UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

———————

FORM 10-K

———————

þ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

For the fiscal year ended December 31, 2008

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

For the transition period from , 20 , to , 20 .

Commission File Number

000-28978

———————

American Fiber Green Products, Inc.

(Exact Name of Registrant as Specified in its Charter)

———————

| | |

NEVADA | | 91-1705387 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification Number) |

4209 Raleigh Street, Tampa, FL 33619

(Address of Principal Executive Offices)

(813) 247-2770

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(g) of the Act:

Title of each class:

Preferred Stock, par value $0.001 per share

Common Stock, par value $0.001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Acts. . ¨ YES þ NO

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.¨ YES þ NO

Check whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act during the past 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ¨ YES þ NO

Check if there is no disclosure of delinquent filers in response to Item 405 of Regulation S-B contained in this form, and no disclosure will be contained, to the best of registrant’s knowledge, in definitive proxy of information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-Kþ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “accelerated filer and large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company þ

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act)¨ YES þ NO

Issuer’s revenues for its most recent fiscal year ended December 31, 2008 was $0.

Aggregate market value of the voting stock held by non-affiliates of the registrant at March 31, 2009 was $2,560,832.

There were 11,385,735 shares of the Registrant’s $.001 par value common stock outstanding as of March 31, 2009

American Fiber Green Products, Inc.

ANNUAL REPORT ON FORM 10-K

FOR THE YEAR ENDED

DECEMBER 31, 2008

TABLE OF CONTENTS

American Fiber Green Products, Inc.

This Annual Report on Form 10-K and the documents incorporated herein by reference contain forward-looking statements that have been made pursuant to the provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are based on current expectations, estimates and projections about Turbine Truck Engines Inc.’s industry, management beliefs, and assumptions made by management. Words such as “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” variations of such words and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and assumptions that are difficult to predict; therefore, actual results and outcomes may differ materially from what is expressed or forecasted in any such forward-looking statements.

PART I

ITEM 1.

DESCRIPTION OF BUSINESS

Company History

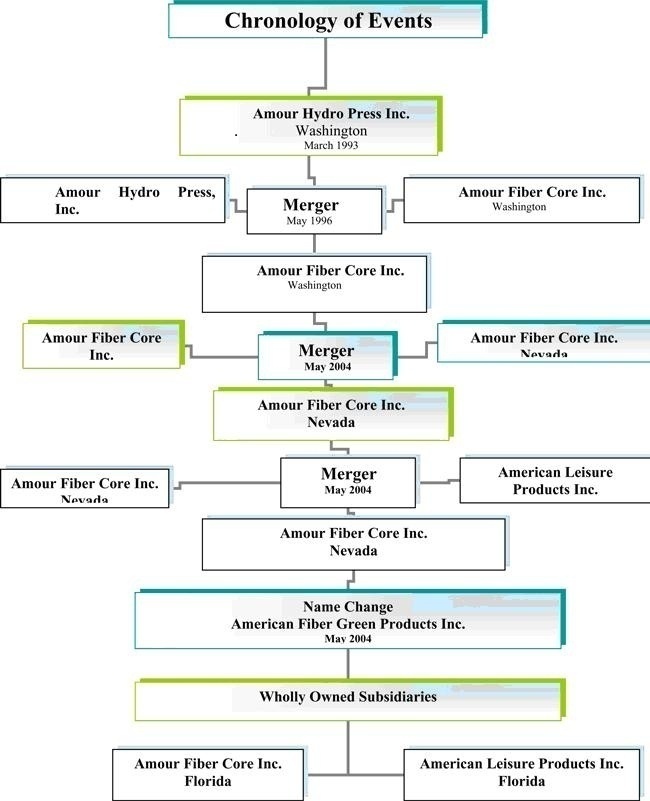

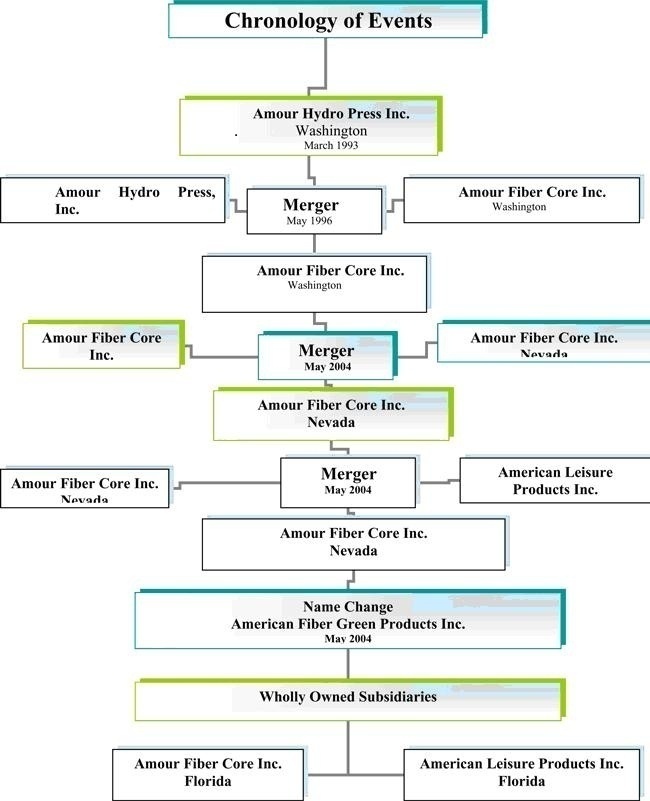

American Fiber Green Products, Inc., formerly known as Amour Fiber Core, Inc. until May 26, 2004, came into existence as a result of the following transactions:

In March of 1993, William Amour founded Amour Hydro Press, Inc. (AHP) to conduct research and development to commercialize proprietary technology that would allow the company to process waste fiberglass and resins into new commercially viable products.

In January of 1996 the Board of Directors authorized the merger of AHP with Amour Fiber Core, Inc. a Washington corporation. Each common share of Amour Hydro Press, Inc. was exchanged for 280 common shares of Amour Fiber Core, Inc. The authorized shares of Amour Fiber Core, Inc. were 5,000,000 shares. The company operated under this configuration until June 1998 when the Board of Directors approved a three for one forward split (3:1) increasing the authorized from 5,000,000 to 15,000,000 common shares. Amendments to the Articles of Incorporation were filed with the State of Washington. Although approved and recorded the 3:1 forward split was not reported to the transfer agent of the company. The resulting change in common stock was from 3,675,996 to 11,027,988 common shares issued and outstanding.

Within months of these actions, William Amour, founder and driving force behind the business was diagnosed with cancer and died in 1999. Attempts by the board to continue the operation of Amour Fiber Core, Inc. resulted in substantially more debt and ultimately the cessation of operations. The value of the company was in the exclusive rights to the proprietary technology, as well as the resources developed to source raw material and vendors and the ability to create viable products from waste material. There were 884 shareholders of record at the time of William Amour’s passing and they remained committed to the success of the Company. The Company ceased operations in January 2000, however, management continued to search for investors to be able to restart production.

On September 15, 2001, after several months of discussion and negotiations with Barb Amour and Gerald Rau, directors of Amour Fiber Core, Inc., Kenneth McCleave (unafilliated with the registrant prior to the merger) incorporated American Leisure Products, Inc. (ALP) a Florida corporation, of which Kenneth McCleave was the sole shareholder of the 100,000 issued and outstanding shares for the purpose of merger with Amour Fiber Core, Inc. (AFC) The terms and conditions of said merger included Mr. McCleave’s assistance in resolution of a number of problems restricting Amour. Litigation with the landlord and disgruntled note holders threatened the collapse of the company unless amicable resolution was achieved. The terms of the merger were established and the concerns were resolved over the subsequent 24 months.

In May of 2004, following appropriate shareholder consent and board action, Amour Fiber Core, Inc. (Washington) merged with a newly formed Nevada corporation of the same name and with the same issued and outstanding shares (11,027,988). Amour Fiber Core, Inc. (Nevada) has authorized 350,000,000 common and 5,000,000 preferred shares.

