QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registranto |

| Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12

|

Zomax Incorporated |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

ZOMAX INCORPORATED

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held

April 24, 2002

TO THE SHAREHOLDERS OF ZOMAX INCORPORATED:

The 2002 Annual Meeting of Shareholders of Zomax Incorporated will be held at the Lutheran Brotherhood Building, 625 Fourth Avenue South, Minneapolis, Minnesota at 3:30 p.m. on Wednesday, April 24, 2002, for the following purposes:

- 1.

- To set the number of members of the Board of Directors at six (6).

- 2.

- To elect members of the Board of Directors.

- 3.

- To approve options granted to officers.

- 4.

- To approve the Company's 2002 Stock Option and Incentive Plan.

- 5.

- To approve an amendment to the Company's 1996 Employee Stock Purchase Plan, including an increase of shares reserved under the plan from 1,000,000 to 2,000,000.

- 6.

- To take action on any other business that may properly come before the meeting or any adjournment thereof.

Accompanying this Notice of Annual Meeting is a Proxy Statement, form of Proxy and the Company's 2001 Annual Report to Shareholders.

Only shareholders of record as shown on the books of the Company at the close of business on March 6, 2002 will be entitled to vote at the 2002 Annual Meeting or any adjournment thereof. Each shareholder is entitled to one vote per share on all matters to be voted on at the meeting.

You are cordially invited to attend the 2002 Annual Meeting. Whether or not you plan to attend the 2002 Annual Meeting, please sign, date and mail the enclosed form of Proxy in the return envelope provided as soon as possible. The Proxy is revocable and will not affect your right to vote in person in the event you attend the meeting. The prompt return of proxies will help the Company avoid the unnecessary expense of further requests for proxies.

BY ORDER OF THE BOARD OF DIRECTORS,

James T. Anderson,Chairman and

Chief Executive Officer

Dated: March 21, 2002

Plymouth, Minnesota

ZOMAX INCORPORATED

PROXY STATEMENT

FOR

ANNUAL MEETING OF SHAREHOLDERS

to be held

April 24, 2002

The accompanying Proxy is solicited by the Board of Directors of Zomax Incorporated (the "Company") for use at the 2002 Annual Meeting of Shareholders of the Company to be held on Wednesday, April 24, 2002, at the location and for the purposes set forth in the Notice of Annual Meeting, and at any adjournment thereof.

The cost of soliciting proxies, including the preparation, assembly and mailing of the proxies and soliciting material, as well as the cost of forwarding such material to the beneficial owners of stock, will be borne by the Company. Directors, officers and regular employees of the Company may, without compensation other than their regular remuneration, solicit proxies personally or by telephone.

Any shareholder giving a Proxy may revoke it any time prior to its use at the 2002 Annual Meeting by giving written notice of such revocation to the Secretary or any other officer of the Company or by filing a later dated written Proxy with an officer of the Company. Personal attendance at the 2002 Annual Meeting is not, by itself, sufficient to revoke a Proxy unless written notice of the revocation or a later dated Proxy is delivered to an officer before the revoked or superseded Proxy is used at the 2002 Annual Meeting. Proxies will be voted as directed therein. Proxies which are signed by shareholders but which lack specific instruction with respect to any proposal will be voted in favor of such proposal as set forth in the Notice of Annual Meeting or, with respect to the election of directors, in favor of the number and slate of directors proposed by the Board of Directors and listed herein.

The presence at the Annual Meeting in person or by proxy of the holders of a majority of the outstanding shares of the Company's Common Stock entitled to vote shall constitute a quorum for the transaction of business. If a broker returns a "non-vote" proxy, indicating a lack of voting instructions by the beneficial holder of the shares and a lack of discretionary authority on the part of the broker to vote on a particular matter, then the shares covered by such non-vote shall be deemed present at the meeting for purposes of determining a quorum but shall not be deemed to be represented at the meeting for purposes of calculating the vote required for approval of such matter. If a shareholder abstains from voting as to any matter, then the shares held by such shareholder shall be deemed present at the meeting for purposes of determining a quorum and for purposes of calculating the vote with respect to such matter, but shall not be deemed to have been voted in favor of such matter. An abstention as to any proposal will therefore have the same effect as a vote against the proposal.

The mailing address of the principal executive office of the Company is 5353 Nathan Lane, Plymouth, Minnesota 55442. The Company expects that this Proxy Statement, the related Proxy and Notice of Annual Meeting will first be mailed to shareholders on or about March 21, 2002.

1

STOCK SPLIT

All information contained herein regarding the Company's Common Stock, including information regarding options to purchase the Company's Common Stock, has been adjusted, as necessary, to reflect the 2-for-1 stock split of the Company's Common Stock which was effected on May 8, 2000.

OUTSTANDING SHARES AND VOTING RIGHTS

The Board of Directors of the Company has fixed March 6, 2002 as the record date for determining shareholders entitled to vote at the 2002 Annual Meeting. Persons who were not shareholders on such date will not be allowed to vote at the 2002 Annual Meeting. At the close of business on March 6, 2002, there were 32,998,865 shares of the Company's Common Stock issued and outstanding. The Common Stock is the only outstanding class of capital stock of the Company. Each share of Common Stock is entitled to one vote on each matter to be voted upon at the 2002 Annual Meeting. Holders of Common Stock are not entitled to cumulative voting rights.

PRINCIPAL SHAREHOLDERS AND MANAGEMENT SHAREHOLDINGS

The following table provides information as of the record date concerning the beneficial ownership of the Company's Common Stock by (i) each director of the Company, (ii) the named executive officers in the Summary Compensation Table, (iii) the persons known by the Company to own more than 5% of the Company's outstanding Common Stock, (iv) each of the named executive officers in the Summary Compensation Table and (v) all current directors and executive officers as a group. Except as otherwise indicated, the persons named in the table have sole voting and investment power with respect to all shares of Common Stock owned by them.

Name (and Address of 5%

Owner) or Identity of Group

| | Number of Shares

Beneficially Owned(1)

| | Percent of Class(1)

| |

|---|

| James T. Anderson(2) | | 443,750 | | 1.3 | % |

Anthony Angelini(3) |

|

404,527 |

|

1.2 |

% |

John Gelp |

|

1,000 |

|

* |

|

Michelle S. Bedard(2) |

|

443,750 |

|

1.3 |

% |

Phillip T. Levin(4) |

|

2,628,424 |

|

8.0 |

% |

Janice Ozzello Wilcox(5) |

|

72,000 |

|

* |

|

Robert Ezrilov(6) |

|

76,000 |

|

* |

|

Howard P. Liszt(7) |

|

92,000 |

|

* |

|

James E. Flaherty(8) |

|

211,400 |

|

* |

|

Barclays Global Investors, N.A. and Barclays Global Fund Advisors(9) |

|

1,718,196 |

|

5.2 |

% |

All Executive Officers and Directors as a Group (8 Individuals)(10) |

|

3,717,701 |

|

11.0 |

% |

- *

- Less than 1% of the outstanding shares of Common Stock.

- (1)

- Under the rules of the SEC, shares not actually outstanding are deemed to be beneficially owned by an individual if such individual has the right to acquire the shares within 60 days. Pursuant to such SEC Rules, shares deemed beneficially owned by virtue of an individual's right to acquire them are also treated as outstanding when calculating the percent of the class owned by such

2

- (2)

- Represents 312,500 shares held by Mr. Anderson, 43,750 shares held by Ms. Bedard and 87,500 shares which may be purchased by Ms. Bedard upon exercise of currently exercisable options. Mr. Anderson and Ms. Bedard are married.

- (3)

- Includes 27,000 shares held in a charitable trust, of which Mr. Angelini is trustee, and 328,800 shares which may be purchased by Mr. Angelini upon exercise of currently exercisable options.

- (4)

- Includes 640,000 shares held by Metacom, Inc., of which Mr. Levin is the majority shareholder, 8,000 shares held by Mr. Levin as custodian for his children and 40,000 shares which may be purchased by

Mr. Levin upon exercise of currently exercisable options. Mr. Levin's address is 1636 Moore Road, Montecito, CA 93108.

