- CCJ Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Cameco (CCJ) 6-KCurrent report (foreign)

Filed: 20 Feb 25, 7:29am

Exhibit 99.3

Management’s discussion and analysis

February 20, 2025

| 10 | MARKET OVERVIEW AND DEVELOPMENTS | |

| 17 | 2024 PERFORMANCE HIGHLIGHTS | |

| 22 | OUR VALUES AND STRATEGY | |

| 32 | OUR SUSTAINABILITY PRINCIPLES AND PRACTICES | |

| 35 | MEASURING OUR RESULTS | |

| 37 | FINANCIAL RESULTS | |

| 73 | OPERATIONS AND PROJECTS | |

| 107 | MINERAL RESERVES AND RESOURCES | |

| 112 | ADDITIONAL INFORMATION | |

This management’s discussion and analysis (MD&A) includes information that will help you understand management’s perspective of our audited consolidated financial statements (financial statements) and notes for the year ended December 31, 2024. The information is based on what we knew as of February 19, 2025.

We encourage you to read our audited consolidated financial statements and notes as you review this MD&A. You can find more information about Cameco, including our financial statements and our most recent annual information form, on our website at cameco.com, on SEDAR+ at www.sedarplus.ca, or on EDGAR at www.sec.gov. You should also read our annual information form before making an investment decision about our securities.

The financial information in this MD&A and in our financial statements and notes is prepared according to International Financial Reporting Standards (IFRS), unless otherwise indicated.

Unless we have specified otherwise, all dollar amounts are in Canadian dollars.

Throughout this document, the terms we, us, our, the Company and Cameco mean Cameco Corporation and its subsidiaries, unless otherwise indicated.

Caution about forward-looking information

Our MD&A includes statements and information about our expectations for the future. When we discuss our strategy, plans, future financial and operating performance, or other things that have not yet taken place, we are making statements considered to be forward-looking information or forward-looking statements under Canadian and United States (US) securities laws. We refer to them in this MD&A as forward-looking information.

Key things to understand about the forward-looking information in this MD&A:

| • | It typically includes words and phrases about the future, such as: anticipate, believe, estimate, expect, forecast, goal, intend, outlook, plan, project, strategy, target, vision, and will (see examples below). |

| • | It represents our current views and can change significantly. |

| • | It is based on a number of material assumptions, including those we have listed on page 5, which may prove to be incorrect. |

| • | Actual results and events may be significantly different from what we currently expect, due to the risks associated with our business. We list a number of these material risks on page 4. We recommend you also review our most recent annual information form, which includes a discussion of other material risks that could cause actual results to differ significantly from our current expectations. |

| • | Forward-looking information is designed to help you understand management’s current views of our near- and longer-term prospects, and it may not be appropriate for other purposes. We will not necessarily update this information unless we are required to by securities laws. |

Examples of forward-looking information in this MD&A

| • | our view that we have the strengths to take advantage of the world’s rising demand for safe, secure, reliable, affordable and carbon-free energy |

| • | that we will continue to focus on delivering our products responsibly and addressing the risks and opportunities that we believe will make our business sustainable and will build long-term value |

| • | our expectations about when future reactors will come online |

| • | our expectations about 2025 and future global uranium supply, consumption, contracting, demand, geopolitical issues and the market including the discussion under the heading Market overview and developments |

| • | our expectations for the future of the nuclear industry and the potential for new enrichment technology, including that nuclear power must be a central part of the solution to the world’s shift to a low-carbon climate-resilient economy and that our investment in enrichment technology, if successful, will allow us to participate in the entire nuclear fuel value chain |

| • | our efforts to participate in the commercialization and deployment of small modular reactors (SMRs) and increase our contributions to decarbonization and help provide energy security by exploring SMRs and other emerging opportunities within the fuel cycle |

| • | our expectations about future demand for SMRs |

| • | our views on our ability to self-manage risk |

| • | the discussion under the heading Our business |

| • | the discussion under the heading Our strategy |

| • | our expectations regarding the effect of supply scarcity on our long-term contract portfolio |

| • | our expectations regarding the operation of, and production levels for, the Cigar Lake mine and McArthur River/Key Lake operation and fuel services, as well as our exploration activities at these and other sites |

| • | our expectations regarding the future average unit cost of production at McArthur River/Key Lake at Cigar Lake and at JV Inkai operations |

| • | our expectations regarding our licences for McArthur River, Key Lake and Crow Butte |

| • | Kazatomprom’s planned production levels for JV Inkai and the timing of deliveries, and our other expectations regarding JV Inkai |

| • | the discussion under the heading Our Sustainability principles and practices including our belief that we can be part of the solution to enhance national, energy and climate security, and our position to deliver significant long-term business value |

| • | our expectations for uranium purchases, sales and deliveries |

| • | our intentions regarding future dividend payments |

| • | the discussion of our expectations relating to our Canada Revenue Agency (CRA) transfer pricing dispute, including our confidence that the courts would reject any attempt by CRA to utilize the same or similar positions for other tax years currently in dispute, our plan to file a notice of objection for 2018 and our belief that CRA should return the full amount of cash and security that has been paid or otherwise secured by us |

| • | the discussion of our future plans for Cigar Lake and McArthur River/Key Lake under the heading 2024 performance highlights |

| • | our views on our ability to align our production with market opportunities and our contract portfolio |

| • | our expectation regarding opportunities to improve operational effectiveness and to reduce our impact on the environment, including through the use of digital and automation technologies |

| • | the discussion under the heading Outlook for 2025, including expected business resiliency, expectations for 2025 average unit cost of sales, average purchase price per pound, deliveries and production, 2025 financial outlook, our revenue, tax rates, adjusted net earnings and cash flow sensitivity, and our price sensitivity analysis for our uranium segment |

2 CAMECO CORPORATION

| • | the discussion under the heading Liquidity and capital resources, including expected liquidity to meet our 2025 obligations |

| • | our expectation that the uranium contract portfolio we have built will continue to provide a solid revenue stream, and our portfolio management strategy, including our inventory strategy and the extent of our spot market purchases |

| • | our expectation that our cash balances and operating cash flows will meet our anticipated 2025 capital requirements |

| • | our expectations for our and Westinghouse Electric Company’s (Westinghouse) future capital expenditures and sources of funds |

| • | our expectation that in 2025 we will be able to comply with all the covenants in our credit agreements |

| • | our expectation that Westinghouse will continue to comply with the covenants in its credit agreements |

| • | life of mine operating cost estimates for the Cigar Lake, McArthur River/Key Lake and JV Inkai operations |

| • | our future plans and expectations for uranium properties, advanced uranium projects, and fuel services operating sites, including production levels and suspension of production at certain properties, pace of advancement and expansion capacity, carbon reduction targets and mine life, and that our core growth is expected to come from our existing mining and fuel services assets |

| • | our expectations related to care and maintenance costs |

| • | our mineral reserve and resource estimates |

| • | our decommissioning estimates |

| • | the discussion of our expectations relating to our 49% interest in Westinghouse, including the investment in Westinghouse expanding our participation in the nuclear fuel value chain, Westinghouse providing a platform for further growth, and various factors and drivers for Westinghouse’s business segment |

| • | our expectation that our investment in Westinghouse will enhance our participation in the nuclear fuel cycle |

| • | our expectation that our investment in Westinghouse will be accretive to us and augment the core of our business |

| • | our expectation of Westinghouse being well positioned to participate in the growing demand profile for nuclear energy |

| • | our plans to update our physical climate risk assessments, incorporate these findings into our internal risk management review and developing an adaptation action plan template and our expectations regarding the timing for implementation of these plans |

| • | our expectations regarding our research and development expenses for 2025 |

| • | our expectations regarding the Canadian Nuclear Safety Commission’s review of our preliminary decommissioning cost estimate for the Port Hope conversion facility |

| • | our expectations regarding which extraction methods we will use in the future |

| • | our expectation that Westinghouse’s durable and growing business will allow Westinghouse to self-fund its approved annual operating budget, maintain its existing capacity to service its annual financial obligations from de-risked cash flows, and pay annual distributions to its owners |

| • | our 2025 outlook for Westinghouse, including Adjusted EBITDA, capital expenditures and revenue |

| • | our expectation that strategic initiatives, including the development of the AP300™ small modular reactor and the eVinci™ microreactor, will provide new business opportunities for Westinghouse that will make a meaningful contribution to Westinghouse’s long-term financial performance |

