| | | | | | | | |

| Union Carbide Corporation and Subsidiaries | EXHIBIT 10.5 |

| | |

SECOND AMENDED AND RESTATED REVOLVING CREDIT AGREEMENT

This SECOND AMENDED AND RESTATED REVOLVING CREDIT AGREEMENT, dated as of December 2, 2024 (the “Effective Date”) (as amended, supplemented or otherwise modified from time to time, this “Agreement”), by and between UNION CARBIDE CORPORATION, a New York corporation (“Carbide” or “Borrower”), as borrower and THE DOW CHEMICAL COMPANY, a Delaware corporation ("TDCC" or “Lender”), as lender.

WHEREAS, Lender and Borrower are parties to an Amended and Restated Revolving Credit Agreement, dated as of May 28, 2004 (as amended, supplemented or otherwise modified immediately prior to the date hereof, the “Existing Credit Agreement”);

WHEREAS, Lender and Borrower are parties to that certain Third Amended and Restated Revolving Loan Agreement, dated as of December 2, 2024 (as amended, supplemented or otherwise modified from time to time, the “Antithetical Agreement”);

WHEREAS, as of the date hereof, the Credit Enhancements (as defined below) listed on Exhibit A are outstanding under the Existing Credit Agreement;

WHEREAS, TDCC wishes to continue lending funds to Carbide from time to time, and Carbide wishes to continue borrowing such funds on the terms and conditions set forth in this Agreement;

WHEREAS, Lender will release all collateral previously pledged by Borrower to secure its obligations under the Existing Credit Agreement on the Effective Date.

NOW, THEREFORE, in consideration of the premises and the covenants and agreements contained herein, the parties agree to amend and restate in its entirety the Existing Credit Agreement with immediate effect as follows:

1. DEFINITIONS

1.1 “Administrative Agent” means The Dow Chemical Company - responsible for administrating this loan agreement and calculating interest pursuant to Section 2.3.

1.2 “Advance(s)” has the meaning stated in Section 2.1.

1.3 “Agreement” has the meaning stated in the preamble.

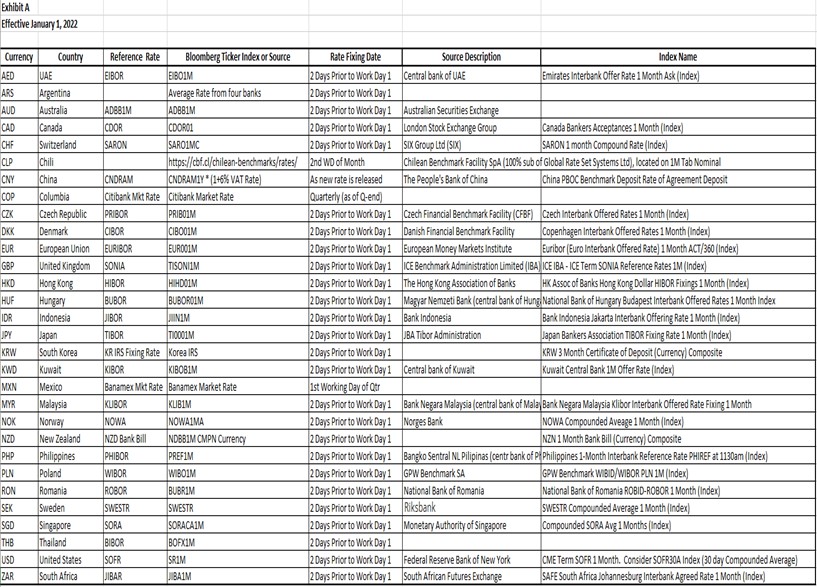

1.4 “Alternative Reference Rate” means the reference rate set forth on Exhibit B attached hereto for the currency applicable to Advances under this Agreement.

1.5 “Antithetical Agreement” has the meaning stated in the preamble.

1.6 “Beneficial Owner” has the meaning assigned to such term in Rule 13d-3 and Rule 13d-5 under the Exchange Act, except that in calculating the beneficial ownership of any particular “person” (as that term is used in Section 13(d)(3) of the Exchange Act), such “person” shall be deemed to have beneficial ownership of all securities that such “person” has the right to acquire by conversion or exercise of other securities, whether such right is currently exercisable or is exercisable only upon the occurrence of a subsequent condition.

1.7 “Borrower” has the meaning stated in the preamble.

1.8 For transactions in the respective currencies, “Business Day” means

(a) for CAD: a day of the year other than Saturday or Sunday or any day on which the Canadian Payments Association does not operate the Large Value Transfer System (LVTS) for CAD settlements;

(b) for USD: a day of the year other than Saturday or Sunday or any day on which the Federal Reserve does not operate the Fed Wire funds transfer system for USD settlements;

1.9 “Capital Stock” means: (a) in the case of a corporation, corporate stock; (b) in the case of an association or business entity, any and all shares, interests, participations, rights or other equivalents (however designated) of corporate stock; (c) in the case of a partnership or limited liability company, partnership or membership interests (whether general or limited); and (d) any other interest or participation that confers on a person the right to receive a share of the profits and losses of, or distributions of assets of, the issuing person.

