Filed by Mirant Corporation

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

of the Securities Exchange Act of 1934, as amended

Subject Company: Mirant Corporation

(Commission File No. 001-16107)

Cautionary Language Regarding Forward-Looking Statements

Some of the statements included herein involve forward-looking information. Mirant cautions that these statements involve known and unknown risks and that there can be no assurance that such results will occur. There are various important factors that could cause actual results to differ materially from those indicated in the forward-looking statements, such as, but not limited to, legislative and regulatory initiatives regarding deregulation, regulation or restructuring of the industry of generating, transmitting and distributing electricity (the “electricity industry”); changes in state, federal and other regulations affecting the electricity industry (including rate and other regulations); changes in, or changes in the application of, environmental and other laws and regulations to which Mirant and its subsidiaries and affiliates are or could become subject; the failure of Mirant’s plants to perform as expected, including outages for unscheduled maintenance or repair; environmental regulations that restrict Mirant’s ability or render it uneconomic to operate its plants, including regulations related to the emission of CO2 and other greenhouse gases; increased regulation that limits Mirant’s access to adequate water supplies and landfill options needed to support power generation or that increases the costs of cooling water and handling, transporting and disposing off-site of ash and other byproducts; changes in market conditions, including developments in the supply, demand, volume and pricing of electricity and other commodities in the energy markets, including efforts to reduce demand for electricity and to encourage the development of renewable sources of electricity, and the extent and timing of the entry of additional competition in our markets; continued poor economic and financial market conditions, including impacts on financial institutions and other current and potential counterparties and negative impacts on liquidity in the power and fuel markets in which Mirant and its subsidiaries hedge and transact; increased credit standards, margin requirements, market volatility or other market conditions that could increase Mirant’s obligations to post collateral beyond amounts that are expected, including additional collateral costs associated with over-the-counter hedging activities as a result of new or proposed rules and regulations governing derivative financial instruments, including those resulting from the Dodd-Frank Wall Street Reform and Consumer Protection Act; Mirant’s inability to access effectively the over-the-counter and exchange-based commodity markets or changes in commodity market conditions and liquidity, including as a result of new or proposed rules and regulations governing derivative financial instruments, including those resulting from the Dodd-Frank Wall Street Reform and Consumer Protection Act, which may affect Mirant’s ability to engage in asset management, proprietary trading and fuel oil management activities as expected, or result in material gains or losses from open positions; deterioration in the financial condition of Mirant’s counterparties and the failure of such parties to pay amounts owed to Mirant or to perform obligations or services due to Mirant beyond collateral posted; hazards customary to the power generation industry and the possibility that Mirant may not have adequate insurance to cover losses resulting from such hazards or the inability of Mirant’s insurers to provide agreed upon coverage; the expected

timing and likelihood of completion of the proposed merger with RRI Energy, including the timing, receipt and terms and conditions of required, governmental and regulatory approvals that may reduce anticipated benefits or cause the parties to abandon the merger; the diversion of management’s time and attention from our ongoing business during the time we are seeking to complete the merger; the ability to maintain relationships with employees, customers and suppliers; the ability to integrate successfully the businesses and realize cost savings and any other synergies; and the risk that credit ratings of the combined company or its subsidiaries may be different from what the companies expect; price mitigation strategies employed by ISOs or RTOs that reduce Mirant’s revenue and may result in a failure to compensate Mirant’s generating units adequately for all of their costs; changes in the rules used to calculate capacity, energy and ancillary services payments; legal and political challenges to the rules used to calculate capacity, energy and ancillary services payments; volatility in Mirant’s gross margin as a result of Mirant’s accounting for derivative financial instruments used in its asset management, proprietary trading and fuel oil management activities and volatility in its cash flow from operations resulting from working capital requirements, including collateral, to support its asset management, proprietary trading and fuel oil management activities; Mirant’s ability to enter into intermediate and long-term contracts to sell power or to hedge our future expected generation of power, and to obtain adequate supply and delivery of fuel for its generating facilities, at Mirant’s required specifications and on terms and prices acceptable to it; the failure to utilize new or advancements in power generation technologies; the inability of Mirant’s operating subsidiaries to generate sufficient cash flow to support its operations; the potential limitation or loss of Mirant’s net operating losses notwithstanding a continuation of its stockholder rights plan; Mirant’s ability to borrow additional funds and access capital markets; strikes, union activity or labor unrest; Mirant’s ability to obtain or develop capable leaders and its ability to retain or replace the services of key employees; weather and other natural phenomena, including hurricanes and earthquakes; the cost and availability of emissions allowances; curtailment of operations and reduced prices for electricity resulting from transmission constraints; Mirant’s ability to execute its business plan in California, including entering into new tolling arrangements in respect of its existing generating facilities; Mirant’s ability to execute its development plan in respect of its Marsh Landing generating facility, including obtaining the permits necessary for construction and operation of the generating facility and completing the construction of the generating facility by mid-2013; the ability of Mirant Marsh Landing to meet the conditions to draw under the Marsh Landing credit agreement; the ability of lenders under the Marsh Landing credit facility to fund the Marsh Landing credit agreement; Mirant’s relative lack of geographic diversification of revenue sources resulting in concentrated exposure to the Mirant Mid-Atlantic market; the ability of lenders under Mirant North America’s revolving credit facility to perform their obligations; war, terrorist activities, cyberterrorism and inadequate cybersecurity, or the occurrence of a catastrophic loss; the failure to provide a safe working environment for Mirant’s employees and visitors thereby increasing Mirant’s exposure to additional liability, loss of productive time, other costs, and a damaged reputation; Mirant’s consolidated indebtedness and the possibility that Mirant or its subsidiaries may incur additional indebtedness in the future; restrictions on the ability of Mirant’s subsidiaries to pay dividends, make distributions or otherwise transfer funds to Mirant, including restrictions on Mirant North America contained in its financing agreements and restrictions on Mirant Mid-Atlantic contained in its leveraged lease documents, which may affect Mirant’s ability to access the cash flows of those subsidiaries to make debt service and other

payments; the failure to comply with, or monitor provisions of Mirant’s loan agreements and debt may lead to a breach and, if not remedied, result in an event of default thereunder, which would limit access to needed capital and damage Mirant’s reputation and relationships with financial institutions; and the disposition of the pending litigation described in Mirant’s Form 10-Q for the quarter ended September 30, 2010, filed with the Securities and Exchange Commission.

