UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ¨ | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| x | | Soliciting Material Pursuant to §240.14a-12 |

POLYCOM, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

This Schedule 14A filing consists of the following communications relating to the proposed acquisition of Polycom, Inc. (“Polycom”) by Mitel Networks Corporation (“Parent”) and Meteor Two, Inc., an indirect wholly-owned subsidiary of Parent (“Merger Sub”) pursuant to the terms of an Agreement and Plan of Merger, dated April 15, 2016 by and among the Polycom, Parent and Merger Sub:

| | (iii) | Industry Analyst Powerpoint Presentation; |

| | (iv) | Social Media Communications; |

| | (v) | Employee Communication; |

| | (vi) | CEO Video Script to Employees; |

| | (vii) | Theater President Communication; |

| | (viii) | Customer Communication; |

| | (ix) | Channel Partner Communication; |

| | (x) | Supply Chain Partner Communication; and |

| | (xi) | Joint Investor Powerpoint Presentation. |

Each item listed above was first used or made available on April 15, 2016.

Press Release:

News Release

Mitel announces definitive agreement to acquire Polycom

Combines global technology leaders to create a complete communications and collaboration portfolio and an enhanced ability to deliver profitable growth

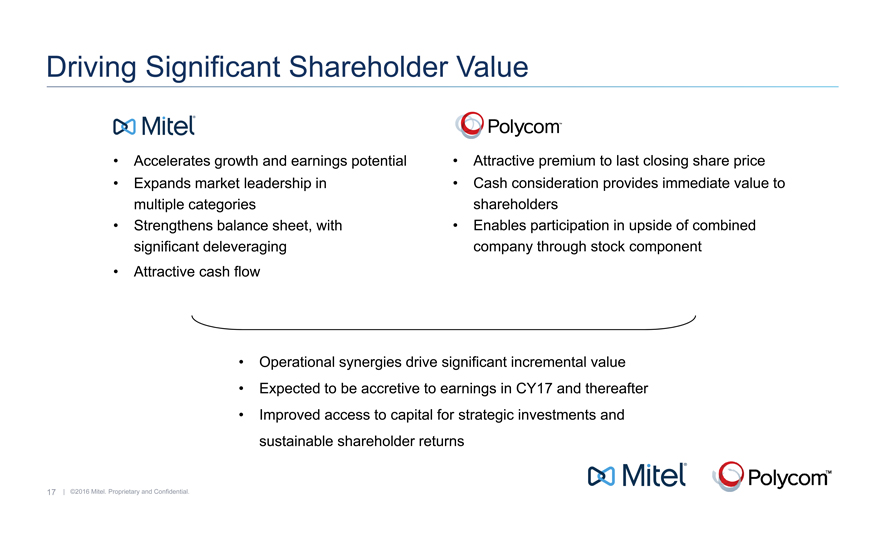

| | • | | Creates new $2.5 billion revenue company with scale and differentiated portfolio to expand in evolving enterprise communications market |

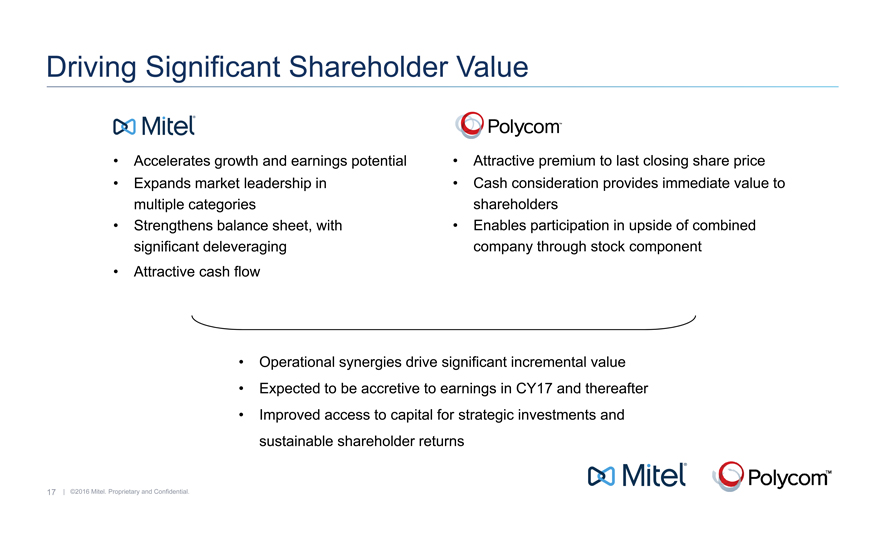

| | • | | Delivers attractive value for Mitel and Polycom’s shareholders with significant operating leverage and synergy opportunities |

| | • | | Polycom brand to be retained |

| | • | | Results in a significant reduction in net debt leverage ratio |

| | • | | Transaction expected to be accretive to Mitel in 2017 |

OTTAWA and SAN JOSE, – April 15, 2016 –Mitel (Nasdaq: MITL) (TSX: MNW) and Polycom (Nasdaq: PLCM), today announced that they have entered into a definitive merger agreement in which Mitel will acquire all of the outstanding shares of Polycom common stock in a cash and stock transaction valued at approximately $1.96 billion. Under the terms of the agreement, Polycom stockholders will be entitled to $3.12 in cash and 1.31 Mitel common shares for each share of Polycom common stock, or $13.68 based on the closing price of a Mitel common share on April 13, 2016. The transaction represented a 22% premium to Polycom shareholders based on Mitel’s and Polycom’s “unaffected” share prices as of April 5, 2016 and is expected to close in the third quarter of 2016, subject to shareholder and regulatory approvals and other customary closing conditions.

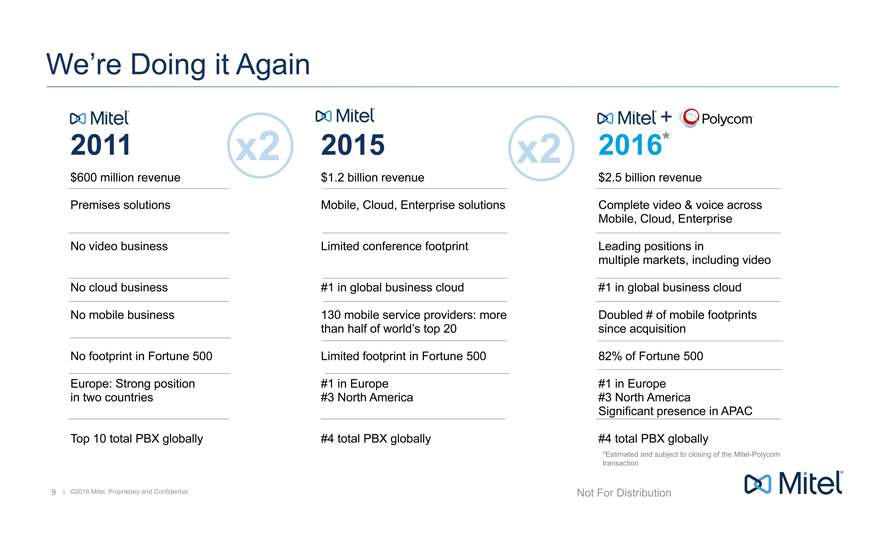

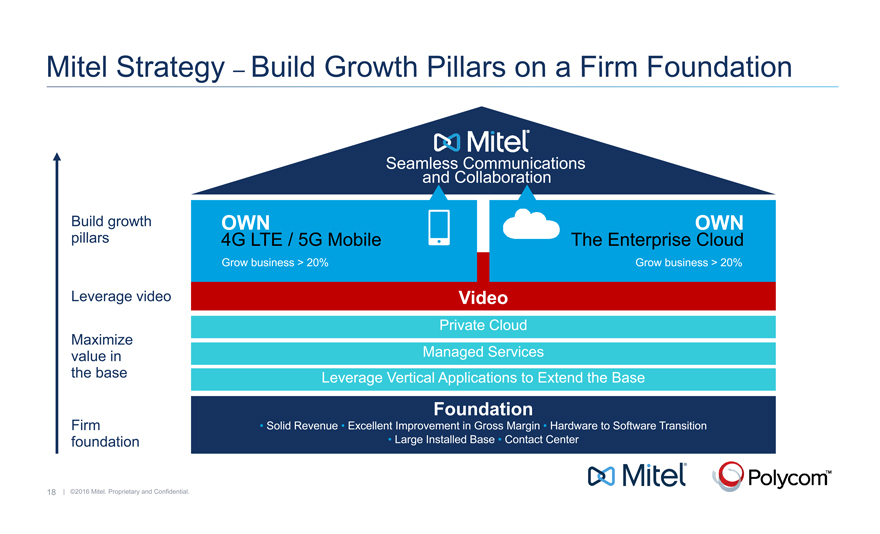

New company with shared vision for seamless communications and collaboration

The communications and collaboration industry is undergoing a period of intense change that is rapidly redrawing the competitive landscape and breaking down barriers between previously discrete markets and technology domains. Through a series of strategic acquisitions, Mitel has successfully capitalized on changing market dynamics and transformed the company to help customers operate more efficiently and cost effectively. The combination of Mitel and Polycom will create a new industry leader leveraging Mitel’s recognized leadership as a pioneer in global communications with Polycom’s well-known premium brand and industry-leading portfolio in the conference and video collaboration market.

The combined company will be headquartered in Ottawa, Canada, and will operate under the Mitel name while maintaining Polycom’s strong global brand. Richard McBee, Mitel’s Chief Executive Officer will lead the combined organization. Steve Spooner, Mitel’s Chief Financial Officer, will also continue in that role. On the closing of the proposed transaction, it is expected that Polycom directors will assume two seats on the Mitel board. Once merged, the combined company will have a global workforce of approximately 7,700 employees.

“Mitel has a simple vision - to provide seamless communications and collaboration to customers. To bring that vision to life we are methodically putting the puzzle pieces in place to provide a seamless customer experience across any device and any environment,” said Mitel CEO Rich McBee. “Polycom is one of the most respected brands in the world and is synonymous with the high quality and innovative conference and video capabilities that are now the norm of everyday collaboration. Together with industry-leading voice communications from Mitel, the combined company will have the talent and technology needed to truly deliver integrated solutions to businesses and service providers across enterprise, mobile and cloud environments.”

“Together, Polycom and Mitel expect to drive meaningful value for our shareholders, customers, partners and employees around the world,” said Peter Leav, President and CEO of Polycom. “We look forward to working closely with the Mitel team to ensure a smooth transition and continued innovation to bring the workplace of the future to our customers.”

Global scale and strategic scope provide key customer benefits

The combined global company will offer customers an integrated technology experience supported by an impressive ecosystem of partners. Key market positions include:

| | • | | #1 in business cloud communications(i) |

| | • | | #1 in IP/PBX extensions in Europe(ii) |

| | • | | #1 in conference phones(iii) |

| | • | | #1 in Open SIP sets(iv) |

| | • | | #2 in video conferencing(v) |

| | • | | #2 in installed audio(vi) |

| | • | | Installed customer base in more than 82% of Fortune 500 companies |

| | • | | Deep product integration with Microsoft solutions |

| | • | | Mobile deployments in 47 of the world’s top 50 economies |

| | • | | Combined portfolio of more than 2,100 patents and more than 500 patents pending |

| | • | | Global presence across five continents with approximately 7,700 employees worldwide |

Enhanced platform expected to deliver profitable growth with opportunities for synergies and significant debt deleveraging

