- VATE Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

INNOVATE (VATE) DEF 14ADefinitive proxy

Filed: 30 Apr 03, 12:00am

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrant /x/ | ||

| Filed by a Party other than the Registrant / / | ||

Check the appropriate box: | ||

| / / | Preliminary Proxy Statement | |

| / / | Confidential, for Use of the Commission Only (as permitted by Rule 14-6(e)(2)) | |

| /x/ | Definitive Proxy Statement | |

| / / | Definitive Additional Materials | |

| / / | Soliciting Material Pursuant to §240.14a-12 | |

Primus Telecommunications Group, Incorporated | ||

| (Name of Registrant as Specified In Its Charter) | ||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||

Payment of Filing Fee (Check the appropriate box):

| /x/ | No fee required. | |||

| / / | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

/ / | Fee paid previously with preliminary materials. | |||

/ / | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

PRIMUS TELECOMMUNICATIONS GROUP, INCORPORATED

1700 Old Meadow Road

McLean, Virginia 22102

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on June 17, 2003

Dear Stockholder:

You are cordially invited to attend the 2003 Annual Meeting of Stockholders of Primus Telecommunications Group, Incorporated, a Delaware corporation (the "Company"), to be held at 10:00 a.m., local time, on June 17, 2003 at the McLean Hilton—Tysons Corner, 7920 Jones Branch Drive, McLean, VA 22102 for the following purposes:

The Board of Directors has fixed April 30, 2003 as the record date for determining the stockholders entitled to receive notice of and vote at the Annual Meeting of Stockholders and any adjournments or postponements thereof. Such stockholders may vote in person or by proxy. The stock transfer books of the Company will not be closed. The accompanying form of proxy is solicited by the Board of Directors of the Company.

IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AT THE MEETING. YOU ARE CORDIALLY INVITED TO ATTEND THE MEETING IN PERSON. WHETHER OR NOT YOU EXPECT TO ATTEND IN PERSON, YOU ARE URGED TO COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY CARD IN THE SELF-ADDRESSED ENVELOPE, ENCLOSED FOR YOUR CONVENIENCE, WHICH REQUIRES NO POSTAGE IF MAILED IN THE UNITED STATES. STOCKHOLDERS MAY ALSO VOTE THEIR SHARES USING THE TWELVE (12) DIGIT CONTROL NUMBER FOUND ON THEIR VOTE INSTRUCTION FORM VIA THE INTERNET AT PROXYVOTE.COM OR BY PHONE AT 1-800-454-8683. IF YOU DECIDE TO ATTEND THE MEETING AND WISH TO VOTE IN PERSON, YOU MAY REVOKE YOUR PROXY BY WRITTEN NOTICE AT THAT TIME.

| By Order of the Board of Directors, | ||

| ||

| K. Paul Singh Chairman of the Board of Directors, President and Chief Executive Officer |

PRIMUS TELECOMMUNICATIONS GROUP, INCORPORATED

1700 Old Meadow Road

McLean, Virginia 22102

PROXY STATEMENT

FOR

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON

June 17, 2003

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors of Primus Telecommunications Group, Incorporated, a Delaware corporation (the "Company"), in connection with the Annual Meeting of Stockholders of the Company (the "Annual Meeting") to be held at 10:00 a.m., local time, on June 17, 2003 at the McLean Hilton—Tysons Corner, 7920 Jones Branch Drive, McLean, VA 22102, and at any adjournments or postponements thereof for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders. This solicitation is made by the Board of Directors of the Company. This Proxy Statement and the accompanying Proxy Card are being mailed on or about May 5, 2003 to stockholders of record of the Company on April 30, 2003 (the "Record Date").

Please complete, date and sign the accompanying Proxy Card and return it promptly to the Company in the enclosed envelope, or vote via the Internet using the twelve (12) digit control number found on your vote instruction form at Proxyvote.com or by phone at 1-800-454-8683.

Stockholders Entitled to Vote. Holders of record of the Company's common stock, par value $.01 per share (the "Common Stock") and Series C Convertible Preferred Stock, par value $.01 per share (the "Preferred Stock"), at the close of business on the Record Date are entitled to receive Notice of the Annual Meeting and vote such shares held by them at the Annual Meeting or at any adjournments or postponements thereof. Each share of Common Stock outstanding on the Record Date entitles its holder to cast one vote on the election of each nominee for director and on any other matter that may properly come before the Annual Meeting. Each holder of Preferred Stock is entitled to cast a number of votes as would pertain to the full number of shares of Common Stock into which shares of Preferred Stock held by such holder would be convertible as of the Record Date. As of March 31, 2003, there were 65,107,616 shares of Common Stock outstanding and 22,616,990 shares of Common Stock issuable upon conversion of all outstanding Preferred Stock entitled to vote.

Quorum. The presence at the meeting, either in person or by proxy, of stockholders entitled to cast a majority of the votes entitled to be cast at the Annual Meeting will constitute a quorum for the transaction of business at the Annual Meeting. Abstentions, votes withheld and broker non-votes (i.e., shares held by a broker or nominee which are represented at the meeting, but with respect to which the broker or nominee is not voting on a particular proposal) will be included in the calculation of the number of shares considered to be present at the meeting for purposes of determining if a quorum exists. Abstentions will have the effect of votes against a particular proposal, and broker non-votes will have no effect on the outcome of the vote on a particular proposal. Stockholders are not entitled to cumulative voting in the election of directors. Directors are elected by the affirmative vote of a plurality of the votes of the shares entitled to vote, present in person or represented by proxy, and votes may be cast in favor of or withheld from each director nominee.

Voting. If the accompanying Proxy Card is properly signed, returned to the Company and not revoked, it will be voted as directed by the stockholder. The persons designated as proxy holders on the Proxy Card will, unless otherwise directed, vote the shares represented by such proxy IN FAVOR OF

the election of all nominees for the Board of Directors named in this Proxy Statement, IN FAVOR OF the amendment to the Employee Stock Option Plan and as recommended by the Board of Directors with regard to any other matters, or, if no such recommendation is given, in their own discretion.

Revocation of a Proxy. A stockholder may revoke a previously granted proxy at any time before it is exercised by filing with the Secretary of the Company a written notice of revocation or a duly executed proxy bearing a later date, or by attending the Annual Meeting and voting in person.

You should rely only on the information provided in this Proxy Statement. The Company has authorized no one to provide you with different information. You should not assume that the information in this Proxy Statement is accurate as of any date other than the date of this Proxy Statement or, where information relates to another date set forth in this Proxy Statement, then as of that date.

PROPOSAL 1

ELECTION OF DIRECTORS

The Company's Board of Directors is divided into three classes with staggered three-year terms. Currently, the Board of Directors has eight members. The terms of current directorsDavid E. Hershberg,Nick Earle andPradman P. Kaul expire at the Annual Meeting, while the terms of the remaining directors expire at the respective annual meetings of stockholders to be held in 2004 or 2005, as specified below. Messrs. Hershberg, Earle and Kaul have been nominated and recommended for election to serve as directors for a three-year term expiring at the Annual Meeting of Stockholders to be held following the year ending December 31, 2005 (the "2006 Annual Meeting"). If, for any reason, at the time of election, any of the nominees named should decline or be unable to accept his nomination or election, it is intended that such proxy will be voted in favor of the election, in the nominee's place, of a substituted nominee, who would be recommended by the Board of Directors. The Board of Directors, however, has no reason to believe that any of the nominees will be unable or unwilling to serve as a director.

Information Regarding Directors

The information set forth below is submitted with respect to the nominees for election to the Board of Directors, as well as those Directors whose terms of office are continuing after the Annual Meeting. There are no family relationships among any of the directors of the Company.

Nominees for Election to the Board of Directors for a Three-Year Term Expiring at the 2006 Annual Meeting of Stockholders

David E. Hershberg, 65, became a director of the Company in 1995. Mr. Hershberg is the founder, and has, since 1994, been Chairman and Chief Executive Officer of GlobeComm Systems, Inc., a system integrator of satellite earth stations. From 1976 to 1994, Mr. Hershberg was the President and Chief Executive Officer of Satellite Transmission Systems, Inc., a global provider of satellite telecommunications equipment, and became a Group President of California Microwave, Inc., the company that acquired Satellite Transmission Systems, Inc.

