- CCJ Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Cameco (CCJ) 6-KCurrent report (foreign)

Filed: 7 Feb 20, 9:48am

Management’s discussion and analysis

February 7, 2020

| 6 | 2019 PERFORMANCE HIGHLIGHTS | |

| 10 | MARKET OVERVIEW AND DEVELOPMENTS | |

| 15 | OUR STRATEGY | |

| 25 | MEASURING OUR RESULTS | |

| 26 | FINANCIAL RESULTS | |

| 55 | OPERATIONS AND PROJECTS | |

| 78 | MINERAL RESERVES AND RESOURCES | |

| 83 | ADDITIONAL INFORMATION | |

This management’s discussion and analysis (MD&A) includes information that will help you understand management’s perspective of our audited consolidated financial statements (financial statements) and notes for the year ended December 31, 2019. The information is based on what we knew as of February 6, 2020.

We encourage you to read our audited consolidated financial statements and notes as you review this MD&A. You can find more information about Cameco, including our financial statements and our most recent annual information form, on our website at cameco.com, on SEDAR at sedar.com or on EDGAR at sec.gov. You should also read our annual information form before making an investment decision about our securities.

The financial information in this MD&A and in our financial statements and notes are prepared according to International Financial Reporting Standards (IFRS), unless otherwise indicated.

Unless we have specified otherwise, all dollar amounts are in Canadian dollars.

Throughout this document, the terms we, us, our, the Company and Cameco mean Cameco Corporation and its subsidiaries, unless otherwise indicated.

Caution about forward-looking information

Our MD&A includes statements and information about our expectations for the future. When we discuss our strategy, plans, future financial and operating performance, or other things that have not yet taken place, we are making statements considered to beforward-looking information orforward-looking statements under Canadian and United States (US) securities laws. We refer to them in this MD&A asforward-looking information.

Key things to understand about the forward-looking information in this MD&A:

| • | It typically includes words and phrases about the future, such as: anticipate, believe, estimate, expect, plan, will, intend, goal, target, forecast, project, strategy and outlook (see examples below). |

| • | It represents our current views, and can change significantly. |

| • | It is based on a number ofmaterial assumptions, including those we have listed on page 3, which may prove to be incorrect. |

| • | Actual results and events may be significantly different from what we currently expect, due to the risks associated with our business. We list a number of thesematerial risks on pages 2 and 3. We recommend you also review our most recent annual information form, which includes a discussion of othermaterial risks that could cause actual results to differ significantly from our current expectations. |

| • | Forward-looking information is designed to help you understand management’s current views of our near and longer term prospects, and it may not be appropriate for other purposes. We will not necessarily update this information unless we are required to by securities laws. |

Examples of forward-looking information in this MD&A

| • | on the financial front, we are well-positioned to execute on our strategy and self-manage risk |

| • | we will continue to take the necessary actions to maintain the strength of our balance sheet so we can self-manage risk, and that we expect will reward shareholders for their continued patience and support of our strategy to build long-term value |

| • | our expectations about 2020 and future global uranium supply, consumption, contracting volumes and demand, including the discussion under the headingMarket overview and developments |

| • | the discussion under the headingOur strategy |

| • | our expectations for uranium purchases |

| • | our expectations for uranium sales and deliveries |

| • | the discussion of our expectations relating to our Canada Revenue Agency (CRA) transfer pricing dispute, including that the Tax Court of Canada’s (Tax Court) ruling will be upheld on appeal, the timing of an appeal decision, the Tax Court ruling diminishes our tax risk relating to our CRA dispute, and our estimate of the amount and timing of expected cash taxes and transfer pricing penalties and the amount of the disbursements award |

| • | the discussion under the headingOutlook for 2020, including our 2020 financial outlook, expectations for 2020 gross profit and cash balances, and our price sensitivity analysis for our uranium segment |

| • | the outlook for our uranium and fuel services segments for 2020 |

| • | our expectations for future tax payments and rates, including effective tax rates |

| • | our expectation that our cash balances and operating cash flows will meet our anticipated 2020 capital requirements |

| • | our expectations for 2020, 2021 and 2022 capital expenditures |

| • | our expectation that in 2020 we will be able to comply with all the covenants in our unsecured revolving credit facility |

| • | production and life of mine operating cost estimates for the Cigar Lake and Inkai operations |

| • | future plans and expectations for uranium properties, advanced uranium projects, and fuel services operating sites |

| • | our expectations related to care and maintenance costs, including incurring between $150 million and $170 million in 2020 |

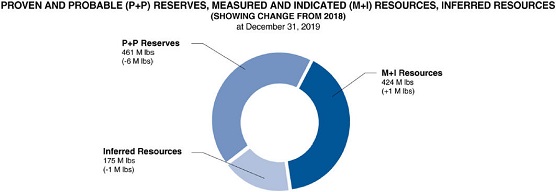

| • | our mineral reserve and resource estimates |

| • | our decommissioning estimates |

Material risks

| • | actual sales volumes or market prices for any of our products or services are lower than we expect for any reason, including changes in market prices, loss of market share to a competitor or trade restrictions |

| • | we are adversely affected by changes in currency exchange rates, interest rates, royalty rates, or tax rates |

| • | our production costs are higher than planned, or our cost reduction strategies are unsuccessful, or necessary supplies are not available, or not available on commercially reasonable terms |

| • | our strategies may change, be unsuccessful or have unanticipated consequences |

| • | our estimates and forecasts prove to be inaccurate, including production, purchases, deliveries, cash flow, revenue, costs, decommissioning, reclamation expenses, our tax expense, or receipt of future dividends from JV Inkai |

| • | we are unable to enforce our legal rights under our existing agreements, permits or licences |

| • | we are subject to litigation or arbitration that has an adverse outcome, including lack of success in our dispute with CRA |

| • | we are unsuccessful in our dispute with CRA and this results in significantly higher cash taxes, interest charges and penalties that could have a material adverse effect on us |

| • | we are unable to utilize letters of credit to the extent anticipated in our dispute with CRA |

| • | there are defects in, or challenges to, title to our properties |

| 2 | CAMECO CORPORATION |

| • | our mineral reserve and resource estimates are not reliable, or there are unexpected or challenging geological, hydrological or mining conditions |

| • | we are affected by environmental, safety and regulatory risks, including increased regulatory burdens or delays |

| • | necessary permits or approvals from government authorities cannot be obtained or maintained |

| • | we are affected by political risks |

| • | we are affected by terrorism, sabotage, blockades, civil unrest, social or political activism, accident or a deterioration in political support for, or demand for, nuclear energy |

| • | a major accident at a nuclear power plant |

| • | we are impacted by changes in the regulation or public perception of the safety of nuclear power plants, which adversely affect the construction of new plants, the relicensing of existing plants and the demand for uranium |

| • | government laws, regulations, policies or decisions that adversely affect us, including tax and trade laws |

| • | our uranium suppliers fail to fulfil delivery commitments or our uranium purchasers fail to fulfil purchase commitments |

| • | our Cigar Lake development, mining or production plans are delayed or do not succeed for any reason |

| • | any difficulties in milling of Cigar Lake ore at the McClean Lake mill |

| • | water quality and environmental concerns could result in a potential deferral of production and additional capital and operating expenses for the Cigar Lake operation |

| • | JV Inkai’s development, mining or production plans are delayed or do not succeed for any reason |

| • | our expectations relating to care and maintenance costs prove to be inaccurate |

| • | we are affected by natural phenomena, including inclement weather, fire, flood and earthquakes |

| • | our operations are disrupted due to problems with our own or our suppliers’ or customers’ facilities, the unavailability of reagents, equipment, operating parts and supplies critical to production, equipment failure, lack of tailings capacity, labour shortages, labour relations issues, strikes or lockouts, underground floods,cave-ins, ground movements, tailings dam failures, transportation disruptions or accidents, unanticipated consequences of our cost reduction strategies, or other development and operating risks |

