0001002910srt:NaturalGasReservesMemberaee:OtherMember2024-01-012024-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| | | | | |

| ☒ | Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the Quarterly Period Ended June 30, 2024 |

OR

| | | | | |

| ☐ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

for the transition period from to |

| | | | | | | | |

Commission

File Number | Exact name of registrant as specified in its charter;

State of Incorporation;

Address and Telephone Number | IRS Employer

Identification No. |

| 1-14756 | Ameren Corporation | 43-1723446 |

(Missouri Corporation)

1901 Chouteau Avenue

St. Louis, Missouri 63103

(314) 621-3222

| | | | | | | | |

| 1-2967 | Union Electric Company | 43-0559760 |

(Missouri Corporation)

1901 Chouteau Avenue

St. Louis, Missouri 63103

(314) 621-3222

| | | | | | | | |

| 1-3672 | Ameren Illinois Company | 37-0211380 |

(Illinois Corporation)

10 Richard Mark Way

Collinsville, Illinois 62234

(618) 343-8150

Securities Registered Pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | AEE | New York Stock Exchange |

Indicate by check mark whether each registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ameren Corporation | | Yes | | ☒ | | No | | ☐ |

| Union Electric Company | | Yes | | ☒ | | No | | ☐ |

| Ameren Illinois Company | | Yes | | ☒ | | No | | ☐ |

Indicate by check mark whether each registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ameren Corporation | | Yes | | ☒ | | No | | ☐ |

| Union Electric Company | | Yes | | ☒ | | No | | ☐ |

| Ameren Illinois Company | | Yes | | ☒ | | No | | ☐ |

Indicate by check mark whether each registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | |

| Ameren Corporation | Large accelerated filer | ☒ | Accelerated filer | ☐ | Non-accelerated filer | ☐ |

| | | Smaller reporting company | ☐ | Emerging growth company | ☐ |

| Union Electric Company | Large accelerated filer | ☐ | Accelerated filer | ☐ | Non-accelerated filer | ☒ |

| | | Smaller reporting company | ☐ | Emerging growth company | ☐ |

| Ameren Illinois Company | Large accelerated filer | ☐ | Accelerated filer | ☐ | Non-accelerated filer | ☒ |

| | | Smaller reporting company | ☐ | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| | | | | |

| Ameren Corporation | ☐ |

| Union Electric Company | ☐ |

| Ameren Illinois Company | ☐ |

Indicate by check mark whether each registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ameren Corporation | | Yes | | ☐ | | No | | ☒ |

| Union Electric Company | | Yes | | ☐ | | No | | ☒ |

| Ameren Illinois Company | | Yes | | ☐ | | No | | ☒ |

The number of shares outstanding of each registrant’s classes of common stock as of July 31, 2024, was as follows:

| | | | | | | | | | | |

| Registrant | | Title of each class of common stock | Shares outstanding |

| Ameren Corporation | | Common stock, $0.01 par value per share | 266,816,725 | |

| Union Electric Company | | Common stock, $5 par value per share, held by Ameren Corporation | 102,123,834 | |

| Ameren Illinois Company | | Common stock, no par value, held by Ameren Corporation | 25,452,373 | |

| | | |

This combined Form 10-Q is separately filed by Ameren Corporation, Union Electric Company, and Ameren Illinois Company. Each registrant hereto is filing on its own behalf all of the information contained in this quarterly report that relates to such registrant. Each registrant hereto is not filing any information that does not relate to such registrant, and therefore makes no representation as to any such information.

TABLE OF CONTENTS

| | | | | | | | |

| | | Page |

| |

| |

| |

| |

| |

| | |

| Item 1. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| |

| |

| | |

| Item 1. | | |

| Item 1A. | | |

| Item 2. | | |

| Item 5. | | |

| Item 6. | | |

| |

| |

GLOSSARY OF TERMS AND ABBREVIATIONS

We use the words “our,” “we” or “us” with respect to certain information that relates to Ameren, Ameren Missouri, and Ameren Illinois, collectively. When appropriate, subsidiaries of Ameren Corporation are named specifically as their various business activities are discussed. Refer to the Form 10-K for a complete listing of glossary terms and abbreviations. Only new or significantly changed terms and abbreviations are included below.

Form 10-K – The combined Annual Report on Form 10-K for the year ended December 31, 2023, filed by the Ameren Companies with the SEC.

QTD – Three months ended June 30.

YTD – Six months ended June 30.

YoY – Compared with the year-ago period.

FORWARD-LOOKING STATEMENTS

Statements in this report not based on historical facts are considered “forward-looking” and, accordingly, involve risks and uncertainties that could cause actual results to differ materially from those discussed. Although such forward-looking statements have been made in good faith and are based on reasonable assumptions, there is no assurance that the expected results will be achieved. These statements include (without limitation) statements as to future expectations, beliefs, plans, projections, strategies, targets, estimates, objectives, events, conditions, and financial performance. In connection with the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, we are providing this cautionary statement to identify important factors that could cause actual results to differ materially from those anticipated. The following factors, in addition to those discussed within Risk Factors in the Form 10-K, and elsewhere in this report and in our other filings with the SEC, could cause actual results to differ materially from management expectations suggested in such forward-looking statements:

•regulatory, judicial, or legislative actions, and any changes in regulatory policies and ratemaking determinations, that may change regulatory recovery mechanisms, such as those that may result from any additional mitigation relief related to the operation of the Rush Island Energy Center that may be ordered by the United States District Court for the Eastern District of Missouri, the MoOPC’s request for rehearing of the MoPSC’s June 2024 financing order to authorize the issuance of securitized utility tariff bonds to finance the cost of the planned accelerated retirement of the Rush Island Energy Center, Ameren Missouri’s electric service regulatory rate review filed with the MoPSC in June 2024, Ameren Missouri’s proposed customer energy-efficiency plan under the MEEIA filed with the MoPSC in January 2024, Ameren Illinois’ December 2023 ICC order for the MYRP electric distribution service regulatory rate review that directed Ameren Illinois to file a revised Grid Plan and a request to update the associated MYRP revenue requirements for 2024 through 2027, both subsequently filed in March 2024, along with the appeal of the December 2023 order to the Illinois Appellate Court for the Fifth Judicial District, Ameren Illinois’ electric distribution service revenue requirement reconciliation adjustment request filed with the ICC in April 2024, Ameren Illinois’ appeal of the November 2023 ICC natural gas delivery service rate order to the Illinois Appellate Court for the Fifth Judicial District, and the August 2022 United States Court of Appeals for the District of Columbia Circuit ruling that vacated the FERC’s MISO ROE-determining orders and remanded the proceedings to the FERC;

•our ability to control costs and make substantial investments in our businesses, including our ability to recover costs and investments, and to earn our allowed ROEs, within frameworks established by our regulators, while maintaining affordability of services for our customers;

•the effect and duration of Ameren Illinois’ election to utilize MYRPs for electric distribution service ratemaking effective for rates beginning in 2024, including the effect of the reconciliation cap on the electric distribution revenue requirement;

•the effect of Ameren Illinois’ use of the performance-based formula ratemaking framework for its participation in electric energy-efficiency programs, and the related impact of the direct relationship between Ameren Illinois’ ROE and the 30-year United States Treasury bond yields;

•the effect on Ameren Missouri of any customer rate caps or limitations on increasing the electric service revenue requirement pursuant to Ameren Missouri’s election to use the PISA;

•Ameren Missouri’s ability to construct and/or acquire wind, solar, and other renewable energy generation facilities and battery storage, as well as natural gas-fired energy centers, extend the operating license for the Callaway Energy Center, retire fossil fuel-fired energy centers, and implement new or existing customer energy-efficiency programs, including any such construction, acquisition, retirement, or implementation in connection with its Smart Energy Plan, integrated resource plan, or emissions reduction goals, and to recover its cost of investment, a related return, and, in the case of customer energy-efficiency programs, any lost electric revenues in a timely manner, each of which is affected by the ability to obtain all necessary regulatory and project approvals, including CCNs from the MoPSC or any other required approvals for the addition of renewable resources and natural gas-fired energy centers;

•Ameren Missouri’s ability to use or transfer federal production and investment tax credits related to renewable energy projects; the cost of wind, solar, and other renewable generation and battery storage technologies; and our ability to obtain timely interconnection agreements with the MISO or other RTOs at an acceptable cost for each facility;

•the outcome of competitive bids related to requests for proposals and project approvals, including CCNs from the MoPSC and the ICC or any other required approvals, associated with the MISO’s long-range transmission planning;

•the inability of our counterparties to meet their obligations with respect to contracts, credit agreements, and financial instruments, including as they relate to the construction and acquisition of electric and natural gas utility infrastructure and the ability of counterparties to complete projects, which is dependent upon the availability of necessary materials and equipment, including those obligations that are affected by supply chain disruptions;

•advancements in energy technologies, including carbon capture, utilization, and sequestration, hydrogen fuel for electric production and energy storage, next generation nuclear, and large-scale long-cycle battery energy storage, and the impact of federal and state energy and economic policies with respect to those technologies;

•the effects of changes in federal, state, or local laws and other governmental actions, including monetary, fiscal, foreign trade, and energy policies;

•the effects of changes in federal, state, or local tax laws or rates, including the effects of the IRA and the 15% minimum tax on adjusted financial statement income, as well as additional regulations, interpretations, amendments, or technical corrections to or in connection with the IRA, and challenges to the tax positions taken by the Ameren Companies, if any, as well as resulting effects on customer rates and the recoverability of the minimum tax imposed under the IRA;

•the effects on energy prices and demand for our services resulting from customer growth patterns or usage, technological advances, including advances in customer energy efficiency, electric vehicles, electrification of various industries, energy storage, and private generation sources, which generate electricity at the site of consumption and are becoming more cost-competitive;

•the cost and availability of fuel, such as low-sulfur coal, natural gas, and enriched uranium used to produce electricity; the cost and availability of natural gas for distribution and the cost and availability of purchased power, including capacity, zero emission credits, renewable energy credits, and emission allowances; and the level and volatility of future market prices for such commodities and credits;

