Exhibit 99.2

Management’s discussion and analysis

for the quarter ended June 30, 2013

| | | | |

SECOND QUARTER UPDATE | | | 4 | |

| |

CONSOLIDATED FINANCIAL RESULTS | | | 8 | |

| |

OUTLOOK FOR 2013 | | | 13 | |

| |

LIQUIDITY AND CAPITAL RESOURCES | | | 14 | |

| |

FINANCIAL RESULTS BY SEGMENT | | | | |

| |

URANIUM | | | 17 | |

| |

FUEL SERVICES | | | 20 | |

| |

NUKEM | | | 21 | |

| |

ELECTRICITY | | | 23 | |

| |

OUR OPERATIONS AND DEVELOPMENT PROJECT | | | 25 | |

| |

URANIUM 2013 Q2 UPDATES | | | 27 | |

| |

FUEL SERVICES 2013 Q2 UPDATES | | | 28 | |

| |

QUALIFIED PERSONS | | | 29 | |

| |

ADDITIONAL INFORMATION | | | 29 | |

This management’s discussion and analysis (MD&A) includes information that will help you understand management’s perspective of our unaudited condensed consolidated interim financial statements and notes for the quarter ended June 30, 2013 (interim financial statements). The information is based on what we knew as of July 31, 2013 and updates our first quarter and annual MD&A included in our 2012 annual report.

As you review this MD&A, we encourage you to read our interim financial statements as well as our audited consolidated financial statements and notes for the year ended December 31, 2012 and annual MD&A. You can find more information about Cameco, including our audited consolidated financial statements and our most recent annual information form, on our website at cameco.com, on SEDAR at sedar.com or on EDGAR at sec.gov. You should also read our annual information form before making an investment decision about our securities.

The financial information in this MD&A and in our financial statements and notes are prepared according to International Financial Reporting Standards (IFRS), unless otherwise indicated.

Unless we have specified otherwise, all dollar amounts are in Canadian dollars.

Throughout this document, the termswe, us, ourandCameco mean Cameco Corporation and its subsidiaries, including NUKEM Energy Gmbh (NUKEM), unless otherwise indicated.

Caution about forward-looking information

Our MD&A includes statements and information about our expectations for the future. When we discuss our strategy, plans, future financial and operating performance, or other things that have not yet taken place, we are making statements considered to beforward-lookinginformation orforward-looking statements under Canadian and United States securities laws. We refer to them in this MD&A asforward-looking information.

Key things to understand about the forward-looking information in this MD&A:

| • | | It typically includes words and phrases about the future, such as: anticipate, believe, estimate, expect, plan, will, intend, goal, target, forecast, project, strategy and outlook (see examples below). |

| • | | It represents our current views, and can change significantly. |

| • | | It is based on a number ofmaterial assumptions, including those we have listed on page 3, which may prove to be incorrect. |

| • | | Actual results and events may be significantly different from what we currently expect, due to the risks associated with our business. We list a number of thesematerial risks on pages 2 and 3. We recommend you also review our annual information form and our annual and first quarter MD&A, which include a discussion of othermaterial risks that could cause actual results to differ significantly from our current expectations. |

| • | | Forward-looking information is designed to help you understand management’s current views of our near and longer term prospects, and it may not be appropriate for other purposes. We will not necessarily update this information unless we are required to by securities laws. |

Examples of forward-looking information in this MD&A

| • | | the discussion under the headingOur strategy |

| • | | our expectations about 2013 and future global uranium supply and demand, including the discussion under the headingUranium market update |

| • | | our target for a sustainable 10% future cost reduction |

| • | | the outlook for each of our operating segments for 2013 and our consolidated outlook for the year |

| • | | our expectation that existing cash balances and operating cash flows will meet our anticipated 2013 capital requirements without the need for any significant additional funding |

| • | | our estimate of the amount and timing of expected cash taxes payable to Canada Revenue Agency (CRA) |

| • | | our expectations for 2013, 2014 and 2015 capital expenditures |

| • | | our expectation that our operating and investment activities in 2013 will not be constrained by the financial covenants in our unsecured revolving credit facility |

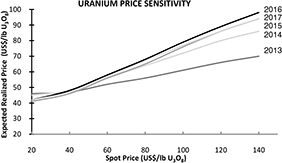

| • | | our uranium price sensitivity analysis |

| • | | forecast production at our uranium operations from 2013 to 2017 and our plan to achieve annual supply of 36 million pounds by 2018 |

| • | | our expectation that Talvivaara will start uranium production in the first half of 2014 |

| • | | our future plans for each of our uranium operating properties and development project |

| • | | our expectation that we will begin jet boring in ore this summer at Cigar Lake with first packaged pounds from AREVA’s McClean Lake mill in the fourth quarter |

| • | | our estimates of Cigar Lake capital costs |

Material risks

| • | | actual sales volumes or market prices for any of our products or services are lower than we expect for any reason, including changes in market prices or loss of market share to a competitor |

| • | | we are adversely affected by changes in foreign currency exchange rates, interest rates or tax rates, or we are unsuccessful in our dispute with the CRA |

| • | | our production costs are higher than planned, or necessary supplies are not available, or not available on commercially reasonable terms |

| • | | our estimates of production, purchases, costs, decommissioning or reclamation expenses, or our tax expense estimates, prove to be inaccurate |

| • | | we are unable to enforce our legal rights under our existing agreements, permits or licences, or are subject to litigation or arbitration that has an adverse outcome |

| • | | there are defects in, or challenges to, title to our properties |

| • | | our mineral reserve and resource estimates are not reliable, or we face unexpected or challenging geological, hydrological or mining conditions |

| • | | we are affected by environmental, safety and regulatory risks, including increased regulatory burdens or delays |

| • | | we cannot obtain or maintain necessary permits or approvals from government authorities |

| • | | we are affected by political risks in a developing country where we operate |

| • | | we are affected by terrorism, sabotage, blockades, civil unrest, social or political activism, accident or a deterioration in political support for, or demand for, nuclear energy |

2 CAMECO CORPORATION

| • | | we are impacted by changes in the regulation or public perception of the safety of nuclear power plants, which adversely affect the construction of new plants, the relicensing of existing plants and the demand for uranium |

| • | | there are changes to government regulations or policies that adversely affect us, including tax and trade laws and policies |

| • | | our uranium and conversion suppliers fail to fulfill delivery commitments |

| • | | our Cigar Lake development, mining or production plans are delayed or do not succeed, including as a result of any difficulties encountered with the jet boring mining method, processing of the ore, or our inability to acquire any of the required jet boring equipment |

| • | | our McArthur River development, mining or production plans are delayed or do not succeed |

| • | | we are affected by natural phenomena, including inclement weather, fire, flood and earthquakes |

| • | | our operations are disrupted due to problems with our own or our customers’ facilities, the unavailability of reagents, equipment, operating parts and supplies critical to production, equipment failure, lack of tailings capacity, labour shortages, labour relations issues (including an inability to renew agreements with unionized employees at McArthur River and Key Lake), strikes or lockouts, underground floods, cave ins, ground movements, tailings dam failures, transportation disruptions or accidents, or other development and operating risks |

| • | | NUKEM’s actual uranium sales volume, cash flows and revenue in 2013 are lower than expected due to losses in connection with spot market purchases, counterparty default on payment or other obligations, counterparty insolvency or other risks |

| • | | departure of key personnel at NUKEM could have an adverse effect on continuing operations |

Material assumptions

| • | | our expectations regarding sales and purchase volumes and prices for uranium, fuel services and electricity |

| • | | our expectations regarding the demand for uranium, the construction of new nuclear power plants and the relicensing of existing nuclear power plants not being more adversely affected than expected by changes in regulation or in the public perception of the safety of nuclear power plants |

| • | | our expected production level and production costs |

| • | | the assumptions regarding market conditions upon which we have based our capital expenditure expectations |

| • | | our expectations regarding spot prices and realized prices for uranium, and other factors discussed on page 19,Price sensitivity analysis: uranium |

| • | | our expectations regarding tax rates and payments, the outcome of the dispute with the CRA, foreign currency exchange rates and interest rates |

| • | | our decommissioning and reclamation expenses |

| • | | our mineral reserve and resource estimates, and the assumptions upon which they are based, are reliable |

| • | | the geological, hydrological and other conditions at our mines |

| • | | our Cigar Lake development, mining and production plans are successful, including success with the jet boring mining method and processing of the ore, and that we will be able to obtain the additional jet boring systems we require on schedule |

| • | | the success of our McArthur River development, mining and production plans |

| • | | our ability to continue to supply our products and services in the expected quantities and at the expected times |

| • | | our ability to comply with current and future environmental, safety and other regulatory requirements, and to obtain and maintain required regulatory approvals |

| • | | our operations are not significantly disrupted as a result of political instability, nationalization, terrorism, sabotage, blockades, civil unrest, breakdown, natural disasters, governmental or political actions, litigation or arbitration proceedings, the unavailability of reagents, equipment, operating parts and supplies critical to production, labour shortages, labour relations issues (including an inability to renew agreements with unionized employees at McArthur River and Key Lake), strikes or lockouts, underground floods, cave ins, ground movements, tailings dam failure, lack of tailings capacity, transportation disruptions or accidents or other development or operating risks |

| • | | NUKEM’s actual uranium sales volume, cash flows and revenue in 2013 will be consistent with our expectations |

| • | | key personnel will remain with NUKEM |

2013 SECOND QUARTER REPORT 3

Our strategy

Our strategy is to profitably increase annual uranium supply to 36 million pounds by 2018, subject to market conditions, and to invest in opportunities across the nuclear fuel cycle that we expect will complement and enhance our business. Lead-times in our industry are long, so we are preparing our assets today to make sure we can be among the first to respond when the market signals new production is needed.

