Exhibit 99.1

Glossary of Certain Defined Terms

CAISO—California Independent System Operator.

CPUC—California Public Utilities Commission.

Clean Air Act—Federal Clean Air Act.

EBITDA—Earnings before interest, taxes, depreciation and amortization.

GAAP—United States generally accepted accounting principles.

GenOn—GenOn Energy, Inc.

Gross Margin—Operating revenue less cost of fuel, electricity and other products, excluding depreciation and amortization.

IBEW—International Brotherhood of Electrical Workers.

ISO—Independent System Operator.

ISONE—Independent System Operator-New England.

kW—Kilowatt.

MDE—Maryland Department of the Environment.

Merger Agreement—The agreement and plan of merger into which Mirant Corporation entered with RRI Energy, Inc. and RRI Energy Holdings, Inc. on April 11, 2010.

Mirant—Mirant Corporation and, except where the context indicates otherwise, its subsidiaries.

Mirant Chalk Point—Mirant Chalk Point, LLC.

Mirant Marsh Landing—Mirant Marsh Landing, LLC.

Mirant Mid-Atlantic—Mirant Mid-Atlantic, LLC and, except where the context indicates otherwise, its subsidiaries.

MISO—Midwest Independent Transmission System Operator

MW—Megawatt.

NYISO—New York Independent System Operator

PG&E—Pacific Gas & Electric Company.

PJM—PJM Interconnection, LLC.

RRI—RRI Energy, Inc.

RTO—Regional Transmission Organization.

SEC—United States Securities and Exchange Commission.

In this exhibit, unless the context otherwise requires, (i) “we,” “us,” “our” and the “combined company” refer collectively to GenOn Energy, Inc. and its subsidiaries (including RRI and Mirant and its subsidiaries) after the completion of the transactions, including the merger, (ii) “RRI” refers to RRI Energy, Inc. and its subsidiaries and (iii) “Mirant” refers to Mirant Corporation and its subsidiaries.

Mirant’s Capacity and Power Purchase Agreement Revenues

At June 30, 2010, Mirant had total capacity and power purchase agreement revenues fixed for 2010 to 2013 of $1.5 billion.

Ratio of Earnings to Fixed Charges (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Years Ended December 31, | | | Six Months

Ended June 30, | | | Twelve

Months

Ended

June 30, | |

(In Millions, except ratio amounts) | | 2005(2) | | | 2006 | | | 2007 | | | 2008 | | | 2009 | | | 2009 | | | 2010 | | | 2010 | |

Fixed charges: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest expense(1) | | $ | 1,404 | | | $ | 289 | | | $ | 247 | | | $ | 189 | | | $ | 138 | | | $ | 72 | | | $ | 99 | | | $ | 165 | |

Interest capitalized | | | — | | | | 9 | | | | 25 | | | | 48 | | | | 72 | | | | 33 | | | | 3 | | | | 42 | |

Interest within rental expense | | | 44 | | | | 44 | | | | 44 | | | | 44 | | | | 44 | | | | 22 | | | | 22 | | | | 44 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total fixed charges | | $ | 1,448 | | | $ | 342 | | | $ | 316 | | | $ | 281 | | | $ | 254 | | | $ | 127 | | | $ | 124 | | | $ | 251 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Earnings from continuing operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) from continuing operations before reorganization items, net and income taxes | | $ | (1,421 | ) | | $ | 1,038 | | | $ | 440 | | | $ | 1,217 | | | $ | 506 | | | $ | 551 | | | $ | 145 | | | $ | 100 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Plus: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Fixed charges from above | | | 1,448 | | | | 342 | | | | 316 | | | | 281 | | | | 254 | | | | 127 | | | | 124 | | | | 251 | |

Amortization of interest capitalized | | | — | | | | — | | | | 1 | | | | 1 | | | | 3 | | | | 1 | | | | 3 | | | | 5 | |

