UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ¨ | | Definitive Proxy Statement |

| |

| x | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material Pursuant to Sec. 240.14a-12 |

Brocade Communications Systems, Inc.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 240.0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

Corporate Governance Update

Brocade Communications Systems, Inc.

March 2015

Cautionary Statements and Disclosures

Please See Risk Factors in Form 10-Q and Form 10-K Filed With the SEC

This presentation includes forward-looking statements regarding Brocade’s financial results, goals, plans, assumptions, strategy, growth, free cash flow, and future dividends and stock repurchases, which are only predictions and involve risks and uncertainties such that actual results may vary significantly. These and other risks are set forth in more detail in our Form 10-Q for the fiscal quarter ended January 31, 2015 and our Form 10-K for the fiscal year ended November 1, 2014. These forward-looking statements reflect beliefs, assumptions and predictions as of today, and Brocade expressly assumes no obligation to update any such forward-looking statements whether as the result of new developments or otherwise.

Certain financial information is presented on a non-GAAP basis. Management believes that the non-GAAP financial measures used in this presentation allow stakeholders to gain a better understanding of Brocade’s comparative operating performance both from period to period, and to its competitors’ operating results. Management also believes these non-GAAP financial measures help indicate Brocade’s baseline performance before gains, losses or charges that are considered by management to be outside of ongoing operating results. Accordingly, management uses these non-GAAP financial measures for planning and forecasting of future periods and in making decisions regarding operations performance and the allocation of resources. The most directly comparable GAAP information and a reconciliation between the non-GAAP and GAAP figures is available at www.brcd.com.

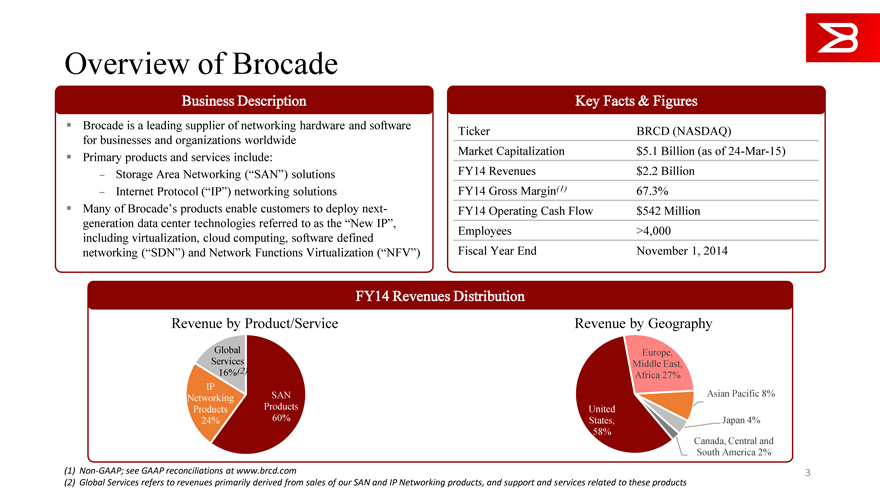

Overview of Brocade

Business Description

? Brocade is a leading supplier of networking hardware and software for businesses and organizations worldwide? Primary products and services include:

– Storage Area Networking (“SAN”) solutions

– Internet Protocol (“IP”) networking solutions

? Many of Brocade’s products enable customers to deploy next-generation data center technologies referred to as the “New IP”, including virtualization, cloud computing, software defined networking (“SDN”) and Network Functions Virtualization (“NFV”)

Key Facts & Figures

Ticker BRCD (NASDAQ)

Market Capitalization $5.1 Billion (as of 24-Mar-15) FY14 Revenues $2.2 Billion FY14 Gross Margin(1) 67.3% FY14 Operating Cash Flow $542 Million Employees >4,000 Fiscal Year End November 1, 2014

FY14 Revenues Distribution

Revenue by Product/Service Revenue by Geography

Global

Services 16%(2)

