SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

April 5, 2005

TRUMP HOTELS & CASINO RESORTS, INC.

(Exact name of registrant as specified in its charter)

| | | | |

| Delaware | | 1-13794 | | 13-3818402 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

| | |

1000 Boardwalk at Virginia Avenue Atlantic City, New Jersey | | 08401 |

| (Address of principal executive offices) | | (Zip Code) |

609-449-6515

(Registrant’s telephone number, including area code)

TRUMP ATLANTIC CITY ASSOCIATES

(Exact name of registrant as specified in its charter)

| | | | |

| New Jersey | | 333-00643 | | 22-3213714 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

| | |

1000 Boardwalk at Virginia Avenue Atlantic City, New Jersey | | 08401 |

| (Address of principal executive offices) | | (Zip Code) |

609-449-6515

(Registrant’s telephone number, including area code)

TRUMP ATLANTIC CITY FUNDING, INC.

(Exact name of registrant as specified in its charter)

| | | | |

| Delaware | | 333-00643 | | 22-3418939 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

| | |

1000 Boardwalk at Virginia Avenue Atlantic City, New Jersey | | 08401 |

| (Address of principal executive offices) | | (Zip Code) |

609-449-6515

(Registrant’s telephone number, including area code)

TRUMP ATLANTIC CITY FUNDING II, INC.

(Exact name of registrant as specified in its charter)

| | | | |

| Delaware | | 333-43979 | | 22-3550202 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

| | |

1000 Boardwalk at Virginia Avenue Atlantic City, New Jersey | | 08401 |

| (Address of principal executive offices) | | (Zip Code) |

609-449-6515

(Registrant’s telephone number, including area code)

TRUMP ATLANTIC CITY FUNDING III, INC.

(Exact name of registrant as specified in its charter)

| | | | |

| Delaware | | 333-43975 | | 22-3550203 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

| | |

1000 Boardwalk at Virginia Avenue Atlantic City, New Jersey | | 08401 |

| (Address of principal executive offices) | | (Zip Code) |

609-449-6515

(Registrant’s telephone number, including area code)

TRUMP CASINO HOLDINGS, LLC

(Exact name of registrant as specified in its charter)

| | | | |

| Delaware | | 333-104916 | | 45-0475879 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

| | |

C/O Trump Hotels & Casino Resorts Holdings, LP 1000 Boardwalk at Virginia Avenue Atlantic City, New Jersey | | 08401 |

| (Address of principal executive offices) | | (Zip Code) |

609-449-6515

(Registrant’s telephone number, including area code)

TRUMP CASINO FUNDING, INC.

(Exact name of registrant as specified in its charter)

| | | | |

| Delaware | | 333-104916 | | 45-0475877 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

| | |

C/O Trump Hotels & Casino Resorts Holdings, LP 1000 Boardwalk at Virginia Avenue Atlantic City, New Jersey | | 08401 |

| (Address of principal executive offices) | | (Zip Code) |

609-449-6515

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.03 Bankruptcy or Receivership.

| | (b) | Order Confirming Plan of Reorganization |

On April 5, 2005, the United States Bankruptcy Court for the District of New Jersey (the “Bankruptcy Court”) entered an order (the “Confirmation Order”) confirming the Second Amended Joint Plan of Reorganization, as amended (the “Plan”), of Trump Hotels & Casino Resorts, Inc. (the “Company” or “THCR”) and certain of its subsidiaries (collectively, the “Debtors”) under chapter 11 of the United States Bankruptcy Code (the “Bankruptcy Code”). On April 8, 2005, the Debtors filed a stipulation (the “Stipulation”) regarding an amended confirmation order (the “Amended Confirmation Order”), which the Bankruptcy Court approved on April 11, 2005. The Debtors had filed voluntary petitions for relief with the Bankruptcy Court under chapter 11 of the Bankruptcy Code on November 21, 2004.

A copy of the Plan, Confirmation Order, Amended Confirmation Order, Stipulation and press release announcing the confirmation of the Plan are attached or incorporated by reference hereto as Exhibits 2.1, 2.2, 2.3, 2.4 and 99.1, respectively. The Plan, Confirmation Order, Amended Confirmation Order and other documents and information concerning the Debtors’ chapter 11 cases are available on the Debtors’ website in connection with the bankruptcy proceedings atwww.THCRrecap.com. The internet address provided in this Current Report on Form 8-K is not intended to act as a hyperlink and the information therein is not and should not be considered part of this report and is not incorporated by reference in this document.

