UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10−Q

(Mark One)

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended:September 30, 2016

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File No.000-30183

CHINA LONGYI GROUP INTERNATIONAL HOLDINGS LIMITED

(Exact Name of Registrant as Specified in Its Charter)

| NEW YORK | 13-3874771 |

| (State or other jurisdiction of | (I.R.S. Empl. Ident. No.) |

| incorporation or organization) | |

8/F East Area

Century Golden Resources Business Center

69 Banjing Road

Haidian District

Beijing, People’s Republic of China, 100089

(Address of Principal Executive Offices)

+86-10-884-52568

(Registrant’s Telephone Number, Including Area Code)

Check whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [X] No [ ]

Indicate by check mark whether the registrant is a larger accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one)

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [ ] Smaller reporting company [X]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ] No [X]

The numbers of shares outstanding of each of the issuer’s classes of common equity, as of November 11, 2016 are as follows:

| Class of Securities | Shares Outstanding |

| Common Stock, $0.01 par value | 77,655,862 |

TABLE OF CONTENTS

Part I – FINANCIAL INFORMATION

CHINA LONGYI GROUP INTERNATIONAL HOLDINGS LIMITED

UNAUDITED CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

September 30, 2016

2

CHINA LONGYI GROUP INTERNATIONAL HOLDINGS LIMITED

CONSOLIDATED BALANCE SHEETS

| | | Unaudited | | | Audited | |

| | | September 30, | | | December 31, | |

| ASSETS | | 2016 | | | 2015 | |

| Current assets | | | | | | |

| Cash and cash equivalents | $ | 152,912 | | $ | 29,429 | |

| Inventories | | 333,210 | | | 359,194 | |

| Account receivables | | 175,775 | | | 5,544 | |

| Due from directors | | 8,099 | | | - | |

| Other receivables | | 77,815 | | | 26,508 | |

| Deposits and prepayments | | 103,523 | | | 14,447 | |

| Total current assets | | 851,334 | | | 435,122 | |

| | | | | | | |

| Investment | | 85,099 | | | 87,512 | |

| Property, plant and equipment (net) | | 295,266 | | | 320,386 | |

| | $ | 1,231,699 | | $ | 843,020 | |

| | | | | | | |

| LIABILITIES AND EQUITY | | | | | | |

| Current liabilities | | | | | | |

| Short-term loan | $ | - | | $ | 58,519 | |

| Accounts payable | | 1,468 | | | 4,869 | |

| Accrued liabilities | | 452,837 | | | 192,306 | |

| Due to directors | | 590,134 | | | 627,832 | |

| Due to related parties | | 394,247 | | | 417,653 | |

| Other payables | | 580,377 | | | 660,868 | |

| Total current liabilities | | 2,019,063 | | | 1,962,047 | |

| | | | | | | |

| Equity | | | | | | |

Common stock:

par value $.01; 200,000,000 shares authorized;

77,655,862 shares issued and outstanding | | 776,558 | | | 776,558 | |

| Additional paid-in capital | | 28,877,540 | | | 28,877,540 | |

| Deficit | | (30,731,204 | ) | | (30,996,907 | ) |

| Other comprehensive income | | 227,473 | | | 204,099 | |

| Stockholders' equity (deficit) | | (849,633 | ) | | (1,138,710 | ) |

| Noncontrolling interest | | 62,269 | | | 19,683 | |

| Total Equity | | (787,364 | ) | | (1,119,027 | ) |

| | $ | 1,231,699 | | $ | 843,020 | |

See notes to unaudited condensed consolidated interim financial statements

3

CHINA LONGYI GROUP INTERNATIONAL HOLDINGS LIMITED

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS)

(UNAUDITED)

| | Three months ended | | | Nine months ended | |

| | | September 30, | | | September 30, | |

| | | 2016 | | | 2015 | | | 2016 | | | 2015 | |

| Revenues | | | | | | | | | | | | |

| Sales | $ | 1,034,223 | | $ | 153,976 | | $ | 1,675,034 | | $ | 163,119 | |

| Cost of sales | | 687,311 | | | 185,308 | | | 1,158,944 | | | 206,167 | |

| Gross margin | | 346,912 | | | (31,332 | ) | | 516,090 | | | (43,048 | ) |

| Operating expenses | | | | | | | | | | | | |

| General and administrative expenses | | 301,162 | | | 121,637 | | | 578,100 | | | 363,965 | |

| | | 301,162 | | | 121,637 | | | 578,100 | | | 363,965 | |

| Profit (Loss) from operations | | 45,750 | | | (152,969 | ) | | (62,010 | ) | | (407,013 | ) |

| Other income (expense) | | | | | | | | | | | | |

| Interest income | | 87 | | | 6 | | | 98 | | | 55 | |

| Other income (expense) | | 195,764 | | | 179,750 | | | 392,186 | | | 193,710 | |

| Foreign exchange gain (loss) | | 210 | | | (10,089 | ) | | (15,993 | ) | | (4,786 | ) |

| Interest expense | | 154 | | | - | | | (8,946 | ) | | - | |

| | | 196,215 | | | 169,667 | | | 367,345 | | | 188,979 | |

| Income (Loss) before income tax and noncontrolling interest | | 241,965 | | | 16,698 | | | 305,335 | | | (218,034 | ) |

| Income tax | | - | | | - | | | - | | | - | |

| Net Income (loss) | | 241,965 | | | 16,698 | | | 305,335 | | | (218,034 | ) |

| Less: Net income (loss) attributable to noncontrolling interest | | (25,272 | ) | | (1,789 | ) | | (39,632 | ) | | 13,485 | |

| Net income (loss) attributable to the Company | $ | 216,693 | | $ | 14,909 | | $ | 265,703 | | $ | (204,549 | ) |

| | | | | | | | | | | | | |

| Basic and diluted income (loss) per share | $ | 0.00 | | $ | 0.00 | | $ | 0.00 | | $ | (0.00 | ) |

| Weighted average number of shares outstanding-basic and diluted | | 77,655,862 | | | 77,655,862 | | | 77,655,862 | | | 77,655,862 | |

| Comprehensive income (loss) | | | | | | | | | | | | |

| Net Income (loss) | $ | 241,965 | | $ | 16,698 | | $ | 305,335 | | $ | (218,034 | ) |

| Foreign currency translation | | (1,144 | ) | | 32,528 | | | 26,328 | | | 26,106 | |

| Comprehensive income (loss) | | 240,821 | | | 49,226 | | | 331,663 | | | -191,928 | |

| | | | | | | | | | | | | |

| Comprehensive income (loss) attributable to noncontrolling interest | | 493 | | | 6,352 | | | 42,586 | | | -8,950 | |

| Comprehensive income (loss) attributable to the Company | $ | 240,328 | | $ | 42,874 | | $ | 289,077 | | $ | (182,978 | ) |