IP SAN Networking Products Products 60% 24%

Europe, Middle East, Africa 27%

Asian Pacific 8% United States, Japan 4% 58% Canada, Central and South America 2%

(1) Non-GAAP; see GAAP reconciliations at www.brcd.com 3 (2) Global Services refers to revenues primarily derived from sales of our SAN and IP Networking products, and support and services related to these products

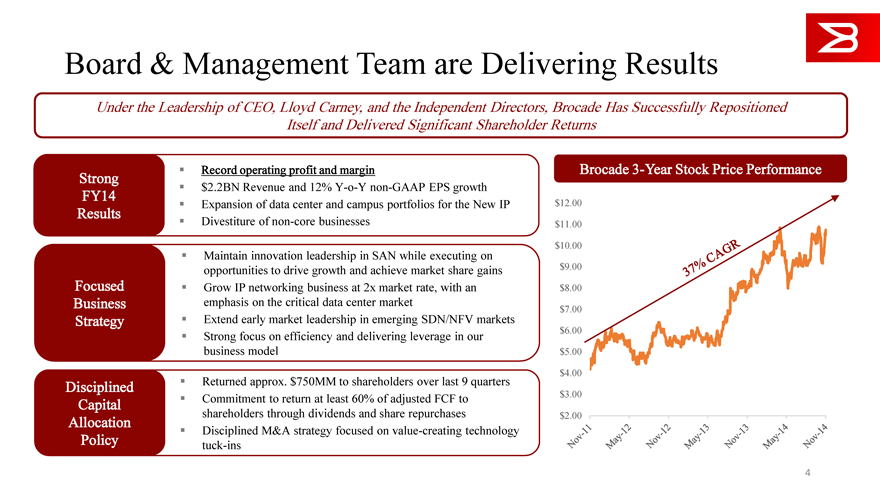

Board & Management Team are Delivering Results

Under the Leadership of CEO, Lloyd Carney, and the Independent Directors, Brocade Has Successfully Repositioned Itself and Delivered Significant Shareholder Returns

Record operating profit and margin

Strong

$2.2BN Revenue and 12% Y-o-Y non-GAAP EPS growth

FY14

Expansion of data center and campus portfolios for the New IP

Results

Divestiture of non-core businesses

Maintain innovation leadership in SAN while executing on opportunities to drive growth and achieve market share gains Focused? Grow IP networking business at 2x market rate, with an Business emphasis on the critical data center market Strategy? Extend early market leadership in emerging SDN/NFV markets Strong focus on efficiency and delivering leverage in our business model

Disciplined Returned approx. $750MM to shareholders over last 9 quarters Capital ? Commitment to return at least 60% of adjusted FCF to shareholders through dividends and share repurchases

