UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07583

HSBC ADVISOR FUNDS TRUST

(Exact name of registrant as specified in charter)

452 FIFTH AVENUE

NEW YORK, NY 10018

(Address of principal executive offices) (Zip code)

CITI FUND SERVICES

3435 STELZER ROAD

COLUMBUS, OH 43219

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-782-8183

Date of fiscal year end: October 31 Date of reporting period: October 31, 2014 |

Item 1. Reports to Stockholders.

HSBC Global Asset Management (USA) Inc.

HSBC Funds

Annual Report

October 31, 2014

| EQUITY FUNDS | | Class A | | Class B | | Class C | | Class I |

| HSBC Growth Fund | | HOTAX | | HOTBX | | HOTCX | | HOTYX |

| HSBC Opportunity Fund | | HSOAX | | HOPBX | | HOPCX | | RESCX |

| Table of Contents |

| HSBC Family of Funds |

| Annual Report - October 31, 2014 |

| Glossary of Terms | | |

| Commentary From the Investment Manager | | 3 |

| Portfolio Reviews | | 4 |

| Statements of Assets and Liabilities | | 8 |

| Statements of Operations | | 9 |

| Statements of Changes in Net Assets | | 10 |

| Financial Highlights | | 14 |

| Notes to Financial Statements | | 17 |

| Report of Independent Registered Public Accounting Firm | | 24 |

| Other Federal Income Tax Information | | 25 |

| Table of Shareholder Expenses | | 26 |

| HSBC Portfolios | | |

| Portfolio Composition | | 28 |

| Schedules of Portfolio Investments | | |

| HSBC Growth Portfolio | | 29 |

| HSBC Opportunity Portfolio | | 31 |

| Statements of Assets and Liabilities | | 33 |

| Statements of Operations | | 34 |

| Statements of Changes in Net Assets | | 35 |

| Financial Highlights | | 36 |

| Notes to Financial Statements | | 37 |

| Report of Independent Registered Public Accounting Firm | | 42 |

| Investment Adviser Contract Approval | | 43 |

| Table of Shareholder Expenses | | 45 |

| Board of Trustees and Officers | | 46 |

| Other Information | | 48 |

Barclays U.S. Aggregate Bond Index is an unmanaged index generally representative of investment-grade, USD-denominated, fixed-rate debt issues, taxable bond market, including Treasuries, government-related and corporate securities, asset-backed, mortgage-backed and commercial mortgage-backed securities, with maturities of at least one year.

Barclays U.S. Corporate High-Yield Bond Index is an unmanaged index that measures the non-investment grade, USD-denominated, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below. The index excludes emerging markets debt.

Gross Domestic Product (“GDP”) measures the market value of the goods and services produced by labor and property in the United States.

Lipper Large-Cap Growth Funds Average is an equally weighted average of mutual funds that, by portfolio practice, invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) above Lipper’s U.S. Diversified Equity large-cap floor. Large-cap growth funds typically have an above-average price-to-earnings ratio, price-to-book ratio, and three-year sales-per-share growth value, compared to the S&P 500 Index.

Lipper Mid-Cap Growth Funds Average is an equally weighted average of mutual funds that, by portfolio practice, invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) below Lipper’s U.S. Diversified Equity large-cap floor. Mid-cap growth funds typically have an above-average price-to-earnings ratio, price-to-book ratio, and three-year sales-per-share growth value, compared to the S&P MidCap 400 Index.

Morgan Stanley Capital International Europe Australasia and Far East (“MSCI EAFE”) Index is an unmanaged equity index which captures large and mid cap representation across Developed Markets countries: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland and the UK (excluding the U.S. and Canada).

Morgan Stanley Capital International Emerging Markets (“MSCI EM”) Index is an unmanaged index that captures large and mid cap representation across 23 Emerging Markets (EM) countries: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Russia, South Africa, Taiwan, Thailand, Turkey and United Arab Emirates.

Price-to-Earnings Ratio (“P/E Ratio”) is a valuation ratio of a company’s current share price to its per-share earnings. A high P/E Ratio means high projected earnings in the future.

Russell 1000® Index is an unmanaged index that measures the performance of the large-cap segment of the U.S. equity universe. It is a subset of the Russell 3000® Index and includes approximately 1000 of the largest securities based on a combination of their market cap and current index membership. The Russell 1000 represents approximately 92% of the U.S. market.

Russell 1000® Growth Index is an unmanaged index that measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values.

Russell 2000® Index is an unmanaged index that measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000® Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership.

Russell 2500™ Growth Index is an unmanaged index that measures the performance of the small- to mid-cap growth segment of the U.S. equity universe. It includes those Russell 2500 companies with higher price-to-book ratios and higher forecasted growth values.

Standard & Poor’s 500 (“S&P 500”) Index is an unmanaged index that is widely regarded as a gauge of the U.S. equities market. This index includes 500 leading companies in leading industries of the U.S. economy. The S&P 500 Index focuses on the large-cap segment of the market, with approximately 75% coverage of U.S. equities.

Lipper is an independent mutual fund performance monitor whose results are based on total return and do not reflect a sales charge.

Securities indices assume reinvestment of all distributions and interest payments and do not take in account brokerage fees or expenses. Securities in the Funds do not match those in the indices and performance of the Funds will differ. Investors cannot invest directly in an index.

2 HSBC FAMILY OF FUNDS

| Commentary From the Investment Manager |

| HSBC Global Asset Management (USA) Inc. |

U.S. Economic Review

The United States posted strong results for the 12-month period between November 1, 2013 and October 31, 2014. Healthy corporate profits and an improving employment picture helped drive strong economic growth in the U.S. and push equity markets to record highs. A different story played out globally, however, with the economies of Japan, China, and the eurozone struggling against significant economic headwinds. Geopolitical turmoil, particularly in the Ukraine and the Middle East, also weighed on global markets. The U.S. economy was one of the few economic bright spots for the period.

Equity markets benefited from the Federal Reserve Board’s (the “Fed”) decision to maintain the federal funds rate—a key factor in lending rates—at a historically low target range between 0.00% and 0.25%. Fears of a premature end to the Fed’s stimulus efforts led to some market volatility early in the period. The Fed Chairman Janet Yellen, who succeeded Ben Bernanke in February, eased those fears after suggesting that any increase in rates would be measured. Investors were reassured by the Fed’s plan to gradually phase out its large-scale bond-buying program by the end of October.

Despite the strong growth, the U.S. economy faced a number of economic headwinds during the period, including a loss of momentum in the housing market recovery, continued weakness in wage growth, and a harsh winter that contributed to a decline in U.S. gross domestic product1 (“GDP”) growth in the first quarter of 2014.

Economic indicators weakened during the first quarter of 2014, which dragged on markets and essentially erased equity gains from earlier in the period. Markets bounced back enough to post modest gains for the first half of the period, through April 30, 2014, however. The muted market response was a result of data showing slowed growth in manufacturing activity, meager improvements in the labor market and poor retail sales. The culmination of the negative indicators came with news that the U.S. economy had shrunk significantly during the first quarter of 2014—contracting at a 2.1% annualized rate.

GDP growth rebounded strongly in the second and third quarters of 2014, posting annualized growth rates of 4.6% and 3.9%, respectively. Economic conditions improved for the second half of the 12-month period as data showed significant improvements in retail sales, home sales, job growth, industrial output and consumer confidence. Progress in these areas generally continued through the end of the period, though important signs of economic weakness remained, such as a slowing rate of home price increases and lower-than-expected job growth. In particular, a large number of workers remain underemployed and reliant on part-time and lower paying jobs.

Outside of the U.S., developed economies faced major economic challenges. Japanese markets experienced volatility as the nation’s central bank pushed forward a plan to revive its economy. A steep increase in Japan’s consumption tax last spring dealt a severe economic blow, leading to a 1.8% decrease in GDP growth for the second quarter of 2014. Economic growth in eurozone economies also slowed dramatically due to high unemployment, decreasing industrial production and other disappointing economic indicators.

Economic conditions deteriorated in many emerging markets during the period. The leading drivers of those declines included geopolitical instability and concerns that tighter monetary policy in the U.S. would negatively impact emerging economies. China’s economy experienced a dramatic slowdown as a slumping real estate market and weak demand led to its lowest level of GDP growth in five years. While not unexpected, the slowdown in China acted as a drag on global economic growth. Meanwhile, Russia’s annexation of Ukraine’s Crimea region created much uncertainty in global markets. Western sanctions and a plummet in the value of the ruble contributed to substantial losses for Russian stocks.

Market Review

The period began with strong gains for U.S. equities. This climb continued through the end of 2013 only to give way to a market sell-off in late January 2014 that was triggered by slowing growth in emerging markets. The prospect of higher interest rates and declining global liquidity fed fears that slowing global economic growth could put a drag on U.S. markets. Robust corporate earnings in the U.S. helped stocks reverse directions in the following months, and positive economic data on housing, manufacturing and employment helped sustain the momentum. Broad market indices posted gains during each quarter of the period. Price-to-Earnings1 ratios also rose throughout the period, as investors grew more confident about the economic outlook.

U.S. small- and mid-cap stocks underperformed large-cap stocks during the period, and emerging markets equities slightly outpaced those of developed economies. The Russell 2000® Index1 of small-company stocks returned 8.06% during the 12 months through October 31, 2014, while the Russell 1000® Index1 returned 16.78%. The MSCI EM Index1 returned 0.98%, while the MSCI World Index returned 9.25%.

