UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K/A

Amendment No. 1

| x | | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the Fiscal Year ended December 31, 2002

OR

| ¨ | | Transition Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the Transition Period from to

Commission File Number: 000-23265

Salix Pharmaceuticals, Ltd.

(Exact name of Registrant as specified in its charter)

Delaware | | 94-3267443 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer Identification No.) |

8540 Colonnade Center Drive, Suite 501

Raleigh, North Carolina 27615

(Address of principal executive offices, including zip code)

(919) 862-1000

(Registrant’s telephone number, including area code)

Securities Registered Pursuant to Section 12(b) of the Act: None

Securities Registered Pursuant to Section 12(g) of the Act:

Title of Each Class

Common Stock, $0.001 Par Value

Preferred Stock Purchase Rights

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is an accelerated filer (as defined) in Rule 12b-2 of the Act. YES x NO ¨

The aggregate market value of the Registrant’s common stock held by non-affiliates of the Registrant on June 30, 2002 (based on the closing sale price of US $15.26 of the Registrant’s common stock, as reported on The Nasdaq National Market on such date) was approximately U.S. $243,655,108. Common stock held by each officer and director and by each person known to the Company who owns 5% or more of the outstanding common stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The number of shares of the Registrant’s common stock outstanding at March 21, 2003 was 21,375,846.

EXPLANATORY NOTE

Certain information required by Part III of Form 10-K was omitted from our report on Form 10-K filed on March 27, 2003, because at that time we intended to file a definitive proxy statement for our 2003 Annual Meeting of Stockholders within 120 days after the end of our fiscal year pursuant to Regulation 14A promulgated under the Securities Exchange Act of 1934, as amended. Because we no longer intend to file the definitive proxy statement within such 120-day period, the omitted information is filed herewith and provided below as required.

PART III

Item 10. Directors and Executive Officers of the Registrant

Directors of the Registrant

As of April 25, 2003, our directors were as set forth below. There are no family relationships among our directors, director nominees or executive officers.

Name Director Since

| | Age

| | Position(s) With Salix

|

Robert P. Ruscher November 1999 | | 42 | | Executive Chairman of the Board of Directors |

|

Carolyn J. Logan July 2002 | | 54 | | President, Chief Executive Officer and Director |

|

John F. Chappell (1) December 1993 | | 66 | | Director |

|

Thomas W. D’Alonzo (1) June 2000 | | 59 | | Director |

|

Richard A. Franco, R.Ph. (1) June 2000 | | 61 | | Director |

| (1) | | Member of Audit Committee and Compensation Committee. |

Robert P. Ruscher joined Salix in April 1995 and has served as the Executive Chairman of the Board since July 2002 and as a member of the Board of Directors since November 1999. Prior to assuming his current position, Mr. Ruscher held various positions of increasing responsibilities within Salix, including President and Chief Executive Officer, Executive Vice President, Vice President of Business Development, Chief Financial Officer and Corporate Secretary. Before joining Salix, Mr. Ruscher practiced law, advising emerging growth pharmaceutical companies in licensing, corporate partnering, financing and general corporate matters with Wyrick Robbins Yates & Ponton from May 1994 to April 1995; with Venture Law Group, which he co-founded, from March 1993 to April 1994; and with Wilson Sonsini Goodrich & Rosati from June 1988 to February 1993. From July 1983 to July 1986, Mr. Ruscher was a Senior Accountant with Price Waterhouse in San Francisco, California, working with emerging growth technology companies. Mr. Ruscher is a Certified Public Accountant and received his J.D. with distinction from the Stanford University School of Law and his B.S. in Commerce (Business Administration) with distinction from the University of Virginia.

Carolyn J. Logan has served as President and Chief Executive Officer and as a member of the Board of Directors since July 2002. She previously served as Senior Vice President, Sales and Marketing from June 2000 to July 2002. Prior to joining Salix, Ms. Logan served as Vice President, Sales and Marketing of the Oclassen Dermatologics division of Watson Pharmaceuticals, Inc. from May 1997 to June 2000, and as Vice President, Sales from February 1997 to May 1997. Prior to that date, she served as Director, Sales of Oclassen Pharmaceuticals, Inc. from January 1993 to February 1997. Prior to joining Oclassen, Ms. Logan held various sales and marketing positions with Galderma Laboratories, Ulmer Pharmacal and Westwood Pharmaceuticals. Ms. Logan received a B.S. degree in Biology and Dental Hygiene from the University of North Carolina at Chapel Hill.

1

John F. Chappell has served as a member of the Board of Directors of Salix since December 1993 and as a member of its Audit and Compensation Committees since December 1994. From 1990 to 2000, he served as founder and Chairman of Plexus Ventures, which specializes in business development and strategic transactions for clients in the biotechnology, pharmaceutical and drug delivery industries. Prior to founding Plexus Ventures, Mr. Chappell served as Chairman, Worldwide Pharmaceuticals for SmithKline Beecham plc (now GlaxoSmithKline plc), where he was responsible for the multi-billion dollar ethical pharmaceutical business with 30,000 employees worldwide. During his 28 years at SmithKline Beecham, Mr. Chappell also headed the International Consumer Products (OTC) operations and the Corporate Development Center. He has served as a Director of SmithKline Beecham, the Pharmaceutical Manufacturers Association, now PhRMA, and the Industrial Biotechnology Association, now BIO. Mr. Chappell is a Director of CIMA Labs, Inc. He holds a Bachelor of Arts degree from Harvard University and attended the Wharton School of the University of Pennsylvania.

