Tupperware To Acquire

Sara Lee Direct Selling

Businesses

August 10, 2005

Rick Goings

Chairman and CEO

Exhibit 99.2

1

Strong Strategic Fit

Expands penetration in high-growth

consumable categories

Reduces risk

Diversifies product line

Balances earnings across geographies

Provides stable earnings and cash flow with

strong upside

Intact management team

Cultural and industry fit

2

Builds Shareholder Value

On 2005 pro-forma basis – about 20% accretive

Intend to continue paying 88 cents per share

dividend

More stable earnings stream

Consumables

Balanced geographies

Multiple expansion potential

Historically consumable peers get higher P/E

3

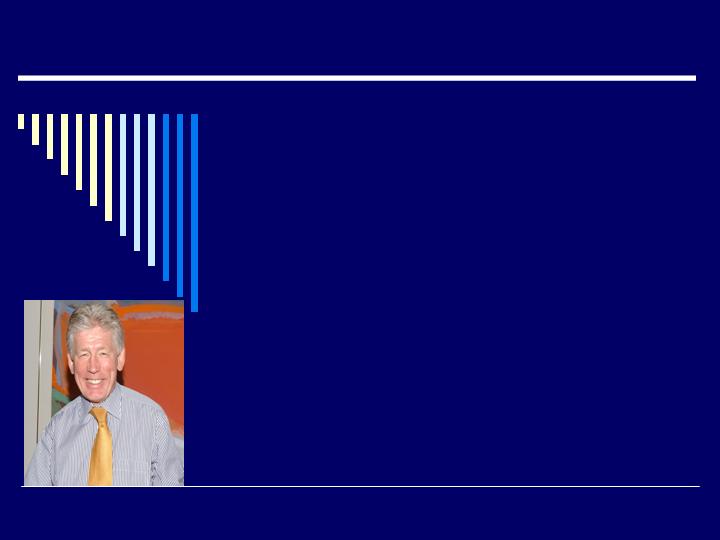

Sara Lee Direct

Selling Introduction

Simon Hemus

Group President

4

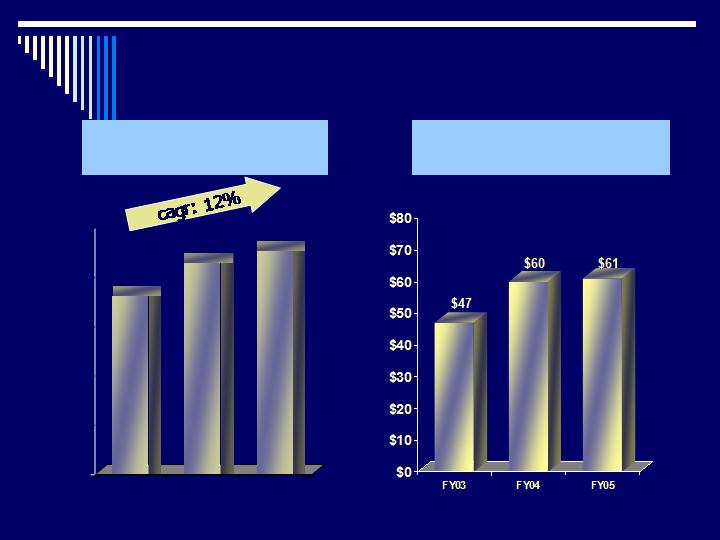

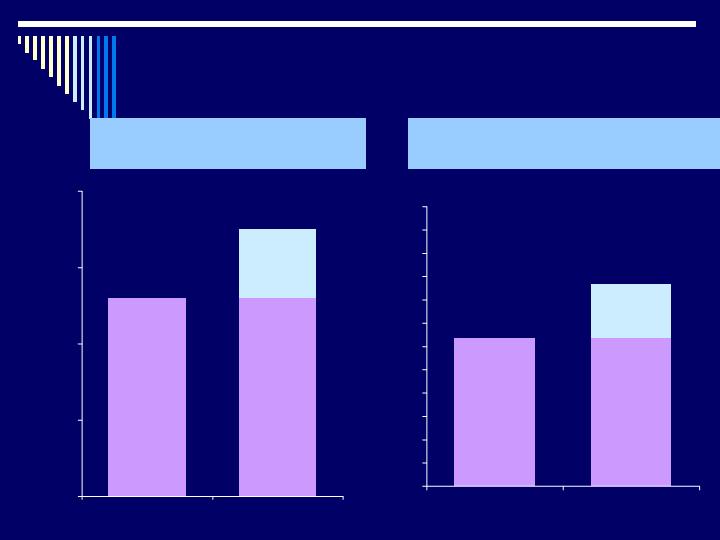

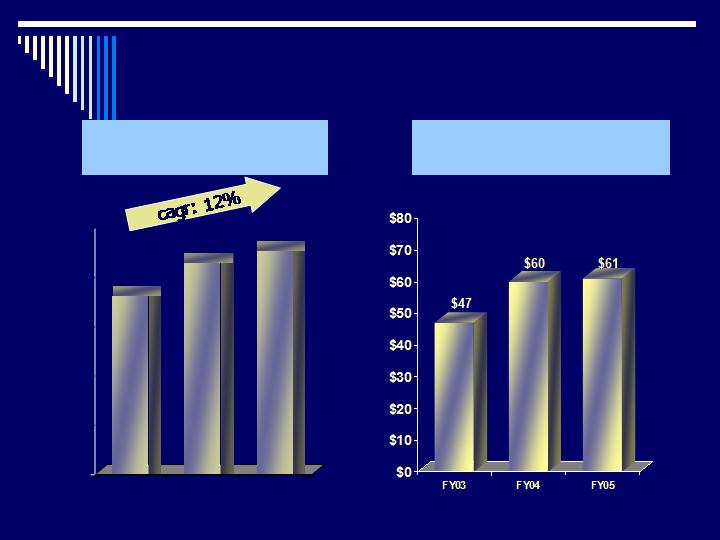

SLD Global Sales

(USD Millions)

SLD Historical Sales

and Profit Evolution

FY05 refers to Sara Lee’s fiscal year which runs from June to July; FY05 includes 12 months of actual sales and operating profit

FY 04 and 03 restated to June actual rates

SLD Global Profit

(USD Millions)

