2012 Annual Report

Message From the Chairman

Dear Shareholders:

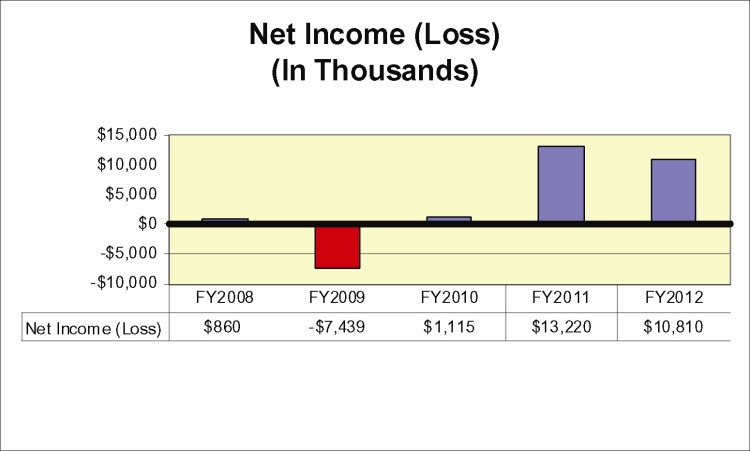

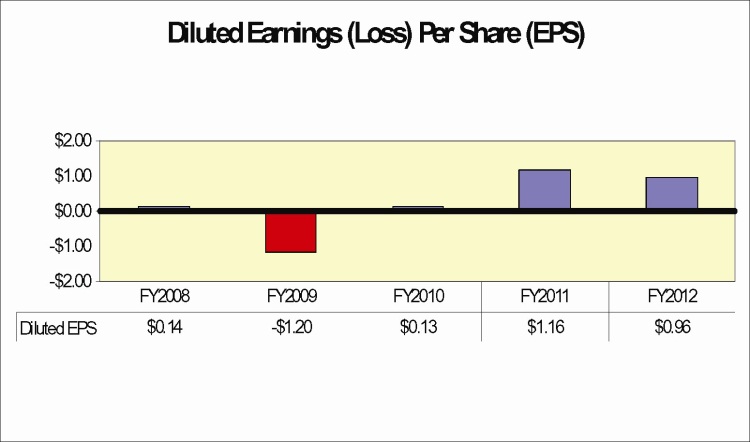

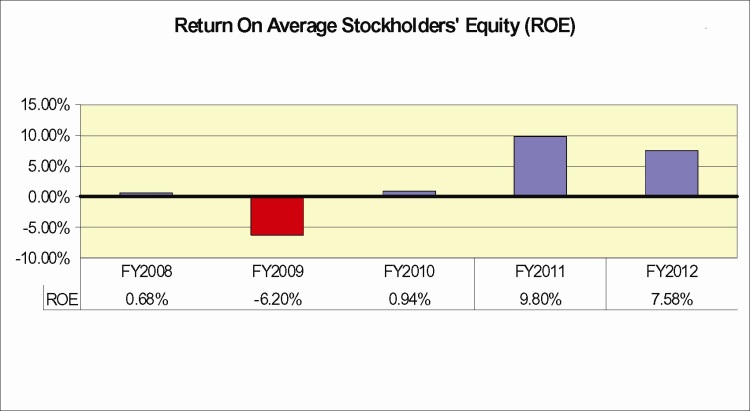

I am pleased to forward our Annual Report for fiscal 2012, which describes the second consecutive year of significantly improved financial results compared to the fiscal years ended June 30, 2010, 2009 and 2008. I believe that we have effectively weathered the weak banking environment which is commonly associated with the period following the financial crisis of 2008 and I also believe that we are well-positioned for future growth. We continue to capitalize on favorable mortgage banking conditions at the same time that credit quality continues to improve. For fiscal 2012, we reported net income of $10.8 million, or $0.96 per diluted share, and a return on equity of 7.6%, which is a solid performance in comparison to many of our peers, although somewhat lower than we would expect in a more normalized banking environment.

Last year, when we were completing our fiscal 2012 Business Plan, we became more confident that in addition to investing in our mortgage banking business we needed to once again establish the foundation for sustainable, organic growth to prepare for an eventual economic recovery. As a result, the Business Plan for the Bank designated investments in our preferred loan origination capabilities and in the resources needed to increase core deposits, while also allocating resources for the ongoing oversight of asset quality issues arising from the loan portfolio. We also felt strongly that our capital position was formidable and could support an increased cash dividend to shareholders and reinstatement of our stock repurchase plan. For Provident Bank Mortgage, the primary goal was to capture significant loan origination volume consistent with the investment we have been making in our retail loan origination capacity and to remain flexible in the event the volatile environment presented low risk opportunities to augment our retail delivery channel.

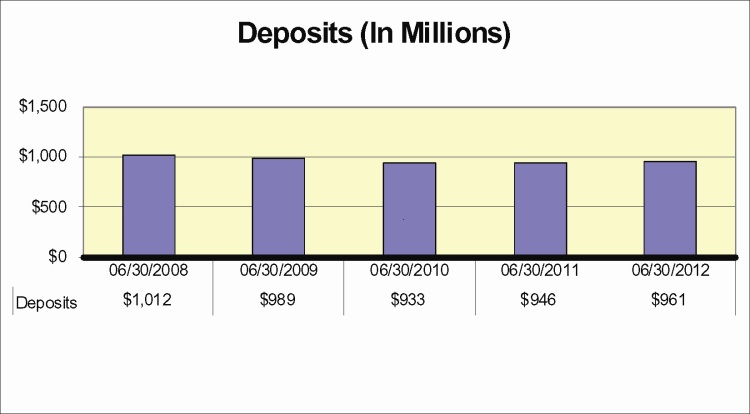

I am pleased to report that we have made progress in connection with all of these initiatives. Specifically, preferred loan originations and purchases were $57.8 million in fiscal 2012, a 335% increase from $13.3 million in fiscal 2011; we opened our 15th full service branch office and increased core deposits by 9%; non-performing assets declined by a noteworthy 12%; and we increased the quarterly cash dividend to $0.04 per share while repurchasing 670,348 shares of our common stock.

Additionally, in fiscal 2012, Provident Bank Mortgage originated over $2.5 billion of loans for sale, the best year in our 56 year history in terms of loan origination volume. Additionally, we opened or acquired four retail loan production offices expanding to 14 statewide and experienced a 34% increase in retail loan origination volume, the first year in our history where retail loan originations exceeded $1.0 billion.

Provident Bank

Our fiscal 2013 Business Plan charts a somewhat more aggressive growth strategy than recent years combined with a capital management plan where we recognize that growth may be difficult given the uncertain economic climate, high levels of unemployment, and the weak, albeit slightly improving, housing markets. We will balance the need to grow with a disciplined approach to market opportunities and return capital to shareholders in the form of cash dividends or common stock repurchases if we believe the growth opportunities carry too much risk. We will continue to invest in our preferred loan origination capabilities and retail deposit platform primarily within our geographic footprint.

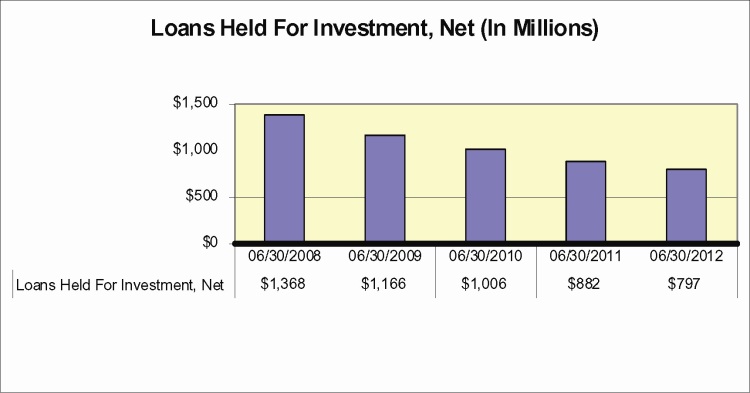

Similar to last year, during the course of fiscal 2013, we will emphasize prudent increases in loans held for investment, the growth of retail deposits (primarily transaction accounts), diligent control of operating expenses and sound capital management decisions. We believe that successful execution of these strategies will enhance our franchise value while limiting our risk profile.

Provident Bank Mortgage

Mortgage interest rates remain at very low levels (from a historical perspective) and, very recently, the housing markets seem to have rebounded from their lowest point in the cycle suggesting that mortgage banking fundamentals will be favorable for much of fiscal 2013. We have never been better prepared to take advantage of the opportunities we see and expect that mortgage banking profitability will improve from fiscal 2012 as we realize the full benefit of the investments made in prior years. We are increasing the percentage of retail originations in

Message From the Chairman

comparison to wholesale originations and plan to continue to do so. We are closely monitoring our loan sale margin and will be quick to respond to poorer fundamentals should they develop.

A Final Word

At the time of this writing, the national political conventions are being held and each political party is making its case to the electorate. I am struck by the sharp differences. However, I am also struck by the one thing that both political parties seem to agree on, that our best days are still ahead of us. I started to wonder, is the same thing true for Provident? Are our best days still ahead of us? After some consideration, I realized that we are fortunate to enjoy a highly skilled staff of banking professionals, exceptional loyalty from our customers in the growing communities we serve, and the dedicated support of our shareholders. I am convinced that these constituencies will work to our advantage, for the betterment of Provident. Yes, I believe our best days are still ahead of us!

Sincerely,

Craig G. Blunden

Chairman and Chief Executive Officer

Message From the Chairman