- (5)

- Includes 48,000 shares which may be purchased by Ms. Wilcox upon exercise of currently exercisable options.

- (6)

- Includes 72,000 shares which may be purchased by Mr. Ezrilov upon exercise of currently exercisable options.

- (7)

- Includes 72,000 shares which may be purchased by Mr. Liszt upon exercise of currently exercisable options.

- (8)

- Includes 76,400 shares which may be purchased by Mr. Flaherty upon exercise of currently exercisable options.

- (9)

- The shares are beneficially owned by Barclays Global Investors, N.A. ("Barclays Investors") and Barclays Global Fund Advisors ("Barclays Advisors"). Barclays Investors has sole power to vote 1,509,097 shares and sole power to dispose 1,589,713 shares, and Barclays Investors has sole power to vote and dispose of 128,483 shares. The address for Barclays Investors and Barclays Advisors is 45 Fremont Street, San Francisco, CA 94105. The Company has relied on information contained in a Schedule 13G filed with the Securities and Exchange Commission on February 14, 2002.

- (10)

- Includes 648,300 shares which may be purchased by current executive officers and directors upon exercise of currently exercisable options; see above footnotes for shares held indirectly or for the benefit of family members.

ELECTION OF DIRECTORS

(Proposals #1 and #2)

The Bylaws of the Company provide that the number of directors shall be the number set by the shareholders, which shall be not less than one. The Board of Directors unanimously recommends that the number of directors be set at six and that the nominees listed below be elected. Unless otherwise instructed, the Proxies will be so voted.

Under applicable Minnesota law, approval of the proposal to set the number of directors at six and the election of the nominees to the Board of Directors require the affirmative vote of the holders of a majority of the voting power of the shares represented in person or by proxy at the Annual Meeting with authority to vote on such matter, provided that such majority must be greater than 25% of the Company's outstanding shares.

In the absence of other instruction, the Proxies will be voted for each of the individuals listed below. If elected, such individuals shall serve until the next annual meeting of shareholders and until their successors shall be duly elected and shall qualify. All of the nominees are members of the current Board of Directors. If, prior to the 2002 Annual Meeting of Shareholders, it should become known that any one of the following individuals will be unable to serve as a director after the 2002 Annual Meeting

3

by reason of death, incapacity or other unexpected occurrence, the Proxies will be voted for such substitute nominee(s) as is selected by the Board of Directors. Alternatively, the Proxies may, at the Board's discretion, be voted for such fewer number of nominees as results from such death, incapacity or other unexpected occurrence. The Board of Directors has no reason to believe that any of the following nominees will be unable to serve.

Name

| | Age

| | Position with

the Company

| | Director

Since

|

|---|

James T. Anderson |

|

44 |

|

Chief Executive Officer and Chairman of the Board |

|

1996 |

Anthony Angelini |

|

38 |

|

President, Chief Operating Officer and Director |

|

2000 |

Phillip T. Levin |

|

58 |

|

Director |

|

1996 |

Janice Ozzello Wilcox |

|

48 |

|

Director |

|

1996 |

Robert Ezrilov |

|

57 |

|

Director |

|

1996 |

Howard P. Liszt |

|

55 |

|

Director |

|

1996 |

Business Experience of the Director Nominees

James T. Anderson has served as Chief Executive Officer and as a director of the Company since he co-founded it in February 1996 and as Chairman since January 2000. He also served as President from February 1996 to January 2000. He was President of ZOMI Corp., the General Partner of Zomax Optical Media Limited Partnership (the "Partnership"), the Company's predecessor, from 1993, when he co-founded it and the Partnership, until May 1996. Mr. Anderson served with Metacom from May 1982 to June 1993, including five years as Vice President of Manufacturing where he was responsible for all manufacturing activities, including purchasing, inventory control, production, warehousing and distribution. Mr. Anderson is married to Michelle S. Bedard, Executive Vice President—Sales and Marketing of the Company.

Anthony Angelini has served as President, Chief Operating Officer and as a Director of the Company since January 2000. He served as Executive Vice President—Global Operations from January 1999 to January 2000. Mr. Angelini joined the Company as Vice President—Western U.S. and European Operations on February 1998 when the Company acquired Primary Marketing Group ("PMG"), Primary Marketing Group Ltd. ("PMG Ltd.") and Next Generation Services LLC ("NGS"). Mr. Angelini co-founded PMG, PMG Ltd. and NGS in October 1989, September 1995 and May 1996, respectively. Mr. Angelini served as Vice President of PMG, a Director of PMG Ltd. and Manager of NGS, and he was a major equity owner of each.

Phillip T. Levin has served as a Director of the Company since he co-founded it in February 1996, and he served as Chairman from February 1996 until January 2000. Mr. Levin was Chairman and Chief Executive Officer of ZOMI Corp. from 1993, when he co-founded it and the Partnership, until May 1996. Mr. Levin served as Chief Executive Officer of RNR, Inc. since he founded it in 1986. Mr. Levin served as a director and officer of Metacom, Inc. from 1970 until 2001.

Janice Ozzello Wilcox has served as Senior Vice President and Chief Financial Officer of Marquette Bancshares, Inc., a bank holding company in Minneapolis, Minnesota, since January 1993. From April 1991 to December 1992, Ms. Wilcox served as Senior Vice President and Chief Financial Officer of Marquette Bank Minneapolis, N.A. in Minneapolis, Minnesota.

4

Robert Ezrilov served as President of Metacom, Inc. from July 1997 to April 2001. Mr. Ezrilov was self-employed as a business consultant from April 1995 to July 1997. Prior to April 1995, he was a partner with Arthur Andersen LLP, which accounting firm he joined in 1966. Mr. Ezrilov also serves on the Board of Directors of C.H. Robinson Worldwide, Inc., a transportation service provider located in Eden Prairie, Minnesota and Christopher & Banks Corporation, an apparel retailer located in Plymouth, Minnesota.

Howard P. Liszt currently serves as a senior fellow with the University of Minnesota. From 1976 to 2000, Mr. Liszt was employed with Campbell Mithun Esty, an advertising agency in Minneapolis, Minnesota, serving most recently as it Chief Executive Officer.

BOARD AND COMMITTEE MEETINGS

During fiscal 2001, the Board of Directors held four meetings. No director attended less than 75% of the meetings of the Board and the committees on which such director served during fiscal 2001.

The Company's Board of Directors has two standing committees, the Audit Committee and Compensation Committee. The Company does not have a nominating committee.

The members of the Audit Committee are Robert Ezrilov, Howard Liszt and Janice Ozzello Wilcox. This committee reviews the selection and work of the Company's independent auditors and the adequacy of internal controls for compliance with corporate policies and directives. The Audit Committee met twice during fiscal 2001.

The members of the Compensation Committee are Robert Ezrilov, Howard Liszt and Janice Ozzello Wilcox. This committee recommends to the Board of Directors from time to time the salaries to be paid to executive officers of the Company and any plan for additional compensation it deems appropriate. In addition, this committee is vested with the same authority as the Board of Directors with respect to the granting of options and the administration of the Company's 1996 Stock Option Plan. The Compensation Committee met six times during fiscal 2001.

5

EXECUTIVE OFFICERS OF THE COMPANY

The names and ages of the Company's current executive officers and the positions held by such officers are listed below.

Name

| | Age

| | Position

|

|---|

James T. Anderson |

|

44 |

|

Chief Executive Officer and Chairman of the Board |

Anthony Angelini |

|

38 |

|

President, Chief Operating Officer and Director |

John Gelp |

|

48 |

|

Executive Vice President, Chief Financial Officer and Secretary |

Michelle S. Bedard |

|

43 |

|

Executive Vice President—Sales and Marketing |

James T. Anderson has served as Chief Executive Officer and as a director of the Company since he co-founded it in February 1996 and as Chairman since January 2000. He also served as President from February 1996 to January 2000. He was President of ZOMI Corp., the General Partner of Zomax Optical Media Limited Partnership (the "Partnership"), the Company's predecessor, from 1993, when he co-founded it and the Partnership, until May 1996. Mr. Anderson served with Metacom from May 1982 to June 1993, including five years as Vice President of Manufacturing where he was responsible for all manufacturing activities, including purchasing, inventory control, production, warehousing and distribution. Mr. Anderson is married to Michelle S. Bedard, Executive Vice President—Sales and Marketing of the Company.

