U.S. Securities and Exchange Commission

Washington, DC 20549

NOTICE OF EXEMPT SOLICITATION

1. Name of the Registrant:

Diversified Healthcare Trust

2. Name of persons relying on exemption:

D. E. Shaw & Co., L.P.

3. Address of persons relying on exemption:

1166 Avenue of the Americas, 9th Floor, New York New York 10036

4. Written materials. Attach written material required to be submitted pursuant to Rule 14a-6(g)(1)

See attached.

THE D. E. SHAW GROUP’S PERSPECTIVES ON THE PROPOSED DHC - OPI MERGER Why We Intend to Vote AGAINST the Transaction AUGUST 2023 UPDATED

Disclaimers 2 This presentation (the “Presentation”) is being made by, and represents the opinions of, D . E . Shaw & Co . , L . P . (“DESCO LP”) on behalf of certain investment funds managed or advised by it (the “Funds”) that currently beneficially own, or otherwise have an economic interest in, shares of Diversified Healthcare Trust (“DHC” or the “Company”) . The Presentation is for informational purposes only and does not take into account the specific investment objectives, financial situation, suitability, or particular need of any person who may receive the Presentation . Nothing in the Presentation constitutes investment, financial, legal, or tax advice, and the Presentation should not be relied on as such . The views expressed in the Presentation are based on publicly available information and DESCO LP’s analyses . The Presentation contains statements reflecting DESCO LP’s opinions and beliefs with respect to the Company and its business based on DESCO LP’s research, analysis, and experience . All such statements are based on DESCO LP’s opinion and belief, whether or not those statements are expressly so qualified . DESCO LP acknowledges that the Company may possess confidential information that could lead the Company to disagree with DESCO LP’s views and/or analyses . Certain financial information and data used in the Presentation have been derived or obtained from filings made with the U . S . Securities and Exchange Commission by the Company or by other companies that DESCO LP considers comparable . DESCO LP has not sought or obtained consent from any third party to use any statements or information indicated in the Presentation, and no such statements or information should be viewed as indicating the support of any third party for the views expressed in the Presentation . Information contained in the Presentation has not been independently verified by DESCO LP, and neither DESCO LP nor any of its affiliates makes any representation or warranty, whether express or implied, as to the accuracy, fairness, or completeness of the information contained herein . By receiving and retaining the Presentation, each recipient agrees and acknowledges that it will not rely on any such information . None of the companies in the D . E . Shaw group ; nor any of their respective affiliates ; nor any shareholders, partners, members, managers, directors, principals, personnel, trustees, or agents of any of the foregoing shall be liable for any errors or omissions (as a result of negligence or otherwise, to the fullest extent permitted by law in the absence of fraud) in the production or contents of the Presentation, or for the consequences of relying on such contents . All of the information in the Presentation is presented as of the date of the Presentation (except as otherwise indicated), is subject to change without notice, and may have changed (possibly materially) between the date as of which such information is presented and the date the Presentation was received . No member of the D . E . Shaw group has any obligation to update the information in the Presentation to account for changes subsequent to any date as of which such information is given or to provide any additional materials . The Funds currently beneficially own, and/or have an economic interest in, shares of the Company . The Funds are in the business of trading (i . e . , buying and selling) securities, and it is expected that the Funds will from time to time engage in transactions that result in changes to their beneficial and/or economic interest in the Company . To the fullest extent permitted by law, DESCO LP may cause the Funds to buy or sell shares in the Company, or otherwise to change the form or substance of any of their investments in the Company, without notice to or the consent of the Company or any other recipient of the Presentation .

Disclaimers (Cont’d) Forward - Looking Statements The Presentation may contain certain information that constitutes “forward - looking statements,” which can be identified by the use of forward - looking terminology such as “may,” “expect,” “will,” “hope,” “forecast,” “intend,” “target,” “believe,” and/or comparable terminology (or the negatives thereof) . Actual events, results, and/or performance may differ materially from what is contemplated in such forward - looking statements . Any such forward - looking statements have been prepared based on, among other things, DESCO LP’s current view of economic conditions, which view it believes to be reasonable in light of information that is presently available but which may prove to be incorrect . This information is subject to uncertainties, changes, and other risks beyond DESCO LP’s control, including without limitation broad trends in business, finance, and the economy (including, for example, monetary policy, interest rates, inflation, and currency values), legislation and regulation, the availability and cost of short - term and/or long - term funding and capital, and the conditions prevailing in the securities and/or other markets . Industry experts may disagree with DESCO LP’s views . No assurance, representation, or warranty is made by any person that any of DESCO LP’s aims, assumptions, expectations, objectives, and/or goals will be achieved . Nothing contained in the Presentation may be relied upon as a guarantee, promise, assurance, or representation as to the future . No Offer or Solicitation The Presentation does not convey an offer of any type . It is not intended to be, and should not be construed as, an offer to sell, or the solicitation of an offer to buy, any security, including without limitation an interest in any Fund . COPYRIGHT © 2023 D . E . SHAW & CO . , L . P . ALL RIGHTS RESERVED . 3

Table of Contents 4 SECTION TITLE PAGE I Executive Summary 5 II The Merger Significantly Undervalues DHC 12 III The Timing Is Wrong and the Strategic Rationale Is Not Compelling 24 IV The Process Was Flawed and Inadequate 32 V Better Alternatives Exist for DHC 38 VI Responding to DHC’s Claims 50 VII Conclusion 54 VIII Appendix 58 NEW

EXECUTIVE SUMMARY 5 SECTION I

Executive Summary 6 The Merger Significantly Undervalues DHC The Timing Is Wrong and the Strategic Rationale Is Not Compelling The Process Was Flawed and Inadequate Better Alternatives Exist for DHC ▪ DHC’s equity, measured in several independent ways, is worth substantially more than the deal consideration ▪ The value of the merger consideration has declined significantly since the announcement of the transaction ▪ For six weeks, DHC stock has traded at a significant premium to the proposed deal consideration ▪ Office REITs are facing significant challenges, and we expect OPI will be impacted for the foreseeable future ▪ Meanwhile, favorable macroeconomic trends are set to provide a tailwind to DHC’s core business ▪ The cost savings are minimal and the industrial logic is not compelling ▪ The sale process was inadequate, with no outreach to strategic or financial acquirers other than OPI ▪ The process was overseen by a special committee with limited real estate experience and ties to other RMR - affiliated entities ▪ DHC has numerous options to address maturities and regain covenant compliance ▪ These options, in our view, are a better choice for DHC shareholders than transferring value to OPI and RMR ▪ We remain supportive of DHC and its agreement with RMR and are eager to work constructively with the Company after the Meeting

▪ The D. E. Shaw Group is a global investment and technology development firm with more than $60 billion in assets under management as of June 1, 2023, including a substantial institutional investor base ▪ We have a significant presence in the world’s capital markets, investing in a wide range of companies and financial instruments in both developed and developing economies, and we have offices in North America, Europe, and Asia ▪ Since our founding in 1988, our firm has earned an international reputation for successful investing based on innovation, careful risk management, and the quality and depth of our staff ▪ We have a track record of working with companies to create long - term, fundamental value. Our investment professionals have significant experience in deep fundamental analysis and credit - driven special situations investments ▪ Our team has followed Diversified Healthcare Trust (“DHC”) closely in recent years and holds significant investments in the Company’s public securities ▪ Funds managed by D. E. Shaw & Co., LP currently own approximately 6% of DHC’s common stock, $20 million of DHC’s 2024 bonds, and $17 million of DHC’s 2025 bonds Overview of the D. E. Shaw Group 7

Overview of Diversified Healthcare Trust (Nasdaq: DHC) 8 Portfolio Summary Geographic Diversification 1 Property Type 2 26 Other States + D.C. : 41% FL : 10% CA : 9% TX : 9% GA : 6% MD : 5% NC : 4% WI : 4% VA : 4% IL : 4% IN : 4% Medical Office : 39% Wellness Centers : 7% Assisted Living : 9% Independent Living : 31% SNFs : 1% Life Science : 13% ▪ Founded in 1998, Diversified Healthcare Trust (“DHC”) is a real estate investment trust (REIT) that owns senior living communities, medical office buildings, and wellness centers ▪ DHC is externally managed by alternative asset management company RMR Group (“RMR”) ▪ DHC’s senior housing operating portfolio (SHOP) segment was deeply impacted by the COVID - 19 pandemic; occupancy rates are beginning to improve, and long - term macroeconomic trends are poised to drive recovery and growth of this segment ▪ DHC has $700 million of debt maturing before mid - year 2024, and is currently out of compliance with its debt incurrence covenant ▪ However, there are numerous ways for DHC to effectively deal with its debt maturities, either by avoiding the covenant constraint entirely or by regaining compliance Enterprise Value ($M) $3,024 Market Capitalization ($M) $585 LTM Adj. EBITDAre ($M) $206 EV/LTM Adj. EBITDAre 14.7x Implied Cap Rate 7.0% Net Debt/LTM Adj. EBITDAre 9.6x Annualized Dividend Yield (End of Q1 2023) 3.0% Headquarters Newton, MA