Summary of the Plan

Set forth below is a summary of certain material provisions of the Plan that is qualified in its entirety by reference to the Plan itself. The general terms and conditions of the Plan were initially set forth in the restructuring support agreement, dated as of October 20, 2004, among certain of the Debtors, Donald J. Trump, certain holders of the 11.25% First Mortgage Notes due 2006 of Trump Atlantic City Associates and Trump Atlantic City Funding Inc., Trump Atlantic City Funding II, Inc. and Trump Atlantic City Funding III, Inc. (collectively, the “TAC Notes”) and certain holders of the 11.625% First Priority Mortgage Notes due 2010 (the “TCH First Priority Notes”) and the 17.625% Second Priority Mortgage Notes due 2010 (the “TCH Second Priority Notes,” together with the TCH First Priority Notes, the “TCH Notes”) of Trump Casino Holdings, LLC and Trump Casino Funding, Inc.

2

Debt Restructuring. The Plan involves a restructuring of the TAC Notes, TCH First Priority Notes and TCH Second Priority Notes (as well as a reverse stock split involving the Company’s common stock), described below:

| | • | | Holders of TAC Notes would exchange their notes, approximately $1.3 billion aggregate principal face amount, for approximately $777.3 million aggregate principal amount of New Notes (as defined below), approximately $384.3 million of common stock (approximately 63.69% of the shares of common stock of the recapitalized Company on a fully diluted basis (excluding any shares reserved for issuance under management stock incentive plans)), and an additional amount in cash equal to simple interest accrued on approximately $777.3 million of New Notes at the annual rate of 8.5% from the last scheduled date to which interest was paid with respect to the TAC Notes (or May 1, 2004) through the effective date of the Plan. In addition, on or following the first anniversary of the effective date, holders of TAC Notes would receive (i) the cash proceeds from the exercise of New Class A Warrants (as defined below), plus any interest accrued thereon and (ii) if any of the New Class A Warrants are not exercised, the shares of the recapitalized Company’s common stock reserved for issuance upon exercise of such warrants. |

| | • | | Holders of TCH First Priority Notes, approximately $425 million aggregate principal face amount, would exchange their notes for approximately $425 million aggregate principal amount of New Notes, $21.25 million in cash, approximately $8.5 million of common stock (approximately 1.41% of the shares of common stock of the recapitalized Company on a fully diluted basis (excluding any shares reserved for issuance under management stock incentive plans)), and an additional amount in cash equal to simple interest accrued on $425 million at the annual rate of 12.625% through the effective date of the Plan (such payments to be made on the regularly scheduled interest payment dates for the TCH First Priority Notes). |

| | • | | The unaffiliated holders of TCH Second Priority Notes, approximately $54.6 aggregate principal face amount, would exchange their notes for approximately $47.7 million aggregate principal amount of New Notes, approximately $2.3 million in cash, approximately $2.1 million of common stock (approximately 0.35% of the shares of common stock of the recapitalized Company on a fully diluted basis (excluding shares reserved for issuance under management stock incentive plans)) and an additional amount in cash equal to simple interest accrued on (i) $54.6 million at the annual rate of 18.625% from the last scheduled date to which interest was paid with respect to the TCH Second Priority Notes to the date that is ninety days after the petition date for the chapter 11 cases (or February 21, 2005), and (ii) approximately $47.7 million at the annual rate of 8.5% from the ninety-first day after the petition date (or February 22, 2005) through the effective date of the Plan. |

The “New Notes” would be issued by Trump Hotels & Casino Resorts Holdings, LP (“THCR Holdings”) and Trump Hotels & Casino Resorts Funding, Inc. (“THCR Funding”), bear interest at an annual rate of 8.5% and have a ten-year maturity. The New Notes would be secured by a security interest in substantially all of the Debtors’ real property and incidental personal property and certain other assets of the Debtors, subject to liens securing a $500 million working capital and term loan facility (the “Exit Facility”) to be entered into on the effective date of the Plan and certain other permitted liens.