However, we are also committed to enhancing our near-term financial returns and continuing to create shareholder value. In the context of current market uncertainty, we have made some modifications to our operating and development plans to ensure we remain a low cost producer and profitably grow the company. This resulted in the consolidation of a number of business and operating functions, which has allowed us to reduce the workforce by about 8%. Though these changes have led to some restructuring costs that will impact our financial results in 2013, our target is to achieve a sustainable 10% future cost reduction through a combination of decreased spending for administration, operations and capital. For more detailed discussion, please seeRestructuring on page 10.

You can read more about our strategy in our 2012 annual MD&A.

Second quarter update

Effective January 1, 2013,IFRS 11 – Joint Arrangements requires that we account for our interest in Bruce Power Limited Partnership (BPLP) using equity accounting. Our quarterly results for 2012 have been restated for comparative purposes. SeeNew standards and interpretations on page 29 for more information.

Our performance

| | | | | | | | | | | | | | | | | | | | | | | | |

HIGHLIGHTS ($ MILLIONS EXCEPT WHERE INDICATED) | | THREE MONTHS

ENDED JUNE 30 | | | CHANGE | | | SIX MONTHS

ENDED JUNE 30 | | | CHANGE | |

| | 2013 | | | 2012 | | | | 2013 | | | 2012 | | |

Revenue | | | 421 | | | | 282 | | | | 49 | % | | | 865 | | | | 748 | | | | 16 | % |

Gross profit | | | 99 | | | | 50 | | | | 98 | % | | | 194 | | | | 200 | | | | (3 | )% |

Net earnings attributable to equity holders | | | 34 | | | | 5 | | | | 580 | % | | | 43 | | | | 133 | | | | (68 | )% |

$ per common share (diluted) | | | 0.09 | | | | 0.01 | | | | 800 | % | | | 0.11 | | | | 0.34 | | | | (68 | )% |

Adjusted net earnings (non-IFRS, see page 9) | | | 61 | | | | 31 | | | | 97 | % | | | 88 | | | | 151 | | | | (42 | )% |

$ per common share (adjusted and diluted) | | | 0.15 | | | | 0.08 | | | | 88 | % | | | 0.22 | | | | 0.38 | | | | (42 | )% |

Cash provided by operations (after working capital changes) | | | (37 | ) | | | (117 | ) | | | 68 | % | | | 232 | | | | 257 | | | | (10 | )% |

SECOND QUARTER

Net earnings attributable to equity holders (net earnings) this quarter were $34 million ($0.09 per share diluted) compared to $5 million ($0.01 per share diluted) in the second quarter of 2012. Net earnings were impacted by the items noted below, partially offset by mark-to-market losses on foreign exchange derivatives.

On an adjusted basis, our earnings this quarter were $61 million ($0.15 per share diluted) compared to $31 million ($0.08 per share diluted) (non-IFRS measure, see page 9) in the second quarter of 2012, mainly due to:

| • | | higher earnings from our uranium business based on higher realized prices and increased sales volumes |

| • | | higher tax recoveries due to a decline in pre-tax earnings in Canada |

| • | | partially offset by lower earnings in the electricity business as a result of lower generation and higher operating costs |

SeeFinancial results by segment on page 9 for more detailed discussion.

FIRST SIX MONTHS

Net earnings in the first six months of the year were $43 million ($0.11 per share diluted) compared to $133 million ($0.34 per share diluted) in the first six months of 2012. In addition to the items noted below, net earnings were impacted by mark-to-market losses on foreign exchange derivatives.

4 CAMECO CORPORATION

On an adjusted basis, our earnings for the first six months of this year were $88 million ($0.22 per share diluted) compared to $151 million ($0.38 per share diluted) (non-IFRS measure, see page 9) for the first six months of 2012, mainly due to:

| • | | lower earnings in the electricity business as a result of lower generation and higher operating costs |

| • | | lower earnings from our uranium business based on lower sales volumes |

| • | | higher expenditures for administration due to the addition of NUKEM’s administration and advisory fee, and costs for corporate restructuring as described in Restructuring on page 10 |

| • | | partially offset by higher tax recoveries due to a decline in pre-tax earnings in Canada |

SeeFinancial results by segment on page 9 for more detailed discussion.

Operations update

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

HIGHLIGHTS | | | THREE MONTHS

ENDED JUNE 30 | | | CHANGE | | | SIX MONTHS

ENDED JUNE 30 | | | CHANGE | |

| | 2013 | | | 2012 | | | | 2013 | | | 2012 | | |

Uranium | | Production volume (million lbs) | | | | 4.4 | | | | 5.3 | | | | (17 | )% | | | 10.3 | | | | 10.2 | | | | 1 | % |

| | Sales volume (million lbs) | | | | 6.4 | | | | 5.0 | | | | 28 | % | | | 11.6 | | | | 13.2 | | | | (12 | )% |

| | Average realized price | | ($ | US/lb | ) | | | 46.30 | | | | 42.17 | | | | 10 | % | | | 47.24 | | | | 46.20 | | | | 2 | % |

| | | | ($ | Cdn/lb | ) | | | 47.35 | | | | 42.29 | | | | 12 | % | | | 47.75 | | | | 46.66 | | | | 2 | % |

| | Revenue ($ millions) | | | | 305 | | | | 211 | | | | 45 | % | | | 552 | | | | 617 | | | | (11 | )% |

| | Gross profit ($ millions) | | | | 91 | | | | 44 | | | | 107 | % | | | 174 | | | | 187 | | | | (7 | )% |

Fuel services | | Production volume (million kgU) | | | | 4.8 | | | | 4.3 | | | | 12 | % | | | 9.6 | | | | 8.8 | | | | 9 | % |

| | Sales volume (million kgU) | | | | 4.0 | | | | 4.2 | | | | (5 | )% | | | 7.3 | | | | 7.1 | | | | 3 | % |

| | Average realized price ($Cdn/kgU) | | | | 16.45 | | | | 16.94 | | | | (3 | )% | | | 17.89 | | | | 18.43 | | | | (3 | )% |

| | Revenue ($ millions) | | | | 65 | | | | 70 | | | | (7 | )% | | | 131 | | | | 130 | | | | 1 | % |

| | Gross profit ($ millions) | | | | 10 | | | | 9 | | | | 11 | % | | | 21 | | | | 20 | | | | 5 | % |

NUKEM1 | | Sales volume U3O8(million lbs) | | | | 1.2 | | | | — | | | | — | | | | 3.5 | | | | — | | | | — | |

| | Average realized price ($Cdn/lb) | | | | 44.40 | | | | — | | | | — | | | | 44.26 | | | | — | | | | — | |

| | Revenue ($ millions) | | | | 53 | | | | — | | | | — | | | | 183 | | | | — | | | | — | |

| | Gross profit ($ millions) | | | | 3 | | | | — | | | | — | | | | 8 | | | | — | | | | — | |

Electricity | | Output (100%) (TWh) | | | | 5.5 | | | | 6.5 | | | | (15 | )% | | | 11.0 | | | | 12.5 | | | | (12 | )% |

| | Average realized price ($Cdn/MWh) | | | | 54.00 | | | | 55.00 | | | | (2 | )% | | | 53.00 | | | | 55.00 | | | | (4 | )% |

| | Revenue (100%) | | | | 307 | | | | 377 | | | | (19 | )% | | | 595 | | | | 711 | | | | (16 | )% |

| | Our share of earnings (loss) before taxes ($ millions) | | | | 1 | | | | 46 | | | | (98 | )% | | | (1 | ) | | | 69 | | | | (101 | )% |

| 1 | SeeNUKEM on page 21 for details of the purchase price allocation. |

Production in our uranium segment this quarter was 17% lower compared to the second quarter of 2012, mainly due to lower production at Rabbit Lake and McArthur River/Key Lake. For the first six months, production is 1% higher than for the same period in 2012 mainly due to higher production from Inkai. SeeUranium 2013 Q2 updates starting on page 27 for more information.

Key highlights:

| • | | At Cigar Lake, we were granted an eight-year mine licence by the Canadian Nuclear Safety Commission (CNSC) and we continued to make progress towards first production. See page 28 for more information. |

| • | | In the US, our North Butte satellite operation began production. See page 27 for more information. |

| • | | Unionized employees at the Port Hope conversion facility accepted new three-year contracts. See Fuel services 2013 Q2 update on page 28 for additional details. |

| • | | On May 31, 2013 we announced the signing of a collaboration agreement that will strengthen the relationship between us, AREVA Resources Canada Inc. and the English River First Nation. This furthers our efforts to |

2013 SECOND QUARTER REPORT 5

formalize our relationship with local communities and continues to build on past cooperation and sharing of benefits from our operations.