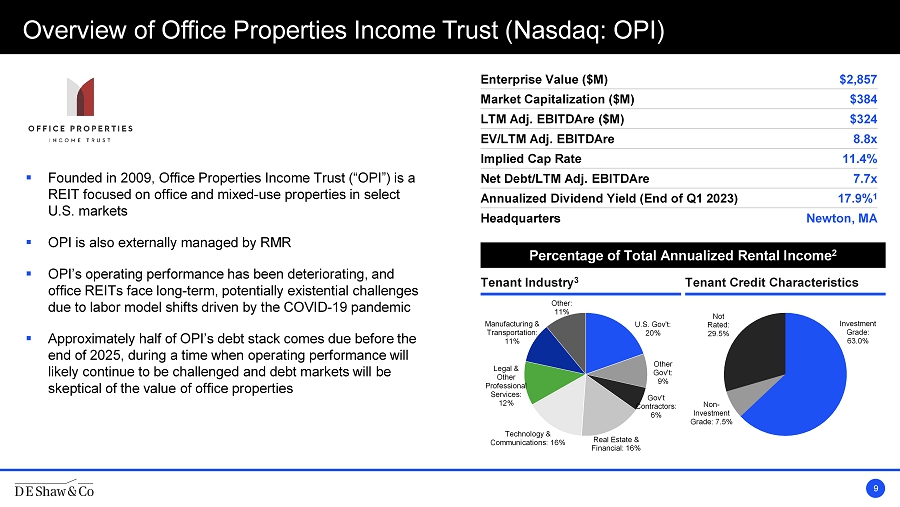

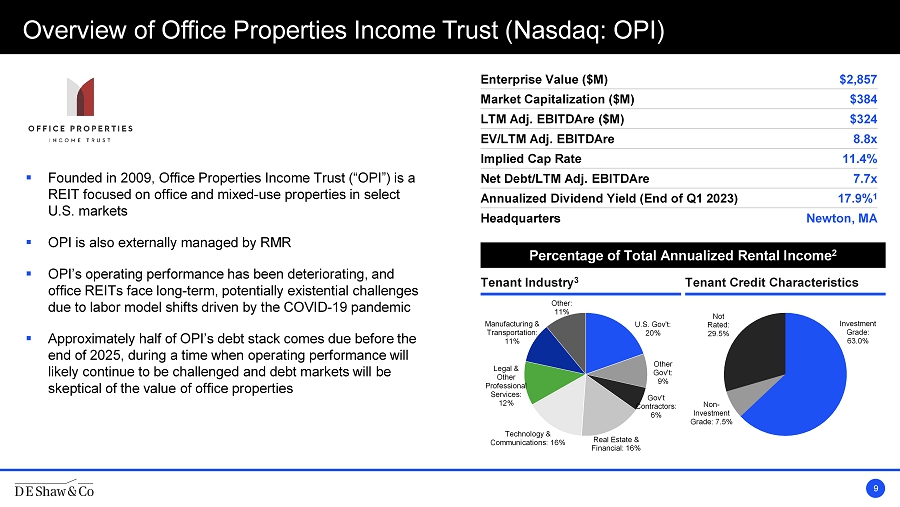

Overview of Office Properties Income Trust (Nasdaq: OPI) 9 ▪ Founded in 2009, Office Properties Income Trust (“OPI”) is a REIT focused on office and mixed - use properties in select U.S. markets ▪ OPI is also externally managed by RMR ▪ OPI’s operating performance has been deteriorating, and office REITs face long - term, potentially existential challenges due to labor model shifts driven by the COVID - 19 pandemic ▪ Approximately half of OPI’s debt stack comes due before the end of 2025, during a time when operating performance will likely continue to be challenged and debt markets will be skeptical of the value of office properties Investment Grade : 63.0% Non - Investment Grade : 7.5% Not Rated : 29.5% U.S. Gov't : 20% Other Gov't : 9% Gov't Contractors : 6% Real Estate & Financial : 16% Technology & Communications : 16% Legal & Other Professional Services : 12% Manufacturing & Transportation : 11% Other : 11% Tenant Credit Characteristics Tenant Industry 3 Percentage of Total Annualized Rental Income 2 Enterprise Value ($M) $2,857 Market Capitalization ($M) $384 LTM Adj. EBITDAre ($M) $324 EV/LTM Adj. EBITDAre 8.8x Implied Cap Rate 11.4% Net Debt/LTM Adj. EBITDAre 7.7x Annualized Dividend Yield (End of Q1 2023) 17.9% 1 Headquarters Newton, MA

Overview of the Proposed Merger 10 Announcement Date April 11, 2023 Special Meeting Date August 9, 2023 Transaction Details ▪ Merger between Office Properties Income Trust and Diversified Healthcare Trust ▪ Post - transaction ownership of approximately 58% for OPI shareholders and 42% for DHC shareholders ▪ Combined company will be led by the OPI management team and will continue to be externally managed by the RMR Group Consideration ▪ DHC shareholders will receive 0.147 shares of OPI for each DHC common share ▪ $1.70 per share as of the Announcement Date ▪ $1.16 per share based on closing price as of July 7, 2023 Offer Premium 2 One Day: 30 Days: 90 Days: One Year: One Year High 37% 15% 44% 33% (41%) Deal Process ▪ DHC Board of Trustees rejected an all - cash proposal to acquire the Company for $4.00/share in May 2022 ▪ Current process began when DHC was trading near an all - time low ▪ No outreach to strategic or financial acquirers beyond OPI

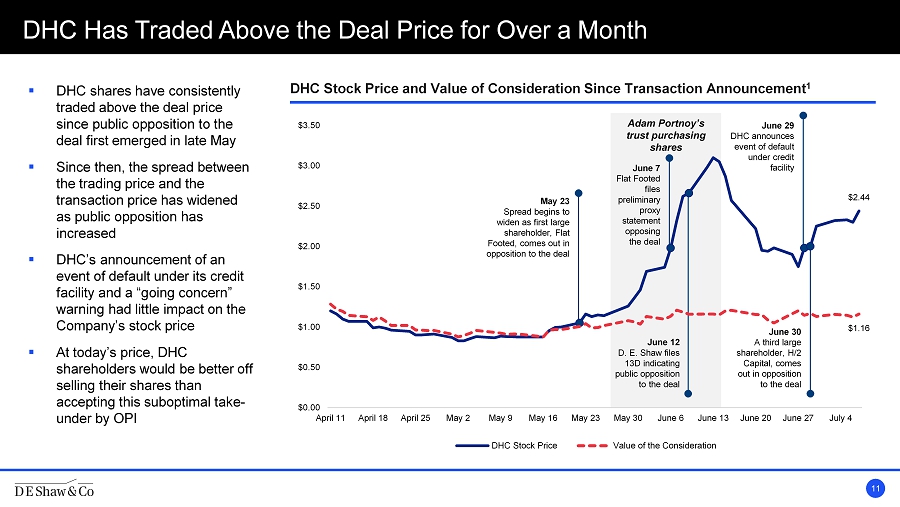

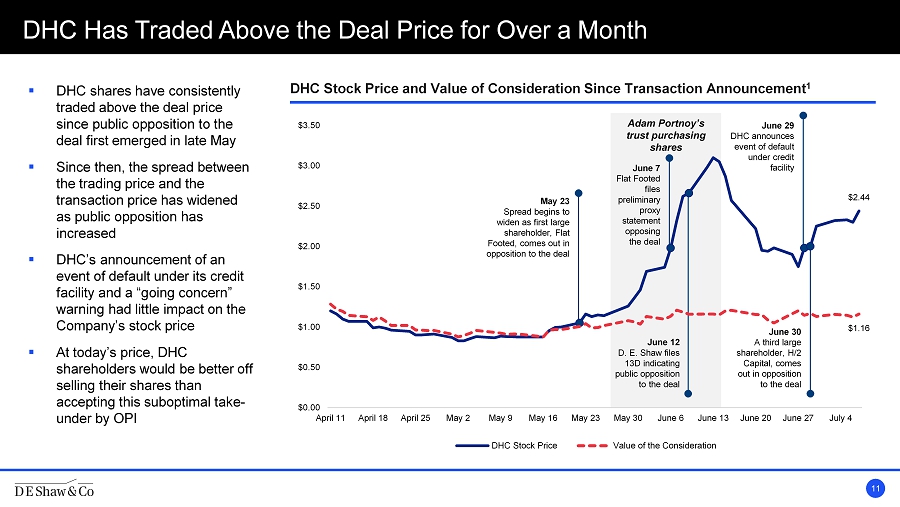

DHC Has Traded Above the Deal Price for Over a Month 11 DHC Stock Price and Value of Consideration Since Transaction Announcement 1 ▪ DHC shares have consistently traded above the deal price since public opposition to the deal first emerged in late May ▪ Since then, the spread between the trading price and the transaction price has widened as public opposition has increased ▪ DHC’s announcement of an event of default under its credit facility and a “going concern” warning had little impact on the Company’s stock price ▪ At today’s price, DHC shareholders would be better off selling their shares than accepting this suboptimal take - under by OPI Adam Portnoy’s trust purchasing shares May 23 Spread begins to widen as first large shareholder, Flat Footed, comes out in opposition to the deal June 7 Flat Footed files preliminary proxy statement opposing the deal June 12 D. E. Shaw files 13D indicating public opposition to the deal June 30 A third large shareholder, H/2 Capital, comes out in opposition to the deal June 29 DHC announces event of default under credit facility $2.44 $1.16 $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 April 11 April 18 April 25 May 2 May 9 May 16 May 23 May 30 June 6 June 13 June 20 June 27 July 4 DHC Stock Price Value of the Consideration

THE MERGER SIGNIFICANTLY UNDERVALUES DHC 12 SECTION II

The Merger Significantly Undervalues DHC 13 The Value of the Consideration has Declined Significantly ▪ OPI’s shares traded down 24% on the day the transaction was announced and have continued to underperform the market ▪ The current value of the consideration is approximately 6% lower than DHC’s value before the transaction was announced and well below analyst price targets and comparable transactions 1 The Value is Inadequate Based on Management’s Projections ▪ DHC’s business has been showing signs of recovery; the merger with OPI, however, values DHC at a trough (and the fairness opinion is largely based on 2023E numbers) ▪ We believe management’s projections of sustained growth warrant a higher valuation inline with forward multiples of peers and precedent transactions DHC Deserves a Greater Share of Pro Forma Equity ▪ OPI’s financial advisor, J.P. Morgan, calculated that DHC’s equity is worth approximately four times the equity of OPI, but the deal gives DHC shareholders only 42% of the combined equity DHC’s Underlying Real Estate is Likely Worth More Than the Deal ▪ We believe DHC’s underlying real estate has equity value in excess of $10 per share ▪ The value of DHC as an enterprise has been depressed due to operational underperformance and public company governance issues, both of which can be addressed (but won’t be with this deal) 1 2 3 4

Value at Announcement: $1.70 $0.00 $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 $1.40 $1.60 $1.80 April 10 April 17 April 24 May 1 May 8 May 15 May 22 May 29 June 5 June 12 June 19 June 26 July 3 Value per DHC Share The Value of the Consideration Has Declined Significantly… 14 1 Value of Merger Consideration 1

…To the Point Where the Merger Is Now a Take - under of DHC 15 14 - Day Premium 1 Premium to One - Year High Prior to Deal 1 One - Day Premium 1 30 - Day Premium 1 37% 22% (6%) Value at Announcement Precedent Healthcare REIT Transactions Current Value of Consideration 30% 20% (11%) Value at Announcement Precedent Healthcare REIT Transactions Current Value of Consideration 15% 20% (21%) Value at Announcement Precedent Healthcare REIT Transactions Current Value of Consideration (41%) 23% (60%) Value at Announcement Precedent Healthcare REIT Transactions Current Value of Consideration 1

The Merger Consideration Is Well Below Analyst Price Targets 16 DHC Mean Analyst Price Target 1 Premium to Mean Analyst Price Target 1,2 $2.30 $2.17 $2.87 $3.33 $4.50 $4.26 $4.45 $4.55 $4.55 $4.05 $3.90 $3.85 $7.50 1Q23 4Q22 3Q22 2Q22 1Q22 4Q21 3Q21 2Q21 1Q21 4Q20 3Q20 2Q20 1Q20 Current Value of Consideration: $1.16 (26%) 10% (50%) Value of Consideration at Transaction Announcement Precedent Healthcare REIT Transactions Current Value of Consideration 1