The Company’s existing common stockholders would receive nominal amounts of common stock of the recapitalized Company (approximately 0.05% of the shares on a fully diluted basis for holders other than Mr. Trump (excluding shares reserved for issuance under management stock incentive plans)). Such existing holders (other than Mr. Trump) would receive New Class A Warrants (as defined below) to purchase up to approximately 5.34% of the recapitalized Company’s common stock on a fully diluted basis (excluding shares reserved for issuance under management stock incentive plans), as described below. All existing options to acquire common stock of the Company or its affiliates would be cancelled. The Company’s common stockholders (excluding Mr. Trump) would also receive an aggregate of $17.5 million in cash, as well as the net proceeds of the sale of a parcel of land owned by the Debtors in Atlantic City, New Jersey constituting the former World’s Fair site, which may be developed for non-gaming related use. The sale of such property would occur after the effective date of the Plan.

On the effective date, the Debtors would issue one-year warrants (the “New Class A Warrants”) to purchase shares of the recapitalized Company’s common stock at an aggregate purchase price of $50 million, or approximately 8.29% of the Company’s fully diluted common stock (excluding any shares reserved for issuance under management stock incentive plans). The Company’s common stockholders (excluding Mr. Trump) would receive New Class A Warrants to purchase up to approximately 5.34% of the recapitalized Company’s common stock and Mr. Trump would receive New Class A Warrants to purchase approximately 2.95% of the recapitalized Company’s common stock. Proceeds from the exercise of New Class A Warrants (plus any interest accrued thereon), and any shares reserved for issuance of such warrants that have not been exercised, would be distributed to holders of TAC Notes on or following the first anniversary of the effective date of the Plan.

3

The Company is unable to predict the price or range of prices of the recapitalized Company’s common stock, New Class A Warrants or New Notes that would be issued in connection with the Plan. The value of the recapitalized Company’s common stock, as provided in the Plan and stated above, is based on the per share purchase price at which Mr. Trump makes his investment (as described below), or an assumed pro forma total equity value of the recapitalized Company of approximately $582.3 million. This assumed pro forma equity value, which appears in the Debtors’ disclosure statement (which was filed as Exhibit T3E-1 to THCR Holdings’ Application for Qualification of Indenture on Form T-3, filed with the Securities and Exchange Commission on April 8, 2005) in connection with the Plan, has not been determined in accordance with generally accepted accounting principles and is not a guarantee or forecast of predicted value of the recapitalized Company.

As part of the Plan, the Company would implement a 1,000 for 1 reverse stock split of the existing common stock of the Company, such that each 1,000 shares of common stock immediately prior to the reverse stock split would be consolidated into one share of new common stock of the recapitalized Company. The aggregate fractional share interests beneficially owned by each holder of existing shares of common stock would be rounded up to the nearest whole number. As of April 8, 2005, the Company had 29,904,764 shares of common stock and 1,000 shares of class B common stock (having a voting equivalency of 13,918,723 shares of the Company’s common stock) issued and outstanding. On the Effective Date, following the reverse stock split, the Company expects to issue or reserve for issuance 41,334,460 shares of common stock (including shares reserved for issuance upon the exchange of limited partnership interests, DJT Warrants (as defined below) and New Class A Warrants under the Plan, but excluding any shares of common stock reserved for issuance under management incentive plans) and 900 shares of class B common stock (having a voting equivalency of the shares of the recapitalized Company’s common stock issuable upon the exchange of limited partnership interests in THCR Holdings). On or following the effective date of the Plan, the Company expects to apply to have its common stock listed on the NYSE or, if the Company is unable to have its common stock listed on the NYSE, the Nasdaq national market system or small cap system or other trading market.

Donald J. Trump Investment. Pursuant to the Plan and an investment agreement entered among Donald J. Trump, THCR and THCR Holdings on January 25, 2005, on the effective date of the Plan, Donald J. Trump would, among other things:

| | • | | invest $55 million in cash and contribute $16.4 million aggregate principal amount of TCH Second Priority Notes beneficially owned by him (including interest accrued thereon) to the Debtors, in exchange for shares of stock (and/or common stock equivalents) of the recapitalized Company; |

| | • | | enter into a new services agreement with the Company, which would have a three-year rolling term, pay Mr. Trump $2.0 million per year, plus a discretionary annual bonus, reimburse Mr. Trump for certain travel and customary administrative expenses incurred by Mr. Trump in his capacity as chairman, and terminate his existing executive agreement; |

| | • | | grant THCR Holdings a perpetual, exclusive, royalty-free license to use his name and likeness in connection with the Debtors’ casino and gaming activities, subject to certain terms and conditions, and terminate his existing trademark license agreement with the Company; |