Production in our fuel services segment was 12% higher this quarter than in the second quarter of 2012 and 9% higher for the first six months compared to last year. We increased our annual production target in 2013, which we expect to result in higher quarterly production over comparable periods in 2012.

In our electricity segment, BPLP’s generation was 15% lower for the quarter and 12% lower for the first half of the year compared to the same periods last year mainly due to an increase in the number of planned outage days. The capacity factor this quarter and for the first half of the year was 77%, compared to 91% in the second quarter of 2012 and 88% for the first six months of 2012.

Uranium market update

Similar to the previous quarter, near- to medium-term uncertainty continues to impede a recovery in the market, with neither buyers nor suppliers under significant pressure to contract. Volumes contracted have remained low, and uranium prices were relatively stable during the second quarter, though there has recently been downward pressure on the spot price. We believe the market will remain in this ‘wait-and-see’ mode for the present, particularly during the summer months, during which contracting is traditionally light.

The inventories and lack of demand as a result of Japan’s idled reactors are largely responsible for the continued market sluggishness, and restarts of those reactors will be an important catalyst. There has been some progress in Japan: the Nuclear Regulatory Authority finalized new safety guidelines against which reactor restarts will be evaluated, and as of July 31, four utilities have applied to restart 12 reactors. Like most industry participants, we will be paying close attention to how the review process progresses and what it could mean for subsequent restart applications.

Over the long term, Japan’s energy policy is still being determined; however, we believe nuclear remains an important energy source for the country. Japan’s Liberal Democratic Party (LDP) has expressed support for nuclear energy as being important for the country’s economy and for achieving their environmental goals. In July, the party won control of the country’s upper house, giving the LDP a strong majority, which we expect to be positive for the industry.

The supply side continues to evolve. Over the past few quarters, we have seen some projects delayed due to uranium prices insufficient to support new production. However, more recently, there have been announcements that other projects, primarily driven by sovereign interests, will go ahead despite market conditions. These developments do not directly impact the near-term market, but could have an effect on the longer term outlook for the uranium industry.

In July, the US Department of Energy (DOE) updated its plan for excess uranium inventories, which is used to outline such things as total volume of inventories, planned use and future sales. Overall, total UF6 volumes and future sales referenced in the plan are generally in line with industry expectations. However, the revised plan removes the well-known guideline which had limited DOE uranium excess inventory sales to 10% of US reactor fuel requirements. There is potential for this to impact the uranium market; however, DOE sales will continue to be governed by Secretarial Determinations, which require that any such sales not have a material adverse impact on the US uranium, conversion and enrichment industries.

Despite the current challenging industry environment, we are well positioned to continue to succeed. We have the advantage of extensive mineral reserves and resources, low cost operations, a strong sales contract portfolio, experienced employees and a growth strategy that will allow us to remain competitive in challenging environments, while maintaining the ability to respond with additional production when the market signals that more supply is required.

Caution about forward-looking information relating to our uranium market update

This discussion of our expectations for the nuclear industry, including future global uranium supply and demand, is forward-looking information that is based upon the assumptions and subject to the material risks discussed under the headingCaution about forward-looking information beginning on page 2.

6 CAMECO CORPORATION

Industry prices

| | | | | | | | | | | | | | | | |

| | | JUN 30

2013 | | | MAR 31

2013 | | | JUN 30

2012 | | | MAR 31

2012 | |

Uranium ($US/lb U3O8) 1 | | | | | | | | | | | | | | | | |

Average spot market price | | | 39.60 | | | | 42.25 | | | | 50.75 | | | | 51.05 | |

Average long-term price | | | 57.00 | | | | 56.50 | | | | 61.25 | | | | 60.00 | |

Fuel services ($US/kgU as UF6)1 | | | | | | | | | | | | | | | | |

Average spot market price | | | | | | | | | | | | | | | | |

North America | | | 10.00 | | | | 10.50 | | | | 6.63 | | | | 6.63 | |

Europe | | | 10.38 | | | | 11.00 | | | | 7.00 | | | | 7.00 | |

Average long-term price | | | | | | | | | | | | | | | | |

North America | | | 16.75 | | | | 16.75 | | | | 16.75 | | | | 16.75 | |

Europe | | | 17.25 | | | | 17.25 | | | | 17.25 | | | | 17.25 | |

Note: the industry does not publish UO2prices. | | | | | | | | | | | | | | | | |

Electricity ($/MWh) | | | | | | | | | | | | | | | | |

Average Ontario electricity spot price | | | 25.00 | | | | 29.00 | | | | 19.00 | | | | 20.00 | |

| 1 | Average of prices reported by TradeTech and Ux Consulting (Ux) |

Buying interest has increased slightly with some utilities evaluating spot and term purchases. However, buyers are currently participating in the spot uranium market largely on a discretionary basis. We anticipate moderate spot and long-term demand through the balance of the year, though total long-term demand is expected to remain below average and lower than our anticipated range of 75 million to 100 million pounds in 2013.

On the spot market, where purchases call for delivery within one year, the volume reported for the second quarter of 2013 was approximately 9 million pounds. This compares to approximately 7 million pounds in the second quarter of 2012.

At the end of the quarter, the average spot price was $39.60 (US) per pound. On July 29, 2013, Ux reported a spot price of $34.50 (US) per pound.

The long-term uranium price held steady during the quarter. Long-term contracts usually call for deliveries to begin more than two years after the contract is finalized, and use a number of pricing formulas, including fixed prices adjusted by inflation indices, and market referenced prices (spot and long-term indicators quoted near the time of delivery).

Spot UF6conversion prices declined during the quarter whereas long-term UF6 conversion prices held firm.

SHARES AND STOCK OPTIONS OUTSTANDING

At July 30, 2013, we had:

| • | | 395,458,205 common shares and one Class B share outstanding |

| • | | 10,147,416 stock options outstanding, with exercise prices ranging from $15.79 to $54.38 |

DIVIDEND POLICY

Our board of directors has established a policy of paying a quarterly dividend of $0.10 ($0.40 per year) per common share. This policy will be reviewed from time to time based on our cash flow, earnings, financial position, strategy and other relevant factors.

2013 SECOND QUARTER REPORT 7

Financial results

This section of our MD&A discusses our performance, financial condition and outlook for the future.

Consolidated financial results

Effective January 1, 2013,IFRS 11 – Joint Arrangements requires that we account for our interest in BPLP using equity accounting. Our quarterly results for 2012 have been restated for comparative purposes. SeeNew standards and interpretations on page 29 for more information.

| | | | | | | | | | | | | | | | | | | | | | | | |

HIGHLIGHTS ($ MILLIONS EXCEPT WHERE INDICATED) | | THREE MONTHS

ENDED JUNE 30 | | | CHANGE | | | SIX MONTHS

ENDED JUNE 30 | | | CHANGE | |

| | 2013 | | | 2012 | | | | 2013 | | | 2012 | | |

Revenue | | | 421 | | | | 282 | | | | 49 | % | | | 865 | | | | 748 | | | | 16 | % |

Gross profit | | | 99 | | | | 50 | | | | 98 | % | | | 194 | | | | 200 | | | | (3 | )% |

Net earnings attributable to equity holders | | | 34 | | | | 5 | | | | 580 | % | | | 43 | | | | 133 | | | | (68 | )% |

$ per common share (basic) | | | 0.09 | | | | 0.01 | | | | 800 | % | | | 0.11 | | | | 0.34 | | | | (68 | )% |

$ per common share (diluted) | | | 0.09 | | | | 0.01 | | | | 800 | % | | | 0.11 | | | | 0.34 | | | | (68 | )% |

Adjusted net earnings (non-IFRS, see page 9) | | | 61 | | | | 31 | | | | 97 | % | | | 88 | | | | 151 | | | | (42 | )% |

$ per common share (adjusted and diluted) | | | 0.15 | | | | 0.08 | | | | 88 | % | | | 0.22 | | | | 0.38 | | | | (42 | )% |

Cash provided by operations (after working capital changes) | | | (37 | ) | | | (117 | ) | | | 68 | % | | | 232 | | | | 257 | | | | (10 | )% |

Net earnings

In the second quarter of 2013, our net earnings were $34 million ($0.09 per share diluted), an increase of $29 million compared to $5 million ($0.01 per share diluted) in 2012. Net earnings were impacted by the items noted below, partially offset by mark-to-market losses on foreign exchange derivatives.

On an adjusted basis, our earnings this quarter were $61 million ($0.15 per share diluted) compared to $31 million ($0.08 per share diluted) (non-IFRS measure, see page 9) in the second quarter of 2012. This increase was largely the result of:

| • | | higher earnings from our uranium business based on higher realized prices and increased sales volumes |

| • | | higher tax recoveries due to a decline in pre-tax earnings in Canada |

| • | | partially offset by lower earnings in the electricity business as a result of lower generation and higher operating costs |

Net earnings in the first six months of the year were $43 million ($0.11 per share diluted), a decrease of $90 million compared to $133 million ($0.34 per share diluted) in 2012. In addition to the items noted below, net earnings were impacted by mark-to-market losses on foreign exchange derivatives.

