Q3 FY 2012

Earnings

Prepared Comments and Slides

August 16, 2012

Rob Eggers

Vice President, Investor Relations

Phone: 408-333-8797

reggers@brocade.com

John Noh

Senior Director, Public Relations

Phone: 408-333-5108

jnoh@brocade.com

NASDAQ: BRCD

Brocade Q3 FY 2012 Earnings 8/16/2012

Prepared comments provided by Rob Eggers, Investor Relations

Thank you for your interest in Brocade's Q3 Fiscal 2012 earnings presentation, which includes prepared remarks, slides, and a press release detailing fiscal third quarter 2012 results. The press release was issued shortly after 1:00 p.m. PT on August 16, 2012 via Marketwire. The press release, along with these prepared comments and slides, has been furnished to the SEC on Form 8-K and will be made available on the Brocade Investor Relations website at www.brcd.com.

© 2012 Brocade Communications Systems, Inc. Page 2 of 27

Brocade Q3 FY 2012 Earnings 8/16/2012

© 2012 Brocade Communications Systems, Inc. Page 3 of 27

Brocade Q3 FY 2012 Earnings 8/16/2012

Today’s prepared comments include remarks by Mike Klayko, Brocade CEO, regarding the company’s quarterly results, its strategy, and a review of operations, as well as industry trends and market/technology drivers related to its business; and by Dan Fairfax, Brocade CFO, who will provide a financial review.

A management discussion and live question and answer conference call will be webcast at 2:30 p.m. PT on August 16 at www.brcd.com and will be archived on the Brocade Investor Relations website.

© 2012 Brocade Communications Systems, Inc. Page 4 of 27

Brocade Q3 FY 2012 Earnings 8/16/2012

Prepared comments provided by Mike Klayko, CEO

© 2012 Brocade Communications Systems, Inc. Page 5 of 27

Brocade Q3 FY 2012 Earnings 8/16/2012

Fiscal Q3 was a great quarter for Brocade. With continued differentiation in our products and focused execution across our organization, we were able to overcome many issues in the current challenging macroeconomic environment. As a result, our financial performance in the quarter exceeded our expectations for revenue, non-GAAP operating margin and earnings per share.

Revenue in the third quarter 2012 increased by 10% from the prior year to $555.3M, driven by healthy growth in both our Storage and Ethernet businesses. Storage revenue grew 17% year-over-year, led by the strong ramp of 16 Gbps products, which now account for nearly 30% of our SAN Director and Switch revenue. Ethernet product revenue in Q3 was the second highest in the company's history, as a result of growth from our Enterprise customer segment, driven by our new Brocade ICX products, and higher Federal revenue.

We are very pleased to report non-GAAP EPS in the third quarter was $0.14, increasing 59% from the prior year and representing the fourth consecutive quarter of year-over-year EPS growth of nearly 20% or more.

On the balance sheet, our improvements were also substantial. With strong cash flows, we continued to pay down our term loan and now anticipate exiting the fiscal year in a net cash position, one year earlier than previously communicated. Further, leveraging our strong cash flow from operations, we repurchased $45M or 8.7M shares during the quarter. Over the past 12 months, we have bought back 60M shares, representing nearly 12% of the shares outstanding exiting Q3 2011.

Over the last several years, we have made significant R&D investments in our technology and product portfolio that have put the company in an industry-leading position. We are confident that these investments position us well as the networking industry continues to evolve with new technologies such as Ethernet fabrics, 16 Gbps SAN, Software-Defined Networking (SDN) and 100 Gigabit Ethernet.