Allocation

Disciplined M&A strategy focused on value-creating technology Policy tuck-ins

Brocade 3-Year Stock Price Performance

$12.00

$11.00

$10.00 $9.00 $8.00 $7.00 $6.00 $5.00 $4.00 $3.00 $2.00

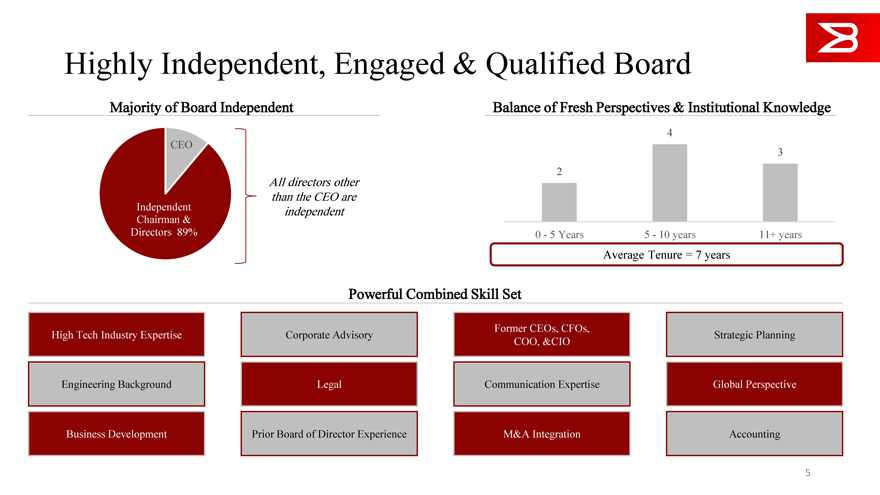

Highly Independent, Engaged & Qualified Board

Majority of Board Independent Balance of Fresh Perspectives & Institutional Knowledge

All directors other Independent than the CEO are independent

Chairman &

Directors 89% 0—5 Years 5—10 years 11+ years

Average Tenure = 7 years

Powerful Combined Skill Set

Former CEOs, CFOs,

High Tech Industry Expertise Corporate Advisory Strategic Planning COO, &CIO

Engineering Background Legal Communication Expertise Global Perspective

Business Development Prior Board of Director Experience M&A Integration Accounting

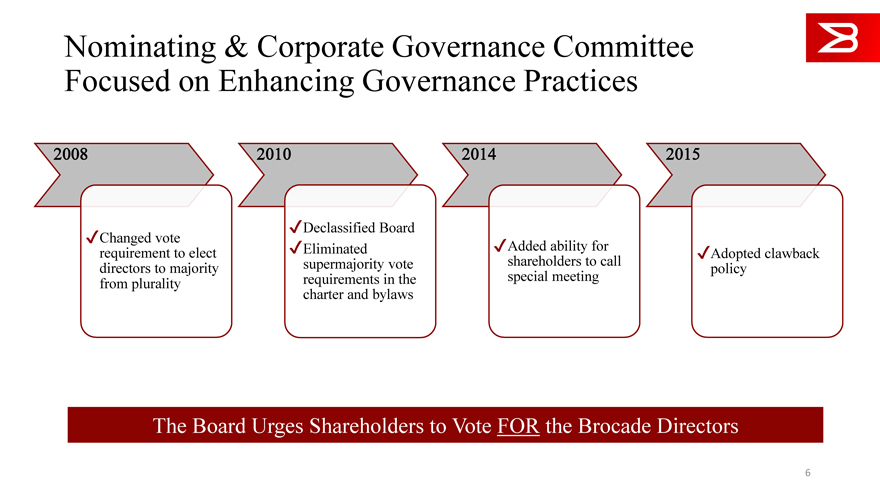

Nominating & Corporate Governance Committee Focused on Enhancing Governance Practices

2008 2010 2014 2015

Declassified Board

Changed vote

Eliminated Added ability for requirement to elect Adopted clawback supermajority vote shareholders to call directors to majority policy requirements in the special meeting from plurality charter and bylaws

