Exhibit 99.4

Cameco Energizing the World 2017 Annual Report

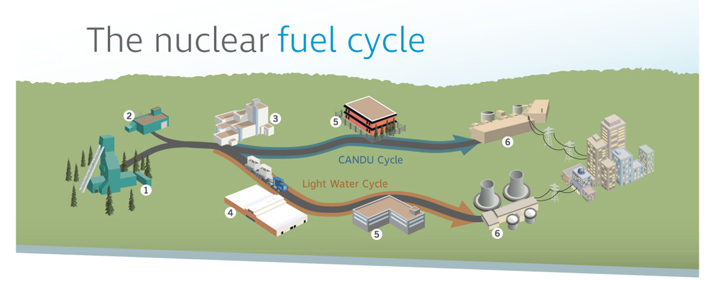

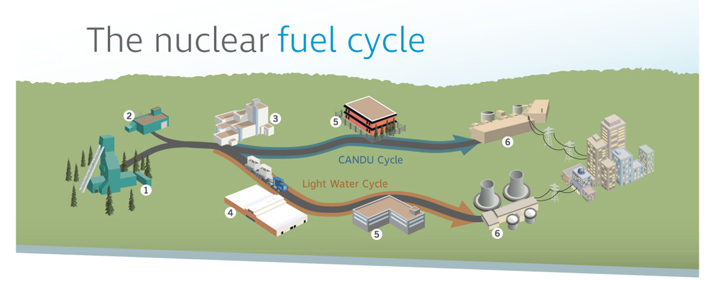

The nuclear fuel cycle 2 3 5 6 CANDU Cycle Light Water Cycle 1 4 5 6

Mining

Mining

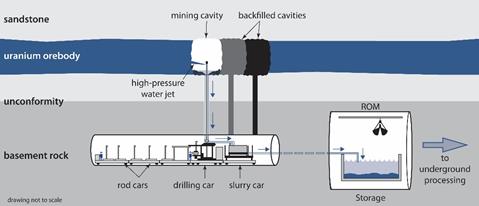

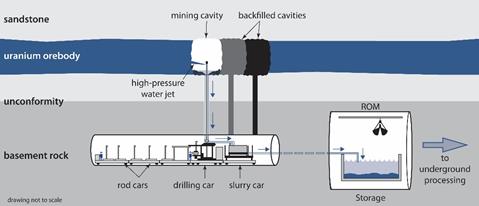

Once an orebody is discovered and defined by exploration, there are three common ways to mine uranium, depending on the depth of the orebody and the deposit’s geological characteristics:

| | • | | Open pit mining is used if the ore is near the surface. The ore is usually mined using drilling and blasting. |

| | • | | Underground mining is used if the ore is too deep to make open pit mining economical. Tunnels and shafts provide access to the ore. |

| | • | | In situ recovery (ISR) does not require large scale excavation. Instead, holes are drilled into the ore and a solution is used to dissolve the uranium. The solution is pumped to the surface where the uranium is recovered. |

Milling

Milling

Ore from open pit and underground mines is processed to extract the uranium and package it as a powder typically referred to asuranium concentrates(U3O8) oryellowcake. The leftover processed rock and other solid waste (tailings) is placed in an engineered tailings facility.

Refining

Refining

Refining removes the impurities from the uranium concentrate and changes its chemical form touranium trioxide (UO3).

Conversion

Conversion

For light water reactors, the UO3 is converted touranium hexafluoride (UF6) gas to prepare it for enrichment. For heavy water reactors like the Candu reactor, the UO3 is converted into powdereduranium dioxide (UO2).

Enrichment

Enrichment

Uranium is made up of two main isotopes:U-238 andU-235. OnlyU-235 atoms, which make up 0.7% of natural uranium, are involved in the nuclear reaction (fission). Most of the world’s commercial nuclear reactors require uranium that has an enriched level ofU-235 atoms.

The enrichment process increases the concentration ofU-235 to between 3% and 5% by separatingU-235 atoms from theU-238. Enriched UF6 gas is then converted to powdered UO2.

Fuel manufacturing

Fuel manufacturing

Natural or enriched UO2 is pressed into pellets, which are baked at a high temperature. These are packed into zircaloy or stainless steel tubes, sealed and then assembled into fuel bundles.

Generation

Generation

Nuclear reactors are used to generate electricity.U-235 atoms in the reactor fuel fission, creating heat that generates steam to drive turbines. The fuel bundles in the reactor need to be replaced as theU-235 atoms are depleted, typically after one or two years depending upon the reactor type. The used – or spent – fuel is stored or reprocessed.

Spent fuel management

The majority of spent fuel is safely stored at the reactor site. A small amount of spent fuel is reprocessed. The reprocessed fuel is used in some European and Japanese reactors.

Management’s discussion and analysis

February 9, 2018

| | |

6 | | 2017 PERFORMANCE HIGHLIGHTS |

| |

| 9 | | MARKET OVERVIEW AND 2017 DEVELOPMENTS |

| |

| 13 | | OUR STRATEGY |

| |

| 21 | | MEASURING OUR RESULTS |

| |

| 22 | | FINANCIAL RESULTS |

| |

| 51 | | OPERATIONS AND PROJECTS |

| |

| 74 | | MINERAL RESERVES AND RESOURCES |

| |

| 79 | | ADDITIONAL INFORMATION |

| |

| 82 | | 2017 CONSOLIDATED FINANCIAL STATEMENTS |

This management’s discussion and analysis (MD&A) includes information that will help you understand management’s perspective of our audited consolidated financial statements (financial statements) and notes for the year ended December 31, 2017. The information is based on what we knew as of February 7, 2018.

We encourage you to read our audited consolidated financial statements and notes as you review this MD&A. You can find more information about Cameco, including our financial statements and our most recent annual information form, on our website at cameco.com, on SEDAR at sedar.com or on EDGAR at sec.gov. You should also read our annual information form before making an investment decision about our securities.

The financial information in this MD&A and in our financial statements and notes are prepared according to International Financial Reporting Standards (IFRS), unless otherwise indicated.

Unless we have specified otherwise, all dollar amounts are in Canadian dollars.

Throughout this document, the terms we, us, our, the Company and Cameco mean Cameco Corporation and its subsidiaries, including NUKEM Energy GmbH (NUKEM), unless otherwise indicated.

Caution about forward-looking information

Our MD&A includes statements and information about our expectations for the future. When we discuss our strategy, plans, future financial and operating performance, or other things that have not yet taken place, we are making statements considered to beforward-looking information orforward-looking statements under Canadian and United States (US) securities laws. We refer to them in this MD&A asforward-looking information.

Key things to understand about the forward-looking information in this MD&A:

| · | | It typically includes words and phrases about the future, such as: anticipate, believe, estimate, expect, plan, will, intend, goal, target, forecast, project, strategy and outlook (see examples below). |

| · | | It represents our current views, and can change significantly. |

| · | | It is based on a number ofmaterial assumptions, including those we have listed on page 3, which may prove to be incorrect. |

| · | | Actual results and events may be significantly different from what we currently expect, due to the risks associated with our business. We list a number of thesematerial risks on pages 2 and 3. We recommend you also review our most recent annual information form, which includes a discussion of othermaterial risks that could cause actual results to differ significantly from our current expectations. |

| · | | Forward-looking information is designed to help you understand management’s current views of our near and longer term prospects, and it may not be appropriate for other purposes. We will not necessarily update this information unless we are required to by securities laws. |

Examples of forward-looking information in this MD&A

| · | | our expectations about 2018 and future global uranium supply, consumption, demand, contracting volumes and number of reactors, including the discussion under the headingMarket overview and 2017 developments |

| · | | the discussion under the headingOur strategy |

| · | | our expectations for uranium deliveries in 2018 |

| · | | the discussion of our expectations relating to our Canada Revenue Agency (CRA) transfer pricing dispute, including our estimate of the amount and timing of expected cash taxes and transfer pricing penalties |

| · | | the discussion of our expectations relating to our dispute with Tokyo Electric Power Company Holdings, Inc. (TEPCO) |

| · | | our expectations that we will recognize a gain in the first quarter of approximately $66 million on the change of Joint Venture Inkai LLP’s (JV Inkai) ownership interest |

| · | | our consolidated outlook for the year and the outlook for our uranium and fuel services segments for 2018 |

| · | | our expectations for future tax payments and rates, including effective tax rates |

| · | | our price sensitivity analysis for our uranium segment |

| · | | our expectation that existing cash balances and operating cash flows will meet our anticipated 2018 capital requirements |