On an adjusted basis, our earnings for the first six months of this year were $88 million ($0.22 per share diluted) compared to $151 million ($0.38 per share diluted) (non-IFRS measure, see page 9). This decline was largely the result of:

| • | | lower earnings in the electricity business as a result of lower generation and higher operating costs |

| • | | lower earnings from our uranium business based on lower sales volumes |

| • | | higher expenditures for administration due to the addition of NUKEM’s administration and advisory fee, and costs for corporate restructuring as described in Restructuring on page 10 |

| • | | partially offset by higher tax recoveries due to a decline in pre-tax earnings in Canada |

SeeFinancial results by segment on page 9 for more detailed discussion.

8 CAMECO CORPORATION

Adjusted net earnings (non-IFRS measure)

Adjusted net earnings is a measure that does not have a standardized meaning or a consistent basis of calculation under IFRS (non-IFRS measure). We use this measure as a more meaningful way to compare our financial performance from period to period. We believe that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate our performance. Adjusted net earnings is our net earnings attributable to equity holders, adjusted to better reflect the underlying financial performance for the reporting period. The adjusted earnings measure reflects the matching of the net benefits of our hedging program with the inflows of foreign currencies in the applicable reporting period, and has been adjusted for impairment charges on a non-producing property.

Adjusted net earnings is non-standard supplemental information and should not be considered in isolation or as a substitute for financial information prepared according to accounting standards. Other companies may calculate this measure differently, so you may not be able to make a direct comparison to similar measures presented by other companies.

The table below reconciles adjusted net earnings with our net earnings.

| | | | | | | | | | | | | | | | |

($ MILLIONS) | | THREE MONTHS

ENDED JUNE 30 | | | SIX MONTHS

ENDED JUNE 30 | |

| | 2013 | | | 2012 | | | 2013 | | | 2012 | |

Net earnings attributable to equity holders | | | 34 | | | | 5 | | | | 43 | | | | 133 | |

| | | | | | | | | | | | | | | | |

Adjustments | | | | | | | | | | | | | | | | |

Adjustments on derivatives1(pre-tax) | | | 36 | | | | 35 | | | | 61 | | | | 25 | |

Income taxes on adjustments to derivatives | | | (9 | ) | | | (9 | ) | | | (16 | ) | | | (7 | ) |

| | | | | | | | | | | | | | | | |

Adjusted net earnings | | | 61 | | | | 31 | | | | 88 | | | | 151 | |

| | | | | | | | | | | | | | | | |

| 1 | We do not apply hedge accounting for our portfolio of foreign currency forward sales contracts. However, we have adjusted our gains or losses on derivatives to reflect what our earnings would have been had hedge accounting been in place. |

The table that follows describes what contributed to the changes in adjusted net earnings this quarter.

| | | | | | | | | | | | |

| | | | | | | THREE MONTHS | | | SIX MONTHS | |

($ MILLIONS) | | | | | | ENDED JUNE 30 | | | ENDED JUNE 30 | |

Adjusted net earnings– 2012 | | | | | 31 | | | | 151 | |

Change in gross profitbysegment | | (we calculate gross profit by deducting from revenue the cost of products and services sold, and depreciation and amortization (D&A), net of hedging benefits) | | | | | | | | |

Uranium | | Higher (lower) sales volume | | | 13 | | | | (24 | ) |

| | Higher realized prices ($US) | | | 27 | | | | 12 | |

| | Foreign exchange impact on realized prices | | | 6 | | | | 1 | |

| | Lower (higher) costs | | | 1 | | | | (1 | ) |

| | Hedging benefits | | | (18 | ) | | | (27 | ) |

| | | | | | | | | | | | |

| | change –uranium | | | 29 | | | | (39 | ) |

| | | | | | | | | | | | |

Fuel services | | Higher sales volume | | | — | | | | 1 | |

| | Lower realized prices ($Cdn) | | | (2 | ) | | | (4 | ) |

| | Lower costs | | | 3 | | | | 4 | |

| | Hedging benefits | | | (3 | ) | | | (4 | ) |

| | | | | | | | | | | | |

| | change –fuel services | | | (2 | ) | | | (3 | ) |

| | | | | | | | | | | | |

NUKEM | | Gross profit | | | 3 | | | | 8 | |

| | | | | | | | | | | | |

| | change –NUKEM | | | 3 | | | | 8 | |

| | | | | | | | | | | | |

Other changes | | | | | | | | |

Lower earnings from equity investment in BPLP | | | (45 | ) | | | (70 | ) |

Lower (higher) administration expenditures | | | 3 | | | | (14 | ) |

Lower exploration expenditures | | | 2 | | | | 4 | |

Lower income taxes | | | 16 | | | | 25 | |

Contract termination fee (incurred in Q2, 2012) | | | 30 | | | | 30 | |

Other | | | (6 | ) | | | (4 | ) |

| | | | | | | | | | | | |

Adjusted net earnings– 2013 | | | 61 | | | | 88 | |

| | | | | | | | | | | | |

SeeFinancial results by segment on page 17 for more detailed discussion.

2013 SECOND QUARTER REPORT 9

Quarterly trends

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

HIGHLIGHTS ($ MILLIONS EXCEPT PER SHARE AMOUNTS) | | 2013 | | | 2012 | | | 2011 | |

| | Q2 | | | Q1 | | | Q41 | | | Q31 | | | Q21 | | | Q11 | | | Q41 | | | Q31 | |

Revenue | | | 421 | | | | 444 | | | | 846 | | | | 296 | | | | 282 | | | | 466 | | | | 971 | | | | 527 | |

Net earnings attributable to equity holders | | | 34 | | | | 9 | | | | 41 | | | | 79 | | | | 5 | | | | 128 | | | | 265 | | | | 39 | |

$ per common share (basic) | | | 0.09 | | | | 0.02 | | | | 0.10 | | | | 0.20 | | | | 0.01 | | | | 0.33 | | | | 0.67 | | | | 0.10 | |

$ per common share (diluted) | | | 0.09 | | | | 0.02 | | | | 0.10 | | | | 0.20 | | | | 0.01 | | | | 0.33 | | | | 0.67 | | | | 0.10 | |

Adjusted net earnings (non-IFRS, see page 9) | | | 61 | | | | 27 | | | | 233 | | | | 49 | | | | 31 | | | | 120 | | | | 249 | | | | 104 | |

$ per common share (adjusted and diluted) | | | 0.15 | | | | 0.07 | | | | 0.59 | | | | 0.12 | | | | 0.08 | | | | 0.30 | | | | 0.63 | | | | 0.26 | |

Cash provided by operations (after working capital changes) | | | (37 | ) | | | 269 | | | | 286 | | | | 36 | | | | (117 | ) | | | 374 | | | | 258 | | | | 192 | |

| 1 | Our quarterly results have been restated in accordance with IFRS 11 – Joint Arrangements and IAS 19 – Employee Benefits. Our quarterly results prior to the first quarter of 2012 have not been restated. |

The table that follows presents the differences between net earnings and adjusted net earnings for the previous seven quarters.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2013 | | | 2012 | | | 2011 | |

($ MILLIONS) | | Q2 | | | Q1 | | | Q42 | | | Q32 | | | Q22 | | | Q12 | | | Q4 | | | Q3 | |

Net earnings attributable to equity holders | | | 34 | | | | 9 | | | | 41 | | | | 79 | | | | 5 | | | | 128 | | | | 265 | | | | 39 | |

Adjustments | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjustments on derivatives1 (pre-tax) | | | 36 | | | | 25 | | | | 33 | | | | (40 | ) | | | 35 | | | | (10 | ) | | | (22 | ) | | | 88 | |

Income taxes on adjustments to derivatives | | | (9 | ) | | | (7 | ) | | | (9 | ) | | | 10 | | | | (9 | ) | | | 2 | | | | 6 | | | | (23 | ) |

Impairment charge on non-producing property | | | — | | | | — | | | | 168 | | | | — | | | | — | | | | — | | | | — | | | | — | |

Adjusted net earnings (non-IFRS, see page 9) | | | 61 | | | | 27 | | | | 233 | | | | 49 | | | | 31 | | | | 120 | | | | 249 | | | | 104 | |

| 1 | We do not apply hedge accounting for our portfolio of foreign currency forward sales contracts. However, we have adjusted our gains or losses on derivatives to reflect what our earnings would have been had hedge accounting been in place. |

| 2 | Our quarterly results have been restated in accordance with IAS 19 – Employee Benefits. Our quarterly results prior to the first quarter of 2012 have not been restated. |

Key things to note:

| • | | Our financial results are strongly influenced by the performance of our uranium segment, which accounted for 72% of consolidated revenues in the second quarter of 2013. |

| • | | The timing of customer requirements, which tends to vary from quarter to quarter, drives revenue in the uranium and fuel services segments. |

| • | | Net earnings do not trend directly with revenue due to unusual items and transactions that occur from time to time. We use adjusted net earnings, a non-IFRS measure, as a more meaningful way to compare our results from period to period (see page 9 for more information). |

| • | | Cash from operations tends to fluctuate as a result of the timing of deliveries and product purchases in our uranium and fuel services segments. |

| • | | Quarterly results are not necessarily a good indication of annual results due to the variability in customer requirements noted above. |

RESTRUCTURING

In response to current market uncertainty, we have made some modifications to our operating and development plans to ensure we remain a low cost producer and profitably grow the company. This resulted in the consolidation of a number of business and operating functions, which has allowed us to reduce the workforce by about 8%. The changes target achieving a sustainable 10% future cost reduction through a combination of decreased spending for administration, operations and capital. In order to achieve our targeted cost reduction, we have incurred $13 million in restructuring costs, which will impact our financial results this year. Of this total, $5 million relates to an increase in our direct administration costs, while the other $8 million will flow through cost of sales. We do not expect to incur any significant additional costs. Our goal is to make the company a

10 CAMECO CORPORATION

more efficient, streamlined and profitable organization that is prepared to weather the current uncertainty, increase our focus on execution and be ready for the sustained long-term growth we expect.

