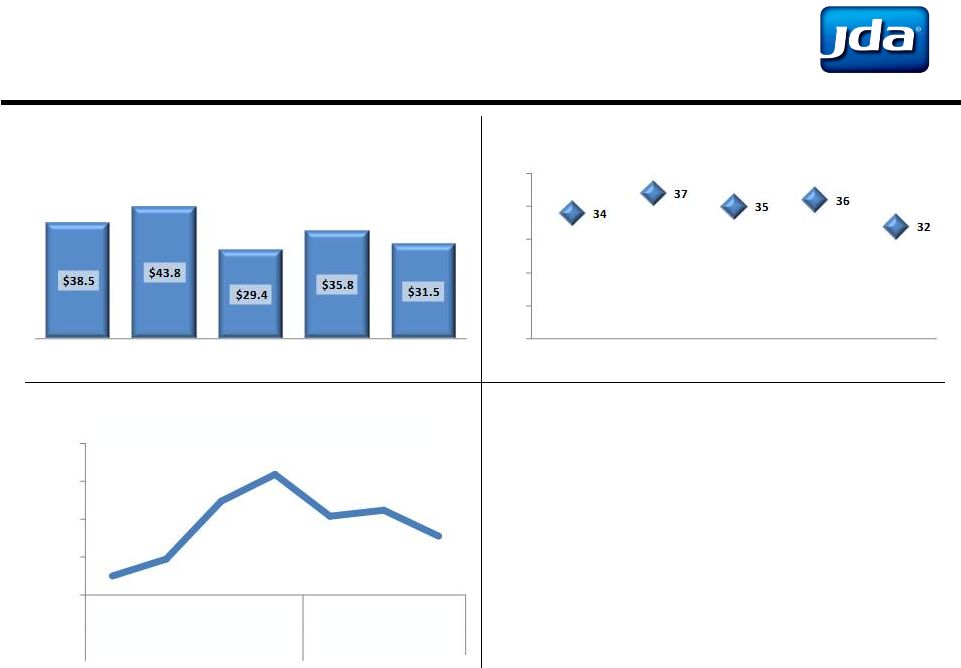

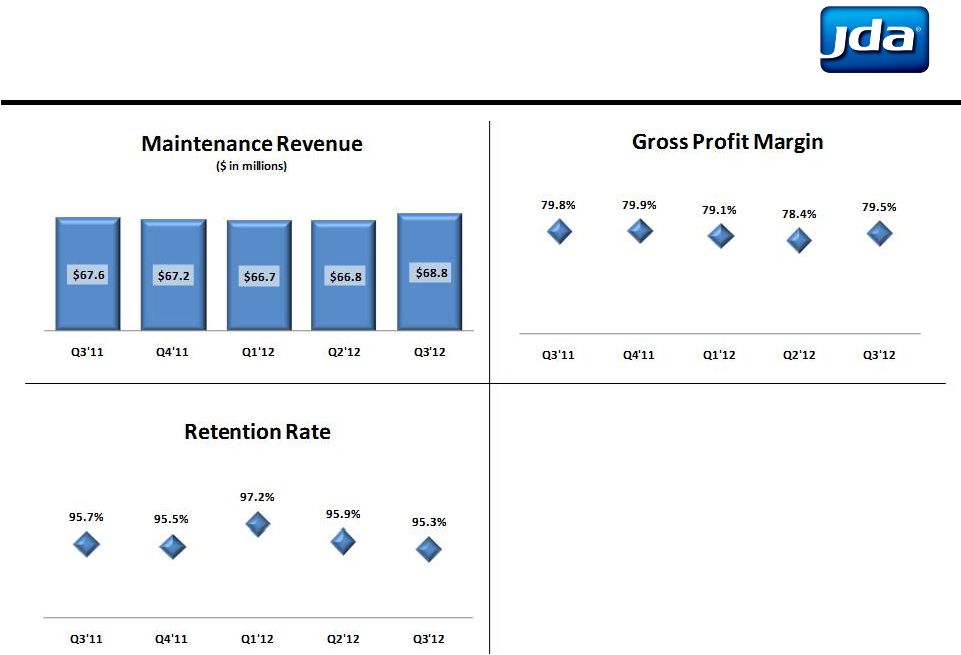

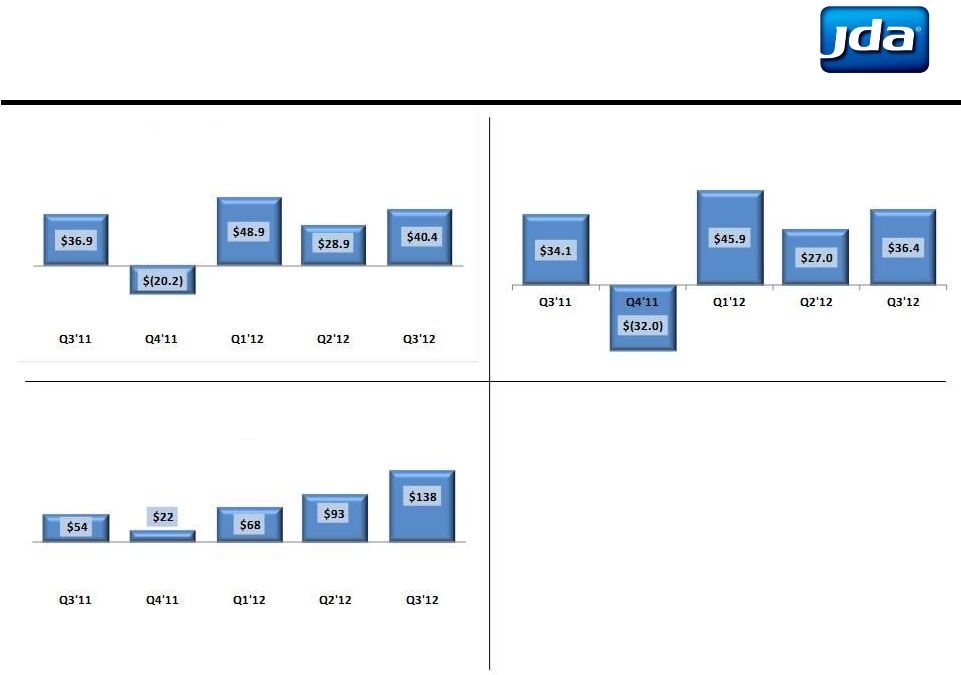

Copyright 2011 JDA Software Group, Inc. - CONFIDENTIAL Non-GAAP Reconciliations¹ Actual Results Notes: 1. Amounts may not add due to rounding ($'s in millions, except per share data) Q3 2011 Q4 2011 Q1 2012 Q2 2012 Q3 2012 Net Income 18.3 $ 3.6 $ 4.7 $ 10.6 $ 11.1 $ Income tax provision (benefit) 11.4 (1.4) 2.8 6.3 7.4 Interest expense & amortization of loan fees 6.4 6.4 6.4 6.5 6.6 Amortization of acquired software technology 1.7 1.7 1.7 1.7 1.7 Amortization of intangibles 9.6 9.5 9.5 9.5 9.5 Depreciation 3.2 3.3 3.7 3.8 3.8 EBITDA 50.7 $ 23.2 $ 28.8 $ 38.5 $ 40.1 $ Restructuring charges 0.8 0.6 2.2 0.2 (0.2) Stock-based compensation 2.1 0.9 2.9 1.7 4.2 Litigation provision and settlements, net - 39.0 - - - Investigation and restatement costs - - 5.2 5.5 1.7 Interest income and other non-operating income, net (0.6) (1.2) (0.3) (1.6) (1.3) Adjusted EBITDA 52.9 $ 62.6 $ 38.9 $ 44.2 $ 44.5 $ Income Before Taxes 29.7 $ 2.2 $ 7.5 $ 16.9 $ 18.5 $ Amortization of acquired software technology 1.7 1.7 1.7 1.7 1.7 Amortization of intangibles 9.6 9.5 9.5 9.5 9.5 Restructuring charges 0.8 0.6 2.2 0.2 (0.2) Stock-based compensation 2.1 0.9 2.9 1.7 4.2 Litigation provision and settlements, net - 39.0 - - - Investigation and restatement costs - - 5.2 5.5 1.7 Adjusted Income Before Income Taxes 43.9 $ 54.0 $ 29.1 $ 35.5 $ 35.4 $ Adjusted Income Tax Expense (15.4) (18.9) (10.2) (12.4) (12.4) Adjusted Net Income 28.5 $ 35.1 $ 18.9 $ 23.1 $ 23.0 $ Adjusted Non-GAAP Diluted EPS 0.67 $ 0.82 $ 0.44 $ 0.54 $ 0.53 $ |