UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Sec. 240.14a-12 |

Brocade Communications Systems, Inc.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

| | |

Brocade Communications Systems, Inc. 1745 Technology Drive, San Jose, CA 95110 www.brocade.com | |  |

To the Stockholders of Brocade Communications Systems, Inc.:

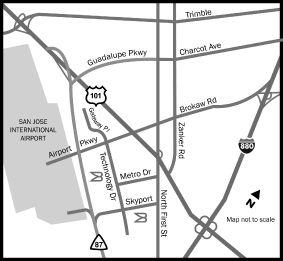

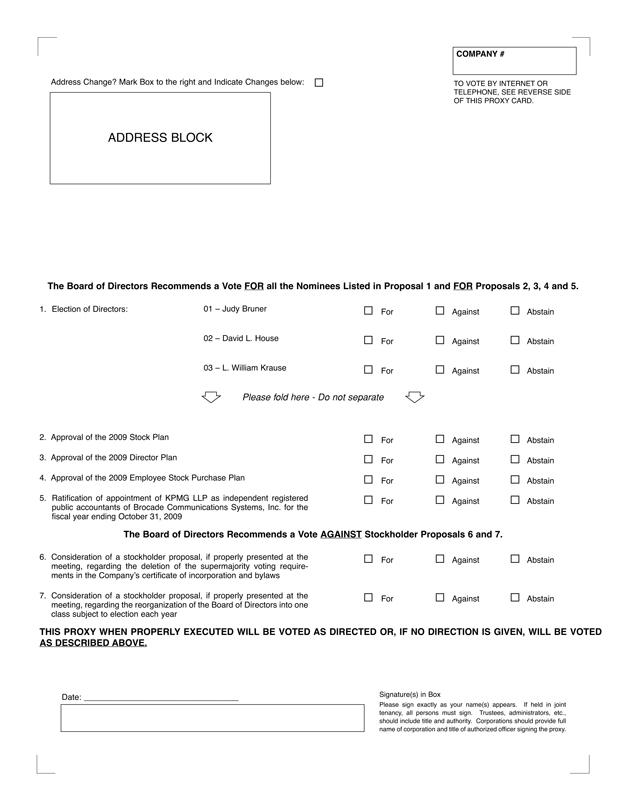

You are cordially invited to attend the 2009 Annual Meeting of Stockholders of Brocade Communications Systems, Inc. The Annual Meeting will be held on April 15, 2009, at 2:00 p.m. Pacific Time, at our corporate offices located at 1745 Technology Drive, San Jose, California 95110. At the Annual Meeting, we will ask you to elect three directors, approve the 2009 Stock Plan, approve the 2009 Director Plan, approve the 2009 Employee Stock Purchase Plan, ratify the appointment of KPMG LLP as our independent registered public accountants for the fiscal year ending October 31, 2009, consider two stockholder proposals, if each is properly presented at the meeting, and to transact such other business that may properly come before the meeting or at any adjournment or postponement thereof.

Similar to last year’s annual stockholder meeting materials, we are also pleased to take advantage of the Securities and Exchange Commission rules allowing issuers to furnish proxy materials over the Internet. Please read the proxy statement for more information on this alternative, which we believe will allow us to provide our stockholders with the information they need while lowering the costs of delivery and reducing the environmental impact of our annual meeting.

Stockholders of record as of February 17, 2009 may vote at the Annual Meeting.

Your vote is important. Whether or not you plan to attend the meeting in person, it is important that your shares be represented. Please vote as soon as possible.

| | | | |

| Sincerely, | | | | |

| | |

| | | |  |

| Dave House | | | | Michael Klayko |

| Chairman of the Board | | | | Chief Executive Officer |

| | | | |

Brocade Communications Systems, Inc. 1745 Technology Drive, San Jose, CA 95110 www.brocade.com | | | |  |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON APRIL 15, 2009

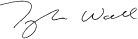

On April 15, 2009, Brocade Communications Systems, Inc. (“Brocade”) will hold its 2009 Annual Meeting of Stockholders at 2:00 p.m. Pacific Time. The meeting will be held at Brocade’s corporate offices located at 1745 Technology Drive, San Jose, California 95110 for the following purposes:

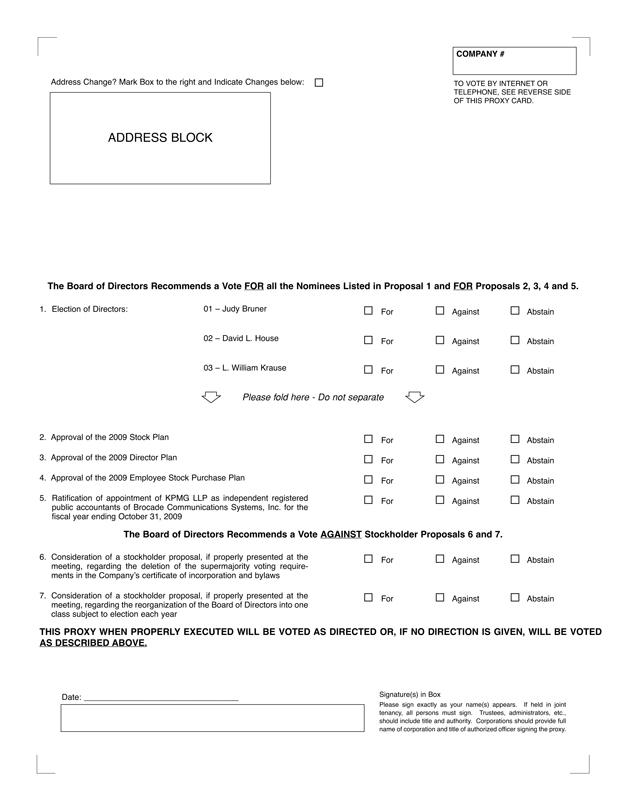

| | • | | To elect Judy Bruner, David L. House and L. William Krause as Class I directors; |

| | • | | To approve the 2009 Stock Plan; |

| | • | | To approve the 2009 Director Plan; |

| | • | | To approve the 2009 Employee Stock Purchase Plan; |

| | • | | To ratify the appointment of KPMG LLP as our independent registered public accountants for the fiscal year ending October 31, 2009; |

| | • | | To consider two stockholder proposals, if each is properly presented at the meeting; and |

| | • | | To transact such other business that may properly come before the meeting or at any adjournment or postponement thereof. |

More information about these business items is described in the proxy statement accompanying this notice. Any of the above matters may be considered at the Annual Meeting at the date and time specified above or at an adjournment or postponement of such meeting.

Your vote is important. Whether or not you plan to attend the meeting in person, it is important that your shares be represented. To ensure that your vote is counted at the meeting, please vote as soon as possible.

|

| For the Board of Directors, |

|

|

| Tyler Wall |

| Vice President, General Counsel and |

| Corporate Secretary |

San Jose, California

February 20, 2009

|

YOUR VOTE IS IMPORTANT. |

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE COMPLETE, SIGN, DATE AND RETURN THE PROXY CARD OR VOTING INSTRUCTION CARD AS INSTRUCTED OR VOTE BY TELEPHONE OR USING THE INTERNET AS INSTRUCTED ON THE PROXY CARD, VOTING INSTRUCTION CARD OR THE NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS. |

TABLE OF CONTENTS

BROCADE COMMUNICATIONS SYSTEMS, INC.

PROXY STATEMENT FOR 2009 ANNUAL MEETING OF STOCKHOLDERS

Brocade’s Board of Directors is providing these proxy materials to you for use in connection with the 2009 Annual Meeting of Stockholders to be held on April 15, 2009 at 2:00 p.m. Pacific Time, and at any postponement or adjournment of the meeting. The Annual Meeting will be held at our offices located at 1745 Technology Drive, San Jose, California 95110. Stockholders of record are invited to attend the Annual Meeting and are asked to vote on the proposals described in this proxy statement.

The Notice of Internet Availability was first mailed to all stockholders entitled to vote at the Annual Meeting, and these proxy solicitation materials combined with the Annual Report on Form 10-K for the fiscal year ended October 25, 2008, including financial statements, were first made available to you on the internet, on or about February 20, 2009. Our principal executive offices are located at 1745 Technology Drive, San Jose, California 95110, and our telephone number is (408) 333-8000.

