As filed with the Securities and Exchange Commission on January 14, 2014

Registration No. 333-192396

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-14

| | REGISTRATION STATEMENT | | x |

| | UNDER THE SECURITIES ACT OF 1933 | | |

| | | | |

| | Pre-Effective Amendment No. 1 | | x |

| | | | |

| | Post-Effective Amendment No. | | o |

| | (Check appropriate box or boxes) | | |

The Universal Institutional Funds, Inc.

(Exact name of Registrant as Specified in its Charter)

522 Fifth Avenue

New York, New York 10036

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Joseph C. Benedetti, Esq.

Morgan Stanley Investment Management Inc.

522 Fifth Avenue

New York, New York 10036

(Name and Address of Agent for Service)

Copy to:

Carl Frischling, Esq.

Kramer Levin Naftalis & Frankel LLP

1177 Avenue of the Americas

New York, New York 10036 | | Stuart M. Strauss, Esq.

Dechert LLP

1095 Avenue of the Americas

New York, New York 10036 |

Approximate Date of Proposed Public Offering: As soon as practicable after the effective date of this Registration Statement.

No filing fee is required because an indefinite number of common shares of beneficial interest of The Universal Institutional Funds, Inc. have previously been registered pursuant to Section 24f-2 under the Investment Company Act of 1940.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Morgan Stanley Select Dimensions Investment Series

Morgan Stanley Variable Investment Series

522 Fifth Avenue

New York, NY 10036

Dear Variable Life Insurance and Variable Annuity Contract Owners:

Morgan Stanley Select Dimensions Investment Series and Morgan Stanley Variable Investment Series (each, a "Trust" and, together, the "Trusts") will hold a joint special meeting of shareholders (the "Meeting") of the Morgan Stanley Select Dimensions Investment Series—Global Infrastructure Portfolio and the Morgan Stanley Variable Investment Series—Global Infrastructure Portfolio (each an "Acquired Fund" and, together, the "Acquired Funds") on March 17, 2014 at 9:00 a.m., New York time, at the offices of Morgan Stanley Investment Management Inc., Conference Room C, 3rd Floor, 522 Fifth Avenue, New York, NY 10036. At the meeting, shareholders of each Acquired Fund will be asked to consider and vote upon a proposal to approve the actions and transactions described in the applicable Agreement and Plan of Reorganization, each dated October 3, 2013 (each, a "Reorganization Agreement") between the respective Trust, on behalf of such Acquired Fund, as applicable, and The Universal Institutional Funds, Inc., on behalf of the Global Infrastructure Portfolio (the "Acquiring Fund"). Pursuant to each Reorganization Agreement, substantially all of the assets and the liabilities of the applicable Acquired Fund will be transferred to the Acquiring Fund in exchange for shares of the Acquiring Fund of the Class described in the accompanying Joint Proxy Statement and Prospectus and pursuant to which such Acquired Fund will be liquidated and terminated (the "Reorganizations"). The Reorganization of each Acquired Fund into the Acquiring Fund is not contingent upon the shareholders of the other Acquired Fund approving its Reorganization. A formal Notice of Joint Special Meeting of Shareholders appears on the next page, followed by the Joint Proxy Statement and Prospectus, which explains in more detail the proposals to be considered.

Like the Acquired Funds, the Acquiring Fund will be offered to certain life insurance companies in connection with particular variable life insurance and/or variable annuity contracts they issue (each an "Insurance Company" and, collectively, the "Insurance Companies"). The Acquiring Fund will also be offered to other entities under qualified pension and retirement plans. Please review the enclosed Joint Proxy Statement and Prospectus for a more detailed description of the Reorganizations and the specific reasons that the Reorganizations are being proposed.

If you are an owner of a variable life insurance and/or variable annuity contract issued by a separate account of an Insurance Company, you are not a shareholder of an Acquired Fund, but you have the right to instruct your Insurance Company on how to vote at the Meeting. You may give voting instructions for the number of shares of an Acquired Fund attributable to your variable life insurance policy or variable annuity contract as of the close of business on December 23, 2013.

The Board of Trustees of each Acquired Fund recommends that you give voting instructions in favor of the applicable Reorganization. In order for shares to be voted at the Meeting based on your instructions, we urge you to read the Joint Proxy Statement and Prospectus and then complete and mail your Voting Instruction Form in the enclosed postage-paid envelope. To give voting instructions by touch-tone telephone or via the Internet, follow the instructions on the Voting Instruction Form.

Please take a few moments to review the details of the proposals. If you have any questions regarding the Reorganizations, please feel free to call the contact number listed in the enclosed Joint Proxy Statement and Prospectus. We urge you to vote at your earliest convenience.

We appreciate your participation and prompt response in this matter and thank you for your continued support.

Very truly yours,

John H. Gernon

President and Principal Executive Officer

January [ ], 2014

MORGAN STANLEY SELECT DIMENSIONS INVESTMENT SERIES—GLOBAL INFRASTRUCTURE PORTFOLIO

MORGAN STANLEY VARIABLE INVESTMENT SERIES—GLOBAL INFRASTRUCTURE PORTFOLIO

522 Fifth Avenue

New York, NY 10036

(800) 548-7786

NOTICE OF JOINT SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD MARCH 17, 2014

To the shareholders of the Morgan Stanley Select Dimensions Investment Series—Global Infrastructure Portfolio and the Morgan Stanley Variable Investment Series—Global Infrastructure Portfolio:

Notice is hereby given of a Joint Special Meeting of Shareholders (the "Meeting") of the Morgan Stanley Select Dimensions Investment Series—Global Infrastructure Portfolio ("SD Global Infrastructure") and the Morgan Stanley Variable Investment Series—Global Infrastructure Portfolio ("VIS Global Infrastructure") (each an "Acquired Fund" and, together, the "Acquired Funds"), existing series of Morgan Stanley Select Dimensions Investment Series ("Select Dimensions") and Morgan Stanley Variable Investment Series ("Variable Investment"), respectively (each, a "Trust" and, together, the "Trusts"), to be held in Conference Room C, 3rd Floor, 522 Fifth Avenue, New York, NY 10036, at 9:00 a.m., New York time, on March 17, 2014, and any adjournments or postponements thereof, for the following purposes:

1. With respect to shareholders of SD Global Infrastructure, to consider and vote upon a proposal to approve the actions and transactions described in that certain Agreement and Plan of Reorganization, dated October 3, 2013 (the "SD Reorganization Agreement"), between Select Dimensions, on behalf of SD Global Infrastructure, and The Universal Institutional Funds, Inc. (the "Company"), on behalf of the Global Infrastructure Portfolio ("UIF Global Infrastructure" or the "Acquiring Fund"), pursuant to which substantially all of the assets and liabilities of SD Global Infrastructure will be transferred to UIF Global Infrastructure in exchange for shares of UIF Global Infrastructure of the Class described in the accompanying Joint Proxy Statement and Prospectus and pursuant to which SD Global Infrastructure will be liquidated and terminated (the "SD Reorganization"). As a result of this transaction, shareholders of SD Global Infrastructure will become shareholders of UIF Global Infrastructure receiving shares of UIF Global Infrastructure with a value equal to the aggregate net asset value ("NAV") of their shares of SD Global Infrastructure held immediately prior to the SD Reorganization;

2. With respect to shareholders of VIS Global Infrastructure, to consider and vote upon a proposal to approve the actions and transactions described in that certain Agreement and Plan of Reorganization, dated October 3, 2013 (the "Variable Reorganization Agreement"), between Variable Investment, on behalf of VIS Global Infrastructure, and the Company, on behalf of UIF Global Infrastructure, pursuant to which substantially all of the assets and liabilities of VIS Global Infrastructure will be transferred to UIF Global Infrastructure in exchange for shares of UIF Global Infrastructure of the Class described in the accompanying Joint Proxy Statement and Prospectus and pursuant to which VIS Global Infrastructure will be liquidated and terminated (the "Variable Reorganization"). As a result of this transaction, shareholders of VIS Global Infrastructure will become shareholders of UIF Global Infrastructure receiving shares of UIF Global Infrastructure with a value equal to the aggregate NAV of their shares of VIS Global Infrastructure held immediately prior to the Variable Reorganization; and

3. To act upon other matters as may properly come before the Meeting.

The Acquired Funds, together with the Acquiring Fund, are referred to herein as the "Funds." The SD Reorganization Agreement and the Variable Reorganization Agreement are each referred to herein as a "Reorganization Agreement," and together as the "Reorganization Agreements." The SD Reorganization and the Variable Reorganization are each referred to herein as a "Reorganization," and together as the "Reorganizations."

The Reorganizations are more fully described in the accompanying Joint Proxy Statement and Prospectus and a form of each Reorganization Agreement is attached as Exhibits A-1 and A-2 thereto. Shareholders of record of the Acquired Funds as of the close of business on December 23, 2013 are entitled to notice of, and to vote at, the Meeting and any adjournments or postponements thereof. The Board of Trustees of each Acquired Fund recommends that shareholders of the applicable Acquired Fund vote in favor of the respective Reorganization.