$397

$443

$470

$0

$100

$200

$300

$400

$500

FY03

FY04

FY05

5

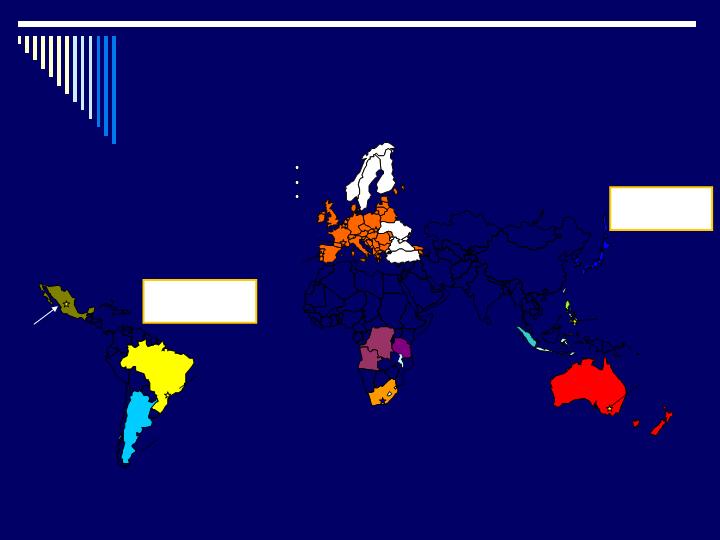

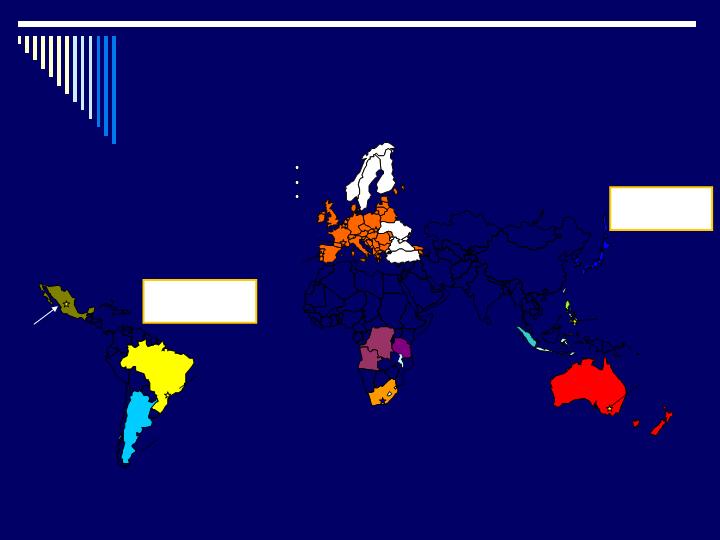

SLD Sells in 18 Markets under 7 Brands

Nutrimetics

France

UK

Greece

Avroy Shlain

South Africa

Sara Lee

Philippines

Nutrimetics

Australia

NaturCare

Japan

Asia Pacific

30% of Sales

House of Fuller

Mexico

Sara Lee

Brazil

House of

Fuller/Nuvo

Cosmetica

Argentina &

Uruguay

Latin America

57% of Sales

Swiss Garde

Central Africa

