RESCISSION AGREEMENT

RESCISSION AGREEMENT (the “Agreement”) entered into as of the 16th day of February, 2011, by and between AFH Holding & Advisory LLC (“AFH Advisory”), a Delaware limited liability company with an address at 9595 Wilshire Blvd STE 700, Beverly Hills, CA 90212 and Timothy J. Brasel (“Brasel”), an individual with an address at 5770 S Beech Court Greenwood Village, CO 80121.

WHEREAS, AFH Acquisition IV, Inc. (“AFH Acquisition”) is a Delaware corporation with its offices located at 9595 Wilshire Blvd., Suite 700, California 90212; and

WHEREAS, Brasel purchased from AFH Advisory a total of 2,500,000 shares (the “Shares”) of the common stock, par value $0.001 per share of AFH Acquisition (the “Common Stock”) owned by AFH Advisory for an aggregate purchase price equal to $12,500 (the “Purchase Price”) in accordance with the terms and conditions of that certain common stock purchase agreement, dated September 24, 2010 by and between Brasel and AFH Advisory, attached hereto as Exhibit A (the “Purchase Agreement”); and

WHEREAS, the parties entered into that certain agreement, dated February 9, 2011, and attached hereto as Exhibit B (the “Amendment”, and together with the Purchase Agreement, the “Transaction Documents”), pursuant to which the terms of the Purchase Agreement were amended;

WHEREAS, the parties now desire to rescind and nullify the transactions contemplated by the Transaction Documents, in accordance with the terms and conditions of this Agreement.

NOW, THEREFORE, in consideration of the promises and the mutual agreements herein contained, Brasel and AFH Advisory hereby agree as follows:

1. Rescission of the Shares. The parties hereby agree that the offer and sale of the Shares from AFH Advisory to Brasel is hereby rescinded and nullified ab initio and therefore is of no force and effect from the outset (the “Rescission”). Except as otherwise set forth in this Agreement, as a result of such rescission, neither party will have any rights, duties or obligations arising under the Transaction Documents.

2. Return of the Purchase Price. As a result of the Rescission, within five (5) business days following the execution of this Agreement, AFH Advisory hereby agrees to return to Brasel, via check, wire transfer or other immediately available funds, an aggregate amount that shall be equal to the Purchase Price minus the Segregated Amount (as such term is hereinafter defined).

3. Segregated Shares. The parties agree that upon the execution and delivery of this Agreement, a certificate, in the name of AFH Advisory, representing 500,000 Shares (the “Segregated Shares”), shall be segregated by AFH Advisory, together with an aggregate amount equal to $2,500 (the “Segregated Amount”) subject to the closing of a business combination or other transaction pursuant to which AFH Acquisition ceases to be a shell company (“Release Event”) and at which time the Segregated Shares shall be released to Brasel and the Segregated Purchase Price shall be released to AFH Advisory.

4. AFH Advisory Option. At any time prior to a Release Event and up to ten days prior to the first closing of the currently contemplated private placement offering of up to 500,000 shares of the Common Stock of AFH Acquisition for aggregate proceeds equal of up to $1,000,000 (without taking into account an over-allotment option), AFH Advisory may, at its sole option and for any reason, provide written notice (the “Notice”) to Brasel that the Segregated Shares shall be released to AFH Advisory (the “AFH Advisory Option”). In the event the AFH Advisory Option shall be exercised pursuant to this Section 4, the Segregated Amount shall be returned to Brasel within five (5) business days of receipt of the Notice.

5. Ownership. Brasel represents and warrants that, except as otherwise provided under this Agreement, (i) he has not transferred the record and/or beneficial ownership of any of the securities that may have been transferred to him pursuant to the terms of the Transaction Documents, (ii) none of the securities that may have transferred to him pursuant to the terms of the Transaction Documents is subject to any liens, claims, charges, encumbrances, pledges, mortgages, security interests, options, rights to acquire, proxies, voting trusts or similar agreements, restrictions on transfer or adverse claims of any nature whatsoever and (iii) he has not made any agreement, commitment or obligation to any person (other than AFH Advisory) granting such person any rights or privileges with respect to the Transaction Documents or the matters reflected therein. Brasel further represents that he has had the advice of legal counsel, and that he has such knowledge and experience in financial and business matters that he is capable of evaluating the merits and risks of the rescission contemplated by this Agreement.

6. Release. Subject to and upon the execution of this Agreement, Brasel, for himself and his successors and assigns, does hereby waive, release, acquit and forever discharge AFH Advisory and AFH Acquisition and its successors and assigns from any and all claims, demands, damages, actions, causes of action or suits, of whatever kind or nature, known or unknown, anticipated or not anticipated, which such releasing party may now have or hereafter have or claim to have against the released party by reason of any matter or thing arising out of or in any way connected with, directly or indirectly, the Transaction Documents.

7. Governing Law. This Agreement shall be governed in all respects by the laws of the State of Delaware, without regard to conflicts of laws principles thereof.

8. Successors and Assigns. Except as otherwise expressly provided herein, the provisions hereof shall inure to the benefit of, and be binding upon, the successors, assigns, heirs, executors and administrators of the parties hereto.

9. Entire Agreement; Amendment; Waiver. This Agreement constitutes the entire and full understanding and agreement between the parties with regard to the subject matter hereof. Neither this Agreement nor any term hereof may be amended, waived, discharged or terminated, except by a written instrument signed by all the parties hereto.

10. Counterparts. This Agreement may be executed in any number of counterparts, each of which shall be an original, but all of which together, shall constitute one instrument.

[The remainder of this page has been intentionally left blank.]

2

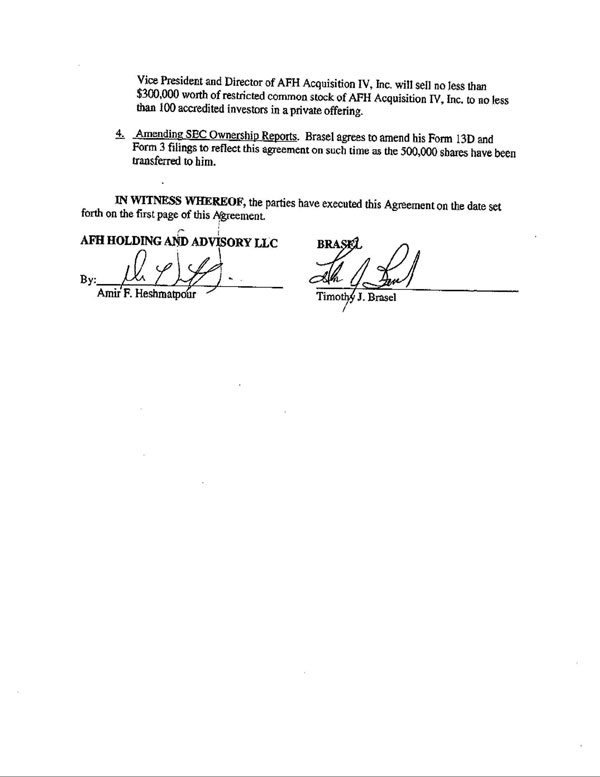

IN WITNESS WHEREOF, the undersigned have hereunto set their hands as of the day and year first above written.

AFH HOLDING & ADVISORY LLC | ||||

| By: | /s/Amir F. Heshmatpour | |||

| Amir F. Heshmatpour | ||||

| /s/Timothy Brasel | ||||

| Timothy Brasel | ||||

Exhibit A