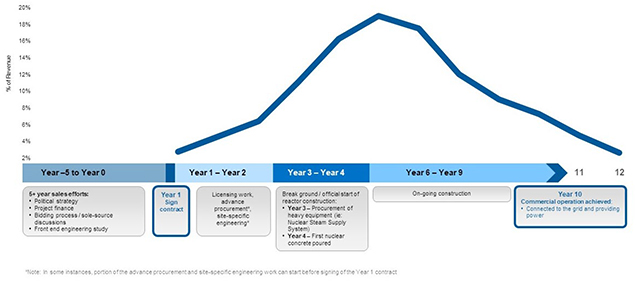

| • | our expectation for Westinghouse projects generating multi-year revenue streams and EBITDA for Westinghouse |

| • | our expectation that the timing of cash distributions from Westinghouse will be aligned with the timing of Westinghouse’s cash flows |

| • | our expectation that Westinghouse’s new opportunities will allow Westinghouse to compete for and win new business |

| • | our expectation that Westinghouse’s reputation and position will benefit its core business as Eastern European countries seek to develop a reliable fuel supply chain |

| • | our expectations regarding the growth of Westinghouse’s Adjusted EBITDA over the next five years |

| • | our estimates in respect of the framework for the timing of revenue flows and profitability of contracts under a new build project |

| • | our expectations with respect to the development of the AP300 small modular reactor and eVinci microreactor |

| • | our expectation on Westinghouse being well-positioned for future growth |

| • | our expectations regarding when Global Laser Enrichment’s technology will be deployed at a commercial scale |

MANAGEMENT’S DISCUSSION AND ANALYSIS 3

Material risks

| • | actual sales volumes or market prices for any of our products or services are lower than we expect, or cost of sales is higher than we expect, for any reason, including changes in market prices, loss of market share to a competitor, trade restrictions, geopolitical issues or the impact of a pandemic |

| • | we are adversely affected by changes in currency exchange rates, interest rates, royalty rates, tax rates, tariffs or inflation |

| • | our production costs are higher than planned, or necessary supplies are not available, or not available on commercially reasonable terms |

| • | our strategies may change, be unsuccessful or have unanticipated consequences, or we may not be able to achieve anticipated operational flexibility and efficiency |

| • | changing views of governments regarding the pursuit of carbon reduction strategies or our view may prove to be inaccurate on the role of nuclear power in pursuit of those strategies |

| • | our estimates and forecasts prove to be inaccurate, including production, purchases, deliveries, cash flow, revenue, costs, decommissioning, reclamation expenses, or timing or receipt of future dividends from JV Inkai |

| • | that we may not realize the expected benefits from our investment in Westinghouse or any of our other joint venture investments |

| • | Westinghouse fails to generate sufficient cash flow to fund its approved annual operating budget or make distributions to the partners |

| • | we are unable to enforce our legal rights under our existing agreements, permits or licences |

| • | we are subject to litigation or arbitration that has an adverse outcome |

| • | that the courts may accept the same, similar or different positions and arguments advanced by CRA to reach decisions that are adverse to us for other tax years |

| • | the possibility of a materially different outcome in disputes with CRA for other tax years |

| • | that CRA does not agree that the court rulings for the years that have been resolved in Cameco’s favour should apply to subsequent tax years |

| • | that CRA will not return all or substantially all of the cash and security that has been paid or otherwise secured in a timely manner, or at all |

| • | there are defects in, or challenges to, title to our properties |

| • | our mineral reserve and resource estimates are not reliable, or there are unexpected or challenging geological, hydrological or mining conditions |

| • | we are affected by environmental, safety and regulatory risks, including workforce health and safety or increased regulatory burdens or delays resulting from a pandemic or other causes |

| • | we are adversely affected by subsurface contamination from current or legacy operations |

| • | necessary permits or approvals from government authorities cannot be obtained or maintained |

| • | we are affected by political risks, including developments in US foreign policy, global conflicts, sanctions or any potential future unrest in Kazakhstan |

| • | we may be affected by crime, corruption, making improper payments or providing benefits that may violate Canadian or US law or laws relating to foreign corrupt practices or sanctions |

| • | operations are disrupted due to problems with our own or our suppliers’ or customers’ facilities, the unavailability of reagents, equipment, operating parts and supplies critical to production, equipment failure, lack of tailings capacity, labour shortages, labour relations issues, strikes or lockouts, underground floods, cave-ins, ground movements, tailings dam failures, transportation disruptions or accidents, aging infrastructure or other development and operating risks |

| • | we are affected by terrorism, sabotage, blockades, civil unrest, social or political activism, outbreak of illness (such as a pandemic), accident or a deterioration in political support for, or demand for, nuclear energy |

| • | a major accident at a nuclear power plant |

| • | we are impacted by changes in the regulation or public perception of the safety of nuclear power plants, which adversely affect the construction of new plants, the relicensing of existing plants and the demand for uranium |

| • | government laws, regulations, policies or decisions that adversely affect us, including tax and trade laws, tariffs and sanctions, including changes in mining laws or regulations |

| • | our uranium suppliers or purchasers fail to fulfil their commitments |

| • | our McArthur River development, mining or production plans are delayed or do not succeed for any reason |

| • | our Cigar Lake development, mining or production plans are delayed or do not succeed for any reason |

| • | our production plans for our fuel services segment do not succeed for any reason |

| • | the McClean Lake’s mill production plan is delayed or does not succeed for any reason |

| • | water quality and environmental concerns could result in a potential deferral of production and additional capital and operating expenses required for the Cigar Lake and McArthur River/Key Lake operations |

| • | JV Inkai’s development, mining or production plans are delayed or do not succeed for any reason, or JV Inkai is unable to transport and deliver its production |

| • | we may be unsuccessful in pursuing innovation or implementing advanced technologies, including the risk that the commercialization and deployment of SMRs or new enrichment technology may incur unanticipated delays or expenses, or ultimately prove to be unsuccessful |

| • | our expectations relating to care and maintenance costs prove to be inaccurate |

| • | the risk that we may not be able to realize our expected cash flow |

| • | the risk that we may become unable to pay future dividends at the expected rate |

4 CAMECO CORPORATION

| • | we are affected by natural phenomena, including inclement weather, fire, flood and earthquakes |

| • | the risks that generally apply to all our operations and advanced uranium projects that are discussed under the heading Managing the risks beginning on page 70 |

| • | the risks relating to our tier-one uranium operations discussed under the heading McArthur River mine/Key Lake mill – Managing Our Risks beginning on page 75, under the heading Cigar Lake – Managing Our Risks beginning on page 79, and under the heading Inkai – Managing Our Risks beginning on page 83 |

| • | unexpected changes in uranium supply, demand, long-term contracting, and prices |

| • | changes in consumer demand for nuclear power and uranium as a result of changing societal views and objectives regarding nuclear power, electrification and decarbonization |

| • | the risk that our views regarding nuclear power, its growth profile, and benefits may prove to be incorrect |

| • | the risk that we and Westinghouse may not be able to meet sales commitments for any reason |

| • | the risk that Westinghouse may not achieve the expected growth in its business |

| • | the risk to Westinghouse’s business associated with potential production disruptions, including those related to global supply chain disruptions, global economic uncertainty, political volatility, labour relations issues, and operating risks |

| • | the risk that Westinghouse may not be able to implement its business objectives in a manner consistent with its or our sustainability principles and other values |

| • | the risk that Westinghouse’s strategies may change, be unsuccessful, or have unanticipated consequences |

| • | the risk that Westinghouse may be unsuccessful in respect of its new business |

| • | the risk that Westinghouse may be delayed in announcing its future financial results |

| • | the risk that Westinghouse may fail to comply with nuclear licence and quality assurance requirements at its facilities |

| • | the risk that Westinghouse may lose protections against liability for nuclear damage, including discontinuation of global nuclear liability regimes and indemnities |

| • | the risk that increased trade barriers may adversely impact our business, or the business of any of the joint ventures in which we have invested |

| • | the risk that Westinghouse may default under its credit facilities, impacting adversely Westinghouse’s ability to fund its ongoing operations and to make distributions |

| • | the risk that liabilities at Westinghouse may exceed our estimates and the discovery of unknown or undisclosed liabilities |

| • | the risk that occupational health and safety issues may arise at Westinghouse’s operations |

| • | the risk that there may be disputes between us and Brookfield Renewable Partners (Brookfield) regarding our strategic partnership, or disputes between us and any of our other joint venture partners |

| • | the risk that we may default under the governance agreement with Brookfield, including us losing some or all of our interest in Westinghouse |