See notes to unaudited condensed consolidated interim financial statements

4

CHINALONGYI GROUP INTERNATIONAL HOLDINGS LIMITED

CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

| | | Nine months ended September 30, | |

| | | 2016 | | | 2015 | |

| Cash flows from operating activities: | | | | | | |

| Net income ( loss) | $ | 305,335 | | $ | (218,034 | ) |

| Adjustments to reconcile net income (loss) to net cash used in operations: | | | | | | |

| Depreciation and amortization | | 22,869 | | | 17,855 | |

| Changes in operating assets and liabilities: | | | | | | |

| Accounts receivables | | (173,029 | ) | | - | |

| Other receivables | | (52,846 | ) | | (55,496 | ) |

| Due from directors | | (8,225 | ) | | - | |

| Deposits and prepayment | | (90,864 | ) | | (9,099 | ) |

| Inventory | | 16,326 | | | 6,064 | |

| Other payables | | 203,929 | | | 278,867 | |

| Due to related parties | | (17,375 | ) | | 32,130 | |

| Accounts payable and accrued liabilities | | (3,318 | ) | | - | |

| Net cash provided by operations | | 202,802 | | | 52,287 | |

| | | | | | | |

| Cash flows from investing activities: | | | | | | |

| Purchase of investment | | - | | | (61,551 | ) |

| Purchases of property and equipment | | (6,335 | ) | | (5,668 | ) |

| Net cash (used in) investing activities | | (6,335 | ) | | (67,219 | ) |

| | | | | | | |

| Cash flows from financing activities: | | | | | | |

| Proceeds (repayments) of short term loans | | (57,788 | ) | | - | |

| Proceeds (repayments) loans from directors | | (23,886 | ) | | (6,479 | ) |

| Net cash (used in) financing activities | | (81,674 | ) | | (6,479 | ) |

| Effect of foreign exchange rate fluctuation | | 8,690 | | | 2,535 | |

| Increase(decrease) in cash and cash equivalents | | 123,483 | | | (18,876 | ) |

| Cash and cash equivalents, beginning of period | | 29,429 | | | 46,366 | |

| Cash and cash equivalents, end of period | $ | 152,912 | | $ | 27,490 | |

| | | | | | | |

| Supplemental disclosures of cash flow information: | | | | | | |

| Cash paid for interest | $ | - | | $ | - | |

| Cash paid for income taxes | $ | - | | $ | - | |

See notes to unaudited condensed consolidated interim financial statements

5

CHINA LONGYI GROUP INTERNATIONAL HOLDINGS LIMITED

Notes to unaudited condensed consolidated interim financial statements

September 30, 2016

The accompanying unaudited consolidated interim financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“US GAAP”) for financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by US GAAP for annual financial statements. These unaudited consolidated interim financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2015. In the opinion of management, all adjustments (consisting of normal recurring accruals) considered necessary for a fair presentation have been included. The unaudited condensed consolidated interim financial statements of China Longyi Group International Holdings Limited (the “Company” or “China Longyi”) include the accounts of China Longyi and its wholly-owned and majority-owned subsidiaries. All material intercompany accounts and transactions have been eliminated in consolidation.

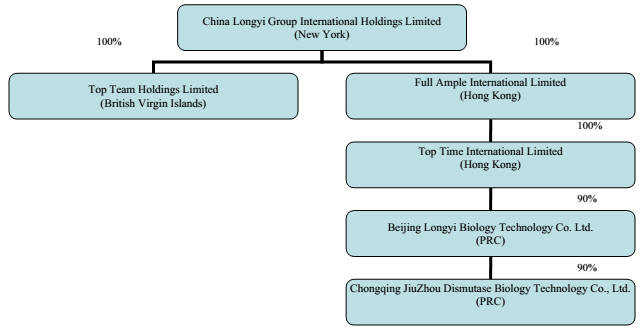

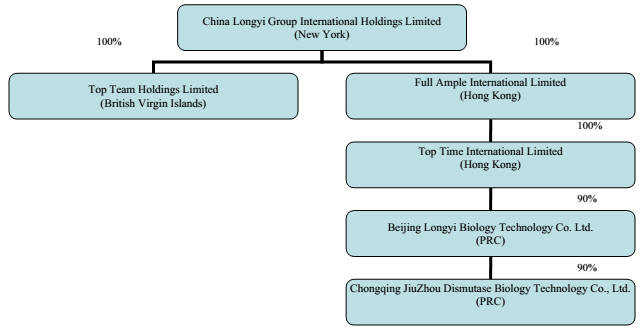

1. BUSINESS DESCRIPTION AND ORGANIZATION

We are a holding company that only operates through our indirect Chinese subsidiaries Beijing SOD and Chongqing SOD. Through our Chinese subsidiaries, we develop, manufacture and market our SOD products in China. SOD is a naturally occurring enzyme which may act as a potent antioxidant defense in cells that are exposed to oxygen.

The following chart reflects our organizational structure as of the date of this report.

6

CHINA LONGYI GROUP INTERNATIONAL HOLDINGS LIMITED

Notes to unaudited condensed consolidated interim financial statements

September 30, 2016

| 1. | BUSINESS DESCRIPTION AND ORGANIZATION (Continued) |

| | |

| CONTROL BY PRINCIPAL STOCKHOLDERS |

| | |

| The directors, executive officers, affiliates and related parties own, beneficially and in the aggregate, the majority of the voting power of the outstanding shares of the common stock of the Company. Accordingly, if they voted their shares uniformly, directors, executive officers and affiliates would have the ability to control the approval of most corporate actions, including increasing the authorized capital stock of China Longyi and the dissolution, merger or sale of the Company's assets. |

| | |

| GOING CONCERN |

| | |

| The Company has earned only insignificant revenues since its inception. As at September 30, 2016, the Company has a working capital deficiency of $1,167,729 and accumulated deficit from recurring net losses of $30,731,204 incurred for the current and prior years as of September 30, 2016. As at September 30, 2016, the Company has cash and cash equivalents of $152,912. |

