UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x |

Filed by a Party other than the Registrant o |

Check the appropriate box: |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material Pursuant to §240.14a-12 |

CARDIOTECH INTERNATIONAL, INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

x | No fee required. |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

| | | |

CARDIOTECH INTERNATIONAL, INC

229 Andover Street

Wilmington, MA 01887

www.cardiotech-inc.com

general-info@cardiotech-inc.com

September 8, 2006

To the Stockholders of CardioTech International, Inc.:

CardioTech International, Inc. (the “Company”) is pleased to send you the enclosed notice of the Annual Meeting of Stockholders (the “Meeting”) to be held Wednesday, October 11, 2006, at 10:00 a.m. (EST) at the office of the Company located at 229 Andover Street, Wilmington, MA 01887. Ordinary annual meeting business will be transacted at the Meeting, including the election of two directors.

Please review the Company’s enclosed Proxy Statement and Annual Report on Form 10-K carefully. If you have any questions regarding this material, please do not hesitate to call me at (978) 657-0075.

| Sincerely yours, |

| |

| /s/ Michael F. Adams |

| Michael F. Adams |

| Chief Executive Officer and President |

| CardioTech International, Inc. |

WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING PLEASE COMPLETE THE ENCLOSED PROXY AND MAIL IT PROMPTLY IN THE ENCLOSED ENVELOPE IN ORDER TO ASSURE REPRESENTATION OF YOUR SHARES AT THE MEETING.

CARDIOTECH INTERNATIONAL, INC

229 Andover Street

Wilmington, MA 01887

| NOTICE OF 2006 ANNUAL MEETING OF STOCKHOLDERS | |

To Be Held on October 11, 2006

The Annual Meeting of Stockholders (the “Meeting”) of CardioTech International, Inc. (the “Company”) will be held Wednesday, October 11, 2006, at 10:00 a.m. (EST) at the office of the Company located at 229 Andover Street, Wilmington, MA 01887, for the following purposes:

(1) To elect two (2) directors to hold office until their successors shall be elected and shall have qualified;

(2) To ratify the selection of Ernst & Young LLP as CardioTech’s independent accountants for the fiscal year ending March 31, 2007; and

(3) To transact such other business as may properly come before the meeting or any adjournment thereof.

The Board has fixed the close of business on August 16, 2006, or any adjournments thereof, as the record date for the determination of stockholders entitled to notice of, and to vote and act at, the Meeting and only stockholders of record at the close of business on that date are entitled to notice of, and to vote and act at, the Meeting.

For a period of ten (10) days prior to the Meeting, a stockholders list will be kept at the Company’s office and shall be available for inspection by stockholders during usual business hours. A stockholders list will also be available for inspection at the Meeting.

Stockholders are cordially invited to attend the Meeting in person. However, to assure your representation at the Meeting, please complete and sign the enclosed proxy card and return it promptly. If you choose, you may still vote in person at the Meeting even though you previously submitted a proxy card.

| By Order of the Board of Directors, |

| |

| /s/ Eric G. Walters |

| Eric G. Walters, Clerk |

Wilmington, Massachusetts

September 8, 2006

CARDIOTECH INTERNATIONAL, INC.

229 Andover Street

Wilmington, Massachusetts 01887

(978) 657-0075

For the 2006 Annual Meeting of Stockholders to

be Held on October 11, 2006

GENERAL MATTERS

The enclosed proxy is solicited by the Board of Directors (the “Board”) of CardioTech International, Inc. (the “Company” or “CardioTech”). A Massachusetts corporation, for use at the 2006 Annual Meeting of Stockholders (the “Annual Meeting”) to be held at the office of the Company at 229 Andover Street, Wilmington, Massachusetts 01887 on Wednesday, October 11, 2006, at 10:00 a.m., local time, and at any adjournment or adjournments of that meeting.

All proxies will be voted in accordance with the instructions contained in the applicable proxy, and if no choice is specified, the proxies will be voted in favor of the matters set forth in the accompanying Notice of Meeting. Any proxy may be revoked by a stockholder at any time before it is exercised by delivery of a written revocation to the Clerk of CardioTech, or by voting in person at the Annual Meeting.

CardioTech’s Annual Report for the fiscal year ended March 31, 2006 is being mailed to stockholders with the mailing of this Notice and Proxy Statement on or about September 4, 2006.

A copy of CardioTech’s Annual Report on Form 10-K for the fiscal year ended March 31, 2006 as filed with the Securities and Exchange Commission on June 28, 2006, without exhibits, will accompany this Proxy Statement. Exhibits will be furnished without charge to any stockholder upon written request to the Vice President and Chief Financial Officer, CardioTech International, Inc., 229 Andover Street, Wilmington, MA 01887.

Quorum and Vote Requirement

On August 16, 2006, the record date for the determination of stockholders entitled to notice and to vote at the Annual Meeting, there were issued and outstanding and entitled to vote an aggregate of 19,907,170 shares of common stock of CardioTech, $0.01 par value per share (“Common Stock”). Each share of Common Stock is entitled to one vote.

The holders of a majority of the shares of Common Stock issued and outstanding and entitled to vote on each matter presented at the Annual Meeting shall constitute a quorum for such matter. Shares of Common Stock present in person or represented by proxy (including shares which abstain or do not vote with respect to one or more of the matters presented for shareholder approval) will be counted for purposes of determining whether a quorum exists for a matter presented at the Annual Meeting.

The affirmative vote of holders of a plurality of votes cast by the stockholders entitled to vote on the matter is required for the election of directors. The affirmative vote of the holders of a majority of the shares of Common Stock present or represented and properly cast on each matter is required for the ratification of the selection of Ernst & Young LLP as CardioTech’s independent accountants.

Shares that abstain from voting as to a particular matter, and shares held in “street name” by brokers or nominees who indicate on their proxies that they do not have discretionary authority to vote such shares as to a particular matter, will not be counted as votes in favor of such matter and will also not be counted as votes cast or shares voting on such matter. Accordingly, abstentions and “broker non-votes” will have no effect on the voting on a matter that requires the affirmative vote of a certain percentage of the votes cast or shares voting on a matter. However, abstentions are considered to be shares present, or represented in determining whether a quorum exists on a given matter.

1

Revoking a Previously Delivered Proxy

A proxy that is properly submitted may be revoked at any time before it is exercised. For a stockholder “of record,” meaning one whose shares are registered in his or her own name, to revoke a proxy, the stockholder may either: (i) send another signed proxy card with a later date to the address indicated on the proxy card; (ii) send a letter revoking the stockholder’s proxy to our Clerk at our principal address; or (iii) attend the Annual Meeting and vote in person.

A “beneficial holder” whose shares are registered in another name, for example in “street name,” must follow the procedures required by the holder of record, which is usually a brokerage firm or bank, to revoke a proxy. You should contact the holder of record directly for more information on these procedures.