Material assumptions

| • | our expectations regarding sales and purchase volumes and prices for uranium and fuel services, cost of sales, trade restrictions, inflation and that counterparties to our sales and purchase agreements will honour their commitments |

| • | our expectations for the nuclear industry, including its growth profile, market conditions, geopolitical issues and the demand for and supply of uranium |

| • | the continuing pursuit of carbon reduction strategies by governments and the role of nuclear in the pursuit of those strategies |

| • | the assumptions discussed under the heading 2025 Financial Outlook |

| • | our expectations regarding spot prices and realized prices for uranium, and other factors discussed under the heading Price sensitivity analysis: uranium segment |

| • | Westinghouse’s ability to generate cash flow and fund its approved annual operating budget and make distributions to the partners |

| • | our ability to compete for additional business opportunities so as to generate additional revenue for us as a result of our investment in Westinghouse |

| • | market conditions and other factors upon which we based our investment in Westinghouse and our related forecasts will be as expected |

| • | the success of our plans and strategies relating to our investment in Westinghouse and our other joint venture investments |

| • | that the construction of new nuclear power plants and the relicensing of existing nuclear power plants will not be more adversely affected than expected by changes in regulation or in the public perception of the safety of nuclear power plants |

| • | our ability to continue to supply our products and services in the expected quantities and at the expected times |

| • | our expected production levels for Cigar Lake, McArthur River/Key Lake, JV Inkai and our fuel services operating sites |

| • | our cost expectations, including production costs, operating costs, and capital costs |

| • | our expectations regarding tax payments, tax rates, tariffs, royalty rates, currency exchange rates and interest rates |

| • | our entitlement to and ability to receive expected refunds and payments from CRA |

MANAGEMENT’S DISCUSSION AND ANALYSIS 5

| • | in our dispute with CRA, that courts will reach consistent decisions for other tax years that are based upon similar positions and arguments |

| • | that CRA will not successfully advance different positions and arguments that may lead to different outcomes for other tax years |

| • | our expectation that we will recover all or substantially all of the amounts paid or secured in respect of the CRA dispute to date |

| • | our decommissioning and reclamation estimates, including the assumptions upon which they are based, are reliable |

| • | our mineral reserve and resource estimates, and the assumptions upon which they are based, are reliable |

| • | our understanding of the geological, hydrological and other conditions at our uranium properties |

| • | our Cigar Lake and McArthur River development, mining and production plans succeed |

| • | our Key Lake mill production plan succeeds |

| • | the McClean Lake mill is able to process Cigar Lake ore as expected |

| • | our production plans for our fuel services segment succeed |

| • | JV Inkai’s development, mining and production plans succeed, and that JV Inkai will be able to transport and deliver its production |

| • | the ability of JV Inkai to pay dividends, or the timing of their payments |

| • | that care and maintenance costs will be as expected |

| • | our and our contractors’ ability to comply with current and future environmental, safety and other regulatory requirements, and to obtain and maintain required regulatory approvals |

| • | that we will be successful in our efforts to renew our operating licence for Crow Butte |

| • | assumptions regarding our expected cash flow |

| • | our operations and those of our joint venture investments are not significantly disrupted as a result of political instability, sanctions, nationalization, developments in US foreign policy, terrorism, sabotage, blockades, civil unrest, breakdown, natural disasters, outbreak of illness (such as a pandemic), governmental or political actions, litigation or arbitration proceedings, the unavailability of reagents, equipment, operating parts and supplies critical to production, labour shortages, labour relations issues, strikes or lockouts, underground floods, cave-ins, ground movements, tailings dam failure, lack of tailings capacity, transportation disruptions or accidents, aging infrastructure or other development or operating risks |

| • | that no major accident at a nuclear power plant will occur |

| • | nuclear power and uranium demand, supply, consumption, long-term contracting, growth in the demand for and global public acceptance of nuclear energy, and prices |

| • | Westinghouse’s production, purchases, sales, deliveries, and costs |

| • | the assumptions and discussion set out under the heading Westinghouse Electric Company – Future Prospects |

| • | the market conditions and other factors upon which we have based Westinghouse’s future plans and forecasts |

| • | Westinghouse’s ability to mitigate adverse consequences of delays in production and construction |

| • | the success of Westinghouse’s plans and strategies |

| • | the absence of new and adverse laws, government regulations, policies or decisions in any country where such developments would affect us, including with respect to changes in mining laws or regulations |

| • | that there will not be any significant adverse consequences to Westinghouse’s business resulting from business disruptions, including those relating to supply disruptions, economic or political uncertainty and volatility, labour relation issues, and operating risks |

| • | Westinghouse’s ability to announce future financial results when expected |

| • | Westinghouse will comply with the covenants in its credit agreements |

| • | Westinghouse will comply with nuclear licence and quality assurance requirements at its facilities |

| • | Westinghouse maintaining protections against liability for nuclear damage, including continuation of global nuclear liability regimes and indemnities |

| • | that known and unknown liabilities at Westinghouse will not materially exceed our estimates |

| • | the absence of disputes between us and Brookfield or any of our other joint venture partners regarding our strategic partnership or joint venture arrangements, and that we do not default under the governance agreement with Brookfield or any other joint venture agreement to which we are a party |

6 CAMECO CORPORATION

[This page is intentionally left blank.]

8 CAMECO CORPORATION

MANAGEMENT’S DISCUSSION AND ANALYSIS 9

Market overview and developments

A market in transition

In 2024, geopolitical uncertainty and heightened concerns about energy security, national security, and climate change continued to improve the demand and supply fundamentals for the nuclear power industry and the fuel cycle that is required to support it. Increasingly, countries and companies around the globe are recognizing the critical role nuclear power must play in providing carbon-free and secure baseload power which was evidenced at the 29th Conference of Parties (COP29), where a total of 31 countries have now signed the declaration to triple nuclear energy capacity by 2050. This growing support has led to a rise in demand as closed reactors are returning to service, reactors are being saved from retirement, life extensions are being sought and approved for existing reactor fleets, and numerous commitments and plans are advancing for the construction of new nuclear generating capacity. In addition, there is increasing interest in small modular reactors (SMR), including smaller versions of existing technology and advanced technology designs, with companies in energy intensive sectors looking to nuclear to help achieve their decarbonization plans. The potential expansion of the markets and use cases for nuclear energy could add significant demand in the decades to come, with a growing number of agreements being signed and several projects already underway.

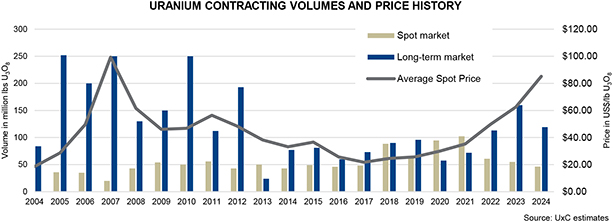

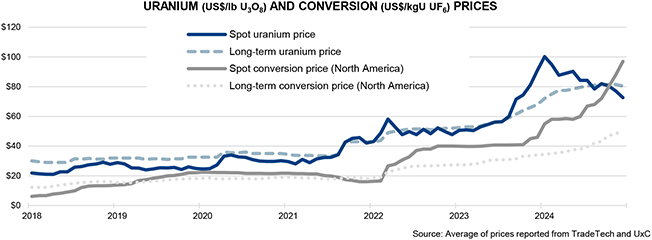

While demand for uranium and nuclear fuel continues to increase, future supply is not keeping pace. Heightened supply risk caused by growing geopolitical uncertainty, shrinking secondary supplies and a lack of investment in new capacity over the past decade has motivated utilities to evaluate their near-, mid- and long-term nuclear fuel supply chains. The uncertainty about where nuclear fuel supplies will come from to satisfy growing demand has led to significant long-term contracting activity in recent years. In 2024, about 119 million pounds of uranium was placed under long-term contracts by utilities. While the volume remains below replacement rate, this potentially increases the cumulative level of uncovered requirements in the future, when primary supply is expected to be limited, and secondary supply stocks have been drawn down. Prices across the nuclear fuel cycle continued to trend higher in 2024, reaching historic highs in conversion, where spot price increased 111% and term price rose 46% compared to 2023, and in enrichment, where spot and term prices rose over 23% and 10% respectively compared to 2023. At the front end of the cycle, uranium spot prices experienced volatility and averaged $85 (US) per pound for 2024, while the long-term uranium price increased 19% over the prior year, ending 2024 above $80 (US) per pound. We expect continued competition to secure uranium, conversion services and enrichment services under long-term contracts with proven sustainable producers and suppliers who have a diversified portfolio of assets in geopolitically attractive jurisdictions, and on terms that help ensure a reliable supply is available to satisfy demand.