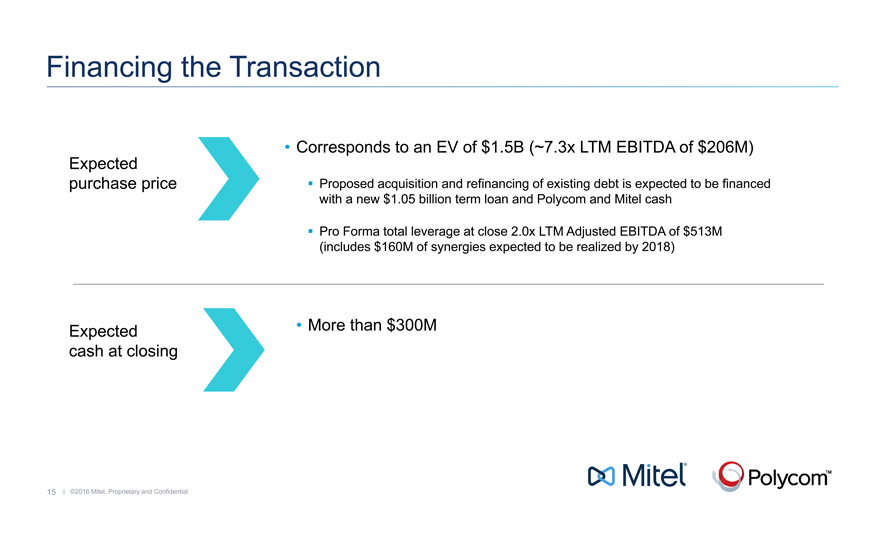

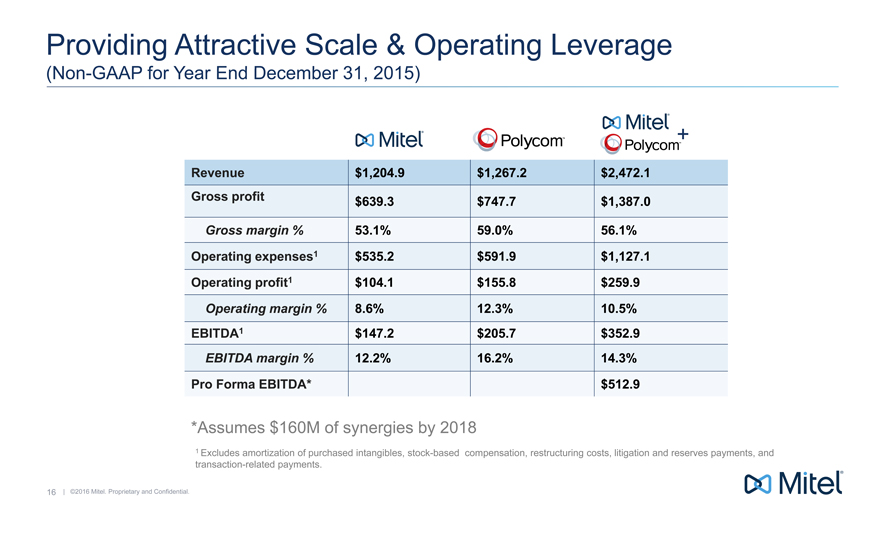

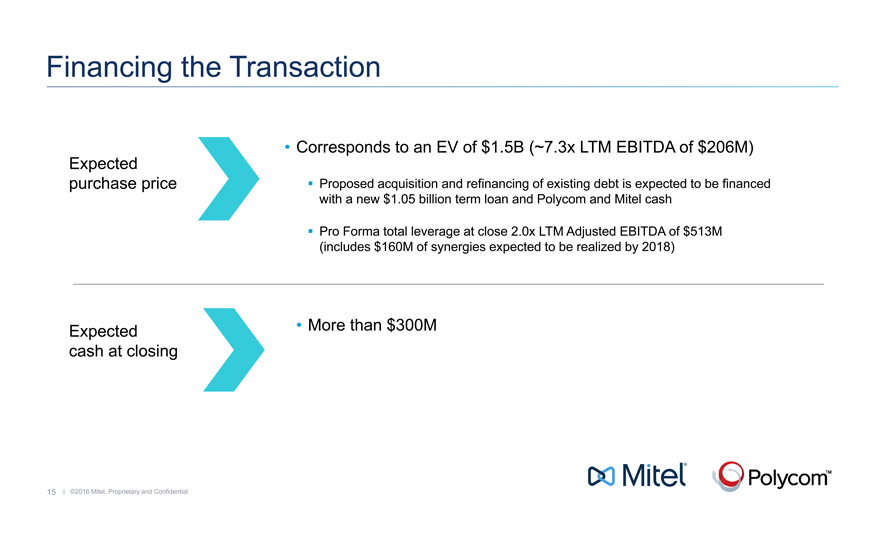

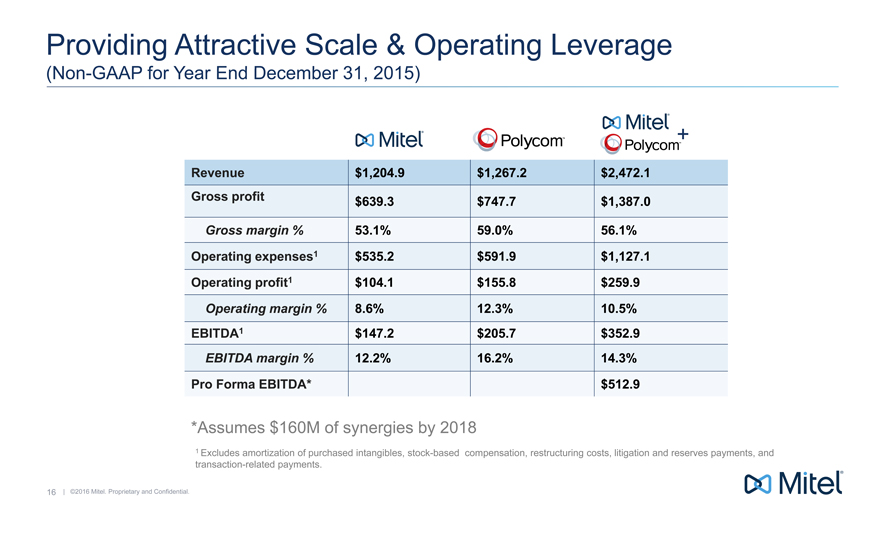

The combined company will have a significantly larger financial platform with the scope, scale and operating leverage needed to strategically expand in an actively evolving market. Financial highlights of the transaction include:

| | • | | Diverse revenue base with pro forma 2015 sales of approximately $2.5 billion |

| | • | | Strong cash flow generation with pro forma 2015 EBITDA of approximately $350 million |

| | • | | Strengthened balance sheet with Mitel’s pro forma 2015 net debt leverage reduced from 3.8x to 2.1x |

| | • | | Expected to be accretive to Mitel shareholders in 2017 |

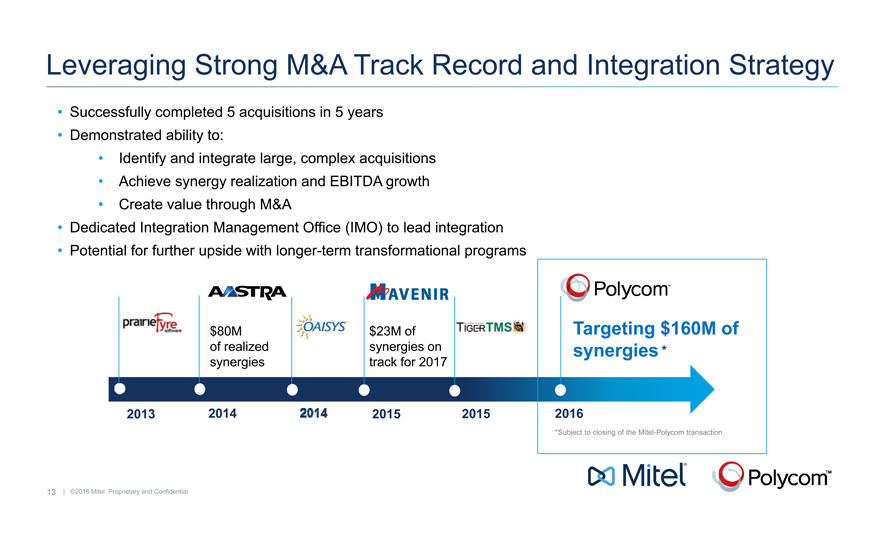

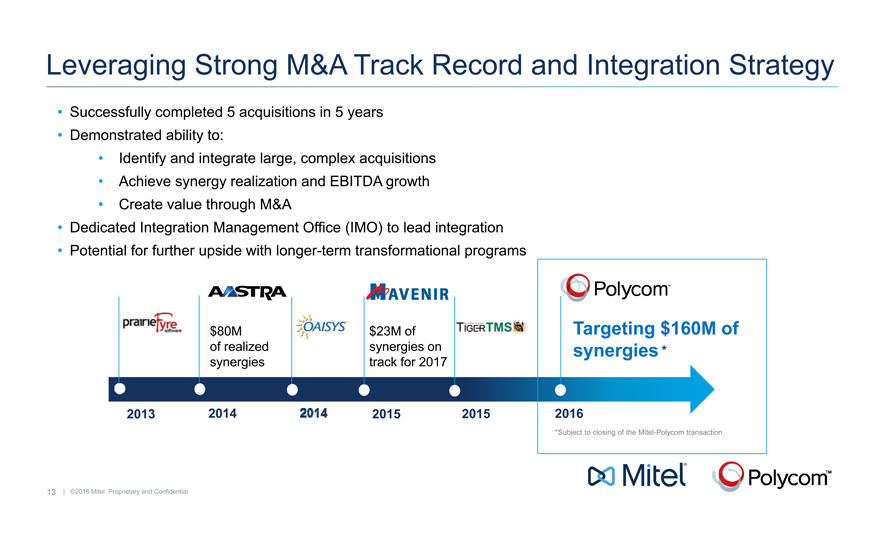

| | • | | Anticipated operating synergies of approximately $160 million by 2018, driven by supply chain optimization, facilities consolidation and economies of scale |

Sources:

| (i) | Source: Synergy Research Group, March 2016 |

| (ii) | Source: MZA Limited, March 2016 |

| (iii) | Source: Frost & Sullivan, Global Audio Conferencing Endpoints, November 2015 |

| (iv) | Source: Synergy Research Group, September 2015 |

| (v) | Source: Q4 2015 UC Market Tracker - Telepresence Market Share Data Reports, February, 2016 |

| (vi) | Source: Frost & Sullivan, Global Audio Conferencing Endpoints, November 2015 |

Transaction Details

Each of Mitel’s and Polycom’s Boards of Directors have unanimously approved the transaction and are resolved to recommend that its shareholders vote in favor of the transaction. Mitel’s directors and executive officers, as well as Kanata Research Park and funds managed by Francisco Partners, have entered into voting agreements with Polycom to vote their respective Mitel common shares in favor of the transaction. Polycom’s directors and executive officers have entered into voting agreements with Mitel to vote their respective shares of Polycom common stock in favor of the transaction. In addition, Elliott Management has entered into voting agreements with each of Mitel and Polycom to vote its Mitel common shares and its shares of Polycom common stock in favor of the transaction.

The transaction is expected to close in the third quarter of this year, subject to stockholder approval by Polycom and Mitel, receipt of regulatory approval in certain jurisdictions and other customary closing conditions. Following the closing of the transaction, former Polycom shareholders are expected to hold approximately 60% and current Mitel shareholders are expected to hold approximately 40% of the outstanding Mitel common shares.

Mitel intends to finance the cash portion of the consideration for the acquisition, and the refinancing of its existing credit facilities and those of Polycom, using a combination of cash on hand from the combined business and proceeds from new financing and has received financing commitments from BofA Merrill Lynch of approximately $1.1 billion in the aggregate.

BofA Merrill Lynch is serving as Mitel’s financial advisor, with Paul, Weiss, Rifkind, Wharton & Garrison LLP and Osler, Hoskin & Harcourt LLP providing legal advice to Mitel.

Morgan Stanley is serving as Polycom’s financial advisor, with Wilson Sonsini Goodrich & Rosati providing legal advice to Polycom and Morrison & Foerster LLP providing legal advice to Polycom’s Board of Directors.

Updated Guidance for Mitel First Quarter for the period ended March 31, 2016

While Mitel is still early in the process of closing the quarter ended March 31, 2016, it is expected that revenue and adjusted EBITDA margin will be within the company’s prior guidance range. Based on preliminary information available at this time, Mitel now expects quarterly non-GAAP revenue will be in the range of $270 million to $280 million and adjusted EBITDA margin will be in the range of 7.5% to 9.5%.

Mitel’s first quarter 2016 results are planned to be issued before the market opens on Thursday, May 5, 2016. Details of the first quarter 2016 conference call will be confirmed by Mitel in a separate announcement.

Conference Call Information

Mitel and Polycom will host a joint conference call and webcast accompanied by slides today at 8:30 a.m. ET (5:30 a.m. PT) to discuss the transaction. To access via tele-conference, please dial (888) 734-0328. Participants dialing in from outside of Canada and the United States can dial (678) 894-3054.

Live internet access for this call will be available through the Investor Relations section of Mitel’s website at www.mitel.com.

Presentation slides will be available on April 15 in conjunction with this release. To access the presentation slides, please go to the Investor Relations section of Mitel’s website at www.mitel.com or use this link: http://investor.mitel.com/events.cfm.