Source: SLD Financial Reports

Nutrimetics

Malaysia

Nutrimetics

Thailand

6

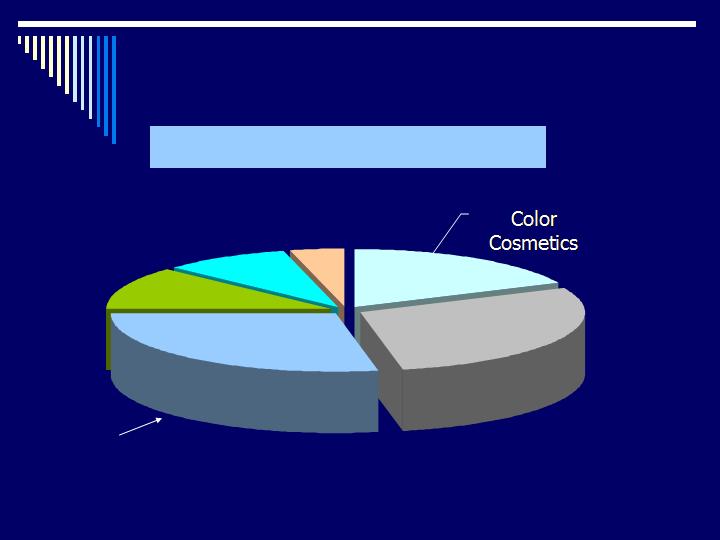

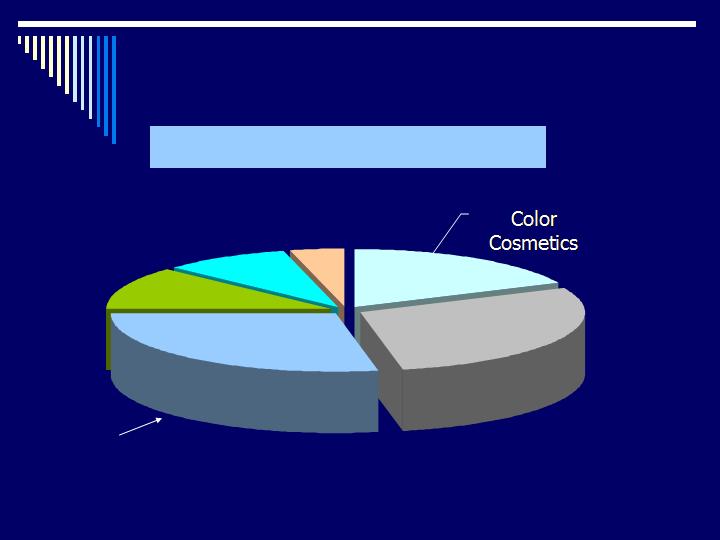

Skin Care and Fragrances are the

Core Categories

Skin Care

Fragrances

Toiletries

Nutritionals

Apparel

Global Sales by Product Category

Source: Sara Lee Financial Reports

4%

18%

9%

12%

28%

29%

7

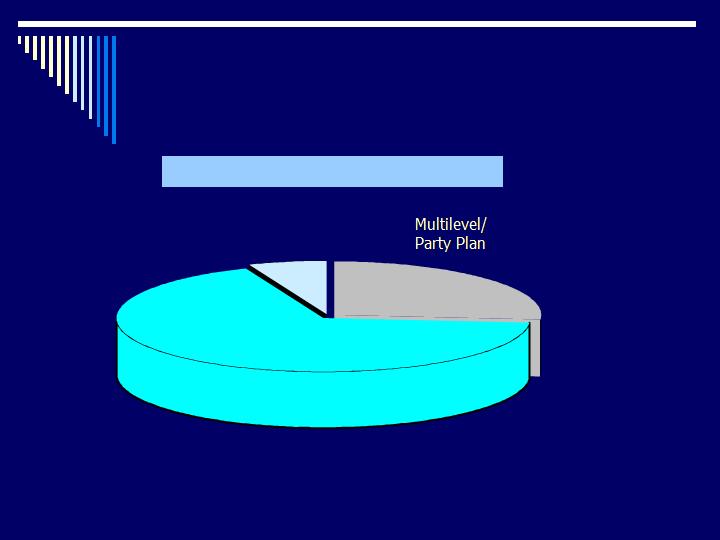

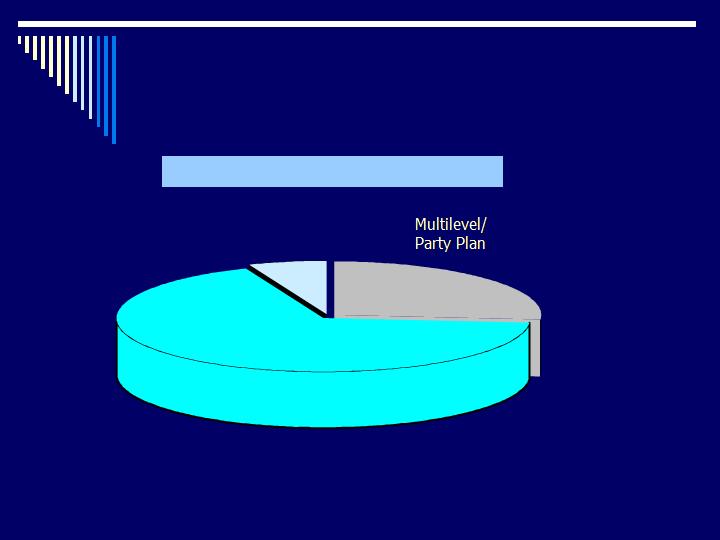

SLD Compensation and Selling Format