Thomas W. D’Alonzo joined the Board of Directors of Salix in May 2000 with over 17 years of pharmaceutical executive experience. From 1996 to 1999, Mr. D’Alonzo served as President and Chief Operating Officer of Pharmaceutical Product Development, Inc. (“PPDI”), a publicly traded research, development and consulting services in life and discovery sciences company with over 3,000 employees worldwide. Before joining PPDI, he served as President and Chief Executive Officer of GENVEC, Inc. (gene therapy biotech) from 1993 to 1996. From 1983 to 1993, Mr. D’Alonzo held positions of increasing responsibility within Glaxo Inc., including President of Glaxo, Inc. Mr. D’Alonzo has served as a Director of Goodmark Foods, PPDI and Amarillo Biosciences, Inc., all publicly traded companies. Mr. D’Alonzo received his B.S. in Business Administration from the University of Delaware, and his law degree from the University of Denver College of Law.

Richard A. Franco joined the Board of Directors of Salix in May 2000 with over 32 year of health care executive and sales and marketing experience. Mr. Franco is President of the Richards Group Ltd., a healthcare consulting firm located in Raleigh, North Carolina. He presently serves as a Director of LipoScience Inc., a medical technology and diagnostics company and Tranzyme, Inc., a research and development company focused on drug discovery and development of therapies for neurosensory disorders. Mr. Franco served as the Chairman of the Board for LipoScience Inc. from May 1997 to October 2002, as well as Chief Executive Officer and President from November 1997 to September 2001. Prior to co-founding LipoScience, he was President, Chief Executive Officer and Director of Trimeris Inc., a biopharmaceutical company. Prior to joining Trimeris, Mr. Franco held several senior positions and served on the Executive Committee of Glaxo Inc., a pharmaceutical company, from 1983 to 1994, including Vice President and General Manager of Glaxo Dermatology, Vice President and General Manager of the Cerenex Division, Vice President of Commercial Development and Vice President of Marketing. Prior to joining Glaxo, Mr. Franco worked in various positions over a 16 year period with Eli Lilly and Company. Richard Franco received a B.S. in Pharmacy from St. John’s University and did his graduate work in pharmaceutical marketing and management at Long Island University.

Board Meetings and Committees

The Board of Directors held a total of ten meetings during the fiscal year ended December 31, 2002. No director attended fewer than 75% of the aggregate of all meetings of the Board of Directors, or its committees on which he served, which occurred during fiscal 2002. The Board has an Audit Committee and a Compensation Committee. It does not have a nominating committee or a committee performing the functions of a nominating committee.

The Audit Committee’s purpose is to assist the Board of Directors:

(1) in its oversight of Salix’s accounting and financial reporting principles and policies and internal audit controls and procedures;

(2) in its oversight of Salix’s financial statements and the independent audit thereof;

(3) in selecting (or nominating the outside auditors to be proposed for stockholder approval in any proxy statement), evaluating and, where deemed appropriate, replacing the outside auditors; and

(4) in evaluating the independence of the outside auditors. The Audit Committee held two meetings during fiscal 2002.

The Audit Committee currently consists of Thomas W. D’Alonzo, Chair, John F. Chappell and Richard A. Franco.

The Compensation Committee is responsible for determining salaries, incentives and other forms of compensation for executive officers and other employees and administers various incentive compensation and benefit plans. The Compensation Committee held three meetings during fiscal 2002. The Compensation Committee currently consists of John F. Chappell, Chair, Thomas W. D’Alonzo and Richard A. Franco.

2

Executive Officers of the Registrant

The following table sets forth certain information concerning our executive officers as of April 25, 2003:

Name

| | Age

| | Position(s) With Salix

|

Robert P. Ruscher | | 42 | | Executive Chairman of the Board of Directors |

|

Carolyn J. Logan | | 54 | | President, Chief Executive Officer and Director |

|

Adam C. Derbyshire | | 37 | | Vice President, Finance and Administration and Chief Financial Officer |

|

Randy W. Hamilton | | 48 | | Founder |

|

R. Scott Sykes, M.D. | | 44 | | Vice President, Medical Affairs and Chief Medical Officer |

Robert P. Ruscher joined Salix in April 1995 and has served as the Executive Chairman of the Board since July 2002 and as a member of the Board of Directors since November 1999. Prior to assuming his current position, Mr. Ruscher held various positions of increasing responsibilities within Salix, including President and Chief Executive Officer, Executive Vice President, Vice President of Business Development, Chief Financial Officer and Corporate Secretary. Before joining Salix, Mr. Ruscher practiced law, advising emerging growth pharmaceutical companies in licensing, corporate partnering, financing and general corporate matters with Wyrick Robbins Yates & Ponton from May 1994 to April 1995; with Venture Law Group, which he co-founded, from March 1993 to April 1994; and with Wilson Sonsini Goodrich & Rosati from June 1988 to February 1993. From July 1983 to July 1986, Mr. Ruscher was a Senior Accountant with Price Waterhouse in San Francisco, California, working with emerging growth technology companies. Mr. Ruscher is a Certified Public Accountant and received his J.D. with distinction from the Stanford University School of Law and his B.S. in Commerce (Business Administration) with distinction from the University of Virginia.

