SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

¨ Preliminary Proxy Statement | | ¨ Confidential, for Use of the Commission Only

(as permitted by Rule 14a-6(e)(2)) |

¨ Definitive Proxy Statement | |

x Definitive Additional Materials

¨ Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12

HALL, KINION & ASSOCIATES, INC.

(Name of Registrant as Specified In Its Charter)

--Enter Company Name Here--

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

Notes:

Hall, Kinion & Associates, Inc.

Executive Compensation Plan Analysis

Prepared by:

Background & Objectives

As a shareholder of Hall, Kinion & Associates, Inc. (“Hall Kinion” or “the Company”) you should have recently received the Company’s 2003 proxy filing. In the filing, among other items, you will find a proposal for the approval and subsequent implementation of an Omnibus Stock Plan and a Non-Employee Director Stock Option Plan. The purpose of this document is to provide detailed information about the proposed Plans and related plan features relative to the existing compensation arrangements currently in place within the Company, as well as the Institutional Shareholder Services (“ISS”) recommendation of a “no” vote on the plans.

As a provider of consultants and direct-hire talent to the technology, financial services, healthcare, government and energy industries, Hall Kinion must pay close attention to the attraction, retention and motivation of its employees. As such, it is critical that the Company’s compensation programs are internally and externally competitive, linked to the Company’s short- and long-term objectives, and provided in a cost effective manner. Accordingly, Hall Kinion retained the Compensation Design Group, Inc. (“CDG”) to assist in refining the Company’s compensation programs.

CDG analyzed Hall Kinion’s total compensation arrangements, with specific focus on the Company’s long-term incentive practices, relative to the competitive market and best practices trends, and subsequently recommended the development and implementation of the 2003 Stock Incentive Plan.

Observations

During our review of Hall Kinion’s compensation practices, we found a number of features which may not be effective in today’s executive pay environment. These include:

| | · | | The ability to reprice stock options; |

| | · | | Ongoing annual evergreen features; |

| | · | | Limited, if any, performance-based linkages to long-term objectives; and |

| | · | | The absence of other performance-based plans. |

1

As such, CDG recommends an omnibus plan that would terminate all existing plans and create a redesigned plan that would:

| | · | | Utilize a succinct long-term incentive plan tied directly to the long-term performance of the Company; |

| | · | | Terminate all evergreen provisions, thus managing current and future overhang levels, as well as the Total Cost to Shareholders; |

| | · | | Restrict the repricing of any awards; and |

| | · | | Provide the ability, within set limits and as directed and administered by a fully independent and outside committee, to grant various performance-based awards. |

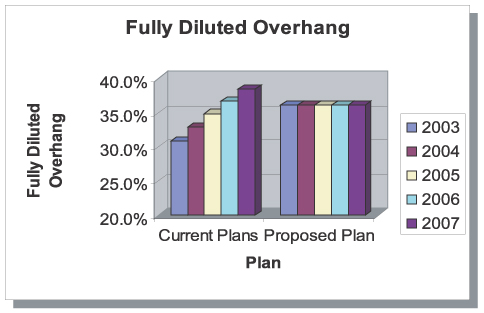

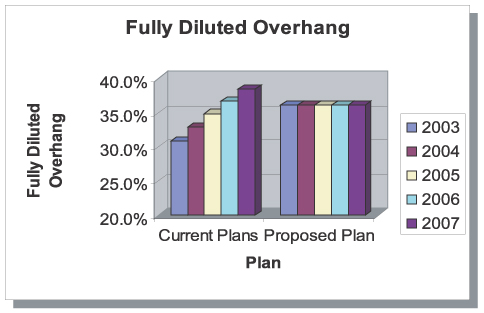

Fully Diluted Overhang is Capped

The proposed 2003 Stock Incentive Plan will prevent a significant increase in dilution. Since current plans have an evergreen provision, fully diluted overhang levels increase from 30.8% (2003) to 38.5% (2007).

Without the evergreen provision, under the proposed plan, fully diluted overhang is capped at 36.1% over the life of the plan.

The following chart compares fully diluted overhang levels of current plans to that of the proposed plan.