A rebroadcast of this call will be available on Monday, April 18, 2016 after 9:00 a.m. ET (6:00 a.m. PT). To access the webcast please use this link: http://investor.mitel.com/events.cfm.

No Offer or Solicitation

This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law.

Important Information for Investors

In connection with the proposed transaction between Mitel and Polycom, Mitel will file with the U.S. Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 that is expected to include a Joint Proxy Statement of Mitel and Polycom that also constitutes a Prospectus of Mitel (the “Joint Proxy Statement/Prospectus”). Mitel and Polycom plan to mail to their respective shareholders the definitive Joint Proxy Statement/Prospectus in connection with the transaction. INVESTORS AND SECURITY HOLDERS OF MITEL AND POLYCOM ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY WHEN IT BECOMES AVAILABLE BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION ABOUT MITEL, POLYCOM, THE TRANSACTION AND RELATED MATTERS. Investors and security holders will be able to obtain free copies of the Joint Proxy Statement/Prospectus (when available) and other documents filed with the SEC by Mitel and Polycom through the website maintained by the SEC at www.sec.gov. Investors will also be able to obtain free copies of the Joint Proxy Statement/Prospectus (when available) and other documents filed with Canadian securities regulatory authorities by Mitel, through the website maintained by the Canadian Securities Administrators at www.sedar.com. In addition, investors and security holders will be able to obtain free copies of the documents filed with the SEC and Canadian securities regulatory authorities on Mitel’s website at investor.Mitel.com or by contacting Mitel’s Investor Relations Department at 469-574-8134. Copies of the documents filed with the SEC by Polycom will be available free of charge on Polycom’s website at http://investor.polycom.com/company/investor-relations/default.aspx or by contacting Polycom’s Investor Relations Department at 408-586-4271.

Participants in the Merger Solicitation

Mitel, Polycom and certain of their respective directors, executive officers and employees may be considered participants in the solicitation of proxies in connection with the proposed transaction. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of the respective shareholders of Mitel and Polycom in connection with the transaction, including a description of their respective

direct or indirect interests, by security holdings or otherwise, will be included in the Joint Proxy Statement/Prospectus described above when it is filed with the SEC and Canadian securities regulatory authorities. Additional information regarding Mitel’s directors and executive officers is also included in Mitel’s proxy circular for its 2015 Annual Meeting of Shareholders, which was filed with the SEC and Canadian securities regulatory authorities on April 15, 2015, and information regarding Polycom’s directors and executive officers is also included in Polycom’s proxy statement for its 2015 Annual Meeting of Stockholders, which was filed with the SEC on April 15, 2015. These documents are available free of charge as described above.

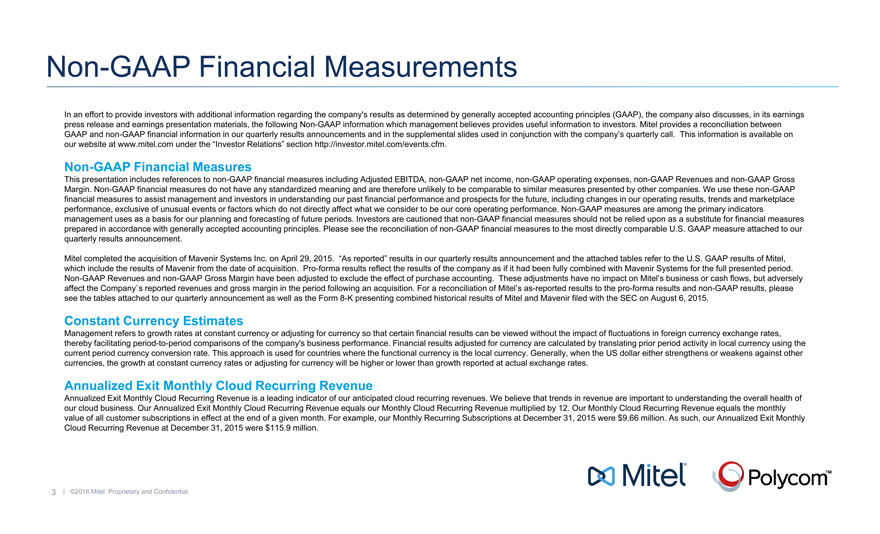

Non-GAAP Financial Measures

In an effort to provide investors with additional information regarding the company’s results as determined by generally accepted accounting principles (GAAP), the company also discusses, in its press releases and presentation materials, non-GAAP information which management believes provides useful information to investors, including Adjusted EBITDA, non-GAAP net income, non-GAAP operating expenses, non-GAAP Revenues and non-GAAP Gross Margin. Non-GAAP financial measures do not have any standardized meaning and are therefore unlikely to be comparable to similar measures presented by other companies. We use these non-GAAP financial measures to assist management and investors in understanding our past financial performance and prospects for the future, including changes in our operating results, trends and marketplace performance, exclusive of unusual events or factors which do not directly affect what we consider to be our core operating performance. Non-GAAP measures are among the primary indicators management uses as a basis for our planning and forecasting of future periods. Investors are cautioned that non-GAAP financial measures should not be relied upon as a substitute for financial measures prepared in accordance with generally accepted accounting principles. Mitel provides a reconciliation between GAAP and non-GAAP financial information in our quarterly results announcements and in the supplemental slides used in conjunction with the company’s quarterly calls. This information is available on our website at www.mitel.com under the “Investor Relations” section http://investor.mitel.com/events.cfm.

Forward Looking Statements

Some of the statements in this press release are forward-looking statements (or forward-looking information) within the meaning of applicable U.S. and Canadian securities laws. These include statements using the words believe, target, outlook, may, will, should, could, estimate, continue, expect, intend, plan, predict, potential, project and anticipate, and similar statements which do not describe the present or provide information about the past. There is no guarantee that the expected events or expected results will actually occur. Such statements reflect the current views of management of Mitel and Polycom and are subject to a number of risks and uncertainties. These statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, operational and other factors. Any changes in these assumptions or other factors could cause actual results to differ materially from current expectations. All forward-looking statements attributable to Mitel or Polycom, or persons acting on either of their behalf, and are expressly qualified in their entirety by the cautionary statements set forth in this paragraph. Undue reliance should not be placed on such statements. In addition, material risks that could cause actual results to differ from forward-looking statements include: the inherent uncertainty associated with financial or other projections; the integration of Mitel and Polycom and the ability to

recognize the anticipated benefits from the combination of Mitel and Polycom; the ability to obtain required regulatory approvals for the transaction, the timing of obtaining such approvals and the risk that such approvals may result in the imposition of conditions that could adversely affect the expected benefits of the transaction; the risk that the conditions to the transaction are not satisfied on a timely basis or at all and the failure of the transaction to close for any other reason; risks relating to the value of the Mitel common shares to be issued in connection with the transaction; the anticipated size of the markets and continued demand for Mitel and Polycom products and services, the impact of competitive products and pricing and disruption to Mitel’s and Polycom’s respective businesses that could result from the announcement of the transaction; and access to available financing on a timely basis and on reasonable terms, including the refinancing of Mitel and Polycom debt to fund the cash portion of the consideration in connection with the transaction. Additional risks are described under the heading “Risk Factors” in Mitel’s Annual Report on Form 10-K for the year ended December 31, 2015, filed with the U.S. Securities and Exchange Commission (the “SEC”) and Canadian securities regulatory authorities on February 29, 2016, and in Polycom’s Annual Report on Form 10-K for the year ended December 31, 2015 filed with the SEC on February 29, 2016. Forward-looking statements speak only as of the date they are made. Except as required by law, neither Mitel nor Polycom has any intention or obligation to update or to publicly announce the results of any revisions to any of the forward-looking statements to reflect actual results, future events or developments, changes in assumptions or changes in other factors affecting the forward-looking statements.

About Mitel

A global market leader in enterprise and mobile communications powering more than 2 billion business connections and 2 billion mobile subscribers every day, Mitel (Nasdaq: MITL) (TSX: MNW) helps businesses and mobile carriers connect, collaborate and provide innovative services to their customers. Our innovation and communications experts serve more than 60 million business users in more than 100 countries, and 130 mobile service providers including 15 of the top 20 mobile carriers in the world. That makes us unique, and the only company able to provide a bridge between enterprise and mobile customers. For more information, go to www.mitel.com and follow us on Twitter @Mitel.

Mitel is the registered trademark of Mitel Networks Corporation.

All other trademarks are the property of their respective owners.

About Polycom

Polycom helps organizations unleash the power of human collaboration. More than 400,000 companies and institutions worldwide defy distance with secure video, voice and content solutions from Polycom to increase productivity, speed time to market, provide better customer service, expand education and save lives. Polycom and its global partner ecosystem provide flexible collaboration solutions for any environment that deliver the best user experience, the broadest multi-vendor interoperability and unmatched investment protection. Visit www.Polycom.com or connect with us on Twitter, Facebook, and LinkedIn to learn more.

© 2016 Polycom, Inc. All rights reserved. POLYCOM®, the Polycom logo, and the names and marks associated with Polycom’s products are trademarks and/or service marks of Polycom, Inc. and are registered and/or common law marks in the United States and various other countries. All other trademarks are property of their respective owners.

MITL-F

Contact Information Mitel:

Media and Industry Analysts – Americas

Amy MacLeod

613-691-3317

amy.macleod@mitel.com

Media – EMEA/AP

Duncan Miller

+44 (0) 1291 612 646

duncan.miller@mitel.com

Investors

Michael McCarthy

469-574-8134

michael.mccarthy@mitel.com

Contact Information Polycom:

Media

Cameron Craig

415-650-9606

Cameron.craig@polycom.com

Investors

Laura Graves

408-586-4271

Laura.graves@polycom.com

Industry Analysts

Niki Hall

408-406-9339

Niki.hall@polycom.com

FAQS:

General FAQs

What was announced today?

| | • | | Mitel and Polycom announced that they have entered into a definitive merger agreement in which Mitel will acquire all of the outstanding shares of Polycom common stock in a cash and stock transaction valued at approximately US $1.96 billion. Under the terms of the agreement, Polycom stockholders will be entitled to $3.12 in cash and 1.31 Mitel common shares for each share of Polycom common stock, or $13.68 based on the closing price of a Mitel common share on April 13, 2016. |

| | • | | Please refer to the press release for additional information. |

| | • | | The name of the combined company will be Mitel. |

Why is Mitel acquiring Polycom?

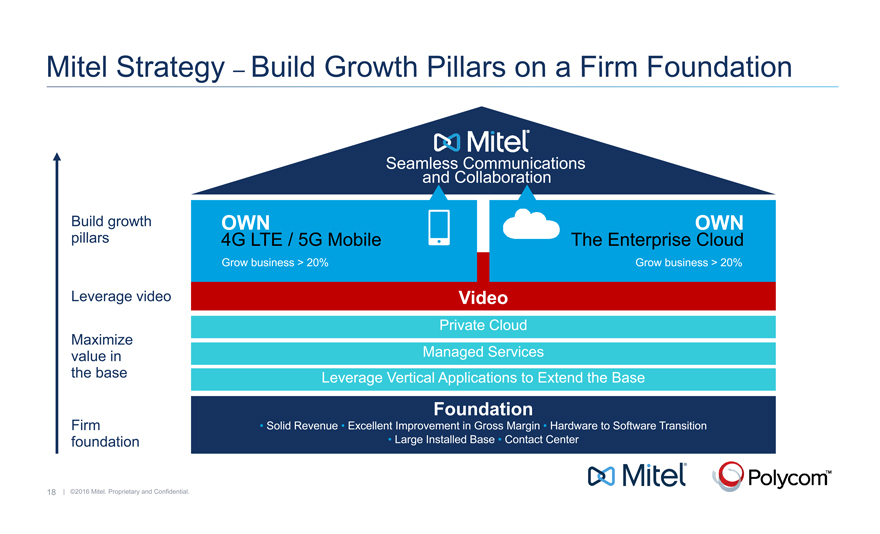

| | • | | Mitel and Polycom are combining in order to create a next generation voice and video communications and collaboration solutions leader, specifically well positioned to address high-growth areas like cloud collaboration and next-generation mobile services. |