The SHOP Segment Has Been Showing Signs of Recovery… 17 DHC SHOP Occupancy 1 DHC SHOP Same Property NOI Margin 1 ▪ Prior to the announcement of the deal, DHC management was upbeat ▪ DHC reported Q4 2022 earnings on March 1, highlighting positive results and outlook and describing a path to covenant compliance 2 – DHC stock rose over the next week, reaching $1.87 per share on March 8 ▪ In May, DHC reported Q1 2023 earnings, which showed sequential improvement driven by several positive trends in the SHOP segment, including continued occupancy recovery and reduced impact from labor cost inflation 3 84% 79% 75% 72% 70% 71% 71% 73% 73% 74% 75% 76% 77% 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 15% 12% 5% 8% 6% 7% 5% 2% 1% 3% (1%) 2% 6% 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2 The year - over - year and quarter - over - quarter improvement in normalized FFO… was largely driven by continued improvements in three areas within our SHOP segment...” – Jennifer Francis , President & CEO of DHC 3

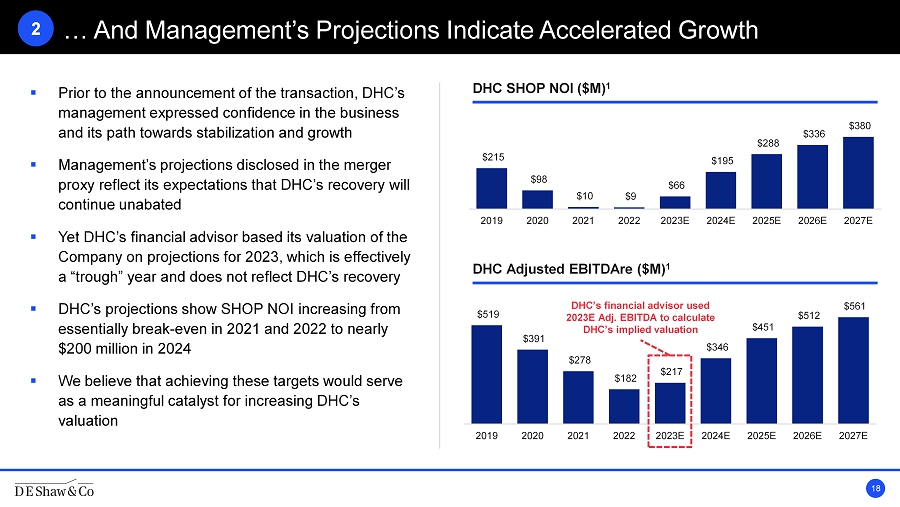

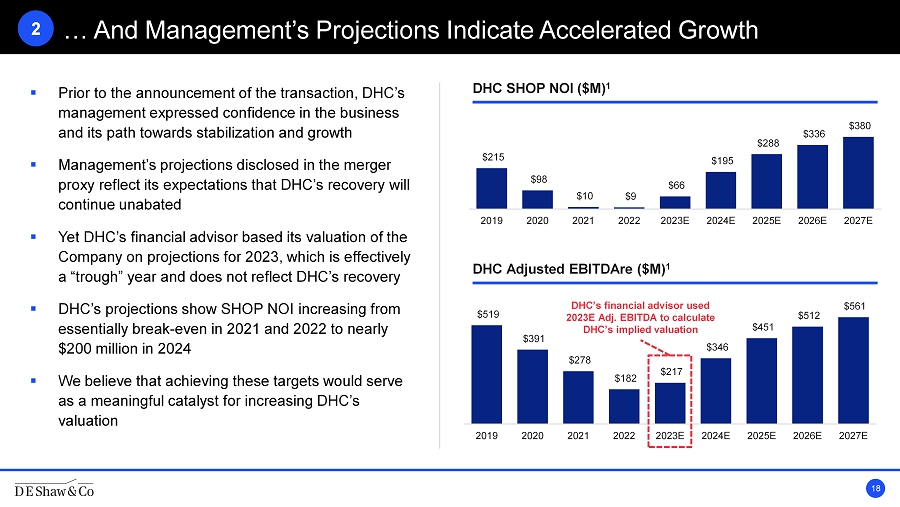

… And Management’s Projections Indicate Accelerated Growth 18 DHC Adjusted EBITDAre ($M) 1 ▪ Prior to the announcement of the transaction, DHC’s management expressed confidence in the business and its path towards stabilization and growth ▪ Management’s projections disclosed in the merger proxy reflect its expectations that DHC’s recovery will continue unabated ▪ Yet DHC’s financial advisor based its valuation of the Company on projections for 2023, which is effectively a “trough” year and does not reflect DHC’s recovery ▪ DHC’s projections show SHOP NOI increasing from essentially break - even in 2021 and 2022 to nearly $200 million in 2024 ▪ We believe that achieving these targets would serve as a meaningful catalyst for increasing DHC’s valuation $215 $98 $10 $9 $66 $195 $288 $336 $380 2019 2020 2021 2022 2023E 2024E 2025E 2026E 2027E $519 $391 $278 $182 $217 $346 $451 $512 $561 2019 2020 2021 2022 2023E 2024E 2025E 2026E 2027E DHC’s financial advisor used 2023E Adj. EBITDA to calculate DHC’s implied valuation 2 DHC SHOP NOI ($M) 1

DHC’s Trustees Are Enthusiastic About Its Prospects 19 2 Macro Environment Supports Continued SHOP Recovery DHC Can Weather Its Challenges and Continue Its Progress Other Options Are Available for DHC to Address Its Maturities “Fundamentally, supply and demand trends are supporting this [senior living] recovery. The number of senior living units under construction is at its lowest level since 2015, with inventory growth moderating to just 1.4% year - over - year… [T]he 80 - plus demographic is projected to increase an average of 3.7% per year over the next two years, compared to the 2% [CAGR] over the last five years.” Jennifer Francis , DHC CEO DHC Q3 2022 Earnings, Nov. 3, 2022 “As a reminder, in the third [calendar] quarter… DHC reported its sixth consecutive quarter of occupancy growth in its senior living communities… That trend is consistent with the broader industry… [W]e are confident DHC can both weather these near - term challenges and continue strategically reinvesting in its assets.” Adam Portnoy , RMR CEO RMR Q1 2023 Earnings, Feb. 3, 2023 “There are a couple of levers [to pull to address maturities]… [W]e have some pretty great MOB and life sciences assets that many investors are interested in, so whether it was a disposition, [or] more likely a JV.” Jennifer Francis , DHC CEO DHC Q4 2022 Earnings, Mar. 2, 2023

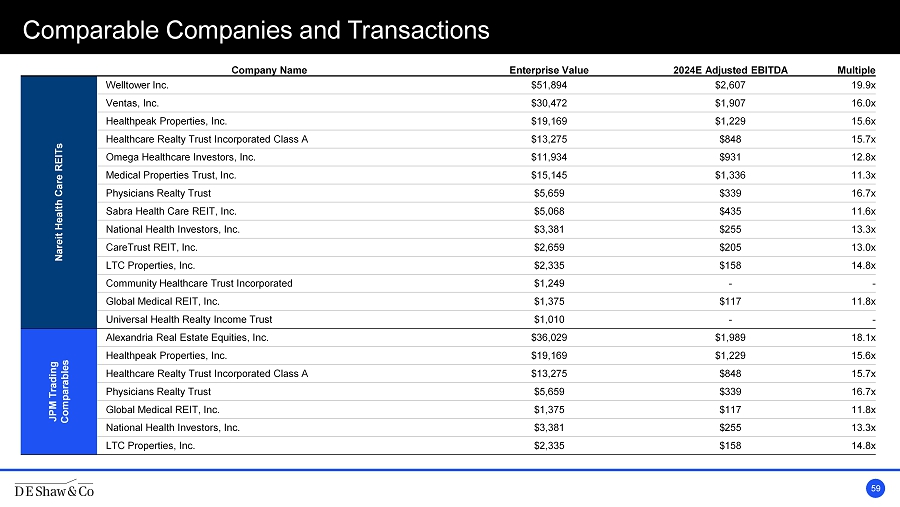

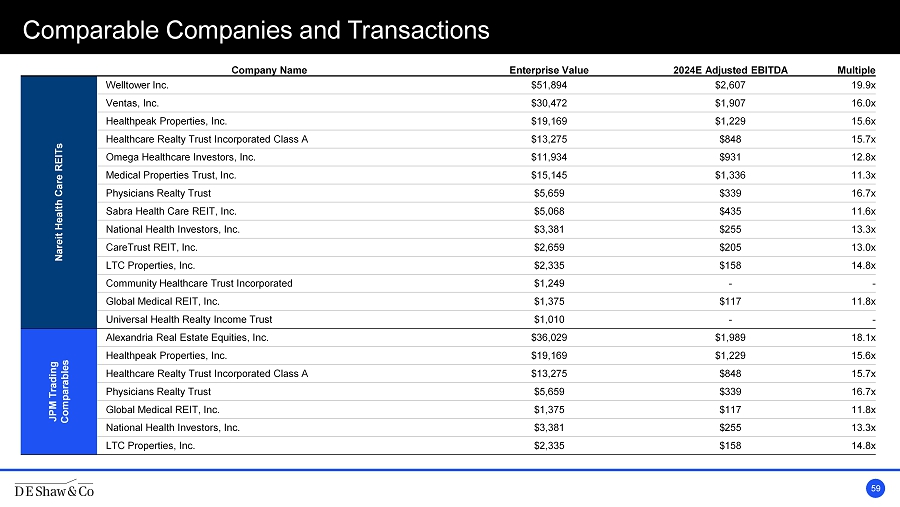

$6.78 $6.94 $7.39 $9.57 $19.15 $22.36 $16.57 $19.15 $0.00 $5.00 $10.00 $15.00 $20.00 $25.00 FTSE Nareit Health Care REITs BofA Precedent Transactions JPM Trading Comparables BofA Trading Comparables We Believe DHC’s Recovery and Growth Warrants a Higher Valuation 20 ▪ DHC’s 2022 Adjusted EBITDAre was a multi - year low, reflecting the full impact of COVID - 19 on the Company’s business ▪ Management, however, is expecting a robust and sustained recovery, with Adjusted EBITDAre projected to compound at a rate of approximately 25% over the next five years ▪ Based on forward Adjusted EBITDA multiples of peers and comparable transactions, the current deal significantly undervalues DHC Low Median High Nareit Health Care REITs 11.3x 14.0x 19.9x BofA Precedent Transactions 11.4x 12.4x 22.1x JPM Trading Comparables 11.8x 15.6x 18.1x BofA Trading Comparables 13.3x 15.8x 19.9x EV/FY+1 Adjusted EBITDA Multiple 1 Implied Valuation Range Based on 2024E Adj. EBITDA 1,2 Current Value of Consideration: $1.16 2