1.10 “Change of Control” has the meaning stated in Section 8.9.

1.11 “Commitment” has the meaning stated in Section 2.1.

1.12 “Commitment Availability” means, as of any time the Commitment in effect at such time less the sum of (a) the aggregate principal amount of Loans outstanding at such time and (b) the aggregate amount of Credit Enhancement Obligations (other than Credit Enhancement Obligations that have become Loans pursuant to Section 2.10(f)) outstanding as of such time.

1.13 “Continuing Directors” means, as of any date of determination, any member of the Board of Directors of Borrower, who: (a) was a member of such Board of Directors on the date of this Agreement or (b) was nominated for election or elected to such Board of Directors with the approval of a majority of the Continuing Directors who were members of such Board of Directors at the time of such nomination or election.

1.14 “Credit Enhancement” means any indemnity, letter of credit, guarantee or other credit enhancement or financial accommodation made or extended by Lender in favor of a third party as security for obligations of Borrower or its Subsidiary to such third party.

1.15 "Credit Enhancement Contingent Liabilities" means, at any time with respect to the Credit Enhancements, the amount of contingent liabilities owed by Borrower to Lender at such time pursuant to the Reimbursement Agreements relating to the Credit Enhancements, but excluding the sum of all Reimbursement Obligations.

1.16 “Credit Enhancement Obligations” means, at any time with respect to any Credit Enhancement, the liability at such time of Borrower to Lender with respect to such Credit Enhancement, whether or not any such liability is contingent, and includes the sum of all Reimbursement Obligations and Credit Enhancement Contingent Liabilities relating to such Credit Enhancement Obligation.

1.17 “Credit Enhancement Request” has the meaning stated in Section 2.10(c).

1.18 “Effective Date” has the meaning stated in the preamble.

1.19 “Event(s) of Default” has the meaning stated in Article 6.

1.20 “Exchange Act” means the Securities Exchange Act of 1934, as amended, and the rules and regulations of the Securities and Exchange Commission promulgated thereunder.

1.21 “Existing Credit Agreement” has the meaning stated in the preamble.

1.22 “Governmental Authority” means any nation or government, any state or other political subdivision thereof and any entity exercising executive, legislative, judicial, regulatory or administrative functions of or pertaining to government.

1.23 “Interest Period” means the period commencing on the first calendar day of each calendar month (or, in the case of the initial Interest Period, the Effective Date) and ending on the last calendar day of each month (or, in the case of the final Interest Period, the Maturity Date).

1.24 “Interest Rate” has the meaning stated in Section 2.3(a).

1.25 “Lender” has the meaning stated in the preamble.

1.26 “Loan” has the meaning stated in Section 2.1; for the avoidance of doubt, except as provided in Section 2.10(f), a Credit Enhancement Obligation shall not be a Loan.

1.27 “Loan Documents” means, collectively, this Agreement, any and all notes, any and all Reimbursement Agreements (and any other agreements between Borrower

and Lender related to such Reimbursement Agreements), and each certificate, agreement or document executed by Borrower and delivered to Lender in connection with or pursuant to any of the foregoing.

1.28 “Maturity Date” shall mean December 2, 2025; provided, however, that the Maturity Date shall automatically be extended from year to year in one year terms expiring December 2, unless (a) either party cancels Lender’s unused Commitment pursuant to Section 2.8 or (b) there are no outstanding Loans or Credit Enhancements under either this Agreement or any Antithetical Agreement for 180 consecutive days, in which case the maturity date shall be the next Business Day following such 180 day period.

1.29 “Obligations” means all advances, debts, liabilities, obligations, covenants and duties owing by Borrower to Lender of every type and description, arising under this Agreement or under any other Loan Document, including all fees and expenses and all interest, charges, expenses, fees, attorneys’ fees and disbursements and other sums chargeable to Borrower hereunder, whether direct or indirect, absolute or contingent, or due or to become due.

1.30 “Person” means an individual, partnership, corporation (including a business trust), joint stock company, estate, trust, limited liability company, unincorporated association, joint venture or other entity, or a Governmental Authority.

1.31 “Reimbursement Agreement” has the meaning specified in Section 2.10(e).

1.32 “Reimbursement Obligations” means, at any time with respect to any Credit Enhancement, all matured reimbursement or repayment obligations of Borrower to Lender then owing under the Reimbursement Agreement relating to such Credit Enhancement, as a result of Lender having advanced funds to the beneficiary of such Credit Enhancement.

1.33 “Subsidiary” means, with respect to any Person, any affiliated entity that is controlled by such Person, directly or indirectly, through one or more intermediaries, where “control” means the possession, direct or indirect, of the power to direct or cause the direction of the management and policies of such Person. For purposes hereof, Borrower and its Subsidiaries shall not be deemed to be Subsidiaries of Lender and Lender’s other Subsidiaries.

