SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

¨ Preliminary Proxy Statement | | ¨ Confidential, for Use of the Commission Only

(as permitted by Rule 14a-6(e)(2)) |

x Definitive Proxy Statement | |

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12

HALL, KINION & ASSOCIATES, INC.

(Name of Registrant as Specified In Its Charter)

--Enter Company Name Here--

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

Notes:

HALL, KINION & ASSOCIATES, INC.

75 Rowland Way, Suite 200

Novato, CA 94945

April 16, 2003

TO THE STOCKHOLDERS OF HALL, KINION & ASSOCIATES, INC.

Dear Stockholder:

You are cordially invited to attend the annual meeting of stockholders (including any adjournments or reschedulings thereof, the “Annual Meeting”) of Hall, Kinion & Associates, Inc. (the “Company”) which will be held at The Stanford Court Hotel, 905 California Street, San Francisco, California, on May 21, 2003, at 2:00 p.m. Pacific Time.

Details of the business to be conducted at the Annual Meeting are given in the attached Proxy Statement and Notice of Annual Meeting of Stockholders.

It is important that your shares be represented and voted at the Annual Meeting.Your vote is important to us regardless of the number of shares you own. Please sign and date the enclosed proxy and return it promptly in the enclosed self-addressed, postage-paid envelope or you may vote your proxy by telephone or on the Internet. As a stockholder you have a unique control number printed on your proxy card along with instructions to assist you in voting by telephone or on the Internet. If you choose either telephone or Internet voting, you may vote as many times as you wish and your latest vote will be the vote counted. If you attend the Annual Meeting, you may also vote in person or by your proxy.

On behalf of the Board of Directors, I would like to express our appreciation for your continued interest in the affairs of the Company. We look forward to seeing you at the Annual Meeting.

Sincerely,

Brenda C. Rhodes

Chief Executive Officer

and Chairman of the Board

HALL, KINION & ASSOCIATES, INC.

75 Rowland Way, Suite 200

Novato, CA 94945

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD May 21, 2003

The annual meeting of the stockholders (including any adjournments or rescheduling thereof, the “Annual Meeting”) of Hall, Kinion & Associates, Inc. (the “Company”) will be held on Wednesday, May 21, 2003, at 2:00 p.m. Pacific Time at The Stanford Court Hotel, 905 California Street, San Francisco, California, for the following purposes:

| | 1. | | To elect two directors of the Board of Directors to serve until the 2006 Annual Meeting or until their successors have been duly elected and qualified; |

| | 2. | | To consider a proposal to approve the 2003 Stock Incentive Plan; |

| | 3. | | To consider a proposal to approve the Non-Employee Director Stock Option Plan; |

| | 4. | | To consider a proposal to ratify the appointment of Deloitte & Touche LLP as the independent public accountants of the Company for the fiscal year ending December 28, 2003; and |

| | 5. | | To transact such other business as may properly come before the Annual Meeting. |

Stockholders of record at the close of business on April 4, 2003 are entitled to notice of, and to vote at, the Annual Meeting and any adjournments or reschedulings thereof. For ten days prior to the Annual Meeting, a complete list of the stockholders entitled to vote at the meeting will be available for examination by any stockholder for any purpose relating to the Annual Meeting during ordinary business hours at the principal office of the Company.

By order of the Board of Directors,

Martin A. Kropelnicki

Secretary

Novato, California

April 16, 2003

IMPORTANT

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE COMPLETE, SIGN, DATE AND PROMPTLY RETURN THE ACCOMPANYING PROXY IN THE ENCLOSED POSTAGE-PAID ENVELOPE. YOU MAY REVOKE YOUR PROXY AT ANY TIME PRIOR TO THE ANNUAL MEETING. IF YOU DECIDE TO ATTEND THE ANNUAL MEETING AND WISH TO CHANGE YOUR PROXY VOTE, YOU MAY DO SO AUTOMATICALLY BY VOTING IN PERSON AT THE ANNUAL MEETING.

HALL, KINION & ASSOCIATES, INC.

75 Rowland Way, Suite 200

Novato, CA 94945

PROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERS

The accompanying proxy is solicited by the Board of Directors of Hall, Kinion & Associates, Inc., a Delaware corporation (the “Company”), for use at the annual meeting of stockholders (including any adjournments or reschedulings thereof, the “Annual Meeting”) to be held Wednesday, May 21, 2003, for the purposes set forth in the accompanying Notice of Annual Meeting. The date of this Proxy Statement is April 16, 2003, the approximate date on which this Proxy Statement and the accompanying form of proxy were first sent or given to stockholders.

PURPOSE OF MEETING

The specific proposals to be considered and acted upon at the Annual Meeting are summarized in the accompanying Notice of Annual Meeting of Stockholders. Each proposal is described in more detail in this Proxy Statement.

VOTING RIGHTS AND SOLICITATION OF PROXIES

The Company’s Common Stock is the only security entitled to vote at the Annual Meeting. On April 4, 2003, the record date for determination of stockholders entitled to vote at the Annual Meeting, there were 12,582,263 shares of Common Stock outstanding. Each stockholder of record on April 4, 2003 is entitled to one vote for each share of Common Stock held. All votes will be tabulated by the inspector of election appointed for the meeting, who will separately tabulate affirmative and negative votes, abstentions, and broker non-votes.

Quorum Required

The Company’s bylaws provide that the holders of a majority of the Company’s Common Stock issued and outstanding and entitled to vote at the Annual Meeting, present in person or represented by proxy, shall constitute a quorum for the transaction of business at the Annual Meeting. Abstentions and broker non-votes will be counted as present for the purpose of determining the presence of a quorum.

Votes Required

Proposal 1. Directors are elected by a plurality of the affirmative votes cast by those shares present in person or represented by proxy and entitled to vote at the Annual Meeting. The nominees for director receiving the highest number of affirmative votes will be elected. Abstentions and broker non-votes will not be counted towards a nominee’s total. Stockholders may not cumulate votes in the election of directors.

Proposal 2 and Proposal 3. Approval of the 2003 Stock Incentive Plan and approval of the Non-Employee Director Stock Option Plan each require the affirmative vote of a majority of those shares present in person, or represented by proxy, at the Annual Meeting. Abstentions and broker non-votes will not be counted as having been voted on the proposal, although they will have the effect of negative votes since they are counted as present for purposes of determining whether a quorum is present.

Proposal 4. Ratification of the appointment of Deloitte & Touche LLP as the Company’s independent public accountants for the fiscal year ending December 28, 2003, requires the affirmative vote of a majority of those shares present in person, or represented by proxy, at the Annual Meeting. Abstentions and broker non-votes will not be counted as having been voted on the proposal.

GENERAL INFORMATION

Annual Report. An annual report for the fiscal year ended December 29, 2002 is enclosed with this Proxy Statement.

Solicitation of Proxies. The cost of soliciting proxies, including the preparation, assembly, printing and mailing of this Proxy Statement, the proxy and any additional soliciting material furnished to stockholders, will be borne by the Company. The Company has engaged Georgeson Shareholder Communications, Inc. as the Proxy Solicitor for the Annual Meeting for an approximate fee of $15,000 plus expenses. In addition to soliciting stockholders by mail through its regular employees, the Company will request banks and brokers, and other custodians, nominees and fiduciaries, to solicit their customers who have stock of the Company registered in the names of such persons and will reimburse them for their reasonable, out-of-pocket costs. The Company may use the services of its officers, directors, and others to solicit proxies, personally or by telephone, without additional compensation. Except as described above, the Company does not presently intend to solicit proxies other than by mail.

Voting of Proxies. All valid proxies received prior to the Annual Meeting will be voted. All shares represented by a proxy will be voted, and where a stockholder specifies by means of the proxy a choice with respect to any matter to be acted upon, the shares will be voted in accordance with the specification so made. If no choice is indicated on the proxy, the shares will be voted in favor of the proposal. A stockholder giving a proxy has the power to revoke his or her proxy, at any time prior to the time it is voted, by delivery to the Secretary of the Company of a written instrument revoking the proxy or a duly executed proxy with a later date, or by attending the Annual Meeting and voting in person. A majority of the shares of Common Stock of the Company present at the Annual Meeting, in person or by proxy, whether or not constituting a quorum, may vote to, or the Company’s Board in its discretion may, adjourn the Annual Meeting from time to time without further notice. Proxies containing a vote against the proposals presented in this Proxy Statement will not be used to vote in favor of any such adjournment.