Carolyn J. Logan has served as President and Chief Executive Officer and as a member of the Board of Directors since July 2002. She previously served as Senior Vice President, Sales and Marketing from June 2000 to July 2002. Prior to joining Salix, Ms. Logan served as Vice President, Sales and Marketing of the Oclassen Dermatologics division of Watson Pharmaceuticals, Inc. from May 1997 to June 2000, and as Vice President, Sales from February 1997 to May 1997. Prior to that date, she served as Director, Sales of Oclassen Pharmaceuticals, Inc. from January 1993 to February 1997. Prior to joining Oclassen, Ms. Logan held various sales and marketing positions with Galderma Laboratories, Ulmer Pharmacal and Westwood Pharmaceuticals. Ms. Logan received a B.S. degree in Biology and Dental Hygiene from the University of North Carolina at Chapel Hill.

Adam C. Derbyshire has served as Vice President, Finance and Administration and Chief Financial Officer since June 2000. Prior to joining Salix, Mr. Derbyshire was Vice President, Corporate Controller and Secretary of Medco Research, Inc. (acquired by King Pharmaceuticals, Inc. in February 2000) from June 1999 to June 2000, Corporate Controller and Secretary of Medco from September 1995 to June 1999 and Assistant Controller of Medco from October 1993 to September 1995. Mr. Derbyshire received his B.S. degree from the University of North Carolina at Wilmington and his MBA from the University of North Carolina at Charlotte.

Randy W. Hamilton is one of the co-founders of Salix and was Chairman of the Board from inception until July 2002. From inception through November 1999 he was also President and Chief Executive Officer. Prior to founding Salix, Mr. Hamilton was Business Development Manager for California Biotechnology, Inc., now Scios, Inc., responsible for licensing products to the Japanese pharmaceutical industry and for the commercial aspects of several of the company’s development projects, including human lung surfactant, nasal drug delivery systems, genetic market diagnosis, and growth factors. Before joining California Biotechnology, Inc., Mr. Hamilton was Director of Strategic Planning and Business Development for SmithKline Diagnostics, then a division of SmithKline Beecham, where he also held positions in market research and marketing information services. Mr. Hamilton received his B.A. in Sociology from California State University, Long Beach.

R. Scott Sykes, M.D. joined Salix in September 2001 with 18 years of industry experience. He is responsible for all medical affairs, including drug information services, product safety, and post-marketing surveillance. Dr. Sykes was previously employed by GlaxoSmithKline, where he served most recently as Vice President, North American Product Surveillance. Dr. Sykes holds an M.D. from the University of North Carolina School of Medicine.

3

Compliance with Section 16(a) of the Securities Exchange Act of 1934.

Section 16(a) of the Securities Exchange Act requires our officers and directors, and persons who own more than 10% of a registered class of our equity securities, to file reports of ownership on Form 3 and changes in ownership on Form 4 or Form 5 with the Securities and Exchange Commission and the National Association of Securities Dealers, Inc. Such officers, directors and 10% stockholders are also required by SEC rules to furnish us with copies of all such forms that they file. Based solely on our review of the copies of such forms received by us, or written representations from reporting persons that no Forms 5 were required for such persons, we believe that during fiscal 2002, our officers, directors and 10% stockholders complied with all applicable Section 16(a) filing requirements.

Item 11. Executive Compensation

The following table sets forth information concerning the compensation awarded to, earned by, or paid for services rendered to Salix and its subsidiaries in all capacities during each of the fiscal years in the three-year period ended December 31, 2002, by (1) our Chief Executive Officer and (2) our next four most highly compensated officers during the year ended December 31, 2002. The officers listed on the table set forth below are referred to collectively in this proxy statement as the “Named Executive Officers.”

SUMMARY COMPENSATION TABLE

| | | | | Annual Compensation

| | Long-Term Compensation Awards

| | All Other Compensation (2)

|

Name and Principal Position

| | Fiscal Year

| | Salary (US $)

| | Bonus(1) (US $)

| | Other (US $)

| | Stock Options

| |

Carolyn J. Logan (3) | | 2002 | | $ | 300,708 | | $ | 115,000 | | $ | 7,000 | | 190,000 | | $ | 5,500 |

President and Chief Executive Officer | �� | 2001 | | $ | 250,000 | | $ | 70,000 | | $ | 12,000 | | — | | $ | 36,830 |

| | 2000 | | $ | 100,850 | | $ | — | | $ | 4,500 | | 160,000 | | $ | 35,656 |

|

Robert P. Ruscher (4) | | 2002 | | $ | 377,083 | | $ | 150,000 | | $ | — | | 35,000 | | $ | 45,005 |

Executive Chairman of the Board | | 2001 | | $ | 350,000 | | $ | 80,000 | | $ | — | | — | | $ | 87,327 |

| | 2000 | | $ | 310,000 | | $ | 36,500 | | $ | — | | — | | $ | 2,550 |

|

Randy W. Hamilton | | 2002 | | $ | 222,500 | | $ | 75,000 | | $ | — | | 12,500 | | $ | 5,500 |

Founder | | 2001 | | $ | 215,000 | | $ | 17,500 | | $ | — | | — | | $ | 2,150 |

| | 2000 | | $ | 215,000 | | $ | 10,750 | | $ | — | | — | | $ | 1,264 |

|

Lorin K. Johnson, Ph.D. (5) | | 2002 | | $ | 227,560 | | $ | 50,000 | | $ | — | | 12,500 | | $ | 4,354 |

Founder and Chief Scientific Officer | | 2001 | | $ | 220,000 | | $ | 52,500 | | $ | — | | — | | $ | 5,100 |

| | 2000 | | $ | 175,875 | | $ | 8,794 | | $ | — | | — | | $ | 1,754 |

|

Adam C. Derbyshire (6) | | 2002 | | $ | 200,500 | | $ | 78,000 | | $ | — | | 20,000 | | $ | 5,500 |