© 2012 Brocade Communications Systems, Inc. Page 6 of 27

Brocade Q3 FY 2012 Earnings 8/16/2012

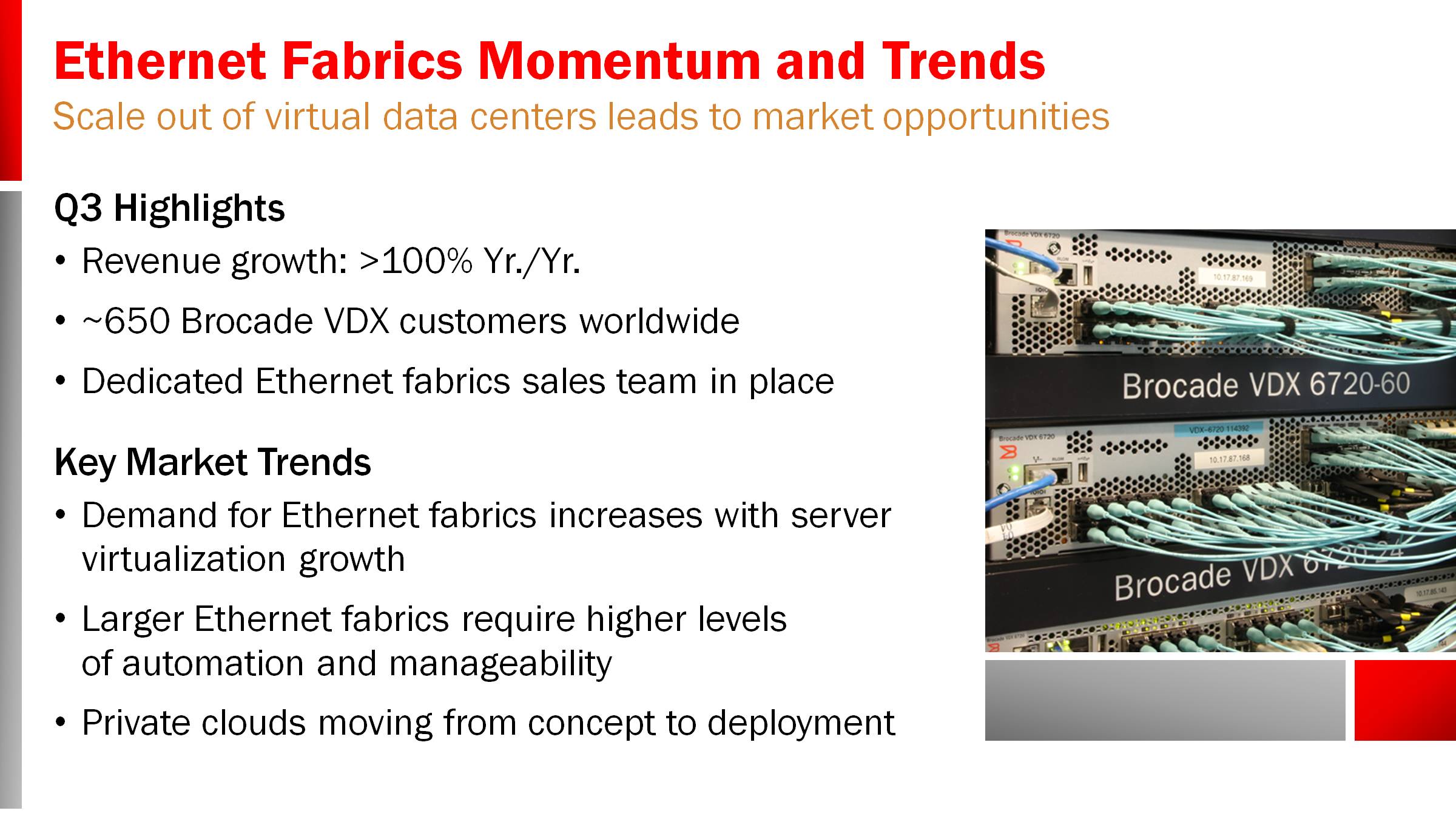

A great example of innovation driving growth, is our investment and leadership in the emerging Ethernet fabric space, where our revenue in Q3 grew by more than 100% year-over-year. We continue to experience great customer interest with nearly 650 customers for the Brocade VDX product line, including many repeat buyers among the early adopters. In fact, one of these early adopters has now purchased well over $1 million to date of VDX products. As we announced last quarter, we now have a dedicated sales team in place to address this rapidly growing market. Our objective with this team is to have a focused effort to win emerging sales opportunities as customers migrate from traditional data center networks to Ethernet fabrics.

One of the important trends that we are beginning to see in the fabric space is customers scaling out their fabrics in order to support private cloud build-outs and server virtualization expansion. Especially when scaling to larger fabrics, customers require more sophisticated automation and management capabilities, which the combined Brocade VDX switch and VCS fabric technology solution delivers. Brocade will continue to innovate in this area and will be making specific announcements that will further differentiate Brocade from the competition at our Analyst and Technology Day event on September 12.

© 2012 Brocade Communications Systems, Inc. Page 7 of 27

Brocade Q3 FY 2012 Earnings 8/16/2012

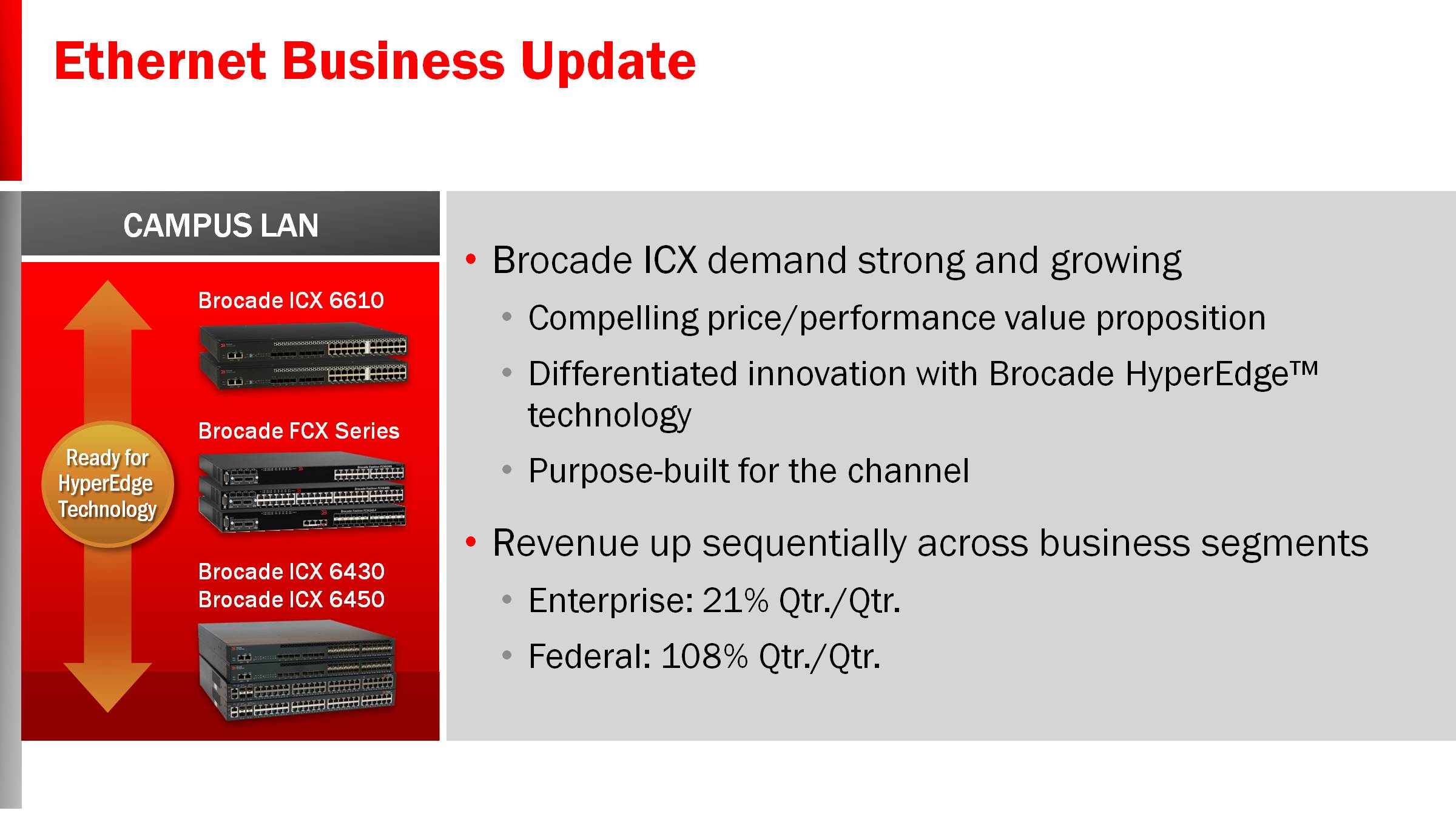

Turning to our Enterprise business, we experienced outstanding sequential growth in the third quarter with revenue increasing by 21% from the prior quarter and 2% year-over-year. This was largely driven by the strong ramp of the new Brocade ICX family of switches. Purpose-built for the channel, and launched in Q2 as part of our Effortless Network™ vision, this portfolio of products offers outstanding functionality and performance at an attractive price point. Another key differentiator is our Brocade HyperEdge™ technology, available next year, which is designed to deliver new levels of automation and simplification as well as significant cost savings and investment protection. Customer demand and feedback has been very encouraging as these products and technology fill a critical gap in the campus LAN market.

Another important driver of our third quarter growth in our Ethernet business was the Federal segment, which grew 108% sequentially and 40% year-over-year. We typically see higher revenue from our Federal customers in the second half of the fiscal year, but our Q3 performance was better than expected. We continue to be optimistic that we can grow our share in the large Federal IT market despite the challenges that exist in this segment.