Less: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest capitalized | | | — | | | | (9 | ) | | | (25 | ) | | | (48 | ) | | | (72 | ) | | | (33 | ) | | | (3 | ) | | | (42 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total earnings | | $ | 27 | | | $ | 1,371 | | | $ | 732 | | | $ | 1,451 | | | $ | 691 | | | $ | 646 | | | $ | 269 | | | $ | 314 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Ratio of earnings from continuing operations to fixed charges | | | — | | | | 4.01 | | | | 2.32 | | | | 5.16 | | | | 2.72 | | | | 5.09 | | | | 2.17 | | | | 1.25 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Includes amortization of discounts, premiums and debt issuance costs. |

| (2) | For 2005, our earnings were insufficient to cover our fixed charges by $1,421 million. |

Summary Unaudited Pro Forma Condensed Combined Consolidated Financial Data (Unaudited)

Under GAAP, Mirant will be treated as the acquirer for accounting purposes and the merger will be accounted for under the acquisition method of accounting as a purchase by Mirant of RRI.

The following table sets forth summary unaudited pro forma condensed combined consolidated financial data of Mirant. The pro forma information has been derived from, and should be read in conjunction with, the “Unaudited pro forma condensed combined consolidated financial statements” and related notes, which are included in the Form S-4 filed by RRI with the SEC on May 28, 2010, as amended on July 6, 2010 and August 12, 2010 and as may be amended from time to time, and give pro forma effect to the transactions.

The following summary unaudited pro forma condensed combined consolidated statements of operations data of Mirant for the six months ended June 30, 2009 and 2010, the year ended December 31, 2009 and for the twelve months ended June 30, 2010, have been prepared to give effect to the transactions as if the transactions had been completed on January 1, 2009. The unaudited pro forma condensed combined consolidated balance sheet data at June 30, 2010, of Mirant has been prepared to give effect to the transactions as if the transactions had been completed on June 30, 2010. The pro forma financial information presented herein for the twelve months, or LTM, period ended June 30, 2010 has been obtained by subtracting the pro forma data for the six months ended June 30, 2009 from the pro forma data for the year ended December 31, 2009 and then adding the pro forma data for the six months ended June 30, 2010. The merger will be accounted for as a reverse acquisition of RRI by Mirant under the acquisition method of accounting of GAAP.

The pro forma adjustments related to the transactions are preliminary and based upon information obtained to date and assumptions that we think are reasonable. The actual adjustments will be made as of the closing date of the transactions and may differ from those reflected in the summary unaudited pro forma condensed combined consolidated financial data presented below. Such differences may be material.

The summary unaudited pro forma condensed combined consolidated financial information is provided for illustrative purposes only and does not purport to represent what the actual consolidated results of operations or the consolidated financial position of Mirant would have been had the transactions occurred on the dates assumed, nor are they necessarily indicative of future consolidated results of operations or consolidated financial position. Future results may vary significantly from the results reflected because of various factors, including those discussed in the section entitled “Risk factors.”

| | | | | | | | | | | | | | | | |

(Dollars in millions) | | Pro forma

year ended

December 31,

2009 | | | Pro forma

six months

ended

June 30, 2009 | | | Pro forma

six months ended

June 30, 2010 | | | Pro forma

twelve months

ended June

30, 2010 | |

Statements of operations data: | | | | | | | | | | | | | | | | |

Operating revenues | | $ | 4,111 | | | $ | 2,218 | | | $ | 2,117 | | | $ | 4,010 | |

Gross margin (excluding depreciation and amortization) | | | 2,290 | | | | 1,199 | | | | 1,122 | | | | 2,213 | |

Depreciation and amortization | | | (330 | ) | | | (163 | ) | | | (199 | ) | | | (366 | ) |

Total operating expenses | | | 1,952 | | | | 761 | | | | 1,148 | | | | 2,339 | |

Operating income (loss) | | | 338 | | | | 438 | | | | (26 | ) | | | (126 | ) |

Income (loss) from continuing operations | | | (42 | ) | | | 253 | | | | (233 | ) | | | (528 | ) |

| | | | |

Balance sheet data (at period end): | | | | | | | | | | | | | | | | |

Cash and cash equivalents(a) | | | | | | | | | | $ | 2,489 | | | | | |

Working capital | | | | | | | | | | | 2,554 | | | | | |

Total assets | | | | | | | | | | | 14,490 | | | | | |

Total debt(b) | | | | | | | | | | | 4,568 | | | | | |

Total net debt(c) | | | | | | | | | | | 2,079 | | | | | |

Total stockholders’ equity | | | | | | | | | | | 6,422 | | | | | |

| | | | |

Other financial data: | | | | | | | | | | | | | | | | |

Capital expenditures | | $ | (866 | ) | | $ | (493 | ) | | $ | (210 | ) | | $ | (583 | ) |