By Order of the Board of Trustees,

Mary E. Mullin

Secretary

January [ ], 2014

THE UNIVERSAL INSTITUTIONAL FUNDS, INC.

GLOBAL INFRASTRUCTURE PORTFOLIO

522 Fifth Avenue

New York, NY 10036

(800) 548-7786

This Joint Proxy Statement and Prospectus is being furnished to shareholders ("Shareholders") of the Morgan Stanley Select Dimensions Investment Series—Global Infrastructure Portfolio ("SD Global Infrastructure") and Morgan Stanley Variable Investment Series—Global Infrastructure Portfolio ("VIS Global Infrastructure") (each, an "Acquired Fund" and, together, the "Acquired Funds"), existing series of Morgan Stanley Select Dimensions Investment Series ("Select Dimensions") and Morgan Stanley Variable Investment Series ("Variable Investment") (each, a "Trust" and, together, the "Trusts"), respectively, in connection with a Joint Special Meeting of Shareholders (the "Meeting") to be held in Conference Room C, 3rd Floor, 522 Fifth Avenue, New York, NY 10036, at 9:00 a.m., New York time, on March 17, 2014, and any adjournments or postponements thereof, for the following purposes:

1. With respect to Shareholders of SD Global Infrastructure, to consider and vote upon a proposal to approve the actions and transactions described in that certain Agreement and Plan of Reorganization, dated October 3, 2013 (the "SD Reorganization Agreement"), between Select Dimensions, on behalf of SD Global Infrastructure, and The Universal Institutional Funds, Inc. (the "Company"), on behalf of the Global Infrastructure Portfolio ("UIF Global Infrastructure" or the "Acquiring Fund"), pursuant to which substantially all of the assets and liabilities of SD Global Infrastructure will be transferred to UIF Global Infrastructure in exchange for shares of UIF Global Infrastructure of the Class described in this Joint Proxy Statement and Prospectus and pursuant to which SD Global Infrastructure will be liquidated and terminated (the "SD Reorganization"). As a result of this transaction, shareholders of SD Global Infrastructure will become shareholders of UIF Global Infrastructure receiving shares of UIF Global Infrastructure with a value equal to the aggregate net asset value ("NAV") of their shares of SD Global Infrastructure held immediately prior to the SD Reorganization;

2. With respect to Shareholders of VIS Global Infrastructure, to consider and vote upon a proposal to approve the actions and transactions described in that certain Agreement and Plan of Reorganization, dated October 3, 2013 (the "Variable Reorganization Agreement"), between Variable Investment, on behalf of VIS Global Infrastructure, and the Company, on behalf of UIF Global Infrastructure, pursuant to which substantially all of the assets and liabilities of VIS Global Infrastructure will be transferred to UIF Global Infrastructure in exchange for shares of UIF Global Infrastructure of the Class described in this Joint Proxy Statement and Prospectus and pursuant to which VIS Global Infrastructure will be liquidated and terminated (the "Variable Reorganization"). As a result of this transaction, Shareholders of VIS Global Infrastructure will become Shareholders of UIF Global Infrastructure receiving shares of UIF Global Infrastructure with a value equal to the aggregate NAV of their shares of VIS Global Infrastructure held immediately prior to the Variable Reorganization; and

3. To act upon such other matters as may properly come before the Meeting.

The Acquired Funds, together with the Acquiring Fund, are referred to herein as the "Funds." The SD Reorganization Agreement and the Variable Reorganization Agreement are each referred to herein as a "Reorganization Agreement," and together as the "Reorganization Agreements." The SD Reorganization and the Variable Reorganization are each referred to herein as a "Reorganization," and together as the "Reorganizations."

The terms and conditions of the transaction are more fully described in this Joint Proxy Statement and Prospectus and in the Form of Agreement and Plan of Reorganization for each Reorganization, copies of which are attached hereto as Exhibits A-1 and A-2. The address and telephone number of each Acquired Fund is the same as that of the Acquiring Fund set forth above. This Joint Proxy Statement also constitutes a Prospectus of the Acquiring Fund, filed by the Company with the Securities and Exchange Commission (the "Commission") as part of the Company's Registration Statement on Form N-14 (the "Registration Statement").

The Funds are each series of registered open-end management investment companies. The Acquiring Fund's investment objective of seeking to provide both capital appreciation and current income is the same as each Acquired Fund's investment objective. Shares of each Acquired Fund are offered only to certain life insurance companies in

connection with particular variable life insurance and/or variable annuity contracts they issue (each an "Insurance Company" and, collectively, the "Insurance Companies"). Each Insurance Company is the legal owner of shares of an Acquired Fund and has the right to vote those shares at the Meeting. Although being an owner of a variable life insurance or variable annuity contract (a "Contract") issued by separate accounts of the Insurance Companies does not make you a shareholder of an Acquired Fund, you have the right to instruct your Insurance Company on how to vote at the Meeting.

This Joint Proxy Statement and Prospectus sets forth concisely information about the Acquiring Fund that Shareholders of an Acquired Fund should know before voting on the applicable Reorganization Agreement. A copy of the Prospectuses for the Acquiring Fund, each dated December 18, 2013, as may be amended and supplemented from time to time, are attached as Exhibit B, which Prospectuses form a part of Post-Effective Amendment No. 53 to the Company's Registration Statement on Form N-1A (File Nos. 333-03013; 811-07607), and incorporated herein by reference. Also incorporated herein by reference are the Prospectuses of the Acquired Funds, each dated April 30, 2013, as may be amended and supplemented from time to time, which Prospectuses form a part of Post-Effective Amendment No. 34 to the Select Dimensions Registration Statement on Form N-1A (File Nos. 33-54047; 811-07185) and of Post-Effective Amendment No. 52 to the Variable Investment Registration Statement on Form N-1A (File Nos. 2-82510; 811-3692), as applicable.

In addition, also incorporated by reference are the Annual and Semi-Annual Reports of each Trust relating to the respective Acquired Fund for the fiscal year ended December 31, 2012 and the six-month period ended June 30, 2013 (File Nos. 811-07185 (Select Dimensions) and 811-3692 (Variable Investment)). A Statement of Additional Information relating to the Reorganizations, described in this Joint Proxy Statement and Prospectus, dated January [ ], 2014, has been filed with the Commission and is also incorporated herein by reference. Such documents are available upon request and without charge by calling (800) 548-7786 or by visiting the Commission's website at www.sec.gov.

Shareholders are advised to read and retain this Joint Proxy Statement and Prospectus for future reference.

The Securities and Exchange Commission has not approved or disapproved these securities or passed upon the adequacy of this Prospectus. Any representation to the contrary is a criminal offense.

This Joint Proxy Statement and Prospectus is dated January [ ], 2014.

TABLE OF CONTENTS

JOINT PROXY STATEMENT AND PROSPECTUS

| | | Page | |

Synopsis | | | 1 | | |

General | | | 1 | | |

The Reorganizations | | | 1 | | |

Fee Tables | | | 2 | | |

Annual Fund Operating Expenses | | | 5 | | |

Portfolio Turnover | | | 5 | | |

Tax Consequences of the Reorganizations | | | 5 | | |

Comparison of the Acquired Funds and Acquiring Fund | | | 5 | | |

Principal Risk Factors | | | 8 | | |

Voting Information | | | 10 | | |

General | | | 10 | | |

Record Date | | | 11 | | |

Solicitation of Proxies and Voting Instructions | | | 11 | | |

Voting Procedures | | | 11 | | |

Quorum | | | 11 | | |

Adjournments; Other Business | | | 12 | | |

Expenses of Solicitation | | | 12 | | |

Vote Required | | | 12 | | |

Performance Information | | | 12 | | |

The Reorganizations | | | 15 | | |

The Board's Considerations | | | 15 | | |

The Reorganization Agreements | | | 17 | | |

Tax Aspects of the Reorganizations | | | 18 | | |

Description of Shares | | | 20 | | |

Capitalization Tables (unaudited) | | | 20 | | |

Appraisal Rights | | | 20 | | |

Comparison of Investment Objectives, Principal Policies and Restrictions | | | 21 | | |

Investment Objectives and Policies | | | 21 | | |

Investment Strategy | | | 21 | | |

Investment Restrictions | | | 22 | | |

Additional Information about the Acquiring Fund and the Acquired Funds | | | 23 | | |

General | | | 23 | | |

Rights of Acquired Fund Shareholders and Acquiring Fund Shareholders | | | 23 | | |

Financial Information | | | 24 | | |

Shareholder Proposals | | | 24 | | |

Management | | | 25 | | |

Description of Shares and Shareholder Inquiries | | | 25 | | |

Dividends, Distributions and Taxes | | | 25 | | |

Purchases and Redemptions | | | 25 | | |

Share Information | | | 26 | | |

Financial Statements And Experts | | | 27 | | |

Legal Matters | | | 27 | | |

Available Information | | | 27 | | |

Other Business | | | 27 | | |

| Exhibit A-1 – Agreement and Plan of Reorganization (SD Global Infrastructure) | | | A-1-1 | | |

| Exhibit A-2 – Agreement and Plan of Reorganization (VIS Global Infrastructure) | | | A-2-1 | | |

Exhibit B – Prospectuses of the Acquiring Fund dated December 18, 2013, as they may be amended

and supplemented from time to time | | | B-1 | | |

SYNOPSIS

The following is a synopsis of certain information contained in or incorporated by reference in this Joint Proxy Statement and Prospectus. This synopsis is only a summary and is qualified in its entirety by the more detailed information contained or incorporated by reference in this Joint Proxy Statement and Prospectus and the Reorganization Agreements. Shareholders should carefully review this Joint Proxy Statement and Prospectus and the Reorganization Agreements in their entirety and, in particular, the Acquiring Fund's Prospectuses, which are attached to this Joint Proxy Statement and Prospectus as Exhibit B and incorporated herein by reference.