Voting in Person

Stockholders of record that attend the Annual Meeting and wish to vote in person will be given a ballot at the meeting. If your shares are held in “street name,” or are otherwise not registered in your name, you will need to obtain a “legal proxy” from the holder of record and present it at the meeting.

Stock Ownership of Certain Beneficial Owners and Management

The following table sets forth the beneficial ownership of shares of our common stock, as of July 31, 2006, of (i) each person known by us to beneficially own five percent (5%) or more of such shares; (ii) each of our directors and executive officers named in the Summary Compensation Table; and (iii) all of our current executive officers, directors, and significant employees as a group. Except as otherwise indicated, all shares are beneficially owned, and the persons named as owners hold investment and voting power.

Beneficial ownership has been determined in accordance with Rule 13d-3 under the Securities Exchange Act of 1934. Under this rule, certain shares may be deemed to be beneficially owned by more than one person, if, for example, persons share the power to vote or the power to dispose of the shares. In addition, shares are deemed to be beneficially owned by a person if the person has the right to acquire shares, for example, upon exercise of an option or warrant, within sixty (60) days of July 31, 2006. In computing the percentage ownership of any person, the amount of shares is deemed to include the amount of shares beneficially owned by such person, and only such person, by reason of such acquisition rights. As a result, the percentage of outstanding shares of any person as shown in the following table does not necessarily reflect the person’s actual voting power at any particular date.

The percentage of beneficial ownership for the following table is based on 19,832,583 shares of CardioTech common stock outstanding as of July 31, 2006. Unless otherwise indicated, the address for each listed stockholder is: c/o CardioTech International, Inc., 229 Andover Street, Wilmington, MA 01887. To CardioTech’s knowledge, except as otherwise indicated in the footnotes to this table and pursuant to applicable community property laws, the persons named in the table have sole voting and investment power with respect to all shares of common stock.

Name and address of beneficial owner | | Common stock

beneficially

owned | | Percentage of

outstanding

shares | |

Michael Szycher, Ph.D. (1) | | 3,608,466 | | 15.6 | % |

Michael L. Barretti (2) | | 210,833 | | 1.1 | % |

Michael F. Adams (3) | | 242,589 | | 1.2 | % |

Anthony J. Armini, Ph.D. (4) | | 143,520 | | 0.7 | % |

William J. O’Neill, Jr. (5) | | 80,000 | | 0.4 | % |

Jeremiah E. Dorsey (6) | | 65,627 | | 0.3 | % |

Eric G. Walters (7) | | 200,000 | | 1.0 | % |

| | | | | |

All executive officers and directors as a group (7 persons) (8) | | 4,551,035 | | 19.0 | % |

| | | | | |

(1) Includes 3,230,743 shares of common stock, which may be purchased within sixty (60) days of July 31, 2006 upon the exercise of stock options and/or warrants. On August 7, 2006, Dr. Michael Szycher resigned as Chief Executive Officer, President, Treasurer and member of the Board of Directors of the Company, effective that date.

2

(2) Includes 194,783 shares of common stock, which may be purchased within sixty (60) days of July 31, 2006 upon the exercise of stock options and/or warrants.

(3) Includes 242,589 shares of common stock, which may be purchased within sixty (60) days of July 31, 2006 upon the exercise of stock options and/or warrants.

(4) Includes 137,520 shares of common stock, which may be purchased within sixty (60) days of July 31, 2006 upon the exercise of stock options and/or warrants.

(5) Includes 80,000 shares of common stock, which may be purchased within sixty (60) days of July 31, 2006 upon the exercise of stock options and/or warrants.

(6) Includes 65,627 shares of common stock, which may be purchased within sixty (60) days of July 31, 2006 upon the exercise of stock options and/or warrants.

(7) Includes 200,000 shares of common stock, which may be purchased within sixty (60) days of July 31, 2006 upon the exercise of stock options and/or warrants.

(8) See footnotes (1) through (7).

Equity Compensation Plan Information

The following table provides information about the securities authorized for issuance under CardioTech’s equity compensation plans as of March 31, 2006:

Plan Category | | Number of securities to

be issued upon exercise

of outstanding options,

warrants and rights (a) | | Weighted average

exercise price of

outstanding options,

warrants and rights (b) | | Number of securities

remaining available for

future issuance (c) | |

Equity compensation plans approved by stockholders | | 5,825,880 | (1) | $ | 2.19 | | 965,954 | |

Equity compensation plans not approved by stockholders | | 385,000 | | $ | 2.46 | | — | |

Total | | 6,210,880 | | $ | 2.21 | | 965,954 | |

(1) This total includes shares to be issued upon exercise of outstanding options under two equity compensation plans that have been approved by CardioTech’s stockholders (i.e., the 1996 Plan and the 2003 Plan).

3

PROPOSAL 1

ELECTION OF DIRECTORS

Pursuant to Section 50A of Chapter 156B of the Massachusetts General Laws, the Board is currently divided into three (3) classes having staggered terms of three (3) years each. Under Section 50A, the Board may determine the total number of directors and the number of directors to be elected at any annual meeting or special meeting in lieu thereof. The Board has fixed at two (2) the number of Class I directors to be elected at the Meeting. At the Meeting, the stockholders will be asked to elect Mr. Michael F. Adams and Dr. Anthony J. Armini as Class I directors to serve in such capacity until the 2009 Annual Meeting and until their successors are duly elected and qualified.

It is the intention of the persons named in the enclosed proxy to vote to elect the nominees named above, whom are both incumbent directors and each of whom has consented to serve if elected. If some unexpected occurrence should make necessary, in the discretion of the Board, the substitution of some other person for the nominee, it is the intention of the persons named in the proxy to vote for the election of such other person as may be designated by the Board.

The Nominees and directors of the Company are as follows:

Name | | Age | | Class | | Position | |

Michael F. Adams | | 50 | | I | | Nominee for Director* Chief Executive Officer and President | |

William O’Neill, Jr. | | 64 | | II | | Chairman of the Board of Directors | |

Anthony J. Armini, Ph.D. | | 68 | | I | | Nominee for Director* | |

Michael L. Barretti | | 61 | | II | | Director | |

Jeremiah E. Dorsey | | 61 | | III | | Director | |

* Nominees for election as a director at this Meeting.

There are no family relationships between any director, executive officer, or person nominated or chosen to become a director or executive officer.