EBITDA(d) | | | 661 | | | | 600 | | | | 174 | | | | 235 | |

Adjusted EBITDA(d) | | | 931 | | | | 350 | | | | 335 | | | | 916 | |

Cash paid for interest(e) | | | 268 | | | | 129 | | | | 137 | | | | 276 | |

Ratio of earnings to fixed charges(f) | | | — | | | | 1.78 | | | | — | | | | — | |

Ratio of Adjusted EBITDA to cash paid for interest | | | 3.47 | | | | 2.71 | | | | 2.45 | | | | 3.32 | |

Ratio of total net debt to Adjusted EBITDA | | | n/a | | | | n/a | | | | n/a | | | | 2.27 | |

| (a) | Includes $75 million of cash to be paid for merger-related expenses. |

| (b) | Includes fair value adjustment of $38 million. |

| (c) | Calculated as total debt less cash and cash equivalents. |

| (d) | EBITDA is defined as net income before interest, taxes, depreciation and amortization. Pro forma combined Adjusted EBITDA is calculated by adjusting EBITDA with the adjustments identified in the reconciliation table below. Adjusted EBITDA is a measure commonly used in the combined company’s industry. Management of the combined company views Adjusted EBITDA as an operating performance measure that provides investors and analysts with a measure of operating results unaffected by differences in capital structures, capital investment cycles and ages of related assets among otherwise comparable companies. In addition, management of the combined company thinks that Adjusted EBITDA eliminates the volatility created by significant shifts in the value of derivative financial instruments and inventories between periods. |

| (e) | See footnote 5 of “Unaudited pro forma condensed combined consolidated financial statements” and related notes, which are included in the Form S-4 filed by RRI with the SEC on May 28, 2010, as amended on July 6, 2010 and August 12, 2010 and as may be amended from time to time. |

| (f) | For 2009, for the six months ended June 30, 2010 and for the twelve months ended June 30, 2010, pro forma combined earnings were insufficient to cover fixed charges by $155 million, $256 million and $620 million, respectively. |

Pro forma combined Adjusted EBITDA is reconciled to income (loss) from continuing operations, the most directly comparable GAAP financial measure, as follows:

| | | | | | | | | | | | | | | | |

(Dollars in millions) | | Pro forma

year ended

December 31,

2009 | | | Pro forma

six months

ended

June 30, 2009 | | | Pro forma

six months

ended

June 30, 2010 | | | Pro forma

twelve

months ended

June 30, 2010 | |

Income (loss) from continuing operations | | $ | (42 | ) | | $ | 253 | | | $ | (233 | ) | | $ | (528 | ) |

Interest expense, net | | | 366 | | | | 176 | | | | 207 | | | | 397 | |

Provision for income taxes | | | 7 | | | | 8 | | | | 1 | | | | — | |

Depreciation and amortization | | | 330 | | | | 163 | | | | 199 | | | | 366 | |

| | | | | | | | | | | | | | | | |

EBITDA | | | 661 | | | | 600 | | | | 174 | | | | 235 | |

Unrealized (gains) losses | | | (69 | ) | | | (203 | ) | | | (73 | ) | | | 61 | |

Western states litigation and similar settlements | | | — | | | | — | | | | 17 | | | | 17 | |

Merger-related costs | | | — | | | | — | | | | 19 | | | | 19 | |

Severance and bonus plan for dispositions | | | 22 | | | | 18 | | | | 2 | | | | 6 | |