Mirant undertakes no obligation to update publicly or revise any forward-looking statements to reflect events or circumstances that may arise. The foregoing review of factors that could cause Mirant’s actual results to differ materially from those contemplated in the forward-looking statements included in this news release should be considered in connection with information regarding risks and uncertainties that may affect Mirant’s future results included in Mirant’s filings with the Securities and Exchange Commission atwww.sec.gov.

Additional Information and Where To Find It

In connection with the proposed merger between RRI Energy and Mirant, RRI Energy filed with the SEC a registration statement on Form S-4 that includes a joint proxy statement of RRI Energy and Mirant and that also constitutes a prospectus of RRI Energy. The registration statement was declared effective by the SEC on September 13, 2010. RRI Energy and Mirant urge investors and shareholders to read the registration statement, and any other relevant documents filed with the SEC, including the joint proxy statement/prospectus that is a part of the registration statement, because they contain important information. You may obtain copies of all documents filed with the SEC regarding this transaction, free of charge, at the SEC’s website (www.sec.gov). You may also obtain these documents, free of charge, from RRI Energy’s website (www.rrienergy.com) under the tab “Investor Relations” and then under the heading “Company Filings” and from Mirant’s website (www.mirant.com) under the tab “Investor Relations” and then under the heading “SEC Filings.”

|

Dickerson Generating Station Mirant Corporation Third Quarter 2010 Earnings Results November 5, 2010 |

|

2 Forward-Looking Statements This presentation may contain statements, estimates or projections that constitute “forward-looking statements” as defined under U.S. federal securities laws. In some cases, one can identify forward-looking statements by terminology such as “will,” “expect,” “plan,” “lead,” “project” or the negative of these terms or other comparable terminology. Forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from Mirant’s historical experience and our present expectations or projections. These risks include, but are not limited to: (i) legislative and regulatory initiatives relating to the electric utility industry; (ii) changes in, or changes in the application of, environmental or other laws; (iii) failure of our assets to perform as expected, including due to outages for unscheduled maintenance or repair; (iv) changes in market conditions or the entry of additional competition in our markets; (v) the expected timing and likelihood of completion of the proposed merger with RRI Energy, including the timing, receipt and terms and conditions of required governmental and regulatory approvals that may reduce anticipated benefits or cause the parties to abandon the merger; the diversion of management’s time and attention from our ongoing business during the time we are seeking to complete the merger; the ability to maintain relationships with employees, customers and suppliers; the ability to integrate successfully the businesses and realize cost savings and any other synergies; and the risk that credit ratings of the combined company or its subsidiaries may be different from what the companies expect; and (vi) those factors contained in our periodic reports filed with the SEC, including in our Quarterly Report on Form 10-Q for the period ended September 30, 2010. The forward-looking information in this document is given as of this date only, and Mirant assumes no duty to update this information. Safe Harbor Statement |

|

3 Additional Information and Where To Find It In connection with the proposed merger between RRI Energy and Mirant, RRI Energy filed with the SEC a registration statement on Form S-4 that includes a joint proxy statement of RRI Energy and Mirant and that also constitutes a prospectus of RRI Energy. The registration statement was declared effective by the SEC on September 13, 2010. RRI Energy and Mirant urge investors and shareholders to read the registration statement, and any other relevant documents filed with the SEC, including the joint proxy statement/prospectus that is a part of the registration statement, because they contain important information. You may obtain copies of all documents filed with the SEC regarding this transaction, free of charge, at the SEC’s website (www.sec.gov). You may also obtain these documents, free of charge, from RRI Energy’s website (www.rrienergy.com) under the tab “Investor Relations” and then under the heading “Company Filings” and from Mirant’s website (www.mirant.com) under the tab “Investor Relations” and then under the heading “SEC Filings.” Non-GAAP Financial Information The following presentation includes certain “non-GAAP financial measures” as defined in Regulation G under the Securities Exchange Act of 1934. A schedule is attached hereto and is posted on the Company’s website at mirant.com (in the Investor Relations - Presentations section) that reconciles the non-GAAP financial measures included in the following presentation to the most directly comparable financial measures calculated and presented in accordance with Generally Accepted Accounting Principles. In addition, the Company has included a more detailed description of each of the non-GAAP financial measures used in this presentation, together with a discussion of the usefulness and purpose of these measures as Exhibit 99.2 to the Company’s Current Report on Form 8-K furnished to the SEC with its earnings press release. Safe Harbor Statement |

|

4 GenOn Energy – Merger Update Mirant and RRI Energy stockholders approved on October 25, 2010 the proposals related to their proposed merger Entered into agreements on September 20, 2010 for revolving credit facility and merger related financings $788 million five-year revolving credit facility $700 million seven-year term loan $675 million of 9.5% senior unsecured notes due 2018 $550 million of 9.875% senior unsecured notes due 2020 Merger remains subject to Hart-Scott-Rodino clearance by the Department of Justice Merger expected to close by the end of 2010 Operational Performance - Cash Generation - Prudent Growth |

