Q2 FY 2013 Earnings

Prepared Comments and Slides

May 16, 2013

Rob Eggers

Vice President, Investor Relations

Phone: 408-333-8797

reggers@brocade.com

John Noh

Senior Director, Public Relations

Phone: 408-333-5108

jnoh@brocade.com

NASDAQ: BRCD

Brocade Q2 FY 2013 Earnings 5/16/2013

Prepared comments provided by Rob Eggers, Investor Relations

Thank you for your interest in Brocade's Q2 Fiscal 2013 earnings presentation, which includes prepared remarks, safe harbor, slides, and a press release detailing fiscal second quarter 2013 results. The press release was issued shortly after 1:00 p.m. PT on May 16, 2013 via Marketwire. The press release, along with these prepared comments and slides, has been furnished to the SEC on Form 8-K and will be made available on the Brocade Investor Relations website at www.brcd.com.

© 2013 Brocade Communications Systems, Inc. Page 2 of 27

Brocade Q2 FY 2013 Earnings 5/16/2013

© 2013 Brocade Communications Systems, Inc. Page 3 of 27

Brocade Q2 FY 2013 Earnings 5/16/2013

Today’s prepared comments include remarks by Lloyd Carney, Brocade CEO, regarding the company’s quarterly results, its strategy, and a review of operations, as well as industry trends and market/technology drivers related to its business; and by Dan Fairfax, Brocade CFO, who will provide a financial review.

A management discussion and live question and answer conference call will be webcast at 2:30 p.m. PT on May 16 at www.brcd.com and will be archived on the Brocade Investor Relations website.

© 2013 Brocade Communications Systems, Inc. Page 4 of 27

Brocade Q2 FY 2013 Earnings 5/16/2013

Prepared comments provided by Lloyd Carney, CEO

© 2013 Brocade Communications Systems, Inc. Page 5 of 27

Brocade Q2 FY 2013 Earnings 5/16/2013

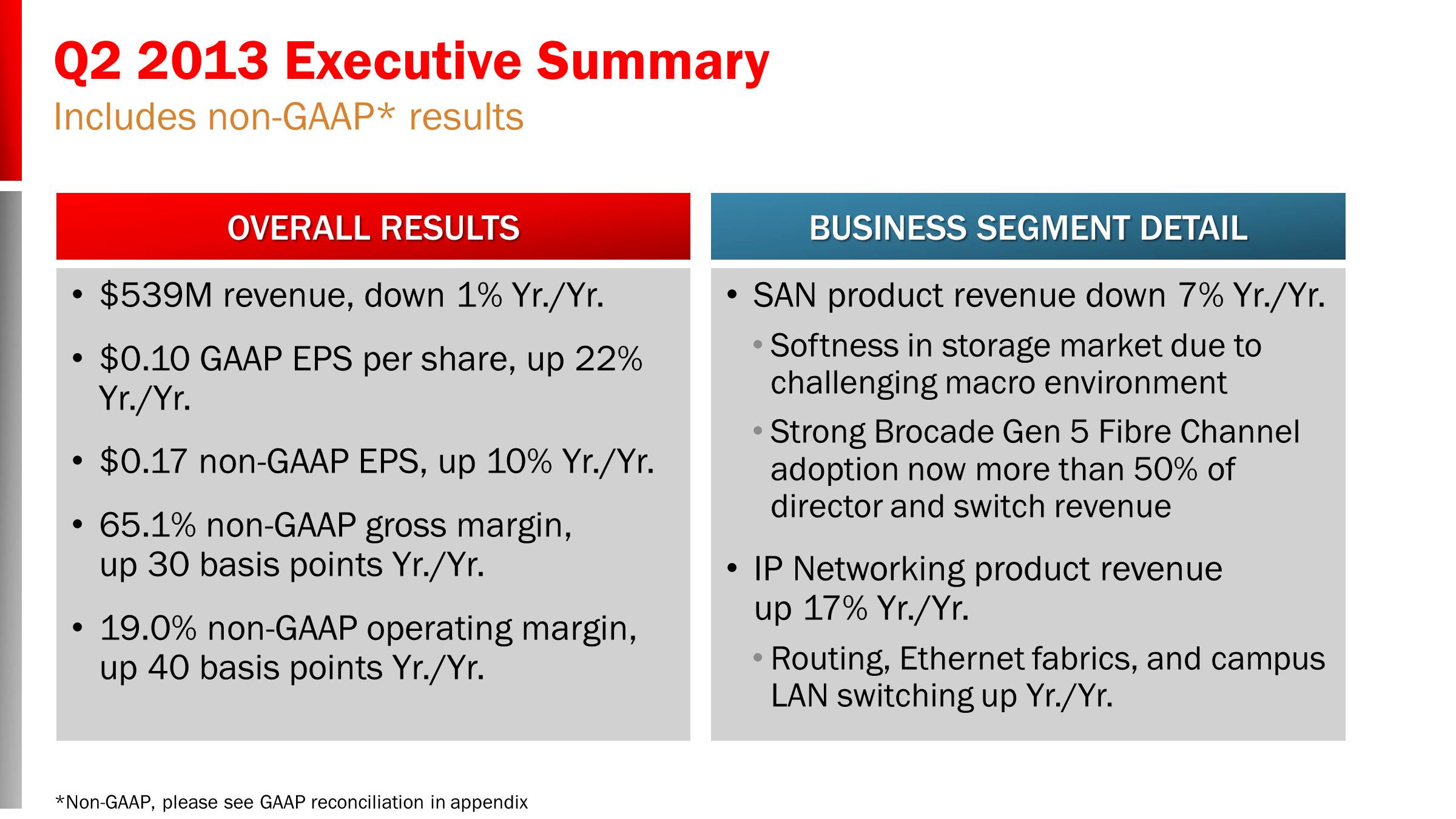

Thank you for joining us today. Q2 13 was a mixed quarter for Brocade's financial results. Against the backdrop of a challenging environment for storage, our SAN revenue came in lower than our original expectations. However, IP Networking revenues showed healthy year-over-year growth, driven by the strength of our product portfolio and improved sales execution. Total revenue in the second quarter was $539M, which was down slightly from Q2 12 and down 8% sequentially.

Coming off of record SAN revenues in Q1, SAN revenue was $319M in Q2, down 7% year-over-year and down 12% quarter-over-quarter. We were disappointed in our storage area networking sales in the second quarter due to short-term slowing in the storage market and execution challenges at a couple of our large OEM partners. These challenges have been well documented in recent headlines from partners, peers, and competitors. Q2 is typically a softer quarter for demand of SAN products, but our results were impacted by these additional factors, which exacerbated the normal seasonality. Despite the current environment, I believe that the longer-term market opportunity for our SAN products continues to be favorable, supported by the fact that Brocade Gen 5 Fibre Channel products exceeded 50% of our shipments of directors and switches in the quarter. I'll discuss the SAN business in more detail in the next section.

IP networking product revenue was $133M, up 17% year-over-year, driven primarily by growth in our campus LAN business from new product offerings and better sales execution. We also saw higher routing sales as well as the success of our Ethernet fabric products. In fact, Q2 Brocade VDX revenue was more than $65M on an annualized run-rate, up approximately 80% from Q2 12. Sequentially, IP networking product revenue was down 6% on lower revenue of Brocade ADX products and seasonally lower Federal revenue.

Our continuing focus on increasing profitability and improving cash flow enabled us to achieve operating results in line with our original expectations for the quarter. Q2 Non-GAAP operating margin was 19%, an increase of 40 basis points from the prior year and non-GAAP EPS was $0.17, up 2 cents year-over-year.

While I am pleased that we were able to increase profitability in a challenging storage environment in Q2, I believe we can do better in driving top-line growth as well as profitability. Following a thorough inspection of the business during my first four months as CEO, I believe that Brocade is well-positioned to be a leader in the new era of networking. To do so, we need to be more focused as a company and we need to deliver consistent, profitable growth to increase shareholder value. I will begin to lay out my strategy for the business today and will provide more details of my plans over the next several months. My goal is to begin our fiscal 2014 with our people, processes, and products in place to enable us to deliver consistent growth in both revenue and profits. Before I go into more specifics about the future, I want to first review the quarter's performance in more detail.