Anthony Angelini has served as President, Chief Operating Officer and as a Director of the Company since January 2000. He served as Executive Vice President—Global Operations from January 1999 to January 2000. Mr. Angelini joined the Company as Vice President—Western U.S. and European Operations on February 1998 when the Company acquired Primary Marketing Group ("PMG"), Primary Marketing Group Ltd. ("PMG Ltd.") and Next Generation Services LLC ("NGS"). Mr. Angelini co-founded PMG, PMG Ltd. and NGS in October 1989, September 1995 and May 1996, respectively. Mr. Angelini served as Vice President of PMG, a Director of PMG Ltd. and Manager of NGS, and he was a major equity owner of each.

John Gelp has served as Executive Vice President, Chief Financial Officer and Secretary of the Company since October 2001. From 2000 to 2001, Mr. Gelp served as Vice President, Chief Financial Officer and Secretary of Nortrax, Inc. From 1990 to 2000, Mr. Gelp served in various positions with Chiquita Brands International, Inc., most recently as Vice President and Chief Financial Officer of its Diversified and Canning Groups. Prior to 1990, Mr. Gelp served in tax accounting positions with various companies, including Price Waterhouse.

Michelle S. Bedard has served as Executive Vice President—Sales and Marketing of the Company since its inception in February 1996, prior to which she served as Vice President of Sales and National Sales Manager of the Partnership since its inception in 1993. From June 1991 to August 1993, Ms. Bedard was National Sales Manager of Metacom, where she was responsible for sales revenue and staff, including eight inside sales representatives and thirteen independent sales groups, the customer service department and various support staff, for all four sales divisions. Ms. Bedard is married to James T. Anderson, Chairman and Chief Executive Officer of the Company.

6

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth certain information regarding compensation paid or accrued during each of the Company's last three fiscal years to the Chief Executive Officer and to each other executive officer whose total annual salary and bonus paid or accrued during fiscal year 2001 exceeded $100,000.

| |

| |

| |

| |

| | Long Term

Compensation

| |

|

|---|

| |

| | Annual Compensation

| |

|

|---|

| | Fiscal

Year

| | All Other

Compensation

($)

|

|---|

| | Salary($)

| | Bonus($)

| | Other($)

| | Options

|

|---|

James T. Anderson

Chairman and Chief

Executive Officer | | 2001

2000

1999 | | 400,000

400,000

400,000 | | 152,000

266,666

2,677,416 | | —

—

— | | 865,000

240,000

— | (1)

(2)

| —

—

— |

Anthony Angelini

President and Chief

Operating Officer |

|

2001

2000

1999 |

|

300,000

300,000

225,000 |

|

124,400

175,000

809,273 |

|

—

—

— |

|

528,000

128,000

— |

(1)

(2)

|

—

—

— |

Michelle S. Bedard

Executive VP—Sales

& Marketing |

|

2001

2000

1999 |

|

277,497

300,000

300,000 |

(3) |

156,818

175,000

719,354 |

|

—

—

— |

|

—

126,000

— |

(2)

|

—

—

— |

James E. Flaherty

Former Chief

Financial Officer(4) |

|

2001

2000

1999 |

|

155,537

175,000

175,000 |

|

43,750

67,083

367,206 |

|

—

—

— |

|

—

52,000

— |

(2)

|

—

—

— |

- (1)

- A portion of the options is subject to shareholder approval (see Proposal #3).

- (2)

- The stock options were granted as part of bonuses earned in 1999, which options could not be granted until fiscal 2000 when the shareholders approved an increase of shares under the Company's 1996 Stock Option Plan; however, the options held by Ms. Bedard and Mr. Flaherty were cancelled in May 2001 for no consideration and those held by Mr. Anderson and Mr. Angelini were cancelled in January 2002 in exchange for $.20 per share.

- (3)

- Includes commissions of $100,000.

- (4)

- Mr. Flaherty resigned in October 2001.

7

Option Grants During 2001 Fiscal Year

The following table provides information regarding stock options granted during fiscal year ended December 28, 2001 to the named executive officers in the Summary Compensation Table. The Company has not granted any stock appreciation rights.

| | Individual Grants

| |

| |

|

|---|

| | Potential Realizable Value at

Assumed Annual Rates of Stock

Price Appreciation for Option

Term(1)

|

|---|

| |

| | % of Total

Options

Granted to

Employees in

Fiscal Year

| |

| |

|

|---|

Name

| | Options

Granted(2)

| | Exercise or

Base Price

($/Sh)(3)

| | Expiration

Date

|

|---|

| | 5% ($)

| | 10% ($)

|

|---|

| James T. Anderson | | 442,439

422,561 | (4)

(5) | 19.4

18.5 | %

% | $

$ | 5.86

5.86 | | 05/08/11

05/08/11 | | $

$ | 1,630,530

1,557,274 | | $

$ | 4,132,084

3,946,437 |

Anthony Angelini |

|

257,561

270,439 |

(4)

(5) |

11.3

11.9 |

%

% |

$

$ |

5.86

5.86 |

|

05/08/11

05/08/11 |

|

$

$ |

949,195

996,655 |

|

$

$ |

2,405,447

2,525,719 |

Michelle S. Bedard |

|

— |

|

— |

|

|

— |

|

— |

|

|

— |

|

|

— |

James E. Flaherty |

|

— |

|

— |

|

|

— |

|

— |

|

|

— |

|

|

— |

- (1)

- The potential realizable value portion of the foregoing table illustrates value that might be realized upon exercise of the options immediately prior to the expiration of their term, assuming the specified compounded rates of appreciation on the Company's Common Stock over the term of the options. These numbers do not take into account provisions of certain options providing for termination of the option following termination of employment, nontransferability or vesting over various periods. If the options are adjusted as set forth in (2) below, the potential realizable value will be somewhat less.

- (2)

- In the event of a change of control of the Company, any unexercisable portion of the options will become immediately exercisable. See "Change of Control Arrangements."

- (3)

- Exercise price is equal to the fair market value on the date of grant.

- (4)

- Option was granted on May 9, 2001 pursuant to the Company's 1996 Stock Option Plan and is exercisable on May 9, 2005, subject to acceleration if certain targets are met.

- (5)

- Option was granted on May 9, 2001, subject to shareholder approval (see Proposal #3), outside of the Company's 1996 Stock Option Plan and is exercisable in four annual increments beginning on May 9, 2002, subject to acceleration if certain targets are met.

8

Option Exercises During 2001 Fiscal Year and Fiscal Year-End Option Values

The following table provides information as to options exercised by the named executive officer in the Summary Compensation Table during fiscal 2001 and the number and value of options at December 28, 2001. The Company does not have any outstanding stock appreciation rights.

| |

| |

| | Number of Unexercised Options

at December 28, 2001

| | Value of Unexercised

In-the Money Options at

December 28, 2001(2)

|

|---|

Name

| | Shares

Acquired on

Exercise (#)

| | Value Realized

($)(1)

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| James T. Anderson | | 156,250 | | $ | 423,844 | | 0 | | 1,105,0000 | | $ | 0 | | $ | 1,954,900 |

Anthony Angelini |

|

— |

|

|

— |

|

292,800 |

|

692,000 |

|

$ |

1,709,315 |

|

$ |

1,403,382 |

Michelle S. Bedard |

|

21,875 |

|

$ |

58,303 |

|

65,626 |

|

21,874 |

|

$ |

396,072 |

|

$ |

132,015 |

James E. Flaherty |

|

50,000 |

|

$ |

139,276 |

|

105,150 |

|

22,250 |

|

$ |

631,518 |

|

$ |

134,768 |

- (1)

- Value realized is calculated on the basis of the difference between the option exercise price and the closing price for the Company's Common Stock on the date of exercise as quoted by The Nasdaq Stock Market, multiplied by the number of shares to which the exercise relates.