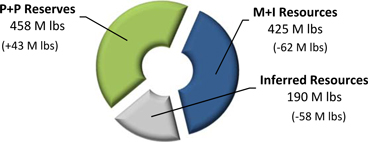

| · | | our expectations for 2018, 2019 and 2020 capital expenditures |

| · | | our expectation that in 2018 we will be able to comply with all the covenants in our unsecured revolving credit facility |

| · | | future plans and expectations for uranium properties, projects under evaluation, and fuel services operating sites |

| · | | our expectations related to care and maintenance costs |

| · | | our mineral reserve and resource estimates |

Material risks

| · | | actual sales volumes or market prices for any of our products or services are lower than we expect for any reason, including changes in market prices, loss of market share to a competitor or trade restrictions |

| · | | we are adversely affected by changes in currency exchange rates, interest rates, royalty rates, or tax rates |

| · | | our production costs are higher than planned, or our cost reduction strategies are unsuccessful, or necessary supplies are not available, or not available on commercially reasonable terms |

| · | | our estimates of production, purchases, costs, decommissioning, reclamation expenses, or our tax expense prove to be inaccurate |

| · | | we are unable to enforce our legal rights under our existing agreements, permits or licences |

| · | | we are subject to litigation or arbitration that has an adverse outcome, including lack of success in our dispute with CRA or with TEPCO |

| · | | our estimate of the gain on the change in ownership interests for JV Inkai prove to be inaccurate |

| · | | we are unsuccessful in our dispute with CRA and this results in significantly higher cash taxes, interest charges and penalties than the amount of our cumulative tax provision |

| · | | we are unable to utilize letters of credit to the extent anticipated in our dispute with CRA |

| · | | there are defects in, or challenges to, title to our properties |

| · | | our mineral reserve and resource estimates are not reliable, or there are unexpected or challenging geological, hydrological or mining conditions |

| · | | we are affected by environmental, safety and regulatory risks, including increased regulatory burdens or delays |

| · | | necessary permits or approvals from government authorities cannot be obtained or maintained |

| · | | we are affected by political risks |

| · | | we are affected by terrorism, sabotage, blockades, civil unrest, social or political activism, accident or a deterioration in political support for, or demand for, nuclear energy |

| · | | we are impacted by changes in the regulation or public perception of the safety of nuclear power plants, which adversely affect the construction of new plants, the relicensing of existing plants and the demand for uranium |

| · | | government regulations or policies that adversely affect us, including tax and trade laws and policies |

| · | | our uranium suppliers fail to fulfil delivery commitments or our uranium purchasers fail to fulfil purchase commitments |

| · | | our McArthur River and/or Cigar Lake development, mining or production plans are delayed or do not succeed for any reason |

| · | | any difficulties in resuming McArthur River production after the end of the production suspension including as a result of failure to reach a new collective agreement |

| · | | any difficulties in milling of Cigar Lake ore at the McClean Lake mill or resuming production after the extended Cigar Lake shutdown scheduled for the third quarter |

| · | | JV Inkai’s development, mining or production plans are delayed or do not succeed for any reason |

| · | | our expectations relating to care and maintenance costs prove to be inaccurate |

| · | | we are affected by natural phenomena, including inclement weather, fire, flood and earthquakes |

| · | | our operations are disrupted due to problems with our own or our suppliers’ or customers’ facilities, the unavailability of reagents, equipment, operating parts and supplies critical to production, equipment failure, lack of tailings capacity, labour shortages, labour relations issues, strikes or lockouts, underground floods,cave-ins, ground movements, tailings dam failures, transportation disruptions or accidents, unanticipated consequences of our cost reduction strategies, or other development and operating risks |

Material assumptions

| · | | our expectations regarding sales and purchase volumes and prices for uranium and fuel services, trade restrictions and that counterparties to our sales and purchase agreements will honour their commitments |

| · | | our expectations regarding the demand for and supply of uranium |

| · | | our expectations regarding spot prices and realized prices for uranium, and other factors discussed under the headingPrice sensitivity analysis: uranium segment |

| · | | that the construction of new nuclear power plants and the relicensing of existing nuclear power plants not being more adversely affected than expected by changes in regulation or in the public perception of the safety of nuclear power plants |

| · | | our ability to continue to supply our products and services in the expected quantities and at the expected times |

| · | | our expected production level |

| · | | our cost expectations, including production costs, purchase costs and the success of our cost reduction strategies |

| · | | our expectations regarding tax rates and payments, royalty rates, currency exchange rates and interest rates |

| · | | the accounting treatment for the change in ownership interests in JV Inkai is as expected |

| · | | our expectations about the outcome of disputes with CRA and with TEPCO |

| · | | we are able to utilize letters of credit to the extent anticipated in our dispute with CRA |

| · | | our decommissioning and reclamation expenses |

| · | | our mineral reserve and resource estimates, and the assumptions upon which they are based, are reliable |

| · | | our understanding of the geological, hydrological and other conditions at our uranium properties |

| · | | our McArthur River development, mining and production plans succeed, including the resumption of production after the end of the production suspension |

| · | | our Cigar Lake development, mining and production plans succeed, including the resumption of production after the end of the extended shutdown scheduled for the third quarter |

| · | | the McClean Lake mill is able to process Cigar Lake ore as expected |

| · | | that care and maintenance costs will be as expected |

| · | | our and our contractors’ ability to comply with current and future environmental, safety and other regulatory requirements, and to obtain and maintain required regulatory approvals |

| · | | our operations are not significantly disrupted as a result of political instability, nationalization, terrorism, sabotage, blockades, civil unrest, breakdown, natural disasters, governmental or political actions, litigation or arbitration proceedings, the unavailability of reagents, equipment, operating parts and supplies critical to production, labour shortages, labour relations issues, strikes or lockouts, underground floods,cave-ins, ground movements, tailings dam failure, lack of tailings capacity, transportation disruptions or accidents, unanticipated consequences of our cost reduction strategies, or other development or operating risks |

| | |

| MANAGEMENT’S DISCUSSION AND ANALYSIS | | 3 |

Our business

We are a pure-play nuclear fuel investment with a proven track record and the strengths to take advantage of the world’s rising demand for safe, clean and reliable energy. Nuclear energy plants around the world use our uranium products to generate one of the cleanest sources of electricity available today.

Our operations and investments span the nuclear fuel cycle, from exploration to fuel manufacturing. Our head office is in Saskatoon, Saskatchewan. c.

URANIUM

Operations

We are one of the world’s largest uranium producers, and in 2017 accounted for about 16% of the world’s production. We have controlling ownership of the world’s largest high-grade reserves.

Uranium Projects under Evaluation

We use a stage gate process to evaluate our uranium projects and will advance them at a pace aligned with market opportunities, in order to respond when the market signals a need for more uranium.

Uranium Exploration (grey shaded)

Our exploration program is directed at replacing mineral reserves as they are depleted by our production. We have a total of about 1 million hectares of land holdings on three continents. Our active exploration programs are focused on Canada.

FUEL SERVICES

We are an integrated uranium fuel supplier, offering refining, conversion and fuel manufacturing services. We control 25% of world primary conversion capacity.

MARKETING

We sell uranium and fuel services to nuclear utilities in 13 countries, with sales commitments to supply about 150 million pounds of U3O8 and over 40 million kilograms of UFg conversion services.

OTHER FUEL CYCLE INVESTMENTS

ENRICHMENT

GE-Hitachi Global Laser Enrichment (GLE) is testing a third-generation technology that, if successful, will use lasers to commercially enrich uranium. We have a 24% interest in GLE, which is currently undergoing restructuring.

McArthur River/Key Lake* Cigar Lake Rabbit Lake*

Millennium

Corporate Office Cameco Marketing Inc. Smith Ranch-Highland* Crow Butte*

GLE Blind River Port Hope Cameco Fuel Manufacturing Inc.

* Operation suspended/curtailed due to current market conditions

4 CAMECO CORPORATION

Advantages

With our extraordinary assets, long-term contract portfolio, employee expertise, comprehensive industry knowledge and strong balance sheet, we are confident in our ability to increase long-term shareholder value.

Cameco Europe Ltd. Inkai Yeelirrie Kintyre

MANACEMENT’S DISCUSSION AND ANALYSIS 5

2017 performance highlights

Our focus throughout 2017 continued to be on lowering our costs and improving efficiency amid ongoing difficult uranium market conditions. We continue to anticipate a market shift as demand increases in the form of restarts and new reactors, while current and future supply decreases through curtailments and lack of investment. However, until we see that shift emerge, we will continue to take the necessary actions intended to shield the company from the nearer-term risks we face and that we expect will reward shareholders for their continued patience and support of our strategy to build long-term value.

Financial performance

| | | | | | | | | | | | |

| | | |

| HIGHLIGHTS | | | | | | | | | |

| | | |

| DECEMBER 31 ($ MILLIONS EXCEPT WHERE INDICATED) | | 2017 | | | 2016 | | | CHANGE | |

Revenue | | | 2,157 | | | | 2,431 | | | | (11)% | |

Gross profit | | | 436 | | | | 463 | | | | (6)% | |

Net loss attributable to equity holders | | | (205) | | | | (62) | | | | >(100%) | |

$ per common share (diluted) | | | (0.52) | | | | (0.16) | | | | >(100%) | |

Adjusted net earnings(non-IFRS, see page 24) | | | 59 | | | | 143 | | | | (59)% | |

$ per common share (adjusted and diluted) | | | 0.15 | | | | 0.36 | | | | (58)% | |

Cash provided by operations (after working capital changes) | | | 596 | | | | 312 | | | | 91% | |

Net loss attributable to equity holders (net loss) and adjusted net earnings were lower in 2017 compared to 2016,in-line with the outlook we provided. See2017 consolidated financial results beginning on page 23 for more information.