| | |

| The Company’s ability to continue as a going concern ultimately is dependent on the management’s ability to obtain equity or debt financing, attain further operating efficiencies, and achieve profitable operations. The unaudited condensed consolidated interim financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts or amounts and classification of liabilities that might be necessary should the Company not be able to continue as a going concern. |

| | |

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

| | |

| PRINCIPLES OF CONSOLIDATION AND BASIS OF PRESENTATION |

| | |

| The unaudited condensed consolidated interim financial statements for all periods presented include the financial statements of China Longyi Group International Holdings Limited, and its subsidiaries: Top Team Holdings Limited, Full Ample Group Limited (Daykeen Group, BVI), Top Time International Limited (HK), Beijing SOD, and Chongqing SOD. The unaudited condensed consolidated interim financial statements have been prepared in accordance with US GAAP. All significant intercompany accounts and transactions have been eliminated. |

| | |

| The Company has determined the People’s Republic of China Chinese Yuan Renminbi (“RMB”) to be its functional currency. The accompanying unaudited condensed consolidated interim financial statements are presented in United States (US) dollars. The unaudited condensed consolidated interim financial statements are translated into US dollars from RMB at quarter-end exchange rates for assets and liabilities, and weighted average exchange rates for revenues and expenses. Capital accounts are translated at their historical exchange rates when the capital transactions occurred. |

| | |

| RMB is not freely convertible into the currency of other nations. All such exchange transactions must take place through authorized institutions. There is no guarantee the RMB amounts could have been, or could be, converted into US dollars at rates used in translation. |

7

CHINA LONGYI GROUP INTERNATIONAL HOLDINGS LIMITED

Notes to condensed consolidated financial statements (Unaudited)

September 30, 2016

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) |

| | |

| NONCONTROLLING INTEREST IN SUBSIDIARIES |

| | |

| The Company owns 90% of the equity interests in Beijing SOD, and the remaining 10% is owned by Miss Ran Wang. Therefore, the Company records non-controlling interest charge in the statement of operations to allocate 10% of the results of operations of the Beijing SOD to Miss Ran Wang, its non-controlling shareholder. |

| | |

| The Company owns 81% of the equity interest in Chongqing SOD of which 9% is owned by Miss Ran Wang, and the remaining 10% by Mr. Guoqing Tan. Therefore, the Company records non-controlling interest charge in the statement of operations to allocate 19% of the results of operations of Chongqing SOD to its non-controlling shareholders. |

| | |

| USE OF ESTIMATES |

| | |

| The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. |

| | |

| SIGNIFICANT ESTIMATES |

| | |

| Several areas require significant management estimates relating to uncertainties for which it is reasonably possible that there will be a material change in the near term. The more significant areas requiring the use of management estimates related to determination of net realizable value of inventory, allowance for doubtful accounts, property and equipment, accrued liabilities, and the useful lives for depreciation. |

| | |

| REVENUE RECOGNITION |

| | |

| Revenue is recognized when persuasive evidence of an arrangement exists, the price is fixed and determinable, delivery has occurred and there is a reasonable assurance of collection of the sales proceeds. The Company generally obtains purchase authorizations from its customers for a specified amount of products at a specified price and considers delivery to have occurred when the customer takes title of the products. |

| | |

| PROPERTY, PLANT AND EQUIPMENT |

| | |

| Property, plant and equipment are recorded at cost. Significant additions and improvements are capitalized, while repairs and maintenance are charged to expenses as incurred. Equipment purchased for specific research and development projects with no alternative uses are expensed. Assets under construction are not depreciated until construction is completed and the assets are ready for their intended use. Gains and losses from the disposal of property, plant and equipment are recorded in loss on disposal and impairment of property, plant and equipment included in the consolidated statements of comprehensive income (loss). |

| | |

| Depreciation and amortization are provided for financial reporting purposes primarily on the straight-line method over the estimated useful lives of the respective assets as follows: |

| | Estimated |

| | Useful Life |

| Transportation equipment | 5 years |

| Furniture and office equipment | 5 years |

| Production equipment | 10 years |

| Building and improvements | 20 years |

8

CHINA LONGYI GROUP INTERNATIONAL HOLDINGS LIMITED

Notes to condensed consolidated financial statements (Unaudited)

September 30, 2016

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) |

| | |

| CASH AND CASH EQUIVALENTS |

| | |

| Cash and Cash Equivalents as of September 30, 2016 were $152,912 and $29,429 in December 31, 2015. |

| | |

| INVENTORY |

| | |

| Prior to January 1, 2015, inventories are stated at the lower of cost or replacement cost with respect to raw materials and the lower of cost or market with respect to finished goods and work in progress. The Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2015-11 (“ASU 2015-11”), Simplifying the Measurement of Inventory, which the Company adopted on January 1, 2015. Subsequent to January 1, 2015, inventories are stated at the lower of cost or replacement cost with respect to raw materials and the lower of cost or net realizable value with respect to finished goods and work in progress. The cost of work in progress and finished goods is determined on a weighted average cost basis and includes direct material, direct labor and overhead costs. Net realizable value represents the anticipated selling price, net of distribution cost, less estimated costs to completion for work in progress. |

| | |

| Inventories as of September 30, 2016 were $333,210 and $359,194 in December 31, 2015. |

| | |

| INCOME TAXES |

| | |

| Income tax expense is based on reported income before income taxes. Deferred income taxes reflect the effect of temporary differences between assets and liabilities that are recognized for financial reporting purposes and the amounts that are recognized for income tax purposes. In accordance with ASC Topic 740 (formerly SFAS No. 109, “Accounting for income taxes”) these deferred taxes are measured by applying currently enacted tax laws. |

| | |

| The Company did not provide any current or deferred income tax provision or benefit for any period presented to date because it has experienced operating losses since inception. The benefit of any tax income (loss) carry forwards is fully offset by a valuation allowance, as there is a more than fifty percent chance that the Company will not realize those benefits. |

| | |

| There are net operating loss carry forwards allowed under the Hong Kong and China Governments’ tax system. |

9

CHINA LONGYI GROUP INTERNATIONAL HOLDINGS LIMITED

Notes to condensed consolidated financial statements (Unaudited)