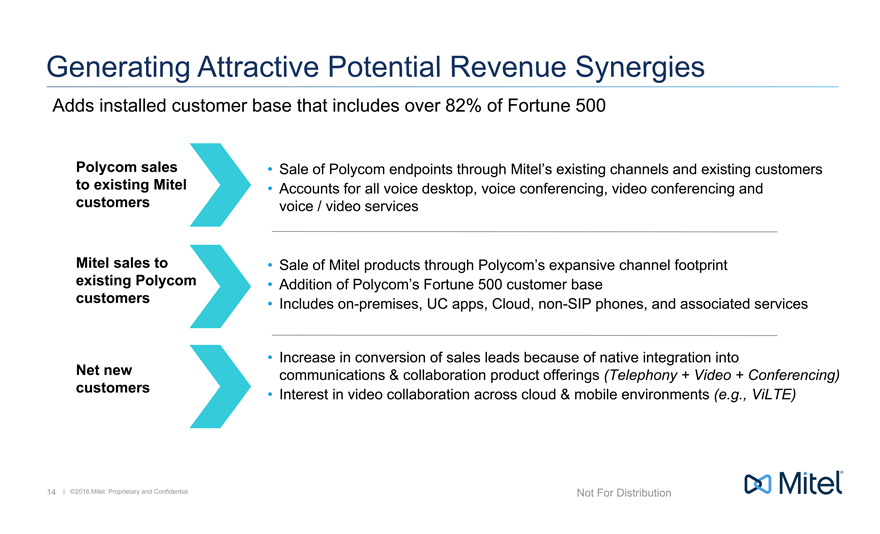

| | • | | The combination of Mitel and Polycom benefits employees, customers, partners, and shareholders as the combined company will have an even broader and more competitive voice and video communications and collaboration solution to meet customer needs as a result of broader geographic reach and complementary focuses. |

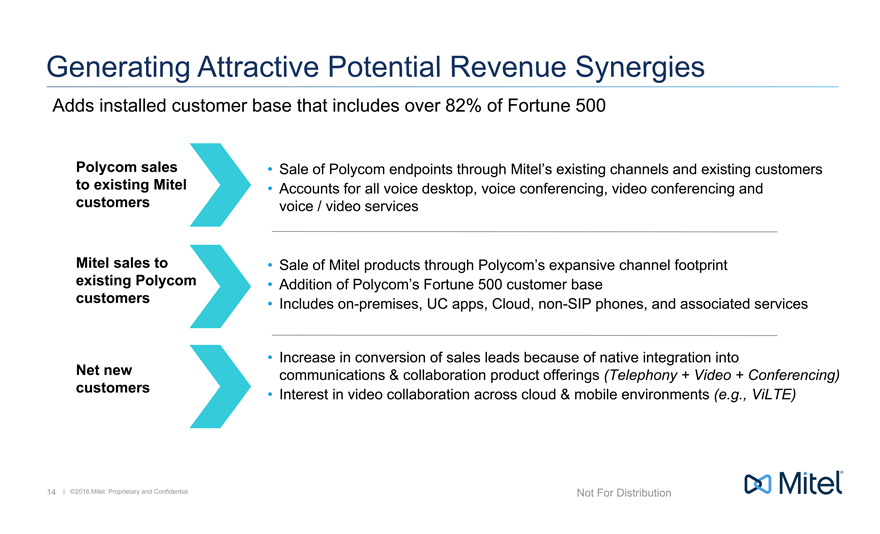

| | • | | Enhanced solution sets: The transaction will bring together two complementary solution sets, as Mitel brings strength in Enterprise Audio Telephony platforms/Infrastructure, Mobile Software and Services and Cloud-Hosted Communication Services and will add Polycom’s strength in collaborations solutions for a market leading offering for both the SMB and enterprise markets. |

| | • | | Mitel’s strong cloud and mobile capabilities complements Polycom’s collaboration device offerings and makes Polycom’s vision to unleash the power of human collaboration a reality via planned Device + Cloud offerings. |

| | • | | Geographic reach: Mitel and Polycom have broad global geographic reach through company employees and our vast network of channel and strategic partners. The combination of the two entities provides a truly global organization to service customers of all sizes. |

| | • | | Increased scale: At its current run rate, Mitel and Polycom combined will generate $2.5 billion in annual revenue and $350 million in EBITDA. |

| | • | | Cost Synergies: Due to the complementary solutions of each company we expect there to be cost synergies over time, as there are with many acquisitions. |

| | • | | We believe the joint entity will be well positioned to capitalize on the strong demand for Cloud, Collaboration and Next Generation Mobility. |

| | • | | This transaction also positions the combined company to lead the convergence of voice, video and content sharing: fixed, mobile and cloud. |

| | • | | There is significant opportunity for cross-selling into our respective customer bases. |

Who will lead the combined company? Who will be the Executive Staff at Polycom and Mitel?

Richard McBee will lead the combined organization as CEO, Terry Matthews as Chairman and Steven Spooner as CFO. All other personnel decisions will be made once the acquisition is final.

Who will the Board of Directors be for the combined entity?

The Board of Directors will be finalized once the acquisition is final. As part of the deal terms, two members of Polycom’s board will join the combined company’s Board.

Where will headquarters be located?

Headquarters will be located in Ottawa, Canada (Mitel’s current headquarters). Mitel also has offices in the U.S., and Mitel’s CEO works out of the Dallas office.

Will Polycom offices close down?

There are no immediate plans to do so. Office and sales locations will be addressed once the transaction closes.

How large will the combined entity be?

The combined entity will have approximately 7,700 employees in 48 countries, with approximately $2.5B in combined annual revenue.

Did Polycom consider buying Mitel?

Mitel made a strategic decision that collaboration and Polycom’s set of solutions would help to round out their voice and video communications and collaboration offering. Mitel made an offer to purchase Polycom at a premium to our stock price. In addition, Mitel’s long-term strategy is to act as a consolidator and acquire best in breed companies to lead in building an end-to-end voice and video communications and collaboration solution to lead the market.

Polycom does not publicly comment on M&A activity or discussions. The Polycom Board of Directors has a fiduciary duty to consider all offers in order to determine if it maximizes shareholder value.

How long will it take for the transaction to close?

The transaction is expected to close in the third quarter of 2016, subject to shareholder and regulatory approvals and other customary closing conditions.

What will happen when the purchase is completed?

The combined company will operate under the name Mitel while continuing to leverage Polycom’s strong brand globally. Polycom will retain the use of its brand and continue to operate as an independent division within Mitel.

Will there be any changes to the operating model and/or reporting relationships?

Polycom will operate as a division within Mitel. Organizational decisions will be determined after the transaction is closed.

Will jobs be eliminated as a result of the acquisition?

Although the companies have complementary businesses, integrating the two companies may create some redundant positions, as with many acquisitions. Management, in conjunction with the integration teams from both companies will work together to create a plan for how Polycom and Mitel employees will come together. This process will take time, and continuity will be important during this transition. Any impacted employees will be treated with respect and provided with appropriate severance and career support.

How will the integration process and timeline of the two companies be managed?

There will be an overall Integration Management Office driving cross-functional coordination. We will also have dedicated functional integration teams across each part of the business, with both Mitel and Polycom’s representation, responsible for developing plans and executing the integration. We will provide you with frequent updates on the progress being made and will implement feedback mechanisms to gather your input along the way.

What combined customer segments will we continue to focus on?

We will continue to focus on both companies’ current customer segments. Following the completion of the acquisition, we will consider cross-selling to each other’s customers where appropriate.

How will this benefit our customers?

The combined entity will have a very strong voice and video communications and collaboration offering to help customers improve productivity, make quicker decisions and reduce costs. Polycom will combine its collaboration business with Mitel’s enterprise voice, cloud and mobile businesses.

How will Mitel products be combined with Polycom’s products?

Mitel plans to fully support the current product roadmaps going forward to protect current investments and ensure no disruption to Polycom’s business or operations. Combined integration teams will design a future integrated product roadmap of differentiated products and services.

Will there be any changes to the customer support model?

We do not currently anticipate any changes to Polycom’s current customer support model. Ensuring customer satisfaction and customer success will remain a top goal for Polycom.

How will the combined entities help us to compete against our key competitors?

The joint entity will create a strong force in the market with highly differentiated solutions and a broad ecosystem to win more deals and drive customer success. The breadth of the portfolio and ecosystem will be a competitive advantage as customers can source their voice and video communications and collaboration solutions from one provider.

Employee FAQs

Why is this acquisition good for Polycom employees?

The combination of Mitel and Polycom benefits employees, customers, partners, and shareholders, as the combined company will have an even broader and more competitive voice and video communications and collaboration solution to meet customer needs as a result of broader geographic reach and complementary focus areas. For our employees, the combined entity will provide enhanced opportunities for employee growth and career development.

Refer to the General FAQs for additional details, and please view the announcement video from Peter Leav.

Is the status of my employment in jeopardy?

Although the companies have complementary businesses, integrating the two companies may create some redundant positions, as with many acquisitions. After the close of the transaction, management from both companies will work together to create a plan for how Polycom and Mitel employees will come together. This process will take time, and continuity will be important during this transition. Any impacted employees will be informed, treated with respect and provided with appropriate severance and career support.

Will my job title or responsibilities change?

Your manager will inform you of any changes to job titles, roles and/or responsibilities as a result of the integration. However, decisions relating to any changes to job titles, roles, and responsibilities as a result of the transaction are not expected to be made until the transaction closes.

Will there be any impact to my pay check, payroll deductions or direct deposit?

There will be no near-term changes to current payroll processes, deductions or pay cycles until the transaction closes. Further information will be provided following the transaction close.

What happens to my health and welfare benefits (e.g. medical, dental, vision, life insurance, etc.)?

For everyone globally, all benefits will remain unchanged at least until the transaction closes.

What happens to my retirement plan(s) (e.g. 401(k) in the U.S.)?

There will be no changes to current retirement plans through at least the closing of the transaction. Outside of the United States, retirement statutory requirements will be adhered to.

What happens to the Employee Stock Purchase Plan?

No further purchases will occur under Polycom’s Employee Stock Purchase Plan (ESPP) and the current, ongoing offering periods are being terminated immediately. Any amounts that participants have contributed to their accounts under the ESPP will be returned to them as soon as practicable. In addition, no new offering periods will begin under the ESPP during the period prior to the closing of the transaction. The ESPP will terminate when the transaction closes.

What happens to my options, RSUs and Performance Shares?

Your equity awards will be treated in connection with the transaction as follows, unless Polycom notifies you otherwise.

Unvested RSUs and PSUs. To the extent outstanding immediately before completion of the transaction, upon completion of the transaction, all Polycom restricted stock units (RSUs) and performance shares (PSUs) that are unvested or otherwise do not vest as a result of the completion of the transaction will be converted into RSU and PSU awards, respectively, that cover Mitel common shares. The number of Mitel common shares subject to a converted RSU or PSU award will equal the number of shares that were subject to the award immediately before conversion, multiplied by a “conversion ratio,” as described further below. PSUs will convert based on 100% of the target number of shares subject to the applicable PSU award. Any fractional shares as a result of the conversion will be rounded down to the nearest whole share.

Converted RSUs will remain on their existing time-based vesting schedules. Converted PSUs also will remain subject to time-based vesting but will not be subject to any performance-based vesting criteria. If your RSU or PSU award originally was granted by Polycom on or before March 14, 2016, any corresponding converted RSU or PSU award may have “double trigger” acceleration, meaning generally that if within one year after the closing of the transaction, your employment is terminated other than for misconduct (or for officers, terminated without cause or due to a resignation for good reason), the converted award immediately will become 100% vested.

Options and Vested RSUs and PSUs. To the extent outstanding immediately before completion of the transaction, upon completion of the transaction, all Polycom options (whether vested or unvested) and Polycom RSUs and PSUs that are vested or vest as a result of the completion of the transaction, will be “cashed out,” meaning that the award will be cancelled in exchange for a right to receive a cash payment (less applicable tax withholdings). The amount of this cash payment will equal the number of shares that were subject to the award immediately before cancellation multiplied by the “transaction value” (as described below), provided that for any cashed out option awards, the amount payable will be reduced by the option award’s aggregate exercise price.

Transaction Value and Conversion Ratio. The “transaction value” generally will equal the sum of (x) $3.12 plus (y) the product of 1.31 multiplied by the average of the volume weighted average price per Mitel common share traded on NASDAQ over the 5 consecutive trading days ending with the trading day immediately before the date that the transaction closes (the “VWAP”). The “conversion ratio” generally will equal the transaction value divided by the VWAP.

Are there any restrictions on being able to sell my shares between signing and closing?

Other than at times that you are subject to any earnings-related or other periodic trading blackouts that may be in effect from time to time under our Insider Trading Policy, and so long as you are not otherwise in possession of material, nonpublic information about Polycom, you are free to make trading decisions and trade your shares as you normally would.

How does the treatment of the equity awards impact current employee performance and rewards programs?

