UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted byRule 14a-6(e)(2))

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to§240.14a-12

POLYCOM, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules14a-6(i)(1) and0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange ActRule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange ActRule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

NOTICE OF 2015 ANNUAL MEETING OF STOCKHOLDERS

To be held on May 27, 2015

To Polycom Stockholders:

Notice is hereby given that the 2015 Annual Meeting of Stockholders (the “2015 Annual Meeting”) of Polycom, Inc., a Delaware corporation, will be held on Wednesday, May 27, 2015, at 10:00 a.m., Pacific time, at Polycom’s corporate headquarters located at 6001 America Center Drive, San Jose, California 95002, for the following purposes:

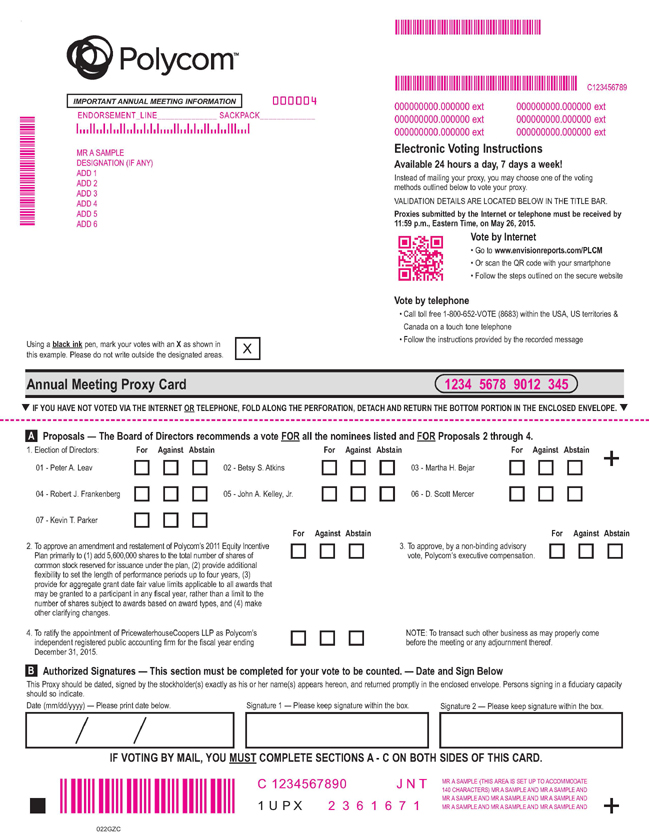

| | 1. | To elect the seven directors listed in the accompanying proxy statement to serve for the ensuing year and until their successors are duly elected and qualified. |

| | 2. | To approve an amendment and restatement of Polycom’s 2011 Equity Incentive Plan primarily to (1) add 5,600,000 shares to the total number of shares of common stock reserved for issuance under the plan, (2) provide additional flexibility to set the length of performance periods up to four years, (3) provide for aggregate grant date fair value limits applicable to all awards that may be granted to a participant in any fiscal year, rather than a limit to the number of shares subject to awards based on award types, and (4) make other clarifying changes. |

| | 3. | To approve, by a non-binding advisory vote, Polycom’s executive compensation. |

| | 4. | To ratify the appointment of PricewaterhouseCoopers LLP as Polycom’s independent registered public accounting firm for the fiscal year ending December 31, 2015. |

| | 5. | To transact such other business as may properly come before the meeting or any adjournment thereof. |

The preceding items of business are more fully described in the proxy statement accompanying this notice. Any action on the items of business described above may be considered at the 2015 Annual Meeting at the time and on the date specified above or at any time and date to which the 2015 Annual Meeting may be properly adjourned or postponed.

We are furnishing our proxy materials over the Internet to all of our stockholders rather than in paper form. We believe that this delivery process reduces our environmental impact and lowers the costs of printing and distributing our proxy materials without impacting our stockholders’ timely access to this important information. Accordingly, stockholders of record at the close of business on April 7, 2015, will receive a Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”) and may vote at the 2015 Annual Meeting and any postponements or adjournments of the meeting. The Notice of Internet Availability is being distributed to stockholders on or about April 15, 2015.

Your vote is very important. Whether or not you plan to attend the 2015 Annual Meeting, we encourage you to read the proxy statement and vote as soon as possible. For specific instructions on how to vote your shares, please refer to the section entitled “Questions and Answers About the 2015 Annual Meeting and Procedural Matters” and the instructions on the Notice of Internet Availability.

All stockholders are cordially invited to attend the 2015 Annual Meeting in person. Any stockholder attending the 2015 Annual Meeting may vote in person even if such stockholder has previously voted by another method, and any previous votes that were submitted by the stockholder, whether by Internet, telephone or mail, will be superseded by the vote that such stockholder casts at the 2015 Annual Meeting.

Thank you for your ongoing support of Polycom.

|

| By Order of the Board of Directors of Polycom, Inc. |

|

|

| Peter A. Leav |

| Chief Executive Officer, President and Director |

PROXY STATEMENT

FOR 2015 ANNUAL MEETING OF STOCKHOLDERS

TABLE OF CONTENTS

i

ii

iii

POLYCOM, INC.

6001 America Center Drive

San Jose, California 95002

PROXY STATEMENT

FOR 2015 ANNUAL MEETING OF STOCKHOLDERS

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

STOCKHOLDER MEETING TO BE HELD ON MAY 27, 2015

The proxy statement and annual report to stockholders are available atwww.edocumentview.com/plcm.

In accordance with rules and regulations adopted by the U.S. Securities and Exchange Commission (the “SEC”), we are pleased to provide access to our proxy materials over the Internet to all of our stockholders rather than in paper form. Accordingly, a Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”) will be mailed to our stockholders on or about April 15, 2015. Stockholders will have the ability to access the proxy materials on a website atwww.edocumentview.com/plcm, or to request a printed set of the proxy materials be sent to them, by following the instructions in the Notice of Internet Availability. By furnishing a notice and providing access to our proxy materials by the Internet, we are lowering the costs and reducing the environmental impact of our annual meeting.

The Notice of Internet Availability will also provide instructions on how you may request that we send future proxy materials to you electronically by e-mail or in printed form by mail. If you choose to receive future proxy materials by e-mail, you will receive an e-mail next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by e-mail or in printed form by mail will remain in effect until you terminate it. We encourage you to choose to receive future proxy materials by e-mail, which will allow us to provide you with the information you need in a more timely manner, will save us the cost of printing and mailing documents to you and will conserve natural resources.

In this proxy statement, the words “Polycom,” “the company,” “we,” “our,” “us” and similar terms refer to Polycom, Inc. and its subsidiaries, unless the context indicates otherwise.

QUESTIONS AND ANSWERS ABOUT THE 2015 ANNUAL MEETING

AND PROCEDURAL MATTERS

| Q: | Why am I receiving these proxy materials? |

| A: | The Board of Directors of Polycom, Inc. (the “Board”) is providing these proxy materials to you in connection with the solicitation of proxies for use at Polycom’s 2015 Annual Meeting of Stockholders (the “2015 Annual Meeting”) to be held Wednesday, May 27, 2015, at 10:00 a.m., Pacific time, and at any adjournment or postponement thereof, for the purpose of considering and acting upon the matters set forth in this proxy statement. These proxy materials are being distributed and made available to you on or about April 15, 2015. As a stockholder, you are invited to attend the 2015 Annual Meeting and are requested to vote on the proposals described in this proxy statement. |

| Q: | Where is the 2015 Annual Meeting? |

| A: | The 2015 Annual Meeting will be held at our corporate headquarters located at 6001 America Center Drive, San Jose, California 95002. Stockholders may request directions by calling (408) 586-6000. |

| Q: | Can I attend the 2015 Annual Meeting? |

| A: | You are invited to attend the 2015 Annual Meeting if you were a stockholder of record or a beneficial owner as of April 7, 2015 (the “Record Date”). You should bring photo identification for entrance to the 2015 |

| | Annual Meeting. Stockholders holding stock in brokerage accounts will need to bring a copy of a brokerage statement reflecting their stock ownership as of the Record Date. The meeting will begin promptly at 10:00 a.m., Pacific time, and you should leave ample time for the check-in procedures. |

| Q: | Who is entitled to vote at the 2015 Annual Meeting? |

| A: | You may vote your shares of Polycom common stock if our records show that you owned your shares of common stock at the close of business on the Record Date. At the close of business on the Record Date, there were 135,054,986 shares of Polycom common stock outstanding and entitled to vote at the 2015 Annual Meeting. You may cast one vote for each share of common stock held by you as of the Record Date on all matters presented. |

| Q: | What is the difference between holding shares as a stockholder of record or as a beneficial owner? |

| A: | If your shares are registered directly in your name with our transfer agent, Computershare Trust Company, N.A., you are considered, with respect to those shares, the “stockholder of record,” and the Notice of Internet Availability has been sent directly to you by Polycom. As the stockholder of record, you have the right to grant your voting proxy directly to Polycom or to a third party, or to vote in person at the 2015 Annual Meeting. |

If your shares are held by a brokerage account or by a bank or another nominee, you are considered the “beneficial owner” of shares held in “street name,” and the Notice of Internet Availability has been forwarded to you by your broker, trustee or nominee who is considered, with respect to those shares, the stockholder of record. As a beneficial owner, you have the right to direct your broker, trustee or nominee as to how to vote your shares. Please refer to the voting instruction card provided by your broker, trustee or nominee. You are also invited to attend the 2015 Annual Meeting. However, because a beneficial owner is not the stockholder of record, you may not vote these shares in person at the 2015 Annual Meeting unless you obtain a “legal proxy” from the broker, trustee or nominee that holds your shares, giving you the right to vote the shares at the 2015 Annual Meeting.

| Q: | How can I vote my shares in person at the 2015 Annual Meeting? |

| A: | Shares held in your name as the stockholder of record may be voted in person at the 2015 Annual Meeting. Shares held beneficially in street name may be voted in person at the 2015 Annual Meeting only if you obtain a “legal proxy” from the broker, trustee or nominee that holds your shares giving you the right to vote the shares.Even if you plan to attend the 2015 Annual Meeting, we recommend that you also submit your vote as instructed on the Notice of Internet Availability and below, so that your vote will be counted even if you later decide not to attend the 2015 Annual Meeting. |

| Q: | How can I vote my shares without attending the 2015 Annual Meeting? |

| A: | Whether you hold shares directly as the stockholder of record or beneficially in street name, you may direct how your shares are voted without attending the 2015 Annual Meeting. For instructions on how to vote by proxy, please refer to the instructions below and those included on the Notice of Internet Availability or, for shares held beneficially in street name, the voting instructions provided to you by your broker, trustee or nominee. |

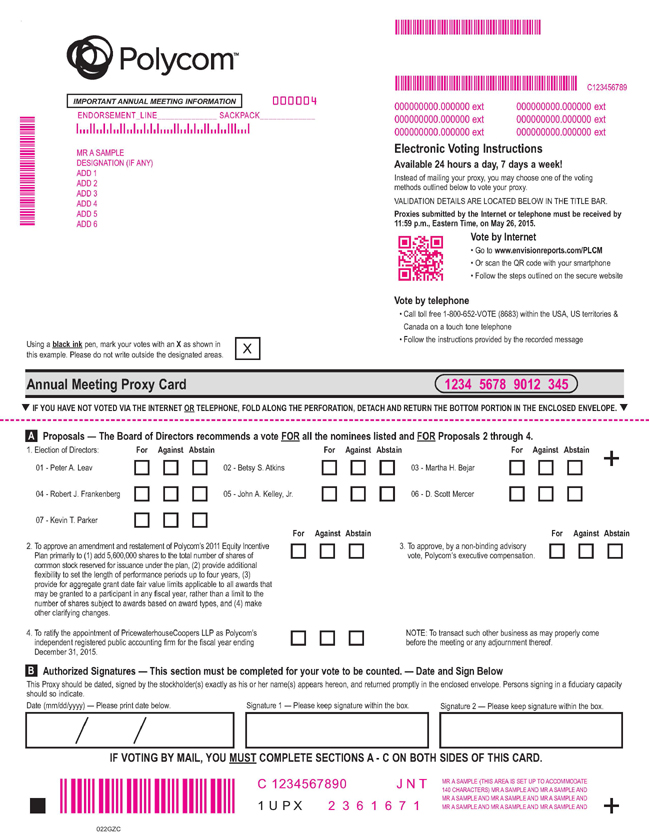

By Internet—Stockholders of record of Polycom common stock with Internet access may submit proxies by following the “Vote by Internet” instructions on the Notice of Internet Availability until 11:59 p.m., Eastern time, on May 26, 2015. If you are a beneficial owner of Polycom common stock held in street name, please check the voting instructions provided by your broker, trustee or nominee for Internet voting availability.

2

By telephone—Stockholders of record of Polycom common stock who live in the United States or Canada may submit proxies by following the “Vote by Telephone” instructions on the Notice of Internet Availability until 11:59 p.m., Eastern time, on May 26, 2015. If you are a beneficial owner of Polycom common stock held in street name, please check the voting instructions provided by your broker, trustee or nominee for telephone voting availability.

By mail—Stockholders of record of Polycom common stock may request a paper proxy card from Polycom by following the procedures outlined in the Notice of Internet Availability. If you elect to vote by mail, please indicate your vote by completing, signing and dating the proxy card where indicated and by returning it in the prepaid envelope that will be included with the proxy card. Proxy cards submitted by mail must be received by the time of the meeting in order for your shares to be voted. If you are a beneficial owner of Polycom common stock held in street name, please check the voting instructions provided by your broker, trustee or nominee for telephone voting availability.

| Q: | How many shares must be present or represented to conduct business at the 2015 Annual Meeting? |

| A: | The presence of the holders of a majority of the shares entitled to vote at the 2015 Annual Meeting is necessary to constitute a quorum at the 2015 Annual Meeting. Such stockholders are counted as present at the meeting if (1) they are present in person at the 2015 Annual Meeting or (2) have properly submitted a proxy by voting their shares as discussed above. |

Under the General Corporation Law of the State of Delaware, abstentions and broker “non-votes” are counted as present and entitled to vote and are, therefore, included for the purposes of determining whether a quorum is present at the 2015 Annual Meeting.

A broker “non-vote” occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that item and has not received voting instructions from the beneficial owner.

| Q: | What proposals will be voted on at the 2015 Annual Meeting? |

| A: | The proposals scheduled to be voted on at the 2015 Annual Meeting are: |

| | • | | The election of seven directors to serve for the ensuing year and until their successors are duly elected and qualified; |

| | • | | The approval of an amendment and restatement of Polycom’s 2011 Equity Incentive Plan primarily to (1) add 5,600,000 shares to the total number of shares of common stock reserved for issuance under the plan, (2) provide additional flexibility to set the length of performance periods up to four years, (3) provide for aggregate grant date fair value limits applicable to all awards that may be granted to a participant in any fiscal year, rather than a limit to the number of shares subject to awards based on award types, and (4) make other clarifying changes; |

| | • | | The approval, by a non-binding, advisory vote, of Polycom’s executive compensation; and |

| | • | | The ratification of the appointment of PricewaterhouseCoopers LLP as Polycom’s independent registered public accounting firm for the fiscal year ending December 31, 2015. |

| Q: | What are the voting requirements to approve each of the proposals? |

| A: | The voting requirements to approve each of the proposals are as follows: |

| | • | | Our bylaws and Corporate Governance Principles provide for a majority voting standard in uncontested elections of directors (i.e., the number of candidates for election as directors does not |

3

| | exceed the number of directors to be elected). Therefore, a nominee will be elected if the number of shares voted “FOR” that nominee exceeds the number of shares “AGAINST” that nominee (Proposal One). If an incumbent director fails to receive the required vote for reelection, the Board expects such director to tender his or her resignation. The Corporate Governance and Nominating Committee will act on an expedited basis to determine whether to accept the director’s resignation and will submit such recommendation for consideration by the Board. The Board will determine whether to accept or reject such resignation within 90 days from the certification of the election results. |

| | • | | The affirmative vote of a majority of votes present in person or represented by proxy and entitled to vote is required (1) to approve the amendments to Polycom’s 2011 Equity Incentive Plan (Proposal Two), (2) to approve, by a non-binding, advisory vote, Polycom’s executive compensation (Proposal Three) and (3) to ratify the appointment of PricewaterhouseCoopers LLP as Polycom’s independent registered public accounting firm (Proposal Four). |

| A: | You may vote “FOR,” “AGAINST” or “ABSTAIN” on each of the nominees for election as director (Proposal One). A nominee for director must receive more votes “FOR” than “AGAINST.” If you hold shares through a bank, broker or other holder of record, you must instruct your bank, broker or other holder of record how to vote so that your vote can be counted on this proposal. Broker non-votes and, pursuant to our bylaws, abstentions, will not be counted as votes cast with respect to this proposal and, therefore, will not affect the outcome of the election. |

You may vote “FOR,” “AGAINST” or “ABSTAIN” on the proposals to approve the amendment to Polycom’s 2011 Equity Incentive Plan (Proposal Two); to approve, by a non-binding, advisory vote, Polycom’s executive compensation (Proposal Three); and to ratify the appointment of PricewaterhouseCoopers LLP as Polycom’s independent registered public accounting firm (Proposal Four).Abstentions are deemed to be votes cast with respect to Proposals Two, Three and Four and have the same effect as a vote “AGAINST” these proposals.However, broker non-votes are not deemed to be entitled to vote and, therefore, are not included in the tabulation of the voting results on these proposals.

All shares entitled to vote and represented by properly executed proxies received prior to the 2015 Annual Meeting (and not revoked) will be voted at the 2015 Annual Meeting in accordance with the instructions indicated. If you submit a proxy via the Internet, by telephone or by mail and do not make voting selections, the shares represented by that proxy will be voted as recommended by the Board.

| Q: | How does the Board of Directors recommend that I vote? |

| A: | The Board of Directors recommends that you vote your shares: |

| | • | | “FOR” the seven nominees for election as directors (Proposal One); |

| | • | | “FOR” the approval of the amendments to Polycom’s 2011 Equity Incentive Plan (Proposal Two); |

| | • | | “FOR” the approval of Polycom’s executive compensation (Proposal Three); and |

| | • | | “FOR” the ratification of the appointment of PricewaterhouseCoopers LLP as Polycom’s independent registered public accounting firm for the fiscal year ending December 31, 2015 (Proposal Four). |

| Q: | What happens if additional matters are presented at the 2015 Annual Meeting? |

| A: | If any other matters are properly presented for consideration at the 2015 Annual Meeting, including, among other things, consideration of a motion to adjourn the 2015 Annual Meeting to another time or place |

4

| | (including, without limitation, for the purpose of soliciting additional proxies), the persons named as proxy holders, Peter A. Leav and Sayed M. Darwish, or either of them, will have discretion to vote on those matters in accordance with their best judgment. Polycom does not currently anticipate that any other matters will be raised at the 2015 Annual Meeting. |

| A: | Subject to any rules your broker, trustee or nominee may have, you may change your proxy instructions at any time before your proxy is voted at the 2015 Annual Meeting. |

If you are the stockholder of record, you may change your vote (1) by granting a new proxy bearing a later date (which automatically revokes the earlier proxy) using any of the methods described above (and until the applicable deadline for each method), (2) by providing a written notice of revocation to Polycom’s Corporate Secretary at Polycom, Inc., 6001 America Center Drive, San Jose, California 95002 prior to your shares being voted, or (3) by attending the 2015 Annual Meeting and voting in person. Attendance at the meeting will not cause your previously granted proxy to be revoked unless you specifically request so.

If you are a beneficial owner of shares held in street name, you may change your vote by (1) submitting new voting instructions to your broker, trustee or nominee or (2) if you have obtained a “legal proxy” from the broker, trustee or nominee that holds your shares giving you the right to vote your shares, by attending the 2015 Annual Meeting and voting in person.

| Q: | What happens if I decide to attend the 2015 Annual Meeting but I have already voted or submitted a proxy card covering my shares? |

| A: | Subject to any rules your broker, trustee or nominee may have, you may attend the 2015 Annual Meeting and vote in person even if you have already voted or submitted a proxy card. Any previous votes that were submitted by you will be superseded by the vote you cast at the 2015 Annual Meeting. Please be aware that attendance at the 2015 Annual Meeting will not, by itself, revoke a proxy. |

If a broker, trustee or nominee beneficially holds your shares in street name and you wish to attend the 2015 Annual Meeting and vote in person, you must obtain a “legal proxy” from the broker, trustee or nominee that holds your shares giving you the right to vote the shares.

| Q: | What should I do if I receive more than one set of voting materials? |

| A: | You may receive more than one set of voting materials, including multiple copies of proxy cards or voting instruction cards. For example, if you hold your shares in more than one brokerage account, you may receive a separate voting instruction card for each brokerage account in which you hold shares. If you are a stockholder of record and your shares are registered in more than one name, you will receive more than one proxy card. Please complete, sign, date and return each proxy card or voting instruction card that you receive to ensure that all your shares are voted. |

| Q: | Is my vote confidential? |

| A: | Proxy instructions, ballots and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within Polycom or to third parties, except: (1) as necessary to meet applicable legal requirements, (2) to allow for the tabulation of votes and certification of the vote and (3) to facilitate a successful proxy solicitation. Occasionally, stockholders provide written comments on their proxy cards, which may be forwarded to Polycom management. |

5

| Q: | Who will serve as inspector of election? |

| A: | The inspector of election will be Computershare Trust Company, N.A. |

| Q: | Where can I find the voting results of the 2015 Annual Meeting? |

| A: | We intend to announce preliminary voting results at the 2015 Annual Meeting and will publish final results in a Current Report on Form 8-K, which will be filed with the SEC within four (4) business days of the 2015 Annual Meeting. |

| Q: | Who will bear the cost of soliciting votes for the 2015 Annual Meeting? |

| A: | We will pay the entire cost of preparing, assembling, printing, mailing and distributing these proxy materials and soliciting votes. We may reimburse brokerage firms, custodians, nominees, fiduciaries and other persons representing beneficial owners for their reasonable expenses in forwarding solicitation material to such beneficial owners. Our directors, officers and employees may also solicit proxies in person or by other means of communication. Such directors, officers and employees will not be additionally compensated but may be reimbursed for reasonable out-of-pocket expenses in connection with such solicitation. We have retained The Proxy Advisory Group, LLC to aid in the solicitation of proxies from certain brokers, bank nominees and other institutional owners for an estimated fee of $17,000 plus reasonable out-of-pocket expenses. |

If you choose to access the proxy materials and/or vote over the Internet, you are responsible for Internet access charges you may incur. If you choose to vote by telephone, you are responsible for telephone charges you may incur.

| Q: | What is the deadline to propose actions for consideration at next year’s annual meeting of stockholders or to nominate individuals to serve as directors? |

| A: | You may submit proposals, including recommendations of director candidates, for consideration at future stockholder meetings. |

For inclusion in Polycom’s proxy materials—Stockholders may present proper proposals for inclusion in Polycom’s proxy statement and for consideration at the next annual meeting of stockholders by submitting their proposals in writing to Polycom’s Corporate Secretary in a timely manner. In order to be included in the proxy statement for the 2016 annual meeting of stockholders, stockholder proposals must be received by Polycom’s Corporate Secretary no later than December 17, 2015, and must otherwise comply with the requirements of Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

To be brought before annual meeting—In addition, our bylaws establish an advance notice procedure for stockholders who wish to present certain matters before an annual meeting of stockholders.

In general, nominations for the election of directors may be made (1) by or at the direction of the Board, or (2) by a stockholder who has delivered written notice to Polycom’s Corporate Secretary within the Notice Period (as defined below) and who was a stockholder at the time of such notice and as of the record date. The notice must contain specified information about the nominees and about the stockholder proposing such nominations.

Our bylaws also provide that the only business that may be conducted at an annual meeting is business that is (1) specified in the notice of meeting given by or at the direction of the Board, (2) properly brought before the meeting by or at the direction of the Board or (3) properly brought before the meeting by a stockholder who has delivered written notice to Polycom’s Corporate Secretary within the Notice Period (as defined

6

below) and who was a stockholder at the time of such notice and as of the record date. The notice must contain specified information about the matters to be brought before such meeting and about the stockholder proposing such matters.

The “Notice Period” is defined as that period not less than 45 days nor more than 75 days prior to the one year anniversary of the date on which we mailed our proxy materials to stockholders in connection with the previous year’s annual meeting of stockholders. As a result, the Notice Period for the 2016 annual meeting of stockholders will start on January 31, 2016 and end on March 1, 2016.

If a stockholder who has notified Polycom of his or her intention to present a proposal at an annual meeting does not appear to present his or her proposal at such meeting, we need not present the proposal for vote at such meeting.

A copy of the full text of the bylaw provisions discussed above may be obtained by writing to Polycom’s Corporate Secretary at our principal executive offices located at 6001 America Center Drive, San Jose, CA 95002 or by accessing our filings on the SEC’s website atwww.sec.gov. All notices of proposals by stockholders, whether or not included in our proxy materials, should be sent to Polycom’s Corporate Secretary at our principal executive offices.

| Q: | How may I obtain a separate copy of the Notice of Internet Availability or the 2014 Annual Report? |

| A: | If you share an address with another stockholder, each stockholder may not receive a separate copy of the Notice of Internet Availability and 2014 Annual Report. Stockholders may request to receive separate or additional copies of the Notice of Internet Availability and Annual Report on Form 10-K for the year ended December 31, 2014, filed with the SEC on February 20, 2015 (“2014 Annual Report”) by calling(408) 586-6000 or by writing to Polycom, Inc., 6001 America Center Drive, San Jose, California 95002, Attention: Investor Relations. Stockholders who share an address and receive multiple copies of the Notice of Internet Availability and 2014 Annual Report can also request to receive a single copy by following the instructions above. |

7

PROPOSAL ONE

ELECTION OF DIRECTORS

General

Our bylaws currently set the number of authorized directors at eight. William A. Owens is not standing for re-election. Therefore, seven directors are to be elected to our Board of Directors at the 2015 Annual Meeting, all of whom have been recommended for nomination by the Corporate Governance and Nominating Committee of the Board of Directors, and all of whom are currently serving as directors of Polycom. All nominees were elected by the stockholders at last year’s annual meeting. Our bylaws have been amended, effective immediately prior to the 2015 Annual Meeting, to reduce the size of the Board of Directors to seven.

Each director holds office until the next annual meeting of stockholders or until that director’s successor is duly elected and qualified. Each person nominated for election has agreed to serve if elected, and management has no reason to believe that any nominee will be unavailable to serve. In the event any nominee is unable or declines to serve as a director at the time of the 2015 Annual Meeting, the proxies will be voted for any nominee who may be proposed by the Corporate Governance and Nominating Committee and designated by the present Board to fill the vacancy. Unless otherwise instructed, the proxy holders will vote the proxies received by them “FOR” the nominees named below. Your proxies cannot be voted for a greater number of persons than the number of nominees named in this proxy statement.

THE BOARDOF DIRECTORS RECOMMENDSA VOTE

“FOR”THE ELECTIONOFTHE NOMINEES LISTED BELOW.

Nominees

The names of the nominees for director, their ages, their positions with Polycom and other biographical information as of March 31, 2015, are set forth below. There are no family relationships among any of our directors or executive officers. Beneath the biographical details of each nominee listed below, we have also detailed the specific experience, qualifications, attributes or skills of each nominee that led the Board to conclude that each nominee should serve on the Board.

| | | | | | |

Name | | Age | | | Position |

Peter A. Leav | | | 44 | | | Chief Executive Officer, President and Director |

Betsy S. Atkins (2)(3) | | | 59 | | | Director |

Martha H. Bejar (1) | | | 52 | | | Director |

Robert J. Frankenberg (1)(2) | | | 67 | | | Director |

John A. Kelley, Jr. (2)(3) | | | 65 | | | Director |

D. Scott Mercer (1)(3) | | | 64 | | | Director |

Kevin T. Parker | | | 55 | | | Chairman of the Board of Directors |

| (1) | Member of Audit Committee |

| (2) | Member of Compensation Committee |

| (3) | Member of Corporate Governance and Nominating Committee |

Director Qualifications and Diversity

We have adopted a policy for evaluating director candidates, which is described in more detail in the “Corporate Governance” section under the heading “Process for Recommending Candidates for Election to the Board of Directors” on page 16 below. Under this policy, the Corporate Governance and Nominating Committee considers issues such as character, judgment, diversity, age, expertise, business experience, length of service, independence, other commitments and the like in evaluating director candidates and members of the

8

Board. We do not maintain a diversity policy with respect to the Board. As noted above, however, we do consider diversity to be a relevant consideration, among others, in the process of evaluating and identifying director candidates. The Board views diversity broadly as it considers those attributes that it believes will allow them to best guide Polycom and its strategic direction through a variety of backgrounds, viewpoints, skills, professional and educational experiences and other attributes. We believe each of our current directors has broad experience at the policy-making level in business and in the technology industry and brings a strong set of relevant skills, giving the Board competence and experience in a wide variety of areas, including technology industry expertise, operations, corporate governance and compliance, board service, executive management, finance, customer segments, mergers and acquisitions, and international business.

As the biographical information of our directors illustrates, all of our directors satisfy our criteria for Board membership. When identifying director candidates, we take into account the present and future needs of the Board and the expertise and experience required for committees of the Board. For instance, depending on the composition of the Board at a given time, a candidate capable of meeting the requirements of an audit committee financial expert might be a more attractive candidate than a candidate with significantly more technology experience, or vice versa. We also consider the character, judgment and integrity of director candidates, which we evaluate through reference checks, background verification and reputation in the business community. We believe all of our directors to be of good character, sound judgment and high integrity. Our principal goal with respect to director qualifications is to seat directors who are best able to effectively carry out their oversight duties, increase the overall effectiveness of the Board and ensure that the best interests of stockholders are being served. Beneath the biographical details of each nominee or director listed below is a discussion of the specific experience, qualifications, attributes or skills of each nominee that led the Board to conclude that each nominee should continue to serve on the Board.

Information Regarding the Nominees

Peter A. Leav has been a director of Polycom and Polycom’s President and Chief Executive Officer since December 2013. Prior to joining Polycom, Mr. Leav served as Executive Vice President and President, Industry and Field Operations of NCR Corporation, a global technology company, from June 2012 to November 2013. Mr. Leav served as Executive Vice President, Global Sales, Professional Services and Consumables of NCR from November 2011 to June 2012, and as Senior Vice President, Worldwide Sales of NCR from January 2009 to October 2011. Prior to joining NCR, he served as Corporate Vice President and General Manager of Motorola, Inc., a provider of mobility products and solutions across broadband and wireless networks, from November 2008 to January 2009, as Vice President and General Manager from December 2007 to November 2008, and as Vice President of Sales from December 2006 to December 2007. From November 2004 to December 2006, Mr. Leav was Director of Sales for Symbol Technologies, Inc., an information technology company. Prior to this position, Mr. Leav was Regional Sales Manager at Cisco Systems, Inc., a manufacturer of communications and information technology networking products, from July 2000 to November 2004. Mr. Leav has served on the board of directors of HD Supply, Inc. since October 2014. Mr. Leav holds a B.A. from Lehigh University.

Qualifications to serve as director: Mr. Leav is uniquely qualified to contribute to Polycom’s future delivery on its strategic initiatives through his strong background in operations, general management and sales, spanning more than 20 years in the communications, technology and services industry. During his career, Mr. Leav has a proven track record of driving revenue and shareholder value, while leading global organizations at such companies as NCR and Motorola and regional organizations at Cisco Systems and Tektronix. In addition, Mr. Leav has a comprehensive understanding of Polycom’s business, operations, competition and financial position.

Betsy S. Atkins has been a director of Polycom since April 1999. Ms. Atkins has served as the Chief Executive Officer of Baja LLC, an independent venture capital firm focused on technology, renewable energy and life sciences industries, since 1994. Ms. Atkins served as Chief Executive Officer and Chairman of the board of directors of Clear Standards, Inc., a provider of enterprise carbon management and sustainability solutions, from February 2009 until August 2009 when Clear Standards was acquired by SAP AG, a business software

9

company. Previously, Ms. Atkins served as Chairman and Chief Executive Officer of NCI, Inc., a functional food/nutraceutical company, from 1991 through 1993. Ms. Atkins was a co-founder of Ascend Communications, Inc. in 1989 and a member of its board of directors, and served as its Executive Vice President of sales, marketing, professional services and international operations prior to its acquisition by Lucent Technologies. Ms. Atkins served on the boards of directors of Towers Watson & Co. from January 2010 to November 2010, Reynolds American Inc. from July 2004 to June 2010, SunPower Corporation from October 2005 to August 2012, Chico’s FAS, Inc. from January 2004 to July 2013, Wix.com Ltd. from November 2013 to July 2014, Ciber, Inc. from July 2014 to October 2014, and has served on the boards of directors of Schneider Electric, SA since April 2011, HD Supply, Inc. since September 2013, Darden Restaurants Inc. since October 2014 and SL Green Realty Corp. since April 2015, as well as the boards of a number of private companies. Ms. Atkins is also an advisor to SAP, was formerly an advisor to British Telecom and was a presidential-appointee to the Pension Benefit Guaranty Corporation advisory committee. Ms. Atkins holds a B.A. from the University of Massachusetts.

Qualifications to serve as director: Ms. Atkins is independent and has deep expertise in many areas, including executive leadership and global operational experience in the telecommunications industry. As a co-founder and Executive Vice President of Ascend Communications and formerly as an advisor to British Telecom, Ms. Atkins has a strong skill set in sales, marketing with deep digital DNA (social, mobile, Big Data analytics, and cyber) and international operations in the telecommunications, software and professional services industries as well as extensive knowledge of its principal customer segments. In addition, Ms. Atkins has significant public board experience, including large, multi-national enterprises, as well as service as a director of The NASDAQ Stock Market LLC and as a former appointee to the Pension Benefit Guaranty corporation advisory committee, which gives her broad experience and thought leadership in executive compensation, sustainability, enterprise risk management and evolving best practices in corporate governance. Ms. Atkins currently serves as the chairperson of Polycom’s Compensation Committee and is a member of the Corporate Governance and Nominating Committee. Ms. Atkins previously served as Lead Independent Director from May 2003 to February 2006.

Martha H. Bejar has been a director of Polycom since October 2013. Ms. Bejar has served as Chief Executive Officer and director of Flow Mobile, Inc., a wireless telecommunications company, since January 2012. Ms. Bejar has been a founding partner at Red Bison Advisory Group since May 2014, which specializes in furthering business relationships between the U.S., China and the rest of the world. Prior to that, Ms. Bejar was a venture partner for The Prometheus Partners group from April 2012 to May 2014, which also specializes in furthering business relationships between the U.S., China and the rest of the world. Prior to joining Flow Mobile, Ms. Bejar served as Chief Executive Officer and director of Wipro Infocrossing Inc., a cloud services company, from March 2011 until January 2012. Ms. Bejar served as President of Worldwide Sales and Operations at Wipro Technologies Inc., an IT services company, from June 2009 to April 2011. From June 2007 to June 2009, Ms. Bejar served as Worldwide Corporate Vice President for Microsoft, Inc., a computer software company. Prior to joining Microsoft, Ms. Bejar held various positions at Nortel Networks Corporation, a telecommunications and data networking company, including as Regional President from 2004 to 2007, President of North America Sales, Sales Engineering and Sales Operations from 2002 to 2004 and General Manager from 1997 to 2002. Ms. Bejar serves on the boards of a number of private and non-profit companies. Ms. Bejar received an Advanced Management Program degree from Harvard University Business School and holds a B.S. in Industrial Engineering from the University of Miami, and a Masters in Business Administration from Nova Southeastern University.

Qualifications to serve as director: Ms. Bejar is independent and has significant senior management expertise in the telecommunications and IT sectors, including as Chief Executive Officer of Flow Mobile and Wipro Infocrossing. Ms. Bejar’s experience as a senior executive officer of technology companies gives her a strong skill set working in different business models with a focus on business intelligence and analytics, wireless solutions, unified communications, and social networking market demand. Ms. Bejar brings experience in technology, planning, operations, and strategy. Ms. Bejar currently serves on Polycom’s Audit Committee.

Robert J. Frankenberg has been a director of Polycom since October 2013. Mr. Frankenberg is the owner of NetVentures, a management consulting firm. Mr. Frankenberg served as Chairman of Kinzan, Inc., an internet

10

services software platform provider, from December 1999 to July 2006. Prior to joining Kinzan, Mr. Frankenberg served as Chairman, President and Chief Executive Officer of Encanto Networks, Inc., an eBusiness software and services company, from June 1997 until July 2000. From April 1994 to August 1996, Mr. Frankenberg served as Chairman and Chief Executive Officer of Novell, Inc., a networking software company. Prior to joining Novell, Mr. Frankenberg held various positions at Hewlett-Packard Corporation, an information technology company, including as Corporate Vice President and General Manager. Mr. Frankenberg served on the board of directors of National Semiconductor from April 1999 to September 2011, and has served on the boards of directors of Nuance Communications, Inc. since March 2000, Wave Systems Corp. since December 2011 and Rubicon Project, Inc. since April 2014, as well as the boards of a number of private and non-profit companies. Mr. Frankenberg holds a B.S. in Computer Engineering from San Jose State University.

Qualifications to serve as director: Mr. Frankenberg is independent and has significant senior management expertise in the technology industry, including previously as Chairman and Chief Executive Officer of Novell, one of the largest networking software companies in the world, where he led the business through a major strategy change to focus the company on the network software business. Mr. Frankenberg’s experience as chairman, president and chief executive officer of various technology companies and his significant board experience provides expertise in technology, business operations, corporate development, strategy, financial reporting, governance and board best practices. Mr. Frankenberg currently serves on Polycom’s Audit Committee and Compensation Committee.

John A. Kelley, Jr.has been a director of Polycom since March 2000. Mr. Kelley has served as the Chief Executive Officer of CereScan Corp., a provider of high-definition functional brain imaging, since July 2009 and as Chairman of the board of directors of CereScan since March 2009. Previously, Mr. Kelley served as the Chairman, President and Chief Executive Officer of McDATA Corporation, a provider of storage networking and data infrastructure solutions until McDATA was acquired by Brocade Communications Systems, Inc., a data infrastructure company, in January 2007. Mr. Kelley started at McDATA as President and Chief Operating Officer in August 2001. Prior to joining McDATA, Mr. Kelley served as Executive Vice President of Networks at Qwest Communications International, Inc. from August 2000 to December 2000. He served as President of Wholesale Markets for U.S. West, Inc. from May 1998 to July 2000. From 1995 to April 1998, Mr. Kelley served as Vice President and General Manager of Large Business and Government Accounts and President of Federal Services for U.S. West. Prior to joining U.S. West, Mr. Kelley was the Area President for Mead Corporation’s Zellerbach Southwest Business Unit from 1991 to 1995, and held senior positions at Xerox Corporation and NBI, Inc. Mr. Kelley has served on the board of directors of Emulex Corporation as Chair of the Compensation Committee since February 2014 and served on the board of directors of McDATA Corporation from August 2001 until McDATA was acquired in January 2007. Mr. Kelley is also a director of one private company and several not-for-profit boards. Mr. Kelley holds a B.S. in business management from the University of Missouri, St. Louis.

Qualifications to serve as director: Mr. Kelley is independent and has broad experience, knowledge and expertise in the communications and networking industries, including as chief executive officer of McDATA and in senior management positions at large telecommunications companies. Mr. Kelley’s strategic and operational experience as a senior executive officer and as chief executive officer in the telecommunications and networking industries is directly relevant to many of the strategic and operational issues faced by Polycom, including strategic planning, operations, finance, governance and industry consolidation. Mr. Kelley currently serves as chairperson of Polycom’s Corporate Governance and Nominating Committee and is a member of the Compensation Committee.

D. Scott Mercer has been a director of Polycom since November 2007. From April 2008 to April 2011, Mr. Mercer served as the Chief Executive Officer of Conexant Systems, Inc., a semiconductor solutions company that provides products for imaging, video, audio and Internet connectivity applications. Mr. Mercer also served on the board of directors of Conexant from May 2003 to April 2011 and served as Chairman of the board of directors of Conexant from August 2008 to April 2011. Mr. Mercer served as interim Chief Executive Officer of Adaptec, Inc., a provider of software and hardware-based storage solutions, from May 2005 through November 2005.

11

Mr. Mercer also served as a senior vice president and advisor to the chief executive officer of Western Digital Corporation, a supplier of disk drives to the personal computer and consumer electronics industries, from February 2004 through December 2004. Prior to that, Mr. Mercer was a Senior Vice President and the Chief Financial Officer of Western Digital Corporation from October 2001 through January 2004. From June 2000 to September 2001, Mr. Mercer served as Vice President and Chief Financial Officer of Teralogic, Inc. From June 1996 to May 2000, Mr. Mercer held various senior operating and financial positions with Dell, Inc. In addition to Conexant, Mr. Mercer served on the board of directors of Palm, Inc. from June 2005 until July 2010 when Palm was acquired by Hewlett-Packard Company. Mr. Mercer has served as a director of QLogic Corporation since September 2010 and Sandisk Corporation since September 2013. Mr. Mercer holds a B.S. in Accounting from California Polytechnic University.

Qualifications to serve as director: Mr. Mercer is independent and an audit committee financial expert, with significant senior management and operational experience over the last 28 years in a number of technology companies. Mr. Mercer’s experience as a senior executive officer, including as both chief executive officer and chief financial officer, of high growth technology companies gives him a strong skill set in planning, operations, compliance and finance matters. Further, Mr. Mercer has significant public board experience, which adds to his relevant knowledge and experience. Mr. Mercer currently serves as the chairman of Polycom’s Audit Committee and is a member of the Corporate Governance and Nominating Committee.

Kevin T. Parkerhas been a director of Polycom since January 2005. In May 2013, Mr. Parker was appointed Chairman of the Board. Mr. Parker served as interim President and Chief Executive Officer of Polycom from July 2013 to December 2013. Mr. Parker is a co-Founder and has been a managing principal of Bridge Growth Partners, LLC, a structured growth-oriented private equity firm that focuses on investments in the technology and financial services sectors, since June 2013. Prior to co-founding Bridge Growth Partners, Mr. Parker served as President and Chief Executive Officer of Deltek, Inc., a provider of enterprise software applications, from June 2005 to December 2012 and as Chairman of the board of directors of Deltek from April 2006 to December 2012. Prior to joining Deltek, Mr. Parker served as Co-President of PeopleSoft, Inc., an enterprise application software company, from October 2004 to December 2004, as Executive Vice President of Finance and Administration and Chief Financial Officer of PeopleSoft from January 2002 to October 2004, and as Senior Vice President and Chief Financial Officer of PeopleSoft from October 2000 to December 2001. Prior to joining PeopleSoft, Mr. Parker served as Senior Vice President and Chief Financial Officer from 1999 to 2000 at Aspect Communications Corporation, a customer relationship management software company. From 1996 to 1999, Mr. Parker was Senior Vice President of Finance and Administration at Fujitsu Computer Products of America. Mr. Parker served on Deltek’s board of directors from April 2006 to December 2012 and has served on the board of directors of Cvent, Inc. since July 2013. Mr. Parker also serves on a private company board. Mr. Parker holds a B.S. in Accounting from Clarkson University.

Qualifications to serve as director: Mr. Parker is independent, an audit committee financial expert, and a recognized technology industry leader with significant senior management and operational experience. Mr. Parker’s service as president and chief executive officer, chief financial officer and in other significant senior finance roles gives him a valuable perspective into the operations and management of a company. From such roles, Mr. Parker has crucial insight into the technology industry, technology trends, and industry consolidation. In addition to his business and financial acumen, Mr. Parker brings operational experience to Polycom from his oversight of administrative, human resources, legal, facilities and IT functions. Mr. Parker currently serves as Polycom’s Chairman of the Board.

See “Corporate Governance” and “Executive Compensation—Compensation of Directors” below for additional information regarding the Board.

Required Vote

Each director nominee who receives more votes “FOR” than “AGAINST” of the shares of Polycom common stock present in person or represented by proxy and entitled to vote will be elected.

12

CORPORATE GOVERNANCE

Corporate Governance Principles and Code of Business Ethics and Conduct

We believe that strong corporate governance practices are the foundation of a successful, well-run company. We are committed to establishing an operating framework that exercises appropriate oversight of responsibilities at all levels throughout Polycom and managing our affairs consistent with high principles of business ethics. The Board has adopted Corporate Governance Principles that set forth our principal corporate governance policies, including the oversight role of the Board. The Board reviews these Corporate Governance Principles regularly, refining them from time to time.

In addition, we maintain a Code of Business Ethics and Conduct, which is applicable to our directors and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions. The Corporate Governance Principles and the Code of Business Ethics and Conduct are available on our website, www.polycom.com, under the tabs “Company” and “Investor Relations—Corporate Governance.” We will disclose on our website any amendment to the Code of Business Ethics and Conduct, as well as any waivers of the Code of Business Ethics and Conduct that are required to be disclosed by the rules of the SEC or The NASDAQ Stock Market LLC (“NASDAQ”).

Director Independence

The Board has determined that, with the exception of Peter A. Leav, who is an employee of Polycom, all of its current members are “independent directors” as that term is defined in the listing standards of NASDAQ. In the course of determining the independence of each non-employee director, the Board considered the annual amount of Polycom’s sales to, or purchases from, any company where a non-employee director serves as an executive officer. The Board determined that any such sales or purchases were made in the ordinary course of business and the amount of such sales or purchases in each of the past three fiscal years was less than 1% of Polycom’s or the applicable company’s consolidated gross revenues for the applicable year.

Board Leadership Structure

We currently separate the positions of Chairman of the Board and Chief Executive Officer. The Board believes that its current leadership structure is appropriate at this time and provides the most effective leadership for Polycom in a highly competitive and rapidly changing technology industry. Separating these positions allows our Chief Executive Officer to focus on our day-to-day business, while allowing the Chairman of the Board to lead the Board in its fundamental role of providing advice to and independent oversight of management. The Board believes that an important component of our current leadership structure is having an independent director serve as the Chairman of the Board who has the broad authority to set Board agendas, direct the actions of the independent directors, conduct executive sessions comprised only of the independent directors and communicate regularly with the Chief Executive Officer.

The Board has three standing committees—Audit, Compensation and Corporate Governance and Nominating, each of which are further described below. Each of the standing board committees is comprised solely of independent directors, and each committee has a separate chair. Our independent directors generally meet in executive session at each regularly scheduled board meeting, and at such other times as necessary or appropriate as determined by the independent directors. In addition, on an annual basis, as part of our governance review and succession planning, the Board (led by the Corporate Governance and Nominating Committee) evaluates our leadership structure to ensure that it remains the optimal structure for Polycom.

We also have a mechanism for stockholders to communicate directly with non-management directors through the Chairman of the Board (see “Contacting the Board of Directors” below for more information).

13

Board Role in Risk Oversight

The Board has risk oversight responsibility for Polycom. In its oversight role, the Board assesses Polycom’s strategy and concurs with management on the risk inherent in that strategy, understands the critical risks facing Polycom, ensures that management has implemented an appropriate system to manage risks (so that it can effectively identify, assess, mitigate, monitor and communicate about such risks) and provides effective risk oversight through the Board’s committee structure and oversight processes. As a technology company, we believe innovation and technological advancement will always require a certain amount of measured risk taking in pursuit of enhancing stockholder value; however, the Board recognizes that it is incumbent upon Polycom and our management to do so in a way that is responsible and consistent with our overall strategy and to have effective systems in place that identify and mitigate those risks that could cause significant damage to our reputation, business model or stockholder value.

Along such lines, it is management’s responsibility to manage risk and to bring material risks to Polycom to the Board’s attention. Our management has established an enterprise risk management (“ERM”) program, which is administered by management with oversight by the Audit Committee. The ERM program covers the strategic, operational, compliance and reporting risks that management believes are the most notable risks at Polycom. As set forth in its charter, the Audit Committee reviews at least annually our processes to manage and monitor business and financial risk through our ERM process. In addition to our ERM process, various committees are also tasked with specific risk oversight functions pursuant to the terms of the various committee charters.

In addition to its oversight of the ERM program, the Audit Committee also oversees the risks relevant to its areas of responsibility as designated under its charter, such as financial and accounting risks, treasury and investment risks, and information technology security risks. Similarly, the Compensation Committee oversees the risks related to its charter responsibilities, such as risks relating to our compensation policies and design of compensation programs and arrangements, and to the attraction and retention of key talent. Further, the Corporate Governance and Nominating Committee, in conjunction with the Compensation Committee, considers the risks relating to Chief Executive Officer and executive succession planning. Each of these committees, in performing their respective risk oversight functions, has access to our management and external advisors, as necessary, and reports their findings to the full Board. In addition, at each of its meetings and in particular at its annual strategic planning session at which the Board considers Polycom’s strategic direction, the Board discusses the key strategic risks that Polycom is currently facing. We believe that our directors provide effective oversight of our risk management function.

Employee Compensation Risks

Per the discussions above, our management and the Compensation Committee have assessed the risks associated with our compensation policies and practices for all employees, including non-executive officers, and retained Radford, An Aon Hewitt Company, to conduct an independent review of such compensation policies, practices and associated risks for the Compensation Committee in April 2015. Based on the results of these assessments, we do not believe that our compensation policies and practices for all employees, including non-executive officers, create risks that are reasonably likely to have a material adverse effect on Polycom.

Board Meetings and Committees

During fiscal 2014, the Board held six (6) meetings. Each of the directors attended or participated in 75% or more of the aggregate of the total number of meetings of the Board and the total number of meetings held by all committees of the Board on which he or she served during the past fiscal year. Each of our standing committees, Audit, Compensation, and Corporate Governance and Nominating, has adopted a written charter approved by the Board, which is available on our website, www.polycom.com, under the tabs “Company” and “Investor Relations—Corporate Governance—Committees & Committee Charters.”

14

Audit Committee

The Audit Committee, which has been established in accordance with Section 3(a)(58)(A) of the Exchange Act, currently consists of D. Scott Mercer, Martha H. Bejar and Robert J. Frankenberg, each of whom is “independent” as defined by the listing standards of NASDAQ. Mr. Mercer is the chairman of the Audit Committee. The Board has determined that Mr. Mercer is an “audit committee financial expert” as defined in the rules of the SEC. The Audit Committee held nine (9) meetings during the last fiscal year.

The Audit Committee is responsible for overseeing Polycom’s accounting and financial reporting processes and the audit of Polycom’s consolidated financial statements. The Audit Committee also assists the Board with the oversight of:

| | • | | the integrity of Polycom’s consolidated financial statements; |

| | • | | Polycom’s internal accounting and financial controls; |

| | • | | Polycom’s compliance with legal and regulatory requirements; |

| | • | | the organization and performance of Polycom’s internal audit function; |

| | • | | the independent registered public accounting firm’s qualifications, independence and performance; and |

The Audit Committee Report is included in this proxy statement on page 73.

Compensation Committee

The Compensation Committee currently consists of Betsy S. Atkins, Robert J. Frankenberg, John A. Kelley (appointed in March 2015) and William A. Owens, each of whom qualifies as an independent director under the listing standards of NASDAQ. Ms. Atkins is the chairman of the Compensation Committee. The Compensation Committee held eight (8) meetings during the last fiscal year. Mr. Owens will step down from the Compensation Committee upon the expiration of his term as a director at the 2015 Annual Meeting.

The Compensation Committee provides oversight of Polycom’s compensation policies, plans and benefit programs. The Compensation Committee also assists the Board in:

| | • | | reviewing and making recommendations to the independent members of the Board with respect to the compensation of Polycom’s Chief Executive Officer and reviewing and approving the compensation of Polycom’s other executive officers; |

| | • | | approving and evaluating Polycom’s executive officer compensation plans, policies and programs; |

| | • | | overseeing the design of and administering Polycom’s equity compensation plans; |

| | • | | overseeing the design of Polycom’s primary incentive plans and administering such plans with respect to executive officers; and |

| | • | | reviewing executive succession planning and evaluating and making recommendations to the independent directors regarding non-employee director compensation in conjunction with the Corporate Governance and Nominating Committee. |

See “Executive Compensation—Compensation Discussion and Analysis” and “Executive Compensation—Compensation of Directors” below for a description of our processes and procedures for the consideration and determination of executive and director compensation.

The Compensation Committee Report is included in this proxy statement on page 56.

15

Compensation Committee Interlocks and Insider Participation

Ms. Atkins, Mr. Frankenberg and Mr. Owens served as members of the Compensation Committee during fiscal 2014. No interlocking relationships exist between any member of Polycom’s Board or Compensation Committee and any member of the board of directors or compensation committee of any other company, nor has any such interlocking relationship existed in the past. No member of the Compensation Committee is or was formerly an officer or an employee of Polycom or our subsidiaries.

Corporate Governance and Nominating Committee

The Corporate Governance and Nominating Committee currently consists of John A. Kelley, Betsy A. Atkins, D. Scott Mercer and William A. Owens, each of whom qualifies as an independent director under the listing standards of NASDAQ. Mr. Kelley is the chairman of the Corporate Governance and Nominating Committee. The Corporate Governance and Nominating Committee held two (2) meetings during the last fiscal year. Mr. Owens will step down from the Corporate Governance and Nominating Committee upon the expiration of his term as a director at the 2015 Annual Meeting.

The Corporate Governance and Nominating Committee reviews and makes recommendations to the Board on matters concerning corporate governance, board composition, board evaluations and nominations, board committee structure and composition, conflicts of interest and stockholder proposals. The Corporate Governance and Nominating Committee also periodically reviews the succession planning for the Chief Executive Officer and other executive officers of Polycom in conjunction with the Compensation Committee, and is responsible for evaluating and making recommendations to the independent directors regarding non-employee director compensation in conjunction with the Compensation Committee. The Corporate Governance and Nominating Committee will consider recommendations of candidates for the Board submitted by stockholders of Polycom (see “Process for Recommending Candidates for Election to the Board of Directors” below for more information).

Process for Recommending Candidates for Election to the Board of Directors

The Corporate Governance and Nominating Committee is responsible for, among other things, determining the criteria for membership to the Board and recommending candidates for election to the Board. It is the policy of the Corporate Governance and Nominating Committee to consider recommendations for candidates to the Board from stockholders. Stockholder recommendations for candidates to the Board must be received by December 31st of the year prior to the year in which the recommended candidates will be considered for nomination, must be directed in writing to Polycom, Inc., 6001 America Center Drive, San Jose, California 95002, Attention: Corporate Secretary, and must include the candidate’s name, home and business contact information, detailed biographical data and qualifications, information regarding any relationships between the candidate and Polycom within the last three years and evidence of the nominating person’s ownership of Polycom stock. Such recommendations must also include a statement from the recommending stockholder in support of the candidate, particularly within the context of the criteria for board membership, including issues of character, judgment, diversity, age, independence, expertise, corporate experience, length of service, other commitments and the like, personal references, and an indication of the candidate’s willingness to serve.

The Corporate Governance and Nominating Committee’s criteria and process for evaluating and identifying the candidates that it recommends to the full Board for selection as director nominees are as follows:

| | • | | The Corporate Governance and Nominating Committee regularly reviews the current composition and size of the Board. |

| | • | | The Corporate Governance and Nominating Committee oversees an annual evaluation of the performance of the Board as a whole and evaluates the performance of individual members of the Board eligible for re-election at the annual meeting of stockholders. |

| | • | | In its evaluation of director candidates, including the members of the Board eligible for reelection, the committee seeks to achieve a balance of knowledge, experience and capability on the Board and considers |

16

| | (1) the current size and composition of the Board and the needs of the Board and the respective committees of the Board, (2) such factors as issues of character, judgment, diversity, age, expertise, business experience, length of service, independence, other commitments and the like, and (3) such other factors as the Corporate Governance and Nominating Committee may consider appropriate. |

| | • | | While the Corporate Governance and Nominating Committee has not established specific minimum qualifications for director candidates, the Corporate Governance and Nominating Committee believes that candidates and nominees must reflect a Board that is comprised of directors who (1) are predominantly independent, (2) are of high integrity, (3) have broad, business-related knowledge and experience at the policy-making level in business or technology, including their understanding of the telecommunications industry and Polycom’s business in particular, (4) have qualifications that will increase overall Board effectiveness and (5) meet other requirements as may be required by applicable rules, such as financial literacy or financial expertise with respect to Audit Committee members. |

| | • | | With regard to candidates who are properly recommended by stockholders or by other means, the Corporate Governance and Nominating Committee will review the qualifications of any such candidate, which review may, in the Corporate Governance and Nominating Committee’s discretion, include interviewing references for the candidate, direct interviews with the candidate, or other actions that the committee deems necessary or proper. |

| | • | | In evaluating and identifying candidates, the Corporate Governance and Nominating Committee has the authority to retain and terminate any third party search firm that is used to identify director candidates and has the authority to approve the fees and retention terms of any search firm. |

| | • | | The Corporate Governance and Nominating Committee will apply these same principles when evaluating candidates who may be elected initially by the full Board to fill vacancies or add additional directors prior to the annual meeting of stockholders at which directors are elected. |

| | • | | After completing its review and evaluation of director candidates, the Corporate Governance and Nominating Committee recommends the director nominees to the full Board for selection. |

Director Resignation

Pursuant to Polycom’s Corporate Governance Principles, a director whose primary employment status changes materially from the most recent annual meeting of stockholders when such director was elected is expected to offer to resign from the Board. The Board does not believe that a director in this circumstance should necessarily leave the Board, but that the director’s continued service should be re-evaluated under the established Board membership criteria. Accordingly, the Corporate Governance and Nominating Committee will review and recommend to the Board whether the director’s continued service is appropriate, and the Board will then determine whether to accept such resignation.

In addition, a director who reaches the age of 72 will notify the Board and offer to submit a letter of resignation to the Board, to be effective at the next annual meeting of stockholders held for the election of directors. Such letter of resignation will be accepted by the Board unless the Corporate Governance and Nominating Committee determines, after weighing the benefits of such director’s continued contributions against the benefits of fresh viewpoints and experience, to nominate the director for another term.

Furthermore, our bylaws and Corporate Governance Principles provide for a majority voting standard in uncontested elections of directors (i.e., the number of candidates for election as directors does not exceed the number of directors to be elected). Therefore, a nominee for election or reelection to the Board must receive more votes cast “FOR” than “AGAINST” his or her election or reelection in order to be elected or reelected to the Board. If an incumbent director fails to receive the required vote for reelection, the Board expects such director to tender his or her resignation. The Corporate Governance and Nominating Committee will act on an

17

expedited basis to determine whether to accept the director’s resignation and will submit such recommendation for consideration by the Board. The Board will determine whether to accept or reject such resignation within 90 days from the certification of the election results.

Attendance at Annual Meetings of Stockholders by the Board of Directors

Although we do not have a formal policy regarding attendance by members of the Board at our annual meeting of stockholders, we encourage, but do not require, directors to attend. Peter A. Leav, Robert J. Frankenberg and Kevin T. Parker attended our 2014 Annual Meeting of Stockholders.

Contacting the Board of Directors

Any stockholder who desires to contact our non-employee directors may do so electronically by sending an e-mail to the following address:directorcom@polycom.com. Our Chairman of the Board receives these communications unfiltered by Polycom, forwards communications to the appropriate committee of the Board or non-employee director, and facilitates an appropriate response. Please note that requests for investor relations materials should be sent toinvestor@polycom.com.

18

PROPOSAL TWO

AMENDMENT AND RESTATEMENT OF THE 2011 EQUITY INCENTIVE PLAN

We are asking stockholders to approve an amendment and restatement of Polycom’s 2011 Equity Incentive Plan (the “2011 Plan”), which (1) adds 5,600,000 shares to the total number of shares of our common stock reserved for issuance under the 2011 Plan, (2) provides additional flexibility to set the length of performance periods (i.e., the period over which the performance goals applicable to performance-based equity awards are measured) up to four years, and (3) provides for aggregate grant date fair value limits applicable to all awards that may be granted to a participant in any fiscal year, rather than a limit to the number of shares subject to awards based on award types. The 2011 Plan has also been revised to include nonmaterial changes such as a provision allowing the Board or Compensation Committee to cause the forfeiture of awards under certain events including in accordance with our clawback policy. The 2011 Plan has not been amended in any material way, other than as described in (1) through (3) above, since stockholders last approved the 2011 Plan at our 2013 Annual Meeting of Stockholders.

Internal Revenue Code Section 162(m) (“Section 162(m)”) generally denies a corporate tax deduction for annual compensation exceeding $1 million paid to the chief executive officer and other “covered employees” as determined under Section 162(m) and applicable guidance. However, certain types of compensation, including performance-based compensation, generally are excluded from this deductibility limit, provided that certain requirements specified under Section 162(m) are met. If approved, the amended 2011 Plan may allow us to deduct for U.S. federal income tax purposes the compensation recognized by certain of our executive officers in connection with certain awards granted under the amended 2011 Plan. By approving the amended 2011 Plan, stockholders will be approving (including for purposes of satisfying the stockholder approval requirements under Section 162(m)) the material terms of the amended 2011 Plan, which include among other terms, the eligibility requirements for participation in the amended 2011 Plan.

The following is a comparative summary of the material changes to the amended 2011 Plan. This summary is qualified in its entirety by reference to the actual text of the amended 2011 Plan, set forth asAppendix A to this proxy statement.

| | • | | The share reserve has been increased by 5,600,000 shares. As a result, the aggregate number of shares that may be issued under the 2011 Plan as amended has been revised from 30,300,000 shares to 35,900,000 shares. The amended 2011 Plan also provides that any shares up to 13,636,548, that otherwise would have returned to Polycom’s 2004 Equity Incentive Plan after May 26, 2011, on account of the expiration, cancellation or forfeiture of awards granted under Polycom’s 1996 Stock Incentive Plan or 2004 Equity Incentive Plan, which provision remains the same as under the 2011 Plan prior to this amendment. |

| | • | | The amended 2011 Plan lengthened the maximum duration of the performance period over which performance goals are measured under performance-based awards. The amended 2011 Plan provides that the performance period must not be shorter than one fiscal quarter or longer than four fiscal years (increased from three fiscal years). |

| | • | | The amended 2011 Plan revised the per person limits that apply to awards granted to an individual during any fiscal year, as follows: |

| | | | |

Award Type | | Annual Limit Under 2011 Plan | | Annual Limit Under Amended 2011 Plan |

| Stock options and/or stock appreciation rights | | 1,500,000 shares, increased by an additional 1,500,000 shares in the fiscal year of an employee’s initial hire | | Aggregate grant date fair value of $10,000,000 with respect to all awards, increased by an additional $5,000,000 in grant date fair value for the fiscal year of an employee’s initial hire |

| Restricted stock, restricted stock units, and/or performance shares | | 7,500,000 shares, increased by an additional 7,500,000 shares in the fiscal year of an employee’s initial hire | |

| Performance units | | Initial value of $3,000,000 | |

19

The Compensation Committee and the Board have approved the amended 2011 Plan, subject to the approval of the stockholders at the 2015 Annual Meeting.

Reasons for the Share Reserve Increase