Q2 FY 2015 Earnings

Prepared Comments and Slides

May 21, 2015

Michael Iburg

Investor Relations

Phone: 408-333-0233

miburg@Brocade.com

Kristy Campbell

Media Relations

Phone: 408-333-4221

kcampbel@Brocade.com

NASDAQ: BRCD

Brocade Q2 FY 2015 Earnings 5/21/2015

Prepared comments provided by Michael Iburg, Investor Relations

Thank you for your interest in Brocade’s Q2 Fiscal 2015 earnings presentation, which includes prepared remarks, cautionary statements and disclosures, slides, and a press release detailing fiscal second quarter 2015 results. The press release, along with these prepared comments and slides, has been furnished to the SEC on Form 8-K and has been made available on the Brocade Investor Relations website at www.brcd.com. The press release will be issued subsequently via Marketwired.

© 2015 Brocade Communications Systems, Inc. Page 2 of 21

Brocade Q2 FY 2015 Earnings 5/21/2015

© 2015 Brocade Communications Systems, Inc. Page 3 of 21

Brocade Q2 FY 2015 Earnings 5/21/2015

Today’s prepared comments include remarks by Lloyd Carney, Brocade CEO, regarding the company’s quarterly results, its strategy, and a review of operations, as well as industry trends and market/technology drivers related to its business; and by Dan Fairfax, Brocade CFO, who will provide a financial review.

A management discussion and live question and answer conference call will be webcast at

2:30 p.m. Pacific Time on May 21 at www.brcd.com and will be archived on the Brocade Investor Relations website.

© 2015 Brocade Communications Systems, Inc. Page 4 of 21

Brocade Q2 FY 2015 Earnings 5/21/2015

Prepared comments provided by Lloyd Carney, CEO

© 2015 Brocade Communications Systems, Inc. Page 5 of 21

Brocade Q2 FY 2015 Earnings 5/21/2015

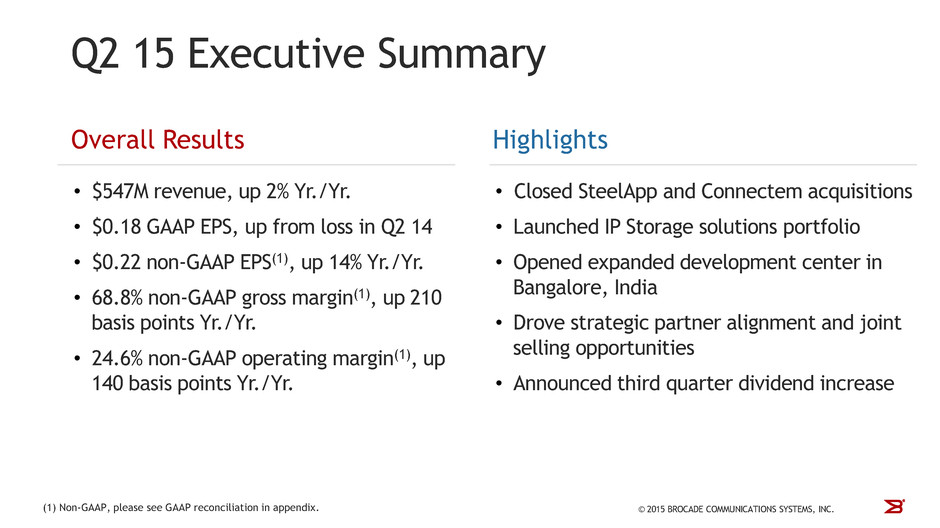

Our achievements in the second quarter highlight the success of our data center-focused strategy and innovation in software-enabled networking. We grew our data center IP revenue, both sequentially and year over year, and continued to advance our product and technology roadmap in both storage and IP networking.

While SAN revenue was at the low end of our outlook for Q2 2015, growth in IP Networking revenue across our key markets was strong and above our long-term model of 8% to 12% growth. Furthermore, we achieved strong gross margin and operating margin performance in the quarter, and we are on track to meet our full-year FY15 operating margin goals.