DURABLE DEMAND GROWTH

The benefits of nuclear energy have come clearly into focus, supporting a level of durability that, we believe, has not been previously seen. The durability is being driven not only by the geopolitical realignment in energy markets but also by a global focus on achieving the net-zero carbon targets set by countries and companies around the world. Geopolitical uncertainty has deepened concerns about energy security and national security, highlighting the role of energy policy in balancing three main objectives: providing a reliable and secure baseload profile; providing an affordable, levelized cost profile; and providing a clean emissions profile. Net-zero carbon targets are also turning global attention to a broader triple challenge: about one-third of the global population must be lifted out of energy poverty by improving access to clean and reliable baseload electricity; approximately 80% of the current global electricity grids that run on carbon-emitting sources of thermal power must be replaced with a carbon-free, reliable alternative; and global power grids must grow by electrifying industries, such as private and commercial transportation, and home and industrial heating, which today are largely powered with carbon-emitting sources of thermal energy. There is increasing recognition that nuclear power meets these objectives and has a key role to play in achieving energy security and decarbonization goals. The growth in demand is not just long-term and in the form of new builds, but medium-term in the form of reactor restarts and life extensions, and near-term with early reactor retirement plans being deferred or cancelled and new markets continuing to emerge. Long-term momentum remains very supportive with the installed base of nuclear capacity and an increasing focus on large-scale new build and the development of SMRs.

10 CAMECO CORPORATION

Demand and energy policy highlights

| • | The inaugural Nuclear Energy Summit was held in Brussels in March, jointly organized by Belgium and the International Atomic Energy Agency (IAEA) with representatives from 32 countries in attendance. The leaders backed supportive measures in areas including financing, regulatory cooperation, technological innovation and workforce training to enable the expansion of nuclear power to help address climate change and boost energy security. |

| • | At the 29th annual Conference of Parties (COP29), the 2024 United Nations Climate Change Conference held in Baku, Azerbaijan, six new countries were added to the declaration to triple nuclear energy capacity by 2050, bringing the total to 31. It was recognized that financing mechanisms will play a key role in meeting targets, and the increased interest and investment from some of the world’s largest and advanced technology companies could help support future nuclear deployment. |

| • | The International Energy Agency’s (IEA) 2024 World Energy Outlook report was released in October. The projections for global electricity demand in the Stated Policies Scenario (SPS) increased 6%, or 2,200 terawatt-hours (TWh) higher in 2035, driven primarily by light industrial consumption, cooling, mobility, and data centers and artificial intelligence (AI). Nuclear generation showed a modest increase in the SPS while the Net Zero Scenario (NZE) shows a 16% increase to 7,000 TWh by 2050, compared to 6,000 TWh in the previous report. |

| • | In China, China National Nuclear Corporation (CNNC) started construction at Zhangzhou unit 3 in early 2024, a domestically designed Hualong One (HPR1000), with plans for six more units at the site. CNNC also commenced construction at the Jinqimen nuclear project where it has plans for six HPR1000s. Additionally, China General Nuclear announced that Fangchenggang unit 4, an HPR1000, began loading fuel in February and began operating on April 1. Finally, in August, four new CAP1400 reactors that use Westinghouse technology were approved, bringing the total number of approved reactors in China to 16. |

| • | In Japan, Onagawa unit 2 restarted in October, becoming the first boiling water reactor (BWR) to return to operation under the post-2011 Japanese Nuclear Regulatory Authority (NRA) safety regime. Additionally, Chugoku Electric Power Company successfully restarted Shimane unit 2 in December, bringing the total number of restarted reactors to 14. Finally, the NRA approved a 10-year life extension for two of Kansai’s reactors, Ohi units 3 and 4, from 30 years to 40 years, allowing them to operate until 2061 and 2063, respectively. |

| • | In South Korea, Korea Hydro & Nuclear Power (KHNP) announced that Shin Hanul unit 2 entered commercial operation, while units 3 and 4 are proceeding toward construction. In addition, Saeul units 3 and 4 are progressing through construction, which upon completion will mark 30 units operating in the country. KHNP also initiated the process to extend the lives of Wolsong units 2, 3 and 4. |

| • | In India, the Atomic Energy Commission reaffirmed the country’s plan to triple nuclear power generation by 2030 from current output of 7.5 GWe, with an additional nine reactors currently under construction and additional units planned at various sites, which could potentially include SMRs. The most recent activity has been at Rajasthan unit 7, which is expected to be fully operational in early 2025, and Rajasthan unit 8 which is expected to come online in early 2026. |

| • | In the Czech Republic, the government announced KHNP as the preferred bid for the construction of two additional units at the existing Dukovany nuclear site and two at the Temelin site. |

| • | Energoatom saw first concrete poured in the construction of Khmelnitski units 5 and 6. The new reactors will be the first built in Ukraine using Westinghouse’s AP1000® technology. |

| • | Italy is moving towards a reversal of the country’s current ban on nuclear power production with plans to finalize a nuclear reintroduction strategy by the end of 2027. |

| • | In Poland, the government approved a plan to build an SMR based on designs from Rolls-Royce. Additionally, Polskie Elektrownie Jądrowe announced it has received a Letter of Interest for $1.5 billion (US) in potential financing from Export Development Canada to support Poland’s AP1000 project, which aims to be the country’s first nuclear power plant. |

| • | In Romania, the US Exim Bank approved a $98 million (US) loan commitment for the financing of an SMR project utilizing NuScale technology, with additional funding announcements at the G7 leaders’ summit, totaling up to $275 million (US). The project aims for 462 MWe of capacity at a retired coal plant in the country, with a total of six 77 MWe modules to be constructed. |

| • | In Egypt, the fourth and final VVER-1200 unit at El Dabba began construction. Unit 1 is expected to begin commercial operation in 2029 with the remaining three to follow in the early to mid-2030s. |

| • | Following a lengthy legal battle, Brazilian utility Electronuclear was successful in appealing the government ordered suspension of activity at Angra unit 3, a 1,350 MWe reactor, allowing it to continue construction. |

MANAGEMENT’S DISCUSSION AND ANALYSIS 11

| • | In the US, Southern Company announced that Vogtle unit 4, a Westinghouse AP1000, moved into commercial operation, making it the second new reactor to come online in the US in over 28 years. |

| • | The US Nuclear Regulatory Commission approved Dominion’s North Anna units 1 and 2 for an extension of their operating licences from 60 to 80 years, keeping the reactors online until the 2050s, while Vistra received approval to operate Comanche Peak units 1 and 2 for up to 60 years. Additionally, approval was received to extend Pacific Gas & Electric’s two-unit Diablo Canyon plant operation until 2030, while filings have already been made to extend the operating lives of the units a further 20 years, until the mid-2040s. |

| • | The US Department of Energy (DOE) released its Advanced Nuclear Commercial Liftoff report, outlining the need to add 200 GWe of new generating capacity in order to triple US nuclear capacity by 2050, as part of their net-zero emissions target. Starting in 2030, the report calls for a 13 GWe annual increase in output for 15 years to reach 300 GWe by 2050. This increase is expected to come from extending reactor operating licences, uprating of capacity, and restarting shutdown reactors, along with new large scale and advanced reactors. The report also calls for a significant increase in capacity across the nuclear fuel supply chain and notably, a secure supply of uranium from the US, allies, and partners. |

| • | The US DOE announced plans to finance $900 million (US) for deployment of light-water SMRs, with $800 million (US) of the funding for two of the “first-mover teams” which can include utilities, SMR producers, vendors, and other end-users. In addition, former President Biden signed the Accelerating Deployment of Versatile, Advanced Nuclear for Clean Energy (ADVANCE) Act into law, which builds on prior legislation to modernize licensing, speed up the licensing process and reduce fees, while simplifying the environmental review process. |