© 2013 Brocade Communications Systems, Inc. Page 6 of 27

Brocade Q2 FY 2013 Earnings 5/16/2013

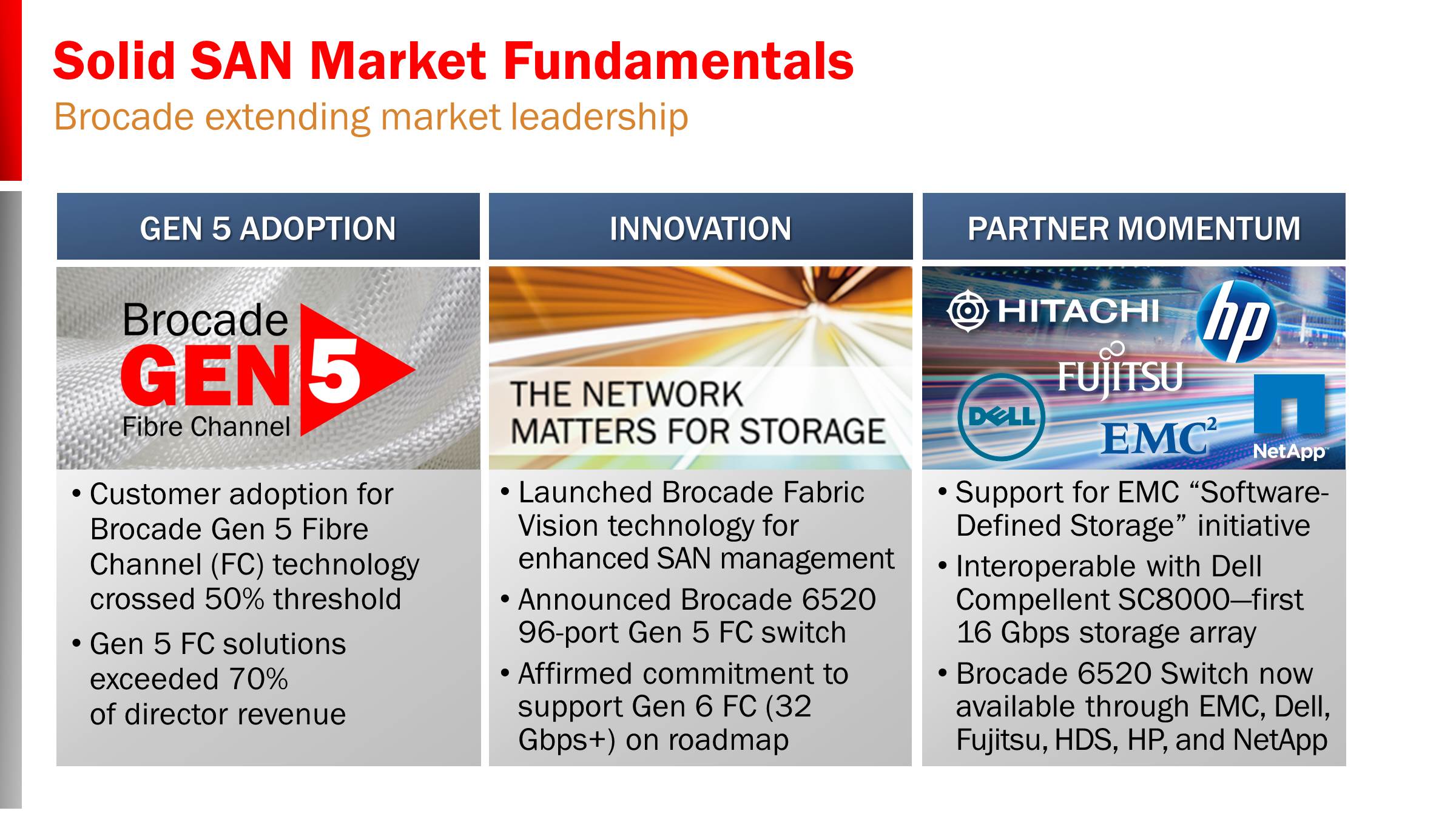

Despite the challenging near-term environment, we believe that the fundamentals of the SAN market are strong, including storage growth related to virtualization, cloud, and unstructured data. We are pleased to see the continued transition to our Gen 5 Fibre Channel products, now representing more than 50% of director and switch revenue in Q2. Our customers understand the benefits of the new technology and value-added features only realized with our Gen 5 portfolio. In 21 months since their launch, our Gen 5 director products now represent more than 70% of total director revenue, demonstrating Brocade's clear leadership in 16 Gbps technology in the market.

We expect that our Fibre Channel business will continue to deliver profitable revenue growth and strong cash flow for years to come. During Q2, we strengthened our product portfolio with Brocade Fabric Vision technology that provides our customers unprecedented levels of visibility and insight into the storage network. We also launched the Brocade 6520 96-port switch that expands our industry-leading portfolio of Gen 5 Fibre Channel modular, fixed-port, and embedded solutions. We also affirmed our commitment to Gen 6 Fibre Channel (32 Gbps+), leveraging our current market position with nearly a two-year lead over competitive solutions.

One of the keys to our success in the SAN market is the ecosystem of OEM partners. In Q2 we enhanced these partnerships with several announcements related to Gen 5 Fibre Channel technology and SAN management advancements, namely:

| |

| • | At EMC World, Brocade announced support for EMC's “Software-Defined Storage” initiative by making the Brocade Gen 5 Fibre Channel portfolio interoperable with the EMC ViPR Software-Defined Storage Platform; |

| |

| • | We announced that the new Brocade 6520 Switch and Brocade Network Advisor 12.0 are now generally available through Dell, EMC, Fujitsu, HDS, HP , and NetApp; |

| |

| • | Dell announced the availability of its Dell Compellent SC8000 Storage Controller, becoming the first in the industry to offer a complete 16-Gbps Fibre Channel solution from servers, to switches and storage. |

© 2013 Brocade Communications Systems, Inc. Page 7 of 27

Brocade Q2 FY 2013 Earnings 5/16/2013

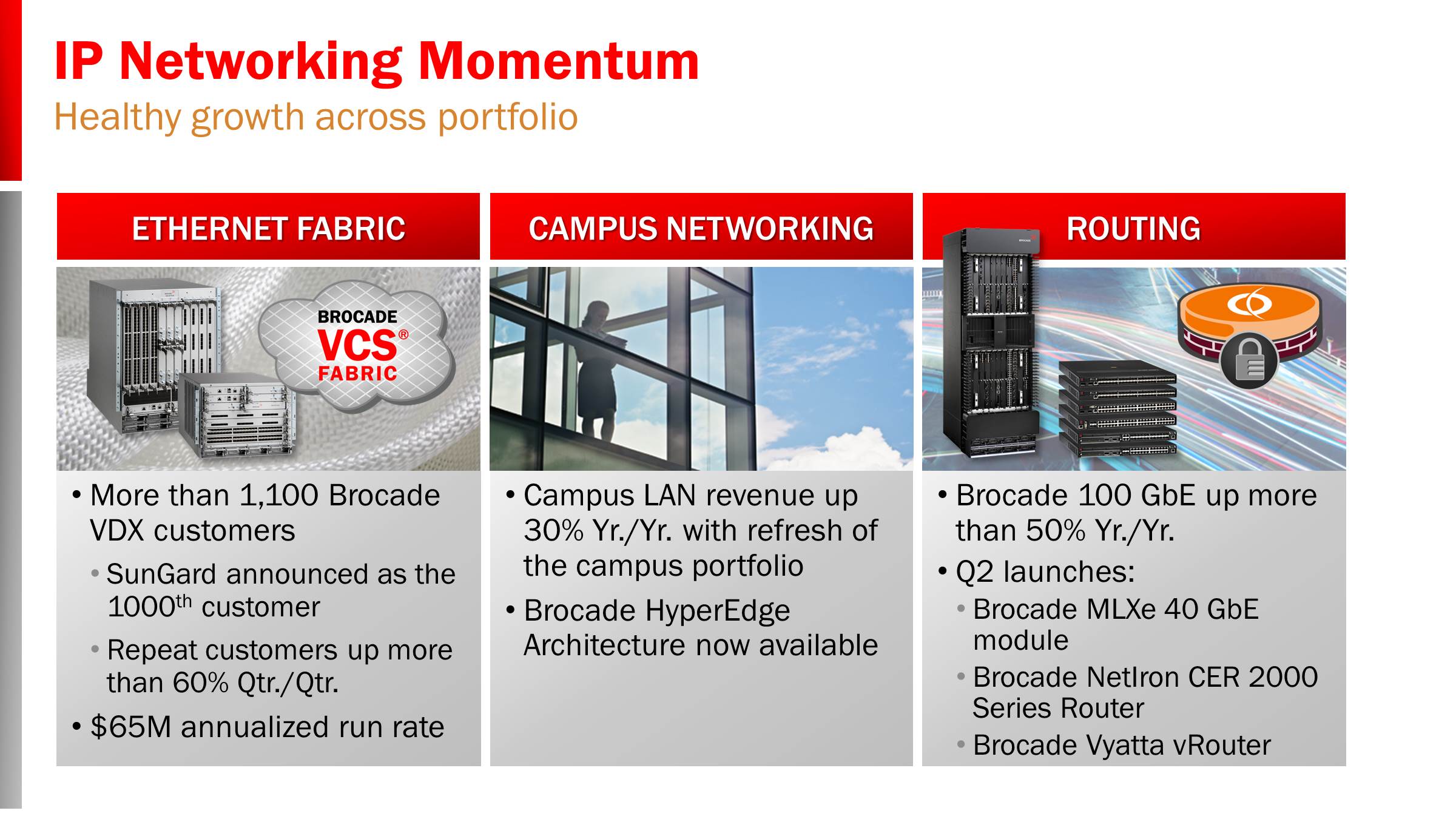

Turning to our IP Networking business, product revenue was $133M, up 17% year-over-year and down 6% quarter-over-quarter. Our strong year-over-year performance was driven by success of our Ethernet fabric products, growth in revenue contribution from our refreshed campus LAN portfolio, increased routing sales, and improved sales execution. The sequential decline in revenue was primarily due to lower Brocade ADX product sales as they returned to a more normal level following a large conversion of Brocade Network Subscription business to product revenue in Q1.

While our sales into the Federal market were seasonally lower than Q1, we saw healthy growth year-over-year. This was largely due to the fact that our campus LAN products are now more broadly marketed and our Federal team and channel partners have been effective in closing opportunities in this strategic customer segment.

During the second quarter, we delivered our innovative Brocade HyperEdge™ Architecture, which automates and simplifies the campus network, creating a holistic wired and wireless infrastructure. The general availability of this technology completes the portfolio of campus LAN products and solutions announced last year.

Ethernet fabric sales continue to grow and we now have more than 1,100 Brocade VDX customers, which is double the number of customers from just a year ago. We are pleased to announce one such customer, SunGard, that chose Brocade VCS Fabric technology for its automation features and to support fast-growing virtualized workloads in its data center, a challenge shared by many of our Brocade VDX customers. In addition to our growing base of new customers, we are also pleased to report that the number of repeat Brocade VDX customers was up 60% in the quarter. The continued healthy adoption of our Ethernet fabric technology highlights its strength in providing an optimal foundation for server virtualization and cloud architectures, as well as future deployment of software-defined networking (SDN) elements.

Brocade also saw growth in shipments of its routing portfolio, including more than 50% year-over-year growth of our 100 GbE modules that are being used in high-performance data center-to-data center connectivity as well as SDN deployments. In Q2, we enhanced our routing portfolio with the announcements of the Brocade Vyatta vRouter, 40 GbE options for the Brocade MLXe, and the Brocade NetIron CER 2000.