Nominees to Serve as Directors for a Term Expiring at the 2009 Annual Meeting (Class I Director)

Mr. Michael F. Adams has been a director of CardioTech since May 1999. Mr. Adams was appointed as Chief Executive Officer and President on August 7, 2006. From April 1, 2006 until August 7, 2006, Mr. Adams was the Company’s Vice President of Regulatory Affairs and Business Development. Prior to April 2006, Mr. Adams was the Vice President of PLC Systems, Inc. Prior to joining PLC Systems in September 2000, Mr. Adams was Vice President of Assurance Medical, Inc. Prior to joining Assurance Medical in June 1999, Mr. Adams was the Chief Operating Officer and Vice President of Regulatory Affairs and Quality Assurance of CardioTech from June 1998 to May 1999. From November 1994 through June 1998, Mr. Adams served as the Vice President of Cytyc Corporation. Mr. Adams received a BS from the University of Massachusetts.

Dr. Anthony J. Armini has been a director of CardioTech since August 2000. Dr. Armini has been the President, Chief Executive Officer, and Chairman of the Board of Directors of Implant Science Corporation since 1984. From 1972 to 1984, prior to founding Implant Sciences, Dr. Armini was Executive Vice President at Spire Corporation. From 1967 to 1972, Dr. Armini was a Senior Scientist at McDonnell Douglas Corporation. Dr. Armini received his Ph.D. in nuclear physics from the University of California, Los Angeles in 1967. Dr. Armini is the author of eleven patents, fifteen patents pending and fourteen publications in the field of implant technology. Dr. Armini has over thirty years of experience working with cyclotrons and linear accelerators, the production and characterization of radioisotopes, and fifteen years experience with ion implantation in the medical and semiconductor fields.

4

Directors for a Term Expiring at the 2008 Annual Meeting (Class III Director)

Mr. Jeremiah E. Dorsey has been a director of CardioTech since May, 2004. Mr. Dorsey retired in 2002. From 1992 to 2002, Mr. Dorsey was President and Chief Operating Officer of The West Company (Lionville, PA), a leading supplier of components to the pharmaceutical, medical device and dental businesses. From 1990 to 1992, Mr. Dorsey was President and Chief Executive Officer of Foster Medical (Waltham, MA), a supplier of hospital equipment. From 1988 to 1990, he was President of Towles Housewares Company (Newburyport, MA), and Vice President and Board Member of J&J Dental Products Company (East Windsor, NJ), a world leader in composite materials, dental amalgams, cleaning and polishing products. Mr. Dorsey received a BA from Assumption College and an MBA from Fairleigh Dickinson University.

Directors for a Term Expiring at the 2007 Annual Meeting (Class II Director)

Mr. Michael L. Barretti has been a director of CardioTech since January 1998. Mr. Barretti is the executive in residence and professor of marketing at Suffolk University in Boston. Mr. Barretti has been the President of Cool Laser Optics, Inc., a company which commercializes optical technology specific to the medical laser industry, since July 1996. From September 1994 to July 1996, Mr. Barretti was Vice President of Marketing for Cynosure, Inc., a manufacturer of medical and scientific lasers. From June 1987 to September 1994, Mr. Barretti was a principal and served as Chief Executive Officer of NorthFleet Management Group, a marketing management firm serving the international medical device industry. From January 1991 to May 1994, Mr. Barretti also acted as President of Derma-Lase, Inc., the U.S. subsidiary of a Glasgow, Scotland supplier of solid-state laser technologies to the medical field. Mr. Barretti received his BA from St. Johns University and an MBA from Suffolk University.

Mr. William J. O’Neill, Jr. has been a director of CardioTech since May 2004 and was appointed as Chairman on August 7, 2006. Mr. O’Neill is currently the Dean of the Frank Sawyer School of Management at Suffolk University in Boston, Massachusetts. Prior to this appointment, Mr. O’Neill spent thirty years (1969-1999) with the Polaroid Corporation, where he held the positions of Executive Vice President of the Corporation, President of Corporate Business Development, and Chief Financial Officer. He was also Senior Financial Analyst at Ford Motor Company. Mr. O’Neill was a Trustee at the Dana Farber Cancer Institute, and is currently a member of the Massachusetts Bar Association, a member of the Board of Directors of the Greater Boston Chamber of Commerce, and serves on the Board of Directors of Concord Camera. He earned a BA at Boston College in mathematics, a MBA in finance from Wayne State University, and a JD from Suffolk University Law School.

5

CORPORATE GOVERNANCE

CardioTech’s Board of Directors has long believed that good corporate governance is important to ensure that CardioTech is managed for the long-term benefit of stockholders. During the past year, CardioTech’s Board of Directors has continued to review its governance practices in light of the Sarbanes-Oxley Act of 2002 and recently revised SEC rules and regulations. This section describes key corporate governance guidelines and practices that the Company has adopted. Complete copies of the corporate governance guidelines, committee charters and code of conduct described below are available on the Company’s website at www.cardiotech-inc.com. Alternatively, you can request a copy of any of these documents by writing to the Vice President and Chief Financial Officer, 229 Andover Street, Wilmington, MA 01887.

Corporate Governance Guidelines

The Board has adopted corporate governance guidelines to assist the Board in the exercise of its duties and responsibilities and to serve in the best interests of the Company and its stockholders. These guidelines, which provide a framework for the conduct of the Board’s business, include that:

· the principal responsibility of the directors is to oversee the management of the Company;

· a majority of the members of the Board shall be independent directors;

· the non-management directors meet regularly in executive session; and

· directors have full and free access to management and, as necessary and appropriate, independent advisors.

Board Determination of Independence

The Board of Directors has adopted director independence guidelines that are consistent with the definitions of “independence” as set forth in Section 301 of the Sarbanes-Oxley Act of 2002, Rule 10A-3 under the Securities Exchange Act of 1934 and AMEX listing standards. In accordance with these guidelines, the Board of Directors has reviewed and considered facts and circumstances relevant to the independence of each of our directors and director nominees and has determined that, each of the Company’s non-management directors qualifies as “independent” under AMEX listing standards.

Board Meetings and Attendance

The Board met five (5) times during the year ended March 31, 2006. Each director attended in excess of 75% of the total number of meetings of the Board and of committees of the Board on which he served during fiscal 2006. Two (2) of the six (6) directors attended the 2005 Annual Meeting of the Company. The non-management members of the Board regularly meet, without any members of management present, at each scheduled Board of Directors meeting. In addition, from time to time, the members of the Board and its committees acted by unanimous written consent pursuant to Massachusetts law.

Board Committees

The Board of Directors has established standing Audit, Compensation, and Nominating committees. The Audit Committee was established in accordance with Section 3(a)(58)(A) of the Exchange Act. The Audit and Compensation committees operate under charters that have been approved by the Board. A copy of the charters of the Audit committee and Compensation committee are posted on the Corporate Governance section of the Company’s website at www.cardiotech-inc.com.

