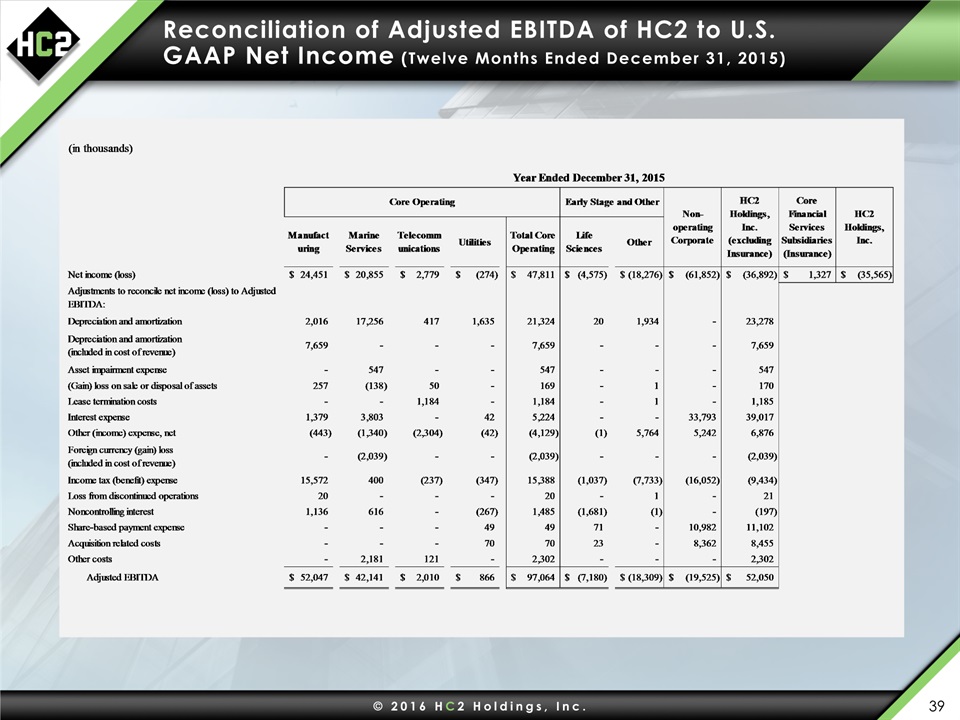

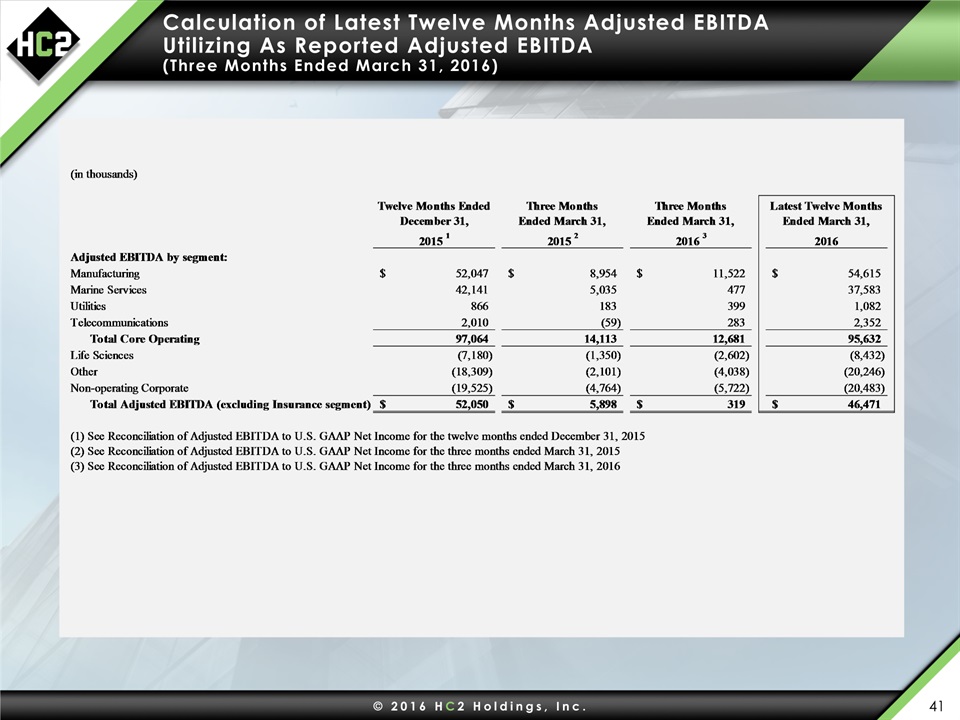

Special Note Regarding Forward-Looking Statements. Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995: This presentation contains, and certain oral statements made by our representatives from time to time may contain, forward-looking statements. Generally, forward-looking statements include information describing actions, events, results, strategies and expectations and are generally identifiable by use of the words “believes,” “expects,” “intends,” “anticipates,” “plans,” “seeks,” “estimates,” “projects,” “may,” “will,” “could,” “might,” or “continues” or similar expressions. The forward-looking statements in this presentation include without limitation statements regarding our expectation regarding building shareholder value. Such statements are based on the beliefs and assumptions of HC2's management and the management of HC2's subsidiaries. The Company believes these judgments are reasonable, but you should understand that these statements are not guarantees of performance or results, and the Company’s actual results could differ materially from those expressed or implied in the forward-looking statements due to a variety of important factors, both positive and negative, that may be revised or supplemented in subsequent reports on Forms 10-K, 10-Q and 8-K. Such important factors include, without limitation, issues related to the restatement of our financial statements; the fact that we have historically identified material weaknesses in our internal control over financial reporting, and any inability to remediate future material weaknesses; capital market conditions; the ability of HC2's subsidiaries to generate sufficient net income and cash flows to make upstream cash distributions; volatility in the trading price of HC2 common stock; the ability of HC2 and its subsidiaries to identify any suitable future acquisition opportunities; our ability to realize efficiencies, cost savings, income and margin improvements, growth, economies of scale and other anticipated benefits of strategic transactions; difficulties related to the integration of financial reporting of acquired or target businesses; difficulties completing pending and future acquisitions and dispositions; effects of litigation, indemnification claims, and other contingent liabilities; changes in regulations and tax laws; and risks that may affect the performance of the operating subsidiaries of HC2. These risks and other important factors discussed under the caption “Risk Factors” in our most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”), and our other reports filed with the SEC could cause actual results to differ materially from those indicated by the forward-looking statements made in this presentation .You should not place undue reliance on forward-looking statements. All forward-looking statements attributable to HC2 or persons acting on its behalf are expressly qualified in their entirety by the foregoing cautionary statements. All such statements speak only as of the date made, and HC2 undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.Non-GAAP Financial Measures In this presentation, HC2 refers to certain financial measures that are not presented in accordance with