Hybrid

SLD Source of Sales

Source: Sara Lee Financial Reports

26%

6%

68%

Single Level/One-to-One

8

Post-Acquisition

Structure and

Transition Strategy

August 2005

Rick Goings

Chairman and CEO

9

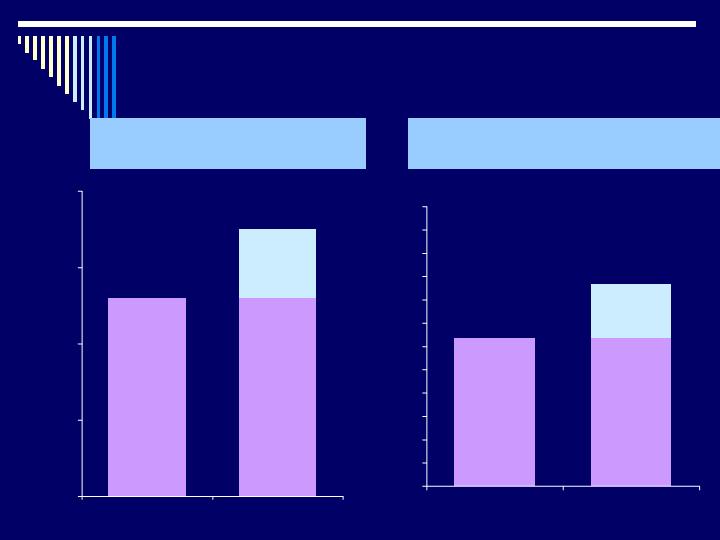

Source: SLD Financial Reports, combined sales based on FY05 sales and profit from SLD and midpoint of 2005 TW external outlook; TW profit is before unallocated expenses

Global Combined Sales

(USD Millions)

Global Operating Profit

(USD Millions)