Nick Earle, 45, became a director of the Company in February 2001. Mr. Earle is currently the Chief Executive Officer of Streamserve Inc., a privately owned software company specializing in business communication software. From August 2000 to April 2001, Mr. Earle was the President and General Manager of Europe, Middle East and Africa division of Ariba Inc., an international software company. Prior to joining Ariba, Mr. Earle served in numerous positions with Hewlett-Packard Co. ("HP") from 1983 through July 2000. From August 1999 through July 2000, Mr. Earle served as the President of HP's Internet incubator, E-Services Solutions, where he directed product development, investments and strategic alliances. From 1996 through 1999, Mr. Earle served as Vice President of

2

Worldwide Marketing, Computer Systems and then as Chief Marketing Officer, Enterprise Computing for HP. Prior to joining HP, Mr. Earle was a Senior Analyst in the mergers and acquisitions department at Citicorp Merchant Bank in London, from 1981 to 1983.

Pradman P. Kaul, 56, became a director of the Company in May 2002 to serve as a member of the Board of Directors for the remainder of former director Herman Fialkov's term, which expires at the annual meeting of stockholders of the Company in 2003. Mr. Kaul has been the Chairman and Chief Executive Officer of Hughes Network Systems ("HNS") and a Senior Vice President of Hughes Electronics Corporation since January 2000. Prior to January 2000, Mr. Kaul served as President and Chief Operating Officer, Executive Vice President, and Director of engineering of HNS. Prior to joining HNS, Mr. Kaul held several positions with COMSAT Laboratories, including Manager, High Speed Digital Logic from June 1968 to April 1973. Mr. Kaul is the Chairman of the Board of Hughes Software Systems, India, Ltd. and a director of Optimos, Inc.

The Board of Directors recommends a vote IN FAVOR OF Proposal 1 to elect the three nominees listed above. If no instructions are given on a properly executed and returned proxy, the shares of Common Stock represented thereby will be voted IN FAVOR OF Messrs. Hershberg, Earle and Kaul.

Incumbent Directors-Terms Expiring at the 2004 Annual Meeting of Stockholders

John G. Puente, 72, became a director of the Company in 1995. Mr. Puente also serves on the Board of Directors of MICROS s\Systems, Inc. From 1987 to 1995, Mr. Puente was Chairman of the Board and Chief Executive Officer of Orion Network Systems, a satellite telecommunications company. Mr. Puente was Chairman of the Board of Telogy Networks, Inc., a privately-held company. Prior to joining Orion, Mr. Puente was Vice Chairman of M/A-Com Inc., a diversified telecommunications and manufacturing company, which he joined in 1978 when M/A-Com acquired Digital Communications Corporation, a satellite terminal and packet switching manufacturer of which Mr. Puente was a founder and Chief Executive Officer.

Douglas M. Karp, 48, became a director of the Company in June 1998. Mr. Karp has been a Managing Partner of Pacific Partners LLC, an investment firm, since August 2000. Prior to August 2000, Mr. Karp was a managing director of E.M. Warburg, Pincus & Co., LLC (or its predecessor, E.M. Warburg, Pincus & Co., Inc.) since May 1991. Prior to joining E.M. Warburg, Pincus & Co., LLC, Mr. Karp held several positions with Salomon Inc. including Managing Director from January 1990 to May 1991, Director from January 1989 to December 1989 and Vice President from October 1986 to December 1988. Mr. Karp is a director of Eon Labs, Inc.

Incumbent Directors-Terms Expiring at the 2005 Annual Meeting of Stockholders; Non-Voting Board Observer—Elected by the Series C Preferred Stockholders

K. Paul Singh, 52, co-founded the Company in 1994 with Mr. DePodesta and serves as its Chairman, President and Chief Executive Officer. From 1991 until he co-founded the Company, he served as the Vice President of Global Product Marketing for MCI Communications, Inc. ("MCI"). Prior to joining MCI, Mr. Singh was the Chairman and Chief Executive Officer of Overseas Telecommunications, Inc. ("OTI"), a provider of private digital communications in over 26 countries which he founded in 1984 and which was purchased by MCI in 1991.

John F. DePodesta, 58, co-founded the Company in 1994 with Mr. Singh and serves as a director and its Executive Vice President. Mr. DePodesta previously served as the Chairman of the Board of Iron Road Railways Incorporated ("Iron Road"), which he co-founded in 1994. He served as Senior Vice President, Law and Public Policy, of Genesis Health Ventures, Inc. ("GHV") from January 1996 through March 1998. Additionally, from 1994 to 1999, he served as "of counsel" to the law firm of Pepper Hamilton LLP, where he was previously a partner since 1979. Before joining Pepper Hamilton LLP, Mr. DePodesta served as the General Counsel of Consolidated Rail Corporation. In 2001,

3

Bangor & Aroostook Railroad Company ("BAR"), a wholly-owned subsidiary of Iron Road, and in 2002 certain affiliates of BAR, entered Chapter 11 bankruptcy proceedings. In 2001, Quebec Southern Railway Company Ltd., a wholly-owned subsidiary of Iron Road, filed a Notice of Intention to Make a Proposal under provisions of the Bankruptcy and Insolvency Act of Canada.

Paul G. Pizzani, 43, became a director of the Company in December 2002. Mr. Pizzani has been a partner of Pizzani Hamlin Capital, L.L.C. ("PH Capital"), which is an advisor to AIG Capital Partners, an indirectly wholly owned subsidiary of American International Group, Inc. ("AIG"), since April 1999. Prior to forming PH Capital, Mr. Pizzani was a Managing Director of Wasserstein Perella Emerging Markets, where he specialized in private equity investments and debt transactions. Prior to joining Wasserstein, Mr. Pizzani served as Treasurer of COMSAT Corporation, an international communications company.

Mr. Pizzani was nominated by the holders of the Preferred Stock for appointment as a director of the Company. In connection with the Company's sale of its Preferred Stock to private equity funds sponsored by AIG and a related additional investor in a private placement pursuant to a stock purchase agreement, dated December 31, 2002, the holders of the Preferred Stock acquired an aggregate of 559,950 shares of Preferred Stock (convertible as of March 31, 2003 into an aggregate 22,616,990 shares of Common Stock), constituting approximately 26% of the Company's outstanding voting securities. The holders of the Preferred Stock were granted the right to elect and appoint a director and one non-voting observer to the Board of Directors so long as they maintain a minimum percentage of ownership of at least 10% of the outstanding voting securities. In the event that the outstanding shares of Preferred Stock represent less than 10% but in excess of 5% of the total outstanding voting power of the Company on a fully diluted basis, the holders of the Preferred Stock shall be entitled to elect a director but no board observer.

Geoffrey L. Hamlin is serving as the board observer appointed by the holders of the Preferred Stock. Mr. Hamlin is a partner of PH Capital and served as a strategic advisor to Wasserstein Perella Emerging Markets prior to founding PH Capital in 1999 with Mr. Pizzani. Prior to joining Wasserstein, Mr. Hamlin worked as an Associate General Counsel at COMSAT Corporation, where he joined Mr. Pizzani in 1994 and served on the senior management team of COMSAT International Ventures.

Meetings of the Board of Directors; Committees

During the year ended December 31, 2002, the Board of Directors held four meetings and acted by written consent on three occasions. Each director attended at least 75% of the aggregate of the total number of meetings of the Board of Directors and of any meetings of committees of the Board of Directors on which he served.

The Board of Directors has an Audit Committee, a Compensation Committee and a Nominating Committee. The Board of Directors has delegated certain functions to these committees as follows:

Audit Committee. During the year ended December 31, 2002, the Audit Committee held five meetings. The Audit Committee currently consists of Messrs. Puente (Chairman), Karp, Pizzani and Hershberg. The Audit Committee has the authority and responsibility to hire one or more independent public accountants to audit the Company's books, records and financial statements and to review the Company's systems of accounting (including its systems of internal control), to discuss with such independent public accountants the results of such audit and review, to conduct periodic independent reviews of the systems of accounting (including systems of internal control), and to make reports periodically to the Board of Directors with respect to its findings.

All of the members of the Audit Committee are independent of the Company (as defined under current Rule 4200(a)(15) of the National Association of Securities Dealers' ("NASD") listing standards).

4

Compensation Committee. During the year ended December 31, 2002, the Compensation Committee, which consists of Messrs. Hershberg (Chairman) and Earle, held three meetings and acted by written consent on two occasions. The Compensation Committee is responsible for fixing the compensation of the Chief Executive Officer and the other executive officers, deciding other compensation matters such as those relating to the operation of the Primus Telecommunications Group, Incorporated Stock Option Plan, as amended (the "Employee Option Plan"), and the Director Stock Option Plan of Primus Telecommunications Group, Incorporated, as amended (the "Director Option Plan"), including the award of options under the Employee Option Plan, and approving certain aspects of the Company's management bonus plan.