Current employee performance and rewards programs will remain in place until the transaction closes. Joint performance management processes and systems are still being determined. Any changes to programs after integration will be communicated to you at that time.

Is the vacation policy changing?

There will be no change to the vacation and holiday policies at least until the transaction closes.

Is it OK to use my social media channels to communicate the news?

No. The corporate team will put out approved messages through our social channels. If you have a question about social media please contact Cameron Craig, Sr. Director, Corporate Communications, Polycom (Cameron.craig@polycom.com).

Will I continue to use the same internal systems?

You will continue to use current systems until the transaction closes. As part of the integration planning, any IT-related decisions that may impact systems you will use in the future will be communicated as necessary.

Will I continue to use my existing laptop and mobile phone?

You will continue using existing technology.

Will employees need to change office locations?

Your current office location will remain the same unless notified otherwise.

Do I need to get a new badge for building access?

Existing badges will remain functional for the foreseeable future.

What can I do as an employee to help make the deal a success?

Continue to do the great job you’ve always done every day. Don’t lose focus on the customer and your day-to-day job responsibilities. Keep an open mind and maintain excitement about the future of the combined company!

Where can I go to get more information?

Periodic updates will be posted on EmployeeConnect. Additionally, your manager will provide updates when appropriate. If you have questions that are not answered, please send an email to questions@polycom.com.

OPERATION OF THE BUSINESS PRIOR TO CLOSE

What can we do before signing and closing?

Mitel and Polycom are, and must remain, independent companies until closing. Thus, it is important for Polycom and Mitel to adhere to the following general principles:

| | • | | Mitel and Polycom must continue to compete, develop, and market their respective products and services independently, as if no potential transaction is pending. Although the two companies may intend to merge, under the antitrust laws, the companies are still independent, and until any potential transaction actually closes, competition must be just as vigorous as it was before the parties engaged in negotiations. |

| | • | | While integration planning is allowed, actual integration is not. Mitel and Polycom must not give customers, partners, or anyone else the impression that they are acting jointly or have indeed combined their operations prior to closing. Mitel and Polycom should avoid even the appearance of actual pre-closing integration. |

| | • | | Employees must not use any competitively sensitive information (in particular pricing data) received during due diligence or negotiations for any commercial purpose. Alert counsel immediately if you come across competitively sensitive information. |

Can we begin integration planning?

Certain forms of integration planning are acceptable prior to closing. Because both parties must still unilaterally direct their actual sales and marketing activities even if there is no competition between Polycom and Mitel, the parties must be careful about certain types of integration planning, in particular front end, or outward-facing integration planning efforts, such as product development and sales and marketing activities. If you are involved in integration planning efforts, additional rules to follow regarding appropriate integration planning will be provided by the Polycom legal team.

Unless you are asked to participate in any integration planning, you should continue to do what you do best and focus on driving Polycom’s business results. If someone from Mitel reaches out to you, please consult with your manager before you answer questions or send information.

Are there any restrictions on how I make sales, marketing, or other business decisions prior to closing?

Until the deal closes, Polycom must conduct its business as usual. Thus, please adhere to the following guidelines:

| | • | | Polycom must sell only Polycom’s products and services. For example,DONOT bundle Polycom’s products together with Mitel’s products in the same purchase order or contract. |

| | • | | DO NOT agree on current or future prices for existing products or those to be released (pricing decisions for Polycom’s products and services must remain unilateral and set only by Polycom). |

| | • | | DO NOT agree with your sales counterparts at Mitel to refrain from pursuing customer prospects or divide new customer prospects between the companies. Additionally,DO NOT agree to suspend or redirect competitive marketing activities prior to closing. |

| | • | | DO NOT make any agreement regarding a joint action that can be taken against a customer, supplier, distributor, or competitor. For example,DO NOT agree to refuse to deal with a particular customer;DO NOT agree to attempt to obtain more favorable terms from a supplier; andDO NOT agree to refuse to enter into cross-supply agreements with a particular competitor. |

| | • | | DO NOT identify yourself to customers as part of Mitel or as a Mitel employee. Similarly, Mitel and its employees cannot identify themselves as part of Polycom. |

Can we talk to customers about the acquisition?

Yes, with several restrictions. You should specifically adhere to the scripts and talking points provided to you. If asked about post-acquisition product plans, you should direct customers to Mitel’s public statements on the topic and make clear that those decisions will be made post close. Please refer to the sales and channel packages provided by your managers, which include approved customer talking points and FAQs. You should also be careful not to give customers the impression that the companies have already begun to integrate. For example, you should make clear that Polycom is still making product development decisions independently with no input from Mitel. In other words, until the deal closes, it is business as usual. Do not comment on the current antitrust review. If asked, you may say that Mitel and Polycom will work cooperatively with the antitrust agencies as they conduct their review of the pending transaction, and that Mitel and Polycom expect the closing of the transaction to occur this year.

What about scheduling a customer meeting with representatives from both Mitel and Polycom?

Representatives from both Mitel and Polycom can meet jointly with customers to discuss the benefits of the acquisition or to address customer concerns. However, you must make clear to the customer that the companies remain independent until the deal closes. Remember that Mitel and Polycom cannot conduct joint sales or marketing until the deal closes. Please contact Polycom legal before meeting jointly with any customers, and additional guidelines will be provided.

Can I talk to my counterparts at Mitel about the acquisition or my business generally?

Yes, if you are asked to be part of the integration teamand work through the Integration Management Office (IMO), with some restrictions. You should not directly reach out to your Mitel counterparts outside of the IMO. Do not use discussions about the acquisition as an opportunity to engage in ad hoc integration planning sessions or to share competitively sensitive customer, pricing, or product information with your counterparts at Mitel. In particular:

| | • | | DO NOT share current or future pricing information, especially prices for specific customers or products. The parties can share historical prices, particularly if the data is aggregated and non-customer/product specific (e.g., average selling prices for a product family). Note that “price” is a broad term and can include margins, discounts, and rebates. |

| | • | | DO NOT share any disaggregated, customer-specific information. For example,DO NOT disclose upcoming opportunities to win new customers;DO NOT discuss prices charged to specific customers; andDO NOT disclose revenues attributable to specific customers. |

Any discussions about the acquisition, merger and your business should be kept relatively high level.

Customer FAQs

What is the commitment from the senior leadership to provide business continuity for customers?

Our leadership is fully committed to continuity of products and solutions to support our customers, and we intend to support the current product portfolios and roadmaps of both companies.

When will there be an integrated product roadmap?

It is expected that Polycom’s roadmap will remain and will be enhanced with potential integration with Mitel’s solutions as we integrate both ecosystems.

Does my service contract or license change? Will my service contracts continue to be honored under existing terms and pricing or will they be replaced with new contracts?

There will be no change to current service contracts or licensing. All will be honored.

Who is my Account Team? Will my sales account team remain the same? Will my reseller or integrator remain the same?

Your current sales reps and channel managers will continue to support the products and services that you have through Polycom.

Who do I contact if I’m a Polycom customer but want to learn about Mitel products (and vice-versa)?

You should contact your current account representative who can help you determine the right solutions for your business needs and vice-versa. Each company will be operating independently until the transaction is approved by regulatory bodies and the transaction is completed.

Will my pricing for service remain the same?

Your current service pricing will continue to be effective.

Will any products be discontinued?

There are no current plans to discontinue products. Product end-of-life will follow standard customer notification processes.

Will the knowledge bases of both Mitel and Polycom be integrated?

At the moment, there will be no change to either knowledge base.

As a customer who should I contact if I have specific questions not answered on either website?

Your current sales reps and channel managers will continue to support the products and services that you have through Mitel or Polycom.

Will there be a co-owned webpage to allow Mitel and Polycom customers to get support from one central location?

At the moment, there will be no change to either website.

Will customers be able to use their user name and password on both company websites?

At the moment, there will be no change to either website and each website will operate separately.

Channel FAQs

Will pricing change?

At this time, there is no plan to change pricing for our channel partners.

When can channel partners begin to sell the full solution?

The new expanded solution has the potential to represent a growth opportunity for channel partners. The go-to-market model, the certification process and channel plans will be communicated sometime after the transaction closes.

Will communications be sent to our channel partners about the acquisition?

Polycom will send out a communication to our channel partners to provide an overview of the transaction and the potential opportunity it presents to them in the coming months.

Will Mitel distributors carry Polycom’s portfolio and vice-versa?

Both Polycom and Mitel’s current distribution relationships remain unchanged. They will carry their existing portfolios. Any decisions about go-to-market strategies will be determined after the transaction closes.

Sales and Product Related FAQs

What if there’s an opportunity to sell products offered from the other company?Until the deal closes, Polycom must conduct its business as usual. If your customer may be interested in a product or products from the other company and/or would like to learn more, you should work with the sales operations group to identify the appropriate account executive who should get involved to have further discussions with the customer.

How do I resolve a conflict where my customer is being approached by a sales employee from the other company?

Any sales-related conflict issues should be escalated to your country manager and regional directors immediately.

What is the commitment from the senior leadership of Mitel and Polycom to provide business continuity for customers?

Leadership is committed to continuity of products and solutions to support our customers. The current product portfolios and roadmaps of both companies will be supported.

Will any products be discontinued?

Current products will not be prematurely discontinued. Product EOL will follow standard customer notification processes.

Polycom recently announced publicly a number of new game changing solutions. Will these solutions still come to market? (RealPresence Trio™, RealPresence Centro™, RealPresence Debut™, and RealPresence® Medialign™)

Yes. RealPresence Trio, RealPresence Centro, RealPresence Debut and RealPresence Medialign are all currently shipping.

Polycom has a Long Range Strategic Plan, which includes an innovation roadmap. Will this now be impacted?

It is anticipated that the roadmap will continue to be delivered on. As the transaction closes, there will likely be an assessment of the roadmap and new opportunities to pursue.

Supplier FAQs

Will my relationship or agreements with Polycom change as a result of this transaction?

Current supply relationships and agreements will remain unchanged until the transaction closes. Any changes following the close of the transaction (e.g., assignment of contracts due to change in control) will be communicated at the appropriate time.

How will you handle active POs?

There will be no change to active POs. Material requirements, delivery schedules, rates, and other PO terms will remain unchanged.

Will there be any changes to existing payment terms or invoice remittance address?

Existing payment terms and invoice remittance addresses will remain unchanged until the transaction closes. If there are changes after the close of the transaction, they will be communicated in advance.

Who will be the supplier point of contact for in-progress and future orders?

Your current Polycom representative will continue to serve as your point of contact until the transaction closes. If there are changes to your POC after the transaction closes, they will be communicated at the appropriate time.

Will we need to do a new vendor setup process?

No new vendor setup is required at this time since you will continue to deal with Polycom like you do today. If any setup or additional information is required after the close of the transaction, we will let you know in advance.

We have an existing NDA in place; will a new NDA be required?

Existing NDAs will remain in force.

Additional Information and Where to Find It

Mitel Networks Corporation (“Mitel”) plans to file with the Securities and Exchange Commission (the “SEC”), and the parties plan to furnish to the stockholders of Polycom, Inc. (“Polycom”) and Mitel, a Registration Statement on Form S-4, which will include a joint proxy statement of Polycom and Mitel, and will also constitute a prospectus of Mitel, in connection with the proposed merger with Meteor Two, Inc., pursuant to which Polycom would be acquired by Mitel (the “Merger”). The prospectus/joint proxy statement described above will contain important information about the proposed Merger and related matters. INVESTORS AND STOCKHOLDERS ARE URGED TO READ THE PROSPECTUS/JOINT PROXY STATEMENT CAREFULLY WHEN IT BECOMES AVAILABLE. Investors and stockholders will be able to obtain free copies of these documents and other documents filed with the SEC by Polycom and Mitel through the website maintained by the SEC at www.sec.gov. In addition, investors and stockholders will be able to obtain free copies of these documents from Polycom by contacting Polycom’s Investor Relations by telephone at (408) 586-4271, by e-mail at Laura.Graves@Polycom.com or by going to Polycom’s Investor Relations page on its corporate web site at investor.Polycom.com and clicking on the link titled “SEC Filings”. These documents may also be obtained, without charge, from Mitel by contacting Mitel’s Investor Relations by telephone at (469) 574-8134 by email at Michael.McCarthy@Mitel.com, or by going to Mitel’s Investor Relations page on the corporate web site at investors.Mitel.com and clicking on the link titled “SEC Filings”.