1.34 “TDCC Reference Rate” means the interest rate established for intercompany financing transactions by the Corporate Treasury Department of The Dow Chemical Company from time to time. This rate is initially comprised of 1 Month Alternative Reference Rate; plus a positive spread that represents transactions with unrelated parties under similar terms and conditions.

1.35 “Voting Stock” of any person as of any date means the Capital Stock of such person that is at the time entitled to vote in the election of the Board of Directors of such person.

2. AMOUNTS AND TERMS OF THE ADVANCES

2.1 Advances.

Lender agrees, on the terms and conditions stated in this Agreement, to extend loans (the “Loans”) to Borrower or provide Credit Enhancements (together with the Loans, the “Advances”) to Borrower or its Subsidiaries in an aggregate outstanding amount not to exceed USD 2,000,000,000.00 (the “Commitment”) during the period from the Effective Date to the Maturity Date; provided, however, that Lender, may in its sole discretion and without future obligation or prejudice, make Advances in excess of the Commitment from time to time (such excess an “Excess Advance”). Unless Lender invokes its rights pursuant to 2.4(a) of this Agreement within 30 days following the making of any such Loan or provision of such Credit Enhancement, the Commitment shall thereafter be increased by the Excess Advance until the Maturity Date. The amount of Loans repaid or Credit Enhancements repaid and/or terminated pursuant to Section 2.4(b) below prior to the Maturity Date, may be reborrowed subject to the limitations contained in this Agreement.

2.2 Making the Advances.

(a) Each Loan shall be made either by bank-initiated transfers pursuant to cash concentration agreements or manual transfers from Lender to Borrower; provided, however that at no time shall Lender be obligated to make a Loan to Borrower to the extent that the aggregate principal amount of Advances outstanding, after giving effect to such Loan, would exceed the Commitment Availability.

(b) Each Credit Enhancement shall be provided pursuant to Section 2.10 of this Agreement.

2.3 Interest.

(a) Each Loan shall bear interest from day to day at an interest rate per annum (the “Interest Rate”) equal to the lesser of:

(i) The TDCC Reference Rate plus 0.0625 percent; and

(ii) the maximum rate allowable by law.

(b) In no event should the “Interest Rate” pursuant to (a) above be negative, in such case the Loan bears interest at a rate of 0.0%.

(c) The Interest Rate for each Interest Period is determined by the Administrative Agent prior to each Interest Period. Such determination is conclusive and binding absent manifest error.

(d) Interest is calculated by the Administrative Agent on the basis of a 360-day year for actual days occurring during the Interest Period.

(e) Interest accrues on the unpaid principal amount of each Loan from the date each Loan is made to the date such Loan is payable in accordance with Section 2.4.

(f) Interest on the unpaid principal amount of each Loan will be calculated on the daily outstanding balance, capitalized and added to the unpaid principal amount of each Loan for value the last day of each Interest Period.

2.4 Repayment and Prepayment.

(a) Lender may demand payment from Borrower of all or any part of any Loan, at any time and from time to time, along with accrued but unpaid interest on the principal amount to be repaid; provided that the repayment date with respect to any such amounts shall be at least 30 days after Borrower’s receipt of written notice from Lender. Lender may select to apply the Interest Rate in effect on the Business Day immediately preceding the notice until the repayment date.

(b) Borrower may prepay in whole or in part, without premium or penalty, all amounts advanced under any Loan, at any time or from time to time. In the case of prepayment in full with effective termination of this agreement or Lender’s Commitment, along with accrued but unpaid interest on the principal amount being repaid.

2.5 Interest on Overdue Principal.

(a) All past due principal of any Loan, and to the extent permitted by law, interest on all past due principal, bears interest from the date such unpaid amount is due until the date such unpaid amount is paid in full, payable on demand, at an interest rate per annum equal to the lesser of:

(i) one percent (1%) per annum above the Interest Rate; and

(ii) the maximum rate allowed by law.

(b) Interest on the past due principal amount of such Loan will be capitalized and added to the unpaid principal amount of such Loan for value the last calendar day of each calendar month.

(c) Without prejudice to the rights of Lender pursuant to Section 2.5(a), Borrower indemnifies Lender against any actual loss or expense which it may sustain or incur as a result of the failure by Borrower to pay when due any principal or interest pursuant to Section 2.4 and 2.5. A certificate signed by an officer of Lender setting forth the basis for the determination of the amounts necessary to indemnify Lender in respect of any loss or expense, submitted to Borrower by Lender, is conclusive and binding for all purposes absent manifest error.

2.6 Fees.

(a) No commitment fee is payable under this Agreement.

(b) Credit Enhancement Fees. With respect to each Credit Enhancement provided by Lender hereunder, Borrower agrees to pay Lender a fee accruing at a rate per annum equal to two and one-half percent (2.5%), or as otherwise mutually agreed in writing by Lender and Borrower, of the maximum Credit Enhancement Contingent Liabilities of Borrower to Lender outstanding from time to time under each such Credit Enhancement, payable in arrears (A) on the first day of each calendar month commencing on the first such day following the issuance of each such Credit Enhancement and (B) on the Maturity Date, provided, further, that during the continuance of an Event of Default, all of such fees shall be increased by two percent (2%) per annum and shall be payable on demand.