Nominating Committee. During the year ended December 31, 2002, the Nominating Committee, which consists of Messrs. Kaul (Chairman) and Puente, held one meeting. The Nominating Committee is responsible for identifying, reviewing and evaluating candidates to serve as directors of the Company, and making recommendations to the Board regarding affairs relating to directors of the Company (excluding director compensation which is the responsibility of the Outside Director Compensation Committee, which consists of Messrs. Singh and DePodesta).

Compensation of Directors

The Company pays non-employee directors an annual fee of $30,000, reimburses their expenses and pays a $2,500 supplement for each meeting attended in person. In addition, the Company grants each person who becomes a non-employee director on the date of initial election, and upon each date of re-election, options to purchase 45,000 shares of the Common Stock pursuant to the Director Option Plan, which options have an exercise price equal to the fair market value of the Common Stock as of the grant date and vest one-third upon the grant date, and one-third on each of the first and second anniversaries of the grant date.

5

PROPOSAL 2

APPROVAL OF THE COMPANY'S EMPLOYEE STOCK OPTION PLAN, AS AMENDED

The Company's Employee Stock Option Plan (the "Employee Plan") provides for the grant of stock options at an exercise price of not less than 100% of the Common Stock's fair value at the date of grant. The total number of shares of Common Stock authorized for issuance under the Employee Plan is 9,000,000. The last amendment to the Employee Plan that increased the number of options available for grant was approved in 2001. Under the Employee Plan, awards may be granted to key employees of the Company and its subsidiaries in the form of incentive stock options or nonqualified stock options. The Employee Plan allows the options to vest over a period of up to three years, and no option will be exercisable more than ten years from the date it is granted. The Board of Directors has authorized an increase in the number of shares of Common Stock issuable under the Employee Plan to 13,000,000 and an extension of the expiration date of the Employee Plan from January 2, 2005 to January 2, 2010 (the Employee Plan, as so amended being referred to as the "Amendment"). If all 13,000,000 options were granted and exercisable they would comprise 13% of the Company's Common Stock on a fully-diluted basis.

The Company is amending the Employee Plan in light of the grant of approximately 2.4 million stock options during January and February 2003 (the "2003 Awards"). As a result of the 2003 Awards, approximately 265,000 shares remain authorized for further option awards under the Employee Plan as of March 31, 2003, before giving effect to the Amendment. The 2003 Awards were made to executive management and employees to provide additional incentives and to reward employees for effecting significant improvements in the Company's operating results, capital resources and liquidity. The January 2003 Awards to the Named Executive Officers were granted after assigning a value to the options as a component of the total compensation package. Stock option grants to the Named Executive Officers pursuant to the 2003 Awards are summarized below:

| Named Executive Officer | Date of Award | Exercise Price of Option | Number of Shares Subject to Option Award | ||||

|---|---|---|---|---|---|---|---|

| K. Paul Singh Chairman of the Board of Directors, President and Chief Execuitve Officer | 1/10/2003 2/12/2003 | $ $ | 1.90 1.98 | 250,000 1,100,000 | |||

Neil L. Hazard Executive Vice President, Chief Operating Officer and Chief Financial Officer | 1/10/2003 | $ | 1.90 | 100,000 | |||

John F. DePodesta Executive Vice President and Director | 1/10/2003 | $ | 1.90 | 100,000 | |||

John Melick Senior Vice President and Co-President of Primus Telecommunications, Inc. | 1/10/2003 | $ | 1.90 | 50,000 | |||

Jay Rosenblatt Senior Vice President and Co-President of Primus Telecommunications, Inc. | 1/10/2003 | $ | 1.90 | 50,000 | |||

Since the Compensation Committee of the Board of Directors makes awards of stock options pursuant to the Employee Plan on a discretionary basis, it is not possible to determine or estimate the amount of any future awards to any of the Named Executive Officers pursuant to the Amendment. No option awards will be made to non-employee directors pursuant to the Amendment.

6

The Employee Plan has been approved by the stockholders of the Company. The Company seeks stockholder approval of the Amendment.The Board of Directors recommends that stockholders vote IN FAVOR OF the Amendment. Information regarding the Employee Plan and other equity incentive plans of the Company is summarized below.

The following table provides certain information with respect to all of the Company's equity compensation plans in effect as of December 31, 2002.

Equity Compensation Plan Information

| Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) | Weighted-average exercise price of outstanding options, warrants and rights (b) | Number of securities remaining available for issuance under equity compensation plans (excluding securities reflected in column (a)) (c)* | |||||

|---|---|---|---|---|---|---|---|---|

| Equity compensation plans approved by security holders | 5,865,442 | $ | 2.10 | 3,778,932 | ** | |||

| Equity compensation plans not approved by security holders*** | 0 | $ | 0.00 | 694,857 | **** | |||

| Total | 5,865,442 | $ | 2.10 | 4,473,789 | ||||

| * | Includes Employee Plan, Director Plan, Restricted Plan and ESPP (as defined below). | |

| ** | Before giving effect to the 2003 Awards under the Employee Plan. | |

| *** | Excludes the additional 4,000,000 options authorization currently proposed for stockholder approval through the Amendment. | |

| **** | Represents the number of authorized but unissued shares under the Restricted Plan. |

The Company sponsors a Restricted Stock Plan (the "Restricted Plan") to facilitate the grant of restricted stock to selected individuals who contribute to the development and success of the Company and a Director Stock Option Plan (the "Director Plan") for non-employee directors. The total number of shares of Common Stock that may be granted under the Restricted Plan is 750,000. During the years ended December 31, 2001 and 2000, the Company issued 17,643 shares and 3,000 shares, respectively, of restricted stock under the Restricted Plan at fair value to certain eligible agents. These restricted shares vest ratably on the issue date, first anniversary and second anniversary of the issue date based on a continued relationship. The Company did not issue any restricted stock under the Restricted Plan for the year ended December 31, 2002. The Restricted Plan is the only equity compensation plan of the Company that was in effect as of December 31, 2002 and adopted without the approval of the Company's stockholders (750,000 shares authorized, 694,857 remaining available). Under the Director Plan, an option is granted to each qualifying non-employee director on the date of initial election, and upon each date of re-election to purchase 45,000 shares of Common Stock, which vests one-third as of the grant date, and one-third on each of the first and second anniversaries of the grant date. The option price per share is the fair market value of a share of Common Stock on the date the option is granted. No option will be exercisable more than ten years from the date of grant. An aggregate of 600,000 shares of Common Stock was reserved for issuance under the Director Plan. The Director Plan and the Employee Stock Purchase Plan ("ESPP") were approved by the Company's stockholders.

The Company sponsors an ESPP that permits eligible employees of the Company and its subsidiaries to purchase shares of Common Stock from the Company by electing to have the Company deduct a specific dollar amount per month from their compensation. The minimum employee payroll deduction per month is 1% of the employee's compensation and the maximum is 15%. Elections to

7

participate in the ESPP are made for specified periods referred to as "Option Periods." At the end of each Option Period, the Company applies the amount deducted from each employee's compensation to the purchase of shares of Common Stock to be issued to the employee. The purchase price for such shares is the lower of: (i) 85% of the closing market price on the first trading day of the Option Period or (ii) 85% of the closing market price on the last trading day of the Option Period. No employee may participate in ESPP if: (i) immediately after the Option Period such employee would own more than 5% of the Company's Common Stock, or (ii) immediately after the Option Period such employee would have purchased more than $25,000 of the Company's Common Stock in the current calendar year.

An employee may elect to participate in the ESPP after six months of employment and must so elect prior to the beginning of an Option Period. An employee may also at any time elect to withdraw from the ESPP and have the employee's contribution returned to him or her, or to terminate his or her participation for the remainder of an Option Period. An aggregate of 2,000,000 shares of Common Stock were reserved for issuance under the ESPP. The ESPP was approved by the Company's stockholders.

EXECUTIVE COMPENSATION AND OTHER INFORMATION

Executive Officers

The following table and biographies set forth information concerning the individuals who serve as executive officers of the Company.

| Name | Age | Position | Year or Expiration of Term as Director | |||

|---|---|---|---|---|---|---|

| K. Paul Singh | 52 | Chairman of the Board of Directors, President and Chief Executive Officer | 2005 | |||

| Neil L. Hazard | 50 | Executive Vice President, Chief Operating Officer and Chief Financial Officer | N/A | |||

| John F. DePodesta | 58 | Executive Vice President and Director | 2005 | |||

| John Melick | 44 | Senior Vice President and Co-President of Primus Telecommunications, Inc. | N/A | |||

| Jay Rosenblatt | 37 | Senior Vice President and Co-President of Primus Telecommunications, Inc. | N/A | |||

| Tracy R. Book | 34 | Vice President—Corporate Controller | N/A |

The biographies ofMessrs. Singh andDePodesta appear under the caption "Election of Directors—Incumbent Directors—Terms Expiring at the 2005 Annual Meeting of Stockholders" on page 3.