•disruptions in the delivery of fuel, failure of our fuel suppliers to provide adequate quantities or quality of fuel, or lack of adequate inventories of fuel, including nuclear fuel assemblies primarily from the one NRC-licensed supplier of assemblies for Ameren Missouri’s Callaway Energy Center;

•the cost and availability of transmission capacity for the energy generated by Ameren Missouri’s energy centers or required to satisfy our energy sales;

•the effectiveness of our risk management strategies and our use of financial and derivative instruments;

•the ability to obtain sufficient insurance, or, in the absence of insurance, the ability to timely recover uninsured losses from our customers;

•the impact of cyberattacks and data security risks on us, our suppliers, or other entities on the grid, which could, among other things, result in the loss of operational control of energy centers and electric and natural gas transmission and distribution systems and/or the loss of data, such as customer, employee, financial, and operating system information;

•acts of sabotage, which have increased in frequency and severity within the utility industry, war, terrorism, or other intentionally disruptive acts;

•business, economic, and capital market conditions, including the impact of such conditions on interest rates, inflation, and investments;

•the impact of inflation or a recession on our customers and the related impact on our results of operations, financial position, and liquidity;

•disruptions of the capital and credit markets, deterioration in credit metrics of the Ameren Companies, or other events that may have an adverse effect on the cost or availability of capital, including short-term credit and liquidity, and our ability to access the capital and credit markets on reasonable terms when needed;

•the actions of credit rating agencies and the effects of such actions;

•the impact of weather conditions and other natural conditions on us and our customers, including the impact of system outages and the level of wind and solar resources;

•the construction, installation, performance, and cost recovery of generation, transmission, and distribution assets;

•the ability to maintain system reliability during the transition to clean energy generation by Ameren Missouri and the electric utility industry, as well as Ameren Missouri’s ability to meet generation capacity obligations;

•the effects of failures of electric generation, electric and natural gas transmission or distribution, or natural gas storage facilities systems and equipment, which could result in unanticipated liabilities or unplanned outages;

•the operation of Ameren Missouri’s Callaway Energy Center, including planned and unplanned outages, as well as the ability to recover costs associated with such outages and the impact of such outages on off-system sales and purchased power, among other things;

•Ameren Missouri’s ability to recover the remaining investment and decommissioning costs associated with the retirement of an energy center, as well as the ability to earn a return on that remaining investment and those decommissioning costs;

•the impact of current environmental laws and new, more stringent, or changing requirements, including those related to NSR, CO2, NOx, and other emissions and discharges, Illinois emission standards, cooling water intake structures, CCR, energy efficiency, and wildlife protection, that could limit or terminate the operation of certain of Ameren Missouri’s energy centers, increase our operating costs or investment requirements, result in an impairment of our assets, cause us to sell our assets, reduce our customers’ demand for electricity or natural gas, or otherwise have a negative financial effect;

•the impact of complying with renewable energy standards in Missouri and Illinois and with the zero emission standard in Illinois;

•the effectiveness of Ameren Missouri’s customer energy-efficiency programs and the related revenues and performance incentives earned under its MEEIA programs;

•Ameren Illinois’ ability to achieve the performance standards applicable to its electric distribution business and electric customer energy-efficiency goals and the resulting impact on its allowed ROE;

•labor disputes, work force reductions, our ability to retain professional and skilled-craft employees, changes in future wage and employee benefits costs, including those resulting from changes in discount rates, mortality tables, returns on benefit plan assets, and other assumptions;

•the impact of negative opinions of us or our utility services that our customers, investors, legislators, regulators, creditors, or other stakeholders may have or develop, which could result from a variety of factors, including failures in system reliability, failure to implement our investment plans or to protect sensitive customer information, increases in rates, negative media coverage, or concerns about ESG practices;

•the impact of adopting new accounting and reporting guidance;

•the effects of strategic initiatives, including mergers, acquisitions, and divestitures;

•legal and administrative proceedings;

•pandemics or other significant global health events, and their impacts on our results of operations, financial position, and liquidity; and

•the impacts of the Russian invasion of Ukraine and conflicts in the Middle East, related sanctions imposed by the United States and other governments, and any broadening of these or other global conflicts, including potential impacts on the cost and availability of fuel, natural gas, enriched uranium, and other commodities, materials, and services, the inability of our counterparties to perform their obligations, disruptions in the capital and credit markets, acts of sabotage or terrorism, including cyberattacks, and other impacts on business, economic, and geopolitical conditions, including inflation.

New factors emerge from time to time, and it is not possible for management to predict all of such factors, nor can it assess the impact of each such factor on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained or implied in any forward-looking statement. Given these uncertainties, undue reliance should not be placed on these forward-looking statements. Except to the extent required by the federal securities laws, we undertake no obligation to update or revise publicly any forward-looking statements to reflect new information or future events.

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS.

AMEREN CORPORATION

CONSOLIDATED STATEMENT OF INCOME AND COMPREHENSIVE INCOME

(Unaudited) (In millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Operating Revenues: | | | | | | | |