2.7 Payments and Computations.

(a) Borrower agrees to make each payment with respect to this Agreement in the same currency in which the related Advance was made. Each payment will be made to Lender’s account at a bank to be designated by Lender.

(b) Whenever any payment to be made under this Agreement is stated to be due on a day other than a Business Day, such payment shall be made on the immediately succeeding Business Day.

(c) Except as otherwise provided in Section 2.5 or 2.6, all payments and any other amounts received by Lender from or for the benefit of Borrower shall be applied: first, to repay the then outstanding principal amount of such Loans (including Reimbursement Obligations that are deemed Loans in accordance with Section 2.10(f)) until all Loans shall have been repaid in full and second, to any other Obligations then due and payable.

2.8 Cancellation or Reduction of Unused Commitment.

Either party may by prior 30 days written notice at any time and from time to time, wholly cancel or permanently reduce Lender’s unused Commitment under this Agreement.

2.9 Evidence of Debt.

Lender maintains in accordance with its usual practice an account or accounts evidencing the indebtedness of Borrower resulting from each Advance made from time to time and the amounts of principal and interest payable and paid from time to time under this Agreement. In any legal action or proceeding in respect of this Agreement, the entries made in such account or accounts are, in the absence of manifest error, conclusive evidence of the existence and amounts of the obligations of Borrower.

2.10 Credit Enhancements.

(a) On the terms and subject to the conditions contained in this Agreement, Lender agrees to provide one or more Credit Enhancements at the request of Borrower from time to time during the period commencing on the Effective Date and ending on 30 days prior to the Maturity Date; provided, however, that Lender shall not be under any obligation to provide any Credit Enhancement if:

(i) the applicable conditions contained in Sections 3.1(c) and 3.1(d) are not then satisfied;

(ii) after giving effect to the issuance of such Credit Enhancement, the aggregate principal amount of Advances outstanding would exceed the Commitment Availability;

(iii) Lender, in its sole discretion, is not satisfied with the relevant documentation proposed to evidence such Credit Enhancement; or

(iv) the issuance of such Credit Enhancement shall have the effect of preventing the occurrence of an Event of Default under Section 6.4 or remedying any such Event of Default.

(b) In no event shall the term of any Credit Enhancement be more than one year after the date of issuance thereof; provided, however, that any Credit Enhancement with a one-year term may provide for the renewal thereof for additional one-year periods.

(c) In connection with the provision of each Credit Enhancement, Borrower shall give Lender at least 10 days’ prior written notice (a “Credit Enhancement Request”), in such written or electronic form as is acceptable to Lender, of the requested Credit Enhancement. Such notice shall describe in reasonable detail the purposes of such Credit

Enhancement, the nature and amount of the underlying obligation, the proposed effective date of such requested Credit Enhancement (which day shall be a Business Day), the date on which such Credit Enhancement is to expire (which date shall be a Business Day), and the Person for whose benefit the requested Credit Enhancement is to be provided.

(d) Subject to Section 2.2 and the satisfaction of the conditions set forth in this Section 2.10, Lender shall, on the requested date, provide a Credit Enhancement on behalf of Borrower.

(e) Prior to the issuance of any Credit Enhancement by Lender, and as a condition of such issuance, Borrower shall have delivered to Lender a reimbursement agreement, in such form as Lender may require (each a “Reimbursement Agreement”), signed by Borrower, and such other documents or items as may be required pursuant to the terms thereof. In the event of any conflict between the terms of any Reimbursement Agreement and this Agreement, the terms of this Agreement shall govern.

(f) At such time as Lender is required to advance funds, services, or other items of value pursuant to any Credit Enhancement, such Credit Enhancement shall become a Reimbursement Obligation, and Borrower agrees to pay to Lender the amount of all Reimbursement Obligations on demand with interest thereon, irrespective of any claim, set-off, defense or other right which Borrower may have at any time against Lender or any other Person. In the event that Lender makes any payment under any Credit Enhancement and Borrower shall not have repaid such amount to Lender pursuant to this clause (f) or such payment is rescinded or set aside for any reason, such Reimbursement Obligation shall be payable on demand with interest thereon computed from the date on which such Reimbursement Obligation arose to the date of repayment in full at the rate of interest applicable to past due Loans during such period, and then Lender shall, notwithstanding whether or not the conditions precedent set forth in Sections 3.1(c) and 3.1(d) shall have been satisfied (which conditions precedent Lender hereby irrevocably waives), be deemed to have made a Loan to Borrower in the principal amount of such unpaid Reimbursement Obligation.