2

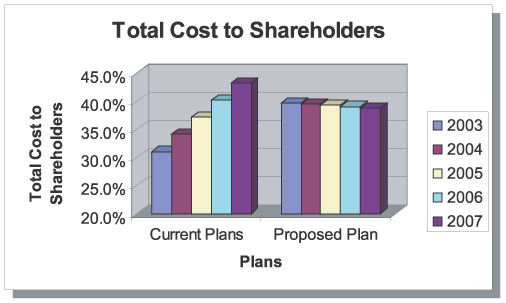

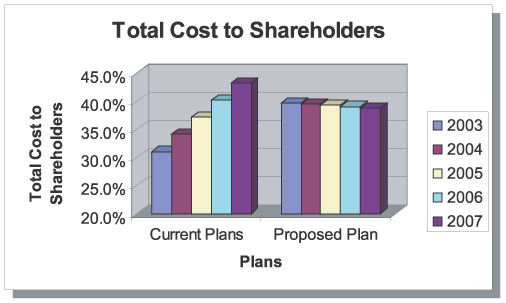

Total Cost to Shareholders is Minimized

In addition to the fully diluted overhang analysis, it is critical to analyze the existing plans compared to the proposed plan from a Total Cost to Shareholders perspective.

Under a projected analysis of Total Cost to Shareholders, the proposed 2003 Stock Incentive Plan has a 4% lower Total Cost over the plan term than existing Hall Kinion arrangements. This is shown in the table and chart on the following page.

Table 1: Total Cost to Shareholders under Current and Proposed Plans

Year

| | Current Plans

| | Proposed Plan

|

| | Weighted SVT (as % of market value)

| | Weighted Overhang (as % of market value)

| | Total Cost to Shareholders

| | Weighted SVT (as % of market value)

| | Weighted Overhang (as % of market value)

| | Total Cost to Shareholders(1)

|

2003 | | 29.52% | | 1.54% | | 31.06% | | 37.88% | | 1.81% | | 39.68% |

2004 | | 32.48% | | 1.65% | | 34.13% | | 37.68% | | 1.81% | | 39.49% |

2005 | | 35.44% | | 1.74% | | 37.19% | | 37.49% | | 1.81% | | 39.30% |

2006 | | 38.40% | | 1.84% | | 40.24% | | 37.30% | | 1.81% | | 39.10% |

2007 | | 41.37% | | 1.92% | | 43.29% | | 37.10% | | 1.81% | | 38.91% |

(1) The Total Cost to Shareholders under the proposed plan varies slightly due to share price appreciation and burn rate assumptions. Assumptions: constant total shares outstanding, 10% annual share appreciation, 10% annual average award appreciation, and 4% annual burn rate.

The following chart summarizes the Total Cost to Shareholders of current plans to that of the proposed plan.

3

Non-Employee Director Plan

As a shareholder, you are also asked to vote on a Non-Employee Director Plan, which was adopted by the Board on April 7, 2003, subject to approval by the Company’s shareholders. The Director Plan is intended to provide a mechanism for the non-discretionary grant of options and shares of stock to non-employee directors of the Company.

The Board and management have concluded that Board compensation should consist of option grants, consistent with the Company’s historical policy, a retainer payable in stock rather than in cash in order to more closely align the interests of directors with the shareholders of the Company, and meeting fees, including fees payable to the chairpersons of committees, payable in cash.

Why is Hall Kinion Seeking Approval of a New Non-Employee Director Plan?

Stock option grants to directors were historically granted pursuant to the Company’s existing broad based plans. Upon approval and implementation of the 2003 Stock Incentive Plan, outside directors will no longer be able to participate in the proposed plan.

With the increased responsibility and subsequent accountability on outside directors brought on by the Sarbanes-Oxley act, as well as various institutional investor organizations, it is becoming more difficult to attract and retain top director talent. Hall Kinion seeks to maintain strong corporate governance guidelines and actions through the actions of its seasoned executives and industry experts that serve on the Company’s Board. In order to accomplish this, as well as maintain a link between Company performance and director compensation, the Company will require a separate long-term compensation plan for its outside directors.

Conclusion

The proposed 2003 Stock Incentive Plan meets the strategic needs of the attracting, retaining and motivating the best and brightest personnel over the long-term, while at the same time optimizing both costs and shareholder return. Additionally, the plan incorporates appropriate checks, controls and balances by including performance-based awards, as administered by independent outside directors.

Additionally, when the 2003 Stock Incentive Plan is approved by shareholders, outside directors will no longer be able to participate in a long-term incentive compensation program. As such, Hall Kinion is seeking approval of the Non-Employee Director Plan.

4

Recommendation for a “Yes” Vote

We recommend a “yes” vote for both the proposed Non-Employee Director Plan and the 2003 Stock Incentive Plan.