General

This Joint Proxy Statement and Prospectus is being furnished to Shareholders of each Acquired Fund, each a series of an open-end management investment company, in connection with the solicitation by each Trust's Board of Trustees (each, a "Board" or "Board of Trustees"), on behalf of the Acquired Funds, of proxies ("Proxies") to be used at the Meeting to consider the Reorganizations. It is expected that the first mailing of this Joint Proxy Statement and Prospectus will be made on or about January 31, 2014.

Shareholders of each Acquired Fund will vote separately on the Reorganization for that Acquired Fund. Each Reorganization is not dependent on the approval of the other. Pursuant to each Reorganization, Class X Shareholders of each Acquired Fund will receive Class I shares of the Acquiring Fund, and Class Y Shareholders of each Acquired Fund will receive Class II shares of the Acquiring Fund. The shares to be issued by the Acquiring Fund in connection with the Reorganizations (the "Acquiring Fund Shares") will be issued at NAV without any sales charges. Further information relating to the Acquiring Fund is set forth herein and in the Acquiring Fund's current Prospectuses, each dated December 18, 2013 (the "Acquiring Fund's Prospectuses"), attached to this Joint Proxy Statement and Prospectus as Exhibit B and incorporated herein by reference.

The Board of Directors of the Company, on behalf of the Acquiring Fund (the "Board of Directors"), has authorized the issuance of the Acquiring Fund Shares to Shareholders of the Acquired Funds in connection with each Reorganization.

The information concerning the Acquired Funds contained herein has been supplied by the applicable Trust. The information concerning the Acquiring Fund contained herein has been supplied by the Company.

The Reorganizations

Each Reorganization is being proposed because the applicable Board has determined that such Reorganization is in the best interests of the respective Acquired Fund and its Shareholders. Although the Board of each Trust recommends that Shareholders approve the Reorganization of the applicable Acquired Fund into the Acquiring Fund, the approval of the Reorganization of one Acquired Fund is not conditioned upon the approval of the Reorganization of the other Acquired Fund. Accordingly, if Shareholders of one Acquired Fund approve its Reorganization, but Shareholders of the other Acquired Fund do not approve that Acquired Fund's Reorganization, it is expected that the Reorganization of the first Acquired Fund will take place as described in this Joint Proxy Statement and Prospectus.

Each Reorganization will allow the Shareholders of the applicable Acquired Fund to be invested in a fund that is managed according to similar investment objectives, strategies and restrictions. In addition, with respect to SD Global Infrastructure, the Reorganization is expected to result in lower (if both Reorganizations are approved) or the same (if only the SD Reorganization is approved) total operating expenses for Shareholders of SD Global Infrastructure and, with respect to VIS Global Infrastructure, the Reorganization is expected to result in the same total operating expenses for Shareholders of VIS Global Infrastructure, each as a result of proposed fee waivers and/or expense reimbursements instituted by Morgan Stanley Investment Management Inc. ("MSIM"), the Acquiring Fund's and Acquired Funds' adviser, and Morgan Stanley Distribution, Inc. ("Distributor"), the Acquiring Fund's and Acquired Funds' distributor. The proposed fee waivers and/or expense reimbursements will continue for at least two years from the date of the Reorganization(s) or until such time as the Company's Board of Directors acts to discontinue all or a portion of such waivers and/or reimbursements when it deems such action is appropriate.

1

Moreover, the Reorganizations will allow Shareholders of the Acquired Funds to be invested in a fund with greater future sales and asset growth potential and a wider distribution through the intermediary insurance channel than the Acquired Funds. There is no assurance that the proposed advisory fee waivers and/or expense reimbursements will continue and therefore the total expense ratio of the Class I and Class II shares of the Acquiring Fund may be higher in the future. See "The Reorganizations—The Board's Considerations."

Each Reorganization Agreement provides for the transfer of substantially all the assets and the liabilities of the applicable Acquired Fund to the Acquiring Fund in exchange for Acquiring Fund Shares. The aggregate NAV of the Acquiring Fund Shares issued in the exchange will equal the aggregate value of the net assets of an Acquired Fund received by the Acquiring Fund. On or after the closing date scheduled for each Reorganization (the "Closing Date"), the applicable Acquired Fund will distribute the Acquiring Fund Shares received by such Acquired Fund to its Shareholders as of the Valuation Date (as defined below) in complete liquidation of such Acquired Fund and, without further notice, the outstanding shares of such Acquired Fund held by the Shareholders will then be redeemed and canceled as permitted by the organizational documents of such Acquired Fund and applicable law. Each Acquired Fund thereafter will be terminated as a series of the applicable Trust. As a result of each Reorganization, each Shareholder will receive that number of full and fractional Acquiring Fund Shares equal in value to such shareholder's pro rata interest in the net assets of the applicable Acquired Fund transferred to the Acquiring Fund. Pursuant to each Reorganization, Class X Shareholders of the applicable Acquired Fund will receive Class I shares of the Acquiring Fund and Class Y Shareholders of the applicable Acquired Fund will receive Class II shares of the Acquiring Fund. The Board has determined that the interests of the Shareholders will not be diluted as a result of the Reorganizations. The "Valuation Date" is the third business day following the receipt of the requisite approval of a Reorganization Agreement by the Shareholders of the applicable Acquired Fund or at such time on such earlier or later date after such approval as may be mutually agreed upon in writing.

For the reasons set forth below under "The Reorganizations—The Boards' Considerations," the respective Board, including the Trustees who are not "interested persons" of the Acquired Funds ("Independent Board Members"), as that term is defined in the Investment Company Act of 1940, as amended (the "1940 Act"), have concluded that the Reorganizations are advisable and in the best interests of the applicable Acquired Fund and their Shareholders and recommends approval of the applicable Reorganization.

Fee Tables

The following tables briefly describe the annual Fund operating expenses that Shareholders of the Funds may pay if they buy and hold shares of the Funds. Total Annual Fund Operating Expenses in the tables below do not reflect the impact of any charges by your insurance company. If they did, Total Annual Fund Operating Expenses would be higher. Each Fund pays expenses for management of its assets, distribution of its shares and other services, and those expenses are reflected in the NAV per share of each Fund. These expenses are deducted from each respective Fund's assets and are based on actual expenses incurred by the Acquired Funds for their fiscal years ended December 31, 2012. The tables also set forth pro forma fees for the surviving combined fund (UIF Global Infrastructure) (the "Combined Fund") reflecting what the fee schedule would have been on December 31, 2012, if (i) both Reorganizations, (ii) only the Variable Reorganization; or (iii) only the SD Reorganization had been consummated twelve (12) months prior to that date.

Annual Fund Operating Expenses

(expenses that are deducted from Fund assets)

SD Global Infrastructure (Acquired Fund) | | Class X | | Class Y | |

Advisory Fee | | | 0.57 | % | | | 0.57 | % | |

Distribution and/or Shareholder Service (12b-1) Fee | | | None | | | | 0.25 | % | |

Other Expenses | | | 0.54 | % | | | 0.54 | % | |

Total Annual Fund Operating Expenses | | | 1.11 | % | | | 1.36 | % | |

2

VIS Global Infrastructure (Acquired Fund) | | Class X | | Class Y | |

Advisory Fee | | | 0.57 | % | | | 0.57 | % | |

Distribution and/or Shareholder Service (12b-1) Fee | | | None | | | | 0.25 | % | |

Other Expenses | | | 0.30 | % | | | 0.30 | % | |

Total Annual Fund Operating Expenses | | | 0.87 | % | | | 1.12 | % | |

UIF Global Infrastructure (Acquiring Fund) | | Class I | | Class II | |

Advisory Fee | | | 0.85 | % | | | 0.85 | % | |

Distribution (12b-1) Fee | | | None | | | | 0.35 | % | |

Other Expenses* | | | 0.50 | % | | | 0.50 | % | |

Total Annual Fund Operating Expenses† | | | 1.35 | % | | | 1.70 | % | |

Fee Waiver and/or Expense Reimbursement† | | | 0.24 | % | | | 0.34 | % | |

Total Annual Fund Operating Expenses After Fee Waiver and/or

Expense Reimbursement† | | | 1.11 | % | | | 1.36 | % | |

Pro Forma Combined Fund

(UIF Global Infrastructure—with approval of both Reorganizations) | | Class I | | Class II | |