On May 24, 2004, Amour Fiber Core, Inc. (Nevada) then entered into an Agreement and Plan of Merger with American Leisure Products, Inc., a Florida corporation with a total issued and outstanding of 100,000 common shares. A 1:6 reverse split of the Amour Fiber Core, Inc. shares held by the AFC shareholders reduced the issued and outstanding common shares of AFC (Nevada) from 11,027,988 to 1,837,998. The merger called for each share of ALP to convert to 73.52 shares of Amour Fiber Core, Inc. (Nevada). The sole shareholder of ALP received 7,352,000 shares of Amour Fiber Core, Inc. (Nevada) in the merger (i.e. a conversion ratio of 73.52:1). Following this transaction, Amour Fiber Core, Inc. (Nevada) had 9,189,998 shares outstanding.

Following this merger and in keeping with the Shareholder Consent and subsequent board action, the name of Amour Fiber Core, Inc. (Nevada) was changed to American Fiber Green Products, Inc. American Leisure Products, Inc. (a Florida corporation) became a wholly owned subsidiary of American Fiber Green Products, Inc. The assets and opportunities of American Fiber Green Products, Inc. (f/k/a Amour Nevada and Amour Washington) were moved to a newly formed, Amour Fiber Core, Inc., ( a Florida Corporation) as a wholly owned subsidiary. The resulting structure is American Fiber Green Products, Inc. (Nevada) holding 100% of the stock of American Leisure Products, Inc. (Florida) and Amour Fiber Core, Inc. (Florida).

1

Amour Fiber Core, Inc

AFC’s primary purpose is performing reclamation manufacturing of commercial fiberglass products from molded fiberglass waste and outdated resin waste. The Company has advanced reclamation techniques combined with a proprietary process to reclaim fiberglass waste products, obsolete fiberglass molded products and outdated or excess fiberglass resins. These waste products are key ingredients in the production of the Amour fiberglass products. Management believes that its ability to transform fiberglass waste into viable commercial products will cause diversion of thousands of tons of refuse from landfills and transform the waste into recycled products with commercial applications. The Company has exclusive rights to two patents for its technologies. Three immediate sources of income are expected; tipping fees, sale of sub-licensing agreements and marketing of finished goods.

American Leisure Products, Inc.

The Company’s second operating subsidiary is American Leisure Products, Inc. (“ALP”), which was incorporated in Florida on September 15, 2001, in order to merge with Amour Fiber Core, Inc. Following the merger on May 24, 2004, ALP began to focus on producing a variety of fiberglass products that provide recreational enjoyment, such as the “Hot Rod” car industry and the “Marine Industry”. Various molds, tooling and equipment were located or built to facilitate this plan of operation. ALP plans to grow through acquisition and strategic partnerships for production of fiberglass cars and boats. Our fiberglass production facilities will also provide future revenue through the production of fiberglass vintage car replicas, boats and other leisure products from current molds and tooling and future acquired molds. See Plan of Operation under Part 2, Item 7.

2

3

Company and Business Overview

The Company’s executive management team is:

| | |

Kenneth W. McCleave | | Chairman of the Board |

Daniel L. Hefner | | President, Chief Executive Officer and Director |

Michael A. Freid | | Chief Financial Officer |

Daniel Henning, PhD | | Advisory Board /Fulbright Senior Specialist |

Our business plan is to engage in both fiberglass reclamation manufacturing and production of fiberglass leisure products from virgin material.

We have developed, tested and placed into limited commercial production a new technology for fiberglass reclamation manufacturing. We have adapted this technology to establish a manufacturing business. From the research and development in Amour’s early stages, many different products have been prototyped and tested. Our initial plan is to produce general planks or boards for marine decking and seawalls. From the planking, we will continue to “brand” our name through park benches and picnic tables, as well as a variety of additional products.

We intend to offer contracts for sub-licensing of our patented technology. We believe that licensing our technology to businesses in both foreign and domestic markets will be an effective method of maximizing the return on our investment in the research and development of our fiberglass recycling technology, without significant additional capital outlays. Additionally, such licensing agreements will increase our public visibility and general awareness of our technology. The licensee will be required to pay an upfront fee for the sub-license, equipment and training prior to delivery and a royalty fee to the Company for each item produced by the licensee. If the wholesale price of the licensee’s produced products is significantly below the production costs of products produced by the Company, we may also offer to purchase product from the licensees. We believe that establishing licensees in various foreign countries is an effective means of intr oducing our technology into new markets without major capital outlays.

The sub-licensing agreements will be for a ten year period with two five year renewal extensions possible. The one-time fee for the sub-licensing will be variable from a low of $250,000 up to $1,000,000 depending upon coverage area. Construction of the processing plant will also be an income stream with the company providing prefabricated equipment and erection to the sub-licensee. The revenue is variable by components, configuration and distance. Royalties will be required from sub-licensees based upon the products and volume on a sliding scale. Finally, Company owned facilities will produce products to be sold commercially.

Additionally, we plan to generate revenues by making waste generators aware of our proprietary process for the recycling of fiberglass. The Amour division will offer an alternative to “filling the landfills” by offering its process through Sub-License Agreements worldwide. Currently, most of the world’s fiberglass is not being recycled and is discarded into landfills. Waste generators will be solicited to pay tipping fees that currently go to the landfills for disposal of the waste, to Amour Fiber Core, Inc. By becoming a client of American Fiber Green Products, Inc. the waste generator will now become part of a genuine recycling operation, achieving coveted ‘green status’. Amour will receive ‘inventory’ at a profit or for minimal cost. To date, we have not entered into any sub-licensing agreements and the terms and fees that are outlined above have not yet been accepted by anyone and are subject to negotiations.

See the discussion of the Company’s plan of operations under Part 2, Item 7.

The Company’s corporate offices and manufacturing facilities are presently located at 4209 Raleigh Street, Tampa, Florida 33619. Our website iswww.americanfibergreenproducts.com.

In Western States, where the Company’s facilities were originally located, the typical cost to a manufacturer to dispose of fiberglass waste in an approved landfill is from $90 - $140 per ton, plus shipping costs. The disposal fee for resin waste in an approved landfill is typically $250 - $350 per 55 gallon drum, plus shipping costs. These costs appear to be representative of the disposal costs of these types of waste throughout the United States. The goal of the Company is to expand its manufacturing capacity to support the processing of a significant percentage of the outdated resins and molded fiberglass waste which are shipped to landfills. The Company will accept resins and fiberglass waste materials from a variety of suppliers. Past suppliers have included the US Navy, The Boeing Company, various boat manufacturers and general fiberglass manufacturers. The Company anticipates that adequate fiberglass wastes and related materials can be obtained from domestic sources; however, should these sources prove to be inadequate, the Company can purchase new materials to supplement any deficiency.

4

The processing fees charged by the Company will range from $100 - $250 per 55 gallon drum for disposal of resins and an average processing fee of $120 per ton for molded fiberglass waste. The revenue from these items is driven by the geographical location of the manufacturing facility. As the Company expands production of the manufacturing plant, it is anticipated that the Company will receive additional processing fees from new manufacturers who will utilize the Company’s recycling services.

Growth Strategy

We believe that there are significant opportunities for us to increase our revenues and market position in the recycling and manufacturing industries through the following:

·

Optimizing our marketing plan;

·

Maintaining our state-of-the-art technology position;

·

Managing our raw material inventory

·

Expanding our products so that new products may be offered ;

·

Increasing our sales volume ;

·

Expanding to regional offices

·

Maintaining a conservative balance sheet and disciplined capital spending program.