Impairment charges | | | 432 | �� | | | — | | | | 248 | | | | 680 | |

Debt extinguishments (gains) losses | | | 8 | | | | (1 | ) | | | — | | | | 9 | |

Bankruptcy charges and legal contingencies | | | (62 | ) | | | (62 | ) | | | 1 | | | | 1 | |

Lower of cost or market inventory adjustments, net | | | (37 | ) | | | (1 | ) | | | (11 | ) | | | (47 | ) |

Postretirement benefit curtailment gain | | | (3 | ) | | | — | | | | (37 | ) | | | (40 | ) |

Lovett shut down costs | | | 5 | | | | — | | | | — | | | | 5 | |

Fair value adjustments for various contracts and other assets and liabilities | | | 5 | | | | 5 | | | | (4 | ) | | | (4 | ) |

Pension and postretirement benefit amounts previously recognized in accumulated other comprehensive loss | | | (9 | ) | | | (3 | ) | | | (1 | ) | | | (7 | ) |

Cash emission costs | | | (23 | ) | | | (6 | ) | | | — | | | | (17 | ) |

Other | | | 1 | | | | 3 | | | | — | | | | (2 | ) |

| | | | | | | | | | | | | | | | |

Adjusted EBITDA | | $ | 931 | | | $ | 350 | | | $ | 335 | | | $ | 916 | |

| | | | | | | | | | | | | | | | |

Mirant’s Net Capacity Factors

The table below presents Mirant’s Net Capacity Factor for the twelve months ended June 30, 2010:

| | | |

Region | | Net Capacity Factor | |

Mid-Atlantic | | 30 | % |

Northeast | | 7 | % |

California | | 4 | % |

Mirant Marsh Landing

On September 2, 2009, Mirant Marsh Landing entered into a ten-year power purchase agreement with PG&E for 760 MW of natural gas-fired peaking generation to be constructed adjacent to Mirant’s Contra Costa generating facility near Antioch, California. Construction of the Marsh Landing generating facility is scheduled to begin in late 2010 and is expected to be completed by mid-2013.

During the ten-year term of the power purchase agreement, Mirant Marsh Landing will receive fixed monthly capacity payments and variable operating payments. The contract provides PG&E with the entire output of the 760 MW generating facility, which will be capable of producing 719 MW during peak July conditions. The California Energy Commission also issued its preliminary approval of environmental permits on July 23, 2010, with final approval issued on August 25, 2010. On September 2, 2010, Californians for Renewable Energy (“CARE”) filed an application for rehearing of the CPUC approval of the power purchase agreement on July 29, 2010. Under the terms of the power purchase agreement, either party may terminate the agreement if the CPUC approval of the power purchase agreement is not final and non-appealable by September 30, 2010. Although Mirant Marsh Landing does not anticipate that either party will exercise such right during the pendency of the review of the application for rehearing filed by CARE, there can be no assurance to such effect. Further, although Mirant Marsh Landing does not anticipate that any resulting delays in the issuances of notices to proceed to vendors and contractors arising out of any delays in the resolution of the CARE application, or the finalization of any other required governmental permits and approvals, will have a material adverse effect on the Marsh Landing project, there can be no assurance to such effect.

Contra Costa Toll Extension

On September 2, 2009, Mirant Delta entered into a new agreement with PG&E for the 674 MW of Contra Costa units 6 and 7 for the period from November 2011 through April 2013. At the end of the agreement, and subject to any necessary regulatory approval, Mirant Delta has agreed to retire Contra Costa units 6 and 7, which began operations in 1964, in furtherance of state and federal policies to retire aging power plants that utilize once-through cooling technology. On September 2, 2010, Californians for Renewable Energy filed an application for rehearing of the CPUC approval of the new Mirant Delta agreement on July 29, 2010.