Advisory Fee | | | 0.85 | % | | | 0.85 | % | |

Distribution (12b-1) Fee | | | None | | | | 0.35 | % | |

Other Expenses* | | | 0.50 | % | | | 0.50 | % | |

Total Annual Fund Operating Expenses‡ | | | 1.35 | % | | | 1.70 | % | |

Fee Waiver and/or Expense Reimbursement‡ | | | 0.48 | % | | | 0.58 | % | |

Total Annual Fund Operating Expenses After Fee Waiver and/or

Expense Reimbursement‡ | | | 0.87 | % | | | 1.12 | % | |

Pro Forma Combined Fund

(UIF Global Infrastructure—with approval of only the Variable Reorganization) | | Class I | | Class II | |

Advisory Fee | | | 0.85 | % | | | 0.85 | % | |

Distribution (12b-1) Fee | | | None | | | | 0.35 | % | |

Other Expenses* | | | 0.58 | % | | | 0.58 | % | |

Total Annual Fund Operating Expenses‡ | | | 1.43 | % | | | 1.78 | % | |

Fee Waiver and/or Expense Reimbursement‡ | | | 0.56 | % | | | 0.66 | % | |

Total Annual Fund Operating Expenses After Fee Waiver and/or

Expense Reimbursement‡ | | | 0.87 | % | | | 1.12 | % | |

Pro Forma Combined Fund

(UIF Global Infrastructure—with approval of only the SD Reorganization) | | Class I | | Class II | |

Advisory Fee | | | 0.85 | % | | | 0.85 | % | |

Distribution (12b-1) Fee | | | None | | | | 0.35 | % | |

Other Expenses* | | | 1.04 | % | | | 1.04 | % | |

Total Annual Fund Operating Expenses‡‡ | | | 1.89 | % | | | 2.24 | % | |

Fee Waiver and/or Expense Reimbursement‡‡ | | | 0.78 | % | | | 0.88 | % | |

Total Annual Fund Operating Expenses After Fee Waiver and/or

Expense Reimbursement‡‡ | | | 1.11 | % | | | 1.36 | % | |

3

* Other expenses have been estimated for the current fiscal year.

† MSIM has agreed to reduce its advisory fee and/or reimburse the Acquiring Fund so that Total Annual Fund Operating Expenses, excluding certain investment related expenses, taxes, interest and other extraordinary expenses (including litigation), will not exceed 1.11% for Class I and 1.36% for Class II. In addition, the Distributor has agreed to waive 0.10% of the 0.35% 12b-1 fee that it may receive with respect to Class II shares. These fee waivers and/or expense reimbursements will continue for at least two years or until such time as the Company's Board of Directors acts to discontinue all or a portion of such waivers and/or reimbursements when it deems such action is appropriate.

‡ MSIM has agreed to reduce its advisory fee and/or reimburse the Combined Fund so that Total Annual Fund Operating Expenses, excluding certain investment related expenses, taxes, interest and other extraordinary expenses (including litigation), will not exceed 0.87% for Class I and 1.12% for Class II. In addition, the Distributor has agreed to waive 0.10% of the 0.35% 12b-1 fee that it may receive with respect to Class II shares. The fee waivers and/or expense reimbursements will continue for at least two years from the date of the Reorganization(s) or until such time as the Company's Board of Directors acts to discontinue all or a portion of such waivers and/or reimbursements when it deems such action is appropriate.

‡‡ MSIM has agreed to reduce its advisory fee and/or reimburse the Combined Fund so that Total Annual Fund Operating Expenses, excluding certain investment related expenses, taxes, interest and other extraordinary expenses (including litigation), will not exceed 1.11% for Class I and 1.36% for Class II. In addition, the Distributor has agreed to waive 0.10% of the 0.35% 12b-1 fee that it may receive with respect to Class II shares. The fee waivers and/or expense reimbursements will continue for at least two years from the date of the SD Reorganization or until such time as the Company's Board of Directors acts to discontinue all or a portion of such waivers and/or reimbursements when it deems such action is appropriate.

Example

The example is intended to help you compare the cost of investing in the Funds with the cost of investing in other mutual Funds.

To attempt to show the effect of annual Fund operating expenses on an investment over time, the hypothetical shown below has been created. The example assumes that an investor invests $10,000 in either the Acquiring Fund or each of the Acquired Funds for the time periods indicated and that an investor then redeems all of his or her shares at the end of those periods. The example also assumes that the investment has a 5% return each year and that the operating expenses for each Fund remains the same (as set forth in the chart above). Although a shareholder's actual costs may be higher or lower, the table below shows a shareholder's costs at the end of each period based on these assumptions.

SD Global Infrastructure (Acquired Fund) | | 1 Year | | 3 Years | | 5 Years | | 10 Years | |

Class X | | $ | 113 | | | $ | 353 | | | $ | 612 | | | $ | 1,352 | | |

Class Y | | $ | 138 | | | $ | 431 | | | $ | 745 | | | $ | 1,635 | | |

VIS Global Infrastructure (Acquired Fund) | |

Class X | | $ | 89 | | | $ | 278 | | | $ | 482 | | | $ | 1,073 | | |

Class Y | | $ | 114 | | | $ | 356 | | | $ | 617 | | | $ | 1,363 | | |

UIF Global Infrastructure (Acquiring Fund) | |

Class I | | $ | 113 | | | $ | 353 | | | $ | 612 | | | $ | 1,352 | | |

Class II | | $ | 138 | | | $ | 431 | | | $ | 745 | | | $ | 1,635 | | |

4

Pro Forma Combined Fund (UIF Global Infrastructure—

with approval of both Reorganizations) | | 1 Year | | 3 Years | | 5 Years | | 10 Years | |

Class I | | $ | 89 | | | $ | 278 | | | $ | 482 | | | $ | 1,073 | | |

Class II | | $ | 114 | | | $ | 356 | | | $ | 617 | | | $ | 1,363 | | |

Pro Forma Combined Fund (UIF Global Infrastructure—

with approval of only the Variable Reorganization) | |

Class I | | $ | 89 | | | $ | 278 | | | $ | 482 | | | $ | 1,073 | | |

Class II | | $ | 114 | | | $ | 356 | | | $ | 617 | | | $ | 1,363 | | |

Pro Forma Combined Fund (UIF Global Infrastructure—

with approval of only the SD Reorganization) | |

Class I | | $ | 113 | | | $ | 353 | | | $ | 612 | | | $ | 1,352 | | |

Class II | | $ | 138 | | | $ | 431 | | | $ | 745 | | | $ | 1,635 | | |

Annual Fund Operating Expenses

The purpose of the foregoing fee tables is to assist Shareholders in understanding the various costs and expenses that a shareholder in each Fund will bear directly or indirectly. For a more complete description of these costs and expenses, see "Comparison of Acquired Funds and Acquiring Fund—Investment Advisory Fees," "—Plan of Distribution Fees," "—Other Significant Fees" and "—Purchases and Redemptions" below.

Portfolio Turnover

Each Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may result in higher transaction costs. These costs, which are not reflected in Total Annual Fund Operating Expenses or in the Example, affect Fund performance. During the most recent fiscal year, SD Global Infrastructure's and VIS Global Infrastructure's portfolio turnover rates were 28% and 28%, respectively, of the average value of their portfolios. The Acquiring Fund has not yet commenced operations and, accordingly, no information regarding portfolio turnover rate is available at this time.

Tax Consequences of the Reorganizations

As a condition to each Reorganization, each Acquired Fund has requested an opinion of Dechert LLP to the effect that, based upon certain facts, assumptions and representations, the applicable Reorganization will constitute a tax-free reorganization for federal income tax purposes, and no gain or loss will be recognized by the Acquired Funds, the Acquiring Fund or the Acquired Funds' Shareholders for federal income tax purposes as a result of the transactions included in the applicable Reorganization. Receipt of such opinion is a condition to each Reorganization. For further information about the tax consequences of the Reorganizations, see "The Reorganizations—Tax Aspects of the Reorganizations" below.

Comparison of Acquired Funds and Acquiring Fund

Investment Objectives. Each Acquired Fund's and the Acquiring Fund's investment objectives are to seek both capital appreciation and current income.

Principal Investment Policies. Each of the Acquired Funds is a diversified fund. The Acquiring Fund is a non-diversified fund.

Each Fund will normally invest at least 80% of its assets in equity securities issued by companies located throughout the world that are engaged in the infrastructure business. A company is considered to be in the infrastructure business if it derives at least 50% of its revenues or earnings from, or devotes at least 50% of its assets to, infrastructure-related activities. Infrastructure refers to the systems and networks of energy, transportation, communication and other services required for the normal function of society. Companies in the infrastructure business may be involved in a variety of areas, including, but not limited to, (i) the transmission, distribution, storage or transportation of electricity, oil and gas (and other bulk liquid products), water, and other natural resources

5

used to produce energy, (ii) the construction and operation of renewable power facilities, (iii) the development, ownership, lease, concession, or management of highways, toll roads, tunnels, bridges, pipelines, airports, marine ports, refueling and related facilities, (iv) the provision of communications, including the development, lease, concession, or management of telephone, broadcast and mobile towers, fiber optic/copper cable, and satellite networks, (v) waste-water management and water purification/desalination and (vi) the construction or operation of essential public structures.