We are presently evaluating plans for our off shore inquires for License agreements. Our future growth will be to support our Licensees by marketing these product lines:

·

Railroad ties

·

Parking stops

·

Dock Fendering Systems

·

Vessel Fendering Systems

·

Bridge Fendering Systems

·

Seawalls

Focusing on Developing Amour as a Brand Name

Increasing Amour’s reputation and name/brand recognition among its customers, manufacturers, employees, management, shareholders, and the investment community is a primary goal of management in 2009.

Regulatory Mandates

Our business model takes into consideration regulatory mandates.

We maintain a website with the addresswww.americanfibergreenproducts.com We are not including the information contained in our website as part of, or incorporating it by reference into, this report on Form 10-K. We will make available, free of charge, through our website any of our filings as soon as reasonably practicable as we electronically file these materials with, or otherwise furnish them to, the Securities and Exchange Commission (“SEC”).

We are an electronic filer with the SEC and the SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC athttp://www.sec.gov.

The Company intends to apply for and receive certification from regulatory agencies, including the Department of Ecology and the US Environmental Protection Agency, to accept certain wastes, including molded fiberglass, resins and related materials. The Company’s manufacturing process and facilities require no additional environmental clearances, other than compliance with the standard regulations and rules which are applicable to US manufacturers of fiberglass products.

Actions by Federal, state and local governments concerning environmental matters could result in laws or regulations that could increase the costs of producing the products manufactured by the Company or otherwise adversely affect demand for its products. The Company does not currently anticipate any material adverse effect on its operations, financial conditions or competitive position as a result of its efforts to comply with environmental requirements. Some risk of environmental liability is inherent in the nature of the Company’s business and there can be no assurance that material environmental liabilities will not arise. It is also possible that future developments in

5

environmental regulations could lead to material environmental compliance or cleanup costs. If the Company were to lose its certification to accept fiberglass wastes, it would be necessary to use new resins in the manufacturing process, which could reduce the Company’s cost advantage.

In compliance with the general intent of Federal and local environmental regulations as they apply to the disposal of outdated resins and fiberglass wastes, some suppliers of recyclable materials require approval or certification of the Company as one of their “authorized” recipients prior to utilization of the Company’s services. In conjunction with these procedural requirements, the Company will seek certification that the Company’s process is approved and the Company is authorized as a recipient of outdated resins and fiberglass wastes. The Company’s products are required to meet material regulations by various federal, state, and local government agencies and the performance standards or requirements of its various customers. As an example, vehicle bumper stops are required to meet standards and guidelines established by the US Department of Transportation (DOT). Additionally, many customers request samples of product s for testing prior to committing the Company’s product to open purchase order procurement. The Company has actively supported potential customers in the testing and evaluation of each product and anticipates the continuation of this procedure as the Company expands its customer base and introduces new products.

How We Will Manage Our Operations

We will electronically hand off to our in-house Customer Care Representatives to handle customer calls, sales, verifications, billing and shipping. Customer orders are processed by our Florida operations facility. The Florida facility is responsible for the following duties that further enhance the customer’s experience: Both of our subsidiaries’, marketing strategy is to satisfy our customer’s needs. Our products meet with instant market approval through carefully crafted aesthetics, function, features and competitive pricing. We hold weekly meetings with all key members of the operational areas of the Company, including sales, compliance, billing, shipping and administration. Such operational weekly meetings result in a thorough discussion of weekly results and problems, with plans and goals for the week set at such meetings

Prospective customers view our material through our website with information of how to contact Amour Fiber Core or American Leisure Products. Once a customer contacts us, our customer care representatives will explain the benefits of our service, qualify the prospective customer, and answers any questions they may have. All of these factors help to solidify customer retention rates and expected long-term brand loyalty.

The overall marketing plan for our product is based on the following fundamentals:

Amour Fiber Core

·

Verify the customers are qualified

·

Establish Licensee’s for each specific product they will market

·

Identify a continuous supply of new opportunities, to fill the sales “funnel”.

·

Ship the products directly

·

Maintain contact with the customer (to insure on-going education and regulatory compliance);

·

Establish a professional, distribution network

·

Develop a system to minimize delivery lead time.

·

Establish protocols to promote follow up sales or referrals from existing customers.

·

Obtain feedback from the customer base to continually improve the product or the sales channel.

American Leisure Products

The overall marketing plan for our product is based on the following fundamentals:

·

Establish a professional, qualified and capable distribution dealer network.

·

Identify a continuous supply of new opportunities, to fill the sales “funnel”.

·

Manage a system to minimize delivery lead time.

·

Manage the systems to promote follow up sales or referrals from existing customers.

·

Obtain feedback from the customer base to continually improve the product or the sales channel.

Initially, all shipping will be direct to the consumer and produced in our Florida facility, with the Company receiving bulk shipments from its suppliers at the same location.

6

American Leisure Products

General Development of Business

American Leisure Products is a company that will produce fiber reinforced plastic composite parts. Although ALP will produce products from its own molds and tooling, we will also be able to serve as an outsource to many industries, including: transportation, marine, commercial and architectural. The reputation and experience of our production employees create a demand for our services in the market place. Our experience in building custom molds for multiple industries is in high demand. Generally, the explosive demand for fiberglass recreational products to fill the demands of affluent ‘baby boomers’ with leisure time on their hands bodes well for ALP and other producers for several years to come. ALP has positioned itself to be a leader within the Fiberglass Reinforced Plastic (FRP) industry by means of its unique designs and product variety, as well as the experience and skill of its employees and management.

Growth Strategy

Growth is intended to be achieved by establishing brand recognition for American Leisure Products both as an owned product line and as a reliable outsource for the FRP manufacturing industry. ALP will increase its customer base requiring FRP products to be built as our reputation for quality and delivery reliability becomes known. These customers require products to be built as they do not have the facility and/or knowledge to produce these products in-house.

In addition to the outside work, ALP intends to produce “in house” products described below that the Company owns or controls. These products will focus on the recreational industry. Growth will be achieved by establishing dealers for the replica car bodies and FRP parts and by participating in rallies and gatherings of hobbyists for the various products. Support will be available through employee’s who can assist with questions, printed material, and commitments by the Company and the dealer at national shows, all linked through the Company’s web site. Advertisement in regional and national publications will increase brand recognition. Our research shows that the dealer network in the “hot markets” in the US could reach a potential of 200 plus dealers. The use of the Internet will allow communication with worldwide customers.

Products

Antique Replicars

·

Nostalgic replica automobiles (commonly referred to as Hot Rods) are provided at completion levels from the hobbyist who wants to build his own car to the enthusiast that wants to buy a complete automobile ready to drive away. These cars are offered in a number of package configurations to serve every segment of the market:

·

Phase 1: These parts package includes all of the major body components. The customer will build the car from the ground up. This customer is normally a serious hobbyist with tools, equipment and the required skills.

·

Phase 2: These parts packages are provided with all of the components required less the engine and the interior. This includes the frame, suspension, brakes, body, steering, wheels, etc. This customer is the hobbyist who wants to build a car and has the space, some equipment, but wants all of the components (already fitted) and complete.

·

Phase 3: This level is for the enthusiast who does not have the place, time, equipment or skills to build an automobile.

Building the cars at various stages will reduce a major part of the dealer’s time. The Company will support the dealers with cars (nick-named rollers). These “rollers” will be assembled, based on various stages of work with easy step-by-step processes to complete. By building the cars in these stages, it will allow the final car to be completed with a minimum of effort.

Boats

ALP will produce fiberglass boats from molds and tooling that will be exclusive to ALP. These boats have long histories and continue to receive regional and nation recognition for their quality construction, unique style and the fierce loyalty of their owners. ALP will produce trawlers, sailboats and flats boats from their own exclusive lines as well as provide outsource service for other manufacturers as need and opportunity allow.

7

Other Products

From time to time as opportunities arise, ALP may opt to develop other products to build for their own account or others. The level of skill and expertise of the management and employees of ALP enhance their imagination and market awareness. Design and /or redesign of a product for the market is within their in-house skills as well as the ability to build the tooling and molds that bring those designs to reality and to market.