Voting on the Internet or By Phone.In order to cast your vote on the Internet or by phone follow the instructions set forth on your Proxy Card.

2

PROPOSAL 1

ELECTION OF DIRECTORS

The Company has a classified Board of Directors that currently consists of three Class I directors (Herbert I. Finkelman, Jack F. Jenkins-Stark, and Michael S. Stein), one Class II director (Todd J. Kinion), and two Class III directors (Brenda C. Rhodes and Jon H. Rowberry). The terms of the Class I directors expire at the annual meeting to be held in 2004, and the term of the Class II director expires at the annual meeting to be held in 2005 and when their successors are duly elected. The terms of the Class III directors expire at the Annual Meeting and when their successors are duly elected. At each Annual Meeting of Stockholders, directors are elected for a full term of three years to succeed any directors whose terms expire on the Annual Meeting of Stockholders date.

Information regarding the directors who are being nominated for election to the Board of Directors (the “Nominees”), including their ages as of April 4, 2003, positions and offices held with the Company and certain biographical information is set forth below. The Nominees have agreed to serve if elected, and management has no reason to believe that the Nominees will be unavailable to serve. In the event any Nominee is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee who may be designated by the present Board of Directors to fill the vacancy. Unless otherwise instructed, the proxy holders will vote the Proxies received by them FOR the Nominees named below. The two Nominees receiving the highest number of affirmative votes of the shares represented and voting on this proposal at the Annual Meeting will be elected as directors of the Company.

Nominee

| | Age

| | Positions & Offices Held with the Company

|

Brenda C. Rhodes | | 50 | | Director and Chief Executive Officer |

Jon H. Rowberry (1) | | 56 | | Director |

| (1) | | Member of the Audit Committee |

Brenda C. Rhodes, 50, co-founded the Company and has been a director since the Company’s incorporation in 1991. From December 1992 to the present, Ms. Rhodes has served as Chief Executive Officer of the Company. Ms. Rhodes also served as President and Assistant Secretary of the Company from December 1991 to October 1996 and from December 1991 to September 1996, respectively. From August 1981 to June 1987, Ms. Rhodes was general manager of a Snelling & Snelling franchise, a personnel services company.

Jon H. Rowberry, 56, has been a director of the Company since August 1996. Mr. Rowberry is currently Chief Executive Officer of The Galileo Initiative, a provider of corporate training products and services. Prior to his current position, Mr. Rowberry served as an independent business consultant from August 1999 through December 2001. Previously Mr. Rowberry had served as President of Franklin Covey, Inc. (“Franklin Covey”), a provider of time management products and training, until July 1999. Mr. Rowberry was President of Franklin Covey from March 1997 to March 1998, Chief Operating Officer from August 1996 to March 1997 and Chief Financial Officer from August 1995 to August 1996. From 1985 to 1995, Mr. Rowberry also was employed in several executive positions with Adia S.A. and Adia Services, Inc., providers of personnel services. Mr. Rowberry holds a B.S. degree in Accounting from Brigham Young University.

Continuing Directors—Terms Ending in 2004

Set forth below is information regarding the continuing directors of the Company, including their ages, the period during which they have served as directors, and information furnished by them as to principal occupation and directorships held by them in corporations whose shares are publicly registered.

Herbert I. Finkelman, 67,has been a director of the Company since July 2000. Mr. Finkelman is currently a partner in Cliff Ventures, LLC, a privately held venture capital firm. Prior to joining Cliff Ventures, LLC, Mr. Finkelman was CEO of a Snelling & Snelling franchise, a personnel services company, from February 1979

3

to August 1996. Prior to 1979, Mr. Finkelman served as President/Chief Executive Officer of Metaframe Corp., a subsidiary of Mattel, Inc., a leisure products manufacturing company and CFO of Barco, a uniform manufacturing company. Mr. Finkelman holds a B.S. degree in Industrial Engineering from San Jose State University.

Jack F. Jenkins-Stark, 52, has been a director of the Company since July 2000. Mr. Jenkins-Stark is currently Senior Vice President and Chief Financial Officer of Silicon Energy Corporation, a global leader in web-based enterprise energy management for commercial and industrial customers, energy service providers, and utilities. Mr. Jenkins-Stark also serves on the TC Pipelines L.P. board of directors, audit and compensation committee and is chair of the conflicts committee. Prior to holding these positions, Mr. Jenkins-Stark served as Senior Vice President and Chief Financial Officer of GATX Capital and held senior management positions at Pacific Gas and Electric Corporation, rising to Senior Vice President of Pacific Gas and Electric Corporation and President and CEO of Pacific Gas and Electric Gas Transmission Company. Mr. Jenkins-Stark holds a B.A. and M.A. degree in Economics from the University of California, Santa Barbara, and a MBA in Finance from the University of California, Berkeley.

Michael S. Stein, 37,has been a director of the Company since July 2000. Mr. Stein is currently Senior Vice President at Equity Management Incorporated, the worldwide leader in the management of corporate trademark licensing programs. Prior to December 31, 2000, Mr. Stein was the Chief Executive Officer of E-Zone Networks, Inc., the developers of an interactive media network that delivers media-rich programming and e-commerce functionality to target communities of individuals. Prior to joining E-Zone Networks, Inc., Mr. Stein served as Senior Vice President of Sales and Marketing for StairMaster, Brand Manager of Sales and Marketing for Warner Bros., was the founder, President and Chief Executive Officer of Pro Sport, Director of Marketing for International Corporate Athletic Center, Account Executive for Howard Marlboro Group (a division of Saatchi & Saatchi) and a stockbroker for Financial Network Investment Corporation. Mr. Stein holds a B.S. degree in International Finance and Marketing from the University of Southern California.

Continuing Directors—Terms Ending in 2005

Todd J. Kinion, 41, co-founded the Company and has been a director of the Company since the Company’s incorporation in 1991. Since August 1996, Mr. Kinion has been a private investor. Mr. Kinion served as Vice President, Recruitment Services of the Company from December 1995 to August 1996. Prior to that time, Mr. Kinion served as Chief Financial Officer and Treasurer of the Company from December 1991 to December 1995. Mr. Kinion also served as Secretary from December 1991 to February 1997. Mr. Kinion holds a B.A. degree in Political Science from the University of California, Santa Barbara.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE NOMINEES LISTED ABOVE.

CORPORATE GOVERNANCE

General

Hall Kinion has always believed that good corporate governance is critical to ensuring that the Company is managed for the long-term benefit of its stockholders. During the past year, the Board has reviewed its corporate governance policies and practices, comparing them to those suggested by various authorities and practices of other companies. The Board has also considered the provisions of the Sarbanes-Oxley Act of 2002, the new and proposed rules of the Securities and Exchange Commission and the proposed new listing standards of Nasdaq National Market.

Based on these reviews, the Board took steps to voluntarily implement many of the proposed new rules and listing standards, including the adoption of corporate governance guidelines, reconstituting its committee

4

structure to create a Nominating and Corporate Governance Committee and adopted a new charter for this committee and adopted new charters for the Audit Committee and Compensation Committee. The Company also reviewed its existing Code of Ethics and approved a new Code of Ethics for Senior Officers. Copies of the current charters of each of the standing Committees are attached to this Proxy Statement and can be accessed through the Company’s Web site. The Web site has been expanded by providing access to the Company’s Code of Ethics and will soon include the Code of Ethics for Senior Officers.

Meetings and Committees of the Board of Directors

During the fiscal year ended December 29, 2002, the Board of Directors met fifteen times. In addition to the full Board meetings, some directors also attended meetings of Board committees. The Board of Directors has an Audit Committee, a Compensation Committee and is creating a Nominating and Corporate Governance Committee. All committees are comprised entirely of independent directors.