Our uranium segment continued to outperform the market

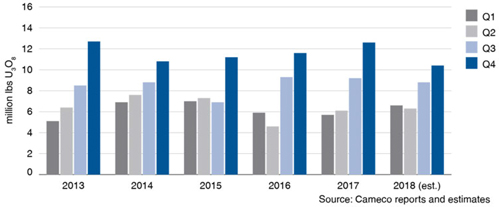

In our uranium segment, annual production was slightly below expectations as a result of both planned and unplanned reductions. Key highlights:

| ● | | annual production of 23.8 million pounds—1% lower than the guidance provided in our 2017 third quarter MD&A |

| ● | | quarterly production of 6.9 million pounds in the fourth quarter—3% lower than in 2016 due to the curtailment of production at the US operations, lower production at Inkai and from McArthur River/Key Lake |

| ● | | achieved ramp up to full production at the Cigar Lake mine and Orano’s (formerly AREVA) McClean Lake mill |

| ● | | closed the agreement with our partner Kazatomprom and JV Inkai to restructure and enhance JV Inkai |

| ● | | successfully implemented operational changes at our mining operations resulting in capital and operating cost savings |

| ● | | announced the temporary production suspension at McArthur River/Key Lake commencing in 2018 |

SeeOur operations and projectsbeginning on page 51 for more information.

Updates on our other segments and investments

Production in 2017 from our fuel services segment was 6% lower than in 2016, as planned, due to weak market conditions for conversion services.

In 2017, the Canadian Nuclear Safety Commission (CNSC) approved a10-year operating licence for Port Hope.

| | | | | | | | | | | | | | | | |

| | | | |

| HIGHLIGHTS | | | | 2017 | | | 2016 | | | CHANGE | |

| Uranium | | Production volume (million lbs) | | | | | 23.8 | | | | 27.0 | | | | (12)% | |

| | Sales volume (million lbs)1 | | | | | 33.6 | | | | 31.5 | | | | 7% | |

| | Average realized price | | ($US/lb) | | | 36.13 | | | | 41.12 | | | | (12)% | |

| | | | ($Cdn/lb) | | | 46.80 | | | | 54.46 | | | | (14)% | |

| | Revenue ($ millions)1 | | | | | 1,574 | | | | 1,718 | | | | (8)% | |

| | Gross profit ($ millions) | | | | | 395 | | | | 444 | | | | (11)% | |

| Fuel services | | Production volume (million kgU) | | | | | 7.9 | | | | 8.4 | | | | (6)% | |

| | Sales volume (million kgU)1 | | | | | 11.5 | | | | 12.7 | | | | (9)% | |

| | Average realized price | | ($Cdn/kgU) | | | 27.20 | | | | 25.37 | | | | 7% | |

| | Revenue ($ millions)1 | | | | | 313 | | | | 321 | | | | (2)% | |

| | Gross profit ($ millions) | | | | | 64 | | | | 63 | | | | 2% | |

| NUKEM | | Sales volume U3O8 (million lbs)1 | | | | | 10.0 | | | | 7.1 | | | | 41% | |

| | Average realized price | | ($Cdn/lb) | | | 32.25 | | | | 47.90 | | | | (33)% | |

| | Revenue ($ millions)1 | | | | | 321 | | | | 391 | | | | (18)% | |

| | Gross loss ($ millions)2 | | | | | (15) | | | | (28) | | | | 46% | |

| 1 | Includes sales and revenue between our uranium, fuel services and NUKEM segments. Please see 2017 Financial results by segment beginning on page 41. |

| 2 | Gross loss includes net inventory write-downs of $9 million in 2017 and $18 million in 2016 due to a decline in the spot price during the year. |

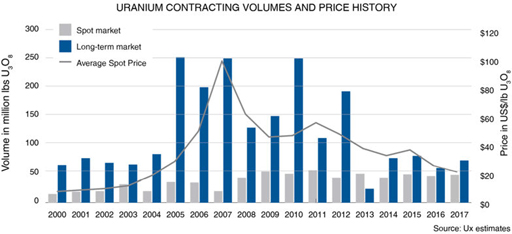

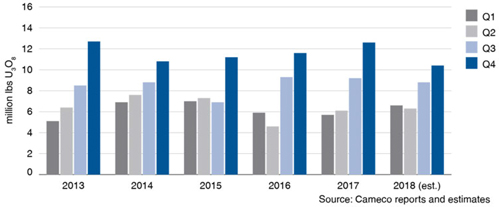

Industry prices

In 2017, the uranium spot price ranged from a high of $24.50 (US) per pound to a low of about $19 (US) per pound, averaging around $22 (US) for the year. Utilities continue to be well covered under existing contracts, and, given the current uncertainties in the market, we expect they and other market participants will continue to be opportunistic in their buying. As a result, contracting is expected to remain discretionary in 2018.

��

| | | | | | | | | | | | | | |

| | | | |

| | | | | 2017 | | | 2016 | | | CHANGE | |

Uranium($US/lb U3O8)1 | | | | | | | | | | | | | | |

Average annual spot market price | | | | | 21.78 | | | | 25.64 | | | | (15)% | |

Average annual long-term price | | | | | 31.92 | | | | 39.00 | | | | (18)% | |

Fuel services ($US/kgU as UF6)1 | | | | | | | | | | | | | | |

Average annual spot market price | | | | | | | | | | | | | | |

North America | | | | | 5.26 | | | | 6.40 | | | | (18)% | |

Europe | | | | | 5.69 | | | | 6.91 | | | | (18)% | |

Average annual long-term price | | | | | | | | | | | | | | |

North America | | | | | 14.00 | | | | 12.58 | | | | 11% | |

Europe | | | | | 14.04 | | | | 13.56 | | | | 4% | |

| | | | |

Note: the industry does not publish UO2 prices. | | | | | | | | | | | | | | |

| 1 | Average of prices reported by TradeTech and Ux Consulting (Ux) |

Also of note

TEPCO contract dispute

On January 31, 2017, TEPCO confirmed that it would not accept a uranium delivery scheduled for February 1, 2017, and would not withdraw the contract termination notice it provided to Cameco Inc. on January 24, 2017 with respect to a uranium supply agreement between TEPCO and Cameco Inc. TEPCO alleged that an event of “force majeure” has occurred because it has been unable to operate its nuclear reactors for 18 consecutive months due to the Fukushima nuclear accident in March 2011 and the resulting government regulations. Cameco Inc. sees no basis for terminating the agreement and is pursuing all its legal rights and remedies against TEPCO.

| | |

| MANAGEMENT’S DISCUSSION AND ANALYSIS | | 7 |

Under the agreement, TEPCO has already received and paid for 2.2 million pounds of uranium since 2014. The termination would affect approximately 9.3 million pounds of uranium deliveries through 2028, worth approximately $1.3 billion in revenue to Cameco, including about $126 million in each of 2017, 2018 and 2019 based on 855,000 pounds of deliveries in each of those years. All estimates and uranium volumes are provided on a consolidated basis for Cameco using expected contract prices and an exchange rate of $1.00 (US) for $1.30 (Cdn) and do not reflect any resale of the cancelled deliveries under the contract with TEPCO.

Three arbitrators have been appointed and based on the current schedule set by them, we expect the case will be heard in the first quarter of 2019. We are seeking $682 million (US) in damages plus interest and legal costs. The $682 million (US) primarily represents the present value of the remaining contracted volumes at the January 2017 contract price less the January 2017 market price of the equivalent volume of uranium concentrates.

The timing for a final decision will be dependent on how long the arbitrators deliberate following the conclusion of the hearing.

In this MD&A, our 2018 financial outlook and other disclosures relating to our contract portfolio are presented on a basis that excludes this agreement with TEPCO, which is under dispute.

JV Inkai restructuring

On December 11, 2017, we announced that the restructuring of JV Inkai outlined in the implementation agreement dated May 27, 2016 with Kazatomprom and JV Inkai closed and would take effect on January 1, 2018. Our ownership interest in JV Inkai is now 40% and Kazatomprom’s is 60%. As a result, we will account for JV Inkai on an equity basis commencing on January 1, 2018.