We also generated cash well above our forecasted range in Q2, primarily through higher profits and working capital improvements. Brocade’s Board of Directors authorized a significant increase in our Q3 2015 dividend of 29%, in support of our ongoing commitment to return cash to our shareholders.

During the quarter, we completed the acquisitions of both the SteelApp assets from Riverbed Technology and Connectem, expanding our portfolio of virtual IP networking products and services to include some of the most advanced application delivery and evolved packet core technology in the industry. These acquisitions complement our industry-leading solutions for the New IP to further support cloud, mobile, and social initiatives.

We opened a state-of-the-art development center in Bangalore, India in April. We can now deliver from India proof-of-concepts and pilot projects for customers and partners worldwide.

Our Q2 product announcements also underscore our commitment to delivering solutions for the demands business-critical storage workloads place on IP networks. Leveraging Brocade’s 20 years of best-practice expertise in storage area networking, we introduced the industry’s broadest portfolio of storage class connectivity solutions.

We are driving strong alignment and Brocade preference throughout our partner ecosystem to bring our innovative products to market. Brocade is committed to delivering best-in-class storage and networking solutions that enable new business opportunities and add strategic value to our partners.

© 2015 Brocade Communications Systems, Inc. Page 6 of 21

Brocade Q2 FY 2015 Earnings 5/21/2015

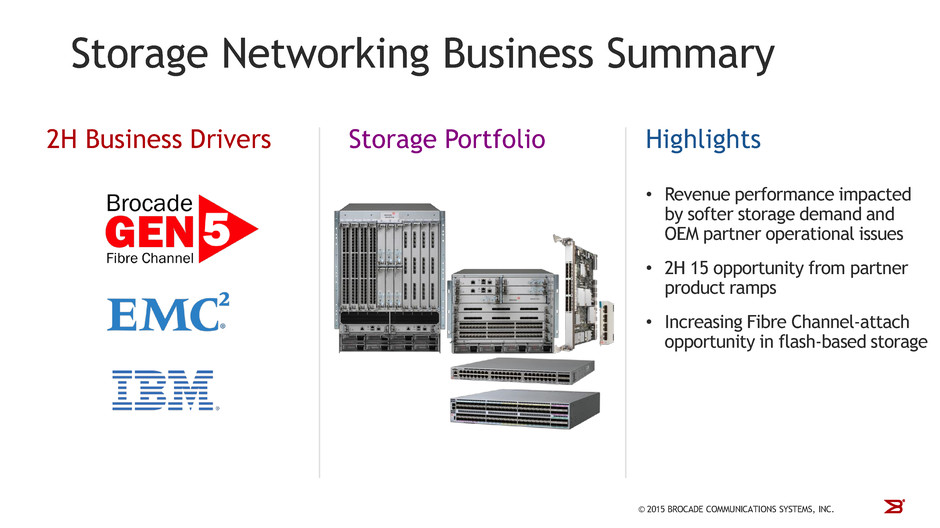

Q1 2015 was one of the strongest quarters in Brocade history for SAN revenue, yet sales in Q2 were seasonally softer and at the low end of our expectations. The SAN decline was primarily the result of softer storage demand and partner-specific issues that impacted the low-end switch and server blade revenue. We hope to recapture some of that opportunity over time. Aside from normal seasonality in Q3, we see several catalysts in the second half of the fiscal year.

IBM is currently ramping its new z13 mainframe and DS8870 storage systems that leverage our Gen 5 FICON and Fibre Channel technology in the durable mainframe environment.

Also, EMC’s refresh of its VMAX3 family is expected to drive sales in the coming quarters. Moreover, at EMC World, EMC launched a new VSPEX® 100K converged infrastructure solution that leverages Brocade Gen 5 Fibre Channel SAN switches and Brocade Fabric Vision monitoring and network diagnostic software.

In addition, all-flash array deployment continues to grow rapidly as enterprises move to managing both mission-critical and business-critical applications in consolidated, highly virtualized environments. Network performance is critical in high-performance deployments and Fibre Channel continues to be the predominant protocol attached to these flash storage technologies.