Neil L. Hazard joined the Company in 1996 as its Executive Vice President and Chief Financial Officer. Beginning in June 2001, Mr. Hazard was appointed Chief Operating Officer of the Company. Prior to joining the Company, Mr. Hazard was employed by MCI from 1991 through 1996 in several executive positions, most recently as its director of Corporate Accounting and Financial Reporting, responsible for consolidation of financial results, external reporting to stockholders and securities compliance reporting. Mr. Hazard served as acting Controller of MCI for six months and as director of Global Product Marketing. Prior to joining MCI in 1991, Mr. Hazard served as the Chief Financial Officer of OTI.

Jay Rosenblatt has served as the Co-President and Chief Operating Officer of Primus Telecommunications, Inc. in the United States since June 2001, as well as Senior Vice President of the Global Service Providers Division since January 1996. Previously, he was Director of Marketing and Sales responsible for the Company's commercial programs from September 1994 to January 1996. Prior to joining the Company, Mr. Rosenblatt was with MCI as the marketing manager responsible for

8

private network services in the Americas and Caribbean region. Prior to joining MCI, Mr. Rosenblatt was a management consultant at Cap Gemini America.

John Melick joined the company in 1994 as its Vice President of Sales and Marketing and since 1996 has served as Senior Vice President of International Business Development. Beginning in June 2001, Mr. Melick also began serving as Co-President of Primus Telecommunications, Inc. in the United States. Prior to joining Primus, Mr. Melick was employed by MCI beginning in 1991 as a result of its acquisition of OTI where he worked from 1987 through 1991.

Tracy R. Book has served as Vice President—Corporate Controller of the Company since January 2003. Since Ms. Book has joined the Company in 1998, she has served as Senior Manager of Corporate and United States Operations Financial Reporting and as Director of Global Financial Reporting, responsible for corporate financial reporting, consolidation of the Company's financial results and external reporting to investors. Prior to joining the Company, Ms. Book was employed as Manager of Profit & Loss Consolidations and Executive Reporting by MCI (acquired by WorldCom, Inc. in 1998) from February 1991 until November 1998.

Summary Compensation Table(1)

The following table sets forth, for the years ended December 31, 2002, 2001 and 2000 certain compensation information with respect to the Company's Chief Executive Officer and the four highest paid other Company executive officers as of December 31, 2002 (the "Named Executive Officers").

| | | Annual Compensation | Long-Term Compensation | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Name and Title | Year | Salary | Bonus | Long-Term Securities Underlying Options/SARs | |||||||

| K. Paul Singh Chairman of the Board of Directors, President and Chief Executive Officer | 2002 2001 2000 | $ $ $ | 415,000 400,000 400,000 | $ $ $ | 1,200,000 375,000 275,000 | 505,000 686,434 125,000 | (2) | ||||

Neil L. Hazard Executive Vice President, Chief Operating Officer and Chief Financial Officer | 2002 2001 2000 | $ $ $ | 322,640 250,000 250,000 | $ $ $ | 789,000 375,000 200,000 | 205,000 148,334 60,000 | (2) | ||||

John F. DePodesta Executive Vice President and Director | 2002 2001 2000 | $ $ $ | 300,000 300,000 300,000 | $ $ $ | 725,000 450,000 200,000 | 430,000 243,334 100,000 | (2) | ||||

John Melick Senior Vice President and Co-President of Primus Telecommunications, Inc. | 2002 2001 2000 | $ $ $ | 204,921 200,000 200,000 | $ $ $ | 512,500 262,500 97,500 | 135,000 95,000 40,000 | (2) | ||||

Jay Rosenblatt Senior Vice President and Co-President of Primus Telecommunications, Inc. | 2002 2001 2000 | $ $ $ | 203,522 200,000 200,000 | $ $ $ | 512,500 262,500 97,500 | 160,000 115,025 45,000 | (2) | ||||

9

Stock Option Grants in 2002

Under the Employee Option Plan, options to purchase the Common Stock are available for grant to all employees of the Company. The following table summarizes certain information regarding stock options to purchase Common Stock granted to the Named Executive Officers during the year ended December 31, 2002. All the stock options granted in 2002 to the Named Executive Officers were in exchange for a similar number of options which had been extinguished in 2002.

| | | | | | Potential Realizable Value at Assumed Rates of Stock Price Appreciation for Option Term | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | % of Total Options Granted to Employees in 2002 | ||||||||

| Name and Title | Options Granted | Exercise Price Per Share | Expiration Date | |||||||||

| 5% (1) | 10% (1) | |||||||||||

| K. Paul Singh Chairman of the Board of Directors, President and Chief Executive Officer | 505,000 | 1.65 | 12/19/2012 | 14.78 | % | 1,357,276 | 2,161,236 | |||||

Neil L. Hazard Executive Vice President, Chief Operating Officer and Chief Financial Officer | 205,000 | 1.65 | 12/19/2012 | 6.00 | % | 550,974 | 877,333 | |||||

John F. DePodesta Executive Vice President and Director | 430,000 | 1.65 | 12/19/2012 | 12.58 | % | 1,155,701 | 1,840,260 | |||||

John Melick Senior Vice President and Co-President of Primus Telecommunications, Inc. | 135,000 | 1.65 | 12/19/2012 | 3.95 | % | 362,836 | 577,756 | |||||

Jay Rosenblatt Senior Vice President and Co-President of Primus Telecommunications, Inc. | 160,000 | 1.65 | 12/19/2012 | 4.68 | % | 430,028 | 684,748 | |||||

10

Aggregated Option Exercises in 2002 and Fiscal Year End Option Values

The following table provides certain information about stock options exercised by the Named Executive Officers in the year ended December 31, 2002 and the year-end values of stock options held by the Named Executive Officers on December 31, 2002.

| | | | Number of Unexercised Options at December 31, 2001 | Value of Unexercised in-the-Money Options at December 31, 2002 (1) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name & Title | Shares Acquired on Exercise | Value Realized | ||||||||||

| Exercisable | Unexercisable | Exercisable | Unexercisable | |||||||||

| K. Paul Singh Chairman of the Board of Directors, President and Chief Executive Officer | — | — | 253,217 | 758,217 | 506,434 | 1,516,434 | ||||||

Neil L. Hazard Executive Vice President, Chief Operating Officer and Chief Financial Officer | — | — | 34,167 | 239,167 | 68,334 | 478,334 | ||||||

John F. DePodesta Executive Vice President and Director | — | — | 71,667 | 501,667 | 143,334 | 1,003,334 | ||||||

John Melick Senior Vice President and Co-President of Primus Telecommunications, Inc. | — | — | 22,500 | 157,500 | 45,000 | 315,000 | ||||||

Jay Rosenblatt Senior Vice President and Co-President of Primus Telecommunications, Inc. | — | — | 27,512 | 187,513 | 55,024 | 375,026 | ||||||

11

Ten-Year Option Repricings

The following table shows certain information concerning the repricing of options received by the Named Executive Officers during the last ten years.

| Name | Date | Number of Securities Underlying Options/SARS Repriced or Amended (#) | Market Price of Stock at Time of Repricing or Amendment ($) | Exercise Price at Time of Repricing or Amendment ($) | New Exercise Price ($) | Length of Original Option Term Remaining at Date of Repricing or Amendment | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| K. Paul Singh Chairman of the Board of Directors, President and Chief Execuitve Officer | 12/19/2002 12/19/2002 12/19/2002 12/19/2002 12/19/2002 | 100,000 100,000 80,000 45,000 180,000 | $ $ $ $ $ | 0.60 0.60 0.60 0.60 0.60 | $ $ $ $ $ | 14.00 13.25 31.94 12.31 2.38 | $ $ $ $ $ | 1.65 1.65 1.65 1.65 1.65 | 0.5 years 6.7 years 7.6 years 8.2 years 8.5 years | ||||||

Neil L. Hazard Executive Vice President, Chief Operating Officer and Chief Financial Officer | 12/19/2002 12/19/2002 12/19/2002 12/19/2002 12/19/2002 | 40,000 25,000 40,000 20,000 80,000 | $ $ $ $ $ | 0.60 0.60 0.60 0.60 0.60 | $ $ $ $ $ | 14.00 13.25 31.94 12.31 2.38 | $ $ $ $ $ | 1.65 1.65 1.65 1.65 1.65 | 0.5 years 6.7 years 7.6 years 8.2 years 8.5 years | ||||||