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS

AND OUR ANNUAL MEETING

| Q: | What is the purpose of the Annual Meeting? |

| A: | To vote on the following proposals: |

| | • | | To elect Judy Bruner, David L. House and L. William Krause as Class I directors; |

| | • | | To approve the 2009 Stock Plan; |

| | • | | To approve the 2009 Director Plan; |

| | • | | To approve the 2009 Employee Stock Purchase Plan; |

| | • | | To ratify the appointment of KPMG LLP as our independent registered public accountants for the fiscal year ending October 31, 2009; |

| | • | | To consider a stockholder proposal, if properly presented at the meeting, to urge the Company to take all steps necessary to delete the supermajority voting requirements in the Company’s certificate of incorporation and bylaws; and |

| | • | | To consider a stockholder proposal, if properly presented at the meeting, to ask the Board of Directors to reorganize the Board of Directors into one class subject to election each year. |

To transact such other business that may properly come before the Annual Meeting or at any adjournment or postponement thereof.

| Q: | What are the Board of Directors’ recommendations? |

| A: | The Board recommends a vote: |

| | • | | FOR the election of Judy Bruner, David L. House and L. William Krause as Class I directors; |

| | • | | FOR approval of the 2009 Stock Plan; |

| | • | | FOR approval of the 2009 Director Plan; |

| | • | | FOR approval of the 2009 Employee Stock Purchase Plan; |

| | • | | FOR the ratification of the appointment of KPMG LLP as our independent registered public accountants for the fiscal year ending October 31, 2009; |

| | • | | AGAINST the stockholder proposal to urge the Company to take all steps necessary to delete the supermajority voting requirements the Company’s certificate of incorporation and bylaws; and |

| | • | | AGAINST the stockholder proposal to ask the Board of Directors to reorganize the Board of Directors into one class subject to election each year. |

1

| Q: | Why did I receive a one-page notice in the mail regarding the Internet availability of proxy materials this year instead of a full set of proxy materials? |

| A: | Pursuant to the rules adopted by the Securities and Exchange Commission (the “SEC”), we have provided access to our proxy materials over the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials (the “Notice”) to our stockholders of record and beneficial owners. Instructions on how to access the proxy materials over the Internet or to request a printed copy by mail may be found on the Notice. In addition, the Notice will provide information on how stockholders may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. |

| Q: | Who is entitled to vote at the meeting? |

| A: | Stockholders Entitled to Vote. Stockholders who our records show owned shares of Brocade as of the close of business on February 17, 2009 (the “Record Date”) may vote at the Annual Meeting. On the Record Date, we had a total of 386,953,943 shares of Brocade common stock (“Common Stock”) issued and outstanding, which were held of record by approximately 2,608 stockholders. The stock transfer books will not be closed between the Record Date and the date of the meeting. As of the Record Date, we had no shares of Preferred Stock outstanding. Each share of Brocade Common Stock is entitled to one vote. |

Registered Stockholders. If your shares are registered directly in your name with Brocade’s transfer agent, you are considered, with respect to those shares, the stockholder of record, and the Notice was provided to you directly by Brocade. As the stockholder of record, you have the right to grant your voting proxy directly to the individuals listed on the proxy card or to vote in person at the Annual Meeting.

Street Name Stockholders. If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in street name. The Notice was forwarded to you by your broker or nominee, who is considered, with respect to those shares, the record holder. As the beneficial owner, you have the right to direct your broker or nominee how to vote, and you are also invited to attend the Annual Meeting. However, since you are not the record holder, you may not vote these shares in person at the Annual Meeting unless you follow your broker’s procedures for obtaining a legal proxy. If you request a printed copy of the proxy materials by mail, your broker or nominee will provide a voting instruction card for you to use.

| Q: | Can I attend the meeting in person? |

| A: | You are invited to attend the Annual Meeting if you are a registered stockholder or a street name stockholder as of the Record Date. In addition, you must also present a form of photo identification acceptable to us, such as a valid driver’s license or passport. |

| Q: | How can I get electronic access to the proxy materials? |

| A: | The Notice will provide you with instructions regarding how to: |

| | • | | View our proxy materials for the Annual Meeting on the Internet; and |

| | • | | Instruct us to send our future proxy materials to you electronically by email. |

Choosing to receive your future proxy materials by email will save us the cost of printing and mailing documents to you and will reduce the impact of our annual stockholders’ meetings on the environment. If you choose to receive future proxy materials by email, you will receive an email next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by email will remain in effect until you terminate it.

| Q: | How can I vote my shares? |

| A: | Registered Stockholders: Registered stockholders may vote in person at the Annual Meeting or by one of the following methods: |

| | • | | By Mail. If you requested printed copies of the proxy materials to be mailed to you, you can complete, sign and date the proxy card and return it in the prepaid envelope provided; |

2

| | • | | By Telephone. Call the toll-free telephone number on the Notice and follow the recorded instructions; or |

| | • | | By Internet. Access Brocade’s secure website registration page through the Internet, as identified on the Notice, and follow the instructions. |

Please note that the Internet and telephone voting facilities for registered stockholders will close at 11:59 PM Central Time on April 14, 2009.

Street Name Stockholders: If your shares are held by a broker, bank or other nominee, you must follow the instructions on the form you receive from your broker, bank or other nominee in order for your shares to be voted. Please follow their instructions carefully. Also, please note that if the holder of record of your shares is a broker, bank or other nominee and you wish to vote at the Annual Meeting, you must request a legal proxy from the bank, broker or other nominee that holds your shares and present that proxy and proof of identification at the Annual Meeting to vote your shares.

Based on the instructions provided by the broker, bank or other holder of record of their shares, street name stockholders may generally vote by one of the following methods:

By Mail. If you requested printed copies of the proxy materials to be mailed to you, you may vote by signing, dating and returning your voting instruction card in the enclosed pre-addressed envelope;

By Methods Listed on Voting Instruction Card. Please refer to your voting instruction card or other information provided by your bank, broker or other holder of record to determine whether you may vote by telephone or electronically on the Internet, and follow the instructions on the voting instruction card or other information provided by the record holder; or

In Person With a Proxy from the Record Holder. A street name stockholder who wishes to vote at the Annual Meeting will need to obtain a legal proxy from his or her bank or brokerage firm. Please consult the voting instruction card of the Notice provided to you by your bank or broker to determine how to obtain a legal proxy in order to vote in person at the Annual Meeting.

| Q: | If I sign a proxy, how will it be voted? |

| A: | When proxies are properly dated, executed and returned, the shares represented by such proxies will be voted at the Annual Meeting in accordance with the instructions of the stockholder. If no specific instructions are given, however, the shares will be voted in accordance with the above recommendations of our Board of Directors. If any matters not described in the Proxy Statement are properly presented at the Annual Meeting, the proxy holders will use their own judgment to determine how to vote your shares. If the Annual Meeting is adjourned, the proxy holders can vote your shares on the new meeting date as well, unless you have revoked your proxy instructions, as described below under “Can I change my vote?” |

| A: | You may change your vote at any time prior to the vote at the Annual Meeting. To revoke your proxy instructions and change your vote if you are a holder of record, you must (i) attend the Annual Meeting and vote your shares in person, (ii) advise our Corporate Secretary at our principal executive office (1745 Technology Drive, San Jose, California 95110) in writing before the proxy holders vote your shares, (iii) deliver later dated and signed proxy instructions or (iv) vote again on a later date on the Internet or by telephone (only your latest Internet or telephone proxy submitted prior to the Annual Meeting will be counted). |

| Q: | What happens if I decide to attend the Annual Meeting but I have already voted or submitted a proxy covering my shares? |

| A: | You may attend the meeting and vote in person even if you have already voted or submitted a proxy. Please be aware that attendance at the Annual Meeting will not, by itself, revoke a proxy. If a bank, broker or other |

3

| | nominee holds your shares and you wish to attend the Annual Meeting and vote in person, you must obtain a legal proxy from the record holder of the shares giving you the right to vote the shares. |

| A: | The Annual Meeting will be held if a majority of the outstanding shares of Common Stock entitled to vote is represented in person or by proxy at the meeting constituting a quorum. If you have returned valid proxy instructions or attend the Annual Meeting in person, your Common Stock will be counted for the purpose of determining whether there is a quorum, even if you wish to abstain from voting on some or all matters at the meeting. |

| A: | Each share of our common stock outstanding on the record date is entitled to one vote on each of the three director nominees and one vote on each other matter. |

Directors are elected by a majority of the votes cast at the annual meeting (i.e., the number of shares voted “for” a director nominee must exceed the number of votes cast “against” that nominee), except in the case of a contested election. If a nominee who is currently serving as a director is not elected at the Annual Meeting, under Delaware law the director will continue to serve on the Board as a “holdover director.” However, as a condition to re-nomination, incumbent directors are required to submit a resignation of their directorships in writing to the Chairman of the Nominating and Corporate Governance Committee of the Board. The resignation will become effective only if the director fails to receive a majority of votes cast for re-election and the Board accepts the resignation. In the event of a contested election in accordance with our Bylaws, directors shall be elected by the vote of a plurality of the votes cast. Abstentions and broker non-votes will have no effect on the outcome of the vote.