| Electric | $ | 1,521 | | | $ | 1,585 | | | $ | 2,885 | | | $ | 3,175 | |

| Natural gas | 172 | | | 175 | | | 624 | | | 647 | |

| Total operating revenues | 1,693 | | | 1,760 | | | 3,509 | | | 3,822 | |

| Operating Expenses: | | | | | | | |

| Fuel and purchased power | 327 | | | 480 | | | 655 | | | 1,088 | |

| | | | | | | |

| Natural gas purchased for resale | 33 | | | 42 | | | 184 | | | 250 | |

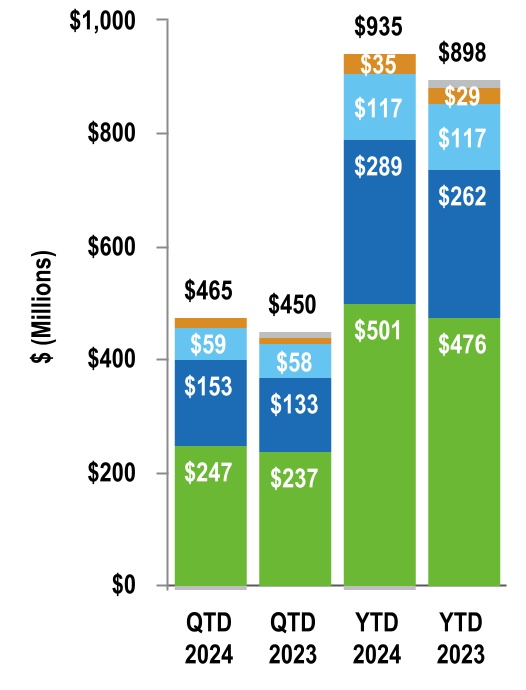

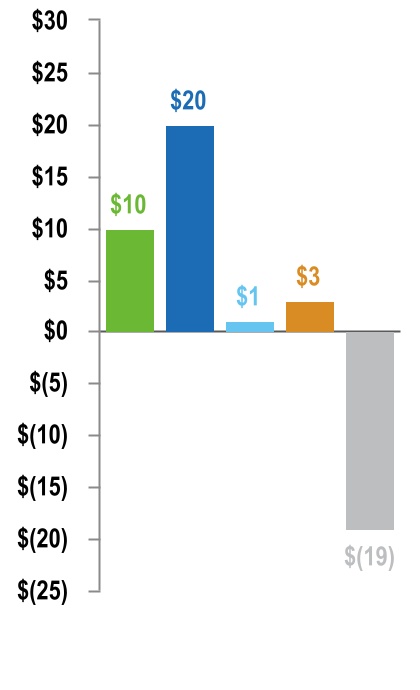

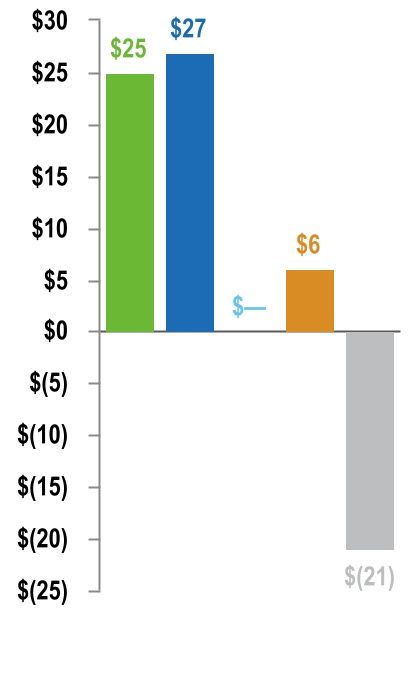

| Other operations and maintenance | 465 | | | 450 | | | 935 | | | 898 | |

| | | | | | | |

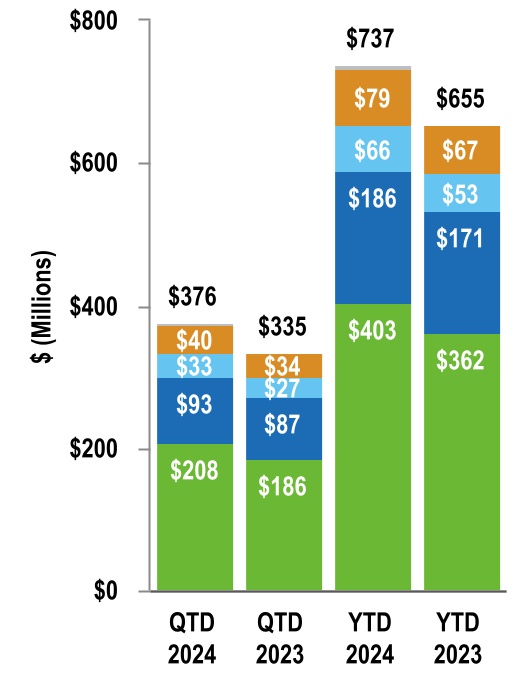

| Depreciation and amortization | 376 | | | 335 | | | 737 | | | 655 | |

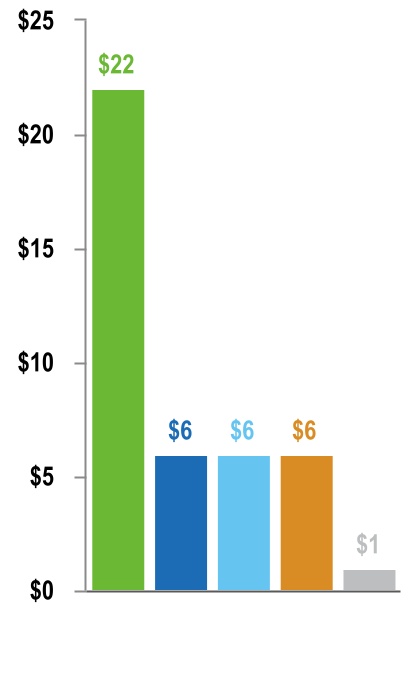

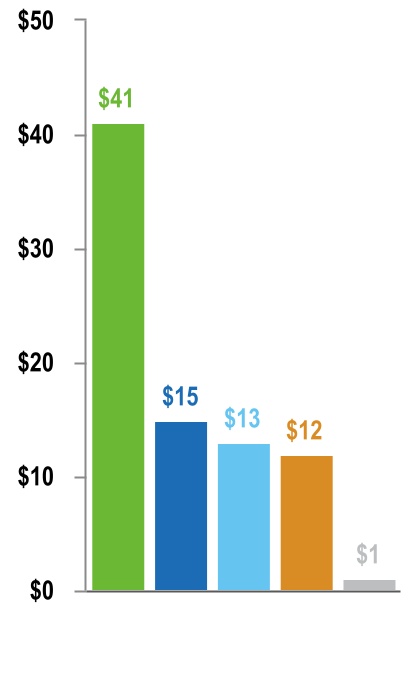

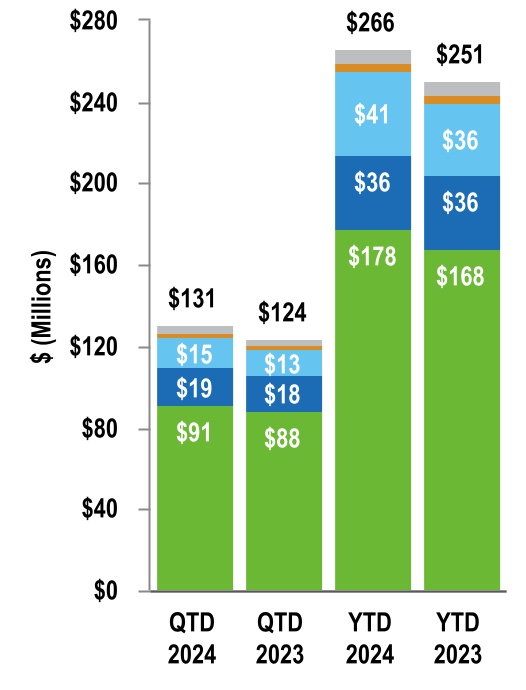

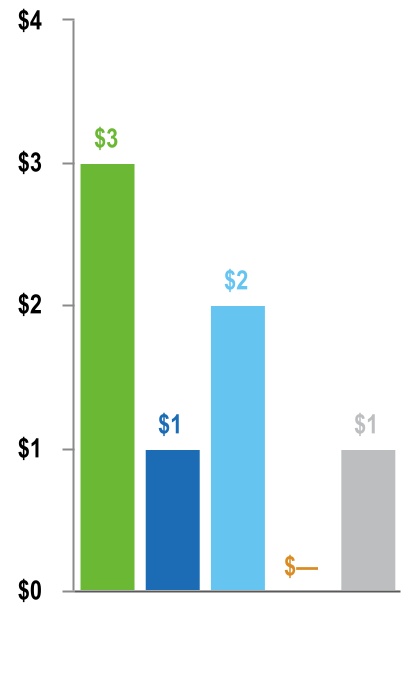

| Taxes other than income taxes | 131 | | | 124 | | | 266 | | | 251 | |

| Total operating expenses | 1,332 | | | 1,431 | | | 2,777 | | | 3,142 | |

| Operating Income | 361 | | | 329 | | | 732 | | | 680 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

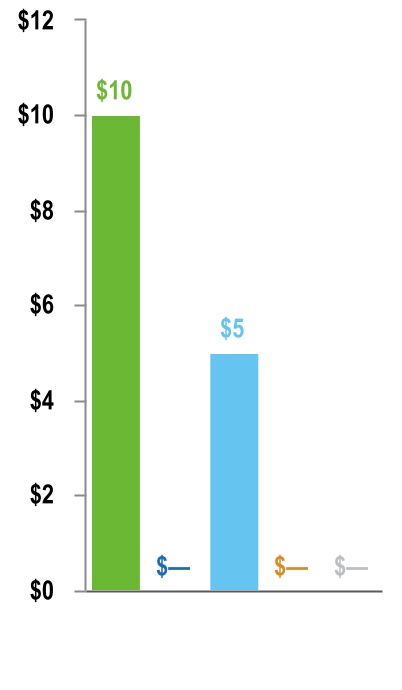

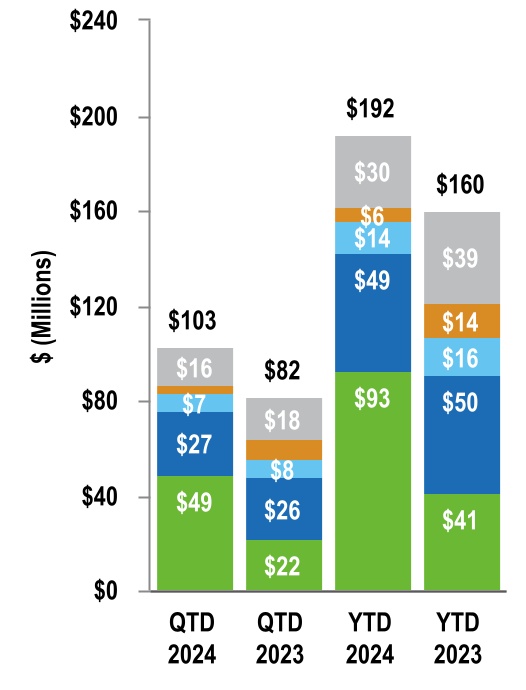

| Other Income, Net | 103 | | | 82 | | | 192 | | | 160 | |

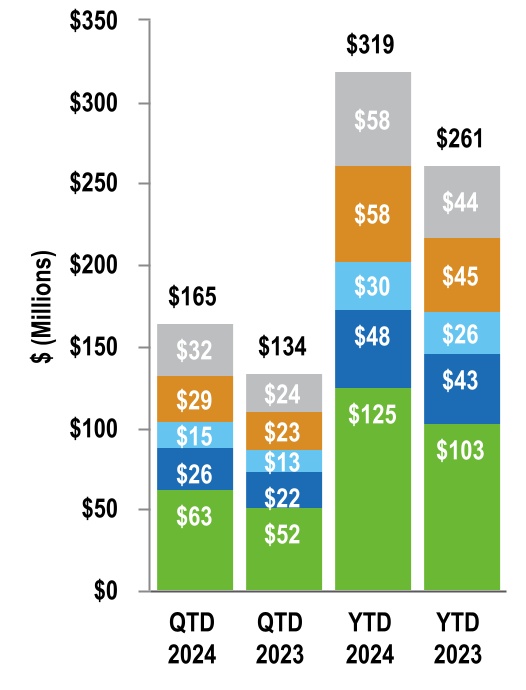

| Interest Charges | 165 | | | 134 | | | 319 | | | 261 | |

| Income Before Income Taxes | 299 | | | 277 | | | 605 | | | 579 | |

| Income Taxes | 39 | | | 38 | | | 83 | | | 75 | |

| | | | | | | |

| | | | | | | |

| Net Income | 260 | | | 239 | | | 522 | | | 504 | |

| Less: Net Income Attributable to Noncontrolling Interests | 2 | | | 2 | | | 3 | | | 3 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net Income Attributable to Ameren Common Shareholders | $ | 258 | | | $ | 237 | | | $ | 519 | | | $ | 501 | |

| | | | | | | |

| | | | | | | |

| Net Income | $ | 260 | | | $ | 239 | | | $ | 522 | | | $ | 504 | |

| Other Comprehensive Loss, Net of Taxes | | | | | | | |

| Pension and other postretirement benefit plan activity, net of income taxes (benefit) of $(1), $—, $(1), and $—, respectively | (2) | | | (1) | | | (3) | | | (2) | |

| Comprehensive Income | 258 | | | 238 | | | 519 | | | 502 | |

| Less: Comprehensive Income Attributable to Noncontrolling Interests | 2 | | | 2 | | | 3 | | | 3 | |

| Comprehensive Income Attributable to Ameren Common Shareholders | $ | 256 | | | $ | 236 | | | $ | 516 | | | $ | 499 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Earnings per Common Share – Basic | $ | 0.97 | | | $ | 0.90 | | | $ | 1.95 | | | $ | 1.91 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Earnings per Common Share – Diluted | $ | 0.97 | | | $ | 0.90 | | | $ | 1.95 | | | $ | 1.90 | |

| | | | | | | |

| Weighted-average Common Shares Outstanding – Basic | 266.7 | | | 262.6 | | | 266.5 | | | 262.4 | |

| Weighted-average Common Shares Outstanding – Diluted | 266.8 | | | 263.2 | | | 266.8 | | | 263.2 | |

The accompanying notes are an integral part of these consolidated financial statements.