Vice President and Chief Financial Officer | | 2001 | | $ | 185,000 | | $ | 42,000 | | $ | — | | — | | $ | 5,100 |

| | 2000 | | $ | 83,558 | | $ | — | | $ | — | | 100,000 | | $ | 50,563 |

| (1) | | Unless otherwise specified, bonuses are reported in the year earned, even if actually paid in a subsequent year. Bonuses earned in 2002 were paid in February 2003. |

| (2) | | Except as otherwise indicated, represents matching contributions under our 401(k) retirement plan. |

| (3) | | Ms. Logan became our President and Chief Executive Officer on July 15, 2002. Ms. Logan was our Vice President, Sales and Marketing from June 12, 2000 to July 15, 2002. Pursuant to her employment, Ms. Logan received a $35,000 hiring bonus included in All Other Compensation in 2000. During 2000, Ms. Logan incurred $33,455 of relocation expenses. We reimbursed Ms. Logan for these expenses in 2001 and included the reimbursement in All Other Compensation in 2001. Additionally, from |

4

| | | August 2000 to July 2002, Ms. Logan received an automobile allowance in the amount of $1,000 per month. This amount is reflected in Other Annual Compensation. |

| (4) | | Mr. Ruscher became our Executive Chairman on July 15, 2002. Mr. Ruscher was our President and Chief Executive Officer from November 1, 1999 to July 15, 2002. During 2001, Mr. Ruscher received a retroactive salary adjustment for the year 2000 in the amount of $80,000 and is included in his salary for 2000. Additionally, during 2001, we forgave a portion of an outstanding note with Mr. Ruscher. The forgiven principal and accrued interest amounted to $82,227, and is included in All Other Compensation. During 2002, Mr. Ruscher received a lump sum payout of his accrued vacation pay. This amount is included in All Other Compensation. |

| (5) | | Mr. Johnson remains employed as our Founder and Chief Scientific Officer, but a determination was made in November 2002 that Mr. Johnson would no longer be deemed an executive officer. |

| (6) | | Mr. Derbyshire became our Vice President and Chief Financial Officer on June 12, 2000. Pursuant to his employment, Mr. Derbyshire received a $50,000 hiring bonus included in All Other Compensation in 2000. |

Option Grants, Exercises and Holdings

and Fiscal Year-End Option Values

The following table sets forth certain information concerning all grants of stock options made during the year ended December 31, 2002 to the Named Executive Officers:

| | | Number of Securities Underlying Options/SARs Granted(1)

| | % of Total Options/SARs Granted to Employees in Fiscal Year(2)

| | | Exercise or Base Price ($/Share)

| | Expiration Date

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(3)

|

Name

| | | | | | 5%

| | 10%

|

Logan, Carolyn (4) | | 190,000 | | 14.3 | % | | $ | 6.10 | | 07/28/12 | | $ | 728,889 | | $ | 1,847,148 |

Ruscher, Bob | | 35,000 | | 2.6 | % | | $ | 6.10 | | 07/28/12 | | $ | 134,269 | | $ | 340,264 |

Hamilton, Randy | | 12,500 | | 0.9 | % | | $ | 6.10 | | 07/28/12 | | $ | 47,953 | | $ | 121,523 |

Johnson, Lorin | | 12,500 | | 0.9 | % | | $ | 6.10 | | 07/28/12 | | $ | 47,953 | | $ | 121,523 |

Derbyshire, Adam | | 20,000 | | 1.5 | % | | $ | 6.10 | | 07/28/12 | | $ | 76,725 | | $ | 194,437 |

| (1) | | All options were granted at an exercise price not less than fair market value of the common stock on the date of the grant. The exercise price may be paid in cash, in shares of common stock valued at fair market value on exercise date or through a cashless exercise procedure involving a same-day sale of the purchased shares. The options become vested in equal monthly installments over the next 48 months. |

| (2) | | A total of 1,331,200 options were granted during the fiscal year ended December 31, 2002. |

| (3) | | Potential realizable value is based on the assumption that our common stock will appreciate at the annual rate shown, compounded annually, from the date of grant until the expiration of the option term (10 years). These amounts are calculated for SEC-mandated disclosure purposes and do not reflect our estimate of future stock prices. |

| (4) | | Ms. Logan’s option grant was associated with becoming our President and Chief Executive Officer on July 15, 2002. |

5

Aggregated Option Exercises In Last Fiscal Year

And Fiscal Year-End Option Values

The following table sets forth information regarding the exercise of stock options by the Named Executive Officers during the fiscal year ended December 31, 2002 and stock options held as of December 31, 2002 by the Named Executive Officers.

Name

| | Shares Acquired On Exercise

| | Value Realized

| | Number of Securities Underlying Unexercised Options at December 31, 2002

| | Value of Unexercised

In-the-Money

Options at

December 31, 2002 (1)

|

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Logan, Carolyn | | — | | $ | — | | 119,790 | | 230,210 | | $ | 546,609 | | $ | 468,891 |

Ruscher, Robert | | 16,000 | | $ | — | | 3,645 | | 31,355 | | $ | 3,244 | | $ | 27,906 |

Hamilton, Randy | | — | | $ | — | | 1,302 | | 11,198 | | $ | 1,159 | | $ | 9,966 |

Johnson, Lorin | | — | | $ | — | | 1,302 | | 11,198 | | $ | 1,159 | | $ | 9,966 |

Derbyshire, Adam | | — | | $ | — | | 64,582 | | 55,418 | | $ | 332,474 | | $ | 214,326 |

| (1) | | Based on the closing sales price in trading on The Nasdaq National Market on December 31, 2002 of $6.99, minus the exercise price for the applicable options. |

Equity Compensation Plan Information

The following table provides information as of December 31, 2002 on all our equity compensation plans currently in effect.