Future Growth Strategy

We will expand the dealer network through direct marketing from the factory. Each dealer will have an area that will be negotiated based on commitments and the demographics that needs to be covered. The “Dealer Package” will be for a certain minimum requirement and a commitment for delivery of additional cars for the remaining year based on the geographic area of the dealer.

See the discussion of the Company’s plan of operations under Part 2, Item 7.

Antique Replicar Rental

Our market research indicates that a business opportunity grows substantially, when we use our own manufactured vintage car products in a rental fleet network in vacation areas. Demand for a fresh, new, fun alternative form of transportation is an exciting prospect for consumers and investors alike.

·

Rental locations will be established throughout the country to satisfy the demand for exotic or premium rentals in locations such as Miami, FL, Daytona, FL, Las Vegas, NV, Los Angeles, CA, etc. The Company intends to use these centers to rent, service, and sell its products.

·

Parts and service. The parts required to assemble these vintage cars will be made available to our dealer network as well as retail consumers. Through the use of our web site, both dealers and consumers will be able to interface with the factory for their needs. The service category includes revenues from customers for the repair of damaged items or items that need to be installed.

Competition - Amour Fiber Core

Recycling

The Company is aware of several experimental fiberglass recycling projects and a few prototype or development stage commercial fiberglass recycling companies. Most of these competitors utilize a process which grinds the fiberglass into a fine powder and feeds the powder into the fluid being sprayed, under pressure, onto fiberglass molds. The Company is not aware of any fiberglass recycling companies which utilize any process similar to the Company’s proprietary process; however, it is possible that others are in the early stages of developing other fiberglass recycling technologies. The Company believes that the patent issued to the Amour Family Trust and licensed to the Company will be sufficient to prevent any potential competitors from utilizing any process similar to that used by the Company.

Products

The Company will compete worldwide with a variety of manufacturers of wood, plastic, concrete and fiberglass products, including many large industrial corporations with resources significantly greater than those of the Company.

The Company competes with new fiberglass products based upon price. New fiberglass products are manufactured with new resins and new glass fibers, which add raw material costs to the wholesale price of the product. Manufacturing of the Company’s product does not incur the same raw materials costs and, therefore, to the extent the Company utilizes recyclable resins and fiberglass wastes, the Company’s products may have a sales price advantage. There are a number of businesses that make or could make fiberglass tables and benches. In general, these businesses must purchase raw materials to manufacture their products, and therefore have higher costs of goods sold.

Like other fiberglass products, the Company’s products are typically sold at a price higher than similar wood products; however like other fiberglass products, the Company’s products have strong resistance to moisture, dry rot and surface damage. The Amour products also present features of higher strength and durability. The Company

8

believes these long term benefits off-set the higher price of the product. The Company’s products are similar in cost to new and recycled plastic products. The advantages that the Company’s products have over plastic products are higher modulus of rupture and elasticity, higher compression allowance, higher density and better structural integrity.

American Leisure Products

The Company believes its products provide an overall better value for the customer when compared to its competition, because of exceptional features such as selling kits that allow for lower cost entry into the hobby. . Even though the feature benefits may be compelling, ALP products will remain competitively priced. The Company does not anticipate erosion in margin due to competition. The leisure market is expanding rapidly and maintenance of market share will insure growth. Most of the competitors in this market offer a cost effective, reliable product that will meet or exceed the functional application requirements.

The distinguishing advantages for ALP are a competitive price point, a superior product, ongoing product evaluation, quality control and support. A complete technical comparison is available; which gives ALP an advantage over its competitors by providing a greater perceived value to the Customer.

Employees

As of December 31, 2008, the Company employed three full-time employees. The Company may engage independent contractors and other temporary employees in its operations as required. None of the Company’s employees is represented by a labor union, and the Company considers its employee relations to be good. The Company believes that its future success will depend in part on its continued ability to attract, hire and retain qualified personnel.

ITEM 1A.

RISKS PARTICULAR TO THE COMPANY’S BUSINESS

The risk to the company’s business model is that the time it takes to fund, organize and begin operations will leave the door open for others to create a competitive solution that could cause us to lose our uniqueness.

ITEM 2.

DESCRIPTION OF PROPERTY

Our office and production facilities are located at 4209 Raleigh Street, Tampa, Florida 33619. Currently, a related company, Public Acquisition Company, has a lease/option on the property where AFGP is located. No monthly rental fee is charged by the related party, but there is no guarantee that this arrangement will continue. The office is approximately 1,000 square feet and is in a condition adequate for our operations. The production facilities will be sufficient for the start up of AFGP. Additional adjacent property is available for lease or purchase. The terms of the lease agreement require thirty days written notice by either party to terminate the lease.

ITEM 3.

LEGAL PROCEEDINGS

The Company is not involved in any legal proceedings and is not aware of any pending or threatened claims.

The Company expects that it may become subject to legal proceedings and claims from time to time in the ordinary course of its business, including, but not limited to, claims of alleged infringement of the trademarks and other intellectual property rights of third parties by the Company and its licensees. Such claims, even if not meritorious, could result in the expenditure of significant financial and managerial resources.

ITEM 4.

SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

During the year ended December 31, 2008, the Company did not submit any matters to a vote of its security holders.

9

PART II

ITEM 5.

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASE OF EQUITY SECURITIES

The Company’s common stock is traded on the Over The Counter Bulletin Board (OTCBB) under the symbol “AFBG”. The table below sets forth the high and low bid prices for the Company’s common stock for each calendar quarter as of the start of trade on May 22, 2008. Quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission, and may not represent actual transactions.

| | | | | |

| | | Bid Prices |

| | | Low | | High |

FISCAL 2008 | | | | | |

First Quarter (January 1, 2008 through March 31, 2008) | | | N/A | | N/A |

Second Quarter (April 1, 2008 through June 30, 2008) | | | $0.50 | | $1.01 |

Third Quarter (July 1, 2008 through September 30, 2008) | | | $0.10 | | $0.95 |

Fourth Quarter (October 1, 2008 through December 31, 2008) | | | $0.07 | | $0.26 |

On March 31, 2009 the closing bid price of the Company's Common Stock as reported by the OTCBB was $0.80 and there were approximately 972 shareholders of record of common stock and no holders of record of preferred stock.

Currently there are no outstanding warrants or options to purchase stock.

Penny Stock Regulations:

The Company’s common stock is subject to provisions of Section 15(g) and Rule 15g-9 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), commonly referred to as the “penny stock rule.” Section 15(g) sets forth certain requirements for transactions in penny stocks, and Rule 15g-9(d) incorporates the definition of “penny stock” that is found in Rule 3a51-1 of the Exchange Act. The SEC generally defines “penny stock” to be any equity security that has a market price less than $5.00 per share, subject to certain exceptions. As long as the Company’s common stock is deemed to be a penny stock, trading in the shares will be subject to additional sales practice requirements on broker-dealers who sell penny stocks to persons other than established customers and accredited investors.

Dividends

The Company does not anticipate paying any cash dividends on its Common Stock in the foreseeable future. The Company expects to retain, if any, its future earnings for expansion or development of the Company’s business. The decision to pay dividends, if any, in the future is within the discretion of the Board of Directors and will depend upon the Company’s earnings, capital requirements, financial condition and other relevant factors such as contractual obligations. There can be no assurance that dividends can or will ever be paid.

During the year ended December 31, 2008, there was no modification of any instruments defining the rights of holders of the Company's common stock and no limitation or qualification of the rights evidenced by the Company's common stock as a result of the issuance of any other class of securities or the modification thereof.

During the year ended December 31, 2008, the Company issued 2,120,188 shares of common stock to a qualified investor for $0.05 per share for the relief of notes payable and related accrued interest of $107,009.

ITEM 6.

SELECTED FINANCIAL DATA

Not applicable.