Voting “for” the Plans will:

| | · | | Decrease dilution and the Total Cost to Shareholders as compared to the current plans; |

| | · | | Optimize plan checks, balance and controls; |

| | · | | Remove existing evergreen and repricing provisions that are dilutive to the shareholder; |

| | · | | Provide a basis for significant linkage to Hall Kinion long-term objectives by providing multiple performance-based rewards rather than only providing stock options; and |

| | · | | Meet the strategic needs of the company, while at the same time enhancing shareholder value. |

Institutional Shareholder Services (“ISS”) Analysis

On May 6, 2003, ISS recommended a vote against the proposed plans on the basis that the total cost of the Company’s 2003 Stock Incentive Plan was above an allowable cap. However, ISS also provided positive feedback on various features of the proposed plan. Though it was somewhat anticipated that ISS would recommend a negative vote, we believe that it is unreasonable to recommend a vote against a plan that will ultimately decrease and manage the Total Cost to Shareholders.

In order to provide an understanding of the ISS approach, please refer to the appendix, which shows how ISS determined dilution costs, and how these compare to the allowable industry cap. It is important to note, that unlike the previously outlined analysis, the ISS approach does not compare and contrast existing arrangements against proposed arrangements over the plan period or for any other stated time frame.

Although ISS did not specifically comment on the removal of evergreen and repricing features, they noted multiple positive aspects of the plan. These include:

| | · | | Term limits that are placed on nonqualified stock options; |

| | · | | The administering committee includes independent outside directors only; |

| | · | | Plan participation extends to non-employees; and |

| | · | | Company loans may not be provided for payment of the exercise price. |

5

Additional considerations that were made by ISS, which CDG does not agree with, include the following:

| | · | | ISS asserted that “Limits were not placed on grants of performance shares, performance units, sales or bonuses of stock, restricted stock, stock purchase warrants, other rights to acquire stock, securities convertible into or redeemable for stock, phantom stock. Such awards are more costly since the price paid on the exercise is lower.” |

This assertion is incorrect. Limits were placed on grants of full value stock. No more than 25% of equity shares may be used for restricted stock. Additionally, ISS asserts that these awards are more costly. This assertion is not necessarily true, since fewer equity shares are used in full value plans. Also, there must be performance basis for all of these award types.

| | · | | ISS asserted that “Performance goals or hurdle rates are established by plan administrators. No assessment can be made as to the basis for grants of performance shares. Awards valued as share grants.” |

The administering committee included independent outside directors only. As such, we believe there are sufficient checks, controls and balances in determining the performance basis of awards. Additionally, performance basis of awards may change as the business needs require at the time.

| | · | | The 2003 Stock Incentive Plan is 100% ISO’s. |

This assertion is incorrect. The plan provides both incentive stock options as well as nonqualified stock options and other awards.

Conclusion on the ISS Recommendation

The 2003 Stock Incentive Plan and the Non-Employee Director Plan have been designed to meet several broad objectives of the Company, and to remove existing plan features under the current plans that are dilutive to shareholders. The fact that ISS recommended a vote against the Plans, based solely on a specific industry overhang cap, has limited bearing on and does not take into consideration the broader strategic objectives of the Plans, nor their decreasing dilution and total cost as compared with current arrangements.

WE ENCOURAGE YOU TO VOTE “FOR” BOTH OF THE PLANS. “YES” VOTES ARE IN THE INTERESTS OF THE HALL KINION SHAREHOLDERS.

Should you have any questions regarding this analysis or the aforementioned 2003 Stock Incentive and Outside Director compensation plans, please contact Frank Glassner, Chief Executive Officer, Compensation Design Group, Inc. at (866) 234-6968 Ext. 214.

6

Appendix

ISS Dilution Calculations

ISS bases its voting decisions on two dilution figures. Shareholder value transfer (SVT), which is the dollar cost to the company as participants exercise awards at fixed prices below the current market price; and voting power dilution (VPD), or the relative reduction in shareholders’ voting rights. These figures are combined on a weighted scale to determine the Total Cost to Shareholders.

Hall Kinion’s SVT is 40.07% and VPD is 36.11%. The combined weighted average is calculated with 95-percent weighting to the SVT and a five-percent weighting to VPD as follows:( 40.07% x 95% ) + ( 36.11% x 5% ) = 39.87%

The total cost of the company’s plans was compared to an allowable cap, as calculated by ISS, utilizing their “proprietary database.” The allowable caps are ISS “industry-specific,” market cap-based, and pegged to the average amount paid by companies performing in the top quartile of their peer groupings.

In the opinion of ISS, the allowable cap was 19.49%. Consequently, their “no” vote was cast.

7