- (2)

- Value of unexercised options is calculated on the basis of the difference between the option exercise price and $8.12, the closing sale price for the Company's Common Stock at December 28, 2001 as quoted by The Nasdaq Stock Market, multiplied by the number of shares of Common Stock underlying the option.

Compensation to Directors

The Company pays fees to the non-officer members of the Board of Directors of $1,500 for each Board meeting and $500 for each Committee meeting attended. The Company reimburses the directors for out-of-pocket expenses incurred while attending Board or Committee meetings.

The 1996 Stock Option Plan provides for automatic option grants to each director who is not an employee of the Company (a "Non-Employee Director"). Each Non-Employee Director who was elected for the first time as a director on or after the adoption of the Plan on March 1, 1996 was granted a nonqualified option to purchase 40,000 shares of the Common Stock. Such option is exercisable to the extent of 8,000 shares on each of the first five anniversaries of the date of grant. Each Non-Employee Director who is re-elected as a director of the Company or whose term of office continues after a meeting of shareholders at which directors are elected shall, as of the date of such re-election or shareholder meeting, automatically be granted a nonqualified option to purchase 8,000 shares of the Common Stock. A Non-Employee Director who receives a 40,000-share option upon initial election to the Board may not receive an 8,000-share option for at least twelve (12) months. All options granted pursuant to these provisions are granted at a per share exercise price equal to 100% of the fair market value of the Common Stock on the date of grant, and they expire on the earlier of (i) three months after the optionee ceases to be a director (except by death) and (ii) ten (10) years after the date of grant. In the event of the death of a Non-Employee Director, any option granted to such Non-Employee Director pursuant to this formula plan may be exercised at any time within twelve (12) months of the death of such Non-Employee Director or until the date on which the option, by its terms, expires, whichever is earlier.

On February 20, 2002, the Board adopted the 2002 Stock Option and Incentive Plan, subject to shareholder approval, which plan provides for the automatic grant of options to outside directors pursuant to the same terms as the 1996 Plan as set forth above (see Proposal #4).

9

Compensation Committee Report on Executive Compensation

Compensation Committee Interlocks and Insider Participation. The Compensation Committee of the Board of Directors of the Company is composed of directors Robert Ezrilov, Janice Ozzello Wilcox and Howard P. Liszt.

Overview and Philosophy. The Compensation Committee's executive compensation policies are designed to enhance the financial performance of the Company, and thus shareholder value, by significantly aligning the financial interests of the Company's key executives with those of the Company's shareholders. Compensation of the Company's executive officers is comprised of four parts: base salary, annual incentive bonuses, fringe benefits and long-term incentive opportunity in the form of stock options.

The Compensation Committee believes that the base salaries of the Company's executive officers for fiscal 2002 are generally comparable to base salaries of executive officers of comparable publicly-held companies. Executive officers also have the opportunity to earn cash bonuses if certain Company financial performance goals are met. Long-term incentives are based on stock performance through stock options. The Compensation Committee believes that stock ownership by the Company's executive officers is beneficial in aligning management's and shareholders' interests in the enhancement of shareholder value. Overall, the intent is to have a significant emphasis on variable compensation components and less on fixed cost components. The Compensation Committee believes this philosophy and structure are in the best interests of the Company's shareholders.

Bonuses. The Company has followed a policy of setting bonus plans for its executive officers, based on the individual performance of the executive officers as well as the overall performance of the Company.

Stock Options and Other Incentives. The Company's stock option program is the Company's long-term incentive plan for executive officers and key employees. The objectives of the program are to align executive and shareholder long-term interests by creating a strong and direct link between executive pay and shareholder return, and to enable executives to develop and maintain a significant, long-term ownership position in the Company's Common Stock.

The Company's 1996 Plan authorizes the Compensation Committee of the Board of Directors to award stock options to executive officers and other employees. Stock options are generally granted each year, at an option price equal to the fair market value of the Company's Common Stock on the date of grant, and vest over a period of three to five years. The amount of stock options awarded is generally a function of the recipient's salary and position in the Company. Awards are intended to be generally competitive with other companies of comparable size and complexity, although the Compensation Committee has not conducted any thorough comparative analysis.

Benefits. The Company provides medical and insurance benefits to its executive officers, which benefits are generally available to all Company employees. The Company has a 401(k) plan in which all qualified employees, including the executive officers, may participate. The amounts of perquisites allowed to executive officers, as determined in accordance with rules of the Securities and Exchange Commission, did not exceed 10% of salary in fiscal 2001.

Chief Executive Officer Compensation. James T. Anderson served as the Company's Chief Executive Officer in fiscal 2001. His compensation was determined in accordance with the policies described above as applicable to all executive officers. In arriving at Mr. Anderson's compensation, the Compensation Committe took into consideration his leadership during a particularly difficult economy and his commitment to the development of the corporate strategy designed to generate improved financial performance in 2002 and thereafter. His base salary remained at $400,000 in fiscal 2001. Mr. Anderson was entitled to a cash bonus of $152,000 for fiscal 2001. In fiscal 2001, Mr. Anderson

10

was granted a stock option to purchase 865,000 shares. In January 2002, Mr. Anderson agreed to cancel a previously granted option to purchase 240,000 shares in exchange for $0.20 per share. Mr. Anderson received a bonus of $266,666 in fiscal 2000. Mr. Anderson's Employment Agreement provides for a bonus, which has been based on the Company's earnings and is approved annually by the Board of Directors in accordance with the terms of his Employment Agreement, which agreement is described in the section of this Proxy Statement entitledExecutive Compensation—Employment Agreements and Termination of Employment Arrangements.

Summary. Aggregate executive compensation was $1,640,770 in fiscal 2001, including $476,968 in bonuses, which were based on the Company's earnings. Options to purchase an aggregate of 1,468,000 shares were granted to the Company's executives in fiscal year 2001. The Compensation Committee intends to continue its policy of paying relatively moderate base salaries, basing bonuses on performance and granting options to provide long-term incentive.

| | | Members of the Compensation Committee |

| | | | Robert Ezrilov |

| | | | Janice Ozzello Wilcox |

| | | | Howard P. Liszt |

11

Report of Audit Committee

The Board of Directors maintains an Audit Committee comprised of three of the Company's outside directors. The Board of Directors and the Audit Committee believe that the Audit Committee's current member composition satisfies the rule of the National Association of Securities Dealers, Inc. ("NASD") that governs audit committees, Rule 4310(c)(26)(B)(i), including the requirement that audit committee members all be "independent directors" as that term is defined by NASD Rule 4200(a)(14).

In accordance with its written charter adopted by the Board of Directors, the Audit Committee assists the Board of Directors with fulfilling its oversight responsibility regarding the quality and integrity of the accounting, auditing and financial reporting practices of the Company. In performing its oversight responsibilities regarding the audit process, the Audit Committee:

- (1)

- reviewed and discussed the audited financial statements with management;

- (2)

- discussed with the independent auditors the material required to be discussed by Statement on Auditing Standards No. 61; and

- (3)

- reviewed the written disclosures and the letter from the independent auditors required by the Independence Standards Board's Standard No.1, and discussed with the independent auditors any relationships that may impact their objectivity and independence.

