November 15, 2012

VIA EDGAR

United States Securities and Exchange Commission

Mail Stop 4720

Washington, D.C. 20549

Attention: Mara L. Ransom

Assistant Director

| | Re: | Accelerated Building Concepts Corporation |

| | | Form 8-K |

| | | Filed July 16, 2012 |

| | | Response dated July 27, 2012 |

| | | File No. 001-11873 |

Dear Ms. Ransom:

Please be advised that the undersigned is the duly-appointed Chief Executive Officer of Accelerated Building Concepts Corporation, the above-referenced issuer (the “Issuer”). This letter is in response to the comments of the staff of the U.S. Securities and Exchange Commission (the “Commission”) with respect to the above-referenced filings provided in your letter dated August 28, 2012 (the “Comment Letter”).

The purpose of this correspondence is to provide responses to the Comment Letter to the Commission and provide explanation, where necessary. Our responses follow the text of each Staff comment reproduced consecutively for your convenience.

General

| | 1. | We note your response to comment 1. Please either amend the Form 8-K to provide the information required by Items 2.01(f), 5.06 and 9.01 or provide us with a detailed legal and factual analysis as to why you are not required to file such information. The analysis should focus on whether you were a shell company, as defined in Rule 12b-2 of the Exchange Act, prior to the transaction reported by the Form 8-K. |

Since the Issuer was not a shell company at the time of the Issuer’s acquisition of WTV Holdings, Inc. (the “Acquisition”) the information required by Items 2.01(f) and 9.01 was not required to be filed upon filing of the current report on Form 8-K in connection with the Issuer’s disclosure of the Acquisition.

At the time of the Acquisition, the Issuer, through its sole Officer and Director, Doug Ward, performed business advisory and consulting services for other publicly traded companies and related service firms that support them.