ADMINISTRATION

| | | | | | | | | | | | | | | | | | | | | | | | |

($ MILLIONS) | | THREE MONTHS

ENDED JUNE 30 | | | CHANGE | | | SIX MONTHS

ENDED JUNE 30 | | | CHANGE | |

| | 2013 | | | 2012 | | | | 2013 | | | 2012 | | |

Direct administration | | | 37 | | | | 38 | | | | (3 | )% | | | 81 | | | | 73 | | | | 11 | % |

Restructuring charges | | | 2 | | | | — | | | | — | | | | 5 | | | | — | | | | — | |

Stock-based compensation | | | 4 | | | | 8 | | | | (50 | )% | | | 13 | | | | 12 | | | | 8 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total administration | | | 43 | | | | 46 | | | | (7 | )% | | | 99 | | | | 85 | | | | 16 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Direct administration costs were $1 million lower this quarter and $8 million higher for the first six months than the same periods last year. The increase in the first six months primarily reflects the addition of NUKEM’s administration ($6 million) and advisory fee ($3 million). In 2013 we also recognized $5 million for one-time restructuring costs. SeeRestructuring on page 10.

Stock based compensation was $4 million lower this quarter and $1 million higher for the first six months of 2013 compared to 2012 due to the timing of awarding options. In 2012, options were issued in May due to a trading blackout, compared to being issued in March in 2013.

EXPLORATION

In the second quarter, uranium exploration expenses were $16 million, a decrease of $2 million compared to the second quarter of 2012. Exploration expenses in the first six months of the year decreased to $37 million from $41 million in 2012 as a result of decreased activity at our Kintyre property in Australia. We expect exploration expenses to be about 15% to 20% lower than they were in 2012. Our exploration efforts in 2013 are focused on Canada, Australia, Kazakhstan and the United States.

INCOME TAXES

We recorded an income tax recovery of $45 million in second quarter of 2013 compared to a recovery of $29 million in the second quarter of 2012. The change in the net recovery was due to the distribution of earnings between jurisdictions. In 2013, we recorded losses of $198 million in Canada compared to $91 million in 2012, whereas earnings in foreign jurisdictions rose to $187 million from $66 million. The tax rate in Canada is higher than the average of the rates in the foreign jurisdictions in which we operate.

On an adjusted basis, we recorded an income tax recovery of $35 million this quarter compared to a recovery of $20 million in the second quarter of 2012 due to the distribution of earnings between jurisdictions.

In the first six months of 2013, we recorded an income tax recovery of $73 million compared to a recovery of $38 million in 2012. The change in the net recovery was in part due to a decline in pre-tax earnings in Canada in 2013. The distribution of earnings between jurisdictions was also different compared to 2012. In 2013, we recorded losses of $326 million in Canada compared to $173 million in 2012, whereas earnings in foreign jurisdictions increased to $295 million from $267 million. The tax rate in Canada is higher than the average of the rates in the foreign jurisdictions in which we operate.

On an adjusted basis, we recorded an income tax recovery of $57 million in the first six months of 2013 compared to a recovery of $31 million in 2012 due in part to lower pre-tax adjusted earnings.

2013 SECOND QUARTER REPORT 11

| | | | | | | | | | | | | | | | |

| | | THREE MONTHS

ENDED JUNE 30 | | | SIX MONTHS

ENDED JUNE 30 | |

($ MILLIONS) | | 2013 | | | 2012 | | | 2013 | | | 2012 | |

Pre-tax adjusted earnings1 | | | | | | | | | | | | | | | | |

Canada2 | | | (156 | ) | | | (56 | ) | | | (262 | ) | | | (148 | ) |

Foreign | | | 181 | | | | 66 | | | | 292 | | | | 267 | |

| | | | | | | | | | | | | | | | |

Total pre-tax adjusted earnings | | | 25 | | | | 10 | | | | 30 | | | | 119 | |

| | | | | | | | | | | | | | | | |

Adjusted income taxes1 | | | | | | | | | | | | | | | | |

Canada2 | | | (36 | ) | | | (20 | ) | | | (64 | ) | | | (40 | ) |

Foreign | | | 1 | | | | — | | | | 7 | | | | 9 | |

| | | | | | | | | | | | | | | | |

Adjusted income tax expense (recovery) | | | (35 | ) | | | (20 | ) | | | (57 | ) | | | (31 | ) |

| | | | | | | | | | | | | | | | |

Effective tax rate | | | (140 | )% | | | (200 | )% | | | (190 | )% | | | (26 | )% |

| | | | | | | | | | | | | | | | |

| 1 | Pre-tax adjusted earnings and adjusted income taxes are non-IFRS measures. |

| 2 | Our IFRS-based measures have been adjusted by the amounts reflected in the table in adjusted net earnings (non-IFRS measure on page 9). |

FOREIGN EXCHANGE

At June 30, 2013:

| • | | The value of the US dollar relative to the Canadian dollar was $1.00 (US) for $1.05 (Cdn), up from $1.00 (US) for $1.02 (Cdn) at March 31, 2013. The exchange rate averaged $1.00 (US) for $1.02 (Cdn) over the quarter. |

| • | | We had foreign currency contracts of $1.5 billion (US) and €123 million at June 30, 2013. The mark-to-market loss on all foreign exchange contracts was $53 million compared to a $17 million loss at March 31, 2013. The average exchange rate for USD currency contracts was $1.00 (US) for $1.02 (Cdn) and €1.00 (EUR) for $1.30 (US) for EUR currency contracts. |

12 CAMECO CORPORATION

Outlook for 2013

Our outlook reflects our expectations for 2013 and the growth expenditures necessary to help us achieve our strategy. Our outlook for NUKEM sales volumes, revenue and operating cash flows, electricity average unit cost of sales (including D&A) and capital expenditures, uranium exploration and consolidated capital expenditures has changed and we explain the changes below. We do not provide an outlook for the items in the table that are marked with a dash.

SeeFinancial results by segment on page 17 for details.

2013 FINANCIAL OUTLOOK

NUKEM is included in the consolidated amounts, BPLP is not included in the consolidated amounts due to a change in accounting. SeeConsolidated financial results on page 8 for details.

| | | | | | | | | | |

| | | CONSOLIDATED | | URANIUM | | FUEL SERVICES | | NUKEM | | ELECTRICITY |

Production | | — | | 23.3 million lbs | | 15 to 16 million

kgU | | — | | — |

Sales volume | | — | | 31 to 33 million lbs | | Increase

5% to 10% | | 8 to 10 million

lbs U3O8 | | — |

Capacity factor | | — | | — | | — | | — | | 88% |

Revenue compared to 2012 | | Increase

25% to 30% | | Increase

0% to 5%1 | | Increase

5% to 10% | | $450 to $550

million | | Decrease

5% to 10% |

NUKEM operating cash flows | | — | | — | | — | | $60 to $80

million | | — |

NUKEM gross profit | | — | | — | | — | | 3% to 5% | | — |

Average unit cost of sales (including D&A) | | — | | Increase

0% to 5%2 | | Decrease

0% to 5% | | — | | Increase

20% to 25% |

Direct administration costs compared to 20123 | | Increase

0% to 5% | | — | | — | | $10 to $12

million | | — |

Exploration costs compared to 2012 | | — | | Decrease

15% to 20% | | — | | — | | — |

Tax rate | | Recovery of

15% to 20% | | — | | — | | Expense of

30% to 35% | | — |

Capital expenditures | | $685 million4

| | — | | — | | — | | $80 million

(our share) |

| 1 | Based on a uranium spot price of $34.50 (US) per pound (the Ux spot price as of July 29, 2013), a long-term price indicator of $55.00 (US) per pound (the Ux long-term indicator on July 29, 2013) and an exchange rate of $1.00 (US) for $1.00 (Cdn). |

| 2 | This increase is based on the unit cost of sale for produced material and committed long-term purchases. If we decide to make discretionary purchases in 2013 then we expect the overall unit cost of product sold to increase further. |

| 3 | Direct administration costs do not include stock-based compensation expenses or restructuring costs. See page 10 for more information. |

| 4 | Does not include our share of capital expenditures at BPLP. |

In the NUKEM segment, sales volumes are now expected to be 8 million to 10 million pounds (previously 9 million to 11 million pounds) as a result of a decision to decrease planned sales activities given the current spot price. We also now expect revenue of $450 million to $550 million (previously $500 million to $600 million) due to the reduced sales expectation. Operating cash flows are, therefore, also expected to be less than previously forecast at $60 million to $80 million (previously $100 million to $125 million).