In addition, we will recognize a gain on the change in ownership interests of approximately $66 million. The resulting gain on restructuring will be reflected in our financial results for the first quarter.

| | |

SHARES AND STOCK OPTIONS OUTSTANDING At February 7, 2018, we had: ● 395,792,732 common shares and one Class B share outstanding ● 8,322,866 stock options outstanding, with exercise prices ranging from $14.70 to $39.53 | | DIVIDEND In 2017, our board of directors reduced the planned dividend to $0.08 per common share to be paid annually. The decision to declare a dividend by our board will be based on our cash flow, financial position, strategy and other relevant factors including appropriate alignment with the cyclical nature of our earnings. |

Market overview and 2017 developments

Cautiously optimistic

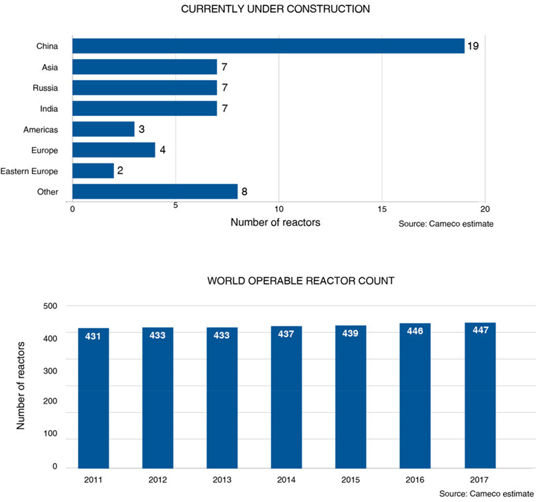

Despite the ongoing market challenges in 2017, we remain cautiously optimistic. We are cautious because we continue to face difficult market conditions and have seen a reduction in global demand expectations, driven by early reactor retirements, delays in reactor construction programs and by changes in governments that have created additional uncertainty for the nuclear industry. At the same time, the industry continues to work its way through supply that was incented during previous price runs. However, we are optimistic because today’s uranium prices are too low to motivate even some of the lowest-cost, profit-driven producers to maintain existing production, let alone invest in new projects that we believe will be required to ensure adequate uranium production is in the market. Additional uranium supply will be needed to support the reactor construction programs currently underway but not yet consuming uranium, the return of idled reactors to the grid, and to satisfy utilities uncovered requirements.

2017: A STORY OF OVERSUPPLY

In 2017, excess uranium supply continued to have a significant impact on the uranium market. Abundant spot material was available to satisfy utilities’ appetite forlow-priced pounds to meet near- tomid-term requirements.

Secondary supplies, consisting largely of government inventories, enricher underfeeding and tailsre-enrichment, where the economics differ considerably from mined production, have been a significant contributor to the supply-demand imbalance in the market. In addition, supply from some producers, whose production decisions are not necessarily driven by the economics of the uranium market, such as large diversified miners and companies mining uranium for strategic or social purposes, has been a contributor to the imbalance. Finally, higher-cost production, though sensitive to the uranium price, continues to be supported by higher prices under long-term contracts and/or advantageous foreign exchange rates. However, in 2017, we started to see evidence that at today’s low uranium prices, not only is some of the higher cost production at risk, even the lowest-cost production faces planned and unplanned risks.

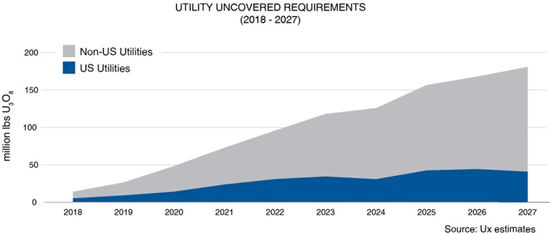

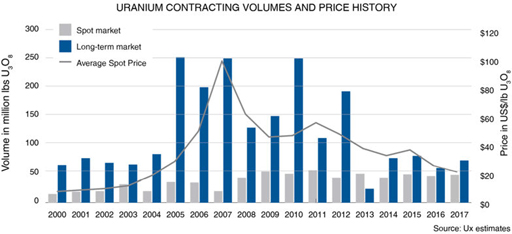

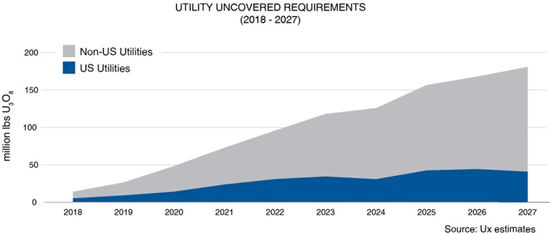

These industry dynamics make it difficult to predict the timing of a market recovery. However, given that Ux Consulting Company, LLC (UxC) reports that over the last five years only 320 million pounds have beenlocked-up in the long-term market, while over 788 million pounds have been consumed in reactors, we remain confident that utilities have a growing gap to fill. As annual supply adjusts and utilities’ annual uncovered requirements grow, we believe the pounds available in the spot market won’t be enough to satisfy demand in the long run.

OPPORTUNITIES FOR THOSE WHO CAN WAIT

MANAGEMENT’S DISCUSSION AND ANALYSIS 9

Like other commodities, the uranium industry is cyclical and the low level of contracting at low prices that we’re seeing today is not new. When prices are low, there is no urgency to contract. The heavy contracting that took place during the previous price run, which drove investment in higher-cost sources of production, contributes to the perception that uranium is abundant and always will be. History demonstrates that the opposite tends to occur when prices rise. After years of low investment in supply, as has been the case so far this decade, security of supply tends to overtake price concerns at some point, and utilitiesre-enter the long-term market to ensure they have the reliable supply of uranium they need to run their reactors.

We believe the backlog of future contracting needs created by thelow-price environment presents a substantial opportunity for suppliers like us that can weather thelow-price part of the cycle. As alow-cost producer, we plan our business with these price cycles in mind.

In our industry, customers don’t come to the market right before they need to load uranium into their reactors. To operate a reactor that could run for more than 60 years, natural uranium and the downstream services have to be purchased years in advance, allowing time for a number of processing steps before it arrives at the power plant as a finished fuel bundle. At present, we believe there is a significant amount of uranium that needs to be contracted to keep reactors running into the next decade.

Estimates by industry consultants show cumulative uncovered requirements to be about 730 million pounds over the next ten years. While annual uncovered requirements do not ramp up significantly in the near-term, the longer the delay in the recovery of the long-term market, the less certainty there is around the availability of future supply to fill growing demand. Ultimately, we expect the current price-sensitive sentiment to give way to increasing concerns about the security of future supply.

SUPPLY IS NOT GUARANTEED

Economic difficulties are beginning to take a toll on the supply side. Not only is there a lack of investment in future supply – we are seeing evidence that existing supply is at risk. Higher-cost producers who have been protected from the low market prices under long-term contracts, are beginning to emerge from that protection, some cutting production, and others having to be recapitalized or seeking protection from bankruptcy. Even the lowest-cost producers are deciding to preserve long-term value by leaving uranium in the ground. Overall, based on a number of developments throughout the year, global production is expected to decrease:

| ● | | In addition to the curtailments at Rabbit Lake and in the US in 2016, we announced our plan to temporarily suspend production at the McArthur River/Key Lake operation in 2018, removing 18 million pounds from the market. |

| ● | | In November, Kazatomprom announced its 2017 uranium production in Kazakhstan would be about 58 million pounds, about 10% less than the nearly 64 million pounds produced in 2016, andin-line with the planned reduction target it announced in January of 2017. In December, it announced a 20% reduction in planned production for 2018 through 2020, which it indicated will result in production volumes similar to 2017. |

| ● | | Paladin entered administration seeking to restructure and recapitalize due to its inability to meet its debt repayment obligations. |

| ● | | Orano, who was recapitalized by the French government, announced plans to cut production at its Somair mine in Niger in 2018, and along with us, agreed to the temporary suspension of production at McArthur River/Key Lake in 2018. |

| ● | | Multiple US ISR projects announced output reductions in 2018. |

| ● | | In 2017, reports regarding production at the Husab mine in Namibia continued to raise uncertainty about the timing and even the possibility of reaching name-plate capacity of 15 million pounds annually. |

| ● | | In the conversion space, earlier in the year, Honeywell announced a capacity reduction, which was followed by an announcement at the end of the year of its plans to temporarily idle its Metropolis site until business conditions improve. |

Coupled with looming uncovered requirements, we expect the risks to future and existing supply could decrease the availability of spot material and increase the pressure for a return to long-term contracting.

DEMAND SIDE DEVELOPMENTS

There was mixed news for the broader nuclear industry in 2017. On a regional demand basis, some of the more significant positive and negative developments were:

| ● | | As part of Bruce Power’s commitment to refurbish its CANDU reactors, in 2017 Bruce Power signed an agreement worth approximately $2 billion with us to extend its fuel supply agreement to 2030. |

| ● | | The US division of Westinghouse Electric Company declared bankruptcy, ultimately resulting in the pending abandonment of the two V.C. Summer units under construction in South Carolina. However, completion of the Vogtle units in Georgia was approved. |

| ● | | Several additional early reactor retirements were announced in the US due to high costs. However, efforts are being made in several states to enact incentives to support the continued operation of nuclear plants, an issue that has also been taken up at the federal level. |

| ● | | In January 2018, two US uranium producers put forward a petition under Section 232 of the Trade Expansion Act due to pressures from state-sponsored (Russia, Kazakhstan, Uzbekistan and China) imports. The petition aims to have 25% of US nuclear reactor requirements sourced from the US and a Buy America policy for US government agencies. Currently less than 5% of US requirements are met by US uranium producers. |

| ● | | China continued to face challenges from excess capacity in the energy sector andfirst-of-a-kind reactor delays on its AP1000 and EPR reactors. However, with Xi Jinping continuing as President of China we believe China will continue with its nuclear growth ambitions. A recent report quotes a Bloomberg analyst who anticipates that nuclear installed capacity could increase tenfold between 2016 and 2050 to over 300 GW in China. |

| ● | | South Korea’s new government announced its plan tophase-out nuclear power. However, a public panel voted in favour of completing the two reactors under construction that the government had previously suspended. |

| ● | | In France, the new government reaffirmed its commitment to reduce its reliance on nuclear by 2025, but later acknowledged that target as unrealistic, postponing the reduction until the 2030 to 2035 timeframe. |

| ● | | Construction on the first nuclear plants in Turkey and Bangladesh was started. |

| ● | | Egypt signed a contract with Russia to build four reactors. |

| ● | | Saudi Arabia is working to prequalify reactor vendors as it moves forward with plans for its first nuclear power plant, marking progress on its ambitions to install 17 gigawatts of nuclear capacity by 2040. |

While 2017 offered some progress in bringing supply and demand closer to equilibrium, uncertainty persists.