For example, our Fibre Channel and IP-based storage networking technologies will be deployed by EMC as a key component for customer solutions based on the new EMC XtremIO 4.0 all-flash storage arrays that were announced at EMC World. The combination of Brocade storage networking with EMC flash enables significant increases in performance and scale for hybrid and private cloud infrastructures.

© 2015 Brocade Communications Systems, Inc. Page 7 of 21

Brocade Q2 FY 2015 Earnings 5/21/2015

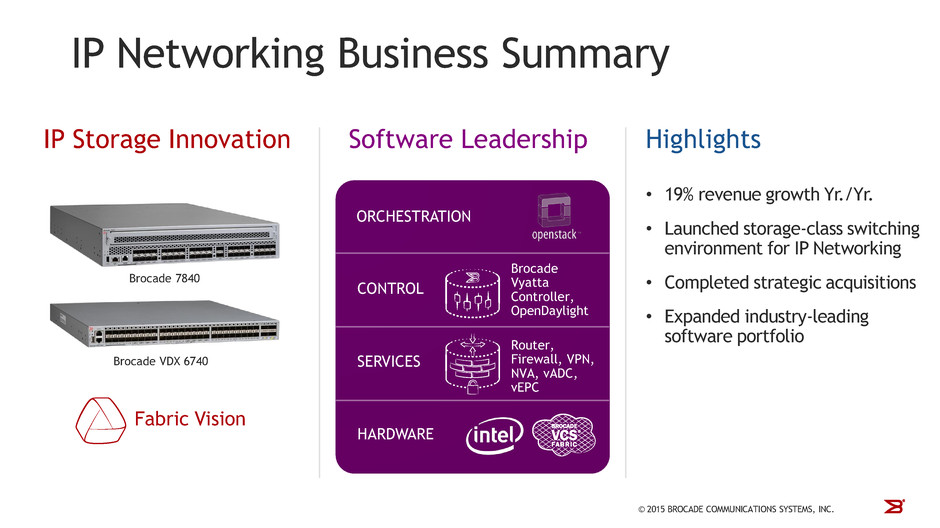

Q2 was another solid quarter for IP Networking with strong revenue growth from U.S. federal customers, as well as router sales into the service provider market. Our sales results in the first half of the fiscal year, coupled with our expectations for Q3, indicate that we are on track to achieve our growth targets for fiscal 2015. Our portfolio of solutions is addressing the key trends in IP Networking – including the emerging IP storage market and the adoption of New IP technologies for cloud, social, and mobile requirements.

During the second quarter, we announced the industry’s first purpose-built IP storage connectivity portfolio for both data center and disaster recovery applications to help enterprise IT teams manage growth, mitigate risk, and reduce cost. These include IP storage switches for the data center, powered by Brocade VCS fabric technology, IP extension switches built for replication between data centers, and advanced management with Brocade Network Advisor and Fabric Vision technology. The result is a storage-class switching environment that enables resilient, high-performance networks for business-critical IP storage workloads.

In addition to the IP storage opportunity, we continue to expand our software-centric capabilities for the New IP through technology innovation and strategic acquisitions. Our acquisition of Connectem, a pioneer in the LTE virtual evolved packet core (vEPC) market, will provide mobile operators the capability to offer highly differentiated solutions. With unique architectural attributes that leverage cloud computing, network virtualization, and software networking technologies, Connectem delivers higher scale and efficiency on industry-standard x86-based servers. We believe this will be a key enabler for the Internet of Things, including machine-to-machine connectivity, industrial Internet, and enterprise mobile data services.

Connectem compliments our broad portfolio of SDN and NFV technologies, including our industry-leading Brocade Vyatta controller, virtual router, firewall, and VPN products, as well as our network visibility and analytics solutions and the SteelApp virtual application delivery controller solution that we recently acquired from Riverbed Technology. We are pleased with the current progress of integrating the SteelApp and Connectem products and technology into our software networking offerings.

© 2015 Brocade Communications Systems, Inc. Page 8 of 21

Brocade Q2 FY 2015 Earnings 5/21/2015

New IP networks are comprised of best-in-class hardware, software, and services based on open and open-source technologies. Within this context, the companies that will be successful are those that can create an ecosystem of technology, business, and go-to-market partners to penetrate new applications and verticals and gain early market share leadership. Brocade has built our business on strong business and technology partnerships, and, after 20 years, the Brocade partner ecosystem is stronger than ever.