|

5 Financial Highlights ($millions) In Q3, change in Adjusted EBITDA principally attributable to - Lower realized value of hedges - Lower energy gross margins from proprietary trading activities - Lower contracted and capacity revenues - Higher operating costs primarily because of scrubbers installed in December 2009 and the Montgomery County, Maryland CO2 levy imposed on our Dickerson generating facility beginning in May 2010 Higher energy gross margins from generation Adjusted EBITDA 190 311 501 706 Q3 9 Months 2010 2009 2010 2009 Operational Performance - Cash Generation - Prudent Growth |

|

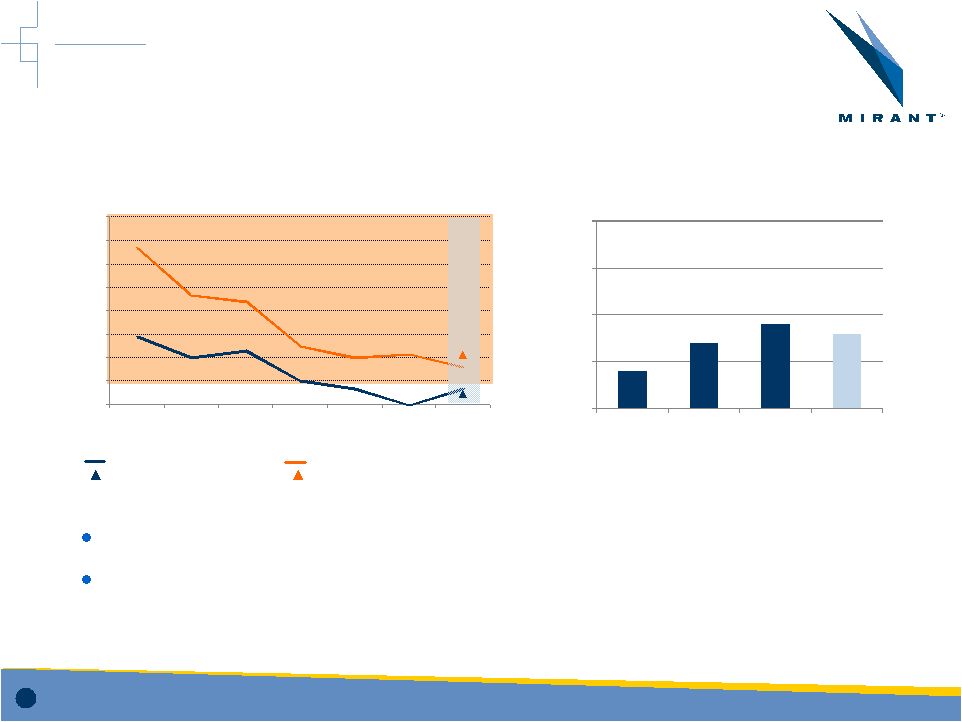

6 1.45 1.01 1.15 0.50 0.34 0 3.35 2.34 2.21 1.24 1.01 1.08 0.00 0.50 1.00 1.50 2.00 2.50 3.00 3.50 4.00 2004 2005 2006 2007 2008 2009 YTD 2010 Operations Highlights Mirant’s safety incident rates remain at low levels Commercial Availability, the percent of maximum achievable energy gross margin that was realized in the period, remains at a high level Commercial Availability Safety Incident Rates Lost Time Incident Rate Lost Time EEI Top Quartile Benchmark Recordable Incident Rate Recordable EEI Top Quartile Benchmark 0.34 0.80 84% 87% 89% 88% 80% 85% 90% 95% 100% 2007 2008 2009 YTD 2010 Operational Performance - Cash Generation - Prudent Growth |

|

7 Market Update Since August Near term (2010 and 2011) Natural gas prices decreased and currently trade around $4.30/mmBtu for 2011 Power prices in PJM decreased but heat rates expanded as power prices declined less than natural gas prices Northern Appalachian coal prices were relatively unchanged and trade around $64/ton for 2011 Dark spreads declined Longer term (2012 – 2015) Natural gas prices decreased and currently trade in a range of $5.00 to $5.80/mmBtu Power prices in PJM decreased but heat rates expanded as power prices declined less than natural gas prices Northern Appalachian coal prices were unchanged and are quoted in a range of $66– $75/ton Dark spreads declined Operational Performance - Cash Generation - Prudent Growth |

|

8 Electricity Markets Reserve Margins Forecasted reserve margins incorporate the latest information from each ISO Eastern markets are forecasted to tighten because little generation is being built Source: Mirant forecasts 8% 12% 16% 20% 24% 28% 32% 36% 40% 2010 2011 2012 2013 2014 New York East N.California PJM East New England PJM RTO (ex. COMED) Target Reserve range Operational Performance - Cash Generation - Prudent Growth |

|

9 Hedge Levels Based on Expected Total Generation Aggregate Baseload Coal 1. Positions as of October 12, 2010 Shaded boxes represent net additions to prior guidance 2. 2010 represents period between November and December 3. Power hedges include hedges with both power and natural gas Operational Performance - Cash Generation - Prudent Growth |

|

10 Marsh Landing Generating Station (760 MW) Total project costs are expected to be approximately $700 million including capital costs and financing fees Directed Kiewit to commence engineering and procurement Construction expected to begin in late 2010 and to be completed by mid-2013 Received approval of PPA with PG&E and all necessary permits to commence construction $650 million project financing closed on October 8, 2010 Includes $500 million construction and term loan and $150 million of letter of credit facilities Operational Performance - Cash Generation - Prudent Growth |