AMEREN CORPORATION

CONSOLIDATED BALANCE SHEET

(Unaudited) (In millions, except per share amounts)

| | | | | | | | | | | |

| June 30,

2024 | | December 31, 2023 |

| ASSETS | | | |

| Current Assets: | | | |

| Cash and cash equivalents | $ | 19 | | | $ | 25 | |

| Accounts receivable – trade (less allowance for doubtful accounts of $37 and $30, respectively) | 514 | | | 494 | |

| Unbilled revenue | 407 | | | 319 | |

| Miscellaneous accounts receivable | 62 | | | 106 | |

| Inventories | 740 | | | 733 | |

| | | |

| | | |

| Current regulatory assets | 345 | | | 365 | |

| | | |

| | | |

| | | |

| Other current assets | 130 | | | 139 | |

| | | |

| Total current assets | 2,217 | | | 2,181 | |

| Property, Plant, and Equipment, Net | 34,873 | | | 33,776 | |

| Investments and Other Assets: | | | |

| Nuclear decommissioning trust fund | 1,266 | | | 1,150 | |

| Goodwill | 411 | | | 411 | |

| | | |

| Regulatory assets | 1,952 | | | 1,810 | |

| Pension and other postretirement benefits | 566 | | | 581 | |

| Other assets | 1,049 | | | 921 | |

| | | |

| Total investments and other assets | 5,244 | | | 4,873 | |

| TOTAL ASSETS | $ | 42,334 | | | $ | 40,830 | |

| LIABILITIES AND EQUITY | | | |

| Current Liabilities: | | | |

| Current maturities of long-term debt | $ | 799 | | | $ | 849 | |

| Short-term debt | 691 | | | 536 | |

| Accounts and wages payable | 774 | | | 1,136 | |

| | | |

| Interest accrued | 177 | | | 147 | |

| Customer deposits | 197 | | | 176 | |

| | | |

| | | |

| | | |

| Other current liabilities | 655 | | | 501 | |

| | | |

| Total current liabilities | 3,293 | | | 3,345 | |

| Long-term Debt, Net | 16,280 | | | 15,121 | |

| Deferred Credits and Other Liabilities: | | | |

| Accumulated deferred income taxes and tax credits, net | 4,325 | | | 4,176 | |

| | | |

| Regulatory liabilities | 5,531 | | | 5,512 | |

| Asset retirement obligations | 791 | | | 772 | |

| | | |

| Other deferred credits and liabilities | 446 | | | 426 | |

| | | |

| Total deferred credits and other liabilities | 11,093 | | | 10,886 | |

| Commitments and Contingencies (Notes 2, 9, and 10) | | | |

| Shareholders’ Equity: | | | |

| Common stock, $.01 par value, 400.0 shares authorized – shares outstanding of 266.8 and 266.3, respectively | 3 | | | 3 | |

| Other paid-in capital, principally premium on common stock | 7,246 | | | 7,216 | |

| Retained earnings | 4,299 | | | 4,136 | |

| Accumulated other comprehensive loss | (9) | | | (6) | |

| | | |

| Total shareholders’ equity | 11,539 | | | 11,349 | |

| Noncontrolling Interests | 129 | | | 129 | |

| Total equity | 11,668 | | | 11,478 | |

| TOTAL LIABILITIES AND EQUITY | $ | 42,334 | | | $ | 40,830 | |

The accompanying notes are an integral part of these consolidated financial statements.

| | | | | | | | | | | |

| AMEREN CORPORATION |

| CONSOLIDATED STATEMENT OF CASH FLOWS |

| (Unaudited) (In millions) |

| | Six Months Ended June 30, |

| | 2024 | | 2023 |

| Cash Flows From Operating Activities: | | | |

| Net income | $ | 522 | | | $ | 504 | |

| | | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Depreciation and amortization | 760 | | | 703 | |

| Amortization of nuclear fuel | 38 | | | 36 | |

| Amortization of debt issuance costs and premium/discounts | 9 | | | 8 | |

| Deferred income taxes and investment tax credits, net | 76 | | | 66 | |

| Allowance for equity funds used during construction | (25) | | | (23) | |

| Stock-based compensation costs | 14 | | | 14 | |

| Other | 13 | | | (19) | |

| Changes in assets and liabilities: | | | |

| Receivables | (85) | | | 173 | |

| Inventories | (7) | | | (44) | |

| Accounts and wages payable | (210) | | | (335) | |

| Taxes accrued | 121 | | | 93 | |

| Regulatory assets and liabilities | (105) | | | (81) | |

| Assets, other | (53) | | | (38) | |

| Liabilities, other | 100 | | | 34 | |

| Pension and other postretirement benefits | (112) | | | (114) | |

| Counterparty collateral, net | (7) | | | 134 | |

| | | |

| | | |

| | | |

| | | |

| Net cash provided by operating activities | 1,049 | | | 1,111 | |

| Cash Flows From Investing Activities: | | | |

| Capital expenditures | (1,892) | | | (1,822) | |

| | | |

| Nuclear fuel expenditures | (37) | | | (50) | |

| Purchases of securities – nuclear decommissioning trust fund | (323) | | | (81) | |

| Sales and maturities of securities – nuclear decommissioning trust fund | 309 | | | 65 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Other | 11 | | | (1) | |

| | | |

| | | |

| Net cash used in investing activities | (1,932) | | | (1,889) | |

| Cash Flows From Financing Activities: | | | |

| Dividends on common stock | (356) | | | (330) | |

| Dividends paid to noncontrolling interest holders | (3) | | | (3) | |

| Short-term debt, net | 156 | | | 260 | |

| Maturities of long-term debt | (350) | | | (100) | |

| | | |

| Issuances of long-term debt | 1,470 | | | 997 | |

| Issuances of common stock | 21 | | | 16 | |

| | | |

| | | |

| Employee payroll taxes related to stock-based compensation | (8) | | | (20) | |

| Debt issuance costs | (18) | | | (9) | |

| Other | — | | | (3) | |

| | | |

| | | |

| | | |

| | | |

| Net cash provided by financing activities | 912 | | | 808 | |

| Net change in cash, cash equivalents, and restricted cash | 29 | | | 30 | |

| Cash, cash equivalents, and restricted cash at beginning of year | 272 | | | 216 | |

| | | |

| | | |

| Cash, cash equivalents, and restricted cash at end of period | $ | 301 | | | $ | 246 | |

| | | |

| | | |

| | | |

| | | |

| | | |

The accompanying notes are an integral part of these consolidated financial statements.

AMEREN CORPORATION

CONSOLIDATED STATEMENT OF SHAREHOLDERS’ EQUITY

(Unaudited) (In millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| Common Stock | $ | 3 | | | $ | 3 | | | $ | 3 | | | $ | 3 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Other Paid-in Capital: | | | | | | | |

| Beginning of period | 7,228 | | | 6,861 | | | 7,216 | | | 6,860 | |

| | | | | | | |

| | | | | | | |

| Shares issued under the DRPlus and 401(k) plan | 11 | | | 11 | | | 21 | | | 23 | |

| Stock-based compensation activity | 7 | | | 8 | | | 9 | | | (3) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Other paid-in capital, end of period | 7,246 | | | 6,880 | | | 7,246 | | | 6,880 | |

| | | | | | | |

| Retained Earnings: | | | | | | | |

| Beginning of period | 4,219 | | | 3,745 | | | 4,136 | | | 3,646 | |

| Net income attributable to Ameren common shareholders | 258 | | | 237 | | | 519 | | | 501 | |

| Dividends on common stock | (178) | | | (165) | | | (356) | | | (330) | |

| | | | | | | |

| Retained earnings, end of period | 4,299 | | | 3,817 | | | 4,299 | | | 3,817 | |

| | | | | | | |

| Accumulated Other Comprehensive Loss: | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Deferred retirement benefit costs, beginning of period | (7) | | | (2) | | | (6) | | | (1) | |

| | | | | | | |

| Change in deferred retirement benefit costs | (2) | | | (1) | | | (3) | | | (2) | |

| | | | | | | |

| Deferred retirement benefit costs, end of period | (9) | | | (3) | | | (9) | | | (3) | |

| Total accumulated other comprehensive loss, end of period | (9) | | | (3) | | | (9) | | | (3) | |

| Total Shareholders’ Equity | $ | 11,539 | | | $ | 10,697 | | | $ | 11,539 | | | $ | 10,697 | |

| | | | | | | |

| Noncontrolling Interests: | | | | | | | |

| Beginning of period | 129 | | | 129 | | | 129 | | | 129 | |

| Net income attributable to noncontrolling interest holders | 2 | | | 2 | | | 3 | | | 3 | |

| Dividends paid to noncontrolling interest holders | (2) | | | (2) | | | (3) | | | (3) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Noncontrolling interests, end of period | 129 | | | 129 | | | 129 | | | 129 | |

| Total Equity | $ | 11,668 | | | $ | 10,826 | | | $ | 11,668 | | | $ | 10,826 | |

| | | | | | | |

| | | | | | | |

| Common stock shares outstanding at beginning of period | 266.6 | | | 262.6 | | | 266.3 | | | 262.0 | |

| | | | | | | |

| | | | | | | |

| Shares issued under the DRPlus and 401(k) plan | 0.2 | | | 0.1 | | | 0.3 | | | 0.2 | |

| Shares issued for stock-based compensation | — | | | — | | | 0.2 | | | 0.5 | |

| Common stock shares outstanding at end of period | 266.8 | | | 262.7 | | | 266.8 | | | 262.7 | |

| | | | | | | |

| Dividends per common share | $ | 0.67 | | | $ | 0.63 | | | $ | 1.34 | | | $ | 1.26 | |

The accompanying notes are an integral part of these consolidated financial statements.