Management’s Own Projections Suggest DHC Is Worth More 21 ▪ On a standalone basis, we believe there is a near - term path to $350 million in NOI, which, in our view, would still reflect a discount to the full potential of DHC’s assets ▪ Management’s own projections show DHC surpassing $500 million in NOI by 2026 (and $350 million as soon as 2024) 1 ▪ Even assuming a conservative discount for DHC’s historical operational performance and governance, we believe DHC should be worth at least $5 per share DHC Consolidated NOI ($M) 1 $233 $362 $468 $530 $580 2023E 2024E 2025E 2026E 2027E DHC 2024E Consolidated NOI ($M) 1 $ 362 Cap Rate 2 8% Enterprise Value ($M) $ 4,519 Book Value of Unconsolidated Assets ($M) 3 $ 157 Plus: Cash ($M) 3 $ 383 Total Value ($M) $ 5,059 Less: Debt ($M) 3 $ 2,830 Equity Value ($M) $ 2,229 Shares Outstanding (M) 3 240 Value per Share $9.30 2

DHC Deserves a Greater Share of the Pro Forma Equity 22 $1,643 $403 DHC OPI 42% 58% DHC OPI 3 ▪ In J.P. Morgan’s fairness opinion for OPI, it used a discounted cash flow model to calculate that OPI’s equity is worth approximately $400 million and DHC’s equity value is approximately $1.6 billion, indicating that DHC shareholders should receive >80% of the equity of the combined company ▪ Yet, the merger would result in DHC shareholders owning only 42% of the combined equity ▪ We believe this allocation materially undervalues DHC and its contribution to the pro forma entity Standalone Equity Value as Calculated by JPM ($M) 1 Proposed Share of Pro Forma Equity 2

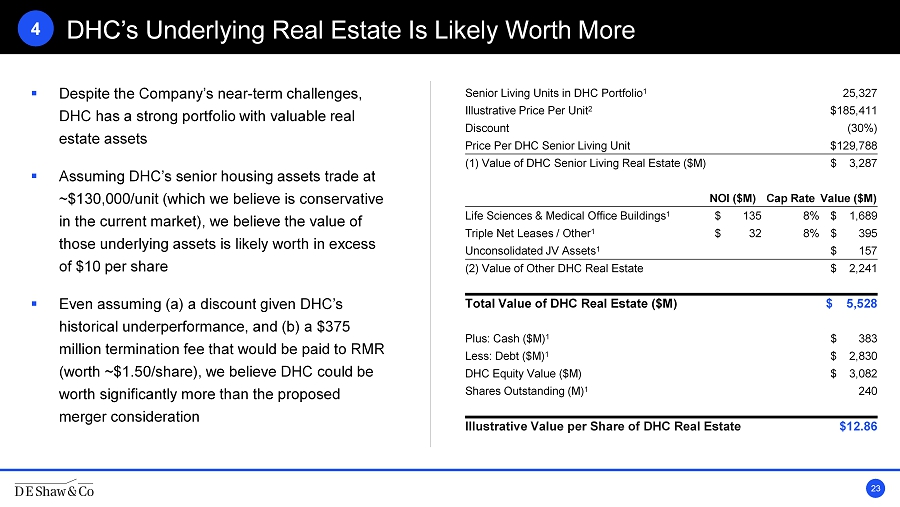

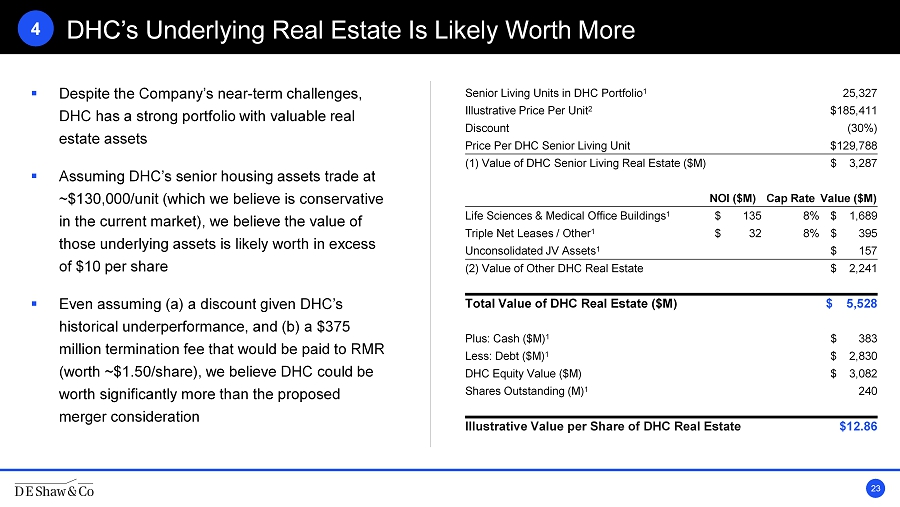

DHC’s Underlying Real Estate Is Likely Worth More 23 Senior Living Units in DHC Portfolio 1 25,327 Illustrative Price Per Unit 2 $185,411 Discount (30%) Price Per DHC Senior Living Unit $129,788 (1) Value of DHC Senior Living Real Estate ($M) $ 3,287 NOI ($M) Cap Rate Value ($M) Life Sciences & Medical Office Buildings 1 $ 135 8% $ 1,689 Triple Net Leases / Other 1 $ 32 8% $ 395 Unconsolidated JV Assets 1 $ 157 (2) Value of Other DHC Real Estate $ 2,241 Total Value of DHC Real Estate ($M) $ 5,528 Plus: Cash ($M) 1 $ 383 Less: Debt ($M) 1 $ 2,830 DHC Equity Value ($M) $ 3,082 Shares Outstanding (M) 1 240 Illustrative Value per Share of DHC Real Estate $12.86 4 ▪ Despite the Company’s near - term challenges, DHC has a strong portfolio with valuable real estate assets ▪ Assuming DHC’s senior housing assets trade at ~$130,000/unit (which we believe is conservative in the current market), we believe the value of those underlying assets is likely worth in excess of $10 per share ▪ Even assuming (a) a discount given DHC’s historical underperformance, and (b) a $375 million termination fee that would be paid to RMR (worth ~$1.50/share), we believe DHC could be worth significantly more than the proposed merger consideration

THE TIMING IS WRONG AND THE STRATEGIC RATIONALE IS NOT COMPELLING 24 SECTION III

The Timing Is Wrong and the Strategic Rationale Is Not Compelling 25 OPI is Facing its Own Challenges ▪ OPI has underperformed its peers and relevant benchmarks over various time periods ▪ OPI is highly leveraged and is facing a looming debt maturity cliff as occupancy rates decline and operating performance is deteriorating The Outlook for Office REITs is Deteriorating ▪ The work - from - home trend appears to be continuing, putting office REITs under significant pressure ▪ Office REITs have fallen out of favor among investors, and the prospects and timeline for recovery are uncertain Senior Housing Prospects are Improving ▪ Senior housing real estate is poised to benefit from long - term demographic and macroeconomic tailwinds, including accelerated population growth in individuals 80+ and tight inventory ▪ Occupancy is continuing to improve across the sector The Strategic Rationale is not Compelling ▪ Synergies between DHC and OPI are limited, and the modest efficiencies are outweighed by significant transaction costs ▪ The combination does not appear to be underpinned by industrial logic other than diversification 1 2 3 4

OPI’s Total Shareholder Returns Have Been Poor 26 3 - Year Total Shareholder Return 1 10 - Year Total Shareholder Return 1 1 - Year Total Shareholder Return 1 5 - Year Total Shareholder Return 1 1 (72%) (9%) 15% 1% (100%) (80%) (60%) (40%) (20%) 0% 20% BofA OPI Public Comparables MSCI US REIT Index FTSE US Office REIT Index (62%) (29%) 11% (22%) (100%) (80%) (60%) (40%) (20%) 0% 20% BofA OPI Public Comparables MSCI US REIT Index FTSE US Office REIT Index (46%) (38%) 12% (37%) (100%) (80%) (60%) (40%) (20%) 0% 20% BofA OPI Public Comparables MSCI US REIT Index FTSE US Office REIT Index (46%) (42%) (23%) (48%) (100%) (80%) (60%) (40%) (20%) 0% 20% BofA OPI Public Comparables MSCI US REIT Index FTSE US Office REIT Index

OPI Faces a Looming Debt Maturity Cliff… 27 ▪ Much of management’s rationale for the proposed transaction has focused on DHC’s challenges ▪ OPI, however, also has significant near - term debt maturities and high leverage ▪ We are concerned that RMR is using the combination with DHC to fortify OPI and therefore preserve its own lucrative management fees % of Debt Maturing in 2023 - 2025 1 46% 27% 34% OPI Nareit Office REITs BofA OPI Public Comparables In an environment when borrowing and refinancing gets tougher and more expensive, the best place to be is not requiring a lot of financing.” – Barclays Research Report 2 1

…As Operating Performance Continues to Deteriorate 28 OPI AFFO/Share 2 OPI Occupancy Rate 2 $6.01 $5.39 $4.87 $4.76 $4.08 2019 2020 2021 2022 LFQ Annualized 94.4% 90.5% 1Q 18 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 2Q 21 3Q 21 4Q 21 1Q 22 2Q 22 3Q 22 4Q 22 1Q 23 1 ▪ OPI’s operating performance has declined for several years, as lingering COVID - related issues like declining occupancy continue to weigh on results ▪ OPI management has warned that more challenges lie ahead, noting that “headwinds in the office sector remain, with added pressure as a result of corporate cost cutting” and “elevated sublease space” 1

Office REITs Face Continued Challenges 29 Remote Work Remains Popular Office Usage Rates Have Stagnated The Sector is Out of Favor Among Investors % of Remote Job Posts 1 Office Tenant Occupancy as a % of Pre - Pandemic Norm 2 Office REITs P/AFFO Premium 3 13% 33% 27% Dec. 2019 Feb. 2022 (Peak) Feb. 2023 48% 47% 41% 45% 50% 45% 44% 47% 10-Metro Average New York San Francisco Washington DC September 2022 March 2023 31% (39%) (50%) (25%) 0% 25% 50% Mar 2018 Mar 2019 Mar 2020 Mar 2021 Mar 2022 Mar 2023 Fully remote work remains prevalent, even as other pandemic - era trends have abated Usage rates have not materially changed in over a year as the return - to - office movement has lost momentum Macroeconomic trends have made office REITs particularly volatile, with fewer investors willing to take on incremental risk 2 REIT dedicated investors are increasingly simply ignoring office, while generalists are often shorting the space. This investor dynamic will continue to be a headwind for the sector until fundamental trends in office [improve].” – Barclays Research Report 4