| | • | | cause the Trump Organization LLC, Mr. Trump’s controlled affiliate, to enter into a three-year right of first offer agreement with THCR and THCR Holdings, pursuant to which the Trump Organization LLC would be granted a three-year right of first offer to serve as project manager, construction manager and/or general contractor with respect to construction and development projects for casinos, casino hotels and related lodging to be performed by third parties on the Company’s existing and future properties, subject to certain terms and conditions; |

| | • | | enter into a voting agreement with the Company that would determine the composition of the recapitalized Company’s board of directors for a certain period (as described below under “Board of Directors of Reorganized Company”), subject to certain terms and conditions and applicable law; |

| | • | | enter into an amended and restated partnership agreement of THCR Holdings, which would, among other things, require the affirmative vote of Mr. Trump with respect to the sale or transfer of one or more of the Company’s current properties; provided, however, that the Company could sell or transfer such properties without Mr. Trump’s consent if THCR Holdings indemnified Mr. Trump up to an aggregate of $100 million for the U.S. federal income tax consequences to Mr. Trump associated with such sale or transfer; and |

| | • | | receive THCR Holdings’ 25% interest in the Miss Universe Pageant. |

4

Upon consummation of the Plan, Mr. Trump would beneficially own approximately 29.16% of the recapitalized Company’s common stock (and/or common stock equivalents) on a fully-diluted basis (excluding shares reserved for issuance under management stock incentive plans), consisting of (i) approximately 9.12% in exchange for Mr. Trump’s $55 million cash investment, (ii) approximately 2.53% in exchange for Mr. Trump’s contribution of approximately $16.4 million aggregate principal face amount of TCH Second Priority Notes beneficially owned by him (including interest accrued thereon), (iii) approximately 11.02% in return for entering into the trademark license agreement described above and agreeing to modifications to certain existing contractual relationships between Mr. Trump and the Debtors (including entering into the new services agreement described above), (iv) approximately 0.06% representing his existing equity interests after dilution upon the issuance of the recapitalized Company’s common stock, (v) approximately 3.5% issuable upon the exercise of certain ten-year warrants (the “DJT Warrants”) to be issued to Mr. Trump upon consummation of the Plan, having an exercise price equal to 1.5 times the per share purchase price at which Mr. Trump makes his $55 million investment and (vi) approximately 2.95% issuable upon exercise of the New Class A Warrants to be issued to Mr. Trump upon consummation of the Plan.

Board of Directors of Reorganized Company. The recapitalized Company’s board of directors would consist of nine members. Initially, five directors (the “Class A Directors”) must be acceptable to the informal committee of certain holders of TAC Notes (the “TAC Noteholder Committee”), and three directors (one of whom shall be Mr. Trump, as Chairman) (the “DJT Directors”) must be acceptable to Mr. Trump. The ninth director shall be mutually acceptable to the TAC Noteholder Committee and Mr. Trump (the “Joint Director”). Based on the information submitted by the TAC Noteholder Committee and Donald J. Trump to the Bankruptcy Court on April 5, 2005, the Company’s board of directors is expected to consist of the following individuals as of the Effective Date:

DJT Directors

Donald J. Trump (Chairman)

Wallace B. Askins

Don M. Thomas

Class A Directors

Edward H. D’Alelio

Cezar M. Froelich

Morton H. Handel

Michael A. Kramer

James B. Perry

Joint Director

James J. Florio

The Plan contemplates that Mr. Trump would enter into a voting agreement that would provide for the continued election of Class A Directors (and any person selected by a majority of Class A Directors then serving as directors to fill any vacancy) until the earlier of (i) the date immediately following the date of the sixth annual meeting of the Company’s stockholders following the effective date of the Plan and (ii) such time as the stockholders of the recapitalized Company shall fail to elect Mr. Trump to the Company’s board of directors, subject to certain terms and conditions. Until the Company and THCR Holdings terminated Mr. Trump’s services agreement for “Cause,” (i) Mr. Trump would have the right to designate up to three directors (along with a ninth director that must be mutually acceptable to Mr. Trump and a majority of Class A Directors), subject to adjustment based on Mr. Trump’s beneficial ownership of shares of the recapitalized Company’s common stock and (ii) Mr. Trump would serve on each committee of the recapitalized Company’s board of directors, other than the compensation committee and audit committee.

