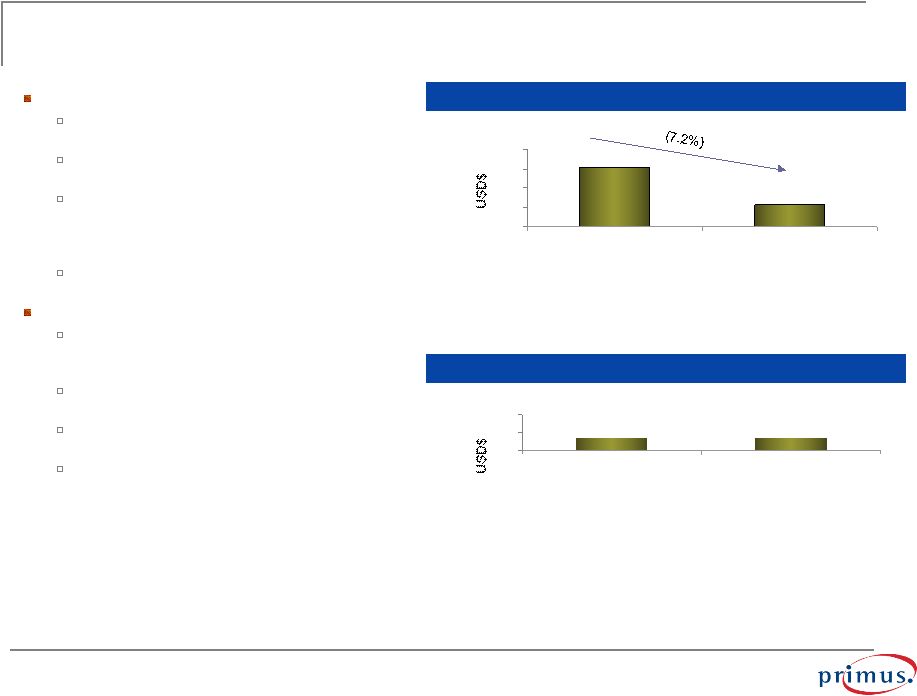

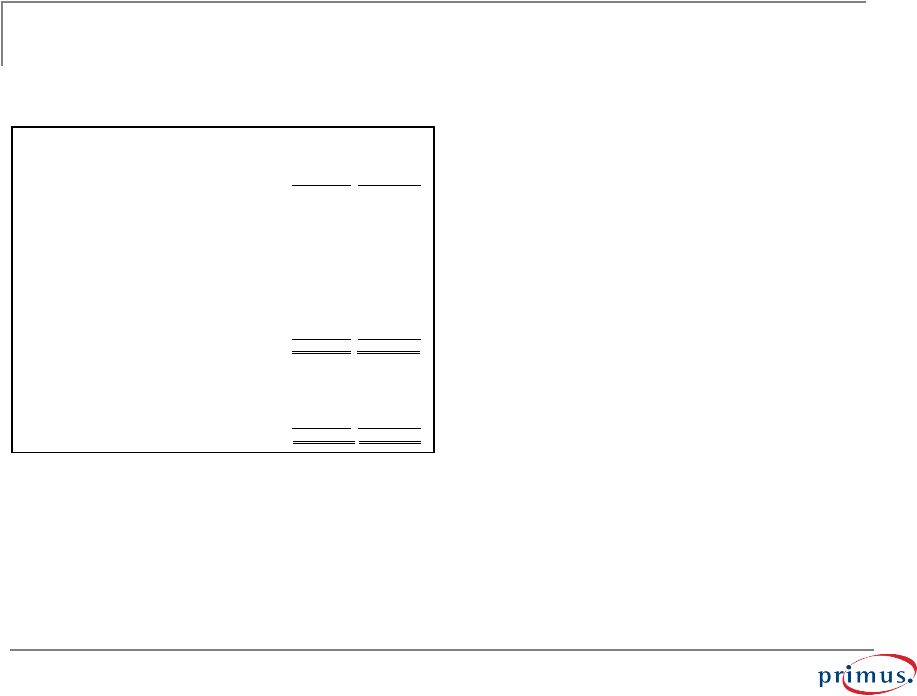

Appendix Non-GAAP Measures 20 September 23, 2009 Adjusted EBITDA Adjusted EBITDA, as defined by us, consists of net income (loss) before reorganization items, net, interest, taxes, depreciation, amortization, share-based compensation expense, gain (loss) on sale of assets, gain (loss) on disposal of assets, asset impairment expense, gain (loss) on early extinguishment or restructuring of debt, foreign currency transaction gain (loss), minority interest income (expense), extraordinary items, other income (expense), income (loss) from discontinued operations, accretion on debt premium and income (loss) from sale of discontinued operations. Our definition of Adjusted EBITDA may not be similar to Adjusted EBITDA measures presented by other companies, is not a measurement under generally accepted accounting principles in the United States, and should be considered in addition to, but not as a substitute for, the information contained in our statements of operations. We believe Adjusted EBITDA is an important performance measurement for our investors because it gives them a metric to analyze our results, exclusive of reorganization and restructuring items, certain non-cash items and items which do not directly correlate to our business of selling and provisioning telecommunications services. We believe Adjusted EBITDA provides further insight into our current performance and period to period performance on a qualitative basis and is a measure that we use to evaluate our results and performance of our management team. Free Cash Flow Free Cash Flow, as defined by us, consists of net cash provided by (used in) operating activities before reorganization items less net cash used in the purchase of property and equipment. Free Cash Flow, as defined above, may not be similar to Free Cash Flow measures presented by other companies, is not a measurement under generally accepted accounting principles in the United States, and should be considered in addition to, but not as a substitute for, the information contained in our consolidated statements of cash flows. We believe Free Cash Flow provides a measure of our ability, after making our capital expenditures and other investments in our infrastructure, to meet scheduled debt payments. We use Free Cash Flow to monitor the impact of our operations on our cash reserves and our ability to generate sufficient cash flow to fund our scheduled debt maturities and other financing activities, including discretionary refinancings and retirements of debt. Because Free Cash Flow represents the amount of cash generated or used in operating activities and used in the purchase of property and equipment before deductions for scheduled debt maturities and other fixed obligations (such as capital leases, vendor financing and other long-term obligations), you should not use it as a measure of the amount of cash available for discretionary expenditures. Non-GAAP Measures ADJUSTED EBITDA Q1 Q2 2009 2009 NET INCOME ATTRIBUTABLE TO PRIMUS TELECOMMUNICATIONS GROUP, INCORPORATED 13,991 $ 25,366 $ Reorganization items, net (16,568) 8,271 Share-based compensation expense 16 11 Depreciation and amortization 6,096 6,250 (Gain) loss on sale or disposal of assets (59) 16 Interest expense 10,776 3,359 Accretion on debt premium, net (189) - Interest and other income (235) (161) Foreign currency transaction (gain) loss 3,049 (24,170) Income tax (benefit) expense 2,797 1,110 Minority interest income (expense) (136) 104 Loss from discontinued operations, net of tax 393 283 Gain from sale of discontinued operations, net of tax (251) - ADJUSTED EBITDA 19,680 $ 20,439 $ FREE CASH FLOW NET CASH PROVIDED BY OPERATING ACTIVITIES BEFORE REORGANIZATION ITEMS 4,643 $ 17,097 $ Net cash used in purchase of property and equipment (2,786) (2,874) FREE CASH FLOW 1,857 $ 14,223 $ |