WHAT HAS TO CHANGE?

Ultimately, the industry needs to fill the demand gap left by forced and premature shut-downs since March of 2011 by continuing to safely bring reactors online. This means Japanese restarts, successful commissioning of new reactors under construction, and continued development of new construction plans. And we’re seeing positive progress on all fronts:

| ● | | Japanese utilities have now successfully navigated through the new, rigorous safety inspection process, with the restart of five reactors and another four expected to restart in 2018. |

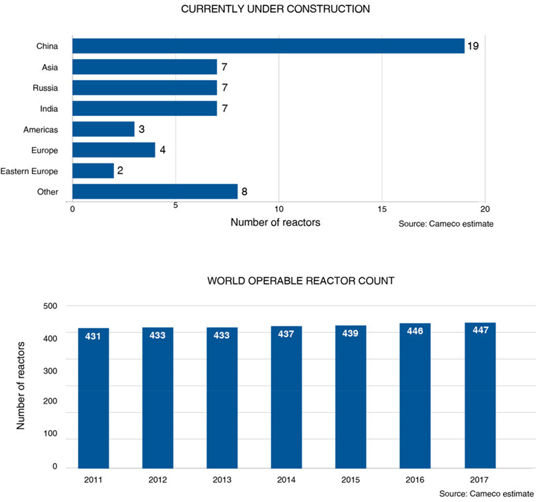

| ● | | In 2017, there were four new reactors connected to the grid. Currently there are 57 reactors under construction around the world, the majority of which are expected to come online in the next three years, if startups occur as planned. |

| ● | | There is a growing acknowledgment that adherence to global climate change goals requires a material dedication to allnon-emitting energy sources, including nuclear. The World Nuclear Associations target of 25% nuclear in 2050 is an example of this movement. Additionally, as a result of the closure of its nuclear plants, Germany has acknowledged that it will no longer be able to meet its climate goals despite its substantial rollout of renewable energy under the government’s policy. |

| | |

| MANAGEMENT’S DISCUSSION AND ANALYSIS | | 11 |

Global population is on the rise, and with the world’s need for safe, clean, reliable baseload energy, nuclear remains an important part of the mix. We remain confident in the future of the nuclear industry, while at the same time recognizing that uncertainty persists.

With demand coming on in the form of restarts and new reactors, and supply declining on curtailments and lack of investment, we’re continuing to expect a market shift. Until that time, we will continue to take the actions we believe are necessary to position the company for long-term success. Therefore, we will undertake contracting activity which aligns with the uncertain timing of a market recovery and is intended to ensure we have adequate protection under our contract portfolio, while maintaining exposure to the rewards that come from having uncommitted,low-cost supply to deliver into a strengthening market.

Our strategy

Tier-one focus

Our strategy is set within the context of a challenging market environment, which we expect to give way to strong long-term fundamentals driven by increasing population, electricity demand and clean air concerns.

We are a pure-play nuclear fuel supplier, focused on taking advantage of the long-term growth we see coming in our industry, while maintaining the ability to respond to market conditions as they evolve. Our strategy is to focus on ourtier-one assets and profitably produce at a pace aligned with market signals in order to preserve the value of those assets and increase long-term shareholder value, and to do that with an emphasis on safety, people and the environment.

URANIUM

Uranium production is central to our strategy, as it is the biggest value driver of the nuclear fuel cycle and our business. In accordance with market conditions, and to mitigate risk, we will evaluate the optimal mix of our production, inventory and purchases in order to satisfy our contractual commitments and in order to return the best value possible. During a prolonged period of uncertainty, this could mean leaving our uranium in the ground. As conditions improve, we expect to meet rising demand with production from our best margin operations.

In light of today’s oversupplied market and the lingering uncertainty as to how long the weak market conditions will persist, we are focused on preserving the value of our lowest cost assets, on maintaining a strong balance sheet, on protecting and extending the value of our contract portfolio and on efficiently managing the company in a low price environment. We have undertaken a number of deliberate and disciplined actions. We have reduced supply, resisted selling into a weak spot market, restructured our global marketing organization, streamlined our operations and reduced costs. In 2017, these actions resulted in lower:

| ● | | direct administration costs |

| ● | | uranium average unit cost of sales |

Consistent with these actions, we have reduced our planned 2018 annual dividend to $0.08 per share and it will be paid annually instead of quarterly. In addition, we are temporarily suspending production at our McArthur River/Key Lake operation, which we expect will remove 18 million pounds of uranium from the market in 2018. Although these actions will have a cost in the short-term, they are intended to position us to be able to self-manage the risks we face and ensure ourtier-one assets are available to us in a market that values them appropriately.

FUEL SERVICES

Our fuel services division is a source of profit and supports our uranium segment while allowing us to vertically integrate across the fuel cycle. Our focus is on maintaining and optimizing profitability.

ENRICHMENT

We continue to explore opportunities in the second largest value driver of the fuel cycle. Having operational control of both uranium production and enrichment facilities would offer operational synergies that could enhance profit margins.

NUKEM

In 2017, we made changes to the way our global marketing activities are organized. To betterco-ordinate our marketing activities and reduce costs, all future Canadian and international marketing activities have been consolidated in Saskatoon. These changes have a significant impact on the activities historically performed by NUKEM. We will continue to be active in the spot market when it makes sense for us and in support of our long-term contract portfolio. However, our marketing activities will now largely be undertaken by our new marketing entity, Cameco Marketing Inc., based out of Saskatoon.

Capital allocation – focus on value

Delivering returns to our long-term shareholders is a top priority. We continually evaluate our investment options to ensure we allocate our capital in a way that we believe will:

| ● | | create the greatest long-term value for our shareholders |

| ● | | allow us to maintain our investment-grade rating |

| ● | | allow us to execute on our dividend while ensuring it is appropriately aligned with the cyclical nature of our earnings |

| | |

| MANAGEMENT’S DISCUSSION AND ANALYSIS | | 13 |

To deliver value, free cash flow must be productively reinvested in the business or returned to shareholders, which requires good execution and disciplined allocation. We have a multidisciplinary capital allocation team that evaluates all possible uses of investable capital.

We start by determining how much cash we have to invest (investable capital), which is based on our expected cash flow from operations minus expenses we consider to be a higher priority, such as dividends and financing costs, and could include others. This investable capital can be reinvested in the company or returned to shareholders.

Amid the uncertain times we are facing today, the objective of our capital allocation is to maximize cash flow, while maintaining our investment-grade rating through close management of our balance sheet metrics, allowing us to self-manage risks. Risks like:

| ● | | a market that remains low for longer |

| ● | | litigation risk related to the CRA and TEPCO disputes |

With the metrics that inform an investment-grade rating in mind, and in this period of low uranium prices, we have taken steps to improve margin and cash flow by:

| ● | | responsibly managing our sources of supply and preserving the value of ourtier-one assets |

| ● | | restructuring our activities to reduce our operating, capital, and general and administrative spending |

| ● | | reducing our planned annual dividend from $0.40 per share to $0.08 per share in 2018 |

REINVESTMENT

If a decision is made to reinvest capital in sustaining, capacity replacement, or growth, all opportunities are ranked and only those that meet the required risk-adjusted return criteria are considered for investment. We also must identify, at the corporate level, the expected impact on cash flow, earnings, and the balance sheet. All project risks must be identified, including the risks of not investing. Allocation of capital only occurs once an investment has cleared these hurdles.

This may result in some opportunities being held back in favour of higher return investments, and should allow us to generate the best return on investment decisions when faced with multiple prospects, while also controlling our costs. If there are not enough good investment prospects internally or externally, this may result in residual investable capital, which we would then consider returning directly to shareholders.

Given the weak uranium market, our focus for 2018 through 2020 is primarily on sustaining and capacity replacement capital to ensure we have the ability to meet our contractual commitments and to maintain optionality longer term. All growth capital has been curtailed.

RETURN

We believe in returning cash to shareholders, but are also focused on protecting the company and rewarding those shareholders who understand and support our strategy to build long-term value. If we determine the best use of cash is to return it to shareholders, we can do that through a share repurchase or dividend—an annual dividend,one-time supplemental dividend or a progressive dividend. When deciding between these options, we consider a number of factors, including generation of excess cash, growth prospects for the company, growth prospects for the industry, and the nature of the excess cash.

Share buyback: If we were generating excess cash while there were few or no growth prospects for the company or the industry, then a share buyback might make sense. However, our current view is that the long-term fundamentals for Cameco and the industry remain strong.