Based upon the review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company's Annual Report on Form 10-K for the fiscal year ended December 28, 2001, as filed with the Securities and Exchange Commission.

| | | Members of the Audit Committee |

| | | | Robert Ezrilov |

| | | | Janice Ozzello Wilcox |

| | | | Howard P. Liszt |

12

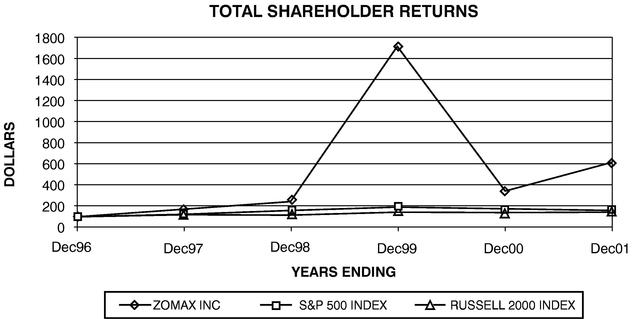

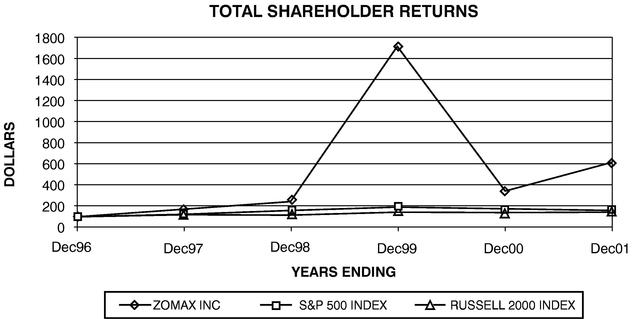

Stock Performance Chart

The following graph compares the yearly percentage change in the cumulative total stockholder return on the Company's Common Stock during the five fiscal years ended December 28, 2001 with the cumulative total return on the S&P 500 Composite Stock Index and the Russell 2000 Index. The comparison assumes $100 was invested on December 27, 1996 in the Company's Common Stock and in each of the foregoing indices and assumes reinvestment of dividends.

| | 12/27/96

| | 12/26/97

| | 12/25/98

| | 12/31/99

| | 12/29/00

| | 12/28/01

|

|---|

| Zomax Incorporated | | $ | 100.00 | | $ | 174.40 | | $ | 246.43 | | $ | 1,723.81 | | $ | 347.62 | | $ | 618.67 |

| S&P 500 Composite Stock Index | | $ | 100.00 | | $ | 123.29 | | $ | 162.06 | | $ | 195.20 | | $ | 177.43 | | $ | 159.44 |

| Russell 2000 Index | | $ | 100.00 | | $ | 119.11 | | $ | 115.66 | | $ | 146.00 | | $ | 141.59 | | $ | 146.63 |

Employment Agreements and Termination of Employment Arrangements

On January 1, 1999, the Company entered into an Employment Agreement with James T. Anderson, Chief Executive Officer of the Company, which agreement is automatically extended for additional one-year terms unless the Company or Mr. Anderson gives notice at least three months prior to the end of the current term. Pursuant to the terms of the agreement, the base salary is to be reviewed at least annually by the Board and has been determined by the Board to be $400,000 for 2002. In addition, Mr. Anderson is entitled to a bonus, consisting of a combination of cash and stock options, the terms of which are determined annually no later than February 28. Upon Mr. Anderson's termination under certain conditions, he is entitled to compensation and benefits. If Mr. Anderson terminates his employment without good reason (as defined in the agreement), the Company will provide him and his family health care benefits for up to five years. If Mr. Anderson's employment is terminated by the Company without cause (as defined in the agreement) or he resigns for good reason or for any reason within one year after a change of control, or the Company fails to extend the agreement, Mr. Anderson is entitled to an amount equal to twice his then current base salary, an amount equal to twice his bonus payment earned for the preceding year or the current year, whichever is higher, all stock options shall become immediately exercisable and health care benefits for five years. In the event Mr. Anderson's employment is terminated because of his disability, the Company shall provide health care benefits for Mr. Anderson and his family. For one year following Mr. Anderson's

13

termination of employment with the Company, he has agreed that he will not compete with the Company, solicit any of the Company's employees to leave the Company or interfere with Company's relationship with its customers.

The Company entered into an Employment Agreement with Anthony Angelini, President and Chief Operating Officer of the Company, effective as of January 1, 2002, which agreement is automatically extended for additional one-year terms on each anniversary date of the date of the agreement unless the Company or Mr. Angelini gives notice on or before September 30 of the current term. Pursuant to the terms of the agreement, the base salary is to be reviewed at least annually by the Board and has been determined by the Board to be $300,000 for 2002. In addition, Mr. Angelini is entitled to a bonus, consisting of a combination of cash and stock options, the terms of which are determined annually no later than February 28. Upon Mr. Angelini's termination under certain conditions, he is entitled to compensation and benefits. If Mr. Angelini's employment is terminated by the Company without cause (as defined in the agreement) or if he resigns for good reason (as defined in the agreement) or for any reason within one year after a change of control if Mr. Anderson is not then employed by the Company or the surviving corporation in a senior executive management position, Mr. Angelini is entitled to (i) an amount equal to his then current base salary, (ii) an amount equal to his bonus payment earned for the preceding year or the current year, whichever is higher, (iii) acceleration of the vesting of all stock options held by Mr. Angelini and (iv) health care benefits for one year. In the event Mr. Angelini's employment is terminated because of his disability, the Company shall provide health care benefits for Mr. Angelini and his family. For one year following Mr. Angelini's termination of employment with the Company, he has agreed that he will not compete with the Company, solicit any of the Company's employees to leave the Company or interfere with Company's relationship with its customers.

Change of Control Arrangements

The Company's 1996 Stock Option Plan (the "Plan") provides that, in the event of an acquisition of the Company through the sale of substantially all of the Company's assets and the consequent discontinuance of its business or through a merger, consolidation, exchange, reorganization, reclassification, extraordinary dividend, divestiture or liquidation of the Company ("change of control"), all outstanding options under the Plan shall become exercisable in full. The acceleration of the exercisability of outstanding options may be limited, however, if such acceleration would subject a participant to an excise tax imposed upon "excess parachute payments." The Board may also decide to take certain additional actions, such as termination of the Plan, providing cash or stock valued at the amount equal to the excess of the fair market value of the stock over the exercise price, or allow exercise of the options for stock of the succeeding company. The Company's 2002 Stock Option and Incentive Plan being presented in Proposal #4 has similar provisions.

Compliance with Section 16(a) of the Exchange Act

Section 16(a) of the Securities Exchange Act of 1934 requires the Company's officers and directors, and persons who own more than ten percent of a registered class of the Company's equity securities, to file reports of ownership and changes in ownership with the Securities and Exchange Commission (the "SEC"). Officers, directors and greater than ten-percent shareholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file.

Based solely on its review of the copies of such forms received by it, the Company believes that, during fiscal year 2001, all officers, directors and greater than ten-percent beneficial owners complied with the applicable filing requirements.

14

Certain Transactions

Pursuant to the Office/Warehouse Lease, as amended (the "Lease") between the Company and Nathan Lane Partnership, LLP, a Minnesota limited partnership, of which Phillip T. Levin, a director and principal shareholder of the Company, owns a one-third interest; the Company leases manufacturing (10,586 square feet), office (26,011 square feet) and warehouse (45,229 square feet) space. The Company pays a base rent of $8.61 per net rentable square foot per annum for the office space; $5.52 per net rentable square foot of production space per annum; and $3.86 per net rentable square foot of warehouse space per annum. Additionally, the Company is obligated to pay taxes and operating expenses. The Lease expires on December 31, 2003.

APPROVAL OF STOCK OPTIONS GRANTED TO OFFICERS

(Proposal #3)

On May 9, 2001, the Board granted, outside of any option plan, an option to purchase 422,561 shares to James T. Anderson and an option to purchase 270,439 shares to Anthony Angelini, officers and directors of the Company, which options have an exercise price of $5.86 per share. The options vest and become exercisable to the extent of 25% of the shares on four annual increments, beginning on May 9, 2002, subject to an acceleration provision, which provides that, if the closing price of the Company's Common Stock as reported on The Nasdaq Stock Market is equal to or greater than $15.00 per share for fifteen (15) days out of a 30-day period, the vesting of the option shall accelerate and be immediately exercisable to the extent of 50% of the option shares, with the balance of the shares becoming exercisable in full one year later. See Option Grants During 2001 Fiscal Year for a description of an additional stock option granted pursuant to the Company's 1996 Stock Option Plan to each of Mr. Anderson and Mr. Angelini. In January 2002, Mr. Anderson and Mr. Angelini agreed to cancel outstanding options to purchase 240,000 and 128,000 shares, respectively, for $.20 per share.