Each Fund's equity investments may include convertible securities. Each Fund's investments may include securities of small and medium capitalization companies. Each Fund's may invest up to 100% of its net assets in foreign securities, which may include emerging market securities. Under normal market conditions, each Fund's invests at least 40% of its assets in the securities of issuers located outside of the United States.

Each Fund's Adviser and/or "Sub-Advisers," Morgan Stanley Investment Management Limited ("MSIM Limited") and Morgan Stanley Investment Management Company ("MSIM Company"), seek to allocate Fund assets between the different types of companies in the infrastructure business based on relative valuation, underlying company fundamentals, and demographic and macroeconomic considerations. Each Fund has a fundamental policy (i.e., one that cannot be changed without shareholder approval) of investing 25% or more of its assets in the infrastructure industry.

In selecting securities to buy, hold or sell for each Fund, the Adviser and/or Sub-Advisers actively manage each Fund using a combination of bottom-up and top-down methodologies. The value-driven approach to bottom-up security selection utilizes proprietary research models to identify infrastructure companies that offer the best value relative to their underlying assets and growth prospects. The top-down allocation provides diversified exposure to major economic infrastructure sectors and countries, with an overweighting to those sectors/countries that offer the best relative valuation. The Adviser and/or Sub-Advisers generally consider selling a portfolio holding when it determines that the holding no longer satisfies its investment criteria.

The principal differences between the principal investment policies of the Acquired Funds and the Acquiring Fund are more fully described under "Comparison of Investment Objectives, Principal Policies and Restrictions" below.

Fund Management. The Acquiring Fund and the Acquired Funds are managed within MSIM's Global Infrastructure Securities team, and, if the Reorganizations are approved, the Acquiring Fund is expected to continue to be managed within MSIM's Global Infrastructure Securities team. Current members of the team jointly and primarily responsible for the day-to-day management of the Acquiring Fund are Theodore R. Bigman and Matthew King.

Mr. Bigman has been associated with the Adviser in an investment management capacity since 1995. Mr. King has been associated with the Adviser in an investment management capacity since 2008.

Additional information about the portfolio managers' compensation structure, other accounts managed by the portfolio managers and the portfolio managers' ownership of securities in the Funds is provided in each of the Trust's and the Company's Statements of Additional Information.

Investment Advisory Fees. The Acquiring Fund and Acquired Funds currently obtain advisory services from MSIM. MSIM is a wholly-owned subsidiary of Morgan Stanley (NYSE: "MS") with its principal office located at 522 Fifth Avenue, New York, NY 10036. Morgan Stanley is a preeminent global financial services firm engaged in securities trading and brokerage activities, as well as providing investment banking, research and analysis, financing and financial advisory services.

The annual advisory fee (as a percentage of daily net assets) payable by the Funds is set forth below. The Acquired Funds pay their advisory fees on a monthly basis and the Acquiring Fund pays its advisory fee on a quarterly basis.

6

SD Global Infrastructure: | | 0.57% of the portion of daily net assets not exceeding $500 million; 0.47% of the portion of daily net assets exceeding $500 million but not exceeding $1 billion; 0.445% of the portion of daily net assets exceeding $1 billion but not exceeding $1.5 billion; 0.42% of the portion of daily net assets exceeding $1.5 billion but not exceeding $2.5 billion; 0.395% of the portion of daily net assets exceeding $2.5 billion but not exceeding $3.5 billion; 0.37% of the portion of daily net assets exceeding $3.5 billion but not exceeding $5 billion; and 0.345% of the portion of daily net assets exceeding $5 billion. | |

VIS Global Infrastructure: | | 0.57% of the portion of daily net assets not exceeding $500 million; 0.47% of the portion of daily net assets exceeding $500 million but not exceeding $1 billion; 0.445% of the portion of daily net assets exceeding $1 billion but not exceeding $1.5 billion; 0.42% of the portion of daily net assets exceeding $1.5 billion but not exceeding $2.5 billion; 0.395% of the portion of daily net assets exceeding $2.5 billion but not exceeding $3.5 billion; 0.37% of the portion of daily net assets exceeding $3.5 billion but not exceeding $5 billion; and 0.345% of the portion of daily net assets exceeding $5 billion. | |

UIF Global Infrastructure*: | | 0.85% of daily net assets. | |

* MSIM has agreed to reduce its advisory fee and/or reimburse the Acquiring Fund so that Total Annual Fund Operating Expenses, excluding certain investment related expenses, taxes, interest and other extraordinary expenses (including litigation), will not exceed 1.11% with respect to Class I shares and 1.36% with respect to Class II shares. The fee waivers and/or expense reimbursements will continue for at least two years or until such time as the Company's Board of Directors acts to discontinue all or a portion of such waivers and/or reimbursements when it deems such action is appropriate.

Comparison of Other Service Providers. The Acquired Funds and Acquiring Fund have the same transfer agent, custodian, distributor and independent registered public accounting firm. For each Fund, the transfer agent is Boston Financial Data Services, Inc., the custodian is State Street Bank and Trust Company, the distributor is Morgan Stanley Distribution, Inc. and the independent registered public accounting firm is Ernst & Young LLP. Each Acquired Fund's administrator is Morgan Stanley Services Company Inc. The Acquiring Fund's administrator is MSIM.

Plan of Distribution Fees. Each Trust has adopted a plan of distribution with respect to Class Y shares of each Acquired Fund, pursuant to Rule 12b-1 under the 1940 Act (the "Trust Plan"). The Company has adopted a plan of distribution with respect to Class II shares of the Acquiring Fund, pursuant to Rule 12b-1 under the 1940 Act (the "Company Plan" and together with the Trust Plan, the "Plans"). Under the Trust Plan, each Acquired Fund pays distribution fees in connection with the sale and distribution of Class Y shares of 0.25% of the average daily net assets of such class. Under the Company Plan, the Acquiring Fund pays distribution fees in connection with the sale and distribution of Class II shares at an annual rate of 0.35% of the Acquiring Fund's average daily net assets attributable to such class. Such amounts are paid to compensate each Fund's distributor for remittance to insurance companies, qualified pension plans or retirement plans (as applicable) which offer the applicable Fund as an investment option. These payments are intended to compensate insurance companies for distribution and/or administrative related expenses incurred or paid in connection with the distribution of the applicable shares of the Funds. The Acquiring Fund's Distributor has agreed to waive 0.10% of the 0.35% 12b-1 fee that it may receive. This waiver will continue for at least two years or until such time as the Company's Board of Directors acts to discontinue all or a portion of such waiver when it deems such action is appropriate. MSIM and/or the Acquiring Fund's Distributor may pay additional compensation (out of their own funds and not as an expense of the Acquiring Fund) to certain insurance companies and/or other financial intermediaries in connection with the sale, distribution, marketing and/or retention of shares of the Acquiring Fund and/or shareholder servicing. For a complete description of the arrangement with respect to each Acquired Fund, see the section of each Acquired Fund's prospectuses entitled "Plan of Distribution" and the section of the Acquired Funds' Statement of Additional Information entitled "V. Investment Advisory and Other Services—D. Rule 12b-1 Plan." For a complete description of the arrangement

7

with respect to the Acquiring Fund, see the section of the Acquiring Fund's Prospectuses (attached as Exhibit B) entitled "Distribution Plan" and the section of the Acquiring Fund's Statement of Additional Information entitled "Distribution of Shares (Applicable to Class II Shares Only)."

Other Significant Fees. The Acquiring Fund and Acquired Funds pay additional fees in connection with their operations, including legal, auditing, transfer agent and custodial fees. See "Synopsis—Fee Tables" above for the percentage of average net assets represented by such "Other Expenses."

Purchases and Redemptions. The Company's Board of Directors has authorized the issuance of the Acquiring Fund Shares in connection with the Reorganizations.

Acquired Funds. Shares of the Acquired Funds are offered on each day that the New York Stock Exchange ("NYSE") is open for business. Each Acquired Fund offers its shares only to insurance company separate accounts that insurance companies establish to fund variable life insurance and/or variable annuity contracts. An insurance company purchases or redeems shares of an Acquired Fund based on, among other things, the amount of net contract premiums or purchase payments allocated to a separate account investment division, transfers to or from a separate account investment division, contract loans and repayments, contract withdrawals and surrenders, and benefit payments. The contract prospectus describes how contract owners may allocate, transfer and withdraw amounts to and from separate accounts.

For further information on the purchase and sale of shares of each Acquired Fund, see the sections of each Acquired Fund's prospectuses entitled "Purchase and Sales of Portfolio Shares" and "Pricing Portfolio Shares," as well as the section of the Acquired Funds' Statement of Additional Information entitled "VIII. Purchase, Redemption and Pricing of Shares."