© 2013 Brocade Communications Systems, Inc. Page 8 of 27

Brocade Q2 FY 2013 Earnings 5/16/2013

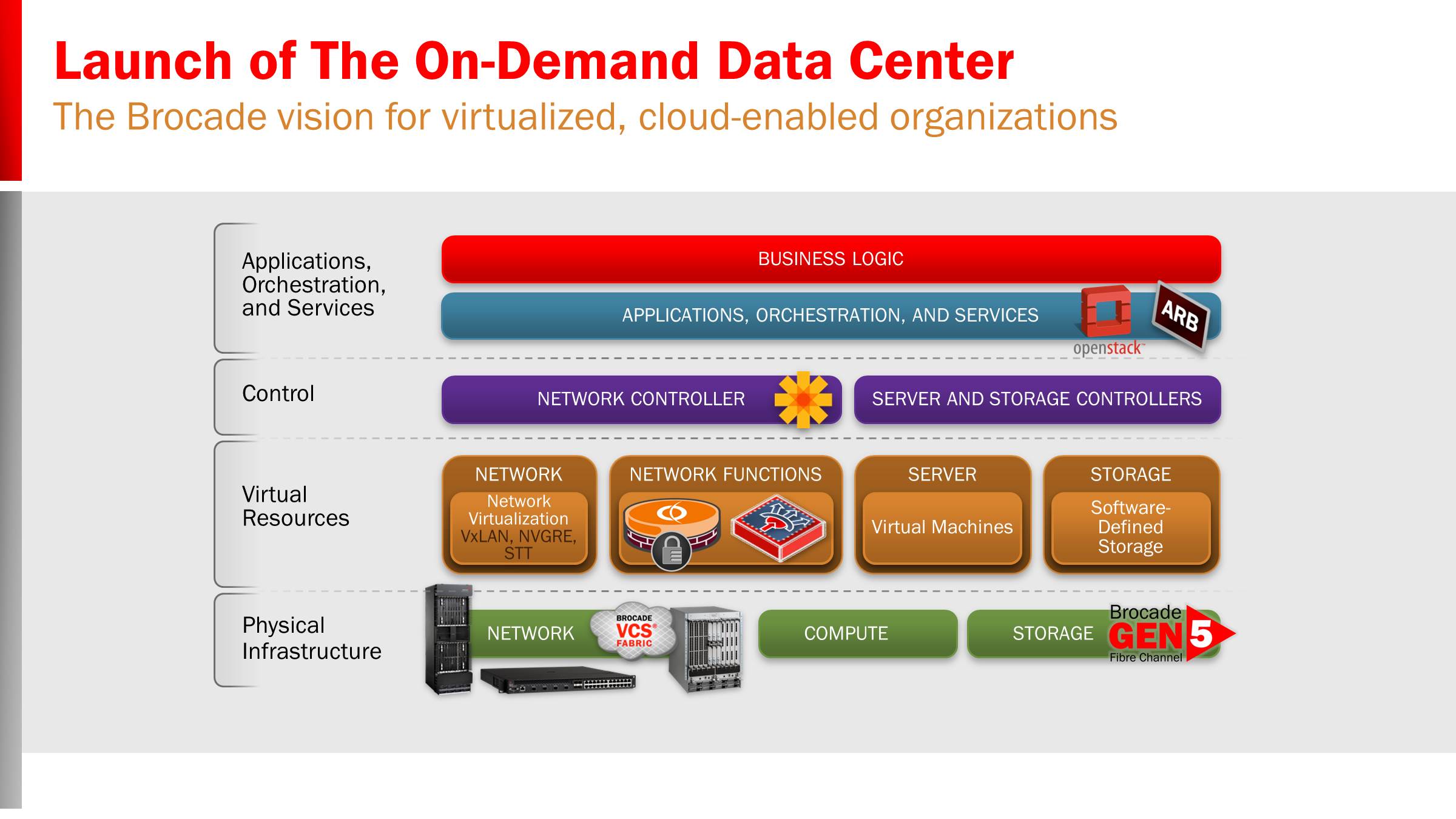

Brocade has been a leader in the area of software-defined networking and we continue to advance our strategy and product portfolio. Along these lines, last month we launched our vision for The On-Demand Data Center that unites the best aspects of virtual and physical networking across an open orchestration framework. This architecture will enable customers to rapidly deploy new applications and services through a highly flexible and simplified network structure. As part of this launch, we announced a number of software and hardware innovations including a Brocade plug-in for OpenStack Cloud Orchestration.

Underscoring our leadership and commitment to open standards, Brocade announced its participation as a founding member of the OpenDaylight SDN Consortium. OpenDaylight provides a standard framework that customers can leverage to build their SDN strategies. It will also enable Brocade customers to simplify the orchestration of key infrastructure and services, providing a truly on-demand data center. The community-led, industry-supported open source framework, consisting of code and architecture, will help rapidly enable and advance an ecosystem surrounding SDN.

We were pleased to announce that Dave Meyer, Brocade's service provider business chief technology officer and chief scientist, was named chairman of the technology steering committee of the OpenDaylight project with the goal of creating an open source SDN framework. Dave has long been a visionary in the area of software-defined networking and his appointment demonstrates Brocade's own commitment to leadership in this important emerging space.

In total, The On-Demand Data Center launch highlights a vision that we at Brocade share with other data center thought leaders. It is characterized by the ability to flexibly deploy data center capacity—compute, networking, storage, and services in real-time. Further, it reflects our focus on data center networking, where we can best leverage our strengths and take advantage of the growing business opportunities.

© 2013 Brocade Communications Systems, Inc. Page 9 of 27

Brocade Q2 FY 2013 Earnings 5/16/2013

Following a thorough inspection of the business during my first four months as CEO, I believe that Brocade is well-positioned to be a leader in the new era of networking. My review of the business included discussions with customers, partners, investors, and of course our employees. During the quarter, I met with more than 40 of the leaders of our company in a comprehensive strategy session, where we examined our company's long-term plans in detail. Coming out of that meeting, the team and I agreed that we need to be more focused as a company and we need to deliver consistent, profitable growth to increase shareholder value. I will begin to lay out my strategy today and will provide more details of my plans over the next several months.

While I believe that our fundamental direction has been sound, we are evolving and adapting our business strategy to markets where we have been and can continue to be most successful. This means focusing on the data center networking opportunity for highly virtualized, cloud-enabled enterprises and service providers. The three key technology segments in which our core competencies and competitive advantages have positioned us for success are:

| |

| • | SAN fabrics for virtualized data centers |

| |

| • | Ethernet fabrics and routing for virtualized data centers |

| |

| • | SDN, network virtualization, and software networking technologies and markets |

Going forward, we will focus on markets in which we can be most successful and where we can hold a leading market share position of meaningful size. We have significant market share in the data center, and we will continue to invest here to expand our installed base in SAN and to grow our footprint in data center Ethernet. We will be focused on delivering on our vision for The On-Demand Data Center with more software-rich offerings, such as the Brocade vRouter, Brocade Virtual ADX, and SDN-ready products. We will also focus on large market opportunities, such as the federal vertical. As the federal government looks to reduce spending and improve efficiencies in its networks, they will look for innovative products and solutions with a compelling ROI like Brocade Ethernet fabrics, Brocade SANs, and our refreshed campus LAN products to meet their needs. We believe that by focusing on this large opportunity and the requirements of the federal vertical, we will be able to provide significant value-add to this market segment while leveraging our investment across other campus LAN customers who have similar needs.

To support the execution of our strategy for 2013 and beyond, I am excited about the organizational changes and alignment on my executive team. We have done extensive searches to fill two vacancies and I am pleased by the quality of talent we have been able to attract. During the second quarter, we welcomed Jeff Lindholm as senior vice president of Worldwide Sales. Jeff's extensive experience and knowledge of the networking space will be highly beneficial in executing against both our current opportunities and future direction. I hope to have an announcement on a new Chief Marketing Officer soon. We have also made organizational changes to better align our product management and sales teams to focus on the key markets and customers to support our strategy.

© 2013 Brocade Communications Systems, Inc. Page 10 of 27

Brocade Q2 FY 2013 Earnings 5/16/2013

We believe that narrowing our focus of our business to key technology areas and aligning our team accordingly will allow us to better realize efficiencies in our business. With a commitment to increasing profitability, managing expenses, and improving cash flow, we believe we can increase shareholder value. We have already started to see the benefits of this strategy with improving margins in IP Networking as well as overall operating margins this quarter. The year-over-year growth in Federal and Ethernet fabric revenue in Q2 helped to increase IP Networking gross margins with a more favorable mix of products. We were also able to control operating expenses to maintain our operating margin expectations in the quarter on lower revenue. I believe there is more that we can do to improve our operating model and I look forward to sharing my plans in the upcoming months.

Finally, as we drive higher profitability and improved cash flow, we are committed to returning cash to shareholders in the most efficient manner, which I currently believe is through an active share repurchase program. We will continue to allocate a significant amount of our cash flow to our share repurchase program with the goal of reducing the number of shares outstanding. During Q2 we repurchased $39M of stock, or 6.8M shares, and so far in Q3 13, we have already repurchased another $51M of stock, or 9.3M shares. I expect to work with the Board to maintain a regular program of returning cash to shareholders.

© 2013 Brocade Communications Systems, Inc. Page 11 of 27

Brocade Q2 FY 2013 Earnings 5/16/2013

In conclusion, this is an exciting time for Brocade. We continue to execute well on delivering a world-class portfolio of software and hardware products for data center networking. Our leadership in strategic technologies, such as data center fabrics, 100 GbE routing, and software-defined networking has positioned us with a solid presence in key emerging areas. We believe that we are ready to seize the opportunity in front of us and I look forward to sharing more with you about our specific plans and accomplishments in the months to come.