|

11 Pittsburg Generating Station Mirant entered into a new tolling agreement with PG&E on October 28, 2010 to provide electricity from Pittsburg units 5, 6, and 7 Agreement is for total capacity of 1,159 MW for three years commencing January 1, 2011 Includes options for PG&E to extend agreements for each of 2014 and 2015 Operational Performance - Cash Generation - Prudent Growth |

|

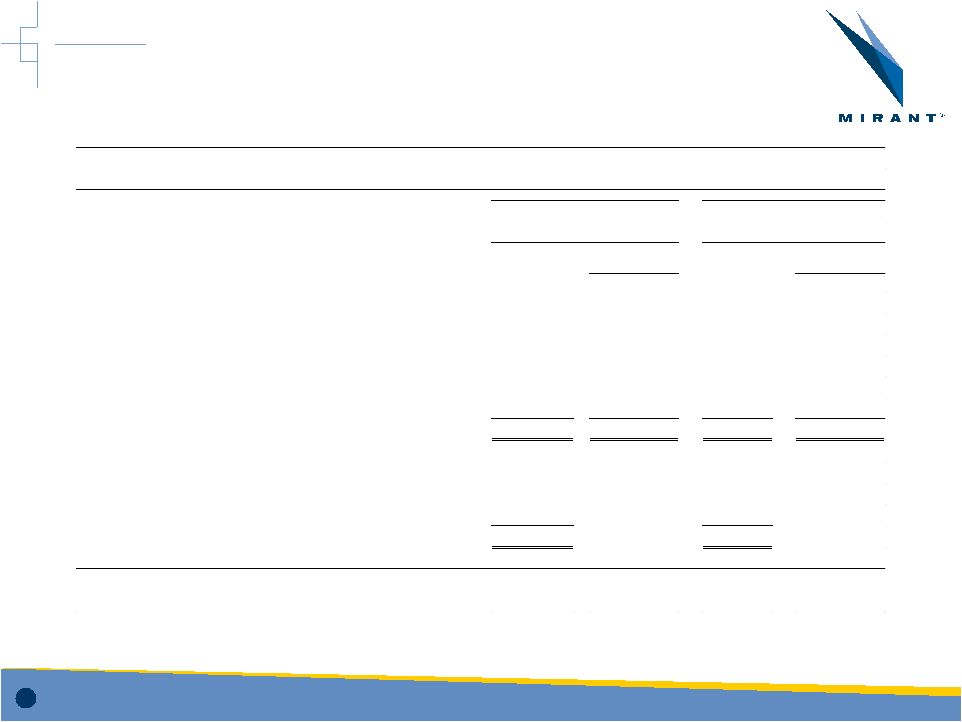

12 Financial Results (millions, except per share amounts) 9 Months 2010 2009 2010 2009 Net income 254 $ 55 $ 398 $ 598 $ Unrealized (gains) losses on derivatives (167) 174 (179) (66) Bankruptcy charges and legal contingencies (1) - - (62) Postretirement benefit curtailment gain - - (37) - Other - 9 11 14 Adjusted net income 86 238 193 484 Interest, taxes, depreciation & amortization 104 73 308 222 Adjusted EBITDA 190 $ 311 $ 501 $ 706 $ Diluted weighted average shares outstanding 146 146 146 145 Earnings per share: Net income 1.74 $ 0.38 $ 2.73 $ 4.12 $ Adjusted net income 0.59 $ 1.63 $ 1.32 $ 3.34 $ Q3 Operational Performance - Cash Generation - Prudent Growth |

|

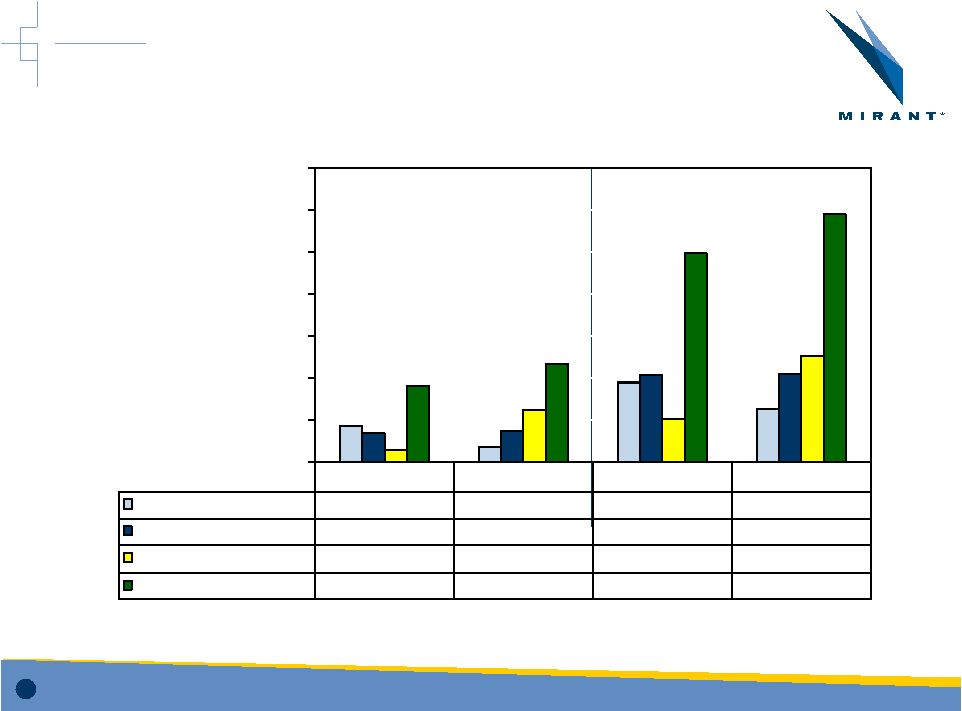

13 Realized Gross Margin (millions) Operational Performance - Cash Generation - Prudent Growth Q3 2010 Q3 2009 YTD 2010 YTD 2009 Energy 171 72 377 254 Contracted & Capacity 135 147 415 418 Realized Value of Hedges 55 247 202 507 Total Realized Gross Margin 361 466 994 1,179 $361 $466 $994 $1,179 $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 |