| • | Numerous utilities made positive progress towards restarting shutdown nuclear plants in 2024. Holtec International announced their intention to restart the Palisades 800 MWe pressurized water reactor in Michigan, with both state and federal governments backing the effort, which would mark the first US reactor to restart after being shut down for decommissioning. Additionally, NextEra Energy announced they have initiated the regulatory process to restart the Duane Arnold plant, which could see the reactor returning to operation as early as 2028. Finally, Constellation Energy announced their $1.6 billion (US) plan to restart the 835 MWe Crane Clean Energy Center (formerly Three Mile Island Unit 1) in Pennsylvania. The restart is planned for 2028 with Microsoft agreeing to a 20-year power purchase agreement to support the investments in restarting the plant. |

| • | With the rapid expansion of AI and data center demand, numerous other technology companies also made commitments to nuclear for both large scale and SMR projects. Notably, Google announced a deal with Kairos Power to buy the output from at least six first-of-a-kind fluoride salt-cooled, high-temperature reactors. Additionally, Amazon and Energy Northwest announced an agreement for Amazon to fund the development of SMRs, with the right to purchase power from the first four Xe-100 units (320 MWe) and an option for Energy Northwest to build up to eight additional units (640 MWe). Finally, Sabey, a US data center developer, is working with TerraPower to explore the deployment of Natrium SMRs at current and future data center sites. |

| • | In Canada, Bruce Power submitted plans for its Bruce C Project, planning to add 4.8 GWe of new generation to complement 6.5 GWe of existing generation. In early 2025, the Ontario government announced plans for Ontario Power Group (OPG) to construct a 10 GWe nuclear plant near Port Hope. In addition, OPG is proceeding with refurbishments of Pickering B’s four units, expected to be completed by the mid-2030s and extending the plants’ operating lives by 30 years. OPG also successfully completed initial site preparation at the Darlington plant for the first of four GE-Hitachi BWRX-300 SMRs, with the nuclear portion of construction for the first unit set to start in early 2025, with planned commercial operation in 2029. |

| • | Westinghouse opened a new nuclear engineering hub in Kitchener, Ontario, where 50 engineers will be stationed. In addition, SaskPower, Westinghouse, and Cameco signed a Memorandum of Understanding to evaluate Saskatchewan’s clean energy needs involving discussions on the AP1000, AP300 and eVinci reactors. The province will be evaluating the suitability of its infrastructure for a nuclear fuel supply chain through SaskNuclear, a newly formed subsidiary of SaskPower. |

12 CAMECO CORPORATION

According to the IAEA, globally there are currently 440 operable reactors and 62 reactors under construction. Several nations are appreciating the energy security and carbon-free energy benefits of nuclear power and have reaffirmed their commitment with plans underway to support existing reactor units and review policies to encourage more nuclear generation. Several other non-nuclear countries have emerged as candidates for new nuclear capacity. In some countries where phase-out policies have been in place, policy reversals and decisions have been made to keep reactors running, with public opinion polls showing increasing support. With a number of reactor construction projects recently approved and many more planned, demand for uranium continues to improve. There is growing recognition of the role nuclear must play in providing safe, affordable, carbon-free baseload electricity to achieve a low-carbon economy, with geopolitical uncertainty causing some utilities to move away from Russian energy supplies and seek nuclear fuel suppliers whose values are aligned with their own, or whose origin of supply better protects them from potential interruptions.

SUPPLY UNCERTAINTY

Geopolitical uncertainty, energy security, and national security remained the most notable factors impacting security of supply in 2024. Driven by the Russian invasion of Ukraine, the mine suspension in Niger, and supply chain challenges, particularly in Kazakhstan, many governments and utilities are re-examining procurement strategies that rely on nuclear fuel supplies from these jurisdictions. In addition, sanctions on Russia and import/export restrictions added to the delivery risks for nuclear fuel supplies coming out of Central Asia. Several uranium projects restarted in 2024 in support of increased demand, though delays and higher-than-expected production costs were a common theme. Despite the positive price trend in 2024, the deepening geopolitical uncertainty, sanctions and trade policy restrictions, and years of underinvestment in new uranium and fuel cycle service capacities has shifted risk from producers to utilities.

MANAGEMENT’S DISCUSSION AND ANALYSIS 13

Supply and trade policy highlights

| • | The Prohibiting Russian Uranium Imports Act (H.R. 1042) went into effect in August with the intent to prohibit the imports of Russian low-enriched uranium (LEU) into the US until 2040. It contains a US DOE waiver process available until 2028, where utilities can apply through a public process for an exception to the import ban in situations concerning energy and national security. In November, the Russian government issued a decree to immediately limit the export of LEU to the US, which was meant to be symmetrical to the trade actions taken by the US earlier in the year. This resulted in two ships departing from St. Petersburg to Baltimore without any of their intended enriched uranium product cargo onboard. |

| • | The DOE approved funding of up to $2.7 billion (US) to support domestic production of LEU and high-assay low-enriched uranium (HALEU) by creating a guaranteed buyer of US-produced nuclear fuel to restore US nuclear fuel production capabilities. Initial awards were granted for HALEU in October and LEU in December. |

| • | In January 2025, Kazatomprom (KAP) announced that 2024 production increased 10% from the prior year to 60.5 million pounds U3O8. No update was provided on 2025 production guidance beyond its previous announcement from August 2024, where it lowered its 2025 guidance range to 65 million to 68.9 million pounds U3O8 (previously 79.3 million to 81.9 million pounds U3O8), citing project delays and continued sulfuric acid shortages. A significant portion of the reduced 2025 guidance resulted from production delays at Appak LLP, as well as JV Budenovskoye LLP. Additionally, KAP reduced production guidance for JV KATCO LLP below annual production capacity until at least 2026. |

| • | In July, the government of Kazakhstan introduced amendments to the Tax Code of the Republic of Kazakhstan which involved changes to the Mineral Extraction Tax (MET) rate for uranium. The MET rate will increase from 6% in 2024, to 9% in 2025, with the introduction of a progressive system based on actual annual production volumes under each subsoil use agreement, starting in 2026, where the highest rate is 18% for operations producing over 10.4 million pounds. An additional MET of up to 2.5% based on the spot market price of uranium, will also be added in 2026. The MET is incurred and paid by the mining entities, impacting both KAP and different JVs and subsidiaries. |

| • | In October, Orano announced plans to temporarily suspend operations at their SOMAIR mine in Niger due to growing financial difficulties resulting from the coup d’état in July 2023 and the subsequent closure of the main supply and export route in Niger. Orano confirmed in December that the Nigerien authorities have taken operational control of the project, resulting from escalating conflicts between the company and the country’s ruling military junta. Earlier in the year, Orano also reported that the Nigerien government revoked their operating permit for their undeveloped Imouraren deposit. Further in the region, GoviEx Uranium Inc. (GoviEx) was informed by the Nigerien government that they no longer have rights over the perimeter of the Madaouela mining permit. In December, both Orano and GoviEx initiated arbitration proceedings against the Republic of Niger for the Imouraren and Madaouela projects respectively. |

| • | In March, Paladin Energy Ltd. (Paladin) announced the restart of its Langer Heinrich mine in Namibia which has an annual production capacity of 5.2 million pounds U3O8 and had been in care and maintenance since 2018. In November, Paladin updated their 2025 production guidance from 4.0-4.5 million pounds U3O8 to 3.0-3.6 million pounds U3O8 due to ongoing challenges and operational variability in ramping up production. |

| • | In 2024, several other uranium projects also restarted production including Boss Energy’s Honeymoon ISR project in Australia, Uranium Energy Corp.’s Christensen Ranch ISR operations in Wyoming, enCore Energy’s Alta Mesa Uranium Central Processing Plant and Wellfield in Texas, and Peninsula Energy Ltd.’s Lance ISR project in Wyoming. In June, Terrafame also reported it officially started recovering natural uranium at its industrial site in Sotkamo, Finland. |

| • | Sprott Physical Uranium Trust (SPUT) purchased about three million pounds U3O8 in 2024, bringing total purchases since inception to nearly 48 million pounds U3O8, and a total physical position of 66.2 million pounds U3O8. Volatility in the equity market impacts SPUT’s ability to raise funds to purchase uranium based on its share price trading at a discount or a premium to the net asset value (NAV) of the uranium it holds; in 2024 SPUT was at a discount to NAV for most of the year, negatively impacting its ability to buy uranium. |

| • | Following 2023 announcements from both Urenco and Orano to proceed with enrichment capacity expansion projects, 2024 saw advancements with the first new centrifuges being installed at Urenco USA and Orano starting construction at its Georges Besse II (GBII) expansion in France. A total capacity expansion of 1.8 million separative work units (SWU) is planned across three Urenco facilities including in Germany and the Netherlands, which represents a 10% capacity increase, whereas Orano seeks to grow GBII’s enrichment capacity by approximately 2.5 million SWU annually, a 30% increase. |