We are also making progress with our two-tier channel strategy and are encouraged by both improved sales execution as well as the positive feedback we are receiving from our channel partners. Our Q3 performance gives us confidence that our strategy and plans are on the

right track.

© 2012 Brocade Communications Systems, Inc. Page 8 of 27

Brocade Q3 FY 2012 Earnings 8/16/2012

Brocade continues to invest strategically in storage area networking where the ramp of our industry-leading 16 Gbps Fibre Channel technology has contributed to significant market share gains. Based on the Dell'Oro Group's most recent report for calendar Q1 2012, our market share has increased by six percentage points, resulting in 71% of the total market. 16 Gbps products now make up nearly 30% of our SAN Director and Switch revenue. With recent launches, such as IBM's Flex System x240 Compute Node and Dell's 6505 switch, we believe the adoption of this technology will continue to drive growth for the company.

The rapid qualification and deployment of our 16 Gbps Fibre Channel products indicate that our continued innovation not only improves network speed and performance but is also helping customers achieve their business goals. For example, these products help organizations to reduce complexity and costs, deploy new technologies and applications, support virtualization and cloud infrastructures, and build highly scalable storage networks that improve business agility and support growth. In total, this market continues to present great opportunities for us and we are committed to developing innovation that maintains our strong leadership.

© 2012 Brocade Communications Systems, Inc. Page 9 of 27

Brocade Q3 FY 2012 Earnings 8/16/2012

Another area of investment and early leadership for Brocade is Software-Defined Networking. Like many of you, we have followed with interest the lively discussion regarding what SDN means for our industry. Brocade views SDN as a tremendous opportunity for growth. This emerging technology has the potential to transform networking infrastructure into a platform for innovation, enabling customers to deliver new services and applications faster and with much larger scale. Importantly, SDN requires and is optimized for fabrics, an area in which our highly differentiated product portfolio excels.

During the third quarter, we announced our comprehensive strategy for SDN and delivered our first SDN-ready products that include support for OpenFlow at 100 Gigabit Ethernet. We are already deploying solutions at customer locations, such as Indiana University and Internet2 (I2). We are also building our partner ecosystem and have established great relationships with OpenFlow partners, such as NEC, Big Switch, Nicira, and others. SDN will be a key theme at our upcoming Analyst and Technology Day and we look forward to showing you how our solutions will be an important enabler for this transformational emerging technology.

© 2012 Brocade Communications Systems, Inc. Page 10 of 27

Brocade Q3 FY 2012 Earnings 8/16/2012

We will be hosting our Analyst and Technology Day event at our campus in San Jose, California on September 12. At that time, we will take you through our financial model, capital structure plans, and market opportunity assessment for the next several years. We will also be discussing our product and technology roadmap that will continue to drive our strategic direction. We encourage you to attend in person or participate virtually, as we will demonstrate our commitment to driving industry-leading innovations that set the stage for our continued growth and success. Please register for the event at www.brocade.com.

© 2012 Brocade Communications Systems, Inc. Page 11 of 27

Brocade Q3 FY 2012 Earnings 8/16/2012

In closing, we are pleased with our ability to drive growth in revenue and profitability. As you know, last quarter we made a number of enhancements to our team and we are already seeing the benefit of these changes with continued progress in our channel, improvement in our ability to drive sales, and increased focus in markets that present exciting growth opportunities for Brocade. Further, the strength of our product portfolio has never been better and our third quarter results show that great products can help overcome a difficult macro environment. We will continue to make investments in strategic areas such as Ethernet fabrics, Storage Area Networking, Software-Defined Networking and 100 Gigabit Ethernet and look forward to showing you where our portfolio will go from here.

© 2012 Brocade Communications Systems, Inc. Page 12 of 27

Brocade Q3 FY 2012 Earnings 8/16/2012

Prepared comments provided by Dan Fairfax, CFO

© 2012 Brocade Communications Systems, Inc. Page 13 of 27

Brocade Q3 FY 2012 Earnings 8/16/2012

In Q3 12 Brocade generated revenue of $555.3M, up 10% compared to Q3 11 and up 2% Qtr./Qtr. Storage product revenue grew 17% Yr./Yr. driven by growth across all our SAN product segments and the continued ramp of our industry-leading 16 Gbps portfolio. Storage product revenue was down 6% Qtr./Qtr. in a seasonally soft quarter and represented approximately 58% of total revenue, down from 63% in Q2 and higher than the 55% reported in Q3 11.

Q3 Ethernet product revenue was up 29% Qtr./Qtr. and up 5% Yr./Yr. Sequentially, our Ethernet business improved significantly as we saw growth across all of our major customer segments, led by Enterprise and Federal. Ethernet product revenue in Q3 represented 26% of total revenue, up from 21% in Q2 and down from 28% in Q3 11.

Global Services revenue was $88M in Q3, up 1% Qtr./Qtr. and down slightly Yr./Yr. Excluding the impact of the sale of our SBS consulting business at the end of FY11, our Global Services revenue increased nearly 7% Yr./Yr. Our Global Services revenue represented approximately 16% of total Q3 revenue, no change from Q2 and down slightly from the previous year.