John F. DePodesta Executive Vice President and Director | 12/19/2002 12/19/2002 12/19/2002 12/19/2002 12/19/2002 | 180,000 50,000 66,000 34,000 100,000 | $ $ $ $ $ | 0.60 0.60 0.60 0.60 0.60 | $ $ $ $ $ | 14.00 13.25 31.94 12.31 2.38 | $ $ $ $ $ | 1.65 1.65 1.65 1.65 1.65 | 0.5 years 6.7 years 7.6 years 8.2 years 8.5 years | ||||||

John Melick Senior Vice President and Co-President of Primus Telecommunications, Inc. | 12/19/2002 12/19/2002 12/19/2002 12/19/2002 12/19/2002 12/19/2002 | 25,000 20,000 20,000 10,000 10,000 50,000 | $ $ $ $ $ $ | 0.60 0.60 0.60 0.60 0.60 0.60 | $ $ $ $ $ $ | 14.00 13.25 31.94 12.31 12.31 2.38 | $ $ $ $ $ $ | 1.65 1.65 1.65 1.65 1.65 1.65 | 0.5 years 6.7 years 7.6 years 8.2 years 8.2 years 8.5 years | ||||||

Jay Rosenblatt Senior Vice President and Co-President of Primus Telecommunications, Inc. | 12/19/2002 12/19/2002 12/19/2002 12/19/2002 12/19/2002 12/19/2002 12/19/2002 | 10,000 20,000 25,000 23,000 12,000 10,000 60,000 | $ $ $ $ $ $ $ | 0.60 0.60 0.60 0.60 0.60 0.60 0.60 | $ $ $ $ $ $ $ | 12.25 14.00 13.25 31.94 12.31 12.31 2.38 | $ $ $ $ $ $ $ | 1.65 1.65 1.65 1.65 1.65 1.65 1.65 | 0.5 years 0.5 years 6.7 years 7.6 years 8.2 years 8.2 years 8.5 years | ||||||

Tracy R. Book Vice President — Corporate Controller | 12/19/2002 12/19/2002 12/19/2002 12/19/2002 12/19/2002 | 5,000 3,500 1,500 10,000 10,000 | $ $ $ $ $ | 0.60 0.60 0.60 0.60 0.60 | $ $ $ $ $ | 11.88 31.94 12.31 12.31 2.38 | $ $ $ $ $ | 1.65 1.65 1.65 1.65 1.65 | 6.3 years 7.6 years 8.2 years 8.2 years 8.5 years | ||||||

Danielle Saunders Vice President, Business Development and General Counsel (former) | 12/19/2002 12/19/2002 12/19/2002 12/19/2002 12/19/2002 | 20,000 10,000 5,000 5,000 40,000 | $ $ $ $ $ | 0.60 0.60 0.60 0.60 0.60 | $ $ $ $ $ | 10.50 31.94 12.31 12.31 2.38 | $ $ $ $ $ | 1.65 1.65 1.65 1.65 1.65 | 6.8 years 7.6 years 8.2 years 8.2 years 8.5 years | ||||||

12

Employment Agreement

The Company has an employment agreement with Mr. Singh (the "Singh Agreement"). The Singh Agreement initially was a five-year contract, with a term beginning on June 1, 1994 and continuing until May 30, 1999, and now continues from year to year unless terminated. Under the terms of the Singh Agreement, Mr. Singh is required to devote his full-time efforts to the Company as Chairman of the Board, President and Chief Executive Officer. The Company is required to compensate Mr. Singh at an annual rate of at least $250,000 effective January 1, 1997 (which amount is reviewed annually by the Board of Directors and is subject to increase at their discretion). The Company is also obligated to (i) allow Mr. Singh to participate in any bonus or incentive compensation plan approved for senior management of the Company, (ii) provide life insurance in an amount equal to three times Mr. Singh's base salary and disability insurance which provides monthly payments in an amount equal to one-twelfth of his then applicable base salary, (iii) provide medical insurance for him and his family and (iv) pay for Mr. Singh's personal tax and financial planning services.

The Company may terminate the Singh Agreement at any time in the event of his disability or for cause, each as defined in the Singh Agreement. Mr. Singh may resign from the Company at any time without penalty (other than the non-competition obligations discussed below). If the Company terminates the Singh Agreement for disability or cause, the Company will have no further obligations to Mr. Singh. If, however, the Company terminates the Singh Agreement other than for disability or cause, the Company must pay Mr. Singh one-twelfth of his then applicable base salary as severance pay. If Mr. Singh resigns, he may not directly or indirectly compete with the Company's business until six months after his resignation. If the Company terminates Mr. Singh's employment for any reason, Mr. Singh may not directly or indirectly compete with the Company's business until six months after the final payment of any amounts owed to him under the Singh Agreement becomes due.

13

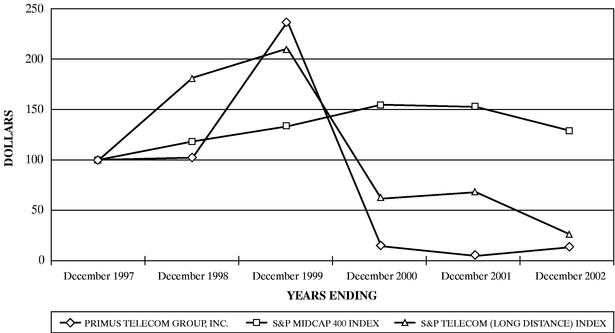

The graph below compares the Company's cumulative total stockholder return on the Common Stock with the cumulative total return of the Standard & Poor's Midcap 400 Index and the Standard & Poor's Telecommunications (Long Distance) Index for the period from December 31, 1997 through May 13, 2002, and the period the Company was on the NASDAQ Small Cap Market from May 14, 2002 through December 31, 2002. The Company's Common Stock is again trading on the NASDAQ National Market again effective March 21, 2003. The comparison assumes $100 was invested on December 31, 1997 in the Company's Common Stock and in each of the foregoing indices and assumes reinvestment of dividends. The stockholder return shown on the graph below is not indicative of future performance.

| | 12/31/1997 | 12/31/1998 | 12/31/1999 | 12/29/2000 | 12/31/2001 | 12/31/2002 | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Primus Telecommunications Group, Incorporated | 100.00 | 102.30 | 237.15 | 14.32 | 4.03 | 12.40 | ||||||

| Standard & Poor's Midcap 400 Index | 100.00 | 117.68 | 133.39 | 155.01 | 152.48 | 128.92 | ||||||

| Standard & Poor's Telecommunications (Long Distance)Index | 100.00 | 180.93 | 210.27 | 60.91 | 67.80 | 26.19 |

Notwithstanding anything to the contrary set forth in any of the Company's filings under the Securities Act of 1933 or the Securities Exchange Act of 1934 that might incorporate SEC filings, in whole or in part, the above Performance Graph will not be incorporated by reference into any such filings.

14

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The Compensation Committee consists of Messrs. Hershberg and Earle. Set forth below is the full report of the Compensation Committee regarding the compensation of executive officers on account of fiscal year 2002. Notwithstanding anything to the contrary set forth in any of the Company's filings under the Securities Act of 1933 or the Securities Exchange Act of 1934 that might incorporate SEC filings, in whole or in part, this Compensation Committee Report on Executive Compensation will not be incorporated by reference into any such filings.

General

During 2002, the compensation of the executive officers was administered and determined by the Compensation Committee of the Board of Directors. The Company's executive compensation programs are designed to attract, motivate and retain the executive talent needed to optimize stockholder value in a competitive environment. The programs are intended to support the goal of increasing stockholder value while facilitating the business strategies and long-range plans of the Company.

Compensation Policy and Philosophy

The Company's executive compensation policy (i) is designed to establish an appropriate relationship between executive pay and the Company's annual performance against annual budgets and relative to the performance of the peer group of the industry sector, its long-term growth objectives and its ability to attract and retain qualified executive officers, and (ii) is based on the belief that the interests of the executives should be closely aligned with the Company's stockholders. In support of this philosophy, a meaningful portion of each executive's compensation is placed at-risk and linked to the accomplishment of specific results that are expected to lead to the creation of value for the Company's stockholders from both the short-term and long-term perspectives. The Compensation Committee believes that cash compensation in the form of salary and performance-based incentive bonuses provides Company executives with short-term rewards for success in operations, and that long-term compensation through the award of stock options encourages growth in management stock ownership which are intended to lead to the creation of value for the Company's stockholders and expansion of management's stake in the long-term performance and success of the Company. The Compensation Committee considers all elements of compensation, including the valuation of options, and the compensation policy when determining individual components of pay.