(g) Borrower's obligation to pay each Reimbursement Obligation shall be absolute, unconditional and irrevocable, and shall be performed strictly in accordance with the terms of this Agreement, under any and all circumstances whatsoever, including the occurrence of any Event of Default, and irrespective of:

(i) any lack of validity or enforceability of any Credit Enhancement or any Loan Document, or any term or provision therein;

(ii) any amendment or waiver of or any consent to or departure from all or any of the provisions of any Credit Enhancement or any Loan Document (provided, that any such amendment shall have been approved in writing by Borrower if the effect of such amendment would have resulted in an increase in Borrower's applicable Credit Enhancement Obligations);

(iii) the existence of any claim, right of set-off, defense or other right that Borrower or other party guaranteeing, or otherwise obligated with, Borrower, or any other Person may at any time have against the beneficiary under any Credit Enhancement, Lender or any other Person, whether in connection with this Agreement, any other Loan Document or any other related or unrelated agreement or transaction;

(iv) any document presented under a Credit Enhancement proving to be forged, fraudulent, invalid or insufficient in any respect or any statement therein being untrue or inaccurate in any respect;

(v) payment by Lender under a Credit Enhancement against presentation of a document that does not comply with the terms of such Credit Enhancement; and

(vi) any other act or omission to act or delay of any kind of Lender or any other Person or any other event or circumstance whatsoever, whether or not similar to any of the foregoing, that might, but for the provisions of this Section 2.10, constitute a legal or equitable discharge of Borrower’s obligations hereunder.

Any action taken or omitted to be taken by Lender under or in connection with any Credit Enhancement shall not form the basis of any resulting liability of Lender to Borrower. In determining whether documents presented under a Credit Enhancement comply with the terms thereof, Lender may accept documents that appear on their face to be in order, without responsibility for further investigation, regardless of any notice or information to the contrary and, in making any payment under any Credit Enhancement, Lender may rely exclusively on the documents presented to it under such Credit Enhancement as to any and all matters set forth therein, including reliance on the amount therein requested to be paid under such Credit Enhancement, whether or not the amount due to the beneficiary thereunder equals such amount and whether or not any document presented pursuant to such Credit Enhancement proves to be insufficient in any respect, if such document on its face appears to be in order.

3. CONDITIONS OF LENDING

The obligation of Lender to make any Loan or provide any Credit Enhancement under this Agreement is subject to the conditions precedent that on the Effective Date and the date of such Advance:

3.1 The following statements are true (and the acceptance by Borrower of the proceeds of any Loan or Credit Enhancements, or the benefits thereof, a representation and warranty by Borrower that on the date of such Advance such statements are true):

(a) The representations and warranties contained in Section 4.1 are correct; and

(b) No event has occurred and is continuing, or would result from such Advance, which, unless cured or waived, constitutes an Event of Default or would constitute an Event of Default but for the requirements that notice be given or time elapse or both; and

(c) With respect to any Credit Enhancement, Lender shall have received a duly executed Credit Enhancement Request (such submission by Borrower of a Credit Enhancement Request and the issuance of each Credit Enhancement requested therein, shall be deemed to constitute a representation and warranty by Borrower as to the matters specified in Section 5.1 on the date of the making of such Credit Enhancement); and

(d) Lender shall have received such other approvals, opinions, or documents as Lender may reasonably request.

4. REPRESENTATIONS AND WARRANTIES OF BORROWER

Borrower represents and warrants as follows:

4.1 Borrower is a company duly organized, validly existing and in good standing under the laws of the state or country indicated in the preamble;

4.2 The execution, delivery and performance by Borrower of this Agreement are within Borrower’s corporate powers, have been duly authorized by all necessary corporate action, and do not contravene:

(a) Borrower’s Articles of Incorporation or Bylaws; or

(b) any law or any judgment in any material respect or any material contractual restriction binding on or affecting Borrower;

4.3 No authorization or approval (including exchange control approval) or other action by, and no notice to or filing with, any governmental authority or

regulatory body (other than routine filings which may be required from time to time) which has not already been obtained or made is required for the due execution, delivery and performance by Borrower of this Agreement; and

4.4 This Agreement is the legal, valid and binding obligation of Borrower enforceable against Borrower in accordance with its terms.

5. COVENANTS OF BORROWER

5.1 So long as any Advance remains unpaid or Lender has any Commitment, Borrower will, unless Lender otherwise consents in writing, furnish to Lender:

(a) As soon as practicable and in any event within five Business Days after the occurrence of each Event of Default, or each event which with notice or lapse of time or both would become an Event of Default, which is continuing on the date of such statement, a statement of an authorized representative of Borrower setting forth details of such Event of Default or event and the action which Borrower proposes to take with respect to such Event of Default or event; and

(b) Such other information respecting the business, properties or the condition or operations, financial or otherwise, of Borrower as Lender may from time to time reasonably request.