The respective directors and executive officers of Polycom and Mitel may be deemed to be participants in the solicitation of proxies from the stockholders of Polycom and Mitel in connection with the proposed Merger. Information regarding the interests of these directors and executive officers in the transaction described herein will be included in the prospectus/joint proxy statement described above. Additional information regarding Polycom’s directors and executive officers is also included in Polycom’s proxy statement for its 2015 Annual Meeting of Stockholders, which was filed with the SEC on April 15, 2015, and information regarding Mitel’s directors and executive officers is also included in Mitel’s proxy statement for its 2015 Annual Meeting of Stockholders, which was filed with the SEC on April 15, 2015. These document are available free of charge as described in the preceding paragraph.

Note on Forward-Looking Statements

This document contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, including but not limited to, statements regarding the proposed Merger and the expected closing of the proposed Merger. These forward-looking statements involve certain risks and uncertainties that could cause actual results to differ materially from those indicated in such forward-looking statements, including, but not limited to, the ability of the parties to consummate the proposed Merger, satisfaction of closing conditions precedent to the consummation of the proposed Merger, integration risks and such other risks as identified in Polycom’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015, as filed with the SEC, which contain and identify important factors that could cause the actual results to differ materially from those contained in the forward-looking statements. Polycom assumes no obligation to update any forward-looking statement contained in this document.

|

Industry Analyst Powerpoint Presentation:

|

Industry Analyst Powerpoint Presentation:

Mitel + Polycom: Creating a Global

Communications and Collaboration Leader

Across Enterprise, Cloud, Mobile

April 2016

© Polycom, Inc. All rights reserved.

Safe Harbor Statement

Note on Forward-Looking Statements

This document contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, including but not limited to, statements regarding the proposed Merger and the expected closing of the proposed Merger. These forward-looking statements involve certain risks and uncertainties that could cause actual results to differ materially from those indicated in such forward-looking statements, including, but not limited to, the ability of the parties to consummate the proposed Merger, satisfaction of closing conditions precedent to the consummation of the proposed Merger, integration risks and such other risks as identified in Polycom’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015, as filed with the SEC, which contain and identify important factors that could cause the actual results to differ materially from those contained in the forward-looking statements. Polycom assumes no obligation to update any forward-looking statement contained in this document.

2 | | © Polycom, Inc. All rights reserved. |

Additional Information and Where to Find It

Mitel Networks Corporation (“Mitel”) plans to file with the Securities and Exchange Commission (the “SEC”), and the parties plan to furnish to the stockholders of Polycom, Inc. (“Polycom”) and Mitel, a Registration Statement on Form S-4, which will include a joint proxy statement of Polycom and Mitel, and will also constitute a prospectus of Mitel, in connection with the proposed merger with Meteor Two,

Inc., pursuant to which Polycom would be acquired by Mitel (the “Merger”). The prospectus/joint proxy statement described above will contain important information about the proposed Merger and related matters. INVESTORS AND STOCKHOLDERS ARE URGED TO READ THE PROSPECTUS/JOINT PROXY STATEMENT CAREFULLY WHEN IT BECOMES AVAILABLE. Investors and stockholders will be able to obtain free copies of these documents and other documents filed with the SEC by Polycom and Mitel through the website maintained by the SEC at www.sec.gov. In addition, investors and stockholders will be able to obtain free copies of these documents from

Polycom by contacting Polycom’s Investor Relations by telephone at (408) 586-4271, by e-mail at Laura.Graves@Polycom.com or by going to Polycom’s Investor Relations page on its corporate web site at investor.Polycom.com and clicking on the link titled “SEC Filings”. These documents may also be obtained, without charge, from Mitel by contacting Mitel’s Investor Relations by telephone at (469) 574-8134 by email at Michael.McCarthy@Mitel.com, or by going to Mitel’s Investor Relations page on the corporate web site at investors.Mitel.com and clicking on the link titled “SEC Filings”.

The respective directors and executive officers of Polycom and Mitel may be deemed to be participants in the solicitation of proxies from the stockholders of Polycom and Mitel in connection with the proposed Merger. Information regarding the interests of these directors and executive officers in the transaction described herein will be included in the prospectus/joint proxy statement described above. Additional information regarding Polycom’s directors and executive officers is also included in Polycom’s proxy statement for its 2015 Annual Meeting of Stockholders, which was filed with the SEC on April 15, 2015, and information regarding Mitel’s directors and executive officers is also included in Mitel’s proxy statement for its 2015 Annual Meeting of Stockholders, which was filed with the SEC on April 15, 2015. These document are available free of charge as described in the preceding paragraph.

© Polycom, Inc. All rights reserved.

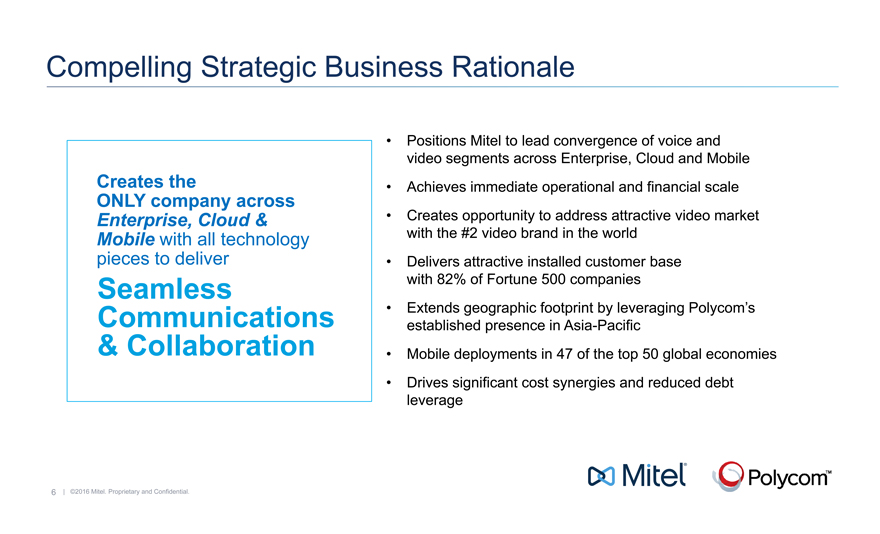

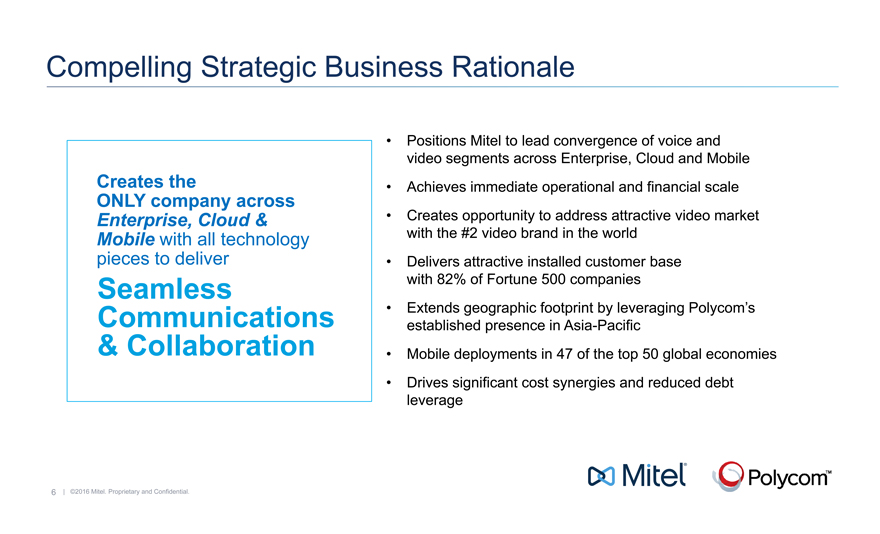

Compelling Strategic Business Rationale

Enhanced Solution Sets/Offerings for Customers

Increased Scale

Broader Geographic Reach

Creates Significant Value for Shareholders of Both Companies

© Polycom, Inc. All rights reserved.

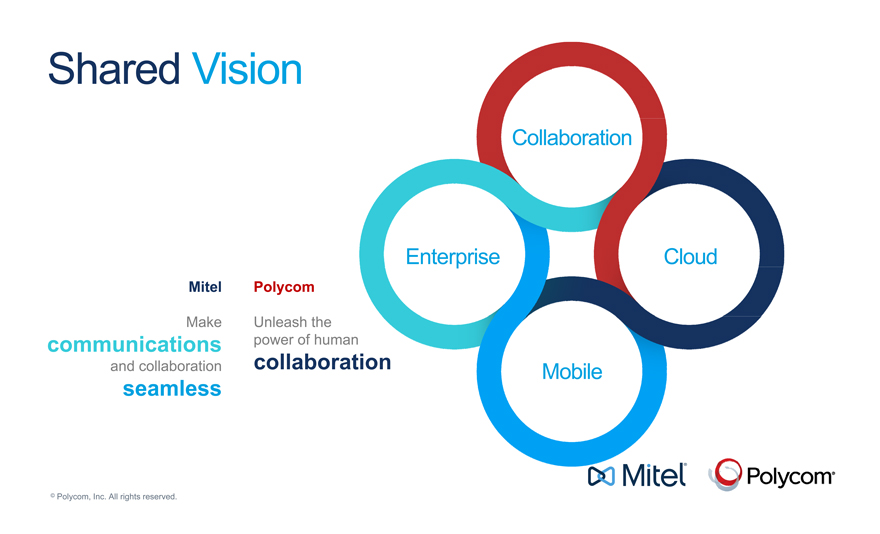

Shared Vision

Mitel Polycom

Make Unleash the

communications power of human

and collaboration collaboration

seamless

Collaboration

Enterprise

Cloud

Mobile

© Polycom, Inc. All rights reserved.

Creating a Global Leader

Across Enterprise, Cloud, Mobile

#1 Business cloud communications

Only company in 5 Gartner Magic Quadrants

Corporate Telephony; Unified Communications; UC for mid-size Enterprises; UC as a Services; Contact Center

130 mobile operators: more than half of world’s top 20

60 million business users worldwide #1 in Europe; #4 globally obile, Cloud, Enterprise revenue

# 1 in conference phones

#1 SIP sets

Gartner Magic Quadrant leader

Group Video Systems

400,000+ customers worldwide 82% of the Global Fortune 500 $1.3 billion revenue

Plan to keep and leverage Polycom’s Brand

© Polycom, Inc. All rights reserved.

Building a Communications Powerhouse with Leading Market Share

Conference phones

#1

Next-generation SIP sets

#1

Business cloud communications

#1

IP/PBX extensions Video Installed audio in Europe conferencing

#1 #2 #2

Strong presence In more than Nearly 9,000 RCS, VoWiFi, Deep product More than 2100 100+ countries, 82% of Fortune channel partners VoLTE in more integration patents; 500 expand in APAC 500 companies than half of top 20 with Microsoft patents pending mobile operators solutions

© Polycom, Inc. All rights reserved.