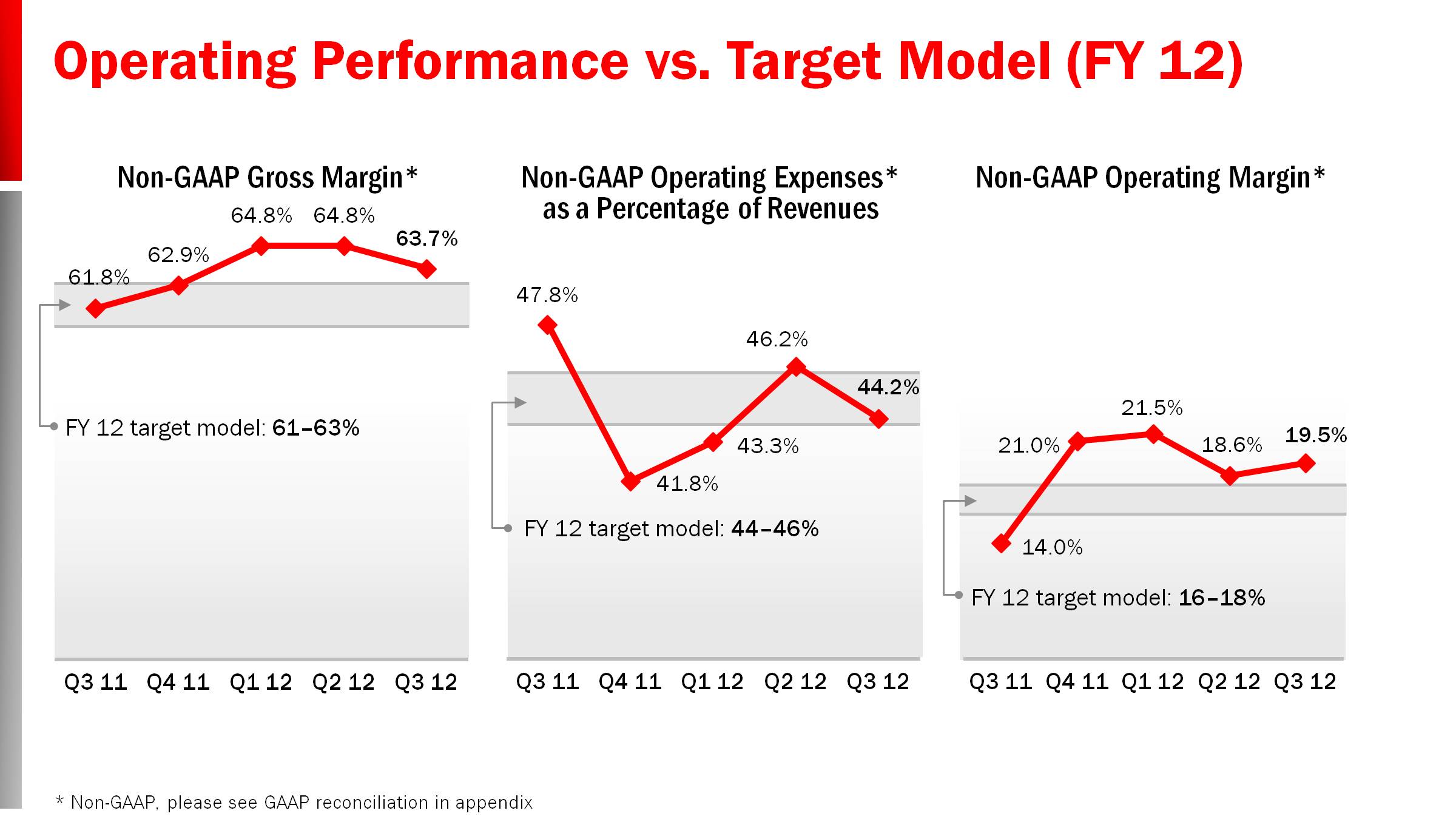

Non-GAAP gross margin was 63.7% in Q3, up 190 basis points from Q3 11 and lower compared with Q2, as expected, due to a higher mix of Ethernet revenue in the quarter. Non-GAAP operating margin was 19.5% in Q3, an improvement of 550 basis points Yr./Yr. and 90 basis points from Q2.

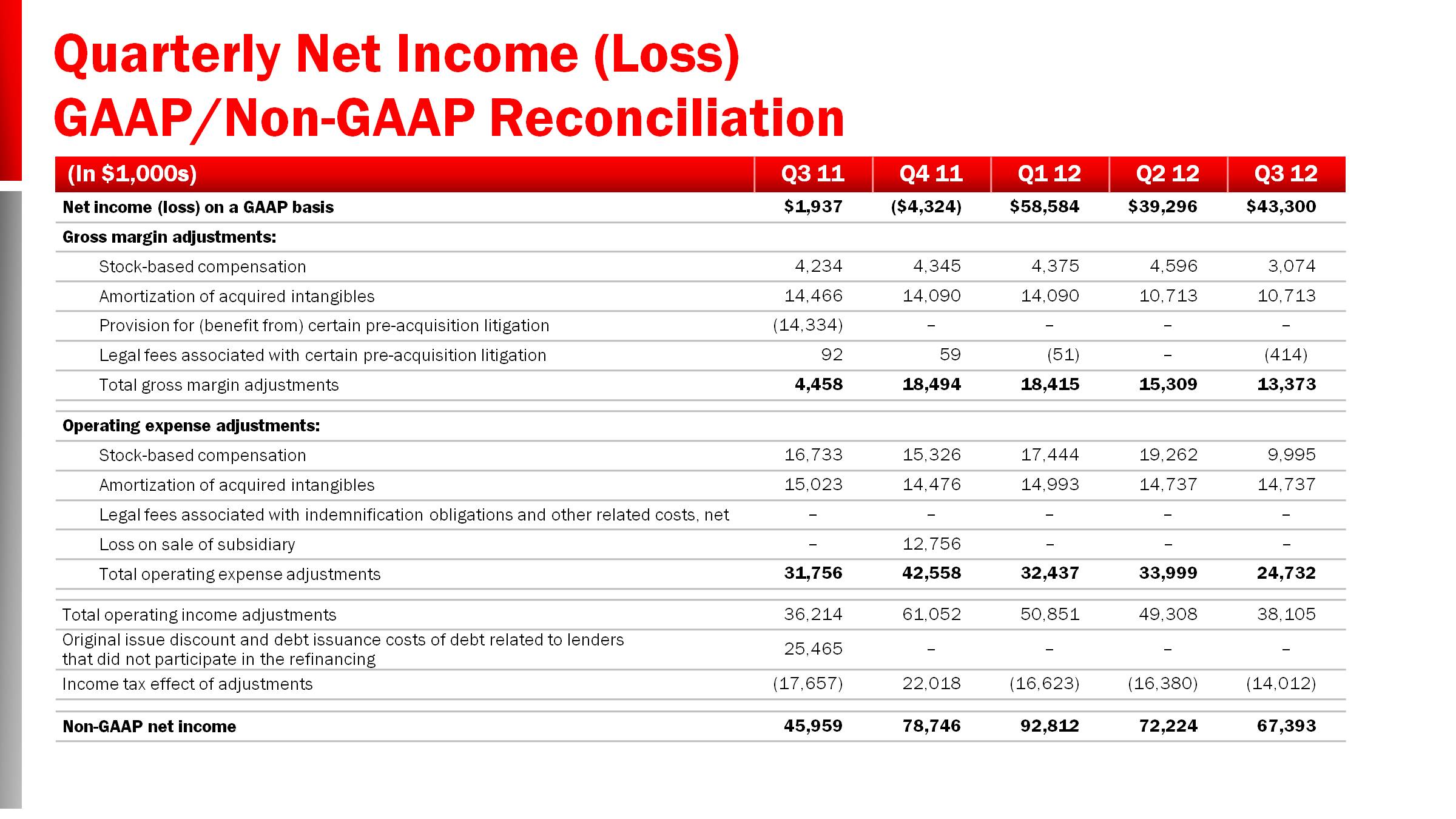

Q3 GAAP EPS on a diluted basis was $0.09, and non-GAAP EPS was $0.14 for the quarter, growing 59% Yr./Yr. The effective GAAP tax rate was 25.7% and the effective non-GAAP tax rate was 30.1% for the quarter. The non-GAAP tax rate was slightly higher than expected due to an increase in the mix of domestic revenue and profits in the quarter.