6. EVENTS OF DEFAULT

If any of the following events (“Event(s) of Default”) occur and continue:

6.1 Borrower fails to pay, within five days of the due date thereof, any installment of principal of any Advance, or shall fail to pay, within ten days of the due date thereof, any interest on any Advance payable hereunder; or

6.2 Any representation or warranty made by Borrower (or any of its authorized representatives) under or in connection with this Agreement proves to have been incorrect in any material respect when made and, to the extent capable of being remedied, such default shall continue unremedied for a period of ten days after Borrower’s knowledge thereof; or

6.3 Borrower fails to perform or observe any other term, covenant or agreement contained in this Agreement (other than those covered by Section 6.2 above) on its part to be performed or observed and any such failure shall remain unremedied for 30 days after written notice has been given to Borrower by Lender; or

6.4 Borrower

(a) fails to make any payment, whether of principal, premium or interest, in an aggregate amount equal to or greater than $100,000,000 in respect of

any indebtedness (other than indebtedness resulting from the Advances) of Borrower when due (whether by scheduled maturity, required prepayment, acceleration, demand or otherwise) and such failure continues after the applicable grace or notice period or cure right, if any, specified in the agreement or instrument relating to such indebtedness; or

(b) any other default under any agreement or instrument relating to any such indebtedness, or any other event (including a default in payment of a lesser amount than that specified above if such default would cause or permit acceleration as described in this clause) shall occur and shall continue after the applicable grace or notice period or cure right, if any, specified in such agreement or instrument, if the effect of such default or event is to (x) permit the acceleration of the maturity of any such indebtedness or (y) result in the acceleration of the maturity of any such indebtedness, in each case in an aggregate principal amount equal to or greater than $400,000,000; provided that

(A) an Event of Default shall not arise under clause (a) or (b)(x) of this Section 6.4 unless the respective failure, default or other event referred to in such clause (a) or (b)(x) shall continue unremedied (after giving effect to the applicable grace or notice period or cure right, if any, specified in such agreement or instrument referred to in such clause (a) or (b)(x)) for a period of 10 days or, if later (and if any such agreement or instrument referred to in such clause (a) or (b)(x) does not contain a grace or notice period or cure right applicable to such failure, default or other event), 10 days after Borrower’s actual knowledge of such failure, default or other event, and

(B) for the avoidance of doubt, the amount of indebtedness in respect of any swap contract or other derivative agreement shall be deemed to be the net obligations under such swap contract or other derivative agreement; or

6.5 Borrower shall commence a voluntary case or other proceeding seeking liquidation, reorganization or other relief with respect to itself or its debts under any bankruptcy, insolvency or other similar law now or hereafter in effect or seeking the appointment of a trustee, receiver, liquidator, custodian or other similar official of it or any substantial part of its property, or shall consent to any such relief or to the appointment of or taking possession by any such official in an involuntary case or other proceeding commenced against it, or shall make a general assignment for the benefit of creditors, or shall fail generally to pay its debts as they become due, or shall take any corporate action to authorize any of the foregoing or an involuntary case or other proceeding shall be commenced against Borrower seeking liquidation, reorganization or other relief with respect to

it or its debts under any bankruptcy, insolvency or other similar law now or hereafter in effect or seeking the appointment of a trustee, receiver, liquidator, custodian or other similar official of it or any substantial part of its property, and such involuntary case or other proceeding shall remain undismissed and unstayed for a period of 60 days; or an order for relief shall be entered against Borrower under the Federal bankruptcy laws as now or hereafter in effect;

then, and in any such event, Lender may by notice to Borrower,

(i) declare Lender’s obligation to make Advances terminated, whereupon the same shall terminate, and

(ii) declare the Obligations immediately due and payable, without presentment, demand, protest or further notice of any kind, all of which are expressly waived by Borrower.

7. RELEASE OF COLLATERAL

7.1 Upon the Effective Date, Lender agrees that any security interest or lien granted to Lender in the property of Borrower or any of its Subsidiaries under the Collateral Documents (as defined in the Existing Credit Agreement), including, but not limited to (a) the “Collateral” as defined in and granted under that certain Amended and Restated Pledge and Security Agreement dated as of May 28, 2004, by Carbide as grantor in favor of Lender (the “Existing Security Agreement”) and (b) all Deposited Cash Collateral (as defined in the Existing Credit Agreement) and cash collateralizing any Credit Enhancements, shall be automatically discharged, released and all Collateral Documents, including, but not limited to, the Existing Security Agreement, shall be terminated, in each case, automatically and without any further notice or action from any Person

7.2 Lender shall promptly make such filings and execute, as applicable, and deliver to Borrower (or any designee of Borrower) any such lien releases, discharges of security interests, pledges and other similar discharge or release documents, as are reasonably requested and necessary to terminate and release, as of record, the security interests and all notices of security interests and liens previously filed under the Collateral Documents or otherwise filed, executed or delivered to secure the obligations under the Existing Credit Agreement or the Collateral Documents. For the avoidance of doubt, upon the Effective Date, Borrower shall be entitled and authorized to make any such filings or recordings on Lenders’ behalf.

8. MISCELLANEOUS

8.1 Amendments.

No amendment or modification of any provision of this Agreement or any instrument delivered under this Agreement is effective unless the same is in writing and signed by an authorized representative of Lender.