Vote Required. The Board of Directors recommends that the shareholders approve the grants of options to the officers. Under applicable Minnesota law, approval of the option grants requires the affirmative vote of the holders of a majority of the voting power of the shares represented in person or by proxy at the Annual Meeting with authority to vote on such matter, provided that such majority must be greater than 25% of the Company's outstanding shares.

APPROVAL OF 2002 STOCK OPTION AND INCENTIVE PLAN

(Proposal #4)

The Board of Directors recently approved the Zomax Incorporated 2002 Stock Option and Incentive Plan (the "2002 Plan"), subject to approval by the Company's shareholders. The Board believes that granting fairly-priced stock options to employees, officers, consultants and directors is an effective means to promote the future growth and development of the Company. Such options, among other things, increase these individuals' proprietary interest in the Company's success and enables the Company to attract and retain qualified personnel. The Board therefore recommends that all shareholders vote in favor of the 2002 Plan.

Description of 2002 Stock Award and Incentive Plan

A general description of the material features of the 2002 Plan follows, but this description is qualified in its entirety by reference to the full text of the 2002 Plan, a copy of which may be obtained without charge upon request to John Gelp, the Company's Chief Financial Officer.

General. On February 20, 2002, the Company adopted the 2002 Stock Option and Incentive Plan. Under the 2002 Plan, the Board or the Compensation Committee may award nonqualified or incentive stock options, restricted stock and performance units (collectively referred to as an "Award" or "Awards") to those officers, directors, consultants and employees (the "Participants") of the Company

15

(including its subsidiaries and affiliates) whose performance, in the judgment of the Administrator, can have a significant effect on the success of the Company. In addition, as described below, the 2002 Plan also provides for the automatic grant of nonqualified stock options to each director who is not an employee of the Company (an "Outside Director"). As of February 28, 2002, the Company had approximately 1,300 employees, of which four are officers, and four directors who are not employees.

Shares Available. Assuming the shareholders approve the 2002 Plan, the total number of shares of the Company's Common Stock available for grants of Awards to Participants directly or indirectly under the 2002 Plan shall be Three Million Five Hundred Thousand (3,500,000) shares of Common Stock, plus an annual increase, beginning January 1, 2003 and on each January 1st thereafter until the termination of the 2002 Plan, equal to (i) the number of shares granted under incentive and nonqualified stock options, restricted stock and other stock-based awards and the issuance of shares for payment of performance units during the immediately preceding calendar year, minus (ii) the number of shares allocable to any Award or portion thereof which expired or terminated during the immediately preceding calendar year. If any Awards granted under the 2002 Plan expire or terminate prior to exercise or otherwise lapse, the shares subject to the such portion of the Award are available for subsequent grants of Awards.

The total number of shares and the exercise price per share of Common Stock that may be issued pursuant to outstanding Awards are subject to adjustment by the Board of Directors upon the occurrence of stock dividends, stock splits or other recapitalizations, or because of mergers, consolidations, reorganizations or similar transactions in which the Company receives no consideration. The Board may also provide for the protection of Participants in the event of a merger, liquidation, reorganization, divestiture (including a spin-off) or similar transaction.

Administration and Types of Awards. With the exception of the automatic grants of nonqualified stock options to Outside Directors described above in "Director Fees and Options," the features of which are established by the Outside Director option provisions specified in the 2002 Plan, the 2002 Plan is administered by the Board of Directors (hereinafter referred to as the "Administrator"). The Administrator has broad powers to administer and interpret the 2002 Plan, including the authority: (i) to establish rules for the administration of the 2002 Plan; (ii) to select the Participants in the 2002 Plan; (iii) to determine the types of Awards to be granted and the number of shares covered by such Awards; and (iv) to set the terms and conditions of such Awards. All determinations and interpretations of the Administrator are binding on all interested parties.

Options. Options granted under the 2002 Plan may be either "incentive stock options" within the meaning of Section 422 of the Internal Revenue Code ("I.R.C.") or "nonqualified" stock options that do not qualify for special tax treatment under Section 422 or similar provisions of the I.R.C. No incentive stock option may be granted with a per share exercise price less than the fair market value of a share of the underlying Common Stock on the date the incentive stock option is granted. Unless otherwise determined by the Administrator, the per share exercise price for nonqualified stock options granted under the 2002 Plan also will not be less than the fair market value of a share of the Company's Common Stock on the date the nonqualified stock option is granted. The fair market value of the Company's Common Stock was $6.89 on February 28, 2002.

The period during which an option may be exercised and whether the option will be exercisable immediately, in stages, or otherwise is set by the Administrator. An incentive stock option may not be exercisable more than ten (10) years from the date of grant. Participants generally must pay for shares upon exercise of options with cash, certified check or Common Stock of the Company valued at the stock's then "fair market value" as defined in the 2002 Plan. Each incentive option granted under the 2002 Plan is nontransferable during the lifetime of the Participant. A nonqualified stock option may, if permitted by the Administrator, be transferred to certain family members, family limited partnerships and family trusts.

16

The Administrator may, in its discretion, modify or impose additional restrictions on the term or exercisability of an option. The Administrator may also determine the effect a Participant's termination of employment with the Company or a subsidiary may have on the exercisability of such option. Except for the annual grants of nonqualified stock options to Outside Directors described above, the grants of stock options under the 2002 Plan are subject to the Administrator's discretion. Consequently, future grants to eligible Participants cannot be determined at this time.

Outside Directors of the Company are also eligible for nonqualified stock options. As specified in the 2002 Plan, and as more fully described above, a nonqualified stock option for 40,000 shares of the Company's Common Stock is granted to each new Outside Director when such new Director is first elected to the Board. Each Outside Director is also granted a nonqualified stock option for 8,000 shares of the Company's Common Stock upon re-election to the Board. The per share exercise price for nonqualified stock options granted to Outside Directors is the fair market value of a share of the Company's Common Stock on the date the nonqualified stock option is granted. All nonqualified stock options granted to Outside Directors expire on the earliest of (i) three months after the Outside Director ceases to be a Director for any reason other than death, (ii) twelve months following the Outside Director's death, and (iii) ten years after the date of grant. Nonqualified stock options granted to an Outside Director when first elected to the Board become exercisable to the extent of 8,000 shares on each of the five succeeding anniversaries of the date of grant. Nonqualified stock options granted to an Outside Director upon re-election to the Board are immediately exercisable.

Restricted Stock Awards and Performance Units. The Administrator is also authorized to grant awards of restricted stock, other stock-based awards and performance units. Each restricted stock or other stock-based award granted under the 2002 Plan shall be for a number of shares as determined by the Administrator, and the Administrator, in its discretion, may also establish continued employment, vesting or other conditions that must be satisfied for the restrictions on the transferability of the shares and the risks of forfeiture to lapse. Performance units generally provide Participants with the opportunity to receive cash or shares of Common Stock if the Company's financial goals or other business objectives are achieved over specified performance periods. Because future grants of restricted stock awards and performance units are subject to the discretion of the Administrator, future awards to eligible Participants cannot be determined at this time.

Amendment. The Board of Directors may terminate or amend the 2002 Plan, except that the terms of Award agreements then outstanding may not be adversely affected without the consent of the Participant. The Board of Directors may not amend the 2002 Plan to materially increase the total number of shares of Common Stock available for issuance under the 2002 Plan, materially increase the benefits accruing to any individual or materially modify the requirements for eligibility to participate in the 2002 Plan without the approval of the Company's shareholders if such approval is required to comply with the I.R.C. or other applicable laws or regulations.

Federal Income Tax Matters.