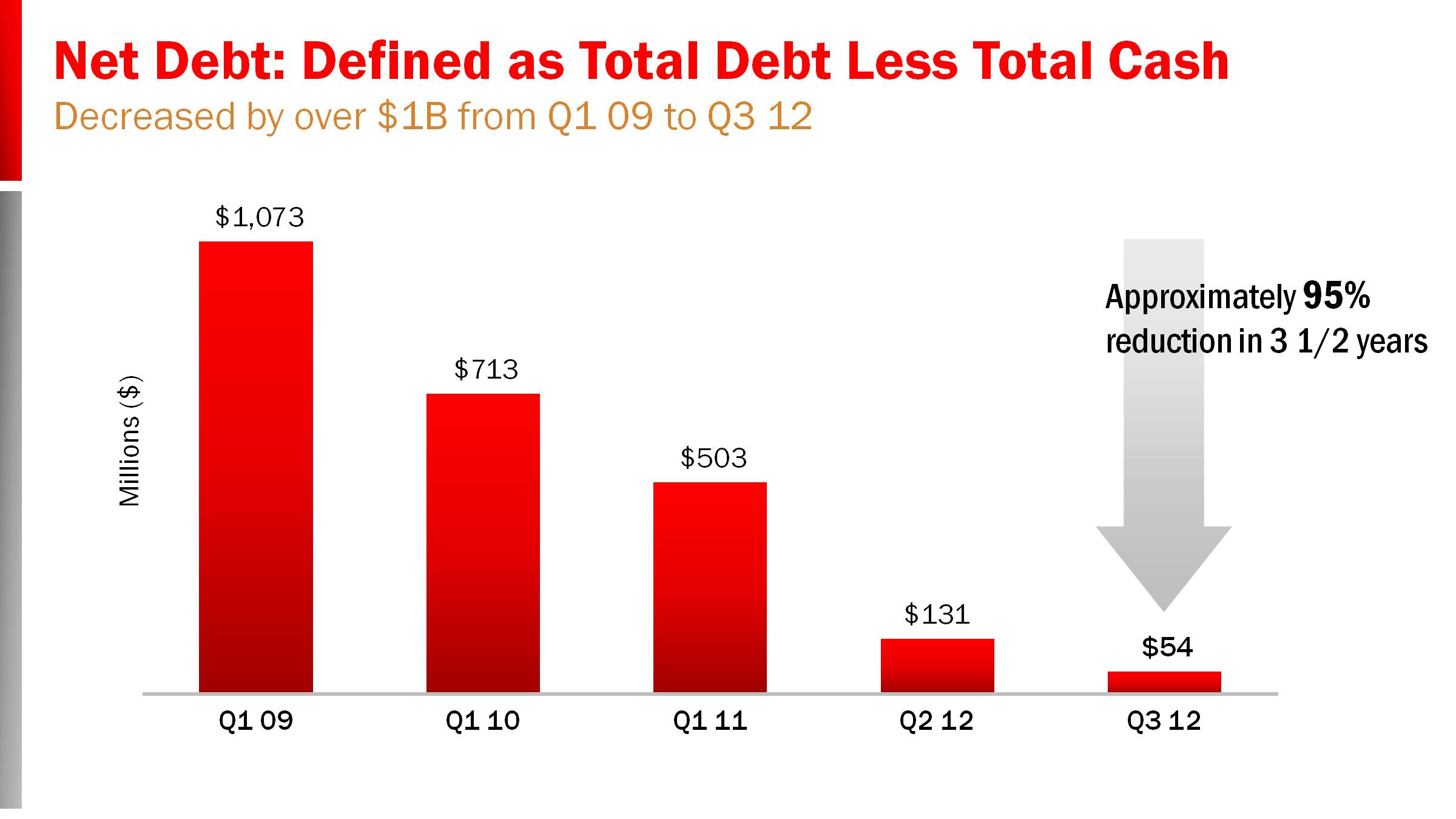

During Q3 we generated $113M in operating cash flow and paid down $40M on our term loan. Net debt was $54M exiting the quarter, down from $131M at the end of Q2. Weighted average diluted shares outstanding were 470M in Q3, lower than the 477M shares reported for Q2, and reflect 8.7M in share repurchases ($45M) during the quarter.