U.S. generally accepted accounting principles (“GAAP”), including Core Operating Subsidiary Adjusted EBITDA, Total Adjusted EBITDA (excluding Insurance) and Insurance AOI. Management believes that Adjusted EBITDA measures provide investors with meaningful information for gaining an understanding of certain results as it is frequently used by the financial community to provide insight into an organization’s operating trends and facilitates comparisons between peer companies, because interest, taxes, depreciation, amortization and the other items for which adjustments are made as noted in the definition of Adjusted EBITDA below can differ greatly between organizations as a result of differing capital structures and tax strategies. Adjusted EBITDA can also be a useful measure of a company’s ability to service debt. In addition, management uses Adjusted EBITDA measures in evaluating certain of the Company’s segments performance because they eliminate the effects of considerable amounts of noncash depreciation and amortization and items not within the control of the Company’s operations managers. While management believes that these non-US GAAP measurements are useful as supplemental information, such adjusted results are not intended to replace our US GAAP financial results and should be read together with HC2’s results reported under GAAP.Management defines Adjusted EBITDA as Net income (loss) adjusted to exclude the impact of asset impairment expense; gain (loss) on sale or disposal of assets; lease termination costs; interest expense; loss on early extinguishment or restructuring of debt; other income (expense), net; foreign currency transaction gain (loss); income tax (benefit) expense; gain (loss) from discontinued operations; non-controlling interest; share-based compensation expense; acquisition related and other non-recurring costs; other costs and depreciation and amortization. A reconciliation of Adjusted EBITDA to net income, the most comparable measure calculated in accordance with GAAP, is included in the financial tables at the end of this release.Management believes that Insurance AOI measures, used frequently in the insurance industry, provide investors with meaningful information for gaining an understanding of certain results and provides insight into an organization’s operating trends and facilitates comparisons between peer companies. Management defines Insurance AOI as Net income (loss) for the Insurance segment adjusted to exclude the impact of net investment gains (losses), including other-than-temporary impairment losses recognized in operations; other income and expense/intercompany elimination and acquisition related and non-recurring costs. Management believes that Insurance AOI provides a meaningful financial metric that helps investors understand certain results and profitability. While these adjustments are an integral part of the overall performance of the Insurance segment, market conditions impacting these items can overshadow the underlying performance of the business. Accordingly, we believe using a measure which excludes their impact is effective in analyzing the trends of our operations.By accepting this document, each recipient agrees to and acknowledges the foregoing terms and conditions. Safe Harbor Disclaimers 1