8.2 Notices.

All written notices and other communications delivered by hand or sent by first class mail are effective when received, and when sent by Telex, e-mail or facsimile are effective when sent:

To Borrower at:

Union Carbide Corporation

7501 State Highway 185 North

Seadrift TX 77983

United States

Attention: Treasurer

and if to Lender at:

The Dow Chemical Company

2211 HH Dow Way

Midland MI 48674

Attention: Treasurer

or, as to each party, at such other address as designated by such party in a written notice to the other party.

8.3 No Waiver; Remedies.

No failure or delay on the part of Lender to exercise any right under this Agreement operates as a waiver of this Agreement. Nor does any single or partial exercise of any right under this Agreement preclude any other or further exercise of any right under this Agreement or the exercise of any other right. The remedies provided in this Agreement are cumulative and not exclusive of any remedies provided by law.

8.4 Changes in Applicable Tax Laws.

If any time during the term of this Agreement, any applicable tax law is changed in such a manner that it increases Lender’s cost of maintaining the Loans hereunder, Borrower agrees to reimburse Lender for all such additional costs; provided, however, that if Borrower is prevented or unable for any reason to reimburse Lender such additional costs of maintaining the Loans, then the unpaid principal amount of the Loans, together with interest on the Loans, shall be repaid.

8.5 Costs and Expenses.

Borrower agrees to pay on demand all losses and all costs and expenses, if any, in connection with the enforcement of this Agreement and any instruments or other documents delivered under this Agreement, including, without limitation, losses, costs and expenses sustained as a result of a default by Borrower in the

performance of its obligations contained in this Agreement or any instrument or document delivered under this Agreement.

8.6 Binding Effect; Assignment.

This Agreement is binding upon and inures to the benefit of Borrower and Lender. Neither Borrower nor Lender have the right to assign any of their respective rights under this Agreement or any interest in this Agreement without the prior written consent of the other party to this Agreement.

8.7 Governing Law.

This Agreement is governed by and construed in accordance with the laws of the State of New York, U.S.A., without regard to its provisions concerning conflicts of law.

8.8 Severability.

In the event that a court of competent jurisdiction determines that any portion of this Agreement is in violation of any statute or public policy, then only the portions of this Agreement that violate such statute or public policy are stricken. All portions of this Agreement that do not violate any statute or public policy continue in full force and effect. Any court order striking any portion of this Agreement modifies the stricken terms as narrowly as possible to give as much effect as possible to the intentions of the parties pursuant to this Agreement.

8.9 Change of Control Provision.

Notwithstanding paragraph 2.4(a) of this Agreement, after any Change of Control (as defined below) of Borrower, Lender may, at its option, upon notice to Borrower declare the obligation of Lender to make Advances under this Agreement to be terminated and declare all principal, interest, and other amounts payable under this Agreement to be immediately due and payable, whereupon the same shall become immediately due and payable. For purposes of this Agreement, “Change of Control” means the occurrence of any of the following: (a) the consummation of any transaction (including, without limitation, any merger or consolidation) the result of which is that any “person” or “group” (as such terms are used in Sections 13(d) and 14(d) of the Exchange Act) becomes the Beneficial Owner, directly or indirectly, of more than 50% of the voting power of the Voting Stock of Borrower and such transaction is not approved by Borrower’s Board of Directors; or (b) the first day on which a majority of the members of the Board of Directors of Borrower are not Continuing Directors.

9. COUNTERPARTS.

This Agreement may be executed and delivered (including by facsimile or other means of electronic transmission, such as by electronic mail in “pdf” form) in one or more counterparts, and by the different parties hereto in separate counterparts, each of which

when executed shall be deemed to be an original, but all of which taken together shall constitute one and the same agreement.

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

IN WITNESS WHEREOF, the parties have caused this Revolving Loan Agreement to be duly executed by their duly authorized representatives.

| | | | | | | | |

| BORROWER: | | LENDER: |

| | |

| Union Carbide Corporation, | | The Dow Chemical Company, |

| | | | | | | | |

| /s/ WENDELL TERRY | | /s/ SAKET SELOT |

| Wendell Terry | | Saket Selot |

| Authorized Signer | | Authorized Signer |

| | |

| | |

Exhibit A

CREDIT ENHANCEMENTS AS OF THE EFFECTIVE DATE

Surety Bonds

| | | | | | | | | | | | | | | | | |

| Bond Number | Issuing Carrier | Principal Name | Expiration Date | Renewal Method |

| 1. | 575779384 | General Insurance Company of America | Union Carbide Corporation | 12/31/2024 | Continuous |

| 2. | 5757793116 | Safeco Insurance Company of America | Union Carbide Corporation | 11/17/2025 | Continuation Certificate |

| 3. | 575779328 | General Insurance Company of America | Union Carbide Corporation | 11/27/2025 | Continuous |

| 4. | 130415006 | Liberty Mutual Insurance Company | Union Carbide Corporation | 06/03/2025 | Continuous |