The Board Urges Shareholders to Vote FOR the Brocade Directors

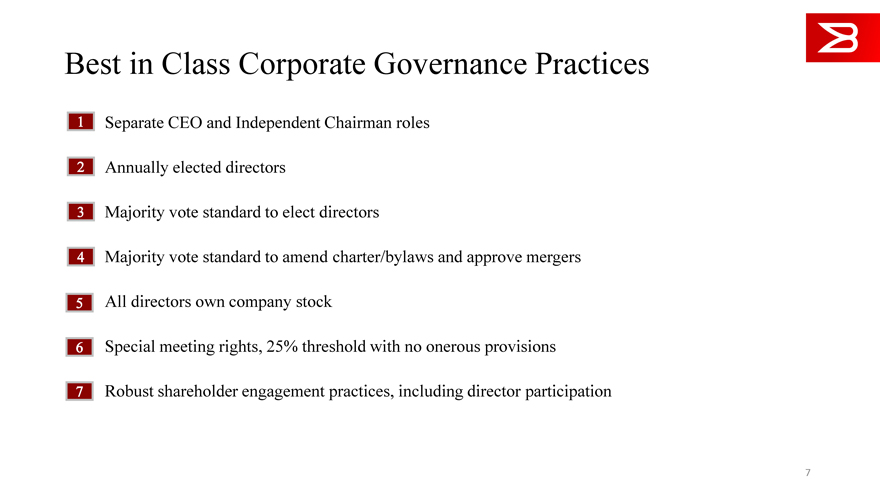

Best in Class Corporate Governance Practices

1 | | Separate CEO and Independent Chairman roles |

2 | | Annually elected directors |

3 | | Majority vote standard to elect directors |

4 | | Majority vote standard to amend charter/bylaws and approve mergers |

5 | | All directors own company stock |

6 | | Special meeting rights, 25% threshold with no onerous provisions |

7 | | Robust shareholder engagement practices, including director participation |

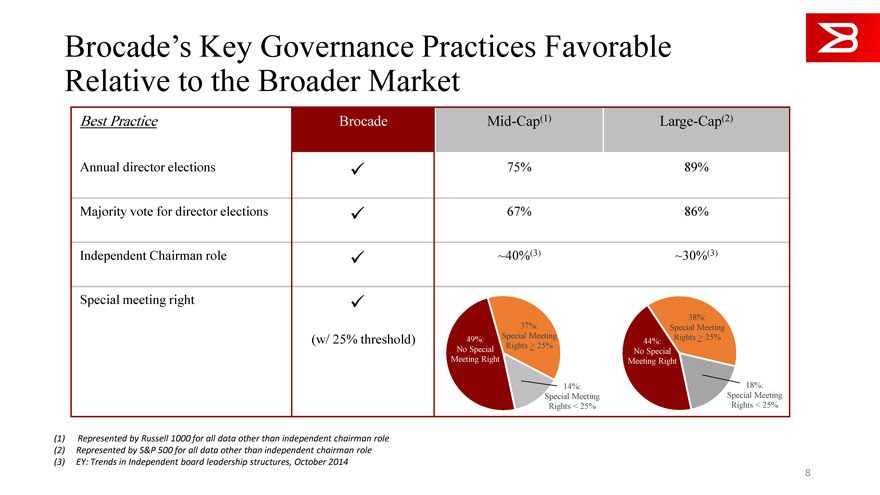

Brocade’s Key Governance Practices Favorable

Relative to the Broader Market

Best Practice Brocade Mid-Cap(1) Large-Cap(2)

Annual director elections? 75% 89% Majority vote for director elections? 67% 86% Independent Chairman role? ~40%(3) ~30%(3)

Special meeting right?

38%: 37%: Special Meeting (w/ 25% threshold) 49%: Special Meeting Rights > 25% 44%: No Special Rights > 25% No Special Meeting Right Meeting Right

14%: 18%: Special Meeting Special Meeting Rights < 25% Rights < 25%

(1) Represented by Russell 1000 for all data other than independent chairman role (2) Represented by S&P 500 for all data other than independent chairman role (3) EY: Trends in Independent board leadership structures, October 2014