|

14 Adjusted Free Cash Flow (millions, except per share amounts) 2010 2009 2010 2009 Net cash provided by operating activities 193 $ 342 $ 343 $ 726 $ Bankruptcy claim payments - - - 1 Emission allowance sales proceeds - 3 3 20 Capitalized interest - (2) (3) (35) Adjusted net cash provided by operating activities 193 343 343 712 Capital expenditures, excluding capitalized interest (54) (128) (211) (473) Adjusted free cash flow 139 215 132 239 MD Healthy Air Act capital expenditures 32 88 109 336 Marsh Landing capital expenditures and working capital 82 16 84 16 Adjusted free cash flow (w/o MD HAA & Marsh Landing) 253 $ 319 $ 325 $ 591 $ Diluted weighted average shares outstanding 146 146 146 145 Adjusted free cash flow per share (w/o MD HAA & Marsh Landing) 1.73 $ 2.18 $ 2.23 $ 4.08 $ 9 Months Q3 Operational Performance - Cash Generation - Prudent Growth |

|

15 Consolidated Debt and Liquidity (millions) Debt $ 2,561 Cash and cash equivalents Mirant Corporation 1,421 $ Mirant Americas Generation 19 Mirant North America 245 Mirant Mid-Atlantic 273 Other 31 Total cash and cash equivalents 1,989 Less restricted and reserved (11) Available cash & cash equivalents 1,978 Revolver & LC availability 712 Total available liquidity 2,690 $ September 30, 2010 Operational Performance - Cash Generation - Prudent Growth |

|

16 Capital Expenditures (millions) Maryland Healthy Air Act spending prior to 2010 totaled approximately $1.405 billion Normalized maintenance CapEx of $50 million to $60 million per year Other environmental expenditures include the amounts deposited in escrow for control of small dust particles as part of the Potomac River agreement Operational Performance - Cash Generation - Prudent Growth 2010 1 2011 Environmental Maryland Healthy Air Act 176 $ 93 $ Other 7 24 Maintenance 103 47 Construction Marsh Landing Generating Station 37 180 Other 24 51 Other 12 12 Total Capital Expenditures 2 359 $ 407 $ 1 Includes actuals for January through September 2 Excludes capitalized interest unrelated to the Marsh Landing project financing Forecast |

|

17 Takeaways Creation of GenOn Energy will deliver significant value to stockholders Hedging cushioned Mirant in Q3 2010 from the effects of relatively low commodity prices Eastern markets are forecasted to tighten because little generation is being built Mirant completed financing for the Marsh Landing generating facility and directed Kiewit to commence engineering and procurement Construction is expected to begin in late 2010 Operational Performance - Cash Generation - Prudent Growth |

|

Dickerson Generating Station Appendix |

|

19 Federal NOL Status Mirant’s estimated Federal NOL balance at December 31, 2009 was $2.7 billion An “ownership change” requires Mirant to reset the limitation that determines how much annual taxable income may be offset by its NOLs in future years An ownership change occurs if there is an increase of more than 50 percentage points in the ownership of Mirant stock held by large Mirant shareholders from the date of a previous ownership change New limitation depends on Mirant stock value on the ownership change date and an interest rate determined by the IRS We expect that Mirant will experience an “ownership change” for federal income tax purposes on the closing date of the proposed merger with RRI Energy Operational Performance - Cash Generation - Prudent Growth |

|

20 Federal NOL Status (Cont.) Assuming the shares of Mirant and RRI Energy are at or near current prices on the closing date of the proposed merger and both companies experience an ownership change, Mirant expects that The combined company, GenOn Energy, will be unable to use any pre merger NOLs for the first 5 years following the merger Thereafter, assuming sufficient taxable income, GenOn will be able to use approximately $100MM – $125MM per year of pre merger NOLs until such NOLs expire Based on current commodity price forecasts, Mirant expects that GenOn Energy will pay only federal Alternative Minimum Tax and certain state income taxes during the 5 years immediately following the merger Mirant’s Board of Directors has extended its stockholder rights plan and the plan was approved at its 2010 Annual Meeting of Stockholders held on May 6, 2010 There is no assurance that the stockholder rights plan will prevent an ownership change prior to the closing date of the proposed merger Operational Performance - Cash Generation - Prudent Growth |

|

21 Additional Hedge Information 1 Projected as of October 12, 2010 2 Power hedges include hedges with both power and natural gas 3 Realized Value of Hedges are nominal values and do not include certain adjustments required under fair value accounting ($millions) Q3 2010 Q3 2009 YTD 2010 YTD 2009 2010 2011 2012 2013 2014 Power 2 59 $ 285 $ 234 $ 608 $ 362 $ 289 $ 208 $ 193 $ 189 $ Fuel (4) (38) (32) (101) (34) (23) (33) 1 1 Realized Value of Hedges 55 $ 247 $ 202 $ 507 $ 328 $ 266 $ 175 $ 194 $ 190 $ Projected 1,3 Actual Operational Performance - Cash Generation - Prudent Growth Nov-Dec 2010 2011 2012 2013 2.37 $ 2.74 $ 2.99 $ 2.74 $ Average contract price of hedged coal before delivery ($/mmBtu) |

