Exhibit 99.1

Creating the Largest Specialty Pharmaceutical Company Focused on Serving U.S. Gastroenterologists and Their Patients July 2005

1

Forward Looking Statement

This presentation contains forward-looking statements regarding future events including statements regarding the effect of the transaction to EPS, the benefits of the merger to InKine and Salix and to each of their stockholders, the timing of completion of the transaction and potential purchase accounting charges. These statements are just predictions and are subject to risks and uncertainties that could cause the actual events or results to differ materially. These risks and uncertainties include receipt of regulatory and stockholder approval, integration of the two companies, post closing, market acceptance for the transaction and approved products, management of rapid growth, risks of regulatory review and clinical trials, intellectual property risks, and the need to acquire additional products. The reader is referred to the documents that Salix and InKine file from time to time with the Securities and Exchange Commission.

2

Deal Summary

Salix and InKine have agreed to merge and create the largest pure-play specialty pharmaceutical company focused on gastroenterology

Type of transaction: Stock-for-Stock Exchange Offer price per InKine share: $3.55

Fixed price collar arrangement

Implied value of transaction: $190.0 million

Resulting ownership: Approximately 80%—20%

Listing: NASDAQ, SLXP

Headquarters: Raleigh, NC

3

Salix – Well Positioned for Future Growth Opportunities

Dedicated to becoming the leading specialty pharmaceutical company in the gastroenterology market

COLAZAL® continues to be the fastest-growing oral branded 5-ASA with 2004 sales of $85.4 million

Focused on maximizing shareholder value through reducing risk and leveraging infrastructure

In-license / acquire selective last-stage/marketed product candidates to drive growth

Proven specialty sales force

68 sales representatives targeting high prescribing gastroenterologists Product revenue per sales rep has grown from $313,000 in 2001 to approximately $1.5 million in 2004

4

Market Overview of U.S. Gastroenterology Market

Small target audience (12,000 physicians) 31.4 million patient visits annually 38 million prescriptions annually $4.8 billion Rx sales annually

Source: Verispan PDDA and NDCHealth PHAST (2004)

5

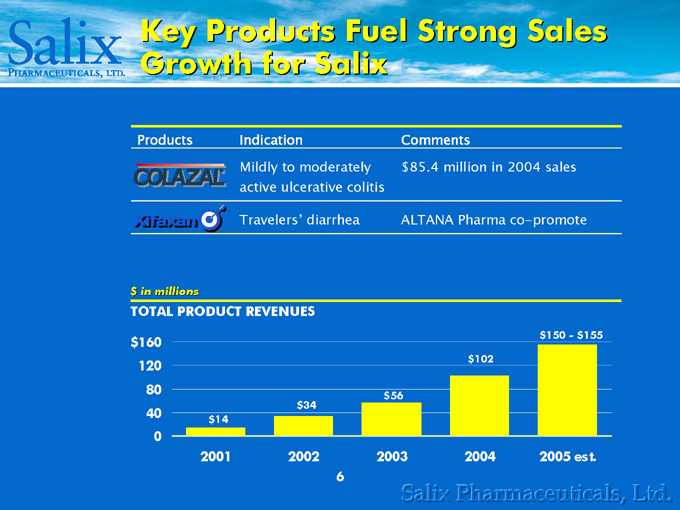

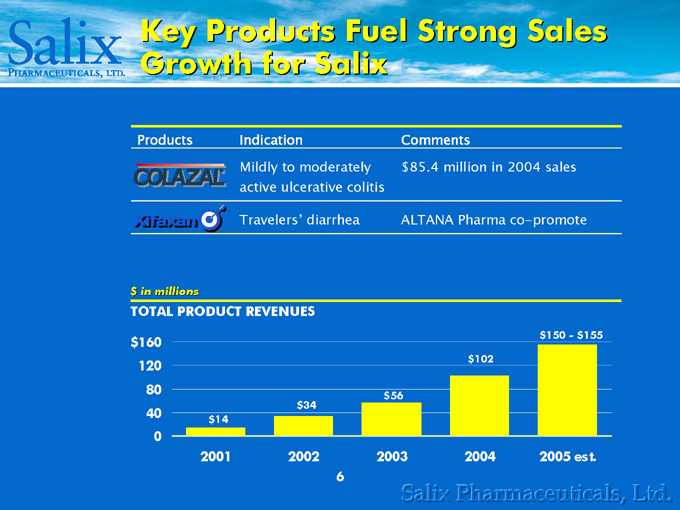

Key Products Fuel Strong Sales Growth for Salix

Products Indication Comments

Mildly to moderately $85.4 million in 2004 sales

active ulcerative colitis

Travelers’ diarrhea ALTANA Pharma co-promote

$in millions

TOTAL PRODUCT REVENUES

$160 120 80 40 0 $14 $34 $56 $102 $150—$155

2001 2002 2003 2004 2005 est.