Material assumptions

| • | our expectations regarding sales and purchase volumes and prices for uranium and fuel services, trade restrictions, and that counterparties to our sales and purchase agreements will honour their commitments |

| • | our expectations regarding the demand for and supply of uranium |

| • | our expectations regarding spot prices and realized prices for uranium, and other factors discussed under the headingPrice sensitivity analysis: uranium segment |

| • | that the construction of new nuclear power plants and the relicensing of existing nuclear power plants not being more adversely affected than expected by changes in regulation or in the public perception of the safety of nuclear power plants |

| • | our ability to continue to supply our products and services in the expected quantities and at the expected times |

| • | our expected production levels for uranium and conversion services |

| • | our cost expectations, including production costs, purchase costs, operating costs, capital costs, and the success of our cost reduction strategies |

| • | our expectations regarding tax rates and payments, royalty rates, currency exchange rates and interest rates |

| • | our expectations about the outcome of our dispute with CRA, including that the Tax Court ruling will be upheld on appeal |

| • | we are able to utilize letters of credit to the extent anticipated in our dispute with CRA |

| • | our decommissioning and reclamation estimates, including the assumptions upon which they are based, are reliable |

| • | our mineral reserve and resource estimates, and the assumptions upon which they are based, are reliable |

| • | our understanding of the geological, hydrological and other conditions at our uranium properties |

| • | our Cigar Lake development, mining and production plans succeed |

| • | the McClean Lake mill is able to process Cigar Lake ore as expected |

| • | JV Inkai’s development, mining and production plans succeed |

| • | the ability of JV Inkai to pay dividends |

| • | that care and maintenance costs will be as expected |

| • | our and our contractors’ ability to comply with current and future environmental, safety and other regulatory requirements, and to obtain and maintain required regulatory approvals |

| • | our operations are not significantly disrupted as a result of political instability, nationalization, terrorism, sabotage, blockades, civil unrest, breakdown, natural disasters, governmental or political actions, litigation or arbitration proceedings, the unavailability of reagents, equipment, operating parts and supplies critical to production, labour shortages, labour relations issues, strikes or lockouts, underground floods,cave-ins, ground movements, tailings dam failure, lack of tailings capacity, transportation disruptions or accidents, unanticipated consequences of our cost reduction strategies, or other development or operating risks |

| MANAGEMENT’S DISCUSSION AND ANALYSIS | 3 |

| 4 | CAMECO CORPORATION |

| MANAGEMENT’S DISCUSSION AND ANALYSIS | 5 |

2019 performance highlights

Throughout 2019 we continued to do what we said we would do, executing on all strategic fronts; operational, marketing and financial. On the operational front, Cigar Lake and our Fuel Services segment are performing very well. With the McArthur River/Key Lake operation still on care and maintenance, production in our uranium segment remained well below our committed sales. As a result, we were actively purchasing material on the spot market. On the financial front, we are well-positioned to execute on our strategy and self-manage risk. Our balance sheet is strong, we are starting 2020 with $1.1 billion in cash and $1 billion in long-term debt with maturities in 2022, 2024 and 2042. In addition, the Federal Court of Appeal hearing of our September 2018 unequivocal Tax Court of Canada (Tax Court) win has been scheduled to be held on March 4, 2020 and we anticipate we could receive a decision in 2020. We believe the Tax Court ruling diminishes the risk related to our tax case with Canada Revenue Agency (CRA) and believe the decision of the Tax Court will be upheld on appeal.

In 2019, the spot market underperformed our expectations, due to the delay ofend-user demand caused by uncertainty largely related to market acess and trade policy issues. However, we were pleased by our performance in the term market. The interest in long-term contracting and ouroff-market conversations with some of our best and largest customers continues. We have not seen the current level of prospective business in our pipeline since before 2011. Since the beginning of 2019, we added just over 36 million pounds of deliveries to our contract portfolio, more than replacing the volumes delivered in 2019, while maintaining leverage to higher future uranium prices. Our customers recognize that, from a security of supply perspective, diversification is important, and in some cases their risk management departments require it. They want access to long-lived,tier-one productive capacity from commercial suppliers who have a proven operating track record. Increasingly, many customers are also required to ensure their suppliers adhere to more stringent environmental, social, and governance performance standards. In addition, in light of the market access and trade policy issues affecting our market, they recognize the potential for trade policy distortions to regionalize supply, and ultimately, along with low prices, make the availability of future supply less certain and less predictable.

In September, the World Nuclear Association released its nuclear fuel report, which highlighted the fact that the demand cycle is on an upswing while the production cycle has swung down. The report outlined three scenarios for uranium demand and supply for the years 2019 through 2040. Demand was up in all three scenarios considered: the low case, the base case, and the high case. Under all three scenarios the report shows that the industry needs to at least double projected primary uranium production by 2040 to satisfy forecasted demand. To achieve this, the WNA report recognized that the market will require the appropriate signals to ensure current levels of production continue, the return of idled capacity, the completion of projects under development, the pursuit of brownfield expansion projects, and the development of currently planned and prospective greenfield projects. Finally, the report recognized that even when inventories are high, mobility can be low. For us, the report reinforced our belief that the uranium market needs to transition, similar to what has happened in the conversion market and is beginning to occur in the enrichment market.

However, until we see that transition occur, we will continue to take the necessary actions to maintain the strength of our balance sheet so we can self-manage risk, and that we expect will reward shareholders for their continued patience and support of our strategy to build long-term value.

| 6 | CAMECO CORPORATION |

Financial performance

| HIGHLIGHTS | ||||||||||||

DECEMBER 31 ($ MILLIONS EXCEPT WHERE INDICATED) | 2019 | 2018 | CHANGE | |||||||||

Revenue | 1,863 | 2,092 | (11 | )% | ||||||||

Gross profit | 242 | 296 | (18 | )% | ||||||||

Net earnings attributable to equity holders | 74 | 166 | (55 | )% | ||||||||

$ per common share (diluted) | 0.19 | 0.42 | (56 | )% | ||||||||

Adjusted net earnings(non-IFRS, see page 28) | 41 | 211 | (81 | )% | ||||||||

$ per common share (adjusted and diluted) | 0.10 | 0.53 | (81 | )% | ||||||||

Cash provided by operations (after working capital changes) | 527 | 668 | (21 | )% | ||||||||

Net earnings attributable to equity holders (net earnings) and adjusted net earnings were lower in 2019 compared to 2018,in-line with the outlook we provided. See 2019 consolidated financial results beginning on page 27 for more information. Key highlights:

| • | generated $527 million in cash from operations |

| • | retiredone-third, $500 million, of our outstanding debt |

| • | extended the maturity date of our revolving credit facility to November 2023, and reduced it by $250 million to $1 billion |

| • | Tax Court awarded $10.25 million in legal fees incurred, plus an amount for disbursements of up to $17.9 million in our dispute with CRA. Timing of any payments under the cost award is uncertain. |

| • | tribunal of international arbitrators ruled in favour of Cameco Inc. in its dispute with Tokyo Electric Power Company Holdings, Inc. (TEPCO), awarding damages of $40.3 million (US), which we received in the third quarter |

| • | received $92.6 million (US) from JV Inkai, representing repayment, in full, of its outstanding loan. In addition, received dividends of $10.6 million (US) in December 2019. |

Our segment updates

In our uranium segment, annual production wasin-line with expectations. Key highlights:

| • | continued the production suspension at McArthur River/Key Lake, removing 18 million pounds per year (100% basis) from the market |

| • | annual production of 9.0 millionpounds—in-line with the 2019 outlook provided |

| • | purchased 19.0 million pounds of uranium, including our spot purchases, committed purchase volumes, JV Inkai purchases and the purchase of NUKEM’s excess inventory |

| • | reached a new collective agreement with unionized employees at our McArthur River/Key Lake operation, which expires December 31, 2022 |

Production in 2019 from our fuel services segment was 27% higher than in 2018, as a result of an increase in UF6 production given the increase in demand in the market. We reached a new collective agreement with unionized employees at our Port Hope conversion facility, which expires July 1, 2022.