The Audit Committee assists the Board in fulfilling its responsibility to oversee (1) management’s conduct of the Company’s financial reporting, including overview of the financial reports and other financial information provided by the Company to any governmental or regulatory body, the public or others, (2) the Company’s systems of internal accounting, financial controls, and internal audit, (3) the annual independent audit of the Company’s financial statements and selection of an independent auditor, and (4) the Company’s legal compliance programs. The Committee is also responsible for (1) the appointment, compensation and oversight of any independent public accounting firm employed by the Company to audit its financial statements and (2) the review and approval of all audit and permitted non-audit services provided by the Company’s independent public accounting firm. The Audit Committee consists of Messrs. Rowberry, who is Chairman, Jenkins-Stark and Kinion, and met five times during the fiscal year ended December 29, 2002. See Appendix 1 for a copy of the Audit Committee charter.

The Compensation Committee is authorized by the Board of Directors to set salaries and incentive compensation, stock options and retirement plans for the Company’s executive officers and employees. The Compensation Committee consists of Messrs. Finkelman, who is Chairman, Jenkins-Stark and Stein, and met three times during the fiscal year ended December 29, 2002. See Appendix 2 for a copy of the Compensation Committee charter.

The new Nominating and Corporate Governance Committee is authorized by the Board of Directors to identify, screen and recommend qualified candidates to serve as directors of the Company, administer the corporate governance policies of the Company and maintain and oversee the operations and effectiveness of the Board of Directors. The Nominating and Corporate Governance Committee consists of Mr. Kinion, who is Chairman, Mr. Rowberry and Mr. Finkelman, and did not meet in 2002. See Appendix 3 for a copy of the Nominating and Corporate Governance charter.

During the fiscal year ended December 29, 2002, all of the directors attended at least 75% of all of the meetings of the Board of Directors and those committees on which they served during the year.

For information regarding compensation received by directors, see “Executive Compensation and Other Information-Compensation of Directors” and “Certain Relationships and Other Transactions.”

Corporate Governance Guidelines

The Board has adopted Guidelines on Corporate Governance. These Guidelines are published on the Company’s Web site. Among other matters, the Guidelines include the following:

| | • | | A substantial majority of the members of the Board are independent, as defined in applicable rules for companies traded on the Nasdaq National Market; |

| | • | | Members of the Audit, Compensation, and Nominating and Corporate Governance Committees consist entirely of independent directors; |

| | • | | The Board and its Committees will develop a process for periodic self-assessment; |

5

| | • | | At least annually, the Board will conduct a formal evaluation of the chief executive officer; |

| | • | | The Board will confer periodically with the chief executive officer regarding succession planning and management development; and |

| | • | | Independent directors will meet in executive session on a regular basis. |

6

PROPOSAL 2

ADOPT THE 2003 STOCK INCENTIVE PLAN

At the Annual Meeting, stockholders will be asked to approve the Company’s 2003 Stock Incentive Plan (the “Incentive Plan”), which was adopted by the Company’s Board of Directors (the “Board”) on April 7, 2003, subject to approval by the Company’s stockholders.

Why Are We Seeking Approval of a New Incentive Plan?

In connection with a review of the Company’s compensation programs for its executive group, the Compensation Committee engaged a nationally recognized independent compensation consulting firm to review the Company’s compensation programs, including the mix of cash and equity compensation and to make recommendations to the Committee and the Board. The consulting firm recommended that compensation in the form of equity be more closely tied to performance and linked to the long-term interests of stockholders. The consulting firm advised the Compensation Committee that the existing stock option plans did not provide adequate flexibility to tailor incentive awards to specific business unit long-term performance measures and that an omnibus plan of the type being submitted to stockholders for approval was more efficient and effective.

The Company currently has three stock option plans in effect, covering an aggregate of 5,610,507 shares of common stock, of which options for 4,036,212 shares are currently outstanding. Two of the plans contain evergreen provisions under which additional shares are added to such plans each year (based on the percentage of shares outstanding, for each of the plans, at the beginning of the year). For 2003, there were 570,792 shares added in total. The existing plans cover approximately 31% of the Company’s outstanding stock on a fully diluted basis. Each of the plans has somewhat different provisions and restrictions, which hamper effective use and efficient administration of the plans. The older plans also do not take into account recent developments in compensation plans or provide flexibility in the type of awards that may be granted in order to maximize participant retention and equity linkage to long-term Company performance. Accordingly, the Company is proposing the adoption of the new Incentive Plan, which provides broad flexibility to the Board and the Compensation Committee to provide equity-based incentives to participants. Directors who are not employees are not permitted to participate in the new Incentive Plan.

In connection with the proposed new Incentive Plan, the Board will freeze all of the existing plans, and no new options will be granted under the old plans. The new Incentive Plan will be the exclusive vehicle for the grant of equity-based incentives to employees and independent contractors. The new Incentive Plan will eliminate the evergreen provisions contained in two of the old plans. The new Incentive Plan does not permit repricing of awards.

The new Incentive Plan provides for the grant of awards covering up to 1,500,000 shares of common stock or approximately 8% of the outstanding stock, on a fully diluted basis, in addition to the 5,610,507 shares available under the old plans, which will be available for grant under the Incentive Plan if it is approved by stockholders. The new Incentive Plan contains a provision that increases the number of shares covered thereby in the event the Company issues new shares in connection with a financing or acquisition with an unrelated party, provided that the number of shares covered by the new Incentive Plan may never exceed 40% of the Company’s outstanding shares on a fully diluted basis.

The Company believes that the new Incentive Plan will provide significant benefits to the Company and its stockholders with resulting dilution falling within acceptable limits.

The following summary of the Incentive Plan is qualified in its entirety by reference to the complete text of the Incentive Plan, which is set forth as Appendix 4 to this Proxy Statement.

General Information

The Incentive Plan provides for the issuance of various types of equity-based awards to employees, independent contractors and consultants (each, a “Participant”) of the Company or any of its direct or indirect subsidiaries, or any of its affiliates, or any entity that becomes a subsidiary after adoption of the Incentive Plan. The purpose of the Incentive Plan is to effectively link incentive awards to the long-term performance of the Company and to enable the Company and its subsidiaries to attract, retain and motivate Participants by providing for or increasing the proprietary interests of those Participants in the Company.

7

Awards

The Compensation Committee of the Board (the “Committee”), on behalf of the Company, is authorized under the Incentive Plan to enter into any type of arrangement with a Participant that is not inconsistent with the provisions of the Incentive Plan. The entering into of any such arrangement is referred to as a “grant” of an “Award.” The Compensation Committee of the Board consists entirely of independent directors.

Awards are not restricted to any specified form or structure and may include, without limitation, sales or bonuses of stock, performance-based restricted stock, stock options, stock purchase warrants, other rights to acquire stock, securities convertible into or redeemable for stock, stock appreciation rights, phantom stock, performance units or performance shares, and an Award may consist of one such security or benefit or two or more of them in tandem or in the alternative. Awards of restricted stock may not exceed 25% of the awards granted under the Incentive Plan. In addition, in no event may the total number of shares granted in any one year under the Incentive Plan to any one individual exceed 500,000 shares.

Awards may be granted, and shares of the common stock may be issued pursuant to Awards, for any lawful consideration, as determined by the Committee, including services rendered or to be rendered by recipients of Awards.

Subject to the provisions of the Incentive Plan, the Committee, in its sole and absolute discretion, determines all of the terms and conditions of each Award granted under the Incentive Plan, which terms and conditions may include, among other things:

(i) a provision permitting the recipient of the Award to pay the purchase price of the common stock or other property issuable pursuant to the Award, or the recipient’s tax withholding obligation with respect to the issuance, in whole or in part, by any one or more of (a) the delivery of cash, (b) the delivery of other property deemed acceptable by the Committee, (c) the delivery of previously owned shares of capital stock of the Company, or (d) a reduction in the amount of common stock or other property otherwise issuable pursuant to the Award;

(ii) a provision conditioning or accelerating the receipt of benefits pursuant to Award upon the occurrence of specified events, including, without limitation, a change of control of the Company (as defined by the Committee), an acquisition of a specified percentage of the voting power of the Company, the dissolution or liquidation of the Company, a sale of substantially all of the property and assets of the Company, a recapitalization of the Company or termination of employment or association of a participant;

(iii) a provision relating to the status of Awards to qualify as an Incentive Stock Option under Section 422 of the Internal Revenue Code of 1986, as amended (the “Code”);

(iv) a provision that upon a termination of employment for cause, the Participant will not be entitled to exercise any Award or other rights at any time after such termination; and

(v) a provision entitling a Participant (or a permitted transferee of such Participant’s rights) to exercise nonstatutory stock options for an extended period from the date of the Participant’s normal retirement from employment in accordance with the Company’s then-current retirement policy, to the extent the Participant (or permitted transferee) was entitled to exercise such nonstatutory stock options on the date of the Participant’s retirement, provided that the exercise is in no event after expiration of the term of the option.

