Exhibit 99.1

A Perspective on Cash Management in today’s Economy

Hello, my name is Richard Deranleau, and I am the CFO, at Brocade Communications. Well, we are certainly living in extraordinary economic times. Today, I wanted to share my perspective on Cash Management in today’s economy.

There is an old saying that “Cash is King” and that adage certainly holds true today. But what does that mean to a company like Brocade? Because Brocade purchased a company, Foundry Networks, back in December of last year, and used debt to finance a portion of the acquisition, we have to think about our cash and liquidity differently than we used to.

For example, along with the debt comes debt covenants that we need to operate within. For Brocade, the most sensitive debt covenant is the Senior debt to EBITDA (Earnings before Interest, Taxes, Depreciation and Amortization) ratio. In Fiscal year 2009, that covenant is 2.3 and in Fiscal year 2010, the covenant is 2.0. Our covenant is calculated on a 12 month trailing EBITDA basis. When we ended Q1’2009 our actual ratio was 1.9, well below covenant.

We recently held our Quarterly Earnings conference call with investors, where we gave our Outlook for Fiscal Year 2009 and shared some thoughts on how the Company is thinking about FY2010. With that information, Wall Street Industry Analysts create financial models to reflect their view of the Company’s quarterly performance.

So let’s see how they might arrive at Brocade’s expected Free Cash Flow, and how that might impact Brocade’s debt levels and covenant compliance

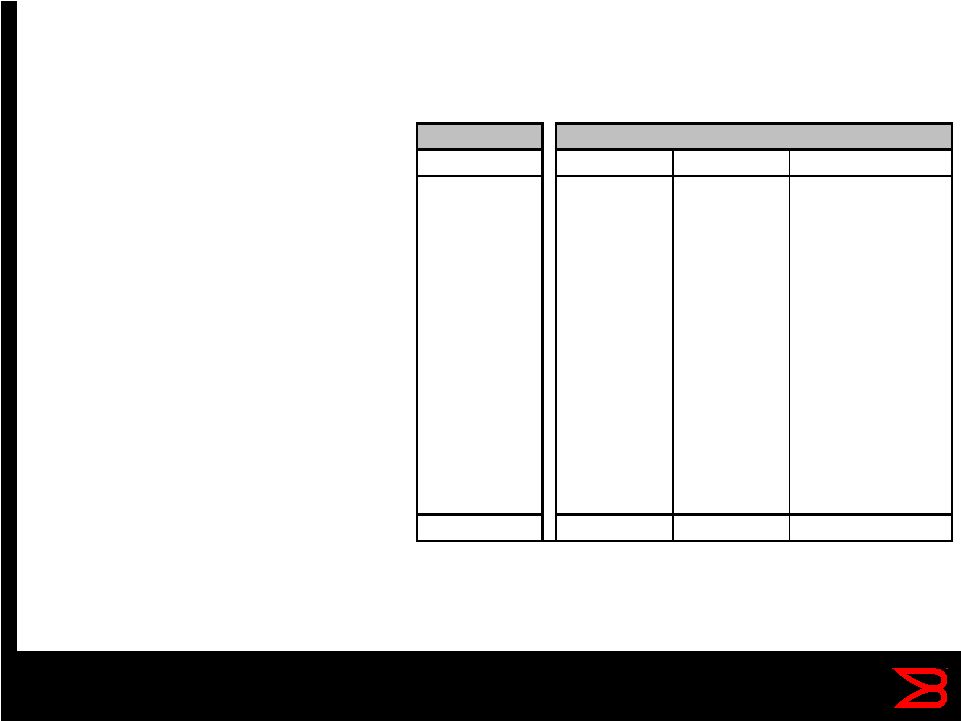

Let’s take a look at Slide #1 – as you can see, based on our guidance we provided on our earnings call, the expected EBITDA for FY2009 would be approximately $345 Million. Using our public statements and public filings, you can extrapolate our EBITDA for 2010 as well, if you use the mid-point on our revenue and Operating margin goals. For the purpose of illustration only, we have used our typical revenue seasonality to shape the quarters in FY2010.

To get to Free Cash Flow, you make some standard additions and subtractions from EBITDA. Those include things like interest, capital expenditures, tax payments and cash from stock option exercises.

As you can see, the Company is expected to generate significant free cash flows for FY2009 and FY2010.