Dividend: The amount and type of dividend paid, annual, progressive orone-time supplemental is evaluated by our board of directors with careful consideration of our cash flow, financial position, strategy, and other relevant factors including appropriate alignment with the cyclical nature of our earnings.

Marketing strategy – balanced contract portfolio

As with our corporate strategy and approach to capital allocation, the purpose of our marketing strategy is to deliver value. Our approach is to secure a solid base of earnings and cash flow by maintaining a balanced contract portfolio that optimizes our realized price.

Uranium is not traded in meaningful quantities on a commodity exchange. Utilities have historically bought the majority of their uranium and fuel services products under long-term contracts with suppliers, and have met the rest of their needs on the spot market. We sell uranium and fuel services directly to nuclear utilities around the world as uranium concentrates, UO2 and UF6, conversion services, or fuel fabrication. We have a solid portfolio of long-term sales contracts that reflect the long-term, trusting relationships we have with our customers.

In accordance with market conditions, and to mitigate risk, we evaluate the optimal mix of our production, inventory and purchases in order to satisfy our contractual commitments and in order to return the best value possible. During a prolonged period of uncertainty, this could mean leaving our uranium in the ground.

In general, we are always active in the market, buying and selling uranium when it is beneficial for us and in support of our long-term contract portfolio. We undertake activity in the spot and term markets prudently, looking at the prices and other business factors to decide whether it is appropriate to purchase or sell into the spot or term market. Not only is this activity a source of profit, it gives us insight into underlying market fundamentals.

In particular, in 2018, in addition to our purchase commitments, we intend to be active buyers in the spot market. This activity may mean we give up some margin in the near-term, however, we believe it will provide us with the supply flexibility we need to meet our sales commitments and will allow us to preserve the value of ourtier-one assets. Our goal is to protect and extend the value of our contract portfolio on terms that recognize the value of our assets and are consistent with our marketing strategy – providing adequate protection when prices go down and allow us to benefit when prices rise.

LONG-TERM CONTRACTING

We deliver large volumes of uranium every year, therefore our net earnings and operating cash flows are affected by changes in the uranium price. Market prices are influenced by the fundamentals of supply and demand, geopolitical events, disruptions in planned supply and demand, and other market factors.

The objectives of our contracting strategy are to:

| ● | | maximize realized price while reducing volatility of our future earnings and cash flow |

| ● | | focus on meeting the nuclear industry’s growing annual uncovered requirements with our future uncommitted supply while ensuring adequate regional diversity |

| ● | | establish and grow market share with strategic customers |

We target a ratio of 40% fixed-pricing and 60% market-related pricing in our portfolio of long-term contracts, including mechanisms to protect us when the market price is declining and allow us to benefit when market prices go up. This is a balanced and flexible approach that allows us to adapt to market conditions and put a floor on our average realized price, and deliver the best value to shareholders over the long term.

This strategy has allowed us to realize prices higher than the market prices during periods of weak uranium demand, and we expect it will enable us to realize increases linked to higher market prices in the future.

Fixed-price contracts for uranium: are typically based on a term-price indicator at the time the contract is accepted and escalated over the term of the contract.

Market-related contracts for uranium: are different from fixed-price contracts in that they may be based on either the spot price or the long-term price, and that price is as quoted at the time of delivery rather than at the time the contract is accepted. These contracts sometimes provide for discounts, and often include floor prices and/or ceiling prices, which are usually escalated over the term of the contract.

Fuel services contracts: the majority of our fuel services contracts are at a fixed price per kgU, escalated over the term of the contract, and reflect the market at the time the contract is accepted.

| | |

| MANAGEMENT’S DISCUSSION AND ANALYSIS | | 15 |

OPTIMIZING THE CONTRACT PORTFOLIO

In today’s weak market environment, we have been working with certain customers to optimize the value of our existing contract portfolio. In cases where a customer is seeking relief due to a challenging policy, operating, or economic environment, we evaluate their specific circumstances and assess their long-term sustainability. Where we deem the customer’s long-term demand to be at risk, we may consider options that allow us to benefit from converting that uncertain future value into certain present value. In contrast, where the customer is considered to have a more certain and predictable future, we may offer relief, for example by blending in more market-related volumes in the near term, but only where the customer is willing to extend the terms and conditions of that contract out into the future, and only where it is beneficial to us.

CONTRACT PORTFOLIO STATUS

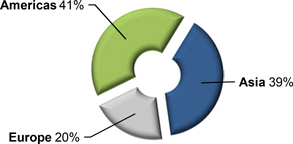

We have commitments to sell almost 150 million pounds of U3O8 with 39 customers worldwide in our uranium segment, and over 40 million kilograms as UF6 conversion with 31 customers worldwide in our fuel services segment. The annual average sales commitments over the next five years in our uranium segment is 22 million pounds, with commitment levels through 2020 higher than in 2021 and 2022.

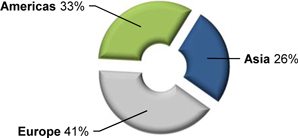

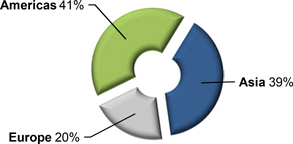

Customers ��� U3O8:

Five largest customers account for 55% of commitments

COMMITTED U3O8SALES BY REGION

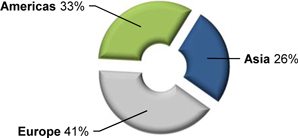

Customers – UF6 conversion:

Five largest customers account for 59% of commitments

COMMITTED UF6SALES BY REGION

MANAGING OUR CONTRACT COMMITMENTS

To meet our delivery commitments, we use our uranium supply, which includes uranium obtained from:

| ● | | our existing production |

| ● | | purchases under our JV Inkai agreement, under long-term agreements and in the spot market |

We allow sales volumes to varyyear-to-year depending on:

| ● | | the level of sales commitments in our long-term contract portfolio |

| ● | | purchases under existing and/or new arrangements |

| ● | | discretionary use of inventories |

Focusing on cost efficiency

PRODUCTION COSTS

In order to operate efficiently and cost-effectively, we manage operating costs and improve plant reliability by prudently investing in production infrastructure, new technology, and business process improvements. Like all mining companies, our uranium segment is affected by the cost of inputs such as labour and fuel.

2017 URANIUM OPERATING COSTS BY CATEGORY

Operating costs in our fuel services segment are mainly fixed. In 2017, labour accounted for about 56% of the total. The largest variable operating cost is for zirconium, followed by energy (natural gas and electricity), maintenance supplies, and anhydrous hydrogen fluoride.

PURCHASES AND INVENTORY COSTS

Our costs are also affected by the purchases of uranium and conversion services we make under long-term contracts and on the spot market.

To meet our delivery commitments, we make use of our mined production and inventories, and we purchase material where it is beneficial to do so. The cost of purchased material may be higher or lower than our other sources of supply, depending on market conditions. The cost of purchased material affects our cost of sales, which is determined by calculating the average of all of our sources of supply, including opening inventory, production, and purchases.

FINANCIAL IMPACT

As greater certainty returns to the uranium market, based on our view that the market will transition from being supply-driven to being demand-driven, we expect uranium prices will rise to reflect the cost of bringing on new primary production to meet growing demand.

We believe the deliberate and disciplined actions we have taken to reduce supply, streamline operations and reduce costs will help shield the company from the nearer term risks we face and will reward shareholders for their continued patience and support of our strategy to build long-term value.

Committed to our values

Our values are at the core of everything we do and define who we are as a company.

SAFETY AND ENVIRONMENT

The safety of people and protection of the environment are the foundations of everything we do, locally and globally.

| | |

| MANAGEMENT’S DISCUSSION AND ANALYSIS | | 17 |

PEOPLE

We value the contribution of every employee and demonstrate respect for individual dignity, creativity and cultural diversity.

INTEGRITY

We lead by example, earn trust, honour our commitments and conduct our business ethically.

EXCELLENCE

Through leadership, collaboration and innovation, we strive to achieve our full potential and inspire others to reach theirs.

Sustainable development: A key part of our strategy, reflecting our values

Social responsibility, safety of our workforce and the public, as well as environmental protection are top priorities for us. In fact, we have built our corporate objectives around them within our four measures of success: a safe, healthy and rewarding workplace, a clean environment, supportive communities, and outstanding financial performance. Sustainability is at the core of our company culture. It helps us:

| ● | | build trust, credibility and corporate reputation |

| ● | | gain and enhance community support for our operations and plans |

| ● | | attract and retain employees |

| ● | | drive innovation and continual improvement to build competitive advantage |

Given this, we have sustainable development principles and practices embedded throughout our organization, from our overall corporate strategy today-to-day operations.

Consequently, we recognize that changes in our operations and support functions, including the suspension of production at Rabbit Lake and curtailment at the US operations in 2016, the temporary suspension of production at our McArthur River/Key Lake operation in 2018, the reduction of the workforce at our northern Saskatchewan operations and at our corporate office, and the changes made to the way our global marketing activities are organized all have a significant impact on the communities where we operate. While we regret the negative impact that these carefully deliberated decisions have on affected employees and other stakeholders, these actions are deemed necessary for the long-term health of the company in a uranium market that continues to be weak and oversupplied. Improving operational efficiency is part of our strategy to effectively manage costs and remain competitive through these low times, while positioning the company and our stakeholders to benefit as the market improves.