September 30, 2016

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) |

| | |

| SHIPPING AND HANDLING |

| | |

| Costs relating to shipping and handling are part of general and administrative expenses in the unaudited consolidated statements of operations and comprehensive loss. Insignificant amount of shipping and handling costs incurred during the nine months ended September 30, 2016 and 2015. |

| | |

| EARNING (LOSS) PER SHARE |

| | |

| Basic earnings (loss) per common share ("LPS") is calculated by dividing net income (loss) by the weighted average number of common shares outstanding during the period. Diluted earnings (loss) per common share is calculated by adjusting the weighted average outstanding shares, assuming conversion of all potentially dilutive stock options. |

| | |

| There were no stock options and potentially dilutive securities outstanding as at September 30, 2016. |

| | |

| STOCK - BASED COMPENSATION |

| | |

| Compensation expense for costs related to all share-based payments, including grants of stock options, is recognized through a fair-value based method. The Company uses the Black-Scholes option-pricing model to determine the grant date fair value for stock options. The Company uses the grant date stock price to determine the grant date fair value of restricted shares. The Company has elected to recognize share-based compensation costs using the straight-line method over the requisite service period with a graded vesting schedule, provided that the amount of compensation costs recognized at any date is at least equal to the portion of the grant date value of the awards that are vested at that date. Forfeitures are estimated at the time of grant and revised, if necessary, in subsequent periods if actual forfeitures differ from initial estimates. Share based compensation costs are recorded net of estimated forfeitures such that expense is recorded only for those awards that are expected to vest. |

| | |

| The Company had no such compensation expense for the nine months ended September 30, 2016 and 2015. |

| | |

| COMPARATIVE FIGURES |

| | |

| Certain comparative figures have been reclassified in order to conform with the presentation adopted in the current period. |

| | |

| COMPREHENSIVE INCOME (LOSS) |

| | |

| The Company’s comprehensive income (loss) consists of net income (loss) and foreign currency translation adjustments. |

| | |

| RECENTLY ADOPTED ACCOUNTING STANDDARDS |

| | |

| There were no changes to the new accounting pronouncements as described in our Annual Report on Form 10- K for the fiscal year ended December 31, 2015 except for the following: |

10

CHINA LONGYI GROUP INTERNATIONAL HOLDINGS LIMITED

Notes to condensed consolidated financial statements (Unaudited)

September 30, 2016

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) |

| | |

| In February 2016, the Financial Accounting Standards Board ("FASB") issued guidance which amends the existing accounting standards for leases. Consistent with existing guidance, the recognition, measurement, and presentation of expenses and cash flows arising from a lease by a lessee primarily will depend on its classification. Under the new guidance, a lessee will be required to recognize right-of-use assets and lease liabilities on the balance sheet. The new guidance is effective for us from November 1, 2020, and interim periods in the following year. Early adoption of this guidance is permitted and we will be required to adopt using a modified retrospective approach. We are evaluating the timing and the impact of adopting this guidance on our unaudited condensed consolidated financial statements and disclosures. |

| | |

| In January 2016, FASB issued amendments to address certain aspects of recognition, measurement, presentation, and disclosure of financial instruments. The standard requires entities to measure equity investments that do not result in consolidation and are not accounted for under the equity method at fair value and recognize any changes in fair value in net income. The provisions under this amendment are effective for us from November 1, 2018, and for interim periods in the following year and early adoption is not permitted. We are evaluating the impact of adopting this guidance to our unaudited condensed consolidated financial statements. |

| | |

| In November 2015, FASB issued guidance intended to simplify accounting for deferred taxes. Beginning on November 1, 2017 and including the interim periods following that date, we will be required to present all deferred tax balances as non-current. Existing GAAP guidance requires us to record deferred tax balances as either current or non-current in accordance with the classification of the underlying attributes. Early adoption of this guidance is permitted and may be applied either prospectively or retrospectively to all periods presented. We expect to early adopt this guidance prospectively at the end of the second quarter of fiscal year 2016, but we are still evaluating how significant the impact of the adoption will be on our consolidated balance sheet. |

| | |

| Other amendments to GAAP in the U.S. that have been issued by the FASB or other standards-setting bodies that do not require adoption until a future date are not expected to have a material impact on our unaudited condensed consolidated financial statements upon adoption. |

| | |

| 3. | STOCKHOLDERS' EQUITY |

| | |

| The Company's capital structure as of September 30, 2016 and December 31, 2015 was as follows: |

| Common stock – par value $0.01 | Authorized | Issued and outstanding |

| | | |

| September 30, 2016 | 200,000,000 | 77,655,862 |

| | | |

| December 31, 2015 | 200,000,000 | 77,655,862 |

As of September 30, 2016, the Company had accumulated deficit of $30,731,204.

11

CHINA LONGYI GROUP INTERNATIONAL HOLDINGS LIMITED

Notes to condensed consolidated financial statements (Unaudited)

September 30, 2016

| 4. | INVESTMENT |

| | |

| On January 5, 2010, the Company acquired 20% equity interest in Cangshan Duoha Vegetable Food Company (“Duoha”) by issuing 50,000 shares of common stock of the Company at $0.2 per share to Duoha’s shareholders. According to the investment agreement, although we own 20% equity interest of Duoha, we do not have significant influence over Duoha’s operating and financing activities. Therefore, the Company used cost method to record the above investment. |

| | |

| In May of 2015, we signed an investment agreement with Guizhou Biology Technology Ltd. (“Guizhou”). According to the investment agreement, the Company invested RMB 500,000 ($74,875) to acquire 20% equity interest in of Guizhou. Although we own 20% equity of Guizhou, we do not have significant influence over Guizhou’s operating and financing activities. |

| | |

| The amount of investment as of September 30, 2016 and December 31, 2015 was $85,099 and $87,512, respectively. |

| | |

| 5. | INVENTORIES |

| | |

| Inventories at September 30, 2016 and December 31, 2015 consisted of: |

| | | September 30, | | | December 31, | |

| | | 2016 | | | 2015 | |

| Raw Materials | $ | 48,558 | | $ | 12,639 | |

| Low value consumables | | 13,113 | | | 13,485 | |

| Work in progress | | 228,802 | | | 266,717 | |

| Finished goods | | 42,737 | | | 66,353 | |

| | $ | 333,210 | | $ | 359,194 | |

| 6. | PROPERTY AND EQUIPMENT |

| | |

| Property and equipment at cost consisted of: |

| | | September 30, | | | December 31, | |

| | | 2016 | | | 2015 | |

| Transportation equipment | $ | 51,434 | | $ | 52,892 | |

| Furniture and office equipment | | 61,707 | | | 57,043 | |

| Production equipment, buildings and improvements | | 365,950 | | | 376,331 | |

| Subtotal | | 479,091 | | | 486,266 | |

| Less: impairment provision | | (46,252 | ) | | (47,563 | ) |

| accumulated depreciation | | (318,149 | ) | | (304,015 | ) |

| | | 114,690 | | | 134,688 | |

| Construction in progress | | 180,576 | | | 185,698 | |

| | $ | 295,266 | | $ | 320,386 | |

Depreciation expense for the nine months ended September 30, 2016 was $22,869. Accumulated impairment as of September 30, 2016 and December 31, 2015 was $46,252 and $47,563.