As evidence, many of our solutions were featured at the recent Mobile World Congress event through a number of innovative partner collaborations, including simultaneous demonstrations with Intel, Dell, Red Hat, IBM, HP, Hitachi Data Systems, and Ciena. Our greatly expanded presence at this year’s conference demonstrates how integral Brocade is to the open NFV solutions being designed for the mobile service provider market.

In addition, we are successfully leveraging our long-standing SAN partnerships to provide another customer entry point for Brocade in a variety of IP Networking use cases. This quarter, we made several announcements with EMC that underscore this growing joint opportunity.

Similarly, Hitachi Data Systems now fully integrates Brocade Fibre Channel and IP networking into its customer offerings, and we are a critical component for its unified compute platform solutions, including virtualization with VMware, Microsoft Exchange, and SAP HANA. Our teams are working closely to combine Brocade solutions for the New IP with Hitachi’s Social Innovation solutions.

© 2015 Brocade Communications Systems, Inc. Page 9 of 21

Brocade Q2 FY 2015 Earnings 5/21/2015

In closing, Q2 highlighted our continued execution towards the strategic vision of the company, which is to grow our presence in the data center, affirm our position as storage networking experts, and be one of the best networking partners in the industry. We are coming to market with the right products at the right time to maximize our opportunity as both storage and IP networking evolve to accommodate new, increasingly demanding business imperatives.

We continue to invest in software-based technologies that enhance the value of our hardware solutions, allowing us to build more strategic relationships with our customers, and underscoring our vision for the New IP. And we are expanding our ecosystem of partners across our technology portfolio to deliver some of the most advanced networking solutions in the industry.

We are pursuing all of these objectives as well as our goal to drive profitable revenue growth and increase shareholder value. We look forward to reporting to you on our continued progress.

© 2015 Brocade Communications Systems, Inc. Page 10 of 21

Brocade Q2 FY 2015 Earnings 5/21/2015

Prepared comments provided by Dan Fairfax, CFO

© 2015 Brocade Communications Systems, Inc. Page 11 of 21

Brocade Q2 FY 2015 Earnings 5/21/2015

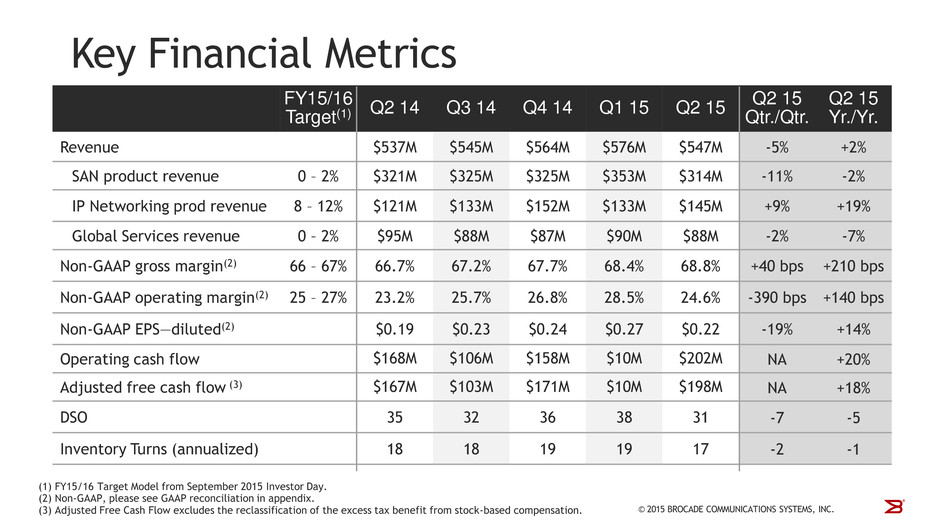

Fiscal Q2 15 followed a normal quarterly seasonal pattern, with a sequential decline in SAN revenue partially offset by an increase in IP Networking revenue.