The Board of Directors has determined that all of the members of each committee are independent as defined under the AMEX rules, including, in the case of all members of the Audit Committee, the independence requirements contemplated by Rule 10A-3 under the Exchange Act. In addition, all of the members of the Audit Committee are independent as defined by the AMEX rules that apply to the Company until the date of the Annual Meeting and otherwise satisfy the AMEX eligibility requirements for Audit Committee membership.

6

Audit Committee. The Audit Committee’s responsibilities include:

· appointing, approving the compensation of, and assessing the independence of the Company’s independent auditors;

· overseeing the work of the Company’s independent auditors, including through the receipt and consideration of certain reports from the independent auditors;

· reviewing and discussing with management and the independent auditors the Company’s annual and quarterly financial statements and related disclosures;

· coordinating the Board of Director’s oversight of the Company’s internal control over financial reporting, disclosure controls and procedures and code of conduct and ethics;

· establishing procedures for the receipt and retention of accounting related complaints and concerns;

· meeting independently with the Company’s internal auditing staff, independent auditors and management; and

· preparing the audit committee report required by SEC rules (which is included on pages 8 and 9 of this proxy statement).

The Board of Directors has determined that Mr. O’Neill is an “audit committee financial expert” as defined in Item 401(h) of Regulation S-K and is independent as that term is defined in Item 7(d)(3)(iv) of Schedule 14A under the Exchange Act.

During the fiscal year ended March 31, 2006, the Audit Committee met four (4) times and the members of the committee were Messrs. O’Neill (Chairman) and Barretti and Dr. Armini. The responsibilities of the Audit Committee are outlined in a written charter, which was included as Appendix A of the Proxy Statement for the 2004 Annual Meeting of Stockholders.

Compensation Committee. The Compensation Committee’s responsibilities include:

· annually reviewing and making recommendations to the Board with respect to the corporate goals and objectives relevant to Chief Executive Officer (“CEO”) compensation;

· reviewing and recommending to the Board the compensation level for the CEO;

· after receiving recommendations from the CEO, reviewing and approving the compensation of the Company’s other executive officers;

· reviewing and making recommendations to the Board with respect of modifications to the Company’s cash compensation and equity incentive plans and all grants pursuant to such plans; and

· reviewing and making recommendations to the Board with respect to director compensation.

During the fiscal year ended March 31, 2006, the Compensation Committee met two (2) times and the members of the committee included Messrs. Adams (Chairman), Barretti and Dorsey. In April 2006, Mr. Adams joined the Company as its Vice President of Regulatory Affairs and Business Development, continued as a director and resigned from the Compensation Committee. At that time, Dr. Armini replaced Mr. Adams as a member of the Compensation Committee and Mr. Barretti was appointed its Chairman. In June 2006, the Compensation Committee approved a written charter, which is included as Exhibit 99.1 of the Annual Report on Form 10-K.

Nominating Committee. The Nominating Committee’s responsibilities include:

· identifying individuals qualified to become Board members;

· recommending to the Board the persons to be nominated for election as directors and to each of the Board’s committees; and

· reviewing and making recommendations to the Board with respect to management succession planning.

During the fiscal year ended March 31, 2006, the Nominating Committee met one (1) time and the members of the committee were Messrs. Dorsey (Chairman), Barretti and Adams. In April 2006, Mr. Adams resigned as a member of the Nominating Committee and remained as a director.

7

Director Nominations

The nominating committee assesses the appropriate size of the Board of Directors, and whether any vacancies on the Board of Directors are expected due to retirement or otherwise. In the event that vacancies are anticipated or otherwise arise, the committee utilizes a variety of methods for identifying and evaluating director candidates. Candidates may come to the attention of the committee through current directors, professional search firms, stockholders or other persons. Once the committee has identified a prospective nominee, the committee will evaluate the prospective nominee in the context of the then current constitution of the Board of Directors and will consider a variety of other factors, including the prospective nominee’s business, finance and financial reporting experience, and attributes that would be expected to contribute to an effective Board of Directors. The committee seeks to identify nominees who possess a wide range of experience, skills, areas of expertise, knowledge and business judgment. Successful nominees must have a history of superior performance or accomplishments in their professional undertakings and should have the highest personal and professional ethics and values. The committee does not evaluate stockholder nominees differently than any other nominee.

Pursuant to procedures set forth in our bylaws, our nominating committee will consider stockholder nominations for directors if we receive timely written notice, in proper form, of the intent to make a nomination at a meeting of stockholders. To be timely, the notice must be received within the time frame identified in our bylaws, a discussion of which appears below on page 16 under the heading “Deadline For Submission of Stockholder Proposals.” To be in proper form, the notice must, among other matters, include each nominee’s written consent to serve as a director if elected, a description of all arrangements or understandings between the nominating stockholder and each nominee and information about the nominating stockholder and each nominee. These requirements are detailed in our bylaws, which were attached as an exhibit to our Report on Form 10 filed on May 10, 1996. A copy of our bylaws will be provided upon written request.

Communicating with the Board Directors

The Board will give appropriate attention to written communications that are submitted by stockholders, and will respond if and as appropriate. Stockholders who wish to send communications on any topic to the Board should address such communications to Board of Directors c/o Vice President and Chief Financial Officer, CardioTech International, Inc., 229 Andover Street, Wilmington, MA 01887.

Code of Conduct and Ethics

The Company has adopted a code of ethics that applies to its chief executive officer, chief financial officer, and vice president of finance. The code of ethics is posted on the Company’s website, the address of which is www.cardiotech-inc.com. The Company intends to include on its website any amendments to, or waivers from, a provision of its code of ethics that applies to the Company’s chief executive officer, chief financial officer, or vice president of finance that relates to any element of the code of ethics definition enumerated in Item 406 of Regulation S-K.

Report of the Audit Committee of the Board

The Audit Committee reviewed CardioTech’s audited financial statements for the fiscal year ended March 31, 2006 and discussed these financial statements with CardioTech’s management. The Audit Committee also reviewed and discussed the audited financial statements and the matters required by Statement of Auditing Standards No. 61 (Communications with Audit Committees) with Ernst & Young LLP, CardioTech’s independent auditors.

CardioTech’s independent auditors also provided the Audit Committee with the written disclosures and the letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees). The Audit Committee discussed with the Independent auditors the matters disclosed in this letter and the independence of the auditors from CardioTech. The Audit Committee also considered whether the independent auditors’ provision of the other, non-audit related services to CardioTech which are referred to in “Independent Auditors Fees and Other Matters” is compatible with maintaining such auditors’ independence and concluded that they were.

Based on discussions with management and the independent auditors, and its review of the representations and information provided by management and the independent auditors, the Audit Committee recommended to

8

CardioTech’s Board that the audited financial statements be included in CardioTech’s Annual Report on Form 10-K for the fiscal year ended March 31, 2006.