Options. "Nonqualified" stock options granted under the 2002 Plan are not intended to and do not qualify for favorable tax treatment available to "incentive" stock options under I.R.C. Section 422. Generally, no income is taxable to the Participant (and the Company is not entitled to any deduction) upon the grant of a nonqualified stock option. When a nonqualified stock option is exercised, the Participant generally must recognize compensation taxable as ordinary income equal to the difference between the option price and the fair market value of the shares on the date of exercise. The Company normally will receive a deduction equal to the amount of compensation the Participant is required to recognize as ordinary income and must comply with applicable tax withholding requirements.

Incentive stock options granted pursuant to the 2002 Plan are intended to qualify for favorable tax treatment to the optionee under Code Section 422. Under Code Section 422, a Participant realizes no

17

taxable income when the incentive stock option is granted. If the Participant has been an employee of the Company or any subsidiary at all times from the date of grant until three months before the date of exercise, the Participant will realize no taxable income when the option is exercised. If the Participant does not dispose of shares acquired upon exercise for a period of two years from the granting of the incentive stock option and one year after receipt of the shares, the Participant may sell the shares and report any gain as capital gain. The Company will not be entitled to a tax deduction in connection with either the grant or exercise of an incentive stock option, but may be required to comply with applicable withholding requirements. If the Participant should dispose of the shares prior to the expiration of the two-year or one-year periods described above, the Participant will be deemed to have received compensation taxable as ordinary income in the year of the early sale in an amount equal to the lesser of (i) the difference between the fair market value of the Company's Common Stock on the date of exercise and the option price of the shares, or (ii) the difference between the sale price of the shares and the option price of shares. In the event of such an early sale, the Company will be entitled to a tax deduction equal to the amount recognized by the Participant as ordinary income. The foregoing discussion ignores the impact of the alternative minimum tax, which may particularly be applicable to the year in which an incentive stock option is exercised.

Restricted Stock Awards. Generally, no income is taxable to the Participant in the year a restricted stock award is granted. Instead, the Participant will recognize compensation taxable as ordinary income equal to the fair market value of the shares in the year in which the transfer restrictions lapse. Alternatively, if the Participant makes a "Section 83(b)" election, the Participant will, in the year that the restricted stock award is granted, recognize compensation taxable as ordinary income equal to the fair market value of the shares on the date the restricted stock award is granted. The Company normally will receive a deduction equal to the amount of compensation the Participant is required to recognize as ordinary taxable income, and must comply with applicable tax withholding requirements.

Performance Unit Awards. A Participant who receives performance units will recognize compensation taxable as ordinary income at the time the Participant receives payment, whether in cash or stock, equal to the value of the units. The Company normally will receive a deduction equal to the amount of compensation the Participant is required to recognize as ordinary taxable income, and must comply with applicable tax withholding requirements.

New Plan Benefits

�� The Company's management and Board of Directors believe that adoption of the 2002 Plan will enable the Company to continue to attract and retain a strong management and employee base, and will further link key employees to and reward them for increases in shareholder value. Currently, no Awards have been granted under the 2002 Plan. Because future grants of Awards under the 2002 Plan are subject to the Administrator's discretion or the Outside Director's re-election to the Board, the future benefits or amounts that may be received by employees, officers, consultants or directors under the 2002 Plan cannot be determined at this time.

Vote Required.

The Board of Directors recommends that the shareholders approve the 2002 Stock Option and Incentive 2002 Plan. Under applicable Minnesota law, approval of the 2002 Plan requires the affirmative vote of the holders of a majority of the voting power of the shares represented in person or by proxy at the Annual Meeting with authority to vote on such matter, provided that such majority must be greater than 25% of the Company's outstanding shares.

18

APPROVAL OF AMENDMENT TO 1996 EMPLOYEE STOCK PURCHASE PLAN

(Proposal #5)

General

On February 20, 2002, the Board amended the Company's 1996 Employee Stock Purchase Plan (the "Stock Purchase Plan") to increase the reserved shares from 1,000,000 to 2,000,000, plus an annual increase, beginning January 1, 2003, and each January 1st thereafter so long as the Plan is in effect, equal to the number of shares issued upon the exercise of options in the Phases ending on June 30th and December 31st of the immediately preceding calendar year. The Board also clarified that non-U.S. employees are eligible to participate in the Plan. A general description of the basic features of the Stock Purchase Plan is presented below, but such description is qualified in its entirety by reference to the full text of the Stock Purchase Plan, a copy of which may be obtained without charge upon written request to John Gelp, the Company's Chief Financial Officer.

Description of 1996 Employee Stock Purchase Plan

Purpose. The purpose of the Stock Purchase Plan is to encourage stock ownership by the Company's employees and in so doing to provide an incentive to remain in the Company's employ, to improve operations, to increase profits and to contribute more significantly to the Company's success.

Eligibility. The Stock Purchase Plan permits employees to purchase stock of the Company at a favorable price and possibly with favorable tax consequences to the employees. Generally speaking, all full-time and part-time employees (including officers) of the Company (or of those subsidiaries authorized by the Board from time to time) who have been employed by the Company (or a subsidiary) for at least 60 days are eligible to participate in any of the phases of the Stock Purchase Plan. However, any employee who would own (as determined under the Internal Revenue Code), immediately after the grant of an option, stock possessing 5% or more of the total combined voting power or value of all classes of the stock of the Company cannot purchase stock through the Stock Purchase Plan. Currently, no employee would be excluded from participation by this limitation. As of February 28, 2002, the Company had approximately 1,300 full-time and part-time employees eligible to participate.

Administration; Term. The Stock Purchase Plan is administered by the Board of Directors. The Stock Purchase Plan gives broad powers to the Board to administer and interpret the Stock Purchase Plan, including the authority to limit the number of shares that may be optioned under the Stock Purchase Plan during a phase. The Stock Purchase Plan will terminate on December 31, 2011.

Options. The Stock Purchase Plan has two six-month phases commencing on January 1 and July 1 of each year. Before the commencement date of each phase, each participating employee must elect to have a certain percentage of his or her compensation deducted during each pay period in such phase; provided, however, that the payroll deductions during a phase must not exceed 10% of the participant's compensation.

The employee may increase or decrease his or her payroll deduction percentage once during a phase. The employee may also request that any further payroll deductions be discontinued until the next phase, or may request a withdrawal of all accumulated payroll deductions.

Based on the amount of accumulated payroll deductions made at the end of the phase, shares will be purchased by each employee at the termination date of such phase (generally six months after the commencement date). The purchase price to be paid by the employees will be the lower of the amount determined under Paragraphs A and B below:

- A.

- 85% of the closing price of the Company's Common Stock quoted by the Nasdaq National Market as of the commencement date of the phase; or

19

- B.

- 85% of the closing price of the Company's Common Stock quoted by the Nasdaq National Market as of the termination date of the phase.

The closing price of the Company's Common Stock on February 28, 2002 was $6.89 per share.

As required by tax law, an employee may not, during any calendar year, receive options under the Stock Purchase Plan for shares which have a total fair market value in excess of $25,000 determined at the time such options are granted. Any amount not used to purchase shares will be carried over to the next phase, unless the employee requests a refund of that amount. No interest is paid by the Company on funds withheld, and such funds are used by the Company for general operating purposes.

If the employee dies or terminates employment for any reason before the end of the phase, the employee's payroll deductions will be refunded, without interest, after the end of the phase.

Amendment. The Board of Directors may, from time to time, revise or amend the Stock Purchase Plan as the Board may deem proper and in the best interest of the Company or as may be necessary to comply with Section 423 of the Internal Revenue Code (the "Code"); provided, that no such revision or amendment may (i) increase the total number of shares for which options may be granted under the Stock Purchase Plan except as provided in the case of stock splits, consolidations, stock dividends or similar events, (ii) modify requirements as to eligibility for participation in the Stock Purchase Plan, or (iii) materially increase the benefits accruing to the participants under the Stock Purchase Plan, without prior approval of the Company's shareholders, if such approval is required to comply with Code Section 423, the requirements of Section 16(b) of the Securities Exchange Act of 1934 (the "Act"), or other applicable federal or state laws.