6

An Introduction to InKine

7

InKine – Uniquely Positioned in the Colonoscopy Market

Strong Presence in the Colonoscopy Preparation Market

VISICOL®—the first and only purgative tablet INKP-102 is the next generation purgative tablet 50-person sales force targeting high prescribing gastroenterologists Profitable and cash flow positive for 2004 and forecasted for 2005

8

Visicol® – The First and Only Purgative Tablet

Launched in January 2001 Advantages

Virtually tasteless

Significantly less nausea, vomiting, and bloating Taken with any clear fluid

High patient compliance with approximately 92% of patients completing the VISICOL® prep High patient acceptance

Greater than 90% of patients would take VISICOL® tablets again, compared to only 10% of patients who took the liquid PEG solution

Source: 1) Gastrointestinal Endoscopy 2001; Vol. 54, No. 6: 705 –713.

2) Data on file. 9

Visicol® – Competing Products

Competing PEG solutions / Sodium Phosphate Solutions

Require 1—4 liters of liquid and have an unpleasant after-taste Frequently cause undesirable symptoms

10

INKP-102 – Near-Term Value Driver

Potential Benefits

Microcrystalline cellulose (MCC) free Smaller tablets Possible lower-dose administration

11

INKP-102 – Near-Term Value Driver

Positive results from Phase II and III clinical trials submitted as SPA (Special Clinical Protocol Assessment) Submitted NDA to FDA on April 29, 2005 for use as a preparation for colonoscopy Filed U.S. patent application on November 16, 2004 – if issued, product will be protected until 2024, well beyond the 2013 patent expiration of VISICOL

12

Colonoscopy Market Growth Drivers

Demographics

Aging population

Poorly-penetrated market – only 50% of Americans over the age of 50 have received colorectal cancer testing

Public awareness

Colon cancer awareness initiatives Expanded Medicare and other third-party reimbursement

Medical practice

Colonoscopy acknowledged as “gold standard” for screening Evolving clinical guidelines are encouraging more frequent screening

Source: Gastroenterology 2004; 127: 1661—1669 13

Bowel Preparation Market Potential

7.0 million bowel prep procedures estimated for 2004

4.5 million prescriptions for May 2005 TTM

Approximately $115 million sales May 2005 TTM

Source: IMS Data, NDC Health PHAST

14

Near-Term Value Driver – Visicol® / INKP-102 for the Treatment of Constipation

InKine met with FDA in January 2005 on development program for a constipation label amendment for VISICOL

Phase IV conclusions

Low dose therapy with VISICOL is highly effective in treating constipation Treatment was associated with prompt and sustained improvements in BM frequency, and all other related symptoms The lowest effective dose may be 2 to 4 tablets

Source: Clinical Therapeutics, 2004; Vol. 26, No.9: 1479-1491 15

Constipation Market Overview

Total U.S. market for prescription drugs: $697 million 61% CAGR in prescription market from May 2002 – May 2005

Launch of new products

Aggressive treatment of severe constipation Aging population

Source: NDC Health PHAST

16

A Compelling Combination

17

The Vision: Creation of the Largest Pure-Play GI-Focused Specialty Pharmaceutical Company

Expanded presence in the gastroenterology market Enhanced position relative to future acquisition / partnering opportunities Complementary sales force Combined product pipeline creates strong near- and long-term growth prospects Ability to further leverage Opportunity to drive VISICOL® adoption in the purgative market Risk diversification