By the Audit Committee of the Board of Directors of CardioTech:

| William J. O’Neill, Jr. |

| Michael L. Barretti |

| Anthony J. Armini, Ph.D. |

Directors’ Compensation

CardioTech’s policy is to pay $750 per meeting compensation to non-employee members of the Board for attendance at Board meetings, and $1,500 per meeting to Committee Chairmen. The chairman of the Audit Committee will also receive $1,500 for each special meeting with CardioTech’s Principal Accountants. All non-employee directors are reimbursed for travel and other related expenses incurred in attending meetings of the Board. Effective January 1, 2006, the compensation policy changed. Each of the Company’s independent directors receives an annual fee of $12,000 pro-rated and payable quarterly at the beginning of each quarter. The Chairman of the Audit Committee earns an additional annual fee of $5,000, pro-rated and payable quarterly at the beginning of each quarter. Each independent director receives $1,000 for each special meeting and $750 for each meeting of a Board committee.

Directors are eligible to participate in the 1996 and 2003 Plans. In fiscal 2004, CardioTech granted each Director an option to purchase 10,000 shares of the Company’s Common Stock and additional 2,500 shares to chairmen of committees. In fiscal 2005, CardioTech granted the chairman of the Audit Committee an option to purchase 50,000 shares and granted each director an option to purchase 30,000 shares. In fiscal 2005, one board member elected to receive stock options to purchase 5,000 shares for each Board meeting attended in fiscal 2005 in lieu of cash compensation. In fiscal 2006, one board member elected to receive stock options to purchase 16,459 shares in lieu of cash compensation.

Compensation of Executive Officers

Non-director Executive Officer. The following table contains the name, position and age of the officer of the Company who is not a director:

Name | | Age | | Position | |

Eric G. Walters | | 54 | | Vice President and Chief Financial Officer | |

Mr. Eric G. Walters has been Vice President and Chief Financial Officer of CardioTech since October 2005. Prior to joining CardioTech, Mr. Walters from October 2004 through September 2005 served as Vice President and Chief Financial Officer at Konarka Technologies, Inc., a developer of light-activated plastic (photovoltaic) material. Prior to joining Konarka, Mr. Walters served in various capacities at PolyMedica Corporation during a 13-year period, including Executive Vice President and Chief Financial Officer. Mr. Walters, a CPA, is a Member of the American Institute of Certified Public Accountants, a Fellow of the Massachusetts Society of Certified Public Accountants, and a Member in Financial Executives International. Mr. Walters also serves as a Director and the Chairman of the Audit Committee of the Board of Directors of MFIC Corporation since November 2005. Mr. Walters received his BS degree from Colgate University and a Certificate in Accounting from Bentley College.

9

Summary Compensation Table. The following table sets forth the aggregate compensation for services rendered in all capacities during the fiscal years ended March 31, 2006, 2005, and 2004 of all persons serving as Chief Executive Officer and all other executive officers whose salary and bonus exceed $100,000 (the “Named Executive Officers”).

| | Annual Compensation | | Long-term Compensation | | | |

Name and Principal Position | | Year | | Salary | | Bonus | | Restricted

Stock

Awards | | Number of

Securities

Underlying

Options | | All Other

Compensation | |

Michael F. Adams (1) | | 2006 | | $ | — | | $ | — | | — | | — | | $ | — | |

CEO and President | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Michael Szycher, Ph.D. (2)(3) | | 2006 | | $ | 325,000 | | $ | — | | — | | — | | $ | 5,498 | |

Chairman, CEO and Treasurer | | 2005 | | $ | 325,000 | | $ | — | | 55,200 | | 600,000 | | $ | 4,797 | |

| | 2004 | | $ | 325,000 | | $ | — | | — | | 1,017,330 | | $ | 8,092 | |

| | | | | | | | | | | | | |

Eric G. Walters (3) (4) | | 2006 | | $ | 69,231 | | $ | — | | — | | 200,000 | | $ | 2,498 | |

Vice President and CFO | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Leslie M. Taeger (5) | | 2006 | | $ | 94,894 | | $ | — | | — | | — | | $ | 250 | |

CFO | | 2005 | | $ | 143,507 | | $ | 15,000 | | — | | 150,000 | | $ | 250 | |

| | 2004 | | $ | 150,470 | | $ | 50,000 | | — | | 100,000 | | $ | 250 | |

(1) Mr. Adams was appointed as Chief Executive Officer and President on August 7, 2006. Since April 1, 2006, Mr. Adams was the Company’s Vice President of Regulatory Affairs and Business Development. Since May 1999, Mr. Adams has been a director of the Company. Although not currently subject to any written employment agreement, Mr. Adams’ base compensation is currently $176,000 per annum plus insurance and other benefit plans maintained for employees and/or executives of the Company.

(2) On August 7, 2006, Dr. Michael Szycher resigned as Chief Executive Officer, President, Treasurer and member of the Board of Directors of the Company, effective that date. On August 11, 2006 the Company entered into a Transition Agreement with Dr. Szycher, which provides for Dr. Szycher to serve in a non-executive capacity as Senior Scientific Advisor to the Company at his current annual base salary of $325,000 for a period of one year, at which time his employment will terminate. The Company has agreed (i) to continue Dr. Szycher’s current life insurance coverage for 12 months following his separation date and (ii) to pay Dr. Szycher’s COBRA medical insurance premiums for a period of 6 months following his separation date.

(3) Includes premiums paid by the Company for disability and term life insurance. Premiums paid in fiscal 2006, 2005 and 2004 for disability and life insurance, respectively, were $1,973, $1,284 and $885 for Dr. Szycher. Premiums paid in fiscal 2006 for disability and life insurance, were $671, for Mr. Walters. Personal use of a leased car for Dr. Szycher was $3,525, $3,510 and $6,247, respectively in fiscal 2006, 2005 and 2004. Personal use of a leased car for Mr. Walters was $1,827 in fiscal 2006.

(4) Mr. Walters was hired by the Company on October 3, 2005 with an annual salary of $150,000. Effective April 3, 2006, his annual salary was adjusted to $175,000.

(5) Mr. Taeger ceased employment with the Company on October 7, 2005.

10

Option Grants. The following table sets forth information regarding each stock option granted during the fiscal year ended March 31, 2006 to each of the named executive officers.

OPTION GRANTS IN LAST FISCAL YEAR

| | Number of

securities

underlying

options | | Percent of

total options

granted to

employees in | | Exercise price | | Date of | | Expiration | | Potential Realizable Value

at Assumed Annual Rates

of Stock Price Appreciation

for Option Term (2) | |

Name | | granted (1) | | fiscal year | | per share | | Grant | | Date | | 5% | | 10% | |

Eric G. Walters | | 200,000 | | 27.4 | % | $ | 2.32 | | 10/3/2005 | | 10/3/2015 | | $ | 291,807 | | $ | 739,497 | |

| | | | | | | | | | | | | | | | | | |

(1) The Company granted options to purchase 730,834 shares of Common Stock to employees and consultants in the fiscal year ended March 31, 2006. All options were granted at an exercise price per share equal to the fair market value of the Common Stock on the date of grant, determined by the closing price on the American Stock Exchange on the trading day immediately preceding the grant date. Options vested on the date of grant and normally expire ten years from the date of the grant.