SeeOur operations and projectsbeginning on page 55 for more information.

| MANAGEMENT’S DISCUSSION AND ANALYSIS | 7 |

HIGHLIGHTS | 2019 | 2018 | CHANGE | |||||||||||||

Uranium | Production volume (million lbs) | 9.0 | 9.2 | (2 | )% | |||||||||||

| Sales volume (million lbs) | 31.5 | 35.1 | (10 | )% | ||||||||||||

| Average realized price | ($US/lb) | 33.77 | 37.01 | (9 | )% | |||||||||||

| ($Cdn/lb) | 44.85 | 47.96 | (6 | )% | ||||||||||||

| Revenue ($ millions) | 1,414 | 1,684 | (16 | )% | ||||||||||||

| Gross profit ($ millions) | 153 | 268 | (43 | )% | ||||||||||||

Fuel services | Production volume (million kgU) | 13.3 | 10.5 | 27 | % | |||||||||||

| Sales volume (million kgU) | 14.1 | 11.6 | 22 | % | ||||||||||||

| Average realized price | ($Cdn/kgU) | 26.21 | 26.78 | (2 | )% | |||||||||||

| Revenue ($ millions) | 370 | 313 | 18 | % | ||||||||||||

| Gross profit ($ millions) | 90 | 59 | 53 | % | ||||||||||||

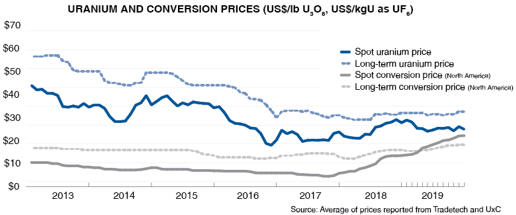

Industry prices

| 2019 | 2018 | CHANGE | ||||||||||

Uranium($US/lb U3O8)1 | ||||||||||||

Average annual spot market price | 25.64 | 24.59 | 4 | % | ||||||||

Average annual long-term price | 31.75 | 30.38 | 5 | % | ||||||||

Fuel services ($US/kgU as UF6)1 | ||||||||||||

Average annual spot market price | ||||||||||||

North America | 18.27 | 9.98 | 83 | % | ||||||||

Europe | 18.12 | 10.32 | 76 | % | ||||||||

Average annual long-term price | ||||||||||||

North America | 16.73 | 14.33 | 17 | % | ||||||||

Europe | 16.63 | 14.44 | 15 | % | ||||||||

Note: the industry does not publish UO2prices.

| 1 | Average of prices reported by TradeTech and UxC, LLC (UxC) |

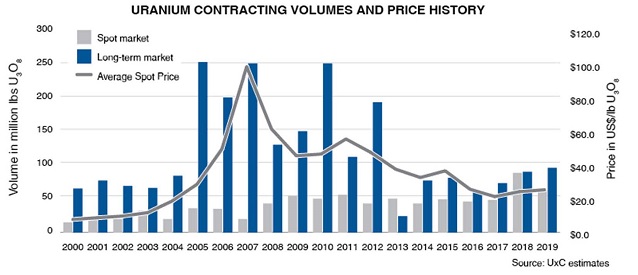

On the spot market, where purchases call for delivery within one year, the volume reported by UxC for 2019 was approximately 63.3 million pounds, compared to 88.7 million pounds in 2018. The majority of the activity in the spot market has been churn, the same material changing hands many times. There has been a lack ofend-user demand primarily caused by the delay of purchasing decisions. Uncertainty due to changing market dynamics, including ongoing market access and trade policy issues continued to keep some utilities on the sidelines. At the end of 2019, the average reported spot price was $24.93 (US) per pound, down $2.82 (US) per pound from the end of 2018. During the year, the uranium spot price ranged from a high of $28.90 (US) per pound to a low of $24.05 (US) per pound, averaging $25.64 (US) for the year.

Long-term contracts usually call for deliveries to begin more than two years after the contract is finalized, and use a number of pricing formulas, including fixed prices escalated over the term of the contract, and market referenced prices (spot and long-term indicators) quoted near the time of delivery. The volume of long-term contracting reported by UxC for 2019 was about 95.8 million pounds compared to about 91.5 million pounds in 2018. While higher than the same period last year, newly contracted volumes continued to be less than the quantities consumed. Uncertainty regarding the future of some reactor fleets and complacency due to low uranium prices continued to impact contracting volumes. The average reported long-term price at the end of the year was $32.50 (US) per pound, up $0.50 (US) from 2018.

With the uncertainty created by market access and trade policy issues facing the nuclear industry, we expect contracting in 2020 could remain largely discretionary.

Spot UF6 conversion prices increased to record levels in both the North American and European markets. For North American delivery, the average reported spot price at the end of 2019 was $22.13 (US) per kilogram uranium as UF6 (US/kgU as UF6), up $8.63 (US) from the end of 2018. Long-term UF6 conversion prices finished 2019 at $18.13 (US/kgU as UF6), up $2.13 (US) from the end of 2018.

| 8 | CAMECO CORPORATION |

SHARES AND STOCK OPTIONS OUTSTANDING

At February 5, 2020, we had:

| • | 395,797,732 common shares and one Class B share outstanding |

| • | 8,594,527 stock options outstanding, with exercise prices ranging from $11.32 to $26.81 |

DIVIDEND

In 2019, our board of directors declared a dividend of $0.08 per common share, which was paid December 13, 2019. The decision to declare an annual dividend by our board will be based on our cash flow, financial position, strategy and other relevant factors including appropriate alignment with the cyclical nature of our earnings.

| MANAGEMENT’S DISCUSSION AND ANALYSIS | 9 |

Market overview and developments

Growing confidence

Market access and trade policy issues were at the top of the list of factors affecting the market in 2019. These issues created uncertainty and consumed a significant amount of time and focus from our customers and contributed to the delay ofend-user demand in the spot market. Despite the significant demand created by the reduction in primary supply this year, at least half of the activity in the spot market has been churn, the same material changing hands many times. In contrast, interest in long-term contracting increased compared to 2018. While the volume of uranium executed under long-term contracts is still below annual consumption levels, it reached its highest level since 2012 and there continues to be significant interest. We believe that underlying this interest is the recognition that the demand cycle is on an upswing while the production cycle has swung down and the market needs to transition to one where price reflects an economic return on primary production. This gives us confidence that the uranium market will undergo the same transition we have seen in the conversion market and that is beginning to occur in the enrichment market.

Supply is not guaranteed

Economic realities and government-driven trade policies continue to have an impact on the security of supply in our industry. Not only does it not make sense to invest in future primary supply, even the lowest-cost producers are deciding to preserve long-term value by leaving uranium in the ground. Adding to security of supply concerns today is the role of commercial and state-owned entities in the uranium market, and the disconnect between where uranium is produced and where it is consumed. Nearly 80% of primary production is in the hands of state-owned enterprises, after taking into account the cuts to primary production that have occurred over the last several years. Furthermore, almost 90% of primary production comes from countries that consumelittle-to-no uranium, and 90% of uranium consumption occurs in countries that havelittle-to-no primary production. As a result, government-driven trade policies can be particularly disruptive for the uranium market. Some of the more significant supply developments are:

| • | In the US, which has the largest fleet of nuclear reactors in the world, the US Nuclear Fuel Working Group (NFWG) was established to further analyze the state of nuclear fuel production in the US. This action followed the determination by the President of the United States under Section 232 of the Trade Expansion Act that imports of foreign uranium do not constitute a national security threat, and that new restrictions on imports were not required. The NFWG has submitted its report to the President, however, the details of the report have not been made public and the President has not made any determinations. |

| • | The concern regarding expanded sanctions on Iran that could extend to countries providing nuclear fuel products and services to Iran (i.e. Russia, China, and some European nations), and therefore disrupt Russian nuclear fuel imports into the US. Compounding this concern is the continued uncertainty regarding Russian sanctions and whether existing quotas on imports of Russian uranium into the US, under the Russian Suspension Agreement, will be extended or amended prior to its expiry in 2020. |

| • | Trade tensions with China continue. On August 14, 2019, the US issued sanctions that involved China General Nuclear Power Group and three of its subsidiaries, effectively banning US companies from supplying these groups with specific nuclear-related commercial ordual-use goods. This has not impacted uranium sales. |

| • | Kazatomprom (KAP) announced that, given current market conditions, it intends to extend its current production limits (20% reduction from planned production volumes) across all its production assets through 2021. Combined with reductions from prior years, KAP indicated its cutbacks are equivalent to stopping all production in Kazakhstan for about one year. They have also indicated that a return to full production will not occur until there is a sustained market recovery. In addition, during the third quarter KAP offered a secondary placement of its shares, increasing its publicly-traded share capital from 15% to 18.8%. |