Change: +38%

Sales: $1.8B

Change : +38%

Op. Profit

$219MM

Increases TUP Sales and Operating

Profit by 38%

SLD

$470

$1.3B

$0

$500

$1,000

$1,500

$2,000

Tupperware

TW+SLD

$158

$61

$0

$25

$50

$75

$100

$125

$150

$175

$200

$225

$250

$275

$300

Tupperware

TW+SLD

TUP

TUP

TUP

TUP

SLD

10

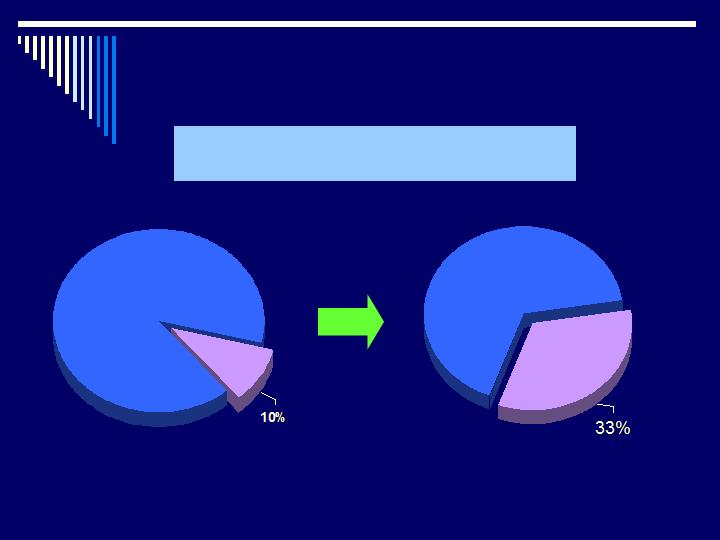

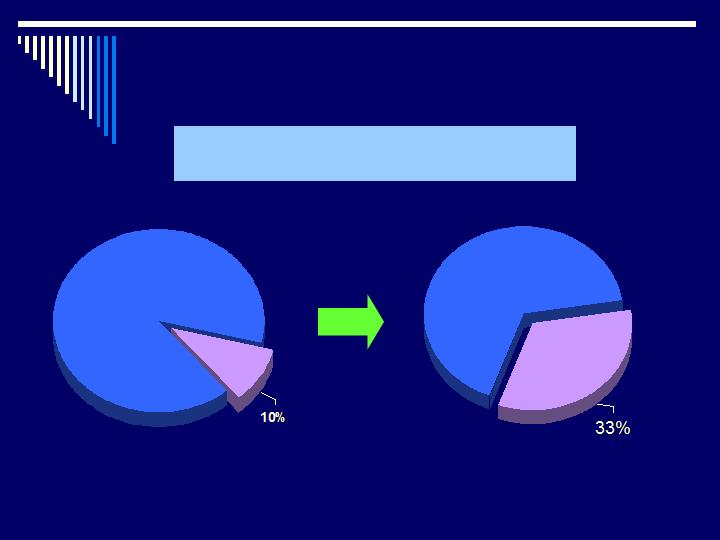

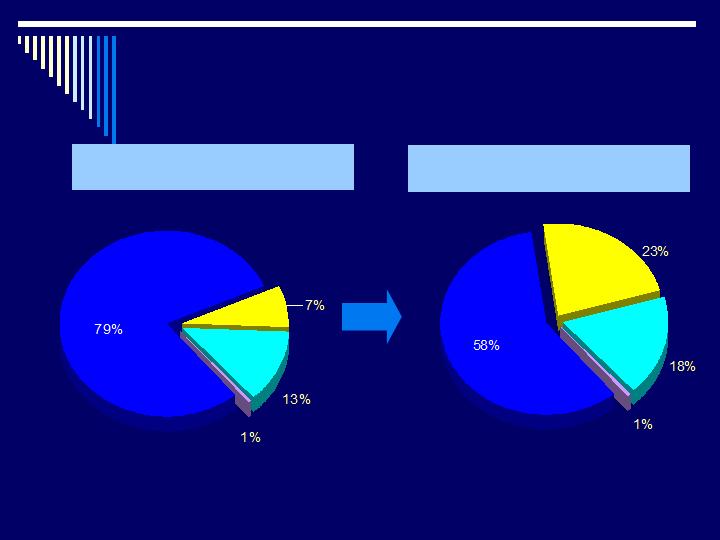

Reduces Exposure to Durable Goods

Economic Cycles

Global Mix

Durable vs. Non-Durable Sales

Durable

90%

Durable

67%

Non-Durable

Non-Durable

Durable

90%

11

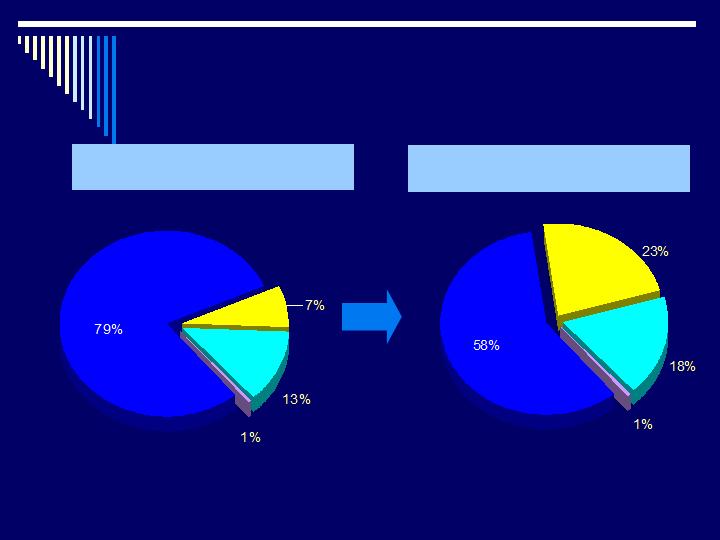

Mix was estimated with SLE Fiscal 2005 segment profit and midpoint of Tupperware 2005 External Outlook