© 2012 Brocade Communications Systems, Inc. Page 14 of 27

Brocade Q3 FY 2012 Earnings 8/16/2012

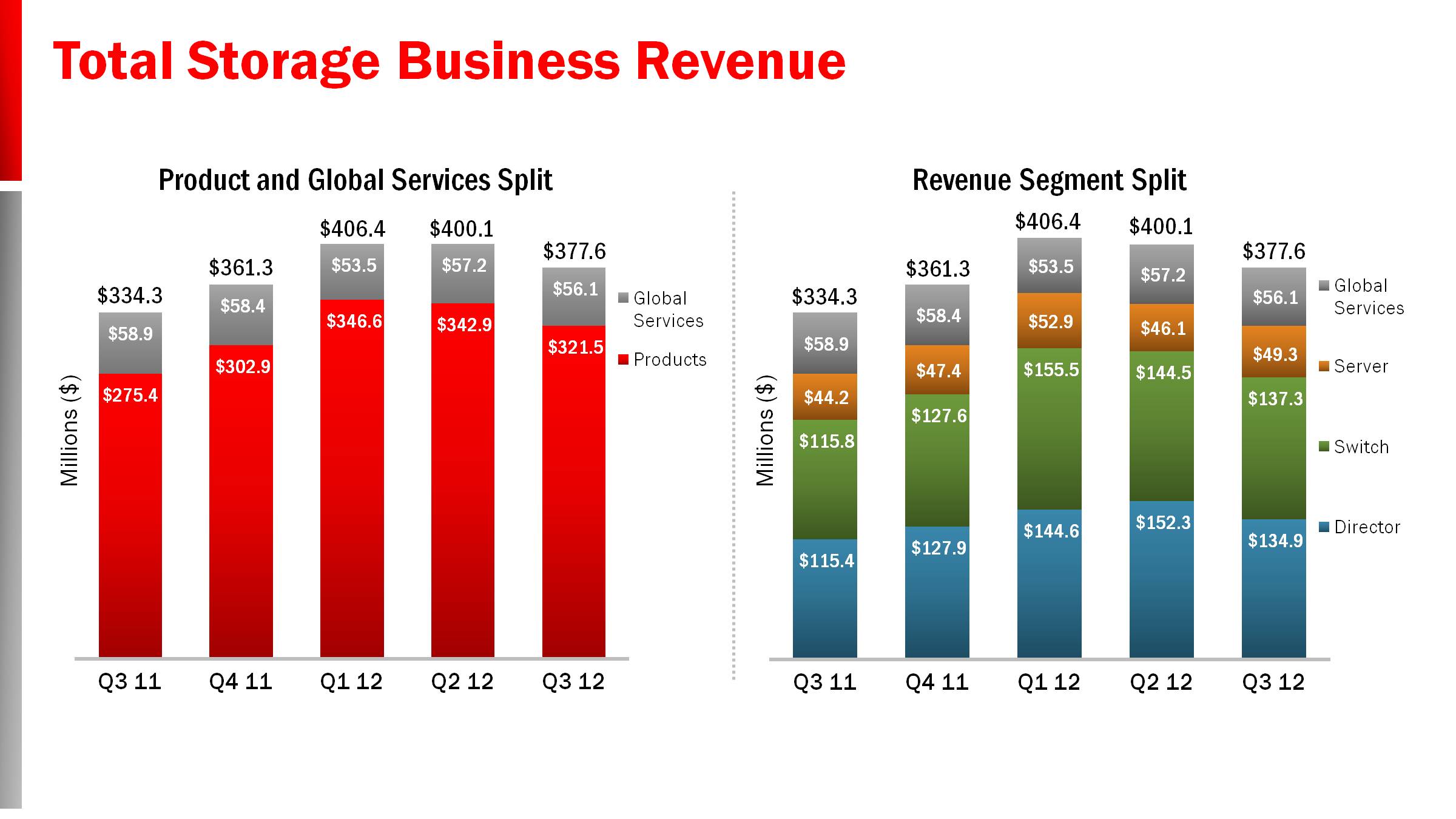

Turning to our Storage business, including hardware and Storage-based support and services, Q3 revenue was $377.6M, up 13% from Q3 11 and down 6% sequentially.

Strong demand for Storage products continues to be driven by the ramp of 16 Gbps products as well as industry trends, including data center virtualization and digital data growth. Storage product revenue was $321.5M in the quarter, up 17% Yr./Yr and down 6% sequentially. The Q3 sequential decline was at the high end of our historical seasonality due to softness in EMEA orders, attributable to the weak macroeconomic environment. Nevertheless, sales from our 16 Gbps products continue to ramp and represent nearly 30% of Director and Switch revenue in the quarter.

We experienced healthy demand for our Director products in Q3 with 17% Yr./Yr. revenue growth. Sequentially Director revenue was down 11%. Switch revenue was up 19% Yr./Yr. and down 5% Qtr./Qtr.

Our Server product group, including embedded switches and server adapter products (HBAs and Mezzanine Cards), posted revenue of $49.3M, up 12% Yr./Yr. and up 7% sequentially. Embedded switch revenue was up 13% Yr./Yr., while our server adapter product revenue was flat Yr./Yr. We launched the first of our 16 Gbps embedded switch products in the quarter, which will help to drive growth in this product group.

Storage-based support and services revenue was $56.1M in the quarter, down 5% Yr./Yr., driven primarily by the sale of our SBS services subsidiary in Q4 11, and down 2% Qtr./Qtr.

© 2012 Brocade Communications Systems, Inc. Page 15 of 27

Brocade Q3 FY 2012 Earnings 8/16/2012

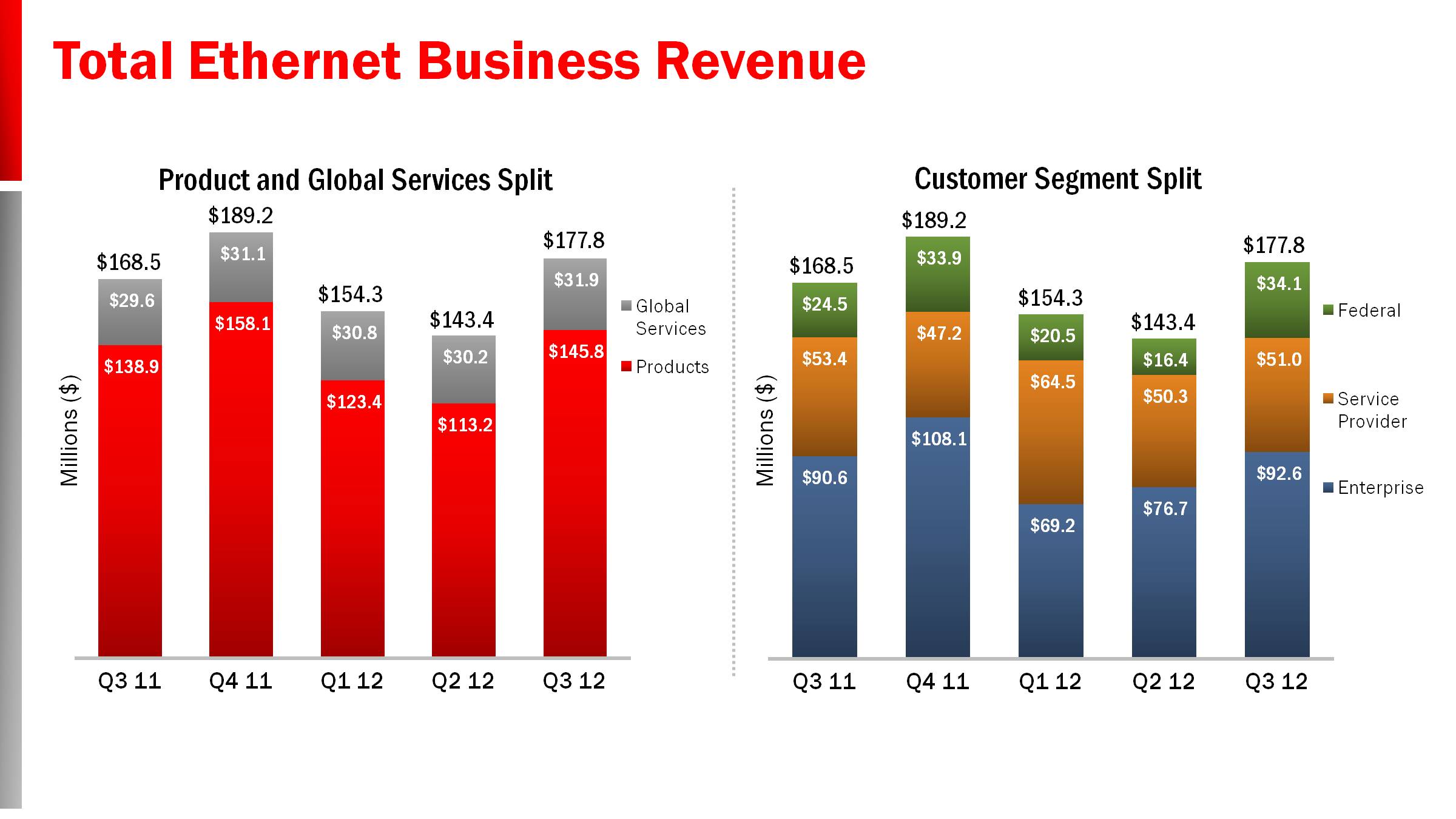

Moving on to our Ethernet business, including hardware and Ethernet-based support and services, Q3 revenue was $177.8M, up 5% Yr./Yr. and up 24% sequentially.