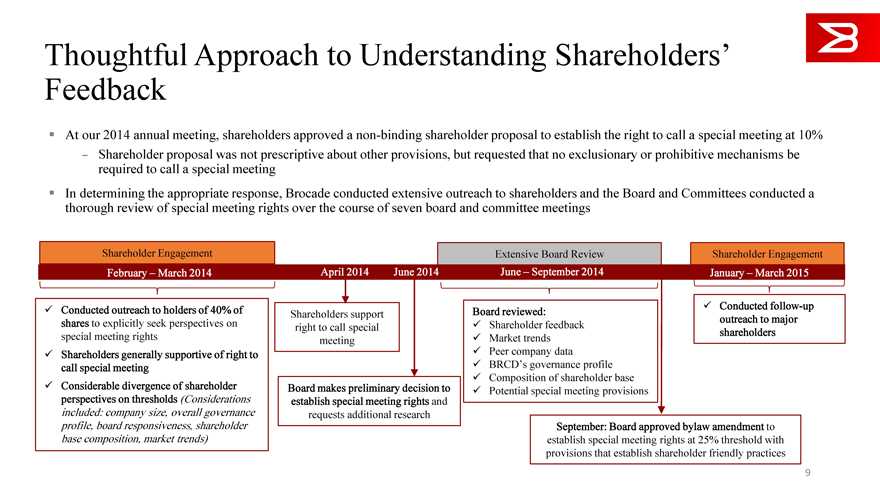

Thoughtful Approach to Understanding Shareholders’ Feedback

At our 2014 annual meeting, shareholders approved a non-binding shareholder proposal to establish the right to call a special meeting at 10%

–Shareholder proposal was not prescriptive about other provisions, but requested that no exclusionary or prohibitive mechanismsberequired to call a special meeting

In determining the appropriate response, Brocade conducted extensive outreach to shareholders and the Board and Committees conducted a thorough review of special meeting rights over the course of seven board and committee meetings

9

Shareholder Engagement Extensive Board Review Shareholder Engagement

February – March 2014 April 2014 June 2014 June – September 2014 January – March 2015

Conducted outreach to holders of 40% of Shareholders support Board reviewed: ? Conducted follow-up

shares to explicitly seek perspectives on right to call special ? Shareholder feedback outreach to major

special meeting rights meeting Market trends shareholders

Shareholders generally supportive of right to Peer company data

call special meeting BRCD’s governance profile

Composition of shareholder base

Considerable divergence of shareholder Board makes preliminary decision to ? Potential special meeting provisions

perspectives on thresholds (Considerations establish special meeting rights and

included: company size, overall governance requests additional research

profile, board responsiveness, shareholder September: Board approved bylaw amendment to

base composition, market trends) establish special meeting rights at 25% threshold with

provisions that establish shareholder friendly practices

9

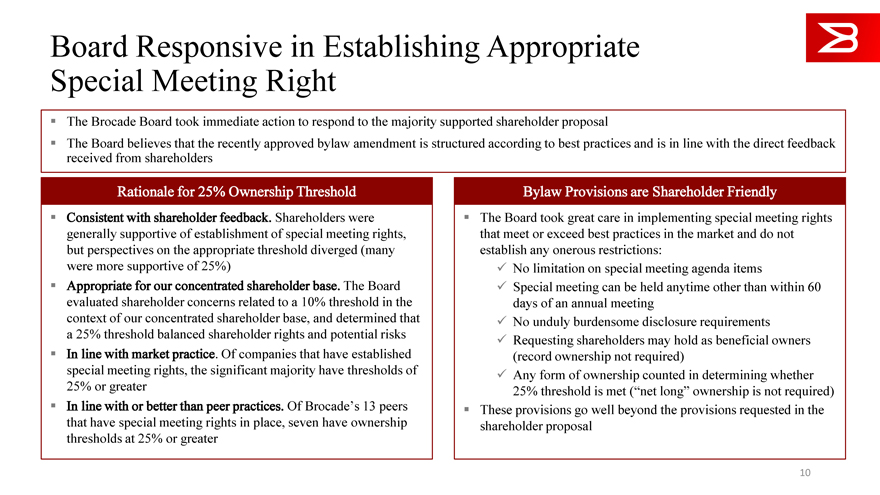

Board Responsive in Establishing Appropriate Special Meeting Right

The Brocade Board took immediate action to respond to the majority supported shareholder proposal

The Board believes that the recently approved bylaw amendment is structured according to best practices and is in line with the direct feedback received from shareholders