14 CAMECO CORPORATION

Long-term contracting creates full-cycle value for proven productive assets

Like other commodities, the demand for uranium is cyclical. However, unlike other commodities, uranium is not traded in meaningful quantities on a commodity exchange. The uranium market is principally based on bilaterally negotiated long-term contracts covering the annual run-rate requirements of nuclear power plants, with a small spot market to serve discretionary demand. History demonstrates that in general, when prices are rising and high, uranium is perceived as scarce, and more contracting activity takes place with proven and reliable suppliers. The higher demand discovered during this contracting cycle drives investment in higher-cost sources of production, which due to lengthy development timelines, tend to miss the contracting cycle and ramp up after demand has already been won by proven producers. When prices are declining and low, there is no perceived urgency to contract, and contracting activity and investment in new supply dramatically decreases. After years of low prices, and a lack of investment in supply, and as the uncommitted material available in the spot market begins to thin, security-of-supply tends to overtake price concerns. Utilities typically re-enter the long-term contracting market to ensure they have a reliable future supply of uranium to run their reactors.

UxC reports that over the last five years approximately 534 million pounds U3O8 equivalent have been locked-up in the long-term market, while approximately 798 million pounds U3O8 equivalent have been consumed in reactors. We remain confident that utilities have a growing gap to fill.

We believe the current backlog of long-term contracting presents a substantial opportunity for proven and reliable suppliers with tier-one productive capacity and a record of honoring supply commitments. As a low-cost producer, we manage our operations to increase value throughout these price cycles.

In our industry, customers do not come to the market right before they need to load nuclear fuel into their reactors. To operate a reactor that could run for more than 60 years, natural uranium and the downstream services have to be purchased years in advance, allowing time for a number of processing steps before a finished fuel bundle arrives at the power plant. At present, we believe there is a significant amount of uranium that needs to be contracted to keep reactors running into the next decade.

MANAGEMENT’S DISCUSSION AND ANALYSIS 15

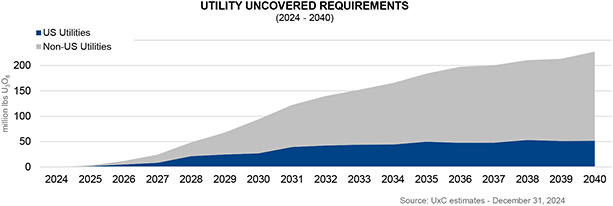

UxC estimates that cumulative uncovered requirements are about 2.1 billion pounds to the end of 2040. With the lack of investment over the past decade, there is growing uncertainty about where uranium will come from to satisfy growing demand, and utilities are becoming increasingly concerned about the availability of material to meet their long-term needs. In addition, secondary supplies have diminished, and the material available in the spot market has thinned as producers and financial funds continue to purchase material. Furthermore, geopolitical uncertainty is causing some utilities to seek nuclear fuel suppliers whose values are aligned with their own or whose origin of supply better protects them from potential interruptions, including from transportation challenges or the possible imposition of formal sanctions.

We will continue to take the actions we believe are necessary to position the company for long-term success. Therefore, we will continue to align our production decisions with our customers’ needs under our contract portfolio. We will undertake contracting activity which is intended to ensure we have adequate protection while maintaining exposure to the benefits that come from having uncommitted, low-cost supply to place into a strengthening market.

16 CAMECO CORPORATION

2024 performance highlights

In 2024, we revised our calculation of adjusted net earnings to adjust for unrealized foreign exchange gains and losses as well as for share-based compensation because it better reflects how we assess our operational performance. We have restated comparative periods to reflect this change. See non-IFRS measures starting on page 65 for more information.

Financial performance

HIGHLIGHTS DECEMBER 31 ($ MILLIONS EXCEPT WHERE INDICATED) | 2024 | 2023 | CHANGE | |||||||||

Revenue | 3,136 | 2,588 | 21 | % | ||||||||

Gross profit | 783 | 562 | 39 | % | ||||||||

Net earnings attributable to equity holders | 172 | 361 | (52 | )% | ||||||||

$ per common share (diluted) | 0.39 | 0.83 | (52 | )% | ||||||||

Adjusted net earnings (non-IFRS, see page 65) | 292 | 383 | (24 | )% | ||||||||

$ per common share (adjusted and diluted) | 0.67 | 0.88 | (24 | )% | ||||||||

Adjusted EBITDA (non-IFRS, see page 65) | 1,531 | 884 | 73 | % | ||||||||

Cash provided by operations | 905 | 688 | 32 | % | ||||||||

Net earnings attributable to equity holders (net earnings) and adjusted net earnings were lower in 2024 compared to 2023 primarily due to the impact of purchase accounting on the full year results of Westinghouse. As a result, we believe adjusted EBITDA is a better measure to assess our operating performance. See 2024 consolidated financial results beginning on page 38 for more information. Of note, we:

| • | increased adjusted EBITDA by 73% as a result of improving results in our uranium segment due to the return to our tier-one production levels, as well as full year results from Westinghouse, our share of its adjusted EBITDA being $483 million for 2024. See non-IFRS measures starting on page 65 for more information. |

| • | generated $905 million in cash from operations |

| • | received a cash dividend of $129 million (US), net of withholdings, from JV Inkai |

| • | received $49 million (US) in February 2025, which represents our share of a $100 million (US) distribution paid by Westinghouse |

| • | successfully refinanced $500 million in unsecured debentures that matured in 2024. The refinanced debt now matures in 2031 with credit spreads reflective of a higher credit rating than we currently have been assigned |

| • | prioritized repayment of $400 million (US) of the $600 million (US) term loan utilized to finance the acquisition of Westinghouse, reducing total debt to $1.3 billion. The remaining $200 million (US) was repaid in January 2025, extinguishing the term loan. See Liquidity starting on page 50 for more information. |

| • | increased our annual dividend to $0.16 per common share in 2024, with a plan to increase the dividend to at least $0.24 per common share over time. See Return for more details. |

Our segment updates and other fuel cycle investment updates

In our uranium segment, we continued to execute our strategy, further ramping up our tier-one assets which had a positive impact on our operations. Of note in 2024, we:

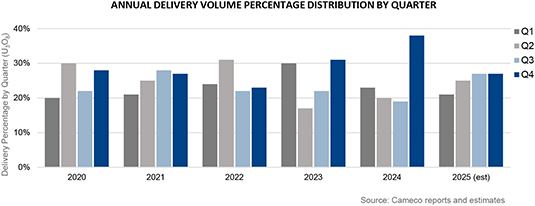

| • | delivered 33.6 million pounds of uranium in alignment with the commitments under our contract portfolio |

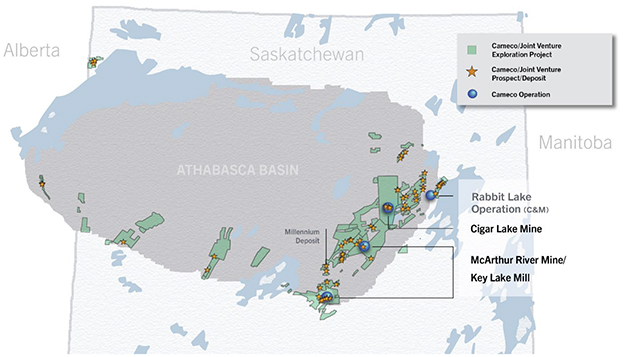

| • | produced 16.9 million pounds (100% basis) at Cigar Lake. Production did not meet our expectations due to a lower production rate at Orano’s McClean Lake mill. |

| • | produced 20.3 million pounds (100% basis) at McArthur River/Key Lake, setting a new production record for a uranium mining operation anywhere in the world, due in large part to off-cycle investments in automation, digitization and optimization projects at Key Lake. |

| • | purchased 11.0 million pounds of uranium, including our spot purchases and committed purchase volumes (including JV Inkai purchases) |

| • | received the final 1.2 million pounds of our share of JV Inkai’s 2023 production, as well as 2.7 million pounds of our total share of JV Inkai’s 2024 production. The remainder of our share of 2024 production, about 0.9 million pounds, is being |

MANAGEMENT’S DISCUSSION AND ANALYSIS 17

stored at JV Inkai for future delivery in order to optimize transportation and delivery costs. The timing of future deliveries is uncertain. |

| • | maintained Rabbit Lake and US ISR operations in care and maintenance |

In 2024, in our fuel services segment, we:

| • | delivered 12.1 million kgU under contract |

| • | produced 13.5 million kgU, including 10.8 million kgU of UF6 |

See Operations and projects beginning on page 73 for more information.