United States Securities and Exchange Commission

November 15, 2012

Page 2

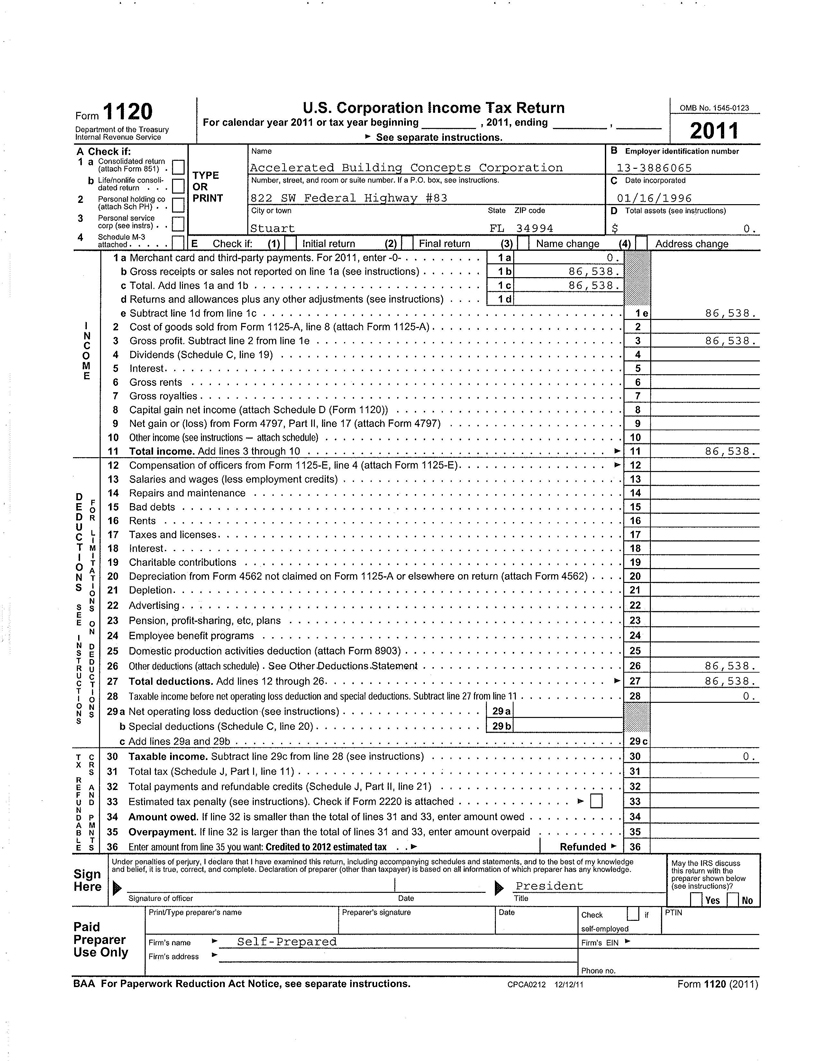

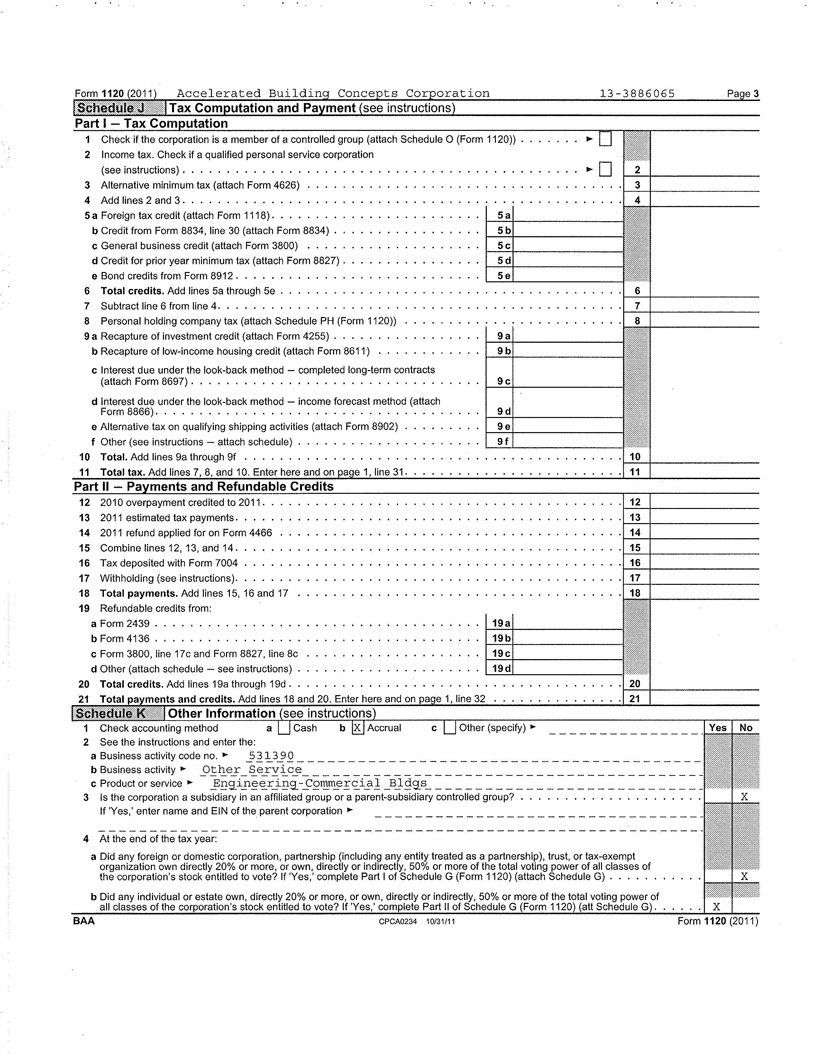

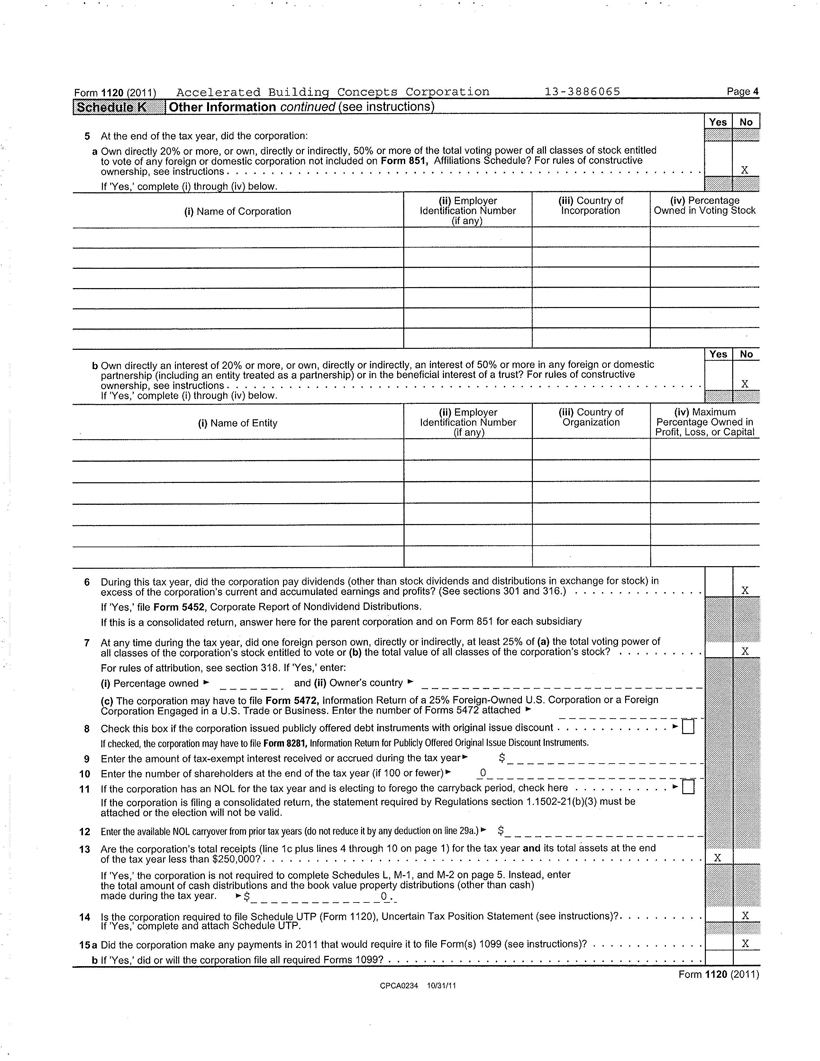

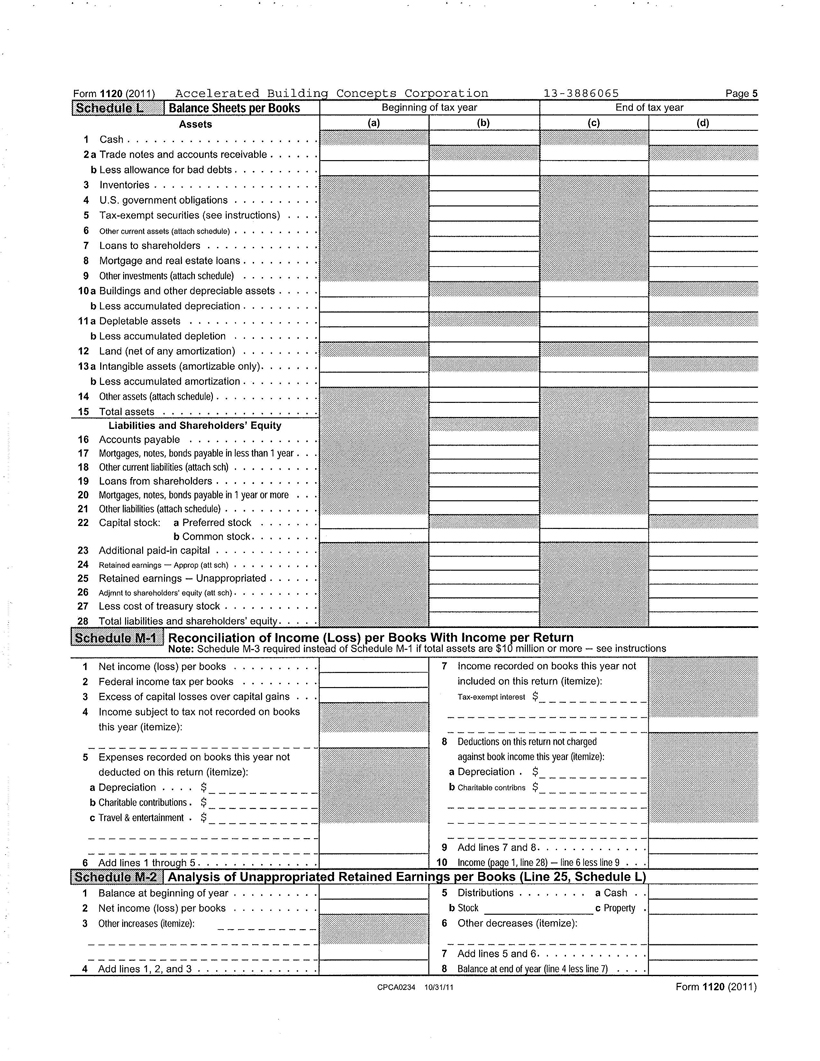

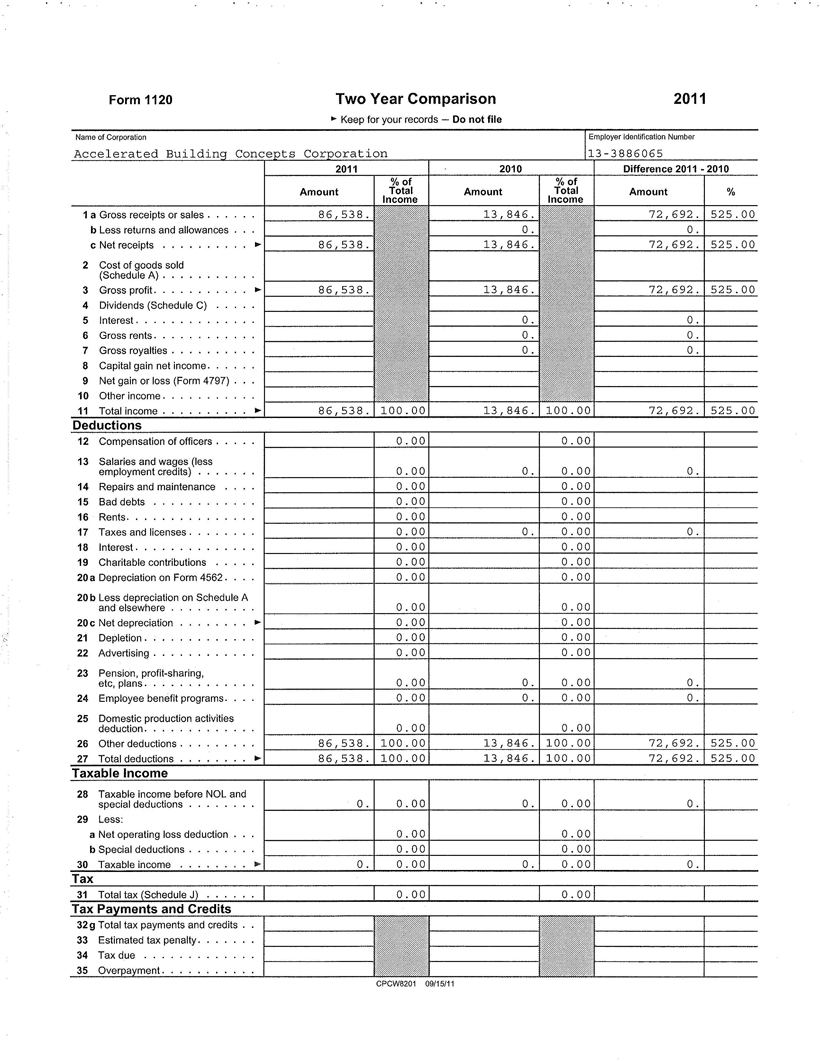

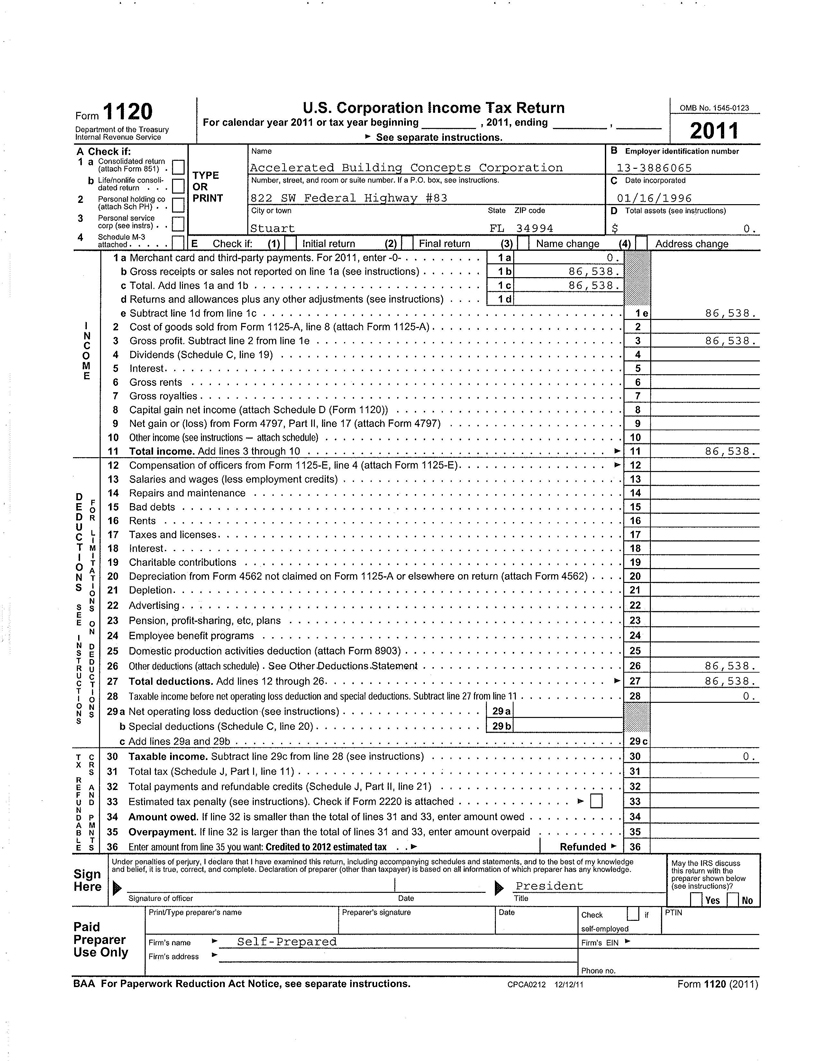