| 5. | 6087429 | Safeco Insurance Company of America | Union Carbide Corporation | 11/30/2025 | Continuous |

| 6. | 019054282 | Liberty Mutual Insurance Company | Union Carbide Corporation | 07/24/2025 | Continuous |

| 7. | 5754655 | General Insurance Company of America | Union Carbide Corporation | 07/22/2025 | Continuous |

| 8. | 019065279 | Liberty Mutual Insurance Company | Umetco Minerals Corporation | 09/04/2025 | Continuous |

| 9. | 130415007 | Liberty Mutual Insurance Company | Union Carbide Corporation | 06/03/2025 | Continuous |

| 10. | 1040781 | Lexon Insurance Company | Umetco Minerals Corporation | 06/10/2025 | Continuous |

| 11. | 019054304 | Liberty Mutual Insurance Company | Umetco Minerals Corporation | 09/15/2025 | Continuous |

| 12. | 019074057 | Liberty Mutual Insurance Company | Union Carbide Corporation | 10/26/2025 | Continuous |

| 13. | K40408824 | Federal Insurance Company | Union Carbide Corporation | 07/05/2025 | Continuous |

| 14. | 221006098 | Liberty Mutual Insurance Company | Union Carbide Corporation | 11/06/2024 | Continuous |

| | | | | | | | | | | | | | | | | |

| 15. | 021026013 | Liberty Mutual Insurance Company | Union Carbide Corporation | 11/23/2025 | Continuous |

| 16. | 019080005 | Liberty Mutual Insurance Company | Penuelas Technology Park LLC | 06/06/2025 | Continuous |

| 17. | K41809450 | Federal Insurance Company | Union Carbide Corporation | 07/10/2025 | Continuous |

Letters of Credit

| | | | | | | | | | | | | | | | | |

| BNP Paribas | | | |

| LCNumber | Guarantor | Applicant | On Behalf Of | Expiry Date |

| 1. | 4130826 | BNP Paribas | Union Carbide Corporation | Union Carbide Corporation | 25-Jul-25 |

| 2. | 4141495 | BNP Paribas | Union Carbide Corporation | Union Carbide Corporation | 30-Apr-25 |

| 3. | 4141497 | BNP Paribas | Union Carbide Corporation | Union Carbide Corporation | 30-Apr-25 |

| 4. | 4146344 | BNP Paribas | Union Carbide Corporation | Union Carbide Corporation | 1-May-25 |

| 5. | 4146346 | BNP Paribas | Union Carbide Corporation | Union Carbide Corporation | 1-May-25 |

| 6. | 04162862 | BNP Paribas | Union Carbide Corporation | Union Carbide Corporation | 5-May-25 |

| 7. | 04162861 | BNP Paribas | Union Carbide Corporation | Union Carbide Corporation | 5-May-25 |

| 8. | 04162868 | BNP Paribas | Union Carbide Corporation | Union Carbide Corporation | 5-May-25 |

| 9. | 04162869 | BNP Paribas | Union Carbide Corporation | Union Carbide Corporation | 5-May-25 |

| 10. | 04173520 | BNP Paribas | Union Carbide Corporation | Union Carbide Corporation | 1-Jun-25 |

| JP Morgan Chase | | | |

| LCNumber | Guarantor | Applicant | On Behalf Of | Expiry Date |

| 1. | 391824 | JPMorgan Chase | UNION CARBIDE CORPORATION | UNION CARBIDE CORPORATION | 8-Jul-25 |

| 2. | 233445 | JPMorgan Chase | UNION CARBIDE CORPORATION | UNION CARBIDE CORPORATION | 15-Dec-24 |

| | | | | | | | | | | | | | | | | |

| Bank of America | | | |

| LCNumber | Guarantor | Applicant | On Behalf Of | Expiry Date |

| 1. | 3103307 | Bank of America | THE DOW CHEMICAL COMPANY | UNION CARBIDE CORPORATION | 13-Dec-24 |

Credit Lines Extended by Citibank to Union Carbide Entities

| | | | | | | | | | | | | | |

| Country | Obligor | Facility Type | Tenor |

| 1. | Dubai | UCAR Emulsion Systems FZE | For issuance of LCs/bank guarantees | 2 years |

| 2. | Dubai | UCAR Emulsion Systems FZE | Commercial Cards Program | 3 months |

| 3. | Dubai | UCAR Emulsion Systems FZE | Supplier Finance program | 6 months |

| 4. | Dubai | UCAR Emulsion Systems FZE | Daylight overdraft | 1 day |

| 5. | Thailand | Carbide Chemical (Thailand) Ltd. | Daylight overdraft | 1 day |

| 6. | Thailand | Carbide Chemical (Thailand) Ltd. | Supplier Finance program | 6 months |

| 7. | South Africa | Union Carbide South Africa (Pty) Ltd. | Daylight overdraft | 1 day |

| 8. | South Africa | Predate Properties (Pty) Ltd. | Daylight overdraft | 1 day |

Exhibit B

ALTERNATIVE REFERENCE RATE