| • | Energy Resources of Australia Ltd. reconfirmed that it is required to discontinue mining and processing activities at the Ranger uranium mine in the Northern Territory of Australia by January 2021. |

| • | The board of directors of Orano’s Cominak mine announced that the mine will shut down in March 2021 due to depletion of reserves. |

| 10 | CAMECO CORPORATION |

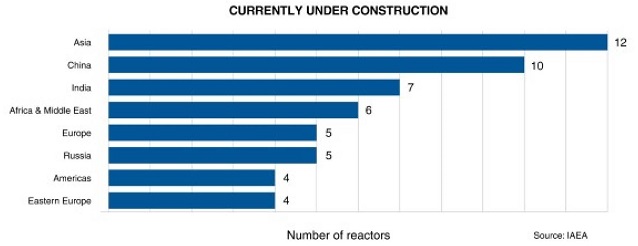

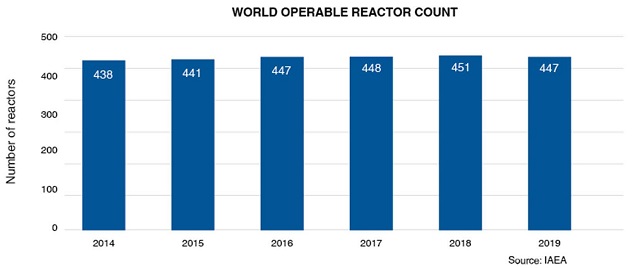

Demand has recovered and is growing

The demand gap left by forced and premature nuclear reactor shut-downs since March of 2011 has been filled. According to the International Atomic Energy Agency (IAEA) five new reactors began commercial operation in 2019, and 53 reactors are under construction. With a number of reactor construction projects recently approved, and many more planned, the demand for uranium is growing. This growth is largely occurring in Asia and the Middle East. Some of this growth is tempered by early reactor retirements, plans for reduced reliance on nuclear, orphase-out policies in other regions. However, there is growing recognition of the role nuclear power must play in providing safe, reliable, affordable carbon-free baseload electricity and achieving alow-carbon future. Some of the more significant demand developments are:

| • | The World Nuclear Association’s 2019 Nuclear Fuel Report shows demand is forecast to be higher in all scenarios examined over the period 2019 through 2040. In addition, the report shows that under all demand scenarios, the industry needs to at least double projected primary uranium production by 2040, which will require the appropriate market signals to ensure current levels of production continue, the return of idled production capacity, completion of projects under development, and development of currently planned and prospective projects. |

| • | In its latest uranium market outlook report, UxC increased its annual demand outlook by 8 million pounds per year and moved its assumed structural deficit from 2026 to 2022. |

| • | In May 2019, the International Energy Agency released its first nuclear report in 20 years, “Nuclear Power in a Clean Energy System”. The report highlights that a steep decline in nuclear power would threaten energy security and climate change goals and result in billions of tonnes of additional carbon emissions by 2040. |

| • | In October 2019, the IAEA held its first ever conference recognizing the critical role for nuclear power in combating climate change, “International Conference on Climate Change and the Role of Nuclear Power”. The IAEA advocates that it will be difficult to achieve the goal of reducing greenhouse gas emissions without a significant increase in nuclear power. |

| • | In November 2019, the European Parliament adopted a resolution recognizing the role of nuclear energy in achieving its 2050 climate plan calling for net zero emissions. |

| • | This year, China National Nuclear Company received the first new construction approval in China in about three years for units 1 and 2 at Zhangzhou, and construction began at unit 1 in October 2019. |

| • | NextEra Energy’s Turkey Point 3 and 4 in Florida received the first ever subsequent license renewal, allowing them to operate for 80 years. |

| • | Duke Energy announced it is seeking to renew the operating licences to 80 years for the 11 reactors it operates in North and South Carolina to support carbon reduction plans. Tennessee Valley Authority also announced plans to extend the licences for its six reactors in Tennessee and Alabama to 80 years. |

| • | Three Mile Island nuclear power plant was retired from service by Exelon after 45 years of operation in Pennsylvania. |

| • | In Ohio, a bill was passed providing funding to support the ongoing operation of the Perry and Davis-Besse nuclear power plants, similar to incentives enacted by other states including Illinois, New Jersey, New York, Connecticut, and pending legislation in Pennsylvania. |

| • | There were reports that Kyushu Electric Power Co. and other utilities in Japan expect to temporarily close their currently operating units over the coming years to complete the implementation of the antiterrorism measures required by the nuclear regulators. Some of these units are expected to shut down starting in 2020 before returning to service within a year. |

| • | Brazil announced the possible construction of six more nuclear reactors by 2050, in addition to completion of Angra unit 3, which is currently under construction. Brazil also plans to restart domestic uranium mining in 2019 for the first time in five years, and is open to private sector investment. |

| MANAGEMENT’S DISCUSSION AND ANALYSIS | 11 |

OPPORTUNITIES FOR THOSE WHO CAN WAIT

UxC reports that over the last five years only 396 million pounds have beenlocked-up in the long-term market, while over 831 million pounds have been consumed in reactors. We remain confident that utilities have a growing gap to fill.

Like other commodities, the uranium industry is cyclical. History demonstrates that in general, when prices are rising and high, uranium is perceived as scarce, and a lot of contracting activity takes place. The heavy contracting that takes place during price runs, drives investment in higher-cost sources of production. Once that production is in the market, it tends to stay in the market longer than is economically rational, creating the perception that uranium is abundant and always will be, and prices decline. When prices are declining and low, like we have seen over the past eight years, there is no perceived urgency to contract, and contracting activity and investment in new supply drops off. After years of low investment in supply, as has been the case since 2011, security of supply tends to overtake price concerns at some point, and utilitiesre-enter the long-term market to ensure they have the reliable supply of uranium they need to run their reactors.

| 12 | CAMECO CORPORATION |

We believe the current backlog of long-term contracting presents a substantial opportunity for commercially motivated suppliers like us that can weather thelow-price part of the cycle. As alow-cost producer, we manage our operations with these price cycles in mind.

In our industry, customers do not come to the market right before they need to load uranium into their reactors. To operate a reactor that could run for more than 60 years, natural uranium and the downstream services have to be purchased years in advance, allowing time for a number of processing steps before it arrives at the power plant as a finished fuel bundle. At present, we believe there is a significant amount of uranium that needs to be contracted to keep reactors running into the next decade.

UxC estimates that cumulative uncovered requirements are about 1.5 billion pounds to the end of 2035. The longer the recovery of the long-term market is delayed, the less certainty there will be about the availability of future supply to fill growing demand. In fact, recent data from the US Energy Information Administration shows that utility inventories are starting to decline and are approaching levels that could put security of supply at risk. Ultimately, we expect the current market uncertainty to give way to increasing concerns about the security of future supply.

As utilities’ uncovered requirements grow, annual supply declines, demand for uranium from producers and financial players increases, and with trade policy potentially restricting access to some markets, we believe the pounds available in the spot market will not be adequate to satisfy the growing backlog of long-term demand. As a result, we expect there will be increased competition to secure uranium under long-term contracts on terms that will ensure the availability of reliable primary supply to meet growing demand.

| MANAGEMENT’S DISCUSSION AND ANALYSIS | 13 |

Global population is on the rise, and with the world’s need for safe, clean, reliable baseload energy, nuclear remains an important part of the energy mix. We remain confident in the future of the nuclear industry. With demand coming on in the form of restarts and new reactors, and supply becoming less certain as a result of low prices, production curtailments, lack of investment, and market access and trade policy issues, we’re continuing to expect a market transition. While the timing of a market transition remains uncertain, we will continue to take the actions we believe are necessary to position the company for long-term success. Therefore, we will undertake contracting activity which aligns with the uncertain timing of a market recovery and is intended to ensure we have adequate protection and will benefit from higher prices under our contract portfolio, while maintaining exposure to the rewards that come from having uncommitted,low-cost supply to deliver into a strengthening market.

| 14 | CAMECO CORPORATION |

Our strategy

Our strategy is set within the context of a challenging market environment, which we expect to give way to strong long-term fundamentals driven by increasing populations, and the impact of growing electricity demand on the world’s climate. Nuclear energy must be a central part of the solution to the world’s shift to alow-carbon, climate resilient economy. It is an option that can provide the power needed, not only reliably, but also safely and affordably, and in a way that will help avoid some of the worst consequences of climate change.