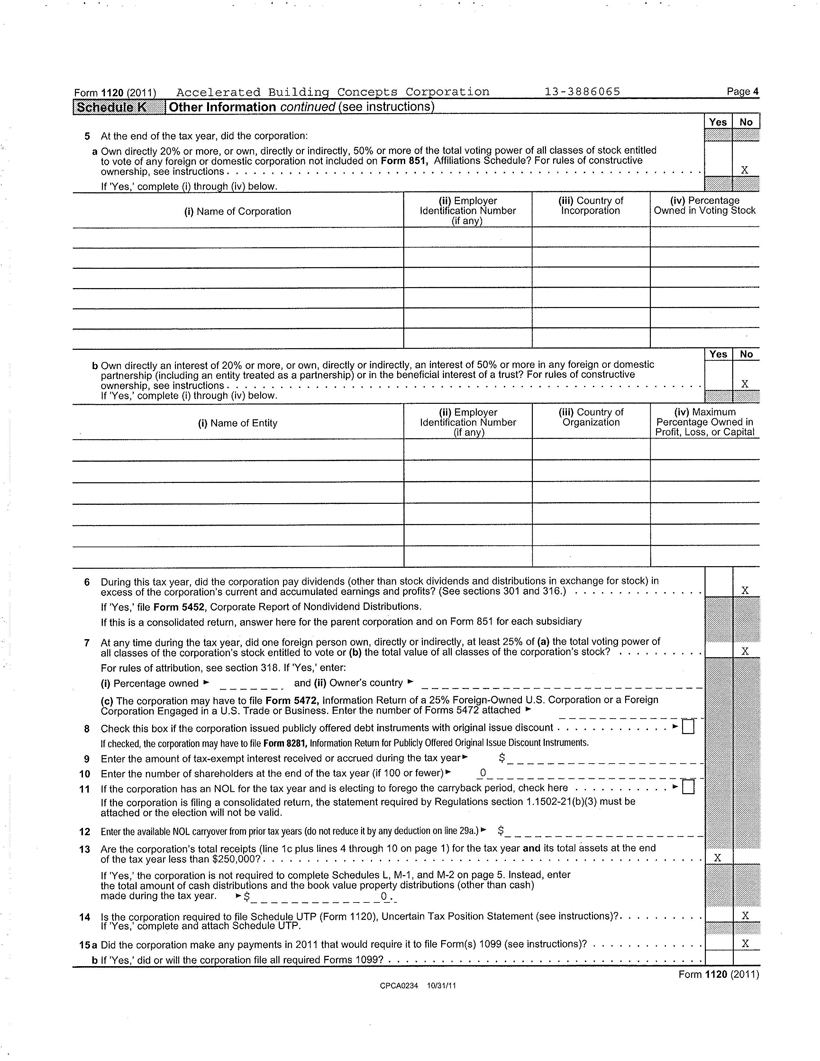

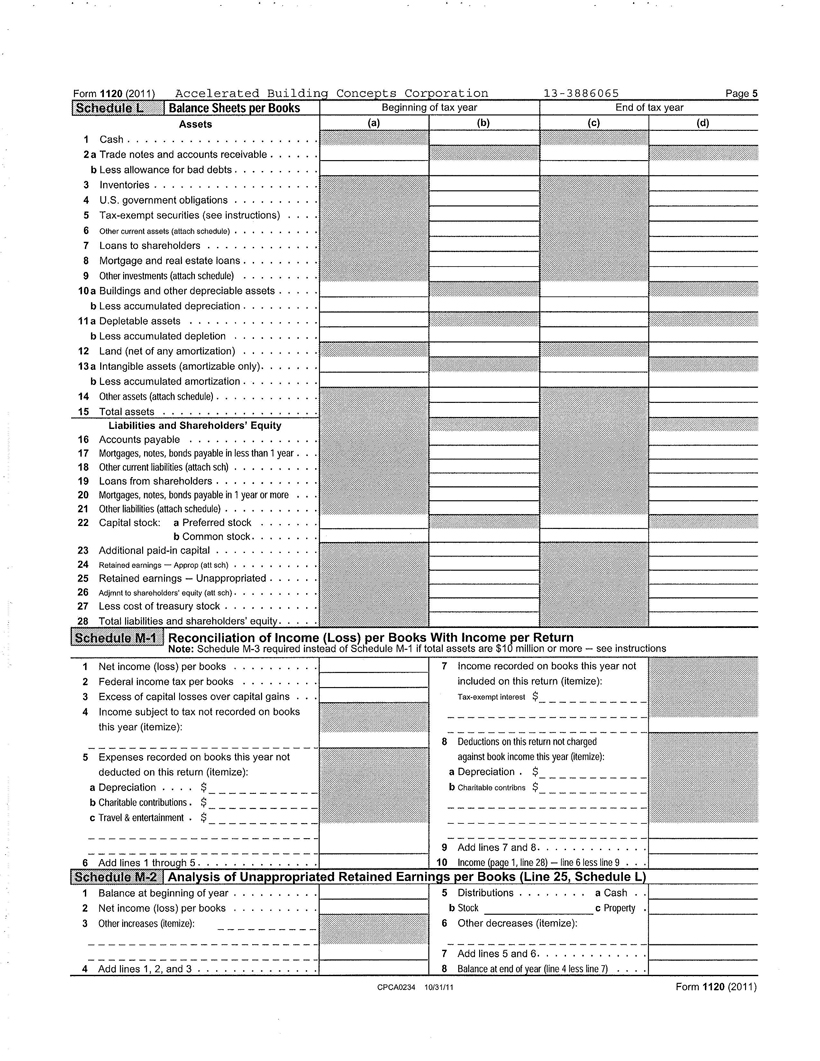

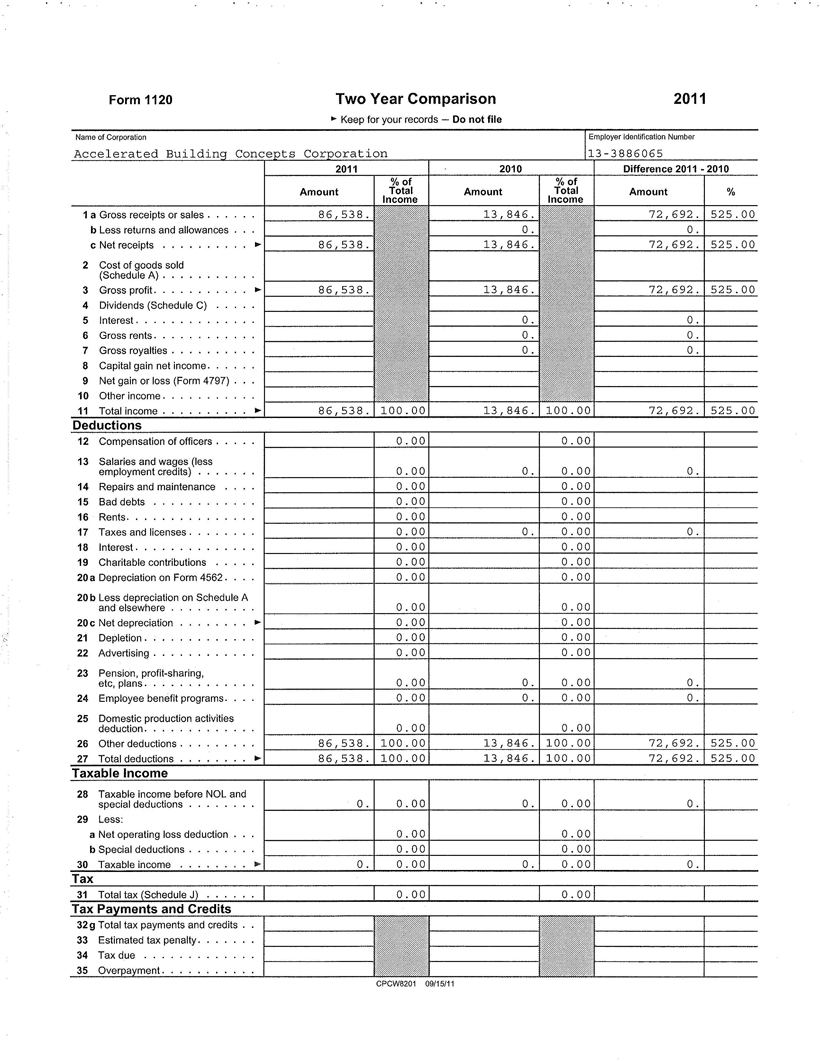

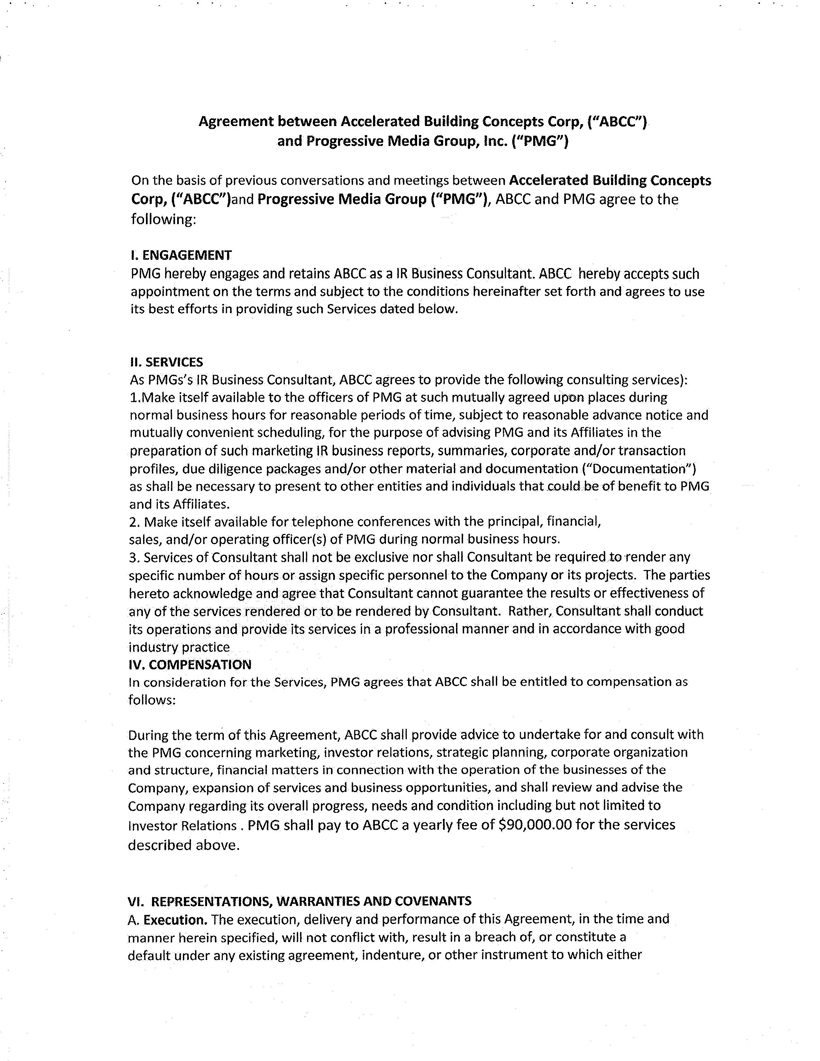

For the year ended 2011, the Issuer had revenues of $86,538 which were earned through such consulting and related services. (a copy of the Issuer’s tax return for the year ended 2011 is attached hereto as Exhibit A.) Although the Issuer’s earnings for 2012 diminished prior to and up to the acquisition of WTV Holdings, Inc., Mr. Ward continued to engage in these activities on a (full-time) basis. The Issuer marketed its services to several companies during this period in an effort to obtain new sales. .) Additionally, the Issuer entered into several consulting agreements with various firms and had discussions and negotiations regarding potential contracts and services. (Attached hereto as Exhibit B are copies of executed agreements and as Exhibit C are copies of proposed but unaccepted agreements.)