Plan Category

| | Number of securities to be issued upon exercise of outstanding options or warrants (a)

| | Weighted-average exercise price of outstanding options or warrants (b)

| | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c)

|

Equity compensation plans approved by shareholders: | | | | | | |

1994 Stock Plan and 1996 Stock Option Plan | | 3,227,611 | | $7.82 | | 858,513 |

|

Equity compensation plans not approved by shareholders: | | | | | | |

Warrants issued in connection with May 1996 initial public offering | | 16,667 | | $3.00 | | — |

|

Total | | 3,244,278 | | $7.79 | | 858,513 |

Compensation of Directors

We reimburse each member of our Board of Directors for out-of-pocket expenses incurred in connection with attending Board meetings. Non-employee directors receive a one-time grant of an option to purchase 15,000 shares at the fair market value as of the date of grant, vesting ratably over 36 months. In July 2002, we implemented an annual option grant program for outside directors pursuant to which each of our outside directors was granted an option to purchase 10,000 shares at the fair market value as of the date of grant, vesting ratably over 12 months. Directors who are granted stock options execute our standard form of stock option agreement. We also pay our non-employee directors a $12,000 annual retainer, and $1,000 per Board meeting attended in person. Non-employee committee chairs receive $750, and members $250, per committee meeting attended in person.

Employment Agreements and Change in Control Arrangements

We have entered into employment agreements with Randy W. Hamilton, Robert P. Ruscher, Lorin K. Johnson, Carolyn J. Logan, Adam C. Derbyshire, and R. Scott Sykes to employ each officer in his or her then current position. The relevant agreement provides for a base salary which is in the amount of $227,500 for Mr. Hamilton, $300,000 for Mr. Ruscher (decreasing to $250,000 effective July 2003), $227,500 for Dr. Johnson, $350,000 for Ms. Logan, $207,000 for Mr. Derbyshire, and $207,000 for Dr. Sykes. Each officer may be given a cash bonus within the sole discretion of the Board of Directors. Each agreement prohibits the officer from entering into employment with any direct competitor and from soliciting any employee of Salix to leave Salix while the agreement is in effect and for one year after termination of the agreement. The agreements have no set term. Each agreement will remain in effect until (1) we terminate the officer whether for “reasonable cause” (as defined in the agreement) or not, (2) the officer terminates whether for “good reason” (as defined in the agreement) or not, or (3) the officer’s death or incapacitating disability. In the event of termination by us without “reasonable cause” or by the officer with “good reason”, the officer will be paid his or her monthly salary for 24 months for Mr. Ruscher, 18 months for Mr. Hamilton, Dr. Johnson and Ms. Logan (after July 1, 2003, such period increases to 24 months for Ms. Logan), and 12 months for Mr. Derbyshire, and Dr. Sykes. In such event, the officer may also be paid a pro rata portion of his or her bonus, if any, for the year in which termination occurs, as we determine. In addition, we will pay the officer for the same period of time all benefits to which he or she was entitled at the time of termination.

Under our 1994 Stock Plan and the 1996 Stock Option Plan, in the event of a merger or change of control of Salix, under certain circumstances, vesting of options outstanding under the stock plans will automatically accelerate such that outstanding options will become fully exercisable, including with respect to shares for which such shares would be otherwise unvested.

6

Compensation Committee Interlocks and Insider Participation

The members of the Compensation Committee during fiscal 2002 were John F. Chappell, Thomas W. D’Alonzo and Richard A. Franco. None of these individuals was at any time during 2002 or at any other time an officer or employee of Salix. Robert P. Ruscher, our President and Chief Executive Officer until July 2002 and our Executive Chairman since then, and Carolyn J. Logan, our President and Chief Executive Officer since July 2002, participate in discussions and decisions regarding salaries and incentive compensation for all executive officers of Salix, except that each was and is excluded from discussions regarding his or her own salary and incentive stock compensation. No interlocking relationship exists between any member of our Compensation Committee and any member of any other company’s board of directors or compensation committee.

Report of the Compensation Committee

Notwithstanding any statement to the contrary in any of our previous or future filings with the SEC, this Report of the Compensation Committee of the Board of Directors shall not be deemed “filed” with the SEC or “soliciting material” under the Exchange Act and shall not be incorporated by reference into any such filings.

Introduction

The Compensation Committee of the Board of Directors was established in December 1994 and is composed only of outside directors. During fiscal 2002, the Compensation Committee consisted of John F. Chappell, Thomas W. D’Alonzo and Richard A. Franco. In general, the Committee is responsible for reviewing and approving Salix’s compensation practices, including executive salary levels and variable compensation programs. With respect to the compensation of its Executive Chairman and Chief Executive Officer, the Committee reviews and approves the various elements of the Executive Chairman’s and the Chief Executive Officer’s compensation. With respect to other executive officers, the Committee reviews the recommendations for such individuals presented by the Chief Executive Officer and the basis therefor.

The Board of Directors administers our 1996 Stock Option Plan and the 1994 Stock Plan.