Tier-one focus

We are a pure-play nuclear fuel investment, focused on providing a clean source of energy, and taking advantage of the long-term growth we see coming in our industry. Our strategy is to focus on ourtier-one assets and profitably produce at a pace aligned with market signals in order to preserve the value of those assets and increase long-term shareholder value, and to do that with an emphasis on safety, people and the environment.

URANIUM

Uranium production is central to our strategy, as it is the biggest value driver of the nuclear fuel cycle and our business. In accordance with market conditions, and to mitigate risk, we will evaluate the optimal mix of our production, inventory and purchases in order to satisfy our contractual commitments and in order to return the best value possible. We will not produce from ourtier-one assets to sell into an oversupplied spot market. During a prolonged period of uncertainty, this could mean leaving our uranium in the ground. As conditions improve, we expect to meet rising demand with production from our best margin operations.

In light of today’s lingering uncertainty as to how long the weak market conditions will persist, we are focused on preserving the value of our lowest cost assets, on maintaining a strong balance sheet, on protecting and extending the value of our contract portfolio and on efficiently managing the company in a low price environment. We have undertaken a number of deliberate and disciplined actions. In 2019, these actions resulted in:

| • | generation of $527 million in cash from operations |

| • | retirement ofone-third, $500 million, of our outstanding debt |

| • | ayear-end balance of $1.1 billion in cash on our balance sheet |

Consistent with our actions, our McArthur River/Key Lake operation remains on care and maintenance for an indeterminate duration, removing 18 million pounds of uranium annually from the market. Some of our actions have a cost in the short term, and we must weigh these costs against the value we expect they will generate over the long term. Accordingly, we will adjust our actions based on market signals with the intent of being able to self-manage risk, and to ensure ourtier-one assets are available to us in a market that values them appropriately.

FUEL SERVICES

Our fuel services division is a source of profit and supports our uranium segment while allowing us to vertically integrate across the fuel cycle.

The UF6 conversion market has gone through a transition that has seen the industry average North American spot price increase by more than 280% and the industry average North American term price increase by almost 40% since the end of 2017. In this environment, with our Port Hope facility the only UF6 plant currently operating in North America, we are focused on securing new long-term contracts that reflect today’s prices and that will allow us to continue to consistently support the long-term needs of our customers.

In addition, we are pursuingnon-traditional markets for our UO2 and fuel fabrication business and have been actively securing new contracts for reactor components to support refurbishment of Canadian reactors.

Our focus will continue to be on maintaining and optimizing the profitability of this segment of our business.

OTHER FUEL CYCLE INVESTMENTS

We continue to explore other opportunities within the nuclear fuel cycle. In particular, we are interested in the second largest value driver of the fuel cycle, enrichment. Having operational control of uranium production, conversion, and enrichment facilities would offer operational synergies that could enhance profit margins.

| MANAGEMENT’S DISCUSSION AND ANALYSIS | 15 |

In 2019, we signed a binding agreement to increase our interest in Global Laser Enrichment (GLE) from 24% to 49%. GLE is testing a third-generation enrichment technology that, if successful, will use lasers to commercially enrich uranium. Closing of the agreement is conditional upon receipt of US regulatory approval and GLE’s contract with the US Department of Energy (DOE) regarding DOE’s inventory of depleted tails remaining in full force and effect.

Capital allocation – focus on value

Delivering returns to our long-term shareholders is a top priority. We continually evaluate our investment options to ensure we allocate our capital in a way that we believe will:

| • | create the greatest long-term value for our shareholders |

| • | allow us to navigate by our investment-grade rating and mitigate risk |

| • | allow us to execute on our dividend while ensuring it is appropriately aligned with the cyclical nature of our earnings |

To deliver value, free cash flow must be productively reinvested in the business or returned to shareholders, which requires good execution and disciplined allocation. Our decisions are based on the run rate of our business, notone-time events. Cash on our balance sheet that exceeds value-adding growth opportunities and/or is not needed to self-manage risk should be returned to shareholders.

We have a multidisciplinary capital allocation team that evaluates all possible uses of investable capital.

We start by determining how much cash we have to invest (investable capital), which is based on our expected cash flow from operations minus expenses we consider to be a higher priority, such as dividends and financing costs, and could include others. This investable capital can be reinvested in the company or returned to shareholders.

Our capital allocation decisions will continue to pivot on what the market is providing. With the continued market uncertainty we are facing, and our ongoing dispute with CRA, the objective of our capital allocation is to maximize cash flow, while navigating by our investment-grade rating through close management of our balance sheet metrics.

With the metrics that inform an investment-grade rating in mind, and in this period of low uranium prices, we have taken steps to improve margin and cash flow by:

| • | responsibly managing our sources of supply thereby preserving the value of ourtier-one assets |

| • | restructuring our activities to reduce our operating, capital, and general and administrative spending |

| • | reducing our annual dividend from $0.40 per share to $0.08 per share in 2018 |

| • | implementing an initiative intended to provide a greater focus on technology and its applications to improve efficiency and reduce costs across the organization, with a particular focus on innovation and accelerating the adoption of advanced digital and automation technologies |

As a result, we are well positioned to self-manage risk.

REINVESTMENT

If a decision is made to reinvest capital in sustaining, capacity replacement, or growth, all opportunities are ranked and only those that meet the required risk-adjusted return criteria are considered for investment. We also must identify, at the corporate level, the expected impact on cash flow, earnings, and the balance sheet. All project risks must be identified, including the risks of not investing. Allocation of capital only occurs once an investment has cleared these hurdles.

This may result in some opportunities being held back in favour of higher return investments, and should allow us to generate the best return on investment decisions when faced with multiple prospects, while also controlling our costs. If there are not enough good investment prospects internally or externally, this may result in residual investable capital, which we would then consider returning directly to shareholders.

| 16 | CAMECO CORPORATION |

We have not yet seen the market transition needed to restart our idled production capacity. Therefore, until we see that transition, our capital expenditures for 2020 through 2022 will be focused primarily on sustaining and capacity replacement capital, and demonstrating our continued commitment to a clean environment through ongoing investment in the Vision in Motion project in Port Hope. In addition, we will focus on improving operational effectiveness across our operations, including the use of digital and automation technologies with a particular goal of substantially reducing operating costs and increasing operational flexibility when it comes time to restart the McArthur River/Key Lake operation. Any opportunities will be rigorously assessed before an investment decision is made. If we get clarity on our CRA dispute prior to a market transition, which generates aone-time cash infusion, we will focus on the debt portion of our ratings metrics. This may mean an even greater emphasis on reducing the debt on our balance sheet. However, if the market does begin to transition and higher uranium prices are beginning to flow through our contract portfolio, and we are able to increase our portfolio of acceptable long-term contracts, the earnings portion of our rating metrics are expected to improve. In that scenario, reducing debt would not be the priority. Our priority would be to invest in restarting our idledtier-one assets, and if warranted, turn to value-adding growth opportunities.

RETURN

We believe in returning cash to shareholders, but are also focused on protecting the company and rewarding those shareholders who understand and support our strategy to build long-term value. If we have excess cash and determine the best use is to return it to shareholders, we can do that through a share repurchase or dividend—an annual dividend,one-time supplemental dividend or a progressive dividend. When deciding between these options, we consider a number of factors, including the nature of the excess cash (one time or cash generated by our business operations), growth prospects for the company, and growth prospects for the industry.

Share buyback: If we were generating excess cash while there were few or no growth prospects for the company or the industry, then a share buyback might make sense. However, our current view is that the long-term fundamentals for Cameco and the industry remain strong.

Dividend: The amount and type of dividend paid, annual, progressive orone-time supplemental is evaluated by our board of directors with careful consideration of our cash flow, financial position, strategy, and other relevant factors including appropriate alignment with the cyclical nature of our earnings.