Q2 15 revenue of $547M was up 2% Yr./Yr. due to increased IP Networking product revenue, which was up 19% Yr./Yr., primarily due to stronger router revenue and increased sales to both service provider and U.S. federal customers. The increase in IP Networking product revenue was partially offset by lower SAN product revenue, which was down 2% Yr./Yr. as both low-end switch and server blade revenue declined Yr./Yr., primarily the result of softer storage demand and operational issues at certain OEM partners. Director revenue was up 9% Yr./Yr.

Non-GAAP gross margin was 68.8% in Q2 15, up 210 basis points Yr./Yr. due to customer mix (higher sales to service provider and U.S. federal customers), product mix (higher percentage of director and router sales), and lower manufacturing period costs, some of which were one-time in nature. Non-GAAP operating margin was 24.6% in Q2 15, up 140 basis points from Q2 14 primarily due to higher revenue and gross margin.

Q2 15 non-GAAP diluted EPS was $0.22, up from $0.19 in Q2 14, primarily due to higher revenue and gross margin and a lower number of outstanding shares as a result of our share repurchase program.

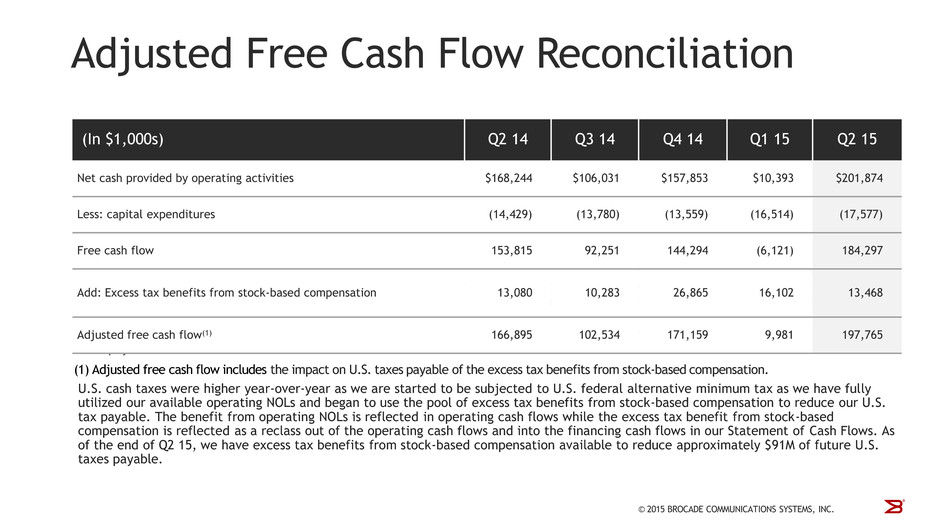

Operating cash flow of $202M and adjusted free cash flow of $198M were very strong in the quarter and above our Q2 outlook range of $165M to 185M and $155M to 175M, respectively, as DSO decreased 7 days sequentially.

The Q2 15 effective non-GAAP tax rate was 25.7%, up 110 basis points Yr./Yr. and within our expected range.