General Compensation Philosophy

The primary objectives of our executive compensation policies include the following:

| | • | | To attract, motivate and retain a highly qualified executive management team; |

| | • | | To link executive compensation to our financial performance as well as to defined individual management objectives established by the Committee; |

| | • | | To compensate competitively with the practices of similarly situated specialty pharmaceutical companies; and |

| | • | | To create management incentives designed to enhance stockholder value. |

We compete in an aggressive and dynamic industry and, as a result, believe that finding, motivating and retaining quality employees, particularly senior managers, sales personnel and technical personnel, are key factors to our future success. The Committee’s compensation philosophy seeks to align the interests of stockholders and management by tying compensation to our performance, either directly in the form of salary or annual bonuses paid in cash or indirectly in the form of appreciation of stock options granted to employees through our equity incentive programs.

Executive Compensation

We have a compensation program which consists of two principal components: cash-based compensation and equity-based compensation. These two principal components are intended to attract, retain, motivate and reward executives who are expected to manage both the short-term and long-term success of our company.

Cash-Based Compensation. Cash-based compensation consists of salary, or base pay, and, subject to the discretion of the Board of Directors, an annual bonus. The salaries and bonuses of each of the Named Executive Officers, other than the Executive Chairman and Chief Executive Officer, for the year ended December 31, 2002 were reviewed by the Board of Directors, upon the recommendation of the Chief Executive Officer. In its review, the Board of Directors considers the extent to which Salix achieved its corporate objectives for the year in question, the executive’s position, his or her individual performance, and other factors.

Equity Incentive Programs. Long-term equity incentives, including stock options granted pursuant to our 1996 Stock Option Plan and 1994 Stock Plan, directly align the economic interests of management and employees with those of its stockholders.

7

Stock options are a particularly strong incentive because they are valuable to employees only if the fair market value of the common stock increases above the exercise price, which is set at the fair market value of the common stock on the date the option is granted. In addition, employees must remain employed for a fixed period of time in order for the options to vest fully. In general, one-eighth of the shares issuable upon exercise of options granted under the 1996 Plan become vested six months after the vesting start date and vest at the rate of 1/48 of the shares for each month thereafter. The Board of Directors or the Committee may grant, and has granted, options with vesting schedules that differ from such general schedule. The number of options granted to each executive, other than the Executive Chairman and Chief Executive Officer, is determined by the Board of Directors, upon the recommendation of the Chief Executive Officer. In making its determination, the Board of Directors considers the executive’s position, his or her individual performance, the number of options held by the executive, with particular attention to the executive’s unvested option position, and other factors.

Compensation of Chief Executive Officer

In determining compensation for the Executive Chairman and Chief Executive Officer, the Committee considers comparative financial and compensation data of selected peer companies. Robert P. Ruscher was elected Salix’s Executive Chairman on July 15, 2002. For fiscal 2003, Salix has set Mr. Ruscher’s base annual salary at $300,000 (decreasing to $250,000 effective July 2003). Carolyn J. Logan was elected Salix’s President and Chief Executive Officer on July 15, 2002. For fiscal 2003, Salix has set Ms. Logan’s base annual salary at $350,000.

Tax Deductibility of Executive Compensation

Section 162 of the Code limits the federal income tax deductibility of compensation paid to the Chief Executive Officer and to each of the Named Executive Officers. We may deduct such compensation only to the extent that during any fiscal year the compensation paid to such individual does not exceed $1 million or meet certain specified conditions (including stockholder approval). Based on our current compensation plans and policies and proposed regulations interpreting this provision of the Code, we believe that, for the near future, there is little risk that we will lose any significant tax deduction for executive compensation.

Summary

The Compensation Committee intends that its compensation program shall be fair and motivating and shall be successful in attracting and retaining qualified employees and in linking compensation directly to Salix’s success. The Board of Directors and the Compensation Committee intend to review this program on an ongoing basis to evaluate its continued effectiveness.

THE COMPENSATION COMMITTEE OF THE

BOARD OF DIRECTORS

John F. Chappell, Chair

Thomas W. D’Alonzo

Richard A. Franco

8

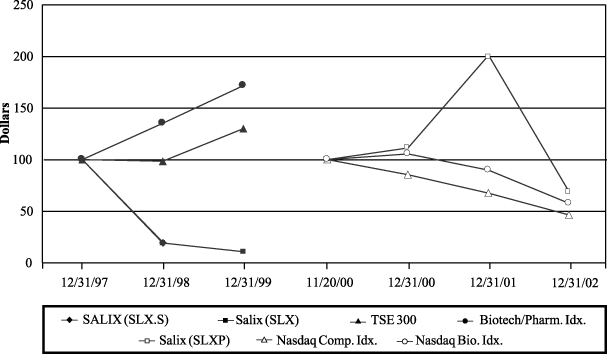

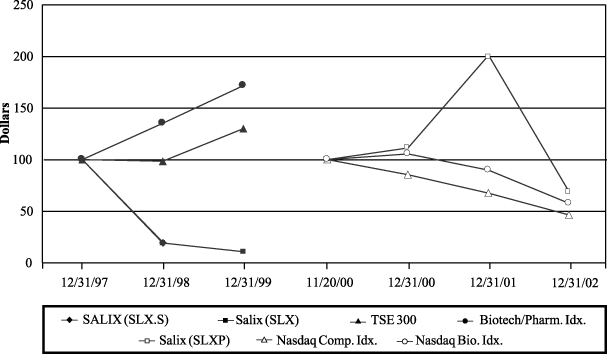

SALIX STOCK PRICE PERFORMANCE GRAPH

The following graph compares our cumulative total stockholder return from December 31, 1997 to December 31, 1999 with those of The Toronto Stock Exchange 300 Index and the Canadian Biotech/Pharmaceuticals Index. The graph assumes that U.S. $100 was invested on December 31, 1997 in (1) our common stock, (2) The Toronto Stock Exchange 300 Index and (3) the Canadian Biotech/Pharmaceuticals Index and that all dividends were reinvested.

From May 1996 to October 1997, our common stock traded on The Toronto Stock Exchange exclusively under the symbol “SLX.s” following our initial public offering in Canada in May 1996. In October 1997, we completed a secondary public offering in Canada and an initial public offering in the United States, and the common stock issued in that offering was traded and quoted separately under the symbol “SLX.” On May 28, 1998, all of our common stock began to trade under the symbol “SLX.”

The graph also compares our cumulative total stockholder return from November 20, 2000 (the effective date of our initial listing on the Nasdaq Small Cap Market) with those of the Nasdaq Composite Index and the Nasdaq Biotech Index and that all dividends were reinvested. The graph assumes that U.S. $100 was invested on November 20, 2000 in (1) our common stock, (2) the Nasdaq Composite Index and (3) the Nasdaq Biotech Index. Note that historic stock price performance is not necessarily indicative of future stock price performance.

On November 20, 2000, our common stock began trading on the Nasdaq Small Cap Market under the symbol “SLXP.” On February 26, 2001, our common stock began trading on the Nasdaq National Market and retained our symbol “SLXP.”

The stock price performance graph set forth below under the caption “Performance Graph” shall not be deemed to be incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act or under the Exchange Act, except to the extent that we specifically incorporate this information by reference, and shall not otherwise be deemed “filed with” or “soliciting material” under such Acts.

Comparison of the Sixty Month Cumulative Total Return Among

Salix Pharmaceuticals, Ltd. and Comparative Indices.

| | | 12/31/97

| | 12/31/98

| | 12/31/99

| | 11/20/00

| | 12/31/00

| | 12/31/01

| | 12/31/2002

|

SLX.S | | 100.00 | | 20.83 | | | | | | | | | | |

SLX | | 100.00 | | 20.00 | | 11.68 | | | | | | | | |

TSE 300 | | 100.00 | | 98.42 | | 129.63 | | | | | | | | |

Biotech/Pharm Idx | | 100.00 | | 134.75 | | 170.86 | | | | | | | | |

SLXP | | | | | | | | 100.00 | | 111.11 | | 200.00 | | 69.04 |

Nasdaq Comp. Idx | | | | | | | | 100.00 | | 85.46 | | 67.80 | | 46.87 |

Nasdaq Bio. Idx | | | | | | | | 100.00 | | 105.44 | | 89.86 | | 58.05 |

No dividends have been declared or paid on our common stock. We intend to retain earnings, if any, to fund our business and do not anticipate paying any cash dividends in the foreseeable future. Stockholder returns over the period indicated should not be considered indicative of future stockholder returns.

9

Item 12. Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information regarding the beneficial ownership of our common stock as of April 25, 2003 for the following:

| | • | | each person or entity known to own beneficially more than 5% of the outstanding common stock; |

| | • | | each director and his or her associates; |

| | • | | each of the executive officers named in the Summary Compensation table and his or her associates; and |

| | • | | all directors and executive officers as a group. |

Applicable percentage ownership is based on 21,414,476 shares of common stock outstanding as of April 25, 2003, together with applicable options for each stockholder. Beneficial ownership is determined in accordance with the rules of the United States Securities and Exchange Commission, based on factors including voting and investment power with respect to shares, subject to community property laws, where applicable. Common stock subject to options currently exercisable, or exercisable within 60 days after April 25, 2003, are deemed outstanding for the purpose of computing the percentage ownership of the person holding those options, but are not deemed outstanding for computing the percentage ownership of any other person.

Five Percent Stockholders, Directors And Executive Officers

| | Shares Beneficially Owned

| | Percentage Beneficially Owned

|

Wellington Management Company, LLP (1) 75 State Street Boston Massachusetts 02109 | | 2,425,200 | | 11.34 |

|

FMR Corp. (2) 82 Devonshire Street Boston, Massachusetts 02109 | | 2,083,700 | | 9.73 |

|

John Chappell (3) | | 912,060 | | 4.25 |

|

Lorin K. Johnson (4) | | 877,226 | | 4.10 |

|

Randy Hamilton (5) | | 741,180 | | 3.46 |

|

Robert Ruscher (6) | | 637,122 | | 2.97 |

|

Carolyn Logan (7) | | 304,441 | | 1.41 |

|

Adam Derbyshire (8) | | 93,583 | | * |

|

Richard Franco (9) | | 41,666 | | * |

|

Scott Sykes (10) | | 47,187 | | * |

|

Thomas D’Alonzo (11) | | 32,666 | | * |

|

All executive officers and directors as a group (9 persons) (12) | | 3,697,131 | | 16.93 |

| (1) | | As reported in Schedule 13G filed on February 12, 2003. |

| (2) | | As reported in Schedule 13G filed on February 14, 2002. Includes 1,652,700 shares held by Fidelity Management Trust Company. |

| (3) | | Includes 21,666 shares issuable upon exercise of options. Also includes 83,000 shares held in trust for the benefit of Mr. Chappell’s two children and grandchildren. |