10

ITEM 7.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION

THIS FILING CONTAINS FORWARD-LOOKING STATEMENTS. THE WORDS “ANTICIPATED,” “BELIEVE,” “EXPECT,” “PLAN,” “INTEND,” “SEEK,” “ESTIMATE,” “PROJECT,” “WILL,” “COULD,” “MAY,” AND SIMILAR EXPRESSIONS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS. THESE STATEMENTS INCLUDE, AMONG OTHERS, INFORMATION REGARDING FUTURE OPERATIONS, FUTURE CAPITAL EXPENDITURES, AND FUTURE NET CASH FLOW. SUCH STATEMENTS REFLECT THE COMPANY’S CURRENT VIEWS WITH RESPECT TO FUTURE EVENTS AND FINANCIAL PERFORMANCE AND INVOLVE RISKS AND UNCERTAINTIES, INCLUDING, WITHOUT LIMITATION, GENERAL ECONOMIC AND BUSINESS CONDITIONS, CHANGES IN FOREIGN, POLITICAL, SOCIAL, AND ECONOMIC CONDITIONS, REGULATORY INITIATIVES AND COMPLIANCE WITH GOVERNMENTAL REGULATIONS, THE ABILITY TO ACHIEVE FURTHER MARKET PENETRATION AND ADDITIONAL CUSTOMERS, AND VARIOUS OTHER MATTERS, MANY OF WH ICH ARE BEYOND THE COMPANY’S CONTROL. SHOULD ONE OR MORE OF THESE RISKS OR UNCERTAINTIES OCCUR, OR SHOULD UNDERLYING ASSUMPTIONS PROVE TO BE INCORRECT, ACTUAL RESULTS MAY VARY MATERIALLY AND ADVERSELY FROM THOSE ANTICIPATED, BELIEVED, ESTIMATED, OR OTHERWISE INDICATED. CONSEQUENTLY, ALL OF THE FORWARD-LOOKING STATEMENTS MADE IN THIS FILING ARE QUALIFIED BY THESE CAUTIONARY STATEMENTS AND THERE CAN BE NO ASSURANCE OF THE ACTUAL RESULTS OR DEVELOPMENTS.

The following discussion and analysis should be read in conjunction with the Company’s consolidated financial statements and related notes thereto included elsewhere in this registration statement. Portions of this document that are not statements of historical or current fact are forward-looking statements that involve risk and uncertainties, such as statements of our plans, objectives, expectations and intentions. The cautionary statements made in this registration statement should be read as applying to all related forward-looking statements wherever they appear in this registration statement. Our actual results could differ materially from those anticipated in the forward-looking statements. Factors that could cause our actual results to differ materially from those anticipated include those discussed in “Risk Factors,” “Business” and “Forward-Looking Statements.”

The following management discussion should be read together with the AFGP’s consolidated financial statements included in this registration statement See “Index to Financial Statements” at page F-1. Those consolidated financial statements have been prepared in accordance with generally accepted accounting principles of the United States of America.

General Overview

American Fiber Green Products, Inc.

From its inception, American Fiber Green Products, Inc. ( f/k/a Amour Hydro Press, Inc; Amour Fiber Core, Inc. [Washington]; Amour Fiber Core, Inc. [Nevada]) has had a focus on the production of Fiberglass Reinforced Plastic (FRP) products to take to market, beginning with the patented recycling technology developed by William Amour, the company’s founder. After spending millions of dollars on research and development and proving that the technology could, in fact, recycle fiberglass waste and produce superior fiberglass products, the Company was forced to suspend operations due to the death of Mr. Amour in 1999. Several years of stagnation and distress left the Company, its creditors and its nearly 850 shareholders on the verge of total loss. In 2001 Kenneth McCleave started dialogue with the Management and shareholders of the Company about merging with American Leisure Products, Inc., a company that would use virgin materials to produce vintage cars, boats and other FRP products. These discussions resulted in a concerted effort by McCleave and his team, as well as the Officers and Directors of the Company, to establish support for and confidence in the proposed plan of merger. In May of 2004 after much creditor negotiation, resolution of legal matters and personal visits with hundreds of shareholders representing over 70% of the issued and outstanding shares of the Company’s common stock, the merger was completed between Amour Fiber Core, Inc. (Nevada) and American Leisure Products, Inc. (Florida) Simultaneously, the combined companies effected a name change to American Fiber Green Products, Inc. (AFGP) The company established that the future operations of the two merged companies would represent two divisions of AFGP. Amour Fiber Core, Inc. (Florida) had been formed to be a subsidiary of American Fiber Green Products, Inc. specifically fiberglass waste recycling. American Leisure Products, Inc. (Florida) will produce fibe rglass components from new materials.

11

Amour Fiber Core

We plan to generate revenues from several areas: a technology and proprietary process for the recycling of fiberglass. Revenues can be produced from the following areas:

Amour Fiber Core primary focus will be to recycle fiberglass, produce products from recycled material and sell license agreements for its process. The Company has developed, tested and previously placed into limited commercial production, a new technology for fiberglass reclamation manufacturing. It has adapted this technology to establish a manufacturing business. From the research and development in Amour’s early stages many different products have been prototyped and tested. Building on this foundation, management has determined that the pilot plant, anticipated to be constructed in Florida in 2009 will produce general planking or boards for marine decking and seawalls. Marketing the planking we will help to “brand” our name through park benches and picnic tables as part of our first line of finished goods.

We intend to offer contracts for our licensing of our patented technology. The Company believes that licensing its technology to businesses in foreign countries and the North American market can be an effective method to maximize the return on its investment in the continued development of its fiberglass recycling technology, without significant additional capital outlays. Additionally, such licensing agreements will increase the Company’s public visibility and general awareness of its technology. The licensee will be required to pay an upfront fee for the sub-license, equipment and training prior to delivery and a royalty fee to the Company for each item produced by the licensee. If the wholesale price of the licensee’s produced products are significantly below the production costs of products produced by the Company, the Company may also offer to purchase product from the licensees. The Company believes the establishment of licensees in various foreign countries is an effective means of introducing the Company’s technology into new markets without major capital outlays.

American Leisure Products.

American Leisure Products (ALP) will produce FRP parts within the fiberglass industry. In addition the Company will produce parts from the company owned molds for the after market hot rod industry and the marine industry. ALP will produce and sell vintage car bodies, boats, and other fiberglass components in the leisure products line. The leisure market has been defined in recent years as one of the fastest growing market segments because of ‘baby boomers’ who have reached a point of financial affluence and increasing leisure time. Their desire to enjoy the ‘fruits of their labor’ has created a massive market that our products will feed. The company currently owns molds for several products, but will also be acquiring additional molds and tooling as funding is achieved through debt or equity or the combination.

Results of Operations

Revenues.

The Company had no revenue for the years ended December 31, 2008 and 2007. The Company has suspended all operations for the past several years while management effected the changes in corporate structure, built a management team, studied the market trends, and generated investment interest in the Company’s business model and opportunity. The Company plans to build a pilot plant in 2009. The Company has begun the process of identifying a network of sub-licensees to collect and process waste fiberglass and to produce finished goods from that process. These sub-licenses will provide income to the Company in initial fees for acquiring the license as well as ongoing revenue from production royalties.

Expenses

The Company incurred interest expense for year ended December 31, 2008, of $87,507. Interest for the year ended December 31, 2007 was $114,457. Interest was charged based on the stated interest rates set forth in the notes. Marketing, general and administrative expenses for the same periods were $87,411 and $173,161 respectively. The decrease in marketing, general and administrative expenses is primarily due to prior year costs associated with corporate filings and registrations.

12

Income tax expense.

The Company has incurred net operating losses since inception. At December 31, 2008 the Company had a net operating loss carry forward of approximately $2,800,787. For U.S. tax purposes the net operating losses will begin expiring in twenty years. We have had a change of ownership as defined by the Internal Revenue Code section 382. As a result, a substantial annual limitation may be imposed upon the future utilization of our net operating loss carry forwards.