We are discontinuing providing outlook for NUKEM’s SWU sales volumes as the amount is not material to our results. Therefore, we will not be reporting NUKEM’s SWU sales volumes and will also discontinue reporting UF6sales volumes. However, the revenue for these sales will be included in the total revenue figure reported for NUKEM.

In our electricity segment, average unit cost of sales (including D&A) is now expected to increase by 20% to 25% (previously 25% to 30%) due to lower outage costs.

We now expect uranium exploration expenditures to be 15% to 20% lower than 2012 (previously 5% to 10%), due to the restructuring activities which took place during the first quarter.

2013 SECOND QUARTER REPORT 13

We expect consolidated capital expenditures to be about $685 million compared to our previous estimate of $655 million mainly due to increased costs at Cigar Lake. In 2013, we expect our capital cost for Cigar Lake will be about $260 million compared to our previous estimate of $182 million due to additional scope, increased costs at the mine and mill and the inclusion of some capital costs that will be incurred subsequent to the mining of the first ore and not included in our previous estimate. Please seeDevelopment Project on page 28 for additional information. For our expected capital expenditures breakdown for 2013 by site and our outlook for investing activities in 2014 and 2015, please seeCapital spendingstarting on page 15.

Capital expenditures for BPLP are now expected to be $80 million (previously $93 million) due to deferral of projects.

In our uranium and fuel services segments, our customers choose when in the year to receive deliveries, so our quarterly delivery patterns, sales volumes and revenue, can vary significantly. However, the majority of delivery notices have been received for 2013, reducing the variability of our delivery pattern for the remainder of the year. Uranium sales for the balance of 2013 are expected to be more heavily weighted (more than 60%) to the second half of the year.

SENSITIVITY ANALYSIS

For the rest of 2013:

| • | | a change of $5 (US) per pound in both the Ux spot price ($34.50 (US) per pound on July 29, 2013) and the Ux long-term price indicator ($55.00 (US) per pound on July 29, 2013) would change revenue by $37 million and net earnings by $19 million |

| • | | a change of $5/MWh in the electricity spot price would change our 2013 net earnings by $1 million based on the assumption that the spot price will remain below the floor price of $52.34/MWh provided under BPLP’s agreement with the Ontario Power Authority (OPA) |

| • | | a one-cent change in the value of the Canadian dollar versus the US dollar would change revenue by $7 million and adjusted net earnings by $3 million, with a decrease in the value of the Canadian dollar versus the US dollar having a positive impact. This sensitivity is based on an exchange rate of $1.00 (US) for $1.00 (Cdn). |

Liquidity and capital resources

Our financial objective is to make sure we have the cash and debt capacity to fund our operating activities, investments and growth. We expect our existing cash balances and operating cash flows will meet our anticipated 2013 capital requirements without the need for significant additional funding.

We have large, creditworthy customers that continue to need uranium even during weak economic conditions, and we expect the uranium contract portfolio we have built to provide a solid revenue stream for years to come.

We expect to continue investing in expanding our production capacity over the next several years. We have a number of alternatives to fund this continued growth, including using our current cash balances, drawing on our existing credit facilities, entering new credit facilities, using our operating cash flow, and raising additional capital through debt or equity financings. We are always considering our financing options so that we can take advantage of favourable market conditions when they arise.

We have an ongoing dispute with CRA regarding our offshore marketing company structure and related transfer pricing arrangements. Until this dispute is settled, we expect to make cash payments to CRA for 50% of the cash taxes payable on income reassessed and the related interest and instalment penalties. We provided an estimate of the amount and timing of the expected cash taxes payable in our first quarter MD&A. There has been no material change to our estimate. See note 12 of our financial statements for more details.

CASH FROM OPERATIONS

Cash from operations was $80 million higher this quarter than in 2012, due largely to higher uranium deliveries. Working capital requirements were the same as in 2013. SeeFinancial results by segment on page 17 for details.

14 CAMECO CORPORATION

Cash from operations was $25 million lower for the first six months of 2013 than for the same period in 2012 mainly due to lower uranium deliveries. Working capital required $52 million less in 2013, largely as a result of an increase in accounts payable during the quarter. Not including working capital requirements, our operating cash flows in the first six months were higher by $27 million. SeeFinancial results by segment on page 17 for details.

CAPITAL SPENDING

We classify capital spending as sustaining, capacity replacement or growth. As a mining company, sustaining capital is the money we spend to keep our facilities running in their present state, which would follow a gradually decreasing production curve, while capacity replacement capital is spent to maintain current production levels at those operations. Growth capital is money we invest to generate incremental production, and for business development.

| | | | |

CAMECO’S SHARE ($ MILLIONS) | | 2013 PLAN | |

Sustaining capital | | | | |

McArthur River/Key Lake | | | 55 | |

Rabbit Lake | | | 70 | |

US ISR | | | 5 | |

Inkai | | | 7 | |

Fuel services | | | 10 | |

Other | | | 23 | |

| | | | |

Total sustaining capital | | | 170 | |

| | | | |

Capacity replacement capital | | | | |

McArthur River/Key Lake | | | 75 | |

Rabbit Lake | | | 5 | |

US ISR | | | 30 | |

Inkai | | | 20 | |

| | | | |

Total capacity replacement capital | | | 130 | |

| | | | |

Growth capital | | | | |

McArthur River/Key Lake | | | 55 | |

US ISR | | | 30 | |

Millennium | | | 5 | |

Inkai | | | 21 | |

Cigar Lake | | | 260 | |

Fuel Services | | | 4 | |

| | | | |

Total growth capital | | | 375 | |

| | | | |

Talvivaara | | | 10 | |

| | | | |

Total uranium & fuel services | | | 685 | |

| | | | |

Electricity(our 31.6% share of BPLP) | | | 80 | |

| | | | |

We expect our total sustaining capital to be $170 million (previously $200 million) primarily due to a reduction in expenditures at McArthur River/Key Lake related to restructuring activities. We expect our total growth capital to be $375 million (previously $310 million) due to additional scope and increased costs at Cigar Lake. Please seeDevelopment Project on page 28 for additional information. Our capital spending related to Talvivaara is expected to increase to $10 million this year (previously $5 million) due to increased costs associated with the construction of the uranium extraction facility.

OUTLOOK FOR INVESTING ACTIVITIES

| | | | | | | | |

CAMECO’S SHARE ($ MILLIONS) | | 2014 PLAN | | | 2015 PLAN | |

Sustaining capital | | | 200-220 | | | | 195-215 | �� |

Capacity replacement capital | | | 125-140 | | | | 120-135 | |

Growth capital | | | 175-190 | | | | 135-150 | |

| | | | | | | | |

Total uranium & fuel services | | | 500-550 | | | | 450-500 | |

| | | | | | | | |

2013 SECOND QUARTER REPORT 15

We expect total uranium and fuel services capital expenditures to be between $500 million and $550 million in 2014 (previously $600 million to $650 million) and between $450 million and $500 million in 2015 (previously $550 million to $600 million) due to a decrease in expected sustaining capital expenditures resulting from our restructuring activities.

DEBT

We use debt to provide additional liquidity. We have sufficient borrowing capacity with unsecured lines of credit totaling about $2.2 billion at June 30, 2013, up $0.1 billion from March 31, 2013. The increase is due to increases in letters of credit and changes in foreign exchange rates. At June 30, 2013, we had approximately $768 million outstanding in letters of credit.

DEBT COVENANTS

We are bound by certain covenants in our unsecured revolving credit facility. The financially related covenants place restrictions on total debt, including guarantees. As at June 30, 2013, we met these financial covenants and do not expect our operating and investment activities for the remainder of 2013 to be constrained by them.

LONG-TERM CONTRACTUAL OBLIGATIONS AND OFF-BALANCE SHEET ARRANGEMENTS

We had two kinds of off-balance sheet arrangements at June 30, 2013:

There have been no material changes to our long-term contractual obligations or financial assurances since December 31, 2012, or to our purchase commitments since March 31, 2013, including payments due for the next five years and thereafter. Please see our annual and first quarter MD&A for more information.

BALANCE SHEET

| | | | | | | | | | | | |

($ MILLIONS) | | JUN 30, 2013 | | | DEC 31, 2012 | | | CHANGE | |

Cash and short-term investments | | | 332 | | | | 799 | | | | (58 | )% |

| | | | | | | | | | | | |

Total debt | | | 1,346 | | | | 1,360 | | | | (1 | )% |

| | | | | | | | | | | | |

Inventory | | | 933 | | | | 564 | | | | 65 | % |

Total cash and short-term investments at June 30, 2013 were $332 million, or 58% lower than at December 31, 2012 due to capital expenditures and completion of the acquisition of NUKEM Energy GmbH in January. Net debt June 30, 2013 was $1,014 million.

Total debt decreased by $14 million to $1,346 million at June 30, 2013. Of this total, $54 million was classified as current, down $13 million compared to December 31, 2012. See notes 16 and 17 of our audited annual financial statements for more detail.

Total product inventories increased by $369 million. Uranium and fuel services inventories increased as sales were lower than production and purchases in the first six months of the year. NUKEM inventories also increased as sales were lower than purchases.