© 2015 Brocade Communications Systems, Inc. Page 12 of 21

Brocade Q2 FY 2015 Earnings 5/21/2015

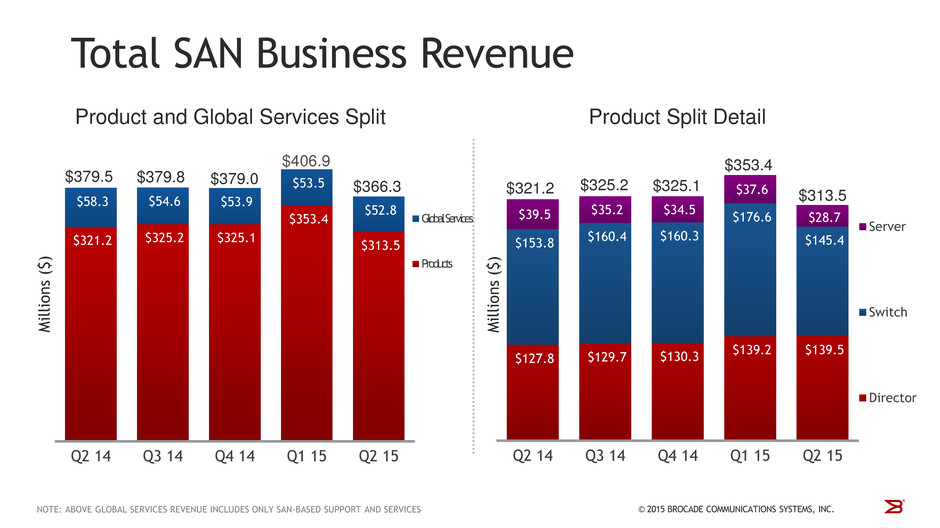

Revenue from our total SAN business, including hardware products and SAN-based support and services, in Q2 15 was $366M, down 3% from Q2 14. The lower revenue was primarily the result of softer storage demand and operational issues at certain OEM partners, which impacted low-end switch and server blade revenue. In addition, Q2 14 was a 14-week quarter and included an additional week of support revenue.

Our SAN product revenue was $314M in the quarter, down 2% Yr./Yr. as switch and server sales were down 6% and 27% Yr./Yr., respectively, partially offset by higher director sales, which were up 9% Yr./Yr. Combining fiscal Q1 and Q2, first-half fiscal year 2015 director sales were up 3% Yr./Yr., and first-half fiscal year 2015 switch sales were up 1% Yr./Yr. First-half fiscal year 2015 server sales were down 25% Yr./Yr.

From a total revenue perspective, including SAN and IP Networking, our channels to market have shifted over time due to the growth of the IP Networking revenue and also reflect the seasonal change in segment mix. Total OEM revenue has declined Yr./Yr. to 63% from 68% of total revenue, while Channel/Direct sales have increased to 37% from 32% of total revenue for these reasons.

© 2015 Brocade Communications Systems, Inc. Page 13 of 21

Brocade Q2 FY 2015 Earnings 5/21/2015

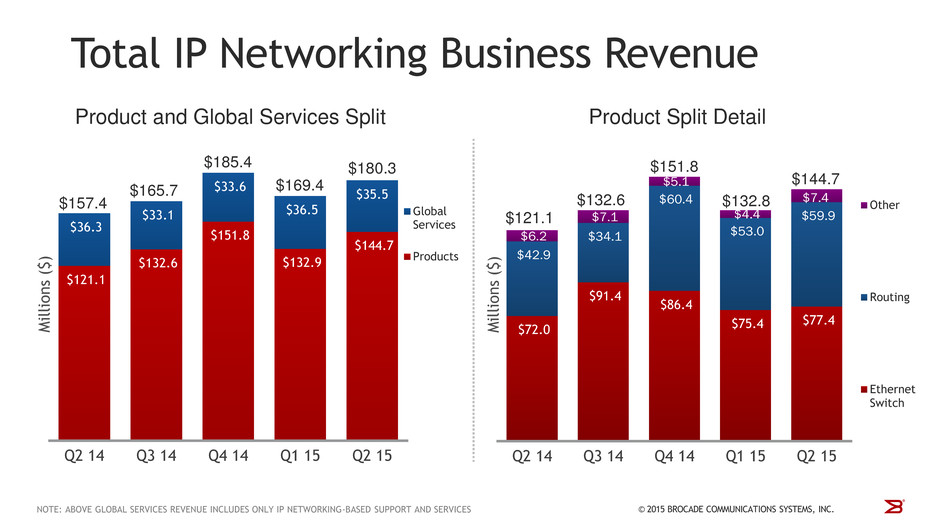

Revenue from our total IP Networking business, including hardware and IP-based support and services, was $180M, up 14% Yr./Yr.

Q2 15 IP Networking product revenue was $145M, up 19% Yr./Yr. due to strong Yr./Yr. growth in both routing (up 40%) and Ethernet switches (up 8%). Geographically, the Yr./Yr. revenue growth was primarily in the Americas (up 12%), U.S. federal (up 78%), and APAC (up 19%).