© 2013 Brocade Communications Systems, Inc. Page 12 of 27

Brocade Q2 FY 2013 Earnings 5/16/2013

Prepared comments provided by Dan Fairfax, CFO

© 2013 Brocade Communications Systems, Inc. Page 13 of 27

Brocade Q2 FY 2013 Earnings 5/16/2013

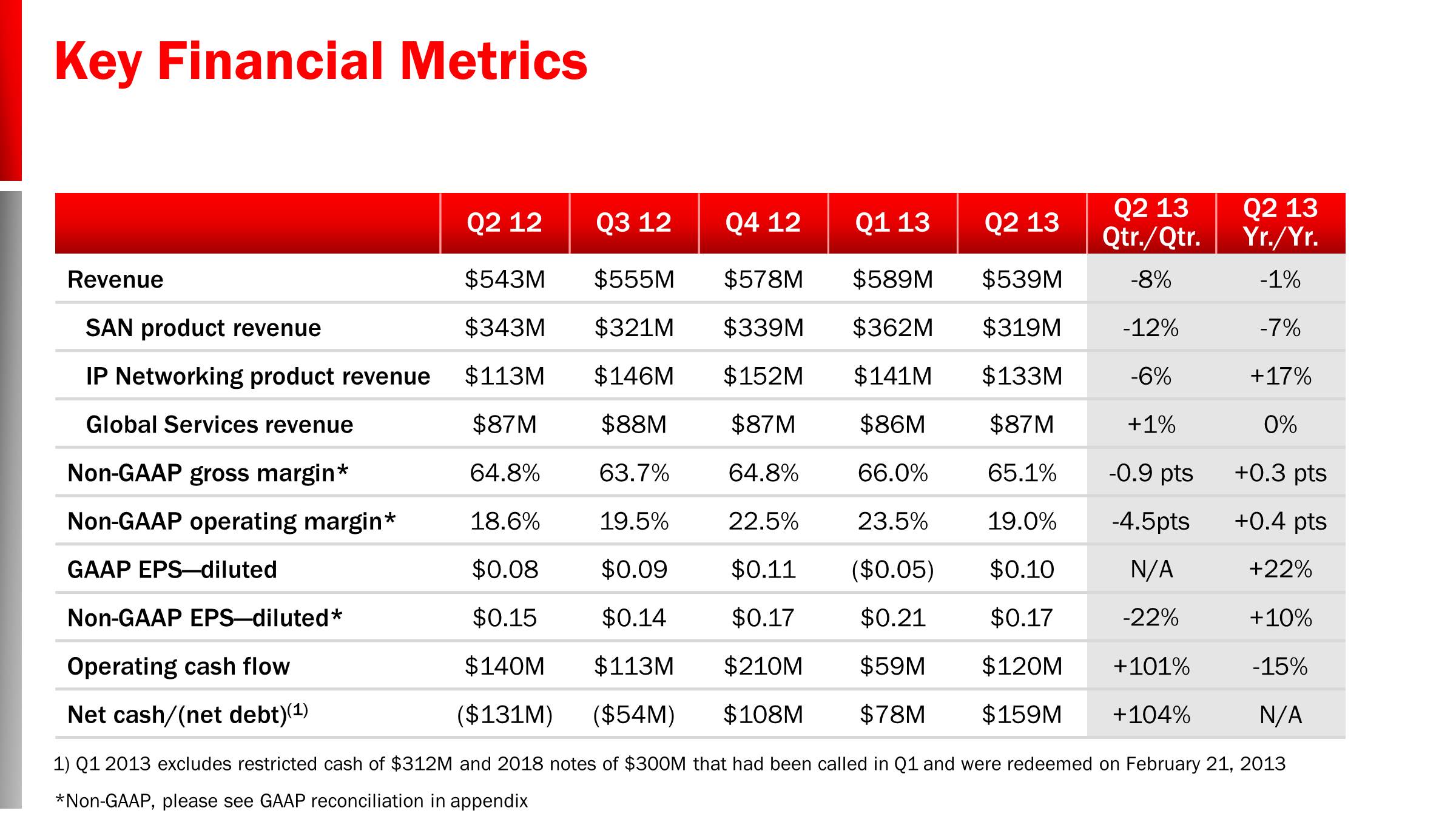

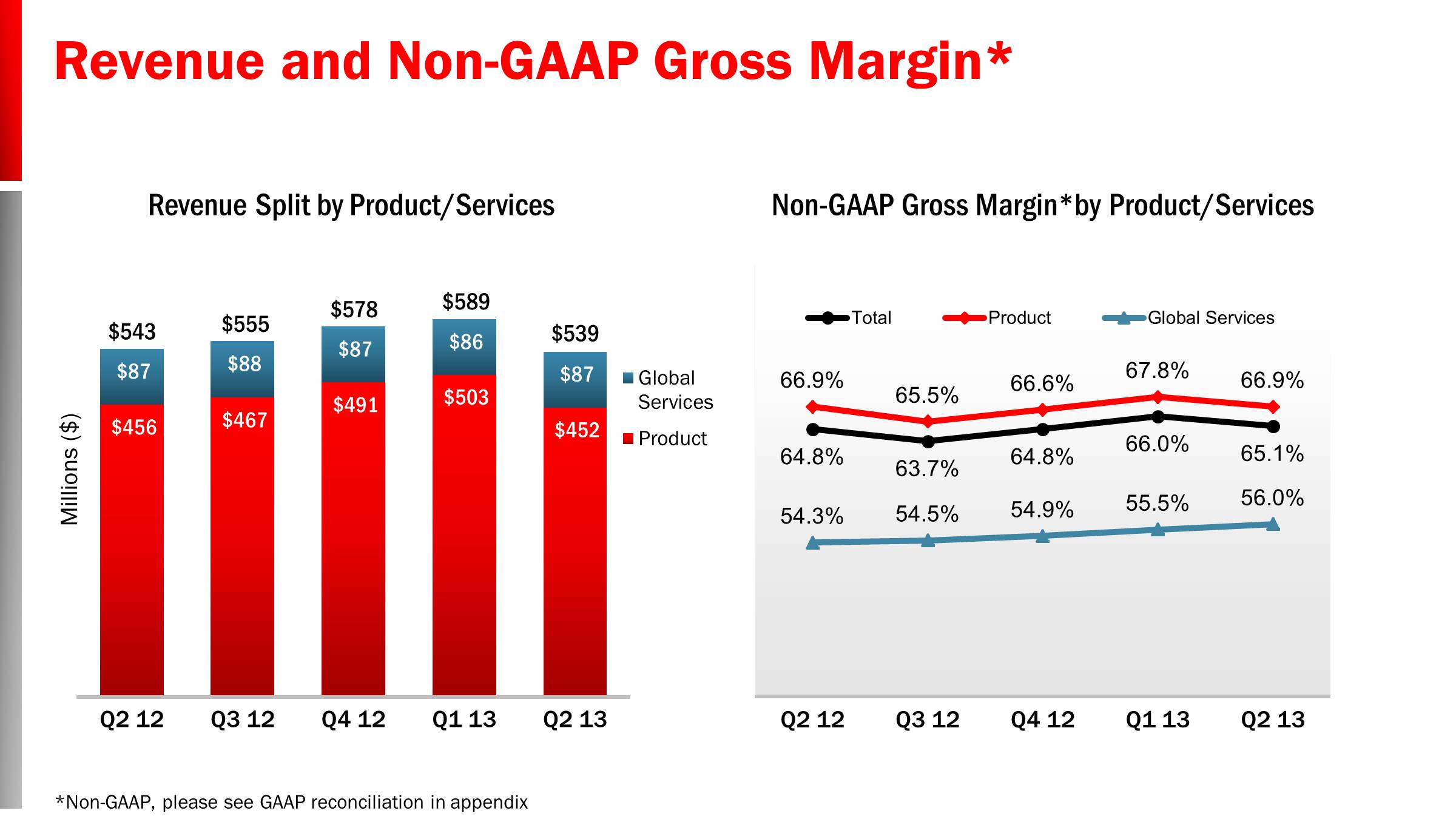

In Q2 13 Brocade reported revenue of $539M, a decrease of 1% Yr./Yr. and down 8% Qtr./Qtr., which is consistent with the guidance range we provided on May 1st. As we look at our business by reporting segment, Q2 SAN product revenue was $319M, a decrease of 7% Yr./Yr. primarily due to order rate softness in the storage array market that impacted some of our OEM partners. SAN product revenue was down 12% sequentially, more than normally expected in a seasonally softer quarter. SAN product revenue represented 59% of total revenue, down from 61% in Q1 13 and 63% reported in Q2 12.

Revenue from our IP Networking products was $133M, up 17% Yr./Yr. and down 6% Qtr./Qtr. The year-over-year increase was driven by higher revenues for Ethernet switching, routing, and Brocade VDX products. The quarter-over-quarter decline was due to lower Brocade ADX product sales and federal campus LAN product sales. IP Networking product revenue represented 25% of total revenue in Q2, up from 24% in Q1 13 and up from 21% in Q2 12.

Q2 Global Services revenue was $87M, down slightly year-over-year and up slightly sequentially. Our Global Services revenue represented 16% of total Q2 revenue, unchanged from Q2 12 and up slightly from Q1 13.

Non-GAAP gross margin was 65.1% in Q2, up 30 basis points from Q2 12 and down 90 basis points from Q1 13. The year-over-year improvement in gross margin was due primarily to a more favorable mix within our Ethernet products. The sequential decrease in gross margin was due in part to lower revenues and a lower contribution from our relatively more profitable SAN products. Non-GAAP operating margin was 19.0% in Q2, up 40 basis points from Q2 12 and down 450 basis points Qtr./Qtr. due to lower revenue.