General Trends and Outlook

We believe that our immediate outlook is extremely favorable, as we believe there is no other company competing with us on a nationwide basis in our market niche for recycling fiberglass and only a limited numbers of companies competing with us in of our products within American Leisure Products. However, there is no assurance that such national competitor will not arise in the future. We do not anticipate any major changes in the Recycling industry. We believe that 2009 will be a significant growth year, and besides the operational business strategies discussed above, we intend to implement the following plans in 2009 in order to maintain and expand our opportunity.

The Company continues to seek funding which will allow us to staff our facility in Tampa, Florida, with customer service representatives and logistical support personnel, to build our Pilot Plant and complete our tooling requirements. Currently this facility is limited in staff. The Tampa plant will serve as the selling platform for the sub-licensing of Amour Fiber Core’s patented technology. Additionally, we will utilize this facility to directly distribute American Leisure’s products to the market.

As we gain strength and stability in the U.S. domestic market, we intend to expand our influence and market in other areas of the world through our license agreements. Inquiries about acquiring use of the Amour recycling technology have been received from Japan, Australia, England, France, Turkey, Egypt, the African continent, Indonesia, Ireland, the Caribbean basin and Canada.

Liquidity and Capital Resources

During the years ended December 31, 2008 and 2007 the Company used cash from operating activities of $86,973 and $123,154, respectively. This use of cash is primarily due to operating losses for both periods and partially offset by deferred compensation.

During the years ended December 31, 2008 and 2007 the Company provided cash from investing activities of $-0- and $546,656, respectively. The decrease in cash flows from investing activities is primarily due to prior year’s reclassification of interest payable from short term to long term. We believe this to be a more appropriate presentation since our priorities are to focus on the business growth and profitability.

During the years ended December 31, 2008 and 2007 the Company (used) provided cash from financing activities of $86,926 and (423,511), respectively. This increase of cash provided by financing activities is primarily due to prior year’s reclassification of interest payable from short term to long term and issuance of common stock to relieve notes payable and accrued interest.

The aggregate value of outstanding loans as of December 31, 2008 is $522,227. This amount is comprised of notes payable to shareholders of $298,035 and long-term payables of $224,192. Notes payable to shareholders are due on demand, together with accumulated interest on a compound basis at rates specified in each note.

Long-term payables are comprised of amounts due to PAC, a related party, of $224,192 of which $221,148 bears interest with terms similar to those of the notes payable to shareholders. The remaining balance of long-term payables of $3,044 has no specified terms or conditions.

Cash flows from operations have been derived primarily from increased liabilities and issuance of equity. As of December 31, 2008, working capital deficit was $328,807. As current operating cash flow is insufficient to finance the Company’s planned growth, we will continue to seek additional financing from alternative sources, including bank loans, supplier agreements and other financing arrangements. The Company has engaged the services of an unaffiliated third party on a performance basis to locate both short term and long term funding in both debt and equity. Preliminary results have produced anticipation of short term financing in the second quarter of 2009 and long term funding in the third quarter.

13

The Company’s financial statements have been prepared assuming that the Company will continue as a going concern. For the year ended December 31, 2008, the Company had a net loss of $161,660, cash used by operations of $64,473, and negative working capital of $328,807. In view of these matters, recoverability of recorded asset amounts shown in the accompanying consolidated financial statements is dependent upon the Company’s ability to commence operations and to achieve a level of profitability. The Company has financed its activities principally from private funding. The Company intends to finance its future development activities and its working capital needs during the next twelve months largely from debt and equity financings until such time that funds provided by operations are sufficient to fund working capital requirements. However, there can be no assurance that any such financing will be available , and that if available, that it will be available on terms that are favorable or acceptable to the Company.

The planned construction of the Pilot Plant is expected to cost approximately $525,000. The Company plans to acquire funding for the construction from outside investors, establishment of license agreements, government grants or through a stock offering.

Unpredictability of future revenues; Potential fluctuations in quarterly operating results; Seasonality

As a result of the Company’s limited operating history, the Company is unable to accurately forecast its revenues. The Company’s current and future expense levels are based largely on its investment plans and estimates of future revenues and are to a large extent fixed and expected to increase.

Sales and operating results generally depend on the volume of, timing of and ability to fulfill the number of orders received and the ability to obtain raw materials at a reasonable price. The Company may be unable to adjust spending in a timely manner to compensate for any unexpected revenue shortfall. Accordingly, any significant shortfall in revenues in relation to the Company’s planned expenditures would have an immediate adverse effect on the Company’s business, prospects, financial condition and results of operations. Further, as a strategic response to changes in the competitive environment, the Company may from time to time make certain pricing, service or marketing decisions which could have a material adverse effect on its business, prospects, financial condition and results of operations.

The Company expects to experience significant fluctuations in its future quarterly operating results due to a variety of factors, many of which are outside the Company’s control. Factors that may adversely affect the Company’s quarterly operating results include (i) the Company’s ability to retain customers, attract new customers at a steady rate and maintain customer satisfaction, we cannot be sure that we will be able to attract sufficient customers to maintain or grow revenue and consequently our long term growth and success may be negatively impacted (ii) the announcement or introduction of new technology by the Company and its competitors, we cannot be sure that our competition will not significantly impact our customer base, and thereby negatively impact our revenues, with new and improved technology; (iii) price competition or higher prices in the industry we cannot be sure that we will be able to maintain our current pricing structure and gross margins to be able to compete with new competitors at reasonable prices; (iv) the Company’s ability to upgrade and develop its systems and infrastructure and attract new personnel in a timely and effective manner, the Company cannot be sure that it will be able to raise sufficient capital in order for it to grow its infrastructure; (v) governmental regulation, the Company must comply with regulations from several governmental agencies to ensure compliance of products, recycling processes and manufacturing facilities, but there is no assurance that the regulations will not change or become more restrictive in the future, thereby limiting the ability of the Company to produce cost effective products.

Capital Stock

Preferred Stock

Although the board has authorized 5,000,000 shares of preferred stock, par value $.001, none has been issued.

Capital expenditures.

We expect to incur capital expenditures in the future. Since our inception, the research and development has been completed. For each division in 2009-2010, we expect to have total capital expenditures of $525,000.00 — Amour Fiber Core $250,000 for the pilot plant and American Leisure Products $275,000.

14

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors.

Significant Accounting Policies

The accounting policies of the Company are in accordance with generally accepted accounting principles of the United States of America, and their basis of application is consistent. Outlined below are those policies considered particularly significant:

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Common stock transactions for services are recorded at either the fair value of the stock issued or the fair value of the services rendered, whichever is more evident on the day that the transactions are executed. The certificates must be issued subsequent to the transaction date.

Research and development costs are charged to operations when incurred and are included in operating expenses.

The accompanying consolidated financial statements include the activity of the Company and its wholly owned subsidiaries. All intercompany transactions have been eliminated in consolidation.

The preparation of consolidated financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements, and the reported amounts of revenues and expenses during the reported periods. Actual results could materially differ from those estimates.

For purpose of the statement of cash flows, the Company considers all highly liquid debt instruments purchased with a maturity of three months or less to be cash equivalents.

Inventory is valued at the lower of cost or market. All inventory will be evaluated periodically for excess amounts on hand and obsolescence. If necessary, appropriate reserves will be established.

Property and equipment are stated at cost and are depreciated over their estimated useful lives. Depreciation is currently recorded as Marketing, General and Administrative expense. At such time as assets are transferred to revenue generating production, their associated depreciation will be recorded as Cost of Sales.

The Company recognizes revenues from 1) tipping fees in the acquisition of scrap fiberglass, 2) sale of products produced with reclaimed fiberglass, 3) fees charged for licensing and installation of the proprietary reclamation and manufacturing processes, 4) royalties charged to licensees for revenues generated by using our licensed processes, 5) sales of other fiberglass products (reproduction cars, boats). Revenue is recorded when products and services are provided to the customer.