(2) Amounts represent hypothetical gains that could be achieved for the respective options if exercised at the end of the option term. These gains are based on assumed rates of stock price appreciation of 5% and 10% compounded annually from the date options are granted to their expiration date and are net of the option exercise price, but do not include deductions for taxes or other expenses associated with the exercise of the option or the sale of the underlying shares. The actual gains, if any, on the exercises of stock options will depend on the future performance of the common stock, the option holder’s continued employment through the period, and the date on which the options are exercised.

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR AND FISCAL YEAR-END OPTION VALUES

Fiscal Year-End Option Values. The following table provides information regarding the number of shares of Common Stock covered by both exercisable and unexercisable stock options held by each of the named executive officers as of March 31, 2006 and the values of “in-the-money” options, which values represent the positive spread between the exercise price of any such option and the fiscal year-end value of the Common Stock.

| | Underlying unexercised

options/SARS at

fiscal year end 2006 | | Value of the unexercised

in the money Options/SARS

at fiscal year end (1) | | Shares acquired | | Value | |

Name | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable | | on exercise | | Realized | |

Michael Szycher, Ph.D. (2) | | 3,230,743 | | — | | $ | 3,845,945 | | $ | — | | — | | $ | — | |

Eric G. Walters | | 200,000 | | — | | 92,000 | | — | | — | | — | |

Leslie M. Taeger (3) | | — | | — | | — | | — | | — | | — | |

| | | | | | | | | | | | | | | | |

(1) The value of unexercised in-the-money options at fiscal year end assumes a fair market value for the Common Stock of $2.78, the closing sale price per share of the Common Stock as reported on the American Stock Exchange for March 31, 2006.

(2) On August 7, 2006, Dr. Michael Szycher resigned as Chief Executive Officer, President, Treasurer and member of the Board of Directors of the Company, effective that date.

(3) During fiscal 2006, Mr. Taeger exercised 50,000 options after he ceased employment with the Company.

11

Employment Agreements

The Company has entered into an employment agreement with Eric G. Walters (the “Walters Agreement”), pursuant to which said individual serves as Vice President and Chief Financial Officer of the Company. Pursuant to the terms of the Walters Agreement, Mr. Walters is to receive an annual base salary of One Hundred Seventy Five Thousand ($175,000) dollars. Mr. Walters salary will be reviewed annually by the Board. Additionally, Mr. Walters may also be entitled to receive an annual bonus payment in an amount, if any, to be determined by the Compensation Committee of the Board.

The term of the Employment Agreement by and between the Company and Mr. Walters is set to expire on April 1, 2008. After such time, the term of the Walters Agreement will be deemed to continue on a month-to-month basis if not expressly extended while Mr. Walters remains employed by the Company. Mr. Walters and CardioTech each have the right to terminate the Walters Agreement at any time, with or without cause (as defined in the Employment Agreement), upon thirty (30) days prior written notice. In the event that CardioTech terminates the applicable Walters Agreement without cause, or Mr. Walters terminates his employment for good reason following a change in control (as such terms are defined in the Walters Agreement) or CardioTech fails to renew the Walters Agreement within two (2) years following the occurrence of a change in control, Mr. Walters will be entitled to receive severance equal to 2.0 times his annual base salary at termination. In such event, Mr. Walters will be bound by a non-compete covenant for one (1) year following termination of his employment.

Compensation Committee Interlocks and Insider Participation

Other than Mr. Adams, no person serving on the Compensation Committee at any time during fiscal 2006 was a present or former officer or employee of the Company or any of its subsidiaries. During fiscal 2006, other than Dr. Szycher, no executive officer of the Company served as a member of the board of directors or compensation committee (or other board committee performing equivalent functions) of another entity. During fiscal 2006. Dr. Szycher served on the board of directors of Implant Sciences Corporation, one of whose executive officers served on the Company’s Board or Compensation Committee. On August 7, 2006, Dr. Michael Szycher resigned as Chief Executive Officer, President, Treasurer and member of the Board of Directors of the Company, effective that date.

Compensation Committee Report on Executive Compensation

The Compensation Committee reviews and determines on both an annual and an as-needed basis the compensation of the Company’s executive officers (including the named executive officers). The Compensation Committee determines all elements of an executive officer’s compensation, including salary, bonus, options, benefits and all other aspects of the total compensation package. Executive officers are those officers designated by the Board of Directors to have the broadest responsibility and policy-making authority in the Company. The Company currently has two (2) executive officers, including Michael F. Adams, the Company’s Chief Executive Officer and President, and Eric G. Walters, the Company’s Vice President and Chief Financial Officer.

The Company’s executive officer compensation program is designed to attract, motivate and retain talented management through a combination of base salary, bonuses, equity compensation such as options, and employee benefits. The Compensation Committee determines the level of compensation for each executive officer after reviewing the officer’s responsibilities and past performance, the expectations for such officer’s performance in the upcoming year and relevant data points for comparable companies.

By the Compensation Committee of the Board of Directors of CardioTech:

| Michael L. Barretti |

| Jeremiah E. Dorsey |

| Anthony J. Armini, Ph.D. |

12

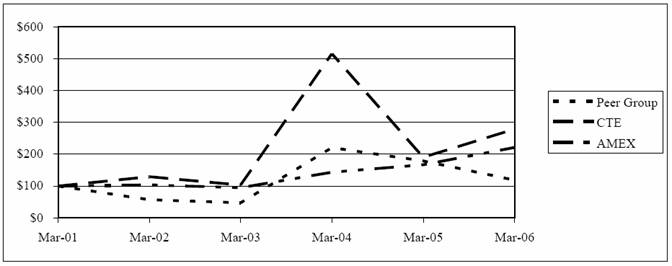

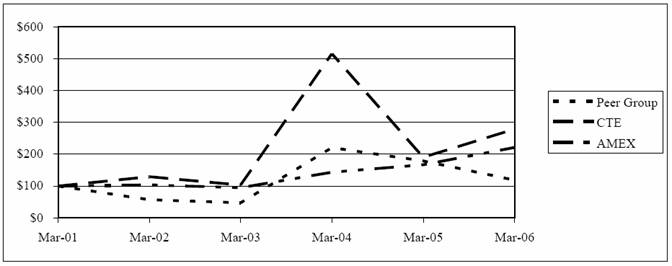

Comparative Stock Performance

The comparative stock performance graph below compares the cumulative stockholder return on the Common Stock of CardioTech for the period from March 31, 2001, and through the fiscal years ended March 31, 2002, 2003, 2004, 2005 and 2006 with the cumulative total return on: (i) the American Stock Exchange Composite Index (the “AMEX Index”) and (ii) a peer group (the “Peer Group”) determined by CardioTech. The graph assumes the investment of $100 in CardioTech’s Common Stock, the AMEX Index, and the Peer Group on March 31, 2001, and reinvestment of all dividends. Measurement points are on March 30, 2001, March 29, 2002, March 31, 2003, 2004, 2005 and 2006.