Approval of the 2009 Stock Plan, approval of the 2009 Director Plan and approval the 2009 Employee Stock Purchase Plan, each require the affirmative vote of the majority of the votes cast (i.e., the number of shares voted “for” the proposal must exceed the number of shares voted “against” the proposal) on such proposal. Abstentions and broker non-votes will have no effect on the outcome of the vote.

The ratification of independent registered public accountants requires the affirmative vote of a majority of shares present in person or represented by proxy and entitled to vote on such proposal. Abstentions are treated as shares present and entitled to vote for purposes of such proposal and, therefore, will have the same effect as a vote “against” the proposal. Broker non-votes will have no effect on the outcome of the vote.

Approval of each of the stockholder proposals requires the affirmative vote of a majority of shares present in person or represented by proxy and entitled to vote on such proposals at the Annual Meeting. Abstentions are treated as shares present and entitled to vote for purposes of each of the two stockholder proposals and, therefore, will have the same effect as a vote “against” the proposal. Broker non-votes will have no effect on the outcome of the vote.

Broker non-votes are shares held by brokers that do not have discretionary authority to vote on the matter and have not received voting instructions from their clients.

| Q: | Who will tabulate the votes? |

| A: | Brocade has designated a representative of Wells Fargo Shareowner Services as the Inspector of Election who will tabulate the votes. |

| Q: | Who is making this solicitation? |

| A: | This proxy is being solicited on behalf of Brocade’s Board of Directors. |

| Q: | Who pays for the proxy solicitation process? |

| A: | Brocade will pay the cost of preparing, assembling, printing, mailing and distributing these proxy materials and soliciting votes. We have retained The Altman Group to assist with the solicitation for an estimated fee |

4

| | of $8,000, plus reasonable out-of-pocket expenses. We may, on request, reimburse brokerage firms and other nominees for their expenses in forwarding proxy materials to beneficial owners. In addition to soliciting proxies by mail, we expect that our directors, officers and employees may solicit proxies in person or by telephone or facsimile. None of these individuals will receive any additional or special compensation for doing this, although we will reimburse these individuals for their reasonable out-of-pocket expenses. |

| Q: | May I propose actions for consideration at next year’s annual meeting of stockholders or nominate individuals to serve as directors? |

| A: | You may present proposals for action at a future meeting only if you comply with the requirements of the proxy rules established by the SEC and our bylaws. In order for a stockholder proposal to be included in our Proxy Statement and form of Proxy relating to the meeting for our 2010 Annual Meeting of Stockholders under rules set forth in the Securities Exchange Act of 1934, as amended (the “Securities Exchange Act”), the proposal must be received by us no later than October 23, 2009. |

If a stockholder intends to submit a proposal or nomination for director for our 2010 Annual Meeting of Stockholders, the stockholder must give us notice in accordance with the requirements set forth in our bylaws no later than the 45th day and no earlier than the 75th day prior to the anniversary of the mailing of the proxy statement for the 2009 Annual Meeting. If the date of the 2010 Annual Meeting is more than 30 days before or more than 60 days after such anniversary date, notice by the stockholder must be received no earlier than 90 days prior to the 2010 Annual Meeting and no later than the later of (i) the 60th day prior to the date of the 2010 Annual Meeting or (ii) the 10th day following the date on which public announcement of the date of the 2010 Annual Meeting is first made by Brocade. Our bylaws require that certain information and acknowledgments with respect to the proposal and the stockholder making the proposal be set forth in the notice.

| Q: | What should I do if I get more than one proxy or voting instruction card? |

| A: | Stockholders may receive more than one set of voting materials, including multiple copies of the Notice, these proxy materials and multiple proxy cards or voting instruction cards. For example, stockholders who hold shares in more than one brokerage account may receive separate Notices for each brokerage account in which shares are held. Stockholders of record whose shares are registered in more than one name will receive more than Notice. You should vote in accordance with all of the Notices you receive relating to our Annual Meeting to ensure that all of your shares are voted. |

| Q: | How do I obtain a separate set of proxy materials or request a single set for my household? |

| A: | We have adopted a procedure approved by the Securities and Exchange Commission called “householding.” Under this procedure, a householding notice will be sent to stockholders who have the same address and last name and do not participate in electronic delivery of proxy materials, and they will receive only one copy of our annual report and proxy statement unless one or more of these stockholders notifies us that they wish to continue receiving individual copies. This procedure reduces our printing costs and postage fees. Each stockholder who participates in householding will continue to receive a separate proxy card. |

If you wish to receive a separate Notice, proxy statement or annual report at this time, please request the additional copy by contacting our transfer agent, Wells Fargo Shareowner Services, by telephone at 800-468-9716, or by facsimile at 651-450-4033. If any stockholders in your household wish to receive a separate annual report and a separate proxy statement in the future, they may call our Investor Relations group at 408-333-6758 or write to Investor Relations, Brocade Communications Systems, Inc., 1745 Technology Drive, San Jose, CA 95110. They may also send an email to our Investor Relations Group at investor-relations@brocade.com. Other stockholders who have multiple accounts in their names or who share an address with other stockholders can authorize us to discontinue mailings of multiple annual reports and proxy statements by calling or writing to Investor Relations.

| Q: | What if I have questions about lost stock certificates or need to change my mailing address? |

| A: | You may contact our transfer agent, Wells Fargo Shareowner Services, by telephone at 800-468-9716, or by facsimile at 651-450-4033, if you have lost your stock certificate or need to change your mailing address. |

5

BOARD OF DIRECTORS MEETINGS AND COMMITTEES

The Board of Directors is presently composed of nine members: Judy Bruner, Renato (Renny) A. DiPentima, Alan L. Earhart, John W. Gerdelman, David L. House, Glenn C. Jones, Michael Klayko, L. William Krause, and Sanjay Vaswani. Mr. House serves as Chairman of the Board of Directors. In addition, Michael Rose served as a director until his resignation effective as of October 1, 2008, and Robert Walker served as a director until the Company’s 2008 Annual Meeting of Stockholders on April 10, 2008. The Board of Directors has determined that each of the directors other than Mr. Klayko is an independent director within the meaning set forth in the NASDAQ rules, as currently in effect. The Board of Directors had determined that Messrs. Rose and Walker were both independent directors with the meaning set forth in the NASDAQ rules during their period of service as a director. Ms. Bruner was appointed to the Board of Directors effective as of January 7, 2009. Mr. Earhart was appointed to the Board of Directors effective as of February 10, 2009. There are no family relationships between any director and executive officer.

The Board of Directors held 13 meetings during fiscal year 2008, four of which were regularly scheduled meetings and nine of which were special meetings. The Board also acted three times by unanimous written consent. Each director attended at least 75% of the aggregate number of meetings of our Board of Directors and the committees on which each director served during fiscal year 2008 and was eligible to attend.

Information About the Directors and Nominees

Set forth below is information regarding our directors and the nominees as of January 20, 2009, except for (and including) Alan L. Earhart who was appointed a director effective February 10, 2009:

| | | | | | |

Name | | Age | | Position | | Director

Since |

Class I Directors whose terms expire at the 2009 Annual Meeting | | | | | | |

Judy Bruner | | 50 | | Director | | 2009 |

David L. House | | 65 | | Chairman | | 2004 |

L. William Krause | | 66 | | Director | | 2004 |

Class II Directors whose terms expire at the 2010 Annual Meeting | | | | | | |

Renato (Renny) A. DiPentima | | 68 | | Director | | 2007 |

Alan L. Earhart | | 65 | | Director | | 2009 |

Sanjay Vaswani | | 49 | | Director | | 2004 |

Class III Directors whose terms expire at the 2011 Annual Meeting | | | | | | |

John W. Gerdelman | | 56 | | Director | | 2007 |

Glenn C. Jones | | 63 | | Director | | 2006 |

Michael Klayko | | 54 | | CEO and Director | | 2005 |

Nominees for Election as Class I Directors — Terms Would Expire at the 2012 Annual Meeting

Judy Bruner has served as a director since January 2009. Ms. Bruner has been the Executive Vice President, Administration and Chief Financial Officer of SanDisk Corporation, a supplier of flash storage products, since June 2004. Ms. Bruner served as Senior Vice President and Chief Financial Officer of Palm, Inc., a provider of handheld computing and communications solutions, from September 1999 until June 2004. Prior to Palm, Inc., Ms. Bruner held financial management positions with 3Com Corporation, Ridge Computers and Hewlett-Packard Company. Ms. Bruner holds a B.A. degree in economics from the University of California, Los Angeles and an M.B.A. degree from Santa Clara University.