Acquiring Fund. Shares of the Acquiring Fund are offered on each day that the NYSE is open for business. The Acquiring Fund offers its shares only to insurance companies for separate accounts that insurance companies establish to fund variable life insurance and variable annuity contracts, and to other entities under qualified pension and retirement plans. An insurance company purchases or redeems shares of the Acquiring Fund based on, among other things, the amount of net contract premiums or purchase payments allocated to a separate account investment division, transfers to or from a separate account investment division, contract loans and repayments, contract withdrawals and surrenders, and benefit payments. The contract prospectus describes how contract owners may allocate, transfer and withdraw amounts to, and from, separate accounts.

For further information on the purchase and sale of shares of the Acquiring Fund, see the sections of the Acquiring Fund's Prospectuses (attached as Exhibit B) entitled "Purchasing and Selling Portfolio Shares" and "Pricing of Portfolio Shares," as well as the section of the Acquiring Fund's Statement of Additional Information entitled "Net Asset Value."

Dividends. Each Fund declares dividends separately for each of its classes. Each Fund pays dividends from net investment income and distributes net realized capital gains, if any, at least annually.

PRINCIPAL RISK FACTORS

The principal risks of investing in the Acquiring Fund are substantially similar to those of investing in an Acquired Fund. The value of an investment in each Fund is based on the market prices of the securities such Fund holds. These prices change daily due to economic and other events that affect markets generally, as well as those that affect particular regions, countries, industries, companies or governments.

Infrastructure Industry. Each Fund, by concentrating its investments in the infrastructure industry, has greater exposure to the potential adverse economic, regulatory, political and other changes affecting companies operating within such industry. Companies within the infrastructure industry are subject to a variety of factors that may adversely affect their business or operations, including high interest costs in connection with capital construction and improvement programs, high leverage, costs associated with compliance with and changes in environmental and other regulations, difficulty in raising capital in adequate amounts and on reasonable terms in periods of high inflation and unsettled capital markets or government budgetary constraints that impact publicly funded projects,

8

the effects of economic slowdown or recession and surplus capacity, increased competition from other providers of services, uncertainties concerning the availability of fuel at reasonable prices, the effects of energy conservation policies and other factors.

Other factors that may affect the operations of companies within the infrastructure industry include innovations in technology that could render the way in which a company delivers a product or service obsolete, significant changes to the number of ultimate end-users of a company's products, inexperience with and potential losses resulting from a developing deregulatory environment, increased susceptibility to terrorist attacks, risks of environmental damage due to a company's operations or an accident, and general changes in market sentiment towards infrastructure and utilities assets. Companies operating in the infrastructure industry face operating risks, including the risk of fire, explosions, leaks, mining and drilling accidents or other catastrophic events. In addition, natural risks, such as earthquakes, floods, lightning, hurricanes, tsunamis and wind, are inherent risks in infrastructure company operations.

Equity Securities. Each Fund invests in equity securities. Equity securities may include common and preferred stocks, convertible securities and equity-linked securities, rights and warrants to purchase common stocks, depositary receipts, limited partnership interests and other specialty securities having equity features. The prices of equity securities will rise and fall in response to a number of different factors. In particular, prices of equity securities fluctuate, and sometimes widely fluctuate, in response to activities specific to the issuer of the security as well as factors unrelated to the fundamental condition of the issuer, including general market, economic and political conditions.

The Funds may invest in equity securities that are publicly-traded on securities exchanges or over-the-counter ("OTC") or in equity securities that are not publicly traded. Securities that are not publicly traded may be more difficult to sell and their value may fluctuate more dramatically than other securities.

Depositary receipts involve many of the same risks as those associated with direct investment in foreign securities. In addition, the underlying issuers of certain depositary receipts, particularly unsponsored or unregistered depositary receipts, are under no obligation to distribute shareholder communications to the holders of such receipts, or to pass through to them any voting rights with respect to the deposited securities.

A convertible security is a bond, debenture, note, preferred stock, right, warrant or other security that may be converted into or exchanged for a prescribed amount of common stock or other security of the same or a different issuer or into cash within a particular period of time at a specified price or formula. A convertible security generally entitles the holder to receive interest paid or accrued on debt securities or the dividend paid on preferred stock until the convertible security matures or is redeemed, converted or exchanged. Before conversion, convertible securities generally have characteristics similar to both debt and equity securities. The value of convertible securities tends to decline as interest rates rise and, because of the conversion feature, tends to vary with fluctuations in the market value of the underlying securities. Convertible securities ordinarily provide a stream of income with generally higher yields than those of common stock of the same or similar issuers. Convertible securities generally rank senior to common stock in a corporation's capital structure but are usually subordinated to comparable nonconvertible securities. Convertible securities generally do not participate directly in any dividend increases or decreases of the underlying securities although the market prices of convertible securities may be affected by any dividend changes or other changes in the underlying securities.

Small and Medium Capitalization Companies. Each Fund may invest in securities of small and medium capitalization companies. Investments in small and medium capitalization companies may involve greater risks than investments in larger, more established companies. The securities issued by small and medium capitalization companies may be less liquid, and such companies may have more limited markets, financial resources and product lines, and may lack the depth of management of larger companies.

Foreign Securities. Each Fund may invest in foreign securities. Foreign issuers generally are subject to different accounting, auditing and financial reporting standards than U.S. issuers. There may be less information available to the public about foreign issuers. Securities of foreign issuers can be less liquid and experience greater price movements. In addition, the prices of such securities may be susceptible to influence by large traders, due to

9

the limited size of many foreign securities markets. In addition, investments in certain foreign markets, which have historically been considered stable, may become more volatile and subject to increased risk due to ongoing developments and changing conditions in such markets. Moreover, the growing interconnectivity of global economies and financial markets has increased the probability that adverse developments and conditions in one country or region will affect the stability of economies and financial markets in other countries or regions. In some foreign countries, there is also the risk of government expropriation, excessive taxation, political or social instability, the imposition of currency controls or diplomatic developments that could affect a Fund's investment. There also can be difficulty obtaining and enforcing judgments against issuers in foreign countries. Foreign stock exchanges, broker-dealers and listed issuers may be subject to less government regulation and oversight. The cost of investing in foreign securities, including brokerage commissions and custodial expenses, can be higher than in the United States.

In connection with their investments in foreign securities, the Funds also may enter into contracts with banks, brokers or dealers to purchase or sell securities or foreign currencies at a future date. A foreign currency forward exchange contract is a negotiated agreement between the contracting parties to exchange a specified amount of currency at a specified future time at a specified rate. The rate can be higher or lower than the spot rate between the currencies that are the subject of the contract. Foreign currency forward exchange contracts may be used to protect against uncertainty in the level of future foreign currency exchange rates or to gain or modify exposure to a particular currency. In addition, the Funds may use cross currency hedging or proxy hedging with respect to currencies in which the Funds have or expect to have portfolio or currency exposure. Cross currency hedges involve the sale of one currency against the positive exposure to a different currency and may be used for hedging purposes or to establish an active exposure to the exchange rate between any two currencies.

Emerging Market Risks. Each Fund may invest in emerging market or developing countries, which are countries that major international financial institutions, such as the World Bank, generally consider to be less economically mature than developed nations, such as the United States or most nations in Western Europe. Emerging market or developing countries may be more likely to experience political turmoil or rapid changes in economic conditions than more developed countries, and the financial condition of issuers in emerging market or developing countries may be more precarious than in other countries. In addition, emerging market securities generally are less liquid and subject to wider price and currency fluctuations than securities issued in more developed countries. These characteristics result in greater risk of price volatility in emerging market or developing countries, which may be heightened by currency fluctuations relative to the U.S. dollar.

Non-Diversification. The Acquiring Fund is a "non-diversified" mutual fund and, as such, its investments are not required to meet certain diversification requirements under federal law. Compared with "diversified" funds, such as the Acquired Funds, the Acquiring Fund may invest a greater percentage of its assets in the securities of an individual corporation or governmental entity. Thus, the Acquiring Fund's assets may be concentrated in fewer securities than other funds. A decline in the value of those investments would cause the Acquiring Fund's overall value to decline to a greater degree.

The foregoing discussion is a summary of the principal risk factors. For a more complete discussion of the risks of the Acquiring Fund, see "Details of the Portfolio—Global Infrastructure Portfolio—Risks" in the Acquiring Fund's Prospectuses attached hereto as Exhibit B. For a more complete discussion of the risks of the Acquired Funds, see "Portfolio Details—Additional Information About the Portfolio's Investment Objective, Strategies and Risks—Principal Risks" in each Acquired Fund's prospectuses, each incorporated herein by reference.

VOTING INFORMATION

General

The shares of the Acquired Funds are currently sold to the Insurance Companies as the record owners for allocation to certain of their separate accounts that are registered as investment companies under the 1940 Act.

10

Record Date

The Board has fixed the close of business on December 23, 2013 as the record date (the "Record Date") for the determination of Shareholders of each Acquired Fund entitled to notice of, and to vote at, the Meeting. As of the Record Date, there were 980,024.652 shares of SD Global Infrastructure and 7,551,857.808 shares of VIS Global Infrastructure issued and outstanding.