Stocks in many developed economies remained largely flat, with the U.S. being a notable exception. Equities in both Japan and Europe ended the 12-month period essentially where they had been at its start. The MSCI EAFE Index1 of international stocks in developed markets posted a -0.17% return. In the U.S., the S&P 500 Index1 of large-company stocks returned 17.27%. Each of the 10 sectors of the index shared in those gains.

Fixed-income markets made modest gains during the period. The yield curve flattened due to expectations that the Fed would move to raise interest rates, and over broader concerns about the health of the global economy. The expectation that short-term rates would soon rise created upward pressure on short-term bond yields.

Meanwhile, the slowdown in major global economies generally made the U.S. economy more attractive to risk-averse investors, which drove up prices on U.S. long-term bonds and caused yields to drop. The flight to quality also led to a strengthening of the U.S. dollar. The Barclays U.S. Aggregate Bond Index1, which tracks the broad investment-grade fixed-income market, returned 4.14% for the 12-month period ended October 2014, while the Barclays U.S. Corporate High-Yield Bond Index1 returned 5.82%.

Fixed-income markets in Europe rallied throughout the period, fueled by the European Central Bank’s bond-buying program and its efforts to lower interest rates. The Barclay’s Euro Aggregate Bond Index returned 8.80%. Emerging markets bonds also ended the period significantly higher as the J.P. Morgan Emerging Markets Bond Index Global returned 7.20%.

| 1 | | For additional information, please refer to the Glossary of Terms. |

HSBC FAMILY OF FUNDS 3

| Portfolio Reviews (Unaudited) |

| HSBC Growth Fund |

| (Class A Shares, Class B Shares, Class C Shares and Class I Shares) |

by Clark J. Winslow, CEO/Portfolio Manager

Justin H. Kelly, CFA, CIO/Portfolio Manager

Patrick M. Burton, CFA, Managing Director/Portfolio Manager

Winslow Capital Management, LLC

The HSBC Growth Fund (the “Fund”) seeks long-term growth of capital. Under normal market conditions, the Fund invests primarily in U.S. and foreign equity securities of high-quality companies with market capitalizations generally in excess of $2 billion, which the subadviser believes have the potential to generate superior levels of long-term profitability and growth. The Fund utilizes a two-tier structure, commonly known as a “master-feeder” structure, in which the Fund invests all of its investable assets in the HSBC Growth Portfolio (the “Portfolio”). The Portfolio employs Winslow Capital Management, LLC as its subadviser.

Investment Concerns

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities.

The growth investment style may fall out of favor in the marketplace and result in significant declines in the value of the Portfolio’s securities. Securities of companies considered to be growth investments may have rapid price swings in the event of earnings disappointments or during periods of market, political, regulatory and economic uncertainty.

For a complete description of these and other risks associated with investment in a mutual fund, please refer to the Fund’s prospectus.

Market Commentary

For the year ended October 31, 2014, the Fund returned 14.59% (without sales charge) for the Class A Shares and 14.94% for the Class I Shares. That compared to a 17.11% total return for the Russell 1000® Growth Index1, the Fund’s primary performance benchmark, and a 15.29% total return for the Lipper Large-Cap Growth Funds Average1.

Portfolio Performance

The U.S. economy continued to gain strength during the period, outpacing many other developed economies. U.S. equities performed well during the period due in part to strong corporate earnings growth and investors’ growing confidence in the strength of the economic recovery. Investors were also encouraged by signs—including continued low inflation—that the Fed was not likely to raise interest rates in the near term.

The Fund performed well in that environment. However, the Fund lagged its benchmark for the period. Individual stock selection was one of the largest detractors from relative performance. In particular, the Fund was hurt by underperforming investments in a global coffee chain that experienced weaker-than-expected same-store sales, and a beauty products retailer that underwent a management change and a revision to its long-term strategic plan.†

An overweight position in the consumer discretionary sector also detracted from relative performance. The sector lagged the benchmark as investors remained concerned about the potential for consumer spending to decline in the wake of harsh winter weather and a lack of significant wage growth among consumers.†

Stock selection in the industrial sector was the top contributor to the Fund’s relative performance. In particular, holdings of an airline and a railroad transportation company boosted returns, with the latter benefiting from higher-than-expected rail volumes and strong pricing power. An underweight position in the consumer staples sector also contributed to relative performance, as such stocks did not perform well during the period.†

| † | | Portfolio composition is subject to change. |

| 1 | | For additional information, please refer to the Glossary of Terms. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-782-8183.

4 HSBC FAMILY OF FUNDS

| Portfolio Reviews (Unaudited) |

| HSBC Growth Fund |

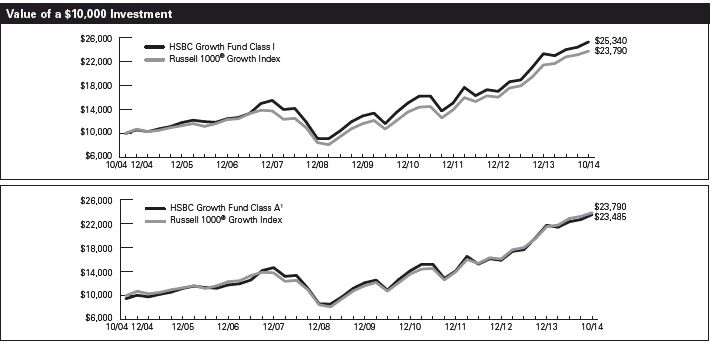

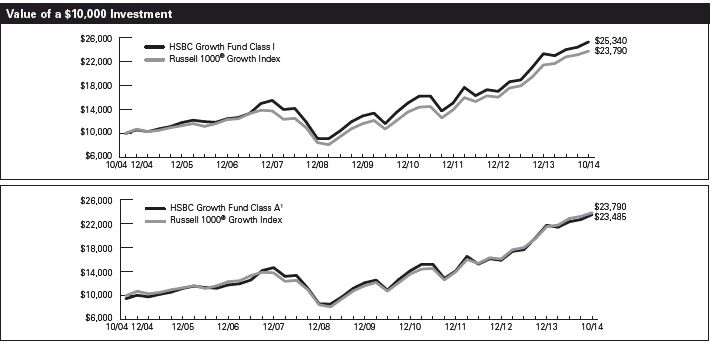

The charts above represent a historical since inception performance comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark and represents the reinvestment of dividends and capital gains in the Fund.

| | | | Average Annual | | Expense |

| Fund Performance | | | | Total Return (%) | | Ratio (%)6 |

| | Inception | | | | | | | | | | |

| As of October 31, 2014 | | Date | | 1 Year | | 5 Year | | 10 Year | | Gross | | Net |

| HSBC Growth Fund Class A1 | | 5/7/045 | | 8.88 | | 15.22 | | 8.91 | | 1.33 | | 1.20 |

| HSBC Growth Fund Class B2 | | 5/7/045 | | 9.83 | | 15.55 | | 8.98 | | 2.08 | | 1.95 |

| HSBC Growth Fund Class C3 | | 5/7/045 | | 12.77 | | 15.54 | | 8.66 | | 2.08 | | 1.95 |

| HSBC Growth Fund Class I | | 5/7/045 | | 14.94 | | 16.71 | | 9.74 | | 1.08 | | 0.95 |

| Russell 1000® Growth Index4 | | — | | 17.11 | | 17.43 | | 9.05 | | N/A | | N/A |

| Lipper Large-Cap Growth Funds Average4 | | — | | 15.29 | | 15.71 | | 8.25 | | N/A | | N/A |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect the taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-782-8183.

The performance above reflects any fee waivers that have been in effect during the applicable periods, as well as any expense reimbursements that have periodically been made. Absent such waivers and reimbursements, returns would have been lower. Currently, contractual fee waivers are in effect for the Fund through March 1, 2015.

Certain returns shown include monies received by the Portfolio, in which the Fund invests, in respect of one-time class action settlements and a one-time reimbursement from HSBC Global Asset Management (USA) Inc. (the “Adviser”) to the Fund related to past marketing arrangements. As a result, the Fund’s total returns for those periods were higher than they would have been had the Portfolio and the Fund not received the payments.

| 1 | | Reflects the maximum sales charge of 5.00%. |

| 2 | | Reflects the applicable contingent deferred sales charge, maximum of 4.00%. |

| 3 | | Reflects the applicable contingent deferred sales charge, maximum of 1.00%. |

| 4 | | For additional information, please refer to the Glossary of Terms. |

| 5 | | The HSBC Growth Fund was initially offered for purchase effective May 7, 2004; however, no shareholder activity occurred until May 10, 2004. |

| 6 | | Reflects the expense ratios as reported in the prospectus dated February 28, 2014. The Adviser has entered into a contractual expense limitation agreement with the Fund under which it will limit total expenses of the Fund (excluding interest, taxes, brokerage commissions, extraordinary expenses and estimated indirect expenses attributable to the Fund’s investments in investment companies) to an annual rate of 1.20%, 1.95%, 1.95% and 0.95% for Class A Shares, Class B Shares, Class C Shares and Class I Shares, respectively. The expense limitation shall be in effect until March 1, 2015. Additional information pertaining to the October 31, 2014 expense ratios can be found in the financial highlights. |

The Fund’s performance is measured against the Russell 1000® Growth Index, an unmanaged index that measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. The performance of the index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these value-added services. Investors cannot invest directly in an index.