The directors would be divided into three classes, each having staggered three-year terms. One of Mr. Trump’s designees, one of the Class A Directors and the Joint Director would serve in the class of directors whose terms would expire at the first annual meeting of stockholders following their election. One of Mr. Trump’s designees and two of the Class A Directors would serve in the class of directors whose terms would expire at the second annual meeting of stockholders following their election. Mr. Trump and two of the Class A Directors would serve in the class of directors whose terms would expire at the third annual meeting of stockholders following their election. The foregoing arrangements with respect to the recapitalized Company’s board of directors would be subject to applicable law (including applicable approvals from gaming authorities), fiduciary duties and stock exchange and securities market rules.

5

Under the Plan, the current members of the Company’s management may serve in their respective positions through the first meeting of the board of directors after the effective date of the Plan, which would take place no later than thirty days after the effective date. A majority of the recapitalized Company’s board of directors would select the senior management of the Debtors, which may include current members of management, subject to mutually acceptable terms of employment.

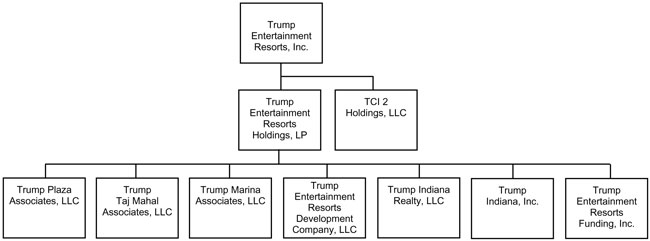

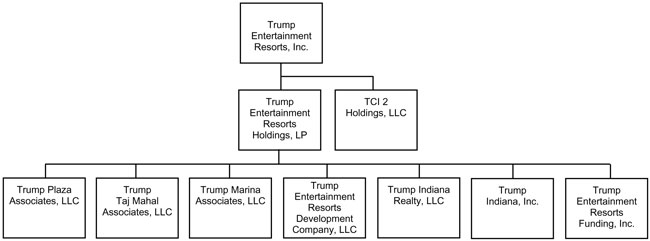

Corporate Reorganizations. On or prior to the effective date of the Plan, certain subsidiaries of the Company would be dissolved or merged out of existence, and other subsidiaries currently existing as partnerships, including Trump Taj Mahal Associates, Trump Plaza Associates and Trump Marina Associates, L.P, would be converted or merged into limited liability companies in the applicable state of organization. In addition, Trump Casinos II, Inc., which is wholly owned by Mr. Trump, would merge into TCI 2 Holdings, LLC, a Delaware limited liability company and wholly-owned subsidiary of THCR. On or prior to the Effective Date, Trump Hotels & Casino Resorts, Inc. would be renamed Trump Entertainment Resorts, Inc., Trump Hotels & Casino Resorts Holdings, LP would be renamed Trump Entertainment Resorts Holdings, LP., Trump Hotels & Casino Resorts Funding, Inc. would be renamed Trump Entertainment Resorts Funding, Inc. and Trump Hotels & Casino Resorts Development Company, LLC would be renamed Trump Entertainment Resorts Development Company, LLC.

The following chart shows the proposed corporate structure of the reorganized Company after consummation of the Plan:

DIP Facility and Exit Facility. On November 22, 2004, the Debtors entered into a debtor-in-possession financing (the “DIP Facility”) providing up to $100 million of borrowings during the Debtors’ chapter 11 cases, secured by a first priority priming lien on substantially all the assets of the Debtors, including the assets securing the TAC Notes and TCH Notes. On the effective date of the Plan, the Debtors expect to enter into the Exit Facility, which would be secured by a first priority security interest in substantially all the Debtors’ assets, senior to the liens securing the New Notes. The Company expects to use the proceeds from the Exit Facility to repay the DIP Facility, fund deferred capital expenditures, pay transaction expenses in connection with the restructuring and finance future expansion of the Debtors’ properties, among other uses.

Although the Bankruptcy Court entered the Confirmation Order on April 5, 2005 and the Amended Confirmation Order on April 11, 2005, the Debtors have yet to consummate the Plan and the Plan is not yet effective. The Plan and Amended Confirmation Order contain certain conditions that must be satisfied or waived prior to the effective date of the Plan. The Debtors anticipate that the effective date will occur in early May 2005. However, the Debtors can make no assurances as to when, or ultimately if, the Plan will become effective. The Debtors and certain other parties may also amend the Plan and the documents ancillary thereto prior to the effective date of the Plan.