Solicitation of Proxies and Voting Instructions

The Board is soliciting proxies from the Shareholders of each Acquired Fund, including the Insurance Companies, which have the right to vote upon matters that may be voted upon at the Meeting. The Insurance Companies will furnish this Joint Proxy Statement and Prospectus to the owners of Contracts participating in their separate accounts that are registered with the Commission under the 1940 Act ("Registered Accounts") and that hold shares of the applicable Acquired Fund to be voted at the Meeting, and will solicit voting instructions from those Contract owners.

Each Insurance Company will vote shares of the applicable Acquired Fund held in its Registered Accounts: (i) for which timely voting instructions are received from Contract owners, in accordance with such instructions; and (ii) for which no voting instructions are timely received, in the same proportion as the instructions received from Contract owners participating in all its Registered Accounts. The Insurance Companies will vote all other shares of the applicable Acquired Fund held by them in the same proportion as the voting instructions timely received by all the Insurance Companies from Contract owners participating in all their Registered Accounts. The effect of proportional voting as described above is that a small number of Contract owners can determine the outcome of the voting. If you wish to give voting instructions, you may submit the enclosed Voting Instruction Form, provide voting instructions by telephone or via the Internet by following the instructions that appear on the Voting Instruction Form or attending the Meeting in person and provide your voting instructions to the relevant Insurance Company.

Voting Procedures

Proxies from Shareholders may be revoked at any time prior to the voting of the shares represented thereby by: (i) mailing written instructions addressed to the Secretary of Morgan Stanley Select Dimensions Investment Series or Morgan Stanley Variable Investment Series (as applicable), 522 Fifth Avenue, 4th Floor, New York, NY 10036; (ii) signing and returning a new proxy; or (iii) attending the Meeting and voting shares. Attendance at the Meeting will not in and of itself revoke a proxy. All valid proxies will be voted in accordance with specifications thereon, or in the absence of specifications, for approval of the applicable Reorganization. Instructions from Contract owners may be revoked by: (i) mailing written instructions addressed to the Secretary of the Trust, 522 Fifth Avenue, 4th Floor, New York, NY 10036; or (ii) signing and returning a new Voting Instruction Form. A Contract owner may also attend the Meeting in person to revoke previously provided voting instructions and to provide new voting instructions.

Quorum

Shareholders of record as of the close of business on the Record Date are entitled to one vote per share and a fractional vote for a fractional share on each matter submitted to a vote at the Meeting. Shareholders of each class of an Acquired Fund will vote together as a single class in connection with the applicable Reorganization Agreement. The holders of a majority of the shares issued and outstanding and entitled to vote of an Acquired Fund, represented in person or by proxy, will constitute a quorum for that Acquired Fund at the Meeting.

In the event that the necessary quorum to transact business or the vote required to approve or reject the Reorganization with respect to an Acquired Fund is not obtained at the Meeting, the persons named as proxies may propose one or more adjournments of the Meeting to permit further solicitation of proxies. Any such adjournment will require the affirmative vote of the holders of a majority of shares of the applicable Acquired Fund present in person or by proxy at the Meeting. Where an adjournment is proposed because the necessary quorum to transact business is not obtained at the Meeting, the persons named as proxies will vote in favor of such adjournment

11

provided that such persons named as proxies determine that such adjournment and additional solicitation is reasonable and in the interests of Shareholders based on all relevant factors, including the nature of the proposal, the percentage of Shareholders present, the nature of the proposed solicitation activities and the nature of the reasons for the further solicitation. Where an adjournment is proposed because the vote required to approve or reject a Reorganization with respect to an Acquired Fund is not obtained at the Meeting, the persons named as proxies will vote in favor of such adjournment those proxies which they are entitled to vote in favor of such Reorganization and will vote against any such adjournment those proxies required to be voted against such Reorganization. Abstentions will not be voted either for or against any such adjournment.

Adjournments; Other Business

The Meeting has been called to transact any business that properly comes before it. The only business that management of the Trusts intends to present or knows that others will present is the Reorganizations. If any other matters properly come before the Meeting, and on all matters incidental to the conduct of the Meeting, the persons named as proxies intend to vote the proxies in accordance with their judgment, unless the Secretary of the Trusts has previously received written contrary instructions from the shareholder entitled to vote the shares.

Expenses of Solicitation

Voting instructions will be solicited primarily by mailing this Joint Proxy Statement and Prospectus and its enclosures. In addition to the voting instructions by mail, employees of MSIM and its affiliates, without additional compensation, may solicit voting instructions in person or by telephone, facsimile or oral communication. The expenses of the Reorganizations, including the cost of printing, filing and voting instructions solicitation, and legal and accounting expenses, are expected to be approximately $67,109 with respect to SD Global Infrastructure (all of which will be borne by SD Global Infrastructure (unless only the SD Reorganization is approved by Shareholders, in which case all of the expenses will be borne by MSIM)) and approximately $69,307 with respect to VIS Global Infrastructure (all of which will be borne by MSIM (whether or not the Variable Reorganization is approved by Shareholders)).

Vote Required

Approval of each Reorganization by Shareholders requires the affirmative vote of the lesser of: (1) more than 50% of the outstanding shares of the Acquired Fund, or (2) 67% or more of the shares of the Acquired Fund represented at the Meeting if the holders of more than 50% of the outstanding shares of the Acquired Fund are present or represented by Proxy. Abstentions are not considered votes "FOR" a Reorganization at the Meeting. As a result, abstentions have the same effect as a vote against a Reorganization because approval of a Reorganization requires the affirmative vote of a percentage of the voting securities present or represented by proxy.

If a Reorganization is not approved by Shareholders of the applicable Acquired Fund, that Acquired Fund will continue in existence and the Board will consider alternative actions for such Acquired Fund.

PERFORMANCE INFORMATION

The Acquiring Fund is newly organized. As a result, the Acquiring Fund has no operating history or performance information to include.

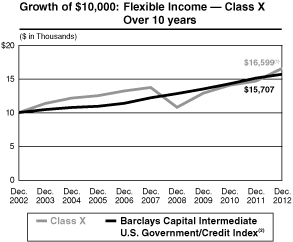

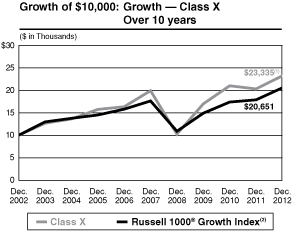

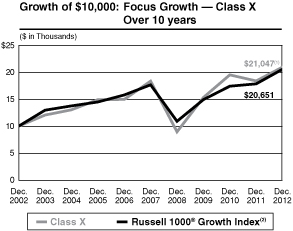

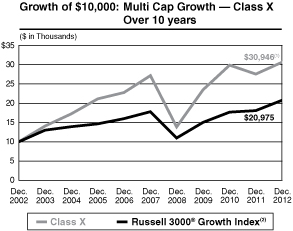

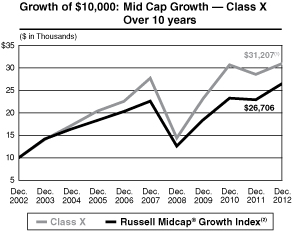

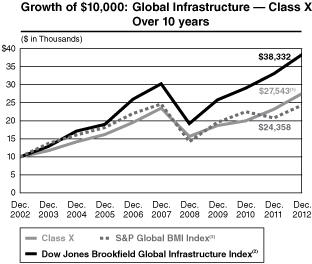

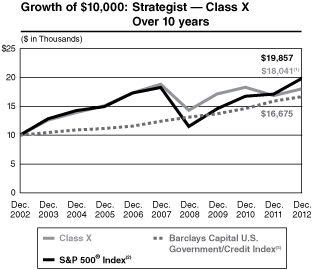

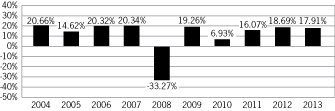

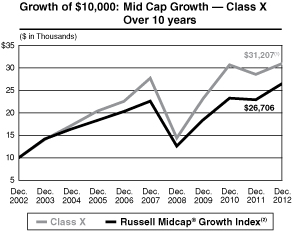

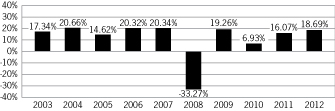

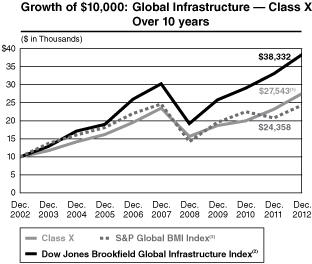

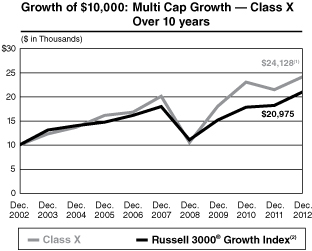

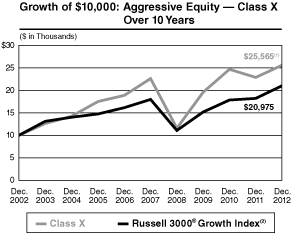

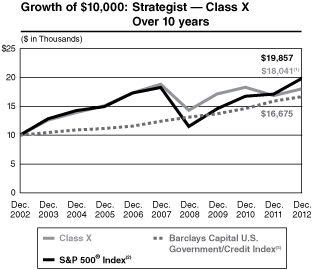

The bar chart and table below provide some indication of the risks of investing in each Acquired Fund by showing changes in the performance of each Acquired Fund's Class X and Class Y shares from year to year and by showing how the average annual returns of each Acquired Fund's Class X and Class Y shares for the one, five and 10 year periods compare with those of a broad measure of market performance over time. This performance information does not include the impact of any charges deducted by your insurance company. If it did, returns would be lower. The Acquired Fund's past performance does not indicate how the Acquired Fund will perform in the future.