HSBC FAMILY OF FUNDS 5

| Portfolio Reviews (Unaudited) |

| HSBC Opportunity Fund (Advisor) |

| (Class I Shares) |

| HSBC Opportunity Fund |

| (Class A Shares, Class B Shares and Class C Shares) |

|

by William A. Muggia, Committee Lead/Portfolio Manager

Ethan J. Myers, CFA, Portfolio Manager

John M. Montgomery, Portfolio Manager

Hamlen Thompson, Portfolio Manager

Bruce N. Jacobs, CFA, Portfolio Manager

Westfield Capital Management Company, L.P.

The HSBC Opportunity Fund and HSBC Opportunity Fund (Advisor) (collectively the “Fund”) seek long-term growth of capital by investing in equity securities of small- and mid-cap companies. Small- and mid-cap companies generally are defined as those that have market capitalizations within the range of market capitalizations represented in the Russell 2500™ Growth Index. The Fund may also invest in equity securities of larger, more established companies and may invest up to 20% of its assets in securities of foreign companies. The Fund employs a two-tier structure, commonly referred to as a “master-feeder” structure, in which the Fund invests all of its investable assets in the HSBC Opportunity Portfolio (the “Portfolio”). The Portfolio employs Westfield Capital Management Company, L.P. as its subadviser.

Investment Concerns

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities.

Small- to mid-capitalization funds typically carry additional risks since smaller companies generally have a higher risk of failure, and historically, their stocks have experienced a greater degree of market volatility than stocks on average.

The growth investment style may fall out of favor in the marketplace and result in significant declines in the value of the Portfolio’s securities. Securities of companies considered to be growth investments may have rapid price swings in the event of earnings disappointments or during periods of market, political, regulatory and economic uncertainty.

There are risks associated with investing in foreign companies, such as erratic market conditions, economic and political instability and fluctuations in currency and exchange rates.

For a complete description of these and other risks associated with investment in a mutual fund, please refer to the Fund’s prospectus.

Market Commentary

For the year ended October 31, 2014, the Class I Shares of the HSBC Opportunity Fund (Advisor) produced a 12.16% total return, and the Class A Shares of the Fund produced a 11.57% total return (without sales charge). The Russell 2500™ Growth Index1, the Fund’s primary performance benchmark, and the Lipper Mid-Cap Growth Funds Average1 returned 10.24% and 10.43%, respectively.

Portfolio Performance

U.S. equities posted strong returns for the period and rallied to historic highs late in the period. The U.S. equity market was a bright spot as many global markets sagged under the weight of sluggish economic growth and geopolitical issues. Investors also remained focused on risk, showing a preference for more stable and tested companies and aversion to speculation, which helped larger cap stocks outperform their smaller cap counterparts.

Defensive sectors such as health care and telecommunications performed well during the period while economically sensitive sectors such as information technology, consumer discretionary and industrials lagged the broader market. The energy sector was among the worst performing sectors as oil prices declined amid economic weakness in Europe and Asia and increased supply from the U.S.

The Fund outperformed its benchmark due in large part to strong stock selection, particularly in the information technology sector. An electronic payment services company was the sector’s top performer due in part to better-than-expected quarterly earnings for five quarters in a row. An underweight position in the overall IT sector also contributed to relative performance as it lagged the broader market.†

Stock selection in the financial sector was another positive contributor. Though the sector experienced volatility during the period due to uncertainty about when the Fed would raise short-term interest rates, the Fund benefited from strong individual selection among financial stocks. In particular, holdings of a global real estate and investment management services provider helped relative returns. The Fund’s investments within the industrial sector also helped boost relative returns.†

The health care sector was the only detractor from the Fund’s relative returns. Despite posting strong absolute returns, the Fund’s sector holdings in the health care sector lagged the benchmark’s holdings. An overweight position to the sector was not enough to overcome the impact of stock selection, especially in the biotechnology subsector. One notable underperformer was a biopharmaceutical company whose stock price suffered from weaker-than-expected sales of its lead product.†

| † | | Portfolio composition is subject to change. |

| 1 | | For additional information, please refer to the Glossary of Terms. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-782-8183.

6 HSBC FAMILY OF FUNDS

| Portfolio Reviews (Unaudited) |

| HSBC Opportunity Fund |

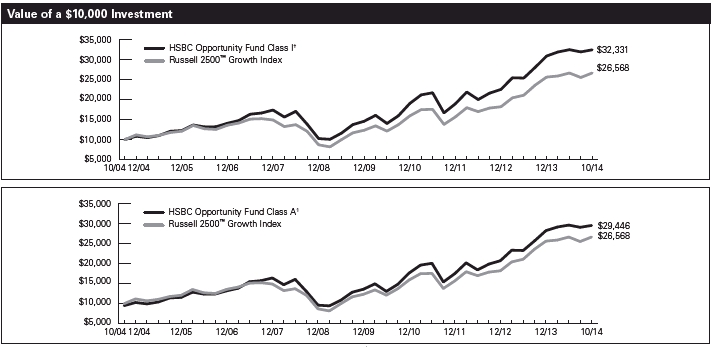

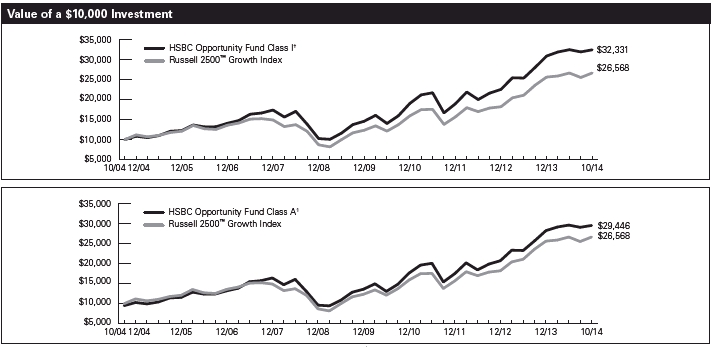

The charts above represent a historical 10-year performance comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark and represents the reinvestment of dividends and capital gains in the Fund.

| | | | Average Annual | | Expense |

| Fund Performance | | | | Total Return (%) | | Ratio (%)5 |

| | Inception | | | | | | | | | | |

| As of October 31, 2014 | | Date | | 1 Year | | 5 Year | | 10 Year | | Gross | | Net |

| HSBC Opportunity Fund Class A1 | | 9/23/96 | | 6.02 | | 17.84 | | 11.40 | | 2.01 | | 1.65 |

| HSBC Opportunity Fund Class B2 | | 1/6/98 | | 6.88 | | 18.17 | | 11.47 | | 2.76 | | 2.40 |

| HSBC Opportunity Fund Class C3 | | 11/4/98 | | 9.68 | | 18.19 | | 11.14 | | 2.76 | | 2.40 |

| HSBC Opportunity Fund Class I† | | 9/3/96 | | 12.16 | | 19.66 | | 12.45 | | 0.99 | | 0.99 |

| Russell 2500™ Growth Index4 | | — | | 10.24 | | 19.20 | | 10.26 | | N/A | | N/A |

| Lipper Mid-Cap Growth Funds Average4 | | — | | 10.43 | | 17.00 | | 9.23 | | N/A | | N/A |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect the taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-782-8183.

The performance above reflects any fee waivers that have been in effect during the applicable periods, as well as any expense reimbursements that have periodically been made. Absent such waivers and reimbursements, returns would have been lower. Currently, contractual fee waivers are in effect for the Fund through March 1, 2015 for Class A Shares, Class B Shares and Class C Shares.

Certain returns shown include monies received by the Portfolio, in which the Fund invests, in respect of one-time class action settlements and a one-time reimbursement from HSBC Global Asset Management (USA) Inc. (the “Adviser”) to the Fund related to past marketing arrangements. As a result, the Fund’s total returns for those periods were higher than they would have been had the Portfolio and the Fund not received the payments.

| † | | The Class I Shares are issued by a series of HSBC Advisor Funds Trust, also named the HSBC Opportunity Fund. |

| 1 | | Reflects the maximum sales charge of 5.00%. |

| 2 | | Reflects the applicable contingent deferred sales charge, maximum of 4.00%. |

| 3 | | Reflects the applicable contingent deferred sales charge, maximum of 1.00%. |

| 4 | | For additional information, please refer to the Glossary of Terms. |

| 5 | | Reflects the expense ratios as reported in the prospectus dated February 28, 2014. The Adviser has entered into a contractual expense limitation agreement with the Fund under which it will limit total expenses of the Fund (excluding interest, taxes, brokerage commissions, extraordinary expenses and estimated indirect expenses attributable to the Fund’s investments in investment companies other than the Portfolio) to an annual rate of 1.65%, 2.40%, and 2.40% for Class A Shares, Class B Shares, and Class C Shares, respectively. The expense limitation shall be in effect until March 1, 2015. Additional information pertaining to the October 31, 2014 expense ratios can be found in the financial highlights. |

The Fund’s performance is measured against the Russell 2500™ Growth Index, an unmanaged index that measures the performance of the small- to mid-cap growth segment of the U.S. equity universe. It includes those Russell 2500 companies with higher price-to-book ratios and higher forecasted growth values. The performance for the index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these value-added services. Investors cannot invest directly in an index.