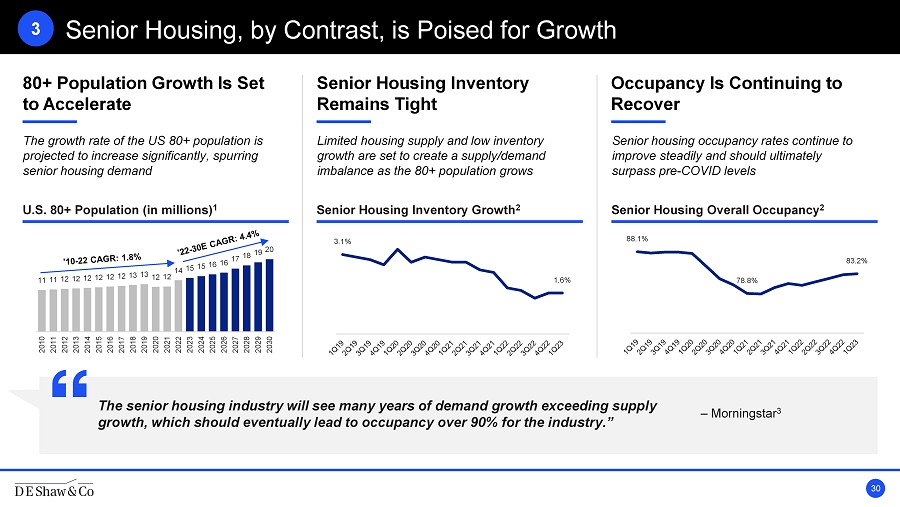

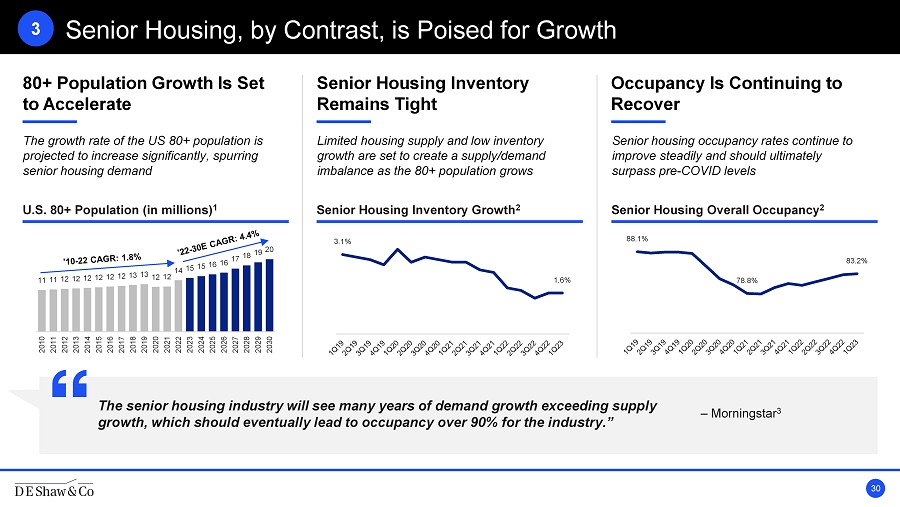

Senior Housing, by Contrast, is Poised for Growth 30 80+ Population Growth Is Set to Accelerate Senior Housing Inventory Remains Tight Occupancy Is Continuing to Recover U.S. 80+ Population (in millions) 1 Senior Housing Inventory Growth 2 Senior Housing Overall Occupancy 2 The growth rate of the US 80+ population is projected to increase significantly, spurring senior housing demand Limited housing supply and low inventory growth are set to create a supply/demand imbalance as the 80+ population grows Senior housing occupancy rates continue to improve steadily and should ultimately surpass pre - COVID levels 3 The senior housing industry will see many years of demand growth exceeding supply growth, which should eventually lead to occupancy over 90% for the industry.” – Morningstar 3 11 11 12 12 12 12 12 12 13 13 12 12 14 15 15 16 16 17 18 19 20 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 3.1% 1.6% 88.1% 78.8% 83.2%

Synergies Are Limited (and Outweighed by Transaction Costs) 31 2.63% 2.07% 1.39% 0.77% DHC/OPI Healthcare Trust/Healthcare Realty New Senior/Ventas Care Capital/Sabra 0.76% 0.51% 0.51% 0.09% New Senior/Ventas Healthcare Trust/Healthcare Realty Care Capital/Sabra DHC/OPI Expected Cost Savings as a % of Transaction Value 1,2 ▪ The expected cost savings of the proposed transaction are minimal relative to previous healthcare REIT deals ▪ On the other hand, the transaction expenses – estimated to be $75 million – are significant ▪ The transaction lacks industrial logic beyond basic diversification, which investors can achieve on their own simply by continuing to own standalone DHC and OPI shares, if they wish ▪ In fact, RMR - affiliated companies have previously acknowledged the benefit of keeping healthcare and office assets separate 3 Transaction Expenses as a % of Transaction Value 1,2

THE PROCESS WAS FLAWED AND INADEQUATE 32 SECTION IV

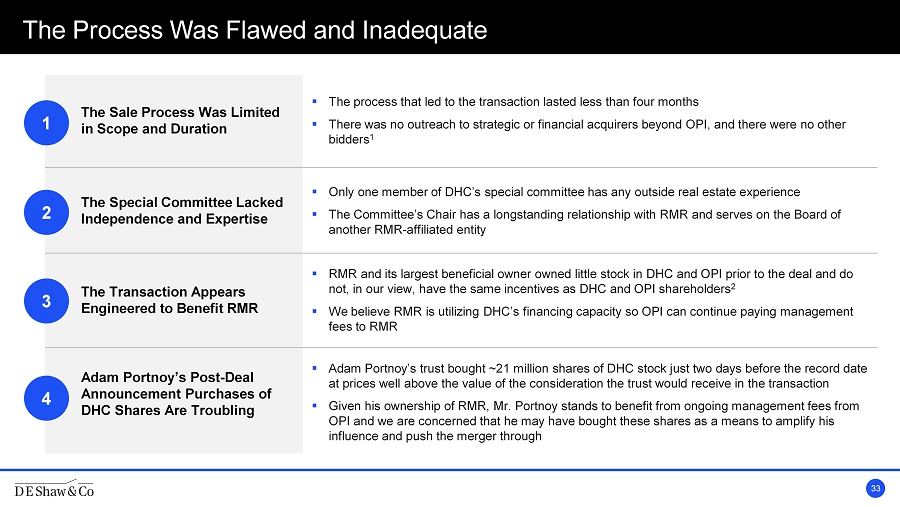

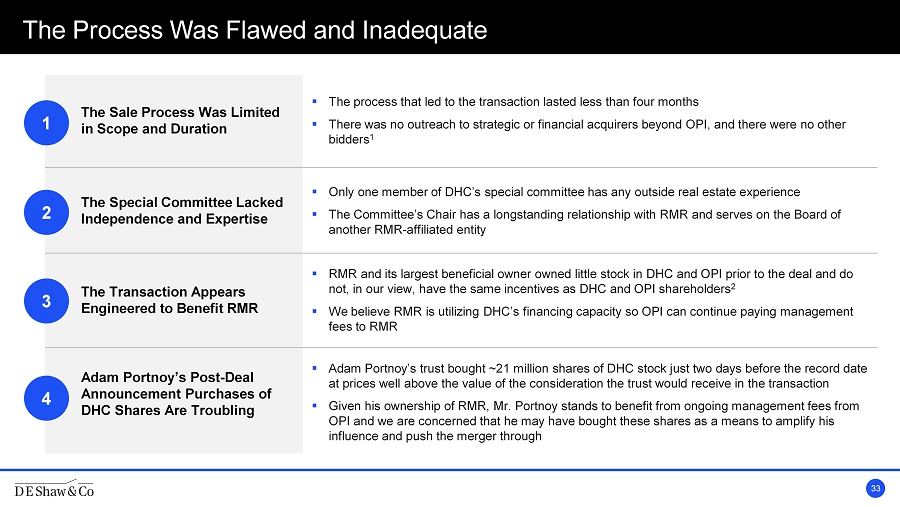

The Process Was Flawed and Inadequate 33 The Sale Process Was Limited in Scope and Duration ▪ The process that led to the transaction lasted less than four months ▪ There was no outreach to strategic or financial acquirers beyond OPI, and there were no other bidders 1 The Special Committee Lacked Independence and Expertise ▪ Only one member of DHC’s special committee has any outside real estate experience ▪ The Committee’s Chair has a longstanding relationship with RMR and serves on the Board of another RMR - affiliated entity The Transaction Appears Engineered to Benefit RMR ▪ RMR and its largest beneficial owner owned little stock in DHC and OPI prior to the deal and do not, in our view, have the same incentives as DHC and OPI shareholders 2 ▪ We believe RMR is utilizing DHC’s financing capacity so OPI can continue paying management fees to RMR Adam Portnoy’s Post - Deal Announcement Purchases of DHC Shares Are Troubling ▪ Adam Portnoy’s trust bought ~21 million shares of DHC stock just two days before the record date at prices well above the value of the consideration the trust would receive in the transaction ▪ Given his ownership of RMR, Mr. Portnoy stands to benefit from ongoing management fees from OPI and we are concerned that he may have bought these shares as a means to amplify his influence and push the merger through 1 2 3 4

The Sale Process Was Limited in Scope and Duration 34 Length of Sale Process (Days) 1,2 Total Number of Bidders 1 ▪ In May 2022, DHC received an unsolicited acquisition proposal from a third party for $4.00 in cash per share ▪ DHC chose not to engage with the third party and only began a sale process when the stock was trading near an all - time low ▪ The sale process lasted just over 100 days ▪ There was no outreach to strategic or financial acquirers beyond OPI; OPI was the only bidder for DHC 1 338 293 150 112 34 Median of Precedent Transactions: 222 MedEquities/Omega Care Capital/Sabra Healthcare Trust/Healthcare Realty DHC/OPI New Senior/Ventas 3 2 2 1 1 Healthcare Trust/Healthcare Realty New Senior/Ventas MedEquities/Omega Care Capital/Sabra DHC/OPI 1