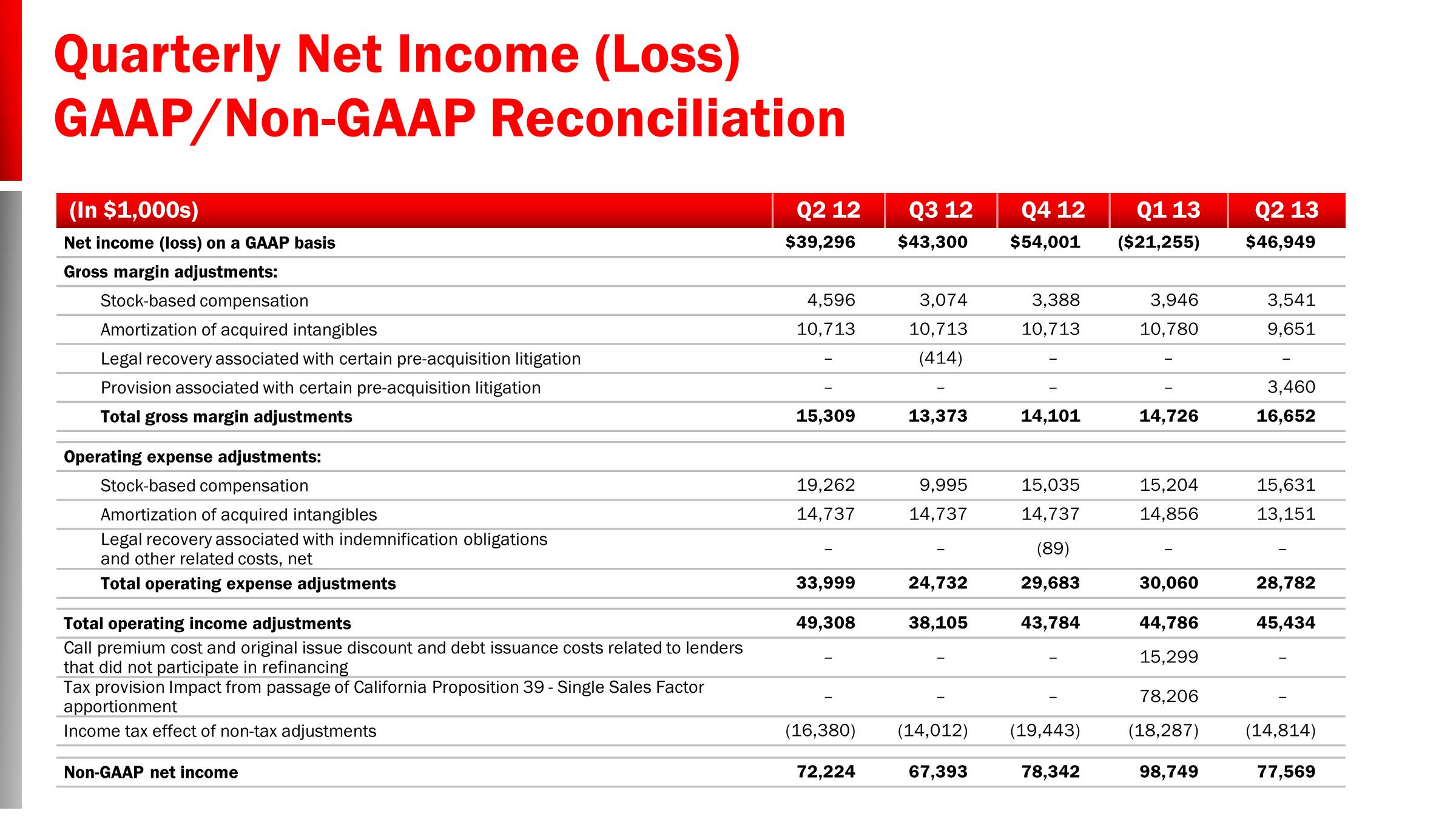

Q2 GAAP diluted EPS was $0.10 and non-GAAP diluted EPS was $0.17 in the quarter, both up $0.02 year-over-year. We saw a benefit in our Q2 tax rate from the closure of IRS tax audits for the years 2006 and 2007 resulting in a more favorable rate, which benefited our EPS by approximately $0.02 in the quarter. The resulting effective GAAP tax benefit rate was (0.4)% and the effective non-GAAP tax rate was 15.9% in Q2.

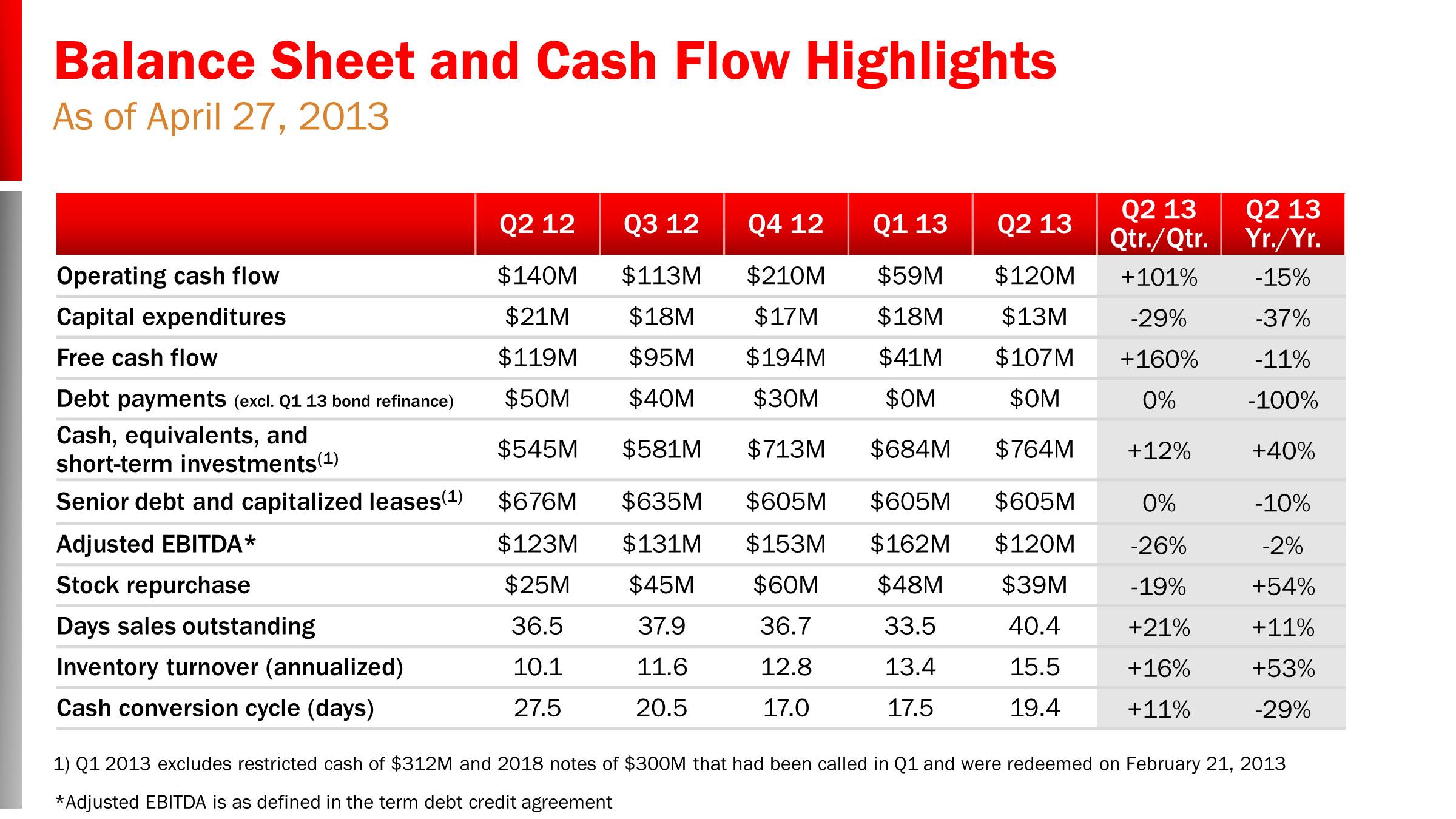

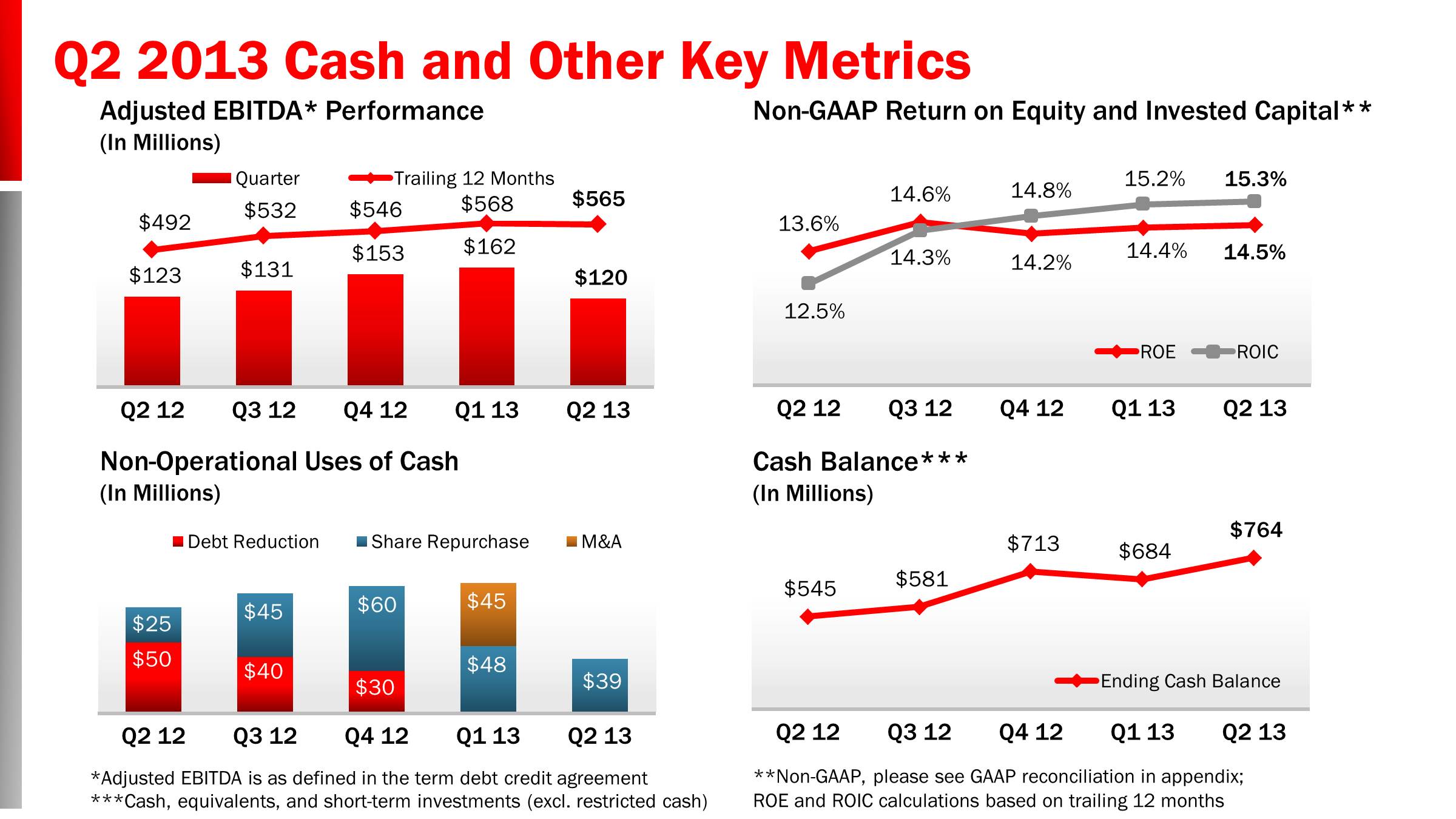

In Q2 we generated $120M in operating cash flow. Weighted average diluted shares outstanding in Q2 was 467M and the company repurchased 6.8M shares for $39M during the quarter.