|

22 Quarterly Generation by Dispatch Type Net MW Net MWh Generated EAF (%) (1) Net Capacity Factor (%) Net MW Net MWh Generated EAF (%) (1) Net Capacity Factor (%) Baseload MidAtlantic 2,729 4,060,219 91.6 67.1 2,765 3,400,766 87.4 55.7 Northeast 238 399,732 94.5 82.7 238 377,785 95.0 78.1 California 0 0 0 0 Total Baseload 2,967 4,459,951 91.8 68.3 3,003 3,778,551 88.0 57.3 Intermediate MidAtlantic 1,400 733,421 71.2 24.8 1,400 194,192 53.1 6.6 Northeast 2,265 324,013 85.1 6.5 2,265 111,191 93.4 2.2 California 2,191 254,390 99.9 5.3 2,191 457,168 99.3 9.5 Total Intermediate 5,856 1,311,824 87.5 10.3 5,856 762,551 86.3 6.0 Peaking MidAtlantic 1,065 120,092 95.3 5.1 1,065 27,772 99.5 1.2 Northeast 32 4,796 100.0 6.8 32 2,012 99.8 2.9 California 156 (235) 98.7 0.0 156 1,484 99.5 0.4 Total Peaking 1,253 124,653 95.8 4.5 1,253 31,268 99.5 1.1 Total Mirant 10,076 5,896,428 89.8 26.7 10,112 4,572,370 88.4 20.7 (1) Equivalent Availability Factor - the total hours a unit is available in a period minus the sum of all full and partial outage equivalent expressed as a percent of all hours in a period. Generation by Dispatch Type Third Quarter 2010 Third Quarter 2009 Operational Performance - Cash Generation - Prudent Growth |

|

23 Year to Date Generation by Dispatch Type Net MW Net MWh Generated EAF (%) (1) Net Capacity Factor (%) Net MW Net MWh Generated EAF (%) (1) Net Capacity Factor (%) Baseload MidAtlantic 2,729 11,094,303 82.2 62.0 2,765 10,568,142 84.9 58.3 Northeast 238 1,119,425 93.2 74.4 238 1,076,030 91.4 71.6 California 0 0 0 0 Total Baseload 2,967 12,213,728 83.0 62.9 3,003 11,644,172 85.4 59.3 Intermediate MidAtlantic 1,400 1,065,311 53.6 11.9 1,400 333,372 41.9 3.7 Northeast 2,265 382,168 86.2 2.6 2,265 682,781 86.5 4.6 California 2,191 466,242 92.4 3.3 2,191 846,415 86.4 5.9 Total Intermediate 5,856 1,913,721 80.9 5.0 5,856 1,862,568 76.0 4.9 Peaking MidAtlantic 1,065 190,146 92.2 2.6 1,065 63,284 94.9 0.9 Northeast 32 6,123 92.7 2.9 32 2,381 98.7 1.1 California 156 (823) 97.7 0.0 156 1,986 89.1 0.2 Total Peaking 1,253 195,446 92.9 2.3 1,253 67,651 94.3 0.8 Total Mirant 10,076 14,322,895 83.1 21.6 10,112 13,574,391 81.2 20.5 (1) Equivalent Availability Factor - the total hours a unit is available in a period minus the sum of all full and partial outage equivalent expressed as a percent of all hours in a period. Generation by Dispatch Type YTD 2010 YTD 2009 Operational Performance - Cash Generation - Prudent Growth |

|

24 Equivalent Forced Outage Rate (EFOR) EFOR = Forced Outage Hours Forced Outage Hours + Service Hours 2010 2009 2010 2009 Mid-Atlantic Baseload Coal 4% 8% 5% 9% Q3 YTD Operational Performance - Cash Generation - Prudent Growth |

|

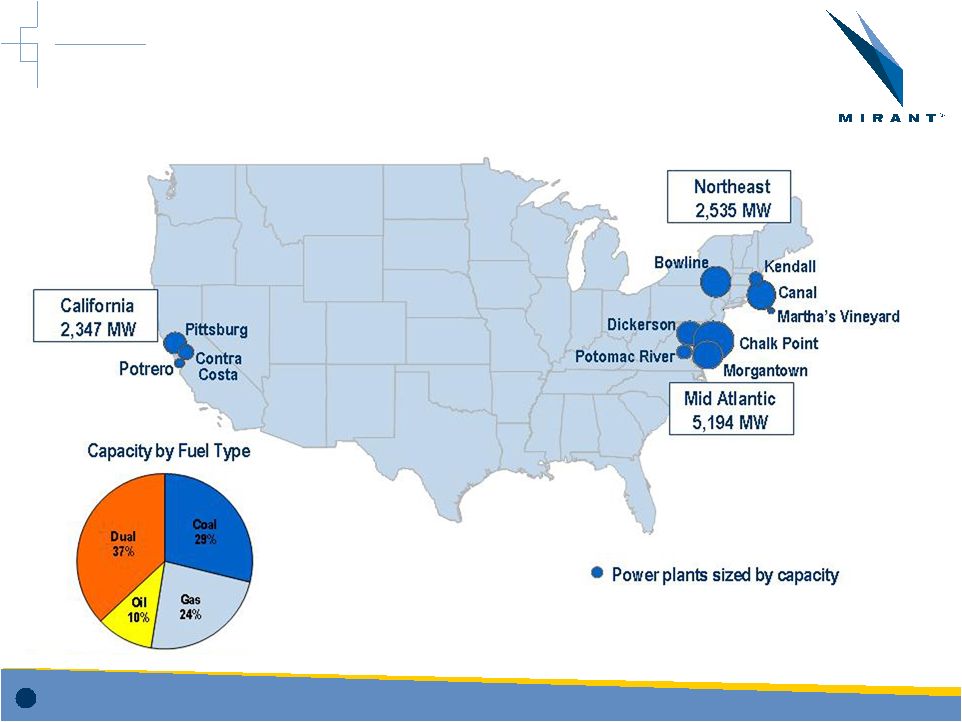

25 Mirant Operations 10,076 MW Operational Performance - Cash Generation - Prudent Growth |

|

26 Development Opportunities • 760 MW Marsh Landing Generating Station will commence commercial operations in mid-2013 • Potential to add 1,700 – 2,700 MWs of capacity California Operational Performance - Cash Generation - Prudent Growth |

