GenOn Energy: A Leader in Electric Energy Generation April 12, 2010 Exhibit 99.2 |

1 Safe Harbor Forward Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are typically identified by words or phrases such as “will,” “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “target,” “forecast,” and other words and terms of similar meaning. These forward-looking statements involve a number of risks and uncertainties. RRI Energy and Mirant caution readers that any forward-looking statement is not a guarantee of future performance and that actual results could differ materially from those contained in the forward- looking statement. Such forward-looking statements include, but are not limited to, statements about the benefits of the proposed merger involving RRI Energy and Mirant, including future financial and operating results, RRI Energy’s and Mirant’s plans, objectives, expectations and intentions, the expected timing of completion of the transaction, and other statements that are not historical facts. Important factors that could cause actual results to differ materially from those indicated by such forward-looking statements are set forth in RRI Energy’s and Mirant’s filings with the Securities and Exchange Commission. These include risks and uncertainties relating to: the ability to obtain the requisite RRI Energy and Mirant shareholder approvals; the risk that Mirant or RRI Energy may be unable to obtain governmental and regulatory approvals required for the merger, or required governmental and regulatory approvals may delay the merger or result in the imposition of conditions that could cause the parties to abandon the merger; the risk that a condition to closing of the merger may not be satisfied; the timing to consummate the proposed merger; the risk that the businesses will not be integrated successfully; the risk that the cost savings and any other synergies from the transaction may not be fully realized or may take longer to realize than expected; disruption from the transaction making it more difficult to maintain relationships with customers, employees or suppliers; the diversion of management time on merger-related issues; general worldwide economic conditions and related uncertainties; and the effect of changes in governmental regulations; and other factors discussed or referred to in the “Risk Factors” section of each of RRI Energy’s and Mirant’s most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission. Each forward- looking statement speaks only as of the date of the particular statement and neither RRI Energy nor Mirant undertake any obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise. Additional Information And Where To Find It This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. In connection with the proposed merger between RRI Energy and Mirant, RRI Energy will file with the SEC a Registration Statement on Form S-4 that will include a joint proxy statement of RRI Energy and Mirant that also constitutes a prospectus of RRI Energy. RRI Energy and the SEC’s website (www.sec.gov). You may also obtain these documents, free of charge, from RRI Energy’s website (www.rrienergy.com) under the tab “Investor Relations” and then under the heading “Company Filings.” You may also obtain these documents, free of charge, from Mirant’s website (www.mirant.com) under the tab “Investor Relations” and then under the heading “SEC Filings.” Participants In The Merger Solicitation RRI Energy, Mirant, and their respective directors, executive officers and certain other members of management and employees may be soliciting proxies from RRI Energy and Mirant shareholders in favor of the merger and related matters. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of RRI Energy and Mirant shareholders in connection with the proposed merger will be set forth in the joint proxy statement/prospectus when it is filed with the SEC. You can find information about RRI Energy’s executive officers and directors in its definitive proxy statement filed with the SEC on April 1, 2010. You can find information about Mirant’s executive officers and directors in its definitive proxy statement filed with the SEC on March 26, 2010. Additional information about RRI Energy’s executive officers and directors and Mirant’s executive officers and directors can be found in the above-referenced Registration Statement on Form S-4 when it becomes available. You can obtain free copies of these documents from RRI Energy and Mirant using the contact information above. Mirant will mail the joint proxy statement/prospectus to their respective shareholders. RRI Energy and Mirant urge investors and shareholders to read the joint proxy statement/prospectus regarding the proposed merger when it becomes available, as well as other documents filed with the SEC, because they will contain important information. You may obtain copies of all documents filed with the SEC regarding this transaction, free of charge, at |

2 Chairman & Chief Executive Officer Mirant Edward R. Muller President & Chief Executive Officer RRI Energy Mark M. Jacobs |

3 Strategic Rationale • Significant near-term value creation driven by annual cost savings of $150 million • Strengthened balance sheet and enhanced financial flexibility • Increased scale and geographic diversity across key regions • Well positioned to benefit from improvement in market fundamentals Creates Leading IPP With 24,700 MW Electric Generating Capacity |

4 Transaction Terms Company Name GenOn Energy Consideration Merger of equals 100% stock transaction Exchange Ratio Mirant stockholders will receive 2.835 shares of RRI Energy in exchange for each share of Mirant Ownership Mirant stockholders will own approximately 54% of GenOn Energy RRI Energy stockholders will own approximately 46% of GenOn Energy Board of Directors GenOn Energy Board to consist of 10 directors 5 Directors from Mirant/5 Directors from RRI Energy Management Edward R. Muller, Chairman & CEO Mark M. Jacobs, President & COO J. William Holden III, CFO Identified executive leadership team reflects balanced representation from both companies Headquarters Corporate headquarters in Houston, TX Transaction Close Expected before the end of 2010 |