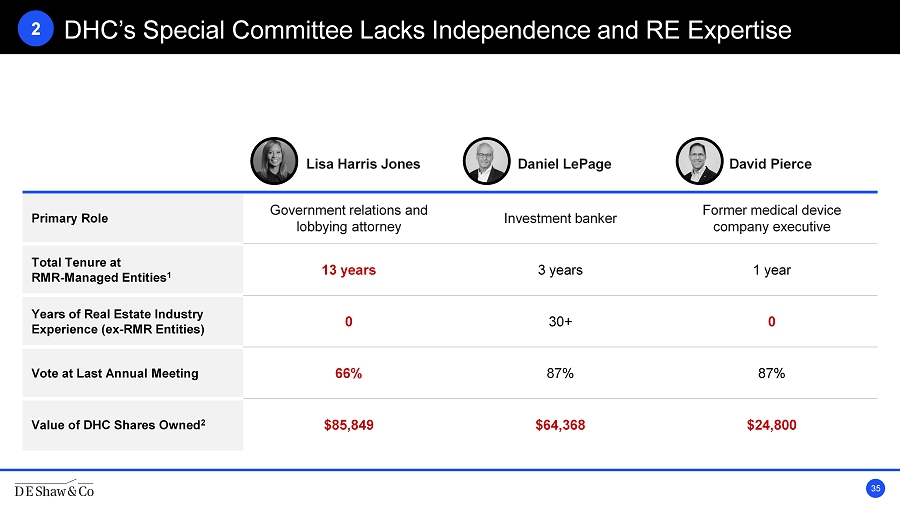

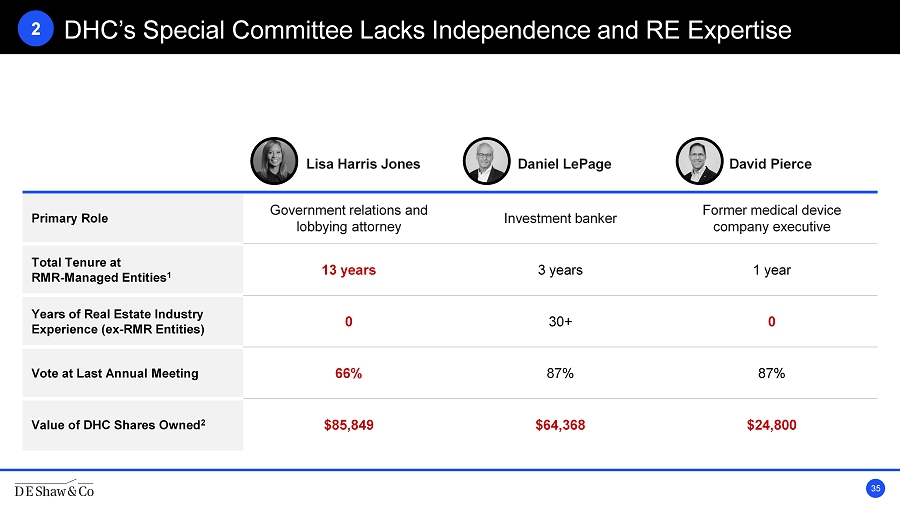

DHC’s Special Committee Lacks Independence and RE Expertise 35 Lisa Harris Jones Daniel LePage David Pierce Primary Role Government relations and lobbying attorney Investment banker Former medical device company executive Total Tenure at RMR - Managed Entities 1 13 years 3 years 1 year Years of Real Estate Industry Experience (ex - RMR Entities) 0 30+ 0 Vote at Last Annual Meeting 66% 87% 87% Value of DHC Shares Owned 2 $85,849 $64,368 $24,800 2

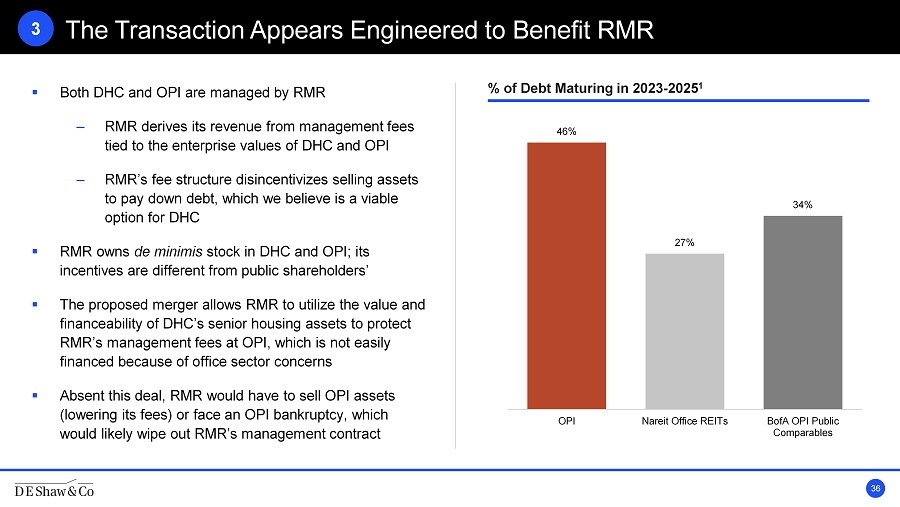

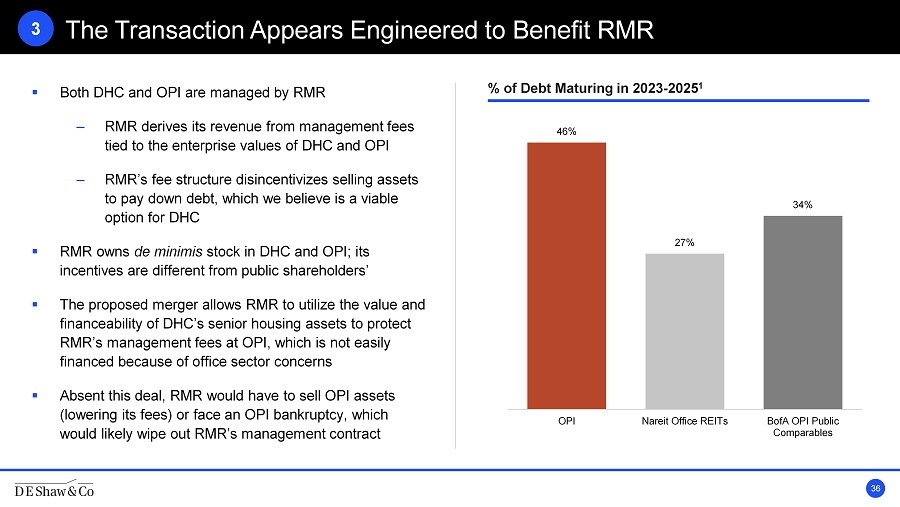

The Transaction Appears Engineered to Benefit RMR 36 ▪ Both DHC and OPI are managed by RMR – RMR derives its revenue from management fees tied to the enterprise values of DHC and OPI – RMR’s fee structure disincentivizes selling assets to pay down debt, which we believe is a viable option for DHC ▪ RMR owns de minimis stock in DHC and OPI; its incentives are different from public shareholders’ ▪ The proposed merger allows RMR to utilize the value and financeability of DHC’s senior housing assets to protect RMR’s management fees at OPI, which is not easily financed because of office sector concerns ▪ Absent this deal, RMR would have to sell OPI assets (lowering its fees) or face an OPI bankruptcy, which would likely wipe out RMR’s management contract % of Debt Maturing in 2023 - 2025 1 46% 27% 34% OPI Nareit Office REITs BofA OPI Public Comparables 3

Mr. Portnoy’s Recent Purchases of DHC Shares Are Troubling 37 ▪ Adam Portnoy is the controlling shareholder of RMR and managing trustee of both OPI and DHC 1 ▪ In the days leading up to the record date, Mr. Portnoy’s trust bought ~21 million shares of DHC, even though the stock was trading at a significant premium to the merger consideration, indicating that he would lose money if the deal goes through ▪ Given Mr. Portnoy’s ties to RMR, we believe that his recent share purchases may indicate an attempt to amplify his influence and push through the merger, which benefits OPI and RMR at the expense of DHC’s shareholders Shares Purchased (M) 2.0 2.0 2.0 1.9 1.7 2.4 1.6 2.3 1.6 1.5 1.1 0.6 $3.07 $3.03 $2.87 $2.59 $2.46 $2.34 $1.87 $1.75 $1.69 $1.47 $1.35 $1.21 June 14 June 13 June 12 June 9 June 8 June 7 June 6 June 5 June 2 June 1 May 31 May 30 Value of Merger Consideration on May 30 DHC Share Price on Date of Mr. Portnoy’s Purchases 2 3

BETTER ALTERNATIVES EXIST FOR DHC 38 SECTION V

We Believe DHC’s Primary Issue Is Short - Term and Fixable 39 ▪ DHC’s primary issue is its non - compliance with its consolidated income - to - debt service ratio covenant – While it is out of compliance with this covenant, DHC is prohibited from raising new debt, including for refinancing and incremental capital spending ▪ However, DHC holds over $5.8 billion in unencumbered assets 1 ▪ Without the covenant constraint, we believe the market would be receptive to DHC issuing secured debt to refinance its 2024 and 2025 maturities – In particular, DHC can access low - cost government - backed agency mortgage debt secured against its senior living assets, which would allow for continued access to attractive financing ▪ We believe DHC has several options to address its near - term maturities that would be preferable to the proposed transaction – Some of these solutions do not even require DHC to regain covenant compliance – Other solutions provide an accelerated path to covenant compliance

Better Alternatives Exist for DHC 40 DHC Could Wait to Achieve Covenant Compliance DHC Could Solicit Consents from Bondholders DHC Could Sell Assets to Repay Debt DHC Could Issue Preferred Stock to Repay Debt DHC Could Issue a Zero - Coupon Bond to Repay Debt DHC Could JV Certain Assets 1 2 3 4 5 6

DHC Could Wait to Achieve Covenant Compliance 41 ▪ DHC has no maturities until 2024 and therefore has more time to let its recovery play out ▪ We believe DHC can achieve covenant compliance by the fourth quarter of 2023 – well before its first bond maturity – Based on Q1 2023 and April results, DHC is on track to exceed its SHOP projections for 2023 by at least $25 million – The market is broadly expecting senior living results to improve industry - wide in the second half of 2023 ▪ Based on the CEO’s statements during the Q4 2022 earnings call and investor calls with management, we were led to believe that this “recovery strategy” was the Company’s preferred path forward ▪ We question DHC management’s sudden change in tone for 2023, just after the merger announcement, in the face of strong YTD operating results and strong projections for 2024 1