The Compensation Committee believes that leadership and motivation of the Company's employees are critical to achieving the objectives of the Company. The Compensation Committee is responsible for ensuring that its executive officers are compensated in a way that furthers the Company's business strategies and which aligns their interests with those of the stockholders. To support this philosophy, the following principles provide a framework for executive compensation: (i) offer compensation opportunities that attract the best talent to the Company; (ii) motivate individuals to perform at their highest levels; (iii) reward outstanding achievement; (iv) retain those with leadership abilities and skills necessary for building long-term stockholder value; (v) maintain a significant portion of executives' total compensation at-risk, tied to both the annual and long-term financial performance of the Company and the creation of incremental stockholder value; and (vi) encourage executives to manage from the perspective of owners with an equity stake in the Company.

Executive Compensation Components

As discussed below, the Company's executive compensation package is primarily comprised of three components: base salary, annual incentive bonuses and stock options. In making its

15

determinations, the Compensation Committee considered five external compensation surveys and studies of comparable entities.

Base Salary. Generally, the Compensation Committee approves the base salaries of the executive officers based on (i) salaries paid to executive officers with comparable responsibilities employed by companies with comparable businesses, (ii) performance and accomplishment of the Company in 2002, which is the most important factor, and (iii) individual performance reviews for 2002 for most executive officers. The Compensation Committee reviews executive officer salaries annually and exercises its judgment based on all the factors described above in making its determination, subject to the terms of such officer's employment agreement. No specific formula is applied to determine the weight of each criterion.

Annual Incentive Bonuses. Annual incentive bonuses for the Chief Executive Officer and the other Named Executive Officers were paid based upon the following criteria: (i) the Company's financial performance for the current year, which for 2002 included accelerated earnings before interest, tax, depreciation and amortization expenses ("EBITDA") generated from cost reductions and increased operational efficiency; (ii) cash generation initiatives and raising debt and equity capital; (iii) the furthering of the Company's strategic position in the marketplace; (iv) debt and interest expense reduction through restructuring activities conducted exclusively by senior management without the assistance and related expense of external financial advisors; and (v) individual merit. In addition to regular annual incentive bonuses, the Compensation Committee, in November 2001, authorized a special bonus program to provide incentives for enhancing the Company's cash flow attributable to operations for the period from November 2001 to February 2002. Half of the special bonus that is attributable to the success of each applicable Named Executive Officer for January and February 2002 is reflected in the Summary Compensation Table on page 9. In return for the special bonus, each recipient entered into a retention agreement requiring the officer to remain with the Company through October 1, 2002. The Compensation Committee also authorized a special bonus program for 2002 geared to the achievement of quarterly EBITDA goals. Under the program, if a quarterly EBITDA goal was not met, no bonus would be paid. Given the Company's improved operating performance, the Compensation Committee adjusted the special bonus program for the latter half of 2002 by increasing the previously established EBITDA goals. While the incentive bonuses paid in 2002 are materially larger than prior years, they reflect the accomplishment of significantly improved financial and operating results in the current business environment.

Long-Term Incentive Compensation. Stock options encourage and reward effective management which results in long-term corporate financial success, as measured by stock price appreciation. The Compensation Committee believes that option grants afford a desirable long-term compensation method because they closely ally the interests of management with stockholder value and that grants of stock options are the best way to motivate executive officers to improve long-term stock market performance. The vesting provisions of options granted under the Employee Plan are designed to encourage longevity of employment with the Company and generally extend over a three-year period. The number of options granted during 2002 to each Named Executive Officer was solely the result of an option exchange program. In May 2002, the Company offered employees the opportunity to exchange all outstanding stock options with exercise prices over $2.00 for replacement options to purchase shares of the Company's Common Stock on the date that was six months and one day after the expiration date of the offer. The option exchange program was implemented in order to provide the executive officers and employees with a long-term incentive to increase stockholder value. Most earlier option grants were far above current market price and provided minimal long-term reward for improved stock market performance.

16

Compensation of Chief Executive Officer

The Compensation Committee believes that K. Paul Singh, the Company's Chief Executive Officer, provides valuable services to the Company and that his compensation should therefore be competitive with that paid to executives at comparable companies. In addition, the Compensation Committee believes that an important portion of his compensation should be based on performance. Mr. Singh's annual salary for 2002 was $415,000. The annual performance bonus paid to Mr. Singh for 2002 was $1,200,000. The factors that the Compensation Committee considered in setting his total compensation for the year 2002 were his individual accomplishments and leadership in driving the overall Company performance in exceeding both the quarterly and annual EBITDA goals and debt reduction targets and in obtaining new financing as well as pay practices of peer companies relating to executives of similar responsibility. Mr. Singh's total cash compensation in 2003 will be $400,000.

Internal Revenue Code Section 162

The Compensation Committee has reviewed the potential consequences for the Company of Section 162(m) of the Internal Revenue Code, which imposes a limit on tax deductions for annual compensation in excess of one million dollars paid to any of the five most highly compensated executive officers, including the Chief Executive Officer. It is the current policy of the Compensation Committee to maximize, to the extent reasonably possible, the Company's ability to obtain a corporate tax deduction for compensation paid to executive officers of the Company to the extent consistent with the best interests of the Company and its stockholders. Due to the Chief Executive Officer's annual incentive bonus being performance-based in calendar year 2002, the limitation under Section 162(m) had no net tax effect on the Company. The limitations of Section 162(m) are not expected to have a material effect on the Company in calendar year 2003.

| Respectfully Submitted, | |

The Compensation Committee of the Company's Board of Directors | |

David E. Hershberg (Chairman) Nick Earle |

17

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The Compensation Committee of the Board of Directors consists of Messrs. Hershberg and Earle, who were not at any time officers or employees of the Company. No executive officer of the Company serves as a member of the Board of Directors or compensation committee of another entity which has one or more executive officers that will serve as a member of the Board of Directors or the Company's Compensation Committee.

In June 1999, the Company contracted with a vendor to provide one satellite earth station in Australia and to provide, operate and maintain a satellite link between the Company's router in Los Angeles, California and the earth station, as well as to monitor a satellite earth station in London. David Hershberg, one of the Company's directors, is the Chairman and a stockholder of the vendor providing such services. The Company paid the vendor approximately $100,000 in 2000 and incurred monthly charges of $148,000 (totaling $1.78 million) in 2001 and $150,000 (totaling $0.9 million) in 2002 until the contract was terminated in June 2002. An additional termination fee of $357,500 was paid during the year ended December 31, 2002.

The Audit Committee has reviewed and discussed the audited consolidated financial statements of the Company for fiscal year 2002 with the Company's management, and also has discussed with Deloitte & Touche LLP, the Company's independent auditors, the matters required to be discussed by Statement on Auditing Standards No. 61, "Communication with Audit Committees." The Audit Committee has received both the written disclosures and the letter from Deloitte & Touche LLP required by Independence Standards Board Standard No. 1, and has discussed with Deloitte & Touche LLP the independence of Deloitte & Touche LLP from the Company.

Based on the foregoing, the Audit Committee recommended to the Board of Directors of the Company that the audited consolidated financial statements of the Company for fiscal year 2002 be included in the Company's Annual Report on Form 10-K filed with the SEC on March 31, 2003.

In addition, the Audit Committee has considered whether the provision of services by Deloitte & Touche LLP falling under the headings "Financial Systems Design and Implementation Fees" and "All Other Fees" (see "Other Matters—Relationship with Independent Accountants" on page 24) is compatible with maintaining the independence of Deloitte & Touche LLP from the Company, and has determined that the provision of such services is compatible with maintaining such independence.

Notwithstanding anything to the contrary set forth in any of the Company's filings under the Securities Act of 1933 or the Securities Exchange Act of 1934 that might incorporate SEC filings, in whole or in part, this Report of the Audit Committee will not be incorporated by reference into any such filings.

| Respectfully Submitted, | |

The Audit Committee of the Company's Board of Directors | |

John G. Puente (Chairman) Douglas M. Karp David E. Hershberg Paul G. Pizzani |

18

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

As of March 31, 2003, the Company had 578 registered holders of record of 65,107,616 shares of its Common Stock and four registered holders of 559,950 shares of its Preferred Stock (convertible as of such date into 22,616,990 shares of Common Stock). For purposes of this filing, beneficial ownership of securities is defined in accordance with the rules of the SEC and means generally the power to vote or exercise investment discretion with respect to securities, regardless of any economic interests therein.