As the Commission is aware, Rule 12b-2’s definition of a shell company is far from a bright line test. No qualitative standards have ever been established by the Commission for the purpose of such evaluation. However, it is still the Issuer’s position that its activities through 2011 and up to May 24, 2012, the date of the Acquisition of WTV, were significantly more than the “no or nominal operations” as defined in Rule 405. Again, while revenues were not substantial during this period, the Issuer’s operations were clearly substantive and rose above the threshold of shell qualification.

Accordingly, since the Issuer was not a shell on the date of the Acquisition, the current report on Form 8-K filed July 16, 2012 did not require the Form 10 type information required by Item 2.01(f).

| | 2. | We note your response to comment 2. Notwithstanding the response, please confirm to us your understanding that you have an existing obligation under the federal securities laws to make all required filings and should become current in those filings in accordance with applicable requirements. |

The Issuer confirms that it is obligated to file reports with the Commission pursuant to federal securities laws and is required to become current in its filings in accordance with such laws.

In furtherance of such obligations, the Issuer is currently preparing a number of previously unfiled financial statements which will be filed as soon as practicable.

Should you have any questions or require any further information, please do not hesitate to contact us.

Very truly yours,

/s/ Mark Cavicchia

Mark Cavicchia,

Chief Executive Officer

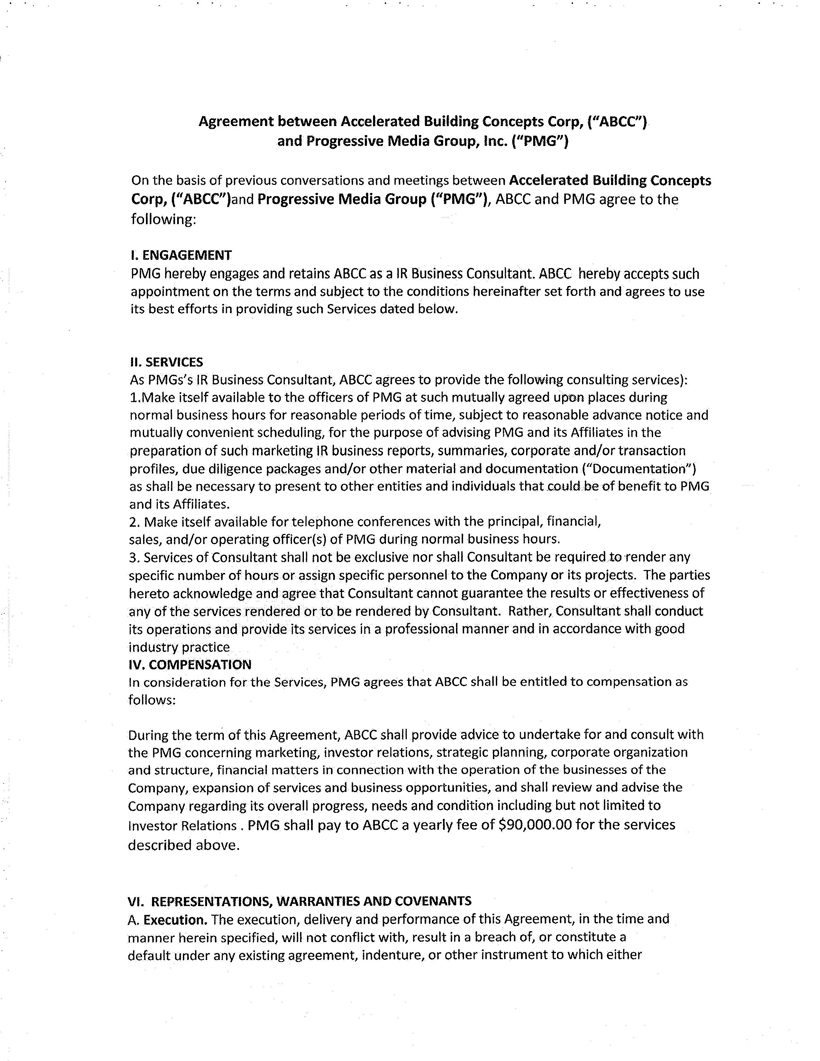

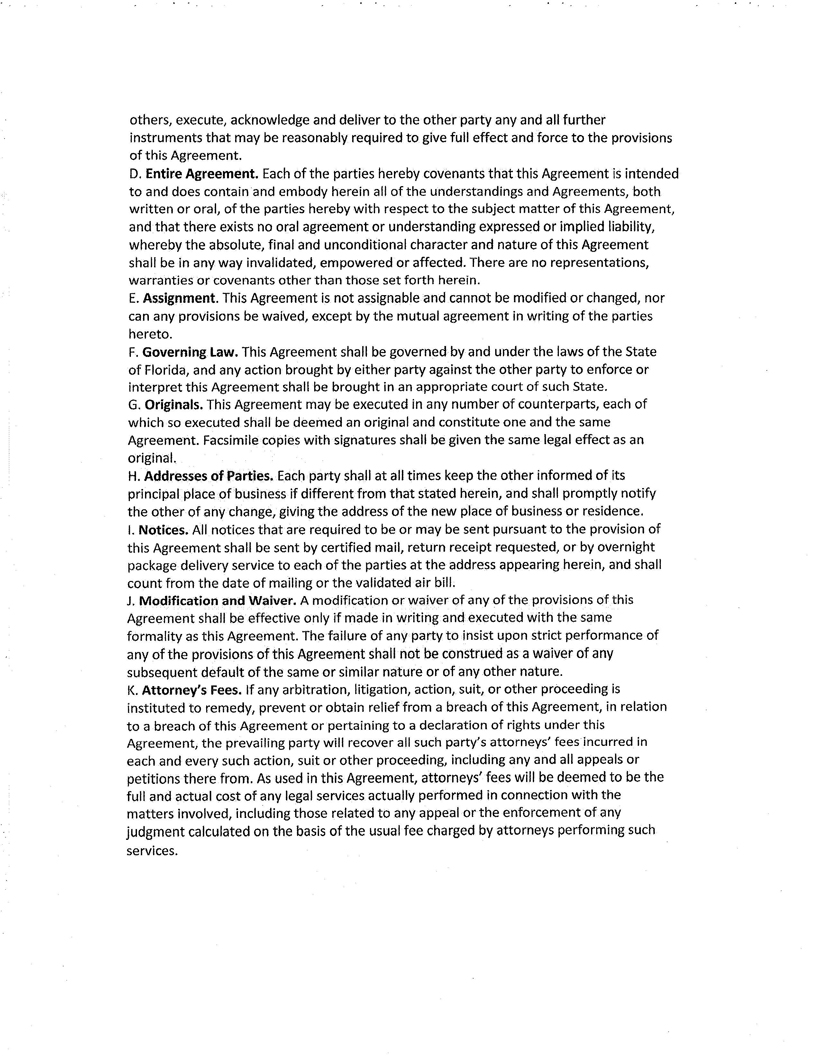

CONSULTING AGREEMENT

CONSULTING AGREEMENT (this"Agreement") is entered into as of March 1, 2011 by and between Accelerated Building Concepts Corp. (ABCC)-Consultant,located at 822 SW Federal Highway #83, Stuart,FI 34994 and SGC Corp. (SGC- Sydney Grechynska) located at Alonsa de Bazan 29600 Marbella Spain

AGREEMENT

NOW,THEREFORE, in consideration of the premises and the covenants,agreements and obligations set forth herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereby covenant and agree as follows:

1.Consulting Services. Consultant shall assistSGC by providing information concerning companies needing global lR services located in the United States.

2.Term. Section 7 notwithstanding, the term of this Agreement shall commence as of the date hereof and shall be effective a period of 24 months (the"Term"). This Agreement may be extended under the same terms by mutual agreement between Consultant and the Company.

3.Compensation. As consideration for the Consulting Services, Progressive Media Group will be responsible for fee to Consultant.

4.Non-Circumvent. The Consultant and SGC mutually agree,including their employees, associates,third party consultants and funding sources,intending to be legally bound, hereby irrevocably and mutually agree not to circumvent, avoid,bypass,or obviate each other,directly or indirectly, to avoid payment or fees,or any form of compensation in any transaction with corporation, partnership or collateral, or finding,or any other transaction involving products, commodity,or services,or addition,renewals,extensions, rollover, amendment, new contract,re-negotiations, parallel contract/agreement or third party assignment hereof.