ISONE Forward Capacity Market Annual Capacity Auctions

The results of the ISONE forward capacity market annual capacity auctions were as follows:

| | | | | |

Auction Date | | Capacity Period | | Price per kW-month |

February 2008 | | June 1, 2010 to May 31, 2011 | | $ | 4.25 |

December 2008 | | June 1, 2011 to May 31, 2012 | | $ | 3.12 |

October 2009 | | June 1, 2012 to May 31, 2013 | | $ | 2.54 |

August 2010 | | June 1, 2013 to May 31, 2014 | | $ | 2.52 |

New York Collective Bargaining Agreement

In August 2010, Mirant entered into a new collective bargaining agreement with its New York employees represented by IBEW Local 503. The previous collective bargaining agreement expired on June 1, 2008. After reaching an impasse in its negotiations with the union, Mirant imposed terms effective January 28, 2009, under which the employees worked without disruption. The new agreement is substantially the same as the imposed contract and expires on April 30, 2013.

Suit Regarding Chalk Point Emissions

On June 25, 2009, the Chesapeake Climate Action Network and four individuals filed a complaint against Mirant Mid-Atlantic and Mirant Chalk Point in the United States District Court for the District of

Maryland. The plaintiffs allege that Mirant Chalk Point has violated the Clean Air Act and Maryland environmental regulations by failing to install controls to limit emissions of particulate matter on unit 3 and unit 4 of the Chalk Point generating facility, which at times burn residual fuel oil. The plaintiffs seek to enjoin the alleged violations, to obtain civil penalties of up to $32,500 per day for past noncompliance and to recover attorneys’ fees. Mirant Mid-Atlantic and Mirant Chalk Point dispute the plaintiffs’ allegations of violations of the Clean Air Act and Maryland environmental regulations. On October 13, 2009, Mirant Mid-Atlantic and Mirant Chalk Point filed a motion seeking dismissal of the complaint on the grounds that it was barred (1) under principles of res judicata by the dismissal with prejudice in January 2007 of similar claims filed by environmental advocacy organizations asserting that emissions from Chalk Point units 3 and 4 violated the Clean Air Act and (2) by actions taken by the MDE currently and over a number of years to ensure compliance by Chalk Point units 3 and 4 with regulations under the Clean Air Act and Maryland law limiting emissions of particulate matter. On August 13, 2010, the district court granted the motion to dismiss based upon MDE’s diligent prosecution of the particulate emissions standard.

Business of Combined Company

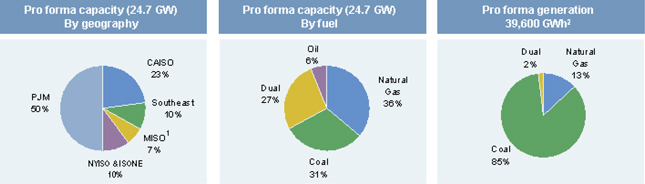

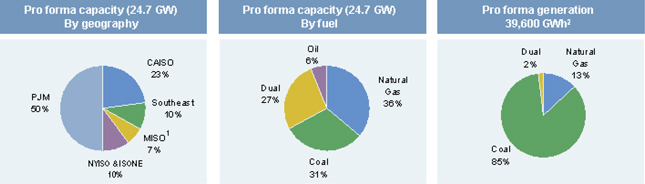

Generating facilities.With over 24,600 MW of electric generating capacity, we will operate across various fuel and technology types, operating characteristics and regional power markets. At June 30, 2010, our generating capacity would have been 50% in PJM, 23% in CAISO, 10% in the Southeast, 7% in MISO and 10% in NYISO and ISONE. The net generating capacity of these facilities would have consisted of

approximately 34% baseload, 44% intermediate and 22% peaking capacity. The charts below illustrate the composition and diversity of our portfolio by geography and fuel type:

| (1) | Approximately 1,300 MW of our generating capacity will move from MISO to PJM in June 2011. |

| (2) | Pro forma capacity by geography and pro forma capacity by fuel are calculated as of June 30, 2010. Pro forma generation is calculated based on RRI’s and Mirant’s reported results for the year ended December 31, 2009. |