12

CHINA LONGYI GROUP INTERNATIONAL HOLDINGS LIMITED

Notes to condensed consolidated financial statements (Unaudited)

September 30, 2016

| 7. | COMMITMENTS AND CONTINGENCIES |

| | |

| From time to time, the Company has disputes that arise in the ordinary course of its business. Currently, according to management, there are no material legal proceedings to which the Company is a party to or to which any of their property is subject that will have a material adverse effect on the Company’s financial condition. |

| | |

| The Company rents office space from the related company on a month to month basis. |

| | |

| 8. | SHORT-TERM LOAN |

| | |

| During the year of 2015, Shiling Wang provided the company an unsecured loan in an amount of RMB 380,000 ($56,905), and the interest rate of the loan is 25% per annum. As of September 30, 2016, the Company has repaid loan in full. |

| | |

| The principal amount as of September 30, 2016 was $0 and as of December 31, 2015 was $58,519, respectively, and were recorded on the balance sheet as short-term loan. |

| | |

| 9. | OTHER PAYABLES |

| | |

| Other payables are carrying value as of the balance sheet date of obligations incurred and payable, which are not elsewhere specified in the taxonomy. |

| | |

| Other payables as of September 30, 2016 and December 31, 2015 consist of the following: |

| | September 30, | | | December 31, | |

| | | 2016 | | | 2015 | |

| Due to Tailong Zhongrui International Corporation | $ | 13,178 | | $ | 35,419 | |

| Due to Beijing De Qiuhong Investment Ltd. | | 382,857 | | | 486,116 | |

| Due to Xinxiang Tianjieshan Biotechnology Co., Ltd. | | 58,457 | | | - | |

| Educational funds | | 7,729 | | | 9,754 | |

| Wage payable | | 85,880 | | | 86,740 | |

| Project payment | | 22, 462 | | | 23,100 | |

| Other payable | | 9,814 | | | 19,739 | |

| Total | $ | 580,377 | | $ | 660,868 | |

| 10. | RELATED PARTY TRANSACTIONS AND STOCKHOLDER’S LOAN |

| | |

| Due to directors, Due from directors and Due to Related Companies are loans that are unsecured, non-interest bearing and have no fixed terms of repayment, therefore, deemed payable on demand. |

| | |

| The Company rents office space from the related company on a month to month basis. |

| | |

| | The amount of Due from directors as of September 30, 2016 and December 31, 2015 was $8,099 and $0, respectively. The amount of $8,099, due from directors was advanced to the Company’s CEO for business related travel and was applied against travel expenses incurred by the Company’s CEO during October 2016. |

| | |

| | The amount of Due to directors as of September 30, 2016 and December 31, 2015 was $590,134 and $627,832, respectively. |

| | |

| | The amount of Due to related parties as of September 30, 2016 and December 31, 2015 was $394,247 and $417,653, respectively. |

| | |

| 11. | SUBSEQUENT EVENTS |

| | |

| Management has considered all events occurring through the date the financial statements have been issued, and has determined that there are no such events that are material to the financial statement. |

13

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with our unaudited condensed consolidated interim financial statements and the notes thereto.

Special Note Regarding Forward-Looking Statements

This Quarterly Report on Form 10-Q, including the following “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” contains “forward-looking statements” relating to the business of China Longyi Group International Holdings Limited and its subsidiary companies. The forward-looking statements include, among others, statements concerning our expected financial performance and strategic and operational plans, as well as all assumptions, expectations, predictions, intentions or beliefs about future events. These statements are based on assumptions and are subject to known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. Risks and uncertainties include risks related to new and existing products; any projections of sales, earnings, revenue, margins or other financial items; any statements of the plans, strategies and objectives of management for future operations; any statements regarding future economic conditions or performance; uncertainties related to conducting business in China; any statements of belief or intention; and any of the factors mentioned in the “Risk Factors” section of the Company’s annual report on Form 10-K filed on April 14, 2016. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

Use of Certain Defined Terms

Except as otherwise indicated by the context, references in this report to:

- “Beijing SOD” are references to Beijing Longyi Biology Technology Co. Ltd., our indirect, 90% owned subsidiary, a PRC company;

- “China” and “PRC” are references to the People’s Republic of China;

- “China Longyi,” “we,” “us,” “our,” or the “Company” are references to the combined business of China Longyi Group International Holdings Limited and/or its consolidated subsidiaries, as the case may be;

- “Chongqing SOD” are references to Chongqing JiuZhou Dismutase Biology Technology Co., Ltd., our indirect, majority-owned subsidiary, a PRC company;

- “Exchange Act” mean the Securities Exchange Act of 1934, as amended;

- “RMB” refer to Renminbi, the legal currency of China;

- “Securities Act” mean the Securities Act of 1933, as amended;

- “Top Time” are references to Top Time International Limited, our indirect wholly-owned subsidiary, a Hong Kong company; and

- “U.S. dollar,” “$” and “US$” are to the legal currency of the United States.

Overview of our Business

We are a holding company that only operates through our indirect Chinese subsidiaries Beijing SOD and Chongqing SOD. Through our Chinese subsidiaries, we develop, manufacture and market our SOD products in China. SOD is a naturally occurring enzyme which may act as a potent antioxidant defense in cells that are exposed to oxygen. Certain research has shown that under certain biological conditions, SOD revitalizes cells and reduces the rate of cell destruction. It neutralizes the most common free radical—superoxide radical—by converting it into hydrogen peroxide and water. Because superoxide is harmful to human cells, and certain forms of SOD exist naturally in most humans, many studies show that SOD is valuable in protecting human cells from the harmful effects of superoxide. SOD is thought to be more powerful than antioxidant vitamins as it activates the body's productions of its own antioxidants. As a result, SOD is referred to as the “enzyme of life.” Commercially, SOD has a wide range of applications and is widely applied in foods, drinks, skin care productions, pharmaceuticals, to combat ailments ranging from sunburn to rheumatoid arthritis.

