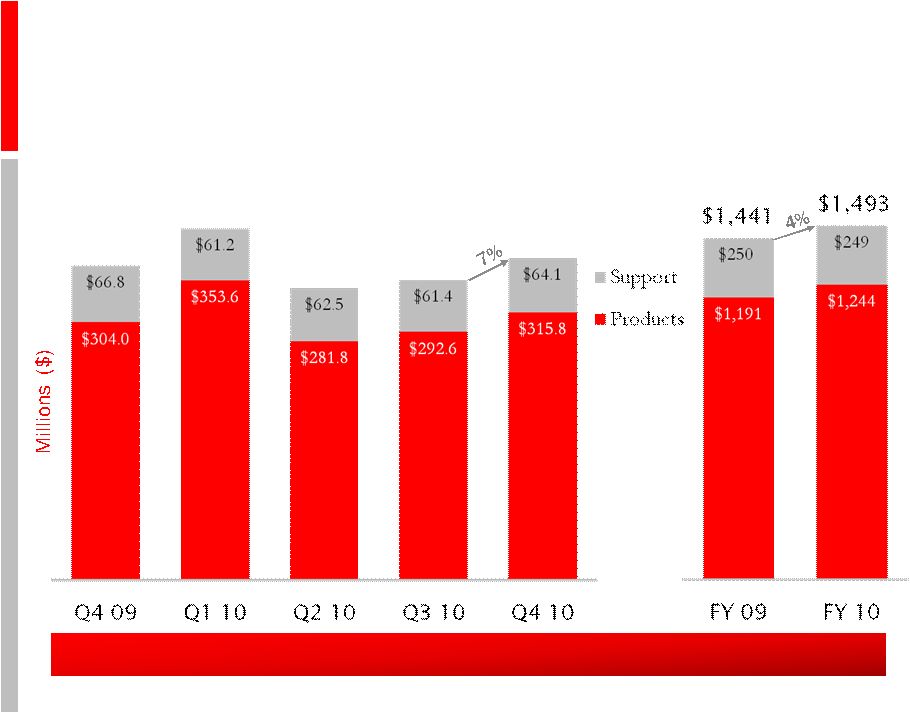

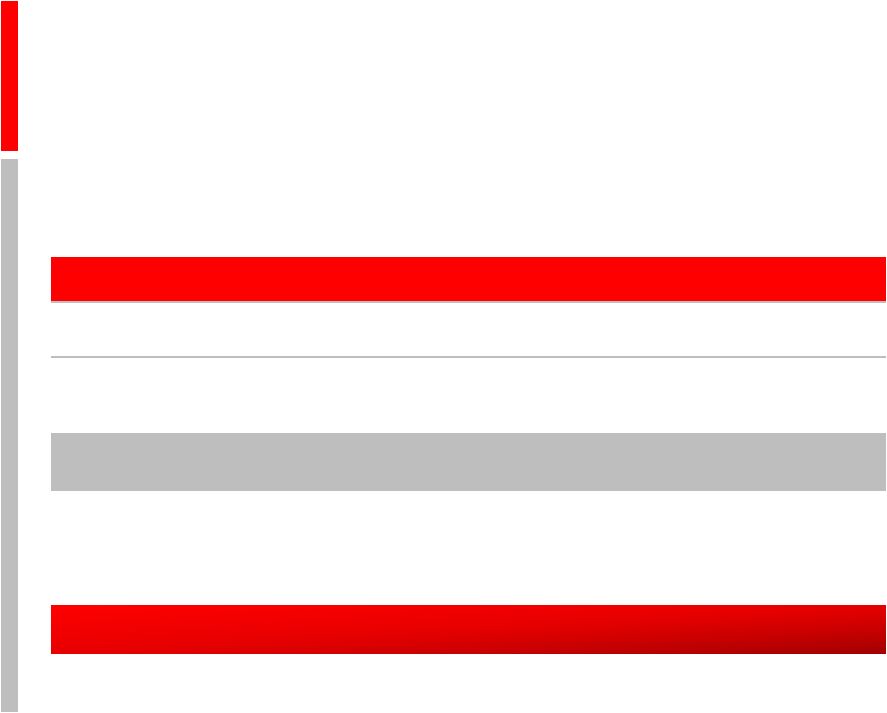

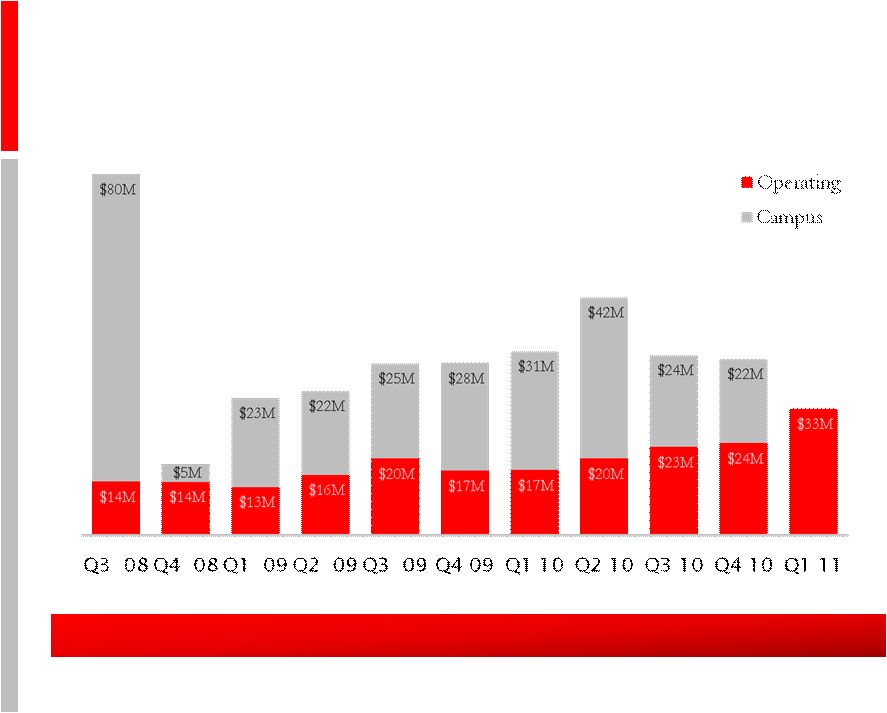

Turning first to revenues, Q4 revenues were $550.4M in a quarter where we experienced strong demand across all of our business segments. Revenues came in at the high end of the guidance we provided on our Q3 earnings call. SAN product revenues were up 7.9% sequentially driven by higher director and server sales, which were up 13.7% and 17.8% respectively. Ethernet product revenues were up 16.8% sequentially driven by growth in the Americas and APAC regions. As Mike mentioned, we continue to be pleased with the performance and growth in our new accounts, specifically in the Americas and APAC regions. Global Services revenues were up 3.6% sequentially driven by higher support and maintenance revenues. OEM inventory levels exiting the quarter were up slightly as OEMs prepared for the end of the calendar year. Based on forward looking demand, we estimate that our partners’ weeks-on-hand inventory is currently at just under 2.5 weeks exiting Q4. Non-GAAP gross margins of 62.3% were up 190 basis points sequentially. The increase in gross margins was principally driven by the increase in revenues and lower period costs in the quarter. Our reported gross margins in Q4 10 and for FY 10 now reflect the change in reporting of System Engineering (SE) spending as discussed at our Analyst Day on September 15. During Q4 10, we reviewed our cost classification, primarily related to our SE costs that were previously classified within cost of revenues. The SE’s primary role has over time migrated from assisting with customer support to primarily performing pre-sales activity to generate future business. As a result of this review, we have