UNION ELECTRIC COMPANY (d/b/a AMEREN MISSOURI)

CONSOLIDATED STATEMENT OF INCOME

(Unaudited) (In millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Operating Revenues: | | | | | | | |

| Electric | $ | 864 | | | $ | 918 | | | $ | 1,578 | | | $ | 1,759 | |

| Natural gas | 24 | | | 23 | | | 85 | | | 105 | |

| | | | | | | |

| Total operating revenues | 888 | | | 941 | | | 1,663 | | | 1,864 | |

| Operating Expenses: | | | | | | | |

| Fuel and purchased power | 189 | | | 289 | | | 355 | | | 610 | |

| | | | | | | |

| Natural gas purchased for resale | 9 | | | 9 | | | 37 | | | 56 | |

| Other operations and maintenance | 247 | | | 237 | | | 501 | | | 476 | |

| | | | | | | |

| Depreciation and amortization | 208 | | | 186 | | | 403 | | | 362 | |

| Taxes other than income taxes | 91 | | | 88 | | | 178 | | | 168 | |

| Total operating expenses | 744 | | | 809 | | | 1,474 | | | 1,672 | |

| Operating Income | 144 | | | 132 | | | 189 | | | 192 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

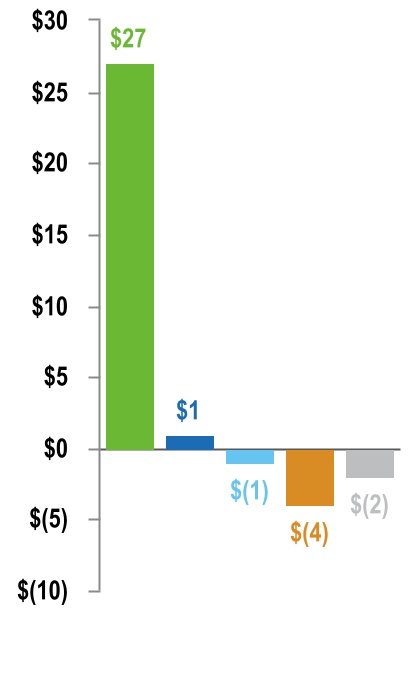

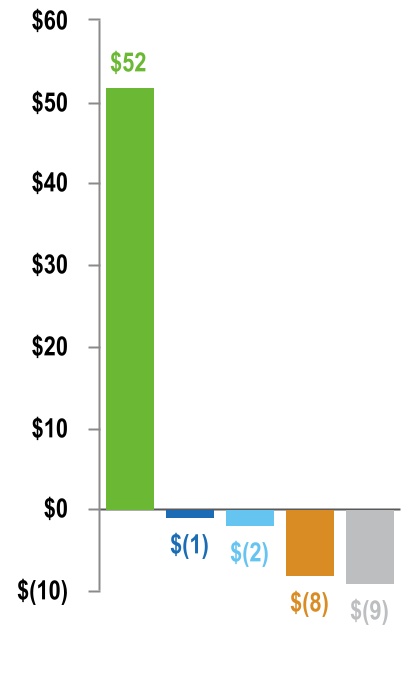

| Other Income, Net | 49 | | | 22 | | | 93 | | | 41 | |

| Interest Charges | 63 | | | 52 | | | 125 | | | 103 | |

| Income Before Income Taxes | 130 | | | 102 | | | 157 | | | 130 | |

| Income Taxes (Benefit) | 1 | | | (1) | | | 2 | | | (2) | |

| Net Income | 129 | | | 103 | | | 155 | | | 132 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Preferred Stock Dividends | 1 | | | 1 | | | 2 | | | 2 | |

| Net Income Available to Common Shareholder | $ | 128 | | | $ | 102 | | | $ | 153 | | | $ | 130 | |

The accompanying notes as they relate to Ameren Missouri are an integral part of these consolidated financial statements.

UNION ELECTRIC COMPANY (d/b/a AMEREN MISSOURI)

CONSOLIDATED BALANCE SHEET

(Unaudited) (In millions, except per share amounts)

| | | | | | | | | | | |

| June 30,

2024 | | December 31, 2023 |

| ASSETS | | | |

| Current Assets: | | | |

| Cash and cash equivalents | $ | — | | | $ | — | |

| | | |

| Accounts receivable – trade (less allowance for doubtful accounts of $12 and $12, respectively) | 211 | | | 204 | |

| Accounts receivable – affiliates | 67 | | | 72 | |

| Unbilled revenue | 271 | | | 163 | |

| Miscellaneous accounts receivable | 30 | | | 26 | |

| Inventories | 520 | | | 508 | |

| | | |

| Current regulatory assets | 124 | | | 101 | |

| | | |

| | | |

| Other current assets | 63 | | | 68 | |

| Total current assets | 1,286 | | | 1,142 | |

| Property, Plant, and Equipment, Net | 17,938 | | | 17,250 | |

| Investments and Other Assets: | | | |

| Nuclear decommissioning trust fund | 1,266 | | | 1,150 | |

| | | |

| Regulatory assets | 733 | | | 755 | |

| Pension and other postretirement benefits | 138 | | | 157 | |

| Other assets | 194 | | | 152 | |

| Total investments and other assets | 2,331 | | | 2,214 | |

| TOTAL ASSETS | $ | 21,555 | | | $ | 20,606 | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | |

| Current Liabilities: | | | |

| Current maturities of long-term debt | $ | — | | | $ | 350 | |

| Short-term debt | 390 | | | 170 | |

| Borrowings from money pool | — | | | 306 | |

| Accounts and wages payable | 366 | | | 618 | |

| Accounts payable – affiliates | 58 | | | 53 | |

| Taxes accrued | 132 | | | 28 | |

| Interest accrued | 82 | | | 69 | |

| | | |

| | | |

| | | |

| Other current liabilities | 234 | | | 153 | |

| Total current liabilities | 1,262 | | | 1,747 | |

| Long-term Debt, Net | 6,830 | | | 5,991 | |

| Deferred Credits and Other Liabilities: | | | |

| Accumulated deferred income taxes and tax credits, net | 2,196 | | | 2,122 | |

| | | |

| Regulatory liabilities | 2,925 | | | 2,959 | |

| Asset retirement obligations | 788 | | | 768 | |

| | | |

| Other deferred credits and liabilities | 88 | | | 56 | |

| Total deferred credits and other liabilities | 5,997 | | | 5,905 | |

| Commitments and Contingencies (Notes 2, 8, 9, and 10) | | | |

| Shareholders’ Equity: | | | |

| Common stock, $5 par value, 150.0 shares authorized – 102.1 shares outstanding | 511 | | | 511 | |

| Other paid-in capital, principally premium on common stock | 3,075 | | | 2,725 | |

| Preferred stock | 80 | | | 80 | |

| Retained earnings | 3,800 | | | 3,647 | |

| Total shareholders’ equity | 7,466 | | | 6,963 | |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 21,555 | | | $ | 20,606 | |

The accompanying notes as they relate to Ameren Missouri are an integral part of these consolidated financial statements.

UNION ELECTRIC COMPANY (d/b/a AMEREN MISSOURI)

CONSOLIDATED STATEMENT OF CASH FLOWS

(Unaudited) (In millions)

| | | | | | | | | | | |

| Six Months Ended June 30, |

| 2024 | | 2023 |

| Cash Flows From Operating Activities: | | | |

| Net income | $ | 155 | | | $ | 132 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| | | |

| Depreciation and amortization | 426 | | | 410 | |

| Amortization of nuclear fuel | 38 | | | 36 | |

| | | |

| Amortization of debt issuance costs and premium/discounts | 3 | | | 3 | |

| Deferred income taxes and investment tax credits, net | 38 | | | 10 | |

| Allowance for equity funds used during construction | (23) | | | (12) | |

| Other | 22 | | | (20) | |

| Changes in assets and liabilities: | | | |

| Receivables | (121) | | | (9) | |

| Inventories | (12) | | | (81) | |

| Accounts and wages payable | (196) | | | (231) | |

| Taxes accrued | 118 | | | 103 | |

| Regulatory assets and liabilities | (31) | | | 28 | |

| Assets, other | (30) | | | 13 | |

| Liabilities, other | 63 | | | 21 | |

| Pension and other postretirement benefits | (40) | | | (41) | |

| Counterparty collateral, net | (3) | | | 81 | |

| Net cash provided by operating activities | 407 | | | 443 | |

| Cash Flows From Investing Activities: | | | |

| Capital expenditures | (1,104) | | | (914) | |

| | | |

| Nuclear fuel expenditures | (37) | | | (50) | |

| Purchases of securities – nuclear decommissioning trust fund | (323) | | | (81) | |

| Sales and maturities of securities – nuclear decommissioning trust fund | 309 | | | 65 | |

| | | |

| | | |

| | | |

| | | |

| Net cash used in investing activities | (1,155) | | | (980) | |

| Cash Flows From Financing Activities: | | | |

| | | |

| Dividends on preferred stock | (2) | | | (2) | |

| Short-term debt, net | 220 | | | 44 | |

| Money pool borrowings, net | (306) | | | — | |

| Maturities of long-term debt | (350) | | | — | |

| Issuances of long-term debt | 846 | | | 499 | |

| Capital contribution from parent | 350 | | | — | |

| Debt issuance costs | (9) | | | (6) | |

| Other | — | | | (3) | |

| Net cash provided by financing activities | 749 | | | 532 | |

| Net change in cash, cash equivalents, and restricted cash | 1 | | | (5) | |

| Cash, cash equivalents, and restricted cash at beginning of year | 10 | | | 13 | |

| Cash, cash equivalents, and restricted cash at end of period | $ | 11 | | | $ | 8 | |

The accompanying notes as they relate to Ameren Missouri are an integral part of these consolidated financial statements.

UNION ELECTRIC COMPANY (d/b/a AMEREN MISSOURI)

CONSOLIDATED STATEMENT OF SHAREHOLDERS’ EQUITY

(Unaudited) (In millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Common Stock | $ | 511 | | | $ | 511 | | | $ | 511 | | | $ | 511 | |

| | | | | | | |

| Other Paid-in Capital: | | | | | | | |

| | | | | | | |

| Beginning of period | 2,725 | | | 2,725 | | | 2,725 | | | 2,725 | |

| Capital contributions from parent | 350 | | | — | | | 350 | | | — | |

| | | | | | | |

| Other paid-in capital, end of period | 3,075 | | | 2,725 | | | 3,075 | | | 2,725 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Preferred Stock | 80 | | | 80 | | | 80 | | | 80 | |

| | | | | | | |

| Retained Earnings: | | | | | | | |

| Beginning of period | 3,672 | | | 3,139 | | | 3,647 | | | 3,111 | |

| Net income | 129 | | | 103 | | | 155 | | | 132 | |

| | | | | | | |

| Dividends on preferred stock | (1) | | | (1) | | | (2) | | | (2) | |

| Retained earnings, end of period | 3,800 | | | 3,241 | | | 3,800 | | | 3,241 | |

| | | | | | | |

| Total Shareholders’ Equity | $ | 7,466 | | | $ | 6,557 | | | $ | 7,466 | | | $ | 6,557 | |

The accompanying notes as they relate to Ameren Missouri are an integral part of these consolidated financial statements.