All grants of Awards under the Incentive Plan, which are Incentive Stock Option Awards, will be at 100% of the Fair Market Value (as defined below) of the shares underlying the common stock as of the date of grant.

Exercise and Termination of Awards

The terms and conditions applicable to the exercise of Awards and the events or occurrences which may trigger the acceleration, termination or forfeiture of such Awards under the Incentive Plan will be set forth in the applicable Awards agreements entered into between the Company and the respective Participants.

8

Definition of Fair Market Value

For purposes of the Incentive Plan, “Fair Market Value” of the common stock means (i) if the common stock is listed on the Nasdaq National Market, the closing sales price on the relevant date as reported in theWall Street Journal, (ii) if the common stock is not listed on the Nasdaq National Market, the average of the closing bid and asked prices per share in the over-the-counter market as quoted on Nasdaq on the relevant date, or (iii) if the common stock is not listed on the Nasdaq National Market or quoted on Nasdaq, an amount determined in good faith by the Board or the Committee.

Stock Subject to the Incentive Plan

The aggregate number of shares of common stock issued and issuable pursuant to incentive stock options (“Incentive Stock Options”) granted under the Incentive Plan may not exceed 5,000,000 shares, and the aggregate number of shares issued and issuable pursuant to all Awards (including all Incentive Stock Options) granted under the Incentive Plan may not exceed 7,110,507 shares, plus 40% of any shares issued in the future in connection with a financing or acquisition with an unrelated party; provided, however, that the maximum number of shares issuable under the Incentive Plan, will in no event exceed 40% of the outstanding stock on a fully diluted basis.

The aggregate number of shares issued and issuable pursuant to Awards granted under the Incentive Plan at any time will be deemed to be equal to the sum of (i) the number of shares that were issued prior to that time pursuant to Awards granted under the Incentive Plan, other than shares that were subsequently reacquired by the Company pursuant to the terms and conditions of those Awards and with respect to which the holder thereof received no benefits of ownership, such as dividends, plus (ii) the maximum number of shares that are or may be issuable at or after that time pursuant to Awards granted under the Incentive Plan prior to that time.

Duration

No Awards may be made under the Incentive Plan after April 7, 2008. Although shares of the common stock may be issued after April 7, 2008 pursuant to Awards made on or prior to that date, no shares will be issued under the Incentive Plan after April 7, 2018.

Administration

The Incentive Plan is administered by the Committee consisting entirely of independent directors. Subject to the provisions of the Incentive Plan, the Committee is authorized and empowered to do all things necessary or desirable in connection with the administration of the Incentive Plan, including, without limitation (i) adopting, amending and rescinding rules and regulations relating to the Incentive Plan; (ii) determining which persons are Participants and to which of such Participants, if any, Awards will be granted; (iii) granting Awards to Participants and determining the terms and conditions thereof, including the number of shares issuable pursuant thereto; (iv) accelerating the exercisability of an Award or extending the period during which an owner of an Award may exercise his or her rights under such Award (but not beyond the termination date of the Incentive Plan); (v) determining whether and the extent to which adjustments are required pursuant to the Incentive Plan in the event of a recapitalization of the Company; and (vi) interpreting and construing the Incentive Plan and the terms and conditions of any Award granted under the Incentive Plan. The Incentive Plan prohibits repricing of awards and the issuance of new awards in exchange for cancellation of outstanding awards. The Committee has the authority to delegate to the chief executive officer the power to grant awards to individuals who are not officers, subject to a limit of 10% of the shares covered by Awards.

Adjustments

If the outstanding securities of the class then subject to the Incentive Plan are increased, decreased or exchanged for or converted into cash, property or a different number or kind of securities, or if cash, property or securities are distributed in respect of those outstanding securities, in any case as a result of a reorganization,

9

merger, consolidation, recapitalization, restructuring, reclassification, dividend (other than a regular quarterly cash dividend) or other distribution, stock split, reverse stock split or the like, or if substantially all of the property and assets of the Company are sold, then, unless the terms of the transaction provide otherwise, the Committee will make appropriate adjustments in (i) the number and type of shares or other property that may be acquired pursuant to Incentive Stock Options and other Awards previously granted under the Incentive Plan, (ii) the maximum number and type of shares or other securities that may be issued pursuant to Incentive Stock Options and other Awards thereafter granted under the Incentive Plan, and (iii) the maximum number of shares for which Awards may be granted during any one calendar year; provided, however, that no adjustment may be made to the number of shares that may be acquired pursuant to outstanding Incentive Stock Options or the maximum number of shares with respect to which Incentive Stock Options may be granted under the Incentive Plan to the extent the adjustment would result in those options being treated as other than Incentive Stock Options; provided, further, that no adjustment will be made to the extent the Committee determines that the adjustment would result in the disallowance of a federal income tax deduction for compensation attributable to Awards by causing the compensation to be other than “performance-based compensation” within the meaning of Section 162(m)(4)(C) of the Code.

Amendment and Termination

The Board may amend or terminate the Incentive Plan at any time and in any manner, provided that:

(i) no such amendment or termination may deprive the recipient of any Award or right previously granted under the Incentive Plan, without the consent of such recipient, and

(ii) each amendment to the Incentive Plan will require approval by the Company’s stockholders, to the extent required to comply with Sections 422 and 162(m) and other applicable provisions of or rules under the Code, but only if the amendment would:

(a) increase the maximum number of shares that may be issued pursuant to (1) all Awards granted under the Incentive Plan, (2) all Incentive Stock Options granted under the Incentive Plan, or (3) Awards granted under the Incentive Plan during any calendar year to any one Participant;

(b) change the class of persons eligible to receive Awards under the Incentive Plan;

(c) affect compliance of the Incentive Plan with applicable provisions of the Code.

The Incentive Plan does not permit repricing of Awards.

No Stockholder Rights and Employment Rights

A Participant will have no stockholder rights with respect to common stock subject to his or her outstanding Awards until such common stock is purchased in accordance with the provisions of the Incentive Plan. Nothing in the Incentive Plan confers upon the Participant any right to continue in the employ of the Company or its subsidiaries.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” APPROVAL OF THE ADOPTION OF THE 2003 STOCK INCENTIVE PLAN.

10

PROPOSAL 3

ADOPT THE NON-EMPLOYEE DIRECTOR STOCK PLAN

At the Annual Meeting, stockholders will be asked to approve the Company’s Non-Employee Director Stock Plan (the “Director Plan”), which was adopted by the Board on April 7, 2003, subject to approval by the Company’s stockholders. The Director Plan is intended to provide a mechanism for the non-discretionary grant of options and shares of stock to non-employee directors of the Company.

Why Are We Seeking Approval of a New Non-Employee Director Plan?

The Company has historically compensated its directors by paying a cash retainer, cash meeting fees and granting stock options. Options to directors were historically granted pursuant to the Company’s 1997 Stock Option Plan, which will no longer be utilized if the Incentive Plan is approved. The Board has concluded that Board compensation should consist of option grants, consistent with the Company’s historical policy, a retainer payable in stock rather than in cash in order to more closely align the interests of directors with the stockholders of the Company, and meeting fees, including fees payable to the chairpersons of committees, payable in cash. The Compensation Committee has concluded that the compensation of the Company’s independent directors should have a larger equity component, but recognizes that to achieve a satisfactory mix of equity and cash compensation, it must provide greater liquidity to the compensation of non-employee directors, and greater consistency and predictability as to the value of such compensation. Accordingly, the Company is proposing to adopt the new Director Plan which provides for the grant of options consistent with the Company’s historical practice and direct annual grants, in lieu of cash retainers, to each non-employee director of shares of common stock with a value of $25,000 as of the date of grant. The Director Plan provides for the automatic grant of non-qualified options covering 50,000 shares of common stock when a director joins the Board or is re-elected after a three-year term. The stock grants are immediately vested and the option grants vest over the three-year term of a director in three equal annual installments.