14

Third Quarter of 2016 Financial Performance Highlights

The following are some financial highlights for the three months ended September 30, 2016:

Revenue: Revenue increase $880,247, to $1,034,223 for the three months ended September 30, 2016, from $153,976 for the same period in 2015.

Expense from operations: Expense from operations increased $179,525, or 147.59%, to $301,162 for the three months ended September 30, 2016, from $121,637 for the same period in 2015.

Net profit: Net profit increased $225,267, or 1349.06%, to $241,965 for the three months ended September 30, 2016, from $16,698 for the same period in 2015.

Fully diluted net income per share: Fully diluted net income per share was $0 for the three months ended September 30, 2016, as compared to $0 for the same period in 2015.

Provision for Income Taxes

United States: China Longyi Group International Holding Limited is subject to United States tax at a tax rate of 34%. No provision for income taxes in the United States has been made as China Longyi Group International Holding Limited had no income subject to United States taxation in the third quarter of 2016.

British Virgin Islands: Our wholly owned subsidiary Top Team Holdings Limited was incorporated in the British Virgin Islands, or the BVI, and, under the current laws of the BVI, is not subject to income taxes.

China: Before the implementation of the enterprise income tax, or EIT, Foreign Invested Enterprises or FIEs, established in the PRC were generally subject to an EIT rate of 33.0%, which includes a 30.0% state income tax and a 3.0% local income tax. On March 16, 2007, the National People’s Congress of China passed the new Corporate Income Tax Law, or EIT Law, and on November 28, 2007, the State Council of China passed the Implementing Rules for the EIT Law, or Implementing Rules, which took effect on January 1, 2008. The EIT Law and Implementing Rules impose a unified EIT of 25.0% on all domestic- invested enterprises and FIEs, unless they qualify under certain limited exceptions. Therefore, nearly all FIEs are subject to the new tax rate alongside other domestic businesses rather than benefiting from the old tax laws applicable to FIEs, and its associated preferential tax treatments, beginning January 1, 2008.

Despite these pending changes, the EIT Law gives the FIEs established before March 16, 2007, or Old FIEs, such as our subsidiaries Beijing SOD and Chongqing SOD, a five-year grandfather period during which they can continue to enjoy their existing preferential tax treatments. During this five-year grandfather period, the Old FIEs which enjoyed tax rates lower than 25% under the original EIT Law shall gradually increase their EIT rate by 2% per year until the tax rate reaches 25%. In addition, the Old FIEs that are eligible for the “two-year exemption and three-year half reduction” or “five-year exemption and five-year half-reduction” under the original EIT Law, are allowed to remain to enjoy their preference until these holidays expire. The discontinuation of any such special or preferential tax treatment or other incentives would have an adverse effect on any organization’s business, fiscal condition and current operations in China.

In addition to the changes to the current tax structure, under the EIT Law, an enterprise established outside of China with “de facto management bodies” within China is considered a resident enterprise and will normally be subject to a EIT of 25.0% on its global income. The Implementing Rules define the term “de facto management bodies” as “an establishment that exercises, in substance, overall management and control over the production, business, personnel, accounting, etc., of a Chinese enterprise.” If the PRC tax authorities subsequently determine that we should be classified as a resident enterprise, then our consolidated global income will be subject to PRC income tax of 25.0% .

15

We incurred no income taxes in either the three months ended September 30, 2016 or the three months ended September 30, 2015.

Results of Operations

Three Months Ended September 30, 2016 Compared to Three Months ended September 30, 2015

The following table summarizes the results of our operations for the three months ended September 30, 2016 and 2015 and provides information regarding the dollar and percentage increase or (decrease) from the three months ended September 30, 2015 to the same period of 2016.

| | | Three Months Ended | | | | | | | |

| | | September 30, | | | Increase | | | % Increase | |

| Item | | 2016 | | | 2015 | | | (Decrease) | | | (% Decrease) | |

| Revenue | $ | 1,034,223 | | $ | 153,976 | | $ | 880,247 | | | 571.68% | |

| Cost of Revenue | | 687,311 | | | 185,308 | | | 502,003 | | | 270.90% | |

| Gross Profit | | 346,912 | | | (31,332 | ) | | 378,244 | | | 1207.21% | |

| Operating Expenses | | 301,162 | | | 121,637 | | | 179,525 | | | 147.59% | |

| Other Income (expense) | | 196,214 | | | 169,667 | | | 26,547 | | | 15.65% | |

| Provision for Taxes | | - | | | - | | | - | | | - | |

| Net income attributable to China | $ | 216,693 | | $ | 14,909 | | $ | 201,784 | | | 1353.44% | |

Revenues. Our revenues are derived primarily from sales of our SOD products. Our revenues increased $880,247, to $1,034,223 for the three months ended September 30, 2016, from $153,976 for the same period in 2015. The increase in revenues was due to more SOD products being sold for the three months ended September 30, 2016 compared with the same period of 2015.

Cost of Revenues.Our cost of revenues is primarily comprised of the costs of our raw materials, labor and overhead. Our cost of revenues increased $502,003, to $687,311 for the three months ended September 30, 2016, from $185,308 during the same period in 2015 because more SOD products being produced and sold for the three months ended September 30, 2016 compared with the same period of 2015.

Gross Profit.Our gross profit increased by $378,244, to $346,912 for the three months ended September 30, 2016 from $(31,332) during the same period in 2015. The gross profit increased mainly due to more SOD products being sold for the three months ended September 30, 2016 compared with the same period of 2015.

Operating Expenses. Our total operating expenses for the three months ended September 30, 2016 increased $179,525, or 147.59%, to $301,162, from $121,637 for the same period in 2015. This increase was mainly because we paid more office fees, rental, sales taxes and advertising expenses for three months ended September 30, 2016 compared with the same period of 2015.

Other Income (expense). Other income was $196,214 during the three months ended September 30, 2016, an increase of $26,547 from $169,667 during the same period in 2015. Such increase was mainly due to the fact that non-operating income increased $16,014, to $195,764 for the three months ended September 30, 2016, from $179,750 for the same period in 2015.

16

Net profit attributable to China Longyi. As a result of above facts, our net profit increased by $201,784, or 1353.44%, to $216,693 for the three months ended September 30, 2016, from $14,909 for the same period in 2015.