AMEREN ILLINOIS COMPANY (d/b/a AMEREN ILLINOIS)

STATEMENT OF INCOME

(Unaudited) (In millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Operating Revenues: | | | | | | | |

| Electric | $ | 618 | | | $ | 627 | | | $ | 1,227 | | | $ | 1,337 | |

| Natural gas | 148 | | | 152 | | | 539 | | | 543 | |

| Total operating revenues | 766 | | | 779 | | | 1,766 | | | 1,880 | |

| Operating Expenses: | | | | | | | |

| Purchased power | 141 | | | 192 | | | 305 | | | 479 | |

| Natural gas purchased for resale | 24 | | | 33 | | | 147 | | | 194 | |

| Other operations and maintenance | 224 | | | 201 | | | 434 | | | 403 | |

| Depreciation and amortization | 154 | | | 138 | | | 307 | | | 271 | |

| Taxes other than income taxes | 35 | | | 32 | | | 79 | | | 74 | |

| Total operating expenses | 578 | | | 596 | | | 1,272 | | | 1,421 | |

| Operating Income | 188 | | | 183 | | | 494 | | | 459 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Other Income, Net | 37 | | | 41 | | | 68 | | | 78 | |

| Interest Charges | 60 | | | 50 | | | 115 | | | 97 | |

| Income Before Income Taxes | 165 | | | 174 | | | 447 | | | 440 | |

| Income Taxes | 40 | | | 44 | | | 107 | | | 112 | |

| Net Income | 125 | | | 130 | | | 340 | | | 328 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Preferred Stock Dividends | 1 | | | 1 | | | 1 | | | 1 | |

| Net Income Available to Common Shareholder | $ | 124 | | | $ | 129 | | | $ | 339 | | | $ | 327 | |

The accompanying notes as they relate to Ameren Illinois are an integral part of these financial statements.

AMEREN ILLINOIS COMPANY (d/b/a AMEREN ILLINOIS)

BALANCE SHEET

(Unaudited) (In millions)

| | | | | | | | | | | |

| June 30,

2024 | | December 31, 2023 |

| ASSETS | | | |

| Current Assets: | | | |

| Cash and cash equivalents | $ | 6 | | | $ | — | |

| Advances to money pool | 30 | | | — | |

| Accounts receivable – trade (less allowance for doubtful accounts of $25 and $18, respectively) | 287 | | | 273 | |

| Accounts receivable – affiliates | 11 | | | 35 | |

| Unbilled revenue | 136 | | | 156 | |

| Miscellaneous accounts receivable | 5 | | | 44 | |

| Inventories | 216 | | | 225 | |

| | | |

| | | |

| Current regulatory assets | 215 | | | 252 | |

| | | |

| Other current assets | 55 | | | 62 | |

| Total current assets | 961 | | | 1,047 | |

| Property, Plant, and Equipment, Net | 15,009 | | | 14,632 | |

| Investments and Other Assets: | | | |

| Goodwill | 411 | | | 411 | |

| Regulatory assets | 1,189 | | | 1,035 | |

| Pension and other postretirement benefits | 412 | | | 394 | |

| Other assets | 656 | | | 603 | |

| Total investments and other assets | 2,668 | | | 2,443 | |

| TOTAL ASSETS | $ | 18,638 | | | $ | 18,122 | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | |

| Current Liabilities: | | | |

| Current maturities of long-term debt | $ | 300 | | | $ | — | |

| Short-term debt | — | | | 366 | |

| Borrowings from money pool | — | | | 135 | |

| Accounts and wages payable | 297 | | | 370 | |

| Accounts payable – affiliates | 97 | | | 52 | |

| | | |

| | | |

| Customer deposits | 161 | | | 141 | |

| | | |

| | | |

| Zero emission credit liabilities | 64 | | | 35 | |

| Current regulatory liabilities | 58 | | | 71 | |

| Other current liabilities | 219 | | | 263 | |

| Total current liabilities | 1,196 | | | 1,433 | |

| Long-term Debt, Net | 5,551 | | | 5,232 | |

| Deferred Credits and Other Liabilities: | | | |

| Accumulated deferred income taxes and investment tax credits, net | 1,967 | | | 1,906 | |

| | | |

| Regulatory liabilities | 2,466 | | | 2,418 | |

| | | |

| | | |

| Other deferred credits and liabilities | 319 | | | 308 | |

| Total deferred credits and other liabilities | 4,752 | | | 4,632 | |

| Commitments and Contingencies (Notes 2, 8, and 9) | | | |

| Shareholders’ Equity: | | | |

| Common stock, no par value, 45.0 shares authorized – 25.5 shares outstanding | — | | | — | |

| Other paid-in capital | 3,020 | | | 3,020 | |

| Preferred stock | 49 | | | 49 | |

| Retained earnings | 4,070 | | | 3,756 | |

| | | |

| Total shareholders’ equity | 7,139 | | | 6,825 | |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 18,638 | | | $ | 18,122 | |

The accompanying notes as they relate to Ameren Illinois are an integral part of these financial statements.

AMEREN ILLINOIS COMPANY (d/b/a AMEREN ILLINOIS)

STATEMENT OF CASH FLOWS

(Unaudited) (In millions)

| | | | | | | | | | | |

| Six Months Ended June 30, |

| 2024 | | 2023 |

| Cash Flows From Operating Activities: | | | |

| Net income | $ | 340 | | | $ | 328 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 307 | | | 271 | |

| Amortization of debt issuance costs and premium/discounts | 2 | | | 2 | |

| Deferred income taxes and investment tax credits, net | 37 | | | 70 | |

| | | |

| Allowance for equity funds used during construction | (2) | | | (10) | |

| Other | 8 | | | 12 | |

| Changes in assets and liabilities: | | | |

| Receivables | 27 | | | 182 | |

| Inventories | 9 | | | 37 | |

| Accounts and wages payable | 7 | | | (92) | |

| Taxes accrued | 55 | | | (36) | |

| Regulatory assets and liabilities | (70) | | | (105) | |

| Assets, other | (23) | | | (42) | |

| Liabilities, other | 32 | | | 13 | |

| Pension and other postretirement benefits | (43) | | | (46) | |

| Counterparty collateral, net | 5 | | | 53 | |

| | | |

| Net cash provided by operating activities | 691 | | | 637 | |

| Cash Flows From Investing Activities: | | | |

| Capital expenditures | (717) | | | (844) | |

| Money pool advances, net | (30) | | | — | |

| Other | 5 | | | (2) | |

| Net cash used in investing activities | (742) | | | (846) | |

| Cash Flows From Financing Activities: | | | |

| Dividends on common stock | (25) | | | — | |

| Dividends on preferred stock | (1) | | | (1) | |

| Short-term debt, net | (366) | | | (147) | |

| Money pool borrowings, net | (135) | | | — | |

| Maturities of long-term debt | — | | | (100) | |

| Issuances of long-term debt | 624 | | | 498 | |

| | | |

| | | |

| | | |

| | | |

| Debt issuance costs | (7) | | | (3) | |

| | | |

| Net cash provided by financing activities | 90 | | | 247 | |

| Net change in cash, cash equivalents, and restricted cash | 39 | | | 38 | |

| Cash, cash equivalents and restricted cash at beginning of year | 234 | | | 191 | |

| Cash, cash equivalents, and restricted cash at end of period | $ | 273 | | | $ | 229 | |

The accompanying notes as they relate to Ameren Illinois are an integral part of these financial statements.

AMEREN ILLINOIS COMPANY (d/b/a AMEREN ILLINOIS)

STATEMENT OF SHAREHOLDERS’ EQUITY

(Unaudited) (In millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Common Stock | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| | | | | | | |

| Other Paid-in Capital: | 3,020 | | | 2,929 | | | 3,020 | | | 2,929 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Preferred Stock | 49 | | | 49 | | | 49 | | | 49 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Retained Earnings: | | | | | | | |

| Beginning of period | 3,971 | | | 3,388 | | | 3,756 | | | 3,190 | |

| Net income | 125 | | | 130 | | | 340 | | | 328 | |

| Dividends on common stock | (25) | | | — | | | (25) | | | — | |

| Dividends on preferred stock | (1) | | | (1) | | | (1) | | | (1) | |

| | | | | | | |

| Retained earnings, end of period | 4,070 | | | 3,517 | | | 4,070 | | | 3,517 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Total Shareholders’ Equity | $ | 7,139 | | | $ | 6,495 | | | $ | 7,139 | | | $ | 6,495 | |

The accompanying notes as they relate to Ameren Illinois are an integral part of these financial statements.

AMEREN CORPORATION (Consolidated)

UNION ELECTRIC COMPANY (Consolidated) (d/b/a Ameren Missouri)

AMEREN ILLINOIS COMPANY (d/b/a Ameren Illinois)

COMBINED NOTES TO FINANCIAL STATEMENTS

(Unaudited)

June 30, 2024

NOTE 1 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

General

Ameren, headquartered in St. Louis, Missouri, is a public utility holding company whose primary assets are its equity interests in its subsidiaries. Ameren’s subsidiaries are separate, independent legal entities with separate businesses, assets, and liabilities. Dividends on Ameren’s common stock and the payment of expenses by Ameren depend on distributions made to it by its subsidiaries. Ameren’s principal subsidiaries are listed below. Ameren also has other subsidiaries that conduct other activities, such as providing shared services.

•Union Electric Company, doing business as Ameren Missouri, operates a rate-regulated electric generation, transmission, and distribution business and a rate-regulated natural gas distribution business in Missouri.

•Ameren Illinois Company, doing business as Ameren Illinois, operates rate-regulated electric transmission, electric distribution, and natural gas distribution businesses in Illinois.

•ATXI operates a FERC rate-regulated electric transmission business in the MISO.

Ameren’s and Ameren Missouri’s financial statements are prepared on a consolidated basis and therefore include the accounts of their majority-owned subsidiaries. All intercompany transactions have been eliminated. Ameren Missouri’s subsidiaries were created for the ownership of renewable generation projects. Ameren Illinois has no subsidiaries. All tabular dollar amounts are in millions, unless otherwise indicated.

Our accounting policies conform to GAAP. Our financial statements reflect all adjustments (which include normal, recurring adjustments) that are necessary, in our opinion, for a fair statement of our results. The preparation of financial statements in conformity with GAAP requires management to make certain estimates and assumptions. Such estimates and assumptions affect reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the dates of financial statements, and the reported amounts of revenues and expenses during the reporting periods. Actual results could differ from those estimates. The results of operations for an interim period may not give a true indication of results that may be expected for a full year. These financial statements should be read in conjunction with the financial statements and accompanying notes included in the Form 10-K.