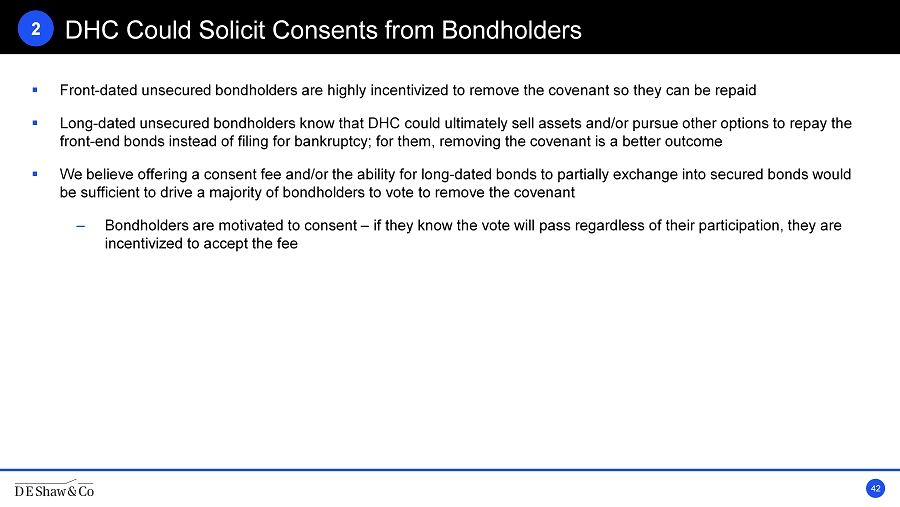

DHC Could Solicit Consents from Bondholders 42 ▪ Front - dated unsecured bondholders are highly incentivized to remove the covenant so they can be repaid ▪ Long - dated unsecured bondholders know that DHC could ultimately sell assets and/or pursue other options to repay the front - end bonds instead of filing for bankruptcy; for them, removing the covenant is a better outcome ▪ We believe offering a consent fee and/or the ability for long - dated bonds to partially exchange into secured bonds would be sufficient to drive a majority of bondholders to vote to remove the covenant – Bondholders are motivated to consent – if they know the vote will pass regardless of their participation, they are incentivized to accept the fee 2

DHC Could Sell Assets to Repay Debt 43 ▪ DHC possesses valuable real estate, most of which is liquid and easily saleable – Most properties fall under the $15 million ticket size and can be mortgaged without difficulty ▪ These assets would be attractive to strategic acquirers like Ventas, Welltower, Healthcare Realty Trust, or Physicians Realty Trust, among others, as complementary to their existing portfolios ▪ This simple option does not require covenant compliance 3

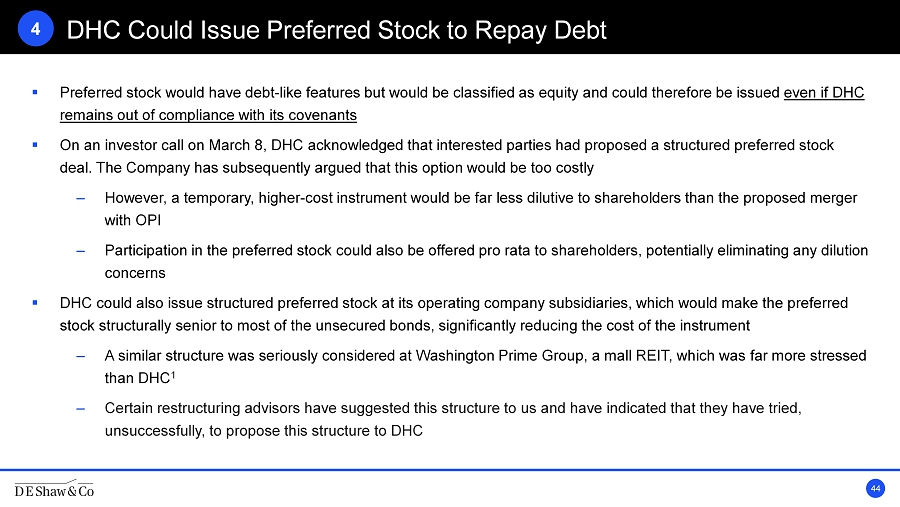

DHC Could Issue Preferred Stock to Repay Debt 44 ▪ Preferred stock would have debt - like features but would be classified as equity and could therefore be issued even if DHC remains out of compliance with its covenants ▪ On an investor call on March 8, DHC acknowledged that interested parties had proposed a structured preferred stock deal. The Company has subsequently argued that this option would be too costly – However, a temporary, higher - cost instrument would be far less dilutive to shareholders than the proposed merger with OPI – Participation in the preferred stock could also be offered pro rata to shareholders, potentially eliminating any dilution concerns ▪ DHC could also issue structured preferred stock at its operating company subsidiaries, which would make the preferred stock structurally senior to most of the unsecured bonds, significantly reducing the cost of the instrument – A similar structure was seriously considered at Washington Prime Group, a mall REIT, which was far more stressed than DHC 1 – Certain restructuring advisors have suggested this structure to us and have indicated that they have tried, unsuccessfully, to propose this structure to DHC 4

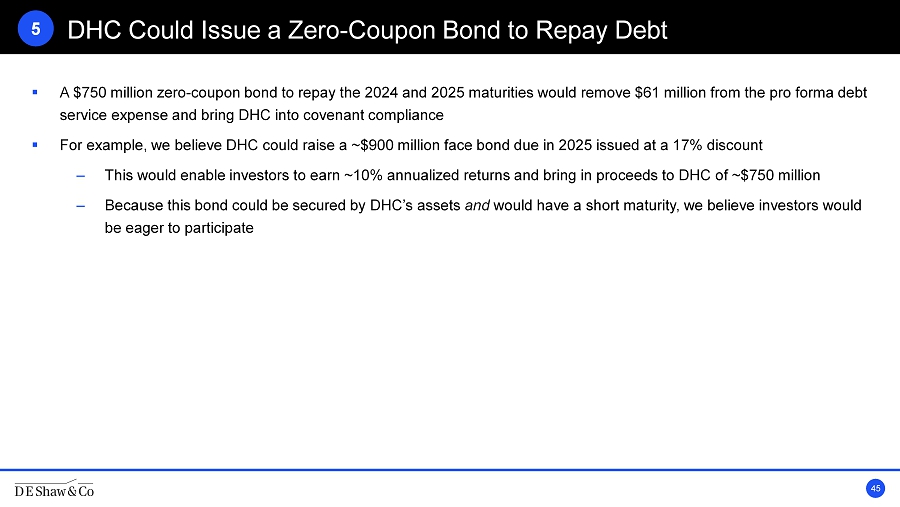

DHC Could Issue a Zero - Coupon Bond to Repay Debt 45 ▪ A $750 million zero - coupon bond to repay the 2024 and 2025 maturities would remove $61 million from the pro forma debt service expense and bring DHC into covenant compliance ▪ For example, we believe DHC could raise a ~$900 million face bond due in 2025 issued at a 17% discount – This would enable investors to earn ~10% annualized returns and bring in proceeds to DHC of ~$750 million – Because this bond could be secured by DHC’s assets and would have a short maturity, we believe investors would be eager to participate 5

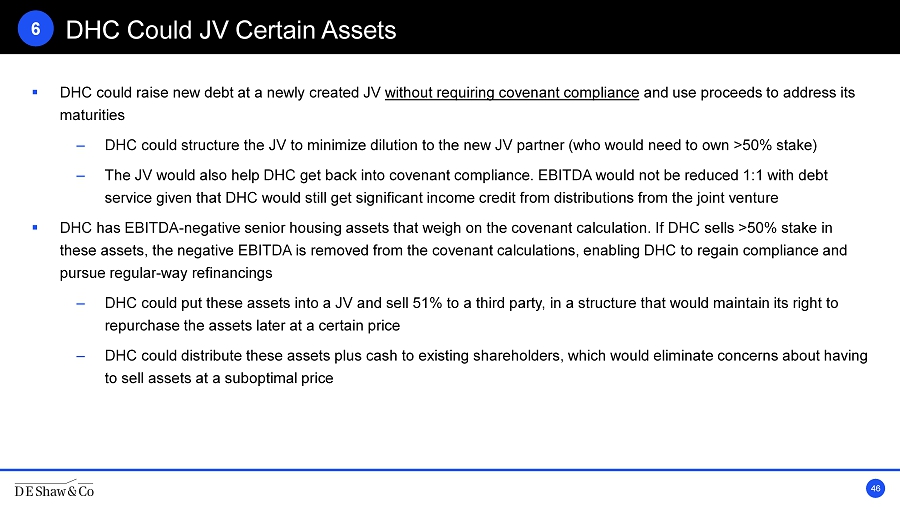

DHC Could JV Certain Assets 46 ▪ DHC could raise new debt at a newly created JV without requiring covenant compliance and use proceeds to address its maturities – DHC could structure the JV to minimize dilution to the new JV partner (who would need to own >50% stake) – The JV would also help DHC get back into covenant compliance. EBITDA would not be reduced 1:1 with debt service given that DHC would still get significant income credit from distributions from the joint venture ▪ DHC has EBITDA - negative senior housing assets that weigh on the covenant calculation. If DHC sells >50% stake in these assets, the negative EBITDA is removed from the covenant calculations, enabling DHC to regain compliance and pursue regular - way refinancings – DHC could put these assets into a JV and sell 51% to a third party, in a structure that would maintain its right to repurchase the assets later at a certain price – DHC could distribute these assets plus cash to existing shareholders, which would eliminate concerns about having to sell assets at a suboptimal price 6

We Believe DHC Could Regain Covenant Compliance 47 ▪ We find it hard to reconcile the Company’s disclosure on its covenants – and we question the change in posture ▪ On its Q4 2022 earnings call, DHC management said that the Company had an NOI shortfall of $74 million to get back into compliance; with results improving, it saw a path to get there ▪ Yet, post - merger announcement, DHC now says it has an NOI shortfall of $81 million, despite the fact that its LTM reported EBITDAre increased by $24 million ▪ Covenant calculations are inherently subject to add - backs and adjustments that require management’s discretion – and we question how the sudden change in posture may be impacting these adjustments.

We Believe DHC Could Regain Covenant Compliance 48 Estimated covenant compliance under various scenarios, even accepting DHC’s newly disclosed baseline 1.05 1.15 1.62 1.72 1.56 0.00 0.50 1.00 1.50 2.00 2.50 Q1 2023 LTM PF Q1 2023 LTM Adj PF Q1 2023 Annualized + $25MM Zero Coupon Bond JV Negative Assets Minimum Ratio for Compliance: 1.50 in millions of USD Estimated Metrics Q1 '23 LTM PF [1] Q1 '23 LTM PF - Further Adj Q1 '23 Run Rate + $25MM Growth Zero Coupon Bond [3] JV Negative Assets out of Portfolio [4] PF Adjusted EBITDAre 206 206 276 206 281 Undisclosed Adjustment (16) (16) (16) (16) Gain from Insurance Proceeds [2] - 18 18 18 18 PF Consolidated Income 190 207 293 207 282 PF Debt Service 181 181 181 121 181 Consolidated Income to Debt Service Ratio 1.05 1.15 1.62 1.72 1.56 Minimum Ratio for Compliance 1.50 1.50 1.50 1.50 1.50 Compliance? No No Yes Yes Yes NOI (Shortfall) Surplus for Compliance (81) (64) 22 26 11 PF with No Proactive Intervention Potential Interventions Based on Q1 '23 LTM PF EBITDA No Proactive Intervention Potential Interventions