10

| (4) | | Includes 2,865 shares issuable upon exercise of options. Also includes 750,501 shares held by a trust for the benefit of Dr. Johnson and his wife, and 30,680 shares held by a family trust, the beneficiaries of which include Dr. Johnson’s minor grandchildren. Dr. Johnson and his wife are named as co-trustees of both trusts. |

| (5) | | Includes 2,865 shares issuable upon exercise of options. Also includes 123,000 shares held by Mr. Hamilton’s spouse, for which Mr. Hamilton disclaims beneficial ownership. |

| (6) | | Includes 8,020 shares issuable upon exercise of options. |

| (7) | | Includes 163,541 shares issuable upon exercise of options. |

| (8) | | Includes 79,583 shares issuable upon exercise of options. |

| (9) | | Includes 21,666 shares issuable upon exercise of options and 4,000 shares held indirectly by Mr. Franco’s spouse. |

| (10) | | Includes 47,187 shares issuable upon exercise of options. |

| (11) | | Includes 21,666 shares issuable upon exercise of options and 1,000 held indirectly by Mr. D’Alonzo’s spouse. |

| (12) | | Includes the shares described in footnotes (3)-(11). |

Item 13. Certain Relationships and Related Transactions

Our policy regarding the transaction with management is that they should be made on terms no less favorable to us than could have been obtained from unaffiliated third parties. All future transactions, including loans, between us and our officers, directors, principal stockholders and their affiliates will be approved by a majority of the Board of Directors, including a majority of the independent and disinterested outside directors, and will continue to be on terms no less favorable to us than could be obtained from unaffiliated third parties.

PART IV

Item 15. Exhibits, Financial Statement Schedules, and Reports on Form 8-K

3. Exhibits

Exhibit No.

| | Description

|

|

99 | | Certifications pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

11

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the Registrant has duly caused this Form 10-K to be signed on its behalf by the undersigned, thereunto duly authorized.

SALIX PHARMACEUTICALS, LTD. |

|

/s/ CAROLYN J. LOGAN

|

Carolyn J. Logan President and Chief Executive Officer |

Date: April 30, 2003

12

CERTIFICATION

I, Carolyn J. Logan, certify that:

| | 1. | | I have reviewed this annual report on Form 10-K/A of Salix Pharmaceuticals, Ltd.; |

| | 2. | | Based on my knowledge, this annual report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this annual report; |

| | 3. | | Based on my knowledge, the financial statements, and other financial information included in this annual report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this annual report; |

| | 4. | | The registrant’s other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-14 and 15d-14) for the registrant and have: |

| | a. | | designed such disclosure controls and procedures to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this annual report is being prepared; |

| | b. | | evaluated the effectiveness of the registrant’s disclosure controls and procedures as of a date within 90 days prior to the filing date of this annual report (the “Evaluation Date”); and |

| | c. | | presented in this annual report our conclusions about the effectiveness of the disclosure controls and procedures based on our evaluation as of the Evaluation Date; |

| | 5. | | The registrant’s other certifying officer and I have disclosed, based on our most recent evaluation, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions): |

| | a. | | all significant deficiencies in the design or operation of internal controls which could adversely affect the registrant’s ability to record, process, summarize and report financial data and have identified for the registrant’s auditors any material weaknesses in internal controls; and |

| | b. | | any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal controls; and |

| | 6. | | The registrant’s other certifying officer and I have indicated in this annual report whether there were significant changes in internal controls or in other factors that could significantly affect internal controls subsequent to the date of our most recent evaluation, including any corrective actions with regard to significant deficiencies and material weaknesses. |

|

Date: | | April 30, 2003

| | | | By: | | /s/ CAROLYN J. LOGAN

|

| | | | | | | | | Carolyn J. Logan President and Chief Executive Officer |

13

CERTIFICATION

I, Adam C. Derbyshire, certify that:

| | 1. | | I have reviewed this annual report on Form 10-K/A of Salix Pharmaceuticals, Ltd.; |

| | 2. | | Based on my knowledge, this annual report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this annual report; |

| | 3. | | Based on my knowledge, the financial statements, and other financial information included in this annual report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this annual report; |

| | 4. | | The registrant’s other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-14 and 15d-14) for the registrant and have: |

| | a. | | designed such disclosure controls and procedures to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this annual report is being prepared; |

| | b. | | evaluated the effectiveness of the registrant’s disclosure controls and procedures as of a date within 90 days prior to the filing date of this annual report (the “Evaluation Date”); and |

| | c. | | presented in this annual report our conclusions about the effectiveness of the disclosure controls and procedures based on our evaluation as of the Evaluation Date; |

| | 5. | | The registrant’s other certifying officer and I have disclosed, based on our most recent evaluation, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions): |

| | a. | | all significant deficiencies in the design or operation of internal controls which could adversely affect the registrant’s ability to record, process, summarize and report financial data and have identified for the registrant’s auditors any material weaknesses in internal controls; and |

| | b. | | any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal controls; and |

| | 6. | | The registrant’s other certifying officer and I have indicated in this annual report whether there were significant changes in internal controls or in other factors that could significantly affect internal controls subsequent to the date of our most recent evaluation, including any corrective actions with regard to significant deficiencies and material weaknesses. |

|

Date: | | April 30, 2003

| | | | By: | | /s/ ADAM C. DERBYSHIRE

|

| | | | | | | | | Adam C. Derbyshire Chief Financial Officer |

14