The Peer Group consists of PLC Medical, Inc., Hydromer Inc., ATS Medical, Inc., Arrhythmia Research Technology, In., and Memry Corporation. Management selected the Peer issuers in good faith and on an industry or line-of-business basis.

| | 3/30/01 | | 3/28/02 | | 3/31/03 | | 3/31/04 | | 3/31/05 | | 3/31/06 | |

CardioTech International, Inc. | | 100.0 | | 129.0 | | 103.0 | | 515.0 | | 190.0 | | 278.0 | |

2006 Self-Determined Peer Group | | 100.0 | | 57.2 | | 47.2 | | 220.4 | | 178.8 | | 118.3 | |

AMEX Composite Index | | 100.0 | | 103.8 | | 94.3 | | 143.3 | | 166.4 | | 220.7 | |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires our executive officers, directors and persons who beneficially own more than 10% of a registered class of our securities to file reports of ownership and changes in ownership with the SEC. Based solely on a review of copies of such forms submitted to CardioTech, we believe that all persons subject to the requirements of Section 16(a) filed such reports on a timely basis in fiscal 2006, except as follows. During fiscal 2006, Mr. Dorsey received eight (8) option grants to purchase shares of the Company and was late in filing all Forms 4 for these option grants.

Certain Relationships and Related Transactions

The Company has an investment in CorNova, Inc., of which Dr. Eric Ryan is President and a major shareholder. The Company, on July 15, 2004, entered into a two-year consulting agreement with Dr. Ryan, which provides for a range of payments, in either cash or common stock, for the achievement of certain milestones related to the manufacturing, commencement of European clinical trials and the receipt of a restricted CE mark of the Company’s CardioPass synthetic coronary artery bypass graft. Total potential payments range from $125,000 to $216,000 based on the timing of the milestone achievements. As part of the agreement, Dr. Ryan has the opportunity to earn up to an additional $56,000 based on the achievement of certain milestones related to other products of the Company. As of March 31, 2006 and 2005, several of the contract milestones had been achieved and, accordingly, costs totaling $38,000 and $73,000 related to performance under this contract have been recognized as a research and development expense as for the years ended of March 31, 2006 and 2005.

13

In July 1999, Dermaphylyx International, Inc., a related party, was formed by certain affiliates of CardioTech to develop advanced wound healing products. Dermaphylyx was merged into CardioTech International, Inc,. pursuant to which it became a wholly owned subsidiary of CardioTech. Due to CardioTech’s controlling financial interest, Dermaphylyx has been consolidated in the financial statements of CardioTech as of December 31, 2003. Prior to December 31, 2003, the operations and total assets of Dermaphylyx were not material to CardioTech. Since July 1999, the year Dermaphylyx was incorporated, all development expenses have been paid by CardioTech International, Inc. In June 2006, the Company’s Board of Directors decided to cease the operations of Dermaphylyx, the costs of which are immaterial to the Company’s operations.

Upon the merger, the current shareholders of Dermaphylyx received 3,827 shares of common stock of CardioTech valued at the net book value of Dermaphylyx International, Inc., as of December 31, 2003, which was approximately $21,000.

Board Recommendation

The Board believes the election of Michael F. Adams and Anthony J. Armini, Ph.D. as Class I Directors of the Company for the ensuing 3 years is in the best interests of CardioTech International, Inc. and its stockholders and recommends a vote FOR such nominees.

14

PROPOSAL TWO

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board, on the recommendation of its Audit Committee, has selected the firm of Ernst & Young LLP (“E&Y”) as CardioTech’s independent registered public accounting firm for the current year. E&Y has served as CardioTech’s independent public accountants since its appointment in July 2002.

Representatives of E&Y are expected to be present at the Annual Meeting. They will have the opportunity to make a statement if they desire to do so and will also be available to respond to appropriate questions from the stockholders.

If the stockholders do not ratify the selection of E&Y as CardioTech’s independent public accountants, the selection of such accountants will be reconsidered by the Board. The Audit Committee reserves the right to change the independent public accountants for the current year if they determine that there is a valid reason to do so. At this time, the Audit Committee does not know of any such reason.

Board Recommendation

Accordingly, the Board believes ratification of the selection of E&Y as CardioTech’s independent registered public accounting firm for the current year is in the best interests of CardioTech and its stockholders and recommends a vote FOR the proposal.

Independent Auditor Fees and Other Matters

The following is a summary of the fees billed to the Company by E&Y, our independent auditors, for professional services rendered for the fiscal years ended March 31, 2006, 2005 and 2004. The Audit Committee considered and discussed with Ernst & Young LLP the provision of non-audit services to the Company and the compatibility of providing such services with maintaining its independence as the Company’s auditor.

Fee Category | | Years Ended March 31, | |

(in thousands) | | 2006 | | 2005 | | 2004 | |

Audit fees | | $ | 254 | | $ | 227 | | $ | 239 | |

Audit-related fees | | — | | — | | — | |

Tax fees | | — | | — | | — | |

All other fees | | — | | — | | — | |

Total fees | | $ | 254 | | $ | 227 | | $ | 239 | |

Audit Fees. This category consists of fees billed for professional services rendered for the audit of our annual financial statements and review of financial statements included in our quarterly reports and other professional services provided in connection with regulatory filings.

Audit-Related Fees. This category consists of fees billed for assurance and related services that related to the performance of the audit or review of our financial statements and are not otherwise reported under “Audit Fees”.

Tax Fees. This category consists of fees billed for professional services for tax compliance, tax advice and tax planning. These services include assistance regarding federal and state tax compliance and acquisitions.

Pre-Approval Policies and Procedures. The Audit Committee has the authority to approve all audit and non-audit services that are to be performed by the Company’s independent auditors. Generally, the Company may not engage its independent auditors to render audit or non-audit services unless the service is specifically approved in advance by the Audit Committee (or a properly delegated subcommittee thereof).

15

OTHER MATTERS

The Board does not know of any other matters, which may come before the Annual Meeting. However, if any other matters are properly presented to the Annual Meeting, it is the intention of the persons named in the accompanying proxy to vote, or otherwise act, in accordance with their judgment on such matters.