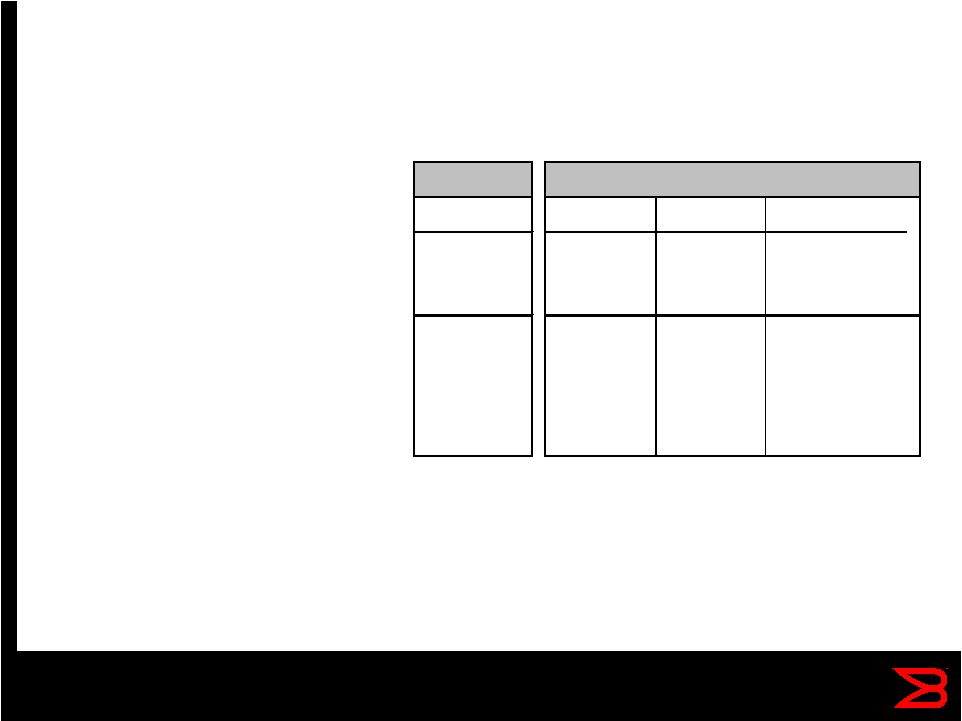

Now let’s take a look at slide #3, and see how Brocade looks at its balance sheet and debt levels. One of the things we have told our investors is that our top priority for cash is paying off the Senior Secured debt, some times referred to as “Term” debt. At the end of our Q1’09 in January, we had approximately $214 million is cash and investments. Because Brocade is typically cash flow positive, we feel that a number close to $200 million is an appropriate level of cash and investments on our balance sheet. That allows us to make extra debt payments with our free cash flow, particularly since we have a credit facility that has $111 Million available that we can borrow.

One other thing we have to think about is what happens when our convertible debt matures in Feb. 2010. That debt totals about $172 million. So as we begin our Q4’2009, we expect to increase our cash levels in anticipation of that debt retirement. Now, we could always consider refinancing that debt with new subordinated debt, but in today’s disrupted capital markets, we have to assume that we are going to pay off that debt at maturity. Plus, an advantage of paying of the debt is that it prevents any potential dilution to earnings. So we prefer just to pay it off. But a good finance person always considers the options.

So what we have seen is that with Brocade’s strong free cash flow, we expect that debt is paid down and covenants are not an issue. But what happens if things go wrong? How does Brocade monitor its liquidity? These are good questions. What Brocade does very well is manage its expenses tightly. Because of our particular business model, over 60% of our quarterly expenses are variable. In addition, Brocade has demonstrated the ability to drive significant cash out of our working capital items, like inventory, account receivables and accounts payable, as we demonstrated in our Q3 and Q4 of Fiscal 2008.

Beyond that, Brocade owns a significant amount of real estate assets, including land, 2 major buildings, one in San Jose and one in Broomfield Co. In addition, we are developing a new Campus that will be opening in late summer 2010. One of the things we could do is to sell the real estate, including the Campus and lease back the property. That could give us significant additional cash to pay down the debt and creates additional cushion on our debt covenants. Also, because we are the owners and developers of the new Campus, this gives us significant control over the extent and the timing of the Campus development. So we can slow it down or defer parts of it to generate additional cash.

So as you can see, we always keep an eye out for trouble and manage our business very carefully, while having options in case something goes wrong. That is what good management has to do in times like these.

So thank you for spending some time with me today, and I hope you found our perspective on Cash Management in today’s economy helpful.

Cash Management in Today’s Economy A Perspective by Brocade’s CFO March 2, 2009 |

® 2009 Brocade Communications Systems, Inc. All rights reserved. Confidential & Proprietary 2 2 Cautionary Statements and Other Disclosures This presentation includes forward-looking statements regarding Brocade's anticipated financial performance, including net income and cash flows and debt covenant compliance. These forward-looking statements are only predictions and involve risks and uncertainties such that actual results may vary significantly. The risks include, but are not limited to, the effect of changes in IT spending levels and our ability to realize anticipated benefits from the acquisition of Foundry. These and other risks are set forth in more detail in our Form 10-Q for the quarter ended January 24, 2009. These forward-looking statements reflect beliefs, assumptions, estimates and predictions as of the original date of this presentation, and Brocade expressly assumes no obligation to update or revise any such forward-looking statements, whether as the result of new developments or otherwise. |

® 2009 Brocade Communications Systems, Inc. All rights reserved. Confidential & Proprietary 3 3 Brocade Cash Flow Assumptions In $ Millions Non-GAAP Net Income (annual) Corresponds to Adjusted EBITDA Minus - Capital Expenditures - New Campus - Capital Expenditures - Operations - Interest Expense - Tax Payments - Equity Grants - Working Capital Adjustments Maturing Convertible Debt Free Cash Flow FY09 FY10 Q2-Q4 Q1 Q2 Total $175 - $225 $50 -$70 $45 - $65 $225 - $275 345 $ 128 $ 125 $ $525 - $575 (65) $ (25) $ (25) $ (100) $ (50) $ (20) $ (20) $ (80) $ (55) $ (17) $ (17) $ $(60) - (70) 10 $ (4) $ (4) $ (15) $ 10 $ 5 $ 5 $ $10-30 20 $ (20) $ 20 $ - $ (173) $ (173) $ 215 $ 47 $ (88) $ $ 97 - 177 |

® 2009 Brocade Communications Systems, Inc. All rights reserved. Confidential & Proprietary 4 4 Brocade Cash Balance and Debt Assumptions In $ Millions FY09 FY10 Q2-Q4 Q1 Q2 Total Senior Secured Debt Beginning 1,114 $ 952 $ 913 $ 952 $ Mandatory Repayments (42) $ (14) $ (14) $ (55) $ Optional Repayments (120) $ (25) $ $(100) -(120) Senior Secured Debt Ending 952 $ 913 $ 900 $ $777 - 797 Senior Secured Leverage Ratio 1.97 1.93 1.87 1.35 - 1.52 Covenant 2.30 2.00 2.00 2.00 Cash Ending 267 $ 275 $ 173 $ $190 - $290 |