The following summary of the new Director Plan is qualified in its entirety by reference to the complete text of the Plan, which is set forth as Appendix 5 to this Proxy Statement.

General Information

The purpose of the Director Plan is to promote the interests of the Company by attracting and retaining highly qualified independent directors by providing such individuals with an investment interest in the Company’s future success.

Nondiscretionary Awards

Under the Director Plan, each member of the Board who is not a full or part-time employee of the Company or any parent or subsidiary (each, an “Eligible Director”) will automatically receive options and shares of common stock as follows:

(i)Initial Options. With respect to each person who becomes an Eligible Director after the effective date of the Director Plan, the Company will issue to such Eligible Director, on the date that such person becomes an Eligible Director, options covering 50,000 shares at fair market value of the shares on the date of grant, vesting over the three-year term of office of the Eligible Director. The options will have a 10 year term. An Eligible Director will receive an additional grant of 50,000 shares if he or she is re-elected to a new three-year term.

(ii)Annual Retainer Issuances. Each year on the date that the Company’s stockholders hold their annual meeting, immediately after the election of directors, the Company will issue to each Eligible Director the number of shares equal to $25,000 divided by the closing price on the issue date of one share on the Nasdaq National Market, rounded up to the nearest whole share, for a purchase price of $0.01 per share. These shares are being issued in lieu of cash retainers.

Terms of Awards

If an Eligible Director’s membership on the Board terminates for any reason, no further shares will be issued under the Director Plan to such former Eligible Director on or after such date of termination.

11

Options will vest over a three-year period, but will become automatically fully vested upon the death or permanent disability of an Eligible Director or in the event of a change in control of the Company.

In connection with the issuance of shares under the Director Plan, the Company may require payment to the Company by the Eligible Director of an amount sufficient to satisfy federal, state and local withholding tax requirements.

Administration

The Director Plan is administered by the Board, which has complete authority to adopt such rules and regulations and to make all such other determinations not inconsistent with the Director Plan. Notwithstanding the foregoing, the Company has no authority or discretion as to the persons eligible to receive shares under the Director Plan, which matters are specifically governed by the provisions of the Director Plan.

Shares Subject to the Director Plan

A total of 500,000 shares are reserved for issuance under the Director Plan, subject to appropriate adjustment in the event of changes in the Company’s capitalization through merger, consolidation, reorganization, recapitalization, stock dividend, dividend in property other than cash, stock split, liquidating dividend, combination of shares, exchange of shares, change in corporate structure, or any other capital reorganization.

Amendment and Termination

The Board may amend the Director Plan at any time; provided, however, that no amendment adopted without stockholders approval may (i) increase the number of shares which may be issued under the Director Plan, (ii) modify the requirements as to eligibility for participation, (iii) materially increase the benefits accruing under the Director Plan, or (iv) change the nondiscretionary manner in which awards are made.

The Board at any time may suspend or terminate the Director Plan. The Director Plan, unless sooner terminated, will terminate on April 7, 2008.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” APPROVAL OF THE ADOPTION OF THE NON-EMPLOYEE DIRECTOR STOCK PLAN.

Tax Information

The following discussion of the federal income tax consequences to the Company of the Incentive Plan and Director Plan (collectively, the “Plans”) is intended to be a summary of applicable federal law as currently in effect. State and local tax consequences may differ, and tax laws may be amended or interpreted differently during the term of the Plans or of Awards thereunder. The following is only a brief summary of general federal income tax rules. Recipients of Awards should not rely on this summary for individual tax advice, as the consequences of any particular Award will depend on the Participant’s individual circumstances and the nature of the Award. Participants are advised to consult their tax advisors prior to exercise of options or other Awards or dispositions of stock acquired pursuant to Awards.

Incentive stock options (“ISOs”) and nonqualified stock options (“NQSOs”) are treated differently for federal income tax purposes. ISOs are intended to comply with the requirements of Section 422 of the Code. NQSOs need not comply with such requirements. Both ISOs and NQSOs may be issued under the Incentive Plan, but only NQSOs may be issued under the Director Plan.

12

In general, an optionee is not taxed, and the Company is not entitled to a deduction, on the grant or exercise of an ISO. However, an optionee could be subject to the alternative minimum tax as a result of the exercise of an ISO. In addition, if an optionee disposes of shares acquired pursuant to exercise of an ISO within one year after the date of exercise or two years after the date of grant of such ISO, the optionee may recognize both ordinary income and capital gain in the year of disposition. The amount of the ordinary income will be the lesser of (i) the excess of the amount realized on disposition over the optionee’s adjusted basis in the shares (usually the exercise price) or (ii) the excess of the fair market value of the shares on the exercise date over the exercise price. The Company will generally be entitled to a deduction equal to the amount of ordinary income recognized by the optionee. The balance of the consideration received on such a disposition will be capital gain.

An optionee is not taxed on the grant of an NQSO. On exercise, however, the optionee recognizes ordinary income equal to the difference between the option price and the fair market value of the shares acquired on the date of exercise; and the Company will be entitled to a tax deduction equal to that amount.

Participants generally are required to recognize ordinary income with respect to restricted stock (and the Company is entitled to a deduction) equal to the fair market value of the shares (less any amount paid to acquire the shares) when the shares are both received and no longer subject to vesting restrictions, except that a Participant who receives restricted stock that is subject to vesting restrictions and who properly makes an election under Section 83(b) of the Code (an “83(b) election”) within 30 days of receipt will recognize ordinary income (and the Company will be entitled to a deduction) based on the value of the underlying shares (determined without regard to the vesting restrictions) on the date of initial receipt (as opposed to the date of vesting).

Special rules will apply in cases where a recipient of an Award pays the exercise or purchase price of the Award or applicable withholding tax obligations under the Plans by delivering previously owned shares or by reducing the number of shares otherwise issuable pursuant to the Award. The surrender or withholding of such shares will in certain circumstances result in the recognition of income with respect to such shares or a carryover basis in the shares acquired, and may constitute a disposition for purposes of applying the ISO holding periods discussed above.

The Company generally will be entitled to withhold any required taxes in connection with the exercise or payment of an Award or grant, and may require the Participant to pay such taxes as a condition to exercise of an Award.

The terms of the agreements or other documents pursuant to which specific Awards are made under the Plans may provide for accelerated vesting or payment of an Award in connection with a change in ownership or control of the Company. In that event and depending upon the individual circumstances of the Participant, certain amounts with respect to such Awards may constitute “excess parachute payments” under the “golden parachute” provisions of the Code. Pursuant to these provisions, a Participant will be subject to a 20% excise tax on any “excess parachute payments” and the Company will be denied any deduction with respect to such payments.

Awards under the Plans may qualify as “performance-based compensation” under Section 162(m) of the Code in order to preserve federal income tax deductions by the Company with respect to any compensation relating to an Award that is paid to a Covered Employee (as defined in Section 162 of the Code). Compensation for any year that is attributable to an Award granted to a Covered Employee and that does not so qualify may not be deductible by the Company to the extent such compensation, when combined with other compensation paid to such employee for the year, exceeds $1,000,000.

13

MANAGEMENT

Executive Officers

The executive officers of the Company as of April 4, 2003 are as follows:

Name

| | Position With the Company

| | Age

|

Brenda C. Rhodes | | Chief Executive Officer and Chairman of the Board | | 50 |

Jeffrey A. Evans | | Executive Vice President | | 34 |

Martin A. Kropelnicki | | Vice President, Chief Financial Officer and Secretary | | 36 |

Rita S. Hazell | | Executive Vice President | | 36 |

Brenda C. Rhodes co-founded the Company and has been a director since the Company’s incorporation in 1991. From December 1992 to the present, Ms. Rhodes has served as Chief Executive Officer of the Company. Ms. Rhodes also served as President and Assistant Secretary of the Company from December 1991 to October 1996 and from December 1991 to September 1996, respectively. From August 1981 to June 1987, Ms. Rhodes was general manager of a Snelling & Snelling franchise, a personnel services company.