Cautionary Language Regarding Forward-Looking Statements

Some of the statements included herein involve forward-looking information. Mirant cautions that these statements involve known and unknown risks and that there can be no assurance that such results will occur. There are various important factors that could cause actual results to differ materially from those indicated in the forward-looking statements, such as, but not limited to, legislative and regulatory initiatives regarding deregulation, regulation or restructuring of the industry of generating, transmitting and distributing electricity (the “electricity industry”); changes in state, federal and other regulations affecting the electricity industry (including rate and other regulations); changes in, or changes in the application of, environmental and other laws and regulations to which Mirant and its subsidiaries and affiliates are or could become subject; the failure of Mirant’s plants to perform as expected, including outages for unscheduled maintenance or repair; environmental regulations that restrict Mirant’s ability or render it uneconomic to operate its business, including regulations related to the emission of CO2 and other greenhouse gases; increased regulation that limits Mirant’s access to adequate water supplies and landfill options needed to support power generation or that increases the costs of cooling water and handling, transporting and disposing off-site of ash and other byproducts; changes in market conditions, including developments in the supply, demand, volume and pricing of electricity and other commodities in the energy markets, including efforts to reduce demand for electricity and to encourage the development of renewable sources of electricity, and the extent and timing of the entry of additional competition in our markets; continued poor economic and financial market conditions, including impacts on financial institutions and other current and potential counterparties and negative impacts on liquidity in the power and fuel markets in which Mirant and its subsidiaries hedge and transact; increased credit standards, margin requirements, market volatility or other market conditions that could increase Mirant’s obligations to post collateral beyond amounts that are expected, including additional collateral costs associated with over-the-counter hedging activities as a result of new or proposed rules and regulations governing derivative financial instruments; Mirant’s inability to access effectively the over-the-counter and exchange-based commodity markets or changes in commodity market conditions and liquidity, including as a result of new or proposed rules and regulations governing derivative financial instruments, which may affect Mirant’s ability to engage in asset management, proprietary trading and fuel oil management activities as expected, or result in material gains or losses from open positions; deterioration in the financial condition of Mirant’s counterparties and the failure of such parties to pay amounts owed to Mirant or to perform obligations or services due to Mirant beyond collateral posted; hazards customary to the power generation industry and the possibility that Mirant may not have adequate insurance to cover losses resulting from such hazards or the inability of Mirant’s insurers to provide agreed upon coverage; the expected timing and likelihood of completion of the proposed merger with RRI Energy, including the timing, receipt and terms and conditions of required stockholder, governmental and regulatory approvals that may reduce anticipated benefits or cause the parties to abandon the merger; the ability of the parties to arrange debt financing in an amount sufficient to fund the refinancing contemplated in, and on terms consistent with, the Merger Agreement; the diversion of management’s time and attention from our ongoing business during the time we are seeking to complete the merger; the ability to maintain relationships with employees, customers and suppliers; the ability to integrate successfully the businesses and realize cost savings and any other synergies; and the risk that credit ratings of the combined company or its subsidiaries may be different from what the companies expect; price mitigation strategies employed by ISOs or RTOs that reduce Mirant’s revenue and may result in a failure to compensate Mirant’s generating units adequately for all of their costs; changes in the rules used to calculate capacity, energy and ancillary services payments; legal and political challenges to the rules used to calculate capacity, energy and ancillary services payments; volatility in Mirant’s gross margin as a result of Mirant’s accounting for derivative financial instruments used in its asset management, proprietary trading and fuel oil management activities and volatility in its cash flow from operations resulting from working capital requirements, including collateral, to support its asset management, proprietary trading and fuel oil management activities; Mirant’s ability to enter into intermediate and long-term contracts to sell power or to hedge our future expected generation of power, and to obtain adequate supply and delivery of fuel for its generating facilities, at Mirant’s required specifications and on terms and prices acceptable to it; the failure to utilize new or advancements in power generation technologies; the inability of Mirant’s operating subsidiaries to generate sufficient cash flow to support its operations; the potential limitation or loss of Mirant’s net operating losses notwithstanding a continuation of its stockholder rights plan; Mirant’s ability to borrow additional funds and access capital