Marketing framework – balanced contract portfolio

As with our corporate strategy and approach to capital allocation, the purpose of our marketing framework is to deliver value. Our approach is to secure a solid base of earnings and cash flow by maintaining a balanced contract portfolio that optimizes our realized price.

We evaluate our strategy in the context of our market environment and continue to adjust our actions in accordance with our marketing framework:

| • | First, we will not produce from ourtier-one assets to sell into an oversupplied spot market. We will not produce from these assets unless we can deliver ourtier-one pounds under long-term contracts that provide an acceptable rate of return on these assets for our owners. |

| • | Second, we do not intend to build up an inventory of excess uranium. Excess inventory serves to contribute to the sense that uranium is abundant and creates an overhang on the market, and it ties up working capital on our balance sheet. |

| • | Third, in addition to our committed sales, we will capture demand in the market where we think we can obtain value. We will take advantage of opportunities the market provides, where it makes sense from an economic, logistical and strategic point of view. Those opportunities may come in the form of spot,mid-term or long-term demand, and will be additive to our current committed sales. |

| • | Fourth, once we capture demand, we will decide how to best source material to satisfy that demand. Depending on the timing and volume of our production, purchase commitments, and our inventory volumes, this means we will be active buyers in the market in order to meet our demand obligations. |

| • | And finally, in general, if we choose to source material to meet demand by purchasing it, we expect the price of that material will be more than offset by the leverage to market prices in our sales portfolio over a rolling12-month period. |

In addition to this framework, our contracting decisions always factor in who the customer is, our desire for regional diversification, the product form, and logistical factors.

| MANAGEMENT’S DISCUSSION AND ANALYSIS | 17 |

Ultimately, our goal is to protect and extend the value of our contract portfolio on terms that recognize the value of our assets and provide adequate protection when prices go down and allow us to benefit when prices rise. We believe using this framework will allow us to create long-term value for our shareholders. Our focus will continue to be on maximizing cash flow, so we can execute on our strategy and self-manage risk.

LONG-TERM CONTRACTING

Uranium is not traded in meaningful quantities on a commodity exchange. Utilities have historically bought the majority of their uranium and fuel services products under long-term contracts with suppliers, and have met the rest of their needs on the spot market. We sell uranium and fuel services directly to nuclear utilities around the world as uranium concentrates, UO2 and UF6, conversion services, or fuel fabrication. We have a solid portfolio of long-term sales contracts that reflect the long-term, trusting relationships we have with our customers.

In general, we are always active in the market, buying and selling uranium when it is beneficial for us and in support of our long-term contract portfolio. We undertake activity in the spot and term markets prudently, looking at the prices and other business factors to decide whether it is appropriate to purchase or sell into the spot or term market. Not only is this activity a source of profit, it gives us insight into underlying market fundamentals.

We deliver large volumes of uranium every year, therefore our net earnings and operating cash flows are affected by changes in the uranium price. Market prices are influenced by the fundamentals of supply and demand, market access and trade policy issues, geopolitical events, disruptions in planned supply and demand, and other market factors.

The objectives of our contracting strategy are to:

| • | maximize realized price while reducing volatility of our future earnings and cash flow |

| • | focus on meeting the nuclear industry’s growing annual uncovered requirements with our future uncommitted supply while ensuring adequate regional diversity |

| • | establish and grow market share with strategic customers |

We target a ratio of 40% fixed-pricing and 60% market-related pricing in our portfolio of long-term contracts, including mechanisms to protect us when the market price is declining and allow us to benefit when market prices go up. This is a balanced and flexible approach that allows us to adapt to market conditions and put a floor on our average realized price, and deliver the best value to shareholders over the long term.

This approach has allowed us to realize prices higher than the market prices during periods of weak uranium demand, and we expect it will enable us to realize increases linked to higher market prices in the future.

Fixed-price contracts for uranium: are typically based on a term-price indicator at the time the contract is accepted and escalated over the term of the contract.

Market-related contracts for uranium: are different from fixed-price contracts in that they may be based on either the spot price or the long-term price, and that price is as quoted at the time of delivery rather than at the time the contract is accepted. These contracts sometimes provide for discounts, and often include floor prices and/or ceiling prices, which are usually escalated over the term of the contract.

Fuel services contracts: the majority of our fuel services contracts are at a fixed price per kgU, escalated over the term of the contract, and reflect the market at the time the contract is accepted.

OPTIMIZING THE CONTRACT PORTFOLIO

We work with our customers to optimize the value of our existing contract portfolio. In cases where a customer is seeking relief due to a challenging policy, operating, or economic environment, we evaluate their specific circumstances and assess their long-term sustainability. Where we deem the customer’s long-term demand to be at risk, we may consider options that allow us to benefit from converting that uncertain future value into certain present value. In contrast, where the customer is considered to have a more certain and predictable future, we may offer relief. For example, in a low price environment, we may blend in more market-related volumes in the near term, but only where the customer is willing to extend the terms and conditions of that contract out into the future, and only where it is beneficial to us.

| 18 | CAMECO CORPORATION |

CONTRACT PORTFOLIO STATUS

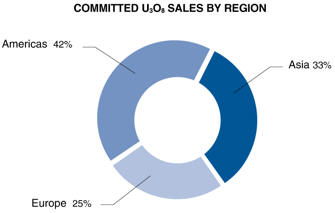

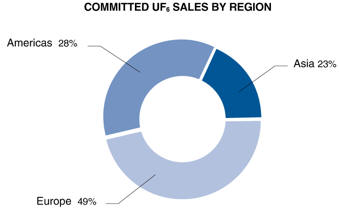

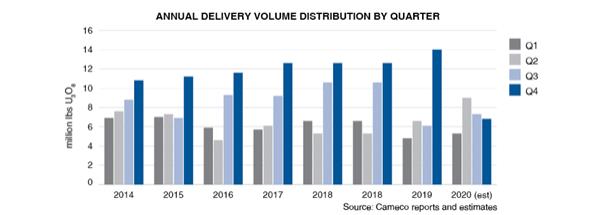

We have commitments to sell over 130 million pounds of U3O8 with 31 customers worldwide in our uranium segment, and over 36 million kilograms as UF6 conversion with 28 customers worldwide in our fuel services segment. The annual average sales commitments over the next five years in our uranium segment is around 19 million pounds, with commitment levels in 2020 and 2021 higher than in 2022 through 2024.

Customers – U3O8:

Five largest customers account for 60% of commitments

Customers – UF6 conversion:

Five largest customers account for 60% of commitments

MANAGING OUR CONTRACT COMMITMENTS

To meet our delivery commitments, we use our uranium supply, which includes uranium obtained from:

| • | our existing production |

| • | purchases under our JV Inkai agreement, from NUKEM, under long-term agreements and in the spot market |

| • | our existing inventory |

We allow sales volumes to varyyear-to-year depending on:

| • | the level of sales commitments in our long-term contract portfolio |

| • | our production volumes |

| • | purchases under existing and/or new arrangements |

| • | discretionary use of inventories |

| • | market opportunities |

| MANAGEMENT’S DISCUSSION AND ANALYSIS | 19 |

Managing our costs

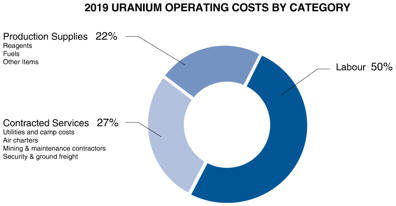

PRODUCTION COSTS

In order to operate efficiently and cost-effectively, we manage operating costs and improve plant reliability by prudently investing in production infrastructure, new technology, and business process improvements. Like all mining companies, our uranium segment is affected by the cost of inputs such as labour and fuel.

Given the current market dynamics, in 2020, our only operating property will be Cigar Lake. Our McArthur River/Key Lake, Rabbit Lake, and US operations are currently on care and maintenance. While we have these operations on standby, our annual cash production costs will reflect the operating cost of mining and milling our share of Cigar Lake mineral reserves, which is estimated to be between $15 and $16 per pound over the entirelife-of-mine.

Operating costs in our fuel services segment are mainly fixed. In 2019, labour accounted for about 44% of the total. The largest variable operating cost is for zirconium, followed by anhydrous hydrogen fluoride, and energy (natural gas and electricity).