HSBC FAMILY OF FUNDS 7

HSBC FAMILY OF FUNDS

Statements of Assets and Liabilities—as of October 31, 2014

| | Growth

Fund | | Opportunity

Fund | | Opportunity

Fund

(Advisor) |

| Assets: | | | | | | | | | | | | | | | | | | |

| Investments in Affiliated Portfolios | | | | 78,931,445 | | | | | | 17,288,352 | | | | | | 205,292,823 | | |

| Receivable for capital shares issued | | | | 1,440 | | | | | | 2,582 | | | | | | 77,608 | | |

| Receivable from Investment Adviser | | | | — | | | | | | 5,074 | | | | | | — | | |

| Prepaid expenses | | | | 19,310 | | | | | | 11,294 | | | | | | 11,558 | | |

| Total Assets | | | | 78,952,195 | | | | | | 17,307,302 | | | | | | 205,381,989 | | |

| | | | | | | | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | | | | | | | |

| Payable for capital shares redeemed | | | | 68,912 | | | | | | 10,048 | | | | | | 87,320 | | |

| Accrued expenses and other liabilities: | | | | | | | | | | | | | | | | | | |

| Investment Management | | | | 17,593 | | | | | | — | | | | | | — | | |

| Administration | | | | 1,573 | | | | | | 348 | | | | | | 4,100 | | |

| Distribution fees | | | | 656 | | | | | | 706 | | | | | | — | | |

| Shareholder Servicing | | | | 3,765 | | | | | | 8,294 | | | | | | — | | |

| Compliance Services | | | | 18 | | | | | | 3 | | | | | | 74 | | |

| Accounting | | | | 2 | | | | | | 1 | | | | | | 1 | | |

| Transfer Agent | | | | 5,002 | | | | | | 4,187 | | | | | | 3,831 | | |

| Trustee | | | | 92 | | | | | | 16 | | | | | | 314 | | |

| Other | | | | 25,229 | | | | | | 17,872 | | | | | | 49,795 | | |

| Total Liabilities | | | | 122,842 | | | | | | 41,475 | | | | | | 145,435 | | |

| Net Assets | | | $ | 78,829,353 | | | | | $ | 17,265,827 | | | | | $ | 205,236,554 | | |

| | | | | | | | | | | | | | | | | | | |

| Composition of Net Assets: | | | | | | | | | | | | | | | | | | |

| Capital | | | | 47,181,364 | | | | | | 11,786,651 | | | | | | 134,062,560 | | |

| Accumulated net investment income (loss) | | | | (191,800 | ) | | | | | (62,315 | ) | | | | | (587,018 | ) | |

| Accumulated net realized gains (losses) from investments | | | | 10,950,030 | | | | | | 3,242,971 | | | | | | 42,885,372 | | |

| Net unrealized appreciation/depreciation on investments | | | | 20,889,759 | | | | | | 2,298,520 | | | | | | 28,875,640 | | |

| Net Assets | | | $ | 78,829,353 | | | | | $ | 17,265,827 | | | | | $ | 205,236,554 | | |

| | | | | | | | | | | | | | | | | | | |

| Net Assets: | | | | | | | | | | | | | | | | | | |

| Class A Shares | | | $ | 13,503,932 | | | | | $ | 16,109,803 | | | | | $ | — | | |

| Class B Shares | | | | 309,528 | | | | | | 334,431 | | | | | | — | | |

| Class C Shares | | | | 763,980 | | | | | | 821,593 | | | | | | — | | |

| Class I Shares | | | | 64,251,913 | | | | | | — | | | | | | 205,236,554 | | |

| Total | | | $ | 78,829,353 | | | | | $ | 17,265,827 | | | | | $ | 205,236,554 | | |

| | | | | | | | | | | | | | | | | | | |

| Shares Outstanding: | | | | | | | | | | | | | | | | | | |

| ($0.001 par value, unlimited number of shares authorized): | | | | | | | | | | | | | | | | | | |

| Class A Shares | | | | 611,218 | | | | | | 1,256,019 | | | | | | — | | |

| Class B Shares | | | | 16,091 | | | | | | 35,163 | | | | | | — | | |

| Class C Shares | | | | 39,413 | | | | | | 83,809 | | | | | | — | | |

| Class I Shares | | | | 2,839,124 | | | | | | — | | | | | | 11,750,909 | | |

| | | | | | | | | | | | | | | | | | | |

| Net Asset Value, Offering Price and Redemption Price per share: | | | | | | | | | | | | | | | | | | |

| Class A Shares | | | $ | 22.09 | | | | | $ | 12.83 | | | | | $ | — | | |

| Class B Shares(a) | | | $ | 19.24 | | | | | $ | 9.51 | | | | | $ | — | | |

| Class C Shares(a) | | | $ | 19.38 | | | | | $ | 9.80 | | | | | $ | — | | |

| Class I Shares | | | $ | 22.63 | | | | | $ | — | | | | | $ | 17.47 | | |

| Maximum Sales Charge: | | | | | | | | | | | | | | | | | | |

| Class A Shares | | | | 5.00 | % | | | | | 5.00 | % | | | | | — | % | |

| Maximum Offering Price per share | | | | | | | | | | | | | | | | | | |

| (Net Asset Value / (100%-maximum sales charge)) | | | | | | | | | | | | | | | | | | |

| Class A Shares | | | $ | 23.25 | | | | | $ | 13.51 | | | | | $ | — | | |

____________________

| (a) | | Redemption Price per share varies by length of time shares are held. |

| 8 HSBC FAMILY OF FUNDS | See notes to financial statements. |

HSBC FAMILY OF FUNDS

Statements of Operations—For the year ended October 31, 2014

| | Growth

Fund | | Opportunity

Fund | | Opportunity

Fund

(Advisor) |

| Investment Income: | | | | | | | | | | | | | | | | | | |

| Investment Income from Affiliated Portfolios | | | $ | 616,571 | | | | | $ | 86,255 | | | | | $ | 1,060,976 | | |

| Expenses from Affiliated Portfolios | | | | (557,622 | ) | | | | | (147,877 | ) | | | | | (1,834,518 | ) | |

| Total Investment Income | | | | 58,949 | | | | | | (61,622 | ) | | | | | (773,542 | ) | |

| | | | | | | | | | | | | | | | | | | |

| Expenses: | | | | | | | | | | | | | | | | | | |

| Administration: | | | | | | | | | | | | | | | | | | |

| Class A Shares | | | | 3,282 | | | | | | 3,911 | | | | | | — | | |

| Class B Shares | | | | 96 | | | | | | 102 | | | | | | — | | |

| Class C Shares | | | | 186 | | | | | | 214 | | | | | | — | | |

| Class I Shares | | | | 16,751 | | | | | | — | | | | | | 52,558 | | |

| Distribution: | | | | | | | | | | | | | | | | | | |

| Class B Shares | | | | 2,850 | | | | | | 3,032 | | | | | | — | | |

| Class C Shares | | | | 5,524 | | | | | | 6,347 | | | | | | — | | |

| Shareholder Servicing: | | | | | | | | | | | | | | | | | | |

| Class A Shares | | | | 32,445 | | | | | | 38,710 | | | | | | — | | |

| Class B Shares | | | | 950 | | | | | | 1,011 | | | | | | — | | |

| Class C Shares | | | | 1,841 | | | | | | 2,116 | | | | | | — | | |

| Accounting | | | | 24,002 | | | | | | 19,002 | | | | | | 9,001 | | |

| Compliance Services | | | | 815 | | | | | | 167 | | | | | | 2,133 | | |

| Printing | | | | 19,275 | | | | | | 4,540 | | | | | | 44,676 | | |

| Audit | | | | 18,725 | | | | | | 18,725 | | | | | | 18,725 | | |

| Transfer Agent | | | | 83,672 | | | | | | 52,435 | | | | | | 78,880 | | |

| Trustee | | | | 2,726 | | | | | | 536 | | | | | | 7,031 | | |

| Registration fees | | | | 30,680 | | | | | | 16,960 | | | | | | 15,308 | | |

| Other | | | | 12,302 | | | | | | 4,440 | | | | | | 24,086 | | |

| Total expenses before fee reductions | | | | 256,122 | | | | | | 172,248 | | | | | | 252,398 | | |

| Fees voluntarily reduced by Investment Adviser | | | | — | | | | | | (16,740 | ) | | | | | — | | |

| Fees contractually reduced by Investment Adviser | | | | (6,785 | ) | | | | | (34,544 | ) | | | | | — | | |

| Net Expenses | | | | 249,337 | | | | | | 120,964 | | | | | | 252,398 | | |

| | | | | | | | | | | | | | | | | | | |

| Net Investment Income (Loss) | | | | (190,388 | ) | | | | | (182,586 | ) | | | | | (1,025,940 | ) | |

| | | | | | | | | | | | | | | | | | | |

| Net Realized/Unrealized Gains (Losses) from Investments: (a) | | | | | | | | | | | | | | | | | | |

| Net realized gains (losses) from investments | | | | 12,286,957 | | | | | | 3,388,218 | | | | | | 43,323,713 | | |

| Change in unrealized appreciation/depreciation on investments | | | | (838,892 | ) | | | | | (1,436,875 | ) | | | | | (18,084,143 | ) | |

| | | | | | | | | | | | | | | | | | | |

| Net realized/unrealized gains (losses) on investments | | | | 11,448,065 | | | | | | 1,951,343 | | | | | | 25,239,570 | | |

| Change In Net Assets Resulting From Operations | | | $ | 11,257,677 | | | | | $ | 1,768,757 | | | | | $ | 24,213,630 | | |