As of February 28, 2005, the Company had consolidated total assets of approximately $1,986,677,000 and consolidated total liabilities of approximately $2,201,389,000. The Debtors consolidating balance sheets and monthly operating reports are available on the Debtors’ website atwww.THCRrecap.com.

Item 7.01. Regulation FD Disclosure.

Attached as Exhibit 99.1 hereto is a press release, dated April 6, 2005, issued by the Company regarding confirmation of the Plan, among other things. Such exhibit shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

6

Cautionary Statement Regarding Forward-Looking Statements

The Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for forward-looking statements so long as those statements are identified as forward-looking and are accompanied by meaningful cautionary statements identifying important factors that could cause actual results to differ materially from those projected in such statements.

The information contained herein includes statements reflecting assumptions, expectations, projections, intentions or beliefs about future events that are intended as “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The forward-looking statements made herein are intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. All statements included herein, other than statements of historical fact, that address activities, events or developments that the Company expects, believes or anticipates will or may occur in the future are forward-looking statements. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance and achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. This can occur as a result of inaccurate assumptions or as a consequence of known or unknown risks and uncertainties. You can identify these statements by the fact that they do not relate strictly to historical or current facts. They use words such as “anticipate,” “estimate,” “intend,” “plan,” “project,” “forecast,” “may,” “predict,” “target,” “potential,” “proposed,” “contemplated,” “will,” “should,” “could,” “would,” “expect” and other words of similar meaning. Any or all of the forward-looking statements may turn out to be wrong. They can be affected by inaccurate assumptions or by known or unknown risks, uncertainties and other factors.

These risks, uncertainties and other factors include the following risks as well as other factors described from time to time in our reports filed with the Securities and Exchange Commission, including our ability to consummate the Plan (or any significant delay with respect thereto); our ability to execute definitive transaction documents in connection with the Plan and perform our obligations thereunder; the instructions, orders and decisions of the Court in connection with the Plan, and related effects of legal and administrative proceedings, settlements, investigations and claims; the duration of the chapter 11 proceedings, including our ability to obtain waivers, if necessary, from the holders of TAC Notes and TCH Notes (and the informal committees representing such holders in connection with the Plan) to extend the effective date of the Plan; the impact of the Plan on the Company’s liquidity and results of operations going forward, including the impact on the Company’s ability to negotiate favorable terms with suppliers, customers, landlords and others; the Company’s ability to operate pursuant to the terms of the DIP Facility; the Company’s alternatives if the Plan is not consummated, including undertaking transactions that may have unforeseeable consequences to the holders of the Company’s common stock and the debt of its subsidiaries and/or other creditors and stakeholders; high levels of indebtedness that will remain even if the Plan is consummated, which will continue to constrain the Company’s financial and operating activities; risks associated with changes in the Company’s board of directors, management and stockholders upon emergence from bankruptcy; the Company’s preparation and submission of an application to have its common stock listed on the New York Stock Exchange or other trading market if the Company is successful in its efforts to consummate the Plan, and the Company’s ability to obtain such a listing; the uncertainty of the Company’s operating results if it is not able to make certain capital expenditures that it has not been able to make in light of diminished cash flows and high interest expenses; the ability of the Company to continue as a going concern; the ability to fund and execute the Company’s business plan; the ability to attract, retain and compensate key executives and associates; the ability of the Company to attract and retain customers; the effects of environmental and structural building conditions relating to the Company’s properties; access to available and feasible financing and insurance; changes in laws, regulations or accounting standards, insurance premiums and relations with third parties; approvals and decisions of courts, regulators and governmental bodies; judicial decisions, legislative referenda and regulatory actions, including gaming and tax-related actions; the ability of the Company’s customer-tracking programs and marketing to continue to increase or sustain customer loyalty; the Company’s ability to recoup costs of capital investments through higher revenues; acts of war or terrorist incidents; abnormal gaming hold percentages; the effects of competition, including locations of competitors and operating and market competition; and the effect of economic, credit and capital market conditions on the economy in general, and on gaming and hotel companies in particular. Accordingly, the forward-looking statements contained herein may not be realized and may differ significantly from the Company’s actual results. In addition, there may be other factors that could cause the Company’s actual results to be materially different from the results referenced, expressed or implied, in the forward-looking statements. Many of these factors will be important in determining the Company’s actual future results. Consequently, no forward-looking statement can be guaranteed.