David L. House has served as a director since 2004 and as the Chairman of our Board of Directors since December 2005. From January 2005 through December 2005, he served as Executive Chairman of the Board.

6

Mr. House served as Chairman and Chief Executive Officer of Allegro Networks, a privately held provider of voice data and broadband services, from January 2001 until April 2003. Prior to that, he served as President of Nortel Networks Corp. from August 1998 until August 1999. Mr. House joined Nortel Networks Corp. when it was merged with Bay Networks, Inc., where he served as Chairman of the Board, President and Chief Executive Officer from October 1996 until August 1998. Mr. House served in senior management positions at Intel Corporation for 23 years. Mr. House received a B.S.E.E. degree from Michigan Technological University and an M.S.E.E. degree from Northeastern University of Boston.

L. William Krause has served as a director since 2004. Mr. Krause has been President of LWK Ventures, a private investment firm since 1991. In addition, Mr. Krause served as Chairman of the Board of Caspian Networks, Inc., an IP networking systems provider, from April 2002 to September 2006 and as Chief Executive Officer from April 2002 until June 2004. From September 2001 to February 2002, Mr. Krause was Chairman and Chief Executive Officer of Exodus Communications, Inc. He also served as President and Chief Executive Officer of 3Com Corporation, a global data networking company, from 1981 to 1990, and as its Chairman from 1987 to 1993 when he retired. Mr. Krause currently serves as director of Core-Mark Holdings, Inc., a distributor of packaged consumer goods, and Sybase, Inc., a provider of enterprise and mobile software solutions for information management, development and integration. Mr. Krause holds a B.S. degree in electrical engineering and received an honorary Doctorate of Science from The Citadel.

Class II Directors — Terms Expire at the 2010 Annual Meeting

Renato (Renny) A. DiPentima has served as a director since February 2007 when he was appointed to the Board in connection with Brocade’s acquisition of McDATA Corporation. Dr. DiPentima is the retired President and Chief Executive Officer of SRA International, a provider of technology and strategic consulting services and solutions, where he served from January 2005 until March 2007. From November 2003 to January 2005, he served as SRA’s President and Chief Operating Officer. Prior to that, Dr. DiPentima served as Senior Vice President and President of SRA’s consulting and systems integration division since the division’s formation in January 2001. From July 1997 to January 2001, he served as President of SRA’s government sector, overseeing government business, projects, and contracts. From July 1995 to July 1997, Dr. DiPentima served as Vice President and as SRA’s Chief Information Officer. Prior to joining SRA, Dr. DiPentima held several senior management positions in the U.S. federal government, most recently serving as deputy commissioner for systems at the Social Security Administration, from May 1990 to June 1995. Dr. DiPentima is also currently serving on several governmental and corporate advisory boards. Dr. DiPentima received a B.A. degree from New York University, an M.A. degree from George Washington University and a Ph.D. degree from the University of Maryland. He has also completed the program for Senior Managers at the John F. Kennedy School of Government at Harvard University.

Alan L. Earharthas served as a director since February 2009. Mr. Earhart served as a member of the Board of Directors of Foundry Networks, Inc. from August 2003 until December 2008 when Foundry was acquired by Brocade. Mr. Earhart has been a retired partner of PricewaterhouseCoopers LLP since 2001. From 1970 to 2001, Mr. Earhart held a variety of positions with Coopers & Lybrand and its successor entity, PricewaterhouseCoopers LLP, an accounting and consulting firm, including most recently as the Managing Partner for PricewaterhouseCoopers’ Silicon Valley office. Mr. Earhart also serves on the board of directors of Macrovision Solutions Corporation, Monolithic Power Systems, Inc. and Network Appliance, Inc. Mr. Earhart holds a B.S. degree in accounting from the University of Oregon.

Sanjay Vaswani has served as a director since April 2004. Mr. Vaswani has been a managing partner of the Center for Corporate Innovation, Inc., a professional services firm, since 1990. From 1987 to 1990 he was with McKinsey & Company. Prior to that, Mr. Vaswani was employed by Intel Corporation. Mr. Vaswani serves as a director of Blue Star Infotech Ltd., an Indian publicly traded software services firm. Mr. Vaswani earned a B.A. degree from the University of Texas at Austin and an M.B.A. degree from the Wharton School of Business at the University of Pennsylvania.

7

Class III Directors — Terms Expire at the 2011 Annual Meeting

John W. Gerdelman has served as a director since February 2007 when he was appointed to the Board in connection with Brocade’s acquisition of McDATA Corporation. Since January 2004, Mr. Gerdelman has been the Chairman of Intelliden Corporation, a company he co-founded that provides software solutions that enable networks to operate more intelligently by automating network change management and enforcing business policy in network operations. From April 2002 to December 2003, Mr. Gerdelman was the Chief Executive Officer for Metromedia Fiber Networks. From January 2000 until March 2002, Mr. Gerdelman worked with several new ventures as Managing Member of Mortonsgroup LLC. From April 1999 to December 1999, he served as the President and CEO of USA.NET. From 1986 until 1999, Mr. Gerdelman held various positions with MCI Communications Corporation in Sales, Marketing, Sales Operations, Network Operations and Information Technology, including President of the Network and Information Technology Division and served as CEO of Long Lines Limited, a startup call center company. Before joining MCI, Mr. Gerdelman was with Baxter Travenol Corporation in Sales Operations and served in the U.S. Navy as a Naval Aviator. He received his B.S. degree in chemistry from the College of William and Mary, where he now serves on the Board of Visitors. Mr. Gerdelman also currently serves as a director of Sycamore Networks, Inc., an optical switching company, and Proxim Wireless Corporation (formerly, Terabeam Corporation), a broadband provider.

Glenn C. Jones has served as a director since April 2006. Mr. Jones has served as a business consultant to technology companies since 1998. Mr. Jones previously served as Chief Financial Officer of Cirrus Logic, Inc. as well as Chief Financial Officer of PMC-Sierra, Inc. Prior to these public company roles, he was Chief Financial Officer for Metaphor Computer Systems, Inc., a privately held company, and served as General Manager of Metaphor’s computer systems business which was acquired by IBM Corporation. He also was the founding Chief Financial Officer and Vice President of Operations for Gain Computer Systems, which was acquired by Sybase Corp. Mr. Jones, a Certified Public Accountant, holds a B.S. degree in accounting from the University of Illinois and an M.B.A. from Golden Gate University.

Michael Klayko has served as our Chief Executive Officer and as a director since January 2005. Prior to that, he served as Vice President, Worldwide Sales from May 2004 until January 2005. From April 2003 until May 2004, Mr. Klayko served as Vice President, Worldwide Marketing and Support, and from January 2003 until April 2003, he was Vice President, OEM Sales. From May 2001 to January 2003, Mr. Klayko was Chief Executive Officer and President of Rhapsody Networks, a privately held technology company acquired by Brocade. From December 1998 to April 2001, Mr. Klayko served as Executive Vice President of McDATA Corporation. From March 1995 to November 1998, Mr. Klayko was Senior Vice President for North American Sales at EMC Corporation, a provider of information storage systems products. Mr. Klayko also held various executive sales and marketing positions at Hewlett-Packard Company and IBM Corporation. Mr. Klayko received a B.S. degree in electronic engineering from Ohio Institute of Technology, in Columbus, Ohio.