SAFE, HEALTHY, REWARDING WORKPLACE

We are committed to living a strong safety culture, while looking to continually improve. As a result of this commitment, we have a long history of strong safety performance at our operations and across the organization.

2017 Highlights:

| ● | | several operations reached significant safety milestones, including the Blind River refinery and the Crow Butte operation passing eleven and ten years respectively without a lost time incident |

| ● | | continued low average dose of radiation to workers, including the Cigar Lake operation as it increased production to licensed capacity |

| ● | | Port Hope conversion facility, Cameco Fuel Manufacturing and Key Lake made significant improvements in their safety performance over 2016 |

| ● | | recognized for several top employer awards |

| ● | | continued improvement of safety systems for support groups, such as exploration and corporate facilities |

A CLEAN ENVIRONMENT

We are committed to being a leading environmental performer. We strive to be a leader not only by complying with legal requirements, but also by keeping risks as low as reasonably achievable, and looking for opportunities to continually improve our performance.

We track our progress by monitoring the air, water and land near our operations, and by measuring the amount of energy we use and the amount of waste generated. We use this information to help identify opportunities to improve.

2017 Highlights:

| ● | | brought Cigar Lake up to full production without exceeding an environmental limit or having a significant environmental incident |

| ● | | while readying to implement the new version of the ISO 14001 standard, added Cameco Fuel Manufacturing to our corporate ISO 14001 certification, which now encompasses all Cameco operations |

| ● | | completed the multi-year implementation of an environmental monitoring database for all Cameco operations |

| ● | | continued efforts to reduce low level radioactive waste stored at our Fuel Services division facilities |

| ● | | successfully managed an extended summer shutdown at Key Lake, McArthur River and Cigar Lake with no significant environmental incidents |

| ● | | implemented new Canadian Standards Association (CSA) environmental standards at our Fuel Services Division facilities |

| ● | | continued efforts to systematically improve energy conservation and efficiency in our Fuel Services and Saskatchewan facilities |

| ● | | continued to carry out industry leading research and innovation in groundwater restoration at our US in situ recovery operations |

SUPPORTIVE COMMUNITIES

Gaining the trust and support of our communities, indigenous people, and governments is necessary to sustain our business. We earn support and trust through excellent safety and environmental performance, by proactively engaging our stakeholders in an open and transparent way, and by making a difference in communities wherever we operate. These efforts are critical to obtaining and maintaining the necessary regulatory approvals.

2017 Highlights:

| ● | | over $170 million in procurement from locally owned northern Saskatchewan companies (80% of total) |

| ● | | 954 local personnel from northern Saskatchewan (603 Cameco employees, 351 contractors) |

| ● | | signed a Collaboration Agreement with the Lac La Ronge Indian Band |

| ● | | for the first time in three years, we held a northern leaders roundtable – featuring nearly 50 northern Saskatchewan leaders, discussing the current uranium market |

OUTSTANDING FINANCIAL PERFORMANCE

Long-term financial stability and profitability are essential to our sustainability as a company. We believe that sound governance is the foundation for strong corporate performance.

2017 Highlights:

| ● | | continue to achieve an average realized price that outperforms the market |

| ● | | ranked 32nd out of 242 Canadian companies by Globe and Mail in governance practices |

Our governance practices

We believe that sound governance is the foundation for strong corporate performance. Our board of directors is responsible for overseeing management and our strategy and business affairs. Its goal is to ensure we operate as a successful business, optimizing financial returns while effectively managing risk.

In 2017, our board consisted of 11 directors who were selected based on their collective ability to contribute expertise to the broad range of issues the board faces when carrying out its responsibilities in overseeing our business and affairs.

WHAT WE DO:

| ● | | Independent board – nine of our ten directors (90%) are independent |

| ● | | Non-executive chair leads the board – we maintain separate chair and CEO positions and have had anon-executive, independent chair of the board since 2003 |

| ● | | Share ownership – we require our directors and executives to own shares, or have an equity interest in Cameco to align their interests with those of our shareholders and share ownership is disclosed |

| ● | | Majority voting for directors – the board adopted a majority voting policy in 2006 |

| | |

| MANAGEMENT’S DISCUSSION AND ANALYSIS | | 19 |

| ● | | Strong risk oversight – the board and committees oversee our risk management program and strategic, financial and operational risks |

| ● | | Formal assessment process – the directors assess the board, committees and individual directors’ performance |

| ● | | Independent third-party review – the director assessment process is augmented by a third-party review every three years |

| ● | | Serving on other boards – we limit the number of other public company boards our directors can serve on, and serve on together |

| ● | | Director recruitment and board succession – we have term limits and a retirement policy for directors |

| ● | | Diverse board – our board has a diverse mix of skills, background and experience and 30% of this year’s director nominees are female |

| ● | | Independent advice – board committees have full authority to retain independent advisors to help them carry out their duties and responsibilities |

| ● | | Code of conduct and ethics – directors, officers and employees must comply with our code of conduct and confirm their compliance every year |

| ● | | Long-standing shareholder engagement – we communicate openly with shareholders and other stakeholders |

| ● | | Say on pay – we have held an advisory vote on our approach to executive compensation every year since 2010 |

More information about our shareholder commitment, our governance principles, how our board operates and profiles of each of our directors can be found in our most recent management proxy circular and on our website atcameco.com/about/board-of-directors.

MONITORING AND MEASUREMENT

We take the integration of sustainable development and measurement of our performance seriously. We have been producing a Sustainable Development (SD) Report since 2005, using the Global Reporting Initiative’s Sustainability Framework (GRI). It is our sustainability report card to our stakeholders. It tells them how we’re performing against globally recognized key indicators that measure our social, environmental and economic impacts in the areas that matter most to them. It provides information about our goals, where we’ve met, exceeded or struggled with them, and how we plan to do better. Our most recent SD Report was released in August, 2016. We produced a data update in 2017, with one more coming in 2018. Our next full report is tentatively scheduled for 2019.

All of our operating sites are ISO 14001 compliant. In addition, we have now transitioned from individual site-based ISO 14001 certifications to a single corporate certification. We have begun to roll our operations into this single certification.

Achievements

We are a five-time Gold award winner through the Progressive Aboriginal Relations program as judged by the Canadian Council for Aboriginal Business. We are also proud to have been named one of Canada’s Top 100 Employers, Saskatchewan’s Top Employers, Canada’s Best Diversity Employers, and Canada’s Top Employers for Young People for 2017. We are a leading employer of indigenous peoples in Canada, and have procured nearly $3.6 billion in services from local suppliers in northern Saskatchewan since 2004.

We encourage you to review our SD report atcameco.com/about/sustainability which outlines our commitment to people and the environment in more detail.

Measuring our results

Each year, we set corporate objectives that are aligned with our strategic plan. These objectives fall under our four measures of success, and performance against specific targets under these objectives forms the foundation for a portion of annual employee and executive compensation. See our most recent management proxy circular for more information on how executive compensation is determined.

| | | | | | |

2017 OBJECTIVES1 | | TARGET | | RESULTS | | |

OUTSTANDING FINANCIAL PERFORMANCE | | |

| Earnings measure | | Achieve targeted adjusted net earnings. | | Did not achieve | | ● adjusted net earnings was below the minimum target |

| Cash flow measure | | Achieve cash flow from operations (after working capital changes). | | Exceeded | | ● cash flow from operations was above the target |

SAFE, HEALTHY AND REWARDING WORKPLACE | | |

| Workplace safety measure | | Strive for no injuries at all Cameco-operated sites. Maintain a long-term downward trend in combined employee and contractor injury frequency and severity, and radiation doses. | | Did not achieve | | ● injury rates did not meet the planned reduction target for the year ● average radiation doses remained low and stable |

CLEAN ENVIRONMENT | | |

| Environmental performance measures | | Achieve divisional environmental aspect improvement targets. | | Achieved | | ● performance was within the targeted range ● there were no significant environmental incidents in 2017 |

SUPPORTIVE COMMUNITIES | | |

| Stakeholder support measure | | Implement Collaboration Agreements by supporting northern business development opportunities and build corporate reputation. | | Exceeded | | ● sourcing of northern services from Northern Saskatchewan vendors was above the target |

| 1 | Detailed results for our 2017 corporate objectives and the related targets will be provided in our 2018 management proxy circular prior to our Annual Meeting of Shareholders on May 16, 2018. |

2018 objectives

|

OUTSTANDING FINANCIAL PERFORMANCE |

● Achieve targeted adjusted net earnings and cash flow from operations. |

|

SAFE, HEALTHY AND REWARDING WORKPLACE |

● Improve workplace safety performance at all sites. |

|

CLEAN ENVIRONMENT |

● Improve environmental performance at all sites. |

|

SUPPORTIVE COMMUNITIES |

● Build and sustain strong stakeholder support for our activities. |

| | |

| MANAGEMENT’S DISCUSSION AND ANALYSIS | | 21 |

Financial results

This section of our MD&A discusses our performance, financial condition and outlook for the future.