IP-based Global Services revenue was $35.5M, down 2% Yr./Yr. due to the 14-week quarter in Q2 14, which included an additional week of support revenue.

The SteelApp transaction closed on March 4, 2015, and the related product and support revenue recognized in the quarter was within the previously provided range of $2M to $3M.

The split of our IP Networking business based on customer use cases is an important measurement of the progress we are making on our data center strategy. Although it is difficult to identify all end users and their specific network deployments due to our two-tier distribution channel, we are providing estimates of the split of our IP Networking business. Our data center customers represented approximately 62% of IP Networking revenue in Q2 15, compared to 57% in Q2 14 and 53% in Q1 15.*

* The estimated percentage of revenue coming from data center IP Networking customers may fluctuate quarter to quarter due to the timing of large data center customer transactions and minor changes to classification from improved visibility of actual customer deployments, as well as the seasonality of the public sector, including federal. Other use cases, such as enterprise campus and carrier networks (MAN/WAN) represent the balance of the business.

© 2015 Brocade Communications Systems, Inc. Page 14 of 21

Brocade Q2 FY 2015 Earnings 5/21/2015

Looking forward to Q3 15, we considered a number of factors, including the following, in setting our outlook:

| |

| • | For Q3 15, we expect SAN revenue to be down 2% to 6% Qtr./Qtr. We typically see weaker sequential buying patterns from our OEM partners in our fiscal Q3 and expect some of the Q2 market and partner challenges to continue into Q3. |

| |

| • | We expect our Q3 15 IP Networking revenue to be up 9% to 13% Qtr./Qtr., principally driven by growth in the U.S. public sector, including federal, and our IP growth initiatives. |

| |

| • | We expect our Global Services revenue to be within a range of up 1% to down 1% Qtr./Qtr. |

| |

| • | Our forecast for SteelApp product and support revenue for the second half of FY15 remains unchanged. We anticipate Q3 and Q4 revenue to be in the range of $5M to $7M per quarter, which is included in the outlook ranges above. |

| |

| • | We expect Q3 15 non-GAAP gross margin to be between 67% to 68%, and non-GAAP operating margin to be between 24.0% to 26.0%, primarily reflecting the expected mix of SAN and IP revenues. |

| |

| • | At the end of Q2 15, OEM inventory was a little more than one and one-half weeks of supply based on SAN business revenue. We expect inventory to be between one to two weeks in Q3 15. |

© 2015 Brocade Communications Systems, Inc. Page 15 of 21

Brocade Q2 FY 2015 Earnings 5/21/2015

Prepared comments provided by Michael Iburg, Investor Relations

That concludes Brocade’s prepared comments. At 2:30 p.m. Pacific Time on May 21, Brocade will host a webcast conference call at www.brcd.com.

Thank you for your interest in Brocade.

© 2015 Brocade Communications Systems, Inc. Page 16 of 21

Brocade Q2 FY 2015 Earnings 5/21/2015

© 2015 Brocade Communications Systems, Inc. Page 17 of 21

Brocade Q2 FY 2015 Earnings 5/21/2015

© 2015 Brocade Communications Systems, Inc. Page 18 of 21

Brocade Q2 FY 2015 Earnings 5/21/2015

Additional Financial Information:

|

| | | | | | |

| | Q2 14 |

| Q1 15 |

| Q2 15 |

|

| GAAP product gross margin | 67.8 | % | 69.2 | % | 70.0 | % |

| Non-GAAP product gross margin | 68.3 | % | 69.7 | % | 70.6 | % |

| | | | |

| GAAP services gross margin | 57.4 | % | 59.3 | % | 58.4 | % |

| Non-GAAP services gross margin | 59.2 | % | 61.4 | % | 59.6 | % |

© 2015 Brocade Communications Systems, Inc. Page 19 of 21

Brocade Q2 FY 2015 Earnings 5/21/2015

© 2015 Brocade Communications Systems, Inc. Page 20 of 21

Brocade Q2 FY 2015 Earnings 5/21/2015

© 2015 Brocade Communications Systems, Inc. Page 21 of 21