18

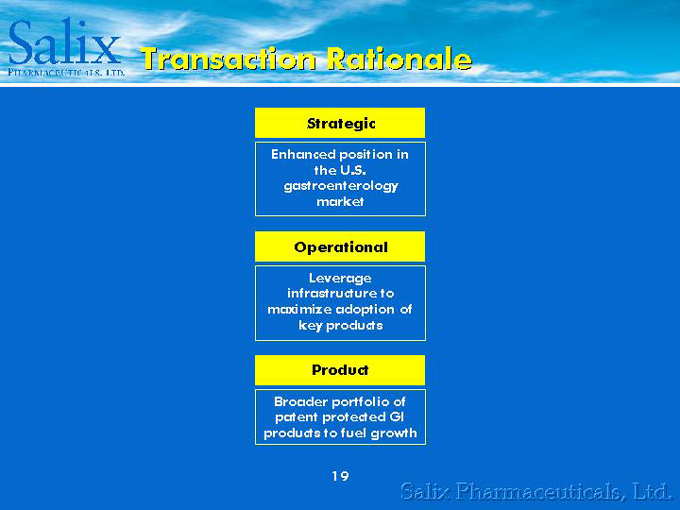

Transaction Rationale

Strategic

Enhanced position in the U.S. gastroenterology market

Operational

Leverage infrastructure to maximize adoption of key products

Product

Broader portfolio of patent protected GI products to fuel growth

19

Transaction Rationale -Strategic

A combination with excellent strategic “fit” and clear rationale

Creation of the largest GI-focused specialty pharmaceutical company (approaching $1.0 billion in market value)

Established product development / business development effort will enhance the ability to pursue additional product acquisitions to improve long-term growth prospects Potential for enhanced top-line performance as well as other synergies

20

Transaction Rationale -Operational

The largest and most well respected specialty sales force in the GI industry

Powerful commercialization effort with combined sales force of approximately 100 sales representatives

VISICOL has strong growth potential over the longer term and can benefit immediately from Salix’s commercial presence

Allow VISICOL to more quickly penetrate and dominate the purgative market

Potential for more effective launch of next-generation purgative INKP-102 (pending patent-protection to 2024) and other indications such as constipation with stronger, broader sales force

21

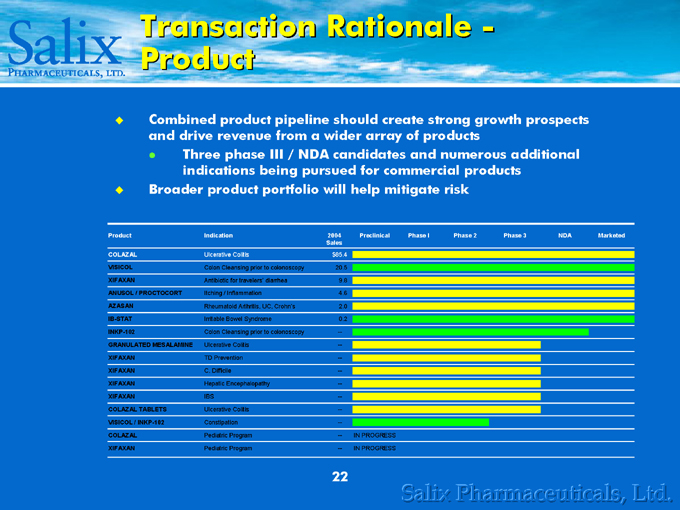

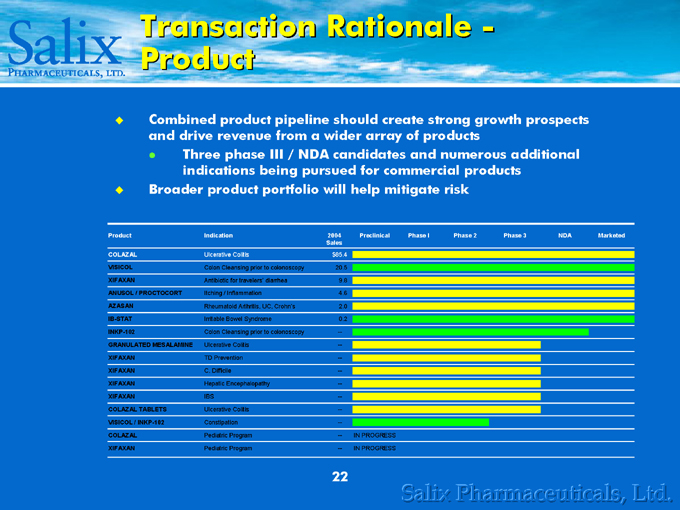

Transaction Rationale -Product

Combined product pipeline should create strong growth prospects and drive revenue from a wider array of products

Three phase III / NDA candidates and numerous additional indications being pursued for commercial products