© 2013 Brocade Communications Systems, Inc. Page 14 of 27

Brocade Q2 FY 2013 Earnings 5/16/2013

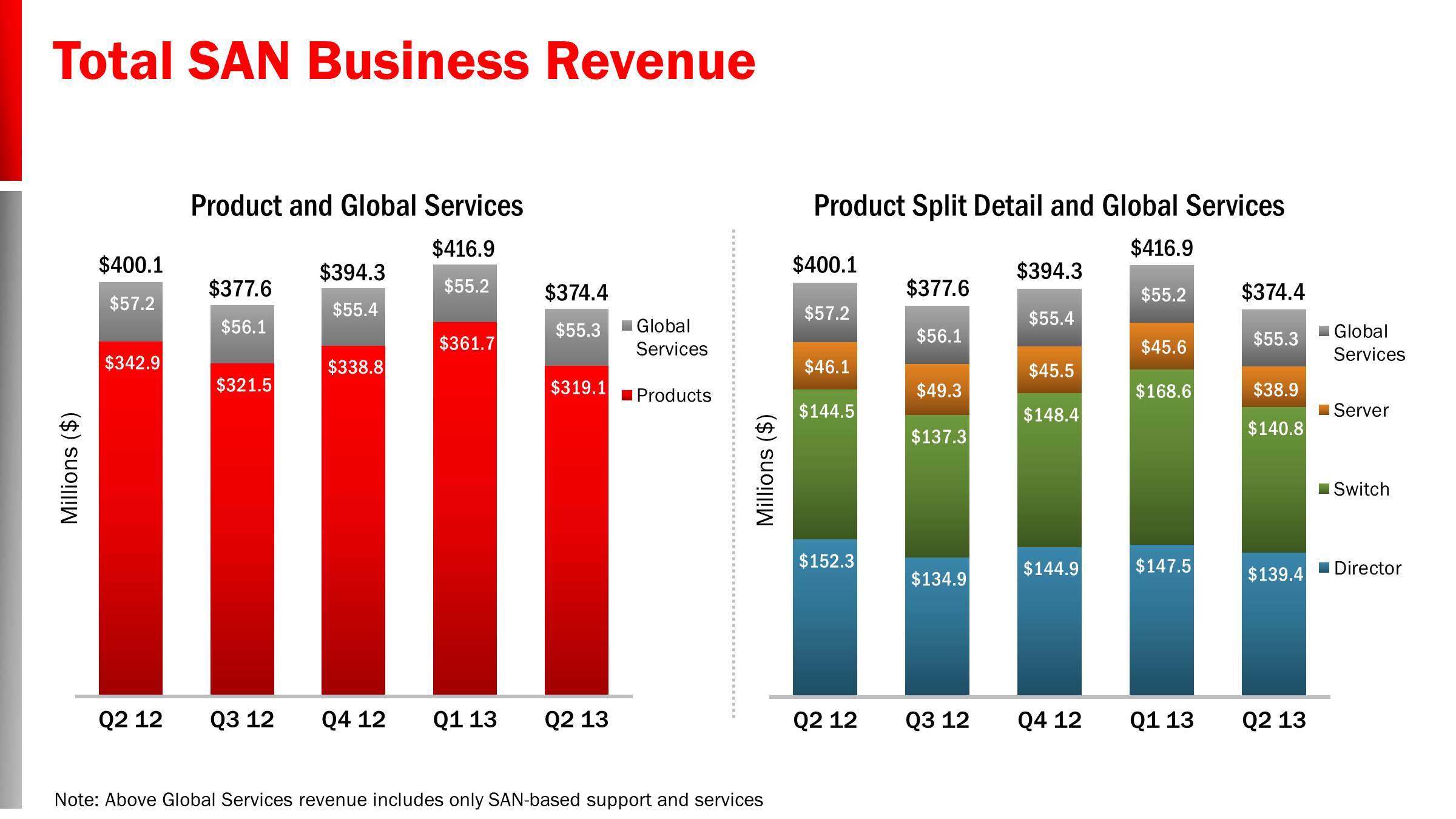

Turning to our total SAN business, including hardware and SAN-based support and services, Q2 revenue was $374.4M, down 6% from Q2 12 and 10% sequentially.

Following a record SAN quarter, we saw a softer-than-expected storage demand environment quickly develop in our fiscal second quarter, which is typically a seasonally soft quarter for SAN. This lower demand and execution issues impacted the SAN purchases by some of our OEM partners during the quarter. However, we saw the expansion of our Gen 5 (16 Gbps) Fibre Channel product revenue as more of our customers continued to upgrade their networking infrastructure. In Q2, our Gen 5 products represented more than 50% of director and switch revenue compared with 42% in Q1 13 and 23% in Q2 12.

SAN product revenue was $319.1M in the quarter, down 7% Yr./Yr. and 12% sequentially. In looking at the SAN product families, director revenue was down 8% Yr./Yr. and 6% sequentially, while switch revenue was down 3% Yr./Yr. and 17% Qtr./Qtr. Our Server product group, including embedded switches and server adapter products, posted revenue of $38.9M, down 16% Yr./Yr. and 15% Qtr./Qtr. The Server product group is more correlated to bladed server chassis sold through our OEM partners.

SAN-based support and services revenue was $55.3M in the quarter, down 3% Yr./Yr. and unchanged quarter-over-quarter.

© 2013 Brocade Communications Systems, Inc. Page 15 of 27

Brocade Q2 FY 2013 Earnings 5/16/2013

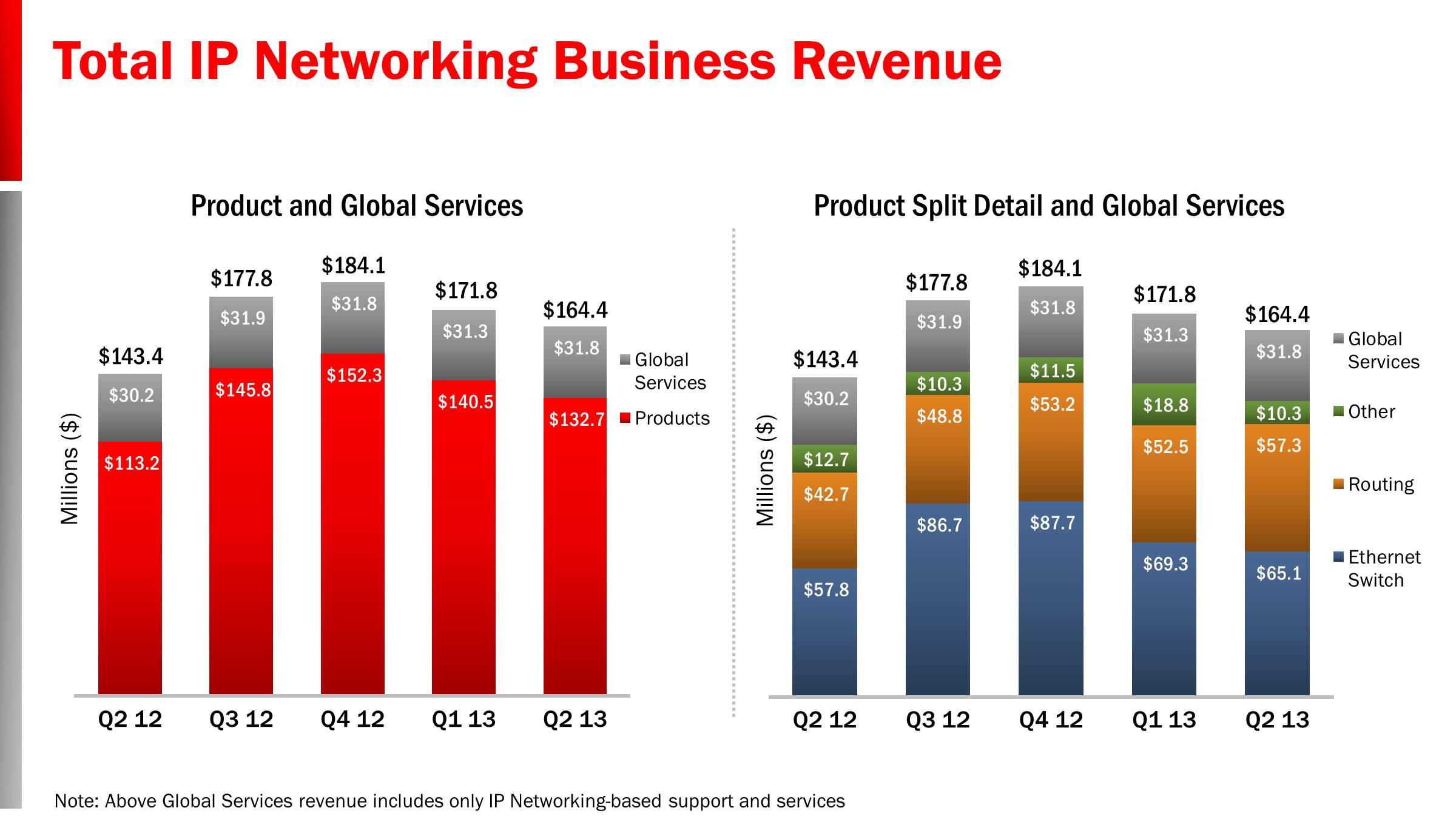

Moving on to our total IP Networking business, including hardware and support, Q2 revenue was $164.4M, up 15% Yr./Yr. and down 4% sequentially.

Q2 IP Networking product revenue was $132.7M, up 17% Yr./Yr. and down 6% Qtr./Qtr. As we look at the product splits for IP Networking in the quarter, we saw good year-over-year performance for our Ethernet switch products and routing products. Ethernet switch products, which include products for the data center and campus LAN environments, generated $65.1M in revenue, up 13% Yr./Yr. We saw continued revenue growth with the Brocade ICX campus product portfolio, which was launched in fiscal 2012, as well as good year-over-year performance with our Ethernet fabric switches. Ethernet switch revenue was down 6% Qtr./Qtr., principally due to lower revenues from our federal customers in a seasonally soft quarter for this vertical.

Routing revenue of $57.3M was up 34% Yr./Yr. and 9% sequentially. The year-over-year increase in routing revenue was driven in part by a higher number of Brocade MLX units sold as well as a mix to more 100 GbE blades. Other IP Networking revenue of $10.3M was down 19% Yr./Yr. and down 45% Qtr./Qtr. on decreased Brocade ADX sales. As we noted in our Q1 earnings report, we had a sizable conversion of Brocade Network Subscription business to product sales that occurred in Q1 13. This conversion caused our Other IP Networking revenue to be significantly higher than normal in Q1 and our results this quarter are more in line with what we typically see. IP Networking-based support and services revenue was $31.8M in the quarter, up 5% Yr./Yr. and slightly higher sequentially.

As we have mentioned over the last several quarters, with more of our IP Networking products sold through our two-tier distribution channel, it has become more difficult to identify the customer split of the end users. To estimate the customer split, we leverage the information reported to us from our channel partners as well as our internal sales funnel. From an estimated customer segment standpoint, our Federal business revenue of $20.9M was up nearly 28% Yr./Yr. and down sequentially as Q2 is a seasonally soft procurement quarter for our federal customers. Q2 Service Provider business revenue of $62.9M was up 25% year-over-year and 2% sequentially, while our Enterprise business revenue of $80.6M was up 5% Yr./Yr. and flat quarter-over-quarter.