|

27 Share Count (millions) Weighted average shares outstanding - basic 146 145 145 145 Effect of dilutive securities 0 1 1 0 Weighted average shares outstanding - diluted 146 146 146 145 Shares outstanding at quarter end - basic 146 145 146 145 Effect of dilutive securities 0 1 0 1 Shares outstanding at end of quarter - diluted 146 146 146 146 Three Three Nine Nine Months Ending September 30, 2009 Months Ending Months Ending Months Ending September 30, 2010 September 30, 2009 September 30, 2010 Operational Performance - Cash Generation - Prudent Growth |

|

28 Regulation G Reconciliation Operational Performance - Cash Generation - Prudent Growth (in millions except per share) Per Share 1 Per Share 1 Net Income 254 $ 1.74 $ 55 $ 0.38 $ Unrealized losses (gains) (167) (1.14) 174 1.19 Impairment losses - - 14 0.10 Lower of cost or market inventory adjustments, net (7) (0.05) (6) (0.04) Merger-related costs 8 0.06 - - Other (2) (0.02) 1 - Adjusted Net Income 86 $ 0.59 $ 238 $ 1.63 $ Provision for income taxes - 3 Interest expense, net 51 33 Depreciation and amortization 53 37 Adjusted EBITDA 190 $ 311 $ Table 1 Net Income to Adjusted Net Income and Adjusted EBITDA Quarter Ending Quarter Ending September 30, 2010 September 30, 2009 1 Per share amounts for 2010 and 2009 are based on diluted weighted average shares outstanding of 146 million. |

|

29 Regulation G Reconciliation Operational Performance - Cash Generation - Prudent Growth (in millions except per share) Per Share 1 Per Share 1 Net Income 398 $ 2.73 $ 598 $ 4.12 $ Unrealized gains (179) (1.23) (66) (0.45) Bankruptcy charges and legal contingencies - - (62) (0.43) Severance and bonus plan for dispositions - - 13 0.09 Impairment losses - - 14 0.10 Lower of cost or market inventory adjustments, net (1) (0.01) (17) (0.12) Postretirement benefit curtailment gain (37) (0.25) - - Merger-related costs 13 0.09 - - Other (1) (0.01) 4 0.03 Adjusted Net Income 193 $ 1.32 $ 484 $ 3.34 $ Provision for income taxes 1 11 Interest expense, net 150 102 Depreciation and amortization 157 109 Adjusted EBITDA 501 $ 706 $ 1 Per share amounts for 2010 are based on diluted weighted average shares outstanding of 146 million. Per share amounts for 2009 are based on diluted weighted average shares outstanding of 145 million. Table 2 Net Income to Adjusted Net Income and Adjusted EBITDA Year to Date Year to Date September 30, 2010 September 30, 2009 |

|

30 Regulation G Reconciliation (in millions ) Mid- Atlantic Northeast California Other Operations Eliminations Total Net Income (Loss) 319 $ (3) $ 11 $ (73) $ - $ 254 $ Unrealized losses (gains) (179) 2 - 10 - (167) Bankruptcy charges and legal contingencies - - (1) - - (1) Lower of cost or market inventory adjustments, net (4) - - (3) - (7) Merger-related costs - - - 8 - 8 Gains on sales of assets (excluding emissions allowances), net - (1) - - - (1) Adjusted Net Income (Loss) 136 $ (2) $ 10 $ (58) $ - $ 86 $ Provision (benefit) for income taxes (1) - - 1 - - Interest expense, net 1 - (1) 51 - 51 Depreciation and amortization 36 5 8 4 - 53 Adjusted EBITDA 172 $ 3 $ 17 $ (2) $ - $ 190 $ Table 3 Adjusted Net Income (Loss) and Adjusted EBITDA Quarter Ending September 30, 2010 Operational Performance - Cash Generation - Prudent Growth |

|

31 Regulation G Reconciliation (in millions ) Mid- Atlantic Northeast California Other Operations Eliminations Total Net Income (Loss) 525 $ (17) $ 17 $ (127) $ - $ 398 $ Unrealized losses (gains) (208) 16 - 13 - (179) Bankruptcy charges and legal contingencies - - (1) 1 - - Lower of cost or market inventory adjustments, net (3) - - 2 - (1) Postretirement benefit curtailment gain - - - (37) - (37) Merger-related costs - - - 13 - 13 Gains on sales of assets (excluding emissions allowances), net - (1) - - - (1) Adjusted Net Income (Loss) 314 $ (2) $ �� 16 $ (135) $ - $ 193 $ Provision (benefit) for income taxes (1) - - 2 - 1 Interest expense, net 2 1 (1) 148 - 150 Depreciation and amortization 105 17 23 12 - 157 Adjusted EBITDA 420 $ 16 $ 38 $ 27 $ - $ 501 $ Table 4 Adjusted Net Income (Loss) and Adjusted EBITDA Year to Date September 30, 2010 Continuing Operations Operational Performance - Cash Generation - Prudent Growth |