reclassified the SE costs within our Consolidated Statements of Operations starting in FY 10. These costs are now presented within sales and marketing expenses, as opposed to cost of revenues. This reclassification did not impact revenue, income from operations, net income, or earnings per share for FY 10. This should also help in peer comparison analysis of non-GAAP gross margin. We will provide a detailed gross margin bridge for Q4 10 and FY 10 by segment later in the presentation. Non-GAAP operating margins were 20.4%. The sequential improvement in operating margin was driven by higher gross margins and operating leverage as we achieved the high end of our revenue guidance for the quarter. Non-GAAP operating expenses grew slower than revenue in Q4 and were down slightly as a percentage of revenue to 41.9%. The increase in operating expense dollars in the quarter was primarily driven by our investments in Ethernet sales and marketing. We hired approximately 130 incremental employees during the quarter. The Q4 10 effective non-GAAP tax rate was 23.2% and effective GAAP tax rate was 20.4%. The FY 10 effective non-GAAP tax rate was 18.9% and effective GAAP tax benefit was negative 7.9%. Both full-year tax rates reflect the benefit that we received in Q3 as we completed various tax audits with the US Federal Government and the State of California, which resulted in a more favorable outcome than expected in our tax reserve position. Looking to the Balance Sheet, Brocade repaid $30.2M of our senior secured debt, of which $25.0M was in excess of the mandatory amount due, bringing our acquisition term debt down to approximately $350M. Total diluted shares were within our expected range for Q4 at 485.7M shares. We did not repurchase any stock during the quarter. |