From a geographic viewpoint, the U.S., EMEA, APAC and Japan regions each had double-digit growth for IP Networking year-over-year, while Canada/South America was lower. On a sequential basis, the U.S. was down 9%, APAC and Japan were each up over 10%, and EMEA was down slightly.

© 2013 Brocade Communications Systems, Inc. Page 16 of 27

Brocade Q2 FY 2013 Earnings 5/16/2013

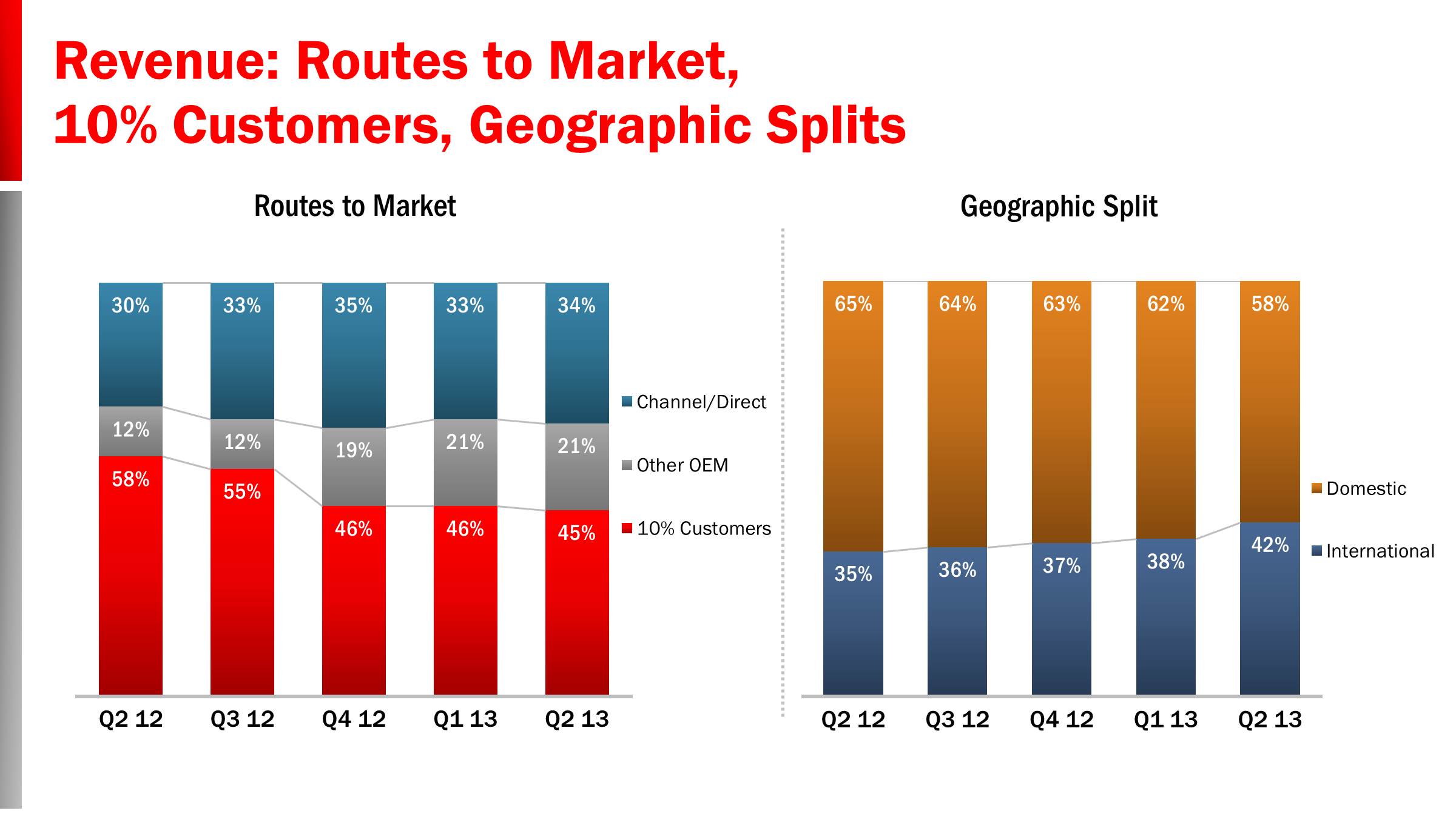

In Q2, three of our customers (EMC, HP , and IBM) each contributed at least 10% of the total company revenue. Our 10% customers collectively contributed 45% of revenue in Q2, down slightly from 46% in Q1 13 and down from 58% in Q2 12 when HDS was also a 10% customer. All other OEMs represented 21% of revenue in Q2, unchanged from Q1 13 and up from 12% in Q2 12 when HDS was a 10% customer. Channel and direct routes to market contributed 34% of revenue in Q2, slightly up from Q1 13 and up from 30% in Q2 12.

The mix of business based on ship-to location was 58% domestic and 42% international in the quarter, a lower domestic split compared with 65% in Q2 12, reflecting lower SAN revenue that was sold into the U.S. market. Revenues in the Americas (including Canada/South America) as well as APAC were lower year-over-year while EMEA and Japan were both higher. Since some of our OEMs take delivery of our products domestically and then ship internationally to their end-users, the percentage of international revenue based on end-user location would be higher.

© 2013 Brocade Communications Systems, Inc. Page 17 of 27

Brocade Q2 FY 2013 Earnings 5/16/2013

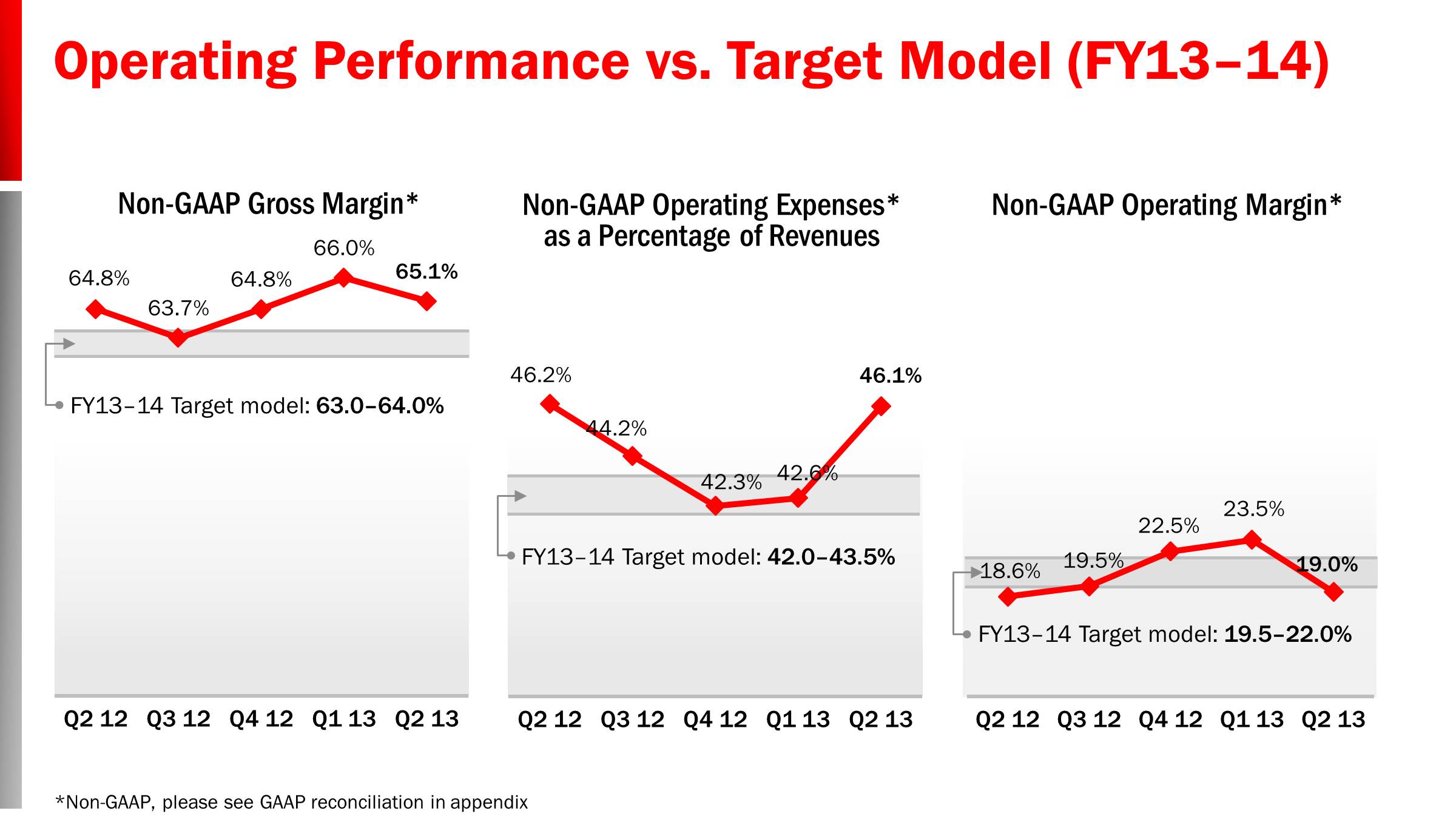

Q2 non-GAAP company gross margin of 65.1% exceeded our original guidance range of 64.0% to 64.5% for the quarter due in part to a more favorable product mix within the SAN and IP Networking segments.

Q2 non-GAAP product gross margin was 66.9%, at the high-end our two-year target model range of 65% to 67%, but down from 67.8% in Q1 13 primarily due to a higher mix of IP Networking products and lower SAN volumes. Q2 non-GAAP SAN product gross margin was in the mid-70's, down approximately 100 basis points compared with Q1 13 and approximately 150 basis points compared with Q2 12 on lower revenues. Q2 non-GAAP IP Networking product gross margin was over 50%, up slightly quarter-over-quarter and up approximately 850 basis points compared with Q2 12 due to higher volumes, a favorable product mix, and lower COGS spending.

Non-GAAP Global Services gross margin was 56.0% in Q2, up 50 basis points quarter-over-quarter and up 170 basis points year-over-year based on lower spending.