Rationale for 25% Ownership Threshold Bylaw Provisions are Shareholder Friendly

Consistent with shareholder feedback. Shareholders were generally supportive of establishment of special meeting rights, but perspectives on the appropriate threshold diverged (many were more supportive of 25%) Appropriate for our concentrated shareholder base. The Board evaluated shareholder concerns related to a 10% threshold in the context of our concentrated shareholder base, and determined that a 25% threshold balanced shareholder rights and potential risks In line with market practice. Of companies that have established special meeting rights, the significant majority have thresholds of 25% or greater In line with or better than peer practices. Of Brocade’s 13 peers that have special meeting rights in place, seven have ownership thresholds at 25% or greater

The Board took great care in implementing special meeting rights that meet or exceed best practices in the market and do not establish any onerous restrictions: No limitation on special meeting agenda items Special meeting can be held anytime other than within 60 days of an annual meeting No unduly burdensome disclosure requirements Requesting shareholders may hold as beneficial owners (record ownership not required) Any form of owners

hip counted in determining whether

25% threshold is met (“net long” ownership is not required)

These provisions go well beyond the provisions requested in the shareholder proposal

10

Board Implementation of Robust Clawback Policy

In January 2015, in response to shareholder feedback, the Board proactively adopted a comprehensive incentive compensation recoupment policy (“clawback policy”)

The Board believes our clawback policy establishes appropriate standards for recouping incentive compensation while providing sufficient detail to appropriately inform and motivate our executives

This policy further strengthens the governance of our compensation program

The Board adopted a clawback policy in advance of expected SEC regulations around compensation recoupment under the Dodd-Frank Act and will revisit the clawback policy once regulations are finalized

The Board will continue to monitor market best-practices on clawback policies

11

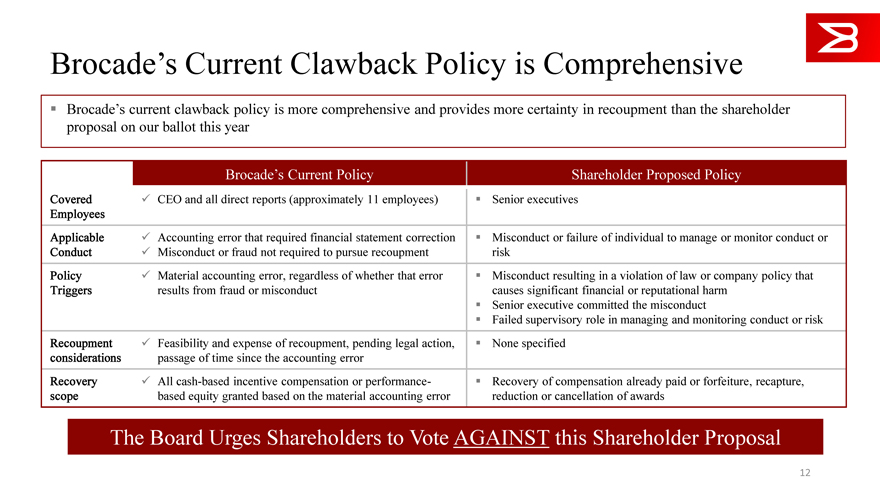

Brocade’s Current Clawback Policy is Comprehensive

Brocade’s current clawback policy is more comprehensive and provides more certainty in recoupment than the shareholder proposal on our ballot this year

Brocade’s Current Policy Shareholder Proposed Policy

Covered CEO and all direct reports (approximately 11 employees) Senior executives Employees

Applicable Accounting error that required financial statement correction Misconduct or failure of individual to manage or monitor conduct or Conduct Misconduct or fraud not required to pursue recoupment risk Policy Material accounting error, regardless of whether that error Misconduct resulting in a violation of law or company policy that Triggers results from fraud or misconduct causes significant financial or reputational harm Senior executive committed the misconduct Failed supervisory role in managing and monitoring conduct or risk Recoupment Feasibility and expense of recoupment, pending legal action, None specified considerations passage of time since the accounting error Recovery All cash-based incentive compensation or performance- Recovery of compensation already paid or forfeiture, recapture, scope based equity granted based on the material accounting error reduction or cancellation of awards

The Board Urges Shareholders to Vote AGAINST this Shareholder Proposal

12