Project development costs are expensed as incurred. The cost of equipment that will be acquired or constructed for project development activities, and that have alternative future uses, both in project development, marketing or sales, will be classified as property and equipment and depreciated over their estimated useful lives. To date, project development costs include the development, engineering, and marketing expenses related to the Company’s fiberglass reclamation process and associated product development.

Effect of Inflation

We do not believe that inflation has had a material effect on our business, results of operations or financial condition during the past two years.

15

New Accounting Pronouncements

In March 2008, the FASB issued Statement of Financial Accounting Standards No. 161, Disclosures About Derivative Instruments and Hedging Activities. ("SFAS 161"). SFAS 161 requires additional disclosures related to the use of derivative instruments, the accounting derivatives and the financial statement impact of derivatives. SFAS No. 161 is effective for fiscal years beginning after November 15, 2008. The adoption of SFAS 161 will not have a material impact on the Company’s consolidated financial statements.

In April 2008, the FASB issued FASB Staff Position (FSP) FAS 142-3, Determination of the Useful Life of Intangible Assets. FSP FAS 142-3 amends the factors that should be considered in developing renewal or extension assumptions used to determine the useful life of a recognized intangible asset under FASB Statement No. 142, Goodwill and Other Intangible Assets. FSP FAS 142-3 is effective for fiscal years beginning after December 15, 2008 and early adoption is prohibited. The adoption of this statement will not have a material effect on the Company’s financial statements.

In May 2008, the FASB issued SFAS No. 162, The Hierarchy of Generally Accepted Accounting Principles. SFAS No. 162 identifies the sources of accounting principles and the framework for selecting the principles to be used in the preparation of financial statements of nongovernmental entities that are presented in conformity with generally accepted accounting principles in the United Statements. It is effective 60 days following the SEC’s approval of the Public Company Accounting Oversight Board amendments to AU Section 411, The Meaning of Present Fairly in Conformity With Generally Accepted Accounting Principles. The adoption of this statement will not have a material effect on the Company’s financial statements.

Other recent accounting pronouncements issued by the FASB (including its EITF), the AICPA, and the SEC did not or are not believed by management to have a material impact on the Company’s present or future financial statements.

ITEM 7A.

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Not applicable.

16

ITEM 8.

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

American Fiber Green Products, Inc.

Consolidated Financial Statements

For The Years Ended December 31, 2008 and 2007

Reports of Independent Registered Public Accounting Firm

Contents

17

ROBERT T.TAYLOR, C.P.A.

18223 102nd Ave NE, Suit B

Bothell, Washington 98011-3454

425-485-8671 FAX 486-7766

REPORT OFINDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Stockholders and Directors

American Fiber Green Products, Inc.

And Subsidiaries

Tampa, Florida

We have audited the accompanying consolidated balance sheets of American Fiber Green Products, Inc. and subsidiaries as of December 31, 2008 and 2007, and the related consolidated statements of operations, changes in stockholders’ equity and cash flows for the years December 31, 2008 and 2007. These consolidated financial statements are the responsibility of management. Our responsibility is to express an option on the financial statements based on our audit.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal controls over financial reporting. Our audit included consideration of internal controls over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an option on the effectiveness of the Company’s internal controls over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management as well as e valuating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of American Fiber Green Products, Inc. and Subsidiaries as of December 31, 2008 and 2007, and the results of its operation and its cash flows for the years then ended, in conformity with accounting principles generally accepted in the United States Of America.

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As reflected in the accompanying financial statements, the Company is without significant operating revenues and has suffered recurring losses from operations and has an accumulated deficit. As discussed in note 2, the current losses and the Company’s working capital shortage indicated that there is substantial doubt about its ability to continue as a going concern. Management’s plans in regard to these matters are described in note 2. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Certified Public Accountant, April 1, 2009, Bothell, Washington

18

American Fiber Green Products, Inc.

Consolidated Condensed Balance Sheets

| | | | | | | | |

| | December 31, 2008 | | | December 31, 2007 | |

Assets | | | | | | |

Current assets: | | | | | | |

Cash | | $ | 25 | | | $ | 72 | |

Interest receivable, related parties | | | 35,926 | | | | 24,343 | |

| | | | | | | | |

Total current assets | | | 35,951 | | | | 24,415 | |

| | | | | | | | |

Notes receivable, net | | | 98,405 | | | | 98,405 | |

Furniture and equipment, net of accumulated depreciation of $22,500 (2008) and $17,500 (2007) | | | 27,500 | | | | 32,500 | |

| | | | | | | | |

| | $ | 161,856 | | | | 155,320 | |

| | | | | | | | |

Liabilities and Stockholders’ Deficit | | | | | | | | |

Current liabilities: | | | | | | | | |

Accounts payable | | $ | 350,308 | | | $ | 347,788 | |

Accrued expenses | | | 4,450 | | | | | |

Subscription payable | | | 10,000 | | | | 10,000 | |

| | | | | | | | |

Total current liabilities | | | 364,758 | | | | 357,788 | |

| | | | | | | | |

Notes payable – shareholders | | | 298,035 | | | | 334,035 | |

Deferred wages | | | 682,697 | | | | 608,397 | |

Accrued interest | | | 579,723 | | | | 566,456 | |

Other payables – related parties | | | 224,192 | | | | 221,542 | |

Total liabilities | | | 2,149,405 | | | | 2,088,218 | |

| | | | | | | | |

Stockholders’ deficit: | | | | | | | | |

Preferred stock; $0.001 par value; 5,000,000 shares authorized; 0 shares issued and outstanding | | | | | | | | |

Common stock; $0.001 par value; 350,000,000 shares authorized; 11,385,735 (2008) and 9,249,628 (2007) shares issued and outstanding | | | 11,386 | | | | 9,250 | |

Additional paid in capital | | | 2,423,383 | | | | 2,318,510 | |

Accumulated deficit | | | (4,422,318 | ) | | | (4,260,658 | ) |

| | | | | | | | |

Total stockholders’ deficit | | | (1,987,549 | ) | | | (1,932,898 | ) |

| | | | | | | | |

| | $ | 161,856 | | | $ | 155,320 | |

The accompanying notes are an integral part of the financial statements.

19

American Fiber Green Products, Inc.

Consolidated Statements of Operations

For the years ended December 31, 2008 and 2007

| | | | | | | |

| December 31, 2008 | | | December 31, 2007 | |

Other Expenses (Income): | | | | | | | |

Marketing, general and administrative expenses | $ | 87,411 | | | $ | 173,161 | |

Interest expense | | 87,507 | | | | 114,457 | |

Interest income | | (13,258 | ) | | | (10,756 | ) |

| | | | | | | |

Total other expense (income) | | 161,660 | | | | 276,862 | |

Net loss | $ | (161,660 | ) | | $ | (276,862 | ) |

| | | | | | | |

Net loss per share | $ | (.02 | ) | | $ | (.03 | ) |

| | | | | | | |

Weighted average number of common shares | | 10,622,152 | | | | 9,230,336 | |

The accompanying notes are an integral part of the financial statements.

20

American Fiber Green Products, Inc.

Consolidated Statements of Changes in Stockholders’ Deficit

For the years ended December 31, 2008 and 2007

| | | | | | | | | | | | | | | | | |

| Common Stock Shares | | Common Stock Amount | | | Additional Paid in Capital | | | Accumulated Deficit | | | Total | |

Balance, December 31, 2006 | 9,199,228 | | $ | 9,200 | | | $ | 2,279,800 | | | $ | (3,983,796 | ) | | $ | (1,694,796 | ) |

Issuance of common stock for cash | 20,400 | | | 20 | | | | 13,240 | | | | | | | | 13,260 | |

Issuance of common stock for services | 30,000 | | | 30 | | | | 25,470 | | | | | | | | 25,500 | |

Net loss | | | | | | | | | | | | (276,862 | ) | | | (276,862 | ) |

Balance, December 31, 2007 | 9,249,628 | | $ | 9,250 | | | $ | 2,318,510 | | | $ | (4,260,658 | ) | | $ | (1,932,898 | ) |

Issuance of common stock for debt | 2,120,188 | | | 2,120 | | | | 104,889 | | | | | | | | 107,009 | |

Transfer agent share balance adjustment | 15,919 | | | 16 | | | | (16 | ) | | | | | | | | |

Net loss | | | | | | | | | | | | (161,660 | ) | | | (161,660 | ) |

Balance, December 31, 2008 | 11,385,735 | | | 11,386 | | | | 2,423,383 | | | | (4,422,318 | ) | | | (1,987,549 | ) |

The accompanying notes are an integral part of the financial statements.