Committees of the Board of Directors

The Board of Directors has the following standing committees: Audit, Compensation, Nominating and Corporate Governance, and Corporate Development. The Board of Directors has adopted a written charter for each of these committees, copies of which can be found on our website at www.brocade.com in the Corporate Governance section of our investor relations webpage. In addition, the Board of Directors has a Special Litigation Committee, which is currently in effect, and a Settlement Committee, which was disbanded in February 2008. All members of the committees appointed by the Board of Directors are non-employee directors and the Board of Directors has determined that all such members are independent under the applicable rules and regulations of NASDAQ and the SEC, as currently in effect, except Michael Klayko, Brocade’s Chief Executive Officer, who serves as Chairman of our Corporate Development Committee. In addition, all directors who served on a committee during any portion of fiscal year 2008, other than Mr. Klayko, were independent under the applicable rules and regulations of NASDAQ and the SEC during such director’s period of service.

8

The following chart details the membership of each standing committee currently and during fiscal year 2008 and the number of meetings each committee held in fiscal year 2008.

| | | | | | | | | | |

Name of Director | | Audit | | | Compensation | | Nominating &

Corporate

Governance | | Corporate

Development | |

Judy Bruner(1) | | M | | | | | | | | |

Renato A. DiPentima | | | | | | | M | | | |

Alan L. Earhart(2) | | M | | | | | | | | |

John W. Gerdelman | | M | | | M | | | | | |

David L. House | | | | | M | | M | | M | |

Glenn C. Jones(3) | | C | | | | | | | | |

Michael Klayko | | | | | | | | | C | |

L. William Krause(4) | | (M | ) | | M | | C | | | |

Michael Rose(5) | | (M | ) | | | | | | (M | ) |

Sanjay Vaswani | | | | | C | | M | | | |

Robert Walker(6) | | (C | ) | | | | | | | |

Number of Meetings in Fiscal 2008 | | 13 | | | 12 | | 5 | | 2 | |

M = Member

C = Chair

| (1) | Ms. Bruner joined the Audit Committee effective as of January 7, 2009. |

| (2) | Mr. Earhart joined the Audit Committee effective as of February 10, 2009. |

| (3) | During fiscal year 2008, Mr. Jones was a member of the Audit Committee until April 10, 2008 and became Chairman of the Audit Committee beginning on April 10, 2008. |

| (4) | Mr. Krause was a member of the Audit Committee from October 1, 2008 until February 10, 2009. |

| (5) | Mr. Rose resigned from the Board of Directors and the Audit Committee and Corporate Development Committee effective as of October 1, 2008. |

| (6) | Mr. Walker was a member of the Board and Chairman of the Audit Committee until April 10, 2008, when he did not stand for re-election to the Board of Directors at the Company’s 2008 Annual Meeting of Stockholders. |

Audit Committee

The Audit Committee oversees our accounting, financial reporting and audit processes; appoints, determines the compensation of, and oversees, the independent registered public accountants; pre-approves audit and non-audit services provided by the independent registered public accountants; reviews the results and scope of audit and other services provided by the independent registered public accountants; reviews the accounting principles and practices and procedures used in preparing our financial statements; oversees the Company’s internal audit function; and reviews our internal controls.

The Audit Committee works closely with management and our independent registered public accountants. The Audit Committee also meets with our independent registered public accountants without members of management present, on a quarterly basis, following completion of our independent registered public accountants’ quarterly reviews and annual audit and prior to our earnings announcements, to review the results of their work. The Audit Committee also meets with our independent registered public accountants to approve the annual scope and fees for the audit services to be performed.

The Nominating and Corporate Governance Committee has determined that each of Ms. Bruner and Messrs. Earhart, Jones and Gerdelman is an “audit committee financial expert” as defined by SEC rules, as currently in effect.

9

The Audit Committee Report is included in this proxy statement on page 68. A copy of the Audit Committee’s written charter was attached as Appendix I to the Company’s proxy statement for the annual meeting of stockholders held on April 17, 2006 and is also available on our website at www.brocade.com in the Corporate Governance Section of our investor relations webpage.

Compensation Committee

The Compensation Committee has overall responsibility for (i) overseeing the Company’s compensation and benefits policies generally; (ii) overseeing, evaluating and approving executive officer and director compensation plans, policies and programs; and (iii) reviewing, and discussing with management, the Compensation Discussion and Analysis section of the Company’s annual proxy statement and preparing the Compensation Committee Report that is required by Securities and Exchange Commission rules to be included in the Company’s annual proxy statement.

The Compensation Committee Report is included herein on page 59. A copy of the Compensation Committee’s written charter is available on our website at www.brocade.com in the Corporate Governance section of our investor relations webpage.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee (i) considers and periodically reports on matters relating to the identification, selection and qualification of the Board of Directors and candidates nominated to the Board of Directors and its committees; (ii) develops and recommends governance principles applicable to Brocade; (iii) oversees the evaluation of the Board of Directors and management from a corporate governance perspective; and (iv) reviews Brocade’s reporting in documents filed with the SEC to the extent related to corporate governance.

The Nominating and Corporate Governance Committee considers properly submitted stockholder recommendations for candidates for membership on the Board of Directors as described below under “Identification and Evaluation of Nominees for Directors.” In evaluating such recommendations, the Nominating and Corporate Governance Committee seeks to achieve a balance of knowledge, experience and capability on the Board of Directors and to address the membership criteria set forth under “Director Qualifications.” Any stockholder recommendations submitted for consideration by the Nominating and Corporate Governance Committee should include the candidate’s name and qualifications for membership on the Board of Directors and should be addressed to the attention of our Corporate Secretary re: stockholder director recommendation. In addition, procedures for stockholder direct nomination of directors are discussed in the in the section titled “Questions and Answers about the Proxy Materials and our Annual Meeting,” and are discussed in detail in our bylaws, a copy of which is available on the SEC’s EDGAR website at www.sec.gov as Exhibit 3.2 to our Form 8-K filed with the SEC on February 10, 2009 and on the investor relations section of our website at www.brocade.com.

Director Qualifications. The Nominating and Corporate Governance Committee does not have any specific, minimum qualifications that must be met by a Nominating and Corporate Governance Committee-recommended nominee, but uses a variety of criteria to evaluate the qualifications and skills necessary for members of our Board of Directors. Under these criteria, members of the Board of Directors should have the highest professional and personal ethics and values. A director should have broad experience at the policy-making level in business, government, education, technology or public interest. A director should be committed to enhancing stockholder value and should have sufficient time to carry out their duties, and to provide insight and practical wisdom based on their past experience. A director’s service on other boards of public companies should be limited to a number that permits them, given their individual circumstances, to perform responsibly their director duties. Each director must represent the interests of Brocade stockholders.

10

Identification and Evaluation of Nominees for Directors. The Nominating and Corporate Governance Committee utilizes a variety of methods for identifying and evaluating nominees for director. The Nominating and Corporate Governance Committee regularly assesses the appropriate size of the Board of Directors, and whether any vacancies on the Board of Directors are expected due to retirement or otherwise. In the event that vacancies are anticipated, or otherwise arise, the Nominating and Corporate Governance Committee considers various potential candidates for director. Candidates may come to the attention of the Nominating and Corporate Governance Committee through current members of the Board of Directors, professional search firms, stockholders or other persons. These candidates are evaluated at regular or special meetings of the Nominating and Corporate Governance Committee, and may be considered at any point during the year. The Nominating and Corporate Governance Committee considers properly submitted stockholder recommendations for candidates for the Board of Directors. In evaluating such recommendations, the Nominating and Corporate Governance Committee uses the qualifications standards discussed above and seeks to achieve a balance of knowledge, experience and capability on the Board of Directors.

In addition to the foregoing, effective following the 2008 Annual Meeting of Stockholders, we implemented majority voting for directors. As a condition to re-nomination, incumbent directors are required to submit a resignation of their directorships in writing to the Chairman of the Nominating and Corporate Governance Committee of the Board. The resignation will become effective only if the director fails to receive a sufficient number of votes for re-election at the meeting of stockholders, as described in the Company’s bylaws as amended, and the Board accepts the resignation.

A copy of the Nominating and Corporate Governance Committee’s written charter is available on our website at www.brocade.com in the Corporate Governance section of our investor relations webpage.

Corporate Development Committee

The Corporate Development Committee works with management to review, consider and consult on potential strategic investment transactions that are consistent with the Company’s strategy. The Corporate Development Committee has the authority to approve certain transactions; and for certain other transactions, the Corporate Development Committee submits a recommendation to the Board of Directors for its consideration.

A copy of the Corporate Development Committee’s written charter is available on our website at www.brocade.com in the Corporate Governance section of our investor relations webpage.