Shares Reserved. The Board of Directors shall equitably adjust the number of shares remaining reserved for grant, the number of shares of stock subject to outstanding options and the price per share of stock subject to an option in the event of certain increases or decreases in the number of outstanding shares of Common Stock of the Company effected as a result of stock splits or consolidations, stock dividends or other transactions in which the Company receives no consideration.

Federal Income Tax Consequences of the Stock Purchase Plan. Options granted under the Stock Purchase Plan are intended to qualify for favorable tax treatment to the employees under Code Sections 421 and 423. Employee contributions are made on an after-tax basis. Under existing federal income tax provisions, no income is taxable to the optionee upon the grant or exercise of an option if the optionee remains an employee of the Company or one of its subsidiaries at all times from the date of grant until three months before the date of exercise. In addition, certain favorable tax consequences may be available to the optionee if shares purchased pursuant to the Stock Purchase Plan are not disposed of by the optionee within two years after the date the option was granted nor within one year after the date of transfer of purchased shares to the optionee. The Company generally will not receive an income tax deduction upon either the grant or exercise of the option.

Plan Benefits. Because participation in the Stock Purchase Plan is voluntary, the future benefits that may be received by participating individuals or groups under the Stock Purchase Plan cannot be determined at this time.

Vote Required

The Board of Directors recommends that the shareholders approve the amendment to the 1996 Employee Stock Purchase Plan. Approval of the amendment requires the affirmative vote of the greater of Under applicable Minnesota law, approval of the option grants requires the affirmative vote of the holders of the greater of a majority of the voting power of the shares represented in person or by proxy at the Annual Meeting with authority to vote on such matter, provided that such majority must be greater than 25% of the Company's outstanding shares.

20

INDEPENDENT PUBLIC ACCOUNTANTS

Arthur Andersen LLP has served as the Company's independent public accountants since its inception in February 1996 and served as the independent public accountants of the Company's predecessor from its inception in 1993 to the reorganization of the Company and its predecessor in May 1996. A representative of Arthur Andersen LLP is expected to be present at the 2002 Annual Meeting and will be given an opportunity to make a statement regarding financial and accounting matters of the Company, if he or she so desires, and will be available to respond to appropriate questions from the Company's shareholders. The Company has not yet selected its independent accountants for the current year ending December 27, 2002.

Audit Fees

The aggregate fees billed and to be billed by Arthur Andersen LLP for professional services rendered for the audit of annual financial statements for fiscal year 2001 and for review of the financial statements included in the Forms 10-Q for such year were $199,099.

Financial Information Systems Design and Implementation Fees

Arthur Andersen LLP did not provide professional services to the Company for fiscal year 2001 with respect to financial information systems design and implementation.

All Other Fees

The aggregate fees billed and to be billed by Arthur Andersen LLP for all other non-audit services, including services related to tax compliance and acquisitions, in fiscal year 2001 were $193,600.

The Company's Audit Committee has considered whether provision of the above non-audit services is compatible with maintaining Arthur Andersen's independence and has determined that such services are compatible with maintaining Arthur Andersen's independence.

OTHER BUSINESS

Management knows of no other matters to be presented at the 2002 Annual Meeting. If any other matter properly comes before the 2002 Annual Meeting, the appointees named in the proxies will vote the proxies in accordance with their best judgment.

SHAREHOLDER PROPOSALS

Any appropriate proposal submitted by a shareholder of the Company and intended to be presented at the 2003 Annual Meeting must be received by the Company by November 21, 2002 to be included in the Company's proxy statement and related proxy for the 2003 Annual Meeting. If a shareholder proposal intended to be presented at the 2003 annual meeting but not included in the proxy materials is received by the Company after February 4, 2003, then management named in the Company's proxy for the 2003 annual meeting will have discretionary authority to vote shares represented by such proxies on the shareholder proposal, if presented at the meeting.

ANNUAL REPORT

A copy of the Company's Annual Report to Shareholders for the fiscal year ended December 28, 2001, including financial statements, accompanies this Notice of Annual Meeting and Proxy Statement. No portion of the Annual Report is incorporated herein or is to be considered proxy soliciting material.

21

FORM 10-K

THE COMPANY WILL FURNISH WITHOUT CHARGE TO EACH PERSON WHOSE PROXY IS BEING SOLICITED, UPON WRITTEN REQUEST OF ANY SUCH PERSON, A COPY OF THE COMPANY'S ANNUAL REPORT ON FORM 10-K FOR THE FISCAL YEAR ENDED DECEMBER 28, 2001, AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION, INCLUDING THE FINANCIAL STATEMENTS AND A LIST OF EXHIBITS TO SUCH FORM 10-K. THE COMPANY WILL FURNISH TO ANY SUCH PERSON ANY EXHIBIT DESCRIBED IN THE LIST ACCOMPANYING THE FORM 10-K UPON THE ADVANCE PAYMENT OF REASONABLE FEES. REQUESTS FOR A COPY OF THE FORM 10-K AND/OR ANY EXHIBIT(S) SHOULD BE DIRECTED TO THE CHIEF FINANCIAL OFFICER OF ZOMAX INCORPORATED, 5353 NATHAN LANE, PLYMOUTH, MINNESOTA 55442. YOUR REQUEST MUST CONTAIN A REPRESENTATION THAT, AS OF MARCH 6, 2002, YOU WERE A BENEFICIAL OWNER OF SHARES ENTITLED TO VOTE AT THE 2002 ANNUAL MEETING OF SHAREHOLDERS.

Dated: March 21, 2002

22

ZOMAX INCORPORATED

2002 STOCK OPTION AND INCENTIVE PLAN

ARTICLE I—INTRODUCTION

1.01 History. On February 20, 2002, the Board adopted the 2002 Stock Option and Incentive Plan, subject to approval by the shareholders of the Corporation.

1.02 Purpose. The primary purpose of the 2002 Stock Option and Incentive Plan (the Plan) is to advance the interests of the Corporation and its stockholders by affording officers, employees, directors, consultants and advisors of the Corporation and its Subsidiaries, upon whose judgment, initiative and efforts the Corporation and its Subsidiaries largely depend for the successful conduct of their business, a proprietary interest in the growth and performance of the Corporation.

ARTICLE II—DEFINITIONS

2.01 "Administrator" means the Board or, if the Board so directs, a Committee of the Board (or any successor to such Committee), which shall consist solely of two or more directors who shall be appointed by and serve at the pleasure of the Board. To the extent necessary for compliance with Rule 16b-3, or any successor provision, each of the members of the Option Administration Committee shall be a "non-employee director," as such term is defined in Rule 16b-3 of the General Rules and Regulations under the Securities Exchange Act of 1934, as amended from time to time.

2.02 "Affiliate" means a Parent or Subsidiary of the Corporation.

2.03 "Award" means the grant of any form of Incentive Stock Option, Nonqualified Stock Option, Restricted Stock Award, Other Stock-Based Award, or any number of Performance Units, whether granted singly, in combination or in tandem, to a Plan Participant pursuant to the Plan on such terms, conditions and limitations as the Administrator may establish in order to fulfill the objectives of the Plan.

2.04 "Award Agreement" means the agreement executed by the Corporation or its Affiliate and a Participant that sets forth the terms, conditions and limitations applicable to the Award.

2.05 "Board" means, at any particular time, the then duly elected and acting directors of the Corporation.

2.06 "Corporation" means Zomax Incorporated, a Minnesota corporation, and any successor in interest by way of consolidation, operation of law, merger or otherwise.

2.07 "Date of Grant" means the date an Award is approved by resolution of the Administrator, or such later date as may be specified in such resolution.

2.08 "Effective Date" means the date the Plan is adopted by the Board under Section 13.01 of Article XIII of the Plan.

2.09 "Eligible Employee" means an employee of the Corporation or an Affiliate.

2.10 "Fair Market Value" means, with respect to shares of Stock on any applicable date:

(a) If the Stock is listed on The Nasdaq Stock Marketor an established stock exchange, the price of such stock at the close of the regular trading session of such market or exchange on such date, as reported byThe Wall Street Journal or a comparable reporting service, or if no sale of such stock shall have occurred on such date, on the next preceding day on which there was a sale of stock;

A-1