| | | | |

| | |

| | 23 | | 2017 CONSOLIDATED FINANCIAL RESULTS |

| | |

| | 34 | | OUTLOOK FOR 2018 |

| | |

| | 36 | | LIQUIDITY AND CAPITAL RESOURCES |

| | |

| | 41 | | 2017 FINANCIAL RESULTS BY SEGMENT |

| | |

| | 41 | | URANIUM |

| | |

| | 43 | | FUEL SERVICES |

| | |

| | 43 | | NUKEM |

| | |

| | 45 | | FOURTH QUARTER FINANCIAL RESULTS |

| | |

| | 45 | | CONSOLIDATED RESULTS |

| | |

| | 48 | | URANIUM |

| | |

| | 50 | | FUEL SERVICES |

| | |

| | 50 | | NUKEM |

| | |

| | | | |

| | |

| | | | |

2017 consolidated financial results

In this MD&A, our 2018 financial outlook and other disclosures relating to our contract portfolio are presented on a basis which excludes the agreement with TEPCO, which is under dispute. SeeAlso of Note on page 7.

| | | | | | | | | | | | | | | | |

| | | |

| HIGHLIGHTS | | | | | | | | CHANGE FROM | |

| | | | |

| DECEMBER 31 ($ MILLIONS EXCEPT WHERE INDICATED) | | 2017 | | | 2016 | | | 2015 | | | 2016 TO 2017 | |

| | | | | |

Revenue | | | 2,157 | | | | 2,431 | | | | 2,754 | | | | (11)% | |

| | | | |

Gross profit | | | 436 | | | | 463 | | | | 697 | | | | (6)% | |

| | | | |

Net earnings (loss) attributable to equity holders | | | (205 | ) | | | (62 | ) | | | 65 | | | | >100% | |

| | | | |

$ per common share (basic) | | | (0.52 | ) | | | (0.16 | ) | | | 0.16 | | | | >100% | |

| | | | |

$ per common share (diluted) | | | (0.52 | ) | | | (0.16 | ) | | | 0.16 | | | | >100% | |

| | | | |

Adjusted net earnings(non-IFRS, see page 24) | | | 59 | | | | 143 | | | | 344 | | | | (59)% | |

| | | | |

$ per common share (adjusted and diluted) | | | 0.15 | | | | 0.36 | | | | 0.87 | | | | (58)% | |

| | | | |

Cash provided by operations (after working capital changes) | | | 596 | | | | 312 | | | | 450 | | | | 91% | |

Net earnings

Our net earnings normally trend with revenue, but, in recent years, have been significantly influenced by impairment charges due to the continued weakness in the uranium market.

The following table shows what contributed to the change in net earnings in 2017 compared to 2016 and 2015.

| | | | | | | | | | | | | | |

| | | |

($ MILLIONS) | | 2017 | | | 2016 | | | 2015 | |

Net earnings (losses) - previous year | | | (62 | ) | | | 65 | | | | 58 | |

Change in gross profit by segment (we calculate gross profit by deducting from revenue the cost of products and services sold, and depreciation and amortization (D&A), net of hedging benefits) | |

| Uranium | | Higher (lower) sales volume | | | 29 | | | | (16 | ) | | | (27 | ) |

| | Lower realized prices ($US) | | | (222 | ) | | | (129 | ) | | | (76 | ) |

| | Foreign exchange impact on realized prices | | | (36 | ) | | | 30 | | | | 245 | |

| | Lower (higher) costs | | | 180 | | | | (49 | ) | | | (136 | ) |

| | change – uranium | | | (49 | ) | | | (164 | ) | | | 6 | |

| Fuel services | | Lower sales volume | | | (5 | ) | | | (4 | ) | | | (5 | ) |

| | Higher realized prices ($Cdn) | | | 21 | | | | 25 | | | | 50 | |

| | Higher costs | | | (15 | ) | | | (19 | ) | | | (22 | ) |

| | change – fuel services | | | 1 | | | | 2 | | | | 23 | |

| NUKEM | | Gross profit | | | 14 | | | | (70 | ) | | | 20 | |

| | | change – NUKEM | | | 14 | | | | (70 | ) | | | 20 | |

Other changes | | | | | | | | | | | | |

Lower (higher) administration expenditures | | | 44 | | | | (20 | ) | | | (10 | ) |

Lower (higher) impairment charges | | | 4 | | | | (147 | ) | | | 112 | |

Lower (higher) exploration expenditures | | | 13 | | | | (2 | ) | | | 6 | |

Change in Rabbit Lake reclamation provision | | | (34 | ) | | | 34 | | | | - | |

Lower (higher) loss on disposal of assets | | | 16 | | | | (21 | ) | | | 43 | |

Change in gains or losses on derivatives | | | 22 | | | | 315 | | | | (160 | ) |

Change in foreign exchange gains or losses | | | (17 | ) | | | (65 | ) | | | 24 | |

Lower loss on equity-accounted investments | | | - | | | | 1 | | | | 16 | |

Gain on customer contract settlements in 2016 | | | (59 | ) | | | 59 | | | | - | |

Contract termination fee (SFL) in 2014 | | | - | | | | - | | | | 18 | |

Arbitration award in 2014 | | | - | | | | - | | | | (66 | ) |

Debenture redemption premium in 2014 | | | - | | | | - | | | | 12 | |

Change in income tax recovery or expense | | | (91 | ) | | | (49 | ) | | | (32 | ) |

Other | | | (7 | ) | | | - | | | | (5 | ) |

Net earnings (losses) – current year | | | (205 | ) | | | (62 | ) | | | 65 | |

| | |

| MANAGEMENT’S DISCUSSION AND ANALYSIS | | 23 |

Impairment charges

In the third quarter, in line with the other disciplined actions we have taken, we made changes to the way our global marketing activities are organized. The changes significantly impact the marketing activities historically performed by NUKEM. As a result, we recognized an impairment charge for the full carrying value of goodwill of $111 million. See note 9 for more information.

During the fourth quarter we announced our plan to temporarily suspend production at the McArthur River/Key Lake operation in 2018. As a result, we havere-evaluated the project to complete the new calciner at Key Lake, which was undertaken to allow for increased production. Given the production suspension, current market conditions, and that we have determined the existing calciner has sufficient capacity to reliably meet our ongoing production requirements, it has been determined that no further investment will be made to complete the project. As a result, we have recognized an impairment charge related to the new calciner of $55 million. See note 8 for more information.

Also during the fourth quarter, we recorded a $184 million write down of our US assets. Due to the continued weakening of the uranium market and the reduction in mineral reserves, we concluded that it was appropriate to recognize an impairment charge for these assets. See note 8 to the financial statements.

Non-IFRS measures

ADJUSTED NET EARNINGS

Adjusted net earnings is a measure that does not have a standardized meaning or a consistent basis of calculation under IFRS(non-IFRS measure). We use this measure as a more meaningful way to compare our financial performance from period to period. We believe that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate our performance. Adjusted net earnings is our net earnings attributable to equity holders, adjusted to better reflect the underlying financial performance for the reporting period. The adjusted earnings measure reflects the matching of the net benefits of our hedging program with the inflows of foreign currencies in the applicable reporting period, and is adjusted for NUKEM purchase price inventory recovery, impairment charges, Rabbit Lake reclamation provision adjustment, and income taxes on adjustments.

Adjusted net earnings isnon-standard supplemental information and should not be considered in isolation or as a substitute for financial information prepared according to accounting standards. Other companies may calculate this measure differently, so you may not be able to make a direct comparison to similar measures presented by other companies.

To facilitate a better understanding of these measures, the table below reconciles adjusted net earnings with our net earnings for the years ended 2017, 2016 and 2015.

| | | | | | | | | | | | |

| | | |

| ($ MILLIONS) | | 2017 | | | 2016 | | | 2015 | |

Net earnings (loss) attributable to equity holders | | | (205 | ) | | | (62 | ) | | | 65 | |

Adjustments | | | | | | | | | | | | |

Adjustments on derivatives | | | (108 | ) | | | (130 | ) | | | 166 | |

NUKEM purchase price inventory recovery | | | - | | | | (6 | ) | | | (3 | ) |

Impairment charges | | | 358 | | | | 362 | | | | 215 | |

Rabbit Lake reclamation provision adjustment | | | - | | | | (34 | ) | | | - | |

Income taxes on adjustments | | | 14 | | | | 13 | | | | (99 | ) |

Adjusted net earnings | | | 59 | | | | 143 | | | | 344 | |

The following table shows what contributed to the change in adjusted net earnings(non-IFRS measure, see above) in 2017 compared to the same period in 2016 and 2015.

| | | | | | | | | | | | | | |

| | | |

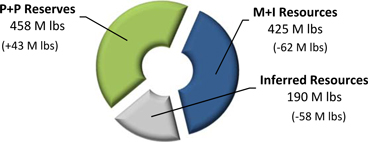

| ($ MILLIONS) | | 2017 | | | 2016 | | | 2015 | |