HIGHLIGHTS | 2024 | 2023 | CHANGE | |||||||||||||

Uranium | Production volume (million lbs) | 23.4 | 17.6 | 33 | % | |||||||||||

Sales volume (million lbs) | 33.6 | 32.0 | 5 | % | ||||||||||||

Average realized price1 | ($US/lb) | 58.34 | 49.76 | 17 | % | |||||||||||

($Cdn/lb) | 79.70 | 67.31 | 18 | % | ||||||||||||

Revenue ($ millions) | 2,677 | 2,153 | 24 | % | ||||||||||||

Gross profit ($ millions) | 681 | 445 | 53 | % | ||||||||||||

Earnings before income taxes | 904 | 606 | 49 | % | ||||||||||||

Adjusted EBITDA (non-IFRS, see page 65) | 1,179 | 835 | 41 | % | ||||||||||||

| Fuel services | Production volume (million kgU) | 13.5 | 13.3 | 2 | % | |||||||||||

Sales volume (million kgU) | 12.1 | 12.0 | 1 | % | ||||||||||||

Average realized price 2 | ($Cdn/kgU) | 37.87 | 35.61 | 6 | % | |||||||||||

Revenue ($ millions) | 459 | 426 | 8 | % | ||||||||||||

Earnings before income taxes | 108 | 129 | (16 | )% | ||||||||||||

Adjusted EBITDA (non-IFRS, see page 65) | 145 | 164 | (12 | )% | ||||||||||||

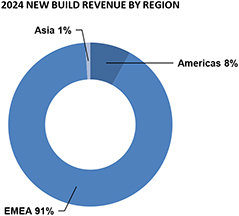

| Westinghouse3 | Revenue ($ millions) | 2,892 | 521 | >100 | % | |||||||||||

(our share) | Net loss | (218 | ) | (24 | ) | >100 | % | |||||||||

Adjusted EBITDA (non-IFRS, see page 65) | 483 | 101 | >100 | % | ||||||||||||

| 1 | Uranium average realized price is calculated as the revenue from sales of uranium concentrate, transportation and storage fees divided by the volume of uranium concentrates sold. |

| 2 | Fuel services average realized price is calculated as revenue from the sale of conversion and fabrication services, including fuel bundles and reactor components, transportation and storage fees divided by the volumes sold. |

| 3 | This table includes comparative results for the period beginning on the date of acquisition until the end of 2023 |

It was another positive year for the nuclear energy industry. Demand for nuclear power, including support for existing reactors, continues to grow, with a focus on energy security and national security amid continued global geopolitical uncertainty. We believe nuclear energy is in durable growth mode, and as we see the growth translate into contracts, we too will be back in durable growth mode. This growth will be sought in the same manner as we approach all aspects of our business; strategic, deliberate, disciplined and responsible and with a focus on generating full-cycle value.

Strong fourth quarter results in the uranium and Westinghouse segments provided a boost to annual results, as expected. Net earnings were $135 million for the quarter and $172 million for the year compared to $80 million for the quarter and $361 for the year in 2023, while adjusted net earnings were $157 million for the quarter and $292 million for the year compared to $108 million for the quarter and $383 million for the year in 2023. The 2024 annual results were lower compared to 2023 primarily due to the impact of purchase accounting on the full year results of Westinghouse. We use adjusted EBITDA to assess our operational performance. Full year adjusted EBITDA increased by approximately $647 million to $1.5 billion compared to $884 million in 2023 mainly due to the contributions from the uranium segment, reflective of a return to our tier-one production levels and an improving price environment, as well as the benefit from a full year of our Westinghouse investment, which was acquired in November 2023.

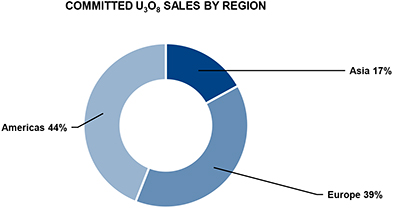

In our uranium segment, despite muted contracting volumes for the industry as utilities focused first on securing enrichment and conversion, we continued to negotiate off-market contracts and add to our long-term portfolio. After delivering our 2024

18 CAMECO CORPORATION

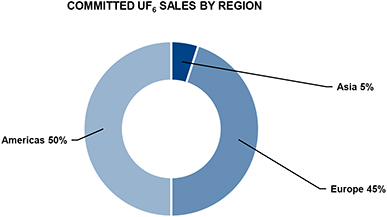

sales, the long-term portfolio now totals about 220 million pounds, representing about 25% of our current reserve and resource base and retaining exposure to the improving demand from our customers as they look to secure their long-term needs. We continue to have a large and growing pipeline of uranium business under discussion. Our focus remains on obtaining market-related pricing mechanisms that benefit from a constructive price environment, while also providing adequate downside protection. We are being strategically patient in our discussions to maximize value in our contract portfolio and to maintain exposure to higher prices with unencumbered future productive capacity. In addition, with strong demand and pricing at historic highs in the UF6 conversion market, we were successful in adding new long-term contracts that bring our total contracted volumes to about 85 million kgU of UF6 that will underpin our fuel services operations for years to come.

Cameco has more than 35 years of experience in this market, and we have designed our strategy of full-cycle value capture to be resilient. Given the nature of our contracts, we have good visibility into when and where we need to deliver material, and we have put in place a number of tools that allow us to self-manage risk.

We have built a strong reputation as a proven and reliable supplier, with a diversified production portfolio that provides us with the flexibility to work with our customers to ensure they maintain access to our reliable supplies to satisfy their ongoing fuel requirements. In addition to our production, we can source material from market purchases today, and while these purchases would be more expensive than our production, our strategy positions us to benefit from added demand for nuclear fuel supplies and services. We have exposure to higher prices under the market-related contracts in our long-term portfolio and a pipeline of contracting discussions underway, which we expect will also benefit from the increased focus on securing access to scarce supplies and generate long-term value for Cameco. Also, we do not have to buy every pound in the spot market. We can source from inventory, to be replaced by production or purchases later. Further, we have the ability to pull forward long-term purchase arrangements that we put in place in a much lower-price environment, and with licensed storage facilities, we have secured the ability to borrow product under the terms of some of our storage agreements. See Managing our Contract Commitments on page 27 for more information on our sourcing options.

The tailwinds that are expected to benefit our core uranium and fuel services businesses are also presenting significant future growth opportunities for Westinghouse, which we own with our partner Brookfield Renewable Partners (Brookfield) (Cameco’s share is 49%). In 2024, we saw the continued advancement of AP1000® new build opportunities in Poland, Bulgaria, Ukraine and Slovenia. In early 2025, Westinghouse also announced a settlement agreement in its technology and export dispute with Korea Electric Power Corporation and Korea Hydro & Nuclear Power Co., Ltd. (KEPCO and KHNP), which resolves the dispute and establishes a framework for additional deployments outside of South Korea, to the mutual and material benefit of Westinghouse, KEPCO and KHNP. See Westinghouse Electric Company starting on page 98 for more information.

Thanks to our disciplined strategy, our balance sheet is strong, and we expect it will enable us to continue executing our strategy while self-managing risk, including risks related to global macro-economic uncertainty and volatility, and uncertain trade policy decisions. As of December 31, 2024, we had $600 million in cash and cash equivalents with $1.3 billion in total debt. In addition, we have a $1.0 billion undrawn credit facility.

In the current environment, we believe the risk to uranium supply is greater than the risk to uranium demand and expect it will create a renewed focus on ensuring availability of long-term supply to fuel nuclear reactors.

We will continue to align our production with our contract portfolio and market opportunities, demonstrating that we continue to responsibly manage our supply in accordance with our customers’ needs.

We will continue to look for opportunities to improve operational effectiveness, to improve our safety performance and reduce our impact on the environment, including through the use of digital and automation technologies to allow us to operate our assets with more flexibility and efficiency. This is key to our ability to continue to align our production decisions with our contract portfolio commitments and opportunities. With a solid base of contracts to underpin our tier-one productive capacity, and a growing contracting pipeline we expect we will continue to generate strong financial performance.