Variable Interest Entities

As of June 30, 2024, and December 31, 2023, Ameren had unconsolidated variable interests in various equity method investments, primarily to advance clean and resilient energy technologies, totaling $75 million and $73 million, respectively, included in “Other assets” on Ameren’s consolidated balance sheet. Any earnings or losses related to these investments are included in “Other Income, Net” on Ameren’s consolidated statement of income and comprehensive income. Ameren is not the primary beneficiary of these investments because it does not have the power to direct matters that most significantly affect the activities of these variable interest entities. As of June 30, 2024, Ameren’s maximum exposure to loss related to these variable interests is limited to its investment of $75 million plus associated outstanding funding commitments of $12 million.

COLI

Ameren and Ameren Illinois have COLI, which is recorded at the net cash surrender value. The net cash surrender value is the amount that can be realized under the insurance policies at the balance sheet date. As of June 30, 2024, the cash surrender value of COLI at Ameren and Ameren Illinois was $255 million (December 31, 2023 – $248 million) and $114 million (December 31, 2023 – $111 million), respectively, while total borrowings against the policies were $103 million (December 31, 2023 – $104 million) at both Ameren and Ameren Illinois. Ameren and Ameren Illinois have the right to offset the borrowings against the cash surrender value of the policies and, consequently, present the net asset in “Other assets” on their respective balance sheets. The net cash surrender value of Ameren’s COLI is affected by the investment performance of a separate account in which Ameren holds a beneficial interest.

NOTE 2 – RATE AND REGULATORY MATTERS

Below is a summary of updates to significant regulatory proceedings and related legal proceedings. See Note 2 – Rate and Regulatory Matters under Part II, Item 8, of the Form 10-K for additional information and a summary of our regulatory frameworks. We are unable to predict the ultimate outcome of these matters, the timing of final decisions of the various agencies and courts, or the impact on our results of operations, financial position, or liquidity.

Missouri

2024 Electric Service Regulatory Rate Review

In June 2024, Ameren Missouri filed a request with the MoPSC seeking approval to increase its annual revenues for electric service by $446 million. The electric rate increase request is based on a 10.25% return on common equity, a capital structure composed of 52% common equity, a rate base of $14 billion, and a test year ended March 31, 2024, with certain pro-forma adjustments expected through an anticipated true-up date of December 31, 2024. Ameren Missouri also requested the continued use of the FAC and trackers for pension and postretirement benefits, uncertain income tax positions, certain excess deferred income taxes, and the utilization of production and investment tax credits or proceeds from the sale of tax credits allowed under the IRA, which the MoPSC previously authorized in earlier electric rate orders. The electric rate increase request reflects the following:

•increased infrastructure investments made under Ameren Missouri’s Smart Energy Plan, including increased cost of capital and depreciation expense. Included in these investments are 500 megawatts of solar generation investment for the Boomtown, Cass County and Huck Finn solar projects along with investments in the Callaway nuclear energy center and other dispatchable generation to support a reliable, low-cost and cleaner mix of energy resources;

•decreased costs resulting from the planned retirement of the Rush Island Energy Center; and

•decreased costs related to the extension of the retirement date of the Sioux Energy Center from 2030 to 2032, consistent with Ameren Missouri’s integrated resource plan filed with the MoPSC in September 2023, to ensure reliability.

The MoPSC proceeding relating to the proposed electric service rate changes will take place over a period of up to 11 months, with a decision by the MoPSC expected by May 2025 and new rates effective by June 2025. Ameren Missouri cannot predict the level of any electric service rate change the MoPSC may approve, whether the requested regulatory recovery mechanisms will be continued, or whether any rate change that may eventually be approved will be sufficient for Ameren Missouri to recover its costs and earn a reasonable return on its investments when the rate change goes into effect.

Generation Facilities

During 2022 and 2023, Ameren Missouri, and certain subsidiaries of Ameren Missouri, entered into agreements to acquire and/or construct various generation facilities. The solar generation facilities are eligible for recovery under the PISA. The following table provides information with respect to each agreement:

| | | | | | | | | | | | | | | | | |

| Agreement type | Facility size | Status of MoPSC CCN | Status of FERC approval of acquisition | Anticipated in-service date(a) |

Huck Finn Solar Project(b)(c) | Build-transfer | 200-MW | Approved February 2023 | Received March 2023 | Fourth quarter 2024 |

Boomtown Solar Project(c)(d) | Build-transfer | 150-MW | Approved April 2023 | Received October 2023 | Fourth quarter 2024(e) |

Cass County Solar Project(d) | Development-transfer(f) | 150-MW | Approved June 2024 | Not applicable | Fourth quarter 2024 |

Vandalia Solar Project(c)(g) | Self-build | 50-MW | Approved March 2024 | Not applicable | Fourth quarter 2025 |

Bowling Green Solar Project(c)(g) | Self-build | 50-MW | Approved March 2024 | Not applicable | First quarter 2026 |

Split Rail Solar Project(g) | Build-transfer | 300-MW | Approved March 2024 | Requested July 2024 | Mid-2026 |

| Castle Bluff Natural Gas Project | Self-build | 800-MW | Filed June 2024 | Not applicable | Fourth quarter 2027 |

(a)Anticipated in-service dates are dependent on the timing of regulatory approvals and construction completion, among other things.

(b)The Huck Finn Solar Project is expected to support Ameren Missouri’s compliance with the state of Missouri’s renewable energy standard. Investments in the project will be eligible for recovery under the RESRAM. Ameren Missouri expects to close on the acquisition of the Huck Finn Solar Project in the fourth quarter of 2024.

(c)These projects collectively represent approximately $0.85 billion of expected capital expenditures.

(d)The Boomtown and Cass County solar projects are expected to support Ameren Missouri’s transition to renewable energy generation and serve customers under the Renewable Solutions Program.

(e)Ameren Missouri expects to close on the acquisition of the Boomtown Solar Project in August 2024.

(f)In June 2024, Ameren Missouri acquired the Cass County Solar Project, which includes solar panels, project design, land rights, and engineering, procurement, and construction agreements, for approximately $250 million and took over construction management of the project.

(g)These solar projects are expected to support Ameren Missouri’s transition to renewable energy generation.

Securitization of Rush Island Energy Center Costs

In June 2024, the MoPSC issued a financing order authorizing the issuance of securitized utility tariff bonds by a wholly owned, special purpose subsidiary of Ameren Missouri to finance approximately $470 million of costs related to the planned accelerated retirement of the Rush Island Energy Center, which includes the expected remaining unrecovered net plant balance associated with the facility, among other costs. Ameren Missouri initially petitioned the MoPSC in November 2023 to finance $519 million of costs. The difference between the initial petition and final financing order will be considered for recovery in future rate proceedings involving the securitized utility tariff charge or base rates. Ameren Missouri will collect the amounts necessary to repay the bonds over approximately 15 years from the date of bond issuance. The financing order also includes a determination that the decision to retire the Rush Island Energy Center was reasonable and prudent. The MoPSC did not make a determination regarding the prudency of Ameren Missouri's prior actions that resulted in the adverse ruling in the NSR and Clean Air Act litigation discussed in Note 9 – Commitments and Contingencies. However, claims regarding such actions could be considered in future regulatory proceedings. If future regulatory proceedings result in revenue reductions based on Ameren Missouri’s prior actions that resulted in the adverse ruling in the NSR and Clean Air Act litigation, it could have a material adverse effect on the results of operations, financial position, and liquidity of Ameren and Ameren Missouri. In July 2024, the MoOPC filed a request for rehearing of the financing order. Ameren Missouri expects a decision on the rehearing request in August 2024. The decision on the rehearing request is subject to appeal. The timing of the issuance of securitized utility tariff bonds is dependent on the conclusion of any appeal process.

MEEIA

In January 2024, Ameren Missouri filed a proposed customer energy-efficiency plan with the MoPSC under the MEEIA. This filing proposed a three-year plan, which includes a portfolio of customer energy-efficiency programs, along with the continued use of the MEEIA rider, which allows Ameren Missouri to collect from customers its actual MEEIA program costs and related lost electric revenues. If the plan is approved, Ameren Missouri intends to invest $123 million annually in the proposed customer energy-efficiency programs from 2025 to 2027. In addition, Ameren Missouri requested performance incentives applicable to each plan year to earn revenues by achieving certain customer energy-efficiency savings and target spending goals. If 100% of the goals are achieved, Ameren Missouri would earn performance incentive revenues totaling $56 million over the three-year plan. Ameren Missouri also requested additional performance incentives applicable to each plan year totaling up to $14 million over the three-year plan, if Ameren Missouri exceeds 100% of the goals. In March 2024, the MoPSC staff and the MoOPC filed responses in opposition to the proposed customer energy-efficiency plan under the MEEIA. Ameren Missouri expects a decision by the MoPSC by October 2024, but cannot predict the ultimate outcome of this regulatory proceeding.

MISO Long-Range Transmission Projects CCN

In July 2022, the MISO approved the first tranche of projects related to a preliminary long-range transmission planning roadmap of projects through 2039. A portion of these projects were assigned or awarded via a competitive bid process to various utilities, including Ameren. In July 2024, ATXI filed a request for a CCN, among other things, with the MoPSC related to a portion of the MISO long-range transmission projects that it will construct within the MoPSC’s jurisdiction. A decision by the MoPSC is expected by mid-2025.