As we look at the Q3 Ethernet customer segment split, including products and services, our Federal business generated $34.1M in revenue, up 108% sequentially as we saw more business close than expected within the quarter, and up 40% compared with Q3 11. We saw continued improvement in our Enterprise business as revenue grew 21% Qtr./Qtr. on top of 11% sequential growth in Q2. We attribute much of this improvement to the launch of the new Brocade ICX products in Q2 and continued focus on our channel go-to-market strategy. Enterprise revenue was up 2% Yr./Yr., and our Service Provider customer segment generated $51.0M in revenue, down 4.5% Yr./Yr. and up 1.3% Qtr./Qtr.

From a geographic viewpoint, Q3 Ethernet revenue was up sequentially across all geographies, with the biggest improvements in the Americas and EMEA. Ethernet revenue was up year-over-year led by growth in EMEA and Japan, while revenue for Americas and APAC were lower.

We continued to see good progress with our award-winning Ethernet fabric-enabled products. In Q3 we saw revenue growth of over 100% Yr./Yr. for our Brocade VDX products, which also surpassed $10M in the quarter for the first time. Many of these customers are returning each quarter, purchasing additional products to build out their Ethernet fabrics, and taking advantage of the scalability of the Brocade VDX offering.

© 2012 Brocade Communications Systems, Inc. Page 16 of 27

Brocade Q3 FY 2012 Earnings 8/16/2012

In Q3, four of our customers, EMC, HDS, HP , and IBM each contributed at least 10% of the total company revenue. These 10% customers collectively contributed 55% of revenue in Q3, down from 58% in Q2, and up from 43% in Q3 11, when HDS was not a 10% customer. Other OEMs as a group, represented 12% of revenue in Q3, unchanged from Q2 and down from 18% in Q3 11, when HDS was not a 10% customer. Channel and direct routes to market contributed 33% of revenue in Q3, an increase from 30% in Q2 and down from 39% in Q3 11. The sequential increase in the percentage of revenue going through channel and/or shipped direct was driven by the shift in revenue mix to more Ethernet revenue, which is predominately sold through channel partners.

The mix of business based on ship-to location was 64% domestic and 36% international in the quarter, reflecting a shift in mix to more domestic revenue from 61% in Q3 11. Since some of our OEMs take delivery of our products domestically and then ship internationally to their end-users, the percentage of international revenue based on end-user location would be higher.

© 2012 Brocade Communications Systems, Inc. Page 17 of 27

Brocade Q3 FY 2012 Earnings 8/16/2012

Q3 non-GAAP Company gross margin of 63.7% was within our guidance range of 63.3% to 63.8% for the quarter. Gross margin improved 190 basis points year-over-year driven by higher volumes and better product gross margins. Gross margin was down as expected from Q2 due to

product mix.

Q3 product non-GAAP gross margin was 65.5%, near the high end of our 63% to 66% target model, and down from 66.9% in Q2 primarily due to product mix. Q3 Storage non-GAAP gross margin percentage was in the mid-70's. Q3 Ethernet non-GAAP gross margin percentage was in the upper-40's, higher compared to Q2 and lower year-over-year due to the increase in sales through the channel.

Global Services non-GAAP gross margin was 54.5% in Q3, up significantly compared with the 49.5% reported in Q3 11, primarily due to the sale of SBS. Global Services gross margin was up slightly quarter-over-quarter, due to lower spending, and was above the high end of our target model of 51% to 54%.

© 2012 Brocade Communications Systems, Inc. Page 18 of 27

Brocade Q3 FY 2012 Earnings 8/16/2012

Q3 Non-GAAP gross margins were 63.7% and continued to be above the high end of our target model range of 61% to 63% for FY12.

On a non-GAAP basis, total operating expenses were 44.2% of revenues in Q3, near the low end of our target model of 44% to 46% for FY12 and lower compared with 46.2% reported in Q2. Operating expenses on a dollar basis decreased from Q2, driven by lower sales expenses as well as normal seasonal spending decreases in Q3. Ending headcount was 4,597 in Q3, essentially unchanged from the prior quarter.

Non-GAAP operating margin was 19.5% in Q3, an increase of 550 basis points compared with Q3 11. The operating margin was above the target model range of 16% to 18% and benefited from improved gross margin and lower operating expenses.

© 2012 Brocade Communications Systems, Inc. Page 19 of 27

Brocade Q3 FY 2012 Earnings 8/16/2012

Cash generated from operations was $113M in Q3, up 922% Yr./Yr. and down 19% sequentially. We continued to see favorable shipment linearity in the quarter, which resulted in DSOs of 38 days, the third quarter in a row our DSOs were less than 40 days. Total capital expenditures in the quarter were $18M.

Cash, equivalents, and short-term investments were $581M, up $36M from Q2 and up $108M from Q3 11. With the $40M principal reduction of our term loan in Q3, our remaining principal is $30M exiting the quarter and we expect to pay off the remaining balance during Q4. We also expect to be net-cash positive as we exit Q4 12. As I mentioned earlier, we repurchased $45M of common stock during Q3 and had $608M remaining in the Board authorized share repurchase program exiting the quarter. In addition, since the beginning of Q4 12, we have repurchased $30M of common stock or 5.9M shares.

Since Q3 11, we have repurchased a total of 60M shares and have reduced our interest expense by nearly 30%.

Adjusted EBITDA in the quarter was $131M, which was up 43% compared to Q3 11 and up 6% Qtr/Qtr. The Senior Secured Leverage Ratio was 1.20x and the Fixed Charge Coverage Ratio was 4.83x. Both ratios have improved significantly over the past year and have comfortable headroom to the covenant requirements of our term credit agreement.