____________________

| (a) | | Represents amounts allocated from the respective Affiliated Portfolios. |

| See notes to financial statements. | HSBC FAMILY OF FUNDS 9 |

HSBC FAMILY OF FUNDS

Statements of Changes in Net Assets

| | Growth Fund | | | | Opportunity Fund | |

| | For the

year ended

October 31, 2014 | | | For the

year ended

October 31, 2013 | | | | For the

year ended

October 31, 2014 | | | For the

year ended

October 31, 2013 | |

| Investment Activities: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | $ | (190,388 | ) | | | | | $ | 111,870 | | | | | | | $ | (182,586 | ) | | | | | $ | (72,706 | ) | | |

| Net realized gains (losses) from investments | | | | 12,286,957 | | | | | | | 9,661,220 | | | | | | | | 3,388,218 | | | | | | | 1,860,103 | | | |

| Change in unrealized appreciation/depreciation | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| on investments | | | | (838,892 | ) | | | | | | 11,851,661 | | | | | | | | (1,436,875 | ) | | | | | | 2,027,660 | | | |

| Change in net assets resulting from operations | | | | 11,257,677 | | | | | | | 21,624,751 | | | | | | | | 1,768,757 | | | | | | | 3,815,057 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Dividends: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class I Shares | | | | — | | | | | | | (77,975 | ) | | | | | | | — | | | | | | | — | | | |

| Net realized gains: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class A Shares | | | | (1,473,999 | ) | | | | | | (789,480 | ) | | | | | | | (1,492,680 | ) | | | | | | (613,652 | ) | | |

| Class B Shares | | | | (61,772 | ) | | | | | | (47,389 | ) | | | | | | | (63,060 | ) | | | | | | (37,922 | ) | | |

| Class C Shares | | | | (91,036 | ) | | | | | | (38,688 | ) | | | | | | | (103,788 | ) | | | | | | (41,509 | ) | | |

| Class I Shares | | | | (7,953,745 | ) | | | | | | (4,180,730 | ) | | | | | | | — | | | | | | | — | | | |

| Change in net assets resulting from | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| shareholder dividends | | | | (9,580,552 | ) | | | | | | (5,134,262 | ) | | | | | | | (1,659,528 | ) | | | | | | (693,083 | ) | | |

| Change in net assets resulting from | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| capital transactions | | | | (5,327,302 | ) | | | | | | (4,356,680 | ) | | | | | | | 1,706,742 | | | | | | | 1,079,236 | | | |

| Change in net assets | | | | (3,650,177 | ) | | | | | | 12,133,809 | | | | | | | | 1,815,971 | | | | | | | 4,201,210 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Beginning of period | | | | 82,479,530 | | | | | | | 70,345,721 | | | | | | | | 15,449,856 | | | | | | | 11,248,646 | | | |

| End of period | | | $ | 78,829,353 | | | | | | $ | 82,479,530 | | | | | | | $ | 17,265,827 | | | | | | $ | 15,449,856 | | | |

| Accumulated net investment income (loss) | | | $ | (191,800 | ) | | | | | $ | (99,109 | ) | | | | | | $ | (62,315 | ) | | | | | $ | 2,125 | | | |

| 10 HSBC FAMILY OF FUNDS | See notes to financial statements. |

HSBC FAMILY OF FUNDS

Statements of Changes in Net Assets (continued)

| Growth Fund | | Opportunity Fund |

| For the

year ended

October 31, 2014 | For the

year ended

October 31, 2013 | | For the

year ended

October 31, 2014 | For the

year ended

October 31, 2013 |

| CAPITAL TRANSACTIONS: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class A Shares: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Proceeds from shares issued | | | $ | 496,557 | | | | | | $ | 513,267 | | | | | | | $ | 1,938,423 | | | | | | $ | 3,386,291 | | | |

| Dividends reinvested | | | | 1,426,628 | | | | | | | 760,894 | | | | | | | | 1,468,888 | | | | | | | 601,275 | | | |

| Value of shares redeemed | | | | (1,492,047 | ) | | | | | | (2,349,534 | ) | | | | | | | (1,701,878 | ) | | | | | | (2,790,702 | ) | | |

| Class A Shares capital transactions | | | | 431,138 | | | | | | | (1,075,373 | ) | | | | | | | 1,705,433 | | | | | | | 1,196,864 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class B Shares: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Proceeds from shares issued | | | | — | | | | | | | 18,851 | | | | | | | | — | | | | | | | 22,345 | | | |

| Dividends reinvested | | | | 61,488 | | | | | | | 47,204 | | | | | | | | 63,060 | | | | | | | 37,922 | | | |

| Value of shares redeemed | | | | (228,368 | ) | | | | | | (290,302 | ) | | | | | | | (190,960 | ) | | | | | | (182,066 | ) | | |

| Class B Shares capital transactions | | | | (166,880 | ) | | | | | | (224,247 | ) | | | | | | | (127,900 | ) | | | | | | (121,799 | ) | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class C Shares: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Proceeds from shares issued | | | | 195,573 | | | | | | | 51,639 | | | | | | | | 219,440 | | | | | | | 365,351 | | | |

| Dividends reinvested | | | | 89,319 | | | | | | | 38,495 | | | | | | | | 102,306 | | | | | | | 41,448 | | | |

| Value of shares redeemed | | | | (126,331 | ) | | | | | | (81,414 | ) | | | | | | | (192,537 | ) | | | | | | (402,628 | ) | | |

| Class C Shares capital transactions | | | | 158,561 | | | | | | | 8,720 | | | | | | | | 129,209 | | | | | | | 4,171 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class I Shares: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Proceeds from shares issued | | | | 12,675,493 | | | | | | | 9,187,688 | | | | | | | | — | | | | | | | — | | | |

| Dividends reinvested | | | | 7,911,912 | | | | | | | 4,246,858 | | | | | | | | — | | | | | | | — | | | |

| Value of shares redeemed | | | | (26,337,526 | ) | | | | | | (16,500,326 | ) | | | | | | | — | | | | | | | — | | | |

| Class I Shares capital transactions | | | | (5,750,121 | ) | | | | | | (3,065,780 | ) | | | | | | | — | | | | | | | — | | | |

| Change in net assets resulting from capital transactions | | | $ | (5,327,302 | ) | | | | | $ | (4,356,680 | ) | | | | | | $ | 1,706,742 | | | | | | $ | 1,079,236 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| SHARE TRANSACTIONS: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class A Shares: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Issued | | | | 24,260 | | | | | | | 27,668 | | | | | | | | 154,943 | | | | | | | 295,105 | | | |

| Reinvested | | | | 70,451 | | | | | | | 45,103 | | | | | | | | 121,096 | | | | | | | 59,888 | | | |

| Redeemed | | | | (70,856 | ) | | | | | | (125,574 | ) | | | | | | | (135,770 | ) | | | | | | (246,880 | ) | | |

| Change in Class A Shares | | | | 23,855 | | | | | | | (52,803 | ) | | | | | | | 140,269 | | | | | | | 108,113 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class B Shares: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Issued | | | | — | | | | | | | 1,163 | | | | | | | | — | | | | | | | 2,603 | | | |

| Reinvested | | | | 3,464 | | | | | | | 3,120 | | | | | | | | 6,968 | | | | | | | 4,862 | | | |

| Redeemed | | | | (12,832 | ) | | | | | | (17,588 | ) | | | | | | | (20,434 | ) | | | | | | (21,126 | ) | | |

| Change in Class B Shares | | | | (9,368 | ) | | | | | | (13,305 | ) | | | | | | | (13,466 | ) | | | | | | (13,661 | ) | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class C Shares: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Issued | | | | 10,381 | | | | | | | 3,117 | | | | | | | | 22,638 | | | | | | | 40,827 | | | |

| Reinvested | | | | 4,996 | | | | | | | 2,526 | | | | | | | | 10,965 | | | | | | | 5,175 | | | |

| Redeemed | | | | (6,864 | ) | | | | | | (4,667 | ) | | | | | | | (19,935 | ) | | | | | | (42,252 | ) | | |

| Change in Class C Shares | | | | 8,513 | | | | | | | 976 | | | | | | | | 13,668 | | | | | | | 3,750 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class I Shares: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Issued | | | | 602,647 | | | | | | | 491,350 | | | | | | | | — | | | | | | | — | | | |

| Reinvested | | | | 382,218 | | | | | | | 247,171 | | | | | | | | — | | | | | | | — | | | |

| Redeemed | | | | (1,244,759 | ) | | | | | | (859,037 | ) | | | | | | | — | | | | | | | — | | | |

| Change in Class I Shares | | | | (259,894 | ) | | | | | | (120,516 | ) | | | | | | | — | | | | | | | — | | | |

| See notes to financial statements. | HSBC FAMILY OF FUNDS 11 |

HSBC FAMILY OF FUNDS

Statements of Changes in Net Assets (continued)

| Opportunity Fund (Advisor) |

| | For the

year ended

October 31, 2014 | | | For the

year ended

October 31, 2013 | |

| Investment Activities: | | | | | | | | | | | | | | |

| Operations: | | | | | | | | | | | | | | |

| Net investment income (loss) | | | $ | (1,025,940 | ) | | | | | $ | 113,802 | | | |

| ��Net realized gains (losses) from investments | | | | 43,323,713 | | | | | | | 22,059,925 | | | |

| Change in unrealized appreciation/depreciation on investments | | | | (18,084,143 | ) | | | | | | 28,194,578 | | | |

| Change in net assets resulting from operations | | | | 24,213,630 | | | | | | | 50,368,305 | | | |

| | | | | | | | | | | | | | | |

| Dividends: | | | | | | | | | | | | | | |

| Net investment income: | | | | | | | | | | | | | | |

| Class I Shares | | | | (433,947 | ) | | | | | | — | | | |

| Net realized gains: | | | | | | | | | | | | | | |

| Class I Shares | | | | (21,203,571 | ) | | | | | | (6,472,825 | ) | | |

| Change in net assets resulting from shareholder dividends | | | | (21,637,518 | ) | | | | | | (6,472,825 | ) | | |