Jeffrey A. Evans has served as Executive Vice President of the OnStaff division since the Company’s acquisition of OnStaff, Inc. in August of 2002. Prior to joining the Company Mr. Evans served as President and Chief Operating Officer of OnStaff Inc. Prior to his role with OnStaff Mr. Evans served as Vice President and General Manager of staffing specialists On Assignment, Inc., where he developed and managed corporate support, business development, mergers and acquisitions, and operations. Prior to working at On Assignment, Mr. Evans had experiences ranging from sales and sales management to running a U.S. Congressional campaign in Georgia’s 6th congressional district. Mr. Evans holds a B.S. degree in Economics from Emory University and an MBA from the Fuqua School of Business at Duke University.

Martin A. Kropelnicki joined the Company in February 1997 as Vice President, Chief Financial Officer and Secretary. Prior to joining the Company, Mr. Kropelnicki was a Director at Deloitte & Touche Consulting Group-ICS, a consulting firm, from February 1996 to February 1997. From June 1989 to February 1996, Mr. Kropelnicki held various positions, most recently as a Director in the financial organization at Pacific Gas & Electric Company, a natural gas and electric utility. Mr. Kropelnicki holds a B.A. degree and an M.A. degree in Business Economics from San Jose State University.

Rita S. Hazell has served as Senior Vice President, R&D Contract Services since April 1996. Prior to assuming her current position, Ms. Hazell served in a variety of positions, including Director, R&D Contract Services and Manager, R&D Contract Services, since joining the Company in September 1993. From November 1987 to September 1993, Ms. Hazell served as a manager for Oxford & Associates, Inc., a technical contract services firm.

14

STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information, as of April 4, 2003 except where noted, with respect to the beneficial ownership of the Company’s Common Stock by (i) all persons known by the Company to be the beneficial owners of more than 5% of the outstanding Common Stock of the Company, (ii) each director and director-nominee of the Company, (iii) each person named in the Summary Compensation Table, and (iv) all executive officers and directors of the Company as a group.

Beneficial ownership has been determined in accordance with Rule 13d-3 under the Securities Exchange Act of 1934 (the “Exchange Act”). Under this rule, certain shares may be deemed to be beneficially owned by more than one person (if, for example, persons share the power to vote or the power to dispose of the shares). In addition, shares are deemed to be beneficially owned by a person if the person has the right to acquire shares (for example, upon exercise of an option) within 60 days of the date as of which the information is provided; in computing the percentage ownership of any person, the amount of shares is deemed to include the amount of shares beneficially owned by such person (and only such person) by reason of these acquisition rights. As a result, the percentage of outstanding shares of any person as shown in the following table does not necessarily reflect the person’s actual voting power at any particular date.

Name and Address of Beneficial Owners (1)(2)

| | Number of Shares

| | Percentage of Class

| |

Brenda C. Rhodes (3) Chief Executive Officer and Chairman of the Board 75 Rowland Way, Suite 200 Novato, CA 94945 | | 2,513,056 | | 19.97 | % |

Jeffrey A. Evans (4) Executive Vice President | | 309,050 | | 2.46 | % |

Martin A. Kropelnicki (5) Vice President, Chief Financial Officer and Secretary | | 278,081 | | 2.21 | % |

Rita S. Hazell (6) Executive Vice President | | 320,830 | | 2.55 | % |

Todd J. Kinion (7) (8) Director | | 723,244 | | 5.75 | % |

Jon H. Rowberry (8) Director | | 55,260 | | * | |

Michael S. Stein (8) Director | | 50,260 | | * | |

Herbert I. Finkelman (8) Director | | 50,260 | | * | |

Jack F. Jenkins-Stark (8) Director | | 50,260 | | * | |

Executive officers and directors as a group (9 persons) (9) | | 4,350,301 | | 34.57 | % |

State of Wisconsin Investment Board (10) P.O. Box 7842 Madison, WI 53707 | | 2,437,000 | | 19.37 | % |

Putnam Investments, LLC (11) One Post Office Square Boston, MA 02109 | | 1,638,590 | | 13.02 | % |

State Street Research & Management Company (12) One Financial Center, 30th Floor Boston, MA 02111 | | 1,256,600 | | 9.99 | % |

Dimensional Fund Advisors, Inc. (13) 1299 Ocean Ave., 11th Floor Santa Monica, CA 90401 | | 700,681 | | 5.57 | % |

Dalton, Greiner, Hartman, Maher & Co. (14) 565 Fifth Ave., Suite 2101 New York, NY 10017 | | 680,900 | | 5.41 | % |

Awad Asset Management (15) 250 Park Avenue, 2nd Floor New York, NY 10177 | | 606,960 | | 4.82 | % |

15

| (1) | | Unless otherwise indicated, 75 Rowland Way, Suite 200, Novato, California is the address for all Officers and Directors of the Company. |

| (2) | | Percentage of beneficial ownership is calculated assuming 12,582,263 shares of Common Stock were outstanding on April 4, 2003. This percentage also includes Common Stock of which such individual or entity has the right to acquire beneficial ownership within 60 days of April 4, 2003 including but not limited to the exercise of an option; however, such Common Stock shall not be deemed outstanding for the purpose of computing the percentage owned by any other individual or entity. Except as indicated in the footnotes to this table, the Company believes that the persons named in the table have sole voting and investment power with respect to all shares of Common Stock shown as beneficially owned by them, subject to community property laws, where applicable. |

| (3) | | Includes 209,672 shares held by Ms. Rhodes’ and/or spouse as custodians for their children and 452,496 shares subject to stock options that are currently exercisable or will become exercisable within 60 days of April 4, 2003. |

| (4) | | Includes 0 shares subject to stock options that are currently exercisable or will become exercisable within 60 days of April 4, 2003. |

| (5) | | Includes 278,081 shares subject to stock options that are currently exercisable or will become exercisable within 60 days of April 4, 2003. |

| (6) | | Includes 308,830 shares subject to stock options that are currently exercisable or will become exercisable within 60 days of April 4, 2003. |

| (7) | | Includes 121,000 shares held by Mr. Kinion as custodian for his children and by Mr. Kinion’s children. |

| (8) | | Includes 50,260 shares subject to stock options that are currently exercisable or will become exercisable within 60 days of April 4, 2003. |

| (9) | | Includes 1,290,707 shares subject to stock options that are currently exercisable or will become exercisable within 60 days of April 4, 2003. |

| (10) | | This information is derived from State of Wisconsin Investment Board’s Schedule 13G, filed with the Securities and Exchange Commission (SEC) on February 12, 2003. |

| (11) | | Includes shares beneficially owned by Putnam Investment Management, LLC, and The Putnam Advisory Company, LLC, which are wholly owned subsidiaries of Putnam Investments, LLC. Putnam Investments, LLC is a wholly owned subsidiary of Marsh & McLennan Companies, Inc. This information is derived from Putnam Investment’s Schedule 13G, filed with the SEC on February 14, 2003. |

| (12) | | This information is derived from State Street Research & Management Co.’s Schedule 13G, filed with the SEC on February 14, 2003. |

| (13) | | This information is derived from Dimensional Fund Advisors, Inc.’s Schedule 13G, filed with the SEC on February 10, 2003. |

| (14) | | This information is derived from Dalton, Greiner, Hartman, Maher & Co.’s Schedule 13G, filed with the SEC on January 27, 2003. |

| (15) | | This information is derived from Awad Asset Management’s Schedule 13G, filed with the SEC on February 3, 2003. |

16

EXECUTIVE COMPENSATION AND OTHER MATTERS

The following table sets forth information concerning the compensation of the Chief Executive Officer of the Company and the three other most highly compensated executive officers of the Company as of December 29, 2002 whose total salary and bonus for the fiscal year ended December 29, 2002 exceeded $100,000, in all cases for services rendered in all capacities to the Company during the fiscal years ended 2002, 2001, and 2000:

SUMMARY COMPENSATION TABLE

| | | Annual Compensation

| | | Long Term Compensation Awards

|

Name and Principal Position

| | Year

| | Salary ($)(1)

| | | Bonus($)

| | Other Annual Compensation($)(2)(3)

| | | Securities Underlying Options(#)

|

Brenda C. Rhodes | | 2002 | | $ | 350,000 | | | $ | — | | $ | 492,000 | (4) | | 400,000 |

Chief Executive Officer and | | 2001 | | | 350,000 | | | | — | | | 678,909 | | | 50,000 |

Chairman of the Board | | 2000 | | | 356,956 | | | | 330,000 | | | — | | | 200,000 |

|

Jeffrey A. Evans | | 2002 | | | 105,000 | (5) | | | 50,000 | | | — | | | 250,000 |

Executive Vice President, | | | | | | | | | | | | | | | |

Corporate Professionals Division | | | | | | | | | | | | | | | |

|

Martin A. Kropelnicki | | 2002 | | | 300,000 | | | | 20,000 | | | — | | | 160,000 |

Vice President, Chief Financial Officer | | 2001 | | | 300,000 | | | | 50,000 | | | — | | | 50,000 |

and Secretary | | 2000 | | | 207,368 | | | | 175,000 | | | — | | | 100,000 |

|

Rita S. Hazell | | 2002 | | | 214,040 | | | | 87,000 | | | 82,000 | (6) | | 175,000 |

Executive Vice President, | | 2001 | | | 265,869 | | | | 84,000 | | | — | | | 50,000 |

Technology Division | | 2000 | | | 233,649 | | | | 185,000 | | | — | | | 100,000 |

| (1) | | Salary includes amounts deferred under the Company’s 401(k) Plan. |

| (2) | | Unless noted, the aggregate amount of all other compensation in the form of perquisites and other personal benefits does not exceed the lesser of either $50,000 or 10% of the total annual salary and bonus for each officer. |

| (3) | | During fiscal 2000, the Company adopted the Hall, Kinion & Associates, Inc., e2-hkequityedge Cash Equity Plan. Under the plan, the Company offers cash bonuses to executives and other employees. The cash bonuses are tied to the proceeds from the exercise of warrants and sale of the underlying stock offered by customers to Hall Kinion as additional fees for services rendered. The awards to executives under the program will only occur if the executive is employed with Hall Kinion at the time of the stock sale and will vary depending on the number of participants sharing in the bonus pool at the time of the stock sale. |

| (4) | | Ms. Rhodes other compensation amount includes $481,000 representing forgiveness of principal and interest on an outstanding stockholder note receivable. |

| (5) | | Mr. Evans’ compensation is reflective of consideration paid to him since the time of the acquisition of OnStaff Inc. and is not representative of a full year. The acquisition of OnStaff Inc. was completed on August 9, 2002. |

| (6) | | Ms. Hazell’s other compensation amount includes approximately $74,000 representing forgiveness of principal and interest on an outstanding loan. |

17

The following table provides information concerning grants of options to purchase the Company’s Common Stock made during the fiscal year ended December 29, 2002 to the persons named in the Summary Compensation Table:

OPTION GRANTS IN LAST FISCAL YEAR

| | | Individual Grants

| | | | |

Name

| | Number of Securities Underlying Options Granted(#)(1)

| | | % of Total Options Granted to Employees in Fiscal

Year(2)

| | | Exercise Price ($/Sh)

| | Expiration Date

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(3)

|

| | | | | | 5%($)

| | 10%($)

|

Brenda C. Rhodes | | 300,000 | (4) | | 14.4 | % | | $ | 7.45 | | 1/29/12 | | $ | 1,405,580 | | $ | 3,562,014 |

| | | 100,000 | | | 4.8 | | | | 5.46 | | 10/2/12 | | | 343,376 | | | 870,183 |

Jeffrey A. Evans | | 250,000 | | | 12.0 | | | | 6.40 | | 8/9/12 | | | 1,006,231 | | | 2,549,988 |

Martin A. Kropelnicki | | 160,000 | (4) | | 7.7 | | | | 7.45 | | 1/29/12 | | | 749,642 | | | 1,899,741 |

Rita S. Hazell | | 175,000 | (4) | | 8.4 | | | | 7.45 | | 1/29/12 | | | 819,921 | | | 2,077,842 |

| (1) | | All options were granted at an exercise price not less than fair market value of the Common Stock on the date of grant. The exercise price may be paid in cash, in shares of Common Stock valued at fair market value on the exercise date or through a cashless exercise procedure involving a same-day sale of the purchased shares. |

| (2) | | A total of 2,564,645 options were granted during the fiscal year ended December 29, 2002. |

| (3) | | The potential realizable values are calculated based on the term of the option at its time of grant (ten years). It is calculated by assuming that the stock price on the date of grant appreciates at the indicated annual rate, compounded annually for the entire term of the option. These amounts represent hypothetical gains assuming rates of appreciation specified by the SEC, and do not represent the Company’s estimated or projection of future Common Stock prices. Actual gains, if any, on stock option exercises are dependent on the future performance of the Company, overall market conditions and the optionees’ continued employment through the vesting period. The amounts reflected in this table may not be achieved. |

| (4) | | The optionees become vested in 25% of the option shares upon the completion of one year of service and the balance of the option shares in equal monthly installments over the next 36 months of service. |

18

The following table provides information concerning exercises of options to purchase the Company’s Common Stock during the fiscal year ended December 29, 2002, and unexercised options held as of December 29, 2002, by the persons named in the Summary Compensation Table:

AGGREGATE OPTION EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR-END OPTION VALUES

| | | Shares Acquired on Exercise(#)

| | Value Realized($)(2)

| | Number of Securities Underlying Unexercised Options at 12/29/02(#)

| | Value of Unexercised

In-the-Money Options at 12/29/02($)(1)

|

Name

| | | | Exercisable

| | | Unexercisable

| | Exercisable

| | Unexercisable

|

Brenda C. Rhodes | | — | | — | | $ | 387,915 | (3) | | 362,085 | | | — | | $ | 33,000 |

Jeffrey A. Evans | | — | | — | | | — | (4) | | 250,000 | | | — | | | — |

Martin A. Kropelnicki | | — | | — | | | 246,311 | (5) | | 139,689 | | | — | | | — |

Rita S. Hazell | | — | | — | | | 273,727 | (6) | | 153,773 | | $ | 65,880 | | | — |

| (1) | | Based on the closing price of $5.79 on the last trading day prior to Sunday, December 29, 2002, less exercise price. |

| (2) | | Market price on date of exercise, less exercise price. |

| (3) | | Options to purchase 387,915 shares are immediately exercisable, subject to certain repurchase rights of the Company. From January 2003 until fully vested the remainder will vest at the rate of 12,917 per month with the exceptions of October 2003, 2004 and 2005. In October 2003, an additional 33,334 shares vest and in October 2004 and 2005, an additional 33,333 will vest. |

| (4) | | Currently no options are immediately exercisable. Options of 62,500 will become immediately exercisable on August 9, 2003; the remainder will vest at the rate of 5,208 from September 2003 through August of 2006. |

| (5) | | Options to purchase 246,311 shares are immediately exercisable, subject to certain repurchase rights of the Company. Options to purchase 6,293 shares vested in January; the remainder will vest at the rate of 6,250 per month during 2003. |

| (6) | | Options to purchase 273,727 shares are immediately exercisable, subject to certain repurchase rights of the Company. Options to purchase 6,816 vested in January 2003; the remainder will vest at the rate of 6,729 from February through August and 6,563 monthly for the remainder of 2003. |

The Company has three stock option plans. The Company’s 1997 Stock Option Plan (the “1997 Plan”) authorizes the issuances of options covering up to 3,759,000 shares of common stock. The 1997 Plan provides for an automatic annual increase in the number of number of shares covered by the 1997 Plan equal to 3.0% of the number of shares of common stock outstanding on the first day of each calendar year. The IT Professional Stock Option Plan (the “IT Plan”) authorizes the issuance of options covering up to 983,000 shares of common stock and provides for an automatic annual increase in the number of shares covered by the IT Plan equal to 1.5% of the number of shares of common stock outstanding on the first day of each calendar year. The Company’s 2000 Stock Option Plan (the “2000 Plan”) authorizes the issuance of options covering up to 1,000,000 shares of common stock. The 2000 Plan does not contain any provisions for automatic increases in the number of shares covered by the 2000 Plan. See Note 7 to the consolidated financial statements filed with the Company’s Form 10-K for the fiscal year ended December 29, 2002 for information regarding other terms of the plans. The IT Plan was established while the Company was still privately held and did not require stockholder approval. The 1997 Plan was approved by the stockholders. The 2000 Plan does not require stockholder approval. The Company also has an Employee Stock Purchase Plan, which was approved by stockholders, but has never been implemented.

19

The following table sets forth information as of December 29, 2002 with respect to the Company’s stock option plans. The table does not include information with respect to the proposed 2003 Stock Incentive Plan for which stockholder approval is being sought at the Annual Meeting.

| | | Number of Shares to be Issued Upon Exercise of Outstanding Options

| | Weighted Average Exercise Price of Outstanding Options

| | Number of Shares Remaining Available for Future Issuance Under Plans(1)

|

Plans approved by stockholders | | 2,913,000 | | $ | 10.24 | | 1,132,000 |

Plans not approved by stockholders (2000 Plan) | | 903,000 | | $ | 7.82 | | 91,000 |

| (1) | | Excludes shares included in first column. Also excludes shares which will be covered under the 1997 Plan and the ITP Plan pursuant to provisions for annual automatic increase described above. |

Employment and Change in Control Arrangements

Effective in January 2001, the Company entered into a new employment agreement with Brenda Rhodes. The agreement provides for an initial term ending on the earlier of the second anniversary of the agreement or when a new Chief Executive Officer is appointed and a subsequent term for up to three years during which Ms. Rhodes will serve as Chairman of the Board until she becomes Chairman Emeritus. During the initial term, Ms. Rhodes is entitled to a base salary of $350,000 and a bonus of up to 75% of her base salary. Ms. Rhodes will be eligible to receive stock options and additional bonuses at the discretion of the Board of Directors. When she becomes Chairman of the Board, she will continue to be entitled to receive her base salary, but no bonus, and when she becomes Chairman Emeritus she will receive no base salary or bonus. The agreement provides for the payment to Ms. Rhodes of certain incidental benefits she is presently receiving. Medical, life and similar insurance benefits will continue for Ms. Rhodes’ lifetime, provided that she does not engage in certain competitive activities.

If Ms. Rhodes’ employment is terminated other than for cause or death or she is constructively discharged, including in connection with a change of control, she will be entitled to receive a payment equal to three times her base salary and bonus paid for the immediately preceding year, any previously unvested stock options will become immediately vested, and any remaining outstanding principal and interest on Ms. Rhodes’ $2.0 million promissory note owed to the Company will be forgiven. If Ms. Rhodes’ employment is terminated by her death, she is entitled to receive her base salary through the date of her death and a pro-rated bonus for the year of her death and any unvested stock options will become fully vested. Upon Ms. Rhodes becoming Chairman Emeritus she will receive a payment equal to three times her base salary and bonus paid for the immediately preceding year. In connection with the agreement, the $2.0 million promissory note due in January 2002 was amended to extend the term to January 2005 and to provide for the forgiveness of 20% of the principal plus interest over a five-year period commencing January 1, 2001. Under the agreement, in the event of a change of control, to the extent that any payments to Ms. Rhodes result in any excise or similar taxes imposed on any “parachute payments” as such term is defined in the Internal Revenue Code, the Company has agreed to pay an additional lump-sum cash payment (the “Gross-Up Payment”) to Ms. Rhodes in an amount such that, after payment of all federal and state taxes on the Gross-Up Payment, she will have sufficient funds to pay the tax obligations arising from the original payment received by her. In addition, for a two-year period after she becomes Chairman Emeritus, Ms. Rhodes will have the right to purchase the Company’s facility in Park City Utah, for a sum equal to the lower of its then current fair market value or 120% of the fair market value of the facility as of April 30, 2001.

In connection with the acquisition of OnStaff, the Company entered into an Employment and Non-Competition Agreement with Jeffrey Evans as an Executive Vice President of the Company. The agreement provides for a five-year term, with an annual salary of $315,000, subject to review and increase by the Board of

20

Directors. Mr. Evans received a signing bonus of $50,000 and is entitled to participate in the Company’s bonus plans for executive officers. The agreement also provided for the grant of options covering 250,000 shares of common stock. The options vest at a rate of 25% after the one year with the balance vesting over a three year period in equal monthly installments. If Mr. Evans’ employment is terminated without cause or he resigns for good reason, as defined in the agreement, or upon a change in control, any unvested options will become immediately vested. Mr. Evans is also provided with a life insurance policy with a $1.0 million benefit and an automobile allowance. If Mr. Evans’ employment is terminated without cause or he resigns for good reason, he is entitled to receive severance in an amount equal to three times his base salary. In the event of Mr. Evans death or complete disability he would receive a pro-rated portion of any performance bonus. The agreement also contains a customary non-competition covenant on the part of Mr. Evans. Mr. Evans is entitled to receive certain earn-out payments in his capacity as a shareholder of OnStaff under the acquisition agreements with OnStaff if the milestones contained in the agreements are satisfied.

The Company has employment agreements with other executives, which generally provide for salary continuation of twelve months in case of termination other than for cause or disability, acceleration of options vesting on change of control and certain other provisions.

The terms of the Company’s 1997 Stock Option Plan (the “1997 Plan”) provide that in the event the Company is acquired by merger, consolidation or asset sale, each option outstanding at the time under the 1997 Plan will terminate to the extent not assumed by the acquiring entity. In addition, the plan administrator generally has the discretion to accelerate the vesting of options.

Compensation of Directors

Under the automatic option grant program of the Company’s 1997 Stock Option Plan, each individual who first joins the Board of Directors of the Company as a non-employee director, will receive at that time, an automatic option grant for 50,000 shares of Common Stock. The optionee will vest in the automatic option grant in a series of four annual installments over the optionee’s period of Board service, beginning one year from the grant date. Each option will have an exercise price equal to the fair market value of the Common Stock on the automatic option grant date and a maximum term of ten years, subject to earlier termination following the optionee’s cessation of Board service. In addition, outside directors receive an annual retainer of $25,000; $1,000 for each meeting attended in person; and, an additional $15,000 for a chairperson of a standing committee.

If the Director Plan is adopted, eligible directors will receive an automatic grant of options covering 50,000 shares upon joining the Board or upon re-election for a new three-year term. These options will vest over the three-year term of the director. Outside directors will receive in lieu of cash retainers, a direct grant of shares with a value of $25,000 per year. Directors will also receive meetings fees in cash in amounts as determined by the Board, including additional amounts for the chairpersons of standing committees.

Compensation Committee Interlocks and Insider Participation in Compensation Decisions

Mr. Finkelman, Mr. Jenkins-Stark, and Mr. Stein served as members of the Board of Directors’ Compensation Committee during 2002. None of these directors has ever been an officer or employee of the Company. No executive officer of the Company served as a member of the Board of Directors or Compensation Committee of any entity that had one or more executive officers serving as a member of the Company’s Board of Directors or Compensation Committee.

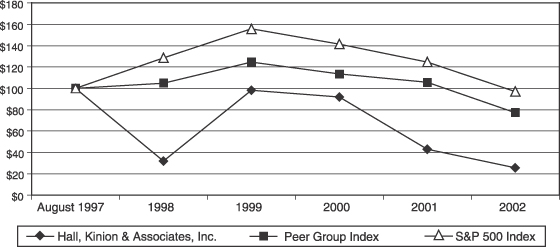

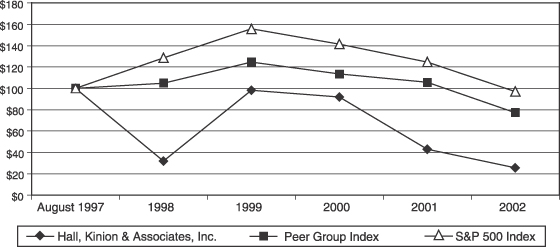

Certain Relationships and Related Transactions