© 2012 Brocade Communications Systems, Inc. Page 20 of 27

Brocade Q3 FY 2012 Earnings 8/16/2012

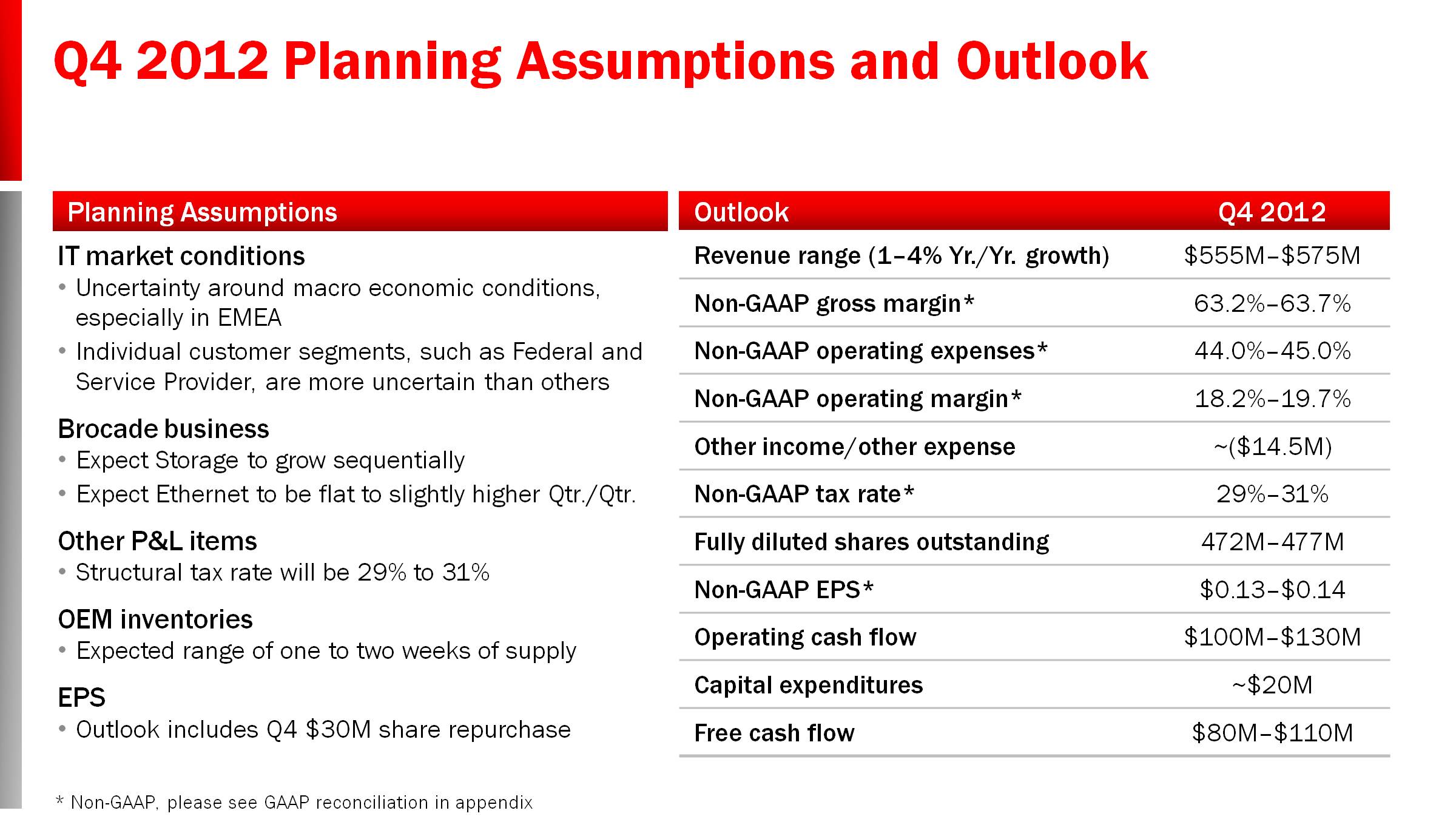

Looking forward to Q4 12, we considered a number of factors, including the following, in setting our outlook:

| |

| • | The current macro environment and economy continue to show uncertainty, especially within the Eurozone countries. |

| |

| • | The overall IT spending is growing but individual customer segments, such as Federal and Service Provider, may experience more uncertainty than others. |

| |

| • | We continue to see encouraging demand trends for our Storage products and expect Q4 Storage revenue to grow sequentially and be up approximately 7% to 10% year-over-year. |

| |

| • | We expect our Q4 Ethernet revenue to be flat to slightly higher Qtr./Qtr. |

| |

| • | We expect non-GAAP operating expenses to be approximately $250M in Q4. |

| |

| • | At the end of Q3, OEM inventory was a little more than one and one-half weeks based on Storage business revenue and we expect OEMs to hold between one week and two weeks of inventory going forward. OEM inventory levels may fluctuate due to both seasonality and large end-user order patterns at the OEMs. |

| |

| • | From a tax rate perspective, we assume a structural non-GAAP rate of 29% to 31% for Q4. Discrete events can impact our tax rate from time to time. However we do not provide guidance on such events due to the inherent uncertainty of their realization and timing. |

| |

| • | Our guidance reflects the share repurchases already completed in Q4. |

| |

| • | Finally, based on our Q4 outlook, we expect to grow overall revenue in FY12 by 3% to 4% Yr./Yr. and non-GAAP EPS by 26% to 28% Yr./Yr. |

© 2012 Brocade Communications Systems, Inc. Page 21 of 27

Brocade Q3 FY 2012 Earnings 8/16/2012

Prepared comments provided by Rob Eggers, Investor Relations

That concludes Brocade’s prepared comments. At 2:30 p.m. Pacific Time on August 16 Brocade will host a webcast conference call at www.brcd.com.

Thank you for your interest in Brocade.

© 2012 Brocade Communications Systems, Inc. Page 22 of 27

Brocade Q3 FY 2012 Earnings 8/16/2012

© 2012 Brocade Communications Systems, Inc. Page 23 of 27

Brocade Q3 FY 2012 Earnings 8/16/2012

Additional Financial Information:

|

| | | | | | |

| | Q3 11 |

| Q2 12 |

| Q3 12 |

|

| GAAP gross margin | 61.0 | % | 62.0 | % | 61.3 | % |

| Non-GAAP gross margin | 61.8 | % | 64.8 | % | 63.7 | % |

| | | | |

| GAAP product gross margin | 64.0 | % | 64.0 | % | 62.8 | % |

| Non-GAAP product gross margin | 64.5 | % | 66.9 | % | 65.5 | % |

| | | | |

| GAAP services gross margin | 46.9 | % | 51.7 | % | 53.2 | % |

| Non-GAAP services gross margin | 49.5 | % | 54.3 | % | 54.5 | % |

| | | | |

| GAAP operating margin | 6.8 | % | 9.5 | % | 12.6 | % |

| Non-GAAP operating margin | 14.0 | % | 18.6 | % | 19.5 | % |

© 2012 Brocade Communications Systems, Inc. Page 24 of 27

Brocade Q3 FY 2012 Earnings 8/16/2012

© 2012 Brocade Communications Systems, Inc. Page 25 of 27

Brocade Q3 FY 2012 Earnings 8/16/2012

© 2012 Brocade Communications Systems, Inc. Page 26 of 27

Brocade Q3 FY 2012 Earnings 8/16/2012

© 2012 Brocade Communications Systems, Inc. Page 27 of 27