16 CAMECO CORPORATION

Financial results by segment

Uranium

| | | | | | | | | | | | | | | | | | | | | | | | |

HIGHLIGHTS | | THREE MONTHS

ENDED JUNE 30 | | | CHANGE | | | SIX MONTHS

ENDED JUNE 30 | | | CHANGE | |

| | 2013 | | | 2012 | | | | 2013 | | | 2012 | | |

Production volume (million lbs) | | | 4.4 | | | | 5.3 | | | | (17 | )% | | | 10.3 | | | | 10.2 | | | | 1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Sales volume (million lbs) | | | 6.4 | | | | 5.0 | | | | 28 | % | | | 11.6 | | | | 13.2 | | | | (12 | )% |

| | | | | | | | | | | | | | | | | | | | | | | | |

Average spot price ($US/lb) | | | 40.18 | | | | 51.33 | | | | (22 | )% | | | 41.45 | | | | 51.53 | | | | (20 | )% |

Average long-term price ($US/lb) | | | 57.00 | | | | 61.00 | | | | (7 | )% | | | 56.75 | | | | 60.67 | | | | (6 | )% |

Average realized price | | | | | | | | | | | | | | | | | | | | | | | | |

($US/lb) | | | 46.30 | | | | 42.17 | | | | 10 | % | | | 47.24 | | | | 46.20 | | | | 2 | % |

($Cdn/lb) | | | 47.35 | | | | 42.29 | | | | 12 | % | | | 47.75 | | | | 46.66 | | | | 2 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Average unit cost of sales ($Cdn/lb) (including D&A) | | | 33.25 | | | | 33.45 | | | | (1 | )% | | | 32.65 | | | | 32.54 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Revenue ($ millions) | | | 305 | | | | 211 | | | | 45 | % | | | 552 | | | | 617 | | | | (11 | )% |

| | | | | | | | | | | | | | | | | | | | | | | | |

Gross profit ($ millions) | | | 91 | | | | 44 | | | | 107 | % | | | 174 | | | | 187 | | | | (7 | )% |

| | | | | | | | | | | | | | | | | | | | | | | | |

Gross profit (%) | | | 30 | | | | 21 | | | | 43 | % | | | 32 | | | | 30 | | | | 7 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

SECOND QUARTER

Production volumes this quarter were 17% lower compared to the second quarter of 2012, due mainly to lower production at Rabbit Lake and McArthur River/Key Lake. SeeUranium 2013 Q2 updates starting on page 27 for more information.

Uranium revenues were up 45% due to a 12% increase in the Canadian dollar average realized price and a 28% increase in sales volumes. The average realized price in the second quarter of 2012 was significantly lower due to lower US dollar prices under fixed price contracts.

Our realized prices this quarter were higher than the second quarter of 2012, mainly due to higher US dollar prices under fixed price contracts. In the second quarter of 2013, our realized foreign exchange rate was $1.02 compared to $1.00 in the prior year.

Total cost of sales (including D&A) increased by 28% ($214 million compared to $167 million in 2012). This was mainly the result of a 28% increase in sales volumes.

The net effect was a $47 million increase in gross profit for the quarter.

FIRST SIX MONTHS

Production volumes for the first six months of the year were 1% higher than in the previous year due to higher production from Inkai. SeeUranium 2013 Q2 updates starting on page 27 for more information.

For the first six months of 2013, uranium revenues were down 11% compared to 2012, due to a 12% decrease in sales volumes, partially offset by a 2% increase in the Canadian dollar average realized price.

Our realized prices for the first six months of 2013 were higher than 2012, mainly due to higher US dollar prices under fixed price contracts.

Total cost of sales (including D&A) decreased by 12% ($377 million compared to $430 million in 2012). This was mainly the result of a 12% decrease in sales volumes.

The net effect was a $13 million decrease in gross profit for the first six months.

The table on the following page shows the costs of produced and purchased uranium incurred in the reporting periods (which are non-IFRS measures, see the paragraphs below the table). These costs do not include selling costs such as royalties, transportation and commissions, nor do they reflect the impact of opening inventories on our reported cost of sales.

2013 SECOND QUARTER REPORT 17

| | | | | | | | | | | | | | | | | | | | | | | | |

($CDN/LB) | | THREE MONTHS

ENDED JUNE 30 | | | CHANGE | | | SIX MONTHS

ENDED JUNE 30 | | | CHANGE | |

| | 2013 | | | 2012 | | | | 2013 | | | 2012 | | |

Produced | | | | | | | | | | | | | | | | | | | | | | | | |

Cash cost | | | 23.00 | | | | 20.13 | | | | 14 | % | | | 20.78 | | | | 21.21 | | | | (2 | )% |

Non-cash cost | | | 9.34 | | | | 7.87 | | | | 19 | % | | | 8.83 | | | | 7.70 | | | | 15 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total production cost | | | 32.34 | | | | 28.00 | | | | 16 | % | | | 29.61 | | | | 28.91 | | | | 2 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Quantity produced (million lbs) | | | 4.4 | | | | 5.3 | | | | (17 | )% | | | 10.3 | | | | 10.2 | | | | 1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Purchased | | | | | | | | | | | | | | | | | | | | | | | | |

Cash cost | | | 24.05 | | | | 24.38 | | | | (1 | )% | | | 28.45 | | | | 28.18 | | | | 1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Quantity purchased (million lbs) | | | 2.6 | | | | 2.4 | | | | 8 | % | | | 4.9 | | | | 3.8 | | | | 29 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Totals | | | | | | | | | | | | | | | | | | | | | | | | |

Produced and purchased costs | | | 29.26 | | | | 26.87 | | | | 9 | % | | | 29.24 | | | | 28.71 | | | | 2 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Quantities produced and purchased (million lbs) | | | 7.0 | | | | 7.7 | | | | (9 | )% | | | 15.2 | | | | 14.0 | | | | 9 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Cash cost per pound, non-cash cost per pound and total cost per pound for produced and purchased uranium presented in the above table are non-IFRS measures. These measures do not have a standardized meaning or a consistent basis of calculation under IFRS. We use these measures in our assessment of the performance of our uranium business. We believe that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate our performance and ability to generate cash flow.

These measures are non-standard supplemental information and should not be considered in isolation or as a substitute for measures of performance prepared according to accounting standards. These measures are not necessarily indicative of operating profit or cash flow from operations as determined under IFRS. Other companies may calculate these measures differently so you may not be able to make a direct comparison to similar measures presented by other companies.

To facilitate a better understanding of these measures, the following table presents a reconciliation of these measures to our unit cost of sales for the second quarters and the first six months of 2013 and 2012.

CASH AND TOTAL COST PER POUND RECONCILIATION

| | | | | | | | | | | | | | | | | | | | | | | | |

($ MILLIONS) | | THREE MONTHS

ENDED JUNE 30 | | | | | | SIX MONTHS

ENDED JUNE 30 | | | | |

| | 2013 | | | 2012 | | | CHANGE | | | 2013 | | | 2012 | | | CHANGE | |

Cost of product sold | | | 213.8 | | | | 167.3 | | | | 28 | % | | | 377.3 | | | | 430.3 | | | | (12 | )% |

Add / (subtract) | | | | | | | | | | | | | | | | | | | | | | | | |

Royalties | | | (17.6 | ) | | | (24.2 | ) | | | (27 | )% | | | (32.1 | ) | | | (57.6 | ) | | | (44 | )% |

Standby charges | | | (9.1 | ) | | | (5.8 | ) | | | 57 | % | | | (17.2 | ) | | | (12.9 | ) | | | 33 | % |

Other selling costs | | | 0.8 | | | | (0.4 | ) | | | (300 | )% | | | 3.6 | | | | (2.4 | ) | | | (250 | )% |

Change in inventories | | | (24.2 | ) | | | 28.3 | | | | (186 | )% | | | 21.8 | | | | (34.0 | ) | | | 164 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Cash operating costs (a) | | | 163.7 | | | | 165.2 | | | | (1 | )% | | | 353.4 | | | | 323.4 | | | | 9 | % |

Add / (subtract) | | | | | | | | | | | | | | | | | | | | | | | | |

Depreciation and amortization | | | 46.7 | | | | 32.7 | | | | 43 | % | | | 66.1 | | | | 64.6 | | | | 2 | % |

Change in inventories | | | (5.6 | ) | | | 9.0 | | | | (162 | )% | | | 24.9 | | | | 13.9 | | | | 79 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total operating costs (b) | | | 204.8 | | | | 206.9 | | | | (1 | )% | | | 444.4 | | | | 401.9 | | | | 11 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Uranium produced & purchased (millions lbs) (c) | | | 7.0 | | | | 7.7 | | | | (9 | )% | | | 15.2 | | | | 14.0 | | | | 9 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Cash costs per pound (a ÷ c) | | | 23.39 | | | | 21.45 | | | | 9 | % | | | 23.25 | | | | 23.10 | | | | 1 | % |

Total costs per pound (b ÷ c) | | | 29.26 | | | | 26.87 | | | | 9 | % | | | 29.24 | | | | 28.71 | | | | 2 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

18 CAMECO CORPORATION

PRICE SENSITIVITY ANALYSIS: URANIUM

The table and graph below are not forecasts of prices we expect to receive. The prices we actually realize will be different from the prices shown in the table and graph. They are designed to indicate how the portfolio of long-term contracts we had in place in our uranium segment on June 30, 2013 would respond to different spot prices. In other words, we would realize these prices only if the contract portfolio remained the same as it was on June 30, 2013, and none of the assumptions we list below change.