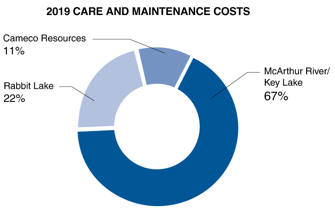

CARE AND MAINTENANCE COSTS

In 2020, we expect to incur between $150 million and $170 million in care and maintenance costs related to the suspension of production at our McArthur River/Key Lake mine and mill, Rabbit Lake mine and mill, and US operations. The largest proportion of these costs will be incurred at McArthur River/Key Lake.

Our expected care and maintenance costs have increased compared to 2019 due to planned expenditures that will allow us to fully assess our operating processes at McArthur River/Key Lake. Consistent with ourtier-one strategy, we expect that production at McArthur River/Key Lake will be the first of our operations to restart once we see the appropriate market signals. Therefore, we are focused on improving operational effectiveness, including the use of digital and automation technologies with a particular goal of substantially reducing operating costs and increasing operational flexibility when it comes time to restart these operations. As a result, care and maintenance costs are expected to be higher compared to Rabbit Lake and in the US. Our Rabbit Lake and US operations are higher-cost, and with plenty of idletier-one capacity andtier-one expansion capacity globally that can come back on line relatively quickly, the restart horizon is less certain.

While Rabbit Lake and our US operations are in standby, we will continue to evaluate our options in order to minimize costs.

| 20 | CAMECO CORPORATION |

PURCHASES AND INVENTORY COSTS

Our costs are also affected by the purchases of uranium and conversion services we make under long-term contracts and on the spot market.

To meet our delivery commitments, we make use of our mined production, inventories, purchases under long-term contracts, and purchases we make on the spot market. In 2020, the price for the majority of our purchases will be quoted at the time of delivery.

The cost of purchased material may be higher or lower than our other sources of supply, depending on market conditions. The cost of purchased material affects our cost of sales, which is determined by calculating the average of all of our sources of supply, including opening inventory, production, and purchases, and adding royalties, selling costs, and care and maintenance costs. If market prices exceed our cost of produced material including royalties, we expect the cost of sales to increase accordingly.

FINANCIAL IMPACT

As greater certainty returns to the uranium market, our view is that the market needs to transition to one where uranium prices reflect the cost of bringing on new primary production to meet growing demand.

We have taken a number of deliberate and disciplined actions to reduce supply and streamline operations. Some of these actions come with a cost in the near term, like care and maintenance costs, but we expect the benefit over the long term will far outweigh those costs.

We believe our actions will help shield the company from the nearer term risks we face and will reward shareholders for their continued patience and support of our strategy to build long-term value.

Committed to our values

Our values are at the core of everything we do and define who we are as a company.

SAFETY AND ENVIRONMENT

The safety of people and protection of the environment are the foundations of everything we do, locally and globally.

PEOPLE

We value the contribution of every employee and demonstrate respect for individual dignity, creativity and cultural diversity.

INTEGRITY

We lead by example, earn trust, honour our commitments and conduct our business ethically.

EXCELLENCE

Through leadership, collaboration and innovation, we strive to achieve our full potential and inspire others to reach theirs.

| MANAGEMENT’S DISCUSSION AND ANALYSIS | 21 |

Our approach to ESG matters

Our uranium is used around the world in the generation of safe, carbon-free, affordable, base-load nuclear energy. As we seek to bring the benefits of carbon-free nuclear energy to the world, we will do so in a manner that reflects our values. We are committed to identifying and addressing the environmental, social and governance (ESG) risks and opportunities that we believe may have a significant impact on our ability to add long-term value for our stakeholders.

SUSTAINABILITY: A KEY PART OF OUR STRATEGY, REFLECTING OUR VALUES

We view sustainability as an integrated approach to conducting business. We integrate sustainability principles and practices into all stages of our activities, from exploration to decommissioning, including factoring them into our objectives and approach to compensation, our overall corporate strategy, and ourday-to-day operations. We adopt established and recognized management system frameworks to guide our integrated approach, which is embedded within ethical business practices and our robust and transparent governance framework. We seek to be transparent with our stakeholders, keeping them updated on the risks and opportunities that we believe may have a significant impact on our ability to add long-term value.

We have a sustainability policy that describes our commitments in this regard. We encourage you to review our sustainability policy atcameco.com/about/governance/policies-programs.

Safety and the Environment

We employ an integrated Safety, Health, Environment and Quality (SHEQ) management system that applies to all phases and aspects of our business. The system is governed by one integrated SHEQ policy that recognizes that the safety and health of our workers and the public, protection of the environment, and quality of our processes are the highest priority during all stages of our activities. The policy is supported by multiple corporate SHEQ management programs. We maintain ISO 14001 certification at a corporate level. We encourage you to review our SHEQ policy atcameco.com/about/governance/policies-programs.

Climate change: Nuclear power is part of the solution

There is growing recognition that uranium is the cleanest energy fuel in the world and of the role nuclear power must play in ensuring safe, reliable and affordable carbon-free electricity generation from key global agencies, such as the United Nations Economic Commission for Europe, the United Nations Intergovernmental Panel on Climate Change, and the Union of Concerned Scientists. Indeed, for the first time in nearly two decades, the International Energy Agency released a report on nuclear energy in the hopes of bringing it back into the global energy debate. The report highlighted that a steep decline in nuclear power would threaten energy security and climate change goals and result in four billion tonnes of additional carbon emissions by 2040.

The nuclear industry recognizes the scale and immediacy of the challenge outlined in the Paris Agreement, and the important role that alllow-carbon and carbon-free energy sources have to play. Led by the World Nuclear Association, the nuclear industry has a program and vision for the future of electricity supply called “Harmony”. The Harmony program sets a target for nuclear power to provide 25% of electricity by 2050 to help avoid the worst consequences of climate change. As members of the World Nuclear Association, and through participation in other industry organizations we fully support and are advocates of this initiative.

We believe that the reduction of carbon and greenhouse gas (GHG) emissions is important and necessary in Canada and around the world, and that nuclear power must be a central part of the solution to the world’s shift to alow-carbon, climate resilient economy. As one of the world’s largest producers of the uranium fuel needed to fuel nuclear reactors, we believe there is a significant opportunity for us to be part of the solution to combating climate change and that we are well positioned to deliver significant long-term business value, while actively working to reduce our emission profile.

We are proud that our the high-grade uranium ores in Saskatchewan’s Athabasca Basin result in our Canadian uranium having among the lowest life cycle greenhouse gas emission intensity internationally, despite the constraints related to our geographic location. In fact, the production of Saskatchewan uranium requires at least one hundred times less greenhouse gas (GHG) emissions than production of the cleanest Canadian natural gas to produce the same amount of electricity and, all of the nuclear power produced is GHG emission free. We have tracked and reported GHG emissions for more than two decades, despite any regulatory requirement to do so. We continue to be focused on improving energy management and the visibility of energy consumption within our organization, with the overall goal of improving the energy intensity of our operations to create business value.

| 22 | CAMECO CORPORATION |

Stakeholder relations

Gaining the support of all our stakeholders is necessary to sustain our business.

We have a people policy that describes our commitment to developing and supporting a flexible, skilled, stable and diverse workforce. The policy is supported by multiple corporate human resource programs, standards and practices. We encourage you to review this policy atcameco.com/about/governance/policies-programs.

In addition, we strive to earn the support of the communities in which we operate, which is one of our key measures of success. We identify opportunities and initiatives that support and respect these communities and their cultures.

We recognize the substantial value in developing and maintaining long-term mutually beneficial relationships with Indigenous communities located within or near our operations and other activities.

Over more than 30 years of operation and partnership in northern Saskatchewan, we have developed a comprehensive strategy that applies to all our operations globally, and is aimed at ensuring the support of the communities with whom we work. The global strategy is flexible and is implemented locally to reflect the needs of the communities. The bulk of the strategy has evolved as a result of the commercial benefits we see from ensuring strong support among local communities wherever we operate and focuses on five key areas:

| • | Workforce development: designed to deliver programming that aims to build educational and skills capacity in local communities. |

| • | Business development: designed to promote involvement of locally-owned businesses in contracting opportunities at our operations, to provide additional jobs, revenue streams and capacity building at the local community level. |

| • | Community engagement: designed with the objective to ensure that we secure support for our operations from local communities and satisfy the obligations placed on us by regulators and laws. |

| • | Community investment: designed to help local communities with much-needed funding for community programming and infrastructure for initiatives focused on youth, education and literacy, health and wellness, and community development. |

| • | Environmental stewardship: designed to support our overall environmental programming and give communities a voice in both the formal environmental assessment regulatory process, as well as ongoing monitoring activities. |

We set standards for the measures that we will conform to in maintaining ongoing and meaningful engagement within the communities where we operate.