© 2013 Brocade Communications Systems, Inc. Page 18 of 27

Brocade Q2 FY 2013 Earnings 5/16/2013

Q2 non-GAAP gross margin was 65.1%, above our two-year target model range of 63% to 64%, driven by a favorable product mix.

On a non-GAAP basis, total operating expenses were $248.2M, or 46.1% of revenues in Q2, above our two-year target model range of 42.0% to 43.5%. Total operating expenses were slightly lower on an absolute dollar basis compared with Q1 13. Operating expenses on a dollar basis decreased slightly quarter-over-quarter as well as year-over-year. Ending headcount was 4,648 in Q2, slightly higher than the prior quarter.

Non-GAAP operating margin was 19.0% in Q2, an increase of 40 basis points compared with Q2 12 and lower compared with Q1 13. The Q2 non-GAAP operating margin was slightly below the two-year target model range of 19.5% to 22.0%, as a result of lower revenues than expected.

© 2013 Brocade Communications Systems, Inc. Page 19 of 27

Brocade Q2 FY 2013 Earnings 5/16/2013

Operating cash flow was $120M in Q2, down 15% Yr./Yr. and up more than 100% sequentially. We typically see higher cash from operations in our fiscal second quarter as Q1 includes the payment of sales commissions and employee variable compensation earned in the prior year as well as the semi-annual payment of the interest on our outstanding notes. We saw slightly worse shipment linearity in the quarter, which resulted in DSOs of 40.4 days, consistent with our long-term DSO model of 40 to 45 days, but up from 36.5 days in Q2 12. Total capital expenditures in the quarter were $13M, below our typical capital spending range due to the timing of some projects that moved outside of the quarter.

Excluding restricted cash, our cash, equivalents, and short-term investments were $764M, up $81M from Q1 13 and up $219M from Q2 12. During the quarter, we paid the $300M principal, associated call premium, and interest earned on February 21, 2013 of the 2018 notes that were previously called in January as part of a refinancing of the notes. For comparison purposes, we are excluding the restricted cash that was used to retire the 2018 notes as well as the corresponding short-term notes payable in this presentation for Q1 13. This will make the comparisons for cash and debt more meaningful as we were in the process of paying off the 2018 notes with the proceeds from the 2023 notes as of the end of Q1.

As I mentioned earlier, we repurchased 6.8M shares of common stock during Q2 and had $462M remaining in the Board authorized share repurchase program exiting the quarter.

Finally, during the quarter we won one case of alleged patent infringement and settled two other long-running patent claims for a fair price that removed the potentially expensive litigation risk and resulted in Brocade having broad licenses to the technology.

© 2013 Brocade Communications Systems, Inc. Page 20 of 27

Brocade Q2 FY 2013 Earnings 5/16/2013

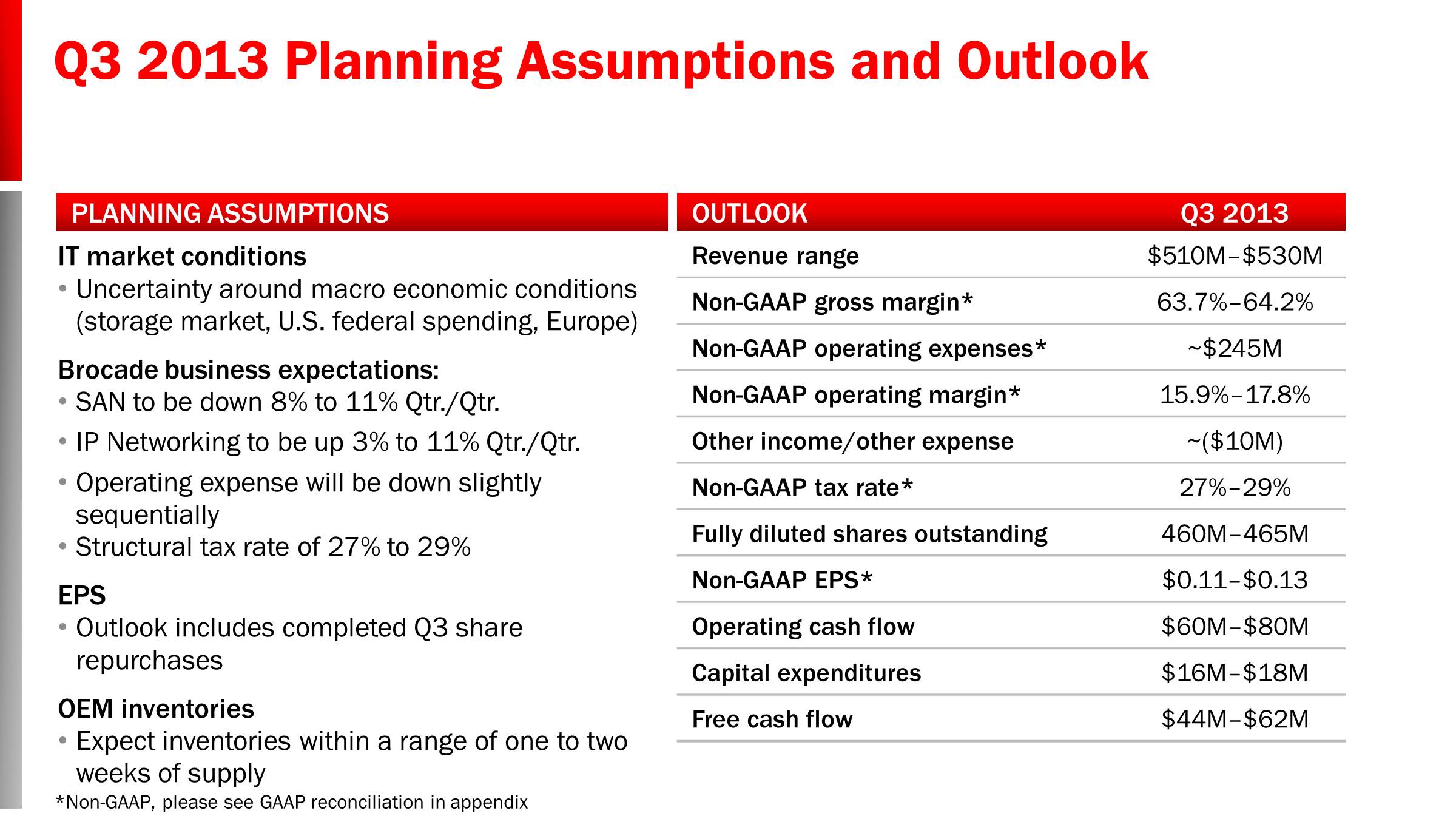

Looking forward to Q3 13, we considered a number of factors, including the following, in setting our outlook:

| |

| • | The current macro environment and economy continue to show uncertainty in the near-term, specifically in the storage market, the U.S. federal government, and in Europe. |

| |

| • | For Q3, we expect SAN revenue to be down 8% to 11% quarter-over-quarter as the current demand for storage remains soft. Our OEM partners are expecting a return to growth in storage during the 2nd half of calendar 2013 and we believe our SAN business will see this benefit outside of our fiscal Q3. |

| |

| • | We expect our Q3 IP Networking revenue to be up 3% to 11% quarter-over-quarter driven by improved U.S. federal orders as well as continued growth of IP Networking revenue from new products including Ethernet fabrics. |

| |

| • | We expect non-GAAP operating expenses to be down 1% to 2% quarter-over-quarter, reflecting some lower spending as we focus our efforts towards the data center, federal, and certain campus LAN opportunities. |

| |

| • | At the end of Q2, OEM inventory was about two weeks of supply based on SAN business revenue, above the inventory levels exiting Q1 13. While we expect inventory to be reduced during Q3, OEM inventory levels may fluctuate due to both seasonality and large end-user order patterns at |

the OEMs.

| |

| • | From a tax rate perspective, we assume a structural non-GAAP tax rate of 27% to 29% for the remainder of FY13. Discrete events can impact our tax rate from time to time. |

| |

| • | Our guidance reflects the share repurchases already completed in Q3. |

| |

| • | Cash from operations will be down slightly sequentially. As a reminder, our cash from operations in Q3 will be lower due to the semi-annual interest payment on our notes as well as our mid-year progress payment on employee variable compensation earned in FY13 to date. |

| |

| • | Based on the company's performance in Q2 and the outlook for Q3, we expect full-year FY13 gross margin to be nearly 65%, above the two-year target model range of 63% to 64%, and FY13 operating margin to be at the low-end to middle of the two-year target model range of |

19.5% to 22.0%.

© 2013 Brocade Communications Systems, Inc. Page 21 of 27

Brocade Q2 FY 2013 Earnings 5/16/2013

Prepared comments provided by Rob Eggers, Investor Relations

That concludes Brocade’s prepared comments. At 2:30 p.m. Pacific Time on May 16, Brocade will host a webcast conference call at www.brcd.com.

Thank you for your interest in Brocade.

© 2013 Brocade Communications Systems, Inc. Page 22 of 27

Brocade Q2 FY 2013 Earnings 5/16/2013

© 2013 Brocade Communications Systems, Inc. Page 23 of 27

Brocade Q2 FY 2013 Earnings 5/16/2013

Additional Financial Information:

|

| | | | | | |

| | Q2 12 |

| Q1 13 |

| Q2 13 |

|

| GAAP gross margin | 62.0 | % | 63.5 | % | 62.0 | % |

| Non-GAAP gross margin | 64.8 | % | 66.0 | % | 65.1 | % |

| | | | |

| GAAP product gross margin | 64.0 | % | 65.3 | % | 63.6 | % |

| Non-GAAP product gross margin | 66.9 | % | 67.8 | % | 66.9 | % |

| | | | |

| GAAP services gross margin | 51.7 | % | 53.3 | % | 54.0 | % |

| Non-GAAP services gross margin | 54.3 | % | 55.5 | % | 56.0 | % |

| | | | |

| GAAP operating margin | 9.5 | % | 15.8 | % | 10.6 | % |

| Non-GAAP operating margin | 18.6 | % | 23.5 | % | 19.0 | % |

© 2013 Brocade Communications Systems, Inc. Page 24 of 27

Brocade Q2 FY 2013 Earnings 5/16/2013

© 2013 Brocade Communications Systems, Inc. Page 25 of 27

Brocade Q2 FY 2013 Earnings 5/16/2013

© 2013 Brocade Communications Systems, Inc. Page 26 of 27

Brocade Q2 FY 2013 Earnings 5/16/2013

© 2013 Brocade Communications Systems, Inc. Page 27 of 27