Compensation Committee Interlocks and Insider Participation

During fiscal year 2008, Messrs. Gerdelman, House, Krause and Vaswani served as members of the Compensation Committee. No member of the Compensation Committee during fiscal 2008 was an officer or employee of Brocade. In addition, no member of the Compensation Committee or executive officer of Brocade served as a member of the Board of Directors or Compensation Committee of any entity that has an executive officer serving as a member of our Board of Directors or Compensation Committee.

Annual Meeting Attendance

We do not have a formal policy regarding attendance by members of the Board of Directors at our annual meetings of stockholders although directors are encouraged to attend annual meetings of Brocade stockholders. All members of the Board of Directors at that time attended the 2008 Annual Meeting of Stockholders.

Communications with the Board of Directors

Although we do not have a formal policy regarding communications with the Board of Directors, stockholders may communicate with the Board of Directors by submitting an email to investor-relations@brocade.com or by writing to us at Brocade Communications Systems, Inc., Attention: Investor

11

Relations, 1745 Technology Drive, San Jose, California 95110. Stockholders who would like their submission directed to a member of the Board of Directors may so specify. All communications will be reviewed by the General Counsel or Director of Investor Relations. All appropriate business-related communications as reasonably determined by the General Counsel or Director of Investor Relations will be forwarded to the Board of Directors or, if applicable, to the individual director.

Code of Ethics

In July 2003, the Board of Directors adopted a Code of Ethics for Principal Executive and Senior Financial Officers, which applies to our Chief Executive Officer, Chief Financial Officer and any other principal financial officer, Controller and any other principal accounting officer, and any other person performing similar functions. The Code of Ethics is posted on our website at www.brocade.com in the Corporate Governance section of our investor relations webpage. The information on our website is not a part of this Proxy Statement. Brocade will disclose any amendment to the Code of Ethics or waiver of a provision of the Code of Ethics that applies to the Company’s Chief Executive Officer, Chief Financial Officer and any other principal financial officer, Controller and any other principal accounting officer, and any other person performing similar functions and relates to certain elements of the Code of Ethics, including the name of the officer to whom the waiver was granted, on our website at www.brocade.com, on our investor relations webpage.

Director Compensation

The following tables provide information about the actual compensation earned by non-employee directors who served during the 2008 fiscal year.

2008 Compensation of Non-Employee Directors

| | | | | | | | | |

Name | | Fees Earned

or Paid in Cash ($) | | Option

Awards(1) ($) | | | Restricted Stock

Unit

Awards(2) ($) | | Total ($) |

Renato A. DiPentima | | 105,964 | | 99,270 | (5) | | 38,949 | | 244,183 |

John W. Gerdelman | | 125,431 | | 99,270 | (5) | | 38,949 | | 263,650 |

David L. House | | 109,000 | | 70,083 | (6) | | 38,949 | | 218,032 |

Glenn C. Jones | | 75,200 | | 92,973 | (7) | | 38,949 | | 207,122 |

L. William Krause | | 77,550 | | 66,904 | (8) | | 38,949 | | 183,403 |

Michael Rose(3) | | 66,962 | | 79,627 | | | 38,949 | | 185,538 |

Sanjay Vaswani | | 80,000 | | 76,083 | (9) | | 38,949 | | 195,032 |

Robert R. Walker(4) | | 32,931 | | 53,047 | | | — | | 85,978 |

| (1) | These amounts reflect the value determined by the Company for accounting purposes for these awards and do not reflect whether the recipient has actually realized a financial benefit from the awards (such as by exercising stock options). This column represents the expense recognized for financial statement reporting purposes for fiscal year 2008 (except for Messrs. Walker and Rose where the amount is through April 10, 2008 and October 1, 2008, respectively, when each ceased being a director of the Company) for stock option awards granted to each of the non-employee directors in fiscal year 2008 as well as prior fiscal years, in accordance with SFAS 123R. Pursuant to SEC rules, the amounts shown exclude the impact of estimated forfeitures related to service-based vesting conditions. No stock option awards were forfeited by any of our non-employee directors in fiscal year 2008, except all unvested portions of options held by Messrs. Walker and Rose on April 10, 2008 and October 1, 2008, respectively, when each ceased being a director. For additional information, see Note 12 of our financial statements in the Form 10-K for the year ended October 25, 2008, as filed with the SEC. For information on the valuation assumptions for grants made prior to fiscal year 2008, see the notes in our financial statements in the Form 10-K for the respective year. |

12

| (2) | These awards were granted April 10, 2008 with a grant date fair market value of $7.18 per share. This column represents the expense recognized for financial statement reporting purposes for fiscal year 2008, in accordance with SFAS 123R. |

| (3) | Director until October 1, 2008 when he resigned from the Board. Mr. Rose received an option award for 20,000 shares of common stock on April 18, 2008 with a grant date fair value of $2.4266. This option was forfeited along with all other unvested portions of options held by Mr. Rose as of October 1, 2008. |

| (4) | Director until April 10, 2008 when he did not stand for re-election to the Board of Directors at the Company’s 2008 Annual Meeting of Stockholders. Mr. Walker did not receive an option award during fiscal 2008. |

| (5) | During fiscal 2008, each of Messrs. DiPentima and Gerdelman received an option award for 20,000 shares of common stock on January 29, 2008 with a grant date fair value of $63,239. |

| (6) | During fiscal 2008, Mr. House received an option award for 20,000 shares of common stock on February 19, 2008 with a grant date fair value of $72,285; and an option award for 7,500 shares of common stock on February 28, 2008 with a grant date fair value of $27,043 |

| (7) | During fiscal 2008, Mr. Jones received an option award for 20,000 shares of common stock on April 18, 2008 with a grant date fair value of $42,532. |

| (8) | During fiscal 2008, Mr. Krause received an option award for 10,000 shares of common stock on October 22, 2008 with a grant date fair value of $12,961. |

| (9) | During fiscal 2008, Mr. Vaswani received an option award for 15,000 shares of common stock on April 30, 2008 with a grant date fair value of $37,451. |

Cash Compensation. Our directors play a critical role in guiding the Company’s strategic direction and overseeing the management of the Company. The increased demand for qualified and talented public company directors requires that we provide adequate incentives for our directors’ continued performance and participation. Each non-employee member of a committee of the Board received, and will receive, the fees as set forth below for his or her service on the Board and each committee of the Board:

| | | |

| | | Fiscal Years 2008 and 2009 |

Annual retainer for serving as a Board member | | $ | 30,000 |

Chairman of the Board | | $ | 30,000 |

Audit Committee Chair* | | $ | 25,000 |

Audit Committee member | | $ | 10,000 |

Compensation Committee Chair* | | $ | 15,000 |

Compensation Committee member | | $ | 7,000 |

Nominating/Governance Committee Chair* | | $ | 10,000 |

Nominating/Governance Committee member | | $ | 5,000 |

Corporate Development Committee Chair* | | $ | 10,000 |

Corporate Development Committee member | | $ | 5,000 |

* Chair is not entitled to receive member fee. | | | |

| |

Additional fees per Board and committee meeting: | | | |

In person | | $ | 1,000 |

By telephone | | $ | 1,000 |

Members of the Company’s Settlement Committee, a special committee authorized to review the Company’s federal and state derivative actions and related matters and make recommendations to the Board, also

13

received per meeting fees (but no additional Chair or member retainers for serving on such committee). The Settlement Committee met one time in fiscal 2008. The Company’s Settlement Committee was disbanded in February 2008, and prior to its disbanding, the Settlement Committee was comprised of Glenn Jones, Michael Rose and Robert Walker.

Members of the Company’s Special Litigation Committee, a special committee authorized to, among other things, evaluate and resolve the claims asserted in the Company’s litigation related to the stock options back dating, are each entitled to receive an annual retainer of $25,000 and per meeting fees of $1,000 per meeting (subject to a maximum of $12,000 in any month). The Special Litigation Committee met 39 times in fiscal 2008. The Special Litigation Committee is comprised of Renato DiPentima and John Gerdelman.

We are also authorized to reimburse directors for expenses in connection with attendance at meetings.

Equity Compensation. Non-employee directors also participated in the Company’s 1999 Director Plan, as amended (the “Director Plan”), which provides for automatic option grants to directors for their service to the Company. Only non-employee directors may participate in the Director Plan.