| Change in net assets resulting from capital transactions | | | | (5,660,696 | ) | | | | | | 29,328,028 | | | |

| Change in net assets | | | | (3,084,584 | ) | | | | | | 73,223,508 | | | |

| | | | | | | | | | | | | | | |

| Net Assets: | | | | | | | | | | | | | | |

| Beginning of period | | | | 208,321,138 | | | | | | | 135,097,630 | | | |

| End of period | | | $ | 205,236,554 | | | | | | $ | 208,321,138 | | | |

| Accumulated net investment income (loss) | | | $ | (587,018 | ) | | | | | $ | 152,233 | | | |

| 12 HSBC FAMILY OF FUNDS | See notes to financial statements. |

HSBC FAMILY OF FUNDS

Statements of Changes in Net Assets (continued)

| Opportunity Fund (Advisor) |

| | For the

year ended

October 31, 2014 | | | For the

year ended

October 31, 2013 | |

| CAPITAL TRANSACTIONS: | | | | | | | | | | | | | | |

| Class I Shares: | | | | | | | | | | | | | | |

| Proceeds from shares issued | | | $ | 23,221,586 | | | | | | $ | 43,552,792 | | | |

| Dividends reinvested | | | | 21,593,694 | | | | | | | 6,463,988 | | | |

| Value of shares redeemed | | | | (50,475,976 | ) | | | | | | (20,688,752 | ) | | |

| Class I Shares capital transactions | | | | (5,660,696 | ) | | | | | | 29,328,028 | | | |

| Change in net assets resulting from capital transactions | | | $ | (5,660,696 | ) | | | | | $ | 29,328,028 | | | |

| | | | | | | | | | | | | | | |

| SHARE TRANSACTIONS: | | | | | | | | | | | | | | |

| Class I Shares: | | | | | | | | | | | | | | |

| Issued | | | | 1,349,096 | | | | | | | 2,895,000 | | | |

| Reinvested | | | | 1,308,790 | | | | | | | 478,814 | | | |

| Redeemed | | | | (2,969,584 | ) | | | | | | (1,392,961 | ) | | |

| Change in Class I Shares | | | | (311,698 | ) | | | | | | 1,980,853 | | | |

| See notes to financial statements. | HSBC FAMILY OF FUNDS 13 |

| HSBC GROWTH FUND |

| Financial Highlights |

Selected data for a share outstanding throughout the periods indicated.*

| | | | Investment Activities | | Dividends | | | | | | Ratios/Supplementary Data |

| | Net Asset

Value,

Beginning

of Period | | Net

Investment

Income

(Loss)(a) | | Net Realized

and Unrealized

Gains

(Losses) from

Investments | | Total from

Investment

Activities | | Net

Investment

Income | | Net Realized

Gains from

Investment

Transactions | | Total

Dividends | | Net

Asset

Value,

End of

Period | | Total

Return(b) | | Net

Assets

at End

of Period

(000’s) | | Ratio

of Net

Expenses to

Average

Net Assets | | Ratio

of Net

Investment

Income

(Loss) to

Average

Net Assets | | Ratio

of Expenses

to Average

Net Assets

(Excluding Fee

Reductions) | | Portfolio

Turnover

(c) |

| Growth Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| CLASS A SHARES | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended October 31, 2010 | | | $ | 12.54 | | | | $ | (0.07 | ) | | | | $ | 2.55 | | | | $ | 2.48 | | | $ | — | | | | $ | — | | | | | $ | — | | | | | $ | 15.02 | | | | 19.78 | %(d),(e) | | | | $ | 16,452 | | | | 1.20 | % | | | | (0.54 | )%(d) | | | | 1.23 | % | | | | 89 | % | |

| Year Ended October 31, 2011 | | | | 15.02 | | | | | (0.07 | ) | | | | | 1.64 | | | | | 1.57 | | | | — | | | | | — | | | | | | — | | | | | | 16.59 | | | | 10.45 | %(e) | | | | | 15,349 | | | | 1.18 | % | | | | (0.45 | )% | | | | 1.18 | % | | | | 56 | % | |

| Year Ended October 31, 2012 | | | | 16.59 | | | | | (0.06 | ) | | | | | 1.16 | | | | | 1.10 | | | | — | | | | | — | | | | | | — | | | | | | 17.69 | | | | 6.63 | %(e) | | | | | 11,327 | | | | 1.20 | % | | | | (0.36 | )% | | | | 1.27 | % | | | | 53 | % | |

| Year Ended October 31, 2013 | | | | 17.69 | | | | | (0.01 | ) | | | | | 5.34 | | | | | 5.33 | | | | — | | | | | (1.29 | ) | | | | | (1.29 | ) | | | | | 21.73 | | | | 32.24 | %(e) | | | | | 12,761 | | | | 1.20 | % | | | | (0.05 | )% | | | | 1.21 | % | | | | 75 | % | |

| Year Ended October 31, 2014 | | | | 21.73 | | | | | (0.09 | ) | | | | | 3.03 | | | | | 2.94 | | | | — | | | | | (2.58 | ) | | | | | (2.58 | ) | | | | | 22.09 | | | | 14.59 | % | | | | | 13,504 | | | | 1.20 | % | | | | (0.44 | )% | | | | 1.21 | % | | | | 68 | % | |

| CLASS B SHARES | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended October 31, 2010 | | | | 11.60 | | | | | (0.16 | ) | | | | | 2.36 | | | | | 2.20 | | | | — | | | | | — | | | | | | — | | | | | | 13.80 | | | | 18.97 | %(d),(e) | | | | | 1,213 | | | | 1.95 | % | | | | (1.28 | )%(d) | | | | 1.98 | % | | | | 89 | % | |

| Year Ended October 31, 2011 | | | | 13.80 | | | | | (0.18 | ) | | | | | 1.51 | | | | | 1.33 | | | | — | | | | | — | | | | | | — | | | | | | 15.13 | | | | 9.64 | %(e) | | | | | 962 | | | | 1.93 | % | | | | (1.19 | )% | | | | 1.93 | % | | | | 56 | % | |

| Year Ended October 31, 2012 | | | | 15.13 | | | | | (0.17 | ) | | | | | 1.06 | | | | | 0.89 | | | | — | | | | | — | | | | | | — | | | | | | 16.02 | | | | 5.88 | %(e) | | | | | 621 | | | | 1.95 | % | | | | (1.10 | )% | | | | 2.03 | % | | | | 53 | % | |

| Year Ended October 31, 2013 | | | | 16.02 | | | | | (0.12 | ) | | | | | 4.75 | | | | | 4.63 | | | | — | | | | | (1.29 | ) | | | | | (1.29 | ) | | | | | 19.36 | | | | 31.16 | %(e) | | | | | 493 | | | | 1.95 | % | | | | (0.72 | )% | | | | 1.96 | % | | | | 75 | % | |

| Year Ended October 31, 2014 | | | | 19.36 | | | | | (0.21 | ) | | | | | 2.67 | | | | | 2.46 | | | | — | | | | | (2.58 | ) | | | | | (2.58 | ) | | | | | 19.24 | | | | 13.81 | % | | | | | 310 | | | | 1.95 | % | | | | (1.17 | )% | | | | 1.96 | % | | | | 68 | % | |

| CLASS C SHARES | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended October 31, 2010 | | | | 11.68 | | | | | (0.17 | ) | | | | | 2.38 | | | | | 2.21 | | | | — | | | | | — | | | | | | — | | | | | | 13.89 | | | | 18.92 | %(d),(e) | | | | | 184 | | | | 1.95 | % | | | | (1.30 | )%(d) | | | | 1.99 | % | | | | 89 | % | |

| Year Ended October 31, 2011 | | | | 13.89 | | | | | (0.18 | ) | | | | | 1.52 | | | | | 1.34 | | | | — | | | | | — | | | | | | — | | | | | | 15.23 | | | | 9.65 | %(e) | | | | | 251 | | | | 1.94 | % | | | | (1.21 | )% | | | | 1.94 | % | | | | 56 | % | |

| Year Ended October 31, 2012 | | | | 15.23 | | | | | (0.18 | ) | | | | | 1.07 | | | | | 0.89 | | | | — | | | | | — | | | | | | — | | | | | | 16.12 | | | | 5.84 | %(e) | | | | | 482 | | | | 1.95 | % | | | | (1.14 | )% | | | | 2.03 | % | | | | 53 | % | |

| Year Ended October 31, 2013 | | | | 16.12 | | | | | (0.14 | ) | | | | | 4.80 | | | | | 4.66 | | | | — | | | | | (1.29 | ) | | | | | (1.29 | ) | | | | | 19.49 | | | | 31.15 | %(e) | | | | | 602 | | | | 1.95 | % | | | | (0.81 | )% | | | | 1.96 | % | | | | 75 | % | |

| Year Ended October 31, 2014 | | | | 19.49 | | | | | (0.22 | ) | | | | | 2.69 | | | | | 2.47 | | | | — | | | | | (2.58 | ) | | | | | (2.58 | ) | | | | | 19.38 | | | | 13.76 | % | | | | | 764 | | | | 1.95 | % | | | | (1.19 | )% | | | | 1.96 | % | | | | 68 | % | |

| CLASS I SHARES | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended October 31, 2010 | | | | 12.65 | | | | | (0.04 | ) | | | | | 2.58 | | | | | 2.54 | | | | — | | | | | — | | | | | | — | | | | | | 15.19 | | | | 20.08 | %(d),(e) | | | | | 49,474 | | | | 0.95 | % | | | | (0.30 | )%(d) | | | | 0.99 | % | | | | 89 | % | |