Illinois

MYRP

In December 2023, the ICC issued an order in Ameren Illinois' MYRP proceeding approving base rates for electric distribution services for 2024 through 2027 and rejecting Ameren Illinois' Grid Plan, which was addressed as part of the MYRP proceeding. Rate changes consistent with the December 2023 order became effective in January 2024 and remained effective through late June 2024, when new rates became effective pursuant to the June 2024 ICC rehearing order discussed below. The December 2023 order adopted an alternative methodology to establish a rate base and revenue requirements for the years 2024 through 2027 using Ameren Illinois’ previously approved 2022 year-end rate base. In January 2024, the ICC partially denied a rehearing requested by Ameren Illinois to revise the allowed ROE in the December 2023 order and granted Ameren Illinois’ rehearing request to reconsider the rate base for each year of the MYRP and to include a base level of investments to maintain grid reliability in each year of the MYRP. In June 2024, the ICC issued an order on Ameren Illinois’ rehearing request, which revised the rate bases for Ameren Illinois’ MYRP test years to include investments for 2023 through 2027, among other things. New rates became effective in late June 2024. For additional information on the ICC’s June 2024 rehearing order, see the table below. In July 2024, Ameren Illinois filed a request for rehearing of the ICC’s June 2024 rehearing order to include an asset associated with other postretirement benefits in the rate base. Subsequently, in August 2024, the ICC denied the rehearing request. The ICC rehearing denial

is subject to appeal. Also, in January 2024, Ameren Illinois filed an appeal of the December 2023 ICC order, including the 8.72% ROE, to the Illinois Appellate Court for the Fifth Judicial District. The court is under no deadline to address the appeal.

In July 2024, Ameren Illinois filed an update to its revised Grid Plan and revised MYRP to update the requested revenue requirements for 2024 through 2027. In July 2024, the ICC staff filed its recommendation regarding Ameren Illinois’ revised MYRP. An ICC decision on the revised Grid Plan and updated revenue requirements is expected by the end of 2024 with rates effective in January 2025.

The following table presents the approved revenue requirements and average annual rate base in the ICC’s June 2024 rehearing order, as well as the proposed revenue requirements and average annual rate base in Ameren Illinois’ July 2024 revised MYRP and the ICC staff’s July 2024 revised MYRP recommendation:

| | | | | | | | | | |

| Year | Revenue Requirement (in millions) | | | Average Annual Rate Base (in billions) |

ICC’s June 2024 Rehearing Order(a): | | | | |

| 2024 | $1,196 | | | $4.0 |

| 2025 | $1,282 | | | $4.3 |

| 2026 | $1,350 | | | $4.5 |

| 2027 | $1,397 | | | $4.7 |

Ameren Illinois’ July 2024 Revised MYRP(a): | | | | |

| 2024 | $1,215 | | | $4.3 |

| 2025 | $1,300 | | | $4.5 |

| 2026 | $1,386 | | | $4.8 |

| 2027 | $1,446 | | | $5.0 |

ICC Staff’s July 2024 Revised MYRP(a): | | | | |

| 2024 | $1,201 | | | $4.2 |

| 2025 | $1,281 | | | $4.4 |

| 2026 | $1,361 | | | $4.6 |

| 2027 | $1,414 | | | $4.8 |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

(a)Based on an allowed ROE of 8.72% and a capital structure composed of 50% common equity. The ROE is under appeal, as discussed above.

Using the 2023 revenue requirement as a starting point, the approved revenue requirements in the ICC’s June 2024 rehearing order represent a cumulative four-year increase of $285 million compared to a cumulative increase of $334 million in Ameren Illinois’ July 2024 revised MYRP and a cumulative increase of $302 million in the ICC staff’s July 2024 revised MYRP recommendation.

Ameren Illinois cannot predict the ultimate outcome of the appeal to the Illinois Appellate Court for the Fifth Judicial District, its revised Grid Plan filing, or its request to update the associated MYRP revenue requirements for 2024 through 2027.

2023 Electric Distribution Revenue Requirement Reconciliation Adjustment Request

In April 2024, Ameren Illinois filed for a reconciliation adjustment to its 2023 electric distribution service revenue requirement with the ICC. In July 2024, Ameren Illinois filed a revised reconciliation adjustment, requesting recovery of $158 million. The reconciliation adjustment reflects a capital structure composed of 50% common equity and Ameren Illinois’ actual 2023 recoverable costs and year-end rate base. In June 2024, the ICC staff submitted its calculation of the reconciliation adjustment, recommending recovery of $157 million. An ICC decision in this proceeding is required by December 2024, and any approved adjustment would be collected from customers in 2025. This is the final revenue requirement reconciliation under the IEIMA formula framework.

Electric Customer Energy-Efficiency Investments

In May 2024, Ameren Illinois filed its annual electric energy-efficiency formula rate update to increase its rates by $26 million with the ICC. An ICC decision in this proceeding is required by December 2024, with new rates effective January 2025.

2023 Natural Gas Delivery Service Rate Order

In November 2023, the ICC issued an order in Ameren Illinois’ January 2023 natural gas delivery service regulatory rate review, which resulted in an increase to its annual revenues for natural gas delivery service of $112 million based on a 9.44% allowed ROE, a capital structure composed of 50% common equity, and a rate base of approximately $2.85 billion. The order reflected a reduction of approximately $93 million of planned distribution and transmission capital investments included in Ameren Illinois’ requested revenue increase, which used a 2024 future test year. The new rates became effective on November 28, 2023.

In December 2023, Ameren Illinois filed a request for rehearing of the ICC’s November 2023 order. The filing requested the ICC revise the order to include an allowed ROE of at least 9.89%, a capital structure composed of 52% common equity, and the reversal of the approximately $93 million reduction of planned distribution and transmission capital investments included in the order, among other things. In January 2024, the ICC denied Ameren Illinois’ rehearing request. Subsequently, in January 2024, Ameren Illinois filed an appeal of the November 2023 ICC order to the Illinois Appellate Court for the Fifth Judicial District. The court is under no deadline to address the appeal. Ameren Illinois cannot predict the ultimate outcome of this appeal.

QIP Reconciliation Hearing

In March 2021, Ameren Illinois filed a request with the ICC to initiate a reconciliation proceeding to determine the accuracy and prudence of natural gas capital investments recovered under the QIP rider during 2020. In October 2023, the Illinois Attorney General’s office challenged the recovery of capital investments that were made during 2020, alleging that the ICC should disallow approximately $53 million in natural gas capital investments as improper and imprudent, providing a potential over-recovery of approximately $3 million in 2020. In October 2023, the ICC staff filed testimony that supports the prudence and reasonableness of the capital investments made during 2020. Ameren Illinois’ 2020 QIP rate recovery request under review by the ICC was within the rate increase limitations allowed by law. The ICC is under no deadline to issue an order in this proceeding. Ameren Illinois cannot predict the ultimate outcome of this regulatory proceeding.

MISO Long-Range Transmission Projects CCN

In July 2022, the MISO approved the first tranche of projects related to a preliminary long-range transmission planning roadmap of projects through 2039. A portion of these projects were assigned or awarded via a competitive bidding process to various utilities, including Ameren. In February 2024, Ameren Illinois and ATXI filed a request for a CCN, among other things, with the ICC related to the portion of the MISO long-range transmission projects they will construct within the ICC’s jurisdiction. A decision by the ICC is expected by mid-2025.

Federal

FERC Complaint Cases

Since November 2013, the allowed base ROE for FERC-regulated transmission rate base under the MISO tariff has been subject to customer complaint cases and has been changed by various FERC orders. In May 2020, the FERC issued an order, which set the allowed base ROE to 10.02% and required refunds, with interest, for the periods November 2013 to February 2015 and from late September 2016 forward. Ameren and Ameren Illinois paid these refunds, including interest, by March 31, 2022. In June and July 2020, Ameren Missouri, Ameren Illinois, and ATXI, as well as various customers, petitioned the United States Court of Appeals for the District of Columbia Circuit for review of the May 2020 order, challenging certain aspects of the new ROE methodology established. The petition filed by Ameren Missouri, Ameren Illinois, and ATXI challenged the refunds required for the period from September 2016 to May 2020. In August 2022, the court issued a ruling that granted the customers’ petition for review, vacated the FERC’s previous MISO ROE-determining orders, and remanded the proceedings to the FERC. The court elected not to rule on the issues raised by Ameren Missouri, Ameren Illinois, and ATXI. The currently allowed base ROE of 10.02% will remain effective for customer billings, but the transmission rates charged during previous periods and the currently effective rates may be subject to refund if the base ROE is changed by the FERC in a future order. The FERC is under no deadline to issue an order related to these proceedings. A 50-basis-point change in the FERC-allowed ROE would affect Ameren’s and Ameren Illinois’ annual revenue by an estimated $21 million and $15 million, respectively, based on each company’s 2024 projected rate base. Ameren and Ameren Illinois are unable to predict the ultimate resolution of this matter; however, such resolution could have a material effect on their results of operations, financial position, and liquidity.

NOTE 3 – SHORT-TERM DEBT AND LIQUIDITY

The liquidity needs of the Ameren Companies are typically supported through the use of available cash, drawings under committed credit agreements, commercial paper issuances, and, in the case of Ameren Missouri and Ameren Illinois, short-term affiliate borrowings. See Note 4 – Short-term Debt and Liquidity under Part II, Item 8, of the Form 10-K for a description of our indebtedness provisions and other covenants as well as a description of money pool agreements.

Short-term Borrowings

The Missouri Credit Agreement and the Illinois Credit Agreement are available to support issuances under Ameren (parent)’s, Ameren Missouri’s, and Ameren Illinois’ commercial paper programs, respectively, subject to borrowing sublimits, and the issuance of letters of credit. As of June 30, 2024, based on commercial paper outstanding and letters of credit issued under the Credit Agreements, along with cash and cash equivalents, the net liquidity available to Ameren (parent), Ameren Missouri, and Ameren Illinois, collectively, was $1.9 billion. The Ameren Companies were in compliance with the covenants in their Credit Agreements as of June 30, 2024. As of June 30, 2024, the ratios of consolidated indebtedness to consolidated total capitalization, calculated in accordance with the provisions of the Credit Agreements, were 61%, 49%, and 45% for Ameren, Ameren Missouri, and Ameren Illinois, respectively.

The following table presents commercial paper outstanding, net of issuance discounts, as of June 30, 2024, and December 31, 2023. There were no borrowings outstanding under the Credit Agreements as of June 30, 2024, or December 31, 2023.

| | | | | | | | | | | | | | |

| June 30, 2024 | | | December 31, 2023 |

| Ameren (parent) | $ | 301 | | | | $ | — | |

| Ameren Missouri | 390 | | | | 170 | |

| Ameren Illinois | — | | | | 366 | |

| Ameren consolidated | $ | 691 | | | | $ | 536 | |