12

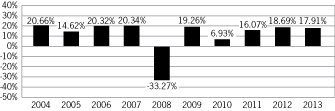

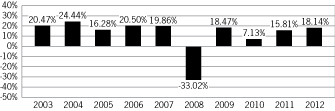

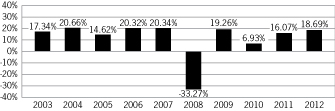

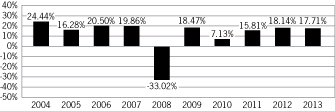

VIS Global Infrastructure

Annual Total Returns—Calendar Years (Class X)

High

Quarter | | 6/30/09: | | | 21.03 | % | |

Low Quarter | | 9/30/08: | | | -18.12 | % | |

Average Annual Total Returns for Periods Ended December 31, 2013 (Class X)

| | Past 1 Year | | Past 5 Years | | Past 10 Years | |

Global Infrastructure Portfolio | | | 17.91 | % | | | 15.68 | % | | | 10.72 | % | |

Dow Jones Brookfield Global

Infrastructure IndexSM

(reflects no deduction for fees, expenses, or taxes)1 | | | 15.89 | % | | | 18.22 | % | | | 13.16 | % | |

S&P Global BMI Index

(reflects no deduction for fees, expenses, or taxes)2 | | | 24.11 | % | | | 16.30 | % | | | 8.23 | % | |

(1) The Dow Jones Brookfield Global Infrastructure IndexSM is a float-adjusted market capitalization weighted index that measures the stock performance of companies that exhibit strong infrastructure characteristics. The Index intends to measure all sectors of the infrastructure market. The Index was first published in July 2008; however, back-tested hypothetical performance information is available for this Index since December 31, 2002. Returns are calculated using the return data of the S&P Global BMI Index through December 31, 2002 and the return data of the Dow Jones Brookfield Global Infrastructure Index for periods thereafter. It is not possible to invest directly in an index.

(2) The Standard & Poor's Global BMI Index (S&P Global BMI Index) is a broad market index designed to capture exposure to equities in all countries in the world that meet minimum size and liquidity requirements. As of the date of this Prospectus, there are approximately 11,000 index members representing 26 developed and 20 emerging market countries. It is not possible to invest directly in an index.

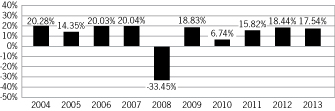

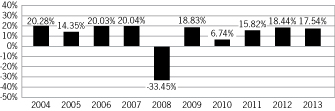

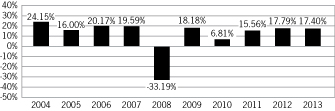

Annual Total Returns—Calendar Years (Class Y)

High

Quarter | | 6/30/09: | | | 21.02 | % | |

Low Quarter | | 9/30/08: | | | -18.14 | % | |

13

Average Annual Total Returns for Periods Ended December 31, 2013 (Class Y)

| | Past 1 Year | | Past 5 Years | | Past 10 Years | |

Global Infrastructure Portfolio | | | 17.54 | % | | | 15.39 | % | | | 10.43 | % | |

Dow Jones Brookfield Global

Infrastructure IndexSM

(reflects no deduction for fees, expenses, or taxes)1 | | | 15.89 | % | | | 18.22 | % | | | 13.16 | % | |

S&P Global BMI Index

(reflects no deduction for fees, expenses, or taxes)2 | | | 24.11 | % | | | 16.30 | % | | | 8.23 | % | |

(1) The Dow Jones Brookfield Global Infrastructure IndexSM is a float-adjusted market capitalization weighted index that measures the stock performance of companies that exhibit strong infrastructure characteristics. The Index intends to measure all sectors of the infrastructure market. The Index was first published in July 2008; however, back-tested hypothetical performance information is available for this Index since December 31, 2002. Returns are calculated using the return data of the S&P Global BMI Index through December 31, 2002 and the return data of the Dow Jones Brookfield Global Infrastructure Index for periods thereafter. It is not possible to invest directly in an index.

(2) The Standard & Poor's Global BMI Index (S&P Global BMI Index) is a broad market index designed to capture exposure to equities in all countries in the world that meet minimum size and liquidity requirements. As of the date of this Prospectus, there are approximately 11,000 index members representing 26 developed and 20 emerging market countries. It is not possible to invest directly in an index.

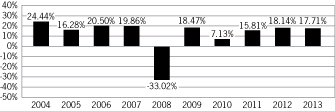

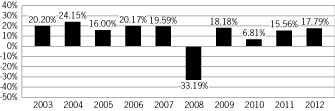

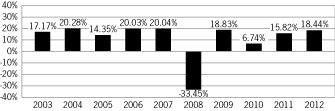

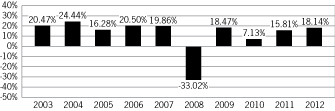

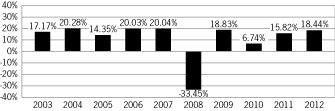

SD Global Infrastructure

Annual Total Returns—Calendar Years (Class X)

High

Quarter | | 6/30/09: | | | 20.93 | % | |

Low Quarter | | 9/30/08: | | | -18.12 | % | |

Average Annual Total Returns for Periods Ended December 31, 2013 (Class X)

| | Past 1 Year | | Past 5 Years | | Past 10 Years | |

Global Infrastructure Portfolio | | | 17.71 | % | | | 15.37 | % | | | 11.08 | % | |

Dow Jones Brookfield

Global Infrastructure IndexSM

(reflects no deduction for fees, expenses or taxes)1 | | | 15.89 | % | | | 18.22 | % | | | 13.16 | % | |

S&P Global BMI Index

(reflects no deduction for fees, expenses or taxes)2 | | | 24.11 | % | | | 16.30 | % | | | 8.23 | % | |

(1) The Dow Jones Brookfield Global Infrastructure IndexSM is a float-adjusted market capitalization weighted index that measures the stock performance of companies that exhibit strong infrastructure characteristics. The Index intends to measure all sectors of the infrastructure market. The Index was first published in July 2008; however, back-tested hypothetical performance information is available for this Index since December 31, 2002. Returns are calculated using the return data of the S&P Global BMI Index through

14

December 31, 2002 and the return data of the Dow Jones Brookfield Global Infrastructure Index for periods thereafter. It is not possible to invest directly in an index.

(2) The Standard & Poor's Global BMI Index (S&P Global BMI Index) is a broad market index designed to capture exposure to equities in all countries in the world that meet minimum size and liquidity requirements. As of the date of this Prospectus, there are approximately 11,000 index members representing 26 developed and 20 emerging market countries. It is not possible to invest directly in an index.

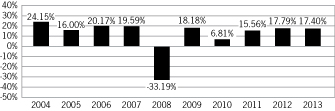

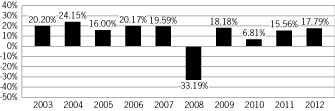

Annual Total Returns—Calendar Years (Class Y)

High

Quarter | | 6/30/09: | | | 20.83 | % | |

Low Quarter | | 9/30/08: | | | -18.18 | % | |

Average Annual Total Returns for Periods Ended December 31, 2013 (Class Y)

| | Past 1 Year | | Past 5 Years | | Past 10 Years | |

Global Infrastructure Portfolio | | | 17.40 | % | | | 15.07 | % | | | 10.80 | % | |

Dow Jones Brookfield

Global Infrastructure IndexSM

(reflects no deduction for fees, expenses or taxes)1 | | | 15.89 | % | | | 18.22 | % | | | 13.16 | % | |

S&P Global BMI Index

(reflects no deduction for fees, expenses or taxes)2 | | | 24.11 | % | | | 16.30 | % | | | 8.23 | % | |

(1) The Dow Jones Brookfield Global Infrastructure IndexSM is a float-adjusted market capitalization weighted index that measures the stock performance of companies that exhibit strong infrastructure characteristics. The Index intends to measure all sectors of the infrastructure market. The Index was first published in July 2008; however, back-tested hypothetical performance information is available for this Index since December 31, 2002. Returns are calculated using the return data of the S&P Global BMI Index through December 31, 2002 and the return data of the Dow Jones Brookfield Global Infrastructure Index for periods thereafter. It is not possible to invest directly in an index.

(2) The Standard & Poor's Global BMI Index (S&P Global BMI Index) is a broad market index designed to capture exposure to equities in all countries in the world that meet minimum size and liquidity requirements. As of the date of this Prospectus, there are approximately 11,000 index members representing 26 developed and 20 emerging market countries. It is not possible to invest directly in an index.

THE REORGANIZATIONS

The Board's Considerations