We intend to update this table and graph each quarter in our MD&A to reflect deliveries made and changes to our contract portfolio each quarter. As a result, we expect the table and graph to change from quarter to quarter.

EXPECTED REALIZED URANIUM PRICE SENSITIVITY UNDER VARIOUS SPOT PRICE ASSUMPTIONS

(rounded to the nearest $1.00)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

SPOT PRICES ($US/LB U3O8) | | | | | | | | | | | | | | | | | | | | | |

| | $ | 20 | | | $ | 40 | | | $ | 60 | | | $ | 80 | | | $ | 100 | | | $ | 120 | | | $ | 140 | |

2013 | | | 46 | | | | 47 | | | | 52 | | | | 56 | | | | 61 | | | | 66 | | | | 70 | |

2014 | | | 45 | | | | 48 | | | | 56 | | | | 64 | | | | 72 | | | | 80 | | | | 86 | |

2015 | | | 41 | | | | 46 | | | | 56 | | | | 65 | | | | 76 | | | | 86 | | | | 94 | |

2016 | | | 42 | | | | 48 | | | | 58 | | | | 68 | | | | 79 | | | | 89 | | | | 98 | |

2017 | | | 42 | | | | 47 | | | | 57 | | | | 67 | | | | 77 | | | | 86 | | | | 94 | |

The table and graph illustrate the mix of long-term contracts in our June 30, 2013 portfolio, and are consistent with our contracting strategy. Both have been updated to reflect deliveries made and contracts entered into up to June 30, 2013.

Our portfolio includes a mix of fixed-price and market-related contracts, which we target at a 40:60 ratio. Those that are fixed at lower prices or have low ceiling prices will yield prices that are lower than current market prices. In 2012, a number of older contracts expired and we are starting to deliver into more favourably priced contracts.

Our portfolio is affected by more than just the spot price. We made the following assumptions (which are not forecasts) to create the table:

Sales

| • | | sales volumes on average of 32 million pounds per year |

Deliveries

| • | | customers take the maximum quantity allowed under each contract (unless they have already provided a delivery notice indicating they will take less) |

| • | | deliveries include our best estimate of quantities under requirements-based contracts |

| • | | we defer a portion of deliveries under existing contracts for 2013 |

Annual inflation

| • | | is 1.5% in Canada and 2% in the US |

Prices

| | • | | the average long-term price indicator is the same as the average spot price for the entire year (a simplified approach for this purpose only). Since 1996, the long-term price indicator has averaged 16% higher than the spot price. This differential has varied significantly. Assuming the long-term price is at a premium to spot, the prices in the table and graph will be higher. |

2013 SECOND QUARTER REPORT 19

ROYALTIES

The government of Saskatchewan has recently approved changes to both the basic and tiered royalty system as outlined in our first quarter MD&A. The overall structure is expected to be positive over the next 15 years, although the magnitude of the impact will not be known until the provincial regulations are finalized.

Fuel services

(includes results for UF6, UO2and fuel fabrication)

| | | | | | | | | | | | | | | | | | | | | | | | |

HIGHLIGHTS | | THREE MONTHS

ENDED JUNE 30 | | | CHANGE | | | SIX MONTHS

ENDED JUNE 30 | | | CHANGE | |

| | 2013 | | | 2012 | | | | 2013 | | | 2012 | | |

Production volume (million kgU) | | | 4.8 | | | | 4.3 | | | | 12 | % | | | 9.6 | | | | 8.8 | | | | 9 | % |

Sales volume (million kgU) | | | 4.0 | | | | 4.2 | | | | (5 | )% | | | 7.3 | | | | 7.1 | | | | 3 | % |

Average realized price ($Cdn/kgU) | | | 16.45 | | | | 16.94 | | | | (3 | )% | | | 17.89 | | | | 18.43 | | | | (3 | )% |

Average unit cost of sales ($Cdn/kgU) (including D&A) | | | 13.98 | | | | 14.76 | | | | (5 | )% | | | 15.03 | | | | 15.54 | | | | (3 | )% |

Revenue ($ millions) | | | 65 | | | | 70 | | | | (7 | )% | | | 131 | | | | 130 | | | | 1 | % |

Gross profit ($ millions) | | | 10 | | | | 9 | | | | 11 | % | | | 21 | | | | 20 | | | | 5 | % |

Gross profit (%) | | | 15 | | | | 13 | | | | 15 | % | | | 16 | | | | 15 | | | | 7 | % |

SECOND QUARTER

Total revenue decreased by 7% due to a 5% decrease in sales volumes and a 3% decrease in realized price.

The total cost of sales (including D&A) decreased by 10% ($55 million compared to $61 million in the second quarter of 2012) mainly due to a 5% decrease in sales volumes and differences in the mix of fuel services products sold.

The net effect was a $1 million increase in gross profit.

FIRST SIX MONTHS

In the first six months of the year, total revenue increased by 1% due to a 3% increase in sales volumes, offset by a 3% decrease in realized price.

The total cost of sales (including D&A) was unchanged at $110 million, as the 3% increase in sales volume was offset by a 3% decrease in the average unit cost of sales. The decrease in the average unit cost of sales was due to the mix of fuel services products sold.

The net effect was a $1 million increase in gross profit.

20 CAMECO CORPORATION

NUKEM

| | | | | | | | | | | | | | | | | | | | | | | | |

($ MILLIONS EXCEPT WHERE INDICATED) | | THREE MONTHS

ENDED JUNE 30 | | | CONSOLIDATED | | | SIX MONTHS

ENDED JUNE 30 | | | CONSOLIDATED | |

| | NUKEM | | | PURCHASE

ACCOUNTING | | | | NUKEM | | | PURCHASE

ACCOUNTING | | |

Uranium sales (million lbs) | | | 1.2 | | | | — | | | | 1.2 | | | | 3.5 | | | | — | | | | 3.5 | |

Revenue | | | 60 | | | | (7 | ) | | | 53 | | | | 191 | | | | (8 | ) | | | 183 | |

Cost of product sold (including D&A) | | | 43 | | | | 7 | | | | 50 | | | | 144 | | | | 31 | | | | 175 | |

Gross profit | | | 17 | | | | (14 | ) | | | 3 | | | | 47 | | | | (39 | ) | | | 8 | |

Net earnings | | | 13 | | | | (10 | ) | | | 3 | | | | 27 | | | | (27 | ) | | | — | |

Adjustments on derivatives1 | | | (5 | ) | | | — | | | | (5 | ) | | | (3 | ) | | | — | | | | (3 | ) |

Adjusted net earnings1 | | | 8 | | | | (10 | ) | | | (2 | ) | | | 24 | | | | (27 | ) | | | (3 | ) |

Cash provided by operations | | | (11 | ) | | | — | | | | (11 | ) | | | 88 | | | | — | | | | 88 | |

| 1 | Adjustments relate to unrealized gains and losses on foreign currency forward sales contracts (non-IFRS measure, see page 9). |

On January 9, 2013, we acquired NUKEM Energy GmbH (NUKEM) for cash consideration of €107 million ($140 million (US)). We also assumed NUKEM’s net debt which amounted to about €79 million ($104 million (US)).

For accounting purposes, the purchase price is allocated to the assets and liabilities acquired based on their fair values as of the acquisition date. The purchase price allocation is provided in the table below. We believe that these values are representative of the transaction; however, it is possible that the final allocation will differ.

Much of the purchase price was related to nuclear fuel inventories and the portfolio of sales and purchase contracts acquired. The amounts attributed to inventory and contracts were based on market values as at the acquisition date. They will be charged to earnings in the period(s) in which related transactions occur. The amount categorized as goodwill reflects the value assigned to the expected future earnings capabilities of the organization. This is the earnings potential that we anticipate will be realized through new business arrangements. Goodwill is not amortized and is tested for impairment at least annually.

PURCHASE PRICE ALLOCATION

| | | | |

| | | $US MILLIONS | |

Net assets | | | | |

Working capital | | | (22 | ) |

Inventory | | | 165 | |

Sales, purchase contracts and other intangibles | | | 88 | |

Goodwill | | | 88 | |

Debt | | | (117 | ) |

Deferred taxes | | | (54 | ) |

| | | | |

Net assets acquired | | | 148 | |

| | | | |

Financed by | | | | |

Cash | | | 140 | |

Additional consideration (earn-out provision) | | | 8 | |

| | | | |

Liabilities and equity | | | 148 | |

| | | | |

SECOND QUARTER

During the second quarter of 2013, NUKEM delivered 1.2 million pounds of uranium. On a consolidated basis, NUKEM contributed $53 million in revenues and $3 million in gross profit. Adjusted net earnings were a loss of $2 million (non-IFRS measure, see page 9). NUKEM’s contribution to our earnings is significantly impacted by our purchase price accounting. Excluding the impact of the purchase accounting, NUKEM’s adjusted net earnings (non-IFRS measure, see page 9) were $8 million for the quarter.

2013 SECOND QUARTER REPORT 21

FIRST SIX MONTHS