HOW WE ARE DOING

We produce a sustainability report for our stakeholders to tell them how we are performing against globally recognized key indicators that measure our environmental, social, governance and financial impacts in the areas that we believe may have a significant impact on our ability to add long-term value for our stakeholders. We use the Global Reporting Initiative’s Sustainability Framework (GRI), in addition to some corporate indicators that are unique to the company to measure and report our performance. This is our report card to our stakeholders. For our most recent performance results, we encourage you to review our sustainability report atcameco.com/about/sustainability.

Given the evolving nature of the ESG landscape, we have established a multi-disciplinary working group to review of our current approach in this area, including how we report. The working group is chaired by our Senior Vice-President and Chief Corporate Officer and will report to the relevant committees of the board.

GOVERNANCE: SOUND GOVERNANCE IS THE FOUNDATION FOR STRONG PERFORMANCE

We believe that sound governance is the foundation for strong corporate performance. Our board of directors is responsible for overseeing management, and our strategy and business affairs and the integration of ESG principles throughout the company. The board’s goal is to ensure we operate as a successful business, optimizing financial returns while effectively managing risk.

The board has formal governance guidelines that set out our approach to governance and the board’s governance role and practices. The guidelines ensure we comply with all of the governance rules and legislation in Canada and the United States that are applicable, conduct ourselves in the best interests of our stakeholders, and meet industry best practices. The guidelines are reviewed and updated regularly.

| MANAGEMENT’S DISCUSSION AND ANALYSIS | 23 |

Risk and Risk Management

We have a mature enterprise risk management (ERM) framework that consists of processes and controls to ensure risks are being appropriately managed and mitigated.

Decisions to accept, mitigate, or transfer identified risks guide management’s plans in our strategic planning and budgeting process. Employees throughout the company take ownership of the risks specific to their area, and are responsible for developing and implementing the controls to manage andre-assess risk, including ESG risks.

Our risk policy sets out a broad, systematic approach to identifying, assessing, reporting and managing the significant risks, including ESG risks, we face in our business and operations. The policy is reviewed annually to ensure that it continues to meet our needs.

SeeManaging the risks, starting on page 56, for a discussion of the risks, including ESG risks, that generally apply to all of our operations and advanced uranium projects, and that could have a material impact on business in the near term. We also recommend you review our most recent annual information form, which includes a discussion of other material risks that could have an impact on our business.

The board is responsible for overseeing management’s implementation of appropriate risk management processes and controls. Time is dedicated at board and committee meetings to risk identification, management, and reporting. In consultation with the board, management works on enhancing its enterprise risk oversight practices, processes and controls. While the board oversees the company’s strategic risks, including ESG/climate-related risks, it also allocates oversight of othertop-tier risks to specific board committees. Set out below is an overview of the responsibilities allocated to specific board committees.

Audit and finance– supports the board in fulfilling its oversight responsibilities regarding the integrity of our accounting and financial reporting, the adequacy and effectiveness of our internal controls and disclosure controls, legal, regulatory (excluding safety, health and the environment) and ethical compliance, the independence and performance of our external and internal auditors, oversight of specific material risks, and prevention and detection of fraudulent activities and financial oversight.

Human resources – supports the board in fulfilling its oversight responsibilities regarding human resource policies, employee and labour relations matters, executive compensation, executive succession and development, pension plan governance, and oversight of material risks assigned to the committee.

Nominating, corporate governance and risk – supports the board in fulfilling its oversight responsibilities by developing and recommending a set of corporate governance principles, identifying and recommending qualified individuals as members of the board and its committees, assessing the effectiveness of the board and committees, and overseeing the risk program.

Reserves oversight - supports the board in fulfilling its oversight responsibilities regarding estimating and disclosing mineral reserves and resources.

Safety, health and environment – supports the board in fulfilling its oversight responsibilities regarding safety, health, environmental and climate-related matters, and supportive communities.

In addition, the safety, health and environment committee and the nominating, corporate governance and risk committees assist the board in fulfilling its oversight responsibility with respect to ESG matters.

More information about our shareholder commitment, our governance principles, how our board operates, its responsibilities, and the profiles of each of our directors can be found in our most recent management proxy circular and on our website atcameco.com/about/board-of-directors.

TARGETS AND METRICS: THE LINK BETWEEN ESG FACTORS AND EXECUTIVE PAY

We recognize the importance of integrating certain ESG factors, such as safety performance, a clean environment and supportive communities, into our executive compensation strategy as we see success in these areas as critical to the long term success of the company. For more information on our compensable targets and our reported performance against those targets see theMeasuring our results section that follows and our most recent management proxy circular.

| 24 | CAMECO CORPORATION |

Measuring our results

Each year, we set corporate objectives that are aligned with our strategic plan. These objectives fall under our four measures of success, and performance against specific targets under these objectives forms the foundation for a portion of annual employee and executive compensation. See our most recent management proxy circular for more information on how executive compensation is determined.

2019 OBJECTIVES1 | TARGET | RESULTS | ||

| OUTSTANDING FINANCIAL PERFORMANCE | ||||

| Earnings measure | Achieve targeted adjusted net earnings. | • adjusted net earnings was above the maximum target | ||

| Cash flow measure | Achieve cash flow from operations (after working capital changes). | • cash flow from operations was above the maximum target | ||

| SAFE, HEALTHY AND REWARDING WORKPLACE | ||||

| Workplace safety measure | Strive for no injuries at all Cameco-operated sites. Maintain a long-term downward trend in combined employee and contractor injury frequency and severity, and radiation doses. | • best safety performance in the history of the company, however TRIR did not meet the 2019 improvement target

• completion of corrective actions and job task observations exceeded the target

• average radiation doses remained low and stable | ||

| CLEAN ENVIRONMENT | ||||

| Environmental performance measures | Achieve divisional environmental aspect improvement targets. | • performance was within the targeted range

• there were no significant environmental incidents in 2019 | ||

| SUPPORTIVE COMMUNITIES | ||||

| Stakeholder support measure | Implement Collaboration Agreements by supporting northern business development opportunities and build corporate reputation. | • of our two targets involving sourcing of services from preferred northern Saskatchewan suppliers, one did not meet the minimum target and the other was above the maximum target | ||

| 1 | Detailed results for our 2019 corporate objectives and the related targets will be provided in our 2020 management proxy circular prior to our Annual Meeting of Shareholders on April 30, 2020. |

2020 objectives

OUTSTANDING FINANCIAL PERFORMANCE

| • | Achieve targeted financial measures focused on controlling costs and generating cash. |

SAFE, HEALTHY AND REWARDING WORKPLACE

| • | Improve workplace safety performance at all sites. |

CLEAN ENVIRONMENT

| • | Improve environmental performance at all sites. |

SUPPORTIVE COMMUNITIES

| • | Build and sustain strong stakeholder support for our activities. |

| MANAGEMENT’S DISCUSSION AND ANALYSIS | 25 |

Financial results

This section of our MD&A discusses our performance, financial condition and outlook for the future.

| 27 | 2019 CONSOLIDATED FINANCIAL RESULTS | |

| 38 | OUTLOOK FOR 2020 | |

| 41 | LIQUIDITY AND CAPITAL RESOURCES | |

| 46 | 2019 FINANCIAL RESULTS BY SEGMENT | |

| 46 | URANIUM | |

| 48 | FUEL SERVICES | |

| 49 | FOURTH QUARTER FINANCIAL RESULTS | |

| 49 | CONSOLIDATED RESULTS | |

| 52 | URANIUM | |

| 54 | FUEL SERVICES | |

| 26 | CAMECO CORPORATION |

2019 consolidated financial results

This section of our MD&A discusses our performance, financial condition and outlook for the future.