| Year Ended October 31, 2011 | | | | 15.19 | | | | | (0.04 | ) | | | | | 1.68 | | | | | 1.64 | | | | — | | | | | — | | | | | | — | | | | | | 16.83 | | | | 10.80 | %(e) | | | | | 57,222 | | | | 0.94 | % | | | | (0.22 | )% | | | | 0.94 | % | | | | 56 | % | |

| Year Ended October 31, 2012 | | | | 16.83 | | | | | (0.02 | ) | | | | | 1.18 | | | | | 1.16 | | | | — | | | | | — | | | | | | — | | | | | | 17.99 | | | | 6.89 | %(e) | | | | | 57,916 | | | | 0.95 | % | | | | (0.12 | )% | | | | 1.04 | % | | | | 53 | % | |

| Year Ended October 31, 2013 | | | | 17.99 | | | | | 0.04 | | | | | | 5.42 | | | | | 5.46 | | | | (0.02 | ) | | | | (1.29 | ) | | | | | (1.31 | ) | | | | | 22.14 | | | | 32.49 | %(e) | | | | | 68,624 | | | | 0.95 | % | | | | 0.20 | % | | | | 0.96 | % | | | | 75 | % | |

| Year Ended October 31, 2014 | | | | 22.14 | | | | | (0.04 | ) | | | | | 3.11 | | | | | 3.07 | | | | — | | | | | (2.58 | ) | | | | | (2.58 | ) | | | | | 22.63 | | | | 14.94 | % | | | | | 64,252 | | | | 0.95 | % | | | | (0.18 | )% | | | | 0.96 | % | | | | 68 | % | |

| * | | The per share amounts and percentages reflect income and expenses assuming inclusion of the Fund’s proportionate share of the income and expenses of the HSBC Growth Portfolio. |

| (a) | | Calculated based on average shares outstanding. |

| (b) | | Total return calculations do not include any sales or redemption charges. |

| (c) | | Portfolio turnover rate is calculated on the basis of the respective Portfolio in which the Fund invests all of its investable assets. Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing between the classes of shares issued. |

| (d) | | During the year ended October 31, 2010, the Fund received a distribution from a “fair fund’ established by the SEC in connection with a consent order against BISYS Fund Services, Inc. (See Note 7 in the Notes to Financial Statements). The corresponding impact to the net income ratio and the total return was 0.02%, 0.02%, 0.02% and .02% for Class A Shares, Class B Shares, Class C Shares and Class I Shares, respectively. |

| (e) | | The Portfolio, in which the Fund invests, received monies related to certain nonrecurring litigation settlements. The corresponding impact to the total return was 0.17%, 0.28%, 0.12% and 0.16% for the years ended October 31, 2010, 2011, 2012 and 2013, respectively. |

Amounts designated as “-” are $0 or have been rounded to $0.

| 14 HSBC FAMILY OF FUNDS | See notes to financial statements. |

| HSBC OPPORTUNITY FUND |

| Financial Highlights |

Selected data for a share outstanding throughout the periods indicated.*

| | | | Investment Activities | | Dividends | | | | | | Ratios/Supplementary Data |

| | Net Asset

Value,

Beginning

of Period | | Net

Investment

Income

(Loss)(a) | | Net Realized

and

Unrealized

Gains

(Losses)

from

Investments | | Total from

Investment

Activities

| | Net Realized

Gains from

Investment

Transactions | | Total

Dividends | | Net

Asset

Value,

End of

Period | | Total

Return(b) | | Net

Assets

at End of

Period

(000’s) | | Ratio

of Net

Expenses

to

Average

Net

Assets | | Ratio

of Net

Investment

Income

(Loss) to

Average

Net Assets | | Ratio

of Expenses

to Average

Net Assets

(Excluding Fee

Reductions) | | Portfolio

Turnover

(c) |

| Opportunity Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| CLASS A SHARES | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended October 31, 2010 | | | $ | 7.56 | | | $ | (0.09 | ) | | | $ | 2.20 | | | $ | 2.11 | | | $ | — | | | $ | — | | | $ | 9.67 | | 27.91 | %(d),(e) | | $ | 11,282 | | | 1.55% | | (1.00 | )%(d) | | 2.07% | | 68% |

| Year Ended October 31, 2011 | | | | 9.67 | | | | (0.07 | ) | | | | 1.19 | | | | 1.12 | | | | (0.16 | ) | | | (0.16 | ) | | | 10.63 | | 11.59 | %(e) | | | 11,145 | | | 1.55% | | (0.62 | )% | | 1.85% | | 69% |

| Year Ended October 31, 2012 | | | | 10.63 | | | | (0.05 | ) | | | | 1.11 | | | | 1.06 | | | | (1.56 | ) | | | (1.56 | ) | | | 10.13 | | 12.08 | %(e) | | | 10,204 | | | 1.55% | | (0.51 | )% | | 2.20% | | 59% |

| Year Ended October 31, 2013 | | | | 10.13 | | | | (0.06 | ) | | | | 3.34 | | | | 3.28 | | | | (0.63 | ) | | | (0.63 | ) | | | 12.78 | | 34.02 | %(e) | | | 14,259 | | | 1.55% | | (0.49 | )% | | 2.01% | | 70% |

| Year Ended October 31, 2014 | | | | 12.78 | | | | (0.13 | ) | | | | 1.53 | | | | 1.40 | | | | (1.35 | ) | | | (1.35 | ) | | | 12.83 | | 11.57 | % | | | 16,110 | | | 1.55% | | (1.04 | )% | | 1.86% | | 66% |

| CLASS B SHARES | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended October 31, 2010 | | | | 6.37 | | | | (0.13 | ) | | | | 1.85 | | | | 1.72 | | | | — | | | | — | | | | 8.09 | | 27.00 | %(d),(e) | | | 658 | | | 2.30% | | (1.78 | )%(d) | | 2.86% | | 68% |

| Year Ended October 31, 2011 | | | | 8.09 | | | | (0.12 | ) | | | | 0.99 | | | | 0.87 | | | | (0.16 | ) | | | (0.16 | ) | | | 8.80 | | 10.75 | %(e) | | | 536 | | | 2.30% | | (1.36 | )% | | 2.64% | | 69% |

| Year Ended October 31, 2012 | | | | 8.80 | | | | (0.10 | ) | | | | 0.87 | | | | 0.77 | | | | (1.56 | ) | | | (1.56 | ) | | | 8.01 | | 11.15 | %(e) | | | 499 | | | 2.30% | | (1.25 | )% | | 2.99% | | 59% |

| Year Ended October 31, 2013 | | | | 8.01 | | | | (0.11 | ) | | | | 2.60 | | | | 2.49 | | | | (0.63 | ) | | | (0.63 | ) | | | 9.87 | | 33.10 | %(e) | | | 480 | | | 2.30% | | (1.24 | )% | | 2.77% | | 70% |

| Year Ended October 31, 2014 | | | | 9.87 | | | | (0.16 | ) | | | | 1.15 | | | | 0.99 | | | | (1.35 | ) | | | (1.35 | ) | | | 9.51 | | 10.74 | % | | | 334 | | | 2.30% | | (1.74 | )% | | 2.60% | | 66% |

| CLASS C SHARES | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended October 31, 2010 | | | | 6.49 | | | | (0.13 | ) | | | | 1.89 | | | | 1.76 | | | | — | | | | — | | | | 8.25 | | 27.12 | %(d),(e) | | | 341 | | | 2.30% | | (1.75 | )%(d) | | 2.86% | | 68% |

| Year Ended October 31, 2011 | | | | 8.25 | | | | (0.13 | ) | | | | 1.02 | | | | 0.89 | | | | (0.16 | ) | | | (0.16 | ) | | | 8.98 | | 10.79 | %(e) | | | 437 | | | 2.30% | | (1.38 | )% | | 2.64% | | 69% |

| Year Ended October 31, 2012 | | | | 8.98 | | | | (0.10 | ) | | | | 0.89 | | | | 0.79 | | | | (1.56 | ) | | | (1.56 | ) | | | 8.21 | | 11.14 | %(e) | | | 545 | | | 2.30% | | (1.19 | )% | | 3.03% | | 59% |

| Year Ended October 31, 2013 | | | | 8.21 | | | | (0.11 | ) | | | | 2.67 | | | | 2.56 | | | | (0.63 | ) | | | (0.63 | ) | | | 10.14 | | 33.15 | %(e) | | | 711 | | | 2.30% | | (1.21 | )% | | 2.76% | | 70% |

| Year Ended October 31, 2014 | | | | 10.14 | | | | (0.17 | ) | | | | 1.18 | | | | 1.01 | | | | (1.35 | ) | | | (1.35 | ) | | | 9.80 | | 10.64 | % | | | 822 | | | 2.30% | | (1.77 | )% | | 2.61% | | 66% |

| * | The per share amounts and percentages reflect income and expenses assuming inclusion of the Fund’s proportionate share of the income and expenses of the HSBC Opportunity Portfolio. |

| (a) | Calculated based on average shares outstanding. |

| (b) | Total return calculations do not include any sales or redemption charges. |

| (c) | Portfolio turnover rate is calculated on the basis of the respective Portfolio in which the Fund invests all of its investable assets. Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing between the classes of shares issued. |