As we execute on our strategy, we will continue to focus on protecting the health and safety of our employees, delivering our products safely and responsibly and addressing the risks and opportunities that we believe will make our business sustainable and will build long-term value.

MANAGEMENT’S DISCUSSION AND ANALYSIS 19

Industry prices

| 2024 | 2023 | CHANGE | ||||||||||

Uranium ($US/lb U3O8)1 | ||||||||||||

Average annual spot market price | 85.14 | 62.51 | 36 | % | ||||||||

Average annual long-term price | 78.88 | 58.20 | 36 | % | ||||||||

Fuel services ($US/kgU as UF6)1 | ||||||||||||

Average annual spot market price | ||||||||||||

North America | 68.29 | 41.23 | 66 | % | ||||||||

Europe | 68.21 | 41.23 | 65 | % | ||||||||

Average annual long-term price | ||||||||||||

North America | 40.57 | 30.55 | 33 | % | ||||||||

Europe | 40.47 | 30.55 | 32 | % | ||||||||

Note: the industry does not publish UO2 prices.

| 1 | Average of prices reported by TradeTech and UxC, LLC (UxC) |

On the spot market, where purchases call for delivery within one year, the volume reported by UxC for 2024 decreased to 46 million pounds U3O8 equivalent, compared to 57 million pounds U3O8 equivalent in 2023. In 2024, total spot purchases by producers, junior uranium companies, financial funds and intermediaries was approximately 40 million pounds U3O8 equivalent, compared to approximately 43 million pounds U3O8 equivalent in 2023; in 2024, these purchases represented over 85% of spot market purchases compared to over 76% in 2023. In 2024, the uranium spot price ranged from a month-end high of $100.25 (US) per pound to a month-end low of $72.63 (US), averaging $85.14 (US) for the year. This average was up $22.63 (US) per pound, or 36%, compared to the 2023 average.

Long-term contracts generally call for deliveries to begin more than two years after the contract is finalized, and use a number of pricing formulas, including base-escalated prices set at time of contracting and escalated over the term of the contract, and market referenced prices (spot and long-term indicators) determined near the time of delivery, which also often include floor prices and ceiling prices that are also escalated to time of delivery. The volume of long-term contracting reported by UxC for 2024 was about 119 million pounds U3O8 equivalent, down from about 161 million pounds U3O8 equivalent in 2023. The contracting volume in 2023 was higher due to significant non-US utilities diversifying away from Russian supply, including our contracts with Ukraine and Bulgaria, one of which totaled over 40 million pounds. The lower long-term uranium volumes reported in 2024 can be attributed in part to US utilities awaiting clarity on implementation of the Russian uranium import ban, the US waiver process, and Russian export restraints, although requests for proposals from utilities are continuing alongside requests for direct off-market negotiations.

The average reported long-term price at the end of the year was $80.50 (US) per pound, up $12.50 (US) from the end of 2023. During the year, the uranium long-term price steadily increased from a month-end low of $72.00 (US) per pound in January to a high of $81.50 (US) per pound in November, averaging $78.88 (US) for the year.

With increased demand for western conversion services, pricing in both North America and Europe continues to be strong. At the end of 2024, the average reported spot price for North American delivery reached a record high of $97.00 (US) per kilogram uranium as UF6 (US/kgU as UF6), up $51.00 (US) from the end of 2023. Long-term UF6 conversion prices for North American delivery also reached a record high and finished 2024 at $50.00 (US/kgU as UF6), up $15.75 (US) from the end of 2023.

20 CAMECO CORPORATION

MANAGEMENT’S DISCUSSION AND ANALYSIS 21

Our values and strategy

We believe we have the right strategy to add long-term value and we will do so in a manner that reflects our values. For over 35 years, we have been delivering our products responsibly. Building on that strong foundation, we remain committed to our efforts to operate in a responsible and sustainable manner, identifying and addressing the risks and opportunities that we believe may have a significant impact on our ability to add long-term value for our stakeholders.

Committed to our values

Our values are discussed below. They define who we are as a company, are at the core of everything we do, and help to embed sustainability principles and practices as we execute on our strategy. They are:

| • | safety and environment |

| • | people |

| • | integrity |

| • | excellence |

SAFETY AND ENVIRONMENT

The safety of people and protection of the environment are the foundations of our work. All of us share in the responsibility of continually improving the safety of our workplace and the quality of our environment.

We are committed to keeping people safe and conducting our business with respect and care for both the local and global environment.

PEOPLE

We value the contribution of every employee, and we treat people fairly by demonstrating our respect for individual dignity, creativity and cultural diversity. By being open and honest, we achieve the strong relationships we seek.

We are committed to developing and supporting a flexible, skilled, stable and diverse workforce, in an environment that:

| • | attracts and retains talented people and inspires them to be fully productive and engaged |

| • | encourages relationships that build the trust, credibility and support we need to grow our business |

INTEGRITY

Through personal and professional integrity, we lead by example, earn trust, honour our commitments and conduct our business ethically.

We are committed to acting with integrity in every area of our business, wherever we operate.

EXCELLENCE

We pursue excellence in all that we do. Through leadership, collaboration and innovation, we strive to achieve our full potential and inspire others to reach theirs.

Our strategy

We are a pure-play investment in the growing demand for nuclear energy, focused on taking advantage of the near-, medium-, and long-term growth occurring in our industry. We provide nuclear fuel and nuclear power products, services, and technologies across the fuel cycle, complemented by our investment in Westinghouse, that support the generation of secure, carbon-free, reliable, and affordable energy. Our strategy is set within the context of what we believe is a transitioning market environment. Increasing populations, a growing focus on electrification and decarbonization, and concerns about energy security and affordability are driving a global focus on tripling nuclear power capacity by 2050, which is expected to durably strengthen the long-term fundamentals for our industry. Nuclear energy must be a central part of the solution to the world’s shift to a low-carbon, secure energy economy. It is an option that can provide the power needed, not only reliably, but also safely and affordably, and in a way that will help achieve climate, energy and national security objectives.

Our strategy is to capture full-cycle value by:

| • | remaining disciplined in our contracting activity, building a balanced portfolio in accordance with our contracting framework |

22 CAMECO CORPORATION

| • | profitably producing from our tier-one assets and aligning our production decisions in all segments of the fuel cycle with contracted demand and customer needs |

| • | being financially disciplined to allow us to: |

| • | execute our strategy |

| • | invest in new opportunities that are expected to add long-term value |

| • | to self-manage risk |

| • | exploring other emerging opportunities within the nuclear power value chain, which align with our commitment to manage our business responsibly and sustainably, contribute to decarbonization, and help to provide secure and affordable energy |

We expect our strategy will allow us to increase long-term value, and we will execute it with an emphasis on safety, people and the environment.

URANIUM

Uranium production is central to our strategy, as it is the biggest value driver of the nuclear fuel cycle and our business. We have tier-one assets that are licensed, permitted, long-lived, and are proven reliable with capacity to expand. These tier-one assets are backed up by idle tier-two assets and what we think is the best exploration portfolio of mineral reserves and resources that in some cases can leverage our existing infrastructure. Currently, we believe that we have ample productive capacity with the ability to expand as the demand for nuclear energy and nuclear fuel grows.

We are focused on protecting and extending the value of our contract portfolio, on aligning our production decisions with our contract portfolio and market opportunities thereby optimizing the value of our lowest cost assets. We also prioritize maintaining a strong balance sheet, and on efficiently managing the company. We have undertaken a number of deliberate and disciplined actions, including a focus on operational effectiveness to allow us to operate our assets more efficiently and with more flexibility.

FUEL SERVICES

Our fuel services segment supports our strategy to capture full-cycle value by providing our customers with access to refining and conversion services for both heavy-water and light-water reactors, and CANDU fuel and reactor component manufacturing for heavy-water reactors.

As in our uranium segment, we are focused on securing new long-term contracts and on aligning our production decisions with our contract portfolio that will allow us to continue to profitably produce and consistently support the long-term needs of our customers.

In addition, we are pursuing non-traditional markets for our UO2 and fuel fabrication business and have been actively securing new contracts for reactor components to support refurbishment of Canadian reactors.

WESTINGHOUSE

In 2023, we completed the acquisition of Westinghouse, a global provider of mission-critical and specialized technologies, products and services for light-water reactors across most phases of the nuclear power sector, in a strategic partnership with Brookfield. We own a 49% interest in Westinghouse.