Under the Director Plan, each non-employee director is entitled to receive the following automatic, non-discretionary grants of options:

| | |

Initial grant upon joining the Board(1) | | 50,000 shares |

Automatic grant on each anniversary of joining the Board(2) | | 20,000 shares |

| (1) | Vests as to 1/3rd of the shares annually and fully vested on the 3rd anniversary of the date of grant. |

| (2) | Vests fully on the first anniversary of each grant. |

All options granted under the Director Plan have a term of 10 years. Under the new 2009 Director Plan, subject to stockholder approval (see Proposal 3), all options granted following the 2009 Annual Meeting will have a term of 7 years. The exercise price of options granted under the Director Plan is 100 percent of the fair market value of the Common Stock, as determined by reference to the closing sales price of the Company’s Common Stock as reported on the Nasdaq Global Select Market on the date of grant.

In addition to the grants above, the Chairman of the Board is entitled to receive an automatic grant at each annual stockholders meeting of an option to purchase 7,500 shares of Common Stock under the Company’s Amended and Restated 1999 Stock Plan. The option has an exercise price equal to 100 percent of the fair market value of the Common Stock as determined by reference to the closing sales price of the Company’s Common Stock as reported on the Nasdaq Global Select Market on the date of grant, has a term of 10 years (7 years for awards made beginning at the 2009 Annual Meeting) and vests as to 1/4th of the shares each quarter, commencing on the 3rd anniversary of the date of grant and will be fully vested on the fourth anniversary of each grant.

In the event of a merger or the sale of substantially all of the assets of the Company, and if the option is not assumed or substituted, each option granted under the Director Plan becomes fully vested and exercisable. In such event, the option holder shall be notified that the option will be fully exercisable for a period of 30 days from the date of the notice. Upon expiration of the 30-day period, the option shall terminate. If the option is assumed or substituted, and the option holder’s status as a director of Brocade or the successor corporation, as applicable, is terminated other than upon a voluntary resignation by such option holder, the option shall be accelerated and become fully exercisable with respect to all shares.

Options granted under the Director Plan may be exercised within 3 months following the date a director’s board service terminates, or within 12 months if termination of service was due to death or disability, but only to

14

the extent that the director was entitled to exercise the option on the date of termination. If an option is not exercised within such 3 or 12-month time period, as applicable, the option shall terminate. In any event, a director may not exercise any option later than the expiration of the applicable term.

Under the Director Plan, and under the proposed 2009 Director Plan if stockholder approval is received, each non-employee director is entitled to receive the following automatic, non-discretionary awards of restricted stock units (each an “RSU”):

| | |

Initial grant upon joining the Board(1) | | 15,000 RSUs |

Automatic grant on each anniversary of joining the Board(2) | | 10,000 RSUs |

| (1) | Vests as to 1/3rd of the shares annually and fully vested on the 3rd anniversary of the date of grant. |

| (2) | Vests fully on the first anniversary of each grant. |

An RSU is a bookkeeping entry representing an amount equal to the fair market value of one share and is settled in stock. Each RSU represents an unfunded and unsecured obligation of the Company. The Director Plan requires payment of earned restricted stock units to be made as soon as practicable after the date set forth in the award agreement evidencing the terms and conditions of the grant. On the participant’s termination as a director, all unvested RSUs will be forfeited to the Company.

Notwithstanding the foregoing, in the event that a director serves through the date of an annual meeting, but is not standing for re-election at that annual meeting, the initial RSU grant (if granted on the date of an annual stockholders meeting and then, only with respect to the portion of the initial RSU grant due to vest in the applicable year) and the annual RSU grant will vest on the earlier of: (1) the anniversary of the date of grant or (2) the annual meeting date for that year.

The same grant and vesting schedule described under the 1999 Director Plan would apply under the 2009 Director Plan, provided, the 2009 Director Plan as set forth under Proposal Three of this proxy statement is approved by stockholders at the 2009 Annual Meeting.

Non-employee director cash and equity compensation is determined by the Compensation Committee. Independent, outside consultants meet with and provide recommendations of the form and amounts of compensation for non-employee directors to the Compensation Committee.

15

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding the beneficial ownership of our Common Stock as of February 2, 2009 as to (i) each person who is known by us to own beneficially more than 5% of our outstanding Common Stock, (ii) each of the executive officers and other persons named in the Summary Compensation Table, (iii) each director and nominee for director, and (iv) all directors and executive officers as a group. Unless otherwise indicated, the address of each listed stockholder is c/o Brocade Communications Systems, Inc., 1745 Technology Drive, San Jose, California 95110.

| | | | | |

Name and Address of Beneficial Owner | | Amount and Nature

of Beneficial

Ownership(1) | | Percent of

Class(2) | |

Capital Group International, Inc.(3) 11100 Santa Monica Boulevard Los Angeles, CA 90025-3384 | | 40,110,270 | | 10.52 | % |

Brookside Capital Partners Fund, L.P.(4) 111 Huntington Avenue Boston, MA 02199 | | 34,383,312 | | 9.02 | % |

Michael Klayko(5) | | 2,270,443 | | | * |

Richard Deranleau(6) | | 360,199 | | | * |

Judy Bruner | | — | | | * |

Renato DiPentima(7) | | 111,451 | | | * |

Alan L. Earhart(8) | | 94,427 | | | * |

John W. Gerdelman(9) | | 221,875 | | | * |

Tejinder (TJ) Grewal(10) | | 782,460 | | | * |

Luc Moyen(11) | | 470,498 | | | * |

Ian Whiting(12) | | 267,046 | | | * |

Glenn Jones(13) | | 55,000 | | | * |

L. William Krause(14) | | 85,230 | | | * |

David L. House(15) | | 130,000 | | | * |

Sanjay Vaswani(16) | | 96,000 | | | * |

All Directors and Executive Officers as a group (17 persons)(17) | | 5,473,234 | | 1.44 | % |

| (1) | Except as indicated in the footnotes to this table and pursuant to applicable community property laws, the persons named in the table have sole voting and investment power with respect to all shares of Common Stock owned by such person. The number of shares beneficially owned includes Common Stock that such individual has the right to acquire as of February 2, 2009 or within 60 days thereafter, including through the exercise of stock options. |

| (2) | Percentage of beneficial ownership is based upon 381,170,418 shares of Common Stock outstanding as of February 2, 2009. For each named person, this percentage includes Common Stock that the person has the right to acquire either currently or within 60 days of February 2, 2009, including through the exercise of an option; however, such Common Stock is not deemed outstanding for the purpose of computing the percentage owned by any other person. |

| (3) | Information based on Schedule 13G/A filed with the SEC on February 12, 2009. |

| (4) | Information based on Schedule 13G/A filed with the SEC on February 17, 2009. |

| (5) | Includes stock options to purchase 1,961,129 shares of Common Stock exercisable as of February 2, 2009 or within 60 days thereafter. Includes 22,889 shares indirectly owned by daughter. |

16

| (6) | Includes stock options to purchase 288,230 shares of Common Stock exercisable as of February 2, 2009 or within 60 days thereafter. |

| (7) | Includes stock options to purchase 75,625 shares of Common Stock exercisable as of February 2, 2009 or within 60 days thereafter. |

| (8) | Alan L. Earhart was appointed to the Board of Directors, effective February 10, 2009. |

| (9) | Includes stock options to purchase 148,375 shares of Common Stock exercisable as of February 2, 2009 or within 60 days thereafter. |

| (10) | Includes stock options to purchase 775,936 shares of Common Stock exercisable as of February 2, 2009 or within 60 days thereafter. |

| (11) | Includes stock options to purchase 470,493 shares of Common Stock exercisable as of February 2, 2009 or within 60 days thereafter. |

| (12) | Includes stock options to purchase 251,197 shares of Common Stock exercisable as of February 2, 2009 or within 60 days thereafter. |

| (13) | Includes stock options to purchase 55,000 shares of Common Stock exercisable as of February 2, 2009 or within 60 days thereafter. |

| (14) | Includes stock options to purchase 85,000 shares of Common Stock exercisable as of February 2, 2009 or within 60 days thereafter. |

| (15) | Includes stock options to purchase 100,000 shares of Common Stock as of February 2, 2009 or within 60 days thereafter. |

| (16) | Includes stock options to purchase 95,000 shares of Common Stock exercisable as of February 2, 2009 or within 60 days thereafter. |

| (17) | Includes stock options to purchase 4,669,677 shares of Common Stock exercisable as of February 2, 2009 or within 60 days thereafter. |

17

PROPOSAL ONE:

ELECTION OF DIRECTORS

We have a classified Board of Directors. The Board of Directors currently consists of nine directors: three Class I directors (whose terms expire in 2009), three Class II directors (whose terms expire in 2010) and three Class III directors (whose terms expire in 2011). At each annual meeting of stockholders, directors are elected for a term of three years and until their respective successors are duly qualified and elected to succeed those directors whose terms expire on the annual meeting dates or such earlier date of resignation or removal.