Nine Months Ended September 30, 2016 Compared to Nine Months ended September 30, 2015

The following table summarizes the results of our operations for the nine months ended September 30, 2016 and 2015 and provides information regarding the dollar and percentage increase or (decrease) from the nine months ended September 30, 2015 to the same period of 2016.

| | | Nine Months Ended | | | | | | | |

| | | September 30, | | | Increase | | | % Increase | |

| Item | | 2016 | | | 2015 | | | (Decrease) | | | (% Decrease) | |

| Revenue | $ | 1,675,034 | | $ | 163,119 | | $ | 1,511,915 | | | 926.88% | |

| Cost of Revenue | | 1,158,944 | | | 206,167 | | | 952,777 | | | 462.14% | |

| Gross Profit | | 516,090 | | | (43,048 | ) | | 559,138 | | | 1298.87% | |

| Operating Expenses | | 578,100 | | | 363,965 | | | 214,135 | | | 58.83% | |

| Other Income (expense) | | 367,344 | | | 188,979 | | | 178,365 | | | 94.38% | |

| Provision for Taxes | | - | | | - | | | - | | | - | |

| Net profit (loss) attributable to China | $ | 265,703 | | $ | (204,549 | ) | $ | 470,252 | | | 229.90% | |

Revenues.Revenues increased $1,511,915, to $1,675,034 for the nine months ended September 30, 2016, from $163,119 for the same period in 2015. The increase in revenues was due to more SOD products being sold for the nine months ended September 30, 2016 compared with the same period of 2015.

Cost of Revenues. Our cost of revenues increased $952,777, to $1,158,944 for the nine months ended September 30, 2016, from $206,167 during the same period in 2015 because more SOD products being produced and sold for the nine months ended September 30, 2016 compared with the same period of 2015.

Gross Profit.Our gross profit increased by $559,138, to $516,090 for the nine months ended September 30, 2016 from $(43,048) during the same period in 2015. The gross profit increased mainly due to more SOD products being sold for the nine months ended September 30, 2016 compared with the same period of 2015.

Operating Expenses. Our total operating expenses for the nine months ended September 30, 2016 increased $214,135, or 58.83%, to $578,100, from $363,965 for the same period in 2015. This increase was mainly because we paid more office fees, rental, sales taxes and advertising expenses for the nine months ended September 30, 2016 compared with the same period of 2015.

Other Income (expense). Other income was $367,344 during the nine months ended September 30, 2016, an increase of $178,365 from $188,979 during a same period in 2015. Such increase was mainly due to the fact that our non-operating income increased $198,476, to $392,186 for the nine months ended September 30, 2016, from $193,710 for the same period in 2015.

Net profit attributable to China Longyi. As a result of above facts, our net profit increased by $470,252, or 229.90%, to $265,703 for the nine months ended September 30, 2016, from $(204,549) for the same period in 2015.

17

Liquidity and Capital Resources

We had $152,912 in cash and cash equivalents as of September 30, 2016. As of such date, we also had total current assets of $851,334 and total assets of $1,231,699. We had total current liabilities (consisting of accounts payable, accrued liabilities, due to directors and other payables) in the amount of $2,019,063. Our stockholders’ equity as of September 30, 2016 was $(787,364). Since inception, we have accumulated a net loss of $30,731,204.

The following table summarizes the statements of cash flows from the unaudited condensed consolidated interim financial statements for the nine months ended September 30, 2016 compared to the nine months ended September 30, 2015:

| | | Nine Months Ended | |

| | | September 30, | |

| | | 2016 | | | 2015 | |

| Net Cash Provided By (Used In) Operating Activities | $ | 202,802 | | $ | 52,287 | |

| Net Cash Provided By (Used In) Investing Activities | | (6,335 | ) | | (67,219 | ) |

| Net Cash Provided By (Used In) Financing Activities | | (81,674 | ) | | (6,479 | ) |

| Effect of foreign exchange rate fluctuation | | 8,690 | | | 2,535 | |

| Net increase (decrease) in Cash and Cash Equivalents | | 123,483 | | | (18,876 | ) |

| Cash and Cash Equivalents - Beginning of Period | | 29,429 | | | 46,366 | |

| Cash and Cash Equivalents – End of Period | | 152,912 | | | 27,490 | |

Operating Activities

Net cash provided by operating activities was $202,802 for the nine-month period ended September 30, 2016 representing an increase of $150,515 from $52,287 of net cash provided by the operating activities for the same period of 2015. The increase in the cash provided by operating activities was mainly attributable to changes in Net income, Account receivables, Deposits and prepayment, and other payables. Cash flows provided by Net Income increased $523,369 to $305,335 for the nine months ended September 30, 2016, from ($218,034) for the same period in 2015. Cash flow used in Account receivables increased $173,029 to $173,029 for the nine months ended September 30, 2016, from $0 for the same period in 2015. Cash flows used in Deposits and prepayment increased $81,765, to $90,864 for nine months ended September 30, 2016, from $9,099 for the same period in 2015. Cash flow provided by other payables decreased $74,938, to $203,929 for nine months ended September 30, 2016, from $278,867 for the same period in 2015.

Investing Activities

Net cash used in investing activities for the nine-month period ended September 30, 2016 was $6,335 as compared with $67,219 of net cash used in investing activities for the same period of 2015. We did not have any investing activities for the nine months ended September 30, 2016 as compared with the same period of 2015.

Financing Activities

Net cash used in financing activities for the nine-month period ended September 30, 2016 was $81,674 as compared to $6,479 used in financing activities for the same period in 2015. We repaid certain short term loans and loans from directors in an amount of $57,788 and $23,886, respectively, for the nine months ended September 30, 2016.

The Company did not have any bank loans as of September 30, 2016.

18

We expect to generate approximately $2 million to $2.5 million of revenues from the sale of our products during the next 12 months. If our cash on hand and cash flow from operations do not meet our expected capital expenditure and working capital requirements for the next 12 months, we expect that our directors will provide more cash as loans to the company. However, we may in the future require additional cash resources due to changed business conditions, implementation of our strategy to expand our production capacity or other investments or acquisitions we may decide to pursue. If our own financial resources are insufficient to satisfy our capital requirements, we may seek to sell additional equity or debt securities or obtain additional credit facilities. The sale of additional equity securities could result in dilution to our stockholders. The incurrence of indebtedness would result in increased debt service obligations and could require us to agree to operating and financial covenants that would restrict our operations. Financing may not be available in amounts or on terms acceptable to us, if at all. Any failure by us to raise additional funds on terms favorable to us, or at all, could limit our ability to expand our business operations and could harm our overall business prospects.