The following table sets forth, as of March 31, 2003, certain information as to the beneficial ownership by each person listed below of shares of the Common Stock, including shares of Common Stock as to which a right to acquire beneficial ownership existed (for example, through the conversion of Preferred Stock outstanding as of March 31, 2003 or the exercise of Common Stock options that are exercisable as of, and within 60 days from, March 31, 2003,) within the meaning of Rule 13d-3(d)(1) under the Securities and Exchange Act of 1934, by: (i) each person or group who is known to the Company to be the beneficial owner of more than five percent of the outstanding Common Stock, (ii) each director or nominee for director, (iii) the Named Executive Officers, and (iv) all directors and executive officers as a group. Unless otherwise indicated, each person had, as of March 31, 2003, sole voting power and sole investment power with respect to the Company's shares, subject to community property laws as applicable.

| Name and Business Address | Number of Shares of Common Stock Beneficially Owned (1) | Percentage of Outstanding Shares of Common Stock (1) | Number of Shares of Preferred Stock Beneficially Owned (1) | Percentage of Outstanding Shares of Preferred Stock | |||||

|---|---|---|---|---|---|---|---|---|---|

| Brener International Group, LLC and affiliates (2) 421 North Beverly Drive, Suite 300 Beverly Hills, CA 90210 | 5,948,000 | 9.14 | % | — | — | ||||

K. Paul Singh (3) 1700 Old Meadow Road McLean, VA 22102 | 4,000,732 | 6.14 | % | — | — | ||||

RS Investment Management Co. LLC (4) 388 Market Street, Suite 200 San Francisco, CA 94111 | 3,707,000 | 5.69 | % | — | — | ||||

John F. DePodesta (5) 1700 Old Meadow Road McLean, VA 22102 | 353,163 | * | — | — | |||||

John G. Puente (6) 1700 Old Meadow Road McLean, VA 22102 | 162,190 | * | — | — | |||||

John Melick (7) 1700 Old Meadow Road McLean, VA 22102 | 129,659 | * | — | — | |||||

Jay Rosenblatt (8) 1700 Old Meadow Road McLean, VA 22102 | 108,572 | * | — | — | |||||

19

Pradman P. Kaul (9) 1700 Old Meadow Road McLean, VA 22102 | 94,366 | * | — | — | |||||

David E. Hershberg (10) 1700 Old Meadow Road McLean, VA 22102 | 81,660 | * | — | — | |||||

Neil L. Hazard (11) 1700 Old Meadow Road McLean, VA 22102 | 46,778 | * | — | — | |||||

Nick Earle (12) 1700 Old Meadow Road McLean, VA 22102 | 45,000 | * | — | — | |||||

Douglas M. Karp (13) 1700 Old Meadow Road McLean, VA 22102 | 30,000 | * | — | — | |||||

Tracy R. Book (14) 1700 Old Meadow Road McLean, VA 22102 | 16,162 | * | — | — | |||||

Paul G. Pizzani (15) 1700 Old Meadow Road McLean, VA 22102 | 15,000 | * | — | — | |||||

American International Group, Inc ("AIG") (16) (17) 70 Pine Street New York, NY 10270 | 21,540,008 | 24.55 | % | 533,286 | 95.23 | % | |||

AIG Global Sports and Entertainment Fund, L.P. ("AIG Global Sports") (18) Ugland House, South Church Street George Town, Grand Cayman | 10,770,004 | 12.28 | % | 266,643 | 47.62 | % | |||

AIG Global Emerging Markets Fund, L.L.C. (AIG Emerging Markets") (19) 175 Water Street, 23rd Floor New York, NY 10038 | 9,739,304 | 11.10 | % | 241,125 | 43.06 | % | |||

All executive officers and directors as a group (20) 1700 Old Meadow Road McLean, VA 22102 | 5,083,282 | 7.81 | % | — | — |

20

subject to conversion of Preferred Stock outstanding as of March 31, 2003 are deemed outstanding for computing the percentage ownership of the person holding such options or warrants, but are not deemed outstanding for computing the percentage ownership of any other person.

21

22

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

On December 13, 2000, the Company loaned Jay Rosenblatt the principal amount of $268,500. This loan is payable in full five years from the date of agreement (subject to earlier repayments upon the termination of Mr. Rosenblatt's employment under certain circumstances) and is secured by shares of the Company's Common Stock pursuant to a full recourse note. Interest is compounded quarterly at a rate of 6% per annum and payable upon maturity. In February 2002, the Company entered into a retention agreement with Mr. Rosenblatt which provided that the personal recourse feature of the notes would be removed if Mr. Rosenblatt remained employed with the Company through May 1, 2003. The shares of the Company's Common Stock acquired upon exercise of Mr. Rosenblatt's options will continue to be held by the Company as collateral for the notes, which collateral had a value of $62,651 at March 31, 2003.

On November 30, 2000, the Company loaned John Melick the principal amount of $209,823. This loan is payable in full five years from the date of agreement (subject to earlier repayments upon the termination of Mr. Melick's employment under certain circumstances) and is secured by shares of the Company's Common Stock and is a full recourse note. Interest is compounded quarterly at a rate of 6% per annum and payable upon maturity. In February 2002, the Company entered into a retention agreement with Mr. Melick which provided that the personal recourse feature of the notes would be removed if Mr. Melick remained employed with the Company through May 1, 2003. The shares of the Company's Common Stock acquired upon exercise of Mr. Melick's options will continue to be held by the Company as collateral for the notes, which collateral had a value of $147,412 at March 31, 2003.

On November 21, 2000, the Company loaned John DePodesta the principal amount of $551,320. This loan is payable in full five years from the date of agreement (subject to earlier repayments upon the termination of Mr. DePodesta's employment under certain circumstances) and is secured by shares of the Company's Common Stock and is a full recourse note. Interest is compounded quarterly at a rate of 6% per annum and payable upon maturity. In February 2002, the Company entered into a retention agreement with Mr. DePodesta which provided that the personal recourse feature of the notes would be removed if Mr. DePodesta remained employed with the Company through May 1, 2003. The shares of the Company's Common Stock acquired upon exercise of Mr. DePodesta's options will continue to be held by the Company as collateral for the notes, which collateral had a value of $221,117 at March 31, 2003.

The Sarbanes-Oxley Act of 2002 effectively prohibits the Company from making loans to our executive officers in the future, although loans outstanding prior to July 30, 2002—including the loans described above to Messrs. Rosenblatt, Melick and DePodesta—were explicitly exempted from this prohibition.

23

Other Business

The Board of Directors knows of no other matters that will be presented at the Annual Meeting other than as set forth in this Proxy Statement. However, if any other matter properly comes before the meeting, or any adjournment or postponement thereof, it is intended that proxies in the accompanying form will be voted, to the extent permitted by applicable law, in accordance with the judgment and at the discretion of the persons named therein.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the Company's directors, executive officers and persons who own more than ten percent of a registered class of the Company's equity securities (collectively, "Reporting Persons") to file with the Securities and Exchange Commission initial reports of changes in ownership of the Common Stock and other equity securities of the Company. Reporting Persons are additionally required to furnish the Company with copies of all Section 16(a) forms they file. Based solely on a review of Forms 4 and 5 filed by the Reporting Persons for the 2002 reporting season, the Company is aware of no late filings or omissions by the Reporting Persons.

Relationship with Independent Accountants

The Company's consolidated financial statements for the fiscal year ended December 31, 2002 have been audited by Deloitte & Touche LLP. Representatives of Deloitte & Touche LLP are expected to be available at the meeting to respond to appropriate questions and to make a statement if they desire to do so.

Aggregate fees billed to the Company for the fiscal year ended December 31, 2002 by the Company's principal accounting firm, Deloitte & Touche LLP, the member firms of Deloitte Touche Tohmatsu and their respective affiliates:

| Audit Fees | $ | 1,701,288 | ||

| Audit-Related Fees | $ | 68,714 | ||

| Audit-related fees include the finalization of the acquisition of CTE Networks, a Canadian long distance reseller, and fees in connection with an option exchange program. | ||||

| Tax Fees | $ | 488,924 | ||

| Tax fees include corporate tax consulting for Primus subsidiaries in the United States, Canada, Australia, the United Kingdom, Japan and Germany. | ||||

| Other Fees | $ | 198,789 | ||

| Other fees include consulting for legal entity structuring and miscellaneous other projects. | ||||

Householding of Proxy Materials

The SEC has adopted rules that permit companies and intermediaries (e.g. brokers) to satisfy the delivery requirements for proxy statements and annual reports with respect to two or more stockholders sharing the same address by delivering a single proxy statement to those stockholders. This process, which is commonly referred to as "householding," potentially means extra convenience for stockholders and cost savings for companies.