All forward-looking statements contained herein, and all subsequent written and oral forward-looking statements attributable to the Company or persons acting on the Company’s behalf are qualified in their entirety by this cautionary statement. Forward-looking statements speak only as of the date they are made, and the Company disclaims any obligation to update any forward-looking statements, including the information contained herein, to reflect events or circumstances after the date hereof, except as otherwise required by applicable law.

7

Item 9.01. Financial Statements and Exhibits.

(c) Exhibits

| | |

Exhibit No.

| | Description

|

| 2.1 | | Debtor’s Second Amended Plan of Reorganization under chapter 11 of the United States Bankruptcy Code, dated March 30, 2005, as amended.* |

| |

| 2.2 | | Order Confirming Second Amended Joint Plan of Reorganization of THCR/LP Corporation et al., dated as of April 5, 2005, and Findings of Fact and Conclusions of Law. |

| |

| 2.3 | | Amended Order Confirming Second Amended Joint Plan of Reorganization of THCR/LP Corporation et al., dated as of April 11, 2005, and Findings of Fact and Conclusions of Law. |

| |

| 2.4 | | Stipulation, dated as of April 8, 2005 (i) setting the Distribution Record Date as March 28, 2005 for purposes of the Second Amended Joint Plan of Reorganization of THCR/LP Corporation et. al., dated as of March 30, 2005, and (ii) changing the Distribution Date of the Election Forms to Holders of TAC Notes and TCH First Priority Notes. |

| |

| 99.1 | | Press Release of Trump Hotels & Casino Resorts, Inc., dated April 6, 2005. |

| * | Filed as Exhibit T3E-2 to THCR Holdings’ Application for Qualification for Indenture on Form T-3, filed April 8, 2005. |

8

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, each of the registrants has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

TRUMP HOTELS & CASINO RESORTS, INC. |

|

/s/ John P. Burke

|

John P. Burke |

Executive Vice President and |

Corporate Treasurer |

Dated: April 11, 2005

| | |

| TRUMP ATLANTIC CITY ASSOCIATES |

| |

| By: | | TRUMP ATLANTIC CITY HOLDING, INC., its Managing General Partner |

| |

| | | /s/ John P. Burke

|

| | | John P. Burke |

| | | Vice President and Treasurer |

Dated: April 11, 2005

| | |

| TRUMP ATLANTIC CITY FUNDING, INC. |

| |

| By: | | /s/ John P. Burke

|

| | | John P. Burke |

| | | Treasurer |

Dated: April 11, 2005

| | |

| TRUMP ATLANTIC CITY FUNDING II, INC. |

| |

| By: | | /s/ John P. Burke

|

| | | John P. Burke |

| | | Treasurer |

Dated: April 11, 2005

9

| | |

| TRUMP ATLANTIC CITY FUNDING III, INC. |

| |

| By: | | /s/ John P. Burke

|

| | | John P. Burke |

| | | Treasurer |

| | | |

Dated: April 11, 2005

| | |

| TRUMP CASINO HOLDINGS, LLC |

| |

| By: | | /s/ John P. Burke

|

| | | John P. Burke |

| | | Executive Vice President |

| | | (Duly Authorized Officer and Principal Financial |

| | | and Accounting Officer) |

Dated: April 11, 2005

| | |

| TRUMP CASINO FUNDING, INC. |

| |

| By: | | /s/ John P. Burke

|

| | | John P. Burke |

| | | Executive Vice President |

| | | (Duly Authorized Officer and Principal Financial |

| | | and Accounting Officer) |

Dated: April 11, 2005

10

EXHIBIT INDEX

| | |

Exhibit No.

| | Description

|

| 2.2 | | Order Confirming Second Amended Joint Plan of Reorganization of THCR/LP Corporation et al., dated as of April 5, 2005, and Findings of Fact and Conclusions of Law. |

| |

| 2.3 | | Amended Order Confirming Second Amended Joint Plan of Reorganization of THCR/LP Corporation et al., dated as of April 11, 2005, and Findings of Fact and Conclusions of Law. |

| |

| 2.4 | | Stipulation, dated as of April 8, 2005 (i) setting the Distribution Record Date as March 28, 2005 for purposes of the Second Amended Joint Plan of Reorganization of THCR/LP Corporation et. al., dated as of March 30, 2005, and (ii) changing the Distribution Date of the Election Forms to Holders of TAC Notes and TCH First Priority Notes. |

| |

| 99.1 | | Press Release of Trump Hotels & Casino Resorts, Inc., dated April 6, 2005. |

11