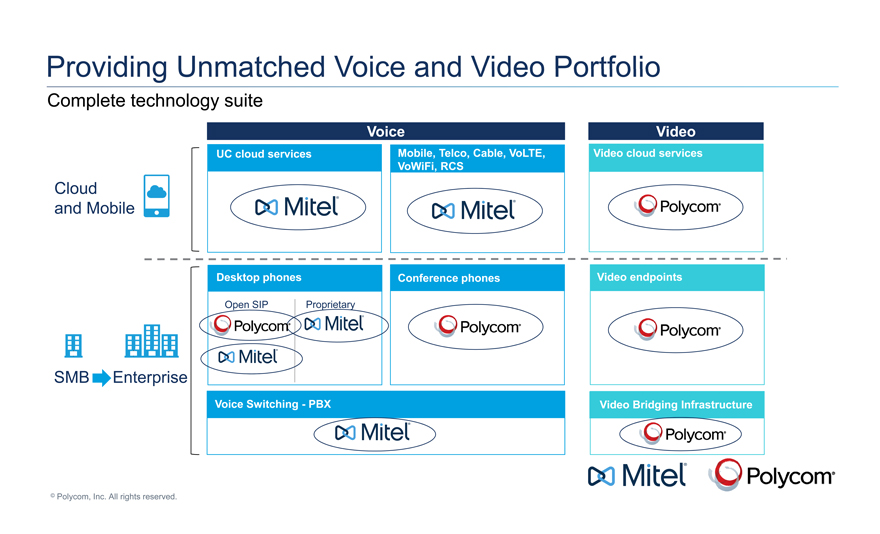

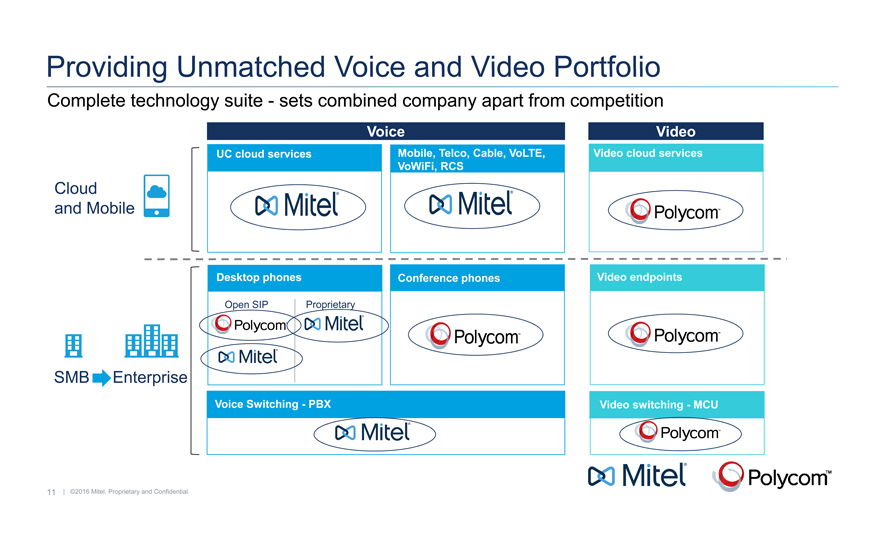

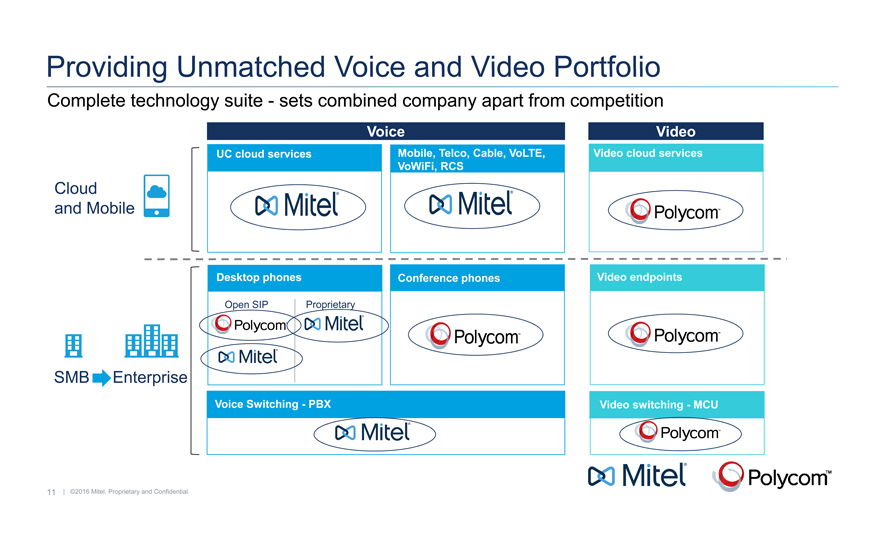

Providing Unmatched Voice and Video Portfolio

Complete technology suite

Cloud and Mobile

SMB Enterprise

Voice

Video

UC cloud services Mobile, Telco, Cable, VoLTE, Video cloud services VoWiFi, RCS

Desktop phones Conference phones Video endpoints

Open SIP Proprietary

Voice Switching—PBX Video Bridging Infrastructure

© Polycom, Inc. All rights reserved.

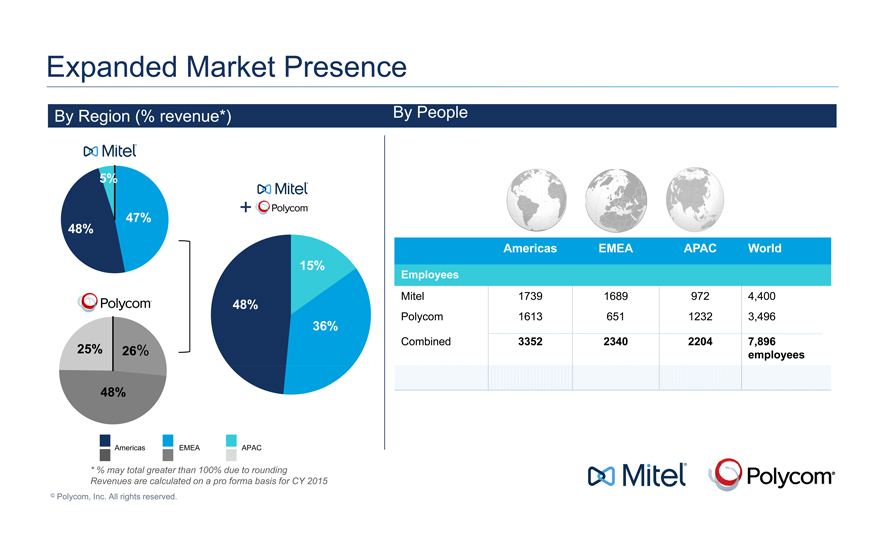

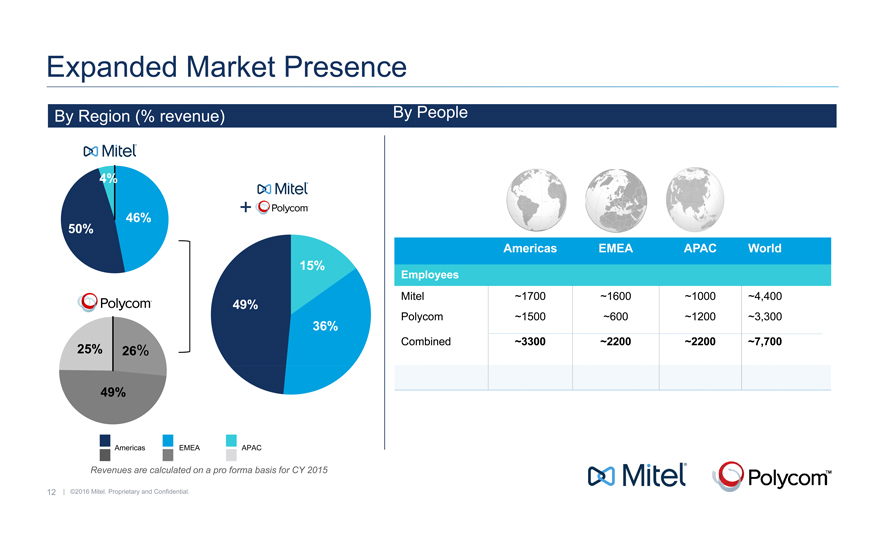

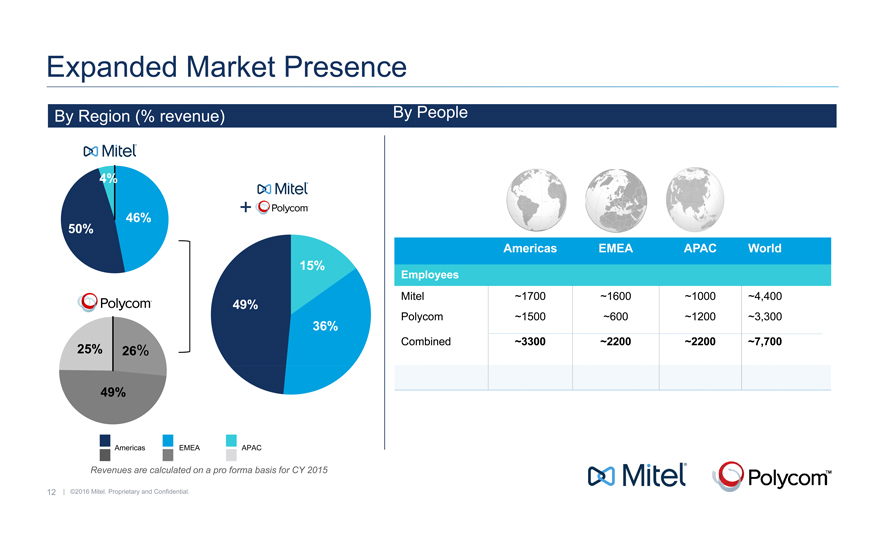

Expanded Market Presence

By Region (% revenue*) By People

Americas EMEA APAC

* | | % may total greater than 100% due to rounding |

Revenues are calculated on a pro forma basis for CY 2015

© Polycom, Inc. All rights reserved.

5%

48% 47%

15%

48%

36%

25% 26%

48%

Americas EMEA APAC World

Employees

Mitel 1739 1689 972 4,400

Polycom 1613 651 1232 3,496

Combined 3352 2340 2204 7,896

employees

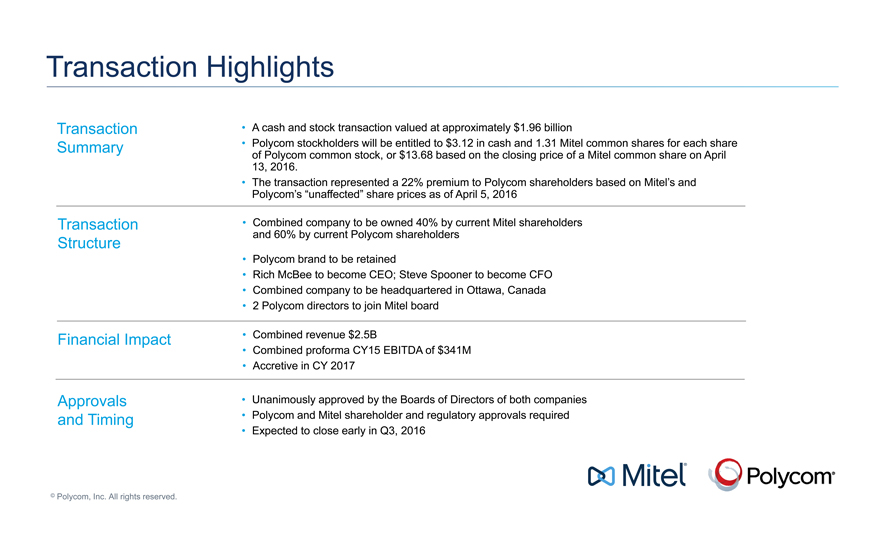

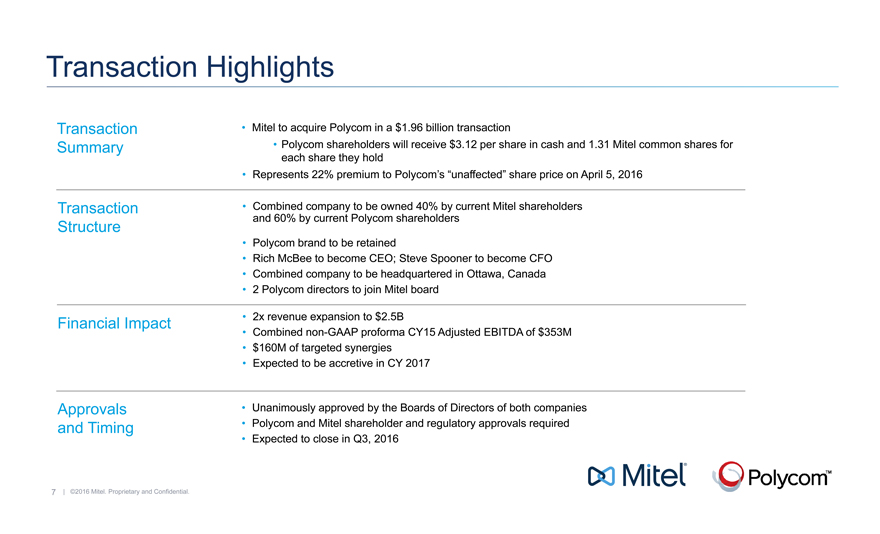

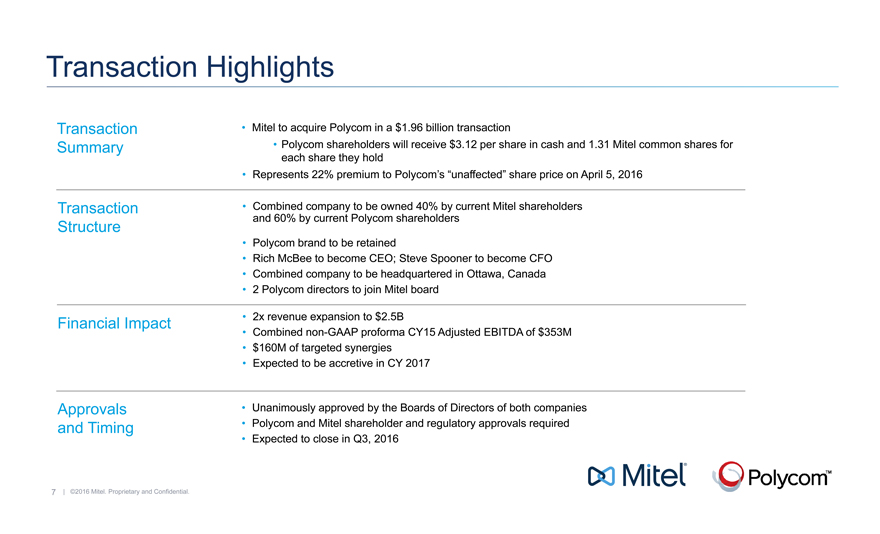

Transaction Highlights

Transaction • A cash and stock transaction valued at approximately $1.96 billion

Summary • Polycom stockholders will be entitled to $3.12 in cash and 1.31 Mitel common shares for each share

of Polycom common stock, or $13.68 based on the closing price of a Mitel common share on April

13, 2016.