5.Relationship. This agreement does not create, and shall not be construed to create,any joint venture or partnership between the parties, and may not be construed as an employment agreement. No officer, employee, agent,servant,or independent contractor of Consultantnor its affiliates shall at any time be deemed to be an employee, agent, servant, or broker of the Company for any purpose whatsoever solely as a result of this Consulting Agreement, and Consultant shall have no right or authority to assume or create any obligation or liability,express or implied, on the Company's behalf, or to bind the Company in any manner or thing whatsoever.

6.Notices. Any notice required or desired to be given under this Agreement shall be in writing and shall be deemed given when personally delivered, sent by an overnight courier service, or sent by certified or registered mail to the following addresses, or such other address as to which one party may have notified the other in such manner:

| If to the Consultant: | ABCC- Douglas Ward |

| | 822 SW Federal Hwy Stuart, Fl34994 |

| | |

| If to the Company: | Sydney Grechynska |

| | Alonsa de Bazan |

| | 29600 Marbella Spain |

7.Applicable Law.The validity, interpretation and performance of this Agreement shall be controlled by and construed under the laws of the State of Florida ....USA

8.Severability.The invalidity or unenforceability of any provision hereof shall in no way affect the validity or enforceability of any other provisions of this Agreement.

9.Waiver of Breach. The waiver by either partyof a breach of any provision of this Agreement by the other shall not operate or be construed as a waiver of any subsequent breach by such party. No waiver shall be valid unless in writing and signed by an authorized officer of the Company or Consultant.

10.Assigns and Assignment. This Agreement shall extend to, inure to the benefit of and be binding upon the parties hereto and their respective permitted successors and assigns.

11.Entire Agreement. This Agreement contains the entire understanding of the parties with respect to its subject matter,SGC and ABCC. It may not be changed orally but only by an agreement in writing signed by the party against whom enforcement of any waiver,change,modification, extension, or discharge is sought.

12.Counterparts. This Agreement may be executed by facsimile and in counterparts each of which shall constitute an original document, and both of which together shall constitute the same document.

IN WITNESS WHEREOF, the parties have executed this Agreement on the day and year first above written.

| The Consultant: | Accelerated Building Concepts Corp. |

| | | | | | |

| | By: | /s/ Douglas Ward | | Date: | 3/1/2011 |

| | | Name: Douglas Ward | | | |

| | | Title: Director | | | |

| | | | | | |

| The Company: | SGC | | | |

| | | | | | |

| | By: | /s/ Sydney Grechynska | | Date: | 3/1/2011 |

| | | Name: Sydney Grechynska | | | |

| | | Title: President | | | |

Accelerated Building Concepts Corp

Proposal of PR/IR Mailing Campaign for Progressive Media Group

| | (FOR PAPA BELLO - PAPA.PK.) |

| | |

| | Invitational Mailer: 200,000 X .50c = $ 100,000 |

| | |

| | Papa Bello Pizza custom research report Qt 5000: $ 1,471.00 |

| | |

| | UpTick & Forecaster newsletters Qt 4000: $ 3,167.00 |

| | |

| | E-mail list: $ 500.00 |

| | |

| | News Wire Press Releases: Papa Bello Pizza’s responsibility. |

(These costs are hard expenses and invoices will be supplied upon request.)