This year, a number of brokers with account holders who are Company stockholders will be householding our proxy materials. A single proxy statement will be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once

24

you have received notice from your broker that they will be householding communications to your address, householding will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in householding and would prefer to receive a separate proxy statement and annual report, please notify your broker or direct your written request to Jordan Darrow, Vice President of Investor Relations, Primus Telecommunications Group, Incorporated, 1700 Old Meadow Road, McLean, Virginia 22102, or contact Jordan Darrow at (212) 703-0116. Stockholders who currently receive multiple copies of the proxy statement at their address and would like to request householding of their communications should contact their broker.

Annual Report

A copy of the Company's Annual Report on Form 10-K for the year ended December 31, 2002 filed with the Securities and Exchange Commission accompanies this Proxy Statement.

Stockholder Proposals

In order for any proposal pursuant to Rule 14a-8 of the rules promulgated under the Securities Exchange Act of 1934 to be eligible for inclusion in the Company's proxy materials for the 2004 Annual Meeting of Stockholders, such proposal must, in addition to meeting the stockholder eligibility and other requirements of the Securities and Exchange Commission's rules governing such proposals, be received not later than December 31, 2003 by the Secretary or Assistant Secretary of the Company at the Company's principal executive offices, 1700 Old Meadow Road, McLean, Virginia 22102.

Solicitation of Proxies

The cost of solicitation of proxies by the Board of Directors will be borne by the Company. Proxies may be solicited by mail, personal interview, telephone, facsimile or telegraph and, in addition, directors, officers and regular employees of the Company may solicit proxies by such methods without additional remuneration. Banks, brokerage houses and other institutions, nominees or fiduciaries will be requested to forward the proxy materials to beneficial owners in order to solicit authorizations for the execution of proxies. The Company will, upon request, reimburse such banks, brokerage houses and other institutions, nominees and fiduciaries for their expenses in forwarding such proxy materials to the beneficial owners of the Common Stock.

THE COMPANY WILL PROVIDE TO EACH PERSON SOLICITED, WITHOUT CHARGE EXCEPT FOR EXHIBITS, UPON REQUEST IN WRITING, A COPY OF ITS ANNUAL REPORT ON FORM 10-K, INCLUDING THE FINANCIAL STATEMENTS AND FINANCIAL STATEMENT SCHEDULE, AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION FOR THE FISCAL YEAR ENDED DECEMBER 31, 2002. REQUESTS SHOULD BE DIRECTED TO INVESTOR RELATIONS, PRIMUS TELECOMMUNICATIONS GROUP, INCORPORATED, 1700 OLD MEADOW ROAD, MCLEAN, VIRGINIA 22102.

STOCKHOLDERS ARE URGED TO IMMEDIATELY MARK, DATE, SIGN AND RETURN THE ENCLOSED PROXY IN THE ENVELOPE PROVIDED, TO WHICH NO POSTAGE NEED BE AFFIXED IF MAILED IN THE UNITED STATES. STOCKHOLDERS MAY ALSO VOTE THEIR SHARES USING THE TWELVE (12) DIGIT CONTROL NUMBER FOUND ON THEIR VOTE INSTRUCTION FORM VIA THE INTERNET AT PROXYVOTE.COM OR BY PHONE AT 1-800-454-8683.

| By Order of the Board of Directors, | ||

| ||

| K. Paul Singh Chairman of the Board of Directors, President and Chief Executive Officer |

25

APPENDIX A

AUDIT COMMITTEE CHARTER

CONTINUOUS ACTIVITIES—GENERAL

CONTINUOUS ACTIVITIES—RE: REPORTING SPECIFIC POLICIES

A-1

SCHEDULED ACTIVITIES

"WHEN NECESSARY" ACTIVITIES

A-2

APPENDIX B

PRIMUS TELECOMMUNICATIONS GROUP, INCORPORATED

STOCK OPTION PLAN

ORIGINALLY EFFECTIVE JANUARY 2, 1995

AMENDED AND RESTATED EFFECTIVE APRIL 30, 2003

PRIMUS TELECOMMUNICATIONS GROUP, INCORPORATED

STOCK OPTION PLAN

Section 1. Purposes.

The purposes of the Plan are (a) to recognize and compensate selected employees and consultants of the Company and its Subsidiaries who contribute to the development and success of the Company and its Subsidiaries; (b) to maintain the competitive position of the Company and its Subsidiaries by attracting and retaining employees and consultants; and (c) to provide incentive compensation to such employees and consultants based upon the Company's performance as measured by the appreciation in Common Stock. The Options granted pursuant to the Plan are intended to constitute either incentive stock options within the meaning of Section 422 of the Code, or non- qualified stock options, as determined by the Board or the Committee at the time of grant. The type of Options granted will be specified in the Option Agreement between the Company and the recipient of the Options. The terms of this Plan shall be incorporated in the Option Agreement to be executed by the Optionee.

Section 2. Definitions.

(a) "Board" shall mean the Board of Directors of the Company, as constituted from time to time.

(b) "Change of Control" shall mean the occurrence of any of the following events:

(i) The acquisition in one or more transactions by any "Person" (as the term person is used for purposes of Sections 13(d) or 14(d) of the Securities Exchange Act of 1934, as amended (the "1934 Act")) of "Beneficial Ownership" (as the term beneficial ownership is used for purposes of Rule 13d-3 promulgated under the 1934 Act) of fifty percent (50%) or more of the combined voting power of the Company's then outstanding voting securities (the "Voting Securities"), provided that for purposes of this Section 2(b)(i), the Voting Securities acquired directly from the Company by any Person shall be excluded from the determination of such Person's Beneficial Ownership of Voting Securities (but such Voting Securities shall be included in the calculation of the total number of Voting Securities then outstanding); or

(ii) Approval by shareholders of the Company of (A) a merger, reorganization or consolidation involving the Company if the shareholders of the Company immediately before such merger, reorganization or consolidation do not or will not own directly or indirectly immediately following such merger, reorganization or consolidation, more than fifty percent (50%) of the combined voting power of the outstanding voting securities of the corporation resulting from or surviving such merger, reorganization or consolidation in substantially the same proportion as their ownership of the Voting Securities immediately before such merger, reorganization or consolidation, or (B) (1) a complete liquidation or dissolution of the Company or (2) an agreement for the sale or other disposition of all or substantially all of the assets of the Company; or

(iii) Acceptance by shareholders of the Company of shares in a share exchange if the shareholders of the Company immediately before such share exchange do not or will not own directly or indirectly immediately following such share exchange more than fifty percent (50%) of the combined voting power of the outstanding voting securities of the corporation resulting from or surviving such share exchange in substantially the same proportion as the ownership of the Voting Securities outstanding immediately before such share exchange.

(c) "Code" shall mean the Internal Revenue Code of 1986, as amended.

(d) "Committee" shall mean the Committee appointed by the Board in accordance with Section 4(a) of the Plan, if one is appointed, in which event, in connection with this Plan, the Committee shall possess all of the power and authority of, and shall be authorized to take any and all actions required to be taken hereunder by, and make any and all determinations required to be made hereunder by, the Board.

(e) "Company" shall mean, Primus Telecommunications Group, Incorporated, a Delaware corporation.

(f) "Common Stock" shall mean common stock of the Company, $.01 par value per share.

(g) "Disability" or "Disabled" shall mean the inability of a Participant or Optionee, as the case may be, to perform his or her normal employment duties for the Company resulting from a mental or physical illness, impairment or any other similar occurrence which can be expected to result in death or which has lasted or can be expected to last for a period of twelve (12) consecutive months, as determined by the Board of Directors.

(h) "Employee" shall mean any person (including officers) employed by the Company or any Subsidiary. Additionally, solely for purposes of determining the persons eligible under the Plan to be granted Options, which Options shall be limited to non-qualified stock options, and not for the purpose of affecting the status of the relationship between such person and the Company, the term "Employee" shall include consultants to the Company; provided, however, that a director of the Company or any Subsidiary shall not be considered to be an Employee of the Company or any Subsidiary for purposes of this Plan solely by reason of serving as such director or receiving compensation from the Company or any Subsidiary for serving as such director.

(i) "Exchange Act" shall mean the Securities Exchange Act of 1934, as in effect from time to time.

(j) "Fair Market Value" shall mean the fair market value of a share of Common Stock, as determined pursuant to Section 7 hereof.

(k) "Non-Employee Director" shall have the meaning set forth in Rule 16b-3(b)(3)(i) promulgated by the Securities and Exchange Commission under the Exchange Act, or any successor definition adopted by the Securities and Exchange Commission; provided, however, that the Board or the Committee may, in its sole discretion, determine from time to time whether the regulations under Section 162(m) of the Code shall apply for purposes of determining which individuals are "Non-Employee Directors."