• The transaction represented a 22% premium to Polycom shareholders based on Mitel’s and

Polycom’s “unaffected” share prices as of April 5, 2016

Transaction • Combined company to be owned 40% by current Mitel shareholders

and 60% by current Polycom shareholders

Structure

• Polycom brand to be retained

• Rich McBee to become CEO; Steve Spooner to become CFO

• Combined company to be headquartered in Ottawa, Canada

• | | 2 Polycom directors to join Mitel board |

Financial Impact • Combined revenue $2.5B

• Combined proforma CY15 EBITDA of $341M

• Accretive in CY 2017

Approvals • Unanimously approved by the Boards of Directors of both companies

and Timing • Polycom and Mitel shareholder and regulatory approvals required

• Expected to close early in Q3, 2016

© Polycom, Inc. All rights reserved.

Thank You

11 ©

Polycom, Inc. All rights reserved.

Social Media Communications:

Social Media Communications for Polycom

TWITTER

3:01 AM PT (following confirmation of public release)

Mitel to acquire Polycom to create global leader w/ a robust voice & video communications and collaboration portfolio [LINK]

8:00 AM PT

A replay of our conference call discussing Mitel’s acquisition of Polycom is available at [LINK] #Polycom #Mitel #FutureOfCollaboration

FACEBOOK & LINKEDIN

3:01 AM PT (following confirmation of public release)

Today we’re excited to share the news that Mitel, a leader in real-time business, cloud and mobile communications, and Polycom, a leader in unified communications and collaboration, have entered into a definitive merger agreement in which Mitel will acquire all of the outstanding shares of Polycom common stock in a cash and stock transaction. We are excited to combine our efforts with Mitel to deliver the workplace of the future driven by innovative collaboration, mobile and cloud solutions that help our customers improve their productivity, reduce costs and make faster decisions.

More information about today’s announcement, including FAQs, can be found here: [LINK]

[GRAPHIC WITH COMBINED LOGOS]

Additional Information and Where to Find It

Mitel Networks Corporation (“Mitel”) plans to file with the Securities and Exchange Commission (the “SEC”), and the parties plan to furnish to the stockholders of Polycom, Inc. (“Polycom”) and Mitel, a Registration Statement on Form S-4, which will include a joint proxy statement of Polycom and Mitel, and will also constitute a prospectus of Mitel, in connection with the proposed merger with Meteor Two, Inc., pursuant to which Polycom would be acquired by Mitel (the “Merger”). The prospectus/joint proxy statement described above will contain important information about the proposed Merger and related matters. INVESTORS AND STOCKHOLDERS ARE URGED TO READ THE PROSPECTUS/JOINT PROXY STATEMENT CAREFULLY WHEN IT BECOMES AVAILABLE. Investors and stockholders will be able to obtain free copies of these documents and other documents filed with the SEC by Polycom and Mitel through the website maintained by the SEC at www.sec.gov. In addition, investors and stockholders will be able to obtain free copies of these documents from Polycom by contacting Polycom’s Investor Relations by telephone at (408) 586-4271, by e-mail at Laura.Graves@Polycom.com or by going to Polycom’s Investor Relations page on its corporate web site at investor.Polycom.com and clicking on the link titled “SEC Filings”. These documents may also be obtained, without charge, from Mitel by contacting Mitel’s Investor Relations by telephone at (469) 574-8134 by email at Michael.McCarthy@Mitel.com, or by going to Mitel’s Investor Relations page on the corporate web site at investors.Mitel.com and clicking on the link titled “SEC Filings”.

The respective directors and executive officers of Polycom and Mitel may be deemed to be participants in the solicitation of proxies from the stockholders of Polycom and Mitel in connection with the proposed Merger. Information regarding the interests of these directors and executive officers in the transaction described herein will be included in the prospectus/joint proxy statement described above. Additional information regarding Polycom’s directors and executive officers is also included in Polycom’s proxy statement for its 2015 Annual Meeting of Stockholders, which was filed with the SEC on April 15, 2015, and information regarding Mitel’s directors and executive officers is also included in Mitel’s proxy statement for its 2015 Annual Meeting of Stockholders, which was filed with the SEC on April 15, 2015. These document are available free of charge as described in the preceding paragraph.

Note on Forward-Looking Statements

This document contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, including but not limited to, statements regarding the proposed Merger and the expected closing of the proposed Merger. These forward-looking statements involve certain risks and uncertainties that could cause actual results to differ materially from those indicated in such forward-looking statements, including, but not limited to, the ability of the parties to consummate the proposed Merger, satisfaction of closing conditions precedent to the consummation of the proposed Merger, integration risks and such other risks as identified in Polycom’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015, as filed with the SEC, which contain and identify important factors that could cause the actual results to differ materially from those contained in the forward-looking statements. Polycom assumes no obligation to update any forward-looking statement contained in this document.

Employee Communication:

Polycom All-Employee Letter to Complement the CEO Video

Team,

Today, we announced that Mitel, a leader in real-time business, cloud and mobile communications, and Polycom, a leader in unified communications and collaboration, have entered into a definitive merger agreement in which Mitel will acquire all of the outstanding shares of Polycom common stock in a cash and stock transaction.

By combining with Mitel, we expect to drive meaningful value for our customers, partners and you, our global employees. The combined company will have a broad portfolio based on the two companies’ capabilities in collaboration, mobile and cloud, with broader geographic reach and increased scale.

Mitel and Polycom have a powerful shared vision for the future – to unleash the power of human collaboration and provide seamless communications in any environment on any device. Ultimately, together with Mitel, we can offer a broader portfolio of solutions with our ecosystem of partners to customers around the world.

Until the transaction closes, which is expected to occur this year, Mitel and Polycom will continue to operate as separate public companies. That means it is important we continue business as usual and ensure we provide our customers with the same service and support they have come to expect from us.

We are committed to informing you of major developments over the coming weeks and months as the integration process begins. We do know that the combined company will operate under the name Mitel, and Polycom will retain the use of its brand and operate as an independent division within Mitel.

We have prepared several resources that outline the details of the transaction and what it means for you on EmployeeConnect – including FAQ’s and a video message. For our field teams, your respective Theater Presidents will be in contact shortly to provide guidelines for reaching out to customers and partners, along with talking points and FAQs to assist with that outreach.

In addition, we will hold an All-Hands meeting for our EMEA and Americas teams Monday, April 18 at 8am Pacific Time, followed by a meeting for the APAC team on Monday, April 18 at 6pm Pacific Time to discuss this news in more detail and answer your questions. Invitations for those meetings will be sent shortly.

I understand this news has the potential to be distracting and raise questions. I encourage you to read through the materials and attend your region’s All-Hands meeting to learn more about the opportunities ahead. During this transition period, it is vital that we all remain focused on our priorities and continue our momentum through 2016.

This transaction is a testament to the strength of our team, our strong performance and the power of our brand. You should all be extremely proud of what we have accomplished, and I thank you for your commitment and dedication to Polycom.

Additional Information and Where to Find It

Mitel Networks Corporation (“Mitel”) plans to file with the Securities and Exchange Commission (the “SEC”), and the parties plan to furnish to the stockholders of Polycom, Inc. (“Polycom”) and Mitel, a Registration Statement on Form S-4, which will include a joint proxy statement of Polycom and Mitel, and will also constitute a prospectus of Mitel, in connection with the proposed merger with Meteor Two, Inc., pursuant to which Polycom would be acquired by Mitel (the “Merger”). The prospectus/joint proxy statement described above will contain important information about the proposed Merger and related matters. INVESTORS AND STOCKHOLDERS ARE URGED TO READ THE PROSPECTUS/JOINT PROXY STATEMENT CAREFULLY WHEN IT BECOMES AVAILABLE. Investors and stockholders will be able to obtain free copies of these documents and other documents filed with the SEC by Polycom and Mitel through the website maintained by the SEC at www.sec.gov. In addition, investors and stockholders will be able to obtain free copies of these documents from Polycom by contacting Polycom’s Investor Relations by telephone at (408) 586-4271, by e-mail at Laura.Graves@Polycom.com or by going to Polycom’s Investor Relations page on its corporate web site at investor.Polycom.com and clicking on the link titled “SEC Filings”. These documents may also be obtained, without charge, from Mitel by contacting Mitel’s Investor Relations by telephone at (469) 574-8134 by email at Michael.McCarthy@Mitel.com, or by going to Mitel’s Investor Relations page on the corporate web site at investors.Mitel.com and clicking on the link titled “SEC Filings”.

The respective directors and executive officers of Polycom and Mitel may be deemed to be participants in the solicitation of proxies from the stockholders of Polycom and Mitel in connection with the proposed Merger. Information regarding the interests of these directors and executive officers in the transaction described herein will be included in the prospectus/joint proxy statement described above. Additional information regarding Polycom’s directors and executive officers is also included in Polycom’s proxy statement for its 2015 Annual Meeting of Stockholders, which was filed with the SEC on April 15, 2015, and information regarding Mitel’s directors and executive officers is also included in Mitel’s proxy statement for its 2015 Annual Meeting of Stockholders, which was filed with the SEC on April 15, 2015. These document are available free of charge as described in the preceding paragraph.

Note on Forward-Looking Statements

This document contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, including but not limited to, statements regarding the proposed Merger and the expected closing of the proposed Merger. These forward-looking statements involve certain risks and uncertainties that could cause actual results to differ materially from those indicated in such forward-looking statements, including, but not limited to, the ability of the parties to consummate the proposed Merger, satisfaction of closing conditions precedent to the consummation of the proposed Merger, integration risks and such other risks as identified in Polycom’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015, as filed with the SEC, which contain and identify important factors that could cause the actual results to differ materially from those contained in the forward-looking statements. Polycom assumes no obligation to update any forward-looking statement contained in this document.

CEO Video Script to Employees:

Polycom CEO Video Recording Script

| | • | | Today we announced that Polycom will be acquired by Mitel, a business communications company headquartered in Ottawa, Canada. |

| | • | | I wanted to share this exciting news with you and tell you more about what it means for all of us. |

| | • | | I’m sure many of you know of Mitel – you may know them as a PBX provider for the SMB market. But they are much more than that – they are a well-recognized global communications provider with strong offerings and leadership in telephony, cloud and mobility. |

| | • | | Powering two billion connections every day, including over 33 million daily cloud connections, Mitel helps businesses to make communication seamless – and Gartner has recognized them as a Leader in three magic quadrant markets: |

| | • | | Global Unified Communications |

| | • | | North America Unified Communications for mid-sized companies and |

| | • | | Global Corporate Telephony |

| | • | | Perhaps most importantly, Mitel and Polycom have a shared, powerful vision for the future – and that is to unleash the power of human collaboration and to provide seamless communication for customers across any environment and any device. We both put the customer in the center of everything we do. |

| | • | | By joining forces, we will be able to advance our vision much faster by delivering a comprehensive offering to SMBs and enterprises across the world. |

| | • | | We’ll be able to do that in several ways: |

| | • | | First, with Polycom’s collaboration solutions and Mitel’s enterprise voice solutions, cloud offerings and mobile software and services, the combined company will be able to offer a significantly enhanced – and comprehensive – communications solution to customers – both on premise and in the cloud. Mitel’s strong cloud and mobile capabilities will be highly complementary to our collaboration solutions, helping to accelerate powerful and differentiated Device + Cloud offerings. |