Broader product portfolio will help mitigate risk

Product Indication 2004 Sales Preclinical Phase 1 Phase 2 Phase 3 NDA Marketed

COLAZAL Ulcerative Colitis $85.4

VISICOL Colon Cleansing prior to colonoscopy 20.5

XIFAXAN Antibiotic for travelers’ diarrhea 9.8

ANUSOL / PROCTOCORT Itching / Inflammation 4.6

AZASAN Rheumatoid Arthritis, UC, Crohn’s 2.0

IB-STAT Irritable Bowel Syndrome 0.2

INKP-102 Colon Cleansing prior to colonoscopy —

GRANULATED MESALAMINE Ulcerative Colitis —

XIFAXAN TD Prevention —

XIFAXAN C. Difficile —

XIFAXAN Hepatic Encephalopathy —

XIFAXAN IBS —

COLAZAL TABLETS Ulcerative Colitis —

VISICOL / INKP-102 Constipation —

COLAZAL Pediatric Program — IN PROGRESS

XIFAXAN Pediatric Program — IN PROGRESS

22

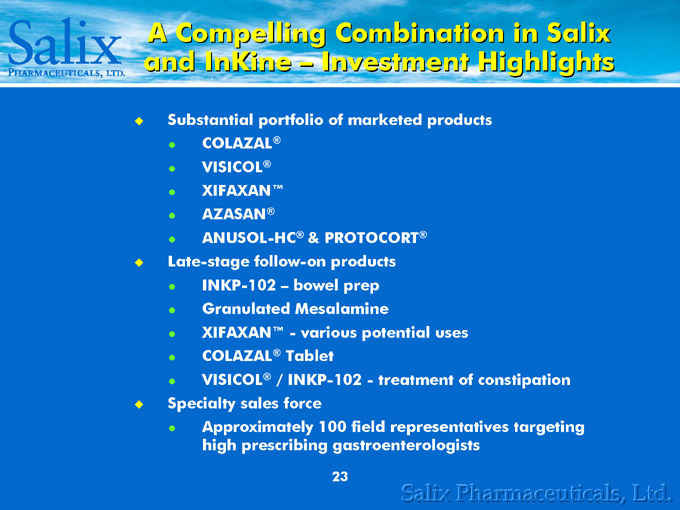

A Compelling Combination in Salix and InKine – Investment Highlights

Substantial portfolio of marketed products

COLAZAL® VISICOL® XIFAXAN™ AZASAN®

ANUSOL-HC® & PROTOCORT®

Late-stage follow-on products

INKP-102 – bowel prep Granulated Mesalamine

XIFAXAN™—various potential uses COLAZAL® Tablet

VISICOL® / INKP-102—treatment of constipation

Specialty sales force

Approximately 100 field representatives targeting high prescribing gastroenterologists

23

In connection with the merger between Salix and InKine, on July 18, 2005 Salix filed with the SEC a registration statement on Form S-4, containing a preliminary joint proxy statement/prospectus and other relevant materials. INVESTORS AND SECURITY HOLDERS OF SALIX AND INKINE ARE URGED TO READ THE DEFINITIVE JOINT PROXY STATEMENT / PROSPECTUS AND THE OTHER RELEVANT MATERIALS WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION ABOUT SALIX, INKINE AND THE MERGER. The joint proxy statement/prospectus and other relevant materials (when they become available), and any other documents filed by Salix or InKine with the SEC, may be obtained free of charge at the SEC’s web site at www.sec.gov. In addition, investors and security holders may obtain free copies of the documents (when they are available) filed with the SEC by Salix by directing a request to: Salix Pharmaceuticals, Ltd., 1700 Perimeter Park Drive, Morrisville, North Carolina 27560, Attn: Investor Relations. Investors and security holders may obtain free copies of the documents filed with the SEC by InKine by contacting InKine Pharmaceutical Company, Inc., 1787 Sentry Parkway West, Building 18, Suite 440, Blue Bell, Pennsylvania 19422, Attn: Investor Relations.

Salix, InKine and their respective executive officers and directors may be deemed to be participants in the solicitation of proxies from the stockholders of Salix and InKine in favor of the merger. Information about the executive officers and directors of Salix and their ownership of Salix common stock is set forth in the proxy statement for Salix’s 2005 Annual Meeting of Stockholders, which was filed with the SEC on April 29, 2005. Information about the executive officers and directors of InKine and their ownership of InKine common stock is set forth in the proxy statement for InKine’s 2005 Annual Meeting of Stockholders, which was filed with the SEC on May 2, 2005. Investors and stockholders may obtain more detailed information regarding the direct and indirect interests of Salix, InKine and their respective executive officers and directors in the merger by reading the joint proxy statement/prospectus regarding the merger when it becomes available.

24