5 Substantial Cost Savings • $150 million in annual cost savings • Achieved through reduction in corporate overhead and G&A, including: Consolidating two headquarters Accounting, finance, human resources, administrative IT systems • Costs to achieve of $125 million • Expected run-rate cost savings fully realized starting in January 2012 Combination Delivers Significant Shareholder Value |

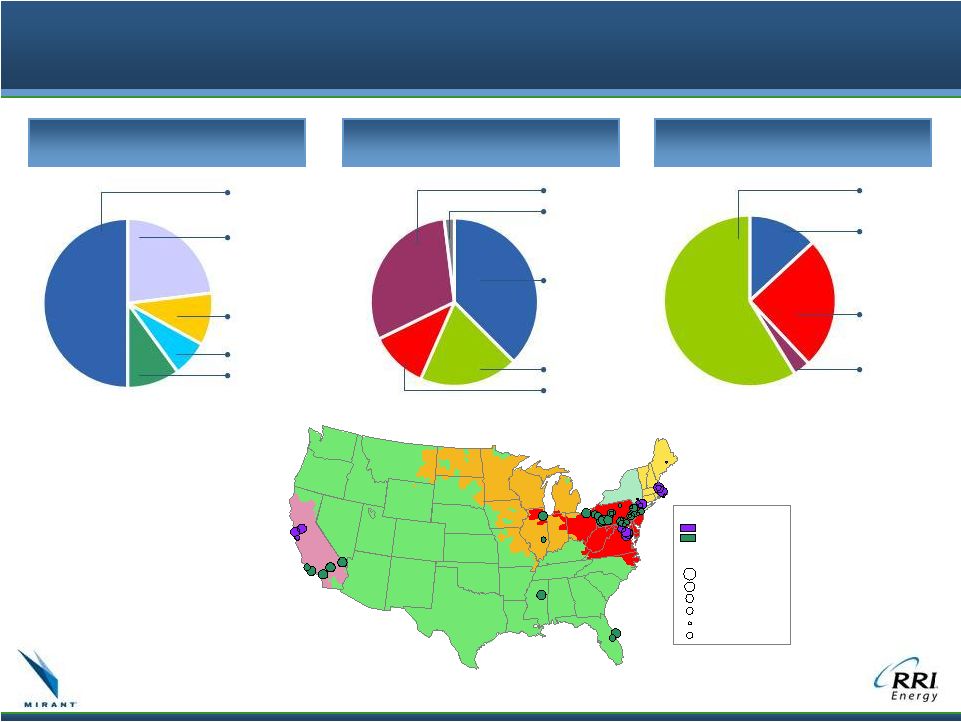

6 6 Increased Diversity and Scale Color by Holding Company Name Mirant RRI Energy Size By Summer Capacity MW 200 to 810 75 to 200 50 to 75 20 to 50 1 to 29 all others * Approximately 1,300 MW will move from MISO to PJM in June 2011 PRO FORMA CAPACITY By Geography PJM – 50% Southeast – 10% MISO* – 7% NYISO & ISONE – 10% CAISO – 23% PRO FORMA CAPACITY 24.7 GW Dual – 30% Oil – 2% Natural Gas – 37% Coal – 19% Controlled Coal – 11% Uncontrolled PRO FORMA GENERATION ~39,600 GWh Coal – 59% Controlled Natural Gas – 13% Coal – 25% Uncontrolled Dual – 3% CAISO Midwest ISO ISO-NE NYISO PJM 1 Based on 2009 actuals 1 |

7 A Market Leader 31.0 24.7 24.3 23.5 21.0 18.1 15.9 14.6 12.4 11.7 10.1 9.9 9.9 9.2 7.0 6.4 6.3 4.6 0 5 10 15 20 25 30 35 (GW) U.S. Competitive Generation Capacity |

8 Strong Balance Sheet and Enhanced Financial Flexibility • Combined cash balance of the companies as of December 31, 2009 was $2.9B • Expect to replace each company’s revolving credit facilities in a new holding company facility • Approximately $1.8B of debt to be addressed MNA Senior Secured Term Loan ($307MM due 2013) MNA Senior Notes ($850MM of 7.375% notes due 2013) RRI Energy Secured Bonds ($279MM due 2014) PEDFA Secured Notes ($371MM due 2036) |

9 Steps to Close • Address $1.8B of debt • Mirant and RRI Energy stockholder approval • Regulatory approvals: Federal Energy Regulatory Commission (FERC) Hart-Scott-Rodino (HSR) Review New York State Public Service Commission • Expected close before the end of 2010 • Proposed reverse stock split at RRI Energy to be completed prior to transaction close Will not impact value of proposed exchange ratio Merger transaction is not conditioned on successful completion |

10 Creating A Power Industry Leader Increased Scale and Diversity Across Key Regions Substantial Cost Savings Stronger Balance Sheet & Ample Liquidity Shared Commitment to Operational & Commercial Excellence Positioned to Benefit from Improvement in Market Fundamentals |