|

32 Regulation G Reconciliation (in millions ) Mid- Atlantic Northeast California Other Operations Eliminations Total Net Income (Loss) 86 $ 5 $ (5) $ (31) $ - $ 55 $ Unrealized losses (gains) 124 26 - 24 - 174 Impairment losses - - 14 - - 14 Generating facility shut down costs - 1 - - - 1 Lower of cost or market inventory adjustments, net (4) - - (2) - (6) Adjusted Net Income (Loss) 206 $ 32 $ 9 $ (9) $ - $ 238 $ Provision for income taxes - - - 3 - 3 Interest expense, net - - 1 32 - 33 Depreciation and amortization 25 4 5 3 - 37 Adjusted EBITDA 231 $ 36 $ 15 $ 29 $ - $ 311 $ Table 5 Adjusted Net Income (Loss) and Adjusted EBITDA Quarter Ending September 30, 2009 Continuing Operations Operational Performance - Cash Generation - Prudent Growth |

|

33 Regulation G Reconciliation (in millions ) Mid- Atlantic Northeast California Other Operations Eliminations Total Net Income (Loss) 604 $ 40 $ (2) $ (45) $ 1 $ 598 $ Unrealized losses (gains) (119) (20) - 73 - (66) Bankruptcy charges and legal contingencies - - - (62) - (62) Severance and bonus plan for dispositions - - - 13 - 13 Impairment losses - - 14 - - 14 Generating facility shut down costs - 4 - - - 4 Lower of cost or market inventory adjustments, net 3 (1) 1 (20) - (17) Adjusted Net Income (Loss) 488 $ 23 $ 13 $ (41) $ 1 $ 484 $ Provision for income taxes - - - 11 - 11 Interest expense, net 2 - 2 98 - 102 Depreciation and amortization 73 13 15 8 - 109 Adjusted EBITDA 563 $ 36 $ 30 $ 76 $ 1 $ 706 $ Table 6 Adjusted Net Income (Loss) and Adjusted EBITDA Year to Date September 30, 2009 Continuing Operations Operational Performance - Cash Generation - Prudent Growth |

|

34 Regulation G Reconciliation (in millions) Mid-Atlantic Northeast California Other Operations Eliminations Total Energy 151 $ 14 $ - $ 6 $ - $ 171 $ Contracted & capacity 83 20 32 - - 135 Incremental realized value of hedges 58 (3) - - - 55 Realized gross margin 292 31 32 6 - 361 Unrealized gross margin 179 (2) - (10) - 167 Gross margin 471 $ 29 $ 32 $ (4) $ - $ 528 $ (in millions) Mid-Atlantic Northeast California Other Operations Eliminations Total Energy 33 $ 3 $ - $ 36 $ - $ 72 $ Contracted & capacity 90 24 33 - - 147 Incremental realized value of hedges 214 33 - - - 247 Realized gross margin 337 60 33 36 - 466 Unrealized gross margin (124) (26) - (24) - (174) Gross margin 213 $ 34 $ 33 $ 12 $ - $ 292 $ Gross Margin Quarter Ending September 30, 2010 Table 7 Quarter Ending September 30, 2009 Operational Performance - Cash Generation - Prudent Growth |

|

35 Regulation G Reconciliation (in millions) Mid-Atlantic Northeast California Other Operations Eliminations Total Energy 321 $ 15 $ - $ 41 $ - $ 377 $ Contracted & capacity 257 67 91 - - 415 Incremental realized value of hedges 189 13 - - - 202 Realized gross margin 767 95 91 41 - 994 Unrealized gross margin 208 (16) - (13) - 179 Gross margin 975 $ 79 $ 91 $ 28 $ - $ 1,173 $ (in millions) Mid-Atlantic Northeast California Other Operations Eliminations Total Energy 124 $ 21 $ - $ 112 $ (3) $ 254 $ Contracted & capacity 261 68 89 - - 418 Incremental realized value of hedges 473 34 - - - 507 Realized gross margin 858 123 89 112 (3) 1,179 Unrealized gross margin 119 20 - (73) - 66 Gross margin 977 $ 143 $ 89 $ 39 $ (3) $ 1,245 $ Table 8 Gross Margin Year to Date September 30, 2010 Year to Date September 30, 2009 Operational Performance - Cash Generation - Prudent Growth |

|

36 Regulation G Reconciliation (in millions) Gross margin 528 $ 292 $ Unrealized gross margin (167) 174 Lower of cost or market inventory adjustments, net (7) (6) Adjusted gross margin 354 460 Operations and maintenance expenses (172) (154) Bankruptcy charges and legal contingencies - - Merger-related costs 8 - Generating facility shut down costs - 1 Adjusted operations and maintenance expenses (164) (153) Gain on sales of emissions allowances, net - 3 Other income (expense), net - 1 Adjusted EBITDA 190 $ 311 $ Table 9 Gross Margin to Adjusted EBITDA Quarter Ending Quarter Ending September 30, 2010 September 30, 2009 Operational Performance - Cash Generation - Prudent Growth |

|

37 Regulation G Reconciliation (in millions) Gross margin 1,173 $ 1,245 $ Unrealized gross margin (179) (66) Lower of cost or market inventory adjustments, net (1) (17) Adjusted gross margin 993 1,162 Operations and maintenance expenses (470) (430) Bankruptcy charges and legal contingencies - (62) Severance and bonus plan for dispositions - 13 Merger-related costs 13 - Postretirement benefit curtailment gain (37) - Generating facility shut down costs - 4 Adjusted operations and maintenance expenses (494) (475) Gain on sales of emissions allowances, net 3 20 Other expense, net (1) (1) Adjusted EBITDA 501 $ 706 $ Table 10 Gross Margin to Adjusted EBITDA Year to Date Year to Date September 30, 2010 September 30, 2009 Operational Performance - Cash Generation - Prudent Growth |