TUP Key Market Profit Contribution

As % of Total

TUP+SLD Key Market Profit

Contribution as % of Total

Balances Geographic Mix

Europe

Latin America

Asia Pacific

North America

Europe

Latin America

Asia Pacific

North America

12

More Sellers

Growth in Number of Sales Consultants

# in millions

1.9

13

Strategic Rationale

Offers greater scale in consumable products

Key markets – Mexico, Australia, Philippines, Japan

Key categories – Cosmetics, Fragrances and Toiletries

Leverages BeautiControl expertise

Acquisition integration, party positioning and multi-level

compensation

14

Operational Opportunities

Brings valuable expertise in

Managing individual sales force

receivables

Consultant-level product distribution

Brochure merchandising and gross margin

management

Provides leverage in key commodities -

leveraging volume with third-party

vendors

15

Human Resource Synergies

Easily transitions into Tupperware organization

– leveraging our BeautiControl experience

Leverages Tupperware’s expertise in running

international markets

Brings seasoned, “known” senior management

team

Offers a good cultural fit – Sara Lee direct

selling team is very receptive to the prospect of

working with Tupperware

16

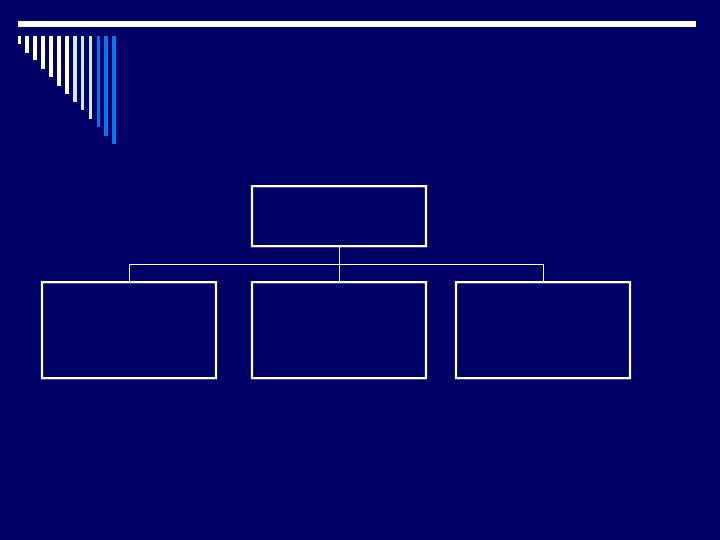

Organizational Structure

Rick Goings

CEO

Glenn Drake

Group President

TW NA , Europe and

South Africa

Dave Halversen

Group President

TW Latin America,

TW Asia Pacific and

BeautiControl

Simon Hemus

Group President

International Beauty

and Personal Care

17

TUPPERWARE

The Premier Global

Direct Seller of

Premium, Innovative

Products

18

Tupperware Brands

19

Financing Structure

August 10, 2005

Mike Poteshman

EVP and CFO

20

Financing

Use of on-hand cash of approximately $50 million

New borrowings of about $540 million

Refinance $100 million of notes due in 2006

21

Financing Continued

Put in a new 5-year $200 million

revolving credit facility

Year-end net debt - $690 million range

vs. $147 million at end of 2004

22

Interest and Covenants

At least 50% of total debt to have a fixed interest rate

Estimate about $50 million of net interest expense

Covenants

Fixed charges coverage test

EBITDA leverage test

Minimum net worth requirement

$40 million of EBITDA cushion versus expected results

before there would be any negative impact on ability to

pay dividends

23

Tupperware stock is listed on the New York Stock Exchange (NYSE:TUP). Statements

contained in this presentation that are not historical fact or that relate to future plans,

events or performances or that use predictive words such as “outlook” or “target” are

“forward-looking” statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Such statements include, but are not limited to, statements about

the benefits of the acquisition, including future financial and operating results,

Tupperware’s plans, objectives, intentions and expectations, including expectation that

the acquisition will close in the fourth quarter of 2005, that are not historical facts.

Readers are cautioned that forward-looking statements are based upon the current

beliefs and expectations of Tupperware’s management and by their nature involve risk

and uncertainty because they relate to events and depend on circumstances that will

occur in the future. Many factors could cause actual results and developments to differ

materially from those expressed or implied by these forward-looking statements,

including, among others, the possibility that the acquisition will not close or will be

significantly delayed. Other risks and uncertainties that could affect Tupperware include

recruiting and activity of the Company’s independent sales forces, the success of new

product introductions and promotional programs, the ability to obtain all government

approvals on land sales, the success of buyers in attracting tenants for commercial

developments, the effects of economic and political conditions generally and foreign

exchange risk in particular and other risks detailed in the Company’s reports on Form 8-

K dated April 10, 2001, as filed with the United States Securities and Exchange

Commission. Tupperware undertakes no obligation to update forward

-looking statements.

24

QUESTIONS

25