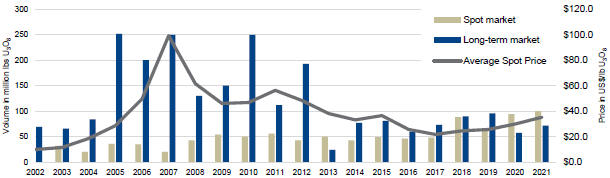

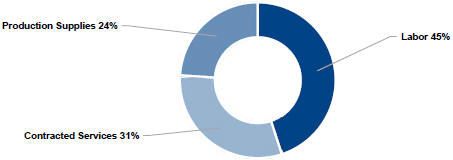

In general, we are always active in the market, buying and selling uranium when it is beneficial for us and in support of our long-term contract portfolio. We undertake activity in the spot and term markets prudently, looking at the prices and other business factors to decide whether it is appropriate to purchase or sell into the spot or term market. Not only is this activity a source of profit, it gives us insight into underlying market fundamentals.

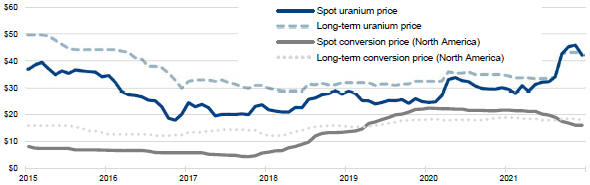

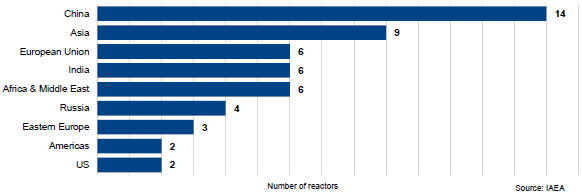

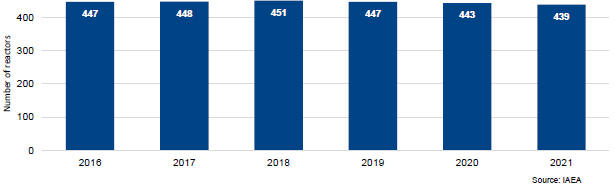

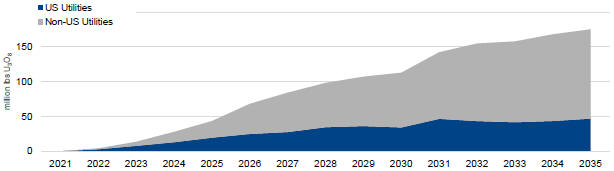

We deliver large volumes of uranium every year, therefore our net earnings and operating cash flows are affected by changes in the uranium price. Market prices are influenced by the fundamentals of supply and demand, market access and trade policy issues, geopolitical events, disruptions in planned supply and demand, and other market factors.

The objectives of our contracting strategy are to:

| • | | maximize realized price while providing some certainty for our future earnings and cash flow |

| • | | focus on meeting the nuclear industry’s growing annual uncovered requirements with our tier-one production |

| • | | establish and grow market share with strategic customers |

We have a portfolio of long-term contracts that have a mix of base-escalated pricing and market-related pricing mechanisms, including provisions to protect us when the market price is declining and allow us to benefit when market prices go up. This is a balanced and flexible approach that allows us to adapt to market conditions, put a floor on our average realized price and deliver the best value over the long term.

This approach has allowed us to realize prices higher than the market prices during periods of weak uranium demand, and we expect it will enable us to realize increases linked to higher market prices in the future.

Base-escalated (fixed prices escalated over the term of the contract) contracts for uranium: typically use a pricing mechanism based on a term-price indicator at the time the contract is accepted and escalated over the term of the contract.

Market-related contracts for uranium: are different from base-escalated contracts in that the pricing mechanism may be based on either the spot price or the long-term price, and that price is as quoted at the time of delivery rather than at the time the contract is accepted. These contracts sometimes provide for discounts, and often include floor prices and/or ceiling prices, which are usually escalated over the term of the contract.

Fuel services contracts: the majority of our fuel services contracts use a base-escalated mechanism per kgU and reflect the market at the time the contract is accepted.

OPTIMIZING OUR CONTRACT PORTFOLIO

We work with our customers to optimize the value of our contract portfolio. With respect to new contracting activity, there is often a lag from when contracting discussions begin and when contracts are executed. With our large pipeline of business under negotiation in our uranium segment, and a value driven strategy, we continue to be strategically patient in considering the commercial terms we are willing to accept. Much of our pending business is off-market but we are starting to see more on-market activity emerge. We remain confident that we can add acceptable new sales commitments to our portfolio of long-term contracts to underpin the long-term operation of our productive capacity and capture long-term value.

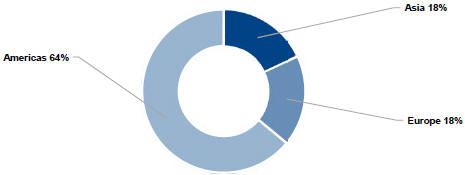

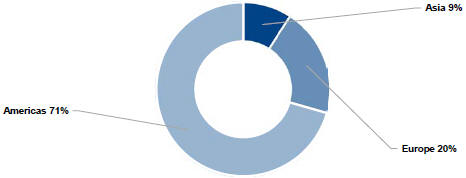

Given our view that uranium prices need to rise to ensure the availability of long-term supply to fuel growing demand for safe, clean, reliable, carbon-free nuclear energy, our preference today is to sign long-term contracts with market-related pricing mechanisms. Unsurprisingly, we believe our customers too expect prices to rise and prefer to lock-in today’s prices, with a fixed-price mechanism. Our goal is to balance all these factors, along with our desire for customer and regional diversification, with product form, and logistical factors to ensure we have adequate protection and will benefit from higher prices under our contract portfolio, while maintaining exposure to the rewards that come from having low-cost supply to deliver into a strengthening market.

With respect to our existing contracts, at times we may also look for opportunities to optimize the value of our portfolio. In cases where a customer is seeking relief under an existing contract due to a challenging policy, operating, or economic environment, or we deem the customer’s long-term demand to be at risk, we may consider options that are beneficial to us and allow us to maintain our customer relationships.

CONTRACT PORTFOLIO STATUS

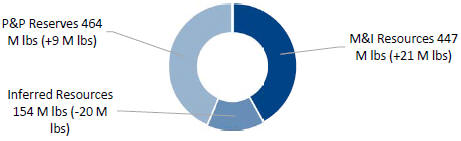

We have commitments to sell over 160 million pounds of U3O8 with 34 customers worldwide in our uranium segment, and over 48 million kilograms as UF6 conversion with 30 customers worldwide in our fuel services segment.

MANAGEMENT’S DISCUSSION AND ANALYSIS 21