Critical Accounting Policies

Foreign Currencies

The company has determined that RMB to be its functional currency. The accompanying unaudited consolidated interim financial statements are presented in U.S. dollars. The unaudited condensed consolidated interim financial statements are translated into US dollars from RMB at period-end exchange rates for assets and liabilities, and weighted average exchange rates for revenues and expenses. Capital accounts are translated at their historical exchange rates when the capital transactions occurred.

| | | September 30, | | December 31, |

| | | 2016 | | 2015 | | 2015 |

| | | RMB | HK$ | | RMB | HK$ | | RMB | HK$ |

| | Balance sheet items, except for equity accounts | 6.6778 | 7.7561 | | 6.3613 | 7.7500 | | 6.4936 | 7.7510 |

| | | | | | | | | | |

| | Items in the statements of income and comprehensive income, and the statements of cash flows | 6.5757 | 7.7636 | | 6.1738 | 7.7528 | | 6.2272 | 7.7522 |

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Several areas require significant management estimates relating to uncertainties for which it is reasonably possible that there will be a material change in the near term. The more significant areas requiring the use of management estimates related to determination of net realizable value of inventory, allowance for doubtful accounts, property and equipment, accrued liabilities and, the useful lives for depreciation.

Revenue Recognition

The Company recognizes revenue in accordance with Staff Accounting Bulletin No.104 “Revenue recognition” (“ASC Topic 605”). Revenues are recognized as earned when the following four criteria are met: (1) a customer issues purchase orders or otherwise agrees to purchase products; (2) products are delivered to the customer; (3) pricing is fixed or determined in accordance with the purchase order or agreement; and (4) collectability is reasonably assured.

19

Inflation

Inflation does not materially affect our business or the results of our operations.

Seasonality

We may experience seasonal variations in our future revenues and our operating costs, however, we do not believe that these variations will be material.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to investors.

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Not Applicable.

ITEMS 4. CONTROLS AND PROCEDURES

Disclosure Controls and Procedures’

Our management, with the participation of our chief executive officer and chief financial officer, Ms. Jie Chen and Mr. Xinmin Pan, respectively, evaluated the effectiveness of our disclosure controls and procedures. The term “disclosure controls and procedures,” as defined in Rules 13a-15(e) and 15d-15(e) under the Exchange Act, means controls and other procedures of a company that are designed to ensure that information required to be disclosed by a company in the reports, such as this report, that it files or submits under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the SEC’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by a company in the reports that it files or submits under the Exchange Act is accumulated and communicated to the company’s management, including its principal executive and principal financial officers, as appropriate to allow timely decisions regarding required disclosure. Management recognizes that any controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving their objectives and management necessarily applies its judgment in evaluating the cost-benefit relationship of possible controls and procedures. Based on that evaluation, Ms. Jie Chen and Mr. Xinmin Pan concluded that as of September 30, 2016, our disclosure controls and procedures were effective at the reasonable assurance level.

Internal Controls Over Financial Reporting

During the quarter ended September 30, 2016, there were no changes in our internal control over financial reporting identified in connection with the evaluation performed that occurred during the fiscal quarter covered by this report that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

20

PART II – OTHER INFORMATION

ITEM 1. LEGAL PROCEEDINGS

From time to time, the Company has disputes that arise in the ordinary course of its business. Currently, there are no material legal proceedings to which the Company is a party to or to which any of its property is subject that will have a material adverse effect on the Company's financial condition.

ITEM 1A. RISK FACTORS

Not applicable.

ITEM 2. UNREGISTERED SHARES OF EQUITY SECURITIES AND USE OF PROCEEDS

We have not sold any equity securities during the fiscal quarter ended September 30, 2016 that were not previously disclosed in a current report on Form 8-K that was filed during that period.

ITEM 3. DEFAULTS UPON SENIOR SECURITIES

Not applicable.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

ITEM 5. OTHER INFORMATION

None.

ITEM 6. EXHIBITS

| Exhibit | |

| Number | Description |

| | |

| 31.1 | Certification of Principal Executive Officer filed pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

| | |

| 31.2 | Certification of Principal Financial Officer filed pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

| | |

| 32.1 | Certification of Principal Executive Officer furnished pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

| | |

| 32.2 | Certification of Principal Financial Officer furnished pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

| | |

| 101 | The following financial information from The China Longyi Group International Holdings Limited's Quarterly Report on Form 10-Q for the quarter ended September 30, 2016, formatted in XBRL (Extensible Business Reporting Language): (i) Consolidated Balance Sheets at September 30, 2016 and December 31, 2015, (ii) Consolidated Statements of Operations and Comprehensive Loss for the three and nine months ended September 30, 2016 and 2015, (iii) Consolidated Statements of Cash Flows for the nine months ended September 30, 2016 and 2015, and (iv) the Notes to Unaudited Condensed Consolidated Financial Statements. |

21

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | CHINA LONGYI GROUP INTERNATIONAL HOLDINGS LIMITED |

| DATED: November 14, 2016 | |

| | By: /s/ Jie Chen |

| | ------------------------------------- |

| | Jie Chen |

| | Chief Executive Officer |

| | (Principal Executive Officer) |

| | |

| DATED: November 14, 2016 | By: /s/ Xinmin Pan |

| | ------------------------------------- |

| | Xinmin Pan |

| | Chief Financial Officer |

| | (Principal Financial Officer and Accounting Officer) |

22

EXHIBIT INDEX

| Exhibit | |

| Number | Description |

| | |

| 31.1 | Certification of Principal Executive Officer filed pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

| | |

| 31.2 | Certification of Principal Financial Officer filed pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

| | |

| 32.1 | Certification of Principal Executive Officer furnished pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

| | |

| 32.2 | Certification of Principal Financial Officer furnished pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

| | |

| 101 | The following financial information from The China Longyi Group International Holdings Limited's Quarterly Report on Form 10-Q for the quarter ended September 30, 2016, formatted in XBRL (Extensible Business Reporting Language): (i) Consolidated Balance Sheets at September 30, 2016 and December 31, 2015, (ii) Consolidated Statements of Operations and Comprehensive Loss for the three and nine months ended September 30, 2016 and 2015, (iii) Consolidated Statements of Cash Flows for the nine months ended September 30, 2016 and 2015, and (iv) the Notes to Unaudited Condensed Consolidated Financial Statements. |

23