309 Greenwich Ave

Suite 201

Greenwich, CT 06830

September 26, 2019

Unico American Corporation

Attn: Mr. Cary Cheldin, Chairman

26050 Mureau Rd

Calabasas, CA 91302

Dear Mr. Cheldin:

I am writing to you on behalf of Ambina Partners, LLC (“Ambina”) which, together with its affiliates, owns more than 8% of the outstanding common stock of Unico American Corporation (NASDAQ: UNAM) (“Unico” or the “Company”). Ambina is disappointed with Unico’s corporate governance, operating and share price performance. Although Ambina is a long-term investor that engages constructively with its portfolio companies, Unico’s Board of Directors (the “Board”) and management team have refrained from addressing our concerns. Our hope is that this letter will persuade the Board to reevaluate its stance on engaging with us.

Our View: Unico Stands At A Crossroads

In our view, Unico’s leadership no longer has the confidence of its shareholders, its stakeholders and the broader marketplace as evidenced by:

| • | | the sustained decline in its share price; |

| • | | the rating downgrade by AM Best; |

| • | | concerns about the Board’s independence and ability to serve as a check on management; |

| • | | a premium decline reflecting a loss of confidence among its producers; |

| • | | perceived difficulty among producers to transact with Crusader versus its peers; |

| • | | repeated delays in developing, purchasing or implementing information technology systems; and |

| • | | adverse development of its loss reserves due to what appears to be claims mismanagement. |

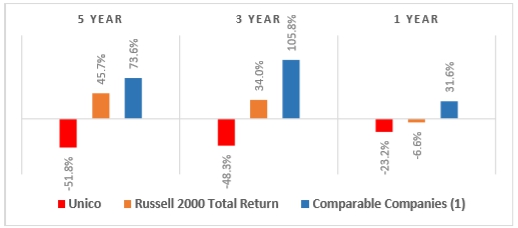

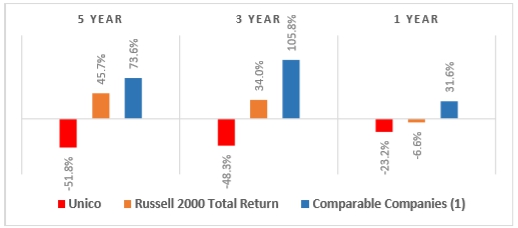

Shareholders holding Unico shares over the past five years have lost more than 50% of their value vs. a 46% increase in the Russell 2000—representing a delta of close to 100%. Such total shareholder return figures suggest fundamental issues exist with the Company.

Note: Calculations as of September 18th, 2019 including total returns.

(1) Average return for specialty insurance companies including: EMCI, GBLI, HALL, JRVR, KNSL, and UFCS. Five year return calculation excludes James River Group (JRVR) and Kinsale Capital Group (KNSL) which went public after September 18th, 2014.

In recent years, we have attempted to enter into a constructive dialogue with Unico’s leadership in order to improve the Company’s financial performance, corporate governance and shareholder communication. Our objective has been to provide suggestions that, if implemented and executed successfully, would have helped the Company reverse its downward trajectory. Our recommendations are based on decades of experience investing in the insurance industry and in small-cap public companies.

However, Unico has disregarded our recommendations, which we interpret as a lack of attention to maximizing shareholder and stakeholder value.

As a small business specialty insurer writing hard to place lines, Unico should be in a significantly better position today. While Unico has not earned a positive return on equity (ROE) and has declined, small business specialty insurers in general have seen profitable growth over the last few years. In comparison, well run specialty carriers such as Kinsale Capital Group (TK: KNSL), have earned ROEs of 20% with growth rates of over 30%. Please note that ten years ago, Kinsale, which currently has an equity market capitalization in excess of $2.0 billion, had a book value and market capitalization similar to Unico before the two companies’ fortunes diverged.

Our Recommendation: Enhance the Board, Improve Corporate Governance Policies and Consider Viable Alternatives

On July 10, 2019, the Company made a series of changes to its Bylaws which appear to be directed towards providing further indemnification to its Directors and officers. Non-industry standard Bylaws with respect to minority shareholders were not addressed. As an example, we strongly recommend that the Board review Article 2, Section 2 to lower the threshold required to hold a special meeting from 67% to 10%, a threshold advocated by Institutional Shareholder Services and Glass Lewis, the two leading corporate governance advisory firms.

To ensure that all shareholders receive the full benefit of our experience, we recently requested that the

Board of Directors add two individuals put forth as nominees by Ambina. We provided resumes and access to four highly-qualified candidates, each of whom has a background relevant to solving the Company’s current problems. The Company, however, chose not to engage and did not even meet with or interview Ambina’s proposed Directors.

We also recently indicated our interest in acquiring 100% of Unico at an attractive premium to its recent trading price. However, the Company and the Board of Directors chose not to engage with us in discussions.

Taking the above into consideration, we suggest that the Company and its Board take the following actions:

| • | | improve the quality of its Board by adding two of the nominees proposed by Ambina; |

| • | | actively engage with us to discuss any new proposals we may make in the future to acquireUnico; |

| • | | amend the Company’s Bylaws to reflect standards advocated by leading corporate governance organizations, and; |

| • | | provide investors detailed quarterly reporting that includes (x) premium and loss ratios by year and by program/line of business, (y) forward looking premium and earnings estimates and (z) a description of key initiatives being undertaken with dates when each initiative will be completed and the financial and operating results of such initiative. |

Acting on the above points in a timely manner can support Unico’s return to a more successful trajectory and deliver value to shareholders.

We look forward to hearing from you.

Sincerely,

Greg Share

Managing Partner

About Ambina Partners

Ambina is a private investment firm focused on investments in insurance and the financial services industry, including related technology and business services companies. Since 2016, the firm has made eight investments in growth-oriented companies. Ambina was founded and is led by Greg Share who has over 20 years of investing experience. He has served in senior leadership roles at private equity firms including Madison Dearborn Partners, Fortress Investment Group and Moelis & Company. Mr. Share has a history of working closely with management teams and boards to drive value creation. He has helped to build large and lasting businesses through his experience as an early partner at both Moelis and Fortress (each of which became publicly traded entities with market capitalizations exceeding $1 billion) and served as the Chairman and founding equity provider of Kinsale Capital Group (TK: KNSL), where he remains a director. He holds a BSc in Economics from the Wharton School and is a CFA charter holder.