markets; strikes, union activity or labor unrest; Mirant’s ability to obtain or develop capable leaders and its ability to retain or replace the services of key employees; weather and other natural phenomena, including hurricanes and earthquakes; the cost and availability of emissions allowances; curtailment of operations and reduced prices for electricity resulting from transmission constraints; Mirant’s ability to execute its business plan in California, including entering into new tolling arrangements in respect of its existing generating facilities; Mirant’s ability to execute its development plan in respect of its Marsh Landing generating facility, including obtaining the permits necessary for construction and operation of the generating facility, securing the necessary project financing for construction of the generating facility, and completing the construction of the generating facility by May 2013; Mirant’s relative lack of geographic diversification of revenue sources resulting in concentrated exposure to the Mirant Mid-Atlantic market; the ability of lenders under Mirant North America’s revolving credit facility to perform their obligations; war, terrorist activities, cyberterrorism and inadequate cybersecurity, or the occurrence of a catastrophic loss; the failure to provide a safe working environment for Mirant’s employees and visitors thereby increasing Mirant’s exposure to additional liability, loss of productive time, other costs, and a damaged reputation; Mirant’s consolidated indebtedness and the possibility that Mirant or its subsidiaries may incur additional indebtedness in the future; restrictions on the ability of Mirant’s subsidiaries to pay dividends, make distributions or otherwise transfer funds to Mirant, including restrictions on Mirant North America contained in its financing agreements and restrictions on Mirant Mid-Atlantic contained in its leveraged lease documents, which may affect Mirant’s ability to access the cash flows of those subsidiaries to make debt service and other payments; the failure to comply with, or monitor provisions of Mirant’s loan agreements and debt may lead to a breach and, if not remedied, result in an event of default thereunder, which would limit access to needed capital and damage Mirant’s reputation and relationships with financial institutions; and the disposition of the pending litigation described in Mirant’s Form 10-Q for the quarter ended June 30, 2010, filed with the Securities and Exchange Commission.

Mirant undertakes no obligation to update publicly or revise any forward-looking statements to reflect events or circumstances that may arise. The foregoing review of factors that could cause Mirant’s actual results to differ materially from those contemplated in the forward-looking statements included in this news release should be considered in connection with information regarding risks and uncertainties that may affect Mirant’s future results included in Mirant’s filings with the Securities and Exchange Commission atwww.sec.gov .

Additional Information and Where to Find It

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. In connection with the proposed merger between RRI Energy and Mirant, on May 28, 2010, RRI Energy filed with the SEC a Registration Statement on Form S-4 that includes a preliminary joint proxy statement of RRI Energy and Mirant and that also constitutes a preliminary prospectus of RRI Energy. On July 6, 2010 and August 12, 2010, RRI Energy amended these materials. These materials are not yet final and will be further amended. RRI Energy and Mirant will distribute the final joint proxy statement/prospectus to their respective shareholders. RRI Energy and Mirant urge investors and shareholders to read the registration statement, and any other relevant documents filed with the SEC, including the preliminary joint proxy statement/prospectus that is a part of the registration statement, and the definitive joint proxy statement/prospectus, when available, because they contain or will contain important information. You may obtain copies of all documents filed with the SEC regarding this transaction, free of charge, at the SEC’s website (www.sec.gov). You may also obtain these documents, free of charge, from RRI Energy’s website (www.rrienergy.com) under the tab “Investor Relations” and then under the heading “Company Filings.” You may also obtain these documents, free of charge, from Mirant’s website (www.mirant.com) under the tab “Investor Relations” and then under the heading “SEC Filings.”

Participants in the Merger Solicitation

RRI Energy, Mirant, and their respective directors, executive officers and certain other members of management and employees may be soliciting proxies from RRI Energy and Mirant shareholders in favor

of the merger and related matters. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of RRI Energy and Mirant shareholders in connection with the proposed merger is contained in the preliminary joint proxy statement/prospectus and will be contained in the definitive joint proxy statement/prospectus when it becomes available. You can find information about RRI Energy’s executive officers and directors in its definitive proxy statement filed with the SEC on April 1, 2010. You can find information about Mirant’s executive officers and directors in its definitive proxy statement filed with the SEC on March 26, 2010 and supplemented on April 28, 2010. Additional information about RRI Energy’s executive officers and directors and Mirant’s executive officers and directors can be found in the above-referenced Registration Statement on Form S-4. You can obtain free copies of these documents from RRI Energy and Mirant as described above.