Basic Overview of campaign:

| 1. | The campaign begins with the creation of the post card mailer. The list purchase will be .08c-.17c per name depending on the lists the client decides to buy, ABCC will help with the selection process. Total cost per mailed piece should be just under .50c for each mailed piece. We will now be creating a database that will be our property and can be used for future mailings. We will also know that the list is current and up to NCOA (National Change of Address) standards. Mail of this type since it is personalized does not look like the standard bulk mailing and since it is offering a free research report along with free 3month trial subscriptions to 2 financial newsletters should garner a higher response rate. Traditional bulk mail expects 1/2 % response but the look of this piece should help us double industry standards. Anything better would be a windfall. |

| 2. | A research report will be created on 8.5”wide X 11” high 2 sided$ 971.00 for 5,000 qty $ 500.00 for writer totaling$ 1,471.00. |

Inks = 4/4 process colors with bleeds Prepress = Customer will supply digital electronic files Proofs = IP (imposition) and Epson color proofs for final approval. Stock = 70# Gloss Text Finishing = Trim Packaging = Carton | |

| 3. | Newsletters (Forecaster & Uptick) will include Papa Bello Pizza research report as an insert expected monthly circulation 4000 total. Set up and printing costs. $ 1527.00 printing + first class postage $ 1,640.00 =$ 3,167.00 |

| 4. | ABCC will set up a designated 800 phone line for immediate responses from e-mail, direct mail or phone inquiries. With immediate distribution of the research report and any new development’s. |

| 5. | ABCC will create and update a double opt in e-mail list of investors. Initially an e-mail list will be bought and scrubbed. This is done by sending out a blast e-mail for investors to receive the free 3 month trial subscriptions to the Forecaster and UpTick newsletters. This e-mail list is bought and sent out initially at the mail house. 500,000 e-mail names and addresses can be bought for as little as$ 500.00. After the blast goes out you have the respondent double opt in for the free trial subscriptions. Now you have the double opt in e-mail address for your own database and you now send out e-mail reports on Papa Bello Pizza. This is called an e-mail white list and avoids having the pink sheets designate the skull and cross bones on Papa Bello Pizza’s stock. There will be a custom template made for all of Papa Bello Pizza’s e-mails. Obviously the more news and updates we can provide the more success we should have and the template should have the same structure with updated information. |

| 6. | ABCC will undertake the starting and moderating various financial chat groups, and handle the press releases to the wire services. We suggest that a minimum of 1 press release monthly would help keep your current and potential shareholders informed. |

| | |

| | |

| | |

| | |

| 7. | Design post card, and research report for mailings. 3rd week of December 2010 Papa Bello Pizza approves and or makes changes to the post card and research report. Print research report and post cards with personalized ink jet names and prepare for mailing. Add the double opt in e-mail list to Papa Bello’s web sites. Go to print on the Forecaster and UpTick newsletters January 1editions. Set up the designated investor relations 800 phone# we already have and write basic call in script getting approval from Papa Bello’s Pizza on dialogue. Last week of December start disseminating information in several chat groups alluding to the fact that both the Forecaster and UpTick newsletters are beginning to initiate coverage on Papa Bello’s Pizza symbol PAPA.PK. This will be an ongoing campaign during the next 6 months. January 9th start the mailing of the postcards. Responses should start coming in at once, so research reports will be mailed immediately. It is expected that the free trial subscription to the financial newsletters will enhance our response. The 4 color double sided glossy Papa Bello Pizza research report with pictures and graphics along with a bland basic black and white 4 page investment newsletter will be mailed immediately. The thought here is we want to get a better response rate by offering free financial news letter’s but at the same time we want them to focus on Papa Bello’s Pizza report which should catch their eye because of its 4 color process. The first financial newsletter with the Papa Bello’s report will be mailed at once to all respondents. The next month they will receive the recommendation in the other financial newsletter with the same Papa Bello’s report. The thought here is just like any basic advertising principals the more a potential candidate sees something the more he or she is likely to react. These financial newsletters will have different information and different looks so in essence it will seem as though 2 separate financial newsletters are recommending Papa Bello’s stock as a good investment. It is also recommended that the company release a news announcement that these financial newsletters are initiating coverage on Papa Bello’s Pizza. The nice thing is once we get the person to respond it now becomes our property. In the 3rd week of January 09, more post cards will be mailed and responses will be mailed the newsletter and research reports. The total postcards expected to be mailed over the campaign will be 200,000. We want to continue this process of sending out the postcards and replying with the research reports on a continued basis to maintain the consistent volume and excitement in the company. Week 1-20,000 Week 2- 20,000 Week 3-15,000 Week 4-15,000 Week 5- 10,000 Week 6-10,000 Week 7-10,000 Week 8-10,000 Week 9-10,000 Week 10- 10,000 Week11-10,000 Week 12-10,000 Week13-24 until all cards mailed 5,000 weekly. |

Please review and let me know your thoughts...

Doug

Accelerated Building Concepts Corp.

Market Awareness Program

The goal of our marketing efforts is to create retail awareness of and exposure to the opportunity your company’s common stock presents. Our program consists of 5 parts:

1. Corporate Marketing Materials

| Ø | Our Creative team will develop 2 sets of marketing materials. The first will be a 1-page Fact sheet. The second will consist of 3 pages and will include a market analysis, sector comparison chart, bullet points, etc. |

| Ø | These materials become the property of the company and can be used in any way you see fit (i.e. posting on the corporate website, including within due diligence kits, etc.) |

| 2. | Dissemination to our core network of stockbrokers |

| Ø | Our active broker network is currently comprised of roughly 1,800 members, representing almost every firm in the United States and Canada. These are brokers we have, over the years, established strong relationships with. |

| Ø | We presentlywork with 23 full-time telephone consultants, giving us access to one of the largest “floors” in this industry. Our size allows us to handle all of your campaign requirements. |

| Ø | Our consultants will call stockbrokers nationwide and provide an oral presentation on your company. Each of our callers is a professional speaker and will deliver your message effectively, positively and with class, without employing fluff or hype. |

| Ø | If requested, we can even focus our efforts geographically. |

| Ø | Each consultant, over a period of 1 month, will present your company to between 1,000 and 1,200 stockbrokers. |

| 4. | Information Distribution |

| Ø | Every positive presentation is followed up with marketing materials on your company. These materials reinforce our presentations, provide additional due diligence resources and greatly enhance broker retention. |

| 5. | Accountability/Campaign Continuance |

| Ø | We provide to the company all new stockbrokers we have made presentations to. We include the broker name, firm, street address, telephone number and either a fax number or email address. This serves 2 purposes: |

| 1. | We provide accountability to our clients. Rather than the “Pay me now and trust me” philosophy that is so prevalent in this industry, we are able to verify exactly what we have accomplished. |

| 2. | We provide to the client the ability to continue the marketing efforts after our services have terminated. You have a healthy audience of brokers who have all received presentations and information on your company. You are free to set up a mailing list (direct, email or fax) or even call these brokers yourself. |