Board Independence

The Board of Directors has determined that each of its current directors, including all directors standing for reelection, except Mr. Klayko, who currently serves as Brocade’s Chief Executive Officer, is an independent director within the meaning set forth in the NASDAQ rules, as currently in effect.

Nominees

The Nominating and Corporate Governance Committee of the Board of Directors recommended, and the Board of Directors approved, Judy Bruner, David L. House and L. William Krause as nominees for election at the Annual Meeting to Class I of the Board of Directors. If elected, Judy Bruner, David L. House and L. William Krause will serve as directors until our annual meeting in 2012, and until a successor is qualified and elected or earlier resignation or removal. Each of the nominees is currently a director of the Company. Please see “Nominees for Election as Class I Directors — Terms Would Expire at the 2012 Annual Meeting” on page 6 of this Proxy Statement for information concerning our incumbent directors standing for re-election.

Unless otherwise instructed, the proxy holders will vote the proxies received by them FOR Judy Bruner, David L. House and L. William Krause. If the nominees are unable or decline to serve as a director at the time of the Annual Meeting, the proxies will be voted for another nominee designated by the Board of Directors. We are not aware of any reason that a nominee would be unable or unwilling to serve as a director.

Vote Required

Provided a quorum is present, directors are elected by a majority of the votes cast at the annual meeting (i.e., the number of shares voted “for” a director nominee must exceed the number of votes cast “against” that nominee), except in the case of a contested election. If a nominee who is currently serving as a director is not elected at the Annual Meeting, under Delaware law the director will continue to serve on the Board as a “holdover director.” However, as a condition to re-nomination, incumbent directors are required to submit a resignation of their directorships in writing to the Chairman of the Nominating and Corporate Governance Committee of the Board. The resignation will become effective only if the director fails to receive a majority of votes cast for re-election and the Board accepts the resignation. In the event of a contested election in accordance with our Bylaws, directors shall be elected by the vote of a plurality of the votes cast.

Abstentions and broker non-votes will have no effect on the election of directors.

The Board of Directors unanimously recommends that stockholders vote “FOR” the election of each of Judy Bruner, David L. House and L. William Krause.

18

PROPOSAL TWO:

APPROVAL OF THE 2009 STOCK PLAN

The stockholders are being asked to approve a new 2009 Stock Plan (the “Stock Plan”). The Board has adopted the Stock Plan, subject to approval from the stockholders at the Annual Meeting. Our current 1999 Stock Plan (the “1999 Stock Plan”) will expire in 2009. If the stockholders approve the Stock Plan, it will replace the 1999 Stock Plan as of the 2009 Annual Meeting and no further awards will be made under the 1999 Stock Plans thereafter. Regardless of whether the Stock Plan is approved, the 1999 Stock Plan will expire on March 17, 2009 by its terms. The 1999 Stock Plan, however, will continue to govern awards previously granted under it.

The Board believes that long-term incentive compensation programs align the interests of management, employees and the stockholders to create long-term stockholder value. The Board believes that plans such as the Stock Plan increase our ability to achieve this objective, especially, in the case of the Stock Plan, by allowing for several different forms of long-term incentive awards, which the Board believes will help us to recruit, reward, motivate and retain talented personnel. Recent changes in the equity compensation accounting rules make it important to have greater flexibility under the employee equity incentive plan. As the new equity compensation accounting rules come into effect for all companies, competitive equity compensation practices may change materially, especially as they pertain to the use of equity compensation vehicles other than stock options.

The Board believes strongly that the approval of the Stock Plan is essential to our continued success. In particular, the Board believes that employees are our most valuable assets and that the awards permitted under the Stock Plan are vital to attract and retain outstanding and highly skilled individuals in the extremely competitive labor markets in which we compete. Such awards also are crucial to our ability to motivate employees to achieve our goals.

Changes Made in the Stock Plan from the 1999 Stock Plan

The following is a summary of some of the material differences between the Stock Plan and the 1999 Stock Plan.

| | • | | In addition to stock options, restricted stock and restricted stock units, the Stock Plan provides for the grant of stock appreciation rights, performance units, performance shares and other stock or cash awards. |

| | • | | The Company recognizes that “evergreen” provisions have the potential for “built-in” dilution to stockholder value. Therefore to address potential stockholder concerns, the “evergreen” provision that provided for an automatic annual increase in the number of shares available under the 1999 Stock Plan is being eliminated under the 2009 Stock Plan. |

| | • | | The Company recognizes that depleting the Stock Plan’s share reserve by granting awards with an exercise price that is less than the fair market value of the Company’s common stock on the date of grant potentially makes the Stock Plan more costly to its stockholders. Accordingly, in order to address potential stockholder concerns, each award granted with an exercise price that is less than fair market value will count against the Stock Plan’s share reserve as 1.56 shares for every one share subject to such award. |

| | • | | The Stock Plan will prohibit repricings of awards unless stockholder approval is obtained. Accordingly under the Stock Plan, an award can neither be (i) amended to reduce the exercise price of such award nor (ii) cancelled in exchange for cash or other awards with an exercise price that is less than the exercise price of the original award without stockholder approval. |

| | • | | The maximum term of a stock option and stock appreciation right under the Stock Plan will be seven years and the Stock Plan will permit the exercise of a stock option through “net exercise,” where the Company will only issue the net shares representing the gain of an exercised stock option. |

19

| | • | | The Stock Plan will prohibit the right of the Administrator (as defined below) to determine and implement the terms and conditions of any program that would permit participants to transfer for value any outstanding awards to a financial institution or any other person without stockholder approval. |

| | • | | The Stock Plan has been drafted to include limitations to the number of shares that may be granted on an annual basis through individual awards. Additionally, specific performance criteria have been added to the Stock Plan so that the Administrator may establish performance objectives upon achievement of which certain awards will vest or be issued, which in turn will allow the Company to receive income tax deductions under Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”). |

This comparative summary is qualified in its entirety by reference to the Stock Plan itself set forth in Appendix I.

Description of the 2009 Stock Plan

The following is a summary of the principal features of the Stock Plan and its operation. The summary is qualified in its entirety by reference to the Stock Plan itself set forth in Appendix I.

General. The Stock Plan provides for the grant of the following types of incentive awards: (i) stock options, (ii) restricted stock, (iii) restricted stock units, (iv) stock appreciation rights, (v) performance units and performance shares, and (vi) and other stock or cash awards. Each of these is referred to individually as an “Award.” Those who will be eligible for Awards under the Stock Plan include employees, directors and consultants who provide services to the Company and any parent or subsidiary. As of February 2, 2009, approximately 3,586 employees, consultants and directors would be eligible to participate in the Stock Plan. The Stock Plan will remain in effect for a term of 10 years.

Number of Shares of Common Stock Available Under the Stock Plan. The Board has reserved 48 million shares of our common stock for issuance under the Stock Plan, plus any Shares subject to stock options or similar awards granted under the Company’s 1999 Plan, the Company’s 1999 Nonstatutory Stock Option Plan and the 2001 McDATA Equity Incentive Plan that expire or otherwise terminate without having been exercised in full and shares issued pursuant to awards granted under the Company’s 1999 Stock Plan, the Company’s 1999 Nonstatutory Stock Option Plan and the 2001 McDATA Equity Incentive Plan that are forfeited to or repurchased by the Company, with the maximum number of Shares to be added to the Plan pursuant to this clause equal to 40,335,624 shares. The shares may be authorized, but unissued, or reacquired common stock. As of February 19, 2009, no Awards have been granted under the Stock Plan.

Shares subject to Awards of restricted stock, restricted stock units, performance units, and performance shares (“Full Value Awards”) count against the share reserve as 1.56 shares for every share subject to such an Award. To the extent that a share that was subject to a Full Value Award is returned to the Stock Plan, the Stock Plan reserve will be credited with 1.56 shares that will thereafter be available for issuance under the Stock Plan.