| (d) | During the year ended October 31, 2010, the Fund received a distribution from a “fair fund” established by the SEC in connection with a consent order against BISYS Fund Services, Inc. (See Note 7 in the Notes to Financial Statements). The corresponding impact to the net income ratio and the total return was 0.01%, 0.01% and 0.01% for Class A Shares, Class B Shares and Class C Shares, respectively. |

| (e) | The Portfolio, in which the Fund invests, received monies related to certain nonrecurring litigation settlements. The corresponding impact to the total return was 0.15%, 0.10%, 0.10% and 0.13% for the years ended October 31, 2010, 2011, 2012 and 2013, respectively. |

| Amounts designated as “-” are $0 or have been rounded to $0. |

| See notes to financial statements. | HSBC FAMILY OF FUNDS 15 |

| HSBC OPPORTUNITY FUND (ADVISOR) |

| Financial Highlights |

Selected data for a share outstanding throughout the periods indicated.*

| | | | Investment Activities | | Dividends | | | | | | Ratios/Supplementary Data |

| | Net Asset

Value,

Beginning

of Period

| | Net

Investment

Income

(Loss)(a) | | Net Realized

and

Unrealized

Gains

(Losses)

from

Investments | | Total from

Investment

Activities | | Net

Investment

Income | | Net Realized

Gains from

Investment

Transactions | | Total

Dividends | | Net

Asset

Value,

End of

Period | | Total

Return(b) | | Net

Assets

at End of

Period

(000’s) | | Ratio

of Net

Expenses

to

Average

Net

Assets | | Ratio

of Net

Investment

Income

(Loss) to

Average

Net Assets | | Ratio

of Expenses

to Average

Net Assets

(Excluding Fee

Reductions) | | Portfolio

Turnover

(c) |

| Opportunity Fund (Advisor) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| CLASS I SHARES | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended October 31, 2010 | | | $ | 9.93 | | | | $ | (0.06 | ) | | | | $ | 2.90 | | | | $ | 2.84 | | | | $ | — | | | | | $ | — | | | | | $ | — | | | | | $ | 12.77 | | | | 28.60 | %(d),(e) | | | | $ | 117,064 | | | | 1.01 | % | | | | (0.46 | )%(d) | | | | 1.01 | % | | | | 68 | % | |

| Year Ended October 31, 2011 | | | | 12.77 | | | | | (0.01 | ) | | | | | 1.57 | | | | | 1.56 | | | | | — | | | | | | (0.31 | ) | | | | | (0.31 | ) | | | | | 14.02 | | | | 12.25 | %(e) | | | | | 122,017 | | | | 1.01 | % | | | | (0.07 | )% | | | | 1.01 | % | | | | 69 | % | |

| Year Ended October 31, 2012 | | | | 14.02 | | | | | (0.01 | ) | | | | | 1.46 | | | | | 1.45 | | | | | — | | | | | | (2.07 | ) | | | | | (2.07 | ) | | | | | 13.40 | | | | 12.50 | %(e) | | | | | 135,098 | | | | 1.08 | % | | | | (0.01 | )% | | | | 1.08 | % | | | | 59 | % | |

| Year Ended October 31, 2013 | | | | 13.40 | | | | | 0.01 | | | | | | 4.47 | | | | | 4.48 | | | | | — | | | | | | (0.61 | ) | | | | | (0.61 | ) | | | | | 17.27 | | | | 34.70 | %(e) | | | | | 208,321 | | | | 0.99 | % | | | | 0.07 | % | | | | 0.99 | % | | | | 70 | % | |

| Year Ended October 31, 2014 | | | | 17.27 | | | | | (0.08 | ) | | | | | 2.07 | | | | | 1.99 | | | | | (0.04 | ) | | | | | (1.75 | ) | | | | | (1.79 | ) | | | | | 17.47 | | | | 12.16 | % | | | | | 205,237 | | | | 1.00 | % | | | | (0.49 | )% | | | | 1.00 | % | | | | 66 | % | |

| * | The per share amounts and percentages reflect income and expenses assuming inclusion of the Fund’s proportionate share of the income and expenses of the HSBC Opportunity Portfolio. |

(a) | Calculated based on average shares outstanding. |

(b) | Total return calculations do not include any sales or redemption charges. |

(c) | Portfolio turnover rate is calculated on the basis of the respective Portfolio in which the Fund invests all of its investable assets. Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing between the classes of shares issued. |

(d) | During the year ended October 31, 2010, the Fund received a distribution from a “fair fund’ established by the SEC in connection with a consent order against BISYS Fund Services, Inc. (See Note 7 in the Notes to Financial Statements). The corresponding impact to the net income ratio and the total return was 0.01% for Class I Shares. |

(e) | The Portfolio, in which the Fund invests, received monies related to certain nonrecurring litigation settlements. The corresponding impact to the total return was 0.15%, 0.10%, 0.10% and 0.13% for the years ended October 31, 2010, 2011, 2012 and 2013, respectively. |

Amounts designated as “-” are $0 or have been rounded to $0. |

| 16 HSBC FAMILY OF FUNDS | See notes to financial statements. |

| HSBC FAMILY OF FUNDS |

Notes to Financial Statements—as of October 31, 2014 |

1. Organization:

The HSBC Funds (the “Trust”), a Massachusetts business trust organized on April 22, 1987, and the HSBC Advisor Funds Trust (the “Advisor Trust”), a Massachusetts business trust organized on April 5, 1996, are registered under the Investment Company Act of 1940, as amended (the “Act”), as open-end management investment companies. As of October 31, 2014, the Trust is composed of 15 separate operational funds and the Advisor Trust is composed of one operational fund, each a series of the HSBC Family of Funds, which also includes the HSBC Portfolios (the “Portfolio Trust”) (collectively the “Trusts”). The accompanying financial statements are presented for the following three funds (individually a “Fund”, collectively the “Funds”) of the Trust and Advisor Trust:

| Fund | | Short Name | | Trust | |

| HSBC Growth Fund | Growth Fund | Trust |

| HSBC Opportunity Fund | Opportunity Fund | Trust |

| HSBC Opportunity Fund (Advisor) | Opportunity Fund (Advisor) | Advisor Trust |

All the Funds are diversified funds. Financial statements for all other funds of the Trusts are published separately.

Each Fund utilizes a master-feeder fund structure and seeks to achieve its investment objectives by investing all of its investable assets in its respective Portfolio (as defined below).

| | Proportionate |

| | Ownership |

| | Interest on |

| Fund | | Respective Portfolio | | October 31, 2014 (%) |

| HSBC Growth Fund | HSBC Growth Portfolio | | 100.0 | |

| HSBC Opportunity Fund | HSBC Opportunity Portfolio | | 7.8 | |

| HSBC Opportunity Fund (Advisor) | HSBC Opportunity Portfolio | | 92.2 | |

The HSBC Growth Portfolio and HSBC Opportunity Portfolio (individually a “Portfolio”, collectively the “Portfolios”) are diversified series of the Portfolio Trust. The Portfolios operate as master funds in master-feeder arrangements and also may receive investments from certain fund of funds.

The financial statements of the Portfolios, including the Schedules of Portfolio Investments, are included elsewhere in this report. The financial statements of the Portfolios should be read in conjunction with the financial statements of the Funds.

The Funds are authorized to issue an unlimited number of shares of beneficial interest with a par value of $ 0.001 per share. The Growth Fund offers four classes of shares: Class A Shares, Class B Shares, Class C Shares, and Class I Shares. The Opportunity Fund offers three classes of shares: Class A Shares, Class B Shares, and Class C Shares. The Opportunity Fund (Advisor) offers one class of shares: Class I Shares. Class A Shares of the Funds have a maximum sales charge of 5.00% as a percentage of the original purchase price. Class B Shares of the Funds are offered without any front-end sales charge but will be subject to a contingent deferred sales charge (“CDSC”) ranging from a maximum of 4.00% if redeemed less than one year after purchase to 0.00% if redeemed more than four years after purchase. Class C Shares of the Funds are offered without any front-end sales charge but will be subject to a maximum CDSC of 1.00% if redeemed less than one year after purchase. No sales charges are assessed with respect to Class I Shares of the Funds. Each class of shares in the Funds has identical rights and privileges except with respect to arrangements pertaining to shareholder servicing and/or distribution, class-related expenses, voting rights on matters affecting a single class of shares, and the exchange privilege of each class of shares. Class B Shares of the Funds may no longer be purchased or acquired by any new or existing Class B shareholder, except through dividend and/or capital gains reinvestment.

HSBC FAMILY OF FUNDS 17

| HSBC FAMILY OF FUNDS |

Notes to Financial Statements—as of October 31, 2014 (continued) |

Under the Trusts’ organizational documents, the Trusts’ officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Funds. In addition, in the normal course of business, the Trusts enter into contracts with service providers, which also provide for indemnifications by the Funds. The Funds’ maximum exposure under these arrangements is unknown, as this would involve any future claims that may be made against the Funds. However, based on experience, the Trusts expect that risk of loss to be remote.

The Funds are investment companies and follow accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies”.

2. Significant Accounting Policies:

The following is a summary of the significant accounting policies followed by the Funds in the preparation of their financial statements. The policies are in conformity with U.S. generally accepted accounting principles (“GAAP”). The preparation of financial statements requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Securities Valuation:

The Funds record their investments at fair value. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The valuation techniques used to determine fair value are further described in Note 3 below.

Investment Transactions and Related Income:

The Funds record investments into the Portfolios on a trade date basis. The Funds record daily their proportionate share of income, expenses, changes in unrealized appreciation and depreciation and realized gains and losses derived from their respective Portfolios. In addition, the Funds accrue their own expenses daily as incurred.

Allocations: