purpose of determining the presence of a quorum. If you do not provide your broker with voting instructions regarding the Accounting Firm Proposal, they will have discretionary authority to vote your shares on the Accounting Firm Proposal.

What are the costs of soliciting these proxies?

We will pay all of the costs of soliciting these proxies. Our directors, officers and employees may solicit proxies in person or by e-mail or other electronic means or by telephone. We will pay these directors, officers and employees no additional compensation for these services. We will ask banks, brokers and other nominees to forward these proxy materials to their principals and to obtain authority to execute proxies. We will then reimburse them for their reasonable, out-of-pocket expenses.

In addition, we have retained Okapi Partners LLC to aid in the solicitation of proxies. We will pay Okapi Partners LLC fees of $10,000 plus reimbursement of its reasonable out-of-pocket costs for its services. If you have questions about the Annual Meeting or need additional copies of this Proxy Statement or additional proxy cards, please contact our proxy solicitation agent as follows:

Okapi Partners LLC

1212 Avenue of the Americas, 24th Floor

New York, NY 10036

Banks and Brokerage Firms, please call (212) 297-0720

Stockholders, please call (877) 629-6355

Via email at HC2proxy@okapipartners.com

What constitutes a quorum for the 2021 Annual Meeting?

The presence online at the 2021 Annual Meeting or by proxy, of the holders of a majority of the voting power of the capital stock of HC2 outstanding and entitled to vote at the 2021 Annual Meeting, including its Common Stock and Preferred Stock, on an as-converted basis, is necessary to constitute a quorum at the 2021 Annual Meeting. Votes of stockholders of record who are present online at the 2021 Annual Meeting or by proxy, broker non-votes and abstentions will be counted for purposes of determining whether a quorum exists. A quorum is necessary before business may be transacted at the 2021 Annual Meeting except that, even if a quorum is not present, with respect to some or all matters to be voted upon, the chairman of the 2021 Annual Meeting or the holders of shares having a majority of the voting power present online at the 2021 Annual Meeting or by proxy, with respect to the matter or matters to be voted upon, shall have the power to adjourn the 2021 Annual Meeting, from time to time until a quorum is present with respect to such matter or matters to be voted upon. As of the Record Date, there were a total of 80,199,616 shares of Common Stock (including the Preferred Stock on an as-converted basis and excluding the Preferred Stock that may not be voted on an as-converted basis) outstanding and entitled to vote. Thus, the holders of 40,099,809 shares of Common Stock or its equivalents must be present online at the 2021 Annual Meeting or represented by proxy at the 2021 Annual Meeting to have a quorum for the transaction of business.

BUSINESS HIGHLIGHTS

Since the beginning of fiscal year 2020 our management team, including our named executive officers, oversaw the following significant developments of the Company.

Corporate Performance Highlights

We believe that a skilled and motivated team of senior executives is essential to achieving positive results and implementing our business objectives. We have continued to structure our compensation program to provide our named executive officers and other senior executives with levels of compensation that we believe are necessary to retain their services and with incentives designed to achieve positive results and successfully implement our business objectives, in both the short and long term. As a result of the strong efforts by our current executive leadership team, we achieved a number of financial and strategic objectives during fiscal year 2020 and the first quarter of 2021:

•The Company sharpened its focus on three key business areas that it believes will drive growth and generate stakeholder value in 2021 and beyond: Infrastructure, Life Sciences and Spectrum. The Company accomplished this strategic simplification through the disposition of the Marine and Telecommunications segments and the sale of several non-core broadcast stations within its Spectrum segment during 2020. Furthermore, in the first quarter of 2021, the Company completed the sale of the Clean Energy segment and entered into a definitive agreement to sell the Insurance segment after having received a non-binding indication of interest for the Insurance segment in the fourth quarter of 2020. In aggregate, the Company will have reduced the number of its operating segments from seven to three through these portfolio optimization initiatives.

•The Company took several additional steps to enhance its capital structure, including a rights offering in November 2020 that raised $65 million in gross proceeds, and the refinancing of holding company debt in February 2021. Combined with the completed asset sales, the Company reduced overall indebtedness by approximately $203 million proforma for the Company’s February 2021 refinancing, which lowered its cost of debt, provided additional liquidity and financial flexibility, and extended near-term debt maturities.

•The Company reduced recurring corporate expenses by approximately 13% for the year primarily through decreased compensation and occupancy costs.

•DBM Global Inc. completed the execution of a number of projects in the Western U.S., and despite challenging end market conditions due to the COVID-19 pandemic, delivered solid results in 2020.

•In March 2021, the Company announced that DBM Global had reached an agreement to acquire 100% of Banker Steel Holdco LLC, which provides fabricated structural steel and erection services primarily for the East Coast and Southeast commercial and industrial construction markets.

•Pansend Life Sciences, LLC continued to focus on the development of innovative technologies and products in the healthcare industry and is currently invested in four companies, in particular making solid progress with its portfolio companies R2 Technologies (“R2”) (aesthetic dermatology) and MediBeacon (kidney monitoring). After a successful pre-order period among aesthetic providers, in April 2021 R2 commenced the commercial launch in the U.S. for Glacial RX™, its FDA-approved device utilizing patented CryoAesthetic technology, and expects to launch commercially in China in the second quarter of this year. In January 2021, R2 received the third and final $10 million in committed investment from Huadong Medicine Company Limited (“Huadong”), which will be used to fund the launch of R2's first-to-market innovations Glacial RX™ and Glacial Spa™ and the continued development of the product platform. MediBeacon received a commitment from Huadong for an additional $20 million in non-dilutive funding over the next two years to pursue Class 1 status in China, which will allow the device to immediately enter the Chinese hospital system. During the fourth quarter of 2020, MediBeacon received the first $10 million of funding upon confirmation from the FDA that China is eligible to be included in MediBeacon’s Global Study. An additional $5 million is expected to be received upon dosing of the first patient in the clinical study in China, and the remaining $5 million is expected to be used for reimbursement of certain expenses incurred by MediBeacon over the next two years.

•HC2 Broadcasting advanced its OTA distribution platform strategy by substantially completing the buildout of its network to 227 operating stations, connecting over 200 stations to its CentralCast system, growing the number of

digital content network leasing capacity on the network to over 80, and significantly reducing costs. Additionally, HC2 Broadcasting completed the sale of four full power television stations and a low power television translator for aggregate gross proceeds of $40.5 million. The sale of these non-core stations, along with a refinancing in August 2020, resulted in reduced debt at HC2 Broadcasting.

Summary Disclosure on Stockholder Engagement

Our Compensation Committee and our Board consider the results of our stockholder votes regarding the non-binding resolution on executive compensation presented at our annual meetings and engage in robust outreach with our stockholders. We have reached out to our investors with the goal of identifying, understanding and addressing the concerns of our stockholders with respect to our executive compensation program. We have discovered during our discussions with those stockholders who engaged with us during our stockholder outreach initiative a general observation among participating stockholders that our executive compensation program, and particularly our prior bonus plan based on “net asset value” (“NAV”) return, was complicated and difficult for investors to understand.

Following these discussions with our investors and all other relevant parties, including the new members of our Board, we approved a new annual bonus program for our named executive officers in respect of the 2020 fiscal year in replacement of the bonus plan based on NAV return. This new incentive compensation program rewards our named executive officers for achieving our key business goals and objectives and is intended to further enhance the alignment between them and our stockholders.

Under the program adopted in 2020, the 2020 annual incentive program for our Chief Executive Officer, Chief Financial Officer and Chief Legal Officer (the “2020 Plan”) was tied to the successful refinancing of our existing debt and equity securities with pending maturities as well as the achievement of individual performance goals.

EXECUTIVE COMPENSATION AND GOVERNANCE HIGHLIGHTS

The following is an overview of the highlights of our compensation and governance structure, and the fundamental compensation and governance policies and practices we do and do not use.

| | | | | | | | | | | |

| WHAT WE DO | WHAT WE DON’T DO |

| ü | Separation of the roles of Chairman of the Board and Chief Executive Officer (“CEO”) | û | No excise tax gross-ups upon a change in control |

| ü | Majority voting for directors in uncontested elections | û | No hedging or pledging activities by our executives and directors |

| ü | Actively engage with stockholders and act on stockholder feedback | û | No defined benefit or supplemental retirement plans |

| ü | Use of performance-based compensation to align the interests of our executives and stockholders | û | No perquisites or other personal benefits to executive officers that are not available to all employees |

| ü | Minimum Vesting Requirement - one year from the date an award is made | û | No dividends on unvested equity awards until, and only to the extent that, those awards vest |

| ü | Double-Trigger Vesting - a “change in control” must also be accompanied by a qualifying termination to trigger acceleration of vesting | û | No repricing or buyouts of underwater options or SARs |

| ü | Engage an independent compensation consultant to review and provide recommendations regarding our executive compensation program | û | No liberal recycling provisions or “evergreen” provisions in equity plans |

| ü | Stock option exercise prices and stock appreciation right (“SAR”) grant prices at or above the fair market value on the grant date | | |

| ü | Robust succession planning for our CEO | | |

| ü | Encourage continuing education for directors | | |

ELECTION OF DIRECTORS

(PROPOSAL 1)

The size of our Board is determined by resolution of the Board, subject to the requirements of our Second Amended and Restated Certificate of Incorporation (as amended, the “Certificate of Incorporation”) and Fourth Amended and Restated By-laws (the “By-Laws”). Our Board currently consists of the following six directors: Avram A. Glazer, Wayne Barr, Jr., Kenneth S. Courtis, Warren H. Gfeller, Michael Gorzynski and Shelly C. Lombard, each of whom is nominated for election at the 2021 Annual Meeting.

The Board will continue to evaluate the size of the Board and make adjustments as needed to meet the current and future needs of the Company.

At the recommendation of the Nominating and Governance Committee, our Board has nominated the following six individuals for election as a director at the 2021 Annual Meeting, to hold office until the 2022 Annual Meeting of Stockholders (the “2022 Annual Meeting”) and until his or her successor is duly elected and qualified: Avram A. Glazer, Wayne Barr, Jr., Kenneth S. Courtis, Warren H. Gfeller, Michael Gorzynski and Shelly C. Lombard. Proxies cannot be voted for a greater number of persons than the number of nominees named in this proposal.

Each nominee is to be elected by a majority of the votes cast by holders of the Common Stock and Preferred Stock, in each case, outstanding and entitled to vote, voting as a single class (with the Preferred Stock voting on an as-converted basis).

If you vote by proxy, the proxy holders will vote your shares in the manner you indicate. If you properly submit a proxy, but do not indicate any voting instructions, the named proxy holders will vote the shares of Company Securities represented thereby for the election as directors of the persons whose names and biographies appear below. All of the persons whose names and biographies appear below are currently serving as our directors.

Each nominee has consented to be named in this Proxy Statement, and we expect each nominee to be able to serve if elected. If any nominee is unable to serve or for good cause will not serve as a director, it is intended that proxies will be voted for a substitute nominee designated by the Board, or, in the discretion of the Board, the Board may elect to reduce its size.

Pursuant to our By-Laws, written notice by stockholders of qualifying nominations for election to our Board of Directors must have been received by our Corporate Secretary by March 10, 2021. We did not receive any such nominations, and no other nominations for election to our Board may be made by stockholders at the Annual Meeting.

| | | | | | | | | | | | | | |

| Board Recommendation |

| The Board unanimously recommends a vote “FOR” the election of Messrs. Glazer, Barr, Courtis, Gfeller and Gorzynski and Ms. Lombard as directors. |

BOARD OF DIRECTORS

Information Regarding Directors

Set forth below is certain information with respect to our nominees for election as directors at the 2021 Annual Meeting, all of whom are current directors of the Company. This information has been provided by each director or director nominee at the request of the Company. None of the directors or nominees is related to any other director or nominee or to any executive officer of the Company. Each of the director nominees has been nominated by our Board for election at the 2021 Annual Meeting, to hold office until the 2022 Annual Meeting and until his or her successor is duly elected and qualified.

Director Nominees

| | | | | | | | | | | | | | |

| Name | Age | Independent | Committee Membership | Director Since |

| Avram A. Glazer | 60 | Yes | Executive Committee and Nominating and Governance Committee (Chair) | 2020 |

| Wayne Barr, Jr. | 57 | No | Executive Committee | 2014 |

| Kenneth S. Courtis | 66 | Yes | Audit Committee, Compensation Committee (Chair) and Nominating and Governance Committee | 2020 |

| Warren H. Gfeller | 68 | Yes | Audit Committee, Compensation Committee and Nominating and Governance Committee | 2016 |

| Michael Gorzynski | 43 | No | Executive Committee | 2020 |

| Shelly C. Lombard | 61 | Yes | Audit Committee (Chair), Compensation Committee, Nominating and Governance Committee | 2020 |

| | |

Avram A. Glazer, Chairman of the Board Age: 60 Director Since: 2020 |

Mr. Glazer has served as a director, and as Chairman of the Board, of HC2 since May 2020. He is also a member of the Executive Committee and Chairman of the Nominating and Governance Committee. Mr. Glazer is the principal of Lancer Capital LLC (“Lancer Capital”) and currently serves as Executive Co-Chairman and Director of Manchester United Plc (NYSE: MANU). Mr. Glazer served as President and Chief Executive Officer of Zapata Corporation, a U.S. public company, from March 1995 to July 2009 and Chairman of the Board of Zapata Corporation from March 2002 to July 2009. He was also previously Chairman and Chief Executive Officer of Safety Components International and Omega Protein Corporation. Mr. Glazer received a business degree from Washington University in St. Louis in 1982. He received a law degree from American University, Washington College of Law in 1985.

| | |

Wayne Barr, Jr. Age: 57 Director Since: 2014 |

Mr. Barr has served as a director of HC2 since January 2014 and Lead Director during March 2020. In June 2020, Mr. Barr was appointed as interim Chief Executive Officer, and has been Chief Executive Officer since November 2020. Mr. Barr is also a member of the Executive Committee and serves, and has served, as a director and/or officer of certain HC2 subsidiaries. From 2016 through April 2020, Mr. Barr was a member of the board of directors of CCUR Holdings, Inc. (OTCQB: CCUR) (“CCUR”) and he served as Executive Chairman, President and CEO of CCUR from March 2019 through April 2020. Mr. Barr is also a member of the board of directors of Alaska Communications Group, Inc., (NASDAQ: ALSK), which he joined in March 2018, where he is chairman of the Compensation and Personnel Committee and serves on the Nominating and Governance Committee. Mr. Barr is the principal of Oakleaf Consulting Group LLC, a management consulting firm focusing on technology and telecommunications companies, which he founded in 2001. Mr. Barr also co-founded and was president from 2003 to 2008 of Capital & Technology Advisors, a management consulting and restructuring firm and served as Managing Director of Alliance Group of NC, LLC, a full service real estate firm providing brokerage, planning and consulting services throughout North Carolina to a wide variety of stakeholders including landowners, developers, builders and investors, from 2013 through September 2018. Mr. Barr has previously served on the boards of directors of several companies, including as a director of Aviat Networks, Inc. (NASDAQ: AVNW) from November 2016 to November 2018. Mr. Barr received his J.D.

degree from Albany Law School of Union University and is admitted to practice law in New York State. He is also a licensed real estate broker in the state of North Carolina.

| | |

Kenneth S. Courtis Age: 66 Director Since: 2020 |

Mr. Courtis has served as a director of HC2 since May 2020 and is Chairman of the Compensation Committee and a member of the Audit and Nominating and Governance Committees. Mr. Courtis is a financial executive with more than 30 years of banking, investment management and board service experience. Since January 2009, Mr. Courtis has served as the Chairman of Starfort Investment Holdings. He previously served as Vice Chairman and Managing Director of Goldman Sachs from November 1998 to April 2009, and Managing Director of Deutsche Bank Asia from September 1986 to October 1998. He received an undergraduate degree from Glendon College in Toronto and an MA in international relations from Sussex University in the United Kingdom. He earned an MBA at the European Institute of Business Administration and received a Doctorate with honors and high distinction from l’Institut d’etudes politiques, Paris.

| | |

Warren H. Gfeller Age: 68 Director Since: 2016 |

Mr. Gfeller has served as a director of HC2 since June 2016, served as interim non-executive Chairman of the Board from April 1, 2020 through May 13, 2020 and is a member of the Audit, Compensation and Nominating and Governance Committees. He also served as a director of Global Marine Holdings, LLC, a majority owned subsidiary of HC2 from June 2018 until its sale in February 2020. He has been a member of the board of directors of Crestwood Equities Partners LP (NYSE: CEQP) since 2013, where he serves as Lead Director, Compensation Committee Chairman and as a member of the Finance Committee. He served as Lead Director and as a member of the Compensation Committee of Crestwood Midstream Partners LP from 2013 until its merger with Crestwood Equities Partners LP in November 2015. Mr. Gfeller served as Lead Director and Chairman of the Audit Committee of Inergy Holdings, L.P. from 2001 to 2013, Inergy Midstream Partners from 2011 to 2013 and Inergy Holdings GP LLC from 2005 to 2011. Mr. Gfeller served as Lead Director, Chairman of the Audit Committee and as a member of the Compensation Committee of Zapata Corporation from 1997 to 2009, and as Chairman of the Board and a member of the Audit Committee of Duckwall-Alco Stores, Inc. from 2003 to 2009. Mr. Gfeller also served as a director of Houlihan’s Restaurant Group from 1993 to 1998 and as a director of Synergy Gas, Inc. from 1992 to 1995. He also served as President and Chief Executive Officer from 1986 to 1991, and as a Director from 1987 to 1991, of Ferrellgas, Inc. (now Ferrellgas Partners LP (NYSE: FGP)) (“Ferrellgas”), a retail and wholesale marketer of propane and other natural gas liquids. Mr. Gfeller began his career with Ferrellgas in 1983, as an executive vice president and financial officer. Prior to joining Ferrellgas, Mr. Gfeller was the Chief Financial Officer of Energy Sources, Inc. from 1978 to 1983 and a Certified Public Accountant at Arthur Young & Co. from 1974 to 1978. Mr. Gfeller received a Bachelor of Arts degree from Kansas State University.

| | |

Michael Gorzynski Age: 43 Director Since: 2020 |

Mr. Gorzynski has served as a director of HC2 since May 2020. He is also a member of the Executive Committee. Mr. Gorzynski is the director of MG Capital Management Ltd., an investment firm focused on complex value-oriented investments. Since September 2020, Mr. Gorzynski has served as Chairman of the Board of Continental General Insurance Company, an indirectly held wholly-owned subsidiary of the Company (“CGIC”), and as Executive Chairman and President of CGIC’s affiliates Continental Insurance Group Ltd. and Continental LTC Inc. He also served on the board of directors of Beyond6, Inc., a majority-owned subsidiary of the Company from June 2020 until it was sold in January 2021. Previously, he invested in special situations globally at Third Point LLC, a large asset management firm, where he focused on macro, event-driven, distressed, and private investments across the capital structure. Mr. Gorzynski is an expert in restructurings and in the insurance and banking industries, having participated in multiple large-scale bank and insurance company restructurings. He began his career at Credit Suisse First Boston in the technology investment banking group and at Spectrum Equity Investors a private equity fund in Boston. Mr. Gorzynski earned a B.A. from the University of California, Berkeley, and received an MBA from Harvard Business School.

| | |

Shelly C. Lombard Age: 61 Director Since: 2020 |

Ms. Lombard has served as a director of HC2 since May 2020 and is Chair of the Audit Committee and a member of the Compensation and Nominating and Governance Committees. Ms. Lombard also served on the board of directors of Beyond6, Inc., a majority-owned subsidiary of the Company from August 2020 until it was sold in January 2021. Ms. Lombard is currently an independent consultant. Ms. Lombard is also a member of the board of directors and Chair of the Audit Committees of Spartacus Acquisition Corp (NASDAQ: TMTS), which she joined in October 2020, and a member of the board of directors and a member of the Audit Committee of Alaska Communications (NASDAQ: ALSK), which she joined in June 2020. From 2011 to 2014, she was the Director of High Yield and Special Situation Research for Britton Hill Capital, a broker dealer specializing in high yield bank debt and bonds and value equities. From 2003 to 2010, Ms. Lombard was a high yield bond analyst covering the automotive and media industries at Gimme Credit, a subscription bond research firm. From 1992 to 2001, Ms. Lombard analyzed, managed, and was involved in the restructurings of proprietary investments for ING, Chase Manhattan Bank, Barclays Bank and Credit Lyonnais. Ms. Lombard began her career at Citibank in the leveraged finance group. As an independent financial analyst and financial trainer, she reviews investment ideas, provides training for new hires at Wall Street banks, and has taught executive education courses in corporate finance, financial analysis, and the financial markets at Columbia University, the Wharton School of Business, and Moody’s. Ms. Lombard has an MBA. in finance from Columbia University.

Analysis of Our Directors in Light of Our Business

We are a diversified holding company with four reportable operating segments based on management’s organization of the enterprise: Infrastructure, Life Sciences, Spectrum and Insurance, plus our Other segment, which includes businesses that do not meet the separately reportable segment thresholds. We expect to focus on operating and managing our portfolio of companies and building value in Infrastructure, Life Sciences and Spectrum in the future. We believe these segments are well positioned to take advantage of current trends in today’s economy and that there is opportunity to build value organically and inorganically in these three segments. We will consider opportunities outside of these businesses in the longer term to acquire and invest in businesses with attractive assets that we consider to be undervalued or fairly valued.

Our Board has considered the experience, qualifications, attributes and skills of its members in light of our business and structure. In addition, our Board has considered, among other things, (i) the risks and uncertainties associated with, and resulting from, the COVID-19 pandemic, (ii) the importance of Board continuity, Board experience and stability in light of the circumstances and (iii) requirements of any Investor Agreements (as defined below) entered into with certain of our stockholders. In particular, with respect to each of our current directors, the Board considered:

•Mr. Glazer’s significant holding company and operational expertise, track record of leading a public company and creating stockholder value, as well as his service and leadership on multiple boards of directors of both public and private companies.

•Mr. Barr’s experience as our CEO and as a director in the telecommunications and technology industries, including his knowledge regarding management consulting matters.

•Mr. Courtis’ experience in global investment banking and investment management, in addition to his long history of board service.

•Mr. Gfeller’s experience in the energy industry and prior experience in various executive positions, as well as his service on the boards of directors of publicly traded companies, coupled with his extensive financial and accounting training and practice.

•Mr. Gorzynski’s experience in global private investment analysis, particularly his expertise in the insurance industry and restructurings.

•Ms. Lombard’s considerable financial and investment experience, particularly her expertise related to credit and mergers and acquisitions.

Director Independence

Our Common Stock is listed on the New York Stock Exchange (the “NYSE”) under the symbol “HCHC.” Under the corporate governance listing standards of the NYSE, at least a majority of the Company’s directors, and all of the members of the Company’s Audit Committee, Compensation Committee and Nominating and Governance Committee, must meet the test of “independence” as defined under the listing standards of the NYSE. The NYSE listing standards provide that to qualify as an “independent” director, in addition to satisfying certain bright-line criteria, the Board must affirmatively determine that a director has no relationship with the Company that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. We have also adopted director independence standards included in our Guidelines (as defined in the section entitled “Corporate Governance Guidelines” beginning on page 16 of this Proxy Statement), which our Board uses to determine if a particular director is independent.

In addition to the independence standards discussed above, members of the Audit Committee must satisfy enhanced independence requirements established by the SEC and the NYSE for audit committee members. Specifically, members of the Audit Committee may not accept, directly or indirectly, any consulting, advisory or other compensatory fee from the Company or any of its subsidiaries other than their directors’ compensation and they may not be an affiliated person of the Company or any of its subsidiaries.

Finally, in affirmatively determining the independence of any director who will serve on the Compensation Committee, the Board must consider all factors specifically relevant to determining whether a director has a relationship to the Company that is material to that director’s ability to be independent from management in connection with the duties of a member of the Compensation Committee, including (1) the sources of compensation of the director, including any consulting, advisory or other compensatory fee paid by the Company to such director; and (2) whether the director is affiliated with the Company, its subsidiaries or its affiliates.

In April 2021, the Board undertook a review of director independence. During this review, the Board considered, among other things, relationships and transactions during the past three years between each director or any member of his or her immediate family, on the one hand, and the Company and its subsidiaries and affiliates, on the other hand. The purpose of the review was to determine whether any such relationships or transactions were inconsistent with a determination that the director is independent as defined under the NYSE listing standards and our Guidelines, as well as the additional independence requirements applicable to Audit Committee and Compensation Committee members. Based on the review, our Board has affirmatively determined that Messrs. Glazer, Courtis, Gfeller and Ms. Lombard are independent directors under NYSE listing standards and our Guidelines and Messrs. Glazer, Courtis, Gfeller and Ms. Lombard are independent for purposes of serving on the Audit Committee, Compensation Committee and Nominating and Governance Committee.

Board Committees

Our Board has four standing committees: the Audit Committee, the Compensation Committee, the Nominating and Governance Committee and the Executive Committee. Our Audit Committee, the Compensation Committee and the Nominating and Governance Committee are composed entirely of independent directors as defined under the rules, regulations and listing qualifications of the NYSE. From time to time, our Board may also create additional committees for special purposes.

The table below provides membership information for each of the standing Board committees as of the date of this Proxy Statement:

| | | | | | | | | | | | | | |

| Director | Audit Committee | Compensation Committee | Nominating and Governance Committee | Executive Committee |

| Avram A. Glazer+ | | | | ü |

| Wayne Barr, Jr. | | | | ü |

| Kenneth S. Courtis* | ü | | ü | |

| Warren H. Gfeller* | ü | ü | | |

| Michael Gorzynski | | | | ü |

| Shelly C. Lombard* | | ü | ü | |

| Number of Meetings Held During 2020 | 12 | 7 | 8 | 27 |

| | | | | |

| + | Chairman of the Board |

| * | Audit Committee financial expert |

| Chair of the Committee |

Audit Committee and Audit Committee Financial Expert

The Audit Committee was established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). During the year ended December 31, 2020, the Audit Committee held 12 meetings. The Audit Committee currently consists of Shelly Lombard (Chair), Kenneth S. Courtis and Warren H. Gfeller, each of whom is an independent director. Our Board has determined that each of Messrs. Courtis and Gfeller and Ms. Lombard qualify as an “audit committee financial expert” as such term is defined in Item 407(d)(5) of Regulation S-K promulgated by the SEC. The Board has considered the qualifications of the current members of the Audit Committee and has determined that they possess the skills necessary to review and analyze the Company’s financial statements and processes and to fulfill their other duties in accordance with the terms of the Audit Committee Charter.

The Audit Committee is responsible, among its other duties, for appointing, compensating and overseeing the Company’s independent registered public accounting firm, pre-approving all audit and non-audit services by the independent registered public accounting firm, reviewing the scope of the audit plan and the results of each audit with management and the independent registered public accounting firm, reviewing the Company’s internal audit function, reviewing the adequacy of the Company’s system of internal accounting controls and disclosure controls and procedures, reviewing the financial statements and other financial information included in the Company’s annual and quarterly reports filed with the SEC, and exercising oversight with respect to the Company’s code of conduct (the “Code of Conduct”) and other policies and procedures regarding adherence with legal requirements. The Audit Committee’s duties are set forth in the Audit Committee Charter. A copy of the Audit Committee Charter is available under the “Investor Relations-Corporate Governance” section of our website at www.hc2.com.

Compensation Committee

During the year ended December 31, 2020, the Compensation Committee held seven meetings. The Compensation Committee currently consists of Kenneth S. Courtis (Chairman), Warren H. Gfeller and Shelly C. Lombard, each of whom is independent and a “non-employee director” as defined by Rule 16b-3 under the Exchange Act.

The Compensation Committee is primarily responsible for establishing and periodically reviewing the compensation of our CEO and our other executive officers and recommending for Board approval the compensation for our non-employee directors. The Compensation Committee is also responsible for administering our equity compensation plans, which includes

the authority to decide compensation matters pertaining to the Second Amended and Restated 2014 Omnibus Equity Award Plan (the “Second Amended 2014 Plan”), including the approval of equity instruments under the Second Amended 2014 Plan as well as administering and approving the Company’s annual incentive plan, if any. The CEO recommends to the Compensation Committee the compensation for our executive officers other than the CEO. The Compensation Committee is responsible for reviewing and assessing whether the Company’s compensation program encourages excessive risk and determines whether it is competitive in the marketplace. The DGCL generally permits the Compensation Committee to delegate its authority and responsibilities to subcommittees consisting of one or more members of such committee. A copy of the Compensation Committee Charter is available under the “Investor Relations — Corporate Governance” section of our website at www.hc2.com.

In addition, the Compensation Committee has the sole authority to hire, and to dismiss, a compensation consultant.

Nominating and Governance Committee

During the year ended December 31, 2020, the Nominating and Governance Committee held eight meetings. The Nominating and Governance Committee currently consists of Avram A. Glazer (Chairman), Kenneth S. Courtis and Shelly C. Lombard.

The Nominating and Governance Committee is responsible for (i) identifying, reviewing and evaluating candidates to serve as directors of the Company, (ii) serving as a focal point for communication between such candidates, non-committee directors and the Company’s senior management, (iii) recommending such candidates to the Board and (iv) making such other recommendations to the Board regarding the governance affairs relating to the directors of the Company (excluding director compensation, which is the responsibility of the Compensation Committee) and advising the Board with respect to Board composition, procedures and committees. The Nominating and Governance Committee’s duties are set forth in the Nominating and Governance Committee Charter. A copy of the Nominating and Governance Committee Charter is available under the “Investor Relations — Corporate Governance” section of our website at www.hc2.com.

Executive Committee

The Executive Committee was established by the Board on June 10, 2020. During the year ended December 31, 2020, the Executive Committee held 27 meetings. The Executive Committee currently consists of Avram A. Glazer, Wayne Barr, Jr. and Michael Gorzynski.

The Executive Committee is responsible for exercising the powers and authority of the Board (except as limited by applicable law and the committee’s charter) in between sessions of the Board, and while the Board is not in session, and for implementing the policy decisions of the Board.

Corporate Governance Guidelines

The Board has approved, following recommendation by the Nominating and Governance Committee, Corporate Governance Guidelines (the “Guidelines”), which address director qualifications and independence standards, responsibilities of the Board, access to management and independent advisors, certain Board compensation matters, procedures for review of related party transactions, Board orientation and continuing education, Board committees, succession planning, communications with stockholders and the media, and certain matters with respect to our Code of Conduct. A copy of the Guidelines is available under the “Investor Relations-Corporate Governance” section of our website at www.hc2.com.

Director Nomination Process

The Nominating and Governance Committee has the primary responsibility for identifying, evaluating, reviewing and recommending qualified candidates to serve on the Board. The Nominating and Governance Committee considers the following factors set forth in the Nominating and Governance Committee Charter in selecting candidates for Board service: experience, skills, expertise, diversity (“Diversity Considerations”), personal and professional integrity, character, business judgment, time availability in light of other commitments, dedication, conflicts of interest and other relevant factors deemed appropriate in the context of the needs of the Board. In evaluating Diversity Considerations, the Nominating and Governance Committee utilizes an expansive definition of diversity that includes differences of experience, education and talents, among other things. While the Nominating and Governance Committee does not have a formal diversity policy, it seeks to achieve a range of talents, skills

and expertise on the Board and evaluates each nominee with regard to the extent to which he or she contributes to this overall mix.

The Nominating and Governance Committee may use multiple sources for identifying director candidates, including its own contacts and referrals from other directors and stockholders, members of management, the Company’s advisors and executive search firms. The Nominating and Governance Committee will consider director candidates recommended by stockholders, in accordance with the procedures described below, and will evaluate such director candidates in the same manner that it evaluates candidates recommended by other sources. For those potential new director candidates who appear upon first consideration to meet the Board’s selection criteria, the Nominating and Governance Committee will conduct appropriate inquiries into their background and qualifications and, depending on the result of such inquiries, arrange for in-person meetings with the potential candidates. Directors are obligated to complete orientation training concerning the Company and to comply with limitations on outside activities that directors may engage in without Board approval.

Stockholders may submit written recommendations of director candidates by submitting such recommendation, including the candidate’s name and contact information and a statement of the candidate’s background and qualifications, to HC2 Holdings, Inc., 450 Park Avenue, 29th Floor, New York, NY 10022, Attention: Corporate Secretary.

The Nominating and Governance Committee is responsible for reviewing and making a recommendation to the Board regarding the continued service of the Company’s directors, (i) based upon service to the Company during a director’s term, attendance, participation, quality of performance and actual or potential conflicts of interest and (ii) in the event an employee director’s employment with the Company is terminated for any reason or a non-employee director changes his/her primary job responsibility since the time such director was most recently elected to the Board. The Guidelines provide that members of the Company’s management serving on the Board who cease to serve as a member of the Company’s management shall offer his or her resignation from the Board effective on the last date of employment; while the Board need not accept such offer of resignation, in general a member of the Company’s management shall not continue to serve as a member of the Board following such cessation of employment. The Guidelines also provide that members of the Board will offer to resign from the Board upon the occurrence of certain specified sanctions, charges or admissions of fault or liability, subject to the Board’s refusal to accept such resignations in certain circumstances.

The Nominating and Governance Committee Charter and the Guidelines are intended to provide a flexible set of criteria for the effective functioning of the Company’s director nomination process. The Nominating and Governance Committee intends to review its Charter and the Guidelines at least annually and anticipates that modifications may be necessary from time to time as the Company’s needs and circumstances evolve, and as applicable legal or listing standards change. The Nominating and Governance Committee may recommend to the Board for approval amendments to the Nominating and Governance Committee Charter and Guidelines at any time.

Stockholder and Other Interested Party Communications with the Board and/or Non-Employee Directors

The Board welcomes communications from the Company’s stockholders and other interested parties and has adopted a procedure for receiving and addressing those communications. Stockholders and other interested parties may send written communications to the Board or the non-employee directors by writing to the Board or the non-employee directors at the following applicable address: Board/Non-Employee Directors, HC2 Holdings, Inc., 450 Park Avenue, 29th Floor, New York, NY 10022, Attention: Corporate Secretary. Communications by email should be addressed to corpsec@hc2.com and marked “Attention: Corporate Secretary” in the “Subject” field. The Corporate Secretary will review and forward all communications from stockholders or other interested parties to the intended recipient.

Meeting Attendance

During the year ended December 31, 2020, our Board held 36 meetings. During 2020, each of our directors attended more than 75% of the aggregate number of meetings of our Board held during the period in which he or she was a director and the committees on which he or she served during the periods they served. Directors are expected, absent schedule conflicts, to attend our Annual Meeting of Stockholders each year. All our then-serving directors and director nominees attended the 2020 Annual Meeting of Stockholders.

Code of Conduct

We have adopted a Code of Conduct applicable to all directors, officers and employees, including the CEO, senior financial officers and other persons performing similar functions. The Code of Conduct is a statement of business practices and principles of behavior that support our commitment to conducting business in accordance with the highest standards of business conduct and ethics. Our Code of Conduct covers, among other things, compliance resources, conflicts of interest, compliance with laws, rules and regulations, internal reporting of violations and accountability for adherence to the Code of Conduct. A copy of the Code of Conduct is available under the “Investor Relations — Corporate Governance” section of our website at www.hc2.com. Any amendment of the Code of Conduct or any waiver of its provisions for a director or executive officer must be approved by the Board or a duly authorized committee thereof. We intend to post on our website all disclosures that are required by law or the rules of the NYSE concerning any amendments to, or waivers from, any provision of the Code of Conduct.

Board Leadership Structure

The Company’s leadership structure currently consists of separate roles for Chairman of the Board and CEO of the Company. On April 1, 2020, the Company announced the separation of the Chairman and CEO roles. On May 13, 2020, the Board elected Mr. Glazer to serve as Chairman of the Board and on June 10, 2020, appointed Wayne Barr, Jr. as interim CEO. On November 25, 2020, Mr. Barr was appointed as the Company’s CEO. At this time, the Board believes that it is in the best interests of the Company and its stockholders to have separate roles for Chairman of the Board and CEO of the Company, allowing Mr. Barr to concentrate his efforts on leading the Company to execute on its strategy, and enabling the Chairman of the Board to lead the Board of Directors in its fundamental role of providing advice, expertise and active oversight of management. The Board believes that having separate positions and having an independent director serve as Chairman of the Board is the appropriate leadership structure for our Company at this time and demonstrates our commitment to good corporate governance.

The Guidelines provide that the Chairman shall be elected annually by the Board and that in the event the Chairman is not an “independent” director, the Board shall select another director to serve as “Lead Independent Director” from among the members of the Board that are determined at that time by the Board to be “independent.” The Chairman may be removed as Chairman at any time by a majority of the members of the Board.

With separate roles for Chairman of the Board and CEO of the Company, our governance structure provides a form of leadership that allows the Board to function distinct from management, capable of objective judgment regarding management’s performance and enables the Board to fulfill its duties effectively and efficiently.