Solicitation of Proxies

All costs of solicitation of proxies will be borne by CardioTech. In addition to solicitations by mail, CardioTech’s directors, officers and regular employees, without additional remuneration, may solicit proxies by telephone, telegraph and personal interviews and CardioTech reserves the right to retain outside agencies for the purpose of soliciting proxies. Brokers, custodians and fiduciaries will be requested to forward proxy soliciting material to the owners of stock held in their names, and CardioTech will reimburse them for their reasonable out-of-pocket expenses incurred in connection with the distribution of proxy materials.

Some banks, brokers and other nominee record holders may be participating in the practice of “householding” proxy statements and annual reports. This means that only one copy of the Company’s proxy statement or annual report may have been sent to multiple stockholders in the same household. The Company will promptly deliver a separate copy of either document to any stockholder upon request by writing or calling the Company at the following address or phone number: CardioTech International, Inc., 229 Andover Street, Wilmington, MA 01887, Attention: Investor Relations or by calling (978) 657-0075. Any stockholder who wants to receive separate copies of the annual report and proxy statement in the future, or who is currently receiving multiple copies and would like to receive only one copy for his or her household, should contact his or her bank, broker or other nominee record holder, or contact the Company at the above address and phone number.

DEADLINE FOR SUBMISSION OF STOCKHOLDER PROPOSALS FOR THE 2007 ANNUAL MEETING

Stockholder proposals submitted pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) for inclusion in the Company’s proxy materials for its 2007 Annual Meeting of Stockholders must be received by the Clerk of the Company at the principal offices of the Company no later than April 7, 2007. The Company has received no stockholder nominations or proposals for the 2006 Meeting.

| By Order of the Board of Directors, |

| |

| /s/ Eric G. Walters |

| Eric G. Walters, Clerk |

| |

September 8, 2006 | |

THE BOARD OF DIRECTORS ENCOURAGES STOCKHOLDERS TO ATTEND THE ANNUAL MEETING. WHETHER OR NOT YOU PLAN TO ATTEND, YOU ARE URGED TO COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY IN THE ACCOMPANYING ENVELOPE. A PROMPT RESPONSE WILL GREATLY FACILITATE ARRANGEMENTS FOR THE ANNUAL MEETING AND YOUR COOPERATION WILL BE APPRECIATED. STOCKHOLDERS WHO ATTEND THIS ANNUAL MEETING MAY VOTE THEIR STOCK PERSONALLY EVEN THOUGH THEY HAVE SENT IN THEIR PROXIES.

16

CARDIOTECH INTERNATIONAL, INC

VICE PRESIDENT AND CFO

229 ANDOVER STREET

WILMINGTON, MA 01887 | VOTE BY INTERNET - www.proxyvote.com

Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 P.M. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form. |

| |

| ELECTRONIC DELIVERY OF FUTURE SHAREHOLDER COMMUNICATIONS If you would like to reduce the costs incurred by CardioTech International, Inc. in mailing proxy materials, you can consent to receiving all future proxy statements, proxy cards and annual reports electronically via e-mail or the Internet. To sign up for electronic delivery, please follow the instructions above to vote using the Internet and, when prompted, indicate that you agree to receive or access shareholder communications electronically in future years. |

| |

| VOTE BY PHONE - 1-800-690-6903 Use any touch-tone telephone to transmit your voting instructions up until 11:59 P.M. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you call and then follow the instructions. |

| |

| VOTE BY MAIL Mark, sign and date your proxy card and return it in the postage paid envelope we have provided or return it to CardioTech International, Inc., c/o ADP, 51 Mercedes Way, Edgewood, NY 11717. |

TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: | CTECH1 | KEEP THIS PORTION FOR YOUR RECORDS |

THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. | DETACH AND RETURN THIS PORTION ONLY |

CARDIOTECH INTERNATIONAL, INC.

Vote on Directors

1. | Election of Directors (Proposal 1). | For | Withhold | For All | To withhold authority to vote for any individual nominee(s), mark |

| | All | All | Except | “For All Except” and write the nominee’s name on the line below. |

| | | | | |

| 01) MICHAEL F. ADAMS | | | | |

| | | | | |

| 02) ANTHONY J. ARMINI | o | o | o | |

Vote on Proposals | For | Against | Abstain |

2. | Ratification of Selection of Ernst & Young LLP as Independent Accountants for the Fiscal Year Ending March 31, 2007 (Proposal 2). | o | o | o |

| | | | |

3. | The proxies are authorized to vote in their discretion upon such other business as may properly come before the Annual Meeting and any matters incident to the conduct of the Meeting. | | | |

| | | | |

| Please date this Proxy and sign exactly as your name appears hereon. If shares are jointly held, this Proxy should be signed by each joint owner. Executors, administrators, guardians or others signing in a fiduciary capacity should state their full titles. A Proxy executed by a corporation should be signed in its name by its president or other authorized officer. A Proxy executed by a partnership should be signed in its name by an authorized person. | | | |

| | | | |

| For address and/or comments, please check this box and write them on the back where indicated | o | | |

| Yes | No | |

Please indicate if you plan to attend this meeting | o | o | |

| | | |

HOUSEHOLDING ELECTION — Please indicate if you consent to receive certain future investor communications in a single package per household. | o | o | |

| | | | | |

| | | | | |

| Signature [PLEASE SIGN WITHIN BOX] | Date | | Signature (Joint Owners) | Date |

CARDIOTECH INTERNATIONAL, INC.

Proxy Solicited by the Board of Directors for the 2006 Annual Meeting of Shareholders

October 11, 2006

The undersigned appoints Michael F. Adams and Eric G. Walters, and each of them, proxies (each with full power of substitution) to represent the undersigned at the CardioTech International, Inc. 2006 Annual Meeting of Shareholders to be held on October 11, 2006, and any adjournments thereof and to vote the shares of the Company’s common stock held of record by the undersigned on August 16, 2006 as directed on the reverse side.

The shares represented by this Proxy will be voted as directed on the reverse side. If no direction is indicated, the shares represented by this Proxy will be voted FOR the director nominees named in Proposal 1 and will be voted in the discretion of the proxies on such other business as may properly come before the Annual Meeting. The undersigned acknowledges receipt of the Notice of Annual Meeting of Shareholders and the Proxy Statement dated September 8, 2006.

| | | | | |

| Address Changes/Comments: | | | |

| | | | | |

| | | | |

| | | | | |

| | | | | | |

(If you noted any Address Changes/Comments above, please mark corresponding box on the reverse side.)

PLEASE PROMPTLY COMPLETE, DATE AND SIGN THIS PROXY AND RETURN IT IN THE ENVELOPE PROVIDED.

PLEASE SIGN ON REVERSE SIDE