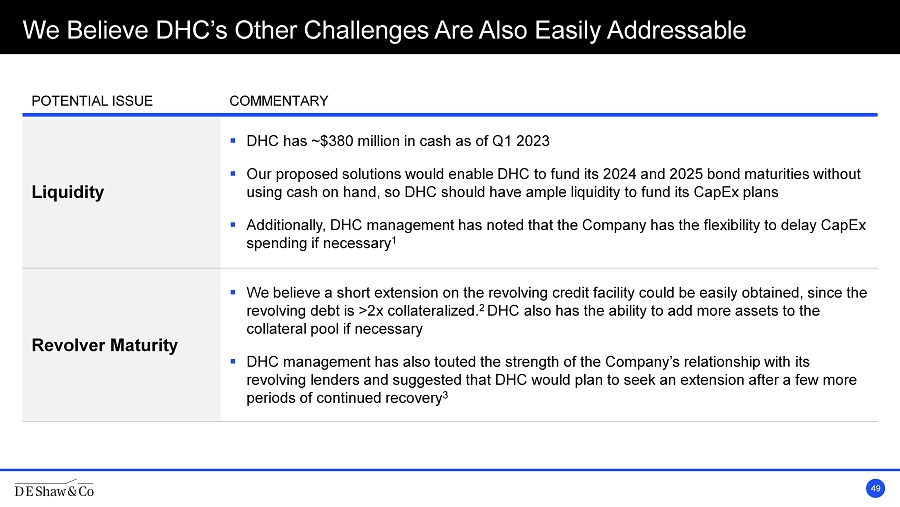

We Believe DHC’s Other Challenges Are Also Easily Addressable 49 POTENTIAL ISSUE COMMENTARY Liquidity ▪ DHC has ~$380 million in cash as of Q1 2023 ▪ Our proposed solutions would enable DHC to fund its 2024 and 2025 bond maturities without using cash on hand, so DHC should have ample liquidity to fund its CapEx plans ▪ Additionally, DHC management has noted that the Company has the flexibility to delay CapEx spending if necessary 1 Revolver Maturity ▪ We believe a short extension on the revolving credit facility could be easily obtained, since the revolving debt is >2x collateralized. 2 DHC also has the ability to add more assets to the collateral pool if necessary ▪ DHC management has also touted the strength of the Company’s relationship with its revolving lenders and suggested that DHC would plan to seek an extension after a few more periods of continued recovery 3

RESPONDING TO DHC’S CLAIMS 50 SECTION VI NEW

The D. E. Shaw Group’s Motivation Is to Seek Fair Value for Its Equity 51 ▪ The Company’s statement that our opposition to the transaction is motivated by our bond holdings is wrong – The D. E. Shaw group owns exclusively front - dated bonds, which stand to benefit if the merger is approved given DHC’s stated plan to repay those bonds in full – Attempting to orchestrate a default would be illogical, especially given our position in the front - dated bonds • In the event of default, the high - priced front - dated bonds would converge with lower - priced long - dated bonds • So, if an investor was expecting a default, it would own the cheaper, long - dated bonds, not the front - dated ones that we own – Our continued ownership of front - dated bonds, along with our opposition to the transaction, demonstrate our belief that the risk of DHC’s default is minimal and overstated • We believe the bonds will be repaid regardless of whether the merger is approved ▪ The D. E. Shaw group held most of its position in DHC’s equity – just under 5% of the outstanding shares – prior to the announcement of the deal – We invested in DHC’s equity because we believe in the underlying value of the Company, not as part of some scheme to engineer a default, as the Company implies

DHC’s Claims in Support of the Transaction Are Misleading 52 DHC’S CLAIM 1 FURTHER CONTEXT The merger offers compelling terms for DHC shareholders ▪ The current value of the consideration represents a 54% discount to DHC’s current share price and a 36% discount to the initial headline value of the deal 2 ▪ DHC shareholders will only own 42% of the combined company, despite contributing >80% of the equity value There is significant downside risk to shareholders if the merger is not approved ▪ Despite a marked shift in tone post merger announcement, the company has many viable standalone options to pursue 3 ▪ The board has a fiduciary duty to pursue the best financing options for DHC shareholders and cannot raise >20% equity without a shareholder vote. The financing terms portrayed by DHC are far more onerous than what investors would demand The Board has been open to alternatives; none have emerged ▪ Multiple investors and restructuring advisors have approached DHC offering to help, but have been rebuffed ▪ We believe DHC’s management agreement with RMR – which the Company acknowledges is a deterrent to potential buyers 4 – is one reason that no other strategic alternatives have been forthcoming Standalone alternatives would not solve DHC’s capex problems ▪ DHC has previously stated that capex could be slowed to align with the cash flow of the business ▪ We believe DHC could moderate its capex in the short - term and accelerate spending once near - term pressures have eased

DHC’s Dismissal of Standalone Alternatives Is Misguided 53 POTENTIAL ALTERNATIVE DHC’S EXCUSE FOR NOT PURSUING 1 THE D. E. SHAW GROUP’S RESPONSE Wait to Achieve Compliance ▪ SHOP recovery will take more time ▪ “Wait and see” approach gives bondholders leverage ▪ The SHOP segment continued to improve in Q2 2023, with SHOP NOI increasing >30% and occupancy increasing by 90 bps quarter - over - quarter ▪ Competitors cite that revenue is trending up while expenses are trending down; the latter stands in direct contrast to what DHC is now saying 2 Solicit Consents ▪ Solicitation is time - consuming, uncertain and generally requires concessions to bondholders ▪ Consent solicitations are standard practice and can be completed expeditiously ▪ They are much more cost effective than a value destructive merger Sell Assets ▪ Financing would be expensive and challenging, and DHC would be selling into a depressed market ▪ Loss of earnings would delay covenant compliance ▪ We believe the Company’s aversion to asset sales is driven mainly by RMR’s desire to preserve its fees ▪ To our knowledge, the DHC Board has not tested the market for asset sales Issue Preferred Stock ▪ Likely to be expensive and under onerous terms ▪ DHC is unlikely to be able to raise the amount needed to address near - term maturities ▪ Ignores the fact that DHC could issue structurally senior preferred equity at a much lower cost ▪ The bond covenant does not preclude preferred equity that can be redeemed by the Company at its option, allowing this to serve as temporary financing Issue Zero - Coupon Bonds ▪ Would likely need to be issued at a large discount and/or with warrants to entice investors ▪ Would increase leverage ▪ These bonds could be secured by DHC’s assets and would have a short maturity; we believe they would be attractive to many investors at ~10% ▪ Could be used to repay 2024 and 2025 debt; next maturities not until 2028 Joint Ventures ▪ Current market conditions make JVs difficult, and pricing is unattractive ▪ Ignores the fact that this is more of a structural tool, and very little equity would need to be sold ▪ Existing equity and bond holders would likely participate

CONCLUSION 54 SECTION VII

Other Large Shareholders Have Publicly Criticized the Merger 55 We believe the Board of Trustees (the “Board”) has failed DHC’s stakeholders by pursuing the proposed merger, which would unnecessarily burden the Company with OPI’s rapidly declining commercial office properties. We also believe the deal disproportionally benefits OPI and the conflicted external manager for both DHC and OPI, The RMR Group LLC (“RMR”), at the expense of DHC stakeholders.” 1 DHC Shareholder May 23, 2023

Other Large Shareholders Have Publicly Criticized the Merger 56 [W]e do not believe that DHC’s proposed merger with Office Properties Income Trust (the “Proposed Merger”) is in the best interests of DHC’s shareholders or creditors. As both a shareholder and bondholder, we believe multiple alternatives to the Proposed Merger exist that better address the Company’s near - term challenges, and which far better serve the interests of DHC’s shareholders and bondholders in the long term.” 1 DHC Shareholder June 30, 2023

Conclusion 57 The proposed merger comes at the wrong time and the valuation and process are inadequate DHC has other, better alternatives than this suboptimal transaction with OPI Shareholders should oppose the proposed merger with OPI ▪ The value of the consideration is too low and has declined significantly; in any event, the split of equity between DHC and OPI was unjustified ▪ There is no industrial logic and very few potential synergies to support a deal ▪ In our view, the transaction process raises numerous red flags ▪ There are numerous realistic, achievable paths DHC could take to address its maturities ▪ The proposed transaction is a suboptimal solution to DHC’s near - term challenges ▪ We see no need to sell DHC for the benefit of OPI and RMR ▪ We do not believe the value of the consideration fairly compensates DHC shareholders for foregoing future growth and upside

APPENDIX 58 SECTION VIII

Comparable Companies and Transactions 59 Company Name Enterprise Value 2024E Adjusted EBITDA Multiple Nareit Health Care REITs Welltower Inc. $51,894 $2,607 19.9x Ventas, Inc. $30,472 $1,907 16.0x Healthpeak Properties, Inc. $19,169 $1,229 15.6x Healthcare Realty Trust Incorporated Class A $13,275 $848 15.7x Omega Healthcare Investors, Inc. $11,934 $931 12.8x Medical Properties Trust, Inc. $15,145 $1,336 11.3x Physicians Realty Trust $5,659 $339 16.7x Sabra Health Care REIT, Inc. $5,068 $435 11.6x National Health Investors, Inc. $3,381 $255 13.3x CareTrust REIT, Inc. $2,659 $205 13.0x LTC Properties, Inc. $2,335 $158 14.8x Community Healthcare Trust Incorporated $1,249 - - Global Medical REIT, Inc. $1,375 $117 11.8x Universal Health Realty Income Trust $1,010 - - JPM Trading Comparables Alexandria Real Estate Equities, Inc. $36,029 $1,989 18.1x Healthpeak Properties, Inc. $19,169 $1,229 15.6x Healthcare Realty Trust Incorporated Class A $13,275 $848 15.7x Physicians Realty Trust $5,659 $339 16.7x Global Medical REIT, Inc. $1,375 $117 11.8x National Health Investors, Inc. $3,381 $255 13.3x LTC Properties, Inc. $2,335 $158 14.8x

Comparable Companies and Transactions (Cont’d) 60 Company Name Enterprise Value 2024E Adjusted EBITDA Multiple BofA Trading Comparables Welltower Inc. $51,894 $2,607 19.9x Ventas, Inc. $30,472 $1,907 16.0x Healthpeak Properties, Inc. $19,169 $1,229 15.6x Healthcare Realty Trust Incorporated Class A $13,275 $848 15.7x Physicians Realty Trust $5,659 $339 16.7x National Health Investors, Inc. $3,381 $255 13.3x

Comparable Companies and Transactions (Cont’d) 61 Company Name (Acquirer) Transaction Value ($M) FY+1 Adjusted EBITDA Multiple BofA Precedent Transactions Care Capital Properties, Inc. (Sabra Health Care REIT, Inc.) $3,914 $316 12.4x Healthcare Trust of America, Inc. (Healthcare Realty Trust, Inc.) $6,723 - - MedEquities Realty Trust, Inc. (Omega Healthcare Investors, Inc.) $603 $53 11.4x New Senior Investment Group, Inc. (Ventas, Inc.) $2,247 $102 22.1x