21

American Fiber Green Products, Inc.

Consolidated Condensed Statements of Cash Flows

For the years ended December 31, 2008 and 2007

| | | | | | | | |

| | December 31, 2008 | | | December 31, 2007 | |

Operating activities | | | | | | | | |

Net loss | | $ | (161,660 | ) | | $ | (276,862 | ) |

Adjustments to reconcile net loss to net cash used by operating activities: | | | | | | | | |

Depreciation | | | 5,000 | | | | 5,000 | |

Issuance of common stock for services | | | | | | | 25,000 | |

(Increase) decrease in: | | | | | | | | |

Prepaid expenses | | | | | | | 21,000 | |

Interest receivable | | | (11,583 | ) | | | (9,881 | ) |

Increase (decrease) in: | | | | | | | | |

Accrued expenses | | | 4,450 | | | | (25,500 | ) |

Accounts payable | | | 2,520 | | | | 63,289 | |

Deferred compensation | | | 74,300 | | | | 74,300 | |

Net cash used by operating activities | | | (86,973 | ) | | | (123,154 | ) |

Investing activities | | | | | | | | |

Other assets | | | | | | | 546,656 | |

Net cash provided (used) by investing activities | | | | | | | 546,656 | |

Financing activities | | | | | | | | |

Capital contribution | | | | | | | | |

Issuance of common stock | | | 107,009 | | | | 13,260 | |

Proceeds from issuance (settlement) of notes payable | | | (36,000 | ) | | | 17,885 | |

Increase in interest payable to shareholders | | | 13,267 | | | | (454,656 | ) |

Proceeds from issuance of other long term liabilities | | | 2,650 | | | | | |

Net cash (used) provided by financing activities | | | 86,926 | | | | (423,511 | ) |

Net decrease in cash | | | (47 | ) | | | (9 | ) |

Cash at beginning of year | | | 72 | | | | 81 | |

Cash at end of year | | $ | 25 | | | $ | 72 | |

The accompanying notes are an integral part of the financial statements.

22

AMERICAN FIBER GREEN PRODUCTS, INC.

Notes to Consolidated Financial Statements

For the Years Ended December 31, 2008 and 2007

NOTE 1 - ORGANIZATION AND BUSINESS

American Fiber Green Products, Inc. came into existence as a result of the following transactions:

In March of 1993, William Amour founded Amour Hydro Press, Inc. (AHP) to conduct research and development to commercialize proprietary technology that would allow the company to process waste fiberglass and resins into new commercially viable products.

In January of 1996 the Board of Directors authorized the merger of AHP with Amour Fiber Core, Inc. a Washington corporation. Each common share of Amour Hydro Press, Inc. was exchanged for 280 common shares of Amour Fiber Core, Inc. The authorized shares of Amour Fiber Core, Inc. were 5,000,000 shares. The company operated under this configuration until June 1998 when the Board of Directors approved a three for one forward split (3:1) increasing the authorized from 5,000,000 to 15,000,000 common shares. Amendments to the Articles of Incorporation were filed with the State of Washington. Although approved and recorded the 3:1 forward split was not reported to the transfer agent of the company. The resulting change in common stock was from 3,675,996 to 11,027,988 common shares issued and outstanding.

Within months of these actions, William Amour, founder and driving force behind the business was diagnosed with cancer and died in 1999. Attempts by the board to continue the operation of Amour Fiber Core, Inc. resulted in substantially more debt and ultimately the cessation of operations. The value of the company was in the exclusive rights to the proprietary technology, as well as the resources developed to source raw material and vendors and the ability to create viable products from waste material. There were 884 shareholders of record at the time of William Amour’s passing and they remained committed to the success of the Company. The Company ceased operations in January 2000, however, management continued to search for investors to be able to restart production.

On September 15, 2001, after several months of discussion and negotiations, Kenneth McCleave incorporated American Leisure Products, Inc. a Florida corporation, of which he was the sole shareholder of the 100,000 issued and outstanding shares for the purpose of merger with Amour Fiber Core, Inc. The terms and conditions of said merger included Mr. McCleave’s assistance in resolution of a number of problems restricting Amour. Litigation with the landlord and disgruntled note holders threatened the collapse of the company unless amicable resolution was achieved. The terms of the merger were established and the concerns were resolved over the subsequent 24 months.

In May of 2004, following appropriate shareholder consent and board action, Amour Fiber Core, Inc. (Washington) merged with a newly formed Nevada corporation of the same name and with the same issued and outstanding shares (11,027,988). Amour Fiber Core, Inc. (Nevada) has authorized 350,000,000 common and 5,000,000 preferred shares.

On May 24, 2004, Amour Fiber Core, Inc. (Nevada) then entered into an Agreement and Plan of Merger with American Leisure Products, Inc., a Florida corporation with a total issued and outstanding of 100,000 common shares. A 1:6 reverse split of the Amour Fiber Core, Inc. shares held by the AFC shareholders reduced the issued and outstanding common shares of AFC (Nevada) from 11,027,988 to 1,837,998. The merger called for each share of ALP to convert to 73.52 shares of Amour Fiber Core, Inc. (Nevada). The sole shareholder of ALP received 7,352,000 shares of Amour Fiber Core, Inc. (Nevada) in the merger (i.e. a conversion ratio of 73.52:1). Following this transaction, Amour Fiber Core, Inc. (Nevada) had 9,189,998 shares outstanding.

Following this merger and in keeping with the Shareholder Consent and subsequent board action, the name of Amour Fiber Core, Inc. (Nevada) was changed to American Fiber Green Products, Inc. American Leisure Products, Inc. (a Florida corporation) became a wholly owned subsidiary of American Fiber Green Products, Inc. The assets and opportunities of American Fiber Green Products, Inc. (f/k/a Amour Nevada and Amour Washington) were moved to a newly formed, Amour Fiber Core, Inc., ( a Florida Corporation) as a wholly owned subsidiary. The resulting structure is American Fiber Green Products, Inc. (Nevada) holding 100% of the stock of American Leisure Products, Inc. (Florida) and Amour Fiber Core, Inc. (Florida).

23

NOTE 2 - GOING CONCERN

The accompanying consolidated financial statements have been prepared assuming the Company will continue as a going concern. The Company’s continued existence is dependent upon the Company’s ability to obtain additional debt and/or equity financing. The Company has incurred losses since inception and, the Company is not generated any revenues from its products. These factors raise substantial doubt about the ability of the Company to continue as a going concern. The Company anticipates beginning construction of a pilot plant within the next 6 months and expects to complete the project and to begin production of scrapped fiberglass reclamation as a raw material within the next 18 months. Although the cost of construction is not readily determinable, the Company estimates the cost to be approximately $250,000 for the pilot plant and as much as $1.6M for a full function plant. Management plans to raise additional funds through the sale of su b-licensing agreements, project financings or through future sales of their common stock, until such time as the Company’s revenues are sufficient to meet its cost structure, and ultimately achieve profitable operations. There is no assurance that the Company will be successful in raising additional capital or achieving profitable operations. The consolidated financial statements do not include any adjustments that might result from the outcome of these uncertainties.

NOTE 3 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The accompanying consolidated financial statements include the activity of